Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LINDSAY CORP | d905370dex991.htm |

| 8-K - 8-K - LINDSAY CORP | d905370d8k.htm |

2nd Quarter Fiscal 2020 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include but are not limited to those outlined in the “Risk Factors” sections of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission and the Company’s quarterly report on Form 10-Q for the fiscal quarter ended February 29, 2020, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For full financial statement information, please see the Company’s earnings release dated April 7, 2020.

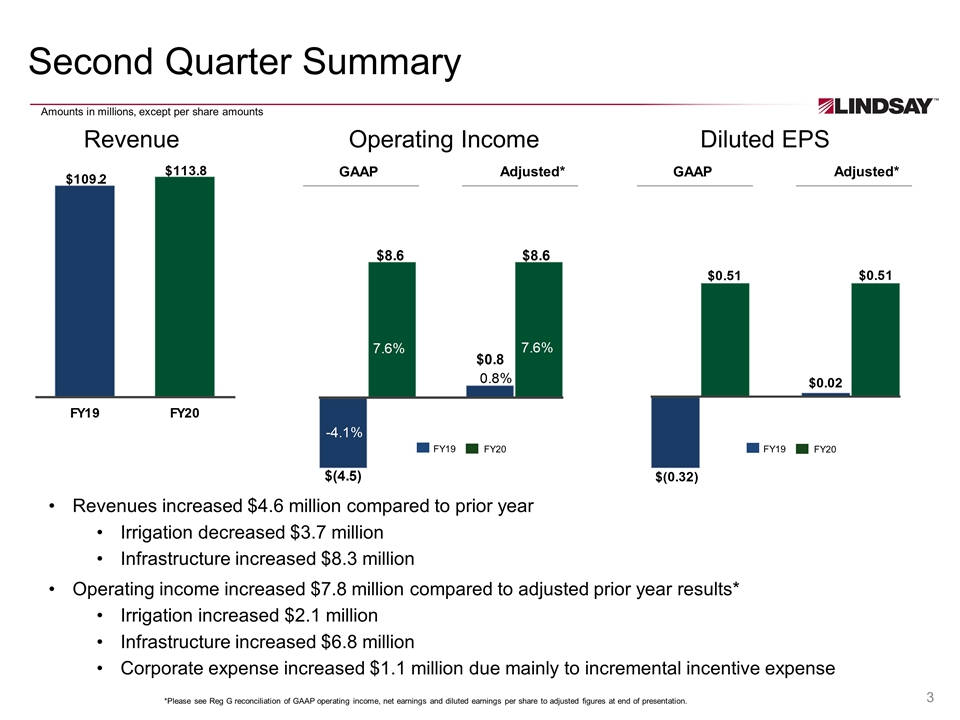

Second Quarter Summary 3 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Revenue Operating Income Diluted EPS Revenues increased $4.6 million compared to prior year Irrigation decreased $3.7 million Infrastructure increased $8.3 million Operating income increased $7.8 million compared to adjusted prior year results* Irrigation increased $2.1 million Infrastructure increased $6.8 million Corporate expense increased $1.1 million due mainly to incremental incentive expense GAAP Adjusted* GAAP Adjusted* Amounts in millions, except per share amounts FY19 FY20 FY19 FY20

