Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Premier, Inc. | d76901dex992.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d76901dex991.htm |

| 8-K - 8-K - Premier, Inc. | d76901d8k.htm |

Fourth-Quarter Fiscal 2020 Financial Results and Update August 25, 2020 Exhibit 99.3

Forward-looking statements and non-GAAP financial measures Forward-looking statements – Statements made in this presentation that are not statements of historical or current facts, such as those related to the expected financial and operational impacts of the COVID-19 pandemic on our business segments, our ability to manage expenses during the COVID-19 pandemic, current market environment and uncertainties, expected financial performance and tax impact and benefits from our recent restructuring, non-GAAP free cash flow generation, the stability, predictability and transparency of our business, matters regarding fiscal 2021 outlook and guidance, and the expected fiscal 2022 growth rates for consolidated net revenue, adjusted EBITDA and adjusted EPS are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” section of Premier’s Form 10-K for the year ended June 30, 2020, expected to be filed with the SEC shortly after the date of this presentation, and also made available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “adjusted” or “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Susan DeVore Chief Executive Officer Premier, Inc. Overview and Business Review

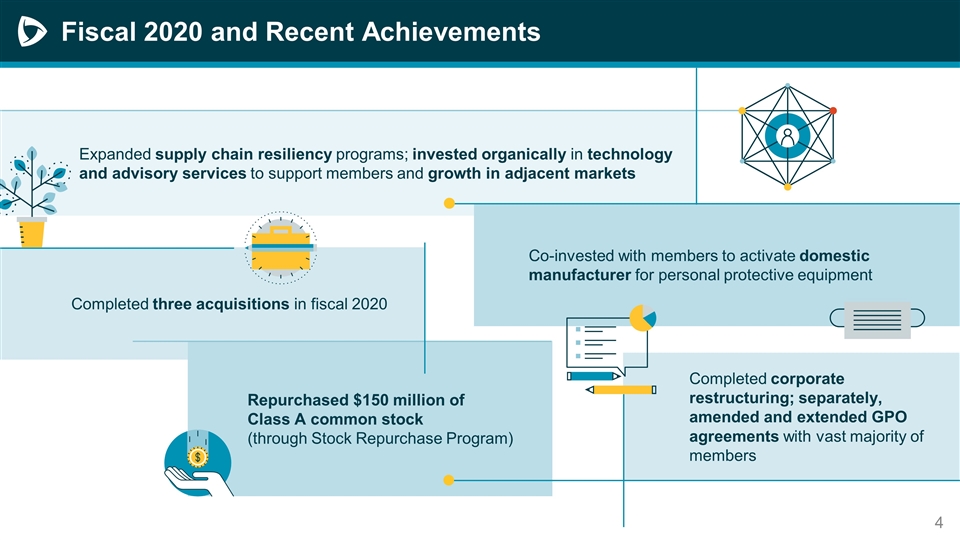

Expanded supply chain resiliency programs; invested organically in technology and advisory services to support members and growth in adjacent markets Fiscal 2020 and Recent Achievements Completed three acquisitions in fiscal 2020 Co-invested with members to activate domestic manufacturer for personal protective equipment Repurchased $150 million of Class A common stock (through Stock Repurchase Program) Completed corporate restructuring; separately, amended and extended GPO agreements with vast majority of members

