Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - WESCO INTERNATIONAL INC | wcc2017ex-322.htm |

| EX-32.1 - EXHIBIT 32.1 - WESCO INTERNATIONAL INC | wcc2017ex-321.htm |

| EX-31.2 - EXHIBIT 31.2 - WESCO INTERNATIONAL INC | wcc2017ex-312.htm |

| EX-31.1 - EXHIBIT 31.1 - WESCO INTERNATIONAL INC | wcc2017ex-311.htm |

| EX-23.1 - EXHIBIT 23.1 - WESCO INTERNATIONAL INC | wcc2017ex-231.htm |

| EX-21.1 - EXHIBIT 21.1 - WESCO INTERNATIONAL INC | wcc2017ex-211.htm |

| EX-10.28 - EXHIBIT 10.28 - WESCO INTERNATIONAL INC | wcc2017ex1028minicozzite.htm |

| EX-10.26 - EXHIBIT 10.26 - WESCO INTERNATIONAL INC | wccex1026formofnoticeofpsu.htm |

| EX-10.25 - EXHIBIT 10.25 - WESCO INTERNATIONAL INC | wccex1025employeesarsagree.htm |

| EX-10.24 - EXHIBIT 10.24 - WESCO INTERNATIONAL INC | wccex1024employeersuagreem.htm |

| EX-10.23 - EXHIBIT 10.23 - WESCO INTERNATIONAL INC | wccex1023nonemployeersuagr.htm |

| EX-10.22 - EXHIBIT 10.22 - WESCO INTERNATIONAL INC | wccex1022sixthamendmentto4.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2017 | ||

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number 001-14989

WESCO International, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 25-1723342 (I.R.S. Employer Identification No.) | |

225 West Station Square Drive Suite 700 Pittsburgh, Pennsylvania (Address of principal executive offices) | 15219 (Zip Code) | |

(412) 454-2200

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Class | Name of Exchange on which registered | |

Common Stock, par value $.01 per share | New York Stock Exchange | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such file). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o | |||

Non-accelerated filer o | (Do not check if a smaller reporting company) | Smaller reporting company o | ||

Emerging growth company o | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Ex-change Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The registrant estimates that the aggregate market value of the voting shares held by non-affiliates of the registrant was approximately $2.7 billion as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price on the New York Stock Exchange for such stock.

As of February 20, 2018, 47,056,716 shares of Common Stock, par value $.01 per share, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III of this Form 10-K incorporates by reference portions of the registrant’s Proxy Statement for its 2018 Annual Meeting of Stockholders.

TABLE OF CONTENTS

Page | |

PART I

Item 1. Business.

In this Annual Report on Form 10-K, “WESCO” refers to WESCO International, Inc., and its subsidiaries and its predecessors unless the context otherwise requires. References to “we,” “us,” “our” and the “Company” refer to WESCO and its subsidiaries.

The Company

WESCO International, Inc. (“WESCO International”), incorporated in 1993 and effectively formed in February 1994 upon acquiring a distribution business from Westinghouse Electric Corporation, is a leading North American-based distributor of products and provider of advanced supply chain management and logistics services used primarily in industrial, construction, utility, and commercial, institutional and government (“CIG”) markets. We are a leading provider of electrical, industrial, and communications maintenance, repair and operating ("MRO") and original equipment manufacturer ("OEM") products, construction materials, and advanced supply chain management and logistics services. Our primary product categories include general supplies, wire, cable and conduit, communications and security, electrical distribution and controls, lighting and sustainability, and automation, controls and motors.

We serve approximately 70,000 active customers globally through approximately 500 branches primarily located in North America, with operations in 15 additional countries and 10 distribution centers located in the United States and Canada. The Company employs approximately 9,100 employees worldwide. We distribute over 1,000,000 products, grouped into six categories, from more than 26,000 suppliers, utilizing a highly automated, proprietary electronic procurement and inventory replenishment system.

In addition, we offer a comprehensive portfolio of value-added capabilities, which includes supply chain management, logistics and transportation, procurement, warehousing and inventory management, as well as kitting, limited assembly of products and system installation. Our value-added capabilities, extensive geographic reach, experienced workforce and broad product and supply chain solutions have enabled us to grow our business and establish a leading position in North America.

Industry Overview

We operate in highly fragmented markets that include thousands of small regional and locally based, privately owned competitors. According to one industry publication, in 2017, the latest year for which market data is available, the five largest full-line electrical distributors in North America, including WESCO, accounted for approximately 33% of an estimated $100 billion-plus of electrical sales in North America. Our global account, integrated supply and OEM programs provide customers with regional, national, North American and global supply chain consolidation opportunities. The demand for these programs is driven primarily by the desire of companies to reduce operating expenses by outsourcing operational and administrative functions associated with the procurement, management and utilization of MRO supplies and OEM components. We believe that opportunities exist for expansion of these programs. The total potential in the United States for purchases of MRO and OEM supplies and services across all industrial distribution market segments and channels is estimated to be nearly $800 billion per a combination of industry sources.

According to various industry sources, electrical distribution industry sales have grown low-single-digits on average over the past three years, despite a low-single-digit decline in 2016. Growth in recent years has been driven by new products, technologies and applications. It is estimated that approximately 75% of electrical products sold in the United States are delivered to the end user through the distribution channel.

1

Markets and Customers

We have a large base of approximately 70,000 active customers across a diverse set of end markets. Our top ten customers accounted for approximately 17% of our sales in 2017. No one customer accounted for more than 4% of our sales in 2017.

The following table outlines our sales breakdown by end market:

Year Ended December 31, | 2017 | 2016 | 2015 | ||

(percentages based on total sales) | |||||

Industrial | 37% | 36% | 39% | ||

Construction | 33% | 34% | 32% | ||

Utility | 16% | 16% | 15% | ||

Commercial, Institutional and Government | 14% | 14% | 14% | ||

Industrial. Sales to industrial customers of MRO, OEM, and construction products and services accounted for approximately 37% of our sales in 2017, compared to 36% in 2016. Industrial sales product categories include a broad range of electrical equipment and supplies as well as lubricants, pipe, valves, fittings, fasteners, cutting tools, power transmission, and safety products. In addition, OEM customers require a reliable supply of assemblies and components to incorporate into their own products as well as value-added services such as supplier consolidation, design and technical support, just-in-time supply and electronic commerce, and supply chain management.

Construction. Sales of electrical and communications products to contractors accounted for approximately 33% of our sales in 2017, compared to 34% in 2016. Customers include a wide array of contractors and engineering, procurement and construction firms for industrial, infrastructure, commercial and data and broadband communications projects. Specific applications include projects for refineries, railways, wastewater treatment facilities, data centers, security installations, offices, and modular and mobile homes. In addition to a wide array of electrical products, we offer contractors communications products for projects related to IT/network modernization, physical security upgrades, broadband deployments, network security, and disaster recovery.

Utility. Sales to utilities and utility contractors accounted for approximately 16% of our sales in 2017 and 2016. Customers include large investor-owned utilities, rural electric cooperatives, municipal power authorities and contractors that serve these customers. We provide our utility customers with products and services to support the construction and maintenance of their generation, transmission and distribution systems along with an extensive range of products that meet their power plant MRO and capital projects needs. Materials management and procurement outsourcing arrangements are also important in this market, as cost pressures and deregulation have caused utility customers to seek improvements in the efficiency and effectiveness of their supply chains.

