Attached files

| file | filename |

|---|---|

| 10-K - 10-K - MESABI TRUST | msb-20200131x10k.htm |

| EX-32 - EX-32 - MESABI TRUST | msb-20200131xex32.htm |

| EX-31 - EX-31 - MESABI TRUST | msb-20200131xex31.htm |

| EX-10.(I) - EX-10.(I) - MESABI TRUST | msb-20200131ex10id28ee1.htm |

| EX-4.(D) - EX-4.(D) - MESABI TRUST | msb-20200131ex4dfe4df32.htm |

Exhibit 13

ANNUAL REPORT

OF THE TRUSTEES OF

MESABI TRUST

For The Year Ended January 31, 2020

ADDRESS

Mesabi Trust

c/o Deutsche Bank Trust Company Americas

Trust & Agency Services

60 Wall Street, 16th Floor

New York, NY 10005

(904) 271-2520 (telephone)

www.mesabi-trust.com

REGISTRAR AND TRANSFER AGENT

Deutsche Bank Trust Company Americas

LEGAL COUNSEL

Fox Rothschild LLP

REGISTRANT INFORMATION

Mesabi Trust maintains a website that provides access to its annual, quarterly, and other reports it files with the Securities and Exchange Commission. Such reports can be accessed at www.mesabi-trust.com. Mesabi Trust will provide, upon the written request of any Unitholder addressed to the Trustees at the above address and without charge to such Unitholder, (i) a paper copy of Mesabi Trust’s Annual Report on Form 10-K for the fiscal year ended January 31, 2020 (the “Annual Report”) as filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, and (ii) the Trustees Code of Ethics.

Table of Contents

|

Page |

|

| 1 | |

| 3 | |

| 14 | |

| 17 | |

|

TRUSTEES’ DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

17 |

| 17 | |

| 22 | |

| 23 | |

| 23 | |

| 23 | |

| 23 | |

| 25 | |

|

TO THE HOLDERS OF CERTIFICATES OF BENEFICIAL INTEREST IN MESABI TRUST |

28 |

| 28 | |

| 29 | |

| 30 | |

|

Description of the Mineral Properties and Northshore’s Mining Operations |

32 |

| 35 | |

| 37 | |

| 37 | |

| 39 | |

| 40 | |

| 41 | |

|

F-1 |

Special Note Regarding Forward-Looking Statements

Certain statements contained in this document are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All such forward-looking statements, including those statements estimating calendar year 2020 production or shipments, are based on input from the lessee/operator (and its parent corporation) of the mine located on the lands owned and held in trust for the benefit of the holders of Units of Beneficial Interest of Mesabi Trust. These statements may be identified by the use of forward-looking words, such as “may,” “will,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other similar words. Such forward-looking statements are inherently subject to known and unknown risks and uncertainties. Actual results and future developments could differ materially from the results or developments expressed in or implied by these forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to, volatility of iron ore and steel prices, market supply and demand, uncertainty or weakness in global economic conditions, reduced economic growth in China, price adjustment provisions in the North American iron ore supply agreements with Cliffs’ customers, regulation or government action, disputes and litigation, and uncertainties about estimates of reserves or the impact of the recent coronavirus (COVID-19), and those described under the caption “Risk Factors” in this Annual Report. Mesabi Trust undertakes no obligation to make any revisions to the forward-looking statements contained in this filing or to update them to reflect circumstances occurring after the date of this filing.

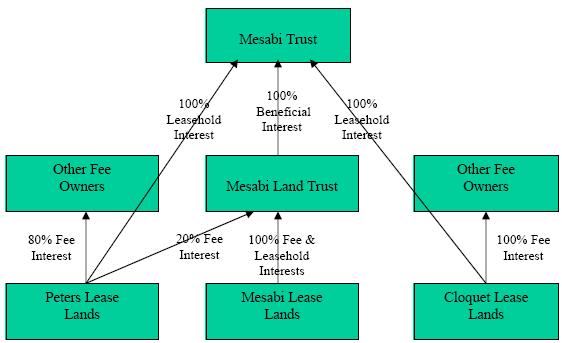

Mesabi Trust (“Mesabi Trust” or the “Trust”), formed pursuant to an Agreement of Trust dated July 18, 1961 (the “Agreement of Trust”), is a trust organized under the laws of the State of New York. Mesabi Trust holds all of the interests formerly owned by Mesabi Iron Company (“MIC”), including all right, title and interest in the Amendment of Assignment, Assumption and Further Assignment of Peters Lease (the “Amended Assignment of Peters Lease”), the Amendment of Assignment, Assumption and Further Assignment of Cloquet Lease (the “Amended Assignment of Cloquet Lease” and together with the Amended Assignment of Peters Lease, the “Amended Assignment Agreements”), the beneficial interest in a trust organized under the laws of the State of Minnesota to administer the Mesabi Fee Lands (as defined below) as the trust corpus in compliance with the laws of the State of Minnesota on July 18, 1961 (the “Mesabi Land Trust”) and all other assets and property identified in the Agreement of Trust. The Amended Assignment of Peters Lease relates to an Indenture made as of April 30, 1915 among East Mesaba Iron Company (“East Mesaba”), Dunka River Iron Company (“Dunka River”) and Claude W. Peters (the “Peters Lease”) and the Amended Assignment of Cloquet Lease relates to an Indenture made May 1, 1916 between Cloquet Lumber Company and Claude W. Peters (the “Cloquet Lease”).

A pass-through trust with certificates of beneficial interest in the trust traded on the New York Stock Exchange

Pursuant to a ruling from the Internal Revenue Service, which ruling was based on the terms of the Agreement of Trust including the prohibition against conducting any business, the Trust is not taxable as a corporation for federal income tax purposes. Instead, the holders of Certificates of Beneficial Interest in Mesabi Trust (“Unitholders”) are considered “owners” of the Trust and the Trust’s income is taxable directly to the Unitholders. The Certificates of Beneficial Interest in Mesabi Trust are listed on the New York Stock Exchange (“NYSE”) and is therefore subject to extensive regulation under, among others, the Securities Act of 1933, the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”), each as amended, and the rules and regulations of the NYSE.

1

Limited authorities and responsibilities of the Trustees

The Agreement of Trust specifically prohibits the Trustees from entering into or engaging in any business. This prohibition seemingly applies even to business activities the Trustees may deem necessary or proper for the preservation and protection of the Trust Estate (as defined on page 28 of this Annual Report). Accordingly, the Trustees’ activities in connection with the administration of Trust assets are limited to collecting income, paying expenses and liabilities, distributing net income to the Unitholders after the payment of, or provision for, such expenses and liabilities, and protecting and conserving the assets held by the Trust.

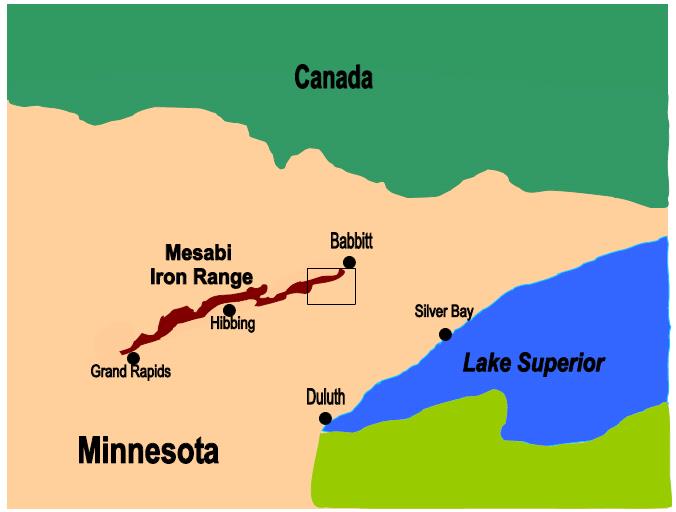

The Trustees do not intend to expand their responsibilities beyond those permitted or required by the Agreement of Trust, the Amendment to the Agreement of Trust dated October 25, 1982 (the “Amendment”), and those required under applicable law. The Trust has no employees, but it engages consultants to assist the Trustees in, among other things, monitoring the volume and sales prices of iron ore products shipped from Silver Bay, Minnesota, based on information supplied to the Trustees by Northshore Mining Company (“Northshore”), the lessee/operator of the lands leased under the Peters Lease and Cloquet Lease (the “Peters Lease Lands” and “Cloquet Lease Lands,” respectively, as further described on page 30 of this Annual Report) and the 20% fee interest of certain lands that are particularly described in, and subject to a mining lease under, the Peters Lease (the “Mesabi Fee Lands,” and together with the Peters Lease Lands and Cloquet Lease Lands, “Mesabi Trust Lands”), and its parent company Cleveland-Cliffs Inc. (“Cliffs”). References to Northshore in this Annual Report, unless the context requires otherwise, are applicable to Cliffs as well.