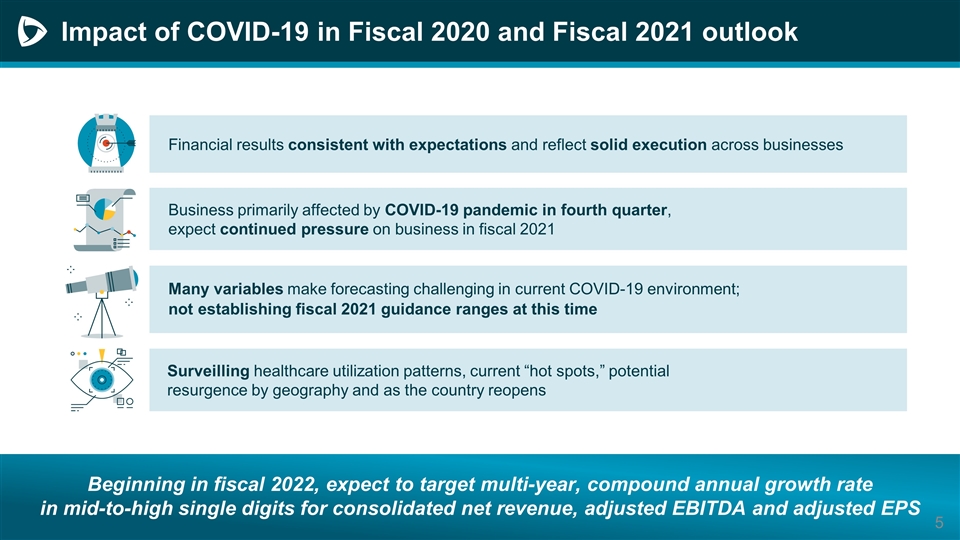

Impact of COVID-19 in Fiscal 2020 and Fiscal 2021 outlook Many variables make forecasting challenging in current COVID-19 environment; not establishing fiscal 2021 guidance ranges at this time Business primarily affected by COVID-19 pandemic in fourth quarter, expect continued pressure on business in fiscal 2021 Surveilling healthcare utilization patterns, current “hot spots,” potential resurgence by geography and as the country reopens Financial results consistent with expectations and reflect solid execution across businesses Beginning in fiscal 2022, expect to target multi-year, compound annual growth rate in mid-to-high single digits for consolidated net revenue, adjusted EBITDA and adjusted EPS

Demonstrating differentiated value and strategic alignment with members Build confidence to fully resume elective and delayed healthcare procedures, while continuing to provide high quality to care for patients with COVID-19 Prepare adequately for upcoming normal flu season and predict potential COVID-19 surge in member communities Discover opportunities for efficiency in both care delivery and infrastructure costs Improve member market position and financial performance Leading, partnering and innovating with member healthcare providers in a challenging environment

Mike Alkire President Premier, Inc. Operations Review

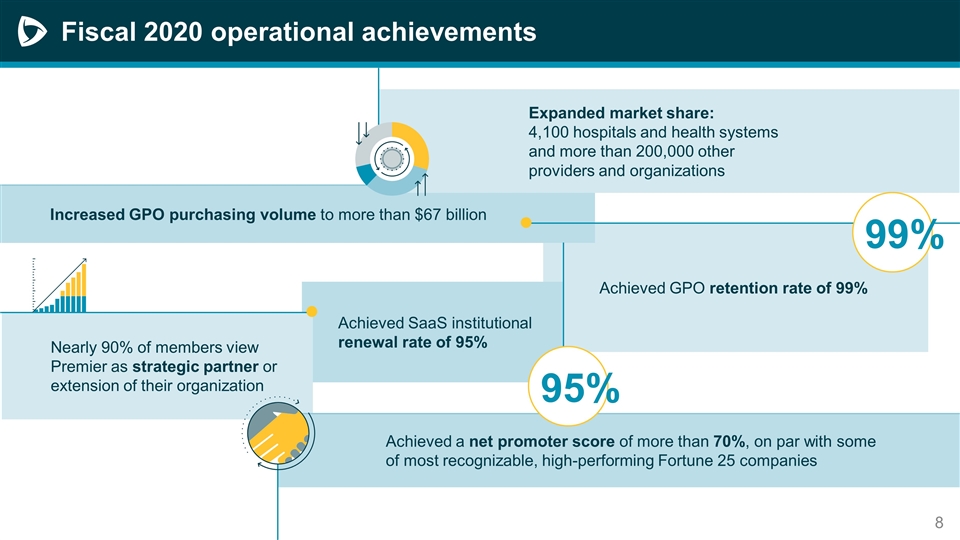

Fiscal 2020 operational achievements Achieved GPO retention rate of 99% Increased GPO purchasing volume to more than $67 billion Achieved SaaS institutional renewal rate of 95% Nearly 90% of members view Premier as strategic partner or extension of their organization Achieved a net promoter score of more than 70%, on par with some of most recognizable, high-performing Fortune 25 companies Expanded market share: 4,100 hospitals and health systems and more than 200,000 other providers and organizations 99% 95%

