Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - RESOURCES CONNECTION, INC. | rgp-20200530xex21_1.htm |

| EX-32.2 - EX-32.2 - RESOURCES CONNECTION, INC. | rgp-20200530xex32_2.htm |

| EX-32.1 - EX-32.1 - RESOURCES CONNECTION, INC. | rgp-20200530xex32_1.htm |

| EX-31.2 - EX-31.2 - RESOURCES CONNECTION, INC. | rgp-20200530xex31_2.htm |

| EX-31.1 - EX-31.1 - RESOURCES CONNECTION, INC. | rgp-20200530xex31_1.htm |

| EX-23.1 - EX-23.1 - RESOURCES CONNECTION, INC. | rgp-20200530xex23_1.htm |

| EX-4.2 - EX-4.2 - RESOURCES CONNECTION, INC. | rgp-20200530xex4_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 30, 2020

OR

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-32113

________________________

RESOURCES CONNECTION, INC.

(Exact Name of Registrant as Specified in Its Charter)

________________________

|

|

|

|

|

Delaware |

|

33-0832424 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

17101 Armstrong Avenue, Irvine, California 92614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (714) 430-6400

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

RGP |

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None (Title of Class)

________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

||||||

|

Large accelerated filer ☐ |

|

|

|

|

|

Accelerated filer ☒ |

|

Non-accelerated filer ☐ |

|

|

|

|

|

Smaller reporting company ☐ |

|

Emerging growth company ☐ |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of November 22, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter), the approximate aggregate market value of common stock held by non-affiliates of the registrant was $457,496,000 (based upon the closing price for shares of the registrant’s common stock as reported by The Nasdaq Global Select Market). As of July 8, 2020, there were approximately 32,144,373 shares of common stock, $.01 par value, outstanding.

________________________

DOCUMENTS INCORPORATED BY REFERENCE

The registrant’s definitive proxy statement for the 2020 Annual Meeting of Stockholders is incorporated by reference in Part III of this Form 10-K to the extent stated herein.

TABLE OF CONTENTS

|

|

|

Page No. |

|

|

|

|

|

|

PART I |

|

|

|

|

|

|

ITEM 1. |

3 |

|

|

|

|

|

|

ITEM 1A. |

8 |

|

|

|

|

|

|

ITEM 1B. |

16 |

|

|

|

|

|

|

ITEM 2. |

16 |

|

|

|

|

|

|

ITEM 3. |

16 |

|

|

|

|

|

|

ITEM 4. |

16 |

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

ITEM 5. |

17 |

|

|

|

|

|

|

ITEM 6. |

19 |

|

|

|

|

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

19 |

|

|

|

|

|

ITEM 7A. |

31 |

|

|

|

|

|

|

ITEM 8. |

33 |

|

|

|

|

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

62 |

|

|

|

|

|

ITEM 9A. |

62 |

|

|

|

|

|

|

ITEM 9B. |

64 |

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

ITEM 10. |

64 |

|

|

|

|

|

|

ITEM 11. |

64 |

|

|

|

|

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

64 |

|

|

|

|

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

65 |

|

|

|

|

|

ITEM 14. |

65 |

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

ITEM 15. |

66 |

|

|

|

|

|

|

ITEM 16. |

68 |

|

|

|

|

|

|

|

69 |

1

In this Annual Report on Form 10-K, “Resources,” “Resources Connection,” “Resources Global Professionals,” “RGP,” “Resources Global,” “Company,” “we,” “us” and “our” refer to the business of Resources Connection, Inc. and its subsidiaries. References in this Annual Report on Form 10-K to “fiscal,” “year” or “fiscal year” refer to our fiscal year that consists of the 52- or 53-week period ending on the Saturday in May closest to May 31. The fiscal year ended May 30, 2020 consisted of 53 weeks. The fiscal years ended May 25, 2019 and May 26, 2018 consisted of 52 weeks.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K, including information incorporated herein by reference, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to expectations concerning matters that are not historical facts. For example, statements discussing, among other things, expected savings, business strategies, growth strategies and initiatives, acquisition strategies, future revenues and future performance, are forward-looking statements. Such forward-looking statements may be identified by words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should” or “will” or the negative of these terms or other comparable terminology.

These statements and all phases of our operations are subject to known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievements and those of our industry to differ materially from those expressed or implied by these forward-looking statements. The disclosures we make concerning risks, uncertainties and other factors that may affect our business or operating results, including those identified in Item 1A “Risk Factors” of this Annual Report on Form 10-K, as well as our other reports filed with the Securities and Exchange Commission (“SEC”) should be reviewed carefully. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business or operating results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We do not intend, and undertake no obligation, to update the forward-looking statements in this filing to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events, unless required by law to do so.

2

PART I

Overview

RGP is a global consulting firm that enables rapid business outcomes by bringing together the right people to create transformative change. As a human capital partner for our clients, we specialize in solving today’s most pressing business problems across the enterprise in the areas of transactions, regulations, and transformations. Our engagements are designed to leverage human connection and collaboration to deliver practical solutions and more impactful results that power our clients, consultants and partners’ success.

RGP was founded in 1996 to help finance executives with operational needs and special projects. Headquartered in Irvine, California, RGP is proud to have served 88 of the Fortune 100 as of July 2020. Our agile human capital model quickly aligns the right resources for the work at hand with speed and efficiency. Our pioneering approach to workforce strategy uniquely positions us to support our clients on their transformation journeys. With more than 3,400 professionals, we annually engage with over 2,400 clients around the world.

Industry Background and Trends

Changing Market for Project- or Initiative-Based Professional Services

RGP’s services respond to a growing marketplace trend: namely, corporate clients are increasingly choosing to address their workforce needs in more flexible ways. We believe this growing shift in workforce strategy towards a project-based orientation might also be accelerated by the COVID-19 pandemic with an enhanced emphasis on business agility. Permanent professional personnel positions are being reduced as clients engage agile talent for project initiatives and transformation work.

