Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 10-K

(Mark One)

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _____ to _____ |

Commission File No. 0-54112

| DONGXING INTERNATIONAL INC. | |||

| (Exact Name of Registrant in its Charter) | |||

| Delaware | 16-1783194 | ||

| (State or Other Jurisdiction of incorporation or organization) | (I.R.S. Employer I.D. No.) | ||

| Room 1001,

International Finance Building, 633 Keji'er Street, Songbei District, Harbin, Heilongjiang Province, P.R. China 150028 | |||

| (Address of principal executive offices) | |||

Issuer's Telephone Number, including Area Code: 86-1394-6000887

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes __ No √_

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No √_

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes __ No √_

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes __ No √_

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes √ No _

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company. or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer Accelerated filer _ Non-accelerated filer Smaller reporting company X

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No √

As of June 30, 2019 (the last business day of the most recently completed second fiscal quarter) the aggregate market value of the common stock held by non-affiliates was $0, as there was no market for the common stock.

As of August 13, 2020, there were 30,000,000 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

FORWARD-LOOKING STATEMENTS: NO ASSURANCES INTENDED

In addition to historical information, this Annual Report contains forward-looking statements, which are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements represent Management’s belief as to the future of Dongxing International Inc. Whether those beliefs become reality will depend on many factors that are not under Management’s control. Many risks and uncertainties exist that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in Section 1A of this Report, entitled “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements.

USE OF DEFINED TERMS; CONVENTIONS

Except where the context otherwise requires and for the purposes of this report only:

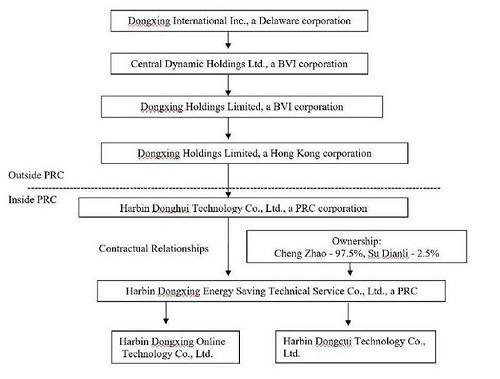

| ● | "we," "us," "our company," "our" “Company” and "Dongxing International" refer to the combined business of Dongxing International Inc., its consolidated subsidiaries and its consolidated affiliate, as the case may be; |

| ● |

"Central Dynamic" refers to Central Dynamic Holdings Limited, our direct, wholly-owned subsidiary, a BVI corporation;

|

| ● | "Dongxing BVI" refers to Dongxing Holdings Limited, our indirect, wholly-owned subsidiary, a BVI corporation; |

| ● | "Dongxing Hong Kong" refers to Dongxing Holdings Limited, our indirect, wholly-owned subsidiary, a Hong Kong corporation; |

| ● | "Harbin Donghui" refers to Harbin Donghui Technology Co., Ltd., our indirect, wholly-owned subsidiary, a Chinese corporation; |

| ● | “Harbin Dongxing” refers to Harbin Dongxing Energy Saving Technical Service Co., Ltd., our indirect, consolidated affiliate, a Chinese corporation; |

| ● | "SEC" refers to the United States Securities and Exchange Commission; |

| ● | "China," "Chinese" and "PRC," refer to the People's Republic of China; |

| ● | "Renminbi" and "RMB" refer to the legal currency of China; |

| ● |

"U.S. dollars," "dollars" and "$" refer to the legal currency of the United States;

|

| ● | "Securities Act" refers to the United States Securities Act of 1933, as amended; and |

| ● | "Exchange Act" refers to the United States Securities Exchange Act of 1934, as amended. |

Solely for the convenience of the reader, this report contains conversions of certain Renminbi amounts into U.S. dollars at specified rates. Except as otherwise indicated, all conversions from Renminbi to U.S. dollars were made based on the Exchange Rate on July 21, 2020, which was RMB 6.98 to $1.00. No representation is made that the Renminbi or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. See “Item 1A: Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could adversely affect our business and the value of our securities” for a discussion of the effects on the Company of fluctuating exchange rates.

| 1 |

PART 1

Item 1. Business

We conduct our operations through Harbin Dongxing, our consolidated affiliate. Harbin Dongxing has, since 2011, been engaged in marketing lighting products and services. Currently Harbin Dongxing is focused heavily on developing a website to facilitate multi-nation trade in connection with China's Belt and Road Initiative. Harbin Dongxing conducts a portion of its business through two wholly-owned subsidiaries: Harbin Dongcui Technology Co., Ltd. (“Harbin Dongcui”) and Harbin Dongxing Online Technology Co., Ltd. (“Dongxing Online”). The offices of Harbin Dongxing and its subsidiaries are located in Harbin City, People’s Republic of China.

The Parent Company

Dongxing International was incorporated in June 2010 in accordance with the laws of the State of Delaware under the name Apex 1, Inc. On November 19, 2015 the Company's corporate name was changed to "Dongxing International Inc." Dongxing International was a “shell company”, as defined in Rule 12b-2 under the Securities Exchange Act of 1934, from the date of its incorporation until September 30, 2016, when it acquired control of Harbin Dongxing.

