Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STAAR SURGICAL CO | staa-8k_20200602.htm |

STAAR Surgical Investor Presentation June 2, 2020 Exhibit 99.1

Forward Looking Statements All statements in this presentation that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections, plans, strategies, and objectives of management for 2020 or prospects for achieving such plans, expectations for sales, revenue, or earnings, the expected impact of the COVID-19 pandemic and related public health measures (including but not limited to its impact on sales, operations or clinical trials globally), product safety or effectiveness, the status of our pipeline of ICL products with regulators, including our EDOF lens for Presbyopia and our EVO family of lenses in the U.S., and any statements of assumptions underlying any of the foregoing, including those relating to our product pipeline and market expansion activities. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to the COVID-19 pandemic and related public health measures, as well as the factors set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended April 3, 2020, and Annual Report on Form 10-K for the year ended January 3, 2020 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. The Visian ICL with CentraFLOW, now known as EVO Visian ICL, is not yet approved for sale in the United States.

The Future of Refractive Surgery is Lens-Based... The Time for STAAR is Now Large and Growing Addressable Market (TAM) Strong Financial Performance includes Expanding Margins and Cash Generation Proprietary Lens Technology and Business Model is Driving Industry-Leading Growth

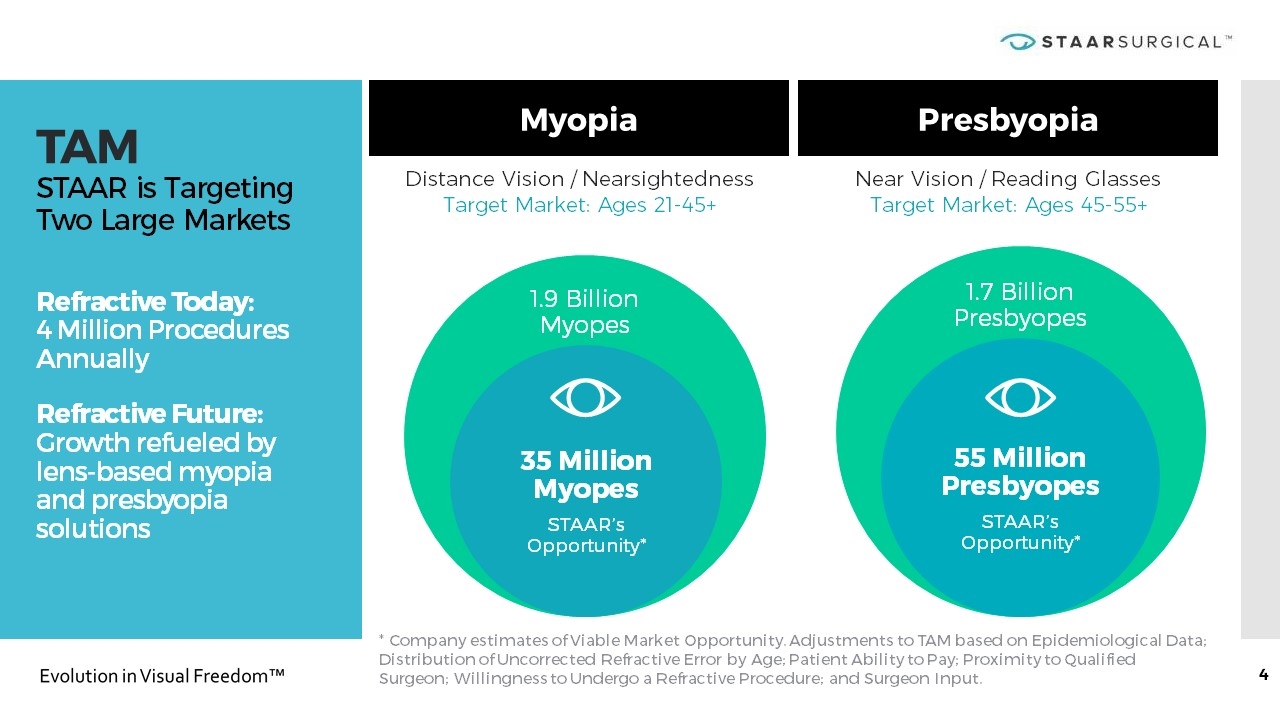

TAM STAAR is Targeting Two Large Markets Refractive Today: 4 Million Procedures Annually Refractive Future: Growth refueled by lens-based myopia and presbyopia solutions Myopia Presbyopia * Company estimates of Viable Market Opportunity. Adjustments to TAM based on Epidemiological Data; Distribution of Uncorrected Refractive Error by Age; Patient Ability to Pay; Proximity to Qualified Surgeon; Willingness to Undergo a Refractive Procedure; and Surgeon Input. Distance Vision / Nearsightedness Target Market: Ages 21-45+ Near Vision / Reading Glasses Target Market: Ages 45-55+ 1.7 Billion Presbyopes 55 Million Presbyopes STAAR’s Opportunity* 1.9 Billion Myopes 35 Million Myopes STAAR’s Opportunity*

