Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Customers Bancorp, Inc. | cubi-20201021.htm |

Q3 2020 Update • Q3 pro forma core revenue of $18.2mm, represents 19.5% YoY growth Q3 Financial Overview • Q3 pro forma core EBITDA of $4.1mm • YTD pro forma adjusted EBITDA of $2.5mm • Q3 End of Period (EOP) serviced deposits rise to $944mm, represents 42% YoY growth • Q3 Card Spend of $741mm, represents 24% YoY growth • Strong growth in new businesses (White Label & Workplace) with rapidly improving account metrics Strong Growth • 150K new accounts LTM (9/30/20) • EOP serviced deposit balances up ~150% per account YoY • Quarterly Card Spend per account increased 60% YoY • Expect 99.7% retention of disbursement services by campuses this year Higher Ed • NACUBO reports that more than half of higher ed institutions are offering remote options for some or all Business Adapts classes, impacting the amount of students on campus (1) • Disbursement dollars are highly persistent as Aug. & Sept. down only ~1.6% YoY ($2.87B vs $2.91B) while YTD to COVID serviced organic deposits have grown 32% and end of period Q3 serviced deposits are up 8% YoY • Corporate restructuring, implementation of automation projects, and vendor negotiations lead to Continued focus on projected $1.7mm of Q4 savings and annualized $7mm of savings starting in 2021 • Expected realization of $10mm annualized expense savings in 2020 resulting from vendor negotiations Operating Leverage and contract restructurings in 2019 • T-Mobile Money product has been extended to the entire Sprint customer base • Officially launched Workplace Banking vertical in Q3 with BenefitHub, one of the largest HR benefits Other Key Developments marketplaces with access to over 6 million potential customers • Hired Jamie Donahue as Chief Digital Officer. Jamie was formerly Head of Cloud Architecture, Engineering & Delivery at Finastra. Note: Q3 2020 financials are still preliminary 1) NACUBO Flash Poll: Fall 2020 Institutional Plans; NACUBO is National Association of College and University Business Officers | 5

Where Does BankMobile Technologies Stand Today? Delivering Full-Featured Digital Banking Platform to Large Scale Non-Bank Partners One of America’s Largest Digital Expert in B2B2C Banking… …Award Winning Banking Technology, Banking Platforms… Focused on Banking Services for Millennials & Middle Income Americans… ✓ Over 2M accounts (1) ✓ Proprietary Banking-as-a-Service (“BaaS”) ✓ Customer-centric approach technology ✓ ~300K accounts opened annually (2) ✓ Provides an affordable, easy-to-use product ✓ Allows for greater speed and cost effectiveness in ✓ ~$944M in serviced deposits as of 9/30/20 ✓ Simplifies banking for the consumer bank roll out for partners ✓ $49M in pro forma core revenue YTD ✓ Creates customers for life with full suite of ✓ High-volume, low-cost customer acquisition banking products, including checking, ✓ $2.5M YTD pro forma core EBITDA model savings, personal loans, credit cards and ✓ Serves ~1 in 3 U.S. students on approximately 725 student refinancing campuses (4) ✓ Creates attractive returns ✓ Launched partnership with T-Mobile via the T- Mobile MONEY checking account ✓ Planned 2021 launch of digital bank account with Google Pay 1) Data as of 9/30/2020 4) Based on market share for Signed Student Enrollments (“SSEs”) (the number of students enrolled at higher-ed institutions); Assumes ~3M SSEs are considered non- 2) Per BankMobile management addressable (beauty schools, trucking schools, etc.); Data per BankMobile’s internal sales database and estimated student market size and National Center for 3) EBITDA is a Non-GAAP financial measure; see page 44 and 45 for reconciliations to | 6 Education Statistics “Enrollment and Employees in Postsecondary Institutions, Fall 2015; Financial Statistics Academic Libraries, Fiscal Year 2015”, February 2017 Non-GAAP financial measures and disclaimers on forward looking financials

