Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Neonode Inc. | ea125394-8k_neonode.htm |

| EX-99.1 - EARNINGS RELEASE OF THE COMPANY DATED AUGUST 14, 2020 - Neonode Inc. | ea125394ex99-1_neonode.htm |

Exhibit 99.2

Neonode Inc. Second Quarter 2020 Presentation Ms. Maria Ek, CFO Mr. David Brunton, Investor Relations August 14, 2020 Dr. Urban Forssell, CEO

2 Disclaimer This presentation contains, and related oral and written statements of Neonode Inc. (“Neonode” or the “Company”) and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include information about current expectations, potential financial performance or future events. The se also may include statements about market and sales growth, financial results, use of free cash flow, product development and introduction, regulatory matters and sales efforts. They are based on assumptions, expectations and information available to the Company and its management and involve a number of known and unknown risks, uncertainties and other factors that may cause th e Company’s actual results, levels of activity, performance or achievements to be materially different from any expressed or im pli ed by these forward-looking statements. These uncertainties and risks include, but are not limited to, those outlined in filings of th e Company with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, including sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are advised to carefully consider these various risks, uncertainties and other factors. Forward-looking stat eme nts are made as of today’s date. The Company and its management undertake no duty to update or revise forward - looking statements. This presentation has been prepared by the Company based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believe s such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information.

3 Business and Strategy Update

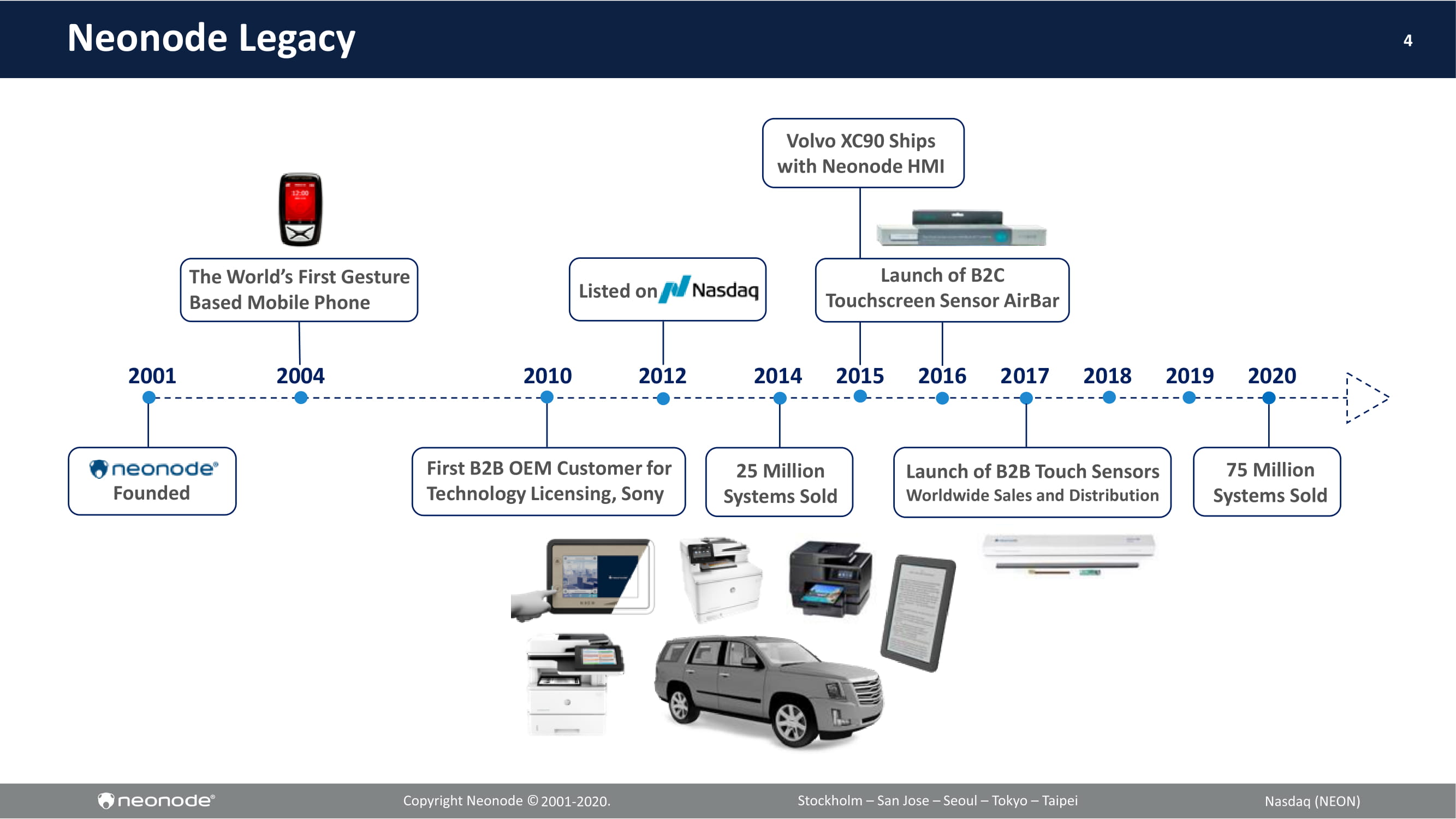

4 Listed on Neonode Legacy 2001 2004 2010 2012 2014 2015 2016 2 017 2018 2019 2020 The World’s First Gesture Based Mobile Phone Volvo XC90 S hips with Neonode HMI Launch of B2C Touchscreen Sensor AirBar 75 Million Systems Sold First B2B OEM Customer for Technology Licensing, Sony 25 Million Systems Sold Launch of B2B Touch Sensors Worldwide Sales and Distribution Founded

5 Contactless Touch – The New Normal Post COVID - 19 TRANSITIONING TO NEONODE 3.0

6 Neonode Today • Proven contactless touch technology deployed in more than 75 million products • Extensive technical expertise and knowhow • Technology protected by more than 120 patents and patents pending worldwide • Scalable product and technology platforms that are easy to integrate and allows for short time - to - market • Well - established worldwide ecosystem of distributors , value added partners and sales reps Neonode is well - positioned to provide contactless touch solutions in a post - COVID world

