Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - HyreCar Inc. | f10k2019ex32-2_hyrecarinc.htm |

| EX-32.1 - CERTIFICATION - HyreCar Inc. | f10k2019ex32-1_hyrecarinc.htm |

| EX-31.2 - CERTIFICATION - HyreCar Inc. | f10k2019ex31-2_hyrecarinc.htm |

| EX-31.1 - CERTIFICATION - HyreCar Inc. | f10k2019ex31-1_hyrecarinc.htm |

| EX-23.1 - CONSENT OF DBBMCKENNON, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - HyreCar Inc. | f10k2019ex23-1_hyrecarinc.htm |

| EX-4.1 - DESCRIPTION OF THE REGISTRANT'S SECURITIES - HyreCar Inc. | f10k2019ex4-1_hyrecarinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2019

Or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from __________ to __________

Commission file number 001-38561

HyreCar Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 47-2480487 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 355 South Grand Avenue, Suite 1650 | ||

| Los Angeles, CA | 90071 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (888) 688-6769

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.00001 per share | HYRE | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $42,782,523 as of June 28, 2019, the last business day of the registrants most recently completed second quarter based on the closing price of the common stock on the Nasdaq Capital Market. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purposes.

16,468,335 shares of common stock were issued and outstanding as of April 14, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2020 annual meeting of stockholders (the “2020 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2020 Proxy Statement will be filed with the Securities and Exchange Commission (the “SEC”) within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

-i-

This Annual Report on Form 10-K contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may be identified by such forward-looking terminology as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties, including the risks and uncertainties inherent in our statements regarding:

| ● | our ability to add new customers or increase listings or rentals on our platform; |

| ● | our ability to expand and train our sales team; |

| ● | the potential benefits of and our ability to maintain our relationships with ridesharing companies, and establish or maintain future collaborations or strategic relationships or obtain additional funding; |

| ● | our marketing capabilities and strategy; |

| ● | our ability to maintain a cost-effective insurance program; |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; |

| ● | our competitive position, and developments and projections relating to our competitors and our industry; |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; and |

| ● | the impact of laws and regulations. |

All of our forward-looking statements are as of the date of this Annual Report on Form 10-K only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this Annual Report on Form 10-K or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the SEC could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Annual Report on Form 10-K, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Annual Report on Form 10-K that modify or impact any of the forward-looking statements contained in this Annual Report on Form 10-K will be deemed to modify or supersede such statements in this Annual Report on Form 10-K.

This Annual Report on Form 10-K may include market data and certain industry data and forecasts, which we may obtain from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications, articles and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. While we believe that such studies and publications are reliable, we have not independently verified market and industry data from third-party sources.

-ii-

Throughout this Annual Report on Form 10-K, the “Company,” “HyreCar,” “we,” “us,” and “our” refers to HyreCar Inc. and “our board of directors” or our “Board” refers to the board of directors of HyreCar Inc.

Overview

HyreCar Inc. was formed as a corporation in the State of Delaware on November 24, 2014. Our founders identified the need for a car-sharing platform for individuals who wanted to drive for ride-sharing companies such as Uber Technologies Inc. (“Uber”) and Lyft, Inc. (“Lyft”), but whose automobiles could not meet the standards imposed by the ride-sharing companies. For example, Uber maintains strict guidelines regarding the types of cars a driver can use. Although guidelines relating to cars can differ by state, in general the use of two door coupes, motorcycles and cars that are 12 years or older are excluded. Our founders, before deciding to purchase qualifying sedans that met Uber’s strict guidelines, first inquired as to whether there were any rental options available from Uber that would allow them to drive for the ride-sharing platform. To their surprise, there were no rental options available, other than a shadow industry of individuals renting cars to one another.

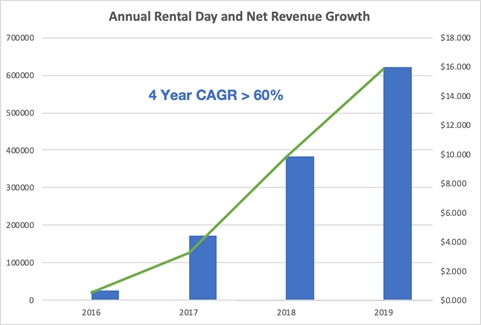

HyreCar is a car-sharing marketplace that allows car owners (collectively, “Owners”) to rent their idle cars to ride-sharing service drivers (collectively, “Drivers”). By sourcing vehicles from individual Owners, part-time Drivers may easily enter and exit the market and our business model allows us to satisfy fluctuating transportation demand in cities around the United States by matching Owners and Drivers. In 2019 we began to diversify our vehicle supply to include commercial owners of vehicles including car dealerships and fleet owners, which has helped us to increase our activity levels later in the year, and now commercial vehicles account for more than three-quarters of the rental days on our platform.

Our business is based on a proprietary car-sharing marketplace developed to (i) onboard Owners and Drivers, (ii) facilitate the matching of Owners and Drivers and (iii) log rental activity for Owners and Drivers. All transactions related to the rental (including, but not limited to, background checks, rentals, deposits and insurance costs) are run securely through the HyreCar platform. Drivers and Owners access their rental or car dashboards through a unique login. Drivers can easily initiate, terminate or extend a rental through the platform while Owners can manage their car or fleet of cars through the platform.

We believe we have a competitive advantage with our commercial automobile insurance policy that covers both Owners and Drivers. The policy is specifically designed to cover the period of time in which a Driver is operating an Owner’s vehicle while not actively operating a vehicle on a ride-sharing platform, such as Uber or Lyft. During the periods when Drivers are actively operating on a ride-sharing platform, the insurance subordinates to the state mandated insurance provided by the ride-sharing business. To our knowledge, we are the only provider of this car-matching service which is made possible by this unique insurance product.

To date, the majority of our growth has been from the dealer sales efforts to build sustainable vehicle supply focused on key markets through the United States. Our car supply has changed from mostly individuals which is where we started to now more the three quarters of our car supply and rental days coming from the commercial side of the business – consisting primarily of dealers and large fleet owners. We have seen a particular emphasis on states in the southern portion of the United States in late 2019, and now the majority of our daily rental days come from a handful of states in the Southern United States including California, Georgia, Maryland and Texas. We have also increased driver leads matched in those same kay markets, which has been achieved through organic search traffic and paid search advertising. Going forward we will direct advertising dollars strategically because we believe that online channels and offline brand awareness will provide substantial opportunities for growth.

