Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DIAMOND OFFSHORE DRILLING, INC. | d99132d8k.htm |

| EX-99.1 - EX-99.1 - DIAMOND OFFSHORE DRILLING, INC. | d99132dex991.htm |

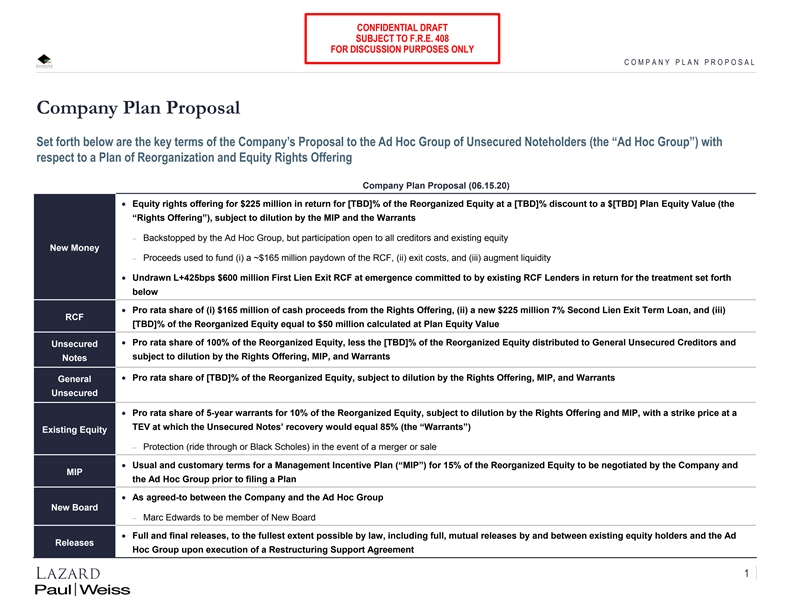

CONFIDENTIAL DRAFT Exhibit 99.2 SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY C O M PA N Y P L A N P R O P O S A LCONFIDENTIAL DRAFT Exhibit 99.2 SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY C O M PA N Y P L A N P R O P O S A L