The information regarding amounts and sales prices of shipped iron ore products is used to compute the royalties payable to the Trust by Northshore. The Trustees request material information, from time to time, for use in the Trust’s periodic reports and as part of their evaluation of the Trust’s disclosure controls and procedures. The Trustees rely on Northshore to provide accurate and timely information for use in the Trust’s periodic and current reports filed with the Securities and Exchange Commission (the “SEC”).

Duration and Termination of the Trust

The Trust is governed by New York trust and estate law, which prohibits creation of any trust estate that suspends the power of alienation by a condition or limitation for a period longer than lives in being at the time of the creation plus a term of twenty-one years. Pursuant to a ruling from the Internal Revenue Service, which ruling was based on the terms of the Agreement of Trust including the prohibition against entering into any business, the Trust is not taxable as a corporation for federal income tax purposes.

Instead, the Unitholders are considered “owners” of the Trust and the Trust’s income is taxable directly to the Unitholders. In accordance with the Agreement of Trust, the Trust may continue to remain in force and effect until twenty-one years after the death of the survivor of twenty-five persons named in an exhibit to the Agreement of Trust. Based upon the results of research conducted by the Trust’s outside legal counsel, as of March 2020, the Trustees believed that there are a number of individuals named in the Agreement of Trust who were also alive as of March 2020, the youngest of whom is believed to be 59 years old.

The Trust may be terminated earlier at any time by the action of Unitholders holding 75% of the total Units of Beneficial Interest of the Trust as evidenced by any instrument executed by such Unitholders or by such Unitholders’ voting in favor of the termination of the Trust at a duly called and held meeting of the Unitholders.

2

The results of operations and financial condition of the Trust are subject to various risks. Some of these risks are described below, and you should take such risks into account in evaluating the Trust or any investment decision involving the Trust. This section does not describe all risks that may be applicable to the Trust and it is intended only as a summary of certain material risk factors. More detailed information concerning the risk factors described below may also be contained in other sections of this Annual Report.

The Trustees have no control over the operations, sales and marketing efforts or other activities of Cliffs or Northshore.

Except within the framework of the Amended Assignment Agreements, neither the Trust nor the Trustees have any control over the operations, sales and marketing efforts or other and activities of Cliffs or its wholly-owned subsidiary, Northshore. Accordingly, the royalty income of the Trust is highly dependent upon the activities, investments and operational decisions of Cliffs and Northshore, including temporary or permanent idling of operations, the supply and demand of suppliers and customers in the iron ore and steel industry in the U.S. and internationally, and the terms and conditions of the Amended Assignment Agreements. Northshore, together with Cliffs, without any input or influence from the Trust or the Trustees, control: (i) current operating plans, including iron ore production volumes, marketing of iron ore products, operating and capital expenditures as they relate to Northshore, environmental and other liabilities and the effects of regulatory changes; (ii) plans for Northshore’s future production, operations and capital expenditures, if any; (iii) geological data relating to iron ore reserve estimates; (iv) sales and marketing efforts, and shipments of iron ore products to customers of Cliffs; and (v) the terms and conditions, especially related to pricing, price adjustment mechanisms and delivery terms, of the sale of all iron ore products to Cliffs’ customers, including the Cliffs Pellet Agreements (described on page 14 of this Annual Report). Any substantial change in Cliffs’ financial condition or business, or the operations, production and shipments of iron ore products by Northshore, including production curtailments, temporary idling or permanent idling of Northshore operations, about which the Trust may have little or no prior notice, could adversely affect the royalty income of the Trust, as well as the resulting cash available for distribution by the Trust to Unitholders.

The Trust is subject to disputes from time to time that could result in litigation, arbitration or other administrative proceedings that could adversely affect the Trust’s operating results and financial condition and the market value of Mesabi Trust Units.

The Trust may become involved in litigation, arbitration or other administrative proceedings from time to time. These proceedings can be costly, and the results of such proceedings are often difficult to predict. The Trust may not have adequate insurance coverage or contractual protection to cover costs and liability in the event we are sued, and to the extent we resort to litigation, arbitration or other administrative proceedings to enforce our rights, we may incur significant costs and ultimately be unsuccessful or unable to recover amounts we believe are owed to us or unable to resolve the matter on favorable terms.

More specifically on December 9, 2019, the Trustees of Mesabi Trust announced that the Trust initiated arbitration against Northshore and its parent, Cliffs (jointly, the “Operator”), the lessee/operator of the leased lands. The arbitration proceeding was commenced with the American Arbitration Association. The Trust asserts claims concerning the calculation of royalties related to the production, shipment and sale of iron ore, including DR-grade pellets. More particularly, the claims involve the Trust’s allegations that the Operator has improperly manipulated royalty amounts with respect to DR-grade pellets by orchestrating isolated sale transactions of low silica iron ore into international markets at prices significantly below standard pellet pricing. Based on information currently available to the Trust, the Trust seeks an award of damages, along with specific performance and declaratory relief. The arbitration is in its early stages and no hearings have been set.

3

Any arbitration, legal or administrative proceedings to which the Mesabi Trust is subject could require the significant involvement of Trustees and the professional advisors and consultants to the Trust, and may divert attention from the Trustees’ other roles and responsibilities. In addition, it is difficult to foresee the results of legal actions, arbitration matters and other proceedings currently involving the Mesabi Trust or of those which may arise in the future, and an adverse result in these matters could have a material adverse effect on the market value of Mesabi Trust units and on Mesabi Trust’s asset value, royalty income, results of operations and financial condition.

Our future royalties could be adversely affected by the recent coronavirus outbreak.

Our future royalties could be adversely affected by the recent coronavirus (COVID-19) outbreak. In December 2019, a novel strain of coronavirus was reported. The spread of this virus may lead to the disruption of the business operations of Cliffs or its wholly-owned subsidiary, Northshore, by impacting the global economy as well as their employees, customers, service providers, vendors and suppliers. For example, on March 20, 2020, Cliffs announced it is temporarily shutting down construction activities at its hot-briquetted iron (HBI) project site in Toledo, Ohio, in accordance with guidelines from the Governor of the State of Ohio about the coronavirus pandemic. The extent to which the coronavirus may impact the HBI project or Cliffs and Northshore’s other business operations is uncertain and will depend on future developments, which are highly uncertain and cannot be predicted, including new information concerning the severity of the coronavirus and the actions taken to contain the coronavirus or treat its impact, among others. These events could have a material adverse effect on the business operations of Cliffs and Northshore, which in turn, could have a material adverse effect on future royalties payable to the Trust.

Cliffs’ Annual Report has cited certain economic and market risks, including risks related to the volatility of commodity prices, uncertainty or weakness in global economic conditions, reduced economic growth in China and oversupply of iron ore and excess steel or imported products, any of which could adversely affect Cliffs’ ability to generate revenue, maintain stable cash flow and fund its operations, which in turn could adversely affect Northshore operations and could adversely affect royalties payable to the Trust.

