Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KAMAN Corp | kamn-20200910.htm |

Creating Tomorrow’s Today Investor Presentation

Forward Looking Statements FORWARD-LOOKING STATEMENTS This presentation includes "forward looking statements" relating to the announced transactions and future operations of the Company, which can be identified by the use of words such as “will,” “expect,” “poise,” “believe,” “plans,” “strategy,” “prospects,” “estimate,” “project”, “seek,” “target,” “anticipate,” “intend,” “future,” “likely,” “may,” “should,” “would,” “could,” and other words of similar meaning in connection with a discussion of future operating or financial performance or events. Forward-looking statements also may be included in other publicly available documents issued by the Company and in oral statements made by our officers and representatives from time to time. These statements are based on assumptions currently believed to be valid but involve significant risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ from those expressed in the forward looking statements. Such risks and uncertainties include, among others, the ability to implement the anticipated business plans following closing and achieve anticipated benefits and savings; and future and estimated revenues, earnings, cash flow, charges, cost savings and expenditures. Additional risks and uncertainties that could cause our actual results to differ from those expressed in the forward looking statements are identified in our reports filed with the SEC, including our Quarterly Reports on Form 10-Q, our Annual Reports on Form 10-K, and our Current Reports on Form 8-K. The forward looking statements included in this presentation are made only as of the date of this presentation, and the Company does not undertake any obligation to update the forward looking statements to reflect subsequent events or circumstances. Non-GAAP Figures Management believes that the Non-GAAP financial measures (i.e. financial measures that are not computed in accordance with Generally Accepted Accounting Principles) identified by an asterisk (*) used in this presentation or in other disclosures provide important perspectives into the Company's ongoing business performance. The Company does not intend for the information to be considered in isolation or as a substitute for the related GAAP measures. Other companies may define the measures differently. Reconciliations from GAAP measures to the Non-GAAP measures are presented herein. 2

The transformation of our business has focused the “New Kaman” on engineered solutions, driving innovation to solve our customers most complex challenges 3

Q2 2020 Overview . Consolidated Sales up 1.8%; Organic sales* down 8.5% . Gross margins in excess of 30% and significant cost control improve profitability Financial . Adjusted EBITDA* of 13.4%, a 370 bps increase over prior year period Performance (from continuing operations) . Adjusted diluted earnings per share* more than doubled to $0.36 . Available cash on hand of $236 million at quarter end; Repaid $100 million on revolving credit agreement in August 2020 . High level of execution despite continued challenges from COVID-19 . Delivering on cost savings initiatives with approximately $34 million in annualized savings; Identified opportunities to deliver $16 million in additional savings Key . Maintained discipline in application of our COVID-19 policies and procedures to Messages protect employees and maintain operations . Strong balance sheet and significant capacity under our revolving credit facility . No debt maturities until 2024 4