Organization of Central Dynamic and Acquisition by Dongxing International

The corporate structure of Dongxing International and its subsidiaries and affiliates was developed through the following steps:

| · | On November 17, 2011 two individuals (Cheng Zhao and Su Dianli) organized Harbin Dongxing as a limited liability company in the PRC. The registered equity was allocated among the founders thus: Cheng Zhao - 97.5%, Su Dianli - 2.5%. Since the time of its organization, Harbin Dongxing has been engaged in the marketing of lighting products and related services. |

| · | On November 10, 2010 Central Dynamic was organized under the BVI Business Companies Act, 2004 in the British Virgin Islands. Cheng Zhao has served as its director since May 8, 2012. Cheng Zhao purchased 4,250,000 ordinary shares (of the 25,000,000 ordinary shares outstanding) from Central Dynamic for a commitment to pay $42,500, and has purchased an additional 1,750,000 shares from other shareholders for an aggregate price of $17,500. The other 19 shareholders of Central Dynamic acquired their 19,000,000 ordinary shares by committing to pay a total of $190,000 to Central Dynamic. Central Dynamic has not engaged in any business since its formation. |

| · | On November 25, 2010 Dongxing BVI was organized under the BVI Business Companies Act, 2004 in the British Virgin Islands under the name "Douce Holdings Limited". Central Dynamic has been the sole equity-owner of Dongxing BVI since December 1, 2011. On November 17, 2014 the corporate name was changed to Dongxing Holdings Limited. Dongxing BVI has not engaged in any business since its formation. |

| · | On January 12, 2011 Dongxing Hong Kong was organized in Hong Kong under the name "Dongke Holdings Limited. Dongxing BVI has been the sole equity-owner of Dongxing Hong Kong since its formation. The corporate name was changed to Dongxing Holdings Limited on November 12, 2014. Dongxing Hong Kong has not engaged in any business since its formation. |

| 2 |

| · | On January 13, 2016 Harbin Donghui was organized in the PRC as a Wholly Foreign-Owned Enterprise. Dongxing Hong Kong has been the sole equity owner of Harbin Donghui since its formation. Harbin Donghui has conducted no business since its formation other than pursuant to the VIE Agreements discussed below. |

| · | On March 30, 2016 Harbin Donghui, Harbin Dongxing and the equity owners in Harbin Dongxing entered into the VIE Agreements discussed below, as a result of which Harbin Dongxing became a controlled affiliate of Harbin Donghui. |

| · | On September 30, 2016 Dongxing International entered into and closed an exchange agreement with Central Dynamic and all of the shareholders of Central Dynamic (the "Exchange Agreement"), pursuant to which the shareholders of Central Dynamic transferred all of the issued and outstanding stock of Central Dynamic to Dongxing International, and we issued to the shareholders of Central Dynamic 25,000,000 shares of our common stock (the “ Share Exchange ”), representing 83.3% of the outstanding shares. This reverse acquisition transaction vested in Dongxing International ownership of the chain of subsidiaries described above. |

After the Share Exchange, our current organizational structure is as follows:

| 3 |

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On March 30, 2016, prior to the reverse acquisition transaction, Harbin Donghui and Harbin Dongxing and its shareholders, Cheng Zhao and Su Dianli, entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Harbin Dongxing became Harbin Donghui’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. Although Harbin Dongxing participates in an industry that is not a restricted or forbidden to foreign investment, PRC regulations make only certain methods of foreign ownership permissible. Stock exchanges are not a permissible method of gaining foreign ownership of a PRC operating company under current PRC regulations. In order for Harbin Donghui to acquire ownership of Harbin Dongxing, Harbin Donghui would have to purchase Harbin Dongxing for cash, and the purchase price would be subject to the approval of the Ministry of Commerce, which would only approve the purchase price after a lengthy review to determine that the purchase price was commercially fair.

Due to the obstacles to actual acquisition of Harbin Dongxing, the Company utilized the VIE Agreements in order to properly gain control and the economic benefits of Harbin Dongxing. The VIE Agreements included:

| (1) | an Exclusive Business Cooperation Agreement between Harbin Donghui and Harbin Dongxing pursuant to which Harbin Donghui has the exclusive right and obligation to provide technical support and management and marketing services to Harbin Dongxing in exchange for (i) 95% the total annual net profit of Harbin Dongxing and (ii) RMB 10,000 per month ($1,433). The term of the agreement is indefinite, and Harbin Dongxing is specifically barred from terminating the agreement. |

| (2) | an Exclusive Purchase Right Agreement among Cheng Zhao, Su Dianli, Harbin Dongxing and Harbin Donghui under which the shareholders of Harbin Dongxing have granted to Harbin Donghui the irrevocable right and option to acquire all of the equity interests in Harbin Dongxing to the extent permitted by PRC law. If PRC law limits the percentage of Harbin Dongxing that Harbin Donghui may purchase at any time, then Harbin Donghui may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB10 ($1.43) or any other price permitted by PRC law. This option could be exercised if, in the future, the PRC liberalizes the regulations governing acquisition of PRC entities, or if Dongxing International transferred to Harbin Donghui sufficient capital to satisfy the requirements of the Ministry of Commerce as to an adequate purchase price. In the meantime, the Exclusive Purchase Right Agreement serves to protect the Company’s interest in Harbin Dongxing, as Harbin Dongxing shareholders agree to refrain from taking certain actions which might harm the value of Harbin Dongxing or Harbin Donghui’s option; |

| (3) | A Pledge of Shares Agreement among Cheng Zhao, Su Dianli, Harbin Dongxing and Harbin Donghui under which the shareholders of Harbin Dongxing have pledged all of their equity in Harbin Dongxing to Harbin Donghui to guarantee Harbin Dongxing’s and Harbin Dongxing’s shareholders’ performance of their obligations under the Exclusive Business Cooperation Agreement and the Exclusive Purchase Right Agreement. |

