Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - N1 Liquidating Trust | n1liquidatingtr123119ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - N1 Liquidating Trust | n1liquidatingtr123119ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - N1 Liquidating Trust | n1liquidatingtr123119ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - N1 Liquidating Trust | n1liquidatingtr123119ex311.htm |

| EX-21.1 - EXHIBIT 21.1 - N1 Liquidating Trust | n1liquidatingtr123119ex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-54671*

N1 Liquidating Trust

(Exact Name of Registrant as Specified in its Charter)

Maryland | 32-6497467 |

(State or Other Jurisdiction of | (IRS Employer |

Incorporation or Organization) | Identification No.) |

515 S. Flower St., 44th Floor, Los Angeles, CA 90071

(Address of Principal Executive Offices, Including Zip Code)

(310) 282-8820

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: None

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

N/A | N/A | N/A | ||

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.* Yes o No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.* Yes o No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).* Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Annual Report on Form 10-K.* o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x | Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2019. Not applicable.

As of March 27, 2020, there were 119,333,203 units of beneficial interest in N1 Liquidating Trust outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

* | N1 Liquidating Trust is the transferee of the assets and liabilities of NorthStar Real Estate Income Trust, Inc. and files reports under the Securities and Exchange Commission (the “SEC”) file number for NorthStar Real Estate Income Trust, Inc. NorthStar Real Estate Income Trust, Inc. filed a Form 15 on February 1, 2018, indicating its notice of termination of registration and filing requirements. |

N1 LIQUIDATING TRUST

FORM 10-K

TABLE OF CONTENTS

Index | Page | |

3

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

• | the ability to complete our plan of liquidation, in the timeframe estimated or at all; |

• | greater than expected liquidation costs or liabilities; |

• | our ability to make distributions to our beneficiaries prior to a liquidation or at all; |

• | the lack of a public trading market for our units of the beneficial interests; |

• | the effect of economic or market conditions on the valuation of the collateral underlying the first mortgage loan in which a subsidiary of the Trust (as defined herein) holds the Junior Participation (as defined herein); |

• | the impact of economic conditions on the first mortgage loan in which a subsidiary of the Trust holds the Junior Participation; |

• | the impact of fluctuations in interest rates; |

• | borrower default or bankruptcy; |

• | the borrower’s ability to sell or dispose of all or portions of the collateral in the timeframe anticipated or at all, and any resulting impact on proceeds available for distribution to unitholders; |

• | a decrease in the cash flow generated by, or the overall value of the properties securing the first mortgage loan in which a subsidiary of the Trust holds the Junior Participation; |

• | difficulties in economic conditions in the geographic markets and industry sector for the collateral underlying the first mortgage loan in which the Trust holds the Junior Participation; |

• | the impact of the Coronavirus (COVID-19) pandemic on the cash flow of the collateral, the borrower’s ability to pay interest and principal on the first mortgage loan, the value of the Junior Participation and the Trust’s ability to make any liquidating distributions to beneficiaries; |

• | changes in our management; |

• | the failure to achieve the desired tax impact of the transactions contemplated with respect to the Trust and resultant tax treatment relating to, arising from or incurred in connection with such transactions; and |

• | changes to U.S. generally accepted accounting principles (“GAAP”). |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our liquidation value are set forth in our filings with the United States Securities and Exchange Commission, or the SEC, including the “Risk Factors” in this Annual Report on Form 10-K beginning on page 10. The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

4

PART I

Item 1. Business

References to the “Trust,” “we,” “us” or “our” refer to N1 Liquidating Trust and its subsidiary, unless context specifically requires otherwise.

Overview

N1 Liquidating Trust was formed on January 5, 2018 as a statutory trust under Maryland law to hold and liquidate a first mortgage loan (the “Loan”) previously held by NorthStar Real Estate Income Trust, Inc. (“NorthStar I”), which was excluded from the combination (the “Combination”) of substantially all of the assets of NorthStar I, NorthStar Real Estate Income II, Inc. (“NorthStar II”) and a select portfolio of assets of Colony Capital, Inc. (“CLNY”) to create Colony Credit Real Estate, Inc., a publicly-traded real estate investment trust (“CLNC”).

Prior to the Combination, NorthStar I, a Maryland corporation formed in January 2009, originated, acquired and asset managed a diversified portfolio of commercial real estate debt and select equity and securities investments. NorthStar I operated and elected to be treated as a real estate investment trust for U.S. federal income tax purposes, commencing with its taxable year ended December 31, 2010.