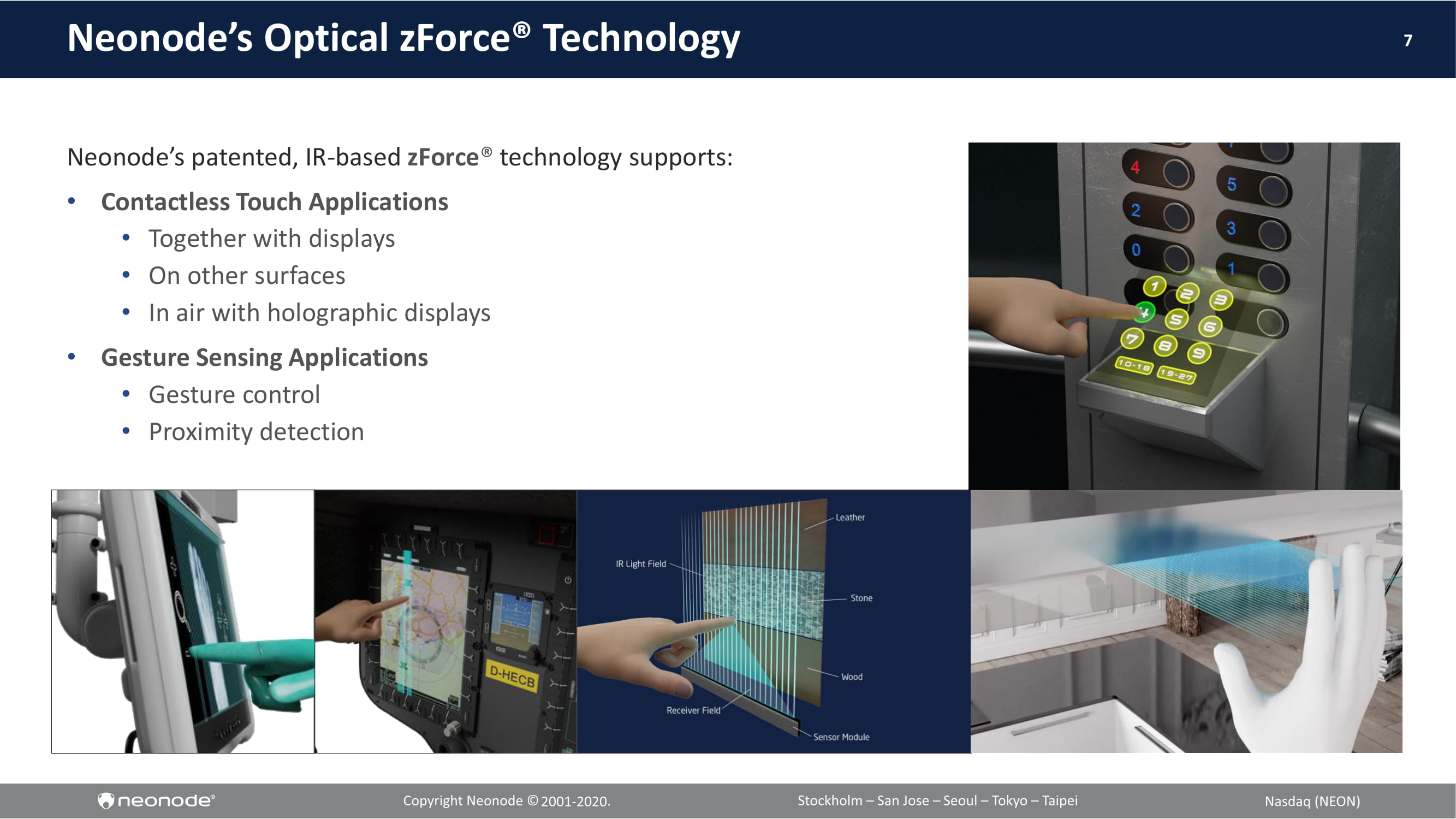

7 Neonode’s Optical zForce ® Technology Neonode’s patented , IR - based zForce ® technology supports: • Contactless Touch Applications • Together with displays • On other surfaces • In air with holographic displays • Gesture Sensing Applications • Gesture control • Proximity detection

