Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - COMMERCE BANCSHARES INC /MO/ | cbsh09302020ex991.htm |

| 8-K - 8-K - COMMERCE BANCSHARES INC /MO/ | cbsh-20201020.htm |

Embracing a Growth Mindset COMMERCE BANCSHARES, INC. INVESTOR UPDATE 3rd Quarter 2020

CAUTIONARY STATEMENT A number of statements we will be making in our presentation and in the accompanying slides are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements of the Corporation’s plans, goals, objectives, expectations, projections, estimates and intentions. These forward- looking statements involve significant risks and uncertainties and are subject to change based on various factors (some of which are beyond the Corporation’s control). Factors that could cause the Corporation’s actual results to differ materially from such forward- looking statements made herein or by management of the Corporation are set forth in the Corporation’s 2019 Annual Report on Form 10-K, 2ND Quarter 2020 Report on Form 10-Q and the Corporation’s Current Reports on Form 8-K. 2 2

COMMERCE BANCSHARES $31.5 $25.7 155 YEARS IN BUSINESS BILLION IN ASSETS BILLION IN TOTAL DEPOSITS 43RD LARGEST U.S. BANK BASED ON ASSET SIZE1 $16.5 BILLION IN TOTAL LOANS2 $6.3 BILLION IN MARKET CAPITALIZATION $9.1 TH BILLION IN COMMERCIAL 16 CARD VOLUME as of 12/31/19 LARGEST U.S. BANK BASED ON MARKET CAPITALIZATION1 8.9% FULL-SERVICE BANKING FOOTPRINT RETURN ON AVERAGE 159 full-service branches and 358 ATMs $54.7 COMMON EQUITY St. Louis Kansas City Springfield Central Missouri BILLION IN as of YTD 09/30/2020 Central Illinois Wichita Tulsa Oklahoma City Denver TRUST ASSETS COMMERCIAL OFFICES TH ND Cincinnati Nashville Dallas Des Moines Indianapolis 17 22 Grand Rapids Houston LARGEST AMONG U.S. YTD ROACE FOR THE TOP 50 U.S. BANKS BASED ON BANK-MANAGED TRUST 1 U.S. PRESENCE COMPANIES BASED ON AUM1 ASSET SIZE Extended Commercial Market Area Commercial Payments Services Offered in 48 states across the U.S. BASELINE MOODY’S RANKS COMMERCE Source: 1S&P Global Market Intelligence as of 06/30/2020, does not include asset management or specialty finance banks; 2Includes loans held for sale; 3Moody’s Credit Opinion – Commerce Bancshares, Inc., September 16, 2020, Baseline credit CREDIT AMONG THE TOP 6 BANKS IN assessment reflects a bank’s standalone credit strength; company reports and filings information as of 09/30/2020 unless ASSESSMENT3 THE COUNTRY otherwise noted. a1 3

SUPER-COMMUNITY BANK PLATFORM A consistent strategy with a long-term view Customer relationship-based: Community Bank Challenge Accepted.® Super-Regional Bank • • Award-winning High-performing teams Sophisticated payment customer service and engaged workforce system capabilities • • Focus on the full client Broad consumer relationship Long history of top quartile product offerings credit quality metrics • • Core values Private Banking; Trust; Capital Markets embraced by team Investment in distinctive, members • Shareholder driven and high-return businesses • strong financial Quickly adapt to performance customer needs Focus on operational • and changing efficiencies Competitive on unit preferences costs Disciplined approach to acquisitions 4

OUR STRONG CULTURE IS THE KEY DRIVER TO OUR LONG-TERM SUCCESS A culture At Commerce, our core values shape the way we live and work. formed 150+ years ago to • We have a long We make decisions today that will be a force for V sustain us well into the future. good in our term View region and • We see diversity and inclusion as an our industry We collaborate O imperative and seize opportunities to as One team build teams that reflect all sides of We act with an issue. I Integrity • We value integrity, we recognize our first duty is to conduct business in We are C Customer ways that merit trust and confidence, focused and that adhere to the highest standards of governance and ethics. We strive for E • We value relationships, our Excellence customers are our primary focus. 5

BEYOND FINANCIALS Supporting each other, our customers and our communities As a socially responsible corporate More than 500 nonprofit organizations citizen, we continuously seek supported by Commerce team members opportunities to make a difference. through leadership roles by serving on boards 2020 Engagement & Enablement2 Consistently scoring above the U.S. High Performance and U.S. Financial Services OUTSTANDING norms for engagement, enablement and community reinvestment rating effectiveness from the Federal Reserve for more than 20 years 83% 85% $22 million ENABLEMENT ENGAGEMENT of charitable investments advised by Commerce Trust Company1 1 Includes investments on behalf of the Commerce Bancshares Foundation and private foundations that have engaged the bank as trustee. 2 The Korn Ferry Hay Group – 2020 survey results 6

OUR COMMITMENT TO INCLUSION, DIVERSITY AND EQUITY Our longstanding approach of “doing what’s right” continues to guide our focus on our team members, customers and communities Building a place to thrive and grow A culture that celebrates inclusion and diversity Commerce offers a variety of internal resource professionally groups, mentoring programs and networking Examples of how we continue to build awareness opportunities • Observance and celebration of cultural heritage months • Mentorship programs to support professional development of diverse leaders and team members Connecting young Empowering women • Unconscious bias and sensitivity training professionals 1,290+ members • Community partnerships to advance inclusive 567+ members efforts • Inclusion & Diversity Councils and Employee New groups launched to support diversity at Commerce Resource Groups to help us better understand the evolving needs of our team members, customers and communities • Feedback tools to hold us accountable and Engaging LGBTQIA+ Valuing multi-cultural help us see if we’re trending in the right community perspectives direction 348+ members 337+ members 7

