Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - DEERE & CO | de-20200821xex99d3.htm |

| EX-99.2 - EX-99.2 - DEERE & CO | de-20200821xex99d2.htm |

| 8-K - 8-K - DEERE & CO | de-20200821x8k.htm |

Exhibit 99.1

(Furnished herewith)

| |

NEWS RELEASE

Jennifer Hartmann

Director, Public Relations

Deere & Company

309-765-5678

Deere Reports Third Quarter Net Income of $811 Million

| ● | Operating margins reach 14.6% helped by strong execution in face of global pandemic. |

| ● | Yearly net income forecast increased to about $2.25 billion. |

| ● | New operating model taking shape. |

MOLINE, Illinois (August 21, 2020) — Deere & Company reported net income of $811 million for the third quarter ended August 2, 2020, or $2.57 per share, compared with net income of $899 million, or $2.81 per share, for the quarter ended July 28, 2019. For the first nine months of the year, net income attributable to Deere & Company was $1.993 billion, or $6.30 per share, compared with $2.532 billion, or $7.87 per share, for the same period last year.

Worldwide net sales and revenues decreased 11 percent, to $8.925 billion, for the third quarter of 2020 and declined 12 percent, to $25.809 billion, for nine months. Net sales of the equipment operations were $7.859 billion for the quarter and $22.612 billion for nine months, compared with $8.969 billion and $26.182 billion last year.

“With outstanding support from our dedicated global workforce and dealer organization, John Deere delivered a strong performance in the third quarter in the face of a serious global pandemic and uncertain market conditions,” said John C. May, chairman and chief executive officer. “As we manage through the pandemic, Deere’s number-one priority continues to be safeguarding the health and well-being of its employees. Thanks to aggressive measures taken early in the crisis, we have had success keeping our employees safe, our factories and parts centers functioning, and our customers served.”

Company Outlook & Summary

Net income attributable to Deere & Company is forecast to be about $2.25 billion for the full year. However, many uncertainties remain regarding the effects of the global pandemic that could negatively affect the company's results and financial position in the future. In addition, the company has announced broad employee-separation programs that will be completed during the fourth quarter in support of its strategy to create a leaner, more agile organization. The programs’ total pretax expense included in the forecast is about $175 million with estimated annual savings of $175 million.

“Although unsettled market conditions and related customer uncertainty are expected to have a moderating effect on key markets in the near term, we believe Deere is well-positioned to help make our customers more profitable and sustainable,” May said. “In addition, we are encouraged by the early benefits we are experiencing from the company’s recently launched smart-industrial operating model. We’re confident it will help accelerate our ability to deliver differentiated solutions to our customers, while contributing to improved efficiencies across the company.”

4

Deere & Company | | Third Quarter | | Year to Date | | ||||||||||||

$ in millions | | 2020 | | 2019 | | % Change | | 2020 | | 2019 | | % Change | | ||||

Net sales and revenues | | $ | 8,925 |

| $ | 10,036 |

| -11% |

| $ | 25,809 |

| $ | 29,362 |

| -12% | |

Net income | | $ | 811 | | $ | 899 | | -10% | | $ | 1,993 | | $ | 2,532 | | -21% | |

Fully diluted EPS | | $ | 2.57 | | $ | 2.81 | | | | $ | 6.30 | | $ | 7.87 | | | |

In the third quarter, the company recorded impairments and closure costs totaling $37 million pretax and after-tax. In addition, the quarter’s net income was unfavorably affected by discrete income-tax adjustments, while the third quarter of 2019 had favorable discrete income-tax adjustments.

Equipment Operations | | Third Quarter | | ||||||

$ in millions | | 2020 | | 2019 | | % Change | | ||

Net sales |

| $ | 7,859 |

| $ | 8,969 |

| -12% | |

Operating profit | | $ | 1,147 | | $ | 990 | | 16% | |

Net income | | $ | 630 | | $ | 717 | | -12% | |

For a discussion of net sales and operating profit results, see the Agriculture & Turf and Construction & Forestry sections below.

Agriculture & Turf | | Third Quarter | | ||||||

$ in millions | | 2020 | | 2019 | | % Change | | ||

Net sales |

| $ | 5,672 |

| $ | 5,946 |

| -5% | |

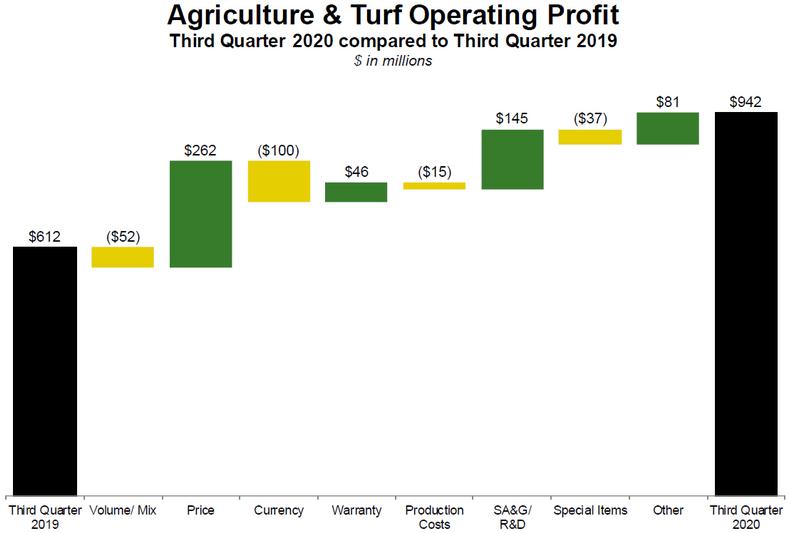

Operating profit | | $ | 942 | | $ | 612 | | 54% | |

Operating margin | | | 16.6% | | | 10.3% | | | |

Agriculture & Turf sales decreased for the quarter due to lower shipment volumes and the unfavorable effects of currency translation, partially offset by price realization. Operating profit increased primarily due to price realization, and lower selling, administrative, and general expenses. Research and development and warranty expenses were down as well. These items were partially offset by the unfavorable effects of foreign-currency exchange, lower shipment volumes / sales mix, and impairments and closure costs.