Commercial, Institutional and Government. Sales to CIG customers accounted for approximately 14% of our sales in 2017 and 2016. Customers include schools, hospitals, property management firms, retailers and federal, state and local government agencies of all types, including federal contractors.

Business Strategy

Our goal is to grow organically at a rate greater than that of our industry while making accretive acquisitions. Our organic growth strategy focuses on enhancing our sales, technical expertise and customer service capabilities to acquire new customers and increase our sales to current customers, broaden our product and service offerings and expand our geographic footprint. We utilize LEAN continuous improvement initiatives on a company-wide basis to deliver operational excellence and improve productivity. We also extend our LEAN initiatives to customers to improve the efficiency and effectiveness of their operations and supply chains. In addition, we seek to develop a distinct competitive advantage through talent management and employee development processes and programs.

We have identified certain growth engines that we believe provide substantial opportunities for above-market growth, and have developed strategies to address each of these areas of opportunity. These growth engines are a combination of business models, selected end markets and product categories, as discussed below.

Grow Our Global Account Customer Relationships and Base. Our typical global account customer is a large, multi-location industrial or commercial company, a large utility, a major contractor, or a government or institutional customer. Our global account program is designed to provide customers with supply chain management services and cost reductions by coordinating and standardizing activity for MRO materials and OEM direct materials across their multiple locations, utilizing our broad geographic footprint and our largely integrated information technology platform. Comprehensive account plans are developed and managed at the local, national and international levels to prioritize activities, identify key performance measures, and track progress against

2

objectives. We involve our preferred suppliers early in the implementation process to contribute expertise and product knowledge to accelerate program implementation and deliver cost savings and process improvements.

Through our growth initiatives, we plan to continue to expand the suite of products and services we offer to current customer sites, while increasing our reach to serve additional customer locations. We plan on expanding our customer base by capitalizing on our industry expertise and supply chain optimization capabilities.

Extend Our Position in Integrated Supply Programs. Our integrated supply programs focus on optimizing the supply chain and replacing the traditional multi-vendor, resource-intensive procurement process with a single, outsourced, automated process. Each integrated supply program employs our product and distribution expertise to reduce the number of suppliers, total procurement costs, and administrative expenses, while meeting the customers’ service needs and improving their operating controls. We believe that large customers will seek to utilize such services to consolidate and simplify their MRO and OEM supply chains.

We are expanding our position in North America as an integrated supply service provider by building upon established relationships within our large customer base and premier supplier network, and extending our services to additional customers and locations around the world. Our services are offered across all four of our end markets.

Expand Our Relationships with Construction Contractors. We support new construction, renovation and retrofit projects across a wide variety of vertical markets, including manufacturing, healthcare, education, enterprise data communications, telecommunications, energy and government infrastructure. We believe that significant cross selling opportunities exist for our electrical and communications products and expertise, and we are utilizing our global account and integrated supply programs, LEAN initiatives and project management expertise to capitalize on new non-residential construction opportunities.

Expand Products and Services for Utilities. Our investor-owned, public power and utility contractor customers continue to focus on improving grid reliability and operating efficiency, while reducing costs. As a result, we anticipate opportunities from distribution grid improvement and transmission expansion projects as well as the continued adoption of integrated supply programs. Accordingly, we are focused on expanding our logistical and project services and supply chain management programs to increase our scope of supply on the distribution grid, generation and other energy projects, including alternative energy projects.

Grow Industrial MRO and Safety Sales. Our sales of industrial MRO materials include a broad range of electrical and non-electrical products used in the ongoing maintenance and repair of equipment used in production processes. These products are also used for facility upkeep in manufacturing, commercial, institutional, and other operations. In addition, through acquisitions, we have expanded our safety products, personal protection safety equipment, first aid supplies, and OSHA compliance categories to complement the industrial MRO product lines.

Expand International Operations. We seek to capitalize on existing and emerging international market opportunities through the expansion of our global product and service platforms. We follow large existing global customers into international markets, extending our procurement outsourcing, integrated supply programs and supplier relationships. Once established, we also seek to develop new business opportunities in these markets. We believe this strategy of working with well-developed customer and supplier relationships significantly reduces risk and provides the opportunity to establish profitable business. Our priorities are focused on global vertical markets including energy, mining and metals, manufacturing, and infrastructure, as well as key product categories such as communications and security.

Grow Our Communications Products Position. Over the last several years, there has been a convergence of electrical and data communications contractors. Our ability to provide both electrical and communications products and services as well as automation, electromechanical, non-electrical MRO, physical security and utility products has presented cross selling opportunities across WESCO. Communications products are in continual demand due to network upgrades, low voltage security investments, data center upgrades and increasing broadband and telecommunications usage.

Grow Lighting System and Sustainability Sales. Lighting applications are undergoing significant innovation, driven by energy efficiency and sustainability trends. We have expanded our sales team and marketing initiatives and increased our presence and customer base with recent acquisitions. We expect to continue to add product and service offerings to provide lighting and energy-saving solutions.

Pursue Strategic Acquisitions. Since 2010, we have made fourteen acquisitions that have helped us broaden and strengthen our product and services portfolio, increase our customer base, and provide an important source of talent.

We believe that the highly fragmented nature of the electrical and industrial distribution industry will continue to provide acquisition opportunities.

Drive Operational Excellence. LEAN continuous improvement is a set of company-wide strategic initiatives to increase efficiency and effectiveness across the entire business enterprise, including sales, operations and administrative processes. The basic principles behind LEAN are to systematically identify and implement improvements through simplification, elimination of waste and reduction in errors. We apply LEAN in our distribution environment, and develop and deploy numerous initiatives through the Kaizen approach targeting improvements in sales, margin, warehouse operations, transportation, purchasing, working

3

capital management and administrative processes. Our objective is to continue to implement LEAN initiatives across our business enterprise and to extend LEAN services to our customers and suppliers.

Manage Our Talent. We seek to develop a distinct competitive advantage through talent management and employee engagement and development. We believe our ability to attract, develop and retain diverse human capital is imperative to ongoing business success. We improve workforce capability through various programs and processes that identify, recruit, develop and promote our talent base. Significant enhancements in these programs have been made over the last several years, and we expect to continue to refine and enhance these programs in the future.

Products and Services

Products

Our network of branches and distribution centers stock approximately 230,000 unique product stock keeping units and we provide customers with access to more than 1,000,000 different products. Each branch tailors its inventory to meet the needs of its local customers.

Representative product categories and associated product lines that we offer include:

• | General Supplies. Wiring devices, fuses, terminals, connectors, boxes, enclosures, fittings, lugs, terminations, wrap, splicing and marking equipment, tools and testers, safety, personal protection, sealants, cutting tools, adhesives, consumables, fasteners, janitorial and other MRO supplies; |

• | Wire, Cable and Conduit. Wire, cable, raceway, metallic and non-metallic conduit; |

• | Communications and Security. Structured cabling systems, broadband products, low voltage specialty systems, specialty wire and cable products, equipment racks and cabinets, access control, alarms, cameras, paging and voice solutions; |

• | Electrical Distribution and Controls. Circuit breakers, transformers, switchboards, panel boards, metering products and busway products; |

• | Lighting and Sustainability. Lamps, fixtures, ballasts and lighting control products, and |

• | Automation, Controls and Motors. Motor control devices, drives, surge and power protection, relays, timers, pushbuttons, operator interfaces, switches, sensors, and interconnects. |

The following table sets forth sales information by product category:

Year Ended December 31, | 2017 | 2016 | 2015 | ||

(percentages based on total sales) | |||||

General Supplies | 40% | 40% | 40% | ||

Wire, Cable and Conduit | 15% | 14% | 15% | ||

Communications and Security | 15% | 15% | 15% | ||

Electrical Distribution and Controls | 10% | 11% | 11% | ||

Lighting and Sustainability | 12% | 12% | 10% | ||

Automation, Controls and Motors | 8% | 8% | 9% | ||

We purchase products from a diverse group of more than 26,000 suppliers. In 2017, our ten largest suppliers accounted for approximately 33% of our purchases. Our largest supplier in 2017 was Eaton Corporation, accounting for approximately 11% of our purchases. No other supplier accounted for more than 4% of our total purchases.