7 Highly Attractive Business Model Income Statement – Historical & Forecasted Revenue Breakout by Major Categories Historical & Projected Income Statement 2019 Pro Forma Core (1) 2020E 2021E 2022E Interchange and MasterCard incentive income based Pro Forma Core Revenues ($mm) $61.3 $72.4 $104.0 $144.4 Card Revenue on card activity and out-of-network ATM fees Less: Pro Forma Core OpEx (Excl. Deprec. & Amort.) ($mm) 63.6 67.2 82.6 94.1 Pro Forma Core EBITDA ($mm) (2) ($2.2) $5.3 $21.5 $50.3 Less: Interest Expense ($mm) 0.5 1.4 0.6 0.3 Less: Deprec. & Amort. ($mm) 9.3 13.0 14.7 16.7 Deposit Servicing Fee charged to partner bank(s) based on average Pro Forma Core Pre-Tax Income ($mm) ($12.1) ($9.2) $6.2 $33.3 Fees balances of serviced deposits Less: Tax Expense ($mm) 0.0 (2.2) 1.5 8.0 Pro Forma Core Net Income ($mm) ($12.1) ($7.0) $4.7 $25.3 Average Serviced Deposits ($mm) $548.5 $705.9 $1,381.4 $2,335.0 Account Fees Monthly account fees, wire fees and card YoY Growth replacement fees Average Serviced Deposits 29% 96% 69% Pro Forma Core Revenues 18% 44% 39% Pro Forma Core OpEx (Excl. Depreciation & Amortization) 6% 23% 14% Pro Forma Core EBITDA - 308% 134% University Fees Subscription and transactional fees charged to Pro Forma Core Net Income - - 442% colleges based on enrollment size, competitive marketplace and disbursement channels and options Various nominal other fees, including fees associated Other Fees with cash deposits Note: 2020 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial projections 1) 2019 financials are shown pro forma for BankMobile’s current deposit servicing and expense agreements with assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and competitive Customers Bank; see page 44 for reconciliations to Pro Forma Core Financials | 23 uncertainties and contingencies, many of which are beyond the control of the Company and its management. 2) EBITDA is a Non-GAAP financial measure; see page 45 for reconciliations to Non-GAAP financial measures

Demonstrating Strong Performance Across Key Metrics Key Performance Indicators – Metrics of Company Success Card Spend Q3 Card Spend YTD EoP Serviced Deposits Organic Deposits YTD Higher Ed Account Interchange Retention Rate YTD 24% 16% 42% 32% 1% 13% $944mm $741mm $2.1bn $1.4bn 98.5% 99.7% 79bps 69bps $1.8bn $597M $666mm $1.1bn Q3' 19 Q3' 20 (1) Q3' 19 Q3' 20 Q3' 19 YTD Q3' 20 YTD Q3' 19 YTD Q3' 20 YTD 3-Year Today Q3' 19 YTD Q3' 20 YTD Trailing Avg. Comments: Strong growth driven by After falling 2% YOY in Growth driven by increase Growth driven by 2020 retention is Decline due to impacts of significant increases in Q1, Debit Card spend in accounts, organic stronger performing tracking above COVID (increase in average both Higher Ed and White grew 32% in Q2 and deposits, and boosted by accounts and boosted by average of trailing 3 ticket size and changing Label 24% in Q3 federal stimulus programs federal stimulus programs years’ retention consumer merchant mix). We expect some positive revision in this rate in 2021 Definition: The aggregate amount of The aggregate amount of Aggregate, end of period Cash inflows to end user Calculated as one minus the Represents the amount of spend on debit cards in Q3 spend on debit cards in Q1- balance of serviced customer deposit accounts, not annual SSE attrition over revenue for each debit card 2020 vs Q3 2019 Q3 2020 vs Q1-Q3 2019 deposits across all business attributable to higher beginning of the year SSE transaction, including interchange lines education disbursements or count maintenance paid by partner white label partner incentive bank, net of network costs, as a % payments of debit spend Note: Q3 2020 financials are still preliminary 1) Management estimate for performance through end of 2020 based on seasonal renewals and performance YTD | 24