5

Construction & Forestry | | Third Quarter | | ||||||

$ in millions | | 2020 | | 2019 | | % Change | | ||

Net sales |

| $ | 2,187 |

| $ | 3,023 |

| -28% | |

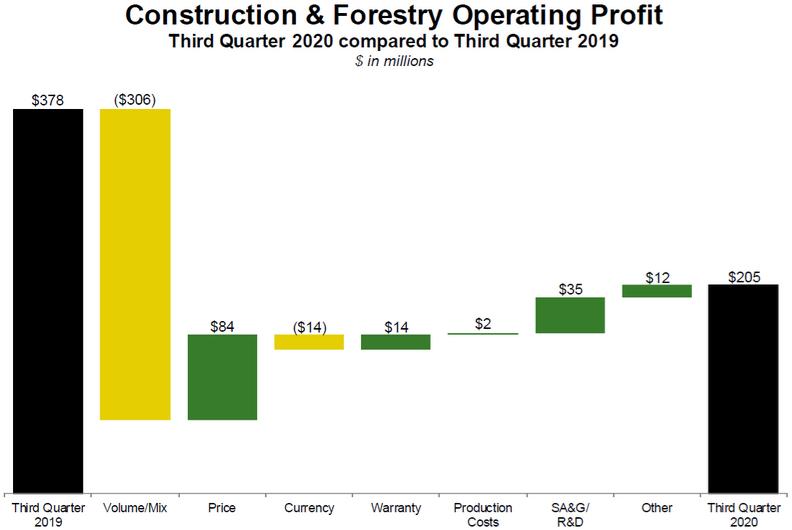

Operating profit | | $ | 205 | | $ | 378 | | -46% | |

Operating margin | | | 9.4% | | | 12.5% | | | |

Construction & Forestry sales declined for the quarter due mainly to lower shipment volumes and the unfavorable effects of currency translation, partially offset by price realization. Third-quarter operating profit declined due largely to lower shipment volumes / sales mix, partially offset by price realization and lower selling, administrative, and general expenses.

Financial Services | | Third Quarter | | ||||||

$ in millions | | 2020 | | 2019 | | % Change | | ||

Net income |

| $ | 183 |

| $ | 175 |

| 5% | |

Financial services net income for the quarter increased due primarily to lower losses on operating-lease residual values, decreased selling, administrative, and general expenses, and a reduced provision for credit losses. These items were largely offset by a higher provision for income taxes related to favorable discrete adjustments last year.

6

Market Conditions and Outlook (Annual) | | | | Currency | | Price | |

$ in millions | | Net Sales | | Translation | | Realization | |

Agriculture & Turf | | -10% | | -2% | | 3% | |

Construction & Forestry | | -25% | | -1% | | 1% | |

| | | | | | | |

John Deere Financial | | Net Income | | $ 510 | | | |

Agriculture & Turf. Deere’s worldwide sales of agriculture and turf equipment are forecast to decline about 10 percent for fiscal year 2020, including a negative currency-translation effect of about 2 percent. Industry sales of agricultural equipment are expected to be down 5 to 10 percent from last year for the U.S. and Canada, while sales in Europe are also expected to be down 5 to 10 percent. South American industry sales of tractors and combines are projected to be down 10 to 15 percent. Asian sales are forecast to be down slightly. Industry sales of turf and utility equipment in the U.S. and Canada are expected to be down about 5 percent for 2020.

Construction & Forestry. Deere’s worldwide sales of construction and forestry equipment are anticipated to be down about 25 percent for 2020, with foreign-currency rates having an unfavorable translation effect of about 1 percent. The outlook reflects market uncertainty as a result of COVID-19 as well as efforts to bring down field inventory levels. Industry construction-equipment sales in North America are expected to decline by about 20 percent for the year. In forestry, global industry sales are expected to be down 20 to 25 percent due to weaker demand in North America and Russia.

Financial Services. Full-year results are expected to decline due to a higher provision for credit losses and less-favorable financing spreads, partially offset by lower losses and impairments on operating-lease residual values.

John Deere Capital Corporation

The following is disclosed on behalf of the company’s financial services subsidiary, John Deere Capital Corporation (JDCC), in connection with the disclosure requirements applicable to its periodic issuance of debt securities in the public market.

| | Third Quarter | | Year to Date | | ||||||||||||

$ in millions | | 2020 | | 2019 | | % Change | | 2020 | | 2019 | | % Change | | ||||

Revenue | | $ | 696 | | $ | 742 | | -6% | | $ | 2,115 | | $ | 2,106 | | | |

Net income | | $ | 146 | | $ | 145 | | 1% | | $ | 271 | | $ | 351 | | -23% | |

Ending portfolio balance | | | | | | | | | | $ | 38,766 | | $ | 38,625 | | | |

Net income for the current quarter was about the same as the third quarter of 2019 with lower losses on operating-lease residual values, a reduced provision for credit losses, and decreased selling, administrative, and general expenses, offset by a higher provision for income taxes from favorable discrete adjustments in the prior year. Nine-month net income declined due to a higher provision for credit losses, unfavorable financing spreads, increased losses and impairments on lease residual values, and a higher provision for income taxes offset in part by income from a higher average portfolio.

7

Safe Harbor Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Statements under “Company Outlook & Summary,” “Market Conditions & Outlook,” and other forward-looking statements herein that relate to future events, expectations, and trends involve factors that are subject to change, and risks and uncertainties that could cause actual results to differ materially. Some of these risks and uncertainties could affect particular lines of business, while others could affect all of the company’s businesses.

The company’s agricultural equipment business is subject to a number of uncertainties including the factors that affect farmers’ confidence and financial condition. These factors include demand for agricultural products, world grain stocks, weather conditions, soil conditions, harvest yields, prices for commodities and livestock, crop and livestock production expenses, availability of transport for crops, trade restrictions and tariffs (e.g., China), global trade agreements (e.g., the United States-Mexico-Canada Agreement), the level of farm product exports (including concerns about genetically modified organisms), the growth and sustainability of non-food uses for some crops (including ethanol and biodiesel production), real estate values, available acreage for farming, the land ownership policies of governments, changes in government farm programs and policies, international reaction to such programs, changes in and effects of crop insurance programs, changes in environmental regulations and their impact on farming practices, animal diseases (e.g., African swine fever) and their effects on poultry, beef and pork consumption and prices and on livestock feed demand, and crop pests and diseases and the impact of the COVID-19 pandemic on the agricultural industry including demand for, and production and exports of, agricultural products, and commodity prices.