Our supplier relationships are important to us, providing access to a wide range of products, services, technical training, and sales and marketing support. We have approximately 300 commercial agreements with more than 200 preferred suppliers and purchase nearly 60% of our products pursuant to these arrangements. Consistent with industry practice, most of our agreements with suppliers, including both distribution agreements and commercial agreements, are terminable by either party on 60 days notice or less.

4

Services

As part of our overall offering, we provide customers a comprehensive portfolio of value-added solutions within a wide range of service categories including construction, e-commerce, energy and sustainability, engineering services, production support, safety and security, supply chain optimization, training, and working capital. These solutions are designed to address our customers' business needs through:

• | Technical advisory strategies, including product lifecycle management and migration planning; |

• | Supply chain and inventory optimization programs, including just-in-time delivery and vendor managed inventory; |

• | Consultation on production and operational efficiencies from cross-functional, cost saving teams; |

• | Transactional process improvements utilizing a suite of e-commerce solutions; |

• | Operational safety and product training for customer's employees, and |

• | Dedicated on-site support personnel. |

Competitive Strengths

As a leading electrical distributor in a highly fragmented North American market, we compete directly with global, national, regional, and local distributors of electrical and other industrial supplies, along with buying groups formed by smaller distributors. Competition is generally based on product line breadth, product availability, service capabilities and price. We believe that our market leadership, broad product offering, value-added services, technical expertise, extensive distribution network and low-cost operator status provide distinct competitive advantages.

Market Leadership. Our ability to manage complex global supply chains, and multi-site facility maintenance programs and construction projects, which require special sourcing, technical advice, logistical support and locally based service, has enabled us to establish a strong presence in the competitive and fragmented North American electrical distribution market.

Broad Product Offering and Value-added Services. We provide a wide range of products, services, and procurement solutions, which draw on our product knowledge, supply and logistics expertise, system capabilities and supplier relationships to enable our customers to maximize productivity, minimize waste, improve efficiencies, reduce costs and enhance safety. Our broad product offering and stable source of supply enables us to consistently meet customers’ wide-ranging capital project, MRO and OEM requirements.

Extensive Distribution Network. We operate approximately 500 geographically dispersed branch locations and ten distribution centers (six in the United States and four in Canada). Our distribution centers add value for our customers, suppliers, and branches through the combination of a broad and deep selection of inventory, online ordering and next-day shipment capabilities, and central order handling and fulfillment. Our distribution center network reduces the lead time and cost of supply chain activities through its automated replenishment and warehouse management system, and provides economies of scale in purchasing, inventory management, administration and transportation. This extensive network, which would be difficult and expensive to replicate, allows us to:

• | Enhance local customer service, technical support and sales coverage; |

• | Tailor individual branch products and services to local customer needs, and |

• | Offer multi-site distribution capabilities to large customers and global accounts. |

Low-Cost Operator. Our competitiveness has been enhanced by our consistent favorable operating cost position, which is based on the use of LEAN, strategically-located distribution centers, and purchasing economies of scale. As a result of these and other factors, we believe our operating costs as a percentage of sales has historically been one of the lowest in our industry. Our selling, general and administrative expenses as a percentage of revenues for 2017 were 14.3%.

5

Geography

Our network of branches and distribution centers are located primarily in North America. We attribute revenues from external customers to individual countries on the basis of the point of sale. The following table sets forth information about us by geographic area:

Net Sales Year Ended December 31, | Long-Lived Assets December 31, | |||||||||||||||||||||||||||||||

2017 | 2016 | 2015 | 2017 | 2016 | 2015 | |||||||||||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||||||||||

United States | $ | 5,775,988 | 75 | % | $ | 5,635,803 | 77 | % | $ | 5,665,962 | 75 | % | $ | 95,851 | $ | 123,465 | $ | 157,570 | ||||||||||||||

Canada | 1,521,378 | 20 | % | 1,394,657 | 19 | % | 1,533,705 | 21 | % | 56,591 | 60,372 | 63,088 | ||||||||||||||||||||

Mexico | 77,280 | 1 | % | 62,430 | 1 | % | 70,048 | 1 | % | 262 | 227 | 332 | ||||||||||||||||||||

Subtotal North American Operations | 7,374,646 | 7,092,890 | 7,269,715 | 152,704 | 184,064 | 220,990 | ||||||||||||||||||||||||||

Other International | 304,375 | 4 | % | 243,127 | 3 | % | 248,772 | 3 | % | 3,741 | 4,583 | 5,369 | ||||||||||||||||||||

Total | $ | 7,679,021 | $ | 7,336,017 | $ | 7,518,487 | $ | 156,445 | $ | 188,647 | $ | 226,359 | ||||||||||||||||||||

United States. To serve our customers in the United States, we operate a network of approximately 340 branches supported by six distribution centers located in Arkansas, Mississippi, Nevada, Pennsylvania, Texas and Wisconsin. Sales in the United States represented approximately 75% of our total sales in 2017. According to an industry source, the U.S. electrical wholesale distribution industry had estimated sales of nearly $100 billion in 2017.

Canada. To serve our Canadian customers, we operate a network of approximately 130 branches in nine provinces. Branch operations are supported by four distribution centers located in Alberta, British Columbia, Ontario and Quebec. Sales in Canada represented approximately 20% of our total sales in 2017. Total annual electrical industry sales in Canada were more than $13 billion in 2017, according to an industry source.

Mexico. We have seven branch locations in Mexico that provide various supply chain services to a broad range of end markets. Our headquarters is near Mexico City. Sales in Mexico represented approximately 1% of our total sales in 2017.

Other International. We sell to global customers through export sales offices located in Calgary, Houston, Miami, Montreal and Pittsburgh within North America and sales offices and branch operations in various international locations. Sales from other international locations represented approximately 4% of our total sales in 2017. Our branches in Aberdeen, Scotland, Dublin, Ireland and Manchester, England support sales efforts in Europe and the Middle East. We have branches in Singapore and Thailand to support our sales in Asia and a branch near Shanghai to serve customers in China. Furthermore, we support sales in South America through our branches in Chile, Ecuador and Peru, and we have operations in six additional countries. Many of our international locations have been established to serve our growing list of customers with global operations.

