Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Red Lion Hotels CORP | d909950d8k.htm |

| EX-99.1 - EX-99.1 - Red Lion Hotels CORP | d909950dex991.htm |

RLH Corporation Investor Update April 2, 2020 Exhibit 99.2

Disclaimer This presentation contains forward-looking statements within the meaning of federal securities law, including statements concerning plans, objectives, goals, strategies, projections of future events or performance and underlying assumptions (many of which are based, in turn, upon further assumptions), and including statements concerning operational and financial impacts of the COVID-19 pandemic. The forward-looking statements in this press release are inherently subject to a variety of risks and uncertainties that could cause actual results to differ materially from those expressed. Such risks and uncertainties include, among others, risks associated with pandemics, contagious diseases or health epidemics, including the effects of the COVID-19 pandemic; restructuring or organizational changes; our asset light model; relationships with our franchisees and properties; competitive conditions in the lodging industry; economic cycles and general economic conditions; changes in future demand and supply for hotel rooms; international conflicts and conditions; impact of government regulations; ability to obtain financing; changes in energy, healthcare, insurance and other operating expenses; ability to sell non-core assets; dependency upon the ability and experience of executive officers and ability to retain or replace such officers as well as other risks and uncertainties discussed in the Company's annual report on Form 10-K for the year ended December 31, 2019, and in other documents filed by the Company with the Securities and Exchange Commission. The forward-looking statements contained herein speak only to the date of this press release. The Company undertakes no obligation to update or revise any forward-looking statements except as required by law.

Back to basics: Focus on core franchise business To improve franchise relations, retention and growth, RLHC launched campaign ROAR: R Recruit new franchises and sell to existing franchises O Onboard and open as quickly as possible A Add value with operations, training, purchasing, revenue management, and marketing programs R Retain franchisees for positive growth RLHC has been executing on its strategic plan focusing on the core franchise business. The three key priorities are: Accelerating new franchise sales and franchise growth Delivering superior value and service to our franchisees to improve franchise retention Aligning cost structure of the business to RLHC’s current size, revenue and profitability requirements

Initiatives related to covid-19 impact Due to the increasing challenges from the COVID-19 pandemic, RLHC implemented several initiatives. Accelerated its cost reduction program, including: A reduction in workforce, executive, staff and Board compensation reductions Closing the Spokane office The suspension of non-essential cap-ex programs Taken a number of measures to alleviate some of the challenges faced by franchise owners, including: Royalty and Marketing Fee deferral program for all brands Temporary fee reductions for review responses, guest relations fees, and certain other fees Delay capital intensive brand standards Providing information on new legislative relief that may be available to them

ORGANIZATIONAL And Board CHANGES The Company announced several organizational changes. Nate Troup was promoted to Chief Financial Officer; previously Mr. Troup was the Company’s Chief Accounting Officer Julie Shiflett, existing Chief Financial Officer is leaving the Company to pursue other interests Paul Moerner was promoted to Chief Accounting Officer; previously Mr. Moerner was Senior Director, Technical Accounting and Reporting The Board of Directors has suspended the Company’s search for a permanent Chief Executive Officer at this time. John Russell, as interim CEO, will continue to lead the organization

Cost saving initiatives The Company has implemented additional measures as part of an accelerated cost-cutting program. A reduction in force. Reducing its corporate workforce by roughly 40% to approximately 100 full-time equivalent employees. After this reduction, the Company has reduced 48% of the corporate workforce on a quarter-to-date basis. The reduction was part of the cost cutting measures begun in late 2019 and now accelerated. The reduction in force and affiliated severance expense totals $0.6 million. Company-wide compensation reductions. Virtually all associates are taking salary reductions, with compensation cuts between 5% and 25%. The Board is taking a 25% reduction in base retainer for Q2. Consolidation of its operations in Denver. Closing the Spokane office and successfully sub-leased its surplus office space in Denver. Cost savings related to the reduction of office space are an estimated $0.3M for the remainder of 2020 and $0.5 million on an annualized basis. A reduction in capital spend. Reducing its 2020 capital expenditures to include only essential projects for an estimated savings of $2.9 million and a reduction in additional key money commitments during this challenging economic time.