Factors affecting the outlook for the company’s turf and utility equipment include consumer confidence, weather conditions, customer profitability, labor supply, consumer borrowing patterns, consumer purchasing preferences, housing starts and supply, infrastructure investment, spending by municipalities and golf courses, and consumable input costs. Many of these factors have been and may continue to be impacted by global economic effects, including the downturn resulting from the COVID-19 pandemic and responses to the pandemic taken by governments and other authorities.

Consumer spending patterns, real estate and housing prices, the number of housing starts, interest rates and the levels of public and non-residential construction are important to sales and results of the company’s construction and forestry equipment. Prices for pulp, paper, lumber and structural panels are important to sales of forestry equipment. Many of these factors affecting the outlook for the company’s construction and forestry equipment have been and may continue to be impacted by global economic effects, including the downturn resulting from the COVID-19 pandemic and responses to the pandemic taken by governments and other authorities.

All of the company’s businesses and its results are affected by general economic conditions in the global markets and industries in which the company operates; customer confidence in general economic conditions; government spending and taxing; foreign currency exchange rates and their volatility, especially fluctuations in the value of the U.S. dollar; interest rates (including the availability of IBOR reference rates); inflation and deflation rates; changes in weather patterns; the political and social stability of the global markets in which the company operates; the effects of, or response to, terrorism and security threats; wars and other conflicts; natural disasters; and the spread of major epidemics (including the COVID-19 pandemic) and government and industry responses to epidemics such as travel restrictions and extended shut down of businesses.

Uncertainties related to the magnitude and duration of the COVID-19 pandemic may significantly adversely affect the company’s business and outlook. These uncertainties include: prolonged reduction or closure of the company’s operations, or a delayed recovery in our operations; additional closures as mandated or otherwise made necessary by governmental authorities; disruptions in the supply chain and a prolonged delay in resumption of operations by one or more key suppliers, or the failure of any key suppliers; the company’s ability to meet commitments to customers on a timely basis as a result of increased costs and supply challenges; the ability to receive goods on a timely basis and at anticipated

8

costs; increased logistics costs; delays in the company’s strategic initiatives as a result of reduced spending on research and development; additional operating costs at facilities that remain open due to remote working arrangements, adherence to social distancing guidelines and other COVID-19-related challenges; absence of employees due to illness; the impact of the pandemic on the company’s customers and dealers, and their delays in their plans to invest in new equipment; requests by the company’s customers or dealers for payment deferrals and contract modifications; the impact of disruptions in the global capital markets and/or continued declines in the company’s financial performance, outlook or credit ratings, which could impact the company’s ability to obtain funding in the future; a resurgence in COVID-19 cases following a reopening in any country, state, or region; and the impact of the pandemic on demand for our products and services as discussed above. It is unclear when a sustained economic recovery could occur and what a recovery may look like. All of these factors could materially and adversely affect our business, liquidity, results of operations and financial position.

Significant changes in market liquidity conditions, changes in the company’s credit ratings and any failure to comply with financial covenants in credit agreements could impact access to funding and funding costs, which could reduce the company’s earnings and cash flows. Financial market conditions could also negatively impact customer access to capital for purchases of the company’s products and customer confidence and purchase decisions, borrowing and repayment practices, and the number and size of customer loan delinquencies and defaults. A debt crisis, in Europe or elsewhere, could negatively impact currencies, global financial markets, social and political stability, funding sources and costs, asset and obligation values, customers, suppliers, demand for equipment, and company operations and results. The company’s investment management activities could be impaired by changes in the equity, bond and other financial markets, which would negatively affect earnings.

The withdrawal of the United Kingdom from the European Union and the perceptions as to the impact of the withdrawal may adversely affect business activity, political stability and economic conditions in the United Kingdom, the European Union and elsewhere. The economic conditions and outlook could be further adversely affected by (i) uncertainty regarding any new or modified trade arrangements between the United Kingdom and the European Union and/or other countries, (ii) the risk that one or more other European Union countries could come under increasing pressure to leave the European Union, or (iii) the risk that the euro as the single currency of the Eurozone could cease to exist. Any of these developments, or the perception that any of these developments are likely to occur, could affect economic growth or business activity in the United Kingdom or the European Union, and could result in the relocation of businesses, cause business interruptions, lead to economic recession or depression, and impact the stability of the financial markets, availability of credit, currency exchange rates, interest rates, financial institutions, and political, financial and monetary systems. Any of these developments could affect our businesses, liquidity, results of operations and financial position.

Additional factors that could materially affect the company’s operations, access to capital, expenses and results include changes in, uncertainty surrounding and the impact of governmental trade, banking, monetary and fiscal policies, including financial regulatory reform and its effects on the consumer finance industry, derivatives, funding costs and other areas, and governmental programs, policies, tariffs and sanctions in particular jurisdictions or for the benefit of certain industries or sectors; retaliatory actions to such changes in trade, banking, monetary and fiscal policies; actions by central banks; actions by financial and securities regulators; actions by environmental, health and safety regulatory agencies, including those related to engine emissions, carbon and other greenhouse gas emissions, noise and the effects of climate change; changes to GPS radio frequency bands or their permitted uses; changes in labor and immigration regulations; changes to accounting standards; changes in tax rates, estimates, laws and regulations and company actions related thereto; changes to and compliance with privacy regulations; compliance with U.S. and foreign laws when expanding to new markets and otherwise; and actions by other regulatory bodies.

Other factors that could materially affect results include production, design and technological innovations and difficulties, including capacity and supply constraints and prices; the loss of or challenges to intellectual property rights whether through theft, infringement, counterfeiting or otherwise; the availability

9

and prices of strategically sourced materials, components and whole goods; delays or disruptions in the company’s supply chain or the loss of liquidity by suppliers; disruptions of infrastructures that support communications, operations or distribution; the failure of suppliers or the company to comply with laws, regulations and company policy pertaining to employment, human rights, health, safety, the environment, anti-corruption, privacy and data protection and other ethical business practices; events that damage the company’s reputation or brand; significant investigations, claims, lawsuits or other legal proceedings; start-up of new plants and products; the success of new product initiatives; changes in customer product preferences and sales mix; gaps or limitations in rural broadband coverage, capacity and speed needed to support technology solutions; oil and energy prices, supplies and volatility; the availability and cost of freight; actions of competitors in the various industries in which the company competes, particularly price discounting; dealer practices especially as to levels of new and used field inventories; changes in demand and pricing for used equipment and resulting impacts on lease residual values; labor relations and contracts; changes in the ability to attract, train and retain qualified personnel; acquisitions and divestitures of businesses; greater than anticipated transaction costs; the integration of new businesses; the failure or delay in closing or realizing anticipated benefits of acquisitions, joint ventures or divestitures; the implementation of organizational changes; the failure to realize anticipated savings or benefits of cost reduction, productivity, or efficiency efforts; difficulties related to the conversion and implementation of enterprise resource planning systems; security breaches, cybersecurity attacks, technology failures and other disruptions to the company’s and suppliers’ information technology infrastructure; changes in company declared dividends and common stock issuances and repurchases; changes in the level and funding of employee retirement benefits; changes in market values of investment assets, compensation, retirement, discount and mortality rates which impact retirement benefit costs; and significant changes in health care costs.