As discussed above, share exchanges are not permitted as a method to transfer ownership of PRC operating companies to foreign investors. As a result, the VIE agreements are an attempt to give Harbin Donghui the option to gain actual ownership of the shares of Harbin Dongxing in the event it is can be achieved in accordance with PRC laws. The transfer of ownership interests in Harbin Dongxing to Harbin Donghui would be beneficial to U.S. investors because having ownership control, in contrast to contractual rights over Harbin Dongxing, strengthens the control the US parent company has over the operating company, Harbin Dongxing.

| 4 |

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. To date, Harbin Dongxing has not made any payment to Harbin Donghui, but all amounts due under the Exclusive Business Cooperation Agreement have been accrued. Our plan for the foreseeable future is that Harbin Dongxing will make payments to Harbin Donghui to the extent necessary for that entity, Dongxing Hong Kong and Central Dynamic to pay their expenses. Harbin Dongxing may also make payments to Harbin Donghui for the purpose of funding the expenses of our U.S. parent company, although in the near term we expect to fund those expenses by borrowing U.S. Dollars from related parties. The remainder of the obligations of Harbin Dongxing to Harbin Donghui will be accrued without interest, penalties or other compensation for the delay in payment. See “Risk Factors - Risks Relating to the VIE Agreements.”

Under the terms of the VIE Agreements, Harbin Dongxing and its shareholders are contractually required to operate Harbin Dongxing prudently and effectively in a manner intended to maximize profits. Without the consent of Harbin Donghui, Harbin Dongxing’s shareholders may not allow it to: dispose of or mortgage its assets or income (except in the ordinary course of business); increase or decrease its registered capital (including issuing any equity securities); enter into any material agreements with its shareholders outside of the ordinary course of business; appoint or remove any of Harbin Dongxing’s directors or management; make any distribution of profits or dividends; or be terminated, liquidated or dissolved.

However, Harbin Dongxing is not specifically prohibited from acting in certain ways which could reduce its value to the Company. For example, Harbin Dongxing can pay its officers and directors compensation without Harbin Donghui’s consent, and such compensation could reduce the net profits payable by Harbin Dongxing to Harbin Donghui under the terms of the Exclusive Business Cooperation Agreement.

Our Business

Mengqiao Cross-Border E-commerce Platform Based on The Belt and Road

Harbin Dongxing and its subsidiaries are located in the Heilongjiang Province of China, which has a border with Russia extending over 3,000 kilometers. Heilongjiang Province's 25 ports (15 shipping ports, 4 aviation ports, 2 railway and 4 road ports) are exceeded in number only by Guangdong Province. For these reasons, Heilongjiang Province is the natural location for trade with eastern Russia, a notion repeatedly emphasized in the proclamations of both China's State Council and the Provincial government. In October 2013 the national government designated Harbin, the capital of Heilongjiang Province, as a pilot city entitled to implement cross border ecommerce.

In July 2013, seeking to take advantage of the opportunities for trade with eastern Russia, we organized Harbin Dongxing Online Business Trading Co., Ltd. ("Dongxing Online") as a subsidiary of Harbin Dongxing for the purpose of effecting online distribution of Chinese lighting products into Russia. Dongxing Online was established in China with registered capital of 1 million RMB. Since its organization, Dongxing Online has been engaged in developing the Mengqiao Cross-Border E-commerce Platform, a B2B website initially designed to distribute lighting products from China to commercial customers in Russia. The prototype website (URL: union-bridge.com) now includes over 5,000 products from almost 100 manufacturers. Among the attractive features of the union-bridge.com website are:

| 5 |

| · | product listings, transactions and customer service offered in three languages: Chinese, Russian and English; |

| · | real-time currency conversion of posted prices; |

| · | supply and demand information is available to registered users, both suppliers and customers. |

| · | a wide variety of payment methods, including Paypal, Visa, MasterCard, Webmoney, Qiwi, RBK Money, UnionPay, WeChatPay, Alipay, E-bank and telegraphic transfer, permitting online payment in RMB, U.S. Dollars and Russian Roubles; |

| · | customer choice of international delivery methods; |

| · | supplier guarantees of delivery within three days. |

Each supplier enters into a Distribution Agreement with Dongxing Online. The agreement provides the supplier will ship products as directed by Dongxing Online, with title and risk of loss retained by the supplier until delivery is complete. Dongxing Online is required to pay for the products upon delivery. The supplier warrants the quality of the products and takes responsibility for the after-sale service that is mandated by Chinese law. The supplier also covenants that the price posted on the website for the advertised goods is the best price offered anywhere.

In 2016 we began to expand the scope of the Mengqiao Platform, to make it a full-fledged participant in China's Belt and Road Initiative. The Belt and Road Initiative, launched in 2013, involves China underwriting billions of dollars of infrastructure investment in countries along the old Silk Road linking China with Europe. China is spending roughly $150bn a year in the 68 countries that have chosen to participate in the Initiative. The mission of the Belt and Road Initiative was described in 2015 by the National Development and Reform Commission, Ministry of Foreign Affairs, and Ministry of Commerce of the People’s Republic of China, thus:

The Initiative is an ambitious economic vision of the opening-up of and cooperation among the countries along the Belt and Road. Countries should work in concert and move toward the objectives of mutual benefit and common security. To be specific, they need to improve the region’s infrastructure, and put in place a secure and efficient network of land, sea and air passages, lifting their connectivity to a higher level; further enhance trade and investment facilitation, establish a network of free trade areas that meet high standards, maintain closer economic ties, and deepen political trust; enhance cultural exchanges; encourage different civilizations to learn from each other and flourish together; and promote mutual understanding, peace and friendship among people of all countries.