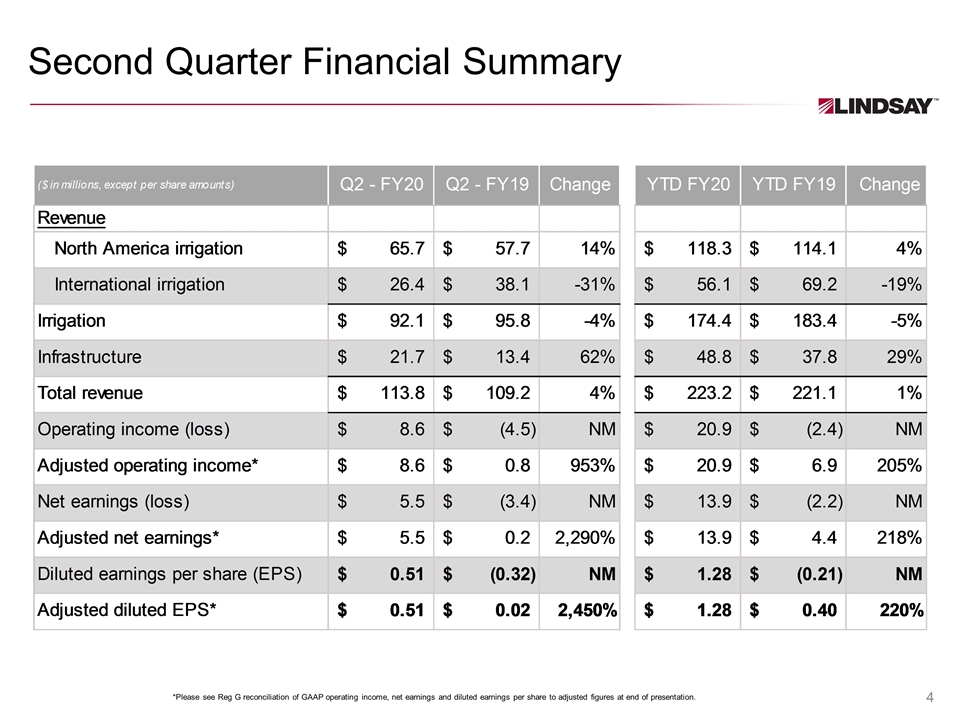

Second Quarter Financial Summary *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation.

Current Market Factors Under the U.S.-China Phase 1 trade deal signed January 15, 2020, China pledged to increase purchases of U.S. agricultural products by $32 billion over two years. This would be more than a 60% increase over the 2017 baseline cited in the deal. 2020 Net Farm Income is projected by the USDA to be $96.7 billion, an increase of 3.3% from 2019. Increases in cash receipts for crops and livestock are partially offset by a decrease in gov’t support payments. Global COVID-19 pandemic creates economic uncertainty and puts downward pressure on agricultural commodity prices. Plunge in oil prices puts downward pressure on ethanol demand and corn prices. Increased uncertainty on timing of international projects. Irrigation Infrastructure States continue the transition to new federal MASH testing standards for road safety products. Almost all of our road safety product offerings in the U.S. have now received MASH eligibility. Our “shift left” strategy is gaining traction and contributing to an increase in Road Zipper System® lease revenue. Road Zipper System® gaining interest globally as a solution to traffic congestion and air quality. A large project in the UK, a new order from Japan, and a second multi-year lease in Germany were secured in the second quarter. The five-year $305 billion U.S. highway bill enacted in December 2015 (the “FAST Act”) is scheduled to expire in September 2020 unless it is reauthorized by Congress.

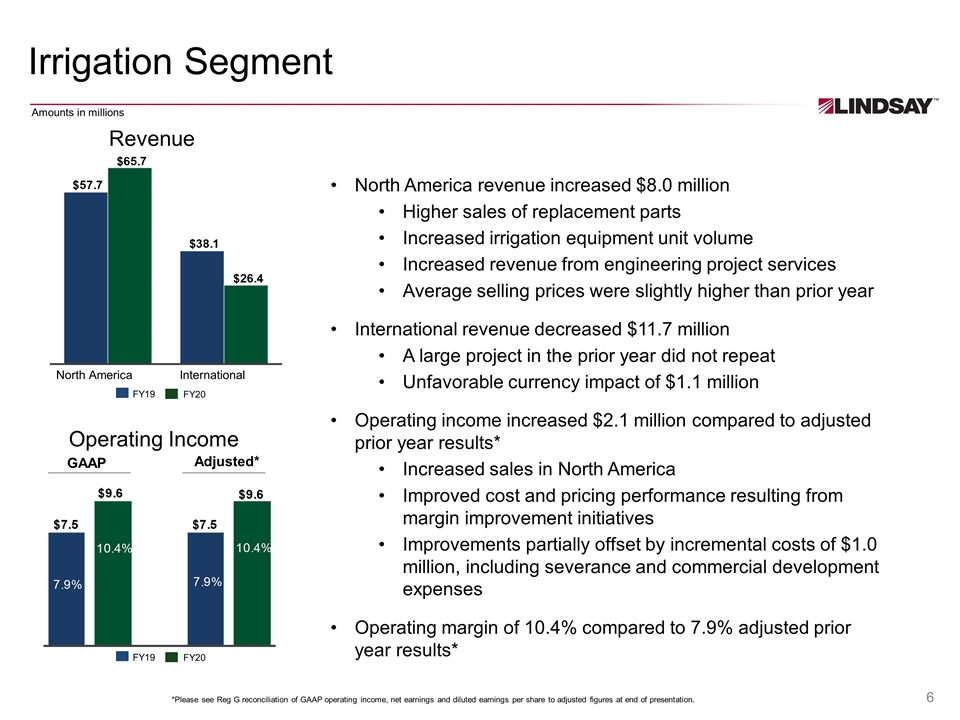

Irrigation Segment North America revenue increased $8.0 million Higher sales of replacement parts Increased irrigation equipment unit volume Increased revenue from engineering project services Average selling prices were slightly higher than prior year International revenue decreased $11.7 million A large project in the prior year did not repeat Unfavorable currency impact of $1.1 million Operating income increased $2.1 million compared to adjusted prior year results* Increased sales in North America Improved cost and pricing performance resulting from margin improvement initiatives Improvements partially offset by incremental costs of $1.0 million, including severance and commercial development expenses Operating margin of 10.4% compared to 7.9% adjusted prior year results* Revenue Operating Income GAAP Adjusted* North America International FY19 FY20 FY19 FY20 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Amounts in millions