-1-

Industry and Market Opportunities

Our company was founded to capitalize on a combination of two growth markets: ridesharing (an industry led by Uber and Lyft) and car-sharing (an industry led by companies such as Turo, Inc. and ZipCar, Inc.). Our customers are the Drivers that use our car-sharing platform to rent a car and then use that car to make money driving for either Uber or Lyft. Finding enough cars and drivers to meet demand has been a problem for ride-sharing companies. Recently we have expanded our business to add additional delivery services with companies like Instacart and Postmates,

The transportation industry represents a massive market. In the United States alone, consumer expenditures on transportation were approximately $1.3 trillion in 2019, and transportation was the second largest household expenditure after housing and was almost twice as large as healthcare and three times as large as entertainment. We believe we are still in the very early phases of capturing this massive opportunity. In 2019, ridesharing accounted for just seven percent of total vehicle miles travelled in the United States and in a 2016 survey, 57% of U.S. respondents who used sharing services said that well-priced and convenient offerings could cause them to give up ownership altogether.

We have added over 25,000 Drivers, matching them with Owner vehicles that have been used on the Uber and Lyft platforms over the past several years. During the years ended December 31, 2019 and 2018, we added approximately 11,000 and 7,000 new Drivers, respectively, into cars so that they could drive for Uber and Lyft. These numbers represent an equivalent 157.1% growth rate in new drivers onto the HyreCar platform year over year.

Ride-sharing Industry (Uber and Lyft)

The growth in ridesharing over the past few years has kicked off a transportation revolution. Smart phones are now used as ride hailing apps, transactions are processed seamlessly through online platforms and transportation as a service is becoming more and more personalized. The industry has experienced tremendous traction. According to a July 2016 post on TechCrunch, it took Uber six years, to December 2015, to complete a billion rides and by the end of 2019, Uber announced that it had completed its two-billionth ride.

Transportation Network Companies (“TNCs”) like Uber and Lyft have reported high demand from Drivers but many of these Drivers do not own a car that qualifies for their platforms. Uber reported that it had 3.9 million drivers and Lyft reported that it had 1.9 million drivers in North America at the end of 2018. In 2016, a spokesperson for Uber estimated that approximately 10% to 15% of their potential drivers/partners do not own a qualifying car. Further, Lyft estimates that there are approximately 60,000 people in the city of Chicago alone that want to drive for their platform, but do not currently own a qualifying car, and General Motors also estimates that there are approximately 160,000 potential drivers in the DC Metro area, Baltimore, Chicago and Boston who do not own a qualifying car.

Accordingly, TNCs are actively taking steps to satisfy their driver demand by setting up programs designed to get eligible drivers into qualified cars, including such programs as the Enterprise/Uber partnership, the Lyft Express Driver partnership with Hertz and Pep Boys and the General Motor’s Maven program. These programs serve as a validation that there is a healthy market to pair eligible drivers with qualified cars.

Food and Package Industry (Instacart and Grubhub)

With the growth in food, package and grocery delivery services such as Uber Eats, Postmates, Grubub and Instacart, Hyrecar expects driver demand for services like HyreCar to continue into 2021. With expected revenues for all food delivery companies to top $123B in 2020 and expectations to increase to $164B by 2024. Drivers participating into the Gig economy are diversifying their sources of income across many different TNCs and delivery services. Over 61% of all HyreCar drivers are active drivers for both rideshare and delivery service companies. The package and food delivery companies have seen tremendous demand in the first quarter of 2020, and expect continued growth into 2021 as more and more households move away from traditional in store purchase to online and mobile purchases for the same goods.

Car-sharing Industry

Shared mobility market began to rapidly develop around 2010-2011 when the total number of its users exceeded one million. In 2017, there were already around 10 million people using this type of service, and according to a study by Frost & Sullivan, by 2025 their numbers will reach 36 million, maintaining the annual growth rate of 16.4%. Global Market Insights forecasts the value of the global car sharing market in 2024 at $11 billion. At present, the leading shared mobility markets are the U.S. and Western Europe, while experts predict that Asia will experience the fastest growth in this field. HyreCar will be able to capitalize on this opportunity as existing demand from traditional taxi and public transportation options is transferred to shared transportation. Further, growth is expected from this opportunity as the accelerating trend of the mass ease-of-use and availability of shared transportation permanently shifts driving habits away from personal vehicle ownership. Evidence of this decline, while not yet a national trend, can be seen in large cities as vehicle ownership is beginning to decline. Longer term, we envision a potential impact on the auto industry as a whole from a subset of people permanently changing their driving habits and selling their cars entirely in favor of using shared transportation.

-2-

Competition

The key differentiator between HyreCar and our competitors is our asset light model, which allows us to connect excess car inventory to drivers without actually owning or managing the vehicles. This allows our prices to be competitive with other vehicle solutions because we do not have the monthly vehicle overhead or infrastructure costs that our competitors may have. Other advantages include the following:

| 1. | Pay-As-You-Go: Drivers using our platform are not locked into lengthy lease agreements, monthly contracts or subscription fees. Our payment model is upfront and transparent. While our competitors engage in auto-debiting payment for the rented vehicle from the Drivers’ accounts, regardless of their current account balance, under our platform Drivers pay for the term of rental up-front, extend if they are financially able, and return the rented vehicle whenever they need with no “strings” attached. We are the only company providing this type of fluid and frictionless car transaction for Uber and Lyft drivers. |

| 2. | Convenience: In some cases, drivers are renting a car from their neighbors. They walk down the street, take the keys and go. With Hertz, FlexDrive, Fair or Avis, only one or two retail outlets participate in the Uber and Lyft programs. |

| 3. | Fungibility: For most of HyreCar’s drivers, the ability to use the same car for rideshare and food delivery is an important reason why they choose our platform. Coupled with a comprehensive protection program that includes insurance and other services, drivers are attracted to this unique service not offered by our competition. |

Among vehicle solutions for ride-sharing rentals, there are Hertz, FlexDrive, Fair, Avis and HyreCar. These car rental companies are similar in one way: they operate in the U.S. and provide cars drivers to rent and drive on the Uber or Lyft platform. However, their business models vary widely.

Fair.com (“Fair”) was a very strong competitor starting in mid-2019 after it entered into a vehicle supply partnership with Uber, following Uber’s spring 2019 Initial Public Offering. Fair was offering promotional weekly rates to Uber drivers which presented a competitive threat in certain marketing, particularly in California. The partnership came to an end in February 2020 when Uber announced it was ending this “Fair Go” partnership, and as a result Fair has exited the weekly rental business and began repossessing cars from more than 10,000 drivers mostly in the state of California in March 2020.