RECENT RECOGNITION Commerce was named to Commerce Bank was selected as Newsweek’s America’s Best Banks list one of 20 best-in-class banks in for Best Customer Service. The Bank Director’s 2019 award recognizes banks with the RankingBanking study. We placed fewest problems reported to the third overall in the Midwest and Consumer Financial Protection ranked first in the Midwest for Best Bureau, a timely response rate to Branch Network Strategy, Best Core complaints, a helpful mobile app Deposit Growth Strategy and Best and a variety of dedicated customer Retail Strategy. service lines. Commerce Trust Company received Highly Commended status Commerce Bank was named among for Best Private Wealth Manager in America’s Best Banks 2020 by Forbes. client services with assets over $5 Ranked in the top quartile nationally billion. PAM Awards recognize top and 2nd Missouri-based bank. Since investment professionals, wealth the first list debuted, Commerce has advisors, legal firms, consultants consistently ranked near the top and other key service providers among the highest-performing operating within the private asset institutions. management industry. Commerce was named Outstanding Employer 2019 by Korn Ferry1. The award publicly recognizes employers that have achieved best-in-class levels of engagement and enablement. Commerce is one of only three companies in the U.S. to receive this global award. 1The Korn Ferry Hay Group – based on 2018 survey results 8

Q3 FINANCIAL RESULTS 9

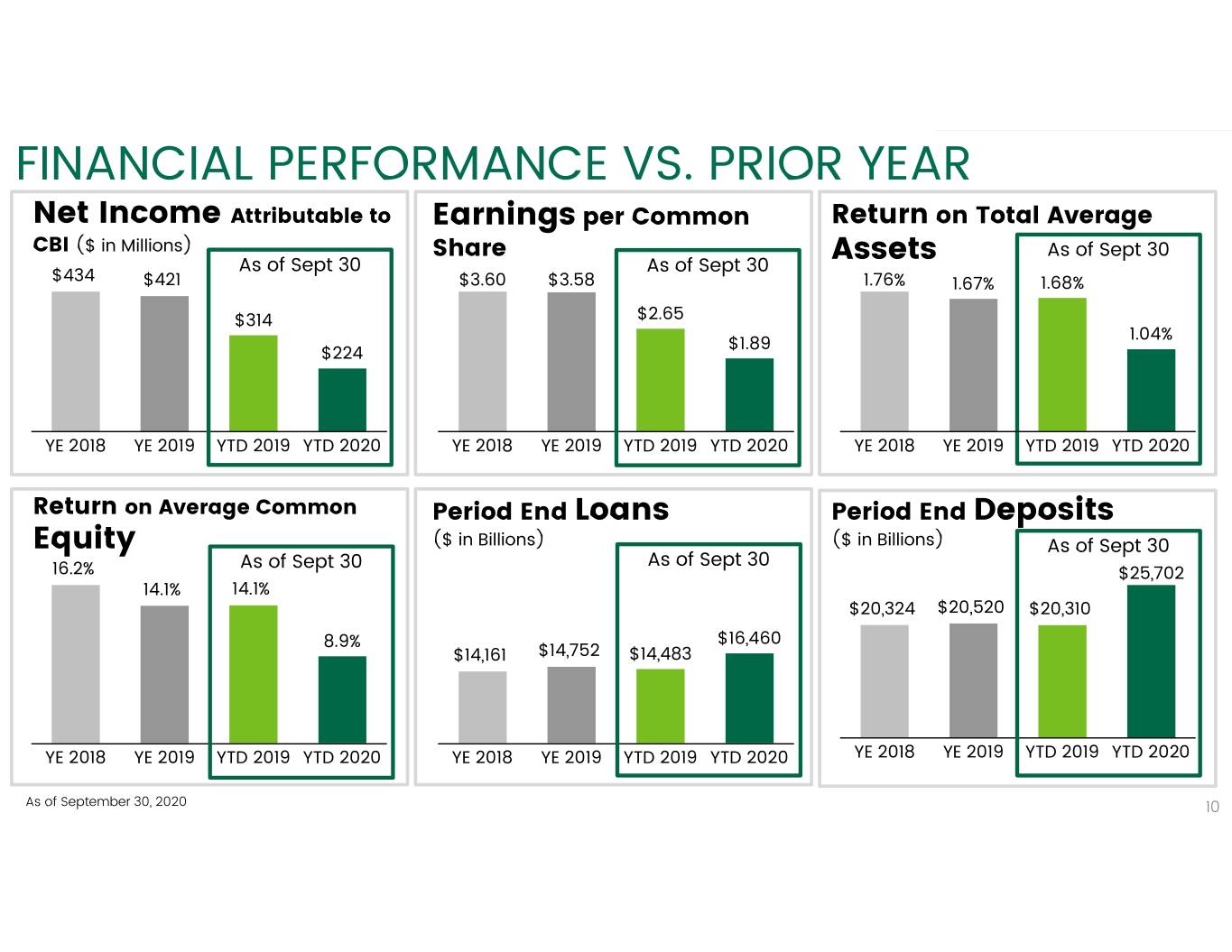

FINANCIAL PERFORMANCE VS. PRIOR YEAR Net Income Attributable to Earnings per Common Return on Total Average CBI ($ in Millions) Share As of Sept 30 As of Sept 30 As of Sept 30 Assets $434 $421 $3.60 $3.58 1.76% 1.67% 1.68% $314 $2.65 1.04% $1.89 $224 YE 2018 YE 2019 YTD 2019 YTD 2020 YE 2018 YE 2019 YTD 2019 YTD 2020 YE 2018 YE 2019 YTD 2019 YTD 2020 Return on Average Common Period End Loans Period End Deposits Equity ($ in Billions) ($ in Billions) As of Sept 30 As of Sept 30 As of Sept 30 16.2% $25,702 14.1% 14.1% $20,324 $20,520 $20,310 8.9% $16,460 $14,161 $14,752 $14,483 YE 2018YE 2019 YTD 2019 YTD 2020 YE 2018 YE 2019 YTD 2019 YTD 2020 YE 2018YE 2019 YTD 2019 YTD 2020 As of September 30, 2020 10