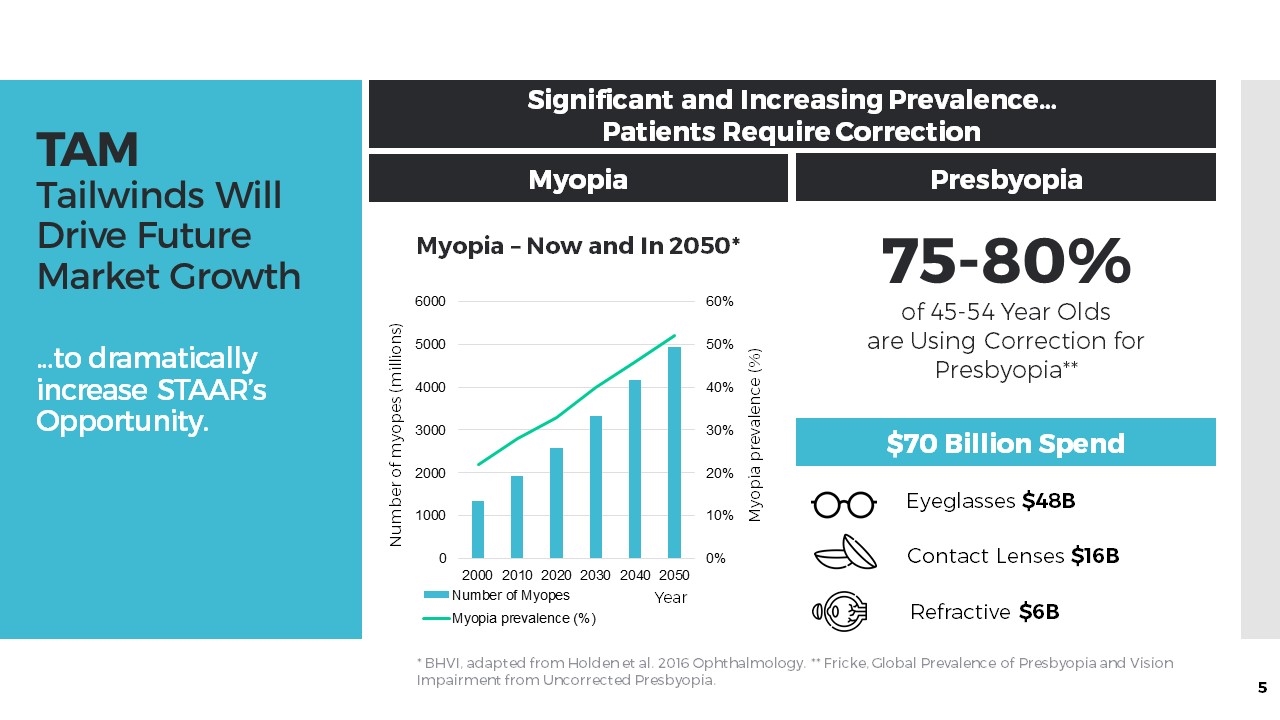

TAM Tailwinds Will Drive Future Market Growth …to dramatically increase STAAR’s Opportunity. Significant and Increasing Prevalence… Patients Require Correction Myopia Presbyopia 75-80% of 45-54 Year Olds are Using Correction for Presbyopia** $70 Billion Spend * BHVI, adapted from Holden et al. 2016 Ophthalmology. ** Fricke, Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia. Eyeglasses $48B Contact Lenses $16B Refractive $6B Number of myopes (millions) Myopia – Now and In 2050* Myopia prevalence (%) Year

