Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESCO INTERNATIONAL INC | wcc-20200915.htm |

WESCO International 2020 RBC Capital Markets Global Industrials Conference 1

Forward-Looking Statements All statements made herein that are not historical facts should be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding the process to divest the legacy WESCO Utility and Datacom businesses in Canada, including the expected length of the process, the expected benefits and costs of the transaction between WESCO and Anixter International Inc., including anticipated future financial and operating results, synergies, accretion and growth rates, and the combined company's plans, objectives, expectations and intentions, statements that address the combined company's expected future business and financial performance, and other statements identified by words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," "will" and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of WESCO's management, as well as assumptions made by, and information currently available to, WESCO's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of WESCO's and WESCO's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Those risks, uncertainties and assumptions include the risk of any unexpected costs or expenses resulting from the transaction, the risk of any litigation or post-closing regulatory action relating to the transaction, the risk that the transaction could have an adverse effect on the ability of the combined company to retain customers and retain and hire key personnel and maintain relationships with its suppliers, customers and other business relationships and on its operating results and business generally, the risk that problems may arise in successfully integrating the businesses of the companies or that the combined company could be required to divest one or more businesses, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits, the risk that the leverage of the company may be higher than anticipated, the impact of natural disasters, health epidemics and other outbreaks, especially the outbreak of COVID-19 since December 2019, which may have a material adverse effect on the combined company's business, results of operations and financial conditions, the risk that the divesture of the legacy WESCO Utility and Datacom businesses in Canada may take longer than expected and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond each company's control. Additional factors that could cause results to differ materially from those described above can be found in WESCO's Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and WESCO's other reports filed with the U.S. Securities and Exchange Commission ("SEC"). Non-GAAP Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") above, this presentation includes certain non-GAAP financial measures. These financial measures include organic sales growth, gross profit, gross margin, decremental operating margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, pro forma adjusted EBITDA, financial leverage, pro forma financial leverage, free cash flow, adjusted income from operations, adjusted operating margin, adjusted net income, and adjusted earnings per diluted share. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude transactions impacting comparability of results, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above. 2

Key Messages • Dramatically strengthened the business through Anixter merger ̶ Mix-shifted the company into higher-growth, less-cyclical markets and businesses ̶ Significantly larger and more balanced portfolio by product line, market, and geography • Extremely strong (and counter-cyclical) free cash flow enables rapid deleveraging while investing in the business • Deploying Anixter’s margin-improvement strategies that led to 7 consecutive quarters of y/y gross margin expansion while implementing WESCO’s lean programs across Anixter • Very high confidence in delivering upside to the year-3 synergy targets • Growth profile bolstered by multiple attractive long-term secular trends • Accelerating integration and digital transformation 3

Customer Solutions Overview With nearly 100 years of excellence, we have the expertise to understand customer needs, the broad product and services portfolio to meet them, and a customer-first approach to ensure their long-term success. Electrical and Communications and Utility and Electronics Solutions Security Solutions Broadband Solutions Single Source for All Technical Excellence Global Reach, Local Comprehensive Smart, Digital Product Needs and Specialization Expertise Value-Added Services Solutions • $2B+ total inventory for prompt • 18,000 professionals worldwide • Deep experience in serving • Installation • Global e-commerce platforms fulfillment • 12,000-person salesforce with global accounts • Materials management • Vendor Managed Inventory (VMI) • Same-day and next-day delivery unparalleled experience and • More than 800 facilities around • Kitting and labeling • Point of Use systems product/application knowledge the globe • 1.5M+ products • Extensive MRO solutions • Digital investments: last mile • Dedicated technical experts • Operations in 50+ countries and • Preferred partner to leading • Onsite job trailer solutions optimization, supply chain OEMs focused on the latest technologies 300+ cities engineering, intelligent • Nearly 100 years of excellence • 24/7 service capability • End-to-end supply chain automation • Network of 30,000 suppliers management representing the industry’s and experience • Serving more industry verticals • Insights from extensive digital premium brands • State-of-the-art lab and than any other distributor in the • Project management and ecosystem (innovation lab, technology briefing centers world execution across the project technology partnerships) lifecycle Save Time Improve Productivity Mitigate Risk Increase Profitability Build for the Future 4

Mission and vision Mission statement Vision statement We build, connect, power and Be the best tech-enabled supply protect the world. chain solutions provider in the world. 5

Recent Highlights Second quarter • Q2 results exceeded our expectations on sales, opex, EBIT, EBIT%, EPS, and free cash flow • Reported sales down 3%; Organic sales down 12% ̶ Sequential sales improvement through the quarter (April -13%, May +9%, June +5%) ̶ Continued strength in Utility; up 7% over prior year with growth in U.S. and Canada • Cost reduction actions significantly exceeded expectations • Decremental margin of 10% for legacy WESCO1 • Exceptionally strong free cash flow generation • Record backlog for legacy WESCO • Improving momentum in Q3 with over 75% of the quarter completed ̶ Pro forma Q3 sales down 8% versus prior year through first 50 workdays; Up 8% sequentially Completed Anixter merger on June 22, 2020 • Successful capital raise • Closed five months after signing agreement, meeting expectation of closing in Q2 or Q3 • Announced senior management team; new segment reporting beginning in Q3 • Reached consent agreement with Competition Bureau of Canada in early August • Excellent progress on integration; accelerating our execution • Significant upside potential on our sales growth, cost, margin, and free cash flow targets • WESCO + Anixter well positioned for evolving secular growth trends Transformational combination of WESCO and Anixter is underway 1 Decremental margin is defined as the year-over-year decline in adjusted income from operations divided by the year-over-year decline in sales. 6 See appendix for reconciliation of all non-GAAP measures.