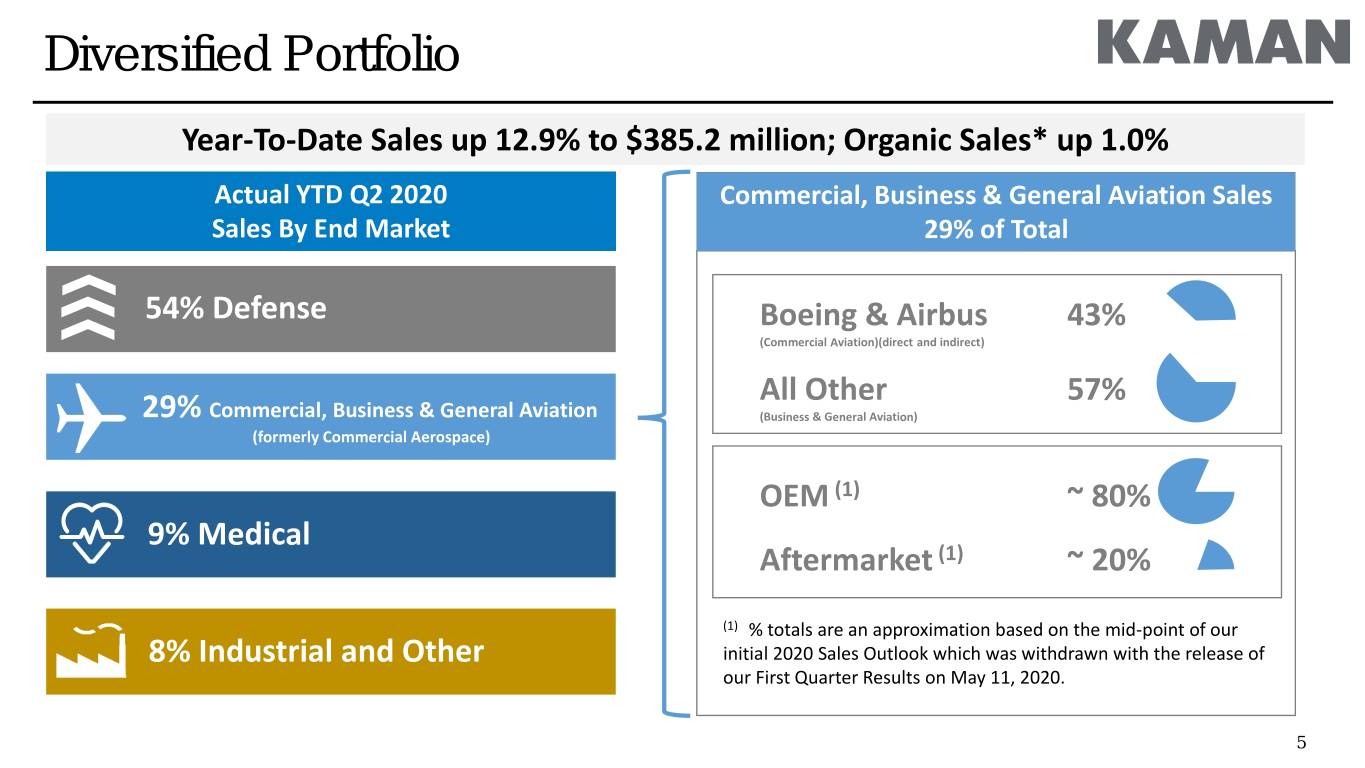

Diversified Portfolio Year-To-Date Sales up 12.9% to $385.2 million; Organic Sales* up 1.0% Actual YTD Q2 2020 Commercial, Business & General Aviation Sales Sales By End Market 29% of Total 54% Defense Boeing & Airbus 43% (Commercial Aviation)(direct and indirect) All Other 57% 29% Commercial, Business & General Aviation (Business & General Aviation) (formerly Commercial Aerospace) OEM (1) ~ 80% 9% Medical Aftermarket (1) ~ 20% (1) % totals are an approximation based on the mid-point of our 8% Industrial and Other initial 2020 Sales Outlook which was withdrawn with the release of our First Quarter Results on May 11, 2020. 5

Meaningful Long Term Growth Diverse End Market Exposure with Meaningful Long Term Growth Platform / Near Term Long Term End Markets Expectations Growth Drivers Performance on pace with Defense exposures provide stability and growth opportunities initial expectations for 2020; + Increase in sales expected in Gaining market share on key defense programs, such as the Defense second half of year F-18, Joint Strike Fighter, and UH-60 BLACKHAWK Headwinds from Commercial Breadth of content on a wide range of fixed wing and rotary Aviation partially offset by Commercial, Business & growth in Business & General Continued investment in R&D through the downturn General Aviation – Aviation Positioned to capture share from COVID-19 headwinds COVID-19 resurgence in US Aging population resulting in continued + / – deferral of elective Increasing biopharma capital budgets Medical procedures Strong technical advances and product development pipelines Opportunity for growth in Increasing number of robotics applications + / – industrial market in second half of the year Maintenance and replacement of industrial equipment Industrials 6