Companies use a mix of alternative resources to execute on projects. Some companies rely solely on their own employees who may lack the requisite time, experience or skills for specific projects. They may outsource entire projects to consulting firms, which provides them access to the expertise of the firm but often entails significant cost and less management control of the project. As a more cost-efficient alternative, companies sometimes use temporary employees from traditional and Internet-based staffing firms, although these employees may be less experienced or less qualified than employees from professional services firms. Finally, companies can supplement their internal resources with employees from agile consulting or other traditional professional services firms, like RGP. The use of project consultants as a viable alternative to traditional accounting, consulting and law firms allows companies to:

|

· Strategically access specialized skills and expertise for projects of set duration |

|

· Access the very best talent across regions and geographies |

|

· Be nimble and mobilize quickly |

|

· Blend independent and fresh points of view |

|

· Effectively supplement internal resources |

|

· Increase labor flexibility |

|

· Reduce overall hiring, training and termination costs |

Supply of Project Consultants

Based on discussions with our consultants, we believe the number of professionals seeking to work on an agile basis has been increasing due to a desire for:

|

· More flexible hours and work arrangements, including working from home options, coupled with an evolving professional culture that offers competitive wages and benefits |

|

· The ability to learn and contribute in different environments and collaborate with diverse team members |

|

· Challenging engagements that advance their careers, develop their skills and add to their experience base |

|

· A work environment that provides a diversity of, and more control over, client engagements |

|

· Alternate employment opportunities in regions throughout the world |

3

The employment alternatives available to professionals may fulfill some, but not all, of an individual’s career objectives. A professional working for a Big Four firm or a consulting firm may receive challenging assignments and training; however, he or she may encounter a career path with less choice and less flexible hours, extensive travel and limited control over work engagements. Alternatively, a professional who works as an independent contractor faces the ongoing task of sourcing assignments and significant administrative burdens, including potential tax and legal issues.

RGP’s Solution

We believe RGP is ideally positioned to capitalize on the confluence of the industry shifts described above. We believe, based on discussions with our clients, that RGP provides the agility companies desire in today’s highly competitive and quickly evolving business environment. Our solution offers the following elements:

|

· A relationship-oriented and collaborative approach to client service |

|

· A professional dedicated talent acquisition and management team adept at developing, managing and deploying a project-based workforce |

|

· Deep functional and/or technical experts who can assess clients’ project needs and customize solutions to meet those needs |

|

· Highly qualified and pedigreed consultants with the requisite expertise, experience and points of view |

|

· Competitive rates on an hourly, rather than project, basis |

|

· Significant client control of their projects with effective knowledge transfer and change management |

RGP’s Strategic Priorities

Our Business Strategy

We are dedicated to serving our clients with highly qualified and experienced talent in support of projects and initiatives in a broad array of functional areas, including:

|

|

|

|

Transactions Integration and divestitures Bankruptcy/restructuring IPO readiness and support Financial process optimization System implementation |

Regulations Accounting regulations Internal audit and compliance Data privacy and security Healthcare compliance Regulatory compliance

|

|

Transformations Finance transformation Digital transformation Supply chain management Cloud migration Data design and analytics

|

|

Our objective is to build RGP’s reputation as the premier provider of agile human capital solutions for companies facing transformation, change and compliance challenges. We have developed the following business strategies to achieve our objectives:

|

· Hire and retain highly qualified, experienced consultants. We believe our highly qualified, experienced consultants provide us with a distinct competitive advantage. Therefore, one of our priorities is to continue to attract and retain high-caliber consultants who are committed to serving clients and solving their problems. We believe we have been successful in attracting and retaining qualified professionals by providing challenging work assignments, competitive compensation and benefits, and continuing professional development and learning opportunities as well as membership to an exclusive community of likeminded professionals, while offering flexible work schedules and more control over choosing client engagements. |

|

· Maintain our distinctive culture. Our corporate culture is the foundation of our business strategy and we believe it has been a significant component of our success. Our senior management team, the majority of whom are Big Four, management consulting and/or Fortune 500 alumni, has created a culture that combines the commitment to quality and client service focus of a Big Four firm with the entrepreneurial energy of an innovative, high-growth company. We believe our shared values, embodied in “LIFE AT RGP”, representing Loyalty, Integrity, Focus, Enthusiasm, Accountability and Talent, has created a circle of quality. Our Power of Human

4

|

(pH) Competencies also bring the opportunity to help our people develop new mindsets, behaviors and actions that not only allow them to be successful in their current roles, but also empower them to take on new opportunities and challenges. Our culture is instrumental to our success in hiring and retaining highly qualified employees who, in turn, attract quality clients. |

|

· Build the RGP brand. Our objective is to build RGP’s reputation in the marketplace as the premier provider of agile human capital solutions for companies facing transformation, change and compliance challenges. We want to be the preferred provider in the future of work. Our primary means of building our brand continues to be the consistent and reliable delivery of high-quality, value-added services to our clients. We have also built a significant referral network through our 2,495 consultants and 938 management and administrative employees as of May 30, 2020. In addition, we have invested in global, regional and local marketing and brand activation efforts that reinforce the RGP brand. |

Our Growth Strategy

Since inception, our growth has been primarily organic with certain strategic acquisitions along the way that supplemented our physical presence or solution offerings. We believe we have significant opportunity for continued organic growth in our core business and also to grow opportunistically through strategic and highly targeted acquisitions as the global economy starts to recover. In both our core and acquired businesses, key elements of our growth strategy include:

|

· Increased penetration of existing client base. A principal component of our strategy is to secure additional work from the clients we have served. We believe, based on discussions with our clients, the amount of revenue we currently generate from many of our clients represents a relatively small percentage of the total amount they spend on professional services. Consistent with current industry trends, we believe our clients may also continue to increase that spend as the global economy recovers and evolves. We believe that by continuing to deliver high-quality services and by further developing our relationships with our clients, we can capture a significantly larger share of our clients’ professional services budgets. Near the end of fiscal 2017, we launched our Strategic Client Program to serve a number of our largest clients with dedicated global account teams. We believe this focus enhances our opportunities to develop in-depth knowledge of these clients’ needs and the ability to increase the scope and size of projects with those clients. |

|

· Growing our client base. We continue to focus on attracting new clients. We strive to develop new client relationships primarily by leveraging the significant contact networks of our management and consultants and through referrals from existing clients. We believe we can continue to attract new clients by building our brand identity and reputation, supplemented by our global, regional and local marketing efforts. We anticipate our growth efforts this year will focus on identifying strategic target accounts especially in the large and middle market client segments. |

|

· Strategic acquisitions. Our acquisition strategy is to engage in targeted M&A efforts that are designed to enhance our digital transformation and technology consulting capabilities. In fiscal 2018, we acquired taskforce, Management on Demand AG (“taskforce”) and substantially all of the assets and assumption of certain liabilities of Accretive Solutions, Inc. (“Accretive”). The acquisitions of taskforce and Accretive satisfied the need to better penetrate the vibrant economic market in Germany and gaps in serving middle market companies in the United States, respectively, while also harmonizing well with RGP’s culture. In fiscal 2020, we acquired Veracity Consulting Group, LLC (“Veracity”) and Expertforce Interim GmbH, LLC (“Expertence”). The acquisition of Veracity accelerated our stated object to enhance our digital capabilities and our ability to offer comprehensive digital innovation services. With the acquisition of Expertence, we are able to offer a full range of project and management consulting services in the German market. |

|

· Providing additional professional service offerings. We continue to develop and consider entry into new professional service offerings. Since our founding, we have diversified our professional service offerings from a primary focus on accounting and finance to other areas in which our clients have significant needs such as integration and divestitures, bankruptcy and restructuring, financial process optimization, accounting regulations, internal audit and compliance, healthcare compliance, finance transformation, digital transformation, and data design and analytics. In fiscal 2017, we formed our Advisory and Project Services group (formerly known as “Integrated Solutions”) to identify project opportunities we can market at a broader level with our talent, tools and methodologies. This group commercializes projects into solution offerings. Currently, our solutions practice is focused on finance transformation, digital transformation, data design and analytics, and system implementation. When evaluating new solutions offerings to market to current and prospective clients, we consider (among other things) cultural fit, growth potential, profitability, cross-marketing opportunities and competition. |

