Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NICHOLAS FINANCIAL INC | nick-8k_20200827.htm |

NICHOLAS FINANCIAL, INC ask that Registered Shareholders limit their questions to two (2) per person at a time to ensure all Registered Shareholders who wish to have questions have the time to do so. If everyone is granted the opportunity to ask their questions and time permits additional questions can be presented. Exhibit 99.1

Nicholas Financial, Inc. 2020 Annual Shareholder General Meeting

New Logos

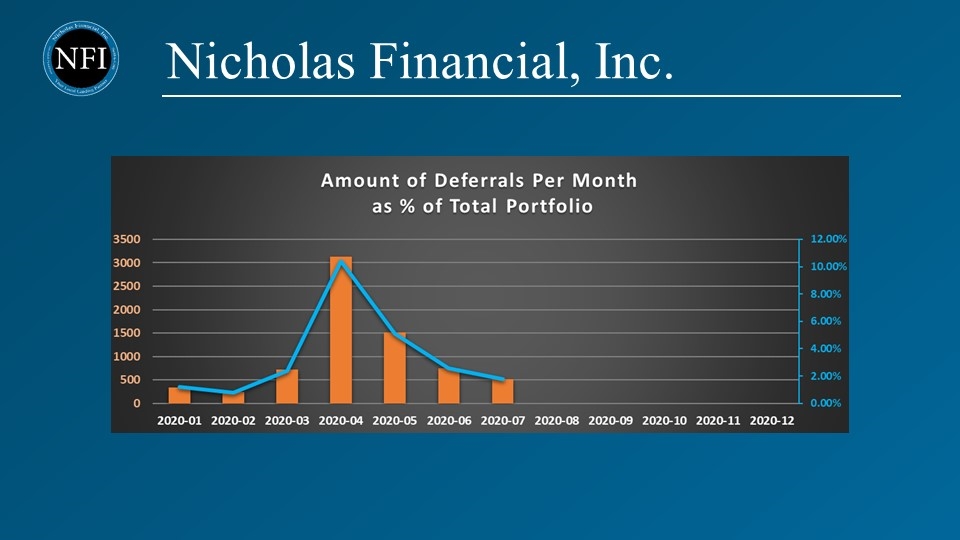

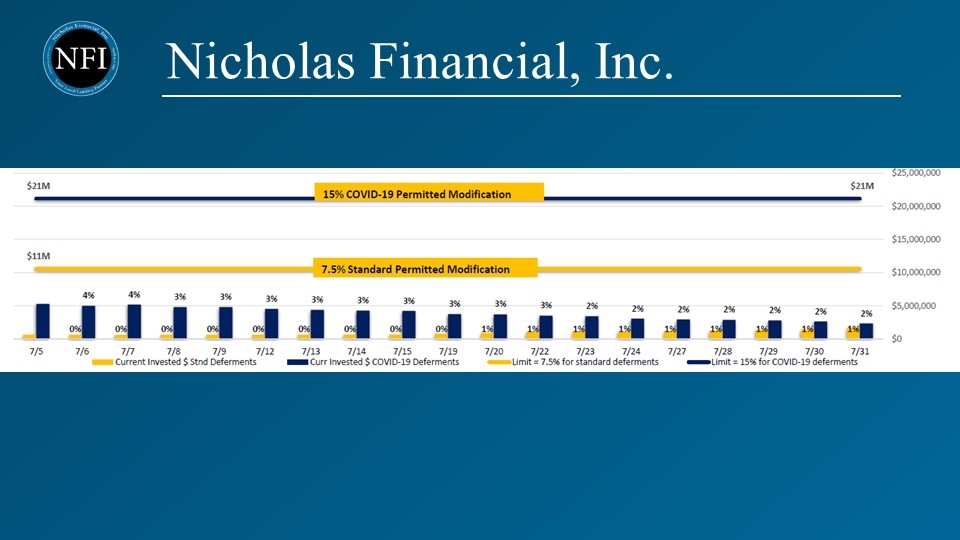

Covid–19: Update & Impact

Product Perfectly Suited for Economic Downturns Branch Model Excellent for the Lockdowns and Restrictions NFI Considered Essential Business in All Markets Stimulus and Expanded UE Helped Greatly Portfolio and Cash Collections Holding Up Extremely Well