Second Quarter Results Overview Three Months Ended June 30, 2020 2019 GAAP Merger- Adjusted Anixter Adjusted GAAP WESCO + related WESCO + Only1 WESCO WESCO $ in millions Anixter1 Adjustments Anixter1 Except per share amounts Sales $ 2,087 $ 2,087 $ 222 $ 1,865 $ 2,150 Gross Profit 394 394 45 349 409 % of Sales 18.9% 18.9% 20.3% 18.7% 19.0% Selling, general and administrative expenses 360 73 286 24 263 296 % of Sales 17.2% 13.7% 10.7% 14.1% 13.8% Operating Profit 15 (73) 89 18 70 98 % of Sales 0.7% 4.2% 8.3% 3.8% 4.6% Net interest and other 61 45 16 1 15 17 (Loss) income before income taxes (45) (118) 73 18 55 81 Income tax (benefit) expense (11) (26) 16 4 12 17 Net (loss) income (34) (92) 57 14 43 63 Minority Interests - - - - - - Net (loss) income attributable to WESCO International, (35) (92) 57 14 44 63 Preferred dividends 1 1 - - - - Net (loss) income attributable to common stockholders $ (36) $ (93) $ 57 $ 14 $ 44 $ 63 Diluted shares2 42.7 42.0 42.0 43.8 Diluted EPS $ (0.84) $ 1.36 $ 1.04 $ 1.45 Decremental margin of 10% for legacy WESCO business 1 Results of Anixter from June 22 – June 30, 2020 2 Adjusted diluted shares for the three months ended June 30, 2020 exclude the weighted-average impact of 8.15 million shares of common stock issued as equity consideration to fund a portion of the merger with Anixter. 7