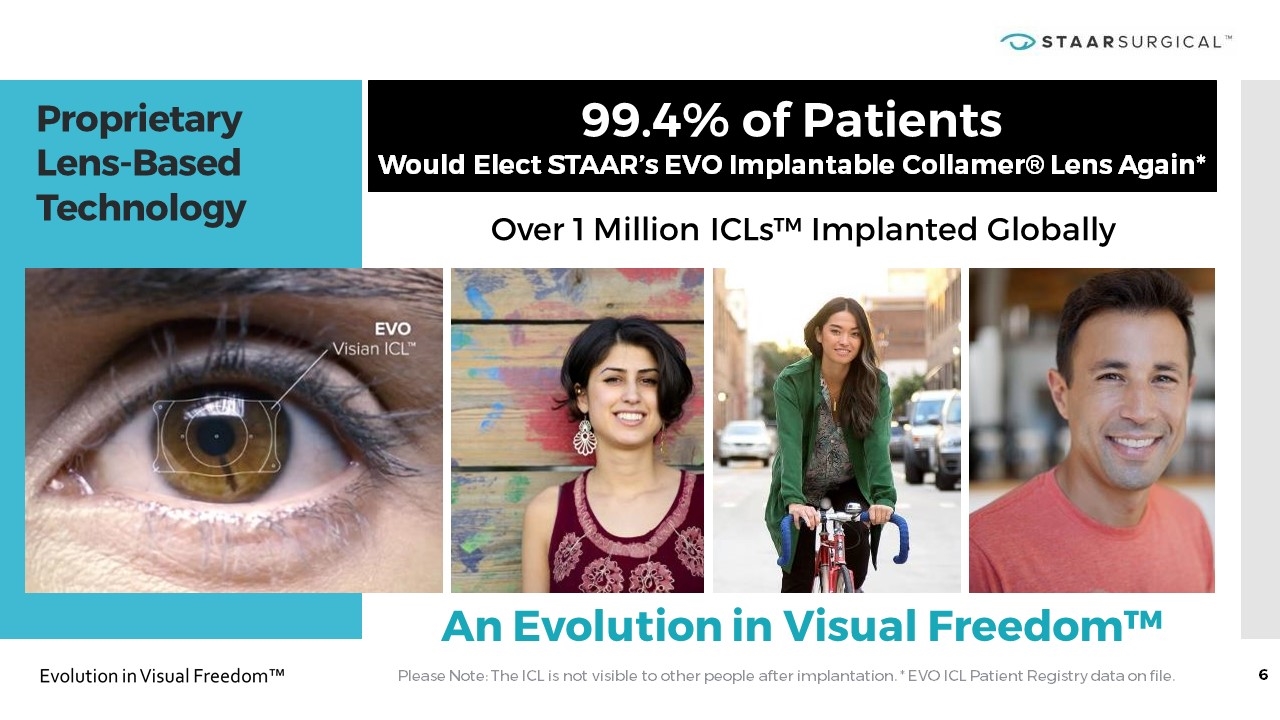

Proprietary Lens-Based Technology Over 1 Million ICLs™ Implanted Globally Please Note: The ICL is not visible to other people after implantation. * EVO ICL Patient Registry data on file. 99.4% of Patients Would Elect STAAR’s EVO Implantable Collamer® Lens Again* An Evolution in Visual Freedom™

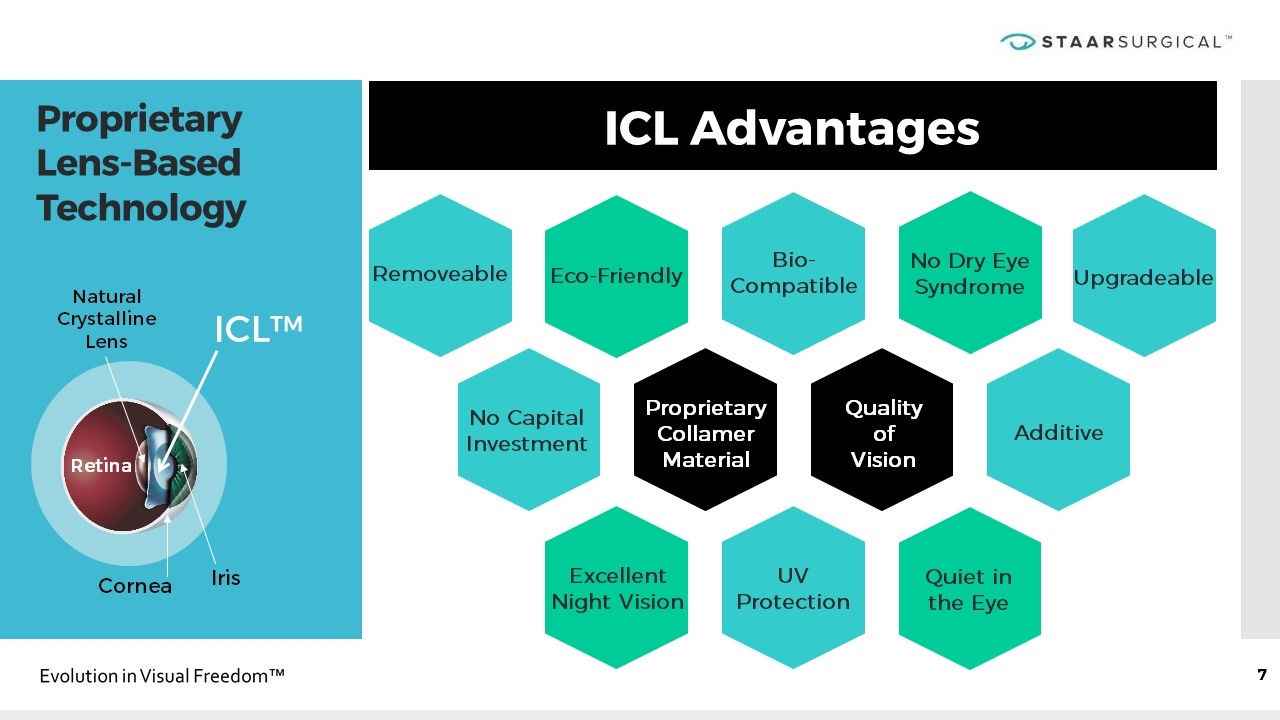

ICL Advantages Proprietary Lens-Based Technology Natural Crystalline Lens Iris Cornea ICL™ Retina Proprietary Collamer Material Quality of Vision Removeable Eco-Friendly Bio-Compatible No Dry Eye Syndrome Upgradeable No Capital Investment Excellent Night Vision Quiet in the Eye Additive UV Protection