5

COVID-19 Impact

Starting in January 2020, the outbreak of COVID-19 (the “Pandemic”) has severely impacted the global economic climate, creating significant challenges and uncertainty in the operations of organizations around the world. We are closely monitoring the impact of the Pandemic on all aspects of our business, including how it impacts our employees and client engagements. While the extent to which our operations may be impacted by the Pandemic is still uncertain and depends largely on future developments, we believe the Pandemic adversely impacted our operating results in the second half of fiscal 2020 and expect the impact is going to continue into fiscal 2021. As further described in Management’s Discussion and Analysis of Financial Condition and Results of Operations below, we initiated our strategic business review in North America and Asia Pacific ahead of the Pandemic, and carried out a reduction in force in early March. We have substantially completed the restructuring initiatives in these markets in fiscal 2020. We believe these actions have enabled us to operate with greater agility as we seek to ensure our organizational health and resilience, and weather the challenges associated with the Pandemic.

Consultants

We believe an important component of our success has been our highly qualified and experienced consultant base. As of May 30, 2020, we employed or contracted 2,495 consultants engaged with clients. Our consultants have professional experience in a wide range of industries and functional areas. We provide our consultants with challenging work assignments, competitive compensation and benefits, and continuing professional development and learning opportunities, while offering more choice concerning work schedules and more control over choosing client engagements.

Almost all of our consultants in the United States are employees of RGP. We typically pay each consultant an hourly rate for each consulting hour worked and for certain administrative time and overtime premiums, and offer benefits, including: paid time off and holidays; a discretionary bonus program; group medical and dental programs, each with an approximate 30-50% contribution by the consultant; a basic term life insurance program; a 401(k) retirement plan with a discretionary company match; and professional development and career training. Typically, a consultant must work a threshold number of hours to be eligible for all of these benefits. In addition, we offer our consultants the ability to participate in our Employee Stock Purchase Plan (“ESPP”), which enables them to purchase shares of our stock at a discount. We intend to maintain competitive compensation and benefit programs. To a much lesser extent, we utilize a “bench model” for consultants with specialized in-demand skills and experience in our Advisory and Project Services group. These consultants are paid a weekly salary rather than for each consulting hour worked and have bonus eligibility based upon utilization.

Internationally, our consultants are a blend of employees and independent contractors. Independent contractor arrangements are more common abroad than in the United States due to the labor laws, tax regulations and customs of the international markets we serve. A few international practices also partially utilize the “bench model” described above.

Clients

We provide our services and solutions to a diverse client base in a broad range of industries. In fiscal 2020, we served over 2,400 clients in 37 countries. Our revenues are not concentrated with any particular client. No single customer accounted for more than 10% of revenue for the 2020, 2019 or 2018 fiscal years. In fiscal 2020, our 10 largest clients accounted for approximately 16% of our revenues.

Operations

We generally provide our professional services to clients at a local level, with the oversight of our market leaders and consultation of our corporate management team. The market leaders and client development directors in each market are responsible for initiating client relationships, ensuring client satisfaction throughout engagements, coordinating services for clients on a national and international platform and maintaining client relationships post-engagement. Market revenue leadership and their teams identify, develop and close new and existing client opportunities, often working in a coordinated effort with other markets on multi-national/multi-location proposals.

Market level leadership works closely with our regionalized talent management team, who are responsible for identifying, hiring and cultivating a sustainable relationship with seasoned professionals fitting the RGP profile of client needs. Our consultant recruiting efforts are regionally and nationally based, depending upon the skill set required; talent management handles both the identification and hiring of consultants specifically skilled to perform client projects as well as monitoring the satisfaction of consultants during and post-completion of assignments. The talent teams focus on getting the right talent in the right place at the right time.

6

We believe a substantial portion of the buying decisions made by our clients are made on a local or regional basis and our offices most often compete with other professional services providers on a local or regional basis. We continue to believe our local market leaders are well-positioned to understand the local and regional outsourced professional services market. Additionally, the complexity of relationships with many of our multinational clients also dictates that in some circumstances a hybrid model, bringing the best of both locally driven relationships as well as global focus and delivery, is important for employee and client satisfaction. Through our Borderless Talent Initiative, which we are in the process of implementing, we are seeking to capitalize on our multinational clients’ needs for a service provider that can partner with them on a global basis by organizing the concerted effort and talent team on a global basis to serve these clients through one integrated service platform. For projects requiring intimate knowledge and thought leadership on particular client concerns, our Advisory and Project Services group consists of individuals with requisite depth of expertise and tools to work with clients.

We believe our ability to deliver professional services successfully to clients is dependent on our leaders in the field working together as a collegial and collaborative team. To build a sense of team spirit and increase camaraderie among our leaders, we have a program for field personnel that awards annual incentives based on specific agreed-to goals focused on the performance of the individual and performance of the Company. We also share across the Company the best and most effective practices of our highest achieving offices and use this as an introductory tool with new vice presidents and directors. New leadership also spends time in other markets or otherwise partners with experienced sales and recruiting personnel in those markets to understand, among many skills, how best to serve current clients, expand our presence with prospects and identify and recruit highly qualified consultants. This allows the veteran leadership to share their success stories, foster our culture with new vice presidents and directors and review specific client and consultant development programs. We believe these team-based practices enable us to better serve clients who prefer a centrally organized service approach.

From our corporate headquarters in Irvine, California, we provide centralized administrative, marketing, finance, human resources (“HR”), information technology (“IT”), legal and real estate support. Our financial reporting is also centralized in our corporate service center. This center handles invoicing, accounts payable and collections, and administers HR services including employee compensation and benefits administration for North American offices. We also have a business support operations center in our Utrecht, Netherlands office to provide centralized finance, HR, IT, payroll and legal support to our European offices. We share our Salesforce software platform world-wide, providing a common database of identified opportunities, prospective new clients, and existing client proposals for additional projects. In addition, in North America, we have a corporate networked IT platform with centralized financial reporting capabilities and a front office client management system. These centralized functions minimize the administrative burdens on our office management and allow them to spend more time focusing on client and consultant development.

