Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Bank of New York Mellon Corp | ex992_financialsupplementx.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank of New York Mellon Corp | ex991_earningsreleasex2q20.htm |

| 8-K - FORM 8-K - Bank of New York Mellon Corp | form8-kearningsjuly152.htm |

Second Quarter 2020 Financial Highlights July 15, 2020

2Q20 Financial Results PROFITS RETURNS BALANCE SHEET › Net Income: $901 million › ROE: 9.4% › CET1: 12.6% › Diluted EPS: $1.01 › ROTCE: 18.5% (a) › Tier 1 Leverage: 6.2% › Returned $0.3 billion to shareholders in dividends (b) › Average LCR: 112% PRE - T A X I N C O M E TOTAL REVENUE ($ millions) ($ millions) › Investment Services revenue up due to higher fee and other revenue, offset by MMF (c) fee (8)% waivers and lower net interest revenue 3,016 › Investment and Wealth Management revenue 3,242 +3% 1,285 1,227 50 primarily impacted by change in AUM mix, MMF 1,181 fee waivers and lower net interest revenue 45 Services 3,107 40 Investment 33% › Provision for credit losses of $143 million; no 30% 29% 35 30 charge-offs and stable nonperforming assets 25 20 913 › Expenses slightly higher 15 898 (3)% › CCAR and DFAST results 10 5 886 › Maintaining quarterly cash dividend of $0.31 Investment Investment andWealth 0 Management No share buybacks in 3Q20 2Q19 1Q20 2Q20 › › Stress capital buffer of 2.5% from October 1(d) Pre-tax operating margin 2Q19 1Q20 2Q20 (a) Represents a non-GAAP measure. See page 14 for corresponding reconciliation of ROTCE (b) Share buybacks temporarily suspended for 2Q as announced jointly with the Financial Services Forum on March 15, 2020 (c) Money market fund (d) Final SCB expected to be confirmed by the Federal Reserve later in 2020 2 Second Quarter 2020 – Financial Highlights