The liquidity and ongoing profitability of John Deere Capital Corporation and other credit subsidiaries depend largely on timely access to capital in order to meet future cash flow requirements, and to fund operations, costs, and purchases of the company’s products. If general economic conditions deteriorate or capital markets become more volatile, including as a result of the COVID-19 pandemic, funding could be unavailable or insufficient. Additionally, customer confidence levels may result in declines in credit applications and increases in delinquencies and default rates, which could materially impact write-offs and provisions for credit losses.

The company’s outlook is based upon assumptions relating to the factors described above, which are sometimes based upon estimates and data prepared by government agencies. Such estimates and data are often revised. The company, except as required by law, undertakes no obligation to update or revise its outlook, whether as a result of new developments or otherwise. Further information concerning the company and its businesses, including factors that could materially affect the company’s financial results, is included in the company’s other filings with the SEC (including, but not limited to, the factors discussed in Item 1A. Risk Factors of the company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q).

10

Third Quarter 2020 Press Release

(in millions of dollars)

Unaudited

| | Three Months Ended | | Nine Months Ended | ||||||||||||

|

| August 2 |

| July 28 |

| % |

| August 2 |

| July 28 |

| % | ||||

| | 2020 | | 2019 | | Change | | 2020 | | 2019 | | Change | ||||

Net sales and revenues: | | | | | | | | | | | | | | | | |

Agriculture and turf | | $ | 5,672 | | $ | 5,946 |

| -5 | | $ | 16,127 | | $ | 17,909 |

| -10 |

Construction and forestry | |

| 2,187 | |

| 3,023 |

| -28 | |

| 6,485 | |

| 8,273 |

| -22 |

Total net sales | |

| 7,859 | |

| 8,969 |

| -12 | |

| 22,612 | |

| 26,182 |

| -14 |

Financial services | |

| 892 | |

| 910 |

| -2 | |

| 2,699 | |

| 2,650 |

| +2 |

Other revenues | |

| 174 | |

| 157 |

| +11 | |

| 498 | |

| 530 | | -6 |

Total net sales and revenues | | $ | 8,925 | | $ | 10,036 |

| -11 | | $ | 25,809 | | $ | 29,362 |

| -12 |

| | | | | | | | | | | | | | | | |

Operating profit: * | | | | | | | | | | | | | | | | |

Agriculture and turf | | $ | 942 | | $ | 612 |

| +54 | | $ | 2,109 | | $ | 1,978 |

| +7 |

Construction and forestry | |

| 205 | |

| 378 |

| -46 | |

| 394 | |

| 954 |

| -59 |

Financial services | |

| 243 | |

| 204 |

| +19 | |

| 498 | |

| 566 |

| -12 |

Total operating profit | |

| 1,390 | |

| 1,194 |

| +16 | |

| 3,001 | |

| 3,498 |

| -14 |

Reconciling items ** | |

| (122) | |

| (74) |

| +65 | |

| (256) | |

| (218) |

| +17 |

Income taxes | |

| (457) | |

| (221) |

| +107 | |

| (752) | |

| (748) |

| +1 |

Net income attributable to Deere & Company | | $ | 811 | | $ | 899 |

| -10 | | $ | 1,993 | | $ | 2,532 |

| -21 |

* Operating profit is income from continuing operations before corporate expenses, certain external interest expense, certain foreign exchange gains and losses, and income taxes. Operating profit of the financial services segment includes the effect of interest expense and foreign exchange gains or losses.

** Reconciling items are primarily corporate expenses, certain external interest expense, certain foreign exchange gains and losses, pension and postretirement benefit costs excluding the service cost component, and net income attributable to noncontrolling interests.

11

DEERE & COMPANY

STATEMENT OF CONSOLIDATED INCOME

For the Three Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars and shares except per share amounts) Unaudited

|

| 2020 |

| 2019 | ||

Net Sales and Revenues | | | | | | |

Net sales | | $ | 7,859 | | $ | 8,969 |

Finance and interest income | |

| 838 | |

| 884 |

Other income | |

| 228 | |

| 183 |

Total | |

| 8,925 | |

| 10,036 |

| | | | | | |

Costs and Expenses | | | | | | |

Cost of sales | |

| 5,835 | |

| 6,870 |

Research and development expenses | |

| 370 | |

| 431 |

Selling, administrative and general expenses | |

| 752 | |

| 896 |

Interest expense | |

| 290 | |

| 374 |

Other operating expenses | |

| 408 | |

| 352 |

Total | |

| 7,655 | |

| 8,923 |

| | | | | | |

Income of Consolidated Group before Income Taxes | |

| 1,270 | |

| 1,113 |

Provision for income taxes | |

| 457 | |

| 221 |

Income of Consolidated Group | |

| 813 | |

| 892 |

Equity in income (loss) of unconsolidated affiliates | |

| (2) | |

| 7 |

Net Income | |

| 811 | |

| 899 |

Less: Net income attributable to noncontrolling interests | |

| | |

| |

Net Income Attributable to Deere & Company | | $ | 811 | | $ | 899 |

| | | | | | |

Per Share Data | | | | | | |

Basic | | $ | 2.59 | | $ | 2.84 |

Diluted | | $ | 2.57 | | $ | 2.81 |

| | | | | | |

Average Shares Outstanding | | | | | | |

Basic | |

| 313.0 | |

| 315.9 |

Diluted | |

| 315.8 | |

| 319.8 |

See Condensed Notes to Interim Consolidated Financial Statements.