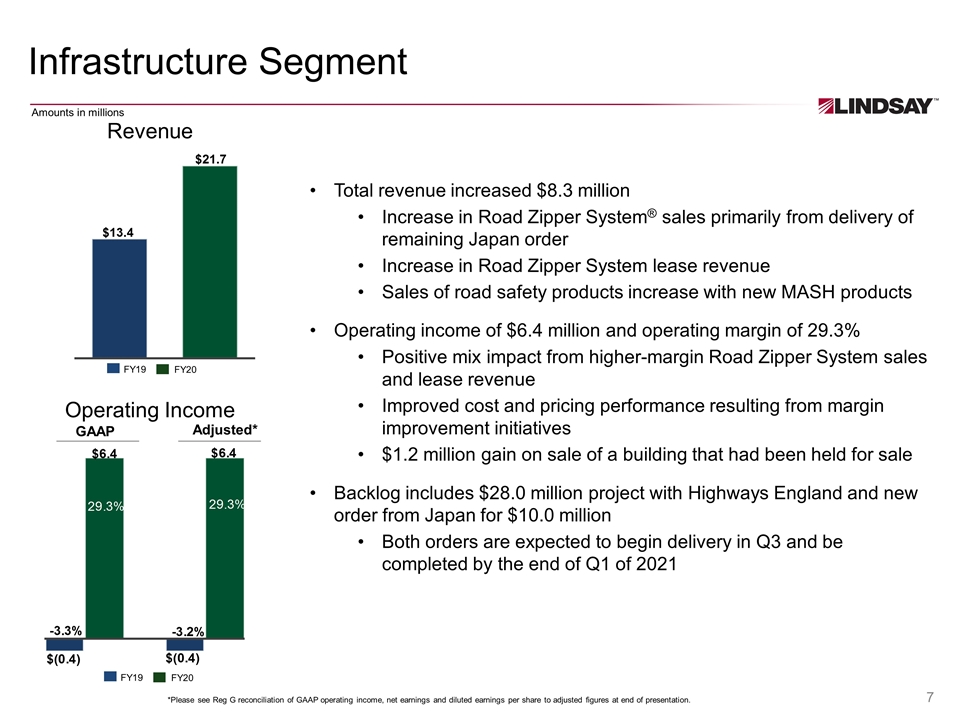

Infrastructure Segment Total revenue increased $8.3 million Increase in Road Zipper System® sales primarily from delivery of remaining Japan order Increase in Road Zipper System lease revenue Sales of road safety products increase with new MASH products Operating income of $6.4 million and operating margin of 29.3% Positive mix impact from higher-margin Road Zipper System sales and lease revenue Improved cost and pricing performance resulting from margin improvement initiatives $1.2 million gain on sale of a building that had been held for sale Backlog includes $28.0 million project with Highways England and new order from Japan for $10.0 million Both orders are expected to begin delivery in Q3 and be completed by the end of Q1 of 2021 Revenue Operating Income GAAP Adjusted* FY19 FY20 FY19 FY20 *Please see Reg G reconciliation of GAAP operating income, net earnings and diluted earnings per share to adjusted figures at end of presentation. Amounts in millions