Our contribution to the Belt and Road Initiative, toward which we are working, will be the expansion of our Mengqiao Platform to serve as an e-commerce platform facilitating trade and cultural exchange among 64 countries along the Silk Road Economic Belt. Our expanded Mengqiao Platform will realize the principles of the Belt and Road Initiative by integrating its multi-national trading network around a Chinese focus, promoting economic and cultural exchange for the sake of a bilateral win-win. As the majority of the countries that are participating in the Belt and Road Initiative are developing countries with limited access to foreign markets, we expect a strong favorable response from the nations that we invite to participate in the Mengqiao Platform.

During 2018 we expanded the participation in the Mengqiao Platform to include cultural and art products. The expanded Mengqiao Platform will offer each of 64 nations its own national or regional pavilion, where online visitors can browse that nation's featured cultural products and learn about the nation's culture, natural environment and opportunities for tourism. In addition to our online customer service staff, which offers assistance in Chinese, English and Russian, each national pavilion will include a customer service staff speaking that nation's principal language, able to facilitate use of the platform, solve customer problems, and aid customers in finding the product offerings they desire among the 64 national pavilions. Fulfillment of sales made on the Mengqiao Platform will be enabled by the construction of a complex of cross-border high-speed railways that is a central part of the Belt and Road Initiative.

| 6 |

Our goal in developing the Mengqiao Eurasian Trade E-commerce Platform was to surmount some of the difficulties that have limited the growth of Chinese manufacturing exports. In particular, we have developed extensive avenues on the website for product and market information to be exchanged between manufacturers and customers, aimed at increasing mutual understanding of the market with a view towards optimizing the benefits of trade for both purchasers and sellers. The Platform offers registered users:

| · | an information portal, offering supply and demand statistics, information on industry trends, and reports of prior sales and customer feedback, among other items; |

| · | a transaction portal enabling contracting, documentation, and transaction tracking; and |

| · | a customer service portal, facilitated by detailed information regarding customer purchases and feedback. |

Dongxing Online has obtained an import/export license from the Government of China that will allow us to facilitate trade with 64 nations. To date we have opened five pavilions on the Mengqiao Platform (China Pavilion, Russia Pavilion, East Asia Pavilion, Southeast Asia Pavilion and Australia Pavilion) housing over 30 merchants with over 100 classes of product displayed. We expect that initial operations of the Mengqiao Platform will commence several months after we secure the necessary financing. Our budget for initiating commercialization of the website is $3 million, to pay for the initial advertising and promotion activities as well as to build our first after-sales service centers. Full development of the Mengqiao Platform, including development of the national or regional pavilions for all 64 nations, with accompanying customer service staffing, is budgeted at $10 million.

Revenue from the Mengqiao Eurasian Trade E-commerce Platform will primarily come from fees paid by participants on the Platform and advertising fees for more advantageous positioning on the website. Dongxing Online will also have the benefit of holding the purchase price for products sold on the website between the date when the end user orders the product and the date on which payment is due. Dongxing Online has not formally launched this Platform yet.

Consulting Services

The Staff of Harbin Dongxing and its subsidiaries possess a broad array of skills, both technological and business-oriented. Their attention to the development of the Mengqiao Platform is subject to interruption from time to time, due to financial constraints and the need to coordinate with the progress of the Belt and Road Initiative. Our staff, therefore, have supplemented revenue by providing consulting services to small and mid-sized companies in Heilongjiang Province.

During 2019, revenue from consulting services represented almost 96% of our total revenue. The services performed by our staff included:

| · | software development; |

| · | online marketing; and |

| · | preparation of business plans, including procurement of sci-tech novelty reports. |

| 7 |

With one client in particular, we signed four contracts during 2019: three for software development and one for online marketing. We completed the software development contracts during 2019 and recorded the revenue; the online marketing contract is being completed during 2020 and the fee for those services is reflected on our balance sheets in "advance from customers".

Our staff offers clients a broad array of possible services, including system integration, network engineering, and business and marketing planning. Until the launch of the Mengqiao Platform, we expect our consulting services will continue to provide the majority of our revenue.

Lighting Contracting

Harbin Dongxing was organized in 2011 to engage in the distribution, installation and service of lighting systems, primarily for commercial enterprises. The overall goal of this business is to provide customers with programs for achieving cost-savings by reconstruction of a facility's lighting or cost-efficient programs for lighting new facilities. Among the services that our employees provide to customers are energy diagnosis, project design, equipment procurement, lighting engineering, technology consulting and personnel training. The customers for our services include both commercial enterprises, such as factories and office buildings, and government agencies, including hospitals, schools and roadways.

In 2016 Harbin Dongxing obtained ISO9001 certification. We also obtained China Compulsory Certification for marketing of LED products. These two certifications will allow us to market to government-related industries, such as participants in the electric grid or participants in the communications grid, as well as to bid on government procurements.

The key to our ability to offer customers cost-savings lighting alternatives is the rapid advances achieved during the past decade in the technology of LED lighting. “LED” is the acronym for light emitting diode, the element of LED lighting that transforms electric current into light. Engineers create diodes by pairing a negatively charged semiconductor. When electric power is connected to the diode, the semiconductors are forced into imbalance and release light as electrons jump to a different energy level.

