Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SMART Global Holdings, Inc. | dp138875_ex9901.htm |

| 8-K - FORM 8-K - SMART Global Holdings, Inc. | dp138875_8k.htm |

Exhibit 99.2

OCTOBER 19, 2020 SMART to Acquire Cree LED Business

2 This presentation and oral communications made during the course of this presentation contain statements that constitute forward - looking statements. Many of these forward - looking statements can be identified by the use of forward - looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others. Forward - looking statements include, but are not limited to, statements regarding the Company’s intent, belief or current expectations. Forward - looking statements are based on management’s beliefs and assumptions and on information currently available to management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in forward - looking statements due to various factors, including, but not limited to, those relating to the following: our inability to obtain or delays in obtaining all regulatory approvals and otherwise completing all steps required to close on the acquisition of Cree LED; issues, delays or complications in completing the acquisition of Cree LED or in the transitioning the carveout of Cree LED to a standalone business separate from Cree, Inc.; incurring unanticipated costs in completing the acquisition of Cree LED; the ability of Cree LED to generate anticipated revenue and profits post - transaction close; risks associated with integration or transition of the operations, assets, systems and personnel of Cree LED; unfavorable reaction to the sale by customers, competitors, suppliers and employees of Cree LED; risks relating to the COVID - 19 pandemic that might delay or otherwise impact our ability to complete the transaction or transition operations and employees of Cree LED; business and economic conditions and growth trends in the technology industry, our customer markets and various geographic regions; global economic conditions and uncertainties in the geopolitical environment; disruptions in our operations or in global markets as a result of the outbreak of COVID - 19; trade regulations and relations; changes in currency exchange rates; overall information technology spending; appropriations for government spending; the success of our strategic initiatives including additional investments in new products, additional capacity and acquisitions; the DRAM market and the temporary and volatile nature of pricing trends; deterioration in customer relationships; production or manufacturing difficulties; competitive factors; technological changes; difficulties with or delays in the introduction of new products; slowing or contraction of growth in the memory market in Brazil; reduction in or termination of local content requirements in Brazil; changes to applicable tax regimes or rates; prices for the end products of our customers; fluctuations in material costs and availability; strikes or labor disputes; deterioration in or loss of relations with any of our limited number of key vendors; changes in the availability of supply of materials, components or memory products; the inability of Penguin Computing to obtain and retain security clearances to expand its government business; other factors that may affect the Company’s financial condition, liquidity and results of operations; and other risk factors discussed under the caption “Risk Factors” in our current filings with the SEC. Such factors and risks as outlined above and in such filings may not constitute all factors and risks that could cause actual results of SMART to be materially different from the historical results and/or from any future results or outcomes expressed or implied by such forward - looking statements. SMART and its subsidiaries operate in a continually changing business environment and new factors emerge from time to time. SMART cannot predict such factors, nor can it assess the impact, if any, from such factors on SMART or its subsidiaries’ results. Accordingly, investors are cautioned not to place undue reliance on any forward - looking statements. Forward - looking statements should not be relied upon as a prediction of actual results. Forward - looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events, except as otherwise required by the rules and regulations of the SEC. Certain information included in this presentation was obtained from third parties and has not been independently verified by the Company. This presentation also includes certain non - GAAP financial measures. These non - GAAP financial measures are in addition to, and not as a substitute for or superior to measures of financial performance prepared in accordance with GAAP. There are a number of limitations related to the use of these non - GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non - GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non - GAAP financial measures as tools for comparison. Forward - looking Statements

Cree LED Transaction Overview Mark Adams, President and CEO

4 Transaction overview Terms & Financing • Transaction valued at up to $300 million • Initial purchase price of $ 175M • $ 50M cash payment upon closing • $ 125M in a seller - financed note payable interest only with principle due August 2023 • Additional potential earnout of up to $ 125M Financial Benefits • Expected to be immediately accretive to Non - GAAP EPS and Free Cash Flow Timing • Expected to close in the first calendar quarter of 2021 Closing Considerations • Subject to customary closing conditions, including regulatory approvals