In its annual report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on February 20, 2020 (“Cliffs’ Annual Report”) Cliffs disclosed that, as a mining company, Cliffs’ profitability is dependent upon the price of the products sold to its customers, and that the price of iron ore has fluctuated significantly in the past and is affected by factors beyond its control including steel inventories; changes in the productive capacity of U.S. domestic steel producers; international demand for raw materials used in steel production; rates of global economic growth, especially construction and infrastructure activity that requires significant amounts of steel; changes in the levels of economic activity in the U.S., China, India, Europe and other industrialized or developing countries; changes in China's emissions policies and environmental compliance enforcement practices; changes in production capacity of other iron ore suppliers, especially as additional supplies come online or where there is a significant increase in imports of steel into the U.S. or Europe; changes in trade laws; weather-related disruptions or natural disasters that may impact the global supply of iron ore; and the proximity, capacity and cost of infrastructure and transportation. Further, Cliffs stated that its earnings may fluctuate with the prices of the products it sells and the products its customers sell. To the extent that the prices of iron ore and steel, including the Platts 62% price, hot-rolled coil steel price, Atlantic Basin pellet premium, Platts international indexed freight rates and changes in specified PPI, including those for industrial commodities, fuel and steel, significantly decline for an extended period of time, Cliffs may have to revise its operating plans, including curtailing production, reducing operating costs and capital expenditures and discontinuing certain exploration and development programs. Cliffs also disclosed that it may have to take impairments on its long-lived assets and/or inventory. Sustained lower prices also could cause Cliffs to reduce existing reserves if certain reserves no longer can be economically mined or processed at prevailing prices. Cliffs may be unable to decrease its costs in an amount sufficient to offset reductions in revenues and may incur losses. These events could have a material adverse effect on Cliffs and,

4

in certain circumstances, could potentially adversely affect Northshore, which in turn, could have a material adverse effect on future royalties payable to the Trust.

New U.S. trade policies may have a material adverse impact on Cliffs’ business, which could adversely affect Cliffs’ ability to generate revenue, which in turn could adversely affect royalties payable to the Trust.

The U.S. government has adopted a new trade policy and in some cases has sought to renegotiate, or potentially terminate, certain existing bilateral or multi-lateral trade agreements (e.g., the renegotiation of the North American Free Trade Agreement (“NAFTA”), which resulted in the United States–Mexico–Canada Agreement, which, if and when ratified, will replace and supersede NAFTA). It has also imposed tariffs on certain foreign goods, which included the imposition of significant tariffs on foreign steel. These measures may, and in some cases already have, resulted in U.S. trading partners, including China, implementing retaliatory trade policies of their own, making it more difficult or costly for Cliffs to export its products abroad. These events could have a material adverse effect on Cliffs and, in certain circumstances, could potentially adversely affect Northshore, which in turn, could have a material adverse effect on future royalties payable to the Trust, and the Trustees are not able to predict the impact that the new U.S. trade policy, or its results and/or consequences, will have on future royalties payable to the Trust.

Uncertainty or weakness in the global economic conditions and reduced economic growth to China and oversupply of iron ore and excess steel or imported products could adversely affect future royalties payable to the Trust.

The world price of iron ore is strongly influenced by global economic conditions, including international demand and supply for iron ore products. In particular, the current level of international demand for raw materials used in steel production is driven largely by industrial growth in China. Cliffs’ Annual Report cautioned that uncertainties or weaknesses in global economic conditions, including the slowing economic growth rate in China, has resulted, and could in the future result, in decreased demand for Cliffs’ products and, together with oversupply of imported products, has and may continue to lead to decreased prices, resulting in lower revenue levels and decreasing margins, which have in the past and may in the future affect adversely its business and negatively impact its financial results. We are not able to predict how the global economic conditions, including the current slower growth and challenging economic conditions of China, will change or not change, or the impact it may have on Cliffs’ and Northshore’s operations and the iron ore and steel industries in general going forward.

Uncertainties or weaknesses in global economic conditions and national or regional economic or political instability, or other events, including the coronavirus pandemic, could produce major changes in demand patterns and consumption of raw materials used in steel production, which could have a material adverse effect on the royalties payable to the Trust. The Trustees are not able to predict the impact that the coronavirus pandemic and the volatile global economic conditions will have on future royalties payable to the Trust.

Although Cliffs reported that it has long-term contractual commitments for a majority of its iron ore pellet sales, it cautioned that the uncertainty in global economic conditions may adversely impact the ability of its customers to meet their obligations. As a result of such market volatility, Cliffs’ customers could approach Cliffs about modifying their supply agreements with Cliffs or fail to perform under such agreements. Considering Cliffs’ limited base of current and potential blast furnace customers, any modifications to Cliffs’ sales agreements or customers’ failures to perform under such agreements could impact adversely Cliffs’ sales, margins, profitability and cash flows. Any modifications to such supply agreements, including reductions in pricing, or Cliffs’ customers’ failures to perform under such agreements could materially adversely affect the royalties payable to the Trust and, in turn, the cash available for distribution to Unitholders.

5

Due to the lack of industry and geographic diversification, adverse developments in the iron ore mining industry could adversely impact the Trust’s financial condition and reduce its ability to make distributions to the Trust’s Unitholders.

Substantially all of the revenue, operating profits and assets of the Trust relate to one business segment—iron ore mining. In addition, the principal assets of the Trust consist of two different interests in certain properties in the Mesabi Iron Range located in northern Minnesota. This concentration could disproportionally expose the Trust’s interests to operational and regulatory risks in that area. Due to the lack of diversification in industry type and location of the Trust’s interests, adverse developments in the iron ore markets or at the location of the Trust’s real estate interests could have a significantly greater impact on the Trust’s financial condition, results of operations and royalty revenues than if the Trust’s interests were more diversified.

The stability of Cliffs’ North American iron ore operations, pricing and the price adjustment provisions in certain North American iron ore supply agreements with Cliffs’ customers could have a significant effect on the cash available for distribution by the Trust to Unitholders.

In Cliffs’ Annual Report, Cliffs reported that during the twelve months ended December 31, 2019, a majority of its mining and pelletizing sales were made under term supply agreements to a limited number of customers; approximately 99% of its revenue was derived from the North American integrated steel industry of which three customers accounted for 97% of such sales revenue. Cliffs’ Annual Report also cautioned that as a result of pricing adjustments contained in Cliffs’ existing customer contracts, its financial results are sensitive to changes in iron ore and steel prices.

As discussed elsewhere in the Trust’s Annual Report, the price adjustment mechanisms under certain of Cliffs’ North American long term customer supply agreements, which can be positive or negative, may result in significant variations in royalties payable to the Trust from quarter to quarter and year to year. These variations could materially adversely affect the royalties payable to the Trust and, in turn, the resulting cash available for distribution to Unitholders.

Royalties received by the Trust, and distributions paid to Unitholders, in any particular quarter or year are not necessarily indicative of royalties or distributions that will be paid in any subsequent quarter or in any full year.

Royalties received by the Trust can fluctuate significantly from quarter to quarter and year to year based upon market prices for iron ore products, the level of orders for iron ore products from Cliffs’ customers, the sales and marketing efforts of Cliffs, the consumption of inventory by Cliffs’ customers, and production decisions made by Northshore. Moreover, because some of the royalties paid to the Trust in any particular quarter include payments made with respect to pellets shipped and sold at estimated prices that are subject to future interim and final multi-year adjustments in accordance with the supply agreements between Cliffs and its customers, a downward trend in demand and market prices for iron and steel products could result in negative adjustments to royalties in future quarters, some of which may be significant. These negative price adjustments could have a material adverse effect on the Trust’s royalty income, which in time could result in lower quarterly distributions paid by the Trust to Unitholders, and possibly reduce or even eliminate funds available for distribution in any quarter and in some quarters may completely offset royalties otherwise payable to the Trust.

Due to the factors described above, cash available for distribution to Unitholders in future quarters could materially decrease, and in some cases, such decrease could result in no cash being available for distribution to Unitholders. As a result, royalties received by the Trust generally can fluctuate materially from quarter to quarter and year to year. As a result, distributions that may be declared and paid to Unitholders, in any particular quarter, are not necessarily indicative of royalties that will be received, or

6

distributions that will be paid, in any subsequent quarter or in any full year. Based on the foregoing and the current uncertainty in the economic environment, the Trust cannot ensure that there will be adequate cash available to make a distribution to Unitholders in any particular quarter.