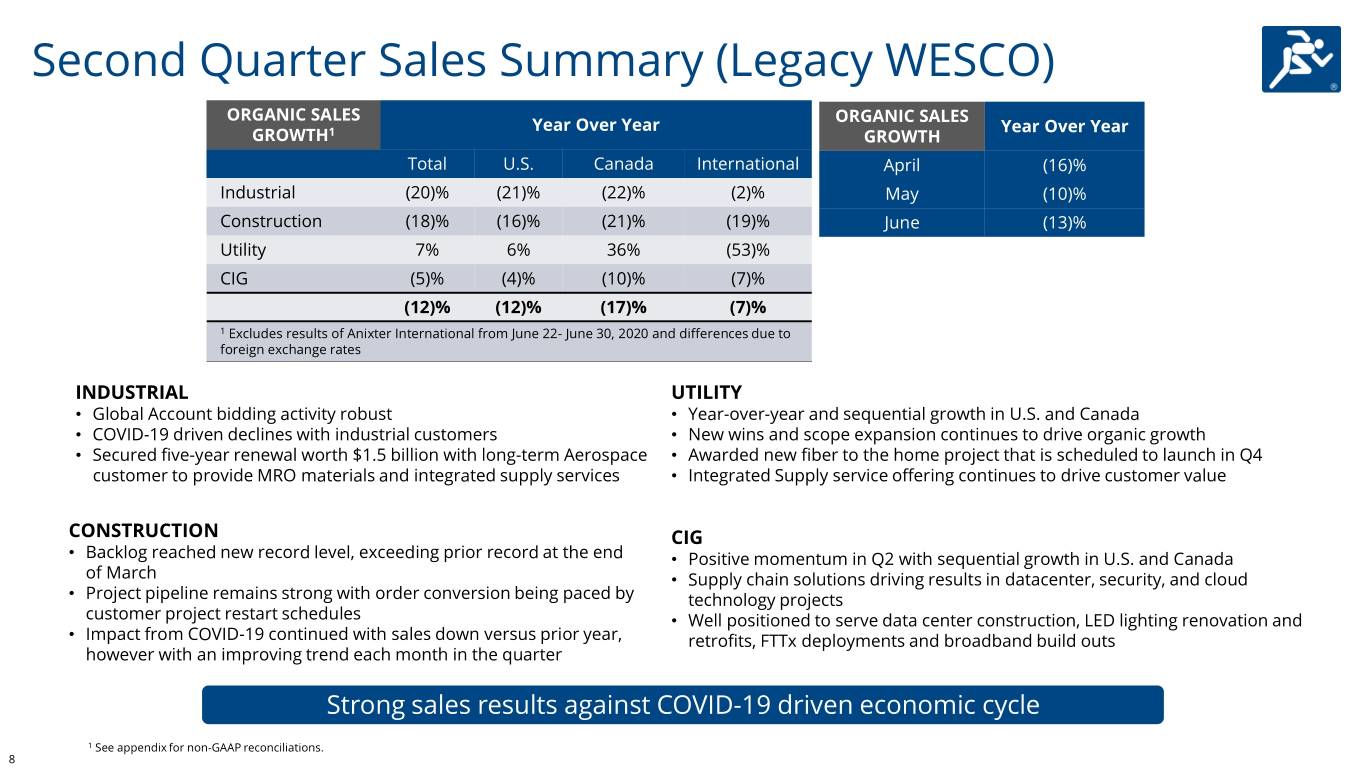

Second Quarter Sales Summary (Legacy WESCO) ORGANIC SALES ORGANIC SALES Year Over Year Year Over Year GROWTH1 GROWTH Total U.S. Canada International April (16)% Industrial (20)% (21)% (22)% (2)% May (10)% Construction (18)% (16)% (21)% (19)% June (13)% Utility 7% 6% 36% (53)% CIG (5)% (4)% (10)% (7)% (12)% (12)% (17)% (7)% 1 Excludes results of Anixter International from June 22- June 30, 2020 and differences due to foreign exchange rates INDUSTRIAL UTILITY • Global Account bidding activity robust • Year-over-year and sequential growth in U.S. and Canada • COVID-19 driven declines with industrial customers • New wins and scope expansion continues to drive organic growth • Secured five-year renewal worth $1.5 billion with long-term Aerospace • Awarded new fiber to the home project that is scheduled to launch in Q4 customer to provide MRO materials and integrated supply services • Integrated Supply service offering continues to drive customer value CONSTRUCTION CIG • Backlog reached new record level, exceeding prior record at the end • Positive momentum in Q2 with sequential growth in U.S. and Canada of March • Supply chain solutions driving results in datacenter, security, and cloud • Project pipeline remains strong with order conversion being paced by technology projects customer project restart schedules • Well positioned to serve data center construction, LED lighting renovation and • Impact from COVID-19 continued with sales down versus prior year, retrofits, FTTx deployments and broadband build outs however with an improving trend each month in the quarter Strong sales results against COVID-19 driven economic cycle 1 See appendix for non-GAAP reconciliations. 8

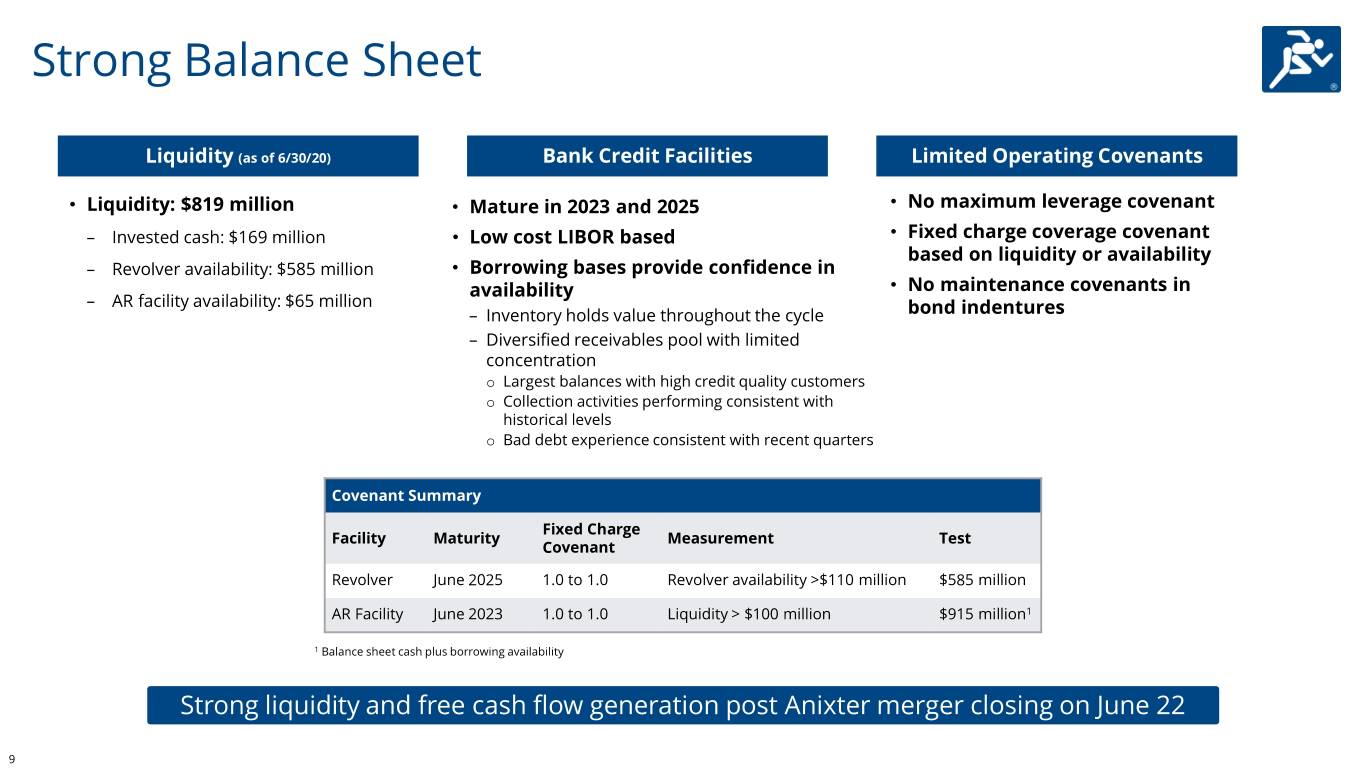

Strong Balance Sheet Liquidity (as of 6/30/20) Bank Credit Facilities Limited Operating Covenants • Liquidity: $819 million • Mature in 2023 and 2025 • No maximum leverage covenant – Invested cash: $169 million • Low cost LIBOR based • Fixed charge coverage covenant based on liquidity or availability – Revolver availability: $585 million • Borrowing bases provide confidence in availability • No maintenance covenants in – AR facility availability: $65 million – Inventory holds value throughout the cycle bond indentures – Diversified receivables pool with limited concentration o Largest balances with high credit quality customers o Collection activities performing consistent with historical levels o Bad debt experience consistent with recent quarters Covenant Summary Fixed Charge Facility Maturity Measurement Test Covenant Revolver June 2025 1.0 to 1.0 Revolver availability >$110 million $585 million AR Facility June 2023 1.0 to 1.0 Liquidity > $100 million $915 million1 1 Balance sheet cash plus borrowing availability Strong liquidity and free cash flow generation post Anixter merger closing on June 22 9

Key Second Half Priorities • Build on improving sales momentum • Maintain disciplined cost management • Deploy Anixter’s gross margin improvement programs that generated seven consecutive quarters of year-over-year improvement through Q2 2020 • Rapidly execute Anixter merger synergies • Focus free cash flow generation on debt repayment • Begin reporting under new Strategic Business Unit structure 10