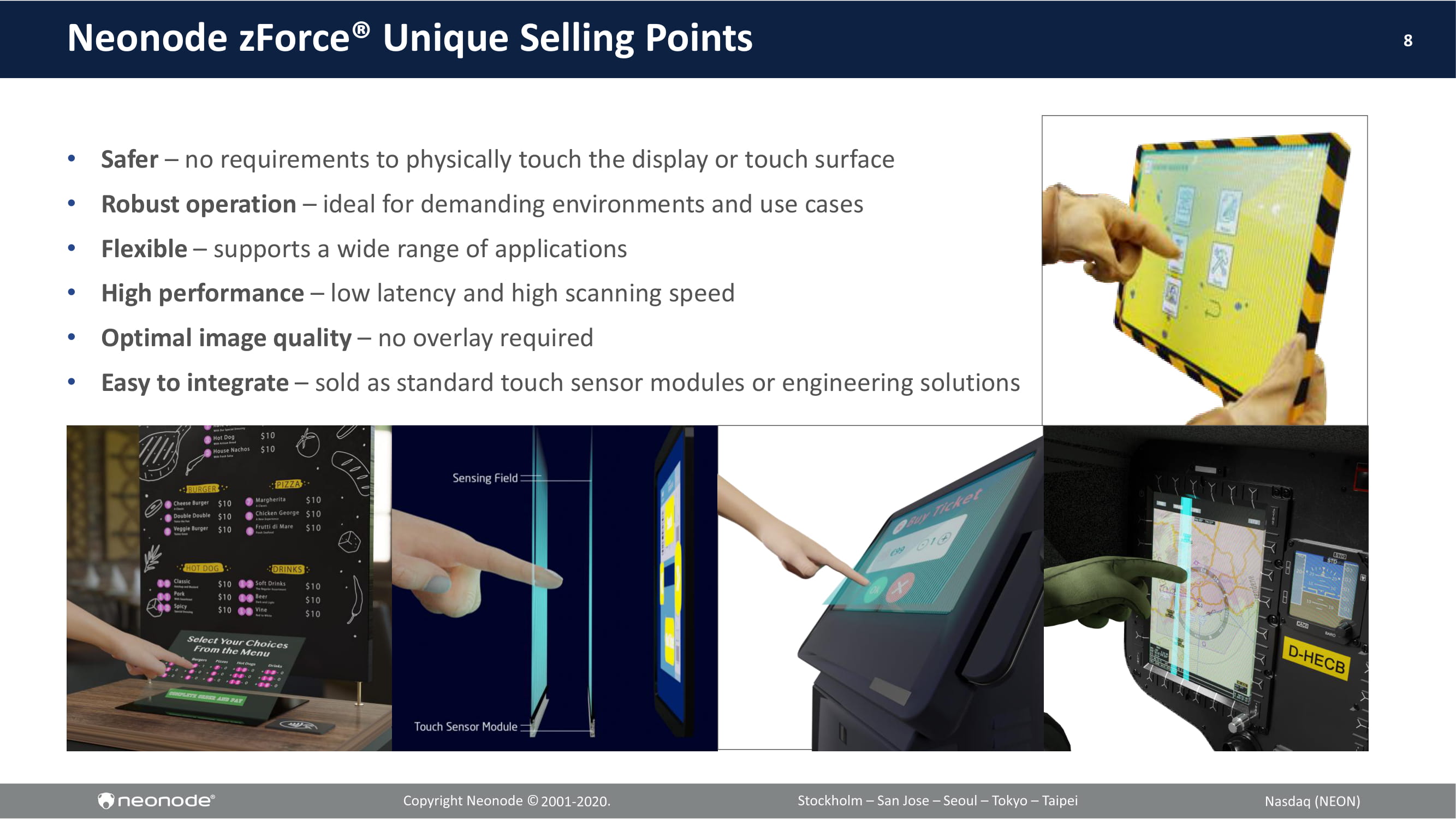

8 Neonode zForce ® Unique Selling Points • Safer – no requirements to physically touch the display or touch surface • Robust operation – ideal for demanding environments and use cases • Flexible – supports a wide range of applications • High performance – low latency and high scanning speed • Optimal image quality – no overlay required • Easy to integrate – sold as standard touch sensor modules or engineering solutions

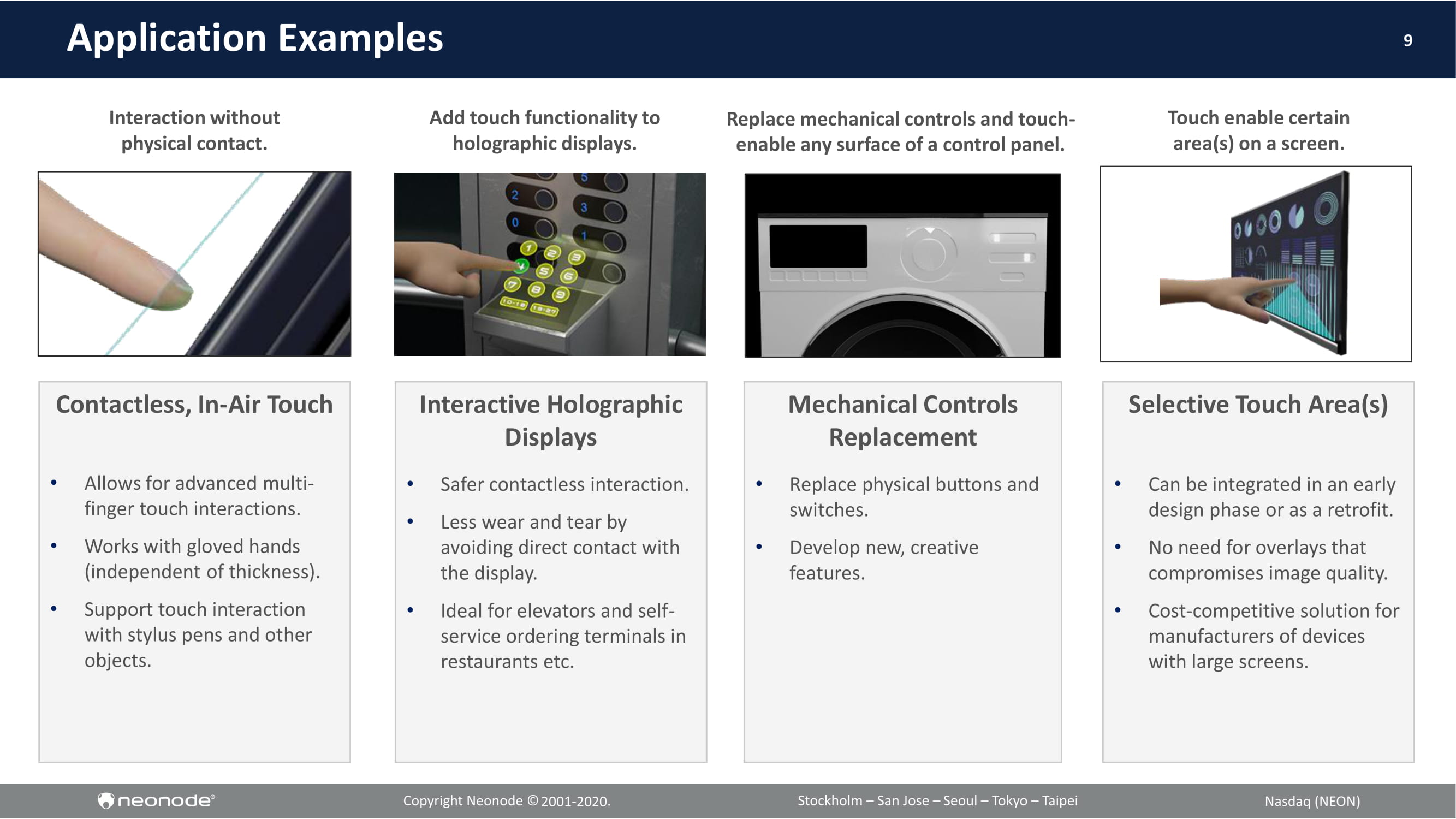

9 Application Examples Interaction without physical contact. Add touch functionality to holographic displays. Contactless, In - Air Touch • Allows for advanced multi - finger touch interactions. • Works with gloved hands (independent of thickness). • Support touch interaction with stylus pens and other objects. Interactive Holographic Displays • Safer contactless interaction . • Less wear and tear by avoiding direct contact with the display. • Ideal for elevators and self - service ordering terminals in restaurants etc. Mechanical Controls Replacement • Replace physical buttons and switches. • Develop new, creative features. Selective Touch Area(s) • Can be integrated in an early design phase or as a retrofit. • No need for overlays that compromises image quality. • Cost - competitive solution for manufacturers of devices with large screens. Replace mechanical controls and touch - enable any surface of a control panel. Touch enable certain area(s) on a screen.