Business Transformation Leading to Significant Cost Savings Significant Cost Savings Achieved; Additional Actions Identified Instituted Cost Savings ~$50 million of Annualized Savings Actions: • Execution on G&A Transformation Initiative • Workforce reductions and furloughs • Salary reductions across senior management and Board of $6.0 Directors • Reduced discretionary spending $3.0 $21.0 Result: $22 Million of Savings in 2020; $34 Million Annualized Savings Additional Actions $21.0 $3.0 $3.0 Actions: $3.0 • Adjust production capacity to meet future demand $20.0 • Completion of our G&A Transformation Initiatives $10.0 $10.0 Result: $16 million of Annualized Savings Instituted Actions Additional Actions Total Savings G&A Transformation Additional Actions Workforce Actions Discretionary Spending 7

Capital Deployment Framework Strong Balance Sheet and Significant Available Capital Cash available on hand; Significant capacity under No debt maturities Repaid $100 million on credit our $800M credit facility until 2024 facility in August Long Term Capital Deployment Priorities Value Creating Investments Return of capital to shareholders Long Term Leverage Target of 2-3X • High return internal investments • Maintain competitive dividend • Deploy the balance sheet in a measured manner • Strategic acquisitions to grow our • Share repurchases to offset portfolio of highly engineered management share grants • products Creates opportunity to stretch leverage for strategic deployment 8

Returning to our Roots Positioned to grow as highly engineered products company 1950s 1970s 1997 2015 2020 Founded Launched Divested Expanded our Acquired Kaman Nuclear Distribution and Kaman engineered product Bal Seal for grew business Sciences offerings with the Engineering Continue to build our diversification through various acquisitions of acquisitions GRW and Extex leading engineered solutions product 1945 1950 1960 1970 1980 1990 2000 2010 2019 portfolio through a combination of organic growth and M&A. 1945 1960s 1980s 2007 2019 Kaman Founded Kamatics and Entered the Divested Divested Aircraft Kaman Music fuzing Kaman Music Kaman Corporation business Distribution founded as Formed Kaman a Helicopter Sciences out of Kaman company Nuclear, AviDyne, Kaman Systems Centers, and SEA 9

Bal Seal Business Overview Business Description Primary Products . Manufacturer of precision springs, seals, and contacts servicing the medical Seals Springs Contacts technology, aerospace & defense and industrial markets . Offers critical, proprietary, precision components that are used in products operating in high cost of failure environments. . Utilizes proprietary manufacturing and material technologies; carries more than 240 patents . Global presence, with manufacturing, sales, and distribution operations across the U.S., Europe and Asia . Leading position within customized springs and seals market . Thousands of unique part numbers specifically designed for the end application Sales Breakdown (2019) Select End Use Applications Medical Seals Aerospace & Defense Springs Medical Industrial A&D Contacts Industrial 16% Fuel Other Radar Cochlear Neuromodulators Pumps & 29% 32% Systems Devices Metering Values 15% 55% Pacemakers Spinal Implants Food Food Grade Grade Detachable 14% Seals Tools 39% Tibial Implants Hydraulic Composite Actuators Trials Pumps Systems & Cable Engines Trays 10

Expanded Product Portfolio Driving Future Growth Kaman sales by end market (%) + 2019 YTD Q2 2020 Meaningful sales and cost synergy opportunities Medical Medical 4% 4% 8% 9% Expanded breadth of highly engineered product offerings with complementary portfolio Leveraging Bal Seal’s proprietary manufacturing and material science technologies and strong customer relationships Advances Kaman’s strategic focus on its engineered products 29% business and adds scale to its operations 53% 39% 54% Strengthens leadership position in medical technologies Defense Commercial Aerospace Medical Industrial and Other Increased exposure to attractive end markets with significant growth potential and favorable margin profile 11