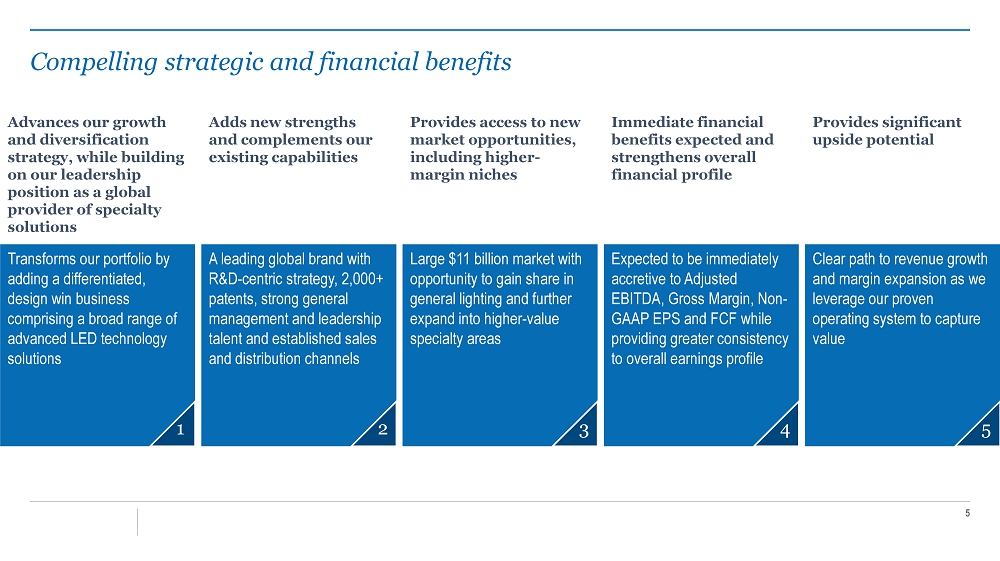

5 Compelling strategic and financial benefits Advances our growth and diversification strategy, while building on our leadership position as a global provider of specialty solutions Transforms our portfolio by adding a differentiated, design win business comprising a broad range of advanced LED technology solutions Adds new strengths and complements our existing capabilities A leading global brand with R&D - centric strategy, 2,000+ patents, strong general management and leadership talent and established sales and distribution channels Provides access to new market opportunities, including higher - margin niches Large $11 billion market with opportunity to gain share in general lighting and further expand into higher - value specialty areas Immediate financial benefits expected and strengthens overall financial profile Expected to be immediately accretive to Adjusted EBITDA, Gross Margin, Non - GAAP EPS and FCF while providing greater consistency to overall earnings profile Provides significant upside potential Clear path to revenue growth and margin expansion as we leverage our proven operating system to capture value 1 2 3 5 4