Intellectual Property

We currently have trademarks, patents and service marks registered with the U.S. Patent and Trademark Office and Canadian Intellectual Property Office. The trademarks and service marks registered in the U.S. include: “WESCO®”, our corporate logo and the running man logo. The Company's "EECOL" trademark is registered in Canada. In addition, trademarks, patents, and service mark applications have been filed in various foreign jurisdictions, including Argentina, Australia, Brazil, Chile, Colombia, Costa Rica, Canada, Chile, China, the European Community, Egypt, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Mexico, New Zealand, Norway, Panama, Peru, Philippines, Russia, Singapore, South Africa, Switzerland, Taiwan, Thailand, United Arab Emirates, United Kingdom, Venezuela, and Vietnam.

Environmental Matters

Our facilities and operations are subject to federal, state and local laws and regulations relating to environmental protection and human health and safety. Some of these laws and regulations may impose strict, joint and several liabilities on certain persons for the cost of investigation or remediation of contaminated properties. These persons may include former, current or future owners or operators of properties and persons who arranged for the disposal of hazardous substances. Our owned and leased real property may give rise to such investigation, remediation and monitoring liabilities under environmental laws. In addition, anyone disposing of certain products we distribute, such as ballasts, fluorescent lighting and batteries, must comply with environmental laws that regulate certain materials in these products.

We believe that we are in compliance, in all material respects, with applicable environmental laws. As a result, we do not anticipate making significant capital expenditures for environmental control matters either in the current year or in the near future.

6

Seasonality

Sales during the first quarter are affected by a reduced level of activity. Sales during the second, third and fourth quarters are generally 6 - 8% higher than the first quarter. Sales typically increase beginning in March, with slight fluctuations per month through October. During periods of economic expansion or contraction, our sales by quarter have varied significantly from this seasonal pattern.

Website Access

Our Internet address is www.wesco.com. Information contained on our website is not part of, and should not be construed as being incorporated by reference into, this Annual Report on Form 10-K. We make available free of charge under the “Investors” heading on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as our Proxy Statements, as soon as reasonably practicable after such documents are electronically filed or furnished, as applicable, with the Securities and Exchange Commission (the “SEC”). You also may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549-0213. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers like us who file electronically with the SEC.

In addition, our charters for our Executive Committee, Nominating and Governance Committee, Audit Committee and Compensation Committee, as well as our Corporate Governance Guidelines, Code of Principles for Senior Executives, Independence Policy, Global Anti-Corruption Policy, and Code of Business Ethics and Conduct for our Directors, officers and employees, are all available on our website in the “Corporate Governance” link under the “Investors” heading.

Forward-Looking Information

This Annual Report on Form 10-K contains various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve certain unknown risks and uncertainties, including, among others, those contained in Item 1, “Business,” Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” When used in this Annual Report on Form 10-K, the words “anticipates,” “plans,” “believes,” “estimates,” “intends,” “expects,” “projects,” “will” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain such words. Such statements, including, but not limited to, our statements regarding business strategy, growth strategy, competitive strengths, productivity and profitability enhancement, competition, new product and service introductions and liquidity and capital resources, are based on management’s beliefs, as well as on assumptions made by and information currently available to management, and involve various risks and uncertainties, some of which are beyond our control. Our actual results could differ materially from those expressed in any forward-looking statement made by us or on our behalf. In light of these risks and uncertainties, there can be no assurance that the forward-looking information will in fact prove to be accurate. We have undertaken no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

7

Executive Officers

Our executive officers and their respective ages and positions as of February 21, 2018, are set forth below.

Name | Age | Position | ||

John J. Engel | 56 | Chairman, President and Chief Executive Officer | ||

Diane E. Lazzaris | 51 | Senior Vice President and General Counsel | ||

Robert Minicozzi | 56 | Vice President and Chief Information Officer | ||

David S. Schulz | 52 | Senior Vice President and Chief Financial Officer | ||

Kimberly G. Windrow | 60 | Senior Vice President and Chief Human Resources Officer | ||

Set forth below is biographical information for our executive officers listed above.

John J. Engel was elected as Chairman of the Board at the 2011 Annual Meeting and has served as President and Chief Executive Officer since 2009. Previously, Mr. Engel served as our Senior Vice President and Chief Operating Officer from 2004 to 2009. Before joining WESCO in 2004, Mr. Engel served as Senior Vice President and General Manager of Gateway, Inc., Executive Vice President and Senior Vice President of Perkin Elmer, Inc., Vice President and General Manager of Allied Signal, Inc., and various engineering, manufacturing and general management positions at General Electric Company.

Diane E. Lazzaris has served as our Senior Vice President and General Counsel since January 2014, and from 2010 to December 2013 she served as our Vice President, Legal Affairs. From 2008 to 2010, Ms. Lazzaris served as Senior Vice President - Legal, General Counsel and Corporate Secretary of Dick’s Sporting Goods, Inc. From 1994 to 2008, she held various corporate counsel positions at Alcoa Inc., including Group Counsel to a group of global businesses.

Robert Minicozzi has served as our Vice President and Chief Information Officer since January 2016. From April 2012 to December 2015, Mr. Minicozzi served as Vice President and Global Divisional Chief Information Officer of Arrow Electronics, Inc. and previously held various information systems leadership positions with Arrow Electronics, Inc.

David S. Schulz has served as our Senior Vice President and Chief Financial Officer since October 2016. From April 2016 to October 2016, he served as Senior Vice President and Chief Operating Officer of Armstrong Flooring, Inc. From November 2013 to March 2016, he served as Senior Vice President and Chief Financial Officer of Armstrong World Industries, Inc., and as Vice President, Finance of the Armstrong Building Products division from 2011 to November 2013. Prior to joining Armstrong World Industries in 2011, he held various financial leadership roles with Procter & Gamble and The J.M. Smucker Company. Mr. Schulz began his career as an officer in the United States Marine Corps.

Kimberly G. Windrow has served as our Senior Vice President and Chief Human Resources Officer since January 2014, and from August 2010 to December 2013 she served as our Vice President, Human Resources. From 2004 until 2010, Ms. Windrow served as Senior Vice President of Human Resources for The McGraw Hill Companies in the education segment. From 2001 until 2004, she served as Senior Vice President of Human Resources for The MONY Group, and from 1988 until 2000, she served in various Human Resource positions at Willis, Inc.

8

Item 1A. Risk Factors.

The following factors, among others, could cause our actual results to differ materially from the forward-looking statements we make. All forward-looking statements attributable to us or persons working on our behalf are expressly qualified by the following factors. This information should be read in conjunction with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7A, Quantitative and Qualitative Disclosures about Market Risks and the consolidated financial statements and related notes included in this Form 10-K.

Operational Risk Factors

Adverse conditions in the global economy and disruptions of financial markets could negatively impact our results of operations, cash flows or financial position.

Our results of operations are affected by the level of business activity of our customers, which in turn is affected by global economic conditions and market factors impacting the industries and markets that they serve. Certain global economies and markets continue to experience significant uncertainty and volatility, particularly commodity-driven end markets such as oil and gas and metals and mining. Adverse economic conditions or lack of liquidity in these markets, particularly in North America, may adversely affect our revenues and operating results. Economic and financial market conditions may also affect the availability of financing for projects and for our customers' capital or other expenditures, which can result in project delays or cancellations and thus affect demand for our products. There can be no assurance that any governmental responses to economic conditions or disruptions in the financial markets ultimately will stabilize the markets or increase our customers' liquidity or the availability of credit to our customers. Should one or more of our larger customers declare bankruptcy, it could adversely affect the collectability of our accounts receivable, along with bad debt reserves and net income. In addition, our ability to access the capital markets may be restricted at a time when we would like, or need, to do so. The economic, political and financial environment also may affect our business and financial condition in ways that we currently cannot predict, and there can be no assurance that economic, political and market conditions will not adversely affect our results of operations, cash flows or financial position in the future.