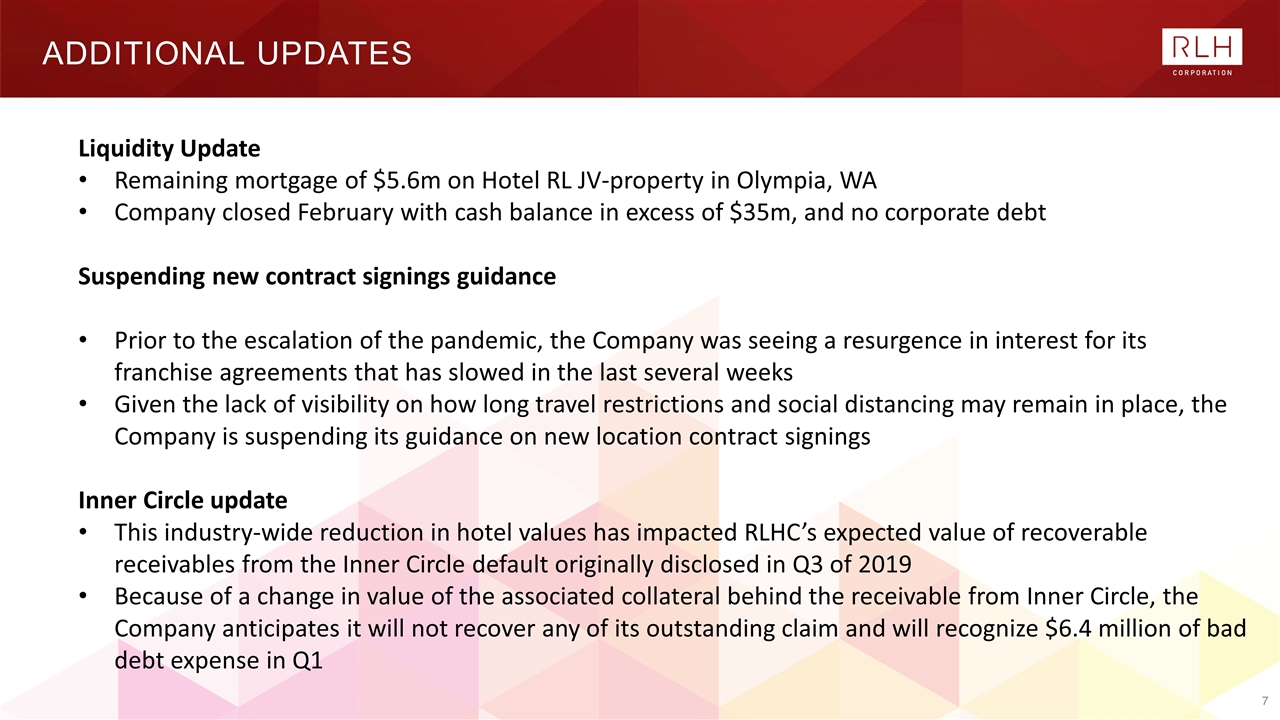

Additional updates Liquidity Update Remaining mortgage of $5.6m on Hotel RL JV-property in Olympia, WA Company closed February with cash balance in excess of $35m, and no corporate debt Suspending new contract signings guidance Prior to the escalation of the pandemic, the Company was seeing a resurgence in interest for its franchise agreements that has slowed in the last several weeks Given the lack of visibility on how long travel restrictions and social distancing may remain in place, the Company is suspending its guidance on new location contract signings Inner Circle update This industry-wide reduction in hotel values has impacted RLHC’s expected value of recoverable receivables from the Inner Circle default originally disclosed in Q3 of 2019 Because of a change in value of the associated collateral behind the receivable from Inner Circle, the Company anticipates it will not recover any of its outstanding claim and will recognize $6.4 million of bad debt expense in Q1