Attached files

| file | filename |

|---|---|

| EX-8.1 - EXHIBIT 8.1 - Fortress Transportation & Infrastructure Investors LLC | nt10013230x2_ex8-1.htm |

| EX-1.1 - EXHIBIT 1.1 - Fortress Transportation & Infrastructure Investors LLC | nt10013230x2_ex1-1.htm |

| 8-K - FORM 8-K - Fortress Transportation & Infrastructure Investors LLC | nt10013230x2_8k.htm |

Exhibit 5.1

June 30, 2020

Fortress Transportation and

Infrastructure Investors LLC

8.25% Fixed-to-Floating Rate Series A Cumulative Perpetual Redeemable Preferred Shares

8.00% Fixed-to-Floating Rate Series B Cumulative Perpetual Redeemable Preferred Shares

8.25% Fixed-to-Floating Rate Series A Cumulative Perpetual Redeemable Preferred Shares

8.00% Fixed-to-Floating Rate Series B Cumulative Perpetual Redeemable Preferred Shares

Ladies and Gentlemen:

We have acted as counsel for Fortress Transportation and Infrastructure Investors LLC, a Delaware limited liability company (the “Company”), in connection with the preparation and

filing with the Securities and Exchange Commission (the “Commission”) of the Prospectus Supplement, dated June 30, 2020 (the “Prospectus Supplement”), of the Company, filed with the Commission and relating to the issuance and sale from time to time by the Company of shares of the Company’s 8.25% Fixed-to-Floating Rate Series A

Cumulative Perpetual Redeemable Preferred Shares, par value $0.01 per share, representing limited liability company interests in the Company, with a liquidation preference of $25.00 per share (the “Series A Preferred Shares”), and 8.00% Fixed-to-Floating Rate Series B Cumulative Perpetual Redeemable Preferred Shares, par value $0.01 per share, representing limited liability company interests in the Company,

with a liquidation preference of $25.00 per share (the “Series B Preferred Shares” and, together with the Series A Preferred Shares, the “Preferred Shares”), having an aggregate gross sales price of up to $100,000,000, in accordance with the At Market Issuance Sales Agreement dated June 30, 2020 (the “Sales Agreement”), by and between the Company and B. Riley FBR, Inc. (the “Sales Agent”).

In that connection, we have examined originals, or copies certified or otherwise identified to our satisfaction, of such documents,

corporate records and other instruments as we have deemed necessary or appropriate for the purposes of this opinion, including: (a) the Certificate of Formation of the Company, dated as of February 13, 2014; (b) the Amended and Restated Limited

Liability Company Agreement of the Company, dated as of May 20, 2015, as amended by the First Amendment thereto dated March 8, 2016; (c) the Second Amended and Restated Limited Liability Company Agreement of the Company, dated as of September 12,

2019; (d) the Third Amended and Restated Limited Liability Company Agreement of the Company, dated as of November 27, 2019; (e) the resolutions adopted by the Board of Directors of the Company (the “Board”) on June 29, 2020, the resolutions adopted by the Compensation Committee of the Board on June 29, 2020 and the Action by Unanimous Written Consent of the Pricing Committee of the Board on June 29, 2020; and

(f) the Registration Statement on Form S‑3 (Registration No. 333-236770) filed with the Commission on February 28, 2020 (the “Registration Statement”), with respect to registration under the Securities Act of 1933, as amended (the “Act”), of an unlimited aggregate amount of various

securities of the Company, to be issued from time to time by the Company. As to various questions of fact material to this opinion, we have relied upon representations of officers or directors of the Company and documents furnished to us by the

Company without independent verification of their accuracy.

In rendering this opinion, we have assumed, with your consent and without independent investigation or verification, the genuineness of

all signatures, the legal capacity and competency of all natural persons, the due authorization, execution and delivery of the agreements by all parties thereto (other than the Company), the authenticity of all documents submitted to us as originals

and the conformity to authentic original documents of all documents submitted to us as duplicates or copies.