Business Development

Our business development initiatives are composed of:

|

· local and global initiatives focused on existing clients and target companies |

|

· national and international targeting efforts focused on multinational companies |

|

· brand marketing activities |

|

· national and local advertising and direct mail programs |

Our business development efforts are driven by the networking and sales efforts of our management. While local senior management focus on market-related activities, they are also part of the regional, national and international sales efforts, especially when the client is part of a multinational entity. In certain markets, sales efforts are also enhanced by management professionals focused solely on business development efforts on a market and national basis based on firm-wide and industry-focused initiatives. These business development professionals, teamed with the vice-presidents and client service teams, are responsible for initiating and fostering relationships with the senior management and decision makers of our targeted client companies. During fiscal 2018, we completed our implementation of software from Salesforce.com on a world-wide basis to enhance our local and worldwide business development efforts.

We believe our national marketing efforts have effectively generated incremental revenues from existing clients and developed new client relationships. Our brand marketing initiatives help bolster RGP’s reputation in the markets we serve. Our brand is reinforced by our professionally designed website, print, and online advertising, direct marketing, seminars, initiative-oriented brochures, social media and public relations efforts. We believe our branding initiatives, coupled with our high-quality client service, help to differentiate us from our competitors and to establish RGP as a credible and reputable global professional services firm.

7

Competition

We operate in a competitive, fragmented market and compete for clients and consultants with a variety of organizations that offer similar services. Our principal competitors include:

|

· consulting firms |

|

· local, regional, national and international accounting and other traditional professional services firms |

|

· independent contractors |

|

· traditional and Internet-based staffing firms |

|

· the in-house or former in-house resources of our clients |

We compete for clients on the basis of the quality of professionals we bring to our clients, the knowledge base they possess, our ability to mobilize the right talent quickly, the scope and price of services, and the geographic reach of services. We believe our attractive value proposition, consisting of our highly qualified consultants, relationship-oriented approach and professional culture, enables us to compete effectively in the marketplace.

Employees

As of May 30, 2020, we had 3,433 employees, including 938 management and administrative employees and 2,495 consultants. Our employees are not covered by any collective bargaining agreements.

Available Information

Our principal executive offices are located at 17101 Armstrong Avenue, Irvine, California 92614. Our telephone number is (714) 430-6400 and our website address is http://www.rgp.com. The information set forth in the website does not constitute part of this Annual Report on Form 10-K. We file our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 with the SEC electronically. These reports are maintained on the SEC’s website at http://www.sec.gov.

A copy of our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K and amendments to those reports may also be obtained free of charge on the Investor Relations page of our website at http://www.ir.rgp.com as soon as reasonably practicable after we file such reports with the SEC.

The risks described below should be considered carefully before a decision to buy shares of our common stock is made. The order of the risks is not an indication of their relative weight or importance. The risks and uncertainties described below are not the only ones facing us but do represent those risks and uncertainties we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely impact and impair our business. If any of the following risks actually occur, our business could be harmed. In that case, the trading price of our common stock could decline, and all or part of the investment in our common stock might be lost. When determining whether to buy our common stock, other information in this Annual Report on Form 10-K, including our financial statements and the related notes should also be reviewed.

Our business is subject to risks arising from epidemic diseases, such as the recent outbreak of the COVID-19 pandemic.

In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic, and the United States and other governmental authorities issued stay-at-home orders, proclamations and directives aimed at minimizing the spread of the virus. The impact of the Pandemic and the resulting restrictions have caused disruptions in the U.S. and global economy and may continue to disrupt financial markets and global economic activities.

A pandemic, including COVID-19, or other public health epidemic poses the risk that we or our employees and partners may be prevented from conducting business activities at full capacity for an indefinite period of time, including due to the spread of the disease or due to shutdowns that are requested or mandated by governmental authorities. The continued spread of COVID-19 and the measures taken by the governments of countries affected and in which we operate may, among other things, reduce demand for or delay client decisions to procure our services, or result in cancellations of existing projects. We may also experience a decline in productivity, impacting our ability to continue to serve our clients efficiently. The Pandemic may also have impacted, and may continue to impact, the overall financial condition of some of our clients and their ability to pay outstanding receivables owed to us. While the full impact from the Pandemic is not quantifiable, we experienced some of the foregoing risks during the fourth quarter of fiscal 2020 and, as a result, our results of operations and cash flows were adversely impacted for the year ended May 30, 2020. For example, during the last

8

12 non-holiday weeks in the fourth quarter of fiscal 2020, which started with the week ended March 7, 2020, our average weekly revenue declined 9.1% compared to the first eight non-holiday weeks of the 2020 calendar year. Our number of consultants also decreased from 2,965 as of May 25, 2019 to 2,495 as of May 30, 2020. Due to the disruption of business operations in the U.S. and globally, we have also experienced some decline in our pipeline, and we expect the adverse effects of the Pandemic will continue into fiscal 2021. Furthermore, we have experienced declines in the market price of our stock subsequent to the end of the third quarter. If there are further decreases in our stock price for a sustained period or other unfavorable factors, we may be required to perform a goodwill impairment assessment, which may result in a recognition of goodwill impairment. Although the impairment is a non-cash expense, it could be material to our Consolidated Financial Statements.

In addition, we have followed government mandatory stay-at-home orders in certain regions, and suspended all non-essential travel worldwide for our employees, which could negatively affect our business. The extent to which the Pandemic impacts our results will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact. While not yet quantifiable, management expects this situation will have an adverse impact to our operating results in fiscal 2021.

Economic conditions or changes in the use of outsourced professional services consultants could adversely affect our business.

The Pandemic has caused disruptions in the U.S. and global economy, and continued uncertainty regarding general economic conditions within some regions and countries in which we operate has led to reluctance on the part of some companies to spend on discretionary projects. This has partially contributed to the decrease in hours worked and the number of professional services consultants at RGP from fiscal 2019 to 2020. Deterioration of or prolonged uncertainty related to the global economy or tightening credit markets could further reduce the demand for our services and adversely affect our business in the future. In addition, the use of professional services consultants on a project-by-project basis could decline for non-economic reasons. In the event of a reduction in the demand for our consultants, our financial results would suffer.

Economic deterioration at one or more of our clients may also affect our allowance for doubtful accounts. Our estimate of losses resulting from our clients’ failure to make required payments for services rendered has historically been within our expectations and the provisions established. While our overall receivable collections have not been severely impacted by the Pandemic, we cannot guarantee we will continue to experience the same credit loss rates we have in the past. A significant change in the liquidity or financial position of our clients could cause unfavorable trends in receivable collections and cash flows and additional allowances may be required. These additional allowances could materially affect our future financial results.