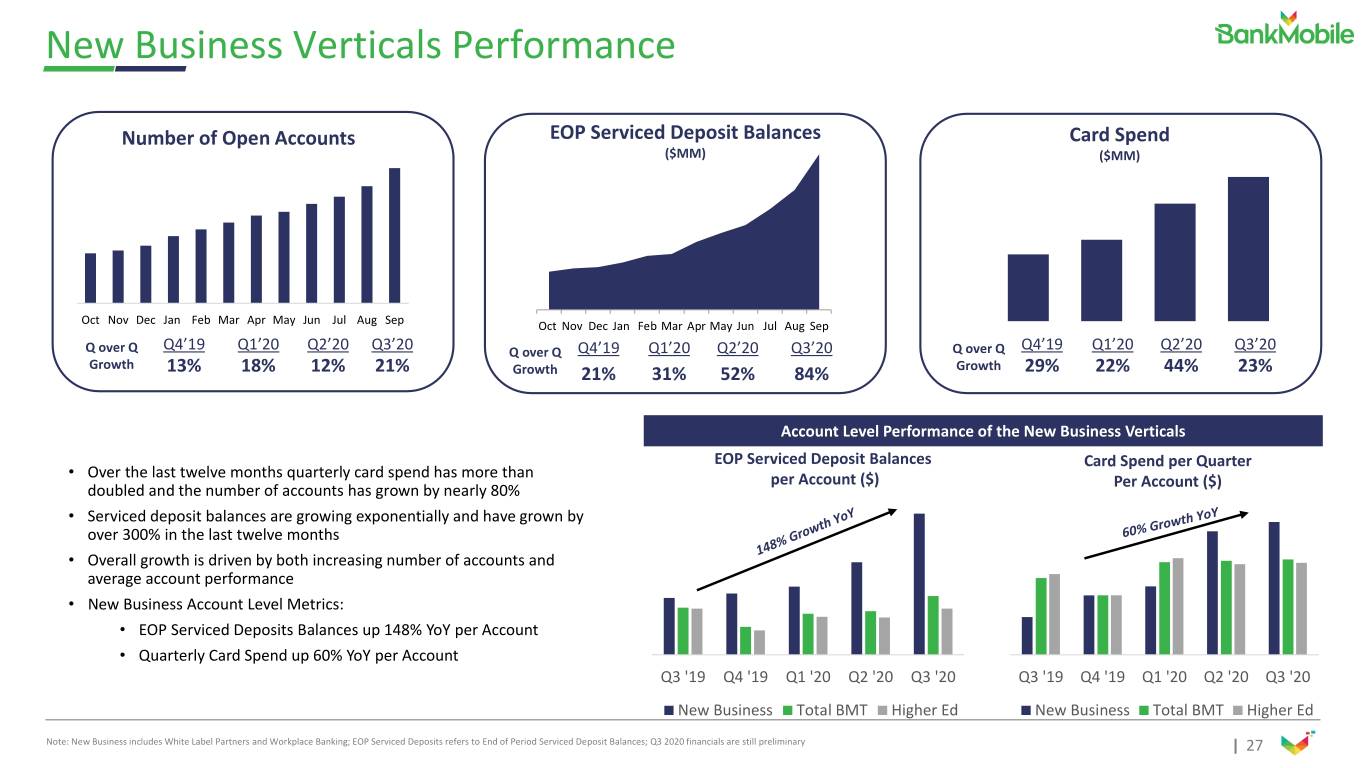

New Business Verticals Performance Number of Open Accounts EOP Serviced Deposit Balances Card Spend ($MM) ($MM) Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Q over Q Q4’19 Q1’20 Q2’20 Q3’20 Q over Q Q4’19 Q1’20 Q2’20 Q3’20 Q over Q Q4’19 Q1’20 Q2’20 Q3’20 Growth 13% 18% 12% 21% Growth 21% 31% 52% 84% Growth 29% 22% 44% 23% Account Level Performance of the New Business Verticals EOP Serviced Deposit Balances Card Spend per Quarter • Over the last twelve months quarterly card spend has more than per Account ($) Per Account ($) doubled and the number of accounts has grown by nearly 80% • Serviced deposit balances are growing exponentially and have grown by over 300% in the last twelve months • Overall growth is driven by both increasing number of accounts and average account performance • New Business Account Level Metrics: • EOP Serviced Deposits Balances up 148% YoY per Account • Quarterly Card Spend up 60% YoY per Account Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 New Business Total BMT Higher Ed New Business Total BMT Higher Ed Note: New Business includes White Label Partners and Workplace Banking; EOP Serviced Deposits refers to End of Period Serviced Deposit Balances; Q3 2020 financials are still preliminary | 27

Income Statement – Pro Forma Core Historical & Forecasted 2019 Pro Forma Core (1) 2020E 2021E 2022E Pro Forma Core Revenues ($mm) $61.3 $72.4 $104.0 $144.4 Less: Pro Forma Core OpEx (Excl. Deprec. & Amort.) ($mm) 63.6 67.2 82.6 94.1 Pro Forma Core EBITDA ($mm) (2) ($2.2) $5.3 $21.5 $50.3 Less: Interest Expense ($mm) 0.5 1.4 0.6 0.3 Less: Deprec. & Amort. ($mm) 9.3 13.0 14.7 16.7 Pro Forma Core Pre-Tax Income ($mm) ($12.1) ($9.2) $6.2 $33.3 Less: Tax Expense ($mm) 0.0 (2.2) 1.5 8.0 Pro Forma Core Net Income ($mm) ($12.1) ($7.0) $4.7 $25.3 Average Serviced Deposits ($mm) $548.5 $705.9 $1,381.4 $2,335.0 YoY Growth Average Serviced Deposits 29% 96% 69% Pro Forma Core Revenues 18% 44% 39% Pro Forma Core OpEx (Excl. Depreciation & Amortization) 6% 23% 14% Pro Forma Core EBITDA - 308% 134% Pro Forma Core Net Income - - 442% Note: 2020 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial projections 1) 2019 financials are shown pro forma for BankMobile’s current deposit servicing and expense agreements with assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and competitive Customers Bank; see page 44 for reconciliations to Pro Forma Core Financials | 33 uncertainties and contingencies, many of which are beyond the control of the Company and its management. 2) EBITDA is a Non-GAAP financial measure; see page 45 for reconciliations to Non-GAAP financial measures