Certain events or conditions, including a failure or breach of our information security systems, could lead to interruptions in our operations, which may materially adversely affect our business operations, financial condition, and results of operations.

We operate a number of facilities and we coordinate company activities, including information technology systems and administrative services and the like, through our headquarters operations. Our operations depend on our ability to maintain existing systems and implement new technology, which includes allocating sufficient resources to periodically upgrade our information technology systems, and to protect our equipment and the information stored in our databases against both manmade and natural disasters, as well as power losses, computer and telecommunications failures, technological breakdowns, unauthorized intrusions, cyber-attacks, and other events. Conversions to new information technology systems may result in cost overruns, delays or business interruptions. If our information technology systems are disrupted, become obsolete or do not adequately support our strategic, operational or compliance needs, it could result in a competitive disadvantage and adversely affect our business operations and financial condition, including our ability to process orders, receive and ship products, maintain inventories, collect accounts receivable and pay expenses, therefore impacting our results of operations.

Because we rely heavily on information technology both in serving our customers and in our enterprise infrastructure in order to achieve our objectives, we may be vulnerable to damage or intrusion from a variety of cyber-attacks, including computer viruses, worms or other malicious software programs that access our systems. Despite the precautions we take to mitigate the risks of such events, an attack on our enterprise information technology system could result in theft or disclosure of our proprietary or confidential information or a breach of confidential customer, supplier or employee information. Such events could have an adverse impact on revenue and harm our reputation. Additionally, such an event could cause us to incur legal liabilities and costs, which could be significant, in order to address and remediate the effects of an attack and related security concerns.

We also depend on accessible office facilities, distribution centers and information technology data centers for our operations to function properly. An interruption of operations at any of our distribution centers could have a material adverse effect on the operations of branches served by the affected distribution center. Such disaster related risks and effects are not predictable with certainty and, although they typically can be mitigated, they cannot be eliminated. We seek to mitigate our exposures to disaster events in a number of ways. For example, where feasible, we design the configuration of our facilities to reduce the consequences of disasters. We also maintain insurance for our facilities against casualties, and we evaluate our risks and develop contingency plans for dealing with them. Although we have reviewed and analyzed a broad range of risks applicable to our business, the ones that actually affect us may not be those that we have concluded are most likely to occur. Furthermore, although our reviews have led to more systematic contingency planning, our plans are in varying stages of development and execution, such that they may not be adequate at the time of occurrence for the magnitude of any particular disaster event that we may encounter.

9

An increase in competition could decrease sales, profit margins, and earnings.

We operate in a highly competitive industry and compete directly with global, national, regional and local providers of like products and services. Some of our existing competitors have, and new market entrants may have, greater resources than us. Competition is generally based on product line breadth, product availability, service capabilities and price. Other sources of competition are buying groups formed by smaller distributors to increase purchasing power and provide some cooperative marketing capability, as well as e-commerce companies. There may be new market entrants with non-traditional business and customer service models, resulting in increased competition and changing industry dynamics.

Existing or future competitors may seek to gain or retain market share by reducing prices, and we may be required to lower our prices or may lose business, which could adversely affect our financial results. Also, to the extent that we do not meet changing customer preferences or demands, or to the extent that one or more of our competitors becomes more successful with private label products, on-line offerings or otherwise, our ability to attract and retain customers could be materially adversely affected. Existing or future competitors also may seek to compete with us for acquisitions, which could have the effect of increasing the price and reducing the number of suitable acquisitions. These factors, in addition to competitive pressures resulting from the fragmented nature of our industry, could affect our sales, profit margins and earnings.

Expansion into new business activities, industries, product lines or geographic areas could subject the company to increased costs and risks and may not achieve the intended results.

We have invested significantly in expanding our e-commerce capabilities and online customer experience. If our efforts to expand our capabilities in this area are not successful, we may not realize the return on our investments as anticipated, or our operating results could be adversely affected by slower than expected sales growth or additional costs. Furthermore, engaging in or significantly expanding business activities in product sourcing, sales and services could subject the company to unexpected costs and risks. Such activities could subject us to increased operating costs, product liability, regulatory requirements and reputational risks. Our expansion into new and existing markets, including manufacturing related or regulated businesses, may present competitive distribution and regulatory challenges that differ from current ones. We may be less familiar with the target customers and may face different or additional risks, as well as increased or unexpected costs, compared to existing operations. Growth into new markets may also bring us into direct competition with companies with whom we have little or no past experience as competitors. To the extent we are reliant upon expansion into new geographic, industry and product markets for growth and do not meet the new challenges posed by such expansion, our future sales growth could be negatively impacted, our operating costs could increase, and our business operations and financial results could be negatively affected.

Loss of key suppliers, product cost fluctuations, lack of product availability, or inefficient supply chain operations could decrease sales, profit margins, and earnings.

Most of our agreements with suppliers are terminable by either party on 60 days' notice or less. Our 10 largest suppliers in 2017 accounted for approximately 33% of our purchases for the period. Our largest supplier in 2017 was Eaton Corporation, accounting for approximately 11% of our purchases. The loss of, or a substantial decrease in the availability of, products from any of these suppliers, a supplier's change in sales strategy to rely less on distribution channels, the loss of key preferred supplier agreements, or disruptions in a key supplier's operations could have a material adverse effect on our business. Supply interruptions could arise from shortages of raw materials, effects of economic, political or financial market conditions on a supplier's operations, labor disputes or weather conditions affecting products or shipments, transportation disruptions, information system disruptions or other reasons beyond our control.

In addition, certain of our products, such as wire and conduit, are commodity price based products and may be subject to significant price fluctuations which are beyond our control. While increases in the cost of energy or products could have adverse effects, decreases in those costs, particularly if severe, could also adversely impact us by creating deflation in selling prices, which could cause our gross profit margin to deteriorate. Fluctuations in energy or raw materials costs can also adversely affect our customers. Declines in oil and gas prices can negatively impact our customers operating in those industries and, consequently, our sales to those customers. Furthermore, we cannot be certain that particular products or product lines will be available to us, or available in quantities sufficient to meet customer demand. Such limited product access could cause us to be at a competitive disadvantage. The profitability of our business is also dependent upon the efficiency of our supply chain. An inefficient or ineffective supply chain strategy or operations could increase operational costs, decrease sales, profit margins and earnings, which could adversely affect our business.

We must attract, retain and motivate key employees, and the failure to do so may adversely affect our business.

Our success depends on hiring, retaining and motivating key employees, including executive, managerial, sales, technical, marketing and support personnel. We may have difficulty locating and hiring qualified personnel. In addition, we may have difficulty retaining such personnel once hired, and key people may leave and compete against us. The loss of key personnel or

10

our failure to attract and retain other qualified and experienced personnel could disrupt or adversely affect our business, its sales and operating results. In addition, our operating results could be adversely affected by increased costs due to increased competition for employees, higher employee turnover, which may also result in loss of significant customer business, or increased employee benefit costs.

Acquisitions that we may undertake would involve a number of inherent risks, any of which could cause us not to realize the benefits anticipated to result.