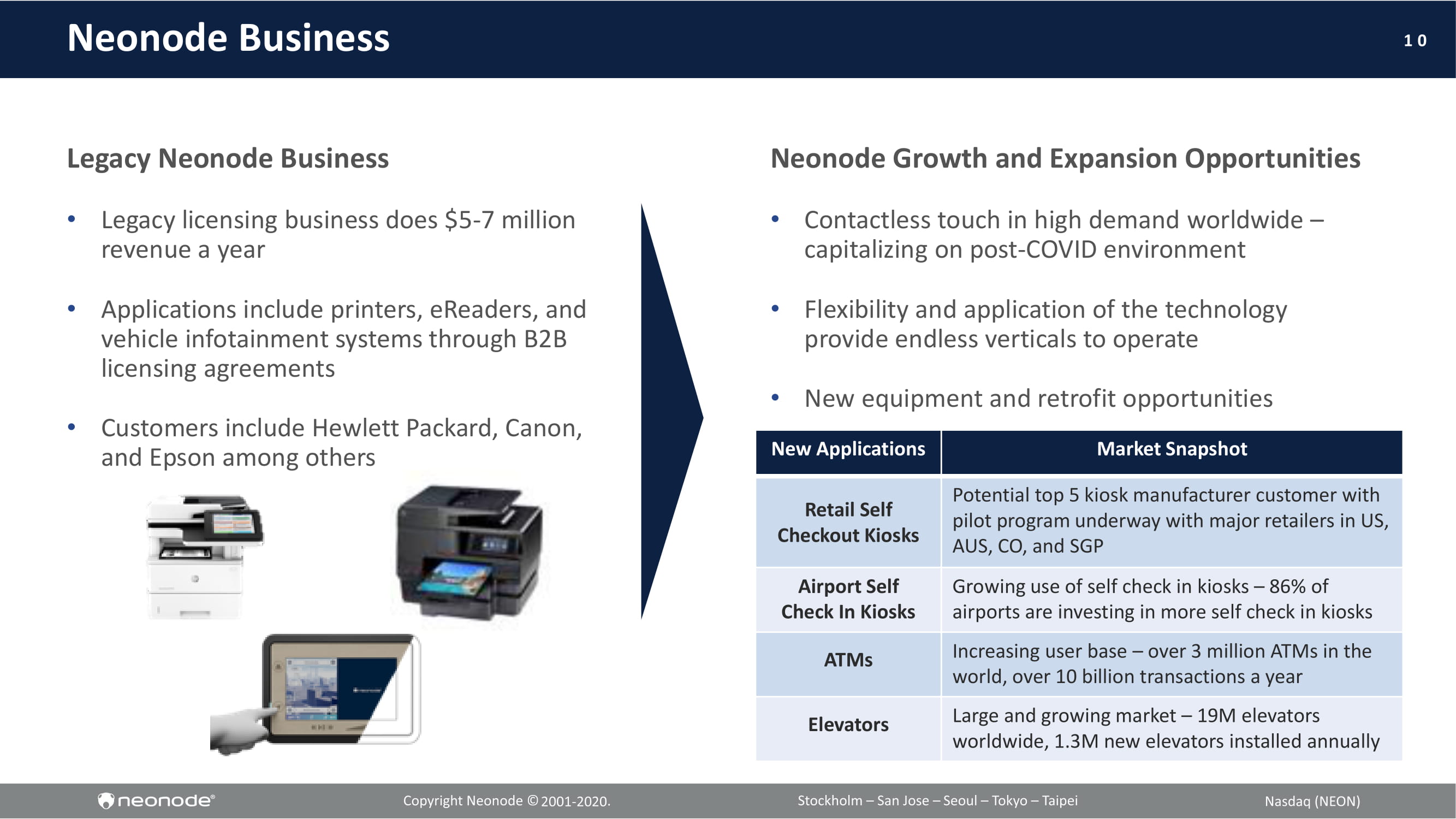

10 Neonode Business Legacy Neonode Business • Legacy licensing business does $5 - 7 million revenue a year • Applications include printers, eReaders , and vehicle infotainment systems through B2B licensing agreements • Customers include Hewlett Packard, Canon, and Epson among others Neonode Growth and Expansion Opportunities • Contactless touch in high demand worldwide – capitalizing on post - COVID environment • Flexibility and application of the technology provide endless verticals to operate • New equipment and retrofit opportunities New Applications Market Snapshot Retail Self Checkout Kiosks Potential top 5 kiosk manufacturer customer with pilot program underway with major retailers in US, AUS, CO, and SGP Airport Self Check In Kiosks Growing use of self check in kiosks – 86% of airports are investing in more self check in kiosks ATMs Increasing user base – over 3 million ATMs in the world, over 10 billion transactions a year Elevators Large and growing market – 19M elevators worldwide, 1.3M new elevators installed annually

11 Pipeline Opportunities – Self Checkout Kiosks • Potential Customer – Top 5 kiosk manufacturer in the world • Application – Touchless display intended for self - checkout kiosks • Background – Customer reached out post COVID and quickly initiated a 6 - 8 week pilot trial • Current Status – Pilot program underway with 6 major retailers in US, AUS, CO, and SGP • Potential Initial Order – 50,000 to 200,000 units • Potential Sales Price – $30 - 50 per unit ; gross margin: 30 - 40% • Distribution – Direct to OEM Market Segment Highlights • There are over 325,000 self checkout kiosks worldwide, expected to grow to more than 675,000 by 2024 1 • $14.8 billion global kiosk market in 2018 expected to grow to $32.5 billion in 2027 2 • Self checkout kiosks alone are growing at a 10.9% CAGR in the Americas to a $7.1 billion market by 2024 3 Sources: 1) RBR Research 2) Allied Market Research 3) P&S Intelligence