Cliffs has disclosed that its hot-briquetted (“HBI”) project will require the commitment of substantial resources. Any unanticipated costs or delays associated with Cliffs’ HBI project could negatively impact production and shipments of iron ore products by Northshore, which in turn could have a material adverse effect on future royalties payable to the Trust.

In Cliffs’ Annual Report, Cliffs has disclosed that its ongoing efforts with respect to the HBI project require the commitment of substantial capital expenditures. Cliffs disclosed that it currently expects to incur capital expenditures through 2020 on the HBI project of approximately $830 million plus a contingency of up to 20%, excluding capitalized interest, on the development of the HBI production plant in Toledo, Ohio, of which approximately $700 million was paid as of December 31, 2019. Cliffs indicated that estimated expenses may increase as personnel and equipment associated with advancing development and commercial production are added. Further, Cliffs disclosed that the timely completion and successful commercial startup of the HBI project will depend in part on the following:

(i)maintaining required federal, state and local permits;

(ii)completing construction work, commissioning and integration of all of the systems comprising the HBI production plant;

(iii)negotiating sales contracts for its planned production; and

(iv)other factors, many of which are beyond Cliffs’ control.

Any unanticipated costs or delays associated with Cliffs’ HBI project could have a material effect on shipments of iron ore products from Silver Bay, which in turn could materially impact the Trust’s royalty revenue, and thereby impact the cash available for distribution by the Trust. Further, the Trustees are not able to predict the impact on the Trust’s future potential royalties of either: (i) Northshore’s future anticipated production and shipments of DR-grade pellets from Silver Bay, or (ii) Cliffs’ HBI project.

On March 20, 2020, Cliffs announced it is temporarily shutting down construction activities at its HBI project site in Toledo, Ohio, in accordance with guidelines from the Governor of the State of Ohio about the coronavirus pandemic. Cliffs indicated in its announcement that it will continue to monitor the situation and will re-start construction of the HBI plant as soon as feasible. The extent to which the coronavirus may impact or delay the HBI project is uncertain and will depend on future developments, which are highly uncertain and cannot be predicted, including new information concerning the severity of the coronavirus and the actions taken to contain the coronavirus or treat its impact, among others.

Cliffs’ Annual Report has disclosed certain financial risks, including risks related to Cliffs’ existing and future level of indebtedness, risks related to potential limitations on its ability to invest in the ongoing needs of its business, risks concerning its ability to generate sufficient cash flow to service all of its debt, and risks related to adverse changes in credit ratings, which may adversely affect its cost of financing.

Cliffs’ Annual Report has disclosed that (i) due to Cliffs’ existing level of indebtedness, it has to dedicate a portion of its cash flow from operations to the payment of debt service, reducing the availability of its cash flow to fund capital expenditures, acquisitions or other strategic development initiatives and other general corporate purposes, (ii) if Cliffs’ cash flows and capital resources are insufficient to fund its debt service obligations, it may face substantial liquidity problems and may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital, including additional secured or

7

unsecured debt, or restructure or refinance its debt, which could be at higher interest rates and may require it to comply with more onerous covenants, which could further restrict its business operations, and (iii) credit rating agencies could downgrade Cliffs’ ratings either due to various developments, including its merger with AK Steel, factors specific to its business, a prolonged cyclical downturn in the mining industry, or macroeconomic trends (such as global or regional recessions) and trends in credit and capital markets more generally, which would may result in an increase to its cost of financing and limit its access to the capital markets, which would harm its financial condition and results of operations, and hinder its ability to refinance existing indebtedness on acceptable terms, and may affect adversely the terms under which it purchases goods and services.

Cliffs’ Annual Report also disclosed that Cliffs has significant capital requirements, including interest payments for debt service. If Cliffs incurs significant losses in future periods, Cliffs disclosed that it may be unable to continue as a going concern. According to Cliffs’ Annual Report, if Cliffs is unable to continue as a going concern, it may consider, among other options, further restructuring its debt although there can be no assurance that these options will be undertaken and, if so undertaken, whether these efforts will succeed.

These potential circumstances, if they become real developments, could have a material adverse effect on Cliffs and Northshore, which in turn, could have a material adverse effect on royalties paid to the Trust in the future.

Equipment failures and other unexpected events at Northshore may lead to production curtailments or shutdown.

Interruptions in production capabilities at the mine operated by Northshore may have an adverse impact on the royalties payable to the Trust. In addition to planned production shutdowns or curtailments and equipment failures, the Northshore facilities are also subject to the risk of loss due to unanticipated events such as fires, explosions or extreme weather conditions. The manufacturing processes that take place in Northshore’s mining operations, as well as in Northshore’s crushing, concentrating and pelletizing facilities, depend on critical pieces of equipment, such as drilling and blasting equipment, crushers, grinding mills, pebble mills, thickeners, separators, filters, mixers, furnaces, kilns and rolling equipment, as well as electrical equipment, such as transformers. It is possible that this equipment may, on occasion, be out of service because of unanticipated failures or unforeseeable acts of vandalism or terrorism. In addition, because the Northshore processing facilities have been in operation for several decades, some of the equipment is aged. Because the Trustees have no control over the operations or maintenance of the equipment at Northshore, a shutdown or reduction in capacity may come with little or no advance warning. The remediation of any interruption in production capability at Northshore could require Cliffs to make large capital expenditures which may take place over an extended period of time. According to Cliffs’ Annual Report, if Cliffs’ cash flows and capital resources are insufficient to fund its debt service obligations, it may be forced to reduce or delay investments and capital expenditures. At the end of November 2015, Northshore shut down all of its taconite production lines and remained idle until May 2016. According to Cliffs, the temporary idle was a result of historic levels of steel imports into the U.S. and reduced demand from its steel-producing customers. Any additional idling, shutdown, reduction in operations, or production curtailment at Northshore would likely adversely affect the royalties payable to the Trust

The mining operations of Northshore are subject to extensive governmental regulations and Northshore is subject to risks related to its compliance with federal and state environmental regulations.

Northshore, as the operator of the mine on Mesabi Trust Lands, is subject to various federal, state and local laws and regulations on matters such as employee health and safety, air quality, water pollution, plant, wetlands, natural resources and wildlife protection, reclamation and restoration of mining properties, the discharge of materials into the environment, and the effects that mining has on groundwater quality, conductivity and availability. Northshore is required to maintain numerous permits and approvals issued by

8

federal and state regulatory agencies and its mining operations are subject to inspection and regulation by the Mine Safety and Health Administration of the United States Department of Labor (“MSHA”) under the provisions of the Mine Safety and Health Act of 1977. The Occupational Safety and Health Administration (“OSHA”) has jurisdiction over safety and health standards not covered by MSHA and the Minnesota Pollution Control Agency (“MPCA”) regulates various aspects of Northshore’s operations. Northshore may from time to time be involved in disputes or litigation with the regulatory agencies over certain aspects of its operation but because the Trust has no control over Northshore’s operations, the potential impact of these proceedings cannot be determined. Moreover, Northshore is solely responsible for its compliance with all laws, regulations or permits applicable to Northshore’s operations and Northshore may at times fail to operate in compliance with such laws, regulations and permits. The Trust has no ability to control or determine whether Northshore has been or will in the future operate in compliance with such laws and regulations. If Northshore fails to comply with these laws, regulations or permits, it could be subject to fines or other sanctions, any of which could have an adverse effect on its operations and its ability to ship iron ore products from Silver Bay, Minnesota, which could, in turn, have a material adverse effect on the royalties paid to the Trust