Financial Summary Pro Forma Core Financial Metrics ($ in millions) 2019 Q3 2020 Q3 YoY Chg % 2019Q3 YTD 2020Q3YTD YoY Chg % Commentary Interchange and card revenue $6.7 $7.4 11% $21.8 $20.1 (8%) • Interchange and card revenues declined, despite significant growth in card spend due to $1mm drop in ATM related revenue Deposit servicing fees 4.0 5.8 45% 12.4 15.6 26% and reduced interchange fee rates Account fees 3.0 2.8 (9%) 7.9 8.5 8% • Deposit servicing fees increased, driven by 25% growth in average deposit balances University fees 1.3 1.3 6% 3.7 4.0 8% • University fees benefitted from COVID-related services provided Other 0.3 0.9 NM 0.7 1.2 77% to new, non-subscription clients Pro Forma Core Revenues $15.2 $18.2 20% $46.5 $49.4 6% • 2020 expense levels benefitted from contract optimization Pro Forma Core OpEx (Excl. Depr. & Amort.) 13.9 14.2 2% 48.7 46.9 (4%) initiatives launched in 2019H2 • Additional benefits expected to be realized from operating Pro Forma Core EBITDA $1.4 $4.1 NM ($2.3) $2.5 NM leverage initiatives implemented in October 2020 Less: Interest Expense 0.1 0.4 NM 0.1 1.1 NM • Interest on debt Less: Depreciation & Amortization 3.2 2.6 (18%) 6.1 8.8 45% Pro Forma Core Pre-Tax Income ($2.0) 1.1 NM ($8.5) ($7.5) NM • Increase in depreciation and amortization expense in 2020 driven by launch of white label products and amortization of capitalized development expenses Total Serviced Deposits - EoP $666 $944 42% $666 $944 42% Total Debit Spend $597 $741 24% $1,813 $2,109 16% Source: Company management Note: Q3’20 financial metrics are preliminary and subject to change Note: Refer to Reconciliation to Pro Forma Core Financials on page 44; Growth rates over 150% deemed not meaningful – “NM” | 34

Cost Controls and Revenue Growth Drive Operating Leverage Focus on Expense Control as BMT Initiatives Launch and Exit “Build” Phase 2019 2020 2021 Beyond Ongoing $10mm Contract Optimization Initiative (1) Recurring Focus on Expense Annualized Benefit $17mm Annual Savings Management • Initiatives focused on contract optimization and OpEx process automation and Ongoing $7mm Annualized Operating Leverage Initiative 25% Savings resulted in permanent Benefit Rate(2) reduction to cost base • Operating leverage initiatives, • Benefits began in 2H 2019 including reorganization, and included $5mm savings automation, and vendor in 2019 negotiations launched in Q4 2020 • Expected to generate $1.7 million of savings in 2020Q4, excluding severance costs Maintaining New Banking Service Revenue High Growth 2019 Pro Forma 2020E 2021E 2022+2022E + BMT Forecast Revenues 1) Majority of savings related to reducing costs of variable services. 2020 projected savings of $10mm calculated by comparing actual costs with projected costs using 2020 account activity and previous agreements and processes 2) Based on 2019 total expenses minus depreciation and amortization | 35 Note: 2019 Pro Forma Revenues

Financial & Operating Highlights BankMobile (BMT)’s Model has enabled it to establish a highly attractive financial & operating profile >5mm $11.7bn *SSEs (1) BankMobile Serves Approximately Total Student Refund 1 in 3 of all US College Students Dollars Processed (3) Pro Forma Core Revenue Revenue EBITDA Margin >2mm $2.7bn $64mm $104mm 21% Debit Spend (3) LTM as of 9/30/20 (1) 2021E (4) 2021E (4) Accounts (1) >98% $944mm New Banking Service Higher-Ed Client EoP Serviced Retention (by SSEs) (1)(2) Deposits (1) • Signed Student Enrollments (“SSEs”) Source: BankMobile management 1) Preliminary Data as of the period end 9/30/2020. Non-GAAP, see slide 44 4) Reflects forecasted full year 2021 data; Forecasted Revenue and EBITDA set forth on “Income Statement History and Forecast“ on slide 23 & 33; EBITDA is a 2) Represents one minus the annual SSE attrition over beginning of the year SSE count Non-GAAP financial measure which can be reconciled on page 45; Forward looking financial projections assume white label business achieves significant forecasted | 36 3) Reflects last twelve-month data for the period end 9/30/2020 growth. These figures are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management