Supporting healthcare partners through COVID-19 pandemic Expediting the contracting process for critically needed COVID-19-related products Identifying new and previously untapped onshore, nearshore and offshore sources of supply Creating a tech-enabled exchange that enables healthcare providers to trade and redistribute excess PPE Co-investing with members in domestic manufacturing, such as investment in Prestige Ameritech, a domestic PPE manufacturer Developing clinical surveillance and supply chain technology to anticipate surges in COVID-19 and predict future demand for supplies

Continued focus on enabling greater supply chain diversity and domestic manufacturing Managing pharmacy supply chain Distributing “at risk” drugs and vaccines through minority-owned specialty distributor, FFF Providing access to more than 150 drugs on shortage list Securing dedicated sources of supply through private-label program, drug shortage program and multi-source contracts Monitoring weekly fill rates for more than 250 drugs necessary for COVID-19-specific care

Advancing enterprise analytics and performance improvement strategy Example: Contigo Health Clinical Advantage™ Product Integration of Health Design Plus progressing as planned Advancing direct-to-employer, high-value care initiative Focused on improving and standardizing care, reducing costs and generating revenue for health system participants Offers care management specializing in development and administration of customized health benefits for employers and health system partners Expanding technology capabilities and services for healthcare provider performance and connectivity to adjacent markets

Long-standing Diversity, Inclusion and Belonging program Diversity of thought, cross-cultural representation and engagement within our workforce Premier remains committed to supporting a diverse and inclusive culture Well-established Diversity, Inclusion and Belonging program for all Premier employees Fiscal 2021 enhancements: comprehensive diversity training, several more employee resource groups & open engagement forums Implemented robust Supplier Diversity program more than 20 years ago Suppliers help members improve quality of life in communities where they serve and create jobs Premier is committed to helping minority-, women- and veteran-owned business and small business enterprises compete, grow and thrive Furthering our mission to improve the health of our communities.

Craig McKasson Chief Administrative and Financial Officer Premier, Inc. Financial Review