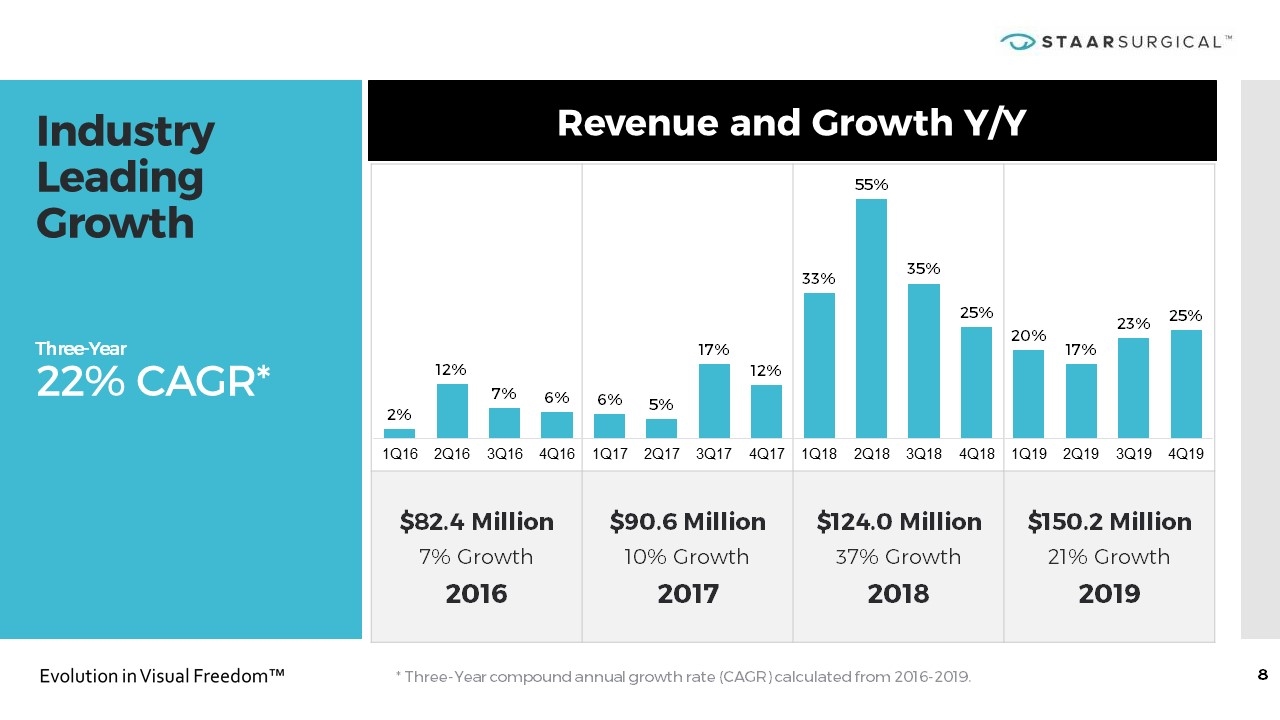

$82.4 Million 7% Growth 2016 $90.6 Million 10% Growth 2017 $124.0 Million 37% Growth 2018 $150.2 Million 21% Growth 2019 Industry Leading Growth Three-Year 22% CAGR* Revenue and Growth Y/Y * Three-Year compound annual growth rate (CAGR) calculated from 2016-2019.

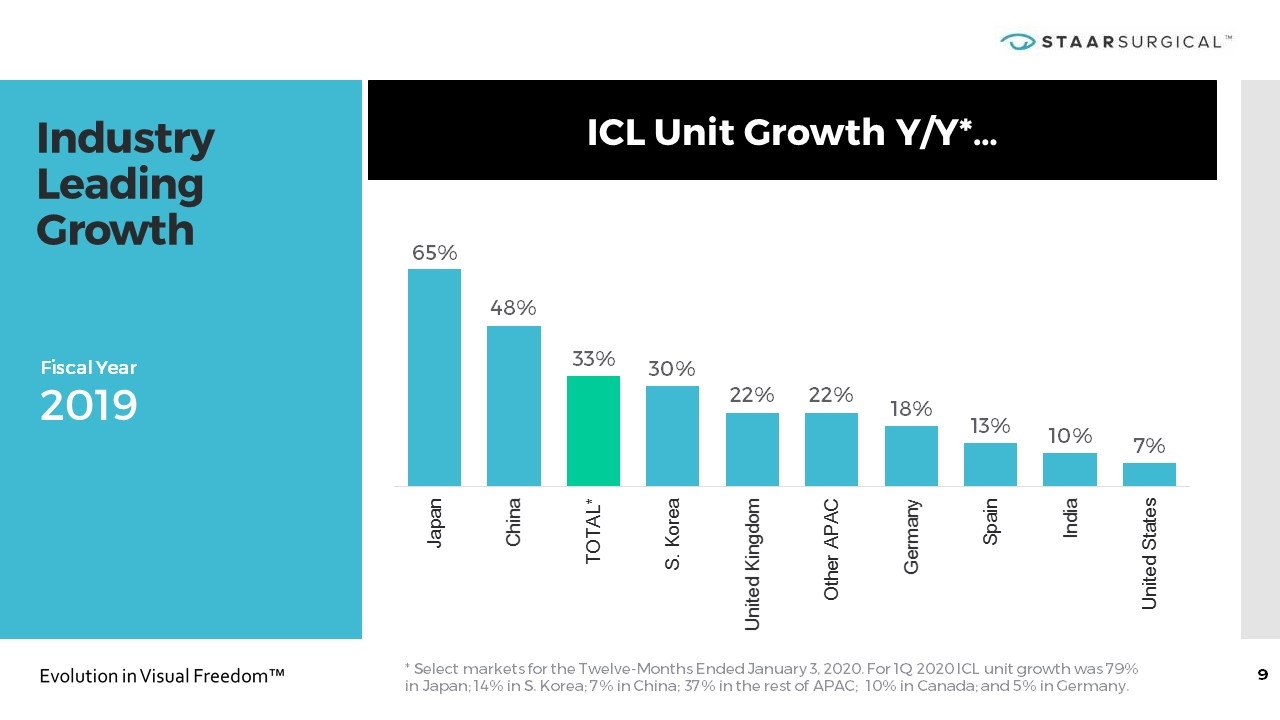

Industry Leading Growth ICL Unit Growth Y/Y*… Fiscal Year 2019 * Select markets for the Twelve-Months Ended January 3, 2020. For 1Q 2020 ICL unit growth was 79% in Japan; 14% in S. Korea; 7% in China; 37% in the rest of APAC; 10% in Canada; and 5% in Germany.