Nicholas Financial, Inc. Business Update / Fiscal Year in Review

Headlines from FY’ 2020 Return to Profitability Direct Loan Expansion Successful Acquisitions

4 - Prong Approach Core Product (Indirect Retail) Direct / Consumer Loans Branch Expansion Portfolio / Company Acquisitions

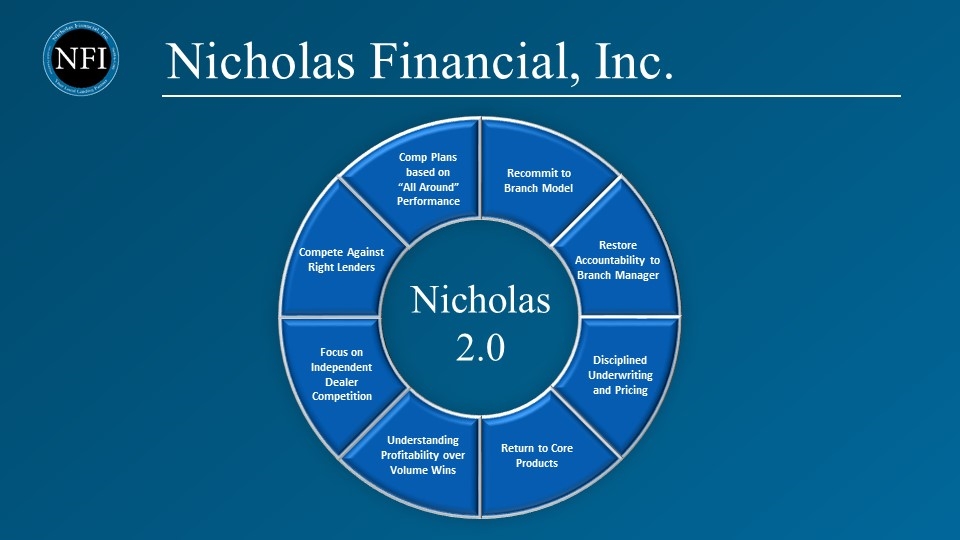

Nicholas 2.0

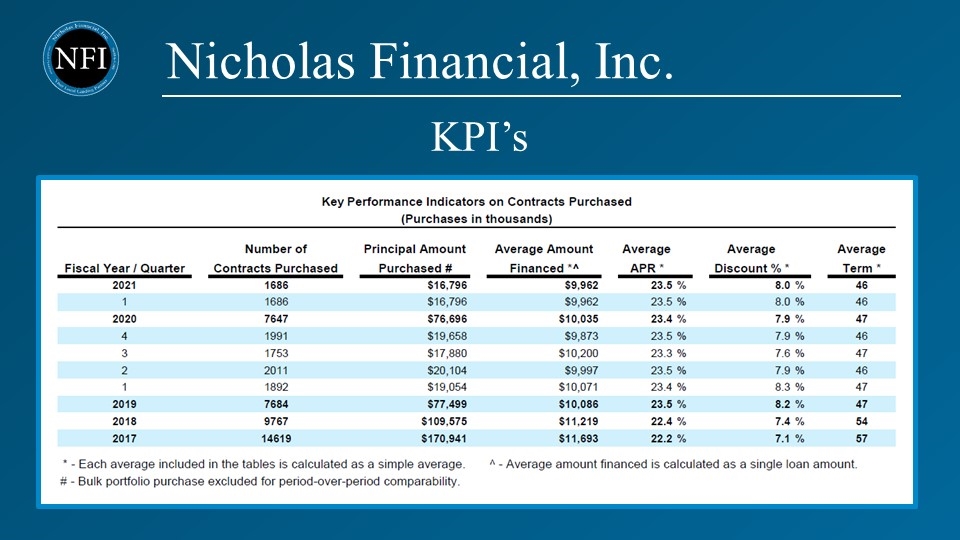

KPI’s

Quarterly Loss Timing Charts

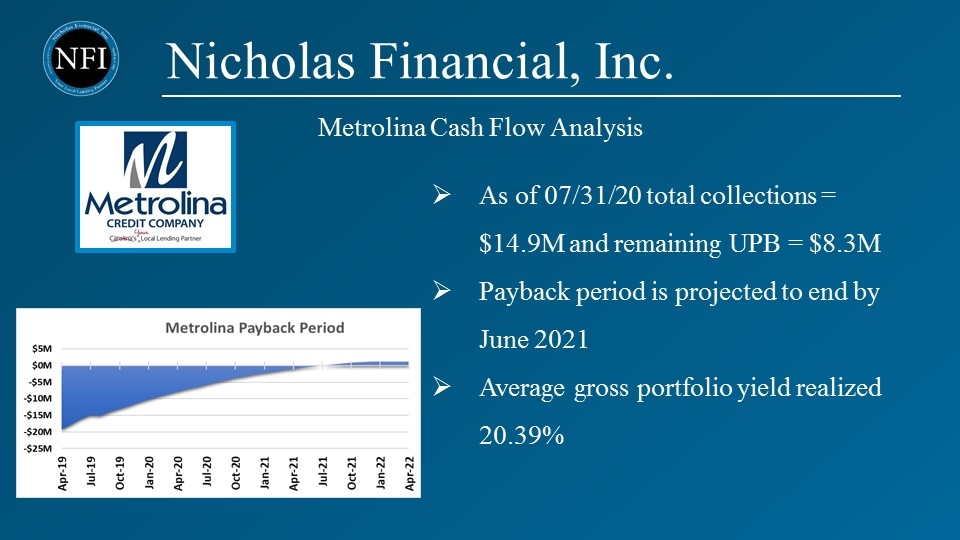