We have expanded our operations through organic growth and selected acquisitions of businesses and assets, and may seek to do so in the future. Acquisitions involve various inherent risks, including: problems that could arise from the integration of the acquired business; uncertainties in assessing the value, strengths, weaknesses, contingent and other liabilities and potential profitability of acquisition candidates; the potential loss of key employees of an acquired business; the ability to achieve identified operating and financial synergies anticipated to result from an acquisition or other transaction; unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying the acquisition or other transaction rationale; and expansion into new countries or geographic markets where we may be less familiar with operating requirements, target customers and regulatory compliance. Any one or more of these factors could increase our costs or cause us not to realize the benefits anticipated to result from the acquisition of a business or assets.

While there are risks associated with acquisitions generally, including integration risks, there are additional risks more specifically associated with owning and operating businesses internationally, including those arising from import and export controls, foreign currency exchange rate changes, material developments in political, regulatory or economic conditions impacting those operations and various environmental and climatic conditions in particular areas of the world.

Financial Risk Factors

Changes in tax laws or challenges to the Company's tax positions by taxing authorities could adversely impact the Company's results of operations and financial condition.

We are subject to taxes in jurisdictions in which we do business, including but not limited to taxes imposed on our income, receipts, stockholders' equity, property, sales, purchases and payroll. As a result, the tax expense we incur can be adversely affected by changes in tax law. We frequently cannot anticipate these changes in tax law, which can cause unexpected volatility in our results of operations. While not limited to the United States (U.S.) and Canada, changes in the tax law at the federal and state/provincial levels in the United States and Canada can have a materially adverse effect on our results of operations.

Additionally, the tax laws to which the Company is subject are inherently complex and ambiguous. Therefore, we must interpret the applicable laws and make subjective judgments about the expected outcome upon challenge by the applicable taxing authorities. As a result, the impact on our results from operations of the application of enacted tax laws to our facts and circumstances is frequently uncertain. If a tax authority successfully challenges our interpretation and application of the tax law to our facts and circumstances, there can be no assurance that we can accurately predict the outcome and the taxes ultimately owed upon effective settlement, which may differ from the tax expense recognized in our consolidated statements of income and comprehensive income (loss) and accrued in our consolidated balance sheets. Additionally, if we cannot meet liquidity requirements in the United States, we may have to repatriate funds from overseas, which would result in additional income taxes being incurred on the amount repatriated.

Uncertainties in the interpretation and application of the Tax Cuts and Jobs Act of 2017 could materially affect our tax obligations and effective tax rate.

The Tax Cuts and Jobs Act of 2017 ("TCJA") was enacted on December 22, 2017, and it significantly affected U.S. tax law by, among other things, changing how the U.S. imposes income tax on multinational corporations. The TCJA requires complex computations not previously provided in U.S. tax law, and the application of accounting guidance for such items is currently uncertain in some respects. Further, compliance with the TCJA and the accounting for such provisions require accumulation of information not previously required or regularly produced. The U.S. Department of Treasury has broad authority to issue regulations and interpretative guidance that may significantly impact how the law is applied and thus impact our results of operations in the period issued.

Also on December 22, 2017, the Securities and Exchange Commission ("SEC") issued guidance to address the accounting implications of the TCJA in which a registrant does not have the necessary information available, prepared or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the TCJA. We have recorded provisional estimates in our financial statements with respect to certain income tax effects of the TCJA for which the accounting is incomplete, but a reasonable estimate was able to be determined. We will continue to perform additional analysis on the application of the TCJA, taking into account any additional regulatory guidance that is issued by the applicable taxing authorities, which may result in adjustments to our previously reported provisional estimates. In accordance with the SEC's guidance, we

11

will recognize any adjustments to our previously reported provisional estimates in the relevant future periods, which could materially affect our tax obligations and our effective tax rate.

Fluctuations in foreign currency have an effect on our results from operations.

The results of our foreign operations are reported in the local currency and then translated into U.S. dollars at the applicable exchange rates for inclusion in our consolidated financial statements. The exchange rates between some of these currencies and the U.S. dollar have fluctuated significantly in recent years, and may continue to do so in the future. We may incur losses related to foreign currency fluctuations, and foreign exchange controls may prevent us from repatriating cash in countries outside the U.S. In addition, because our financial statements are stated in U.S. dollars, such fluctuations may also affect the comparability of our results between financial periods.

Our outstanding indebtedness requires debt service commitments that could adversely affect our ability to fulfill our obligations and could limit our growth and impose restrictions on our business.

As of December 31, 2017, excluding debt discount and debt issuance costs, we had $1.36 billion of consolidated indebtedness. We and our subsidiaries may undertake additional borrowings in the future, subject to certain limitations contained in the debt instruments governing our indebtedness. Over the next three years, we will be required to repay or refinance approximately $512.8 million of our currently outstanding indebtedness.

Our debt service obligations impact our ability to operate and grow our business. Our payments of principal and interest on our indebtedness reduce the amount of funds available to us to invest in operations, future business opportunities, acquisitions, and other potentially beneficial activities. Our debt service obligations also increase our vulnerability to adverse economic, financial market and industry conditions. Our ability to service and refinance our indebtedness, make scheduled payments on our operating leases and fund capital expenditures, acquisitions or other business opportunities, will depend in large part on both our future performance and the availability of additional financing in the future. There can be no assurance that our business will continue to generate sufficient cash flows from operations in the future to service our debt, make necessary capital expenditures, or meet other cash needs. If unable to do so, we may be required to refinance all or a portion of our existing debt, sell assets, or obtain additional financing.

Our debt agreements contain restrictions that may limit our ability to operate our business.

Our credit facilities require us to maintain specific earnings to fixed expense ratios and to meet minimum net worth requirements in certain circumstances. In addition, our credit facilities and our other debt agreements contain, and any of our future debt agreements may contain, additional covenant restrictions that limit our ability to operate our business, or are dependent upon our future financial performance.

As a result of these covenants, our ability to respond to changes in business and economic conditions and to obtain additional financing, if needed, may be significantly restricted, and we may be prevented from engaging in transactions that might otherwise be beneficial to us. See the liquidity section in "Item 7. Management's Discussion and Analysis" for further details.

There is a risk that the market value of our common stock may decline.

Stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies in our industry have been volatile. For some issuers, the markets have exerted downward pressure on stock prices and credit capacity. It is impossible to predict whether the price of our common stock will rise or fall. Trading prices of our common stock will be influenced by our operating results and prospects and by economic, political, financial, and other factors.

Regulatory and Legal Risk Factor

We are subject to costs and risks associated with global laws and regulations affecting our business, as well as litigation for product liability or other matters affecting our business.

The global legal and regulatory environment is complex and exposes us to compliance costs and risks, as well as litigation and other legal proceedings, which could materially affect our operations and financial results. These laws and regulations may change, sometimes significantly, as a result of political or economic events, and some changes are anticipated to occur in the coming year. They include tax laws and regulations, import and export laws and regulations, labor and employment laws and regulations, product safety, occupational safety and health laws and regulations, securities and exchange laws and regulations, data privacy laws and regulations (and other laws applicable to publicly-traded companies such as the Foreign Corrupt Practices Act), and environmental laws and regulations. Furthermore, as a government contractor selling to federal, state and local government entities, we are also subject to a wide variety of additional laws and regulations. Proposed laws and regulations in these and other areas could affect the cost of our business operations.

