Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IMMERSION CORP | immr8-k09222020.htm |

IMMERSION CORPORATION Sidoti Conference September 23-24, 2020

FORWARD-LOOKING STATEMENTS All statements, other than the statements of historical fact, are statements that may predictions as of the date of this presentation. Immersion does not intend to update be deemed forward-looking statements, including any statements of the plans, these forward-looking statements as a result of financial, business, or any other strategies, and objectives of management for future operations, and statements developments occurring after the date of this presentation. regarding projected future financial results. In addition, the use of the word “partner” or “partnership” does not imply a legal Immersion’s actual results may differ materially from those stated or implied by such partnership between Immersion and any other company. forward-looking statements due to risks and uncertainties associated with its business, which include but are not limited to negative trends in the macroeconomic Use of Non-GAAP Financial Information. In this presentation the Company will climate; delay in or failure to achieve commercial demand for Immersion’s or its be discussing non-GAAP measures of adjusted operating expenses and adjusted net licensees’ intellectual property, products or services; delay in or failure to achieve the income, which are adjusted from results based on GAAP. These non-GAAP financial acceptance of haptics as a critical user experience; the commercial success of measures are provided to enhance the user's overall understanding of the applications or devices into which Immersion's intellectual property or technology is Company’s current financial performance and the Company’s prospects for the licensed; potentially lengthy sales cycles and design processes; any changes to laws future and are not comprehensive of the Company’s financial results. Such measures that adversely affect Immersion's ability to license its intellectual should not be viewed as a substitute for the Company’s financial statements property; unanticipated difficulties and challenges encountered in managing prepared in accordance with GAAP. You can find a reconciliation of these metrics to operating expenses; potential restructuring charges; failure to retain key personnel; the reported GAAP results in the reconciliation tables provided in the appendix to potential and actual claims and proceedings relating to such matters; and other this presentation. A reconciliation of non-GAAP measures to corresponding GAAP factors. Many of these risks and uncertainties are beyond Immersion’s control. measures on a forward-looking basis is not available due to high variability and low visibility with respect to the charges which are excluded from these non-GAAP For a more detailed discussion of these factors, and other factors that could cause measures. actual results to vary materially, interested parties should review the risk factors listed in Immersion’s most recent Form 10-K and Form 10-Q, which are on file with the U.S. Securities and Exchange Commission and available at www.sec.gov. The forward-looking statements in this presentation reflect Immersion’s beliefs and 2 © 2020 Immersion

OUR MISSION TOUCH Our mission is to develop and expand the use of haptic technology to improve people’s MAKES THE interactions with their digital environment, making it intuitive, engaging, and helpful. EXPERIENCE We invent, accelerate, and scale haptic REAL experiences across markets where we can provide value. 3 © 2020 Immersion

IMMERSION AT A GLANCE WHAT WE DO 1993 SAN FRANCISCO Founded Headquarters • We build and demonstrate system solutions • We create new haptic applications and use cases 3B+ ~2,000 We essential software and new • provide Devices Patents techniques for building haptic system that improve performance and are more effective and efficient 60 150+ • We offer expertise in touch to enable Employees(1) Licensed customers customers to bring new experiences to market • We enable broad adoption by working across the ecosystem Alps Alpine Panasonic LG Bosch Samsung Samsung Google Continental Sony 4 Note: (1) As of September 19, 2020. © 2020 Immersion Source: Company information, press

IMMERSION MANAGEMENT TEAM Ramzi Haidamus Aaron Akerman Mike Okada Todd Conroy President & CEO CFO General Counsel and SVP, Research & Development SVP, IP Licensing & Legal Affairs President, Nokia Technologies CFO, Hypertec Group VP, Customer Experience, LogiSense EVP of Sales & Marketing, Dolby CFO, Lasik MD Group VP, IP Transactions & Legal Affairs, Dolby VP, Systems Engineering, BlackBerry Partner, Wilson Sonsini Goodrich & Rosati John Griffin Jared Smith Chris Ullrich Sophie Laval VP, Products & Marketing VP, Worldwide Sales Chief Technology Officer Head of Human Resources VP, Digital & Interactive Entertainment, Dolby VP, Strategic Alliances, ARM Ltd VP, Technology, Immersion Head of Human Resources, Montreal Studio Board Member, Minnetonka Audio Software VP, Licensing & Business Development, Rambus CTO, Haptify.com Founder / Principal HR Consultant, Xtensis Management 5 © 2020 Immersion