In addition, we are required periodically, but at least annually, to assess the recoverability of certain assets, including deferred tax assets and goodwill. Continued downturns in the United States economy and international economies could adversely affect our evaluation of the recoverability of deferred tax assets, requiring us to record additional tax valuation allowances. Our assessment of impairment of goodwill is currently based upon comparing our market capitalization to our net book value. Therefore, a significant and protracted downturn in the future market value of our stock could potentially result in an impairment of our goodwill. Although the impairment is a non-cash expense, it could materially affect our future financial results and financial condition.

The market for professional services is highly competitive, and if we are unable to compete effectively against our competitors, our business and operating results could be adversely affected.

We operate in a competitive, fragmented market, and we compete for clients and consultants with a variety of organizations that offer similar services. The competition is likely to increase in the future due to the expected growth of the market and the relatively few barriers to entry. Our principal competitors include:

|

· consulting firms |

|

· local, regional, national and international accounting and other traditional professional services firms |

|

· independent contractors |

|

· traditional and Internet-based staffing firms |

|

· the in-house or former in-house resources of our clients |

We cannot provide assurance that we will be able to compete effectively against existing or future competitors. Many of our competitors have significantly greater financial resources, greater revenues and greater name recognition, which may afford them an advantage in attracting and retaining clients and consultants and in offering pricing concessions. Some of our competitors in certain markets do not provide medical and other benefits to their consultants, thereby allowing them to potentially charge lower rates to clients. In addition, our competitors may be able to respond more quickly to changes in companies’ needs and developments in the professional services industry.

9

Our business depends upon our ability to secure new projects from clients and, therefore, we could be adversely affected if we fail to do so.

We do not have long-term agreements with our clients for the provision of services and our clients may terminate engagements with us at any time. The success of our business is dependent on our ability to secure new projects from clients. For example, if we are unable to secure new client projects because of improvements in our competitors’ service offerings, or because of a change in government regulatory requirements, or because of an economic downturn decreasing the demand for outsourced professional services, our business is likely to be materially adversely affected. New impediments to our ability to secure projects from clients may develop over time, such as the increasing use by large clients of in-house procurement groups that manage their relationship with service providers.

We may be legally liable for damages resulting from the performance of projects by our consultants or for our clients’ mistreatment of our personnel.

Many of our engagements with our clients involve projects or services critical to our clients’ businesses. If we fail to meet our contractual obligations, we could be subject to legal liability or damage to our reputation, which could adversely affect our business, operating results and financial condition. While we are not currently subject to any client-related legal claims which we believe are material, it remains possible, because of the nature of our business, we may be involved in litigation in the future that could materially affect our future financial results. Claims brought against us could have a serious negative effect on our reputation and on our business, financial condition and results of operations.

Because we are in the business of placing our personnel in the workplaces of other companies, we are subject to possible claims by our personnel alleging discrimination, sexual harassment, negligence and other similar activities by our clients. We may also be subject to similar claims from our clients based on activities by our personnel. The cost of defending such claims, even if groundless, could be substantial and the associated negative publicity could adversely affect our ability to attract and retain personnel and clients.

We may not be able to grow our business, manage our growth or sustain our current business.

Historically, we have grown by opening new offices and by increasing the volume of services provided through existing offices. Beginning late in fiscal 2017, we embarked on several new strategic initiatives, including the implementation of a new operating model to drive growth. In addition, in February 2020, we initiated a plan to consolidate our physical geographic presence to certain key markets while shifting to a virtual operating model in certain other markets. Our ability to execute on those strategies or the disruptions related to implementation of the new operating model may impact or limit our ability to grow our business. There can be no assurance we will be able to maintain or expand our market presence in our current locations, successfully enter other markets or locations or successfully operate our business virtually without a physical presence in all our markets. Our ability to continue to grow our business will depend upon an improving global economy and a number of factors, including our ability to:

|

· grow our client base |

|

· expand profitably into new geographies |

|

· drive growth in core markets and the digital transformation space |

|

· provide additional professional services offerings |

|

· hire qualified and experienced consultants |

|

· maintain margins in the face of pricing pressures |

|

· manage costs |

|

· maintain or grow revenues and increase other service offerings from existing clients |

Even if we are able to resume more rapid growth in our revenue, the growth will result in new and increased responsibilities for our management as well as increased demands on our internal systems, procedures and controls, and our administrative, financial, marketing and other resources. For instance, a limited number of clients are requesting certain engagements be of a fixed fee nature rather than our traditional hourly time and materials approach, thus shifting a portion of the burden of financial risk and monitoring to us. Failure to adequately respond to these new responsibilities and demands may adversely affect our business, financial condition and results of operations.

10

Our ability to serve clients internationally is integral to our strategy and our international activities expose us to additional operational challenges we might not otherwise face.

Our international activities require us to confront and manage a number of risks and expenses we would not face if we conducted our operations solely in the United States. Any of these risks or expenses could cause a material negative effect on our operating results. These risks and expenses include:

|

· difficulties in staffing and managing foreign offices as a result of, among other things, distance, language and cultural differences |

|

· less flexible or future changes in labor laws and regulations in the U.S. and in foreign countries |

|

· expenses associated with customizing our professional services for clients in foreign countries |

|

· foreign currency exchange rate fluctuations when we sell our professional services in denominations other than United States dollars |

|

· protectionist laws and business practices that favor local companies |

|

· political and economic instability in some international markets |

|

· multiple, conflicting and changing government laws and regulations |

|

· trade barriers |

|

· compliance with stringent and varying privacy laws in the markets in which we operate |

|

· reduced protection for intellectual property rights in some countries |

|

· potentially adverse tax consequences |

We have acquired, and may continue to acquire, companies, and these acquisitions could disrupt our business.

We have acquired several companies, including two in each of fiscal 2020 and fiscal 2018, and we may continue to acquire companies in the future. Entering into an acquisition entails many risks, any of which could harm our business, including:

|

· diversion of management’s attention from other business concerns |

|

· failure to integrate the acquired company with our existing business |

|

· failure to motivate, or loss of, key employees from either our existing business or the acquired business |

|

· failure to identify certain risks or liabilities during the due diligence process |

|

· potential impairment of relationships with our existing employees and clients |

|

· additional operating expenses not offset by additional revenue |

|

· incurrence of significant non-recurring charges |

|

· incurrence of additional debt with restrictive covenants or other limitations |

|

· addition of significant amounts of intangible assets, including goodwill, that are subject to periodic assessment of impairment, primarily through comparison of market value of our stock to our net book value, with such non-cash impairment potentially resulting in a material impact on our future financial results and financial condition |

|

· dilution of our stock as a result of issuing equity securities |

|

· assumption of liabilities of the acquired company |

11

Our failure to be successful in addressing these risks or other problems encountered in connection with our past or future acquisitions could cause us to fail to realize the anticipated benefits of such acquisitions, incur unanticipated liabilities and harm our business generally.