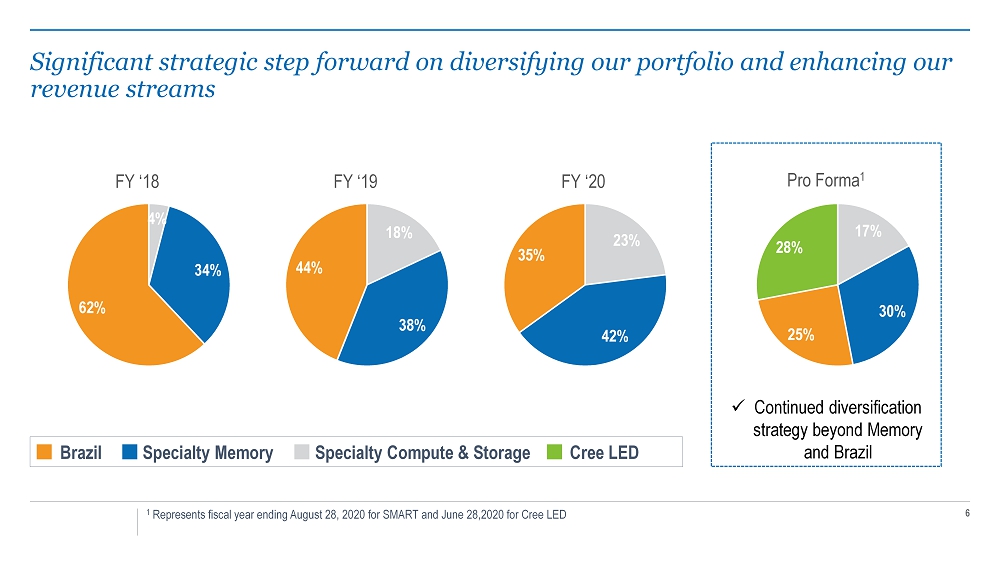

6 x Continued diversification strategy beyond Memory and Brazil Significant strategic step forward on diversifying our portfolio and enhancing our revenue streams 4% 34% 62% FY ‘18 Brazil Specialty Memory Specialty Compute & Storage Cree LED 18% 38% 44% FY ‘19 23% 42% 35% FY ‘20 17% 30% 25% 28% Pro Forma 1 1 Represents fiscal year ending August 28, 2020 for SMART and June 28,2020 for Cree LED

7 Our proven operating system is a sustainable competitive advantage… Proven Operating System IT Optimization Supply Chain/ Inventory Control Global Manufacturing Centers of Excellence (Finance / HR) Customer Relationship Management

8 …Resulting in a strong track record of successful acquisitions Invest in and Expand Existing Lines of Businesses Continue to Strengthen Operational and Management Teams Execute Accretive & Synergistic M&A SMART Global Holdings Strategy Date Jun 2018 Jul 2019 Jul 2019 Oct 2020 Strategic Benefit Benefits from shared infrastructure and the ability to leverage the products and capabilities of SMART into the emerging AI and ML markets, advanced modeling and high - performance computing Advanced engineering capabilities to further develop leading edge system - on - module and single board computer products for IoT applications Entry into embedded computing market Strengthened product offerings and high - reliability technologies in embedded computing requirements Diversifies revenue base and broadens SMART capabilities, including strong R&D and IP portfolio, expands global sales, marketing channels, customer base and talent force Selected Financial Results Improved Gross Margin by 400 bps in Year 1 Improved Gross Margin by ~570 bps in Year 1 Achieved 50% Revenue Growth YoY Significant opportunity to expand gross margins by leveraging our proven operating system Just Announced