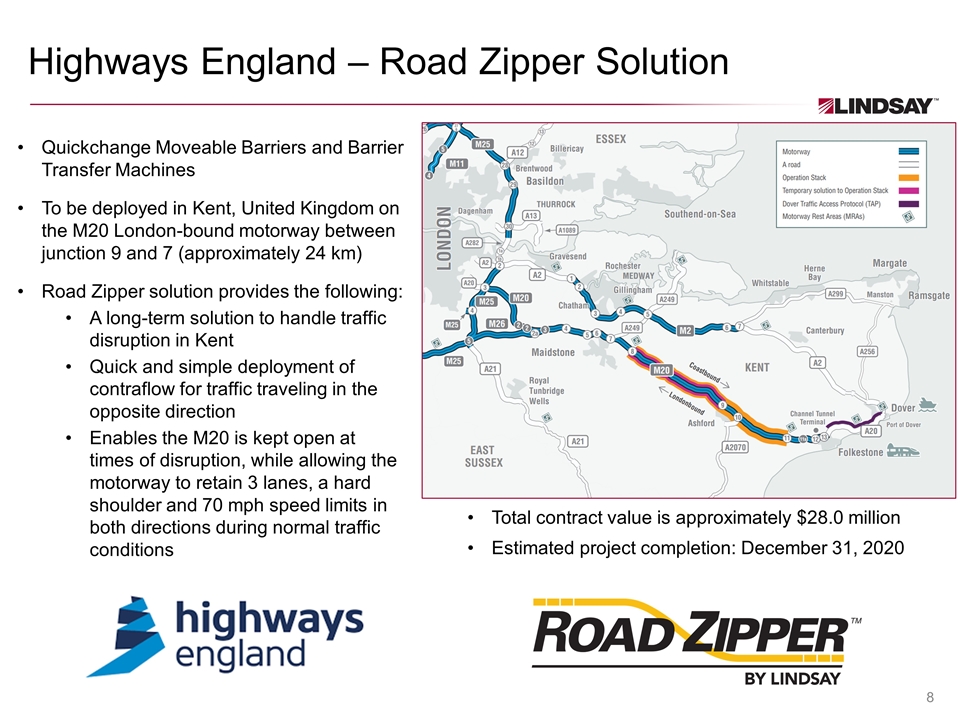

Innovative Market Leader – Sustainable Solutions Highways England – Road Zipper Solution Quickchange Moveable Barriers and Barrier Transfer Machines To be deployed in Kent, United Kingdom on the M20 London-bound motorway between junction 9 and 7 (approximately 24 km) Road Zipper solution provides the following: A long-term solution to handle traffic disruption in Kent Quick and simple deployment of contraflow for traffic traveling in the opposite direction Enables the M20 is kept open at times of disruption, while allowing the motorway to retain 3 lanes, a hard shoulder and 70 mph speed limits in both directions during normal traffic conditions Total contract value is approximately $28.0 million Estimated project completion: December 31, 2020