12 Pipeline Opportunities – Touchless ATMs Self Checkout Kiosk Success Enables ATM Penetration • Neonode’s self checkout kiosk partner in its pilot program is also a leading ATM manufacturer • A succesfull self checkout kiosk pilot is an entry point into the ATM installed base • Main drivers: • Demand for contactless touch post COVID • Cost savings by replacing physical keypad by touch solution • More standardized HW design and fewer components ; fewer SKUs • More robust and durable solution; lower maintenance costs Market Segment Highlights • There are over 3 million ATMs in the world 1 and over 470,000 ATMs only in the US 2 • Average ATM gets used 300 times/month with over 10 billion transactions performed on ATMs each year 2 • The ATM market is valued at over $20 billion today and expected to reach $30 billion by 2027 3 Sources: 1) The World Bank 2) National Cash Systems 3) Allied Market Research

13 Pipeline Opportunities – Elevators Elevators – A Huge Opportunity For Neonode’s Technology • Contactless touch in air through Neonode’s parallel plane approach or using holographic displays • Reduces the spread of pathogens due to elevator button contact • Incredibly deep market potential through current elevator retrofitting and new deployment • Direct sales to elevator OEMs and control panel suppliers • Indirect sales through value added partners and integrators • Neonode’s recent customer orders from Anhui Easpeed Technology Co. and Yesar Electronics Technology (Shanghai) Co. Ltd. • Potential to upgrade thousands of elevators in China with holographic button panels • Additional customers have also commissioned or are developing retrofit contactless touch solutions for elevators using Neonode’s technology • Parallel discussions with several elevator OEMs Market Segment Highlights • According to Statista, the global elevator market is expected to grow from $93.8B in 2018 to $135.5B in 2026 (4.5% CAGR) 1 • Currently 19M existing elevators deployed globally 2 • ~1.3M new elevators deployed annually (7% CAGR) 3 • ~2M upgrades annually (estimate) Sources: 1) Statista 2) Kone 3) Research and Markets

14 Pipeline Opportunities – Airport Kiosks Asian Airport – A Model For Future Expansion • Passenger safety in a post - COVID world is a top priority for airports and airlines worldwide • Asian Airport, consistently the top ranked airport in the world, chose Neonode contactless touch solutions for their self - check in kiosks, vending machines and other self - service kiosks; further applications being discussed • Huge retrofit opportunity , in addition new equipment opportunity • Typical sales price of Neonode’s touch sensor modules to retrofit customers is $50 - 80 per unit with a gross margin of 40% - 50% Market Segment Highlights • There are more than 17,000 commercial airports in the world 1 • Some 14,000 self - service check in kiosks are installed in airports worldwide with 86% of airports investing in more self - check in kiosks 2 • In 2019, over 925 million passengers traveled through airports in the US alone 3 Sources: 1) Airports Council International 1) Acuant Corporation 2) Bureau of Transportation

15 Pipeline Opportunities – zForce ® Technology Licensing • Typical customers are OEMs developing, producing and selling products featuring touch - enabled displays. Examples include: • Military/Avionics Displays • Industrial Control Systems • Office Equipment and Household Appliances • Have entered 42 zForce ® technology license agreements with global OEMs, ODMs, and Tier 1 suppliers as of December 31, 2019 • Customer product development and release cycles typically take 12 to 36 months Technology Key Benefits • Ideal for both indoor and outdoor applications • Works in harsh conditions and with any input, including gloved fingers • Works well with any protective cover/front glass • No electromagnetic interference issues • Low power consumption • Limited footprint and flexible industrial design • Neonode’s solutions can co - exist with other touch systems to achieve redundancy Prototype sales NRE revenues Licensing revenues Typical Timeline Revenue Opportunities Sales (3 - 12 months) Development (12 - 36 months) Production (5 - 10 years)

16 Pipeline Opportunities – MultiSensing ® Software Licensing • Neonode’s software platform MultiSensing ® a ddresses the need for robust, cost - effective driver and cabin monitoring systems • Compliant with the new EU general safety regulations (GSR) and meets the Euro NCAP guidelines, applicable for all new vehicles from 2024 • Engaged in discussions with several OEMs and Tier 1s; shortlisted for shortlisted for sourcing process for 2024+ platform design win with a premium OEM • Customer product development and release cycles typically take 24 to 36 months Technology Key Benefits • Scalable – fits many different applications and supports different features and performance levels • Hardware - agnostic - software can be integrated and run on different processor units and use different types of input signals • Low computational footprint - supports low - cost system designs Prototype sales NRE revenues Licensing revenues Typical Timeline Revenue Opportunities Sales (3 - 12 months) Development (24 - 36 months) Production (5 - 10 years)

17 Private Placement Closed August 7 • On August 7, 2020, the company completed a private placement transaction consisting of common and preferred stock receiving cash proceeds totaling $13.1 million, net of offering expenses. • The company also converted $1.0 million short - term working capital loans into shares of preferred stock. The preferred stock will be converted into common stock upon shareholder approval. • Management and members of the Board participated in the transaction investing a total of $3.1million in cash plus converting the $1.0 million outstanding short - term loans. • The proceeds from this financing transaction will be used to strengthen the company’s cash position to accelerate growth to meet the rapidly increasing demands for contactless touch solutions from customers worldwide.

18 Patent Agreement with Aequitas Technologies • Neonode has an embedded call option associated with its patent agreement with Aequitas Technologies LLC. • In May 2019, Neonode assigned two patent families related to old smartphone technology to Aequitas in exchange for 50% of the net proceeds if Aequitas succeeds in monetizing the patents. • In June 2020, Neonode Smartphone LLC, a subsidiary of Aequitas, filed patent infringement lawsuits against Apple Inc., and Samsung Electronics Co. Ltd. and Samsung Electronics America Inc., respectively, in the Western District of Texas, USA. • Neonode will not bear any of the expenses associated with the lawsuits.

