Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMPUTER TASK GROUP INC | d53802d8k.htm |

Exhibit 99.1

August 7, 2020

Fellow CTG Shareholders:

During the past calendar year, we took further strategic actions to position CTG for short- and long-term success. As we continue to drive improvements throughout the business, I welcome this opportunity on behalf of the Board of Directors to share with you CTG’s recent accomplishments and provide an update on the Company’s direction.

We were pleased to report exceptional results for 2019, with revenue reaching a six-year high, driven by a combination of organic growth and the contribution from our two successful acquisitions in Europe. Our relentless focus on improved revenue quality and cost reductions yielded significant improvement in operating margin and net income, and resulted in the highest reported earnings per share in four years. We extended this momentum in the first half of 2020, with the Company reporting the highest first-half non-GAAP operating margin and earnings per share in six years.

CTG’s strong performance is a testament to the continued execution of our strategic plan driven by the highly effective leadership of Filip Gydé, who the Board unanimously appointed CEO on March 1, 2019. Consistent with his long-term record of success in Europe, Filip hit the ground running by making the necessary changes in our North American operation to continue advancing the Company’s transformation to a more Solutions-centric, higher-margin organization. He also rapidly established a company-wide culture, unifying employees around our mission to deliver for our clients while enhancing shareholder value. The Board has great confidence in Filip, who together with an exceptional leadership team, is delivering strong operating results and ultimately increasing value for our shareholders.

We started the new year with the expectation of building on the momentum generated in 2019, but like so many other companies, we needed to quickly adapt and implement effective measures to address the COVID-19 pandemic. Our first priority is the health and safety of our employees, as we continue to reliably and effectively serve the needs of our clients. Despite the heightened near-term uncertainty associated with the pandemic, the Board is extremely confident in our management team’s ability to navigate this unprecedented environment realizing improved quality of revenue and profits across the enterprise while remaining focused on the execution of the Company’s strategic plan.

On behalf of your CTG Board, thank you for your continued support of our Company.

Daniel J. Sullivan

Chairman of the Board

August 7, 2020

Fellow Shareholders of CTG:

As I reflect on the past eighteen months as CEO, I am excited to report that the CTG team has delivered significant progress towards positioning the Company for sustainable long-term growth, increased profitability and improved shareholder value.

Over the course of 2019, we took decisive actions to transform CTG’s business toward a Solutions-centric organization, building upon the strategic plan we implemented several years ago. The primary objectives underlying our strategic plan include:

| 1. | Immediately improve margins and profitability |

| 2. | Generate long-term growth above that of our served markets, while emphasizing higher-margin business opportunities |

| 3. | Optimally allocate capital in support of solutions development and acquisitions that will provide continued financial improvement and shareholder value creation |

Through disciplined execution, we achieved impressive financial results for 2019, including the second consecutive year of strong top-line growth, and a significant year-over-year improvement in CTG’s profitability. Key highlights from our full year 2019 financial results included:

| • | Total revenue increased 9.9% to $394.2 million, representing a six-year high |

| • | Revenue from IT Solutions grew 24.9% to represent 35.8% of total revenue, contributing to an increasing mix of higher-margin business |

| • | Revenue in Europe increased 20.5% (27.2% in local currency) year-over-year, reflecting a combination of expanded new engagements and the contribution from the Tech-IT acquisition |

| • | Operating income more than tripled year-over-year to $7.0 million, demonstrating our successful ongoing transition towards a more Solutions-centric organization with a focus on higher-margin engagements |

| • | GAAP net income significantly increased to $4.1 million, or $0.29 per diluted share, CTG’s highest earnings per share in four years |