We must provide our clients with highly qualified and experienced consultants, and the loss of a significant number of our consultants, or an inability to attract and retain new consultants, could adversely affect our business and operating results.

Our business involves the delivery of professional services, and our success depends on our ability to provide our clients with highly qualified and experienced consultants who possess the skills and experience necessary to satisfy their needs. At various times, such professionals can be in great demand, particularly in certain geographic areas or if they have specific skill sets. Our ability to attract and retain consultants with the requisite experience and skills depends on several factors including, but not limited to, our ability to:

|

· provide our consultants with either full-time or flexible-time employment |

|

· obtain the type of challenging and high-quality projects our consultants seek |

|

· pay competitive compensation and provide competitive benefits |

|

· provide our consultants with flexibility as to hours worked and assignment of client engagements |

There can be no assurance we will be successful in accomplishing any of these factors and, even if we are, we cannot assure we will be successful in attracting and retaining the number of highly qualified and experienced consultants necessary to maintain and grow our business.

We may be unable to realize the level of benefit that we expect from our restructuring initiatives, which may adversely impact our business and results of operations.

We may be unable to realize some or all of the anticipated benefits of restructuring initiatives we have undertaken, which may adversely impact our business and results of operations. In response to changes in industry and market conditions, we have undertaken in the past, and may undertake in the future, restructuring, reorganization, or other strategic initiatives and business transformation plans to realign our resources with our growth strategies, operate more efficiently and control costs. For example, on February 27, 2020, management and our board of directors committed to a restructuring plan to reduce approximately 7.5% of our management and administrative workforce and consolidate our geographic presence to certain key markets. The restructuring plan was designed to streamline our organizational structure, reduce operating costs and more effectively align resources with business priorities. The successful implementation of our restructuring activities may from time to time require us to effect business and asset dispositions, workforce reductions, management restructurings, decisions to limit investments in or otherwise exit businesses, office consolidations and closures, and other actions, each of which may depend on a number of factors that may not be within our control.

Any such effort to realign or streamline our organization may result in the recording of restructuring or other charges, such as asset impairment charges, contract and lease termination costs, exit costs, termination benefits, and other restructuring costs. Further, as a result of restructuring initiatives, we may experience a loss of continuity, loss of accumulated knowledge and/or inefficiency, adverse effects on employee morale, loss of key employees and/or other retention issues during transitional periods. Reorganization and restructuring can impact a significant amount of management and other employees’ time and focus, which may divert attention from operating and growing our business. Further, upon completion of any restructuring initiatives, our business may not be more efficient or effective than prior to the implementation of the plan and we may be unable to achieve anticipated operating enhancements or cost reductions, which would adversely affect our business, competitive position, operating results and financial condition.

Our computer hardware and software and telecommunications systems are susceptible to damage, breach or interruption.

The management of our business is aided by the uninterrupted operation of our computer and telecommunication systems. These systems are vulnerable to security breaches, natural disasters or other catastrophic events, computer viruses, or other interruptions or damage stemming from power outages, equipment failure or unintended usage by employees. In particular, our employees may have access or exposure to personally identifiable or otherwise confidential information and customer data and systems, the misuse of which could result in legal liability. In addition, we rely on information technology systems to process, transmit and store electronic information and to communicate among our locations around the world and with our clients, partners and consultants. The breadth and complexity of this infrastructure increases the potential risk of security breaches. Security breaches, including cyber-attacks or cyber-intrusions by computer hackers, foreign governments, cyber terrorists or others with grievances against the industry in which we operate or us in particular, may disable or damage the proper functioning of our networks and systems. We review and update our systems and have implemented processes and procedures to protect against security breaches and unauthorized access to our data. Despite our implementation of security controls, our systems and networks are vulnerable to computer viruses, malware, worms, hackers and other security issues, including physical and electronic break-ins, router disruption, sabotage or espionage, disruptions from unauthorized

12

access and tampering (including through social engineering such as phishing attacks), impersonation of authorized users and coordinated denial-of-service attacks. For example, in the past we have experienced cyber security incidents resulting from unauthorized access to our systems, which to date have not had a material impact on our business or results of operations; however, there is no assurance that such impacts will not be material in the future. Our systems may be subject to additional risk introduced by software that we license from third parties. This licensed software may introduce vulnerabilities within our own operations as it is integrated with our systems, or as we provide client services through partnership agreements.

It is also possible our security controls over personal and other data may not prevent unauthorized access to, or destruction, loss, theft, misappropriation or release of personally identifiable or other proprietary, confidential, sensitive or valuable information of ours or others; this access could lead to potential unauthorized disclosure of confidential personal, Company or client information that others could use to compete against us or for other disruptive, destructive or harmful purposes and outcomes. Any such disclosure or damage to our networks and systems could subject us to third party claims against us and reputational harm. If these events occur, our ability to attract new clients may be impaired or we may be subjected to damages or penalties. In addition, system-wide or local failures of these information technology systems could have a material adverse effect on our business, financial condition, results of operations or cash flows.

Failure to comply with data privacy laws and regulations could have a materially adverse effect on our reputation, results of operations or financial condition, or have other adverse consequences.

The collection, hosting, transfer, disclosure, use, storage and security of personal information required to provide our services is subject to federal, state and foreign data privacy laws. These laws, which are not uniform, do one or more of the following: regulate the collection, transfer (including in some cases, the transfer outside the country of collection), processing, storage, use and disclosure of personal information, require notice to individuals of privacy practices; give individuals certain access and correction rights with respect to their personal information; and prevent the use or disclosure of personal information for secondary purposes such as marketing. Under certain circumstances, some of these laws require us to provide notification to affected individuals, data protection authorities and/or other regulators in the event of a data breach. In many cases, these laws apply not only to third-party transactions, but also to transfers of information among us and our subsidiaries. In addition, the European Union adopted a comprehensive General Data Protection Regulation (the “GDPR”) that replaced the EU Data Protection Directive and related country-specific legislation. The GDPR became fully effective in May 2018. Complying with the enhanced obligations imposed by the GDPR may result in additional costs to our business and require us to amend certain of our business practices.