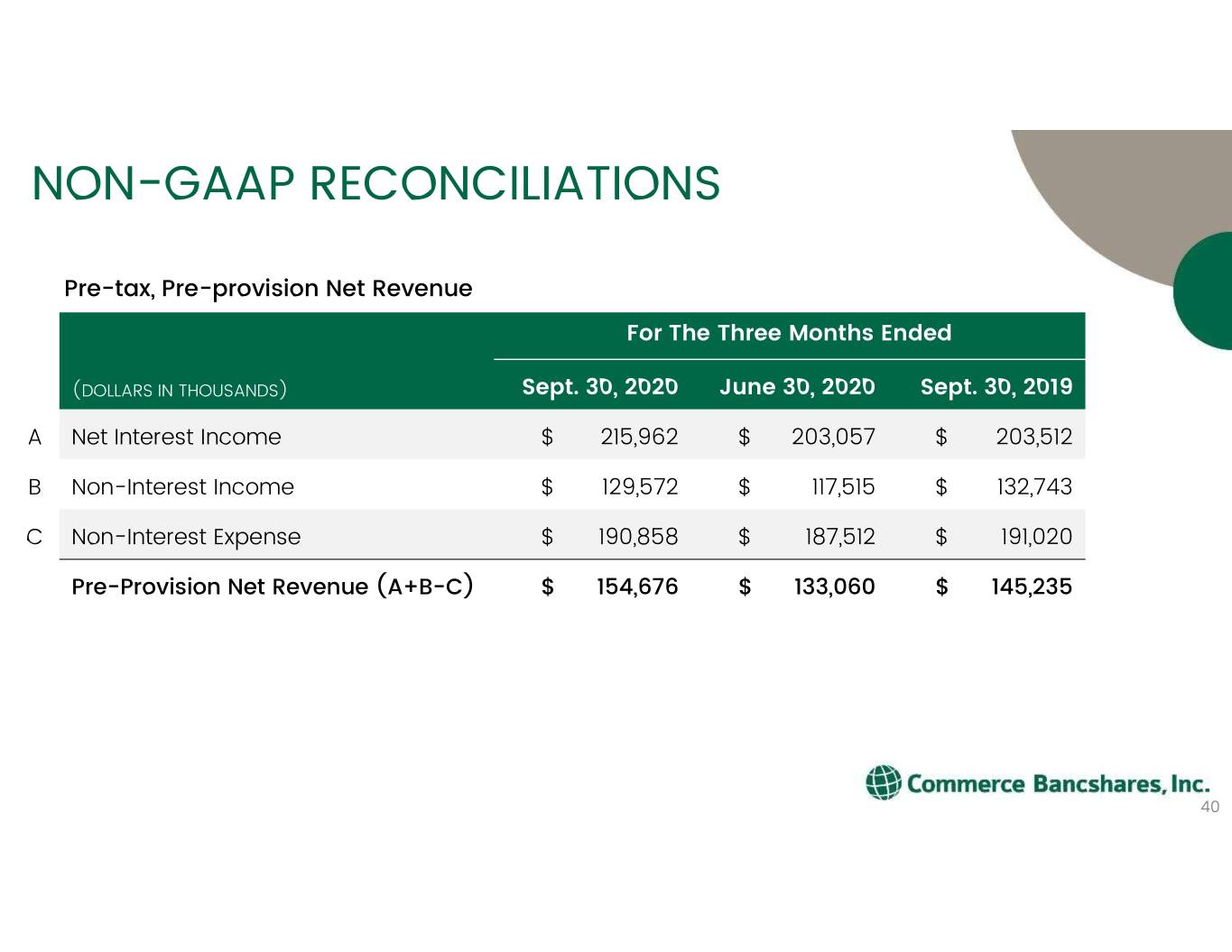

DRIVERS OF 3RD QUARTER 2020 EARNINGS NIM increased 3 bps to 2.97% from 2.94% in the previous quarter, Net Interest driven by higher average balances of investment securities and loans, Margin partially offset by lower loan yields. Interest-bearing deposit costs decreased 7 bps from the previous quarter. Fee Income Fee income decreased 2.4% vs the same quarter in the prior year, mainly due to lower bank card fees, partly offset by growth in loan fees and sales. Expense was down slightly compared to the same period last year, driven by Non-Interest Expense lower travel and entertainment, marketing, and supplies and communication expense, partly offset by higher salaries and employee benefits expense. Pre-Provision Net Excluding the provision for credit losses and securities gains, PPNR grew 16.2% Revenue (PPNR)1 over the second quarter. Provision for credit losses totaled $3.2 million and was $4.4 million lower than CECL net loan charge-offs. Investment Securities Net securities gains in the current quarter resulted from gains of $13.4 million on sales of mortgage-backed securities coupled with unrealized gains of $2.4 Gains and Losses million in the private equity investment portfolio. 1See the non-GAAP reconciliation on page 40 11

PRE-TAX, PRE-PROVISION NET REVENUE (PPNR) Net Interest Income (+) Non-Interest Expense (-) Non-Interest Income (+) Pre-Tax, Pre-Provision Net Revenue (=) $346 $336 $321 3Q2020 Comparison $191 $203 $191 $216 vs. 3Q2019 +6.5% $203 $188 vs. 2Q2020 +16.2% $155 $145 $133 $133 $118 $130 3Q2019 2Q2020 3Q2020 See the non-GAAP reconciliation on page 40 12