A comparative analysis of markets, pricing limitations and age requirements are as follows:

|

|

|

|

| |

| Available Markets | Nationwide | ATL, Boston, Chicago, Denver, Los Angeles, Orange County, Miami, New Orleans and the San Francisco Bay Area | ATL, Austin, Houston, Los Angeles, Philadelphia and San Francisco | Primarily California |

Atlanta,

Austin, Boston, Charlotte, Chicago, Cincinnati, Cleveland, Columbus, Dallas, Denver, Houston, Indianapolis, Las Vegas, Los

Angeles, Miami, St. Paul, Nashville, New Jersey, Philadelphia, Pittsburgh, Portland, Raleigh-Durham, San Diego, San Francisco,

Seattle, St Louis and Washington, D.C. |

| Rental Minimum | Minimum 2 days rental | Minimum 7 days rental and can only extend in 7 days increments 3 times then car has to be returned after 28 days for inspection. | Minimum

7 days rental Disqualified from Express Pay and driving bonuses |

Minimum 7 days but you can keep car as long as you want, after 3 days per 100 miles return policy | Minimum 7 days rental |

| Service Limitation | None, a Driver can drive for Lyft, Uber, Uber Eats, DoorDash, Postmates, etc. | Lyft only | Lyft only | Uber only | Uber only |

| Deposit | None | $200 | $250 | $185 | None |

| Average Weekly Rates | Owners set pricing average at $250 per week | $240 per week plus tax and mileage fees | $209 per week, taken directly out of earnings | $185 per week | $150 plus tax for 700 miles or $214 plus tax per week unlimited miles |

| Age Requirement | 21 | 25 | 25 | 21 | 25 |

| Other | Variety of different locations depending on the market to be picked up in 24 hours | Not available at all Hertz locations. Appointments do not always mean vehicles are available, can take weeks. | Pick up at CarMax locations. Must set an appointment day in advance, can take weeks to get into a car. |

Uber cancelled the Fair Go weekly rental partnership in February 2020. | Avis locations, must rent in advance with appointment |

-3-

Our Strengths

Using our website platform or mobile applications (iOS and Android), vehicle Owners can post their cars to our marketplace and Drivers can browse car inventory prior to rental. Once a Driver finds a car, he or she creates a profile, enters his or her personal information and credentials (including, address, city, state, a copy of applicable state issued driver’s license, Uber or Lyft credentials and social security number) and submits a credit card for payment. We then perform a criminal background check, DMV driving record check, Homeland Security Watch-list and Sex Offender database check. HyreCar’s screening criteria is stricter than Uber and Lyft’s background check and we are focused on maintaining a safe user experience and ensuring that all transactions between owners and drivers are processed through a secure web platform. The attraction and vetting of qualified gig economy drivers is a primary reason why commercial automobile businesses around the country are increasingly working with the Company.

Why Drivers Use Our Service

| ● | Attractive Market: Drivers’ ability to earn income by driving for a ride-sharing business. |

| ● | Pay-As-You-Go: Drivers are not locked into long-term lease agreements, long-term monthly payments or subscription fees. |

| ● | Convenience: Drivers can pick up the car from someone close by. Time from registration to getting behind the wheel currently averages under 48 hours. |

| ● | Transparency and Trust: There are no hidden fees and only Owners that have been properly screened are permitted to use the platform. |

| ● | Customer Experience: Application of game-design elements (i.e. gamification) of the platform keeps Drivers engaged. |

Why Owners Use Our Service

Data from a national survey of driving behavior indicates that private vehicles are in use 5% or less during any given day, or about one hour per day. Given the excess capacity of vehicle hours, higher vehicle utilization rates, and lower vehicle ownership rates, we expect a consumer shift towards acceptance of car-sharing. Based on the results of the survey, we believe our platform is advantageous for the following reasons:

| ● | Passive Income: We often match Owners with long term Drivers, which provides the Owners with a steady source of passive income resulting from our seamless re-booking process. |

| ● | Insurance: Liability policy fills the gaps left by personal and ride-sharing policies. |

| ● | Review of Drivers: Drivers must pass our extensive background checks and most Drivers have also passed the Uber and Lyft background checks. |

Insurance Coverage

A key component to our business is our commercial auto insurance coverage. The two-sided nature of our platform means that we need to insure both the Driver and the Owner. Prior to any rental the Driver and Owner are provided an insurance ID card that lists the driver’s name and the vehicle identification number. Insurance is typically generated twenty-four hours in advance of the commencement of the rental through to when the Owner confirms drop-off of the rented vehicle by the Driver. The vehicle pick-up and drop-off is all managed through our platform. An Owner takes pictures of his or her vehicle prior to pressing the “Confirm Pick-up” button on the HyreCar mobile app. (If pictures are not taken and the button is not pressed, it provides grounds for a claim denial; subsequent liability and/or physical damage rests solely on the Driver and Owner.) After the rental is completed, the Owner presses the “Confirm Drop-off” button on the HyreCar mobile app and the rental ends.

-4-

American Business Insurance Services (“ABI”) is our insurance broker and YRisk is our mobility-focused managing general underwriter, YRisk was sold by our incumbent insurance company American International Group (NYSE: AIG) to The Hartford (NYSE: HIG) in December 2018 and is currently a subsidiary of HIG. We moved our annual car insurance policy to The Hartford for the plan year from April 2019 to May 2020 under superior pricing and terms. ABI handles all of our back-end insurance generation and processing through an API connection with HyreCar databases. ABI is a top broker in the United States for the Taxi and Livery business. Mr. David Haley, president of ABI, sits on our strategic advisory board.

For insurance purposes a vehicle rental is broken into four distinct driving periods. Period 0 is when the Driver has picked a vehicle up from the Owner and is driving with the Uber or Lyft app turned-off. Period 1 is when the Driver has the Uber or Lyft app turned-on but has not yet accepted a fare. Period 2 is when the Driver has accepted a fare and is on the way to pick-up a passenger. Period 3 is when a passenger is in the vehicle. The HyreCar policy is specifically written to cover periods in which the Drivers are operating HyreCar vehicles OFF the Uber or Lyft platform (period 0). During the periods when Drivers are operating ON the Uber or Lyft platform (periods 1, 2 and 3), the HyreCar insurance subordinates to state mandated insurance provided by Uber and Lyft. This enables us to keep insurance costs and liability low by leveraging state mandated insurance policies provided by the TNCs.

Business Structure and Strategy

We operate out of our corporate office in Los Angeles, California. Our technology platform allows for a relatively small staff compared to the size and reach of our business. For example, our platform matches drivers and owners in all 50 U.S. States and the District of Columbia with no physical presence in those states, with the exception of California. Our business structure is divided into three distinct departments: General and Administrative, Sales and Marketing and Research and Development.

Sales and Marketing are vital to our future profitability and growth. Most of our customers need to be sold into a car because they are initially reluctant to pay upfront fees. Early interactions with our customers indicated that if customers were walked through the process once by a member of our sales and marketing team, the customers were more inclined to use and continue to use our services for a longer period of time.