12

From time to time we are involved in legal proceedings, audits or investigations which may relate to, for example, product liability, labor and employment (including wage and hour), tax, escheat, import and export compliance, government contracts, worker health and safety, and general commercial and securities matters. While we believe the outcome of any pending matter is unlikely to have a material adverse effect on our financial condition or liquidity, additional legal proceedings may arise in the future and the outcome of these as well as other contingencies could require us to take actions, which could adversely affect our operations or could require us to pay substantial amounts of money.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We have approximately 500 branches, of which approximately 340 are located in the United States, approximately 130 are located in Canada, seven are located in Mexico and the remainder are in other countries located in Asia, Europe and South America. Approximately 15% of our branches are owned facilities, and the remainder are leased.

The following table summarizes our distribution centers:

Square Feet | Leased/Owned | |||

Location | ||||

Little Rock, AR | 100,000 | Leased | ||

Byhalia, MS (1) | 148,000 | Owned | ||

Sparks, NV | 199,000 | Leased | ||

Warrendale, PA (1) | 194,000 | Owned | ||

Dallas, TX | 112,000 | Leased | ||

Madison, WI | 136,000 | Leased | ||

Edmonton, AB | 101,000 | Leased | ||

Burnaby, BC | 65,000 | Leased | ||

Mississauga, ON | 246,000 | Leased | ||

Montreal, QC | 126,000 | Leased | ||

(1) Property pledged as collateral under our Term Loan Facility.

We also lease our 97,000 square-foot headquarters in Pittsburgh, Pennsylvania. We do not regard the real property associated with any single branch location as material to our operations. We believe our facilities are in good operating condition and are adequate for their respective uses.

Item 3. Legal Proceedings.

From time to time, a number of lawsuits and claims have been or may be asserted against us relating to the conduct of our business, including routine litigation relating to commercial and employment matters. The outcome of any litigation cannot be predicted with certainty, and some lawsuits may be determined adversely to us. However, management does not believe that the ultimate outcome of any such pending matters is likely to have a material adverse effect on our financial condition or liquidity, although the resolution in any fiscal period of one or more of these matters may have a material adverse effect on our results of operations for that period.

Information relating to legal proceedings is included in Note 13, "Commitments and Contingencies," of the Notes to Consolidated Financial Statements and is incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

13

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market, Stockholder and Dividend Information. Our common stock is listed on the New York Stock Exchange under the symbol “WCC.” As of February 20, 2018, there were 47,056,716 shares of common stock outstanding held by approximately 17 holders of record. We have not paid dividends on the common stock and do not currently plan to pay dividends. We do, however, evaluate the possibility from time to time. It is currently expected that earnings will be reinvested to support growth initiatives, acquisitions, debt reduction, and share repurchases. In addition, our Revolving Credit Facility, Term Loan Facility, 2021 Notes and 2024 Notes limit our ability to pay dividends and repurchase our common stock. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

The following table sets forth the high and low sales prices per share of our common stock, as reported on the New York Stock Exchange, for the periods indicated.

Sales Prices | |||||||

Quarter | High | Low | |||||

2016 | |||||||

First | $ | 55.92 | $ | 34.00 | |||

Second | 62.66 | 50.64 | |||||

Third | 63.90 | 49.67 | |||||

Fourth | 73.40 | 51.45 | |||||

2017 | |||||||

First | $ | 76.15 | $ | 64.25 | |||

Second | 70.95 | 53.60 | |||||

Third | 60.50 | 48.95 | |||||

Fourth | 69.35 | 57.25 | |||||

Issuer Purchases of Equity Securities. On December 17, 2014, WESCO announced that its Board of Directors approved, on December 11, 2014, the repurchase of up to $300 million of the Company's common stock through December 31, 2017. Under this repurchase authorization, WESCO repurchased 4,247,113 shares of the Company's common stock for $250.0 million.

On December 13, 2017, WESCO announced that its Board of Directors approved, on December 7, 2017, the repurchase of up to $300 million of the Company's common stock through December 31, 2020. As of December 31, 2017, no shares have been repurchased under this repurchase authorization.

14

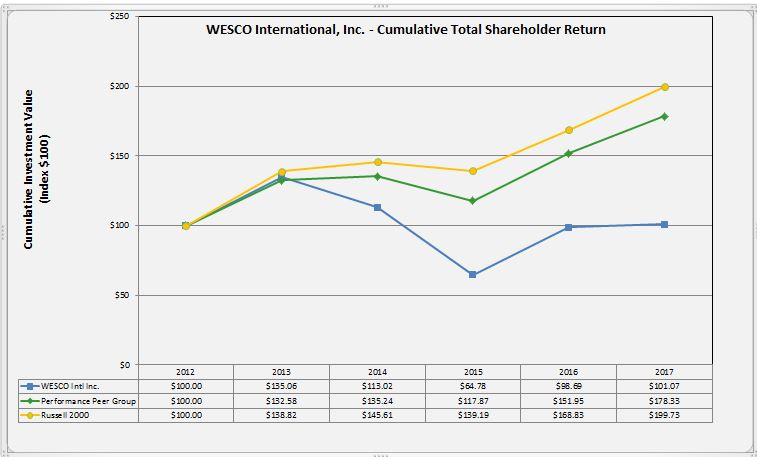

Company Performance. The following stock price performance graph illustrates the cumulative total return on an investment in WESCO International, a 2017 Performance Peer Group, and the Russell 2000 Index. The graph covers the period from December 31, 2012 to December 31, 2017, and assumes that the value for each investment was $100 on December 31, 2012, and that all dividends were reinvested.

2017 Performance Peer Group (1): | ||

Anixter International, Inc. | Essendant, Inc. | MSC Industrial Direct Co., Inc. |

Applied Industrial Technologies, Inc. | Fastenal Company | Rexel SA |

Arrow Electronics, Inc. | Genuine Parts Company | Rockwell Automation, Inc. |

Avnet, Inc. | HD Supply Holdings, Inc. | Tech Data Corporation |

Barnes Group | Hubbell, Inc. | W.W. Grainger, Inc. |

Eaton Corporation Plc | MRC Global, Inc. | |

1 | Airgas, Inc. and Ingram Micro, Inc. were removed from the performance peer group in 2017 due to acquisition. |

15

Item 6. Selected Financial Data.

Selected financial data and significant events related to the Company’s financial results for the last five fiscal years are listed below. The financial data should be read in conjunction with the Consolidated Financial Statements and Notes thereto included in Item 8, and with Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7.