19 Financial Update Second Quarter 2020

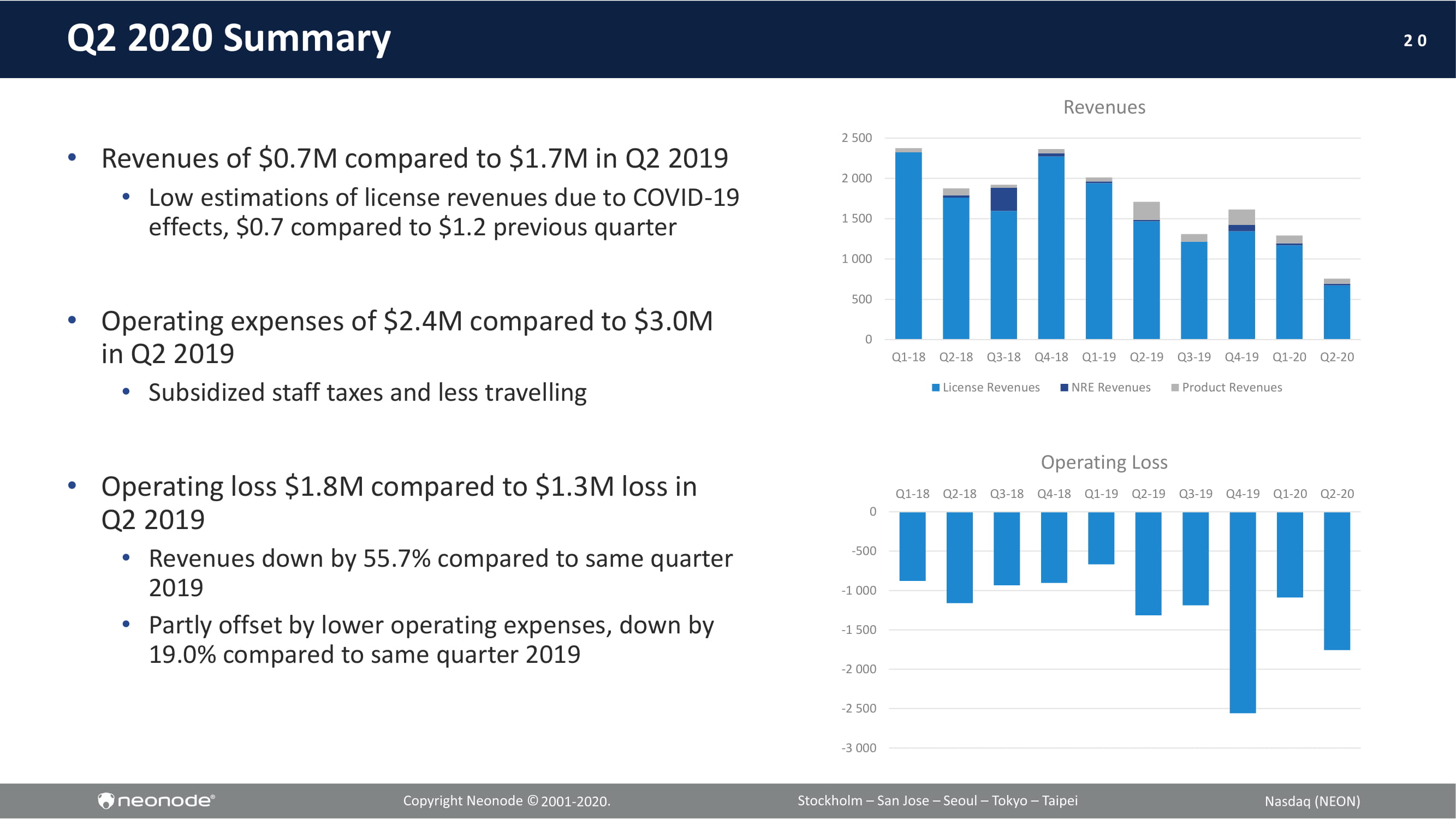

20 Q2 2020 Summary • Revenues of $0.7M compared to $1.7M in Q2 2019 • Low estimations of license revenues due to COVID - 19 effects, $0.7 compared to $1.2 previous quarter • Operating expenses of $2.4M compared to $3.0M in Q2 2019 • Subsidized staff taxes and less travelling • Operating loss $1.8M compared to $1.3M loss in Q2 2019 • Revenues down by 55.7% compared to same quarter 2019 • Partly offset by lower operating expenses, down by 19.0% compared to same quarter 2019 0 500 1,000 1,500 2,000 2,500 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Revenues License Revenues NRE Revenues Product Revenues -3,000 -2,500 -2,000 -1,500 -1,000 -500 0 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Operating Loss