Over the past decade, as the technology has improved, the popularity of LED lighting has soared. The advantages of LED lamps over traditional incandescent and fluorescent lighting include:

| · | Longer Life Span. Electrodes in incandescent and conventional fluorescent lamps decay, producing less light over time, and are generally the limiting factor in the lives of the light. The average life span of a traditional lamp is no more than one year. By avoiding the use of electrodes, LED lamps can have life spans of up to 60,000 hours. The extended life reduces the frequency and cost of replacement. It also makes LED lamps particularly suitable for locations or structures where servicing and light replacement are difficult. |

| · | High Luminous Efficiency. Electrodes in incandescent or conventional fluorescent lighting give rise to power loss and place limits on the gas pressure and its composition. These restrictions do not apply to LED lights, as they have no electrodes. As a result, the power rating and light output of the lamps can be significantly increased. |

| · | Quick Start. LED lights can be started or restarted without pre-heating. Only a low current is necessary to initiate operation. This enables the size of the distribution box to be reduced, lowering the installation cost. Their quick start-up makes the technology particularly well suited for emergency lighting. |

| · | Automatic Brightness Adjustment. Many of our products incorporate programmable smart cards, which can adjust the level of brightness based on such factors as the time of day or the level of natural light. The lamps can function at any point down to 30% of their capacity, providing significant flexibility. |

| 8 |

| · | Energy Efficiency. LED technology can save as much as 75% of the energy that would be used in conventional fluorescent lamps. |

| · | High Lighting Quality. LEDs also emit steady light, producing a very limited amount of flickering under steady current. |

In prior years, a number of the sales by Harbin Dongxing took the form of energy management contracts (“EMC”). In this business model, energy efficient equipment is sold to an end user on a payment plan designed to net no cost to the customer: payments by the customer are scheduled to conform to the savings realized from use of the energy efficient equipment. Typically, a customer's payment obligation to us represents 90% of the cost-savings realized in the first year after installation, 80% of the savings in year two; 70% in year three; 60% in year four and 50% in year five. At the end of the fifth year, title to the lighting systems is passed to the customer. Harbin Dongxing and Harbin Dongcui offer this option to customers directly as well as to contractors as part of a broader EMC program. Although an EMC sale results in significantly longer payment terms than a conventional net-90 days sale, profit margins on EMC sales are far higher than on conventional sales, as customers are much less price-resistant in the EMC model. In 2017 we had EMC contracts with two customers, one of which was completed at the end of 2017 and the other was completed in 2018. We cannot predict at this time whether we will have additional EMC arrangements in the future.

Most of our sales to date have occurred in Heilongjiang Province. At the end of 2019, we were involved in two ongoing construction projects, reflected as "project in progress" on our balance sheet. Nevertheless, the scale of our lighting operations has been too small to be efficient. So we have curtailed most of our lighting contracting operations: during 2019 lighting contracting provided only 4% of our revenue. In the future, we intend to attend international trade fairs to promote expanded international trade for our lighting business. In addition, we expect that when our Mengqiao Platform goes live and becomes well-known, the association of Harbin Dongxing with that website will increase recognition of our brand and increase demand for our services beyond Heilongjiang Province.

Intellectual Property

We have registered the copyright for Dongxing Online's trading platform with the National Copyright Administration of the People's Republic of China: the copyright registration number 2015SR078522.

We have also registered our trademark with the national government: trademark registration number TMZC16118206ZCSL01.

Harbin Dongxing holds a patent in China for its invention of an LED external control nixie tube. The patent number is ZL201220204547.X.

Employees

The Company has seven employees: two are employed by Harbin Dongxing, four are employed by Dongxing Online, and one is employed by Harbin Dongcui.

| 9 |

| Item 1A. | Risk Factors |

Investing in our common stock will involve risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks is realized, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related To Our Business

The impact of COVID-19 on the business community of Heilongjiang Province may delay our efforts to implement our business plan and expand our business operations.

The Company’s operations are affected by the recent and ongoing outbreak of the coronavirus disease 2019 (COVID-19), which in March 2020 was declared a pandemic by the World Health Organization. The COVID-19 outbreak is causing lockdowns, travel restrictions, and closures of businesses. The Company’s business has been negatively impacted by the COVID-19 outbreak.

From early February 2020 to the end of March 2020, the Company had to temporarily suspend its operations due to government restrictions. During the temporary business closure period, the employees had very limited access to the facilities and, as a result, the Company had no new business from sales of LED lights. In addition, due to the COVID-19 outbreak, some of the customers may experience financial distress, delay or default on their payments, reduce the scale of their business, or suffer disruptions in their business due to the outbreak. Any increased difficulty in collecting accounts receivable, delayed raw materials supply, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact the Company’s results of operations.

In light of the current circumstances and available information, the Company estimated that for the period from January to June 2020, the Company’s revenues from product sales could be significantly lower than originally planned. The COVID-19 influence on the revenues from provision of technical and consulting services is relatively small as these services can be performed on a remote and virtual basis. In addition, the Company originally planned to expand its international trade and export sales in 2020. With the outbreak of COVID-19, all business development activities related to this were suspended with originally scheduled oversea trade fairs all cancelled.

As of the date of this filing, the COVID-19 coronavirus outbreak in China appears to have slowed down and most provinces and cities have resumed business activities under the guidance and support of the government. The Company’s business has been gradually recovering since the beginning of April with the reopening of the Company's executive office. However, there is still significant uncertainty regarding the possibility of a second wave of infections, and the breadth and duration of business disruptions related to COVID-19, which could continue to have a material impact on the Company’s operations.