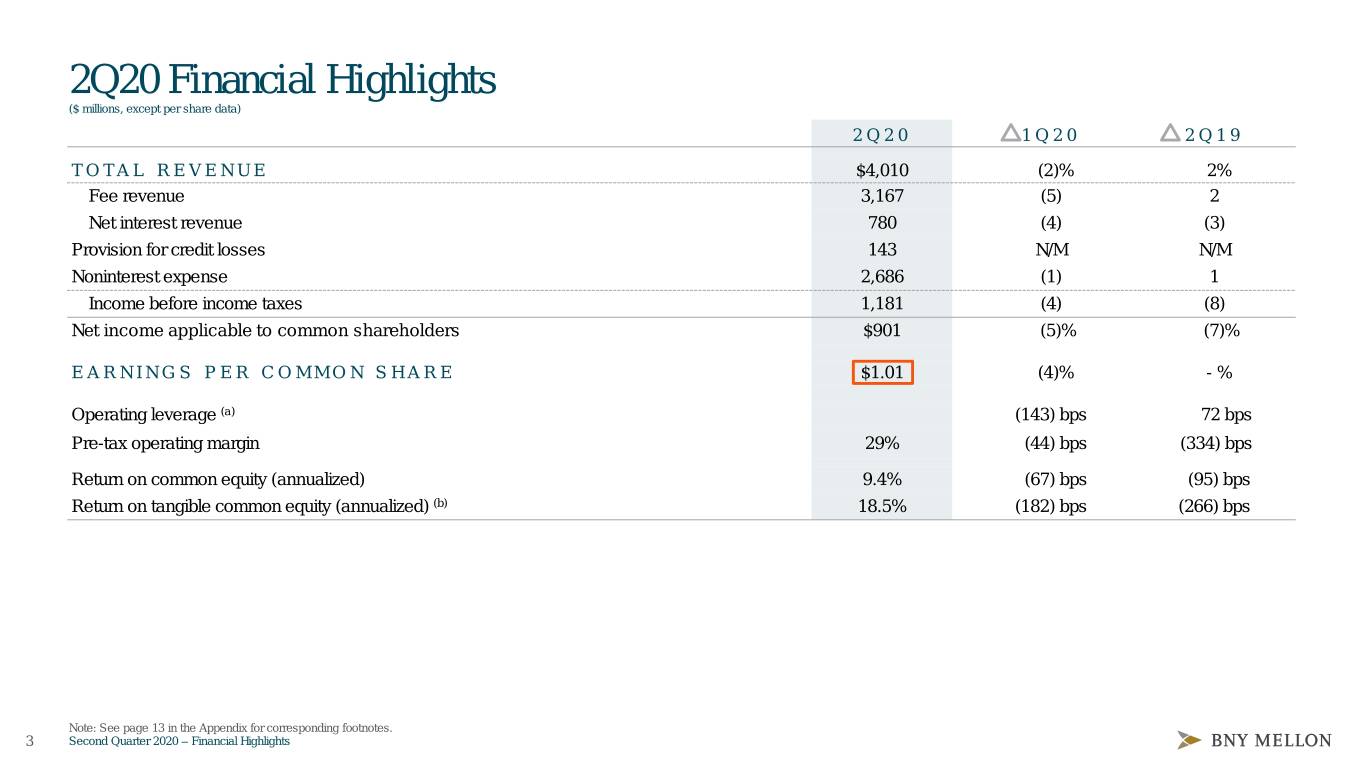

2Q20 Financial Highlights ($ millions, except per share data) 2 Q 2 0 1 Q 2 0 2 Q 1 9 TOTAL REVENUE $4,010 (2)% 2% Fee revenue 3,167 (5) 2 Net interest revenue 780 (4) (3) Provision for credit losses 143 N/M N/M Noninterest expense 2,686 (1) 1 Income before income taxes 1,181 (4) (8) Net income applicable to common shareholders $901 (5)% (7)% EARNINGS PER COMMON SHARE $1.01 (4)% - % Operating leverage (a) (143) bps 72 bps Pre-tax operating margin 29% (44) bps (334) bps Return on common equity (annualized) 9.4% (67) bps (95) bps Return on tangible common equity (annualized) (b) 18.5% (182) bps (266) bps Note: See page 13 in the Appendix for corresponding footnotes. 3 Second Quarter 2020 – Financial Highlights

Capital and Liquidity 2 Q 20 1 Q 20 2 Q 19 Consolidated regulatory capital ratios: (a) Common Equity Tier 1 (“CET1”) ratio 12.6% 11.3% 11.1% Tier 1 capital ratio 15.4 13.5 13.2 Total capital ratio 16.3 14.3 14.0 Tier 1 leverage ratio 6.2 6.0 6.8 Supplementary leverage ratio (“SLR“) (b) 8.2 5.6 6.3 Average liquidity coverage ratio (“LCR“) 112% 115% 117% Book value per common share $44.21 $42.47 $40.30 Tangible book value per common share – non-GAAP (c) $23.31 $21.53 $20.45 Cash dividends per common share $0.31 $0.31 $0.28 Common shares outstanding (thousands) 885,862 885,443 942,662 Note: See page 13 in the Appendix for corresponding footnotes. 4 Second Quarter 2020 – Financial Highlights

Net Interest Revenue DRIVERS OF SEQUENTIAL NIR CHANGE ($ millions) 814 780 › Client-driven deposit growth more than offset by + Average + Securities + Hedging – Rate impact impact of lower interest rates across the yield curve deposit and loan and other (i.e. lower balances balances (largely yields partly up ~$25bn up ~$20bn offset in FX offset by lower › Strong growth in average deposit balances and Other deposit and sequentially and year-over-year trading) funding costs) › Broad-based across all business lines and linked 1Q20 2Q20 to operational and fee-generating activities AVERAGE DEPOSITS › Negative interest-bearing deposits rate a result of ($ billions) significant growth in low rate USD deposits and +28% negative rates on Euro denominated deposits +10% 283 258 › Incrementally deploying increasing deposits into 221 investment securities 1.04% 198 211 Interest-bearing 0.49% deposits 168 Interest-bearing (0.03)% deposits rate Noninterest-bearing 72 deposits 53 61 2Q19 1Q20 2Q20 5 Second Quarter 2020 – Financial Highlights