SOUND CAPITAL AND LIQUIDITY POSITION Total Risk-Based Capital Ratio1 Loan to Deposit Ratio Peer Median: 13.6% CBSH 15.2% Large, stable deposit base and low OZK 15.2% loan to deposit ratio SFNC 14.9% UBSI Core Deposits Average Loan to 14.8% Deposit Ratio3 UMPQ 14.5% 66%Commerce CFR 14.4% $23.72 Average Loan to PNFP 14.0% Billion 86% Deposit Ratio1 ASB 13.8% Peer Average BXS 13.8% Total Deposits FULT 13.8% FCNC.A 13.6% BOKF 13.4% Core Deposits WBS 13.4% - Non-Interest PB 13.4% UMBF Bearing 13.2% Certificates of - Interest Checking WTFC 12.8% Deposit 8% 92% ONB - Savings and 12.7% Money Market HWC 12.4% VLY 12.2% FNB 11.9% 1S&P Global Market Intelligence, Information as of June 30, 2020 2Period-end balances, as of September 30, 2020 3Includes loans held for sale, as of QTD September 30, 2020 13

MAINTAINING STRONG CREDIT QUALITY Net Loan Charge-Offs (NCOs) Allowance for Credit $ in millions Losses on Loans (ACL) $28.9 $ in millions $294.9 $240.7 $236.4 $160.7 $11.5 .53% $144.3 $7.9 $8.4 $7.6 1.47% 1.44% .32% .21% 1.38% .18% .17% 1.11% .76% 3Q2019 2Q20 3Q20 3Q19 2Q20 3Q20 NCOs- CBSH NCO/Average Loans1 - CBSH ACL - CBSH ACL / Total Loans2 - CBSH NCOs - Peer Average NCO/Average Loans1 – Peer Average ACL - Peer Average ACL / Total Loans – Peer Average Non-Performing Loans (NPLs) Allowance for Credit Losses on Loans (ACL) to NPLs $ in millions $147.3 13.7x $120.2 10.6x .67% .68% .25% 5.9x .14% .08% $40.3 $22.6 2.7x $11.7 1.5x 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 NPLs - CBSH NPLs / Total Loans - CBSH ACL / NPLs - CBSH ACL / NPLs - Peer Average NPLs - Peer Average NPLs / Total Loans – Peer Average Percentages are illustrative and not to scale; Peer Banks include: ASB, BOKF, BXS CFR, FCNC.A, FNB, FULT, HWC, ONB, OZK, PB, PNFP, SFNC, UBSI, UMBF, UMPQ, VLY, WBS, WTFC 1As a percentage of average loans (excluding loans held for sale) 2Excluding PPP loans, allowance for credit losses on loans to total loans was 1.59% and 1.62% as of September 30, 2020 and June 30, 2020, respectively 14

NET INTEREST INCOME: YTD – September 30, 2020 Quarterly Net Interest Income $220 4.0% • Net interest income (tax equivalent) increased $12.9 (Tax Equivalent) million over the prior quarter, which included growth $210 3.8% of $6.3 million in TIPs inflation income. 3.6% NetYield $200 3.4% • The net yield on interest earning assets increased 3 basis points over the previous quarter. $190 3.2% • The increase over 2Q 2020 reflected higher average $180 3.0% $ in millions $ in 2.8% loan and investment securities balances coupled with lower deposit costs. $170 2.6% Net interest income – income interestNet $160 2.4% 3Q19 4Q19 1Q20 2Q20 3Q20 2019 Net int inc 2020 Net int inc TIPs Interest - $ in 000s $8,000 260 Net Yield Adjusted Net Yield* 258 $6,000 *Adjusted to exclude TIPs inflation income 256 254 $4,000 252 CPI-U 250 Tax equivalent -YTD 2019 2020 Change $2,000 248 Rates earned - assets 3.96% 3.25% (0.71)% $0 246 Interest income Interest 244 -$2,000 242 Rates paid - liabilities 0.69% 0.31% (0.38)% 240 -$4,000 238 Net yield - earning assets 3.52% 3.07% (0.45)% 1Q17 1Q18 1Q19 2Q17 3Q17 4Q17 2Q18 3Q18 1Q20 2Q19 3Q19 4Q18 4Q19 2Q20 3Q20 Normal int. Inflation inc. CPI-U 1515

NIM PROTECTION Hedge against lower interest rates by purchasing interest rate floor contracts Floor Impact on Loan Yields Assumes Loans at LIBOR +200bps 8% Unhedged Illustrative 2.5% Floor (effective 6/1/2020, monetized 7/2020) Entered into three interest rate floors with a combined notional 2.25% Floor (effective 1/1/2020, monetized 7/2020) 6% value of $1.5 billion, to hedge the 2% Floor (effective 12/15/2020) risk of declining interest rates on floating rate commercial loans Current 1ML: 0.15%* indexed to 1 Month LIBOR. Each 4% contract had a term of 6 years. Loan Yield 2% Two floors were monetized in 2020 with $95 million in gains to be recognized in earnings through 2026. 0% 0.0%0.5% 1.0% 1.5%2.0% 2.5%3.0% 3.5% 4.0% 4.5% 5.0% 1 Month LIBOR *As of October 13, 2020 16 16

A FULL-SERVICE, DIVERSIFIED OPERATING MODEL Card, Wealth & Deposit fees provide stable, growing revenue source Non-Interest Income Net Interest Income $ in millions As of Sept 30 3% $525 $461 $501 10% Wealth Management $422 $447 2% $381 $371 7% Deposit Service Charges Commerce Fees and Commissions 1 Bank Card Income 13% 2015 201620172018 2019 YTD YTD 65% Other 2019 2020 Continued focus on growing fee income through new 13% 2% and existing product and service offerings 4% Examples: 4% Peer • toggle® • Accounts Payable Automation • • 6% Banks1 Remitconnect™ Interest Rate Swaps • • 71% Claims Payments CommerceHealthcare™ • Horizons • Asset Management Peer Banks include: ASB, BOKF, BXS CFR, FCNC.A, FNB, FULT, HWC, ONB, OZK, PB, PNFP, SFNC, UBSI, UMBF, UMPQ, VLY, WBS, WTFC 1Sources: S&P Global Market Intelligence & FIS as of June 30, 2020 17