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

We have only recently initiated operations, and to date we have realized very limited revenues. You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of development. We may not successfully address these risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate in the future. Our current business plan involves initiating online marketing of an array of lighting and other products, which we expect to be the engine for the growth of our company. However, no member of our management has experience with online product distribution, and our website remains in the development stage. Therefore, our ability to carry out our business plan successfully is completely untested. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products and services. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, and inadequate sales and marketing. Our failure to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

| 10 |

Our auditor has indicated that there is a substantial doubt as to whether we will be able to continue as a going concern.

In its report on our financial statements for the year ended December 31, 2019, our independent registered public accounting firm has stated that the fact that the Company has generated limited revenues and does not have positive cash flow from operations raises substantial doubt as to our ability to continue as a going concern. A “going concern” opinion is an indication that the auditor’s review of the company’s resources and business activities raised doubt as to whether the company will be able to realize its assets and discharge its liabilities in the ordinary course of business. The risk of investing in a company whose financial statements carry a going concern opinion is that you are likely to lose all of your investment if the company fails to continue as a going concern. In the case of Dongxing International, the fact that we have minimal assets and a limited source of revenue means that we will continue as a going concern only if we are able to obtain the funds necessary to implement our business plan and are successful in that implementation. If we are not able to convert our business into a going concern, investors in the Company will lose their investment.

Our expansion into the international market will require capital investment, which may result in dilution of the equity of our present shareholders or significantly increased borrowing costs.

Our business plan contemplates that we will expand our sales both domestically and internationally. To achieve that aim, we will need capital. So our business plan contemplates that we will raise $3 million in capital during the next year in order to complete development of our product distribution website and initiate marketing. Subsequently, we expect to invest an additional $7 million in expansion of our website. We intend to raise all or a large portion of the necessary funds by selling equity in our company. At present we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary amounts. It is possible that we will be required to dilute the value of our current shareholders’ equity in order to obtain the funds. On the other hand, if we are forced to borrow these amounts, our cost of capital will significantly increase. But if we are unable to raise the necessary funds, our growth will be limited, as will our ability to compete effectively.

We may not be able to find suitable software developers at an acceptable cost.

We have contracted with a software developer to further develop and upgrade our website and associated backend interface. We will continue to require such expertise in the future, in order to meet the demands of developing online technology. Due to the current demand for skilled software developers, we run the risk of not being able to find or retain suitable personnel at an acceptable price. We would also need to ensure that the candidates are adequately qualified to develop a website that is user friendly, free of errors and seamless in design. Without these developers, we may not be able to further develop and upgrade the software, which is the most important aspect of our business development.

| 11 |

Our management has limited experience in managing and operating a public company. Any failure to comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our management personnel have no prior experience managing and operating a public company. They will rely in many instances on the professional experience and advice of third parties, including our attorneys and accountants. None of the members of our management staff were educated and trained in U.S. business systems, and we may have difficulty hiring new employees in the PRC with such training. As a result, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002, as amended. This may result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with the SEC rules and regulations. Failure to comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in development of an active and liquid trading market for our common stock. To the extent that the market place perceives that we do not have a strong financial staff and financial controls, the market for, and price of, our stock may be impaired.

The lack of expertise in U.S. GAAP among the staff of our finance department could result in errors in our filings.

The books and records of Harbin Dongxing and its subsidiaries, our operating entities, and Harbin Donghui are maintained in accordance with bookkeeping practices that are customary in China. These financial statements are prepared in accordance with accounting principles generally accepted in China. The staff of our finance department, which prepares those financial statements, has experience with Chinese GAAP, but very limited experience with U.S. GAAP. Therefore, in order to file with the SEC consolidated financial statements prepared in accordance with U.S. GAAP, we have engaged an independent consultant who makes the adjustments to the financial statements of Harbin Dongxing and Harbin Donghui necessary to achieve compliance with U.S. GAAP, then performs the consolidation required to produce the consolidated financial statements of Dongxing International. Because that consultant, who is not present in our executive offices, is the only participant in the preparation of our financial statements possessing a familiarity with U.S. GAAP, there is a risk that the persons responsible for the initial classifications of the elements of our financial results will err in making those classifications, which will cause our reported financial statements to be erroneous. Any such errors, besides being misleading to investors, could result in subsequent restatements, which could have an adverse effect on the perception of the Company among investors.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts companies with a public float of less than $250 million from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation if our public float exceeds $250 million.

| 12 |

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional financing as needed.

We require highly qualified personnel and, if we are unable to hire or retain qualified personnel, we may not be able to grow effectively.

Our future success also depends upon our ability to attract and retain highly qualified personnel. Expansion of our business and the proposed growth of our business will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. We may not be able to attract or retain highly qualified personnel. Competition for skilled marketing and administrative personnel in China is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

The loss of the services of our key employees, particularly the services rendered by Cheng Zhao, our chief executive officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Cheng Zhao, who founded our business and now serves as our chief executive officer. We currently do not have key employee insurance for our officers and directors. The loss of any of these key employees, including members of our senior management team, could harm our business.

We do not anticipate paying dividends in the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future. Investors requiring current or near-term income from their investment should not invest in our Company.

| 13 |

Risks Relating to the VIE Agreements

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Harbin Donghui provides support and consulting service to Harbin Dongxing pursuant to the VIE Agreements. Almost all economic benefits and risks arising from Harbin Dongxing’s operations are transferred to Harbin Donghui under these agreements. There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. Our PRC counsel has advised that if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

| ● |

imposing economic penalties;

|

| ● |

discontinuing or restricting the operations of Harbin Donghui or Harbin Dongxing;

|

| ● |

imposing conditions or requirements in respect of the VIE Agreements with which Harbin Donghui or Harbin Dongxing may not be able to comply;

|

| ● |

requiring our company to restructure the relevant ownership structure or operations;

|

| ● |

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

| ● |

revoking the business licenses and/or the licenses or certificates of Harbin Dongxing, and/or voiding the VIE Agreements.

|

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Harbin Dongxing, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to control Harbin Dongxing under the VIE Agreements may not be as effective as direct ownership.