| • | Non-GAAP net income was $5.6 million, or $0.40 per diluted share |

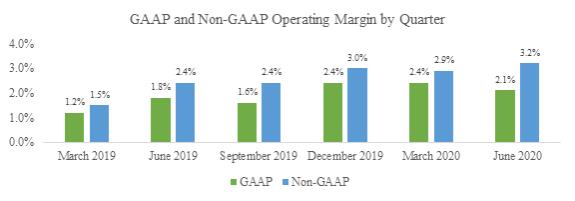

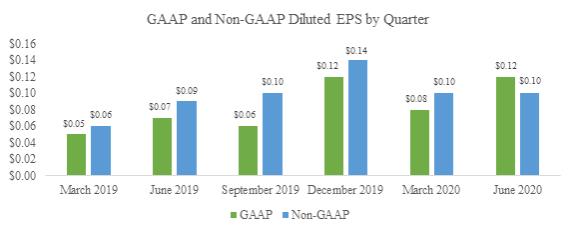

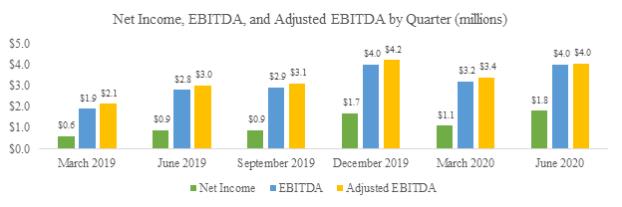

Key financial highlights from the past six quarters include significant improvement in the non-GAAP operating margin, diluted EPS, and adjusted EBITDA:

It was particularly rewarding to see the tremendous financial progress we made across the business that came from our team’s consistent efforts and focused execution. We are especially proud that we have achieved $0.38 of GAAP diluted EPS, $0.44 of non-GAAP diluted EPS, net income of $5.5 million, and adjusted EBITDA of $14.7 million for the twelve month period ended June 2020.

In addition to the actions taken to protect the wellbeing of our employees in light of the COVID-19 pandemic, our entire organization quickly and safely adapted to the changing business landscape to fully meet the needs of CTG clients, including a work-from-home model. We made these adjustments without a loss in productivity, which resulted in both increased efficiencies and higher utilization across our global operations.

Additionally, we took proactive steps to further strengthen the Company’s financial position by securing liquidity in the form of drawing down $12.0 million under our revolving credit facility and accelerating the collection of receivables from our largest IT Staffing client. We also streamlined expenses, such as the implementation of selective furloughs and temporary salary adjustments for nearly all non-billable employees, including senior management.

The actions taken since year-end have proven highly successful and contributed to our reporting of solid financial results through the first half of 2020, with non-GAAP operating margins and earnings per share representing the highest achieved in six years. Underlying these results was a significant increase in higher-quality revenue and margins driven by our expanding mix of IT Solutions business, as well as improvement in the quality of Staffing revenue through better pricing and disengaging from lower-margin projects.

Despite the recent environment, our business development and solutions organizations have remained focused on maintaining a robust pipeline of new business opportunities. We remain confident in our strategy as outlined below and are committed to ongoing disciplined execution of the plan. We believe the increased adoption of remote work environments will ultimately expand clients’ needs for scalable IT and cloud-based solutions, supporting a potential acceleration of our transformational shift towards a Solutions-centric organization.

Continuing to Advance our Strategic Shift to IT Solutions

Our IT Solutions business continued its momentum, with 2019 marking another year of more than 20% year-over-year growth. The significant drivers within this business are CTG’s core global solutions offerings – Application Advantage and EIM Advantage – which have gained traction in our financial, healthcare and energy verticals. Application Advantage includes application management, support, and service desk solutions, while EIM Advantage includes data related services, such as data management and analytics.

We recently added a third core solutions offering, Global Testing Solutions, which builds upon our testing expertise in Europe. Our Testing Solutions include services for websites, software, mobile applications and Internet of Things connected objects. We recently commenced an automated testing solution for a leading integrated healthcare organization in the northeastern U.S., which represented the Company’s first-ever engagement for testing solutions in North America. Each of our solutions offerings are scalable and command higher margins due to the value they provide our clients. The greater mix of solutions in our overall business has significantly contributed to CTG’s operating results throughout 2019 and in the first half of 2020.

As part of our go-forward strategy, we extended our solutions capability by making our repeatable offerings and delivery platforms available in new and existing markets. In mid-2020, we expanded CTG’s strategic delivery platform with the opening of our newest delivery center in Bogotá, Colombia. This new location complements our established delivery centers in North America, Western Europe and India, all of which leverage a proven centralized approach to deliver high-quality, cost-effective IT services and solutions for clients. Additionally, we are continuously expanding our global solutions portfolio with new offerings focused around our core areas of application support, data management and testing. As an example, in March of 2020 we announced the acquisition of StarDust, with operations in France and Canada, which supports our strategy to expand Global Testing Solutions across all of CTG’s served geographies. Additionally, we will officially launch our Microsoft 365 Services (M365) offering later this year. This solution is specifically targeted at helping clients maximize the value of their M365 investments, from initial implementation and migration planning, to deployment, optimization, and maintenance.