TMDL (a regulatory term describing a value of the maximum amount of a pollutant that a body of water can receive while still meeting water quality standards under the Clean Water Act) regulations are contained in the Clean Water Act and, as a part of Minnesota’s Mercury TMDL Implementation Plan, in cooperation with the MPCA, the taconite industry developed a Taconite Mercury Reduction Strategy and signed a voluntary agreement to effectuate its terms. The strategy includes a 75% target reduction of mercury air emissions from Minnesota pellet plants collectively by 2025. For Cliffs, the requirements in the voluntary agreement do not apply to Northshore. Late in 2013, however, Minnesota published a draft mercury control rule that would require annual mercury emissions reporting and could require installation of mercury emission control equipment on all Cliffs’ Minnesota facilities including those of Northshore. On September 22, 2014, Minnesota promulgated the Mercury Air Emissions Reporting and Reduction Rule mandating mercury air emissions reporting and reduction. The adopted rule expanded applicability to all of Cliffs’ Minnesota operations and required (i) a 70% reduction of mercury emissions from Northshore’s industrial boilers by January 1, 2018, and (ii) by the end of 2018, the submission of a plan to reduce mercury emissions by 72% from all of Cliffs’ Minnesota taconite furnaces, with such plan implementation requirements to become effective on January 1, 2025. Cliffs expressed its concerns about the technical and economic feasibility to reduce taconite mercury emissions by 72% and conducted detailed engineering analyses to determine the impact of the regulations on each unique iron ore indurating furnace affected by the Mercury Air Emissions Reporting and Reduction Rule. Cliffs’ Annual Report states that one of the main tenets agreed upon for evaluating potential mercury reduction technologies during TMDL implementation and the 2014 rule development proceedings was that the selected technology must meet the following “Adaptive Management Criteria”: the technology (i) must be technically feasible; (ii) must be economically feasible; (iii) must not impact pellet quality; and (iv) must not cause excessive corrosion in the indurating furnaces or air pollution control equipment. According to Cliffs’ Annual Report, there is currently no proven technology to cost-effectively reduce mercury emissions from taconite furnaces to the target level of 72% that would meet all four Adaptive Management Criteria. Cliffs submitted its mercury reduction plans for its Minnesota facilities to the MPCA in December 2018, and they are currently being reviewed by the MPCA.

The Trustees are unable to predict what impact, if any, the Mercury Air Emissions Reporting and Reduction Rule will have on production and shipments of iron ore products from Northshore or future royalties payable to the Trust.

The Trust does not control the portion of Northshore’s shipments that will come from iron ore mined from Mesabi Trust Lands.

The Trustees do not exert any influence over mining operational decisions at Northshore and Northshore alone determines whether to mine from Mesabi Trust Lands or state-owned lands, based on its

9

current production estimates and engineering plan. Northshore’s mining operations include Mesabi Trust Lands and mineral-producing land owned by the State of Minnesota and others. Iron ore mined by Northshore from lands other than Mesabi Trust Lands is processed, along with iron ore mined from Mesabi Trust Lands, in Northshore-owned crushing, concentrating and pelletizing facilities and is separately accounted for on a periodic basis. Northshore also has the ability to process and ship iron ore products from lands other than Mesabi Trust Lands. In certain circumstances, the Trust may be entitled to royalties on those other shipments, but not in all cases. In general, the Trust will receive higher royalties (assuming all other factors are equal) if a higher percentage of shipments is from Mesabi Trust Lands. The percentages of shipments from Mesabi Trust Lands were 89.6%, 89.8%, 92.6%, 99.6%, 88.9%, 90.8% and 93.5% in calendar years 2019, 2018, 2017, 2016, 2015, 2014 and 2013, respectively. If Northshore decides to materially reduce the percentage of iron ore mined, or pellets shipped, from Mesabi Trust Lands, the income of the Trust could be materially adversely affected.

Royalties payable to the Trust could be materially adversely affected by the failure of the Trust’s independent consultants to competently perform.

As permitted by the terms of the Agreement of Trust and the Amendment, the Trustees are authorized to, and in fact do, rely upon certain independent consultants to assist the Trustees in carrying out and fulfilling their obligations as Trustees. Independent consultants perform a variety of services for the Trust, render advice and produce reports with respect to monthly production and shipments, which include figures on crude iron ore production, iron ore pellet production, iron ore pellet shipments, and discussions concerning the condition and accuracy of the scales used to weigh iron ore pellets produced at Northshore’s facilities. The Trustees have also retained an accounting firm to provide non-audit services, including preparing financial statements, reviewing financial data related to shipping and sales reports provided by Northshore and reviewing the schedule of leasehold and fee royalties payable to the Trust. The Trustees believe that the independent consultants engaged by the Trust are qualified to perform the services and functions assigned to them. Nevertheless, any negligence or the failure of any such independent consultants to competently perform could materially adversely affect the royalties to be received by the Trust.

The Trust relies on Cliffs’ estimates of recoverable reserves, and if those estimates are inaccurate, the total potential future royalty stream to the Trust and distributions payable to Unitholders may be materially adversely affected.

The Trustees do not participate in preparing the recoverable iron ore reserve estimates reported by Cliffs. According to Cliffs’ Annual Report, Cliffs regularly evaluates its iron ore reserves based on revenues and costs and updates them as required in accordance with Securities Act Industry Guide 7, promulgated by the SEC. Additionally, according to Cliffs’ Annual Report, Cliffs indicated that it will also update its iron ore reserve estimates to comply (to the extent it is not already compliant) with Final Rule 13-10570, Modernization of Property Disclosures for Mining Registrants, adopted in October 2018 and compliance with which will be required beginning on January 1, 2021, at which point Final Rule 13-10570 will rescind Securities Act Industry Guide 7. In 2013, the Trustees engaged an independent firm of geological experts to evaluate the process Cliffs uses to estimate the recoverable iron ore reserves at the Peter Mitchell Mine. Still, there are numerous uncertainties inherent in estimating quantities of reserves of mineral producing lands and such estimates necessarily depend upon a number of variable factors and assumptions, such as production capacity, effects of regulations by governmental agencies, future prices for iron ore, future industry conditions and operating costs, severance and excise taxes, development costs and costs of extraction and reclamation costs, all of which may in fact vary considerably from actual results. All of these factors are outside of the control and influence of the Trustees. For these reasons, estimates of the economically recoverable quantities of mineralized deposits attributable to Mesabi Trust Lands and the classifications of such reserves based on the risk of recovery prepared by different engineers or by the same engineers at different times may vary substantially as the criteria change. Cliffs’ estimate of the iron ore reserves could be negatively affected by future industry conditions, geological conditions and ongoing mine planning at the

10

Peter Mitchell Mine. Actual reserves will likely vary from estimates, and if such variances are negative and material, the expected royalties payable to the Trust could be materially adversely affected and the value of the Trust’s Units could decline.

Cliffs has disclosed certain operational risks, including risks that could arise related to substantial costs from idled production capacity, announced and potential mine closures and risks related to its ability to transport its products to customers at competitive rates and in a timely manner.

According to Cliffs’ Annual Report, Cliffs indicated that its decisions concerning which facilities to operate and at what capacity levels are made based upon its customers’ orders for products, as well as the quality, performance capabilities and production cost of its operations. During depressed market conditions, Cliffs may concentrate production at certain facilities and not operate others in response to customer demand and as a result Cliffs would incur idle facility costs. In 2016, two of its Minnesota mines were temporarily idled for a portion of the year and it indefinitely idled the Empire mine in Michigan in August 2016. When Cliffs restarts idled facilities, it incurs certain costs to replenish inventories, prepare the previously idled facilities for operation, perform the required mine stripping, repair and maintenance activities, and prepare employees to return to work safely and to resume production responsibilities. The amount of any such costs can be material, depending on a variety of factors, such as the period of idle time, necessary repairs and available employees, and is difficult to project. In addition, Cliffs stated that faced with overcapacity in the iron ore market it may seek to rationalize assets through asset sales, temporary shutdowns, indefinite idles or facility closures.

Cliffs also disclosed that in its iron ore operations, disruption of the lake, rail and trucking transportation services due to weather-related problems and lack of alternative transportation sources could impair Cliffs’ ability to supply iron ore to its customers at competitive rates or in a timely manner, and thus, could adversely affect its sales, margins and profitability.

These events could have a material adverse effect on Cliffs and potentially Northshore, which in turn, could have a material adverse effect on royalties paid to the Trust in the future.

The operations at Northshore are largely dependent on a single-source energy supplier.