Laws and regulations in this area are evolving and generally becoming more stringent. For example, the New York State Department of Financial Services has issued cybersecurity regulations that outline a variety of required security measures for protection of data. Other U.S. states, including California and South Carolina, have also recently enacted cybersecurity laws requiring certain security measures of regulated entities that are broadly similar to GDPR requirements, and we expect other states will follow suit. As these laws continue to evolve, we may be required to make changes to our systems, services, solutions and/or products so as to enable us and/or our clients to meet the new legal requirements, including by taking on more onerous obligations in our contracts, limiting our storage, transfer and processing of data and, in some cases, limiting our service and/or solution offerings in certain locations. Changes in these laws, or the interpretation and application thereof, may also increase our potential exposure through significantly higher potential penalties for non-compliance. The costs of compliance with, and other burdens imposed by, such laws and regulations and client demand in this area may limit the use of, or demand for, our services, solutions and/or products, make it more difficult and costly to meet client expectations, or lead to significant fines, penalties or liabilities for noncompliance, any of which could adversely affect our business, financial condition, and results of operations.

Our business could suffer if we lose the services of one or more key members of our senior management.

Our future success depends upon the continued employment of our senior management team. The unforeseen departure of one or more key members of our senior management team could significantly disrupt our operations if we are unable to successfully manage the transition. The replacement of members of senior management can involve significant time and expense and create uncertainties that could delay, prevent the achievement of, or make it more difficult for us to pursue and execute on our business opportunities, which could have an adverse effect on our business, financial condition and operating results.

Further, we generally do not have non-compete agreements with our employees and, therefore, they could terminate their employment with us at any time. Our ability to retain the services of members of our senior management and other key employees could be impacted by a number of factors, including competitors’ hiring practices or the effectiveness of our compensation programs. If members of our senior management or other key employees leave our employ for any reason, they could pursue other employment opportunities with our competitors or otherwise compete with us. If we are unable to retain the services of these key personnel or attract and retain other qualified and experienced personnel on acceptable terms, our business, financial condition and operating results could be adversely affected.

13

It may be difficult for a third party to acquire us, and this could depress our stock price.

Delaware corporate law and our amended and restated certificate of incorporation and amended and restated bylaws contain provisions that could delay, defer or prevent a change of control of the Company or our management. These provisions could also discourage proxy contests and make it difficult for our stockholders to elect directors and take other corporate actions. As a result, these provisions could limit the price future investors are willing to pay for our shares. These provisions:

|

· authorize our board of directors to establish one or more series of undesignated preferred stock, the terms of which can be determined by the board of directors at the time of issuance |

|

· divide our board of directors into three classes of directors, with each class serving a staggered three-year term. Because the classification of the board of directors generally increases the difficulty of replacing a majority of the directors, it may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us and may make it difficult to change the composition of the board of directors |

|

· prohibit cumulative voting in the election of directors which, if not prohibited, could allow a minority stockholder holding a sufficient percentage of a class of shares to ensure the election of one or more directors |

|

· require that any action required or permitted to be taken by our stockholders must be effected at a duly called annual or special meeting of stockholders and may not be effected by any consent in writing |

|

· state that special meetings of our stockholders may be called only by the chairman of the board of directors, by our chief executive officer, by the board of directors after a resolution is adopted by a majority of the total number of authorized directors, or by the holders of not less than 10% of our outstanding voting stock |

|

· establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting |

|

· provide that certain provisions of our certificate of incorporation and bylaws can be amended only by supermajority vote (a 66 2/3 % majority) of the outstanding shares. In addition, our board of directors can amend our bylaws by majority vote of the members of our board of directors |

|

· allow our directors, not our stockholders, to fill vacancies on our board of directors |

|

· provide that the authorized number of directors may be changed only by resolution of the board of directors |

The terms of our credit facility impose operating and financial restrictions on us, which may limit our ability to respond to changing business and economic conditions.

We currently have a $120.0 million secured revolving credit facility which is available through October 17, 2021. We are subject to various operating covenants under the credit facility which restrict our ability to, among other things, incur liens, incur additional indebtedness, make certain restricted payments, merge or consolidate and make dispositions of assets. The credit facility also requires us to comply with financial covenants limiting our total funded debt, minimum interest coverage ratio and maximum leverage ratio. Any failure to comply with these covenants may constitute a breach under the credit facility, which could result in the acceleration of all or a substantial portion of any outstanding indebtedness and termination of revolving credit commitments under the credit facility. Our inability to maintain our credit facility could materially and adversely affect our liquidity and our business.

We may be unable to or elect not to pay our quarterly dividend payment.

We currently pay a regular quarterly dividend, subject to quarterly board of director approval. The payment of, or continuation of, the quarterly dividend is at the discretion of our board of directors and is dependent upon our financial condition, results of operations, capital requirements, general business conditions, tax treatment of dividends in the United States, contractual restrictions contained in credit agreements and other agreements and other factors deemed relevant by our board of directors. We can give no assurance that dividends will be declared and paid in the future. The failure to pay the quarterly dividend, reduction of the quarterly dividend rate or the discontinuance of the quarterly dividend could adversely affect the trading price of our common stock.

Our recent rebranding efforts may not be successful. In addition, we may be unable to adequately protect our intellectual property rights, including our brand name.

We believe establishing, maintaining and enhancing the RGP and Resources Global Professionals brand name is important to our business. We rely on trademark registrations and common law trademark rights to protect the distinctiveness of our brand. After the end of fiscal year 2019, we launched a significant global rebranding initiative. However, there can be no assurance that our rebranding initiative will result in a positive return on investment. In addition, there can be no assurance that the actions we have taken to establish and protect our trademarks will be adequate to prevent use of our trademarks by others. Further, not all of our trademarks were able to successfully register in all of the desired countries. Accordingly, we may not be able to claim or assert trademark or unfair competition claims against third parties for any number of reasons. For example, a judge, jury or other adjudicative body may find that

14

the conduct of competitors does not infringe or violate our trademark rights. In addition, third parties may claim that the use of our trademarks and branding infringe, dilute or otherwise violate the common law or registered marks of that party, or that our marketing efforts constitute unfair competition. Such claims could result in injunctive relief prohibiting the use of our marks, branding and marketing activities as well as significant damages, fees and costs. If such a claim was made and we were required to change our name or any of our marks, the value of our brand may diminish and our results of operations and financial condition could be adversely affected.

Reclassification of our independent contractors by foreign tax or regulatory authorities could have an adverse effect on our business model and/or could require us to pay significant retroactive wages, taxes and penalties.

Internationally, our consultants are a blend of employees and independent contractors. Independent contractor arrangements are more common abroad than in the United States due to the labor laws, tax regulations and customs of the international markets we serve. However, changes to foreign laws governing the definition or classification of independent contractors, or judicial decisions regarding independent contractor classification could require classification of consultants as employees. Such reclassification could have an adverse effect on our business and results of operations, could require us to pay significant retroactive wages, taxes and penalties, and could force us to change our contractor business model in the foreign jurisdictions affected.