We have expanded the sales team to a total of 42 employees, including 3 managers, which are divided into a Driver team and an Owner team. The Driver team has a total of 16 sales agents and Driver team members make a large volume of calls a day to new customer leads with a mandate to facilitate drivers into cars via the HyreCar platform. The Owner team has a total of 14 sales agents split evenly into the following three regions: west coast states, central states and east coast states. The Owner sales team’s primary objective is to get Owners to list their cars on the HyreCar platform. As the sales team has become more efficient as we have scaled, we don’t expect the need to add headcount as rapidly through 2020 in order for us to continue to achieve forecasted revenue growth rates.

Leveraging headcount more efficiently is a key assumption that we believe drives profitability. The ability to grow topline revenue without significant increases to operating expense is achieved through a combination of marketing, sales, support and technology. Attribution of organic bookings is directly related to the quality of marketing leads generated and user interface/experience enhancements (UI/UX) per technology development. HyreCar has invested in a partnership with a leading SEO firm to continue maximizing organic rankings on Google search pages. Additionally, new market automation tools have allowed HyreCar to communicate directly with its drivers with specially curated messaging to increase awareness of available vehicles and incentive programs for each target DMA and market segment. The company’s expectation is that both aspects contribute to low operating expense growth in relation to revenue, which in-turn, the company believes, will lead to higher gross profit in 2020.

We currently operate with one technology development team in the United States, including multiple full-time developers based out of our home office in Los Angeles. These teams are tasked with maintaining the current codebase and website, and incrementally adding enhancement to the Owner and Driver application and website to support our expansion into institutional car supply nationally.

Support and operations underpin the company. New Dealer onboarding, insurance claims management, owner payment resolutions, Driver payment resolutions, collections, chat support, email support, phone support, late rentals, car recovery, Driver verifications, insurance generation and insurance verification all work together to create what we believe is a “best in class” customer service experience. Currently, we have 14 in-house customer support staff in our Los Angeles office as well as 40 independent contractors located in the Central Time Zone through our outsourced partner who we added in mid-2019. Our plan is to focus our domestic customer support team on being client-facing for larger commercial accounts and scale by outsourcing as we continue to grow. We believe that customer service is critical to our goal of bringing new Drivers/Owners onto the platform and retaining those customers who have already utilized our services.

-5-

Revenue Model

We generate revenue by taking a fee out of each rental processed on our platform. Each rental transaction represents a Driver renting a car from an Owner. Drivers pay a daily rental rate set by the Car Owner, plus a 10% HyreCar Driver Fee and direct daily insurance costs. Owners receive their daily rental rate minus a 15-25% HyreCar Owner Fee. For example, as of December 31, 2019, the average daily rental rate of a HyreCar vehicle nationally is approximately $38.00 (“Daily Rental Rate”), plus a 10% HyreCar Driver fee ($3.80) and daily direct insurance fee of $13.00, totaling $54.80 in total daily gross billings in paid by the Driver via a credit card transaction. On average approximately 80% of the daily rental or $30.40 is transferred to the Owner via our merchant processing partner. HyreCar earns revenues from the two revenue share fees and the insurance totaling approximately $24.40 per day. Accordingly, the GAAP reportable revenue recognized by HyreCar is $24.40 in this example transaction as detailed in the following table:

| Daily Gross Revenue Example | Daily Net (GAAP) Revenue Example | |||||||||

| National Avenger Daily Rental Rate | $ | 38.00 | HyreCar Owner Fee (20% Avg) | $ | 7.60 | |||||

| Driver Fee | $ | 3.80 | HyreCar Driver Fee (10% rate) | $ | 3.80 | |||||

| Daily Insurance Fee | $ | 13.00 | Insurance Fee (100% of fee) | $ | 13.00 | |||||

| Daily Gross Billing Paid by Driver | $ | 54.80 | Daily Avenger Net Revenue | $ | 24.40 | |||||

Gross billings is an important measure by which we evaluate and manage our business. We define gross billings as the amount billed to Drivers, without any adjustments for amounts paid to Owners or refunds. It is important to note that gross billings is a non-GAAP measure and as such, is not recorded in our consolidated financial statements as revenue. However, we use gross billings to asses our business growth, scale of operations and our ability to generate gross billings is strongly correlated to our ability to generate revenues. Gross billings may also be used to calculate net revenue margin, defined as the company’s GAAP reportable revenue over gross billings. Using the definition of net revenue margin and the example above, HyreCar’s net revenue margin is equal to approximately 44.3% ($15,854,924 HyreCar’s GAAP revenue over $35,819,000 Total Gross Billings). A breakout of revenue components is provided in the section of this Annual Report on Form 10-K titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the footnotes to our audited consolidated financial statements.

Marketing Plan

Our marketing team periodically reviews keyword searches using Google Analytics. Thirty keywords and phrases were chosen and analyzed, allowing the team to determine in which cities the persons searching for the keywords and phrases were located. For example, approximately 400,000 people in Los Angeles googled key words like, “rent a car for Uber,” “Uber,” and “Uber Leasing.” Overlaying our customer demographics with the Google search results created a Driver/Owner affinity population of approximately 25 million potential customers, with the bulk of the 25 million concentrated in 16 core geographic locations. Our key geographies currently consist of ten key metropolitan statistical areas (MSA) based on the driver demand for ridesharing and delivery activity as part of the gig economy with large population bases. As we built out the institutional car supply through year ended December 31, 2019, our historical car supply constraints were addressed. Further, we have started focusing more locally on approximately ten key metropolitan markets primarily in the southern United States. Currently more than 75% of our car supply comes from commercial versus individual sources, with half of our rental days come from four southern states.

-6-

Insurance Opportunity

A large percentage of our cost of revenues is direct insurance expense, which we pay to the insurance company. The premiums are broken into two categories, liability insurance and physical damage. The unique nature of our insurance enables us to keep insurance costs and liability low by leveraging state mandated insurance policies provided by the Transportation Network Companies.

In addition to self-insurance, the company is also working with our Managing General Underwriter (“MGU”) to develop new and innovative insurance products. The company has proposed a new type of owner “lay-up” insurance and higher insurance level for fleet vehicle owners on the HyreCar platform. Lay-up insurance replaces the need for an owner’s personal auto insurance policy and would represent significant cost savings when compared to other insurance options available in the market today. Offering this type of insurance product benefits the company in multiple verticals, including reduced insurance claim expense, greater customer retention and stickiness to the HyreCar platform. Our MGU has begun piloting lay-up insurance to vehicle owners.