WELL-DIVERSIFIED LOAN PORTFOLIO Business Loans YTD Average Loans2 $s in millions 3% Construction $15,756 17% Business RE $14,243 $13,629 $13,946 38% Residential RE $12,953 Commerce Consumer/HELOCs 18% Bank1 Credit Card 2016 2017 20182019 2020 Loans Held for Sale 6% 2020 Loan Growth by Category 18% 8% 1% (Average loans Sept. 2020 vs. Jun. 2020) 17% 33% Personal RE $140 million Peer Business RE & construction $106 million Banks1 Auto/ motorcycle/ other $48 million 8% Consumer credit card $18 million 33% Business/ lease/ tax-free $52 million Peer Banks include: ASB, BOKF, BXS CFR, FCNC.A, FNB, FULT, HWC, ONB, OZK, PB, PNFP, SFNC, UBSI, UMBF, UMPQ, VLY, WBS, WTFC 1Source: S&P Global Market Intelligence & FIS as of June 30, 2020 2Includes loans held for sale, as of September 30, 2020 18

PAYCHECK PROTECTION PROGRAM IMPACT AND UPDATE 7,618 Total SBA PPP $1.5BTotal SBA PPP $206KAverage SBA PPP $34KMedian SBA PPP loans approved secured funding loan size loan size Business Loan Yield QTD Avg As of September 30, 2020 AS OF SEPTEMBER 30 3.02% • Total PPP loan balance: 2.95% $1.5 billion 2.92% • Loan forgiveness application process has started Business Business PPP Loan Yield Loan Yield Loan Yield excluding PPP Information as of September 30, 2020 19

SUMMARY OF FIXED & FLOATING LOANS Nearly 58% of total loans are variable; 65% of commercial loans have floating rates; mostly tied to a LIBOR index Fixed Variable Business Construction Business RE Total Loans: $5.6B Total Loans: $0.9B Total Loans: $2.8B 4% 35% 44% 56% 65% Commercial 96% Personal RE Consumer HELOC Consumer Card Total Loans: $2.4B Total Loans: $2.0B Total Loans: $0.3B Total Loans: $0.8B 2% 7% 32% 32% 68% 68% Consumer 98% 93% 20 Source: 2019 10K, as of 12/31/2019 20

HIGH QUALITY, HIGHLY LIQUID AND DIVERSE INVESTMENT PORTFOLIO Composition of AFS Portfolio AFS Portfolio as of September 30, 2020 Total average investments3 $11.5 billion 4% 9% Treasury & agency 14% Unrealized gain3 $368.2 million 15% Municipal 12 month maturities / pay-downs $1.7 billion MBS Duration Other asset backed December 2017 3.0 years December 2018 3.2 years Corporate December 2019 3.0 years 58% September 2020 3.4 years YTD Tax Equivalent Rate – Investments4 Duration QTD - September 30, 2020 Avg Rate 2.8% 2.8% (yrs) 2.8% Treasury & agency1 3.7% 3.0 2.6% 2.5% Municipal 2.5%2 5.4 2.4% 2.4% 2.4% MBS 2.0% 3.1 2.2% Other asset-backed 1.9% 1.8 2.0% Corporate 2.4% 5.2 2016 20172018 2019 YTD 2020 1 2 3 Excludes inflation effect on TIPs; Tax equivalent yield; QTD averages; 21 4Information as of December 31 for prior years; YTD 2020 is as of September 30 21

IMPACT OF CECL: ALLOCATION OF ALLOWANCE CECL allowances reflect the economic and market outlook due to COVID-19 December 31, 2019 June 30, 2020 September 30, 2020 Incurred Model CECL Model CECL Model Methodology and Allowance Allowance Variables Allowance % of for Credit % of for Credit % of • for Loan Outstanding Losses Outstanding Losses Outstanding CECL model utilizes 3rd $ in millions Losses Loans (ACL) Loans (ACL) Loans party baseline forecast Business $ 44.3 .80% $ 89.7 1.31% $ 78.7 1.18% • Key variables include: Bus R/E 25.9 .91% 23.2 .79% 31.3 1.05% GDP, disposable Construction 21.6 2.40% 17.6 1.89% 18.4 1.83% income, unemployment Commercial total $ 91.8 .99% $ 130.5 1.22% $ 128.4 1.20% rate, various interest Consumer 15.9 .81% 24.3 1.24% 18.2 .90% rates, CPI inflation rate, Consumer CC 48.0 6.27% 76.0 11.39% 79.2 12.23% HPI, CREPI and market Personal R/E 3.1 .13% 7.7 .29% 8.7 .32% volatility Revolving H/E .6 .18% 2.1 .63% 1.8 .55% • Overdrafts 1.2 19.51% .1 2.00% .1 2.56% Q3 provision for credit Consumer total $ 68.9 1.27% $ 110.2 1.95% $ 108.0 1.88% loss expense of $3.1 Allowance for credit losses on loans $ 160.7 1.09% $ 240.7 1.47% $ 236.4 1.44% million, includes $4.5 Liability for unfunded lending million CECL related commitments 1.1 35.3 35.2 reserve decrease Total allowance for credit losses $ 161.8 $ 276.0 $ 271.6 * Note: The Liability for unfunded lending commitments is included in Other liabilities on the consolidated balance sheets. 22