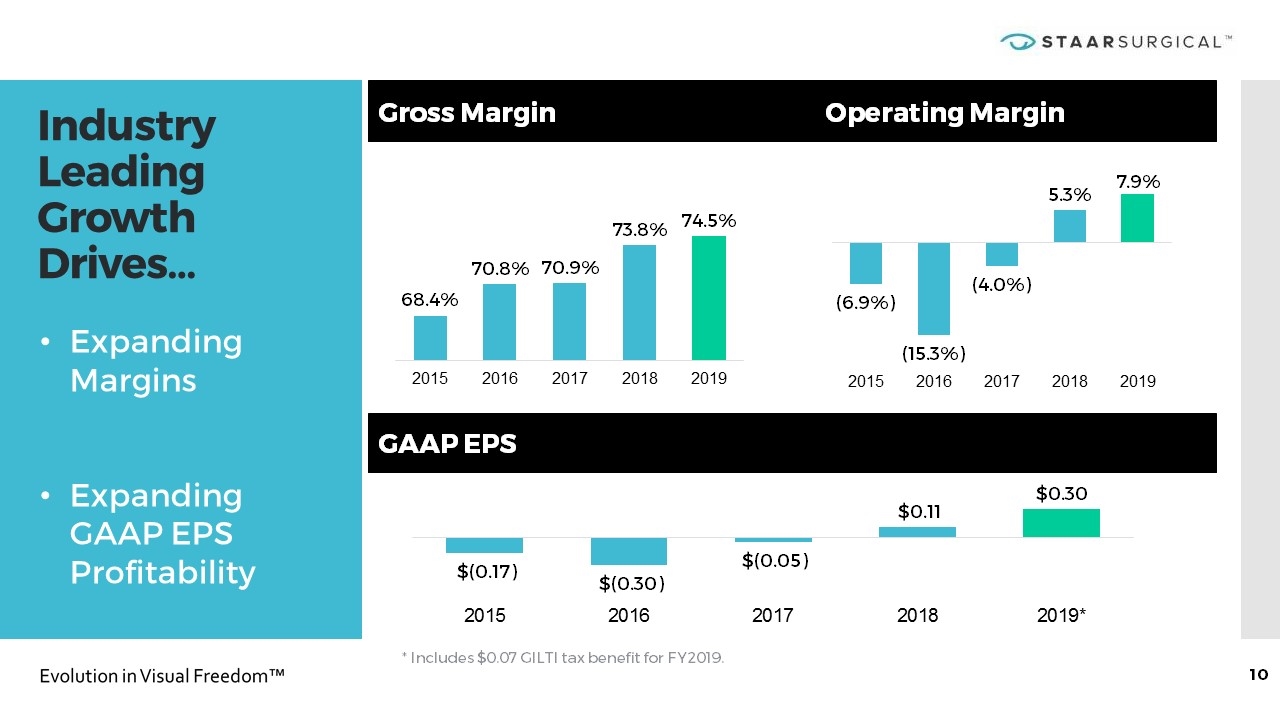

Industry Leading Growth Drives… Gross Margin Operating Margin GAAP EPS * Includes $0.07 GILTI tax benefit for FY2019. Expanding Margins Expanding GAAP EPS Profitability