Regulation

The California Public Utilities Commission (“CPUC”) was the first state regulatory body to impose rules and guidelines for ridesharing in the United States. The CPUC designated Uber and Lyft as “transportation network companies” or TNCs. The CPUC guidelines became the standard for all states across the U.S. Most states have adopted some form of the guidelines. California is one of the strictest states when it comes to regulating the TNCs. Our insurance works within the California guidelines which make it easily adoptable by future state mandates outside of California.

Changes in government regulation of our business have the potential to materially alter our business practices or our operational results. Depending on the jurisdiction, those changes may come about through the issuance of new laws and regulations or changes in the interpretation of existing laws and regulations by a court, regulatory body or governmental official. Sometimes those changes may have not just prospective but also retroactive effect; this is particularly true when a change is made through reinterpretation of laws or regulations that have been in effect for some time. Moreover, changes in regulation that may seem neutral on their face may have either more or less impact on us than on ride-sharing businesses, depending on the circumstances. Potential changes in law or regulation that may affect us relate to insurance intermediaries, customer privacy, data security and rate regulation.

In addition, our operations also could be affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. We are not aware of any current proposal to impose such a regime in the U.S. or internationally. Such a regime could, however, be quickly imposed if there was a serious disruption in the fuel supply for any reason, including an act of war, terrorist incident or other problem, such as the devastation caused by hurricane Harvey, affecting the petroleum supply, refining, distribution or pricing.

Employees

As of April 14, 2020, we employ 86 full-time personnel primarily in our headquarters location in downtown Los Angeles, California.

Our Corporate Information

We were incorporated as a Delaware corporation on November 24, 2014. Our principal executive offices are located at 355 South Grand Avenue, Suite 1650, Los Angeles, California 90071, and our telephone number is (888) 688-6769.

Available Information

Our website address is www.hyrecar.com. The contents of, or information accessible through, our website are not part of this Annual Report on Form 10-K, and our website address is included in this document as an inactive textual reference only. We make our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports, available free of charge on our website as soon as reasonably practicable after we file such reports with, or furnish such reports to, the SEC. The public may read and copy the materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may also obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an internet site that contains reports, proxy and information statements and other information. The address of the SEC’s website is www.sec.gov. The information contained in the SEC’s website is not intended to be a part of this filing.

-7-

You should carefully consider the risks described below, as well as general economic and business risks and the other information in this Annual Report on Form 10-K. The occurrence of any of the events or circumstances described below or other adverse events could have a material adverse effect on our business, results of operations and financial condition and could cause the trading price of our common stock to decline. Additional risks or uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to Our Business and Our Industry

Our limited operating history makes it difficult to evaluate our current business and prospects and may increase the risks associated with your investment.

We were founded in 2014. Our limited operating history makes it difficult to evaluate our current business and prospects and plan for and model our future growth. We have encountered and will continue to encounter risks and uncertainties frequently encountered by rapidly growing companies in developing markets. If our assumptions regarding these risks and uncertainties are incorrect or change in response to changes in the ridesharing or car-sharing market, our results of operations and financial results could differ materially from our plans and forecasts. Although we have experienced rapid growth since our inception, there is no assurance that such growth will continue. Any success we may experience in the future will depend in large part on our ability to, among other things:

| ● | maintain and expand our customer base and the ways in which customers use our platform; |

| ● | expand revenue from existing customers through increased or broader use of our platform; |

| ● | improve the performance and capabilities of our platform through research and development; |

| ● | effectively expand our business domestically and internationally, which will require that we rapidly expand our sales force and fill key management positions; and |

| ● | successfully compete with other companies that currently provide, or may in the future provide, solutions like ours. |

If we are unable to achieve our key objectives, including the objectives listed above, our business and results of operations will be adversely affected, and the fair market value of our securities could decline.

If we do not respond appropriately, the evolution of the automotive industry towards autonomous vehicles and mobility on demand services could adversely affect our business.

The automotive industry is increasingly focused on the development of advanced driver assistance technologies, with the goal of developing and introducing a commercially viable, fully automated driving experience. The high development cost of active safety and autonomous driving technologies may result in a higher risk of exposure to the success of new or disruptive technologies different than those being developed by us. There has also been an increase in consumer preferences for mobility on demand services, such as car and ridesharing, as opposed to automobile ownership, which may result in a long-term reduction in the number of vehicles per capita. These evolving areas have also attracted increased competition from entrants outside the traditional automotive industry. If we do not continue to innovate to develop or acquire new and compelling products that capitalize upon new technologies in response to OEM and consumer preferences, this could have an adverse impact on our results of operations.

-8-

If we do not effectively expand and train our direct sales force, we may be unable to add new customers or increase sales to our existing customers, and our business will be adversely affected.

We continue to be substantially dependent on our direct sales force to obtain new customers and increase sales with existing customers. There is significant competition for sales personnel with the skills and technical knowledge that we require. Our ability to achieve significant revenue growth will depend, in large part, on our success in recruiting, training and retaining sufficient numbers of sales personnel to support our growth. New hires require significant training and may take significant time before they achieve full productivity. Our recent hires and planned hires may not become productive as quickly as we expect, and we may be unable to hire or retain sufficient numbers of qualified individuals in the markets where we do business or plan to do business. In addition, because we continue to grow rapidly, a large percentage of our sales force is new to our company. If we are unable to hire and train a sufficient number of effective sales personnel, or the sales personnel we hire are not successful in obtaining new customers or increasing sales to our existing customer base, our business will be adversely affected.

Fluctuating economic conditions make it difficult to predict revenue for a particular period, and a shortfall in revenue may harm our operating results.

Our revenue depends significantly on general economic conditions and the demand for products in the ridesharing and car-sharing market. Economic weakness, customer financial difficulties, global macroeconomic shocks such as the recent coronavirus outbreak, and constrained spending on ridesharing may result in decreased revenue and earnings. Such factors could make it difficult to accurately forecast our sales and operating results.

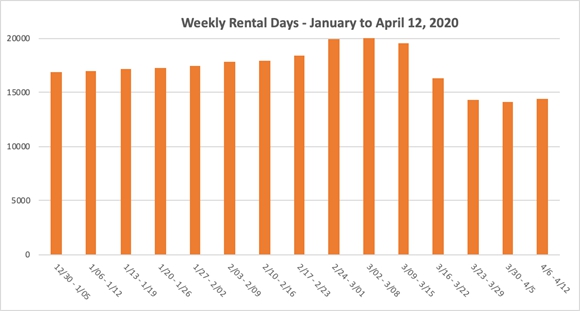

On January 30, 2019 the World Health Organization declared the COVID-19 coronavirus outbreak a “Public Health Emergency of International Concern” and on March 10, 2020, declared it to be a pandemic. Actions taken around the world to help mitigate the spread of the coronavirus include restrictions on travel, and quarantines in certain areas, and forced closures for certain types of public places and businesses. The COVID-19 coronavirus and actions taken to mitigate it have had and are expected to continue to have an adverse impact on the economies and financial markets of many countries, including the geographical area in which the Company operates. While it is unknown how long these conditions will last and what the complete financial effect will be to the company, to date, the Company has experienced a revenue decrease of approximately one-third of net sales from the beginning to the end of March 2020 due to lower driver demand and car supply shortages in certain metropolitan markets. Our concentrations in large metropolitan markets make it reasonably possible that we are vulnerable to the risk of a significant near-term impact. In response, the Company has moved aggressively to diversity its business from to include delivery in addition to ridesharing.