Year Ended December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

(In millions, except per share data) | |||||||||||||||||||

Income Statement Data: | |||||||||||||||||||

Net sales | $ | 7,679.0 | $ | 7,336.0 | $ | 7,518.5 | $ | 7,889.6 | $ | 7,513.3 | |||||||||

Cost of goods sold (excluding depreciation and amortization) | 6,194.4 | 5,887.8 | 6,024.8 | 6,278.6 | 5,967.9 | ||||||||||||||

Selling, general and administrative expenses | 1,099.6 | 1,049.3 | 1,055.0 | 1,076.8 | 996.8 | ||||||||||||||

Depreciation and amortization | 64.0 | 66.9 | 65.0 | 68.0 | 67.6 | ||||||||||||||

Income from operations | 321.0 | 332.0 | 373.7 | 466.2 | 481.0 | ||||||||||||||

Interest expense, net | 68.5 | 76.6 | 69.8 | 82.1 | 85.6 | ||||||||||||||

Loss on debt extinguishment(1) | — | 123.9 | — | — | 13.2 | ||||||||||||||

Other loss(2) | — | — | — | — | 2.3 | ||||||||||||||

Income before income taxes | 252.5 | 131.5 | 303.9 | 384.1 | 379.9 | ||||||||||||||

Provision for income taxes | 89.3 | 30.4 | 95.5 | 108.7 | 103.4 | ||||||||||||||

Net income | 163.2 | 101.1 | 208.4 | 275.4 | 276.5 | ||||||||||||||

Net loss (income) attributable to noncontrolling interests(3) | 0.3 | 0.5 | 2.3 | 0.5 | (0.1 | ) | |||||||||||||

Net income attributable to WESCO International | $ | 163.5 | $ | 101.6 | $ | 210.7 | $ | 275.9 | $ | 276.4 | |||||||||

Earnings per common share attributable to WESCO International | |||||||||||||||||||

Basic | $ | 3.42 | $ | 2.30 | $ | 4.85 | $ | 6.21 | $ | 6.26 | |||||||||

Diluted | $ | 3.38 | $ | 2.10 | $ | 4.18 | $ | 5.18 | $ | 5.25 | |||||||||

Weighted-average common shares outstanding | |||||||||||||||||||

Basic | 47.8 | 44.1 | 43.4 | 44.4 | 44.1 | ||||||||||||||

Diluted | 48.4 | 48.3 | 50.4 | 53.3 | 52.7 | ||||||||||||||

Other Financial Data: | |||||||||||||||||||

Capital expenditures | $ | 21.5 | $ | 18.0 | $ | 21.7 | $ | 20.5 | $ | 27.8 | |||||||||

Net cash provided by operating activities | 149.1 | 300.2 | 283.1 | 251.2 | 315.1 | ||||||||||||||

Net cash used in investing activities | (5.3 | ) | (70.5 | ) | (170.2 | ) | (144.2 | ) | (18.2 | ) | |||||||||

Net cash used in financing activities | (141.2 | ) | (276.3 | ) | (67.8 | ) | (95.5 | ) | (257.5 | ) | |||||||||

Balance Sheet Data: | |||||||||||||||||||

Total assets(4) | $ | 4,735.5 | $ | 4,431.8 | $ | 4,569.7 | $ | 4,754.4 | $ | 4,648.9 | |||||||||

Total debt (including current and short-term debt)(5) | 1,348.6 | 1,385.3 | 1,483.4 | 1,415.6 | 1,487.7 | ||||||||||||||

Stockholders’ equity(4) | 2,116.1 | 1,963.6 | 1,773.9 | 1,928.2 | 1,764.8 | ||||||||||||||

(1) Represents the loss recognized in 2016 related to the redemption of the then outstanding 6.0% Convertible Senior Debentures due 2029 ("2029 Debentures") and the loss recognized in 2013 related to the $500 million prepayment made to the U.S. sub-facility of the Term Loan Facility.

(2) Represents the loss on the sale of a foreign operation in 2013.

(3) Represents the portion of net loss (income) attributable to consolidated entities that are not owned by the Company.

(4) The Consolidated Balance Sheet at December 31, 2016 was revised from the previously issued financial statements. The revision impacted the presentation of total assets and stockholders' equity. See Note 2 of the Notes to Consolidated Financial Statements.

(5) Includes the discount related to the 6.0% Convertible Senior Debentures due 2029 and Term Loan Facility. For 2017, 2016 and 2015, also includes debt issuance costs. See Note 7 of the Notes to Consolidated Financial Statements.

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the audited consolidated financial statements and notes thereto included in Item 8 of this Annual Report on Form 10-K.

Company Overview

Our 2017 financial results reflect a return to growth, driven by improved business momentum in our end markets and geographies. Sales increased $343.0 million, or 4.7%, over the prior year. Foreign exchange rates and acquisitions positively impacted net sales by 0.4% and 0.2%, respectively, and were partially offset by a 0.4% impact from the number of work days, resulting in organic sales growth of 4.5%. Cost of goods sold as a percentage of net sales was 80.7% and 80.3% in 2017 and 2016, respectively. Operating income was $320.9 million for 2017, compared to $332.1 million for 2016. Operating income decreased due to lower gross margin and the restoration of incentive and discretionary compensation. Net income attributable to WESCO International of $163.5 million increased by 60.9% compared to 2016 net income of $101.6 million, which included a $123.9 million loss on debt redemption. Earnings per diluted share attributable to WESCO International was $3.38 in 2017, based on 48.4 million diluted shares, compared with earnings per diluted share of $2.10 in 2016, based on 48.3 million diluted shares. Excluding the impact of the TCJA of $0.55, adjusted earnings per diluted share for 2017 was $3.93.

Our end markets consist of industrial firms, electrical and data communications contractors, utilities, and commercial organizations, institutions and government entities. Our transaction types to these markets can be categorized as stock, direct ship and special order. Stock orders are filled directly from existing inventory and represent approximately 52% of total sales. Approximately 38% of our total sales are direct ship sales. Direct ship sales are typically custom-built products, large orders or products that are too bulky to be easily handled and, as a result, are shipped directly to the customer from the supplier. Special orders are for products that are not ordinarily stocked in inventory and are ordered based on a customer’s specific request. Special orders represent the remaining 10% of total sales.

We have historically financed our working capital requirements, capital expenditures, acquisitions, share repurchases and new branch openings through internally-generated cash flow, debt issuances, borrowings under our Revolving Credit Facility and funding through our Receivables Facility.

Cash Flow

We generated $149.1 million in operating cash flow during 2017. Cash provided by operating activities included net income of $163.1 million, adjustments to net income totaling $28.5 million, which were offset by changes in assets and liabilities of $42.5 million. Investing activities included capital expenditures of $21.5 million. Financing activities consisted of borrowings and repayments of $834.4 million and $826.4 million, respectively, related to our Revolving Credit Facility, borrowings and repayments of both $670.2 million, related to our Receivables Facility, repayments of $60.0 million applied to our Term Loan Facility as well as borrowings and repayments on our various international lines of credit of $175.8 million and $164.0 million, respectively. Financing activities also included the repurchase of $106.8 million of the Company's common stock, of which $100 million was pursuant to the share repurchase plan announced on December 17, 2014.

Free cash flow for the years ended December 31, 2017 and 2016 was $127.6 million and $282.2 million, respectively.

The following table sets forth the components of free cash flow:

Twelve Months Ended December 31, | |||||||

2017 | 2016 | ||||||

Free Cash Flow: | |||||||

(In millions) | |||||||

Cash flow provided by operations | $ | 149.1 | $ | 300.2 | |||

Less: Capital expenditures | (21.5 | ) | (18.0 | ) | |||

Free cash flow | $ | 127.6 | $ | 282.2 | |||

Note: The table above reconciles cash flow provided by operations to free cash flow. Free cash flow is a non-GAAP financial measure of liquidity. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund investing and financing activities.

17

Financing Availability

As of December 31, 2017, we had $562.9 million in total available borrowing capacity under our Revolving Credit Facility, which was comprised of $365.3 million of availability under the U.S. sub-facility and $197.6 million of availability under the Canadian sub-facility. Available borrowing capacity under our Receivables Facility was $170.0 million. The Receivables Facility and Revolving Credit Facility both mature in September 2020.

Critical Accounting Policies and Estimates