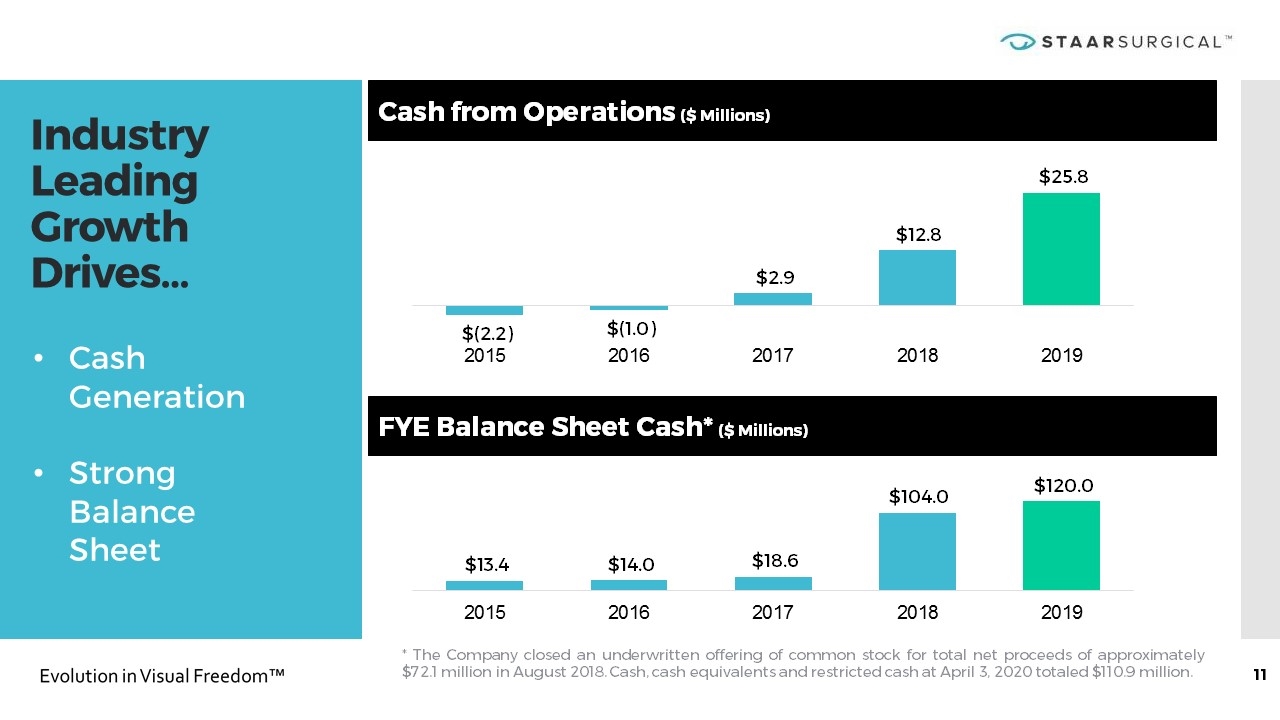

Industry Leading Growth Drives… Cash from Operations ($ Millions) FYE Balance Sheet Cash* ($ Millions) Cash Generation Strong Balance Sheet * The Company closed an underwritten offering of common stock for total net proceeds of approximately $72.1 million in August 2018. Cash, cash equivalents and restricted cash at April 3, 2020 totaled $110.9 million.

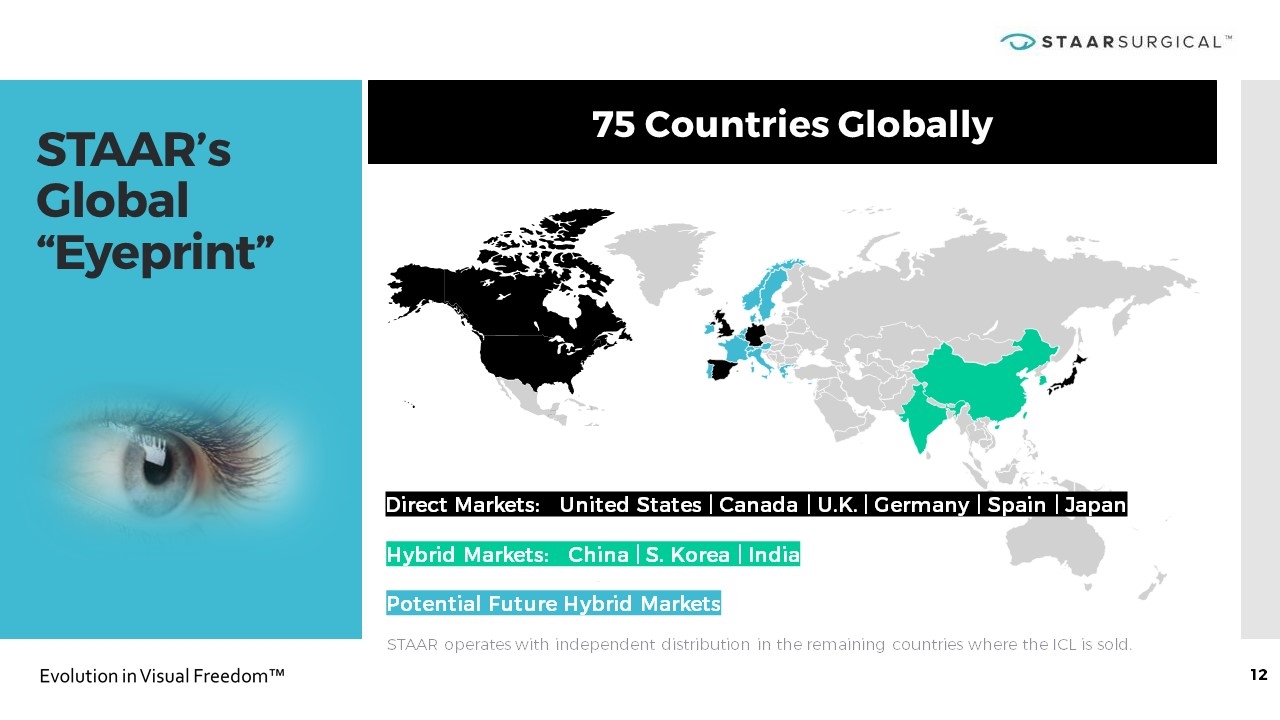

STAAR’s Global “Eyeprint” 75 Countries Globally STAAR operates with independent distribution in the remaining countries where the ICL is sold. Hybrid Markets: China | S. Korea | India Potential Future Hybrid Markets Direct Markets: United States | Canada | U.K. | Germany | Spain | Japan