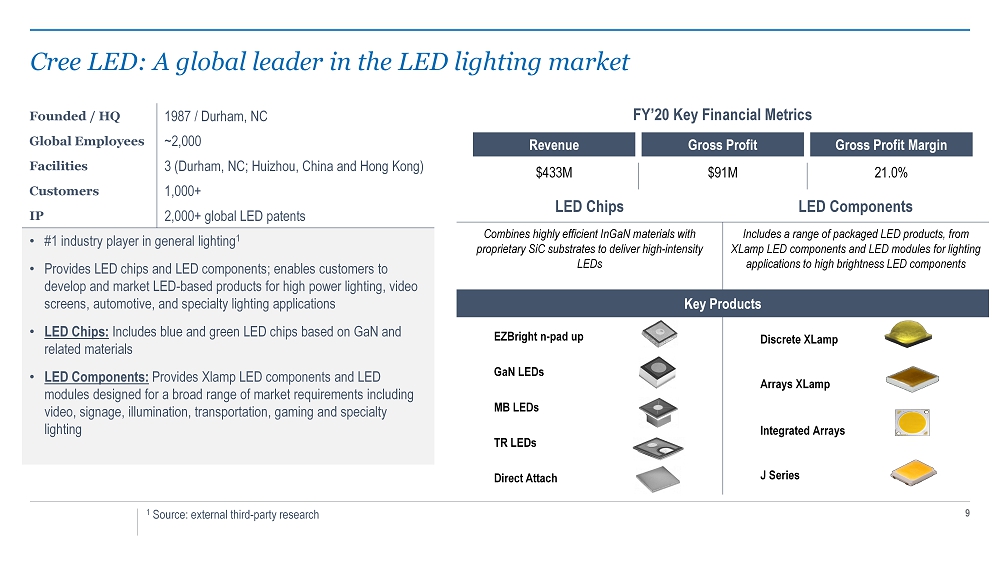

9 Cree LED: A global leader in the LED lighting market Founded / HQ 1987 / Durham, NC Global Employees ~2,000 Facilities 3 (Durham, NC; Huizhou, China and Hong Kong) Customers 1,000+ IP 2,000+ global LED patents • #1 industry player in general lighting 1 • Provides LED chips and LED components; enables customers to develop and market LED - based products for high power lighting, video screens, automotive, and specialty lighting applications • LED Chips: Includes blue and green LED chips based on GaN and related materials • LED Components: Provides Xlamp LED components and LED modules designed for a broad range of market requirements including video, signage, illumination, transportation, gaming and specialty lighting LED Chips LED Components Combines highly efficient InGaN materials with proprietary SiC substrates to deliver high - intensity LEDs Includes a range of packaged LED products, from XLamp LED components and LED modules for lighting applications to high brightness LED components Key Products EZBright n - pad up Discrete XLamp GaN LEDs Arrays XLamp MB LEDs Integrated Arrays TR LEDs J Series Direct Attach Revenue Gross Profit Gross Profit Margin $433M $91M 21.0% FY’20 Key Financial Metrics 1 Source : e xternal third - party research

10 Large total addressable market opportunity 1 End Market 2019 Revenue Contribution Applications End Uses General Lighting 58% Space illumination or ambient effects, Tunnels, parking, garages, outdoor retail displays, roadway display and street illumination, area/stadium lighting Specialty Lighting 30% Tailored specifications to differentiate specialty spaces, Studios/stages, commercial landscaping fixtures, horticulture and architectural illumination Large Format Video Screens 11% Outdoor/indoor displays and signage, Score boards, retail displays, billboards, and game machines Automotive 1% Headlamps, turn indicators Light bars, spotlights, headlights, daytime running lamps, rear/brake lights, turning lights, interior lights 1 2019 – 2024; source: company data and external third - party research Macro Trends Support Market Share Opportunity Growing focus on sustainability and testing / safety Growing consumer conscientiousness of environmental impact, increased regulations on testing and safety, ongoing government rebates to encourage adoption TAM $11 billion 5 - year 1 CAGR of 4.5% Increasing development of IoT smart lighting systems Rise in next - gen smart illumination systems that enable data - driven light adjustment for optimal environment control