The Company worked closely with our primary banking partner to apply for a Small Business Administration (SBA) Paycheck Protection Program Loan in the amount of $2,004,175 as an existing client on April 9, 2020. The application was processed through the SBA system, the loan was approved and funded, with the Company receiving the full loan proceeds of $2,004,175 in its bank account on April 13, 2020.

We have no formal contracts with either Uber or Lyft and our current relationships with either of these companies could change in the future, which could adversely affect our revenues.

Although we have deployed drivers and cars to the systems of both Uber and Lyft since our operations began in 2015, there is currently no formal contractual relationship in place with either company. We have an arrangement with Lyft that allows us to activate our Drivers through Lyft’s sign-up portal; however, this is an oral arrangement that has not been memorialized in a written agreement. Consequently, each of these relationships could be discontinued at any time. In addition, virtually all of our revenue is generated by cars and drivers operating on both the Uber or Lyft platform and therefore this concentration represents a high degree of risk to us and to potential investors.

The ride-sharing model may not continue to grow, which would adversely affect our business.

Our business and future growth is significantly dependent on the continued success of each of Uber, Lyft, and other software-based systems that have come into the marketplace to compete with standard taxicab transportation organizations.

While the effect of those companies has been to decrease the cost and therefore increase the utilization of ride-sharing, there can be no assurance that consumer utilization of these systems will continue to grow, or that competition and the resulting price pressure will not undermine the viability of these types of systems, thereby adversely affecting our business.

Our unique peer to peer structure could be duplicated and our inability to accurately predict user behavior could negatively impact our sales business.

Although to date neither Uber nor Lyft have endeavored to develop a peer-to-peer system to match drivers and car owners as we are doing, there can be no assurance that either one of these companies or other competitors subsequently entering the marketplace will not endeavor to do so, and there can be no assurance that such competition will not have a negative impact on our business.

Furthermore, although several attempts to match up fleets of cars owned by operators with Uber and Lyft drivers have failed, there can be no assurance that other entities will not enter the marketplace on this basis with economic and logistical models that solve the problems that caused this failure.

-9-

The market forecasts included in this Annual Report on Form 10-K may prove to be inaccurate, and even if the markets in which we operate achieve growth, we cannot assure you our business will grow at similar rates, if at all.

Growth forecasts are subject to significant uncertainty and are based on assumptions and estimates, which may not prove to be accurate. Forecasts relating to the expected growth in the ride-sharing market, including the forecasts or projections referenced in this Annual Report, may prove to be inaccurate. Even if the ride-sharing market experiences the forecasted growth, we may not grow our business at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of market growth included in this Annual Report should not be taken as indicative of our future growth.

We rely on third-party insurance policies to insure auto-related risks. If insurance coverage is insufficient for the needs of our business or our insurance providers are unable to meet their obligations, we may not be able to mitigate the risks facing our business, which could adversely affect our business, financial condition and results of operations.

We procure third-party insurance policies which provide coverage for both Owners and Drivers on our platform. If the amount of one or more auto-related claims were to exceed our applicable aggregate coverage limits, we may bear the excess liability. Insurance providers have raised premiums and deductibles for many businesses and may do so in the future. As a result, our insurance and claims expense could increase. Our business, financial condition and results of operations could be adversely affected if (i) cost per claim, premiums or the number of claims significantly exceeds our historical experience and coverage limits, (ii) we experience a claim in excess of coverage limits, (iii) our insurance providers fail to pay insurance claims, or (iv) we experience a claim for which coverage is not provided.

Our actual losses may exceed our insurance reserves, which could adversely affect our financial condition and results of operations.

We establish insurance reserves for claims incurred but not yet paid and claims incurred but not yet reported and any related estimable expenses, and we periodically evaluate and, as necessary, adjust our insurance reserves as our experience develops or new information is learned. We employ various predictive modeling actuarial techniques and make numerous assumptions based on limited historical experience and industry statistics to estimate our insurance reserves. Estimating the number and severity of claims, as well as related judgment or settlement amounts, is inherently difficult, subjective, and speculative. A number of external factors can affect the actual losses incurred for any given claim, including the length of time the claim remains open, fluctuations in healthcare costs, legislative and regulatory developments and judicial developments. Additionally, we may encounter in the future, instances of insurance fraud, which could increase our actual insurance-related costs. For any of the foregoing reasons, our actual losses for claims and related expenses may deviate, individually or in the aggregate, from the insurance reserves reflected in our consolidated financial statements. If we determine that our estimated insurance reserves are inadequate, we may be required to increase such reserves at the time of the determination, which could result in an increase to our net loss in the period in which the deficiency is determined and negatively impact our financial condition and results of operations.

Our operations are dependent on our current management. The loss of any member of our management team could adversely affect our operations and financial results.

We are highly dependent upon the retention of the services of our current executive management team, specifically Joseph Furnari, Mike Furnari, Henry Park and Scott Brogi. The loss of any one of these individuals could adversely affect our operations and financial results. Our business also depends on our ability to attract and retain additional highly qualified management, technical, operating, and sales and marketing personnel. We do not currently maintain key person life insurance policies on any of our employees. We do not have fixed term employment agreements with any of our management employees, all of whom could terminate their relationship with us at any time.

-10-

Our results of operations are likely to vary significantly from period to period, which could cause the price of our common stock to decline.

Our results of operations have varied significantly from period to period. For example, the months of January, February and March are traditionally very slow for transportation demand. We expect that our results of operations will continue to vary as a result of a number of factors, many of which are outside of our control and may be difficult to predict, including:

| ● | our ability to attract and retain new customers; | |

| ● | the budgeting cycles and purchasing practices of customers; | |

| ● | the timing and success of new service introductions by us or our competitors or any other change in the competitive landscape of the ridesharing or car-sharing market, including consolidation among our competitors; | |

| ● | our ability to successfully expand our business domestically and internationally; | |

| ● | changes in our pricing policies or those of our competitors; | |

| ● | any disruption in, or termination of, our relationship with our insurance carriers or ride sharing companies with which we do business; | |

| ● | the cost and potential outcomes of future litigation, if any; | |

| ● | seasonality in our business; | |

| ● | general economic conditions, both domestic and foreign, assuming we expand into foreign markets; | |

| ● | future accounting pronouncements or changes in our accounting policies or practices; and | |

| ● | the amount and timing of operating costs and capital expenditures related to the expansion of our business. |

Any of the above factors, individually or in the aggregate, may result in significant fluctuations in our financial and other operating results from period to period. As a result of this variability, our historical results of operations should not be relied upon as an indication of future performance. Moreover, this variability and unpredictability could result in our failure to meet our operating plan or the expectations of investors or analysts for any period. If we fail to meet such expectations for these or other reasons, the price of our common stock could fall substantially, and we could face costly lawsuits, including securities class action suits.