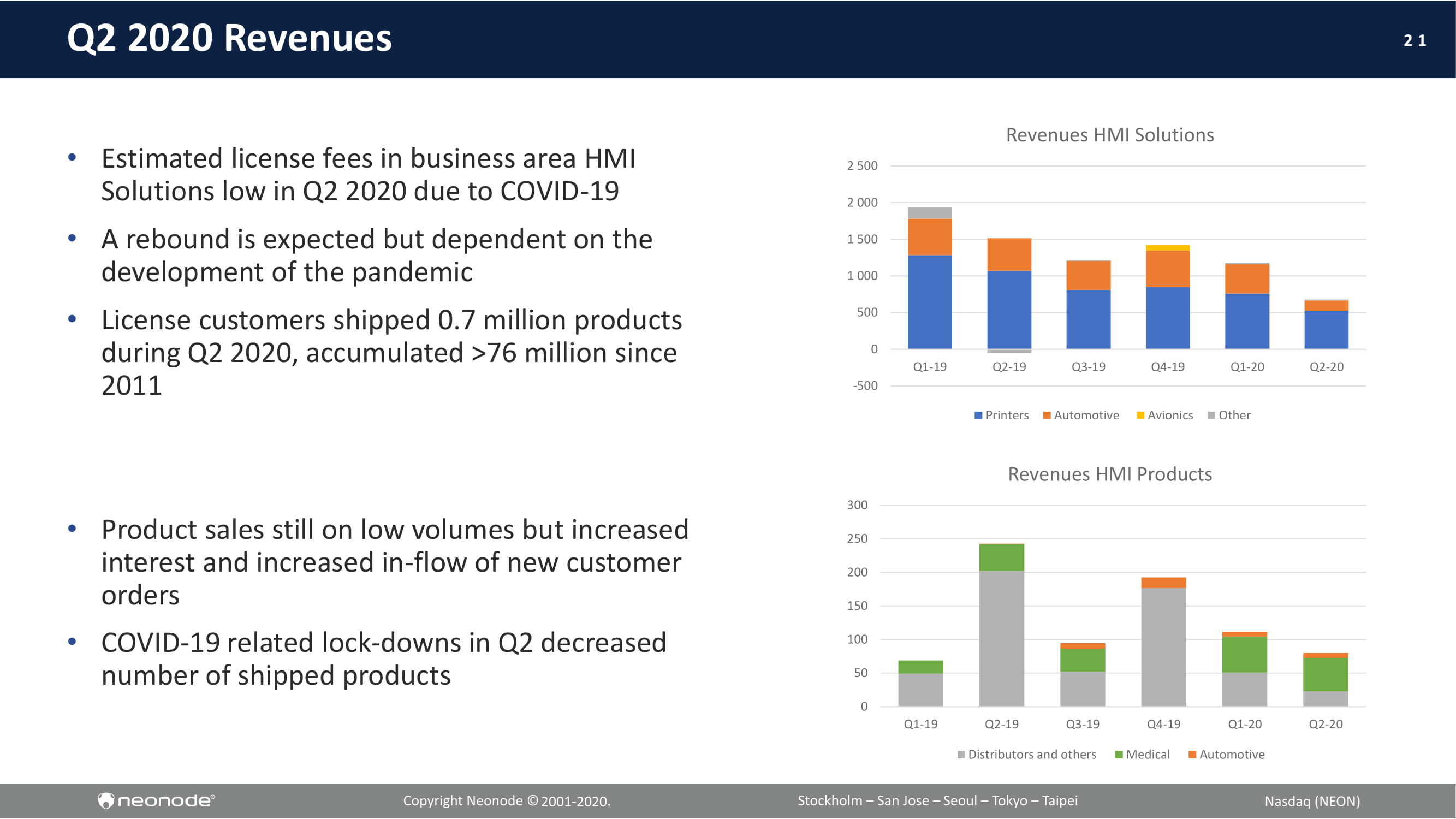

21 Q2 2020 Revenues • Estimated license fees in business area HMI Solutions low in Q2 2020 due to COVID - 19 • A rebound is expected but dependent on the development of the pandemic • License customers shipped 0.7 million products during Q2 2020, accumulated >76 million since 2011 • Product sales still on low volumes but increased interest and increased in - flow of new customer orders • COVID - 19 related lock - downs in Q2 decreased number of shipped products -500 0 500 1,000 1,500 2,000 2,500 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Revenues HMI Solutions Printers Automotive Avionics Other 0 50 100 150 200 250 300 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Revenues HMI Products Distributors and others Medical Automotive