ANIXTER MERGER UPDATE 11

WESCO-Anixter Merger Highlights Transformational Combination Creates the Industry Leader in Electrical, Communications, and Utility Distribution and Supply Chain Solutions Differentiated Scale and Capabilities in Highly Fragmented Industry Complementary Products, Industries and Geographies Drive Accelerated Growth Significant Estimated Cost Synergies Identified with Meaningful Upside Expected to Accelerate Growth and Meaningfully Expand Margins Resilient Business Model with Substantial Free Cash Flow and Proven Ability to Deleverage Results Oriented Management Team Focused on Execution and Efficient Integration Combination creates the industry leader with substantial free cash flow 12

Transformational Combination Creates the Industry Leader in Electrical, Communications, and Utility Distribution and Supply Chain Solutions A leader in electrical distribution A leader in data communications, security, and wire & cable distribution ~$17 billion ~$1 billion ~50 ~18,900 Pro Forma Pro Forma 6/30 2 2 6/30 TTM Sales TTM Adjusted EBITDA 1 Countries Employees Digital Operational Cross Selling to Premier Back Office Technologies Excellence and Expanded Supply Chain Scale and and Innovation Logistics Customer Base Services Efficiencies to Drive Value Optimization Combination expected to generate significant annual cost synergies of $200+ million, enhance cash flow and accelerate growth 1. Adj. EBITDA includes stock based compensation expense at WESCO and Anixter, merger-related costs, foreign exchange and the impact of year three synergies of $200mm. Adj. EBITDA is a non-GAAP financial metric. 2. Country and employee counts reflect FY2019. 13

Differentiated Scale and Capabilities in Highly Fragmented Industry 6/30 TTM Net Sales North American Share 1 ($ in billions) $16.6 7% 6% Sonepar $8.1 $8.5 Other 5,000+ Graybar Rest of Rexel Top 200 + Combination enhances capabilities, expands share and increases scale 1. Source: Electrical Wholesaling Top 200 Electrical Distributors, 2019. Based on 2018 net sales. 14