Credit Risk Profile AVERAGE INTEREST - › Well collateralized with assets under custody EARNING ASSETS ( $ 3 5 8 b n ) › $1.1bn manufacturing; $1.1bn services and other; $0.1bn energy and utilities +24% +10% › 92% investment grade 358 › 74% secured, predominantly office and residential LOANS ( a ) 324 › 95% of unsecured consist of predominantly investment 57 ( $ 5 5 b n ) grade REITS and real estate operating companies 287 56 › Concentrated in NY Metro area Overdrafts and other 12% Loans 50 Commercial 4% CRE › Mostly secured, 95% investment grade; 94% due <1 year 155 11% 136 › $7.0bn banks; $1.6bn securities industry Securities 124 Financial institutions 19% › Collateralized with marketable securities in excess of 100% Margin loans 23% of loan value Cash/ 132 146 113 Wealth management & › Secured by marketable securities and/or residential property Reverse repo 30% Other Residential Mtges › High quality mortgages; limited forbearance requests 2Q19 1Q20 2Q20 2Q20 (a) Preliminary data as of 6/30/20. May not foot due to rounding. 6 Second Quarter 2020 – Financial Highlights

Noninterest Expense ($ millions) 2 Q 2 0 1 Q 20 2 Q 19 › Noninterest expenses up year-over-year $1,464 Staff (1)% 3% › Primarily reflecting continued investments in Software and equipment 345 6 13 technology and higher staff and pension expenses, Professional, legal and other purchased services 337 2 - partially offset by lower business development (travel and marketing) expense and the favorable Net occupancy 137 1 (1) impact of a stronger U.S. dollar Sub-custodian and clearing 120 14 4 Distribution and servicing 85 (7) (10) › Technology expenses are included in staff, software and .equipment and professional, legal and other 35 - 13 Bank assessment charges purchased services Business development 20 (52) (64) Amortization of intangible assets 26 - (13) Other 117 (16) (3) Total noninterest expense $2,686 (1)% 1% 7 Second Quarter 2020 – Financial Highlights