12

DEERE & COMPANY

STATEMENT OF CONSOLIDATED INCOME

For the Nine Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars and shares except per share amounts) Unaudited

|

| 2020 |

| 2019 | ||

Net Sales and Revenues | | | | | | |

Net sales | | $ | 22,612 | | $ | 26,182 |

Finance and interest income | |

| 2,584 | |

| 2,537 |

Other income | |

| 613 | |

| 643 |

Total | |

| 25,809 | |

| 29,362 |

| | | | | | |

Costs and Expenses | | | | | | |

Cost of sales | |

| 17,206 | |

| 20,056 |

Research and development expenses | |

| 1,201 | |

| 1,295 |

Selling, administrative and general expenses | |

| 2,467 | |

| 2,607 |

Interest expense | |

| 969 | |

| 1,078 |

Other operating expenses | |

| 1,199 | |

| 1,063 |

Total | |

| 23,042 | |

| 26,099 |

| | | | | | |

Income of Consolidated Group before Income Taxes | |

| 2,767 | |

| 3,263 |

Provision for income taxes | |

| 752 | |

| 748 |

Income of Consolidated Group | |

| 2,015 | |

| 2,515 |

Equity in income (loss) of unconsolidated affiliates | |

| (20) | |

| 20 |

Net Income | |

| 1,995 | |

| 2,535 |

Less: Net income attributable to noncontrolling interests | |

| 2 | |

| 3 |

Net Income Attributable to Deere & Company | | $ | 1,993 | | $ | 2,532 |

| | | | | | |

Per Share Data | | | | | | |

Basic | | $ | 6.36 | | $ | 7.98 |

Diluted | | $ | 6.30 | | $ | 7.87 |

| | | | | | |

Average Shares Outstanding | | | | | | |

Basic | |

| 313.3 | |

| 317.3 |

Diluted | |

| 316.4 | |

| 321.5 |

See Condensed Notes to Interim Consolidated Financial Statements.

13

DEERE & COMPANY

CONDENSED CONSOLIDATED BALANCE SHEET

(In millions of dollars) Unaudited

| | August 2 | | November 3 | | July 28 | |||

|

| 2020 |

| 2019 |

| 2019 | |||

Assets | | | | | | | | | |

Cash and cash equivalents | | $ | 8,190 | | $ | 3,857 | | $ | 3,383 |

Marketable securities | |

| 640 | |

| 581 | |

| 565 |

Receivables from unconsolidated affiliates | |

| 26 | |

| 46 | |

| 54 |

Trade accounts and notes receivable - net | |

| 5,473 | |

| 5,230 | |

| 6,758 |

Financing receivables - net | |

| 27,814 | |

| 29,195 | |

| 27,049 |

Financing receivables securitized - net | |

| 5,469 | |

| 4,383 | |

| 5,200 |

Other receivables | |

| 1,217 | |

| 1,487 | |

| 1,535 |

Equipment on operating leases - net | |

| 7,158 | |

| 7,567 | |

| 7,269 |

Inventories | |

| 5,650 | |

| 5,975 | |

| 6,747 |

Property and equipment - net | |

| 5,754 | |

| 5,973 | |

| 5,798 |

Investments in unconsolidated affiliates | |

| 199 | |

| 215 | |

| 219 |

Goodwill | |

| 2,984 | |

| 2,917 | |

| 3,013 |

Other intangible assets - net | |

| 1,301 | |

| 1,380 | |

| 1,444 |

Retirement benefits | |

| 1,031 | |

| 840 | |

| 1,431 |

Deferred income taxes | |

| 1,534 | |

| 1,466 | |

| 1,088 |

Other assets | |

| 2,824 | |

| 1,899 | |

| 1,977 |

Total Assets | | $ | 77,264 | | $ | 73,011 | | $ | 73,530 |

| | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | |

| | | | | | | | | |

Liabilities | | | | | | | | | |

Short-term borrowings | | $ | 9,075 | | $ | 10,784 | | $ | 11,142 |

Short-term securitization borrowings | |

| 5,361 | |

| 4,321 | |

| 5,048 |

Payables to unconsolidated affiliates | |

| 80 | |

| 142 | |

| 136 |

Accounts payable and accrued expenses | |

| 9,565 | |

| 9,656 | |

| 9,390 |

Deferred income taxes | |

| 479 | |

| 495 | |

| 507 |

Long-term borrowings | |

| 34,037 | |

| 30,229 | |

| 29,242 |

Retirement benefits and other liabilities | |

| 5,776 | |

| 5,953 | |

| 5,781 |

Total liabilities | |

| 64,373 | |

| 61,580 | |

| 61,246 |

| | | | | | | | | |

Redeemable noncontrolling interest | | | | | | 14 | | | 14 |

| | | | | | | | | |

Stockholders’ Equity | | | | | | | | | |

Total Deere & Company stockholders’ equity | |

| 12,888 | |

| 11,413 | |

| 12,266 |

Noncontrolling interests | |

| 3 | |

| 4 | |

| 4 |

Total stockholders’ equity | |

| 12,891 | |

| 11,417 | |

| 12,270 |

Total Liabilities and Stockholders’ Equity | | $ | 77,264 | | $ | 73,011 | | $ | 73,530 |

See Condensed Notes to Interim Consolidated Financial Statements.

14

DEERE & COMPANY

STATEMENT OF CONSOLIDATED CASH FLOWS

For the Nine Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars) Unaudited

|

| 2020 |

| 2019 | ||

Cash Flows from Operating Activities | | | | | | |

Net income | | $ | 1,995 | | $ | 2,535 |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