Broad Range of Engineered Products Serving Diverse End Markets End Use Product Offering Differentiator Primary End Markets Characteristics Karon® Self Defense, Aerospace, Self Lubricating High Load, Low RPM Lubricating Industrial, Marine, Bearings Applications Machinable Liner Hydropower, Space Traditional Custom Design Low Friction, High Accuracy, Defense, Aerospace Airframe Bearings Capability High Speed Applications Patented and Integrated Fail-Safe, Mission Flexible Drive Proprietary Critical, High Torque Rotorcraft Systems technology applications High Precision Proprietary design, Low Load, High Medical, Industrial, Defense, Miniature machining, and RPM Precision Applications Aerospace Bearings assembly Engine FAA Parts Flight Critical Aftermarket Manufacturing Defense, Aerospace Aerospace Applications Components Authorization 12

Advanced Safe and Arm Devices Broad Portfolio of Safe and Arm devices Highlight on JPF Key Programs JPF supports the U.S. Air Force and - Joint Programmable Fuze 40 Foreign militaries - Harpoon Qualified on 20 U.S. and Foreign Military Aircraft - Maverick - Tomahawk Completed Negotiations of Option 15 & 16 of - SLAM-ER USG Contract - JASSM USG Option 15 award of $57 million; - ATACMS Awaiting Option 16 - Standard - AMRAAM Strong demand from foreign militaries Significant sales growth and substantial backlog JPF Deliveries (units) 60,000 $500 50,000 $400 (1) $300 $305 40,000 $200 30,000 $228 $246 $100 $164 $185 $196 20,000 $- 10,000 2016 2017 2018 2019 LTM Q2 2020 0 Sales Backlog 2012 2013 2014 2015 2016 2017 2018 2019 2020 (1) Backlog at Q2 2020 does not include the $57 million USG Option 15 order received in August 2020 or $10.6 million 13 Missile Fuze Order received in September 2020.

Opportunities for K-MAX® continue to increase Strong Support for K-MAX® Aircraft Investing for future K-MAX® Opportunities • Aircraft meets the diverse needs of our customers Demand remains high; 1 New Aircraft Order • Construction, firefighting, logging, humanitarian, and Received in Q3 2020; Actively negotiating new agricultural orders, including multi-aircraft opportunities • Expect to nearly double fleet size by 2021 Next Generation Unmanned Systems • Driving increased service & support revenues - 5 orders received in 2019 • Continued support from USMC and Congress All Composite Rotor Blades • Secured contract with USMC to reactivate their two aircraft • $18.5 million in funds in DoD budget proposal Aftermarket sales generally increase 24 – 36 months after initial sale. K-MAX® in Operation 22 36 >40 0 10 20 30 40 50 2015 2019 2021 14

Improving Performance on Structures Programs Results of Actions to Improve Performance Selected Programs Action Status Increase capacity utilization Achieved Disciplined approach to new program Achieved opportunities Improve operational efficiency Achieved Reduce facility footprint Achieved Achieved annualized savings of ~$8.0 million Achieved Supplier Recognition Supports Operational Improvement “ELITE SUPPLIER” “$118 MILLION NEW Sikorsky CONTRACT AWARD”(1) Major Engine OEM “KINECO KAMAN NAMED GOLD TIER SUPPLIER” “BEST NEW SUPPLIER” BAE Systems Rolls Royce (1) Represents the potential future value of the award received in the third quarter of 2020. 15

Growth through Innovation Designing new solutions to solve our customers toughest challenges Developing Next Evolving Innovative Material Continuing to evolve Generation Munition requirements of our Science for new our state-of-art Technologies: K-MAX® operators: engineered products: Technology: Height of Burst Next Generation Titanium Diffusion Tufflex® Couplings Sensor Unmanned Systems Hardening and Drive Shafts Collaborating on integrated solutions across our bearings and sealing technologies 16