Metrolina Cash Flow Analysis As of 07/31/20 total collections = $14.9M and remaining UPB = $8.3M Payback period is projected to end by June 2021 Average gross portfolio yield realized 20.39%

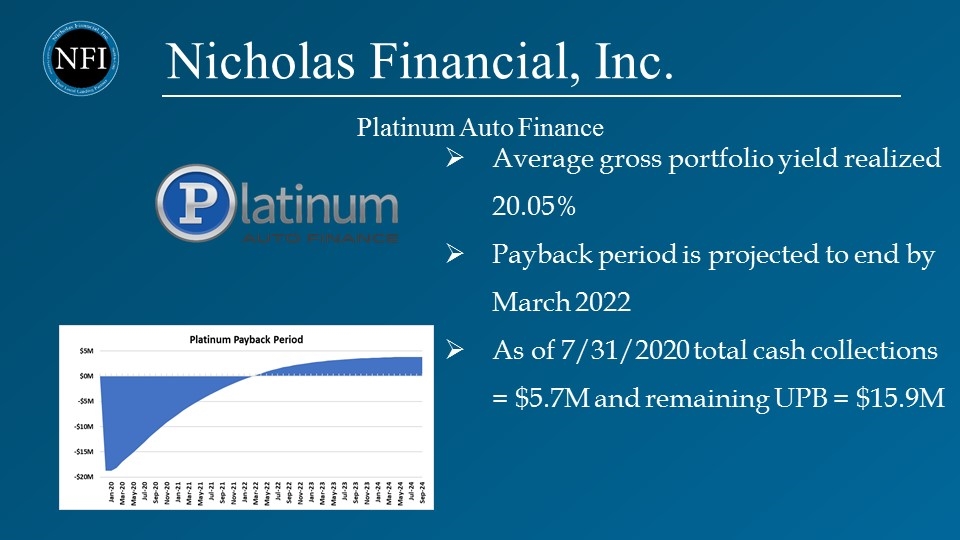

Platinum Auto Finance Average gross portfolio yield realized 20.05% Payback period is projected to end by March 2022 As of 7/31/2020 total cash collections = $5.7M and remaining UPB = $15.9M