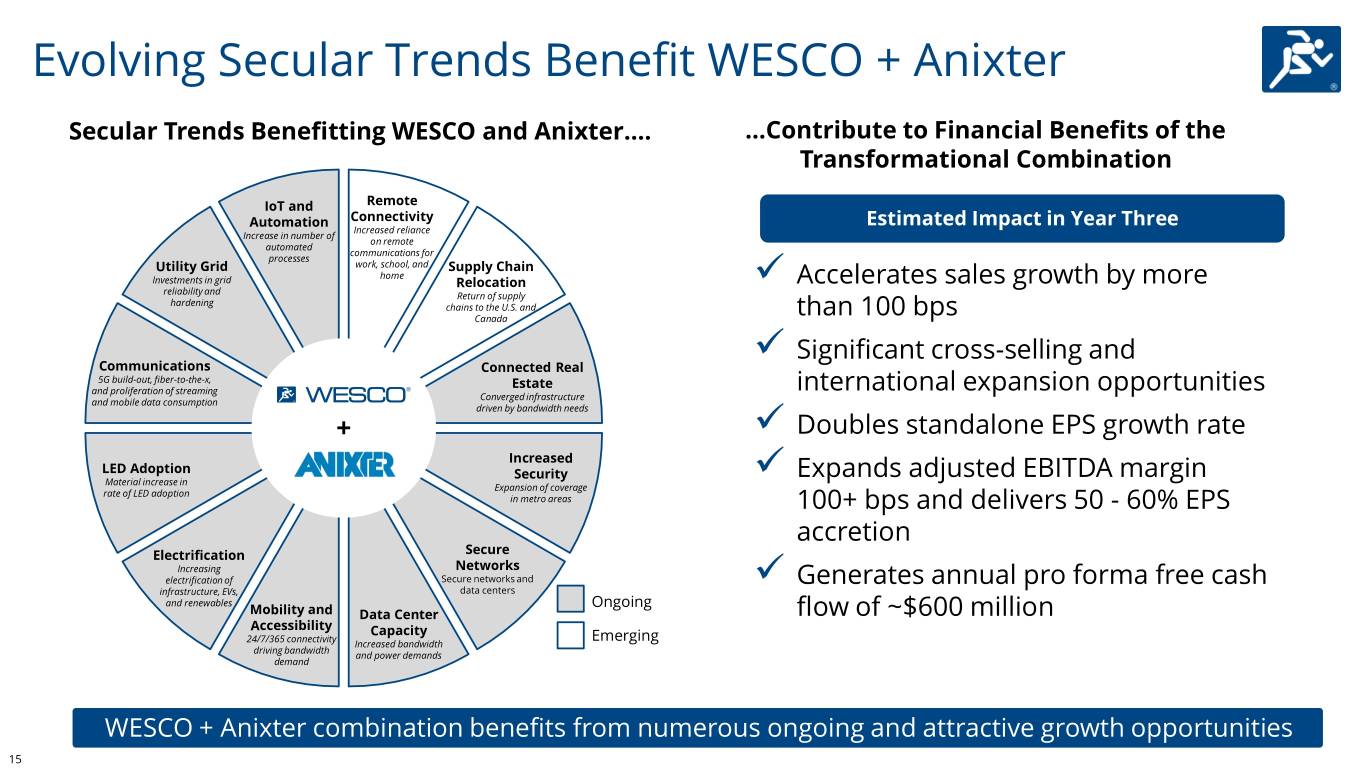

Evolving Secular Trends Benefit WESCO + Anixter Secular Trends Benefitting WESCO and Anixter…. …Contribute to Financial Benefits of the Transformational Combination IoT and Remote Automation Connectivity Estimated Impact in Year Three Increased reliance Increase in number of on remote automated communications for processes Utility Grid work, school, and Supply Chain home Investments in grid Relocation ✓ Accelerates sales growth by more reliability and Return of supply hardening chains to the U.S. and Canada than 100 bps ✓ Significant cross-selling and Communications Connected Real 5G build-out, fiber-to-the-x, Estate and proliferation of streaming international expansion opportunities Converged infrastructure and mobile data consumption driven by bandwidth needs + ✓ Doubles standalone EPS growth rate Increased LED Adoption Security ✓ Expands adjusted EBITDA margin Material increase in Expansion of coverage rate of LED adoption in metro areas 100+ bps and delivers 50 - 60% EPS accretion Electrification Secure Increasing Networks electrification of Secure networks and ✓ Generates annual pro forma free cash infrastructure, EVs, data centers and renewables Ongoing Mobility and Data Center flow of ~$600 million Accessibility Capacity 24/7/365 connectivity Emerging Increased bandwidth driving bandwidth and power demands demand WESCO + Anixter combination benefits from numerous ongoing and attractive growth opportunities 15

Anixter Merger – Consistently Meeting Commitments Commitments Results Successfully raised bank and bond debt of ~$5 billion; Complete capital raise to fund Anixter merger Bond offerings were substantially oversubscribed Close transaction in Q2 or Q3 Transaction Closed on June 22, 2020 Maintain ample liquidity Increased liquidity to over $800 million Rapidly integrate the businesses and begin Six weeks post-close, completed actions to deliver over generating year one synergies 50% of our year one cost savings target of $68 million Generate sales synergies that are additive to Realized cross-sell sales synergies in the first month $200 million minimum cost synergies after closing All commitments are on track with high confidence of significant upside 16

Process-Oriented Approach to Drive Integration Execution Flawless Build World Deliver Value OBJECTIVES: Day 1 / Day Class New Capture 100 Execution Company • Ensure uninterrupted operations and • Combined company spend and growth • Implement operating model and design protect the base business synergy targets by function, geography, organization structure and business • Detailed plans for key business • Talent selection and retention plans processes for Day 1, including • Prioritize and deliver synergy in • Build change management into integration architecture, tracking and functions that drive majority of value integration governance capture • Deploy cutting edge digital business • Communication and onboarding for capabilities combined teams • Optimize working capital INTEGRATION Partnering with a leading global consulting firm to GOVERNANCE: support integration management and execution VALUE DELIVERY SUPPLY MARKETING / CORPORATE COMMERCIAL DIGITAL / IT OPERATIONS WORKSTREAMS: CHAIN BRANDING FUNCTIONS Resources and detailed roadmap support synergy realization with upside 17

On-Track to Deliver on the Core Integration Objectives G On-Track Objective Execute a Flawless Day One Deliver Value Capture Build a World-Class NewCo Status Complete G G Highlights • Executed Day One with minimal • All master planning and value capture • Announced new organization disruption to the business integration initiatives are on-track with structure organized around three our accelerated time frame Strategic Business Units and two • Stood up dedicated employee, levels of the senior leadership team customer and supplier issue • Planned $200 million+ in recurring response teams (no major issues) cost savings initiatives: • Launched company-wide, broad- based cultural survey to identify • Launched a combined intranet – On-track to exceed $68 million in areas of compatibility and plan to site with comprehensive list of year one synergies harmonize the best of both cultures Frequently Asked Questions – Executed required actions to • Identified critical talent across • Held townhalls company-wide, at capture over $35 million in year legacy organizations and ensuring Strategic Business Unit (SBU) and one synergies since closing strong employee engagement Corporate functional levels • Deployed commercial targets for sales • Received positive feedback from growth and cash flow to businesses customers, suppliers, employees • Demonstrating initial success with first and investors cross-sell pilots Completed flawless day one; accelerating execution 18

Making Rapid Progress on Synergy Capture Cost Synergies ($ millions) Substantial Progress Since Closing • Captured operational synergies including renegotiating contracts, reducing duplicative spend with vendors, and redundant headcount Field Meaningful Operations G&A • Delivered on over 30 unique initiatives Upside 20% 30% ̶ Eliminated duplicative public company- related expenses reducing costs by more 70% than $7 million Supply of total 34% Chain Corporate ̶ Eliminated C-suite and other duplicative of total $200 roles providing over $20 million in savings 35% Overhead $140 15% $68 Executed required actions to capture over Year One Year Two Year Three $35 million in annual synergies since closing Highly confident in delivering upside to $200 million cost synergies target 19

Resilient Business Model with Substantial Free Cash Flow and Proven Ability to Deleverage Net Debt / Adj. EBITDA ✓ Anticipated deleveraging to be driven through a combination of: 2 + Strong free cash flow1 generation 5.7x + Cost savings realization 5.3x3 – Additional capital expenditures to drive synergies ✓ At closing, strong liquidity of $800+ million ✓ Strength of combined company’s cash flows and significant synergies provide a path to reaching leverage target of 2.0 – 3.5x within 36 months of close At Close Within 36 Months of Close Combined platform expected to generate significant free cash flow1 to drive rapid deleveraging 1. Free cash flow defined as cash flow from operating activities less capital expenditures and merger-related expenditures. See appendix for non-GAAP reconciliation. 2. Excludes $68 million of expected year one synergies. 3. Includes $68 million of expected year one synergies. 20