Based on the foregoing and subject to the qualifications set forth herein and subject to compliance with applicable state securities laws,

we are of opinion that the Preferred Shares, when issued and delivered against payment therefor in accordance with the Sales Agreement, will be validly issued, and the holders of such Preferred Shares will have no obligation to make any further

payments for the purchase of such Preferred Shares or contributions to the Company solely by reason of their ownership of such Preferred Shares (except as may otherwise be required by Sections 18-607 and 18-804 of the Limited Liability Company Act of

the State of Delaware).

We are admitted to practice in the State of New York, and we express no opinion as to matters governed by any laws other than the laws of

the State of New York, the Limited Liability Company Act of the State of Delaware and the Federal laws of the United States of America.

We are aware that we are referred to under the heading “Legal Matters” in the Prospectus Supplement. We hereby consent to such use of our name therein and to the filing of this opinion as Exhibit 5.1 to the Company’s Current Report on Form 8-K filed on June 30, 2020, and to the incorporation by reference of this opinion into the Registration Statement. In giving this consent, we do not hereby admit that we are within the category

of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

|

|

Very truly yours, |

|

|

|

|

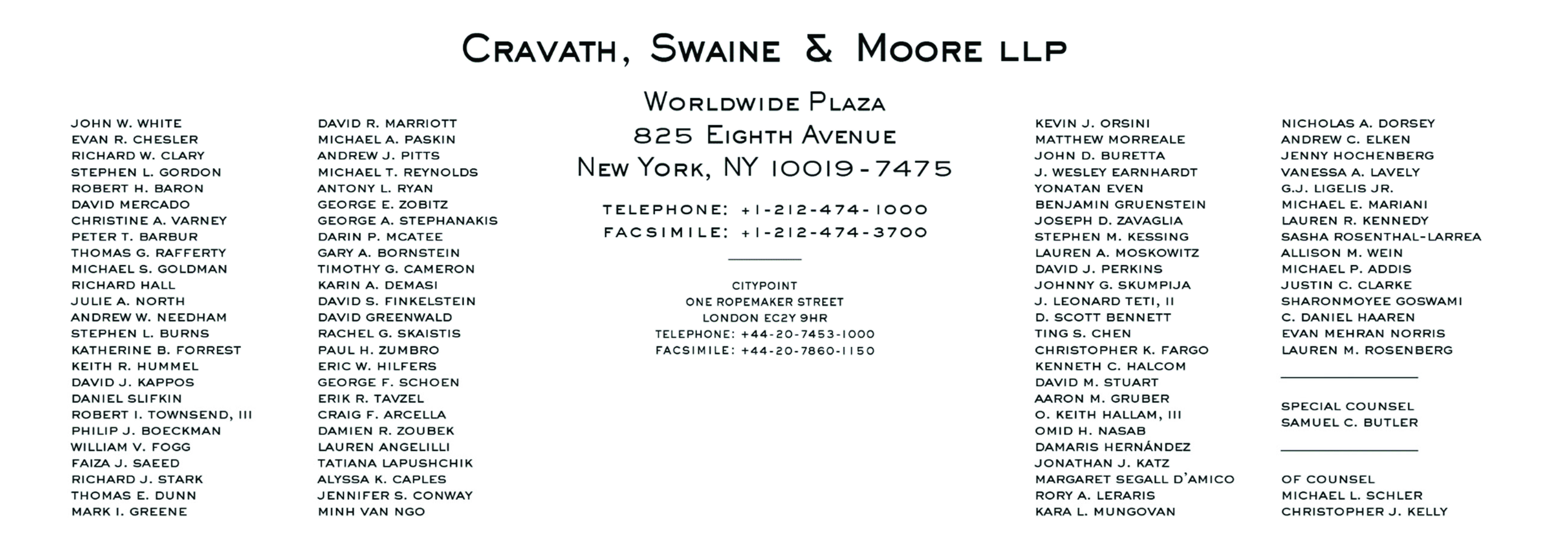

/s/ Cravath, Swaine & Moore LLP

|

Fortress Transportation and Infrastructure Investors LLC

1345 Avenue of the Americas, 45th Floor

New York, New York 10105

O