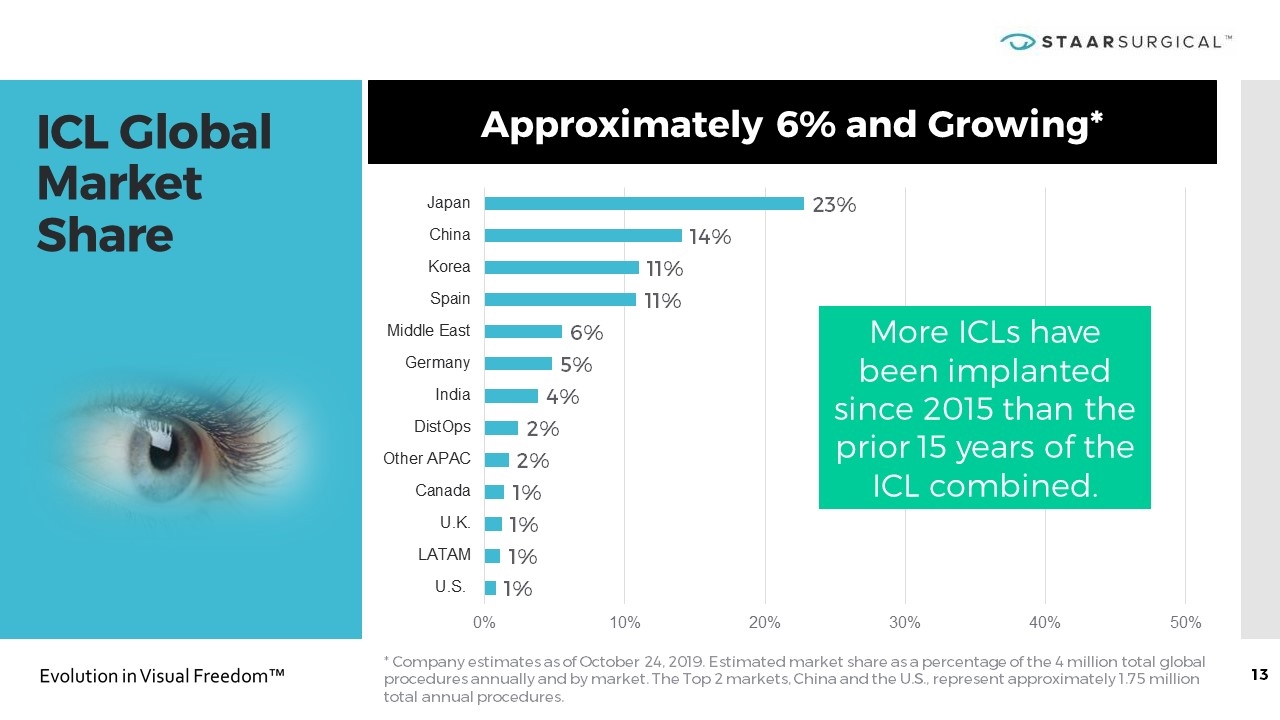

ICL Global Market Share * Company estimates as of October 24, 2019. Estimated market share as a percentage of the 4 million total global procedures annually and by market. The Top 2 markets, China and the U.S., represent approximately 1.75 million total annual procedures. Approximately 6% and Growing* More ICLs have been implanted since 2015 than the prior 15 years of the ICL combined.

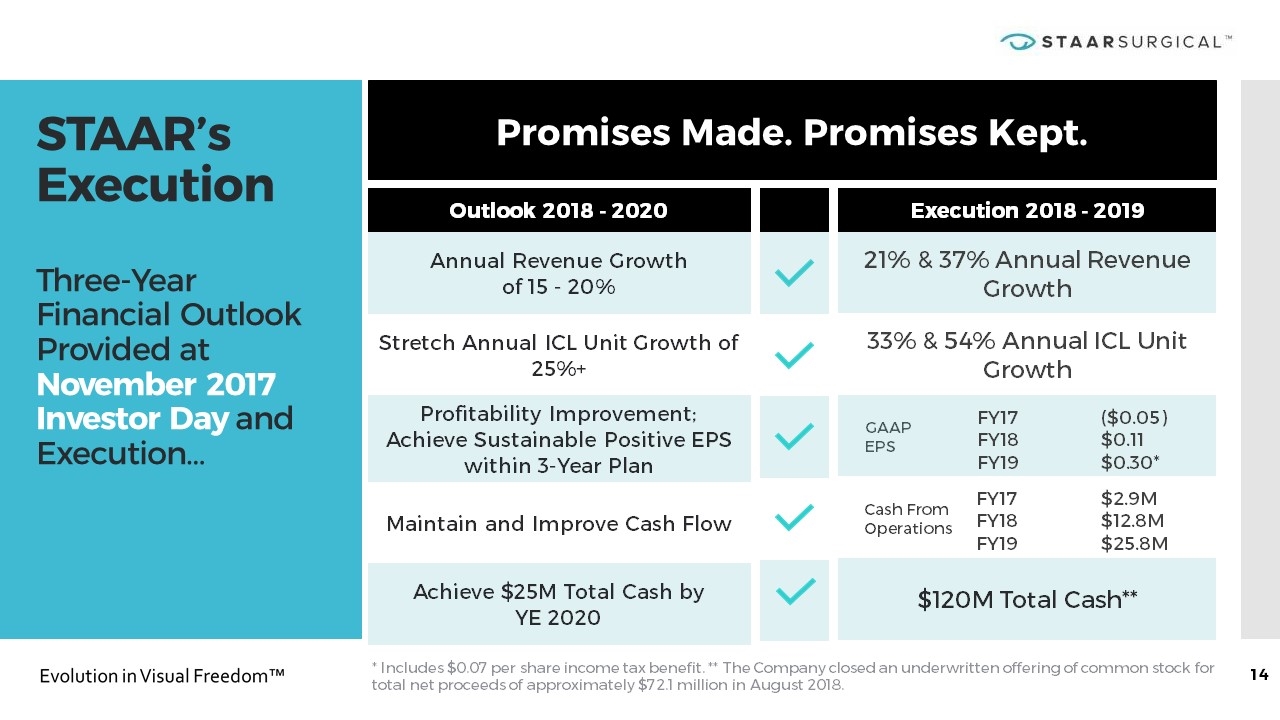

STAAR’s Execution Three-Year Financial Outlook Provided at November 2017 Investor Day and Execution… Promises Made. Promises Kept. GAAP EPS Outlook 2018 - 2020 Annual Revenue Growth of 15 - 20% Stretch Annual ICL Unit Growth of 25%+ Profitability Improvement; Achieve Sustainable Positive EPS within 3-Year Plan Maintain and Improve Cash Flow Achieve $25M Total Cash by YE 2020 Execution 2018 - 2019 21% & 37% Annual Revenue Growth 33% & 54% Annual ICL Unit Growth $120M Total Cash** FY17 FY18 FY19 ($0.05) $0.11 $0.30* Cash From Operations FY17 FY18 FY19 $2.9M $12.8M $25.8M * Includes $0.07 per share income tax benefit. ** The Company closed an underwritten offering of common stock for total net proceeds of approximately $72.1 million in August 2018.