Resilient Business Model with Substantial Free Cash Flow and Rapid Deleveraging Proven ability to deleverage….. Q2 Free Cash Flow5 Through the Cycle 1 Post M&A 1 2.9x 4.5x $103 million 2.7x 1.6x Acq. EECOL 2 legacy WESCO 2007 2011 2012 2014 + ~$1.0 billion cumulative FCF ~$800 million cumulative FCF 4.1x $39 million 2.1x Acq. HDS 2.8x 2.0x Power Anixter Solutions 3 2007 2011 2015 2017 $142 million total ~$900 million cumulative FCF ~$500 million cumulative FCF 248% of adjusted ...aided by dynamic countercyclical cash flow ...through efficient integration and synergy realization net income Since the Global Financial Crisis 4, on a combined basis, WESCO and Anixter have generated free cash flow 5 in excess of $4.0 billion 1. Charts reflect net debt to EBITDA. 2. WESCO completed its acquisition of EECOL in December 2012 for ~$1.1 billion. 3. Anixter competed its acquisition of HD Supply Power Solutions in October 2015 for ~$825 million. 4. Period reflects CY2009 through CY2019. 5. See appendix for non-GAAP reconciliation. 21

Consent Agreement with Canadian Competition Bureau • Announced agreement with Canadian Competition Bureau on August 6, 2020 • Merger was permitted to close when the waiting period expired on June 18, 2020 • Agreement requires WESCO to divest legacy businesses in Canada: ̶ Utility ̶ Datacom (inside plant) • These businesses had total sales of approximately US $150 million in 2019 • Will complete transactions as expeditiously as possible 22

Summary • Continue to take decisive actions in response to COVID-19 pandemic • Executed successful capital raise with strong liquidity and favorable borrowing terms • Completed Anixter merger on June 22, 2020 meeting our expectation of second or third quarter closing • Larger and more diverse by product line, end market, and geography • Differentiated scale and capabilities in highly fragmented industry • Resilient business model and strong free cash flow throughout the cycle • Substantial progress made on integration execution in first six weeks • WESCO + Anixter exceptionally well positioned for evolving secular growth trends • Expect to exceed cost savings, sales growth and cash generation synergy targets of the transformational combination of WESCO and Anixter The start of a new era for WESCO 23

APPENDIX

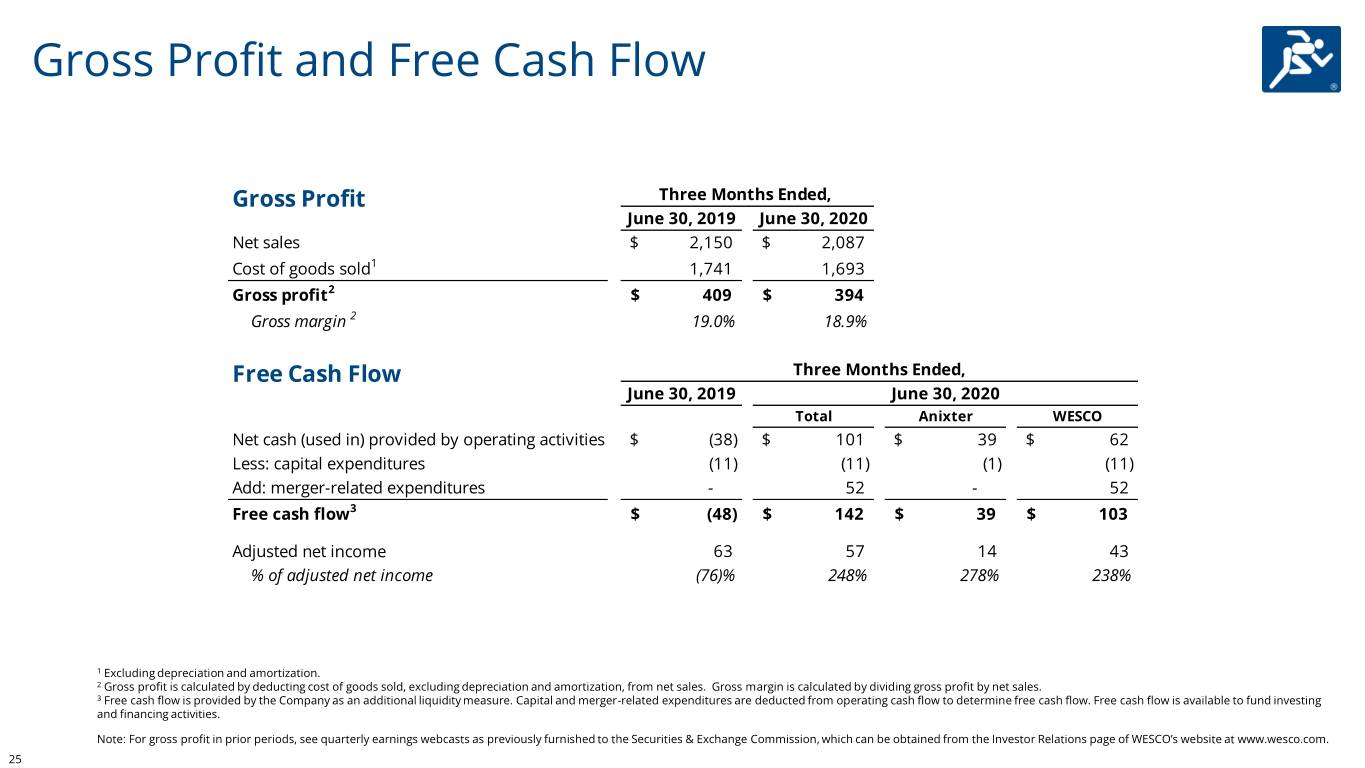

Gross Profit and Free Cash Flow Gross Profit Three Months Ended, June 30, 2019 June 30, 2020 Net sales $ 2,150 $ 2,087 Cost of goods sold1 1,741 1,693 Gross profit2 $ 409 $ 394 Gross margin 2 19.0% 18.9% Free Cash Flow Three Months Ended, June 30, 2019 June 30, 2020 Total Anixter WESCO Net cash (used in) provided by operating activities $ (38) $ 101 $ 39 $ 62 Less: capital expenditures (11) (11) (1) (11) Add: merger-related expenditures - 52 - 52 Free cash flow3 $ (48) $ 142 $ 39 $ 103 Adjusted net income 63 57 14 43 % of adjusted net income (76)% 248% 278% 238% 1 Excluding depreciation and amortization. 2 Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales. 3 Free cash flow is provided by the Company as an additional liquidity measure. Capital and merger-related expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund investing and financing activities. Note: For gross profit in prior periods, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the Investor Relations page of WESCO’s website at www.wesco.com. 25