Nicholas Financial, Inc. Fiscal Year 2021 Outlook

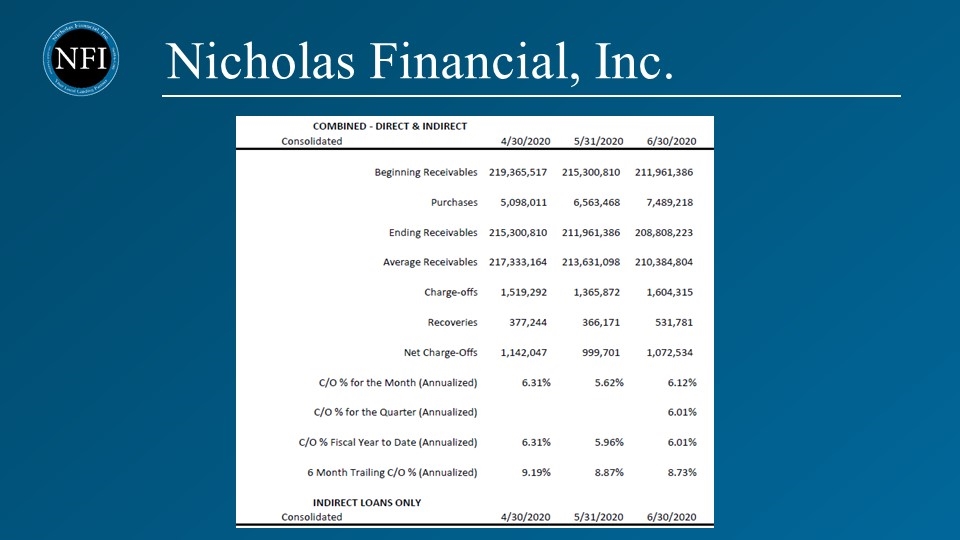

1st Quarter Highlights Indirect Originations Direct Loan Production Portfolio Performance Positive Earnings