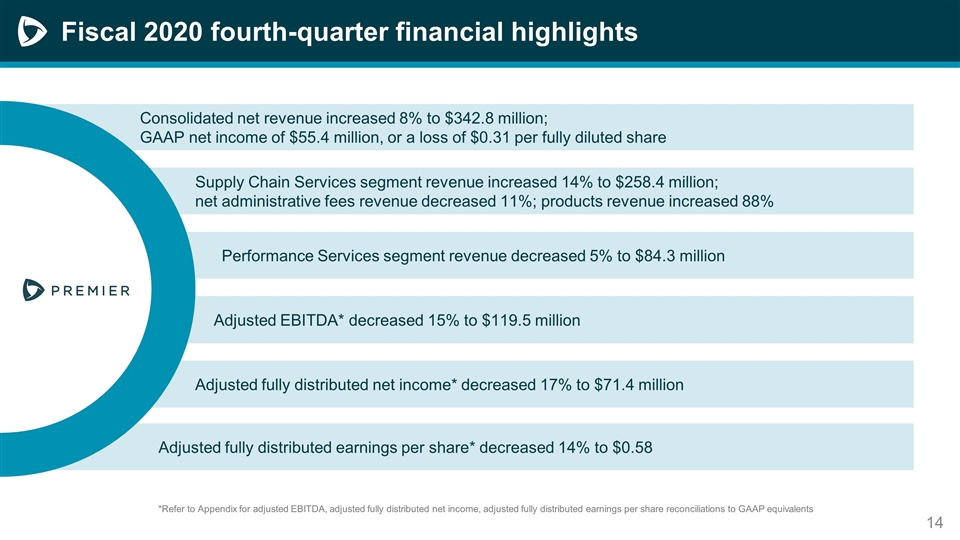

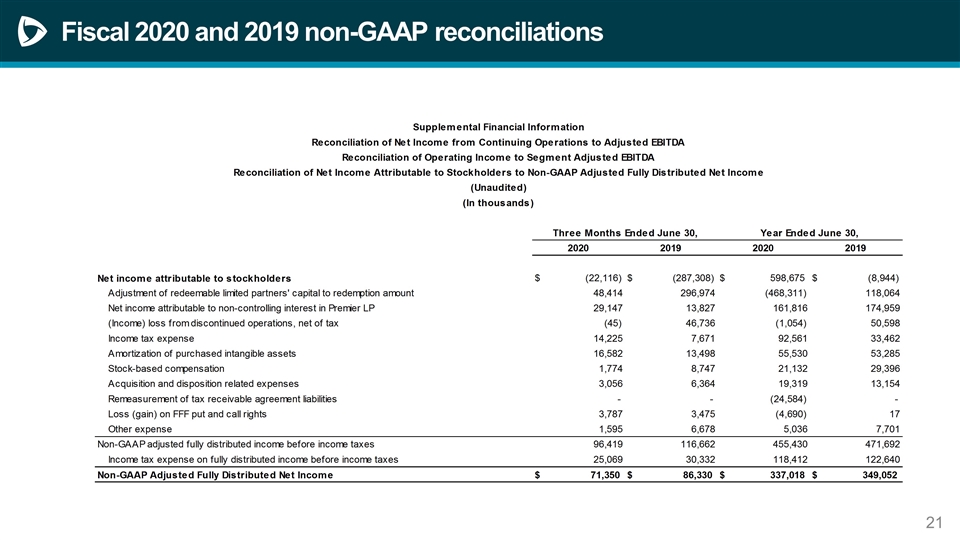

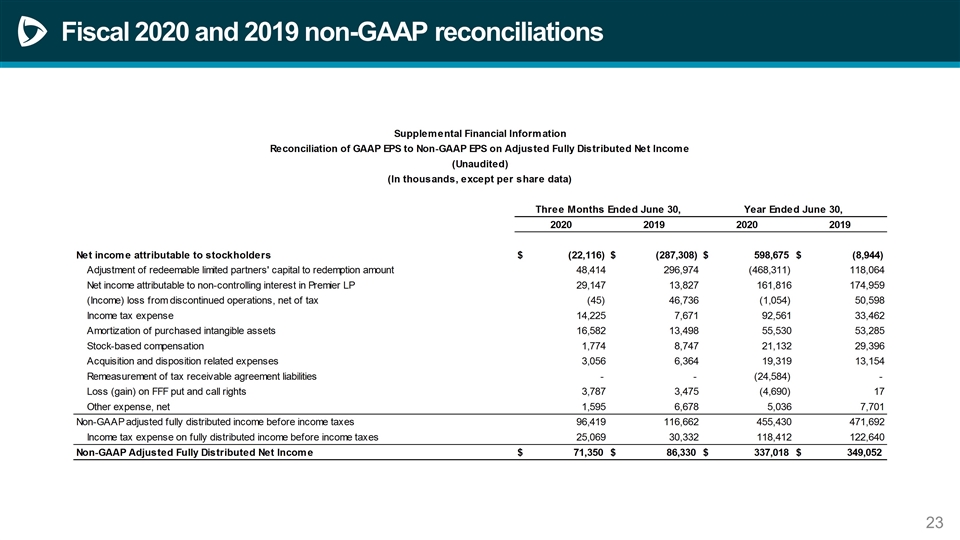

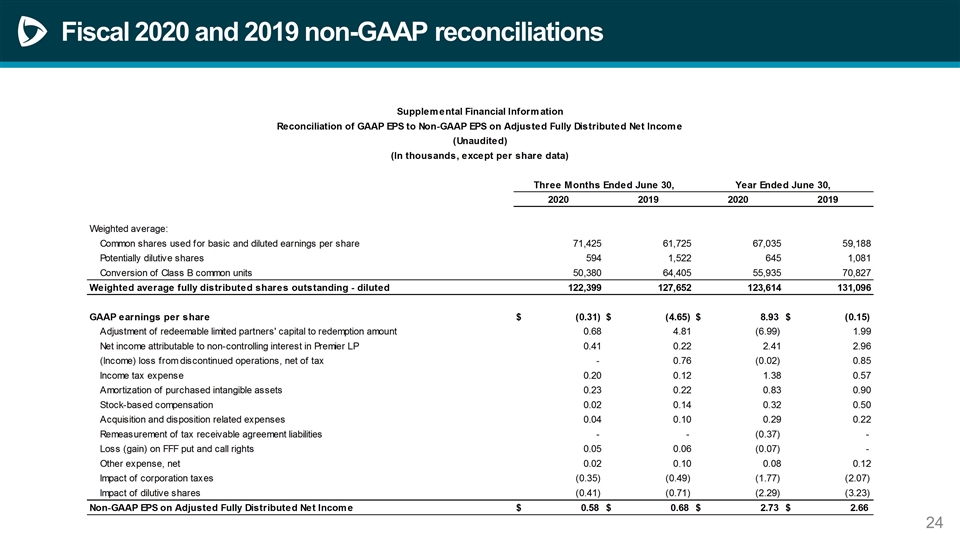

Fiscal 2020 fourth-quarter financial highlights Performance Services segment revenue decreased 5% to $84.3 million Supply Chain Services segment revenue increased 14% to $258.4 million; net administrative fees revenue decreased 11%; products revenue increased 88% Adjusted EBITDA* decreased 15% to $119.5 million Adjusted fully distributed net income* decreased 17% to $71.4 million Adjusted fully distributed earnings per share* decreased 14% to $0.58 Consolidated net revenue increased 8% to $342.8 million; GAAP net income of $55.4 million, or a loss of $0.31 per fully diluted share *Refer to Appendix for adjusted EBITDA, adjusted fully distributed net income, adjusted fully distributed earnings per share reconciliations to GAAP equivalents