Second Quarter Organic Sales Growth $ in millions Year-over-Year Three Months Ended, Core Less: Less: Organic June 30, 2019 June 30, 2020 Growth FX Impact Workday Growth Industrial core sales 765 608 (20.6)% (1.0)% 0.0% (19.6)% Construction core sales 707 575 (18.7)% (1.1)% 0.0% (17.6)% Utility core sales 348 372 6.7% (0.3)% 0.0% 7.0% CIG core sales 338 317 (6.4)% (1.2)% 0.0% (5.2)% Total core sales $ 2,159 $ 1,871 (13.2)% (0.9)% 0.0% (12.3)% U.S. core sales 1,623 1,437 (11.5)% 0.0% 0.0% (11.5)% Canada core sales 417 332 (20.4)% (3.0)% 0.0% (17.4)% International core sales 119 103 (13.7)% (6.4)% 0.0% (7.3)% Total core sales $ 2,159 $ 1,871 (13.2)% (0.9)% 0.0% (12.3)% Plus: Anixter - 222 Less: Sales discounts and reductions (9) (8) Total net sales $ 2,150 $ 2,086 Sequential Three Months Ended, Reported Less: Less: Organic March 31, 2020 June 30, 2020 Growth FX Impact Workday Growth Industrial sales 705 608 (13.8)% (1.1)% 0.0% (12.7)% Construction sales 639 575 (9.9)% (1.6)% 0.0% (8.3)% Utility sales 342 372 8.6% (0.5)% 0.0% 9.1% CIG sales 290 317 9.3% (1.4)% 0.0% 10.7% Total core sales 1,975 1,871 (5.3)% (1.2)% 0.0% (4.1)% Plus: Anixter - 222 Less: Sales discounts and reductions (7) (8) Total net sales $ 1,969 $ 2,086 26