Provision for credit losses | |

| 123 | |

| 58 |

Provision for depreciation and amortization | |

| 1,614 | |

| 1,522 |

Impairment charges | | | 147 | |

| |

Share-based compensation expense | |

| 63 | |

| 63 |

Undistributed earnings of unconsolidated affiliates | |

| (5) | |

| 10 |

Credit for deferred income taxes | |

| (160) | |

| (332) |

Changes in assets and liabilities: | | | | | | |

Trade, notes, and financing receivables related to sales | |

| 626 | |

| (2,206) |

Inventories | |

| (1) | |

| (1,168) |

Accounts payable and accrued expenses | |

| (572) | |

| (306) |

Accrued income taxes payable/receivable | |

| 4 | |

| 253 |

Retirement benefits | |

| 88 | |

| 40 |

Other | |

| 135 | |

| (65) |

Net cash provided by operating activities | |

| 4,057 | |

| 404 |

| | | | | | |

Cash Flows from Investing Activities | | | | | | |

Collections of receivables (excluding receivables related to sales) | |

| 13,237 | |

| 12,685 |

Proceeds from maturities and sales of marketable securities | |

| 70 | |

| 72 |

Proceeds from sales of equipment on operating leases | |

| 1,310 | |

| 1,171 |

Cost of receivables acquired (excluding receivables related to sales) | |

| (14,449) | |

| (13,662) |

Purchases of marketable securities | |

| (91) | |

| (110) |

Purchases of property and equipment | |

| (594) | |

| (756) |

Cost of equipment on operating leases acquired | |

| (1,312) | |

| (1,462) |

Collateral on derivatives - net | | | 324 | |

| 59 |

Other | |

| (12) | |

| (126) |

Net cash used for investing activities | |

| (1,517) | |

| (2,129) |

| | | | | | |

Cash Flows from Financing Activities | | | | | | |

Increase (decrease) in total short-term borrowings | |

| 170 | |

| (336) |

Proceeds from long-term borrowings | |

| 8,331 | |

| 7,440 |

Payments of long-term borrowings | |

| (5,797) | |

| (4,356) |

Proceeds from issuance of common stock | |

| 111 | |

| 133 |

Repurchases of common stock | |

| (263) | |

| (880) |

Dividends paid | |

| (718) | |

| (703) |

Other | |

| (110) | |

| (82) |

Net cash provided by financing activities | |

| 1,724 | |

| 1,216 |

| | | | | | |

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | |

| 80 | |

| (24) |

| | | | | | |

Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash | |

| 4,344 | |

| (533) |

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | |

| 3,956 | |

| 4,015 |

Cash, Cash Equivalents, and Restricted Cash at End of Period | | $ | 8,300 | | $ | 3,482 |

See Condensed Notes to Interim Consolidated Financial Statements.

15

Condensed Notes to Interim Consolidated Financial Statements (Unaudited)

| (1) | In the third quarter of 2020, the Company reached a definitive agreement to sell its German walk-behind lawn mower business, which is expected to close in the fourth quarter. As a result, a non-cash charge of $24 million pretax and after-tax was recorded in “Other operating expenses” for an impairment to write the operations down to approximate realizable value. The Company also closed a factory producing small agricultural equipment in China at the end of the third quarter. In connection with this closure, a non-cash impairment of property and intangible assets of $9 million, and severance costs of $4 million, both pretax and after-tax, were recorded. The charges were recorded in “Cost of sales.” Both operations are in the agriculture and turf division. |

The Company recorded non-cash asset impairments in the second quarter of 2020 totaling $114 million pretax and approximately $105 million after-tax. The impairments related to the following: $62 million pretax of fixed assets of an asphalt plant factory in Germany, which is included in the Company’s construction and forestry operations with the impairment recorded in “Cost of sales”; $32 million pretax of equipment on operating leases and matured operating lease inventory, which is included in the financial services operations with the impairments recorded in “Other operating expenses”; and $20 million pretax of a minority investment in a construction equipment company headquartered in South Africa, which is included in the construction and forestry operations with the impairment recorded in “Equity in loss of unconsolidated affiliates.”

| (3) | Dividends declared and paid on a per share basis were as follows: |

| | Three Months Ended | | Nine Months Ended | | ||||||||

| | August 2 | | July 28 | | August 2 | | July 28 | | ||||

|

| 2020 |

| 2019 |

| 2020 |

| 2019 | | ||||

Dividends declared | | $ | .76 | | $ | .76 | | $ | 2.28 | | $ | 2.28 | |

Dividends paid | | $ | .76 | | $ | .76 | | $ | 2.28 | | $ | 2.21 | |

| (4) | The calculation of basic net income per share is based on the average number of shares outstanding. The calculation of diluted net income per share recognizes any dilutive effect of share-based compensation. |

| (5) | The consolidated financial statements represent the consolidation of all Deere & Company’s subsidiaries. In the supplemental consolidating data in Note 6 to the financial statements, “Equipment Operations” include the Company’s agriculture and turf operations and construction and forestry operations with “Financial Services” reflected on the equity basis. |

16

(6) SUPPLEMENTAL CONSOLIDATING DATA

STATEMENT OF INCOME

For the Three Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars) Unaudited | | EQUIPMENT OPERATIONS* | | FINANCIAL SERVICES | ||||||||

|

| 2020 |

| 2019 |

| 2020 |

| 2019 | ||||

Net Sales and Revenues | | | | | | | | | | | | |

Net sales | | $ | 7,859 | | $ | 8,969 | | | | | | |

Finance and interest income | |

| 25 | |

| 30 | | $ | 878 | | $ | 952 |

Other income | |

| 206 | |

| 185 | |

| 73 | |

| 51 |

Total | |

| 8,090 | |

| 9,184 | |

| 951 | |

| 1,003 |

| | | | | | | | | | | | |

Costs and Expenses | | | | | | | | | | | | |

Cost of sales | |

| 5,836 | |

| 6,871 | | | | | | |

Research and development expenses | |

| 370 | |

| 431 | | | | | | |

Selling, administrative and general expenses | |

| 616 | |

| 751 | |

| 137 | |

| 147 |

Interest expense | |

| 91 | |

| 67 | |

| 206 | |

| 311 |

Interest compensation to Financial Services | |

| 58 | |

| 93 | | | | | | |

Other operating expenses | |

| 94 | |

| 64 | |

| 363 | |

| 339 |

Total | |

| 7,065 | |

| 8,277 | |

| 706 | |

| 797 |

| | | | | | | | | | | | |

Income of Consolidated Group before Income Taxes | |

| 1,025 | |

| 907 | |

| 245 | |

| 206 |

Provision for income taxes | |

| 395 | |

| 190 | |

| 62 | |

| 31 |

Income of Consolidated Group | |

| 630 | |

| 717 | |

| 183 | |

| 175 |

| | | | | | | | | | | | |

Equity in Income (Loss) of Unconsolidated Subsidiaries and Affiliates | | | | | | | | | | | | |

Financial Services | |

| 183 | |

| 175 | |

| | |

| |

Other | |

| (2) | |

| 7 | | | | | | |

Total | |

| 181 | |

| 182 | |

| | |

| |

Net Income | |

| 811 | |

| 899 | |

| 183 | |

| 175 |

Less: Net income attributable to noncontrolling interests | |

| | |

| | | | | | | |

Net Income Attributable to Deere & Company | | $ | 811 | | $ | 899 | | $ | 183 | | $ | 175 |

* Deere & Company with Financial Services on the equity basis.

The supplemental consolidating data is presented for informational purposes. Transactions between the “Equipment Operations” and “Financial Services” have been eliminated to arrive at the consolidated financial statements.