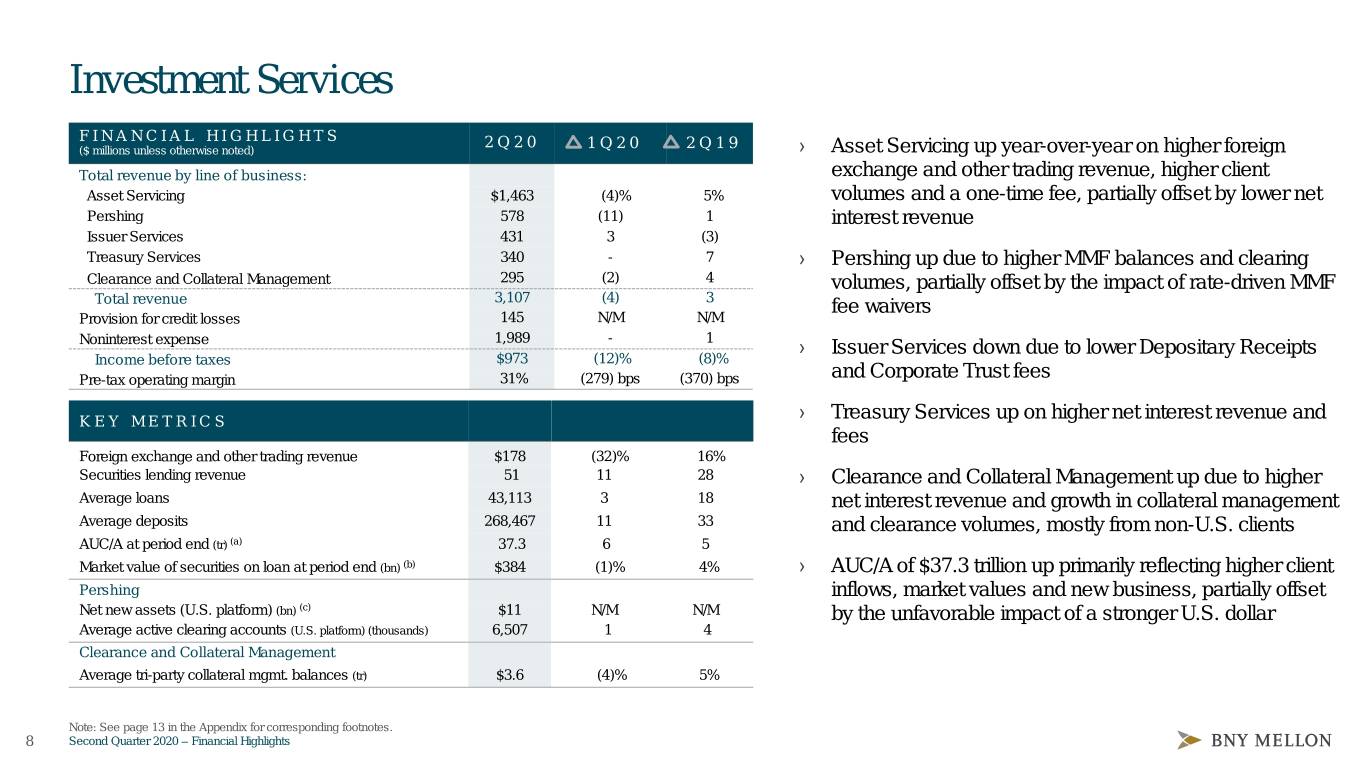

Investment Services FINANCIAL HIGHLIGHTS 2 Q 2 0 ($ millions unless otherwise noted) 1 Q 2 0 2 Q 1 9 › Asset Servicing up year-over-year on higher foreign Total revenue by line of business: exchange and other trading revenue, higher client Asset Servicing $1,463 (4)% 5% volumes and a one-time fee, partially offset by lower net Pershing 578 (11) 1 interest revenue Issuer Services 431 3 (3) Treasury Services 340 - 7 › Pershing up due to higher MMF balances and clearing Clearance and Collateral Management 295 (2) 4 volumes, partially offset by the impact of rate-driven MMF Total revenue 3,107 (4) 3 fee waivers Provision for credit losses 145 N/M N/M Noninterest expense 1,989 - 1 › Issuer Services down due to lower Depositary Receipts Income before taxes $973 (12)% (8)% Pre-tax operating margin 31% (279) bps (370) bps and Corporate Trust fees KEY METRICS › Treasury Services up on higher net interest revenue and fees Foreign exchange and other trading revenue $178 (32)% 16% Securities lending revenue 51 11 28 › Clearance and Collateral Management up due to higher Average loans 43,113 3 18 net interest revenue and growth in collateral management Average deposits 268,467 11 33 and clearance volumes, mostly from non-U.S. clients AUC/A at period end (tr) (a) 37.3 6 5 Market value of securities on loan at period end (bn) (b) $384 (1)% 4% › AUC/A of $37.3 trillion up primarily reflecting higher client Pershing inflows, market values and new business, partially offset Net new assets (U.S. platform) (bn) (c) $11 N/M N/M by the unfavorable impact of a stronger U.S. dollar Average active clearing accounts (U.S. platform) (thousands) 6,507 1 4 Clearance and Collateral Management Average tri-party collateral mgmt. balances (tr) $3.6 (4)% 5% Note: See page 13 in the Appendix for corresponding footnotes. 8 Second Quarter 2020 – Financial Highlights

Investment Services - Revenue Drivers ($ millions) (3)% +5% +7% +4% +1% 446 431 340 295 1,397 1,463 317 284 572 578 2Q19 2Q20 2Q19 2Q20 2Q19 2Q20 2Q19 2Q20 2Q19 2Q20 A S S E T I S S U E R T R E A S U R Y CLEARANCE AND SERVICING PERSHING SERVICES SERVICES COLLATERAL + FX and other trading + Money market fund + Depositary Receipts + Deposit and loan + Clearance volumes revenue balances cross border volumes balances + Average tri-party balances + Liquidity services + Clearing volumes + Corporate Trust new + Liquidity services + NIB deposits + Client volumes - Money market fund fee business - Payment volumes + AUC/A waivers - Corporate Trust volumes + Deposit and loan - Depositary Receipts balances dividend fees - Interest rates 9 Second Quarter 2020 – Financial Highlights