The operations at Northshore are largely dependent on Silver Bay Power Company, a 115 megawatt power plant, for its electrical supply. Silver Bay Power Company, which is wholly-owned by Northshore, has an interconnection agreement with Minnesota Power, Inc. for backup power when excess generation is necessary. In May 2016, Silver Bay Power entered into an agreement with Minnesota Power to purchase roughly half of Northshore’s electricity needs from Minnesota Power through 2019. Cliffs disclosed in its Annual Report that beginning September 15, 2019, it began to purchase 100% of the electricity requirements of Northshore from Minnesota Power, but under certain circumstances, the parties agreed to an interconnection agreement for Silver Bay Power to provide backup power when excess generation is necessary. Until the transition is complete, a significant interruption in service from Silver Bay Power Company due to vandalism, terrorism, weather conditions, natural disasters, or any other cause could cause a decrease in production capacity or require a temporary shutdown of Northshore’s operations. In addition, one natural gas pipeline serves all of Cliffs’ Minnesota mines, and a pipeline failure could idle or substantially impair the operations at Northshore. Any substantial interruption of, or material reduction in, Northshore’s operations could materially adversely affect the royalties payable to the Trust.

If steelmakers use methods other than blast furnace production to produce steel or shut down or reduce production using blast furnaces, the demand for iron ore pellets may decrease.

According to Cliffs’ Annual Report, demand for Cliffs’ iron ore products in North America is largely determined by the operating rates for the blast furnaces of steel companies, although not all finished steel is produced by blast furnaces. Finished steel also may be produced by other methods that do not require iron

11

ore pellets and use scrap steel, pig iron, hot briquetted iron and direct reduced iron. North American steel producers can also produce steel using imported iron ore products, which may reduce or eliminate the need for domestic iron ore. Future environmental restrictions on the use of blast furnaces in North America also may reduce the use of blast furnaces in steel production. Because the maintenance of blast furnaces can require substantial capital expenditures and may cause prolonged outages, which may reduce demand for pellets, steel manufacturers may choose not to maintain their blast furnaces, and some of them may not have the resources necessary to adequately maintain their blast furnaces. If steel manufacturers alter the methods they use to produce steel or otherwise substantially reduce their use of iron ore pellets, demand for iron ore pellets will decrease, which could materially adversely affect the royalties payable to the Trust.

Certain risk factors affecting Cliffs’ North American Iron Ore business generally, and Northshore operations in particular, could have a material adverse effect on the royalties payable to the Trust.

Because substantially all of the Trust’s revenue is derived from iron ore products shipped by Northshore from Silver Bay, Northshore’s iron ore pellet processing and shipping activities directly impact the Trust’s revenues in each quarter and each year. According to Cliffs’ Annual Report, a number of risk factors affect Cliffs’ operations and could impact Northshore’s production and shipment volume. Cliffs’ Annual Report identified the following seven categories of risk to which Cliffs is subject: (i) economic and market, (ii) regulatory, (iii) financial, (iv) operational, (v) development and sustainability, (vi) human capital and (vii) risks related to the recently completed merger with AK Steel. These risk factors include, among others, the global economic climate and financial market conditions, economic conditions in the iron ore industry, extensive governmental regulations relating to environmental matters and the costs and risks related thereto, availability of substitute materials, pricing by domestic and international competitors, long-term customer contracts or arrangements by Northshore or its competitors, price adjustment provisions in Cliffs’ North American term supply agreements (which take into account various price indexes), availability of lake freighters, production at Northshore’s mining operations, natural disasters, shipping conditions in the Great Lakes and production at Northshore’s pelletizing/processing facility. Specifically, if any portion of Northshore’s pelletizing lines becomes idle for any reason, production, shipments and, consequently, the royalties payable to the Trust could be materially adversely affected.

Furthermore, other events such as terrorist acts, conflicts, wars and geopolitical uncertainties, whether or not occurring in or involving, directly or indirectly, the United States, may cause serious harm to Cliffs’ and/or Northshore’s business, operations and revenue. The potential for the occurrence of any of these types of events has created global and domestic economic and political uncertainties. If any of these types of events were to occur, the results would be unpredictable, but may include decreases in demand for iron ore, difficulties related to shipping of iron ore products to Cliffs’ customers, and delays and inefficiencies in Cliffs’ supply chain. The Trust is uninsured, and cannot obtain insurance, for losses and interruptions caused by any of these types of events.

Certain risks arising from Cliffs’ merger with AK Steel may impact Cliffs’ financial condition and operating results as well as its operations, which in turn could have a material adverse effect on future royalties payable to the Trust.

On March 13, 2020, Cliffs announced the completion of its merger with AK Steel. Cliffs’ Annual Report disclosed a number of risk factors related to the merger. Cliffs discussed the following potential risks associated with the completion of the merger: (i) the merger may be less accretive than expected, or may be dilutive, which may negatively impact the market price of its common stock, (ii) it will incur significant transaction and merger-related costs, which may be in excess of those anticipated, (iii) its debt may limit its financial flexibility, (iv) it may fail to realize all of the anticipated benefits or the proposed merger, and its integration with AK Steel may not be as successful as anticipated, (v) the market price of its common shares may decline in the future as a result of the sale of its common shares held by former AK Steel stockholders or Cliffs’ current shareholders, (vi) it may record tangible and intangible assets, including goodwill, that could

12

become impaired and result in material non-cash charges to its results of operations in the future, (vii) the ability to use AK Steel’s and its pre-merger net operating loss carryforwards and certain other tax attributes to offset future taxable income may be subject to certain limitations, and (viii) completion of the merger may trigger change in control or other provisions in certain agreements to which AK Steel is a party. These risks could have a material adverse effect on Cliffs’ financial condition and operating results, which in turn could have a material adverse effect on future royalties payable to the Trust.

Cliffs noted in its Annual Report that the merger involves numerous operational, strategic, financial, accounting, legal, tax and other functions, systems and management controls that must be integrated and that difficulties in integrating the two companies may result in the combined company performing differently than expected, in operational challenges or in the failure to realize anticipated expense-related efficiencies. Following completion of the merger, Cliffs indicated it may also experience challenges associated with managing the larger, more complex, integrated businesses. The integration process may result in the loss of key employees, the disruption of ongoing businesses, or inconsistencies in standards, controls, procedures and policies. To the extent these issues have a material adverse effect on Cliffs’ operations following the completion of the merger, they in turn could have a material adverse effect on future royalties payable to the Trust.

We are dependent upon third party information technology systems, which are subject to cyber threats, disruption, damage and failure.

We are dependent upon third party information systems and other technologies, including those related to our financial and operational management and those related to Cliffs’ and Northshore’s financial and operational management. Network and information systems-related events, such as computer hackings, cyber-attacks, ransomware, computer viruses, worms or other destructive or disruptive software, process breakdowns, denial of service attacks, malicious social engineering or other malicious activities, or any combination of the foregoing, or power outages, natural disasters, terrorist attacks or other similar events, could result in damage to our information and data that is stored or transmitted by our third party vendors or damage or disruption to Cliffs’ or Northshore’s business operations. Any security breaches, such as computer viruses and more sophisticated and targeted cyber-related attacks, as well as misappropriation, misuse, leakage, falsification or accidental release or loss of information maintained in these information technology systems could result in significant losses and damage to our reputation, or the reputations of Northshore and/or Cliffs, and require us, Northshore or Cliffs to expend significant capital and other resources to remedy any such security breach. There can be no assurance that these events and security breaches will not occur in the future or not ultimately have an adverse effect on the royalties payable to the Trust.

The Trustees are not subject to annual election and, as a result, the ability of the holders of Trust Certificates to influence the policies of the Trust may be limited.

Directors of a corporation are generally subject to election at each annual meeting of shareholders or, in the case of staggered boards, at regular intervals. However, under the Agreement of Trust, the Trust is not required to hold annual meetings of holders of Trust Certificates to elect Trustees and Trustees generally hold office until their death, resignation or disqualification. As a result, the ability of holders of Trust Certificates to effect changes in the composition of those serving as Trustees and the policies of the Trust is significantly more limited than that of the shareholders of a corporation.