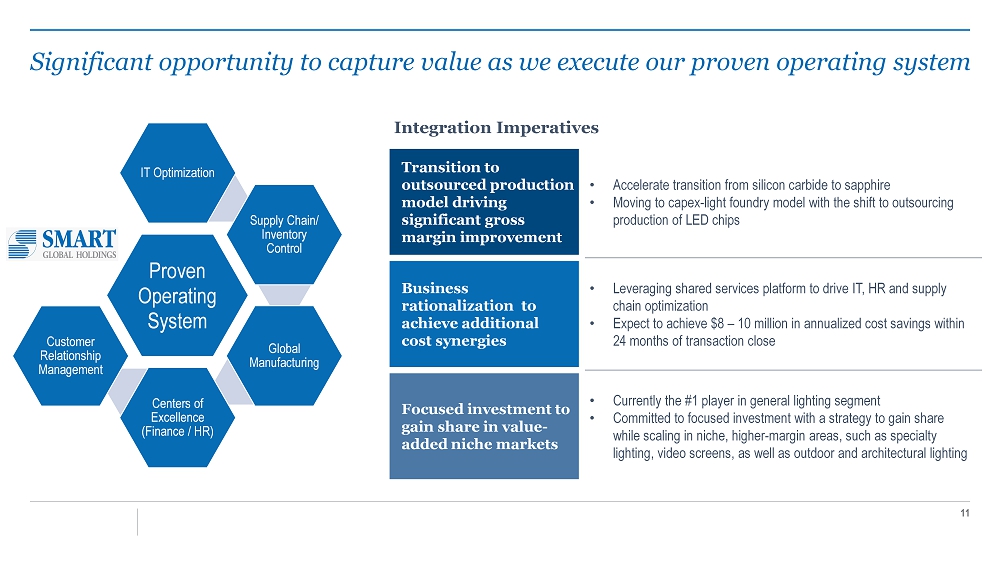

11 Significant opportunity to capture value as we execute our proven operating system Proven Operating System IT Optimization Supply Chain/ Inventory Control Global Manufacturing Centers of Excellence (Finance / HR) Customer Relationship Management Integration Imperatives Transition to outsourced production model driving significant gross margin improvement • Accelerate transition from silicon carbide to sapphire • Moving to capex - light foundry model with the shift to outsourcing production of LED chips Business rationalization to achieve additional cost synergies • Leveraging shared services platform to drive IT, HR and supply chain optimization • Expect to achieve $8 – 10 million in annualized cost savings within 24 months of transaction close Focused investment to gain share in value - added niche markets • Currently the #1 player in general lighting segment • Committed to focused investment with a strategy to gain share while scaling in niche, higher - margin areas, such as specialty lighting, video screens, as well as outdoor and architectural lighting

Cree LED Transaction Financial Overview Jack Pacheco, COO and CFO

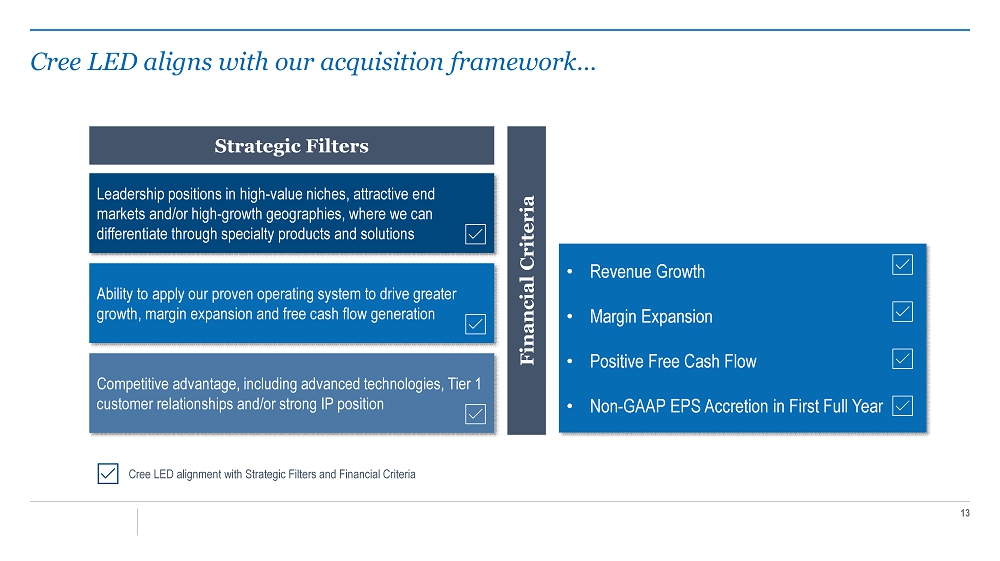

13 Cree LED aligns with our acquisition framework… Leadership positions in high - value niches, attractive end markets and/or high - growth geographies, where we can differentiate through specialty products and solutions Ability to apply our proven operating system to drive greater growth, margin expansion and free cash flow generation Competitive advantage, including advanced technologies, Tier 1 customer relationships and/or strong IP position Strategic Filters Financial Criteria • Revenue Growth • Margin Expansion • Positive Free Cash Flow • Non - GAAP EPS Accretion in First Full Year Cree LED alignment with Strategic Filters and Financial Criteria

14 …And significantly enhances SMART’s financial profile FY 2020 Actuals (SMART Global Holdings) Year 1 Targets (12 months post close) Revenue $ 1.1B $ 1.5B – $ 1.6B Gross Margin 1 19.8% 200 – 400 bps improvement Operating Margin 1 7.5% 150 – 250 bps improvement EPS 1 $2.59 $4.00 – $4.25 FCF $ 55M $ 25M – 35M increase 1 Non - GAAP