We conduct our business in the PRC and generate all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on expanding the operations of Harbin Dongxing and its subsidiaries. However, the VIE Agreements may not be as effective in providing us with control over Harbin Dongxing as direct ownership. Under the current VIE arrangements, as a legal matter, if Harbin Dongxing fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Harbin Dongxing, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

The VIE Agreements are governed by PRC law and provide for the resolution of disputes through the jurisdiction of courts in the PRC. If Harbin Dongxing or its shareholders fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Harbin Dongxing or its shareholder to meet their obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

| 14 |

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through the payments we receive pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability, or cause other adverse financial consequences.

Risks Related To Doing Business In China

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary and affiliate in the PRC. Our operating subsidiary and affiliate are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

We are a Delaware holding company and most of our assets are located outside of the United States. All of our current business operations are conducted in the PRC through our VIE entity, Harbin Dongxing. In addition, all of our directors and officers are nationals and residents of the PRC, and the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, none of whom are residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiary and affiliate may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future.

| 15 |

Foreign exchange transactions by our PRC operating subsidiary under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiary by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary's ability to make dividend and other distributions could materially and adversely affect our ability to grow, make investments or complete acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiary. However, PRC regulations restrict the ability of our PRC subsidiary to make dividend and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of the subsidiary's registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

| 16 |

Under the EIT Law, we may be classified as a "resident enterprise" of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

Under the New Income Tax Law, enterprises established outside the PRC whose “de facto management bodies” are located in the PRC are considered “resident enterprises” and their global income will generally be subject to the uniform 25% enterprise income tax rate. On December 6, 2007, the PRC State Council promulgated the Implementation Regulations on the New Income Tax Law, which define “de facto management bodies” as bodies that have material and overall management control over the business, personnel, accounts and properties of an enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 provides that a foreign enterprise controlled by a PRC company or a PRC company group will be classified as a “resident enterprise” with its “de facto management bodies” located within the PRC if the following requirements are satisfied:

| (i) | the senior management and core management departments in charge of its daily operations function mainly in the PRC; |

| (ii) |

its financial and human resources decisions are subject to determination or approval by persons or bodies in the PRC;

|

| (iii) | its major assets, accounting books, company seals, and minutes and files of its board and shareholders' meetings are located or kept in the PRC; and |

| (iv) |

more than half of the enterprise's directors or senior management with voting rights reside in the PRC. |

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary or affiliate, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

| 17 |

On July 4, 2014, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange for Overseas Investment and Financing and Reverse Investment by Domestic Residents via Special Purpose Vehicles, or Circular 37, which replaced the Notice on Issues Relating to the Administration of Foreign Exchange for the Financing and Reverse Investment by Domestic Residents via Offshore Special Purpose Vehicles issued by SAFE in October 2005, or Circular 75. Pursuant to Circular 37, any PRC residents, including both PRC institutions and individual residents, are required to register with the local SAFE branch before making any contribution to a company set up or controlled by the PRC residents outside of the PRC for the purpose of overseas investment or financing with their legally owned domestic or offshore assets or interests, referred to in this circular as a "special purpose vehicle." Under Circular 37, the term "PRC institutions" refers to entities with legal person status or other economic organizations established within the territory of the PRC. The term "PRC individual residents" includes all PRC citizens (also including PRC citizens abroad) and foreigners who habitually reside in the PRC for economic benefits. A registered special purpose vehicle is required to amend its SAFE registration in the event of any change of basic information including PRC individual resident shareholder, name, term of operation, or PRC individual resident's increase or decrease of capital, transfer or exchange of shares, merger, division or other material changes. In addition, if a non-listed special purpose vehicle grants any equity incentives to directors, supervisors or employees of domestic companies under its direct or indirect control, the relevant PRC individual residents could register with the local SAFE branch before exercising such options. The SAFE simultaneously issued a series of guidances to its local branches with respect to the implementation of Circular 37. Circular 37 modified certain defined terms under Circular 75 to clarify the SAFE registration scope. For example, Circular 37 broadened the definition of special purpose vehicle to offshore entities that were (i) established for the purpose of overseas investments by PRC residents (in addition to for the purpose of financing as defined under Circular 75) and (ii) established by PRC residents with their legally owned offshore assets or interests (in addition to domestic assets or interests as defined under Circular 75); and it also broadened the definition of reverse investment to include establishing new foreign invested entities or projects as a way of domestic direct investment by PRC residents, directly or indirectly, through a special purpose vehicle, which was excluded by Circular 75. Furthermore, Circular 37 modified certain SAFE registration procedures and requirements for special purpose vehicles and clarified the SAFE registration procedures for equity incentive awards granted by non-listed special purpose vehicles to directors, supervisors or employees of their controlled domestic companies.