On January 31, 2018, the closing date of the Combination, NorthStar I completed its merger with and into CLNC (the “NorthStar I Merger”). At the effective time of the NorthStar I Merger (the “NorthStar I Merger Effective Time”), each share of NorthStar I’s common stock, par value $0.01 per share, issued and outstanding immediately prior to the NorthStar I Merger Effective Time, was cancelled and converted into the right to receive 0.3532 shares of Class A common stock of CLNC, plus cash in lieu of any fractional shares (the “NorthStar I Merger Consideration”). In addition, prior to the NorthStar I Merger Effective Time, NorthStar I distributed to its stockholders, as a special dividend, all of the units of beneficial interest in the Trust (the “Units”), with each share of NorthStar I’s common stock receiving one Unit (plus a fractional portion of a Unit equal to any fractional shares) (the “Special Dividend”).

On February 1, 2018, NorthStar I filed a Form 15 with the SEC to terminate the registration of NorthStar I’s common stock under the Exchange Act, at which point NorthStar I ceased filing reports under the Exchange Act.

The Trust

On January 31, 2018, in accordance with the provisions of the combination agreement (the “Combination Agreement”), which provisions (together with the Liquidating Trust Agreement (as defined below)) we refer to herein as our “plan of liquidation,” NorthStar I, through a subsidiary, transferred the Loan to N1 Hendon Holdings, LLC, a Delaware limited liability company (the “Liquidating Company”), in exchange for all of the common equity interests in the Liquidating Company. Following such transfer, the Liquidating Company entered into a participation agreement (the “Participation Agreement”) with CFI Hendon Holdings, LLC, a Delaware limited liability company and subsidiary of CLNY (“CFI Holdings”), pursuant to which CFI Holdings purchased from the Liquidating Company a $65.0 million senior participation interest in the Loan (the “Senior Participation”), and the Liquidating Company retained a $85.15 million junior participation interest in the Loan (the “Junior Participation”).

Also on January 31, 2018, Sujan S. Patel, James J. Thomas and Chris S. Westfahl, in their capacities as trustees of the Trust, and NorthStar I entered into an Agreement and Declaration of Trust (the “Liquidating Trust Agreement”). NorthStar I subsequently transferred all of its ownership interests in the Liquidating Company to the Trust in exchange for 100% of the outstanding Units, which NorthStar I then distributed in the Special Dividend to its stockholders. Effective as of December 6, 2018, Sujan S. Patel resigned as a trustee of the Trust, and David Belford was concurrently appointed by the remaining trustees as Chairman and a trustee of the Trust.

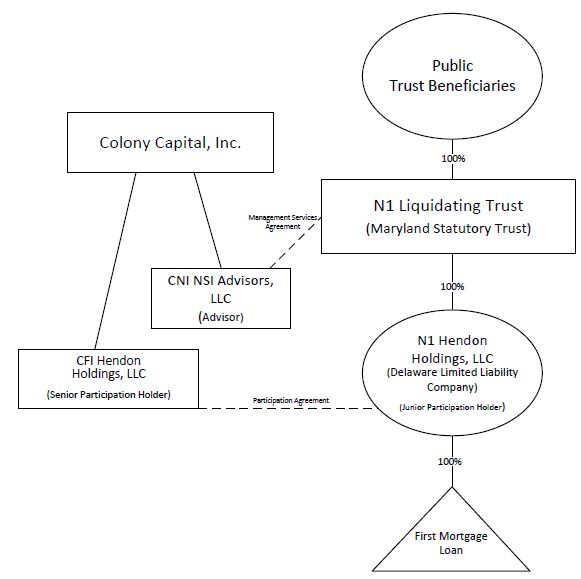

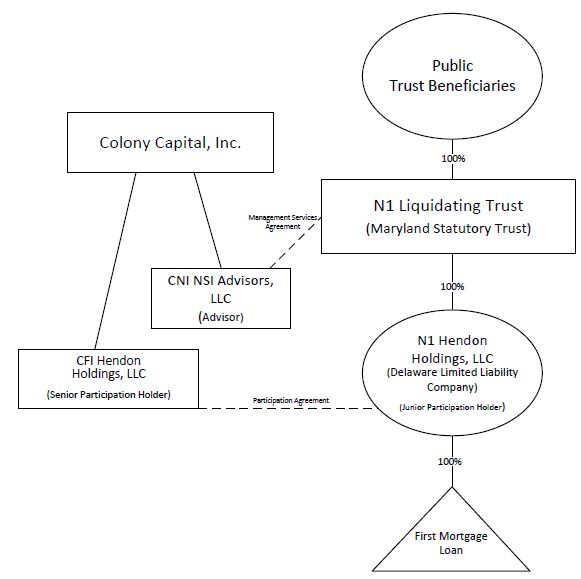

The Trust holds the Loan through its ownership of 100% of the membership interests in the Liquidating Company, which directly holds the Loan. The Trust acts as the managing member of the Liquidating Company. The organizational structure of the Trust and its assets is as follows:

5

The beneficial interests in the Trust are expressed in terms of units for ease of administration, but the Units are not certificated. Each Unit represents ownership of an undivided proportionate interest in all of the assets and liabilities of the Trust. Subject to certain limited exceptions with regard to retirement accounts, Units may not be transferred or assigned other than by will, intestate succession or operation of law, and except for certain limited transfers by a tax-qualified employee retirement plan or account to the extent required to satisfy a required minimum distribution.

The Liquidating Trust Agreement provides that our trustees are responsible for overseeing the management and liquidation of the Trust’s assets, including servicing through the maturity or otherwise disposing of the Loan, and that our trustees have the discretion to make distributions of available cash to the beneficiaries as and when they deem such distributions to be in the best interests of the beneficiaries, taking into account the administrative costs of making such distributions, our anticipated costs and expenses and such other factors as they may consider appropriate.

The Liquidating Trust Agreement further provides that the Trust will terminate upon the earlier of (i) the liquidation and distribution of the net proceeds of all the assets held by the Trust and its subsidiaries or (ii) three years from January 31, 2018. Notwithstanding the foregoing, the trustees may continue the existence of the Trust beyond the three-year term if the trustees reasonably determine that an extension is necessary to fulfill the purposes of the Trust. As a result of the Loan Modification discussed below, the Loan is scheduled to mature on December 9, 2020, with three, one-year extension options at the borrower group’s (the “Borrower”) option subject to satisfying certain conditions. To the extent that the Borrower meets the required conditions and exercises its options to extend the term of the Loan, the Trust expects to extend the term of the Trust accordingly.

We currently operate as one reportable segment comprised of the Junior Participation. Refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data,” for further details concerning our financial information.

Advisor

On January 31, 2018, the Trust, the Liquidating Company, and CNI NSI Advisors, LLC, a Delaware limited liability company (the “Advisor”), entered into a management services agreement (the “Management Services Agreement”) pursuant to which the Advisor was appointed to provide assistance in the management, sale, disposition and/or liquidation of the Trust’s assets, and to provide administrative services to the Trust, the Liquidating Company and their subsidiaries, for the duration of the Trust. As compensation, the Advisor will receive a monthly management fee equal to one-twelfth of 1.25% of the fair market value of the Trust’s net assets. The Advisor is an affiliate of CLNY and CFI Holdings, the holder of the Senior Participation.

6

Trust Objectives

Our primary objective is to prudently manage the Loan until it is disposed of or matures, and to collect and distribute the proceeds from the Trust’s assets to its beneficiaries as promptly as possible. The amount per Unit that would be paid in cash upon the final maturity date or sale of the Loan will be determined by, among other things, market conditions, the Borrower’s ability to repay the remaining principal balance of the Loan, the principal and interest then owed on the Senior Participation, the amount of time it takes to complete the liquidation and the potential costs associated with the liquidation. There can be no assurance regarding the amount of cash that ultimately will be distributed to the beneficiaries of the Trust or the timing of the liquidation of the Trust.

The Loan and Junior Participation

Our sole asset is the Junior Participation, which has an outstanding principal balance of $85.2 million as of March 27, 2020. The Junior Participation represents a subordinated interest in the Loan, which is a first mortgage loan collateralized by certain retail properties in the Southeast United States. The terms of the Junior Participation are governed by the Participation Agreement with CFI Holdings, which owns the Senior Participation. The outstanding principal balance of the Senior Participation is $40.6 million as of March 27, 2020.