Valuation Overview ▪ Enterprise Value multiples are valued at a significant discount when looking at 2021E EBITDA and revenue Enterprise Value / (1) (1) Public Comparable Companies Public Comparable Companies 2021E Rev. 2021E EBITDA Bank Tech Comparables EV / 2021E EBITDA Multiples EV / 2021E Revenue Multiples FIS 7.9x 17.6x 8.1x Intuit 9.7x 26.3x 19.6x Fiserv 5.8x 14.0x 6.8x 17.7x ADP 4.3x 17.8x 5.3x 15.8x Jack Henry 6.8x 21.5x Temenos 9.6x 22.2x 6.5x Q2 11.0x NM 1.3x ACI Worldwide 3.4x 12.9x Bottomline Tech. 3.9x 17.4x BankMobile(2) Bank Tech Payment B2B / Card Issuers BankMobile(2) Bank Tech Payment B2B / Card Issuers Median 6.8x 17.7x Technology and & Processors Technology and & Processors Software Sol. Software Sol. Payment Technology and Software Solutions Comparables ▪ Private market valuations for US and Int’l Neobanks using disclosed valuations and number of accounts (3) PayPal 8.8x 31.0x Valuation / Customers Square 8.6x NM Repay 11.2x 24.9x (4) 2019 Avg Rev per Customer Global Payments 8.1x 17.0x $725 $700 BankMobile: $32 $667 i3 Verticals 5.5x 19.1x Revolut: $31: $550 Monzo: $27 Shift4 Payments 2.3x 16.1x Average: $458 per Customer Paya, Inc. 5.6x 20.1x $400 $375 Median 8.1x 19.6x $178 B2B / Card Issuers & Processors Comparables $64 FleetCor 8.8x 15.8x WEX 4.6x 10.4x Alliance Data Systems 3.7x 11.9x BankMobile Chime Stash NuBank N26 Revolut Monzo Aspiration Worldline 5.3x 19.8x Valuation EML Payments 5.5x 17.1x ($mm) $140mm $5,800mm $800mm $10,000mm $3,500mm $5,500mm $1,500mm $1,000mm Median 5.3x 15.8x Accounts(3) (millions) 2mm 8mm 5mm 25mm 5mm 10mm 4mm 2mm Source: Capital IQ & FactSet Research Systems, Inc.; Market data as of 10/7/2020 3) FT Partners Research, “The Rise of Challenger Banks”, Business Insider, TechCrunch and Bloomberg; References to number of Note: Multiples exclude valuations less than 0.0x and greater than 50.0x; Peer data reflects consensus estimates customers is assumed to apply accounts; BMT account data as of 9/30/2020 1) Reflects median values for comparable companies in each respective industry 4) See slide 41; 2019 Ending Revenue reported by Monzo and Revolut / Avg # of customers throughout the year. Conversion at 1.29 | 37 2) Forecasted Revenue and EBITDA are set forth on “Income Statement History and Forecast“ on slide 33; EBITDA is a Non-GAAP financial measure which can be reconciled on page 44 USD to GBP; https://sifted.eu/articles/a-comparison-of-uk-top-three-digital-banks/

Investment Thesis Unique Opportunity to Invest in a Premier Brand Positioned for Significant Growth Recognized Rapid Market Best-in-Class Positioned For Strong Market Leader Expansion Digital Bank Significant Growth Financial Profile Among the Largest Sophisticated Planned 2021 Launch ~$72M Digital Banking Capabilities of Collaboration with Platforms Google Pay 2020E Revenue Higher-Ed Frictionless White-Label Partner 19% Proprietary “BaaS” Onboarding Expansion 2020E Revenue Growth Technology ~$812M White-Label Powerful New White-Label 2020E EoP Serviced Partnerships Customer Acquisition Partner Additions High Volume, Low Cost Deposits Acquisition Model Proprietary Distribution Channel 29% Infrastructure and Product Offering 2020E Avg. Service Deposit Workplace Expansion Growth Full Suite of Banking Banking Products Through Dynamic 27% Consumer Data Strategic M&A Partner Banks 2020E Debit Spend Growth | 38

BankMobile Average Account Performance Comparison Key Operating Metrics Comparison against Leading UK based Digital Banks Illustrative Analysis Highlights $32 $31 BankMobile compares Revenue per Account (1) $29 favorably with both Monzo $27 and Revolut on key metrics Category 1 Category 2 Category 3 Category 4 ‘20 YTD 2019 Fiscal 2019 (4) 2019 Revolut reported 10mm Annualized customers at the end of 2019 $439 $460 EOP Serviced $304 and was last valued at $5.5B $209 Deposits per Account Monzo reported 2.75mm Category 1 Category 2 Category 3 Category 4 As of 9/30/20 2019 Fiscal 2019 2019 customers as of 2/29/20 and $19.6 was last valued at $1.5B Card Rev per $13.0 $13.5 $13.8 Account (2) Category 1 Category 2 Category 3 Category 4 ‘20 YTD 2019 Fiscal 2019 (4) 2019 Annualized $550.0 Valuation per $375.0 Account (3) $64.0 Category 1 Category 2 Category 3 1) Total reported revenue divided by average number of customers throughout the year calculated using beginning and end of year customer counts. Customer counts identified using either disclosed number of accounts or customers.; 2) Reported by Monzo as Net fee and commission income; Reported by Revolut as Card & Interchange; (3) Latest private market valuation divided by number of accounts for Monzo and Revolut; Transaction valuation divided by number of accounts for BankMobile; See Page 41; (4) Net of $10.7mm Fee and Commission Expense Source: https://sifted.eu/articles/a-comparison-of-uk-top-three-digital-banks; Revolut and Monzo Annual Reports; FT Partners Research, “The Rise of Challenger Banks”, Business Insider, TechCrunch and Bloomberg; | 40 Note: Exchange Rate of GBP to USD = 1.29 for all Monzo and Revolut data; Monzo data is Fiscal year end Feb 29,2020 and Revolut data is year end Dec 31, 2019; BankMobile Revenue is pro forma core revenue