NET LOAN CHARGE-OFFS: YTD – September 30, 2020 2020 YTD YTD Actual Loss • Loss rate on credit card $ in 000s 2019 2020 $ Chge Rate loans increased from Business $ 1,066 $ 3,084 $ 2,018 0.07% 2.17% in the prior quarter Overdraft 1,016 942 (74) 39.16% to 4.47% this quarter. Construction (117) (1) 116 0.00% • Relief program Business R/E (95) (40) 55 0.00% implemented in Q2, Personal R/E 50 (273) (323) (0.01)% which allowed credit Consumer 5,716 3,284 (2,432) 0.22% card customers to skip payments for 2 months, HELOC 254 (158) (412) (0.06)% ended. Credit card 26,592 20,004 (6,588) 3.93% Total $ 34,482 $26,842 $(7,640) 0.23% $300 Non-Performing Assets & ACL - Loans 0.5% $15 90-Day Delinquencies: Credit Card & Consumer Loans $250 0.4% to Loans NPAs $200 $10 0.3% $150 0.2% $100 $5 $ in millions $ in $ in in millions $ $50 0.1% $0 0.0% $0 2016 2017 2018 2019 3Q2020 Sep18Mar19 Sep19 Mar20 Sep20 $ Allow for Credit Losses - Loans % NPAs to Total Loans Credit card Consumer $ Non-Perform Assets 23

COMMERCE AND COVID-19 24

PROVIDING RELIEF TO OUR CUSTOMERS Active deferral exposure reduced as pandemic continues Payment Relief Requests Active deferrals1 Cumulative deferrals1 through July 16, 2020 as of September 30, 2020 Number Total Number Total % of Portfolio2 % of Portfolio Loan Type of Amount of of Amount of (by $ amount) (by $ amount) Requests Requests Requests Requests Commercial 741 7.8% $720MM 11 .5% $48MM Mortgage 192 1.9% $48MM 111 1.0% $25MM Consumer Card 1,597 1.5% $10MM 73 .1% $0.5MM Installment 3,940 5.8% $76MM 553 .8% $11MM Med/HSF3 3,427 4.3% $9MM 76 .1% $0.2MM TOTAL 9,897 6.2% $863MM 824 .6% $85MM 1Deferrals are defined as modifications, payment deferrals, forbearance agreements, or change in terms 2 Portfolio as of June 30, 2020 3 No direct consumer credit exposure. 25

LOAN PORTFOLIO: LIMITED EXPOSURE TO PANDEMIC-SENSITIVE INDUSTRIES While we expect nearly every industry to be impacted to some degree by Coronavirus-related disruptions, we have identified eight industries that will be most impacted. % of Loan Portfolio $ in $ in Loan Outstandings Highest Impacted millions millions Portfolio Highest Industries 6/30 9/30 9/30 Impacted Hospitals $757 $758 5.1% Industries Multifamily / Student Housing 568 608 4.1% 18% CRE Retail 392 389 2.6% Senior Living 302 310 2.1% Hotels 285 291 2.0% Energy 168 150 1.0% 82% Retail Stores 136 141 .9% All Restaurants 82 67 .4% Other Total $2,690 $2,714 18.2% Loans Industry breakdowns represent outstanding balances, excluding PPP loans, as of September 30, 2020, segmented by NAICS codes 26

STRONG CAPITAL POSITION – FLEXIBILITY IN CAPITAL PLANNING 52 consecutive years of regular common cash dividend increases1 Capital Returned to Common Shareholders as a percentage of Net Income2 $300 Cash dividends paid on common stock (left) 200% $250 Common share repurchase (left) % Payout (right) 150% $200 $150 100% $100 $ in millions $ 50% $50 (%) Ratio Payout $0 0% 201020112012 2013 2014 2015 2016 20172018 2019 Capital Ratios – 6/30/2020 • Special cash dividend paid in 2012 totaled $131 million. • 2014 included $200 million accelerated share repurchase in conjunction Tier 1 common risk-based capital 13.3% with preferred stock issuance. Tier 1 risk-based capital 14.0% • 2015 included a $100 million accelerated share repurchase. Total risk-based capital 15.2% • 2019 included a $150 million accelerated share repurchase. • Common cash dividends increased 10% in 2018, 16% in 2019 and 9% in 1Based on 1st quarter 2020 declared dividend; 2Net Income is 2020 (based on 1Q2020 declared dividend). defined as Net Income Available to Common Shareholders 27 27

STRATEGIC POSITION 28

STRATEGIC POSTURE: MAINTAINING THE BALANCE STRONG PERFORMANCE with Disciplined focus on PRIORITY ongoing refinement of the BLUE CHIP investments “Core Bank” • Diversity, Equity and • Super-Community Bank platform Inclusion • • Relationship-based banking Develop Claims Payment • • Accelerate Growth in High-touch customer service Healthcare • Full suite of product and service • Enhance Consumer Digital offerings • Accelerate Expansion Market • Disciplined attention to risk return Growth • • Retain and Grow Mass Affluent Divest in businesses & activities Households that no longer provide acceptable • Enhance Enterprise Customer returns Relationship Management • A highly engaged team (CRM) • • Focus on profitability and Implement Transform 360 shareholder return • Enhance the People Experience Commerce …emphasis on culture, collaboration and core values EDGE 29

GROWTH MINDSET: CONSUMER BANKING Enhancing the Customer Experience Engaging with customers through the channels they prefer. CommercePremier Branch Design Advanced ATMs • Technology investments • New engagement programs • Enhanced product offerings • Improved operating model Video Advisors Exploration Centers Consumer Digital Business 2018 2019 Evolving our digital experiences to meet our customers’ expectations. 25 22 4.7 releases releases 74k ratings • Digital Mortgage application • CommercePremier user interface • Mobile push notifications, improved alerts management • Pilot Appointment setting solution 30

GROWTH MINDSET: INTERNAL INNOVATION AT COMMERCE Internal software development Commerce’s commitment to As innovation and technology rapidly events to rapidly build, test, and promoting an innovative mindset, drive change, our customers’ needs TOOLS promote new products or services from everyday incremental and expectations continue to evolve. for both internal and external improvement to transformative AGILE enables our organization to customers. changes in the way we do business. meet this disruption head on. TRUST CRM Target Operating Model Customer Advising & Commerce’s (TOM) is an initiative to Referral Assistant (CARA) Commerce Trust implementation of a help Commerce design a is a guided conversation Company’s A Bank-wide single, integrated future operating model tool that helps us better implementation of a project to replace Customer Relationship across people, process, understand our Customer Relationship the existing Management (CRM) and technology to simplify customers’ needs, make Management (CRM) mainframe core platform that will processes, drive consistent platform to improve system with a KEY PROJECTS KEY enable commercial consistency, and improve recommendations, and sales, service levels, and new and modern business lines to efficiencies in a way that free up time to fulfillment interactions solution. improve sales, service, can best support the concentrate on building with clients. and fulfillment commercial lending model relationships with our interactions with clients. and customer experience. clients. 31