In accordance with the Participation Agreement, we may generally receive payments of interest and principal made by the Borrower on the Loan, subject the following order of priority: first, to CFI Holdings for any unreimbursed costs and expenses it paid with respect to the Loan; second, with respect to interest payments received, to CFI Holdings in an amount equal to the accrued and unpaid interest on the principal balance of the Senior Participation at a rate equal to the modified interest rate (as described below); third, with respect to interest payments received, to the Liquidating Company in an amount equal to the accrued and unpaid interest on the principal balance of the Junior Participation at a rate equal to the modified interest rate; fourth, with respect to any principal payments received, to CFI Holdings until the principal balance of the Senior Participation has been reduced to zero and there are no outstanding obligations to CFI Holdings; fifth, with respect to any principal payments received, to the Liquidating Company until the principal balance of the Junior Participation has been reduced to zero and there are no outstanding obligations to Liquidating Company; and sixth, if any excess amount is available to be distributed in respect of the Loan, and not otherwise applied in accordance with the foregoing, any remaining amount shall be paid pro rata to CFI Holdings and Liquidating Company in accordance with their respective percentage interests.

If an event of default occurs on the Loan, pursuant to the Participation Agreement, the order of priority of payments made on the Loan will change to reflect that CFI Holdings will first receive all interest and principal payments made on the Loan until CFI Holdings receives all of its unreimbursed costs and expenses, and accrued and unpaid interest and outstanding principal on the Senior Participation, before the Liquidating Company will receive any accrued and unpaid interest and outstanding principal on the Junior Participation.

Pursuant to the Participation Agreement, the Loan is serviced by CFI Holdings. CFI Holdings provides the day-to-day management of the Loan, subject to our consent for certain major decisions, including, but not limited to, a material modification of the Loan (including any extension of the maturity date or change to the amount or timing of principal and interest payments), a waiver of an event of default, a transfer or material alteration of the retail portfolio serving as collateral for the Loan (the “Portfolio”), and the approval of any additional lien on the property in the Portfolio.

In addition, we may not transfer the Junior Participation without CFI Holdings’ consent. Further, pursuant to the Participation Agreement, in the event that the Liquidating Company or its affiliate acquires title to any of the properties within the Portfolio on behalf of itself and CFI Holdings through foreclosure, delivery of a deed in lieu of foreclosure or otherwise, CFI Holdings has agreed to provide an additional $10.0 million loan to the Liquidating Company or its affiliate to fund the operations of any such properties acquired.

In connection with the Loan Modification (as described below), we recognized an impairment charge of $28.1 million in the period ended December 31, 2018 on the Junior Participation. In addition, in accordance with liquidation basis accounting under GAAP, we recognized aggregate losses of $9.5 million relating to the exit fee waiver and the Modified Interest Rate (as described below) as well as the additional management fees and other expenses that are expected to be incurred over the term of the Loan, as modified by the Loan Modification.

We assessed the projected future cash flows of the underlying collateral along with its current fair market value and potential for future increases in fair value as of December 31, 2019. We concluded that as result of changes in market conditions as well as lower occupancy, higher rent concessions and lower rents triggered by co-tenancy provisions, the recurring cash flow and fair market values for the Borrower's collateral had significantly declined. As such, we recorded an additional $27.1 million loan loss provision for the year ended December 31, 2019. As a result of this additional loan loss provision, management fee expense expected to be incurred over the term of the Loan decreased. See Note 4, “Investment in Note Receivable, net” in Part II, Item 8, “Financial Statements and Supplementary Data” for further detail.

7

Loan Modification and Amended and Restated Participation Agreement

In February 2019, the Trust modified certain terms of the Loan (the “Loan Modification”) primarily by:

(1) | bifurcating the $150.15 million outstanding principal of the Loan into two tranches - a Tranche A and a Tranche B, with Tranche A equaling $65.6 million (reflecting a $19.4 million payment of Loan principal using a portion of the proceeds received from an insurance settlement agreement as described below) and continuing to bear interest at a rate of 620 basis points, plus the greater of (a) 25 basis points and (b) the 30-day London Interbank Offered Rate (“LIBOR”), but not to exceed 9% per annum (the “Modified Interest Rate”). The remaining $65.15 million Tranche B of the Loan no longer bears interest; |

(2) | requiring a new $5.5 million capital contribution (“New Capital Contribution”) from the Borrower into a general reserve account to be used for capital expenditures, tenant improvements, leasing costs and operating shortfalls, which is subordinated to Tranche A and is entitled to an 8% return; |

(3) | extending the initial maturity date of the Loan to December 9, 2020, with three, one-year extension options at the Borrower’s option subject to satisfying certain conditions, including, among others, sales of select properties within the Portfolio; |