Proposed Capitalization and Ownership Proposed Sources & Uses Analysis Capitalization at Closing Proposed Sources ($mm) Share Price $10.38 (1) CUBI Rollover Equity $54.7 Total Shares Outstanding 11.3 PIPE Proceeds 20.0 BMT Pro Forma Equity Value $117.2 Pre-Closing Cash on B/S at MFAC 33.2 Net Debt at Close (2) 13.4 NWC Adjustment (0.9) BankMobile Excess Cash Net of Reserve Adjustment (3) 5.3 Estimated Transaction Expenses 5.0 Total $126.6 BankMobile Excess Cash Net of Reserve Adjustment (3) 5.3 Proposed Uses ($mm) Adjusted Equity Value $126.6 (8) Cash - Consideration to Equity (1)(4) $31.9 Debt at Close 28.4 Stock Consideration: $10.38 per share (1) 54.7 Cash at Close (9) (15.0) Estimated Transaction Expenses 5.0 Enterprise Value $140.0 Cash to Pro Forma Balance Sheet 10.0 BMT 2020E Adjusted EBITDA ($mm) (10) $6.3 Debt Repayment 11.6 (10) Net Debt at Close (2) 13.4 BMT 2021E EBITDA ($mm) $21.5 (10) Total $126.6 BMT 2021E Revenue ($mm) $104.0 Proposed Equity Capitalization Summary(1) EV / 2020E Adjusted EBITDA 22.1x Share Count % of EV / 2021E EBITDA 6.5x Party (millions) Total (5) MFAC Shareholders 3.2 28.3% EV / 2021E Revenue 1.3x PIPE Investors (6) 2.8 25.0% (7) Shares Issued to CUBI 5.3 46.7% Total 11.3 100.0% Note: Analysis assumes the full $33.2 million cash held in the trust account by MFAC related to existing MFAC public stockholders will not be redeemed upon Transaction closing, shares will remain outstanding and cash will be available for use in the Transaction Note: Net Working Capital at close is $0.9mm above target level resulting in an upward adjustment to the merger consideration 1) Total non-cash merger consideration to equity includes downward deal value adjustment of $13.4mm related to sponsor equity adjustments, net working capital adjustments and transaction expenses 2) Estimated at closing 12/31/2020; See page 46 “Reconciliation to Non-GAAP Financial Measures” for closing net debt calculation 3) Cash held by BankMobile in excess of $5.0mm will serve as additional cash consideration to Customers Bank; Based on estimated cash at closing of $10.3mm 4) Cash consideration includes $20.0mm of proceeds related to the PIPE offering (net of $5.0mm in estimated transaction expenses), $5.3mm excess cash held by BankMobile at close and an additional $11.6mm of cash held in escrow in MFAC’s trust account 5) Assuming no redemptions for public stockholders 6) Based on total PIPE investment of $20.0mm and MFAC’s share price $10.38; Includes retained founder shares of 0.7m from initial founder investment; Excludes .3m founder shares subject to vesting and forfeiture unless the stock price reaches $15 per share for 20 out of 30 days 7) Reflects total non-cash merger consideration to equity, issuance based on MFAC share price of $10.38 8) Reflects pro forma intercompany debt after partial paydown 9) Includes maximum cash reserve of $5.0mm held by BankMobile and an estimated $10.3mm of cash allocated to BankMobile’s balance sheet by cash held in the trust account by MFAC | 42 10) Forecasted Revenue, EBITDA and Adjusted EBITDA set forth on “Income Statement History and Forecast“ and “Reconciliation to Non-GAAP Financial Measures” on slides 33, 44 and 45, respectively