Investment and Wealth Management FINANCIAL HIGHLIGHTS 2 Q 2 0 ($ millions unless otherwise noted) 1 Q 2 0 2 Q 1 9 › Investment Management (formerly Asset Management) decreased year-over-year primarily reflecting the Total revenue by line of business: Investment Management (formerly Asset Management) $621 - % - % unfavorable change in the mix of AUM since 2Q19 and Wealth Management 265 (5) (9) the impact of MMF fee waivers, partially offset by equity Total revenue 886 (1) (3) Provision for credit losses 7 N/M N/M investment gains (net of hedges), including seed capital Noninterest expense 658 (5) - Income before taxes $221 14% (15)% › Wealth Management down primarily reflecting lower net Pre-tax operating margin 25% 324 bps (371) bps interest revenue and a shift within portfolios to lower fee Adjusted pre-tax operating margin – non-GAAP (a) 28% 345 bps (433) bps asset classes KEY METRICS › Noninterest expense increased slightly primarily Average loans $11,791 (3)% (3)% reflecting higher continued investments in technology Average deposits 17,491 8 20 Wealth Management client assets (bn) (b) $254 8% (1)% › AUM of $2.0 trillion up primarily reflecting higher market CHANGES IN AUM (bn)(C) 2 Q 2 0 1 Q 2 0 2 Q 1 9 values and net inflows, partially offset by the Beginning balance $1,796 $1,910 $1,841 unfavorable impact of a stronger U.S. dollar Equity (2) (2) (2) Fixed income 4 - (4) Liability-driven investments (2) (5) 1 Multi-asset and alternatives investments - (1) 1 Index 9 3 (22) Cash 11 43 2 Total net inflows (outflows) 20 38 (24) Net market impact 143 (91) 42 Net currency impact 2 (61) (16) Ending balance $1,961 $1,796 $1,843 Note: See page 13 in the Appendix for corresponding footnotes. 10 Second Quarter 2020 – Financial Highlights

Other Segment FINANCIAL HIGHLIGHTS 2 Q 2 0 › Fee revenue increased year-over-year primarily ($ millions unless otherwise noted) 1 Q 2 0 2 Q 1 9 reflecting higher equity investment income, partially Fee revenue $29 $21 $24 Net securities gains 9 9 7 offset by sequentially lower foreign currency translation Total fee and other revenue 38 30 31 gains Net interest (expense) (36) (44) (40) Total revenue (loss) 2 (14) (9) › Net interest expense decreased year-over-year primarily Provision for credit losses (9) 11 (2) reflecting corporate treasury activity Noninterest expense 39 30 29 (Loss) before taxes $(28) $(55) $(36) › Noninterest expense increased year-over-year reflecting higher staff expense 11 Second Quarter 2020 – Financial Highlights

Appendix

Footnotes 2Q20 Financial Highlights, Page 3 (a) Operating leverage is the rate of increase (decrease) in total revenue less the rate of increase (decrease) in total noninterest expense. (b) See page 14 for corresponding reconciliation of this non-GAAP measure. Capital and Liquidity, Page 4 (a) Regulatory capital ratios for June 30, 2020 are preliminary. For our CET1, Tier 1 capital and Total capital ratios, our effective capital ratios under the U.S. capital rules are the lower of the ratios as calculated under the Standardized and Advanced Approaches, which for June 30, 2020 and June 30, 2019 was the Advanced Approaches, and for March 31, 2020 was the Standardized Approach for the CET1 and Tier 1 capital ratios and the Advanced Approaches for the Total capital ratio. (b) Reflects the application of a new rule effective April 1, 2020 to exclude certain central bank placements as well as the temporary exclusion of U.S. Treasury securities from the leverage exposure used in the SLR calculation. The temporary exclusion of U.S. Treasury securities from the SLR’s leverage exposure increased our SLR by 40 basis points. (c) Tangible book value per common share – non-GAAP – excludes goodwill and intangible assets, net of deferred tax liabilities. See page 14 for corresponding reconciliation of this non-GAAP measure. Investment Services, Page 8 (a) Current period is preliminary. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.3 trillion at June 30, 2020, $1.2 trillion at March 31, 2020 and $1.4 trillion at June 30, 2019. (b) Represents the total amount of securities on loan in our agency securities lending program managed by the Investment Services business. Excludes securities for which BNY Mellon acts as agent on behalf of CIBC Mellon clients, which totaled $62 billion at June 30, 2020, $59 billion at March 31, 2020 and $64 billion at June 30, 2019. (c) Net new assets represents net flows of assets (e.g., net cash deposits and net securities transfers) in customer accounts in Pershing LLC, a U.S. broker-dealer. Investment and Wealth Management, Page 10 (a) Net of distribution and servicing expense. See page 15 for corresponding reconciliation of this non-GAAP measure. (b) Current period is preliminary. Includes AUM and AUC/A in the Wealth Management business. (c) Current period is preliminary. Excludes securities lending cash management assets and assets managed in the Investment Services business. 13 Second Quarter 2020 – Financial Highlights