WE MAKE HAPTIC EXPERIENCES POSSIBLE Industry Experts in Haptic Development and Licensing of Software, Services, and IP SOFTWARE – Next-generation haptic creation tools – Efficient and scalable haptic codecs – Haptic rendering engine for any actuator – Integration with new sensor technologies, pressure and more HAPTIC DESIGN SERVICES TECHNOLOGY – Extensive catalog of user-validated haptic use cases – Custom multimodal (visual, audio, haptic) design services IMMERSION INTEGRATION LEADERSHIP EXPERTISE – Mechanical and engineering services – FAE program DESIGN LICENSING SERVICES & ENGINEERING TOOLS SUPPORT – Broad and deep portfolio of patents 6 © 2020 Immersion

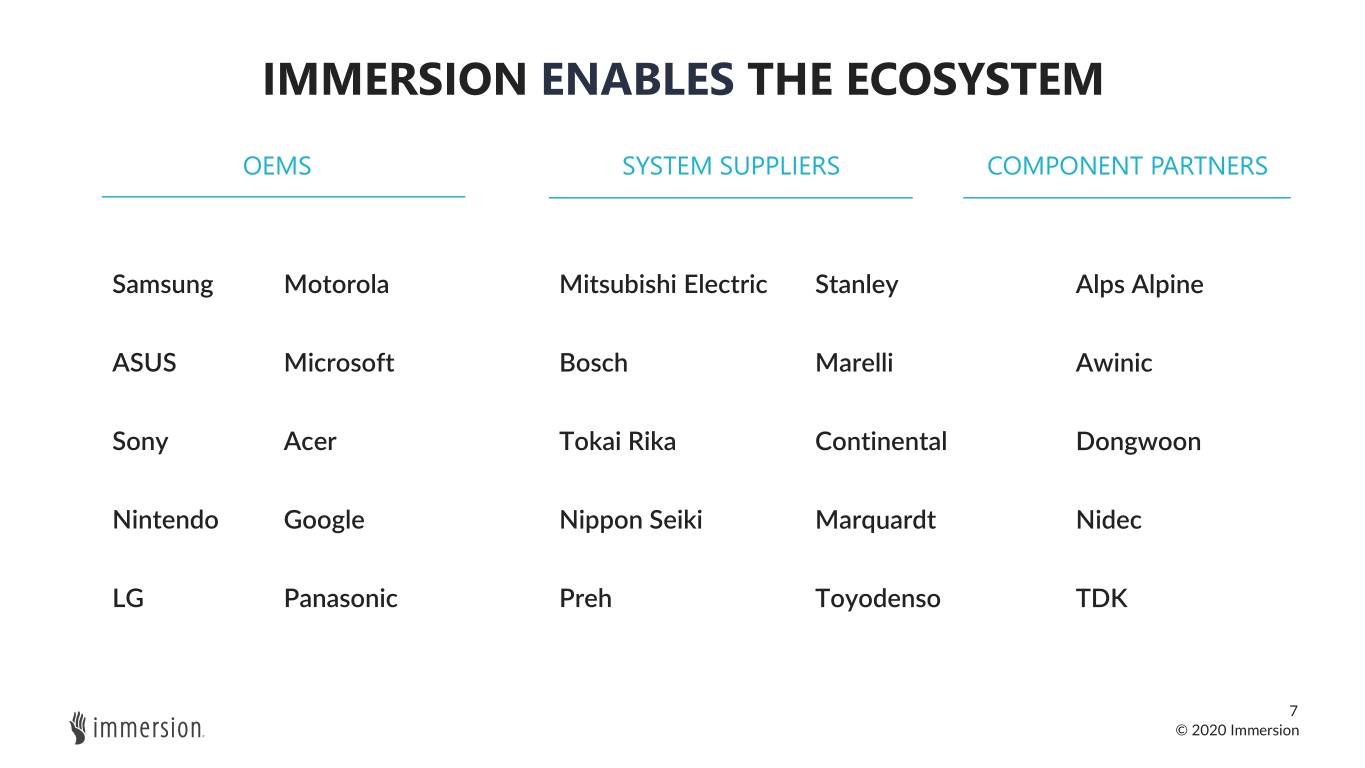

IMMERSION ENABLES THE ECOSYSTEM OEMS SYSTEM SUPPLIERS COMPONENT PARTNERS Samsung Motorola Mitsubishi Electric Stanley Alps Alpine ASUS Microsoft Bosch Marelli Awinic Sony Acer Tokai Rika Continental Dongwoon Nintendo Google Nippon Seiki Marquardt Nidec LG Panasonic Preh Toyodenso TDK 7 © 2020 Immersion

OUR TARGET MARKETS AUTOMOTIVE GAMING / VR MOBILE 8 © 2020 Immersion

AUTOMOTIVE Opportunity to scale intuitive touch experiences in automotive HMI and enhance safety USE CASES 2023 TAM* 90M+ CLIMATE CONTROL DASHBOARD BUTTON IN-CAR NAVIGATION BUTTON PANEL vehicles with touch TEXTURES surfaces We are investing in reference designs, firmware, and support to: – Accelerate market adoption of advanced haptic experiences – Expand use of haptics to multiple interfaces in car – Deliver and capture more value 9 *Source: IHS Markit, Inc. (2020) ©© 2020 2020 Immersion Immersion