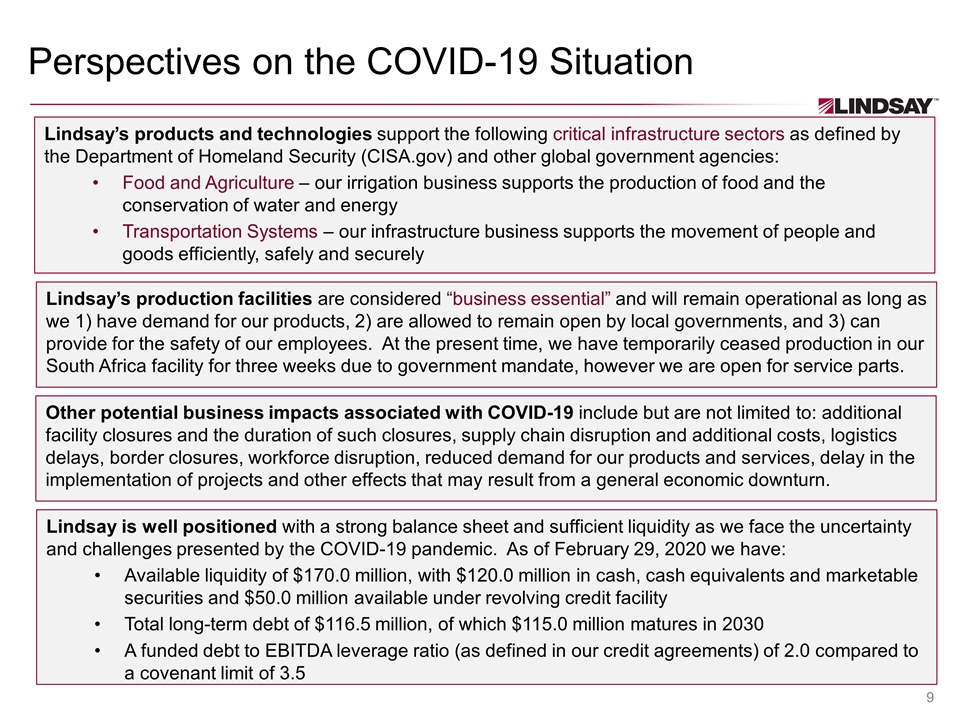

Perspectives on the COVID-19 Situation Innovative Market Leader – Sustainable Solutions Lindsay’s products and technologies support the following critical infrastructure sectors as defined by the Department of Homeland Security (CISA.gov) and other global government agencies: Food and Agriculture – our irrigation business supports the production of food and the conservation of water and energy Transportation Systems – our infrastructure business supports the movement of people and goods efficiently, safely and securely Lindsay’s production facilities are considered “business essential” and will remain operational as long as we 1) have demand for our products, 2) are allowed to remain open by local governments, and 3) can provide for the safety of our employees. At the present time, we have temporarily ceased production in our South Africa facility for three weeks due to government mandate, however we are open for service parts. Other potential business impacts associated with COVID-19 include but are not limited to: additional facility closures and the duration of such closures, supply chain disruption and additional costs, logistics delays, border closures, workforce disruption, reduced demand for our products and services, delay in the implementation of projects and other effects that may result from a general economic downturn. Lindsay is well positioned with a strong balance sheet and sufficient liquidity as we face the uncertainty and challenges presented by the COVID-19 pandemic. As of February 29, 2020 we have: Available liquidity of $170.0 million, with $120.0 million in cash, cash equivalents and marketable securities and $50.0 million available under revolving credit facility Total long-term debt of $116.5 million, of which $115.0 million matures in 2030 A funded debt to EBITDA leverage ratio (as defined in our credit agreements) of 2.0 compared to a covenant limit of 3.5

COVID-19 Protocols in Place Innovative Market Leader – Sustainable Solutions Protecting the health and well-being of our employees is a top priority, as is maintaining frequent communication and providing important updates. Beginning in early March, we have: Created a global task force and communication strategy Implemented social distancing protocols Initiated remote work strategy for employees not essential to factory operations Restricted domestic and international travel for business-essential purposes Completed an electrostatic spray deep clean at our global headquarters Limited visitors to all of our facilities to essential personnel only Conducted screening questionnaires for all facility visitors Increased frequency and intensity of disinfecting all high-touch areas Implemented twice daily disinfecting procedures for production equipment Implemented staggered breaks in our factory operations Created a COVID-19 Manager at each facility to ensure rigid discipline of protocols Established protocols in the event of a confirmed COVID-19 diagnosis Published weekly updates by location specific to CDC and WHO updates and guidelines Implemented virtual or phone meeting protocol

Executing Long-Term Value Creation Innovative Market Leader – Sustainable Solutions Deepening customer relationships through technology differentiation Solutions and growth aligned to market megatrends…. designed to sustain and protect our evolving world Foundation for Growth initiative driving margin expansion Empowered global culture through Vision, Values and Behaviors Framework Innovative Market Leader – Sustainable Solutions ONE LINDSAY

