Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PRECIGEN, INC. | d37132dex992.htm |

| EX-99.1 - EX-99.1 - PRECIGEN, INC. | d37132dex991.htm |

| 8-K - 8-K - PRECIGEN, INC. | d37132d8k.htm |

Non-GAAP Financial Information This presentation includes Segment Adjusted EBITDA, which is a non-GAAP financial measure within the meaning of applicable rules and regulations of the Securities and Exchange Commission (SEC). Management believes this financial metric is a key indicator of operating results since it excludes noncash revenues and expenses that are not reflective of the underlying business performance of an individual enterprise. The Company defines Segment Adjusted EBITDA as net loss before (i) interest expense, (ii) income tax expense or benefit, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) adjustments for bonuses paid in equity awards, (vi) loss on impairment of goodwill and other long-lived assets, (vii) equity in net loss of affiliates, and (viii) recognition of previously deferred revenue associated with upfront and milestone payments as well as cash outflows from capital expenditures and investments in affiliates. For the six months ended June 30, 2020, the Company modified the current period definition of Segment Adjusted EBITDA to exclude adjustments recorded to reverse bonuses accrued as of December 31, 2019, as the Company determined in March 2020 that those bonuses would be paid through the grant of equity awards instead of cash. Segment Adjusted EBITDA for the six months ended June 30, 2019 was not impacted by this change. Segment Adjusted EBITDA is provided as additional information, not as an alternative to Precigen’s consolidated financial statements presented in accordance with GAAP, and is intended to enhance an overall understanding of the Precigen’s current financial performance. Exhibit 99.3

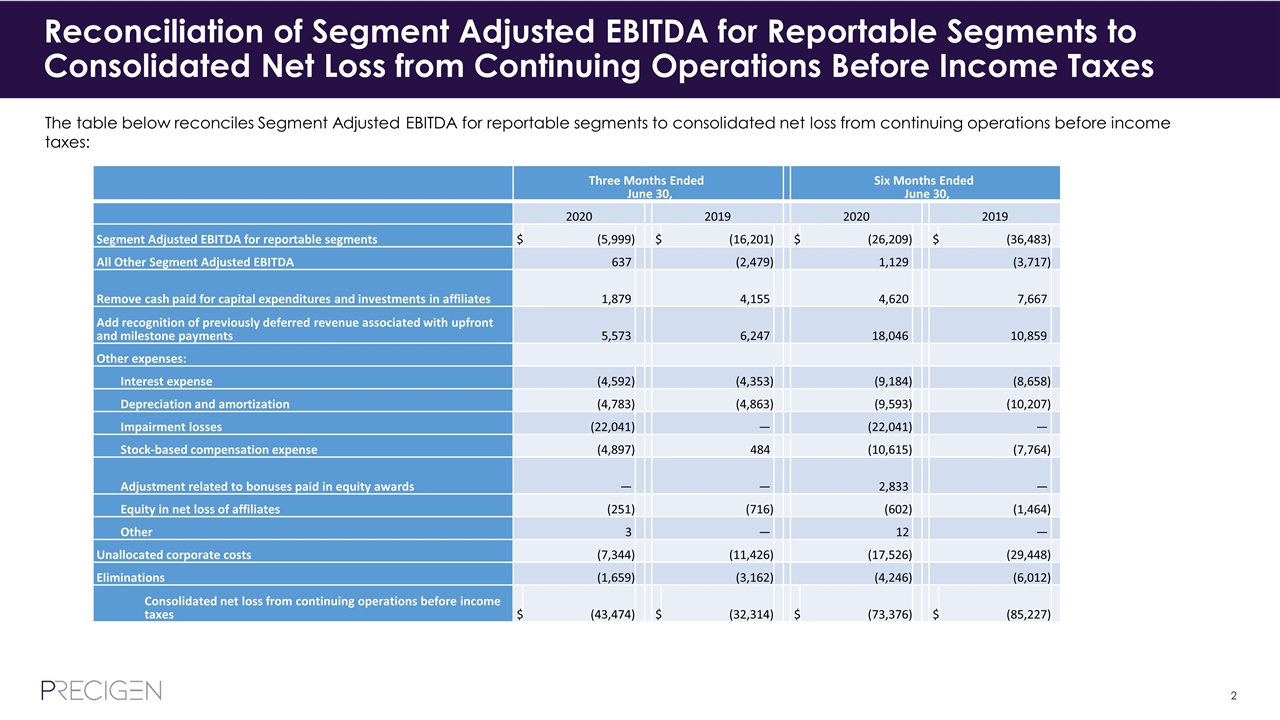

Reconciliation of Segment Adjusted EBITDA for Reportable Segments to Consolidated Net Loss from Continuing Operations Before Income Taxes The table below reconciles Segment Adjusted EBITDA for reportable segments to consolidated net loss from continuing operations before income taxes: Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 Segment Adjusted EBITDA for reportable segments $ (5,999) $ (16,201) $ (26,209) $ (36,483) All Other Segment Adjusted EBITDA 637 (2,479) 1,129 (3,717) Remove cash paid for capital expenditures and investments in affiliates 1,879 4,155 4,620 7,667 Add recognition of previously deferred revenue associated with upfront and milestone payments 5,573 6,247 18,046 10,859 Other expenses: Interest expense (4,592) (4,353) (9,184) (8,658) Depreciation and amortization (4,783) (4,863) (9,593) (10,207) Impairment losses (22,041) — (22,041) — Stock-based compensation expense (4,897) 484 (10,615) (7,764) Adjustment related to bonuses paid in equity awards — — 2,833 — Equity in net loss of affiliates (251) (716) (602) (1,464) Other 3 — 12 — Unallocated corporate costs (7,344) (11,426) (17,526) (29,448) Eliminations (1,659) (3,162) (4,246) (6,012) Consolidated net loss from continuing operations before income taxes $ (43,474) $ (32,314) $ (73,376) $ (85,227)