CONFIDENTIAL DRAFT SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY COMPANY PLAN PROPOSAL Company Plan Proposal Set forth below are the key terms of the Company’s Proposal to the Ad Hoc Group of Unsecured Noteholders (the “Ad Hoc Group”) with respect to a Plan of Reorganization and Equity Rights Offering Company Plan Proposal (06.15.20) • Equity rights offering for $225 million in return for [TBD]% of the Reorganized Equity at a [TBD]% discount to a $[TBD] Plan Equity Value (the “Rights Offering”), subject to dilution by the MIP and the Warrants − Backstopped by the Ad Hoc Group, but participation open to all creditors and existing equity New Money − Proceeds used to fund (i) a ~$165 million paydown of the RCF, (ii) exit costs, and (iii) augment liquidity • Undrawn L+425bps $600 million First Lien Exit RCF at emergence committed to by existing RCF Lenders in return for the treatment set forth below • Pro rata share of (i) $165 million of cash proceeds from the Rights Offering, (ii) a new $225 million 7% Second Lien Exit Term Loan, and (iii) RCF [TBD]% of the Reorganized Equity equal to $50 million calculated at Plan Equity Value • Pro rata share of 100% of the Reorganized Equity, less the [TBD]% of the Reorganized Equity distributed to General Unsecured Creditors and Unsecured subject to dilution by the Rights Offering, MIP, and Warrants Notes • Pro rata share of [TBD]% of the Reorganized Equity, subject to dilution by the Rights Offering, MIP, and Warrants General Unsecured • Pro rata share of 5-year warrants for 10% of the Reorganized Equity, subject to dilution by the Rights Offering and MIP, with a strike price at a TEV at which the Unsecured Notes’ recovery would equal 85% (the “Warrants”) Existing Equity − Protection (ride through or Black Scholes) in the event of a merger or sale • Usual and customary terms for a Management Incentive Plan (“MIP”) for 15% of the Reorganized Equity to be negotiated by the Company and MIP the Ad Hoc Group prior to filing a Plan • As agreed-to between the Company and the Ad Hoc Group New Board − Marc Edwards to be member of New Board • Full and final releases, to the fullest extent possible by law, including full, mutual releases by and between existing equity holders and the Ad Releases Hoc Group upon execution of a Restructuring Support Agreement 1CONFIDENTIAL DRAFT SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY COMPANY PLAN PROPOSAL Company Plan Proposal Set forth below are the key terms of the Company’s Proposal to the Ad Hoc Group of Unsecured Noteholders (the “Ad Hoc Group”) with respect to a Plan of Reorganization and Equity Rights Offering Company Plan Proposal (06.15.20) • Equity rights offering for $225 million in return for [TBD]% of the Reorganized Equity at a [TBD]% discount to a $[TBD] Plan Equity Value (the “Rights Offering”), subject to dilution by the MIP and the Warrants − Backstopped by the Ad Hoc Group, but participation open to all creditors and existing equity New Money − Proceeds used to fund (i) a ~$165 million paydown of the RCF, (ii) exit costs, and (iii) augment liquidity • Undrawn L+425bps $600 million First Lien Exit RCF at emergence committed to by existing RCF Lenders in return for the treatment set forth below • Pro rata share of (i) $165 million of cash proceeds from the Rights Offering, (ii) a new $225 million 7% Second Lien Exit Term Loan, and (iii) RCF [TBD]% of the Reorganized Equity equal to $50 million calculated at Plan Equity Value • Pro rata share of 100% of the Reorganized Equity, less the [TBD]% of the Reorganized Equity distributed to General Unsecured Creditors and Unsecured subject to dilution by the Rights Offering, MIP, and Warrants Notes • Pro rata share of [TBD]% of the Reorganized Equity, subject to dilution by the Rights Offering, MIP, and Warrants General Unsecured • Pro rata share of 5-year warrants for 10% of the Reorganized Equity, subject to dilution by the Rights Offering and MIP, with a strike price at a TEV at which the Unsecured Notes’ recovery would equal 85% (the “Warrants”) Existing Equity − Protection (ride through or Black Scholes) in the event of a merger or sale • Usual and customary terms for a Management Incentive Plan (“MIP”) for 15% of the Reorganized Equity to be negotiated by the Company and MIP the Ad Hoc Group prior to filing a Plan • As agreed-to between the Company and the Ad Hoc Group New Board − Marc Edwards to be member of New Board • Full and final releases, to the fullest extent possible by law, including full, mutual releases by and between existing equity holders and the Ad Releases Hoc Group upon execution of a Restructuring Support Agreement 1

CONFIDENTIAL DRAFT SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY C O N F I D E N T I A L Disclaimer Lazard has prepared the information herein (acting at the direction of Paul Weiss) based upon publicly available information regarding Diamond Offshore Drilling, Inc. and certain of its affiliates (the“Company”). We have relied upon the accuracy and completeness of this information, and have not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company, or any other entity, or concerning solvency or fair value of the Company or any other entity. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise. These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without Lazard's prior written consent. These materials are preliminary and summary in nature and do not include all of the information that the recipient should evaluate in considering a possible transaction. Nothing herein shall constitute a commitment or undertaking on the part of Lazard or any other party to provide any service. Lazard is not responsible for and will not provide any tax, accounting, actuarial, legal or other specialist advice. The information presented herein is in the nature of settlement discussions and is subject to F.R.E. 408 and all state law equivalents. This presentation is not an offer, nor a solicitation of an offer, of the sale or purchase of any securities. 2CONFIDENTIAL DRAFT SUBJECT TO F.R.E. 408 FOR DISCUSSION PURPOSES ONLY C O N F I D E N T I A L Disclaimer Lazard has prepared the information herein (acting at the direction of Paul Weiss) based upon publicly available information regarding Diamond Offshore Drilling, Inc. and certain of its affiliates (the“Company”). We have relied upon the accuracy and completeness of this information, and have not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company, or any other entity, or concerning solvency or fair value of the Company or any other entity. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise. These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without Lazard's prior written consent. These materials are preliminary and summary in nature and do not include all of the information that the recipient should evaluate in considering a possible transaction. Nothing herein shall constitute a commitment or undertaking on the part of Lazard or any other party to provide any service. Lazard is not responsible for and will not provide any tax, accounting, actuarial, legal or other specialist advice. The information presented herein is in the nature of settlement discussions and is subject to F.R.E. 408 and all state law equivalents. This presentation is not an offer, nor a solicitation of an offer, of the sale or purchase of any securities. 2