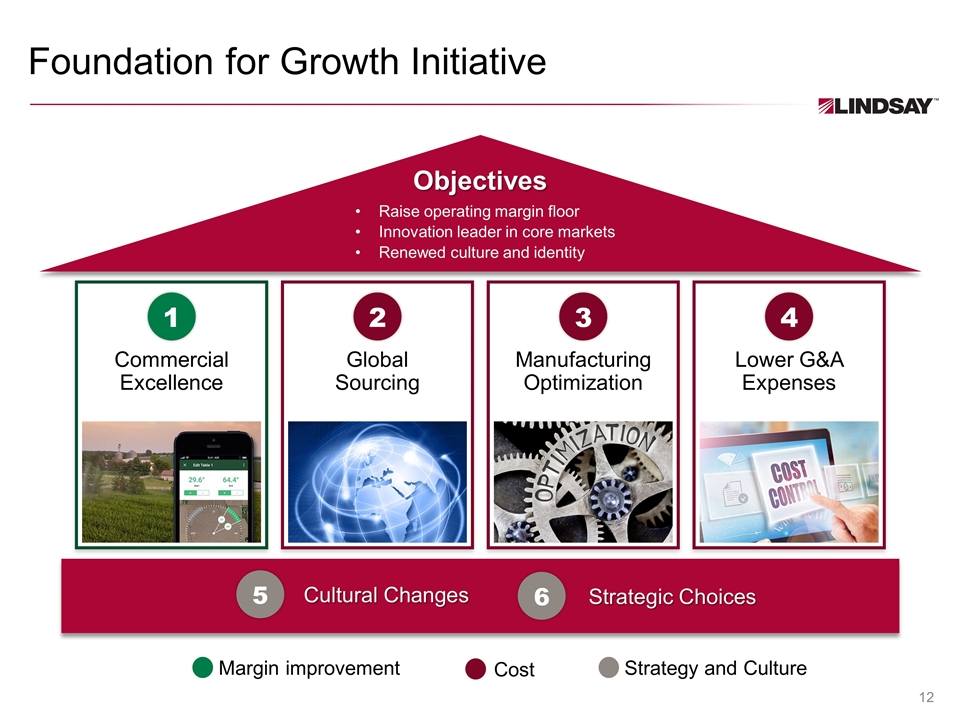

Foundation for Growth Initiative Margin improvement Cost Strategy and Culture Objectives Raise operating margin floor Innovation leader in core markets Renewed culture and identity 1 2 3 4 5 6 Commercial Excellence Global Sourcing Manufacturing Optimization Lower G&A Expenses Cultural Changes Strategic Choices

Foundation for Growth Execution Execution is on track Accomplishments through Q2 Fiscal 2020 Divested four non-core businesses ü Established a centralized shared services organization ü Closed and sold an infrastructure facility; consolidated activity into an existing irrigation facility ü Made tangible progress in culture change and aligning behaviors to strategy ü Projects in each of the four margin-improvement workstreams have moved to implementation and realization stage ü