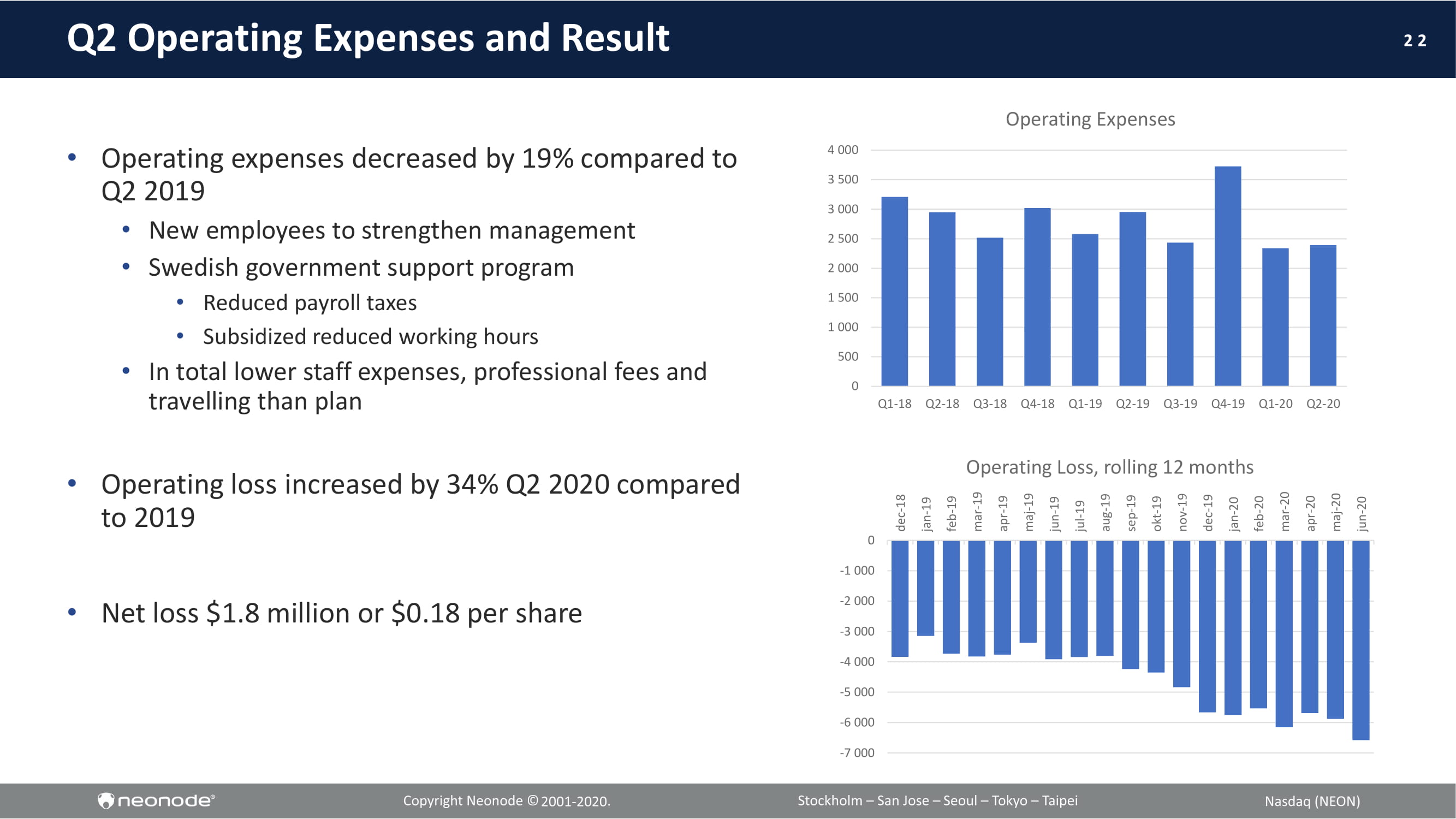

22 Q2 Operating Expenses and Result • Operating expenses decreased by 19% compared to Q2 2019 • New employees to strengthen management • Swedish government support program • Reduced payroll taxes • Subsidized reduced working hours • In total lower staff expenses , professional fees and travelling than plan • Operating loss increased by 34% Q2 2020 compared to 2019 • Net loss $1.8 million or $0.18 per share 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Operating Expenses -7,000 -6,000 -5,000 -4,000 -3,000 -2,000 -1,000 0 dec/18 jan/19 feb/19 mar/19 apr/19 maj/19 jun/19 jul/19 aug/19 sep/19 okt/19 nov/19 dec/19 jan/20 feb/20 mar/20 apr/20 maj/20 jun/20 Operating Loss, rolling 12 months

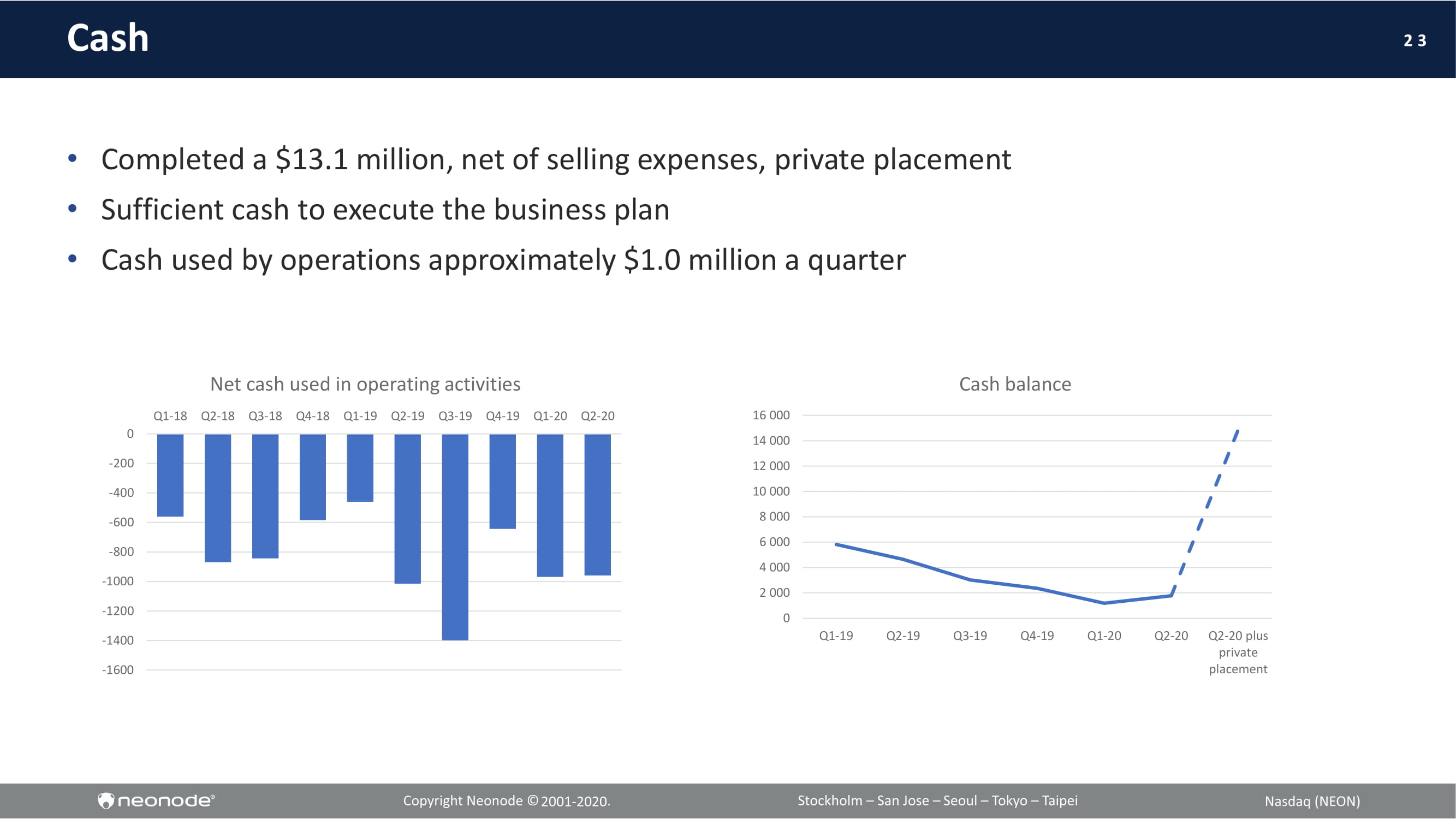

23 Cash • Completed a $13.1 million, net of selling expenses, private placement • Sufficient cash to execute the business plan • Cash used by operations approximately $1.0 million a quarter -1600 -1400 -1200 -1000 -800 -600 -400 -200 0 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Net cash used in operating activities 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q2-20 plus private placement Cash balance

24 Highlights • Through the private placement closed on August 7 we have adequate cash resources needed to accelerate growth and capitalize on current and future opportunities • Our zForce ® technology – patent protected – is an enabling technology ideally positioned to solve for a lifestyle shift to contactless touch solutions brought on by COVID - 19 • Demand for contactless touch solutions is exploding – enormous market opportunity to integrate Neonode technology into new and retrofitted equipment , for instance in » Interactive kiosks ( ticketing , vending , self checkout in retail , ATMs etc.) – pilot with leading OEM underway » Elevators – several customers and tech partners have developed solutions and secured agreements for retrofitting , engaged in discussions with several OEMs • We also see strong demand for our zForce ® and MultiSensing ® technology and software licensing offers from customers in the avionics and industrial control system industries and the automotive industry, respectively • The focus the coming 6 - 12 months will be on execution

Thank You info@neonode.com neonode.com Thank You info@neonode.com neonode.com