Return on Common Equity and Tangible Common Equity Reconciliation ($ millions) 2 Q 20 1 Q 20 2 Q19 Net income applicable to common shareholders of The Bank of New York Mellon Corporation – GAAP $901 $944 $969 Add: Amortization of intangible assets 26 26 30 Less: Tax impact of amortization of intangible assets 6 6 7 Adjusted net income applicable to common shareholders of The Bank of New York Mellon Corporation, excluding $921 $964 $992 amortization of intangible assets – non-GAAP Average common shareholders’ equity $38,476 $37,664 $37,487 Less: Average goodwill 17,243 17,311 17,343 Average intangible assets 3,058 3,089 3,178 Add: Deferred tax liability – tax deductible goodwill 1,119 1,109 1,094 Deferred tax liability – intangible assets 664 666 687 Average tangible common shareholders’ equity – non-GAAP $19,958 $19,039 $18,747 Return on common equity (annualized) – GAAP 9.4% 10.1% 10.4% Return on tangible common equity (annualized) – non-GAAP 18.5% 20.4% 21.2% Book Value and Tangible Book Value Per Common Share Reconciliation ($ millions, except common shares) June 30, 2020 March 31, 2020 June 30, 2019 BNY Mellon shareholders’ equity at period end – GAAP $43,697 $41,145 $41,533 Less: Preferred stock 4,532 3,542 3,542 BNY Mellon common shareholders’ equity at period end – GAAP 39,165 37,603 37,991 Less: Goodwill 17,253 17,240 17,337 Intangible assets 3,045 3,070 3,160 Add: Deferred tax liability – tax deductible goodwill 1,119 1,109 1,094 Deferred tax liability – intangible assets 664 666 687 BNY Mellon tangible common shareholders’ equity at period end – non-GAAP $20,650 $19,068 $19,275 Period-end common shares outstanding (in thousands) 885,862 885,443 942,662 Book value per common share – GAAP $44.21 $42.47 $40.30 Tangible book value per common share – non-GAAP $23.31 $21.53 $20.45 14 Second Quarter 2020 – Financial Highlights