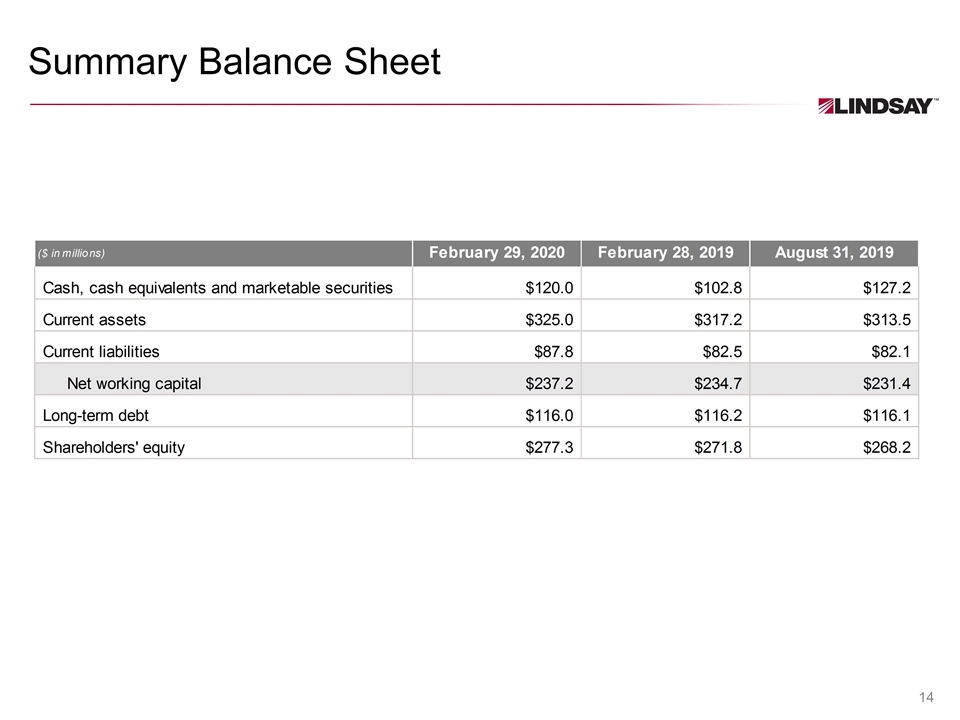

Summary Balance Sheet 4

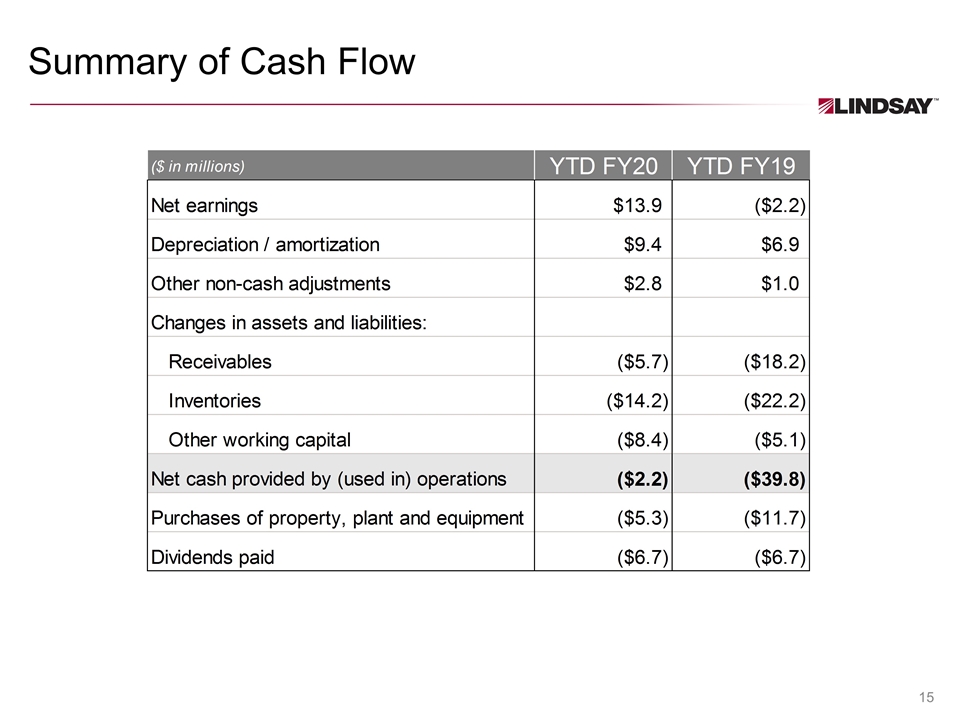

Summary of Cash Flow

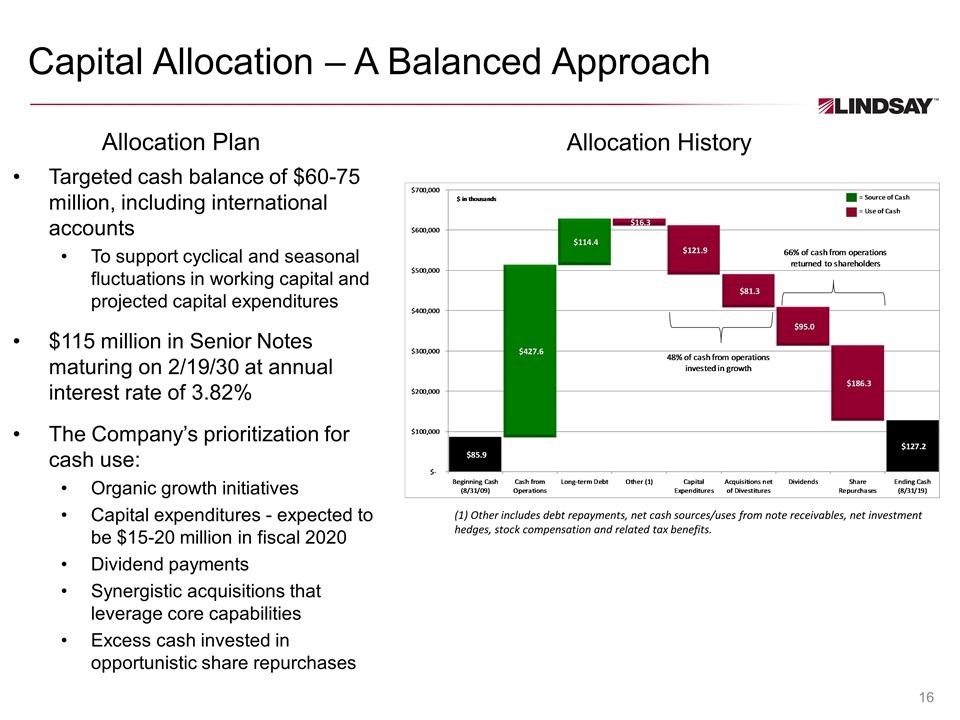

Capital Allocation – A Balanced Approach Allocation History (1) Other includes debt repayments, net cash sources/uses from note receivables, net investment hedges, stock compensation and related tax benefits. Targeted cash balance of $60-75 million, including international accounts To support cyclical and seasonal fluctuations in working capital and projected capital expenditures $115 million in Senior Notes maturing on 2/19/30 at annual interest rate of 3.82% The Company’s prioritization for cash use: Organic growth initiatives Capital expenditures - expected to be $15-20 million in fiscal 2020 Dividend payments Synergistic acquisitions that leverage core capabilities Excess cash invested in opportunistic share repurchases Allocation Plan

Attractive Long-Term Megatrends Water Conservation Alternative Fuels Increase Yields Improve Road Safety Population Growth Advancing Technology