CONSUMER BANKING SNAPSHOT 164 $10.4 $4.2 1.1 Full-service BILLION BILLION MILLION branches Consumer Consumer Consumer 366 Deposits Loans* Households* ATMs Focus on Digital Commerce Digital HH Digital Loan Mobile Bank App Rating Penetration Sales (000s) Deposit Use 4.7 46% $42,755 13% 4.7 Period end balances, information as of December 31, 2019; App store rating as of 1/15/2020 32 *Excludes Trust Company / Private Banking households 32

For high net worth individuals who are looking to simplify their complex financial life, Commerce Trust Company provides a full-service approach to wealth management. Key Growth Initiatives TH • Implement new Private 20Largest Among $57 $34 $539 Banking Lending Program Bank-Managed BILLION BILLION MILLION Total Client Assets Under Managed • Accelerate growth of Mass Trust 2 Companies1 Assets Management Brokerage Affluent households Assets • Implement enhanced 2 sales process with new Total Client Assets Assets Under Management Client Relationship $ in billions $ in billions Management system $56.7 $48.7 $50.0 • $43.1 Expand the CTC brand $38.4 $34.4 $30.0 $30.3 • $25.4 Enhance the digital client $22.6 experience • Invest in team training and onboarding resources 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Period end balances, information as of December 31, 2019 33 1S&P Global Market Intelligence ranking as of 12/31/2019, based on assets under management 2Assets under administration 33

COMMERCIAL BANKING Revenue growth opportunities Financing solutions – options for all sizes and types of businesses • Equipment Financing • Working Capital Lines of Credit • Government Lending Programs • International Financing • Term Financing • Interest Rate Swaps • Employee Stock & Ownership Financing • Construction & Real Estate Loans • Floor Plan Lending • Tax-exempt Financing $9.6 $8.1 $547 BILLION BILLION MILLION Commercial Commercial Commercial Loans Deposits Revenue Commercial Loans Commercial Deposits Commercial Revenue $ in billions $9.6 $ in billions $ in millions $548 $9.1 $547 $8.9 $8.0 $8.1 $7.9 $514 2017 2018 2019 20172018 2019 2017 2018 2019 Commercial segment as of December 31, 2019 34

COMMERCIAL BANKING – EXPANSION MARKETS OFFER GROWTH OPPORTUNITIES Expansion Market Loan Growth Expansion Fee Income $ in millions Market Loan Team Overview for Growth $2,316 Growth Expansion Markets $2,200 # of team members per market 89% (includes open positions) $1,913 98% since 2015 since 2015 2012 2019 $1,619 $1,338 Oklahoma 31 52 Texas 3 23 Denver 41 47 Cincinnati/ 11 13 Indianapolis 2015 2016 2017 2018 2019 Expansion Markets Nashville 3 6 • Cincinnati • Houston • • Oklahoma Nashville Dallas Indianapolis Des Moines 0 3 • Denver • Nashville Texas Des Moines • Des Moines • Oklahoma City • • Grand Rapids 0 2 Denver Grand Rapids Grand Rapids Tulsa Cincinnati & Indianapolis Period end balances as of December 31, 2019 35