17

SUPPLEMENTAL CONSOLIDATING DATA (Continued)

STATEMENT OF INCOME

For the Nine Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars) Unaudited | | EQUIPMENT OPERATIONS* | | FINANCIAL SERVICES | ||||||||

|

| 2020 |

| 2019 |

| 2020 |

| 2019 | ||||

Net Sales and Revenues | | | | | | | | | | | | |

Net sales | | $ | 22,612 | | $ | 26,182 | | | | | | |

Finance and interest income | |

| 75 | |

| 79 | | $ | 2,720 | | $ | 2,727 |

Other income | |

| 597 | |

| 614 | |

| 196 | |

| 184 |

Total | |

| 23,284 | |

| 26,875 | |

| 2,916 | |

| 2,911 |

| | | | | | | | | | | | |

Costs and Expenses | | | | | | | | | | | | |

Cost of sales | |

| 17,208 | |

| 20,058 | | | | | | |

Research and development expenses | |

| 1,201 | |

| 1,295 | | | | | | |

Selling, administrative and general expenses | |

| 1,989 | |

| 2,191 | |

| 483 | |

| 422 |

Interest expense | |

| 237 | |

| 182 | |

| 747 | |

| 910 |

Interest compensation to Financial Services | |

| 195 | |

| 254 | | | | | | |

Other operating expenses | |

| 186 | |

| 203 | |

| 1,187 | |

| 1,008 |

Total | |

| 21,016 | |

| 24,183 | |

| 2,417 | |

| 2,340 |

| | | | | | | | | | | | |

Income of Consolidated Group before Income Taxes | |

| 2,268 | |

| 2,692 | |

| 499 | |

| 571 |

Provision for income taxes | |

| 632 | |

| 625 | |

| 120 | |

| 123 |

Income of Consolidated Group | |

| 1,636 | |

| 2,067 | |

| 379 | |

| 448 |

| | | | | | | | | | | | |

Equity in Income (Loss) of Unconsolidated Subsidiaries and Affiliates | | | | | | | | | | | | |

Financial Services | |

| 381 | |

| 450 | |

| 2 | |

| 2 |

Other | |

| (22) | |

| 18 | | | | | | |

Total | |

| 359 | |

| 468 | |

| 2 | |

| 2 |

Net Income | |

| 1,995 | |

| 2,535 | |

| 381 | |

| 450 |

Less: Net income attributable to noncontrolling interests | |

| 2 | |

| 3 | | | | | | |

Net Income Attributable to Deere & Company | | $ | 1,993 | | $ | 2,532 | | $ | 381 | | $ | 450 |

* Deere & Company with Financial Services on the equity basis.

The supplemental consolidating data is presented for informational purposes. Transactions between the “Equipment Operations” and “Financial Services” have been eliminated to arrive at the consolidated financial statements.

18

SUPPLEMENTAL CONSOLIDATING DATA (Continued)

CONDENSED BALANCE SHEET

(In millions of dollars) Unaudited | | EQUIPMENT OPERATIONS* | | FINANCIAL SERVICES | ||||||||||||||

|

| August 2 | | November 3 | | July 28 |

| August 2 | | November 3 | | July 28 | ||||||

| | 2020 |

| 2019 |

| 2019 | | 2020 |

| 2019 |

| 2019 | ||||||

Assets | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 7,440 | | $ | 3,175 | | $ | 2,694 | | $ | 750 | | $ | 682 | | $ | 689 |

Marketable securities | | | 8 | |

| 1 | |

| 5 | |

| 632 | |

| 580 | |

| 560 |

Receivables from unconsolidated subsidiaries and affiliates | |

| 3,619 | |

| 2,017 | |

| 2,395 | | | | | | | | | |

Trade accounts and notes receivable - net | |

| 1,251 | |

| 1,482 | |

| 1,606 | |

| 5,595 | |

| 5,153 | |

| 6,807 |

Financing receivables - net | |

| 111 | |

| 65 | |

| 100 | |

| 27,703 | |

| 29,130 | |

| 26,949 |

Financing receivables securitized - net | | | 37 | | | 44 | | | 54 | |

| 5,432 | |

| 4,339 | |

| 5,146 |

Other receivables | |

| 1,083 | |

| 1,376 | |

| 1,428 | |

| 162 | |

| 116 | |

| 126 |

Equipment on operating leases - net | | | | | | | | | | |

| 7,158 | |

| 7,567 | |

| 7,269 |

Inventories | |

| 5,650 | |

| 5,975 | |

| 6,747 | | | | | | | | | |

Property and equipment - net | |

| 5,711 | |

| 5,929 | |

| 5,753 | |

| 43 | |

| 44 | |

| 45 |

Investments in unconsolidated subsidiaries and affiliates | |

| 5,383 | |

| 5,326 | |

| 5,309 | |

| 19 | |

| 16 | |

| 16 |

Goodwill | |

| 2,984 | |

| 2,917 | |

| 3,013 | | | | | | | | | |

Other intangible assets - net | |

| 1,301 | |

| 1,380 | |

| 1,444 | | | | |

| | |

| |

Retirement benefits | |

| 972 | |

| 836 | |

| 1,374 | |

| 59 | |

| 58 | |

| 57 |

Deferred income taxes | |

| 1,865 | |

| 1,896 | |

| 1,579 | |

| 56 | |

| 57 | |

| 72 |

Other assets | |

| 1,566 | |

| 1,158 | |

| 1,269 | |

| 1,260 | |

| 741 | |

| 708 |

Total Assets | | $ | 38,981 | | $ | 33,577 | | $ | 34,770 | | $ | 48,869 | | $ | 48,483 | | $ | 48,444 |

| | | | | | | | | | | | | | | | | | |

Liabilities and Stockholders’ Equity | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | |

Short-term borrowings | | $ | 853 | | $ | 987 | | $ | 1,372 | | $ | 8,222 | | $ | 9,797 | | $ | 9,770 |