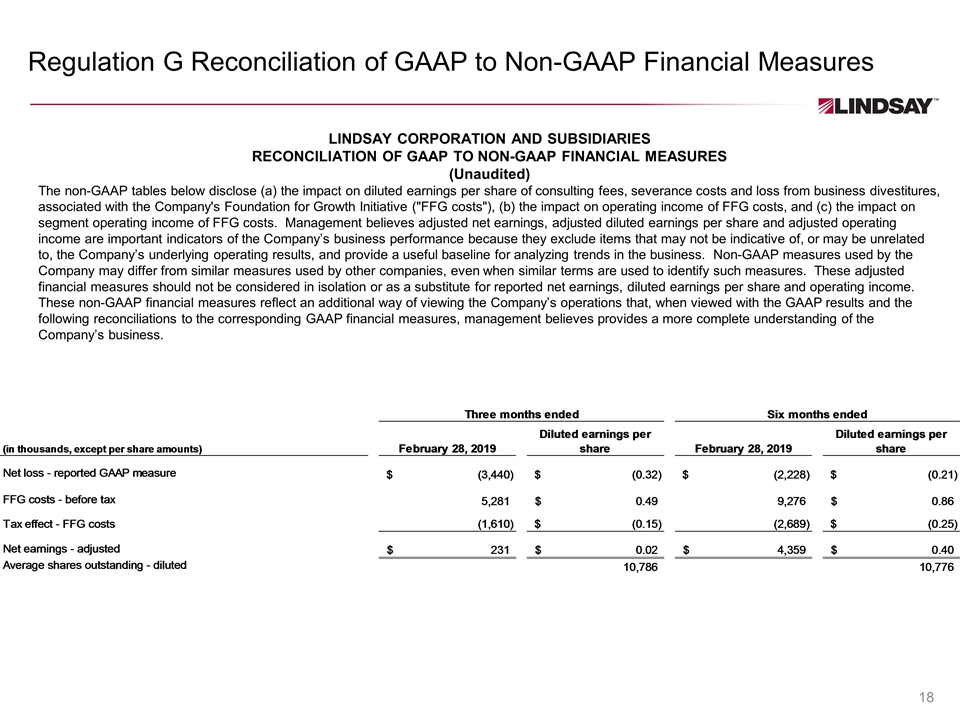

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of consulting fees, severance costs and loss from business divestitures, associated with the Company's Foundation for Growth Initiative ("FFG costs"), (b) the impact on operating income of FFG costs, and (c) the impact on segment operating income of FFG costs. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

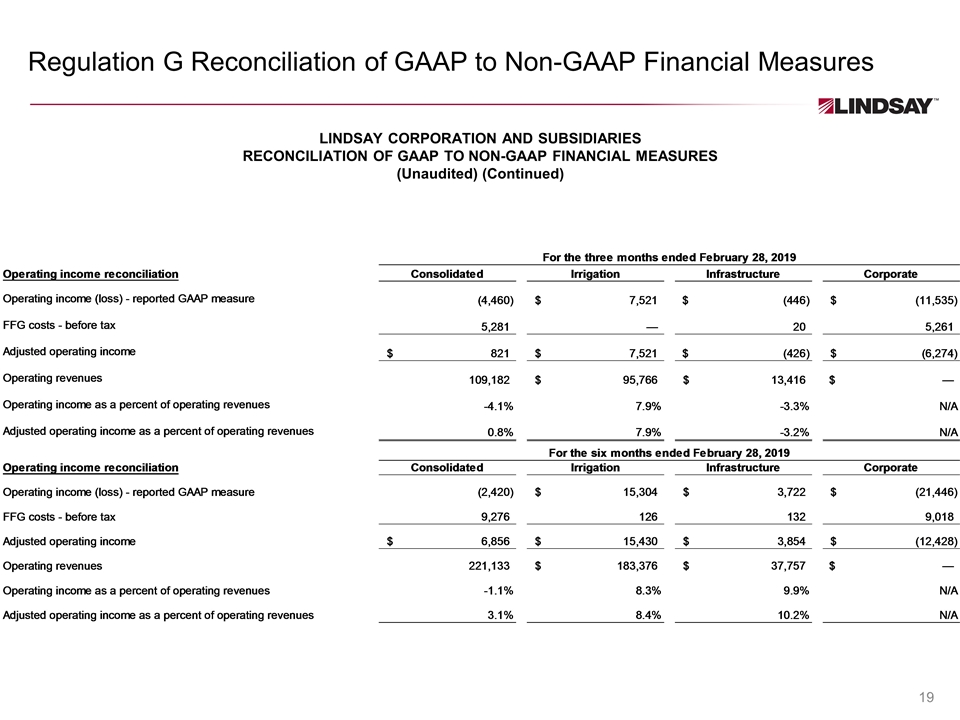

Regulation G Reconciliation of GAAP to Non-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) (Continued)