We are subject to the continued listing criteria of the NYSE, and our failure to satisfy these criteria may result in delisting of our Units.

Our Units are currently listed for trading on the NYSE. In order to maintain the listing, we must maintain certain objective standards such as Unit prices and a minimum number of public Unitholders. In addition to objective standards, the NYSE may delist the securities of any issuer using subjective standards

13

such as, if in the NYSE’s opinion, the issuer’s financial condition and/or operating results appear unsatisfactory or if any event occurs or any condition exists which makes continued listing on the NYSE inadvisable.

If the NYSE delists our Units, Unitholders may face material adverse consequences, including, but not limited to, a lack of trading market for our Units and reduced liquidity

OVERVIEW OF TRUST’S ROYALTY STRUCTURE

Leasehold royalty income constitutes the principal source of the Trust’s revenue. The income of the Trust is highly dependent upon the activities and operations of Northshore. Royalty rates and the resulting royalty payments received by the Trust are determined in accordance with the terms of the Trust’s leases and assignments of leases.

Three types of royalties, as well as royalty bonuses, comprise the Trust’s leasehold royalty income:

|

· |

Base overriding royalties. Base overriding royalties have historically constituted the majority of the Trust’s royalty income. Base overriding royalties are determined by both the volume and selling price of iron ore products shipped. Northshore is obligated to pay the Trust base overriding royalties in varying amounts, based on the volume of iron ore products shipped. Base overriding royalties are calculated as a percentage of the gross proceeds of iron ore products produced at Mesabi Trust Lands (and to a limited extent other lands) and shipped from Silver Bay, Minnesota. The percentage ranges from 2-1/2% of the gross proceeds for the first one million tons of iron ore products shipped annually to 6% of the gross proceeds for all iron ore products in excess of four million tons so shipped annually. Base overriding royalties are subject to interim and final price adjustments under the term contracts between Northshore, Cliffs and their customers (the “Cliffs Pellet Agreements”) and, as described elsewhere in this Annual Report, such adjustments may be positive or negative. |

|

· |

Royalty bonuses. The Trust earns royalty bonuses when iron ore products shipped from Silver Bay are sold at prices above a threshold price per ton. The royalty bonus is based on a percentage of the gross proceeds of product shipped from Silver Bay. The threshold price is adjusted (but not below $30.00 per ton) on an annual basis for inflation and deflation (the “Adjusted Threshold Price”). The Adjusted Threshold Price was $55.74 per ton for calendar year 2018 and $56.93 per ton for calendar year 2019, and will be $57.85 per ton for calendar year 2020. The royalty bonus percentage ranges from 1/2 of 1% of the gross proceeds (on all tonnage shipped for sale at prices between the Adjusted Threshold Price and $2.00 above the Adjusted Threshold Price) to 3% of the gross proceeds (on all tonnage shipped for sale at prices $10.00 or more above the Adjusted Threshold Price). Royalty bonuses are subject to price adjustments under the Cliffs Pellet Agreements (and, as described elsewhere in this Annual Report); such adjustments may be positive or negative. See the section entitled “Comparison of Financial Results for Fiscal Years ended January 31, 2020 and January 31, 2019” in this Annual Report for more information. |

|

· |

Fee royalties. Fee royalties have historically constituted a smaller component of the Trust’s total royalty income. Fee royalties are payable to the Mesabi Land Trust, a Minnesota land trust, which holds a 20% interest as fee owner in the Amended Assignment of Peters Lease. Mesabi Trust holds the entire beneficial interest in the Mesabi Land Trust for which U.S. Bank N.A. acts as the corporate trustee. Mesabi Trust receives the net income of the Mesabi Land Trust, which is generated from royalties on the amount of crude ore mined after the payment of expenses to U.S. Bank N.A. for its services as the corporate trustee. Crude ore is the source of iron oxides used to make iron ore pellets and other products. The fee royalty on crude ore is based on an agreed price per ton, subject to certain indexing. |

14

|

· |

Minimum advance royalties. Northshore’s obligation to pay base overriding royalties and royalty bonuses with respect to the sale of iron ore products generally accrues upon the shipment of those products from Silver Bay. However, regardless of whether any shipment has occurred, Northshore is obligated to pay to Mesabi Trust a minimum advance royalty. Each year, the amount of the minimum advance royalty is adjusted (but not below $500,000 per annum) for inflation and deflation. The minimum advance royalty was $929,320 for calendar year 2018 and $949,295 for calendar year 2019, and will be $964,659 for calendar year 2020. Until overriding royalties (and royalty bonuses, if any) for a particular year equal or exceed the minimum advance royalty for the year, Northshore must make quarterly payments of up to 25% of the minimum advance royalty for the year. Because minimum advance royalties are essentially prepayments of base overriding royalties and royalty bonuses earned each year, any minimum advance royalties paid in a fiscal quarter are recouped by credits against base overriding royalties and royalty bonuses earned in later fiscal quarters during the year. |

The current royalty rate schedule became effective on August 17, 1989 pursuant to the Amended Assignment Agreements, which the Trust entered into with Cyprus Northshore Mining Corporation (“Cyprus NMC”). Pursuant to the Amended Assignment Agreements, overriding royalties are determined by both the volume and selling price of iron ore products shipped. In 1994, Cyprus NMC was sold by its parent corporation to Cliffs and renamed Northshore Mining Company. Cliffs now operates Northshore as a wholly-owned subsidiary.

Under the relevant agreements, Northshore has the right to mine and ship iron ore products from lands other than Mesabi Trust Lands. Northshore alone determines whether to conduct mining operations on Mesabi Trust Lands and/or such other lands based on its current mining and engineering plan. The Trustees do not exert any influence over mining operational decisions. To encourage the use of iron ore products from Mesabi Trust Lands, Mesabi Trust receives royalties on stated percentages of iron ore shipped from Silver Bay, whether or not the iron ore products are from Mesabi Trust Lands. Mesabi Trust receives royalties at the greater of (i) the aggregate quantity of iron ore products shipped that were mined from Mesabi Trust Lands, and (ii) a portion of the aggregate quantity of all iron ore products shipped from Silver Bay that were mined from any lands, such portion being 90% of the first four million tons shipped from Silver Bay during such year, 85% of the next two million tons shipped during such year, and 25% of all tonnage shipped during such year in excess of six million tons. The royalty percentage paid to the Trust increases as the aggregate tonnage of iron ore products shipped, attributable to the Trust, in any calendar year increases past each of the first four one-million ton volume thresholds. Assuming a consistent sales price per ton throughout a calendar year, shipments of iron ore product attributable to the Trust later in the year generate a higher royalty to the Trust, as total shipments for the year exceed increasing levels of royalty percentages and pass each of the first four one-million ton volume thresholds.

Royalty income, which constitutes the principal source of the Trust’s revenue, comprised 99.1% to 99.7% of the Trust’s total revenue in each of the fiscal years ended January 31, 2020, January 31, 2019 and January 31, 2018. A more complete discussion of royalty rates and the manner in which they are determined is set forth under the headings “Leasehold Royalties” and “Land Trust and Fee Royalties,” in this Annual Report.

During the course of its fiscal year some portion of royalties expected to be paid to Mesabi Trust is based in part on estimated prices for iron ore products sold under the Cliffs Pellet Agreements. The Cliffs Pellet Agreements use estimated prices which are subject to interim and final pricing adjustments, which can be positive or negative, and which adjustments are dependent in part on multiple price and inflation index factors that are not known until after the end of a contract year. Even though Mesabi Trust is not a party to the Cliffs Pellet Agreements, these adjustments can result in significant variations in royalties payable to Mesabi Trust (and in turn the resulting amount available for distribution to Unitholders by the Trust) from quarter to quarter and on a comparative historical basis, and these variations, which can be positive or

15

negative, cannot be predicted by the Trust. In either case, these price adjustments will impact future royalties payable to the Trust and, in turn, will impact cash reserves that become available for distribution to Unitholders.