Investing for Growth Investing Across the Full Range of our Engineered Products Product Investment Status New facility to support new products for key customer Traditional Airframe Bearings Complete platforms Self Lubricating Bearings / Flexible Drive Systems Expansion to support growth and new applications Complete New facility to increase capacity to support Engine Aftermarket Components Complete sales growth New facility to expand test capabilities and reduce time Test Facility In process to market Next Generation System Advancing our USMC Program K-MAX® Unmanned System In Process and Expanding the Commercial Opportunities Modernization of aircraft blade system reducing All Composite K-MAX® Rotor Blade maintenance cycles and increasing attractiveness of In Process platform to operators. 17

Premier Global Customer Base 18

Our Manufacturing Footprint 14 12 13 11 2 7 10 1 4 9 3 5 6 8 15 = Low cost facility 1. Foothills Ranch, CA 5. Jacksonville, FL 9. Middletown, CT 12. Rimpar, Germany Seals, Springs, and Contacts Assembly & Metallic o Safe and Arm Devices Precision miniature bearings 2. Colorado Springs, CO Structures o Memory and 13. Prachatice, Czech Republic Springs and Contacts 6. Chihuahua, Mexico Measuring Precision miniature bearings Metallic Structures 10. Bloomfield, CT 3. Gilbert, AZ o Air Vehicles 14. Darwen, UK Aftermarket Components 7. Bennington, VT o Self-lubricating bearings Composite structures 4. Wichita, KS Composites Structures o Flexible drive shafts 15. Goa, India (Joint Venture) Composites Structures 8. Orlando, FL 11. Hochstadt, Germany Composites structures Safe and Arm Devices Traditional airframe bearings 19

Questions 20

Non-GAAP Reconciliations 21

Non-GAAP Reconciliation Organic Sales Organic Sales is defined as "Net Sales" less sales derived from acquisitions completed during the preceding twelve months. We believe that this measure provides management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of acquisitions, which can obscure underlying trends. We also believe that presenting Organic Sales enables a more direct comparison to other businesses and companies in similar industries. Management recognizes that the term "Organic Sales" may be interpreted differently by other companies and under different circumstances. No other adjustments were made during the three-month and six-month fiscal periods ended July 3, 2020 and June 28, 2019, respectively. The following table illustrates the calculation of Organic Sales using the GAAP measure, "Net Sales". For the Three Months Ended For the Six Months Ended July 3, June 28, July 3, June 28, (in thousands) 2020 2019 2020 2019 Net Sales From Continuing Operations $ 177,890 $ 174,712 $ 385,212 $ 341,146 Acquisition Sales 18,056 - 41,417 - Organic Sales $ 159,834 $ 174,412 $ 343,795 $ 341,146 $ Change $ (14,878) $ 2,649 % Change (8.5)% 0.8% 22