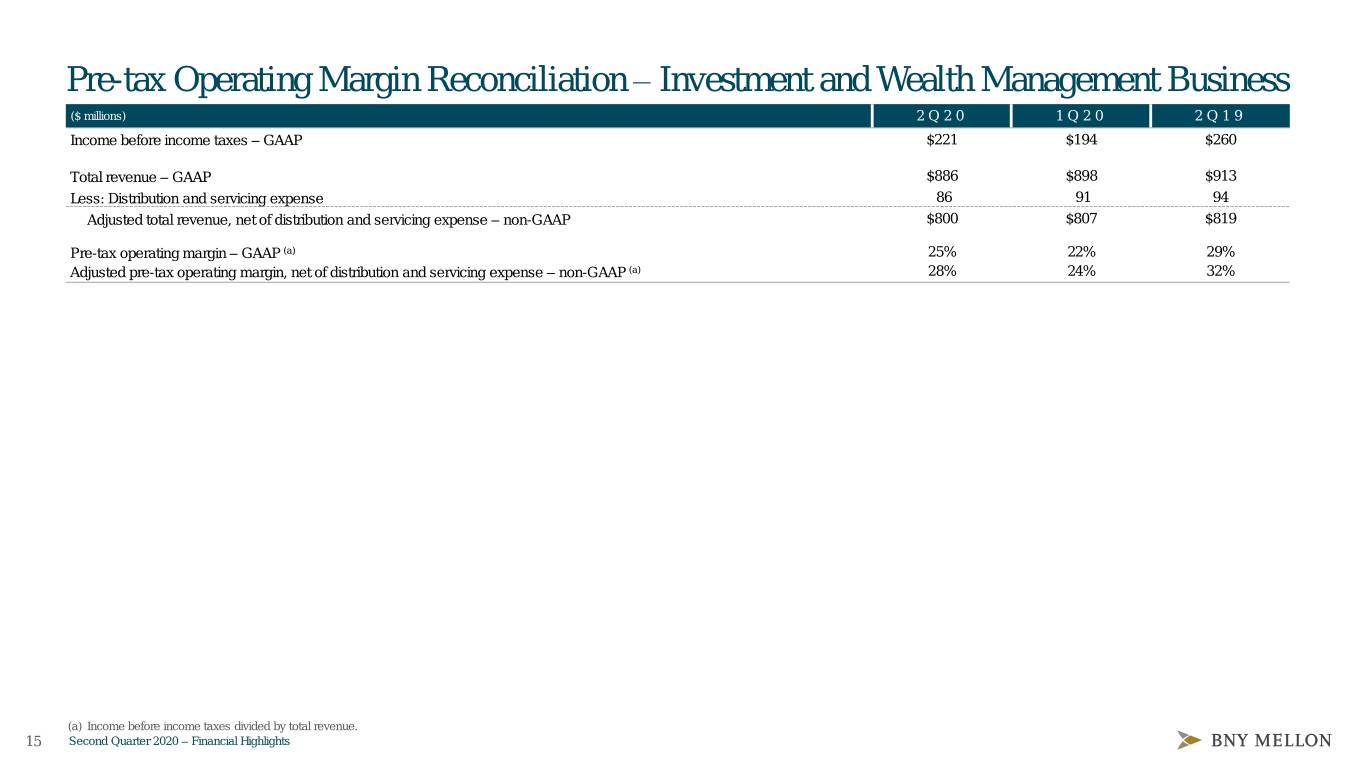

Pre-tax Operating Margin Reconciliation – Investment and Wealth Management Business ($ millions) 2 Q 20 1 Q 20 2 Q19 Income before income taxes – GAAP $221 $194 $260 Total revenue – GAAP $886 $898 $913 Less: Distribution and servicing expense 86 91 94 Adjusted total revenue, net of distribution and servicing expense – non-GAAP $800 $807 $819 Pre-tax operating margin – GAAP (a) 25% 22% 29% Adjusted pre-tax operating margin, net of distribution and servicing expense – non-GAAP (a) 28% 24% 32% (a) Income before income taxes divided by total revenue. 15 Second Quarter 2020 – Financial Highlights

Cautionary Statement A number of statements in The Bank of New York Mellon Corporation’s (the “Corporation”) presentations, the accompanying slides and the responses to your questions are “forward-looking statements.” Words such as “estimate,” “forecast,” “project,” “anticipate,” “likely,” “target,” “expect,” “intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,” “opportunities,” “trends,” “future” and words of similar meaning may signify forward-looking statements. These statements relate to, among other things, the Corporation’s expectations regarding: capital plans, strategic priorities, financial goals, organic growth, performance, organizational quality and efficiency, investments, including in technology and product development, capabilities, resiliency, revenue, net interest revenue, fees, expenses, cost discipline, sustainable growth, company management, deposits, interest rates and yield curves, securities portfolio, taxes, business opportunities, divestments, volatility, preliminary business metrics and regulatory capital ratios and statements regarding the Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives, expectations, outlooks, estimates, intentions, targets, opportunities and initiatives, including the potential effects of the coronavirus pandemic on any of the foregoing. These forward-looking statements are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation’s control). Actual outcomes may differ materially from those expressed or implied as a result of a number of factors, including, but not limited to, those discussed in “Risk Factors” in the Corporation’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 (the “First Quarter 2020 Form 10-Q”) and the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Annual Report”) and in other filings of the Corporation with the Securities and Exchange Commission (the “SEC”). Statements about the effects of the current and near-term market and macroeconomic outlook on the Corporation, including on its business, operations, financial performance and prospects, may constitute forward-looking statements, and are based on assumptions that involve risks and uncertainties and that are subject to change based on various important factors (some of which are beyond the Corporation's control), including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on the Corporation, its clients, customers and third parties. Preliminary business metrics and regulatory capital ratios are subject to change, possibly materially, as the Corporation completes its Form 10-Q for the second quarter of 2020. All forward- looking statements speak only as of July 15, 2020, and the Corporation undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events. For additional information regarding the Corporation, please refer to the Corporation's SEC filings available at www.bnymellon.com/investorrelations. Non-GAAP Measures: In this presentation we discuss some non-GAAP measures in detailing the Corporation’s performance, which exclude certain items or otherwise include components that differ from GAAP. We believe these measures are useful to the investment community in analyzing the financial results and trends of ongoing operations. We believe they facilitate comparisons with prior periods and reflect the principal basis on which the Corporation’s management monitors financial performance. Additional disclosures relating to non-GAAP measures are contained in the Corporation’s reports filed with the SEC, including the First Quarter 2020 Form 10-Q and the 2019 Annual Report, and are available at www.bnymellon.com/investorrelations. 16 Second Quarter 2020 – Financial Highlights