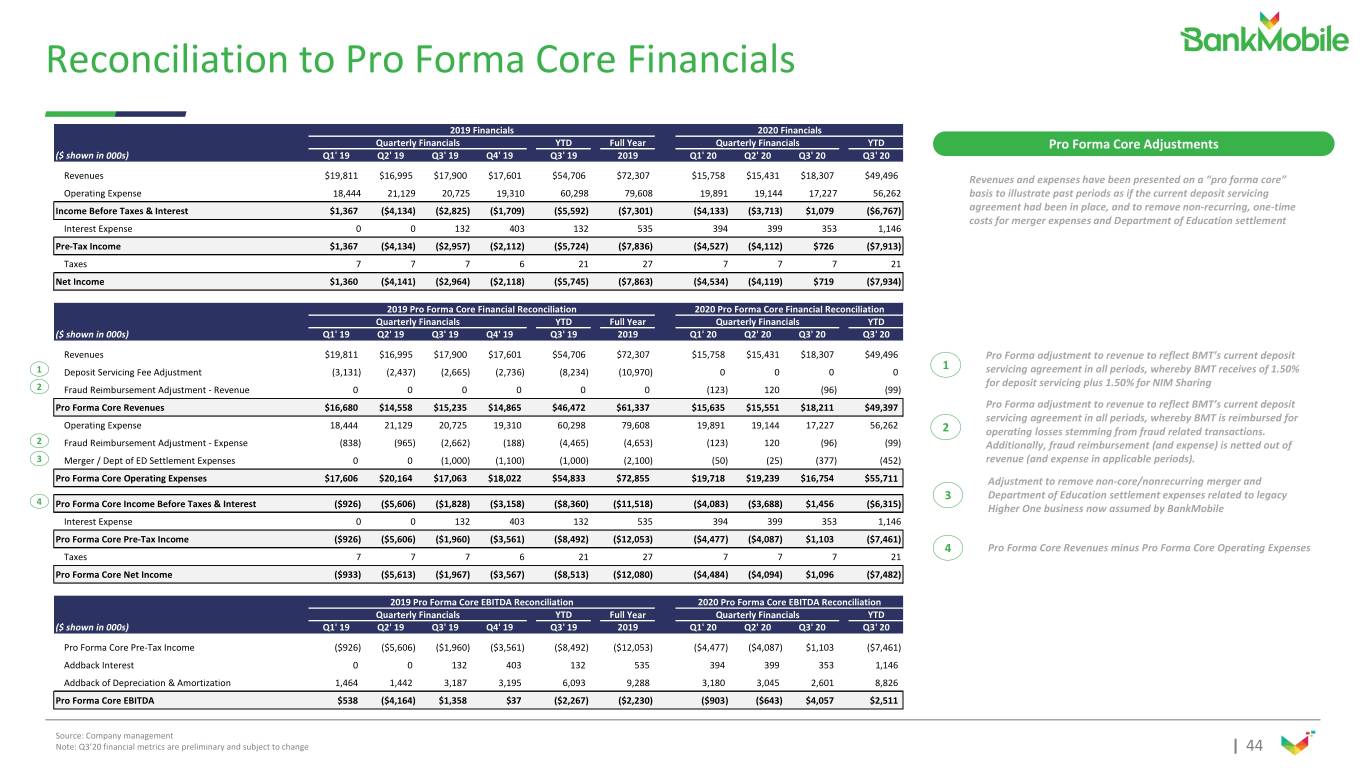

Reconciliation to Pro Forma Core Financials 2019 Financials 2020 Financials Quarterly Financials YTD Full Year Quarterly Financials YTD Pro Forma Core Adjustments ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Revenues $19,811 $16,995 $17,900 $17,601 $54,706 $72,307 $15,758 $15,431 $18,307 $49,496 Revenues and expenses have been presented on a “pro forma core” Operating Expense 18,444 21,129 20,725 19,310 60,298 79,608 19,891 19,144 17,227 56,262 basis to illustrate past periods as if the current deposit servicing Income Before Taxes & Interest $1,367 ($4,134) ($2,825) ($1,709) ($5,592) ($7,301) ($4,133) ($3,713) $1,079 ($6,767) agreement had been in place, and to remove non-recurring, one-time costs for merger expenses and Department of Education settlement Interest Expense 0 0 132 403 132 535 394 399 353 1,146 Pre-Tax Income $1,367 ($4,134) ($2,957) ($2,112) ($5,724) ($7,836) ($4,527) ($4,112) $726 ($7,913) Taxes 7 7 7 6 21 27 7 7 7 21 Net Income $1,360 ($4,141) ($2,964) ($2,118) ($5,745) ($7,863) ($4,534) ($4,119) $719 ($7,934) 2019 Pro Forma Core Financial Reconciliation 2020 Pro Forma Core Financial Reconciliation Quarterly Financials YTD Full Year Quarterly Financials YTD ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Revenues $19,811 $16,995 $17,900 $17,601 $54,706 $72,307 $15,758 $15,431 $18,307 $49,496 Pro Forma adjustment to revenue to reflect BMT’s current deposit 1 1 Deposit Servicing Fee Adjustment (3,131) (2,437) (2,665) (2,736) (8,234) (10,970) 0 0 0 0 servicing agreement in all periods, whereby BMT receives of 1.50% for deposit servicing plus 1.50% for NIM Sharing 2 Fraud Reimbursement Adjustment - Revenue 0 0 0 0 0 0 (123) 120 (96) (99) Pro Forma Core Revenues $16,680 $14,558 $15,235 $14,865 $46,472 $61,337 $15,635 $15,551 $18,211 $49,397 Pro Forma adjustment to revenue to reflect BMT’s current deposit servicing agreement in all periods, whereby BMT is reimbursed for Operating Expense 18,444 21,129 20,725 19,310 60,298 79,608 19,891 19,144 17,227 56,262 2 operating losses stemming from fraud related transactions. 2 Fraud Reimbursement Adjustment - Expense (838) (965) (2,662) (188) (4,465) (4,653) (123) 120 (96) (99) Additionally, fraud reimbursement (and expense) is netted out of 3 Merger / Dept of ED Settlement Expenses 0 0 (1,000) (1,100) (1,000) (2,100) (50) (25) (377) (452) revenue (and expense in applicable periods). Pro Forma Core Operating Expenses $17,606 $20,164 $17,063 $18,022 $54,833 $72,855 $19,718 $19,239 $16,754 $55,711 Adjustment to remove non-core/nonrecurring merger and Department of Education settlement expenses related to legacy 4 3 Pro Forma Core Income Before Taxes & Interest ($926) ($5,606) ($1,828) ($3,158) ($8,360) ($11,518) ($4,083) ($3,688) $1,456 ($6,315) Higher One business now assumed by BankMobile Interest Expense 0 0 132 403 132 535 394 399 353 1,146 Pro Forma Core Pre-Tax Income ($926) ($5,606) ($1,960) ($3,561) ($8,492) ($12,053) ($4,477) ($4,087) $1,103 ($7,461) 4 Pro Forma Core Revenues minus Pro Forma Core Operating Expenses Taxes 7 7 7 6 21 27 7 7 7 21 Pro Forma Core Net Income ($933) ($5,613) ($1,967) ($3,567) ($8,513) ($12,080) ($4,484) ($4,094) $1,096 ($7,482) 2019 Pro Forma Core EBITDA Reconciliation 2020 Pro Forma Core EBITDA Reconciliation Quarterly Financials YTD Full Year Quarterly Financials YTD ($ shown in 000s) Q1' 19 Q2' 19 Q3' 19 Q4' 19 Q3' 19 2019 Q1' 20 Q2' 20 Q3' 20 Q3' 20 Pro Forma Core Pre-Tax Income ($926) ($5,606) ($1,960) ($3,561) ($8,492) ($12,053) ($4,477) ($4,087) $1,103 ($7,461) Addback Interest 0 0 132 403 132 535 394 399 353 1,146 Addback of Depreciation & Amortization 1,464 1,442 3,187 3,195 6,093 9,288 3,180 3,045 2,601 8,826 Pro Forma Core EBITDA $538 ($4,164) $1,358 $37 ($2,267) ($2,230) ($903) ($643) $4,057 $2,511 Source: Company management Note: Q3’20 financial metrics are preliminary and subject to change | 44

Reconciliation to Non-GAAP Financial Measures ($ shown in millions) 2019 Pro Forma Core (1) 2020E 2021E 2022E Pro Forma Core Pre-Tax Income ($12.1) ($8.1) $6.2 $33.3 Addback of Interest Expense (2) 0.5 1.4 0.6 0.3 Addback of Depreciation & Amortization 9.3 13.0 14.7 16.7 Pro Forma Core EBITDA ($2.2) $6.3 $21.5 $50.3 Pro Forma Core EBITDA ($2.2) $6.3 $21.5 $50.3 Pro Forma Core Revenue 61.3 72.4 104.0 144.4 Pro Forma Core EBITDA Margin (4%) 9% 21% 35% Source: BankMobile management projections Note: 2021 – 2022 forecasted figures incorporate additional public company cost upon consummation of the transaction. Forward looking financial 1) Refer to Reconciliation to Pro Forma Core Financials on page 44 projections assume white label business achieves significant forecasted growth. These figures are subject to significant business, economic, regulatory and 2) Reflects cost of intercompany debt | 45 competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management.

Reconciliation to Non-GAAP Financial Measures (Continued) 2020E BankMobile Estimated Debt at Closing $40.0 Trust Cash Allocated for Debt Paydown (1) (11.6) Pro Forma Estimated Debt at Closing $28.4 Beginning BankMobile Cash $10.3 Less: BankMobile Excess Cash Used in Cash Consideration (2) (5.3) Plus: Cash Held in MFAC Trust Allocated to Balance Sheet 10.0 Estimated Closing Cash on Balance Sheet $15.0 Pro Forma Estimated Debt at Closing $28.4 Less: Estimated Closing Cash on Balance Sheet 15.0 Estimated Net Debt at Close $13.4 Pro Forma Core EBITDA 6.3 Net Leverage Ratio (Net Debt / Adjusted EBITDA) 2.1x Source: BankMobile management projections 2) Cash held by BankMobile in excess of $5.0mm will serve as additional cash consideration to Customers Bank 1) Assumes $33.2mm cash held in escrow at MFAC related to existing MFAC investors will not be redeemed upon Transaction closing; Assumes 50% of trust cash in excess of $10.0 mm will serve as proceeds used to partially paydown existing | 46 intercompany debt