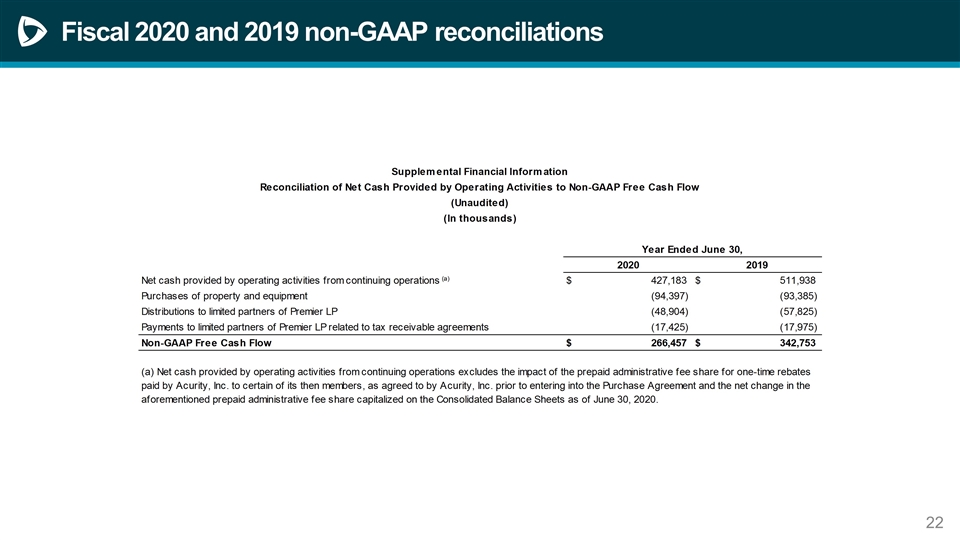

Strong, consistent operating cash flow and flexible balance sheet Cash flow from operations of $339.9 million Free cash flow* of $266.5 million Cash and cash equivalents of $99.3 million Outstanding borrowings of $75.0 million on $1.0 billion five-year unsecured revolving credit facility; repaid $25.0 million subsequent to quarter end Balanced approach to capital deployment priorities Reinvestment in organic growth Disciplined acquisitions and investments to support strategic goals Returning capital to shareholders through quarterly cash dividend payment *See free cash flow reconciliation to GAAP equivalent in Appendix. As of June 30, 2020