We have advised our shareholders who are PRC residents, as defined in Circular 37, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary and affiliate. However, as SAFE registration is a personal obligation of each shareholder, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 37. Moreover, because of uncertainty over how Circular 37 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 37 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 37. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 37, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

| 18 |

Additionally in October of 2016, the Interim Measures for the Administration of the Establishment and Record Alteration of Foreign Investment Enterprises (“Interim Measures”) took effect and now mandates that WFOEs, among other types of PRC domiciled companies must register with MOFCOM and request MOFCOM’s approval for any change in ownership by foreign investors. Neither our U.S. parent company nor our operating subsidiary, Harbin Dongxing, are affected by the Interim Measures, but our subsidiary Harbin Donghui is subject to the Interim Measures as a WFOE. As such, any change in ownership of Harbin Donghui would require the approval of MOFCOM, and such approval cannot be guaranteed. Any failure to seek approval of any change in ownership of Harbin Donghui could create liability affecting our U.S. parent company, and the potential barrier in changing the ownership structure of the U.S. parent and its subsidiaries owned by Harbin Donghui could limit opportunities for restructuring. Harbin Donghui has already registered its current ownership with MOFCOM prior to the effective date of the Interim Measures, so under the U.S. Company’s current corporate structure, the Interim Measures will not affect our business. Harbin Donghui does not have any material operations, and we plan to retain the current ownership structure under Harbin Donghui’s existing registration with MOFCOM in order to avoid any risk.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption law, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the U.S. Foreign Corrupt Practices Act, (“FCPA”) and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers for the purpose of obtaining or retaining business. We are also subject to Chinese anti-corruption law, which strictly prohibits the payment of bribes to government officials.

We principally have operations, agreements with third parties and make sales in China, which may experience corruption. Our activities in China create the risk of unauthorized payments or offers of payments by one of the employees, consultants or distributors of our company, because these parties are not always subject to our control. We believe that to date we have complied in all material respects with the provisions of the FCPA and Chinese anti-corruption law. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption law may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition.

Risks Related to the Market for Our Stock Generally

The trading volume in our common stock may be inadequate to provide liquidity for our shareholders.

Our common stock is listed for trading on the OTC Pink Market. To date, however, no shares have traded. The small number of holders of our common stock means that for some indefinite period of time the trading volume in our common stock will be very low. Therefore, for some period of the future, our shareholders may find it difficult or impossible to sell their shares when they wish and for prices they consider reasonable.

Our common stock is likely to be subject to penny stock rules for the foreseeable future.

If a market for our common stock does develop, unless the market price exceeds $5.00 per share, our common stock will be subject to SEC regulations for "penny stock". SEC Rules 15g-1 through 15g-9 under the Exchange Act impose certain sales practice requirements on broker-dealers which sell penny stock to persons other than established customers and “accredited investors” (generally, individuals with net worth's in excess of $1,000,000 or annual incomes exceeding $200,000 (or $300,000 together with their spouses)). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to the sale. This rule would adversely affect the ability of broker-dealers to sell our common stock and the ability of our stockholders to sell their shares of common stock.

| 19 |

Penny stock includes any equity security that is not listed on a national exchange and has a market price of less than $5.00 per share, subject to certain exceptions. The regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule set forth by the SEC relating to the penny stock market must be delivered to the purchaser of such penny stock. This disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the common stock. The regulations also require that monthly statements be sent to holders of penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. If applicable, these requirements would adversely affect the market liquidity of our common stock.

Item 1B. Unresolved Staff Comments

Not Applicable.

Item 2. Properties

Harbin Dongxing leases its office facility at 633 Keji'er Street in Harbin from Cheng Zhao, its Chairman, pursuant to a lease with that will terminate on May 31, 2021. The annual rental is approximately $22,000.

Item 3. Legal Proceedings

None.

Item 4. Mine Safety Disclosures.

Not Applicable.

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities.

(a) Market Information

Our shares of common stock have been listed for trading on the OTC Pink Market of OTC Markets under the trading symbol "DNXG" since December 9, 2019. There is, however, no active trading market for our shares of common stock: no shares have traded publicly at any time.

(b) Shareholders

Our shareholders list contains the names of 299 stockholders of record of the Company’s Common Stock.

| 20 |

(c) Dividends

The Company has not, within the past decade, paid or declared any cash dividends on its Common Stock and does not foresee doing so in the foreseeable future. The Company intends to retain any future earnings for the operation and expansion of the business. Any decision as to future payment of dividends will depend on the available earnings, the capital requirements of the Company, its general financial condition and other factors deemed pertinent by the Board of Directors.

(d) Securities Authorized for Issuance Under Equity Compensation Plans

The Company had no securities authorized for issuance under equity compensation plans as of December 31, 2019.

(e) Sale of Unregistered Securities

The Company did not issue any unregistered equity securities during the 4th quarter of fiscal 2019.

(f) Repurchase of Equity Securities

The Company did not repurchase any shares of its common stock during the 4th quarter of 2019.

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis

Accounting for Variable Interest

Dongxing International is a holding company whose only asset is an indirect 100% ownership interest in Harbin Donghui, a Wholly Foreign Owned Entity organized under the laws of the People’s Republic of China on January 13, 2016. On March 30, 2016, Harbin Donghui entered into three agreements with Harbin Dongxing and with the equity owners in Harbin Dongxing. Collectively, the VIE agreements provide Harbin Donghui exclusive control over the business of Harbin Dongxing, and provide that 95% of the income or loss realized by Harbin Dongxing accrues to the account of Harbin Donghui.

The accounting effect of the VIE Agreements between Harbin Donghui and Harbin Dongxing is to cause the balance sheets and financial results of Harbin Dongxing to be consolidated with those of Harbin Donghui, with respect to which Harbin Dongxing is now a variable interest entity. Since the parties to the VIE Agreements were both controlled by Cheng Zhao, who is CEO of both Harbin Donghui and Harbin Dongxing, the financial statements included in this report reflect the consolidation of the results of operations and cash flows of Harbin Dongxing since its inception.

Results of Operations