We have had operating losses each year and quarterly period since our inception and may not achieve or maintain profitability in the future.

We have incurred operating losses each year and every quarterly period since inception. For the years ended December 31, 2019 and 2018, our operating loss was $12,689,558 and $9,158,663, respectively. We expect our operating expenses to decrease in the future as we curtail expenditures by scaling back certain sales and marketing and research and development expenses. Our revenue growth may slow or our revenue may decline for a number of other reasons, including reduced demand for our services, economic weakness, global macroeconomic shocks such as the recent coronavirus outbreak, increased competition, a decrease in the growth or size of the ride-sharing or car-sharing market or any failure to capitalize on growth opportunities. Any failure to increase our revenue as we grow our business could prevent us from achieving or maintaining profitability. If we are unable to meet these risks and challenges as we encounter them, our business, financial condition and results of operations may suffer.

We face intense competition and could lose market share to our competitors, which could adversely affect our business, financial condition and results of operations.

The market for ridesharing and car-sharing services is intensely competitive and characterized by rapid changes in technology, customer requirements, industry standards and frequent new service introductions and improvements. We anticipate continued challenges from current competitors, as well as by new entrants into the industry. If we are unable to anticipate or effectively react to these competitive challenges, our competitive position could weaken, and we could experience a decline in our growth rate or revenue that could adversely affect our business and results of operations.

-11-

Changes in government regulations could have an adverse impact on our business.

Currently, there are few laws regulating our business, however, as our business matures, this may change. Changes in government regulation of our business have the potential to materially alter our business practices, or our operational results. Depending on the jurisdiction, those changes may come about through the issuance of new laws and regulations or changes in the interpretation of existing laws and regulations by a court, regulatory body or governmental official. Sometimes those changes may have not just prospective but also retroactive effect; this is particularly true when a change is made through reinterpretation of laws or regulations that have been in effect for some time. Moreover, changes in regulation that may seem neutral on their face may have either more or less impact on us than on ride-sharing businesses, depending on the circumstances. Potential changes in law or regulation that may affect us relate to insurance intermediaries, customer privacy, data security and rate regulation.

Any material limitation in the fuel supply could adversely affect our business.

Our operations could be adversely affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. We are not aware of any current proposal to impose such a regime in the U.S. or internationally. Such a regime could, however, be quickly imposed if there was a serious disruption in the fuel supply for any reason, including an act of war, terrorist incident or other problem, such as the devastation caused by hurricane Harvey, affecting the petroleum supply, refining, distribution or pricing.

A security breach or other disruption to our information technology systems or our platform could result in the loss, theft, misuse, or unauthorized disclosure of user or sensitive company information, could disrupt our operations, or could frustrate or thwart our users’ ability to access our products and services, which could damage our relationships with users and partners, may cause our users and partners to cut back on or stop using our products and services altogether, could expose us to litigation or regulatory proceedings, or harm to our reputation, any of which could seriously harm our business.

Our business involves the storage and transmission of a significant amount of personal and/or confidential information, including the personal information of our users, the personal information of our drivers and employees, information relating to user preferences, confidential information of our partners, and our own proprietary financial, operational and strategic information. The protection of our information, as well as information relating to our users, drivers, partners, and employees, is vitally important to us as the loss, theft, misuse, or unauthorized disclosure of such information could lead to significant reputational or competitive harm, result in litigation involving us or our business partners, expose us to regulatory proceedings, and cause us to incur substantial liability or expenses.

As has been well documented in the media, the frequency, intensity, and sophistication of cyber-attacks and data security incidents has significantly increased in recent years. As with many businesses, we are subject to numerous data privacy and security risks, which may prevent us from maintaining the privacy of personal, confidential, and sensitive information, result in the disruption of our business, and require us to expend significant resources attempting to secure and protect such information and respond to incidents, any of which could seriously harm our business. Due to the increased risk of these types of attacks and incidents, we expend significant resources on information technology and data security tools, measures, and processes designed to protect personal, confidential or sensitive information and to ensure an effective response to any cyber-attack or data security incident. Whether or not these measures are ultimately successful, the expenditures could have an adverse impact on our financial condition and results of operations and divert management’s attention from pursuing our strategic objectives.

In addition, although we take the security of our information technology systems and platform seriously, our efforts to protect the personal and confidential information of our users, drivers, partners, employees, and company may be unsuccessful due to the actions of third parties, malicious code, software bugs, or other technical malfunctions. Despite our security efforts, because the techniques used to obtain unauthorized access to information technology systems and our platform are constantly evolving and, in some cases, becoming more sophisticated and harder to detect, we may be unable to anticipate these techniques or implement adequate preventive measures in response, and cyber-attacks or data incidents could remain undetected for some period, which could potentially result in greater harm to our systems, our platform, and the information stored and transmitted by our systems. In addition, and despite our security efforts and training, our employees may also inadvertently or intentionally cause security incidents that could result in the unauthorized disclosure of personal or confidential information, and third parties may attempt to fraudulently induce employees or users to disclose information to gain access to our data or our users’ data. If any of these events occur, our confidential information or our users’ personal information could be accessed, acquired, disclosed, or used without authorization, which could harm our relationships with users, put us at a competitive disadvantage, result in the deterioration of our users’ confidence in us, cause our partners to reconsider their relationship with our company or impose more onerous contractual provisions, and subject us to potential litigation, liability, fines, and penalties. For example, we could be subject to regulatory or other actions pursuant to domestic privacy laws, including newer regulations such as the California Consumer Privacy Act. This could result in costly investigations and litigation, civil or criminal penalties, operational changes, and negative publicity that could adversely affect our reputation.