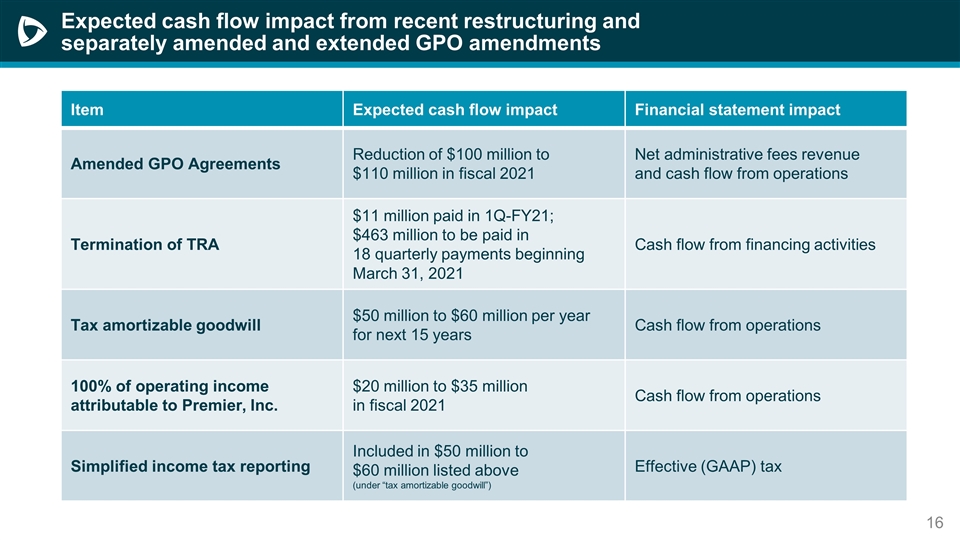

Expected cash flow impact from recent restructuring and separately amended and extended GPO amendments Item Expected cash flow impact Financial statement impact Amended GPO Agreements Reduction of $100 million to $110 million in fiscal 2021 Net administrative fees revenue and cash flow from operations Termination of TRA $11 million paid in 1Q-FY21; $463 million to be paid in 18 quarterly payments beginning March 31, 2021 Cash flow from financing activities Tax amortizable goodwill $50 million to $60 million per year for next 15 years Cash flow from operations 100% of operating income attributable to Premier, Inc. $20 million to $35 million in fiscal 2021 Cash flow from operations Simplified income tax reporting Included in $50 million to $60 million listed above (under “tax amortizable goodwill”) Effective (GAAP) tax

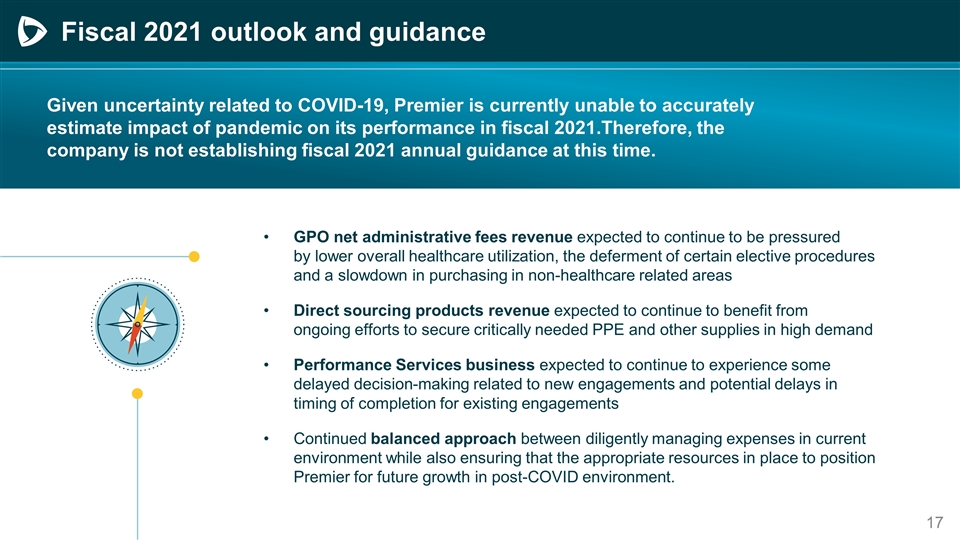

Fiscal 2021 outlook and guidance GPO net administrative fees revenue expected to continue to be pressured by lower overall healthcare utilization, the deferment of certain elective procedures and a slowdown in purchasing in non-healthcare related areas Direct sourcing products revenue expected to continue to benefit from ongoing efforts to secure critically needed PPE and other supplies in high demand Performance Services business expected to continue to experience some delayed decision-making related to new engagements and potential delays in timing of completion for existing engagements Continued balanced approach between diligently managing expenses in current environment while also ensuring that the appropriate resources in place to position Premier for future growth in post-COVID environment. Given uncertainty related to COVID-19, Premier is currently unable to accurately estimate impact of pandemic on its performance in fiscal 2021.Therefore, the company is not establishing fiscal 2021 annual guidance at this time.