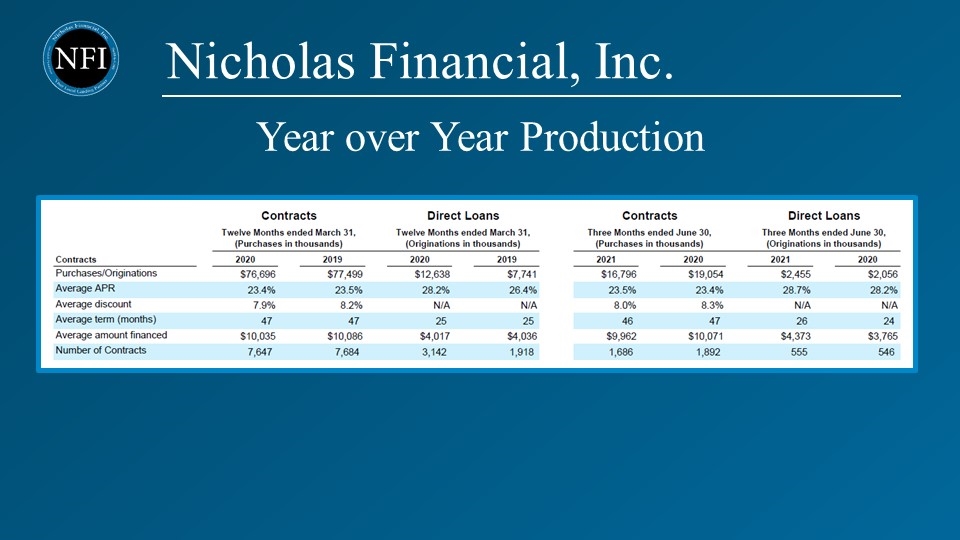

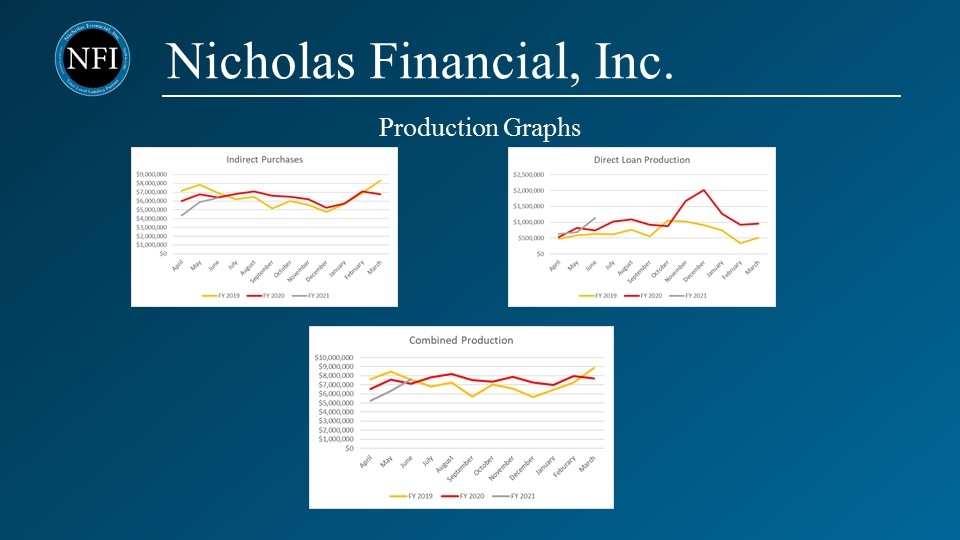

Year over Year Production

Production Graphs

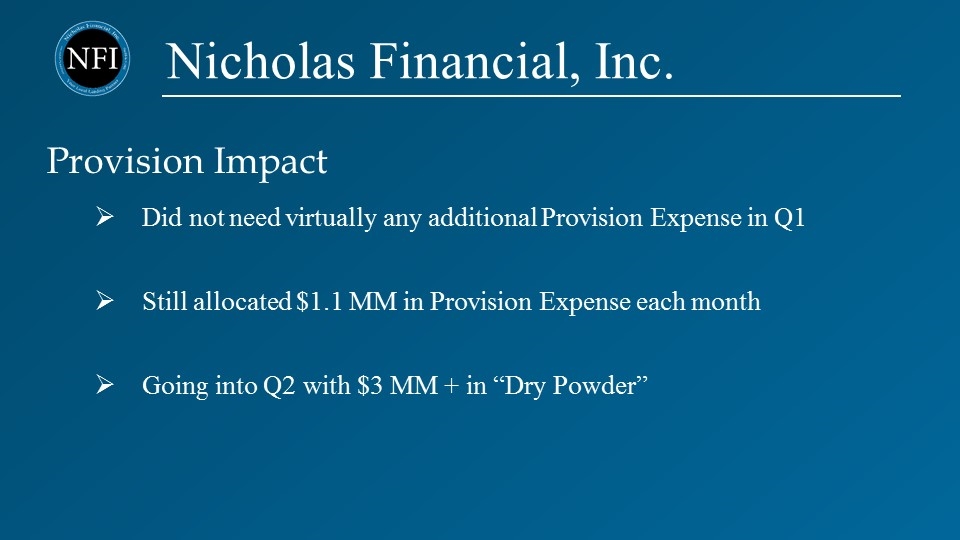

Provision Impact Did not need virtually any additional Provision Expense in Q1 Still allocated $1.1 MM in Provision Expense each month Going into Q2 with $3 MM + in “Dry Powder”

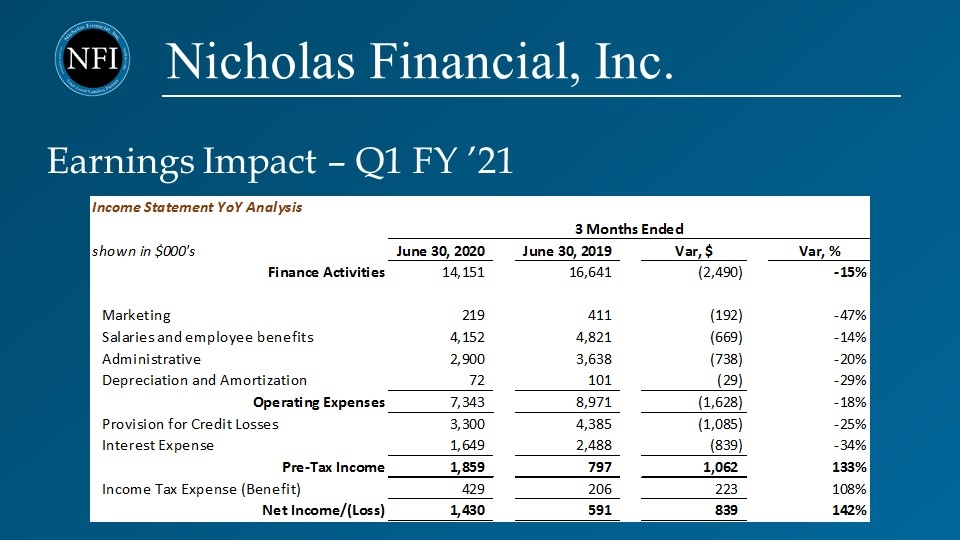

Earnings Impact – Q1 FY ’21

Nicholas Financial, Inc. Expansion

Expansion Plans Columbia, SC Las Vegas, NV Milwaukee, WI Salt Lake City, UT Boise, ID Looking to add 4+ Branches each year

Branch Expansion - Branch Locations - Expansion Markets

Questions?