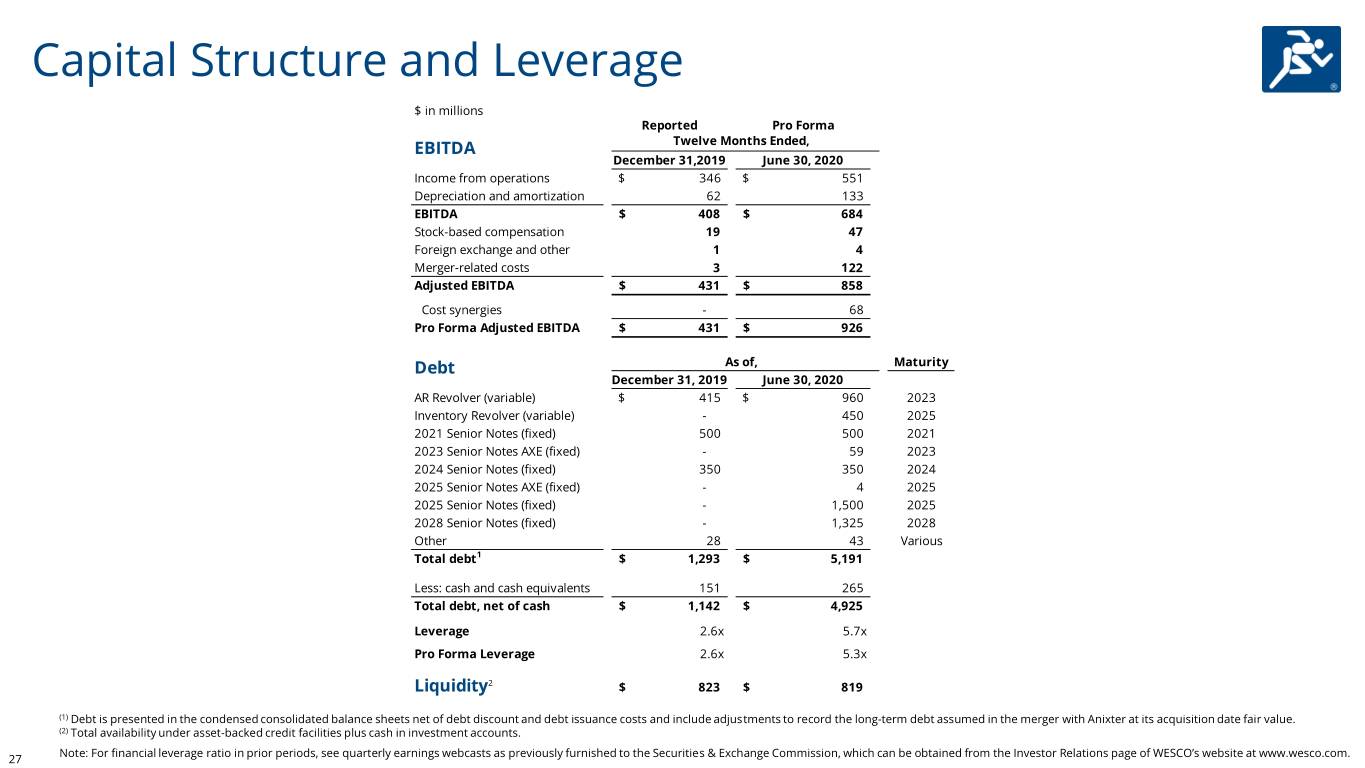

Capital Structure and Leverage $ in millions Reported Pro Forma EBITDA Twelve Months Ended, December 31,2019 June 30, 2020 Income from operations $ 346 $ 551 Depreciation and amortization 62 133 EBITDA $ 408 $ 684 Stock-based compensation 19 47 Foreign exchange and other 1 4 Merger-related costs 3 122 Adjusted EBITDA $ 431 $ 858 Cost synergies - 68 Pro Forma Adjusted EBITDA $ 431 $ 926 Debt As of, Maturity December 31, 2019 June 30, 2020 AR Revolver (variable) $ 415 $ 960 2023 Inventory Revolver (variable) - 450 2025 2021 Senior Notes (fixed) 500 500 2021 2023 Senior Notes AXE (fixed) - 59 2023 2024 Senior Notes (fixed) 350 350 2024 2025 Senior Notes AXE (fixed) - 4 2025 2025 Senior Notes (fixed) - 1,500 2025 2028 Senior Notes (fixed) - 1,325 2028 Other 28 43 Various Total debt1 $ 1,293 $ 5,191 Less: cash and cash equivalents 151 265 Total debt, net of cash $ 1,142 $ 4,925 Leverage 2.6x 5.7x Pro Forma Leverage 2.6x 5.3x Liquidity2 $ 823 $ 819 (1) Debt is presented in the condensed consolidated balance sheets net of debt discount and debt issuance costs and include adjustments to record the long-term debt assumed in the merger with Anixter at its acquisition date fair value. (2) Total availability under asset-backed credit facilities plus cash in investment accounts. Note: For financial leverage ratio in prior periods, see quarterly earnings webcasts as previously furnished to the Securities & Exchange Commission, which can be obtained from the Investor Relations page of WESCO’s website at www.wesco.com. 27

Decremental Operating Margin Decremental Operating Margin Three Months Ended June 30, 2020 June 30, 2019 Adjusted $ in millions WESCO Reported Change Net sales $ 1,865 $ 2,150 $ (285) Income from operations 70 98 (28) Decremental operating margin 10% Note: Decremental operating margin is defined as the year-over-year decline in income from operations divided by the year-over-year decline in net sales. Decremental operating margin is a financial measure commonly used in an economic downturn to assess the Company's ability to reduce operating costs in response to declining sales. 28

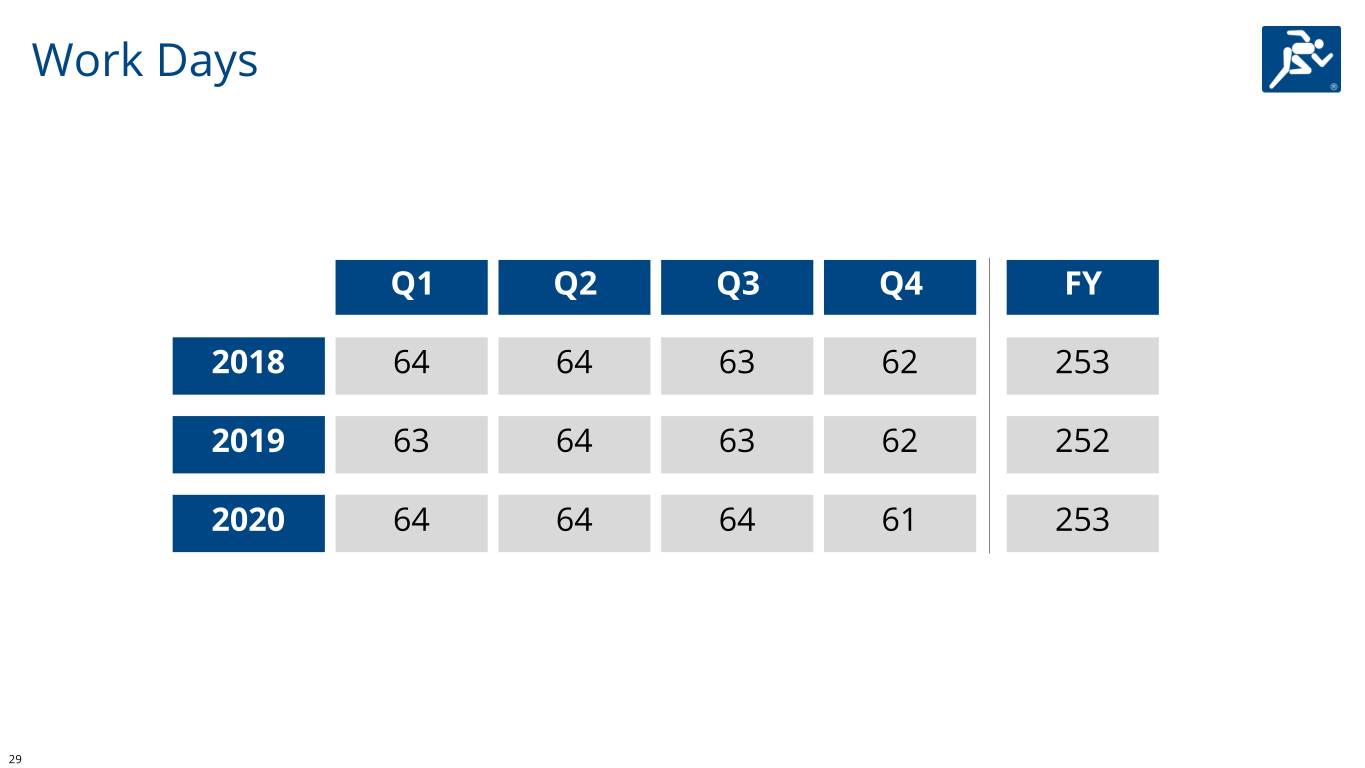

Work Days Q1 Q2 Q3 Q4 FY 2018 64 64 63 62 253 2019 63 64 63 62 252 2020 64 64 64 61 253 29