According to Cliffs’ Annual Report, sales volumes under most of its multi-year supply agreements with Cliffs’ customers are largely dependent on customer requirements and contain a base price that is adjusted annually using one or more adjustment factors. The factors that could result in price adjustments under Cliffs’ customer contracts include changes in the Platts 62% Price, hot-rolled coil steel price, the Atlantic Basin pellet premium, published Platts international indexed freight rates and changes in specified producer price indices, including those for industrial commodities, fuel and steel.

As also described elsewhere in this Annual Report, the Trust receives a bonus royalty equal to a percentage of the gross proceeds of iron ore products (mined from Mesabi Trust lands) shipped from Silver Bay and sold at prices above the Adjusted Threshold Price. Although 93.2% all of the iron ore products shipped from Silver Bay during calendar 2019 were sold at prices higher than the Adjusted Threshold Price, the Trustees are unable to project whether Cliffs will continue to be able to sell iron ore products at prices above the applicable Adjusted Threshold Price, entitling the Trust to any future bonus royalty payments.

Deutsche Bank Trust Company Americas, the Corporate Trustee, performs certain administrative functions for Mesabi Trust. The Trust maintains a website at www.mesabi-trust.com. The Trust makes available (free of charge) its annual, quarterly and current reports (and any amendments thereto) filed with the SEC through its website as soon as reasonably practicable after electronically filing or furnishing such material with or to the SEC.

16

|

Years ended |

|

2020 |

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|

|||||

|

Royalty and interest income(1) |

|

$ |

31,990,874 |

|

$ |

47,293,765 |

|

$ |

34,495,415 |

|

$ |

10,887,193 |

|

$ |

9,721,508 |

|

|

Trust expenses |

|

|

1,935,122 |

|

|

1,734,721 |

|

|

1,071,990 |

|

|

1,123,422 |

|

|

1,162,667 |

|

|

Net income(2) |

|

$ |

30,055,752 |

|

$ |

45,559,044 |

|

$ |

33,423,425 |

|

$ |

9,763,771 |

|

$ |

8,558,841 |

|

|

Net income per Unit(3) |

|

$ |

2.291 |

|

$ |

3.472 |

|

$ |

2.548 |

|

$ |

0.744 |

|

$ |

0.652 |

|

|

Distributions declared Per unit(3)(4) |

|

$ |

2.670 |

|

$ |

3.000 |

|

$ |

2.530 |

|

$ |

0.640 |

|

$ |

0.090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

23,647,374 |

|

$ |

35,454,014 |

|

$ |

26,222,284 |

|

$ |

14,421,288 |

|

$ |

9,816,961 |

|

|

(1) |

In fiscal 2019, we adopted ASU 2014-09, which impacted our annual recognition of revenues and expenses. Fiscal year 2016 throughout this document has not been adjusted for this new accounting standard. |

|

(2) |

The Trust, as a grantor trust, is exempt from federal and state income taxes. |

|

(3) |

Based on 13,120,010 Units of Beneficial Interest outstanding during all years. |

|

(4) |

In January each year, the Trustees consider whether the Trust will declare a cash distribution, and if so determined, such a distribution would be paid in February, which is in the Trust’s next fiscal year. Because of this, distributions declared generally do not equal the amount of cash distributed in the same fiscal year. To further illustrate, during the Trust’s fiscal year ended January 31, 2020, the Trustees distributed a total of $3.36 per Unit (including $1.39 per Unit declared in fiscal 2019 but distributed in fiscal 2020 (February 2019)) and in fiscal 2020 declared a distribution of $0.70 per Unit payable in February 2020, the next fiscal year. For a complete description of distributions paid and declared in fiscal years ended 2020, 2019, and 2018, see page F-6. |

TRUSTEES’ DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

Comparison of Iron Ore Pellet Production and Shipments for the Fiscal Years Ended January 31, 2020, January 31, 2019 and January 31, 2018

During fiscal 2020, production attributed to Trust lands totaled approximately 4.8 million tons, a decrease of 4.4% as compared to production for fiscal year 2019 and a decrease of 0.1% as compared to production for fiscal 2018. Shipments to Northshore’s customers attributed to the Trust totaled approximately 4.7 million tons during fiscal 2020. This represents a decrease of 8.9% as compared to shipments for fiscal year 2019 and a decrease of 4.9% as compared to shipments for fiscal year 2018. The table below, which is based on information provided to the Trust by Northshore, shows the total production and total shipments of iron ore pellets from Mesabi Trust lands during the prior three fiscal years.

|

|

|

Pellets Produced from |

|

Pellets Shipped from |

|

|

|

|

Trust Lands |

|

Trust Lands |

|

|

Year Ended |

|

(Tons) |

|

(Tons) |

|

|

January 31, 2020 |

|

4,802,269 |

|

4,678,321 |

|

|

January 31, 2019 |

|

5,025,850 |

|

5,138,157 |

|

|

January 31, 2018 |

|

4,806,391 |

|

4,920,633 |

|

Production of iron ore pellets for the fourth quarter of fiscal 2020 decreased 4.6% as compared to production of iron ore pellets for the fourth quarter of fiscal 2019 due primarily to a decrease in orders from Northshore’s customers as they adjusted production based on anticipated future demand from their customers. Shipments of iron ore pellets by Northshore during the fourth quarter of fiscal 2020 increased by 43.2% as compared to

17

shipments of iron ore pellets during the fourth quarter of fiscal 2019. The increase in shipments in the fourth quarter of fiscal 2020 was caused by an increase in demand from Northshore’s customers during the quarter.

|

|

|

Pellets Produced from |

|

Pellets Shipped from |

|

|

|

|

Trust Lands |

|

Trust Lands |

|

|

Three Months Ended |

|

(Tons) |

|

(Tons) |

|

|

January 31, 2020 |

|

1,226,721 |

|

1,364,254 |

|

|

January 31, 2019 |

|

1,285,735 |

|

952,740 |

|

|

January 31, 2018 |

|

1,335,413 |

|

649,469 |

|

The table below shows the change in the percentages of production and shipments from lands owned or leased by Mesabi Trust versus the percentages of production and shipments from lands owned by the State of Minnesota and others for the most recent three fiscal years.

|

|

|

|

|

|

|

Percentage of |

|

Percentage of |

|

|

|

|

Percentage of |

|

Percentage of |

|

Pellets |

|

Pellets |

|

|

|

|

Pellets Produced |

|

Pellets Produced |

|

Shipped |

|

Shipped |

|

|

|

|

From Trust |

|

From Non-Trust |

|

From Trust |

|

From Non-Trust |

|

|

Fiscal Year ended |

|

Lands |

|

Lands |

|

Lands |

|

Lands |

|

|

January 31, 2020 |

|

90.3% |

|

9.7% |

|

89.6% |

|

10.4% |

|

|

January 31, 2019 |

|

90.3% |

|

9.7% |

|

89.8% |

|

10.2% |

|

|

January 31, 2018 |

|

89.1% |

|

10.9% |

|

92.6% |

|

7.4% |

|

As is the case with the volume of shipments from Silver Bay, Minnesota, the Trustees cannot predict what percentage of production or shipments will be attributable to iron ore mined from Mesabi Trust lands in fiscal 2021. However, pursuant to the Amendment, Mesabi Trust will be credited with at least 90% of the first four million tons of iron ore pellets shipped from Silver Bay, Minnesota in each calendar year, at least 85% of the next two million tons of pellets shipped from Silver Bay, Minnesota in each calendar year, and at least 25% of all tons of pellets shipped from Silver Bay, Minnesota in each calendar year in excess of six million tons.

18

Comparison of Financial Results for Fiscal Years ended January 31, 2020 and January 31, 2019

Royalty Income

As shown in the table below, in fiscal 2020 base royalties decreased by 33.9%, bonus royalties decreased by 32.3% and fee royalties increased by 20.1%, each as compared to fiscal 2019. Accordingly, the Trust’s total royalty income decreased by 32.6% in fiscal 2020 as compared to fiscal 2019. The decrease in royalties received by the Trust is primarily the result of a decrease in iron prices and a decrease in tons shipped in fiscal 2020, as compared to fiscal 2019.

|

|

|

Fiscal Year ended January 31, |

|

% increase |

|

||||

|

|