Further, some of our partners may store personal or confidential information that we share with them. If these third parties fail to implement adequate data-security practices or fail to comply with our terms and policies, our users’ data may be improperly accessed, acquired, or disclosed. And even if these third parties take all these steps, their networks and information technology systems may still suffer a security breach, which could compromise our users’ data or our company data. Any incidents where our users’ information or confidential company information is accessed without authorization, improperly disclosed, or misused, or incidents that violate our terms of service or policies, could damage our reputation and our brand and diminish our competitive position. Maintaining the trust of our users is important to sustain our growth, retention, and user engagement. Concerns over our privacy practices, whether actual or unfounded, could damage our reputation and brand and deter users, advertisers, and partners from using our products and services. Any of these occurrences could seriously harm our business.

-12-

Risks Related to Our Common Stock

The price of our common stock may fluctuate substantially.

You should consider an investment in our common stock to be risky, and you should invest in our common stock only if you can withstand a significant loss and wide fluctuations in the market value of your investment. Some factors that may cause the market price of our common stock to fluctuate, in addition to the other risks mentioned in this “Risk Factors” section and elsewhere in this Annual Report, are:

| ● | sale of our common stock by our shareholders, executives, and directors; | |

| ● | volatility and limitations in trading volumes of our shares of common stock; | |

| ● | our ability to obtain financings to conduct and complete research and development activities including, but not limited to, our clinical trials, and other business activities; | |

| ● | the timing and success of introductions of new products by us or our competitors or any other change in the competitive dynamics of our industry, including consolidation among competitors; | |

| ● | our ability to attract new customers; | |

| ● | changes in our capital structure or dividend policy, future issuances of securities, sales of large blocks of common stock by our shareholders; | |

| ● | our cash position; | |

| ● | announcements and events surrounding financing efforts, including debt and equity securities; | |

| ● | our inability to enter into new markets or develop new products; | |

| ● | reputational issues; | |

| ● | announcements of acquisitions, partnerships, collaborations, joint ventures, new products, capital commitments, or other events by us or our competitors; | |

| ● | changes in general economic, political and market conditions in or any of the regions in which we conduct our business; | |

| ● | changes in industry conditions or perceptions; | |

| ● | analyst research reports, recommendation and changes in recommendations, price targets, and withdrawals of coverage; | |

| ● | departures and additions of key personnel; | |

| ● | disputes and litigations related to intellectual properties, proprietary rights, and contractual obligations; | |

| ● | changes in applicable laws, rules, regulations, or accounting practices and other dynamics; and | |

| ● | other events or factors, many of which may be out of our control, including but not limited to pandemics, war, or other acts of God. |

In addition, if the market for stocks in our industry or industries related to our industry, or the stock market in general, experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition and results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if unsuccessful, could be costly to defend and a distraction to management.

-13-

We may acquire other companies or technologies, which could divert our management’s attention, result in dilution to our stockholders and otherwise disrupt our operations and adversely affect our operating results.

We may in the future seek to acquire or invest in businesses, applications and services or technologies that we believe could complement or expand our services, enhance our technical capabilities or otherwise offer growth opportunities. The pursuit of potential acquisitions may divert the attention of management and cause us to incur various expenses in identifying, investigating and pursuing suitable acquisitions, whether or not they are consummated.

In addition, we do not have any experience in acquiring other businesses. If we acquire additional businesses, we may not be able to integrate the acquired personnel, operations and technologies successfully, or effectively manage the combined business following the acquisition. We also may not achieve the anticipated benefits from the acquired business due to a number of factors, including:

| ● | inability to integrate or benefit from acquired technologies or services in a profitable manner; | |

| ● | unanticipated costs or liabilities associated with the acquisition; | |

| ● | difficulty integrating the accounting systems, operations and personnel of the acquired business; | |

| ● | difficulties and additional expenses associated with supporting legacy products and hosting infrastructure of the acquired business; | |

| ● | difficulty converting the customers of the acquired business onto our platform and contract terms, including disparities in the revenue, licensing, support or professional services model of the acquired company; | |

| ● | diversion of management’s attention from other business concerns; | |

| ● | adverse effects to our existing business relationships with business partners and customers as a result of the acquisition; | |

| ● | the potential loss of key employees; | |

| ● | use of resources that are needed in other parts of our business; and | |

| ● | use of substantial portions of our available cash to consummate the acquisition. |

In addition, a significant portion of the purchase price of companies we acquire may be allocated to acquired goodwill and other intangible assets, which must be assessed for impairment at least annually. In the future, if our acquisitions do not yield expected returns, we may be required to take charges to our operating results based on this impairment assessment process, which could adversely affect our results of operations.

Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our operating results. In addition, if an acquired business fails to meet our expectations, our operating results, business and financial position may suffer.

Market and economic conditions may negatively impact our business, financial condition and share price.

Concerns over inflation, energy costs, geopolitical issues, the U.S. mortgage market and a declining real estate market, unstable global credit markets and financial conditions, and volatile oil prices have led to periods of significant economic instability, diminished liquidity and credit availability, declines in consumer confidence and discretionary spending, diminished expectations for the global economy and expectations of slower global economic growth going forward, increased unemployment rates, and increased credit defaults in recent years. Our general business strategy may be adversely affected by any such economic downturns, volatile business environments and continued unstable or unpredictable economic and market conditions. If these conditions continue to deteriorate or do not improve, it may make any necessary debt or equity financing more difficult to complete, more costly, and more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our growth strategy, financial performance, and share price and could require us to delay or abandon development or commercialization plans.

-14-

If securities or industry analysts do not publish research or reports, or publish unfavorable research or reports about our business, our stock price and trading volume may decline.

The trading market for our common stock will rely in part on the research and reports that industry or financial analysts publish about us, our business, our markets and our competitors. We do not control these analysts. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect the market price of our common stock. Furthermore, if one or more of the analysts who do cover us downgrade our stock or if those analysts issue other unfavorable commentary about us or our business, our stock price would likely decline. If one or more of these analysts cease coverage of us or fails to regularly publish reports on us, we could lose visibility in the market and interest in our stock could decrease, which in turn could cause our stock price or trading volume to decline and may also impair our ability to expand our business with existing customers and attract new customers.

Future sales and issuances of our securities could result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall.

We expect that significant additional capital will be needed in the future to continue our planned operations, including research and development, increased marketing, hiring new personnel, commercializing our products and services, and continuing activities as an operating public company. To the extent we raise additional capital by issuing equity securities, our shareholders may experience substantial dilution. We may sell common stock, convertible securities or other equity securities in one or more transactions at prices and in a manner, we determine from time to time. If we sell common stock, convertible securities or other equity securities in more than one transaction, investors may be materially diluted by subsequent sales. Such sales may also result in material dilution to our existing shareholders, and new investors could gain rights superior to our existing shareholders.

We do not intend to pay cash dividends on our shares of common stock so any returns will be limited to the value of our shares.

We currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable future. Any return to shareholders will therefore be limited to the increase, if any, of our share price.

We are an “emerging growth company” and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our common stock less attractive to investors.