Closing Comments Mark Adams, President and CEO

16 Invest with us as we continue to transform SMART Global Holdings Executing our growth and diversification strategy, while building on our leadership position as a global provider of specialty solutions Strong cash generation capability supports organic and inorganic expansion Successful acquisition track record enabled by disciplined approach and proven operating system Addition of Cree LED is expected to be immediately accretive, strengthens our overall financial profile and provides catalysts for upside value creation

Appendix

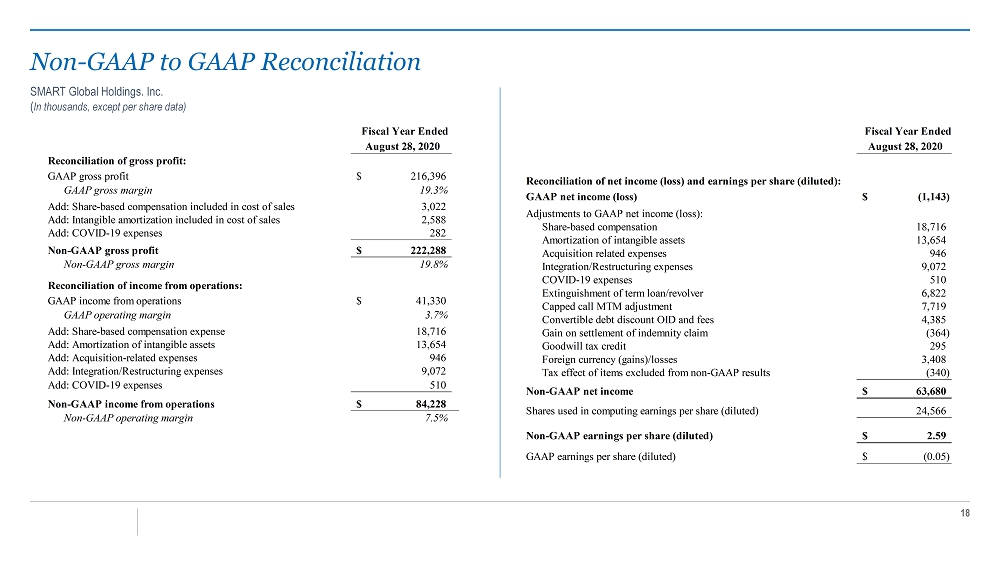

18 Non - GAAP to GAAP Reconciliation August 28, 2020 Reconciliation of gross profit: GAAP gross profit 216,396$ GAAP gross margin 19.3% Add: Share-based compensation included in cost of sales 3,022 Add: Intangible amortization included in cost of sales 2,588 Add: COVID-19 expenses 282 Non-GAAP gross profit 222,288$ Non-GAAP gross margin 19.8% Reconciliation of income from operations: GAAP income from operations 41,330$ GAAP operating margin 3.7% Add: Share-based compensation expense 18,716 Add: Amortization of intangible assets 13,654 Add: Acquisition-related expenses 946 Add: Integration/Restructuring expenses 9,072 Add: COVID-19 expenses 510 Non-GAAP income from operations 84,228$ Non-GAAP operating margin 7.5% Fiscal Year Ended August 28, 2020 GAAP net income (loss) (1,143)$ Adjustments to GAAP net income (loss): Share-based compensation 18,716 Amortization of intangible assets 13,654 Acquisition related expenses 946 Integration/Restructuring expenses 9,072 COVID-19 expenses 510 Extinguishment of term loan/revolver 6,822 Capped call MTM adjustment 7,719 Convertible debt discount OID and fees 4,385 Gain on settlement of indemnity claim (364) Goodwill tax credit 295 Foreign currency (gains)/losses 3,408 Tax effect of items excluded from non-GAAP results (340) Non-GAAP net income 63,680$ Shares used in computing earnings per share (diluted) 24,566 Non-GAAP earnings per share (diluted) 2.59$ GAAP earnings per share (diluted) (0.05)$ Reconciliation of net income (loss) and earnings per share (diluted): Fiscal Year Ended SMART Global Holdings. Inc. ( In thousands, except per share data)