Non-GAAP Reconciliation Adjusted EBITDA from Continuing Operations Adjusted EBITDA from continuing operations is defined as earnings from continuing operations before interest, taxes, other expense (income), net, depreciation and amortization and certain items that are not indicative of the operating performance of the Company's for the period presented. Adjusted EBITDA from continuing operations differs from earnings from continuing operations, as calculated in accordance with GAAP, in that it excludes interest expense, net, income tax expense, depreciation and amortization, other expense (income), net, non-service pension and post retirement benefit expense (income), and certain items that are not indicative of the operating performance of the Company for the period presented. We have made numerous investments in our business, such as acquisitions and capital expenditures, including facility improvements, new machinery and equipment, improvements to our information technology infrastructure and ERP systems, which we have adjusted for in Adjusted EBITDA from continuing operations. Adjusted EBITDA from continuing operations also does not give effect to cash used for debt service requirements and thus does not reflect funds available for distributions, reinvestments or other discretionary uses. Management believes Adjusted EBITDA from continuing operations provides an additional perspective on the operating results of the organization and its earnings capacity and helps improve the comparability of our results between periods because it provides a view of our operations that excludes items that management believes are not reflective of operating performance, such as items traditionally removed from net earnings in the calculation of EBITDA as well as Other expense (income), net and certain items that are not indicative of the operating performance of the Company for the period presented. Adjusted EBITDA from continuing operations is not presented as an alternative measure of operating performance, as determined in accordance with GAAP. No other adjustments were made during the three-month and six-month fiscal periods ended July 3, 2020 and June 28, 2019. The following table illustrates the calculation of Adjusted EBITDA from continuing operations using GAAP measures, “Earnings from Continuing Operations, net of tax”. For the Three Months Ended For the Six Months Ended July 3, June 28, July 3, June 28, (in thousands) 2020 2019 2020 2019 Net Sales From Continuing Operations $ 177,890 $ 174,712 $ 385,212 $ 341,146 (Loss) earnings from continuing operations, net of tax $ (100) $ 6,389 $ (507) $ 12,211 Interest Expense, net 5,808 5,236 9,055 10,537 Income Tax (Benefit) Expense (1,258) (487) (1,701) 947 Non-service pension and Post-Retirement Income (4,062) (100) (8,125) (199) Other expense (income), net (108) (463) 110 (552) Depreciation and Amortization 10,305 6,243 19,814 12,365 Other Adjustments Restructuring and severance costs 4,484 206 6,279 472 Cost associated with corporate development activities 679 - 2,466 - Bal Seal acquisition costs (36) - 8,447 - Expenses associated with Bal Seal purchase accounting 6,882 - 13,762 - Transition service agreement cost, net of transition service agreement income 1,323 - 2,489 - Reversal of prior year accruals in current period - - (1,475) - Gain on sales of U.K Tooling business - - (493) - Adjusted EBITDA from Continuing Operations $ 23,917 $ 17,024 $ 50,121 $ 35,781 Adjusted EBITDA Margin 13.4% 9.7% 13.0% 10.5% 23

Non-GAAP Reconciliation Adjusted Earnings from Continuing Operations and Adjusted Diluted Earnings Per Share from Continuing Operations Adjusted Earnings from Continuing Operations and Adjusted Diluted Earnings per Share from Continuing Operations are defined as GAAP "Earnings from Continuing Operations" and "Diluted earnings per share from continuing operations", less items that are not indicative of the operating performance of the business for the periods presented. These items are included in the reconciliation below. Management uses Adjusted Earnings from Continuing Operations and Adjusted Diluted Earnings per Share from Continuing Operations to evaluate performance period over period, to analyze the underlying trends in our business and to assess its performance relative to its competitors. We believe that this information is useful for investors and financial institutions seeking to analyze and compare companies on the basis of operating performance. The following table illustrates the calculation of Adjusted Earnings from Continuing Operations and Adjusted Diluted Earnings per Share from Continuing Operations using “Earnings from Continuing Operations” and “Diluted earnings per share from continuing operations” from the “Consolidated Statements of Operations” included in the Company's Form 10-Q filed with the Securities and Exchange Commission on August 10, 2020. For the three months ended July 3, 2020 Adjustments to Tax Effect of Adjustments to Calculation of Net Earnings, Adjustments to Net Earnings, Adjusted Diluted (in thousands, expect per share amounts) Pre Tax Net Earnings Net of Tax Earnings Per Share Net loss from continuing operations $(100) $(0.00) Adjustments Restructuring and severance costs $4,484 $1,143 $3,341 $0.12 Cost associated with corporate development activities 679 173 506 0.02 Bal Seal acquisition costs (36) (9) (27) 0.00 Expenses associated with Bal Seal purchase accounting 6,882 1,755 5,127 0.18 Transition service agreement cost, net of transition service agreement income 1,323 337 986 0.04 Adjusted earnings from continuing operations $9,833 $0.36 Weighted Average Shares Outstanding – Diluted 27,659 24