Maintaining Strong Growth in Europe

Our European business was again a key driver of our consolidated revenue and earnings growth in 2019. At the center of this sustained performance was continued new business growth, highlighted by a series of new or extended contracts with the EU institutions and prominent financial services clients in Belgium, France, Luxembourg, and the United Kingdom.

The excellent performance of our European business reflected the significant contributions from our acquisition of Tech-IT, which included securing several sizable IT infrastructure and implementation solutions contracts. We are leveraging our previous acquisition in France and Tech-IT in Luxembourg to cross-sell our enhanced solutions services across all of the geographies we serve to further expand our business, as demonstrated by our nearly 21% revenue growth rate in 2019.

Capitalizing on Long-term Growth Opportunities in Health Solutions

In 2019, we achieved double-digit year-over-year growth in our Health Solutions business for the second consecutive year. This organic growth was driven by continued strong demand for our core Solutions offerings across new and extended contract wins throughout the year. We achieved a meaningful milestone in the first half of 2020, with our team successfully converting an existing application management project into a secured multi-million dollar contract to manage the go-live implementation of EPIC-based electronic health records (EHR) for a prominent healthcare system in the northeastern U.S.

We believe that healthcare represents a large vertical with long-term growth opportunity. We continue to align CTG’s Health Solutions offerings with important industry trends, including value-based care. Our strategy is focused on expanding existing Solutions offerings to better address the industry’s growing needs for data and analytics, testing, and the deployment and optimization of EHR.

Maximizing Return on IT Staffing Through More Selective Engagements

Throughout 2019, our priority in the IT Staffing business remained focused around improving revenue quality and operating performance. Following a comprehensive strategic review of this business during the first half of the year, we implemented a series of structural changes primarily in North America. We are now more selective on specific staffing engagements, including our current contracted business and prospective engagements. As a result, we began transitioning away from certain lower margin staffing business late in 2019.

In addition, we made structural changes to consolidate our sales and delivery resources to concentrate our commercial efforts on higher-value IT and professional staffing services with middle-market companies. We continue to explore strategic offerings with select clients to convert existing staffing projects to managed services engagements. If successful, such conversions would ultimately benefit both CTG and our clients by enabling potential cost savings, higher profitability and added value. We will continue to be disciplined on pricing and resource prioritization to ensure we maintain an efficient, low cost delivery organization capable of supporting higher volume clients.

Strategic Acquisitions Contributing to Accelerated Transformation

In late 2019, we completed the integration of Tech-IT, which followed the successful acquisition and integration of Soft Company in 2018. Together, these highly strategic and immediately accretive transactions have played a key role in our overall success, providing synergies and augmenting our ongoing transformational shift to a more Solutions-centric organization.

Soft Company and Tech-IT each provided unique strategic synergies and benefits: Soft Company meaningfully expanded CTG’s footprint in Europe by establishing a solid presence in France, and Tech-IT added highly complementary infrastructure solutions which together enable CTG to deliver complete end-to-end solutions in Europe.

We plan to continue to evaluate and opportunistically pursue targeted acquisitions that complement our strategic plan and ongoing shift toward IT solutions, while also contributing higher margins that are immediately accretive to growth and profitability.

Continuing to Build on Accomplishments

We remain committed to building on our ongoing success and maintaining the momentum we have generated these past eighteen months. Driving this company-wide effort is a well-seasoned leadership team with a shared vision for the continued expansion of CTG’s time-tested solutions, IT capabilities, and expertise.

We have done an excellent job navigating the recent environment to meet the needs of clients, and will continue managing the factors within our control. Importantly, CTG remains well capitalized with a strong balance sheet and sufficient working capital to support significant growth in our business. Our leadership team is aligned and confident that we have the right strategy to deliver increased value to our shareholders, and we are actively working to utilize the current environment to support an accelerated shift toward an increasingly Solutions focused organization. As we continue to drive transformational growth in our IT Solutions business, we expect it to become a substantially larger portion of our overall business, which will generate improved operating leverage, resulting in significant long-term profitability.

Given the steps we have taken, I am confident we are on track to position CTG as a premier global solutions provider. I would like to thank all of our shareholders for their continued support. Our success would not be possible without our incredible people – the hard-working employees of CTG, our world-class executive leadership team, and our active and engaged Board of Directors.