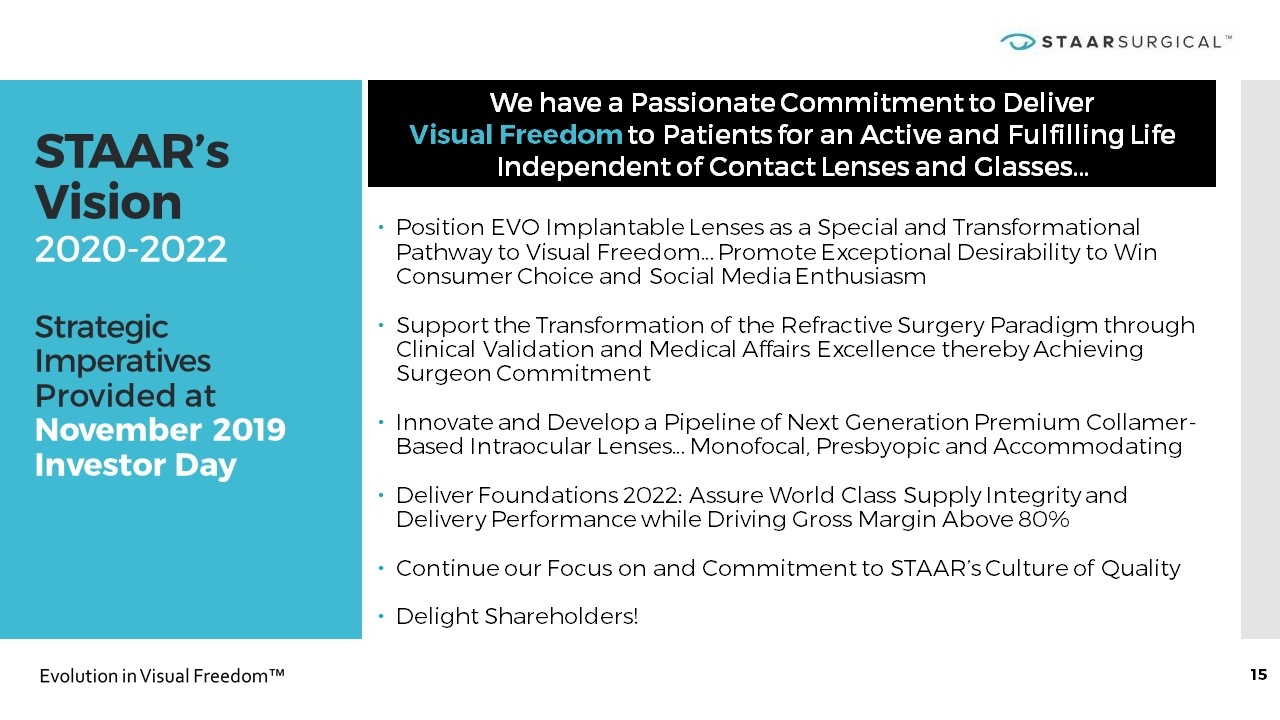

STAAR’s Vision 2020-2022 Strategic Imperatives Provided at November 2019 Investor Day Position EVO Implantable Lenses as a Special and Transformational Pathway to Visual Freedom… Promote Exceptional Desirability to Win Consumer Choice and Social Media Enthusiasm Support the Transformation of the Refractive Surgery Paradigm through Clinical Validation and Medical Affairs Excellence thereby Achieving Surgeon Commitment Innovate and Develop a Pipeline of Next Generation Premium Collamer-Based Intraocular Lenses… Monofocal, Presbyopic and Accommodating Deliver Foundations 2022: Assure World Class Supply Integrity and Delivery Performance while Driving Gross Margin Above 80% Continue our Focus on and Commitment to STAAR’s Culture of Quality Delight Shareholders! We have a Passionate Commitment to Deliver Visual Freedom to Patients for an Active and Fulfilling Life Independent of Contact Lenses and Glasses…

COVID-19 Estimated COVID-19 impact on Q1 2020 total net sales of approximately $3.8M. Adjusting for the impact of COVID-19, Q1 net sales growth would have been approximately 20% Y/Y as compared to the 8% reported. STAAR resumed manufacturing at its California production facilities on April 27, 2020 following a six-week pause enabled by inventory deployment early in the pandemic. All 14 of the principal investigator sites for the U.S. EVO Clinical trial are now opened. Patient recruiting, screening and implantation of qualified patients is underway. ICL growth in Asian markets appears to be normalizing and/or strengthening. Europe, North America, Latin America, the Middle East and smaller Asian markets are progressing at varying cadences based upon public health directives. Barring additional forced closures or challenging COVID-19 scenarios for surgeons and patients beyond Q2, STAAR expects to resume the double-digit growth outlook in Q3 and Q4.

www.staar.com www.discoverevo.com The Future of Refractive Surgery is Lens-Based... The Time for STAAR is Now