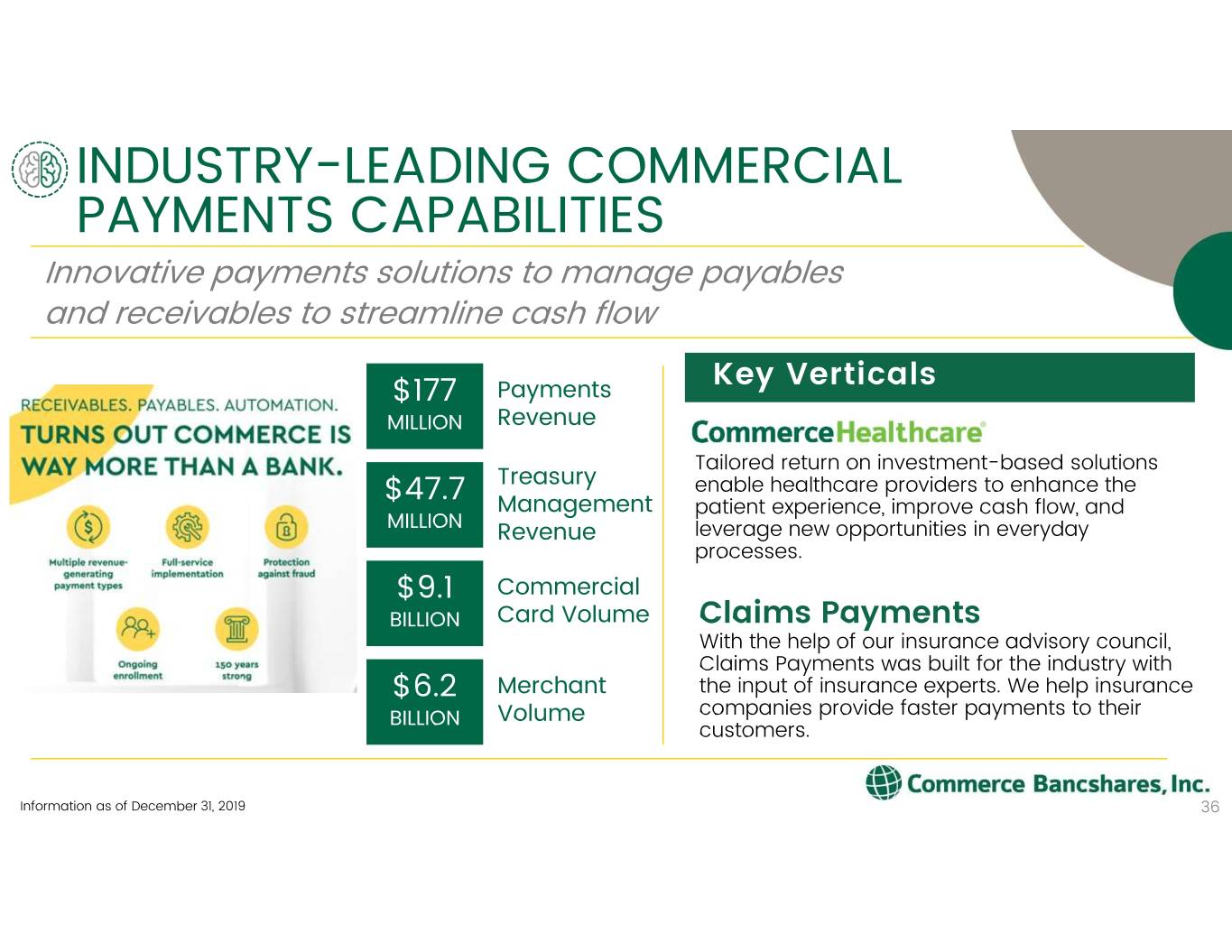

INDUSTRY-LEADING COMMERCIAL PAYMENTS CAPABILITIES Innovative payments solutions to manage payables and receivables to streamline cash flow Key Verticals $177 Payments MILLION Revenue Tailored return on investment-based solutions Treasury enable healthcare providers to enhance the $47.7 Management patient experience, improve cash flow, and MILLION Revenue leverage new opportunities in everyday processes. $9.1 Commercial BILLION Card Volume Claims Payments With the help of our insurance advisory council, Claims Payments was built for the industry with $6.2 Merchant the input of insurance experts. We help insurance companies provide faster payments to their BILLION Volume customers. Information as of December 31, 2019 36

CARD PRODUCTS – A LEADER AMONGST TOP 50 U.S. BANKS Consistently ranked among the top issuers in the Nilson Report Commercial Consumer Commercial#12 Purchasing#7 1 #12Bank Consumer#12 #19Debit #14Prepaid Card Issuer Card Issuer Acquirer Card Card Card A full suite of innovative card and payment product offerings • Health Services Financing • Claims Payments • Multi Account Chip • Co-Brand • toggle® • Prepaid Expense • Contactless Visa® Debit Card Early adopter 1 Includes fleet cards Source: Nilson Reports (Debit: April 2019; Consumer Card: February 2019; Prepaid: July 2019; Merchant: March 2019; Purchasing: June 2019; Commercial Card: June 2019), based on the top 50 U.S. banks ranked by total assets as of 12/31/2018, S&P Global Market Intelligence 37

COMMERCE BANK MAINTAINS SOLID PERFORMANCE OVER TIME Return on Average Assets 2.0% 1.5% ROAA 10-yr average 1.0% CBSH: 1.31% 0.5% Peers: 1.00% 0.0% 20102011 2012 2013 2014 2015 2016 20172018 2019 Commerce Peer Banks Large Banks Return on Average Common Equity 20.0% 15.0% ROACE 10-yr average 10.0% CBSH: 12.4% 5.0% Peers: 8.4% 0.0% 201020112012 20132014 2015 2016 2017 2018 2019 CommercePeer Banks Large Banks Peer Banks include ASB, BOKF, BXS, CFR, FCNC.A, FNB, FULT, HWC, ONB, OZK, PB, PNFP, SFNC, UBSI, UMBF, UMPQ, VLY, WBS, WTFC Large Banks include: JPM, BAC, C, WFC, USB, PNC, FITH, RF Sources: S&P Global Market Intelligence and company reports and filings as of 12/31/2019 38

STEADY SHAREHOLDER RETURNS as of September 30, 2020 Annualized Comparison Total Shareholder Returns Total Shareholder Returns Indexed, 09/30/2005 = $100 Percent CBSH NASDAQ Bank 400 S&P 500 KBW Bank COMMERCE 20% 350 NASDAQ 10% BANK 300 0% KBW BANK 250 S&P 500 -10% 200 -20% 150 -30% 1 Year 3 Year5 Year 10 Year 15 Year 100 CBSH -0.9% 5.8% 11.4% 11.9% 8.1% 50 S&P 15.1% 12.3% 14.1% 13.7% 9.2% NASDAQ 0 BANK -28.6% -11.5% 0.4% 6.6% 1.1% 20062008 2010 20122014 2016 2018 2020 KBW BANK -24.2% -7.0% 3.6% 7.0% 0.7% Consistent, positive returns to shareholders Significant outperformance relative to banks over long period Source: Bloomberg; data as of 09/30/2020 39

NON-GAAP RECONCILIATIONS Pre-tax, Pre-provision Net Revenue For The Three Months Ended (DOLLARS IN THOUSANDS) Sept. 30, 2020 June 30, 2020 Sept. 30, 2019 A Net Interest Income $ 215,962 $ 203,057 $ 203,512 B Non-Interest Income $ 129,572 $ 117,515 $ 132,743 C Non-Interest Expense $ 190,858 $ 187,512 $ 191,020 Pre-Provision Net Revenue (A+B-C) $ 154,676 $ 133,060 $ 145,235 40

Contact Information: Matthew Burkemper Senior Vice President, Commerce Bank Corporate Development and Investor Relations 314.746.7485 Matthew.Burkemper@commercebank.com Commerce Bancshares, Inc. Investor Relations website: http://investor.commercebank.com/

Embracing a Growth Mindset