Filip J.L. Gydé

President and Chief Executive Officer

Reconciliation of GAAP to Non-GAAP Information

The Company has referenced non-GAAP information in this shareholder letter. The Company believes that the use of non-GAAP financial information provides useful information to investors and management to gain an overall understanding of its current financial performance and prospects. In addition, non-GAAP financial measures are used by management for forecasting, facilitating ongoing operating decisions, and measuring the Company’s overall performance. The Company believes that these non-GAAP measures align closely with its internal measurement processes and are reflective of the Company’s core operating results.

Specifically, the non-GAAP information as presented exclude gains from life insurance proceeds and on the sale of real estate, and costs associated with severance and certain acquisition-related expenses. In 2020, the acquisition-related expenses consist of due diligence costs, and the amortization of intangible assets. In 2019, acquisition-related expenses also include changes in the value of earn-out payments upon the achievement of certain financial targets from the acquisitions of Soft Company and Tech-IT.

The reconciliation of GAAP to non-GAAP operating margin by quarter is as follows:

| March | June | Sept. | Dec. | March | June | |||||||||||||||||||

| 2019 | 2019 | 2019 | 2019 | 2020 | 2020 | |||||||||||||||||||

| GAAP Operating Margin |

1.2 | % | 1.8 | % | 1.6 | % | 2.4 | % | 2.4 | % | 2.1 | % | ||||||||||||

| Acquisition-related expenses |

0.3 | % | 0.6 | % | 0.8 | % | 0.6 | % | 0.5 | % | 0.4 | % | ||||||||||||

| Severance |

0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.7 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-GAAP Operating Margin |

1.5 | % | 2.4 | % | 2.4 | % | 3.0 | % | 2.9 | % | 3.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The reconciliation of GAAP to non-GAAP diluted earnings per share by quarter is as follows:

| March | June | Sept. | Dec. | March | June | |||||||||||||||||||

| 2019 | 2019 | 2019 | 2019 | 2020 | 2020 | |||||||||||||||||||

| GAAP Diluted Earnings per Share |

$ | 0.05 | $ | 0.07 | $ | 0.06 | $ | 0.12 | $ | 0.08 | $ | 0.12 | ||||||||||||

| Acquisition-related expenses |

0.01 | 0.02 | 0.04 | 0.02 | 0.02 | 0.02 | ||||||||||||||||||

| Severance |

— | — | — | — | — | 0.02 | ||||||||||||||||||

| Gain on sale of building |

— | — | — | — | — | (0.03 | ) | |||||||||||||||||

| Non-taxable life insurance gain |

— | — | — | — | — | (0.03 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-GAAP Diluted Earnings per Share |

$ | 0.06 | $ | 0.09 | $ | 0.10 | $ | 0.14 | $ | 0.10 | $ | 0.10 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The reconciliation of Net income to Earnings before Interest, Taxes and Depreciation (EBITDA) and adjusted EBITDA by quarter is as follows:

| March | June | Sept. | Dec. | March | June | |||||||||||||||||||

| (in millions) |

2019 | 2019 | 2019 | 2019 | 2020 | 2020 | ||||||||||||||||||

| Net income |

$ | 0.6 | $ | 0.9 | $ | 0.9 | $ | 1.7 | $ | 1.1 | $ | 1.8 | ||||||||||||

| Taxes |

0.3 | 0.6 | 0.4 | 0.8 | 0.7 | 1.4 | ||||||||||||||||||

| Interest |

0.1 | 0.1 | 0.1 | 0.1 | 0.1 | — | ||||||||||||||||||

| Depreciation and amortization |

0.7 | 0.7 | 1.0 | 0.8 | 0.8 | 0.8 | ||||||||||||||||||

| Equity-Based compensation expense |

0.2 | 0.5 | 0.5 | 0.6 | 0.5 | 0.6 | ||||||||||||||||||

| Severance |

— | — | — | — | — | 0.6 | ||||||||||||||||||

| Non-taxable life insurance gain |

— | — | — | — | — | (0.4 | ) | |||||||||||||||||

| Gain on sale of building |

— | — | — | — | — | (0.8 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

$ | 1.9 | $ | 2.8 | $ | 2.9 | $ | 4.0 | $ | 3.2 | $ | 4.0 | ||||||||||||

| Acquisition-related expenses |

0.2 | 0.2 | 0.2 | 0.2 | 0.2 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 2.1 | $ | 3.0 | $ | 3.1 | $ | 4.2 | $ | 3.4 | $ | 4.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||