COMMERCIAL AUTOMOTIVE IMPLEMENTATIONS OF HAPTIC TECHNOLOGY TOUCHSCREEN CONTROL KNOBS BUTTON PANEL 10 ©© 20202020 ImmersionImmersion

NISSAN ARIYA WILL FEATURE HAPTIC INTERFACES 11 © 2020 Immersion

GAMING & VR Opportunity to bring new, immersive experiences USE CASES 2023 TAM* 150M peripherals TRIGGER GAME VR TRIGGER HAPTIC CONTROLLER CONTROLLER HEADPHONES Ecosystem solutions for new experiences & gameplay possibilities 1212 *Source: Statista (2020), Strategy Analytics (2020), IDC (2020), Internal projections ©© © 20202020 2020 ImmersionImmersion Immersion

November 2020 IMMERSION & SONY PLAYSTATION 5 Holiday Launch Immersion and Sony Interactive Entertainment entered into licensing agreement for Advanced Haptics in May 2019. License covers gaming and VR controllers. 15–20M* PS4 sold units per year, PlayStation 5 DualSense controllers features 2014-2020 advanced haptics and adaptive trigger technology. Industry Excitement: “The haptic feedback precision allows us to do all “As a player, I’m 45M* sorts of new things. In Marvel’s Spider-Man: Miles excited to finally Total console market Morales, we’ll be hinting to players which direction FEEL which weapon unit sales per year attacks are coming from by providing haptic I’m holding in my 2006 - 2019 feedback from the appropriate direction on the hands...” DualSense wireless controller.” - Keith Lee, CEO - Brian Horton, Creative Director Counterplay Games Marvel’s Spider-Man: Miles Morales 13 *Source: Statista (2020), Quotes from PlayStation.blog (Aug 2020) ©© 20202020 ImmersionImmersion

MOBILE Opportunity to bring new, immersive experiences USE CASES 2023 TAM* 1.4B HD HAPTICS MOBILE GAMES & AR TACTILE ILLUSION smartphones Solutions for new mobile experiences possibilities: – License OEMs and select haptic supply chain solution providers – Partner with haptic component suppliers to establish a low friction license channel 1414 *Source: Gartner (2019) ©© © 20202020 2020 ImmersionImmersion Immersion

FINANCIAL OVERVIEW © 2020 Immersion

RECENT QUARTERLY PERFORMANCE Streamlined cost structure positions us for improved profitability as end-markets recover • Revenues on upward trend Recent Quarterly Performance prior to COVID-19 $20 • Recurring revenues greater $15 than 90% of total revenues in 1H 2020 $10 • Non-GAAP Opex down 64% from Q1-2019 to Q2-2020 $5 • On track to exit Q4 with Non- $M USD GAAP Opex run-rate of $17- $- $19M annually • On track to deliver sequential $(5) growth in revenue and profitability (on a quarter- $(10) over-quarter basis) Revenues Non-GAAP Opex Non-GAAP NI(L) Note - Please refer to Appendix for reconciliation of Non-GAAP financial information to GAAP financial information. 16 © 2020 Immersion

THANK YOU © 2020 Immersion

APPENDIX © 2020 Immersion

RECONCILIATION OF GAAP NET INCOME (LOSS) TO NON-GAAP NET INCOME(LOSS) Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 GAAP net income (loss) $ (11,016) $ (8,620) $ (1,387) $ 979 $ (4,828) $ (712) Add: Provision for income taxes 115 (3) 88 271 52 41 Less: Non-GAAP provision for income taxes (42) (13) (90) (72) (42) (5) Add: Stock-based compensation 2,103 1,081 1,187 1,093 729 1,365 Add: Restructuring expense - - 250 844 524 66 Add: Depreciation and amortization of property and equipment 205 200 183 702 963 40 Non-GAAP net income (loss) $ (8,635) $ (7,355) $ 231 $ 3,817 $ (2,602) $ 795 19 © 2020 Immersion

RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 $ 10,93 GAAP operating expenses $ 16,606 $ 17,858 $ 11,837 $ 10,761 $ 6,665 3 Adjustments to non-GAAP operating expenses: Stock-based compensation expense - S&M (320) (173) (207) (247) (45) (343) Stock-based compensation expense - R&D (630) (190) (234) (250) (168) (251) Stock-based compensation expense - G&A (1,153) (718) (746) (596) (516) (771) - - - Restructuring expense (524) (66) Depreciation and amortization of property and equipment (205) (200) (183) (702) (963) (40) Non-GAAP operating expense $ 14,298 $ 16,577 $ 10,467 $ 9,138 $ 8,545 $ 5,194 20 © 2020 Immersion