Short-term securitization borrowings | | | 37 | | | 44 | | | 53 | |

| 5,324 | |

| 4,277 | |

| 4,995 |

Payables to unconsolidated subsidiaries and affiliates | |

| 80 | |

| 142 | |

| 136 | |

| 3,593 | |

| 1,970 | |

| 2,341 |

Accounts payable and accrued expenses | |

| 8,834 | |

| 9,232 | |

| 9,422 | |

| 2,134 | |

| 1,836 | |

| 1,641 |

Deferred income taxes | |

| 398 | |

| 414 | |

| 454 | |

| 468 | |

| 568 | |

| 616 |

Long-term borrowings | |

| 10,217 | |

| 5,415 | |

| 5,364 | |

| 23,820 | |

| 24,814 | |

| 23,878 |

Retirement benefits and other liabilities | |

| 5,671 | |

| 5,912 | |

| 5,685 | |

| 105 | |

| 94 | |

| 97 |

Total liabilities | |

| 26,090 | |

| 22,146 | |

| 22,486 | |

| 43,666 | |

| 43,356 | |

| 43,338 |

| | | | | | | | | | | | | | | | | | |

Redeemable noncontrolling interest | | | | | | 14 | | | 14 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Stockholders’ Equity | | | | | | | | | | | | | | | | | | |

Total Deere & Company stockholders’ equity | |

| 12,888 | |

| 11,413 | |

| 12,266 | |

| 5,203 | |

| 5,127 | |

| 5,106 |

Noncontrolling interests | |

| 3 | |

| 4 | |

| 4 | | | | | | | | | |

Total stockholders’ equity | |

| 12,891 | |

| 11,417 | |

| 12,270 | |

| 5,203 | |

| 5,127 | |

| 5,106 |

Total Liabilities and Stockholders’ Equity | | $ | 38,981 | | $ | 33,577 | | $ | 34,770 | | $ | 48,869 | | $ | 48,483 | | $ | 48,444 |

* Deere & Company with Financial Services on the equity basis.

The supplemental consolidating data is presented for informational purposes. Transactions between the “Equipment Operations” and “Financial Services” have been eliminated to arrive at the consolidated financial statements.

19

SUPPLEMENTAL CONSOLIDATING DATA (Continued)

STATEMENT OF CASH FLOWS

For the Nine Months Ended August 2, 2020 and July 28, 2019

(In millions of dollars) Unaudited | | EQUIPMENT OPERATIONS* | | FINANCIAL SERVICES | ||||||||

|

| 2020 |

| 2019 |

| 2020 |

| 2019 | ||||

Cash Flows from Operating Activities | | | | | | | | | | | | |

Net income | | $ | 1,995 | | $ | 2,535 | | $ | 381 | | $ | 450 |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | |

Provision for credit losses | |

| 6 | |

| 1 | |

| 117 | |

| 57 |

Provision for depreciation and amortization | |

| 787 | |

| 782 | |

| 925 | |

| 836 |

Impairment charges | | | 115 | |

| | | | 32 | | | |

Undistributed earnings of unconsolidated subsidiaries and affiliates | |

| (124) | |

| (62) | |

| (1) | |

| (1) |

Credit for deferred income taxes | |

| (57) | |

| (123) | |

| (103) | |

| (209) |

Changes in assets and liabilities: | | | | | | | | | | | | |

Trade receivables and Equipment Operations' financing receivables | |

| 116 | |

| (248) | | | | | | |

Inventories | |

| 387 | |

| (670) | | | | | | |

Accounts payable and accrued expenses | |

| (567) | |

| 50 | |

| (38) | |

| 23 |

Accrued income taxes payable/receivable | |

| (25) | |

| (282) | |

| 29 | |

| 535 |

Retirement benefits | |

| 77 | |

| 35 | |

| 11 | |

| 5 |

Other | |

| 145 | |

| (59) | |

| 89 | |

| 140 |

Net cash provided by operating activities | |

| 2,855 | |

| 1,959 | |

| 1,442 | |

| 1,836 |

| | | | | | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | | | | | |

Collections of receivables (excluding trade and wholesale) | | | | | | | |

| 14,352 | |

| 13,807 |

Proceeds from maturities and sales of marketable securities | |

| | |

| 9 | |

| 70 | |

| 63 |

Proceeds from sales of equipment on operating leases | | | | | | | |

| 1,310 | |

| 1,171 |

Cost of receivables acquired (excluding trade and wholesale) | | | | | | | |

| (15,367) | |

| (14,597) |

Purchases of marketable securities | | | | |

| (3) | |

| (91) | |

| (107) |

Purchases of property and equipment | |

| (591) | |

| (754) | |

| (3) | |

| (2) |

Cost of equipment on operating leases acquired | | | | | | | |

| (1,836) | |

| (2,135) |

Decrease (increase) in trade and wholesale receivables | | | | | | | |

| 423 | |

| (2,551) |

Collateral on derivatives - net | | | (6) | | | | | | 330 | | | 59 |

Other | |

| (55) | |

| (64) | |

| (46) | |

| (47) |

Net cash used for investing activities | |

| (652) | |

| (812) | |

| (858) | |

| (4,339) |

| | | | | | | | | | | | |

Cash Flows from Financing Activities | | | | | | | | | | | | |

Increase (decrease) in total short-term borrowings | |

| (32) | |

| (119) | |

| 202 | |

| (217) |

Change in intercompany receivables/payables | |

| (1,468) | |

| (683) | |

| 1,468 | |

| 683 |

Proceeds from long-term borrowings | |

| 4,592 | |

| 868 | |

| 3,739 | |

| 6,572 |

Payments of long-term borrowings | |

| (179) | |

| (194) | |

| (5,618) | |

| (4,162) |

Proceeds from issuance of common stock | |

| 111 | |

| 133 | | | | | | |

Repurchases of common stock | |

| (263) | |

| (880) | | | | | | |

Dividends paid | |

| (718) | |

| (703) | |

| (260) | |

| (377) |

Other | |

| (86) | |

| (52) | |

| (11) | |

| (22) |

Net cash provided by (used for) financing activities | |

| 1,957 | |

| (1,630) | |

| (480) | |

| 2,477 |

| | | | | | | | | | | | |

Effect of Exchange Rate Changes on Cash, Cash Equivalents, and Restricted Cash | |

| 95 | |

| (16) | |

| (15) | |

| (8) |

| | | | | | | | | | | | |

Net Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash | |

| 4,255 | |

| (499) | |

| 89 | |

| (34) |

Cash, Cash Equivalents, and Restricted Cash at Beginning of Period | |

| 3,196 | |

| 3,202 | |

| 760 | |

| 813 |

Cash, Cash Equivalents, and Restricted Cash at End of Period | | $ | 7,451 | | $ | 2,703 | | $ | 849 | | $ | 779 |

* Deere & Company with Financial Services on the equity basis.

The supplemental consolidating data is presented for informational purposes. Transactions between the “Equipment Operations” and “Financial Services” have been eliminated to arrive at the consolidated financial statements.

20