Appendix

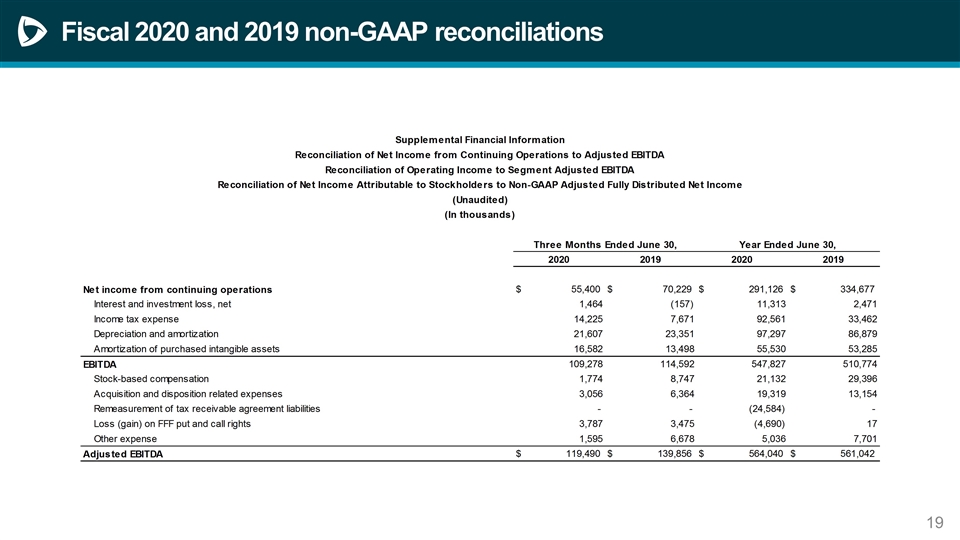

Fiscal 2020 and 2019 non-GAAP reconciliations

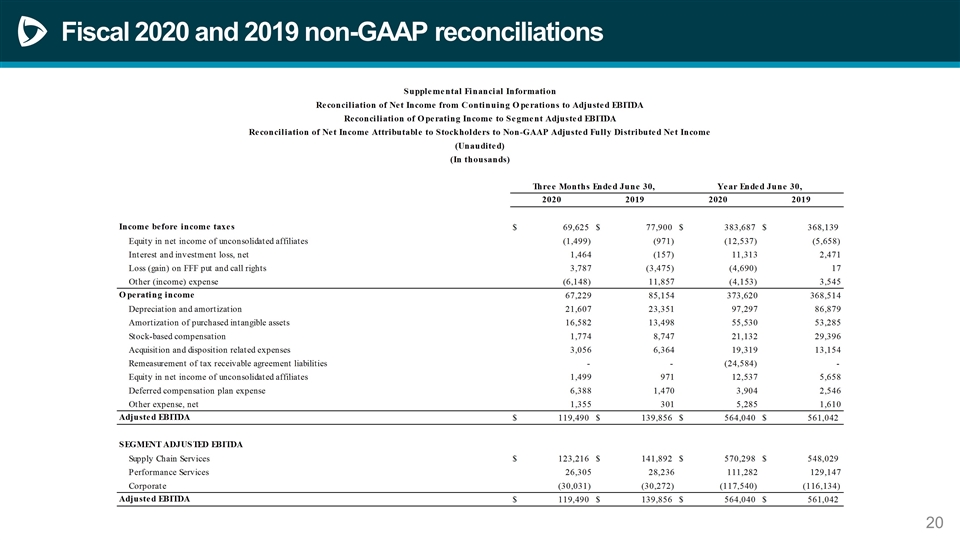

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations

Fiscal 2020 and 2019 non-GAAP reconciliations