(4) | providing the Borrower with (a) (i) the ability to sell to a third party select properties within the Portfolio and (ii) an option, not to be exercised prior to July 9, 2020, to sell any of such select properties within the Portfolio to an affiliate of Borrower (collectively, the “Initial Portfolio Sale Option”) and (b) an option, not to be exercised prior to December 9, 2021 (or June 9, 2022, in the case of a sale to an affiliate of Borrower), to sell to a third party any enclosed mall within the Portfolio (the “Enclosed Mall Sale Option”); and |

(5) | waiving the 1% exit fee on the Loan. |

In addition, in accordance with the distribution provisions of the Loan Modification after debt service payments and other senior priority payments have been made, any excess cash flow generated by the Borrower’s collateral will be applied to reduce the principal balance of Tranche A and Tranche B, and reduce the Borrower’s new capital contribution.

In general, proceeds resulting from sales of select properties within the Portfolio or an exercise of the Initial Portfolio Sale Option and Enclosed Mall Sale Option will be applied to repay the Tranche A and Tranche B principal balances then outstanding; however, the Borrower will be entitled to receive a certain portion of any such proceeds, as follows:

(i) | 20% of proceeds from a sale of Portfolio properties or an exercise of the Initial Portfolio Sale Option, until the Borrower’s $5.5 million new capital contribution is repaid in full; and |

(ii) | subject to the Tranche A principal balance being paid in full, 30% of proceeds from a sale of Portfolio properties or an exercise of an Enclosed Mall Sale Option until the Borrower’s new capital contribution and original $40.2 million capital contribution, is repaid in full. |

Following full repayment of Tranche A, Tranche B and the Borrower’s capital contributions as described above, any remaining proceeds from an Initial Portfolio Sale Option or Enclosed Mall Sale Option exercise will be distributed 90% to the Borrower and 10% to the lender. Any proceeds received by the Liquidating Company as lender of the Loan (whether in repayment of Tranche A, Tranche B or otherwise) will be applied to the Senior Participation and/or the Junior Participation, in accordance with the Participation Agreement.

Further, pursuant to the Loan Modification and subject to certain conditions, if the Borrower fails to pay the outstanding principal balance of the Loan at the final maturity date and the Liquidating Company acquires title of the remaining properties within the Portfolio, then for a period of up to 60 months (the “Tail Term”), the Borrower will have the right to participate in the net operating income and proceeds of any sales of such remaining properties within the Portfolio in the same manner as provided for in the Loan Modification Agreement with respect to distributions of net operating income and proceeds from an Initial Portfolio Sale Option or Enclosed Mall Sale Option, as applicable; provided that, if a sale of the remaining Portfolio does not occur within 36 months, then Borrower will be entitled to a 9% return on any outstanding new capital contribution for the remaining Tail Term.

In February 2019, concurrently with the Loan Modification, the Trust, through the Liquidating Company, amended and restated the Participation Agreement with CFI Holdings primarily to reflect the Loan Modification.

Further, CFI Holdings reaffirmed its obligation to provide an additional $10 million loan to the Liquidating Company or its affiliate in the event that the Liquidating Company or its affiliate acquires title to any of the properties within the Portfolio on behalf of itself and CFI Holdings through foreclosure, delivery of a deed in lieu of foreclosure or otherwise, in accordance with certain terms and conditions set forth in the Participation Agreement as amended and restated.

8

Insurance Settlement and Collateral Sale and Release

In October 2018, Hurricane Michael caused extensive damage to certain of the properties within the Portfolio (the “Affected Properties”). In February 2019, concurrently with the Loan Modification, in connection with an insurance settlement agreement related to the Affected Properties, the Borrower received $21.5 million in proceeds from an insurance provider, $19.4 million of which was used to paydown Loan principal of Senior Participation and the remaining $2.1 million was used to reimburse the Borrower for costs incurred in restoring and repairing the Affected Properties. In connection with such principal paydown, the Loan Modification released a portion of the Affected Properties (representing 17.6% of the Portfolio based on rentable square feet) from serving as collateral for the Loan.

In June 2019, the Borrower completed a sale of one of the properties within the Portfolio pursuant to an exercise of its Initial Portfolio Sale Option, which resulted in a $1.1 million principal repayment on the Senior Participation. Upon completing this sale and collateral release, the Borrower satisfied certain conditions required for the first one-year extension option of the Loan maturity.

In August 2019, the Borrower completed an additional sale of one of the properties within the Portfolio pursuant to an