15

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

As of May 30, 2020, we maintained 39 domestic offices, all under operating lease agreements (except for the Irvine, California location), in the following metropolitan areas:

|

|

||

|

Phoenix, Arizona |

Chicago, Illinois |

Pittsburgh, Pennsylvania |

|

Irvine, California |

Oakbrook Terrace, Illinois |

Nashville, Tennessee |

|

Los Angeles, California (2) |

Indianapolis, Indiana |

Dallas, Texas |

|

Mountain View, California |

Minneapolis, Minnesota |

San Antonio, Texas |

|

Sacramento, California (2) |

Kansas City, Missouri |

Seattle, Washington |

|

Santa Clara, California |

Las Vegas, Nevada |

Richmond, Virginia |

|

San Diego, California |

Parsippany, New Jersey |

|

|

San Francisco, California (2) |

New York, New York |

|

|

Walnut Creek, California |

Charlotte, North Carolina |

|

|

Woodland Hills, California |

Cleveland, Ohio |

|

|

Denver, Colorado |

Columbus, Ohio |

|

|

Stamford, Connecticut |

Tulsa, Oklahoma |

|

|

Tampa, Florida |

Portland, Oregon |

|

|

Atlanta, Georgia |

Cranberry Township, Pennsylvania |

|

|

Honolulu, Hawaii |

Philadelphia, Pennsylvania |

As of May 30, 2020, we maintained 23 international offices under operating lease agreements, located in the following cities and countries:

|

|

||

|

Sydney, Australia |

Milan, Italy |

Singapore |

|

Toronto, Canada |

Tokyo, Japan |

Seoul, South Korea |

|

Paris, France |

Mexico City, Mexico |

Zurich, Switzerland |

|

Frankfurt, Germany |

Amsterdam (Utrecht), Netherlands |

Taipei, Taiwan |

|

Muenster, Germany |

Beijing, People’s Republic of China |

London, United Kingdom |

|

Munich, Germany |

Hong Kong, People’s Republic of China |

|

|

Bangalore, India |

Guangzhou, People’s Republic of China |

|

|

Mumbai, India |

Shanghai, People’s Republic of China |

|

|

Dublin, Ireland |

Manila, Philippines |

Our corporate offices are located in Irvine, California. We own an approximately 57,000 square foot office building in Irvine, California, of which we occupied approximately 40,000 square feet as of May 30, 2020, including space occupied by our Orange County, California practice. Approximately 13,000 square feet is leased to independent third parties, and 4,000 square feet is vacant.

We are not currently subject to any material legal proceedings; however, we are a party to various legal proceedings arising in the ordinary course of our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

16

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Price Range of Common Stock

Effective April 2, 2020, we changed our ticker symbol from “RECN” to “RGP” and began trading on the Nasdaq Capital Market under this new ticker symbol. We changed our ticker symbol when RGP became available, as it aligns directly with our trade name, Resources Global Professionals or RGP. Prior to this change in ticker symbol, our common stock had traded on the Nasdaq Global Select Market under the symbol “RECN” since December 15, 2000. As of July 8, 2020, the last reported sales price on Nasdaq of our common stock was $11.40 per share and the approximate number of holders of record of our common stock was 47 (a holder of record is the name of an individual or entity that an issuer carries in its records as the registered holder (not necessarily the beneficial owner) of the issuer’s securities).

Dividend Policy

Our board of directors has established a quarterly dividend, subject to quarterly board of directors’ approval. Pursuant to declaration and approval by our board of directors, we declared a dividend of $0.14 per share of common stock during each quarter in fiscal 2020, $0.13 per share of common stock during each quarter in fiscal 2019, and $0.12 per share of common stock during each quarter in fiscal 2018. On April 15, 2020, our board of directors declared a regular quarterly dividend of $0.14 per share of our common stock. The dividend was paid on June 10, 2020 to stockholders of record at the close of business on May 13, 2020. Continuation of the quarterly dividend will be at the discretion of our board of directors and will depend upon our financial condition, results of operations, capital requirements, general business condition, contractual restrictions contained in our current or future credit agreements and other agreements, and other factors deemed relevant by our board of directors.

Issuances of Unregistered Securities

None.

Issuer Purchases of Equity Securities

In July 2015, our board of directors approved a stock repurchase program (the “July 2015 Program”), authorizing the purchase, at the discretion of our senior executives, of our common stock for an aggregate dollar limit not to exceed $150.0 million. Subject to the aggregate dollar limit, the currently authorized stock repurchase program does not have an expiration date. Repurchases under the program may take place in the open market or in privately negotiated transactions and may be made pursuant to a Rule 10b5-1 plan.

There were no repurchases of our common stock during the fourth quarter of fiscal 2020.

Performance Graph

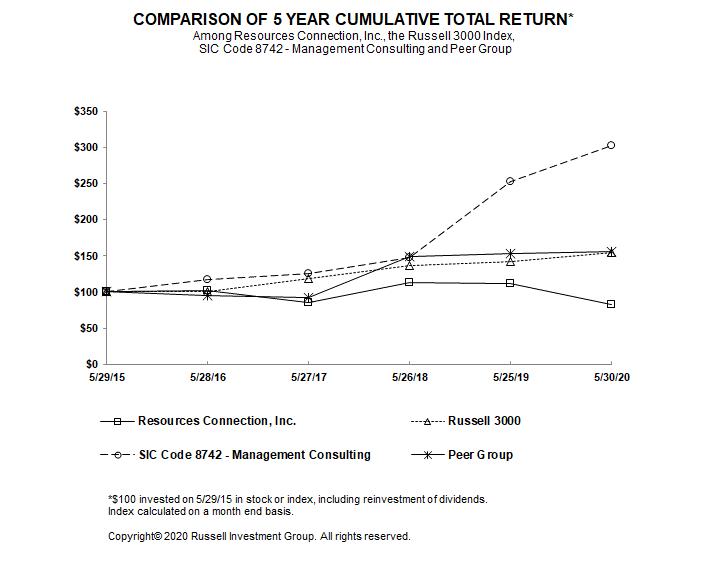

Set forth below is a line graph comparing the annual percentage change in the cumulative total return to the holders of our common stock with the cumulative total return of the Russell 3000 Index, a customized peer group consisting of eight companies listed below the following table and a combined classification of companies under Standard Industry Codes as 8742-Management Consulting Services for the five years ended May 30, 2020. The graph assumes $100 was invested at market close on May 29, 2015 in our common stock and in each index (based on prices from the close of trading on May 29, 2015), and that all dividends are reinvested. Stockholder returns over the indicated period may not be indicative of future stockholder returns.

The information contained in the performance graph shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into such filing.

17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Fiscal Years Ended |

||||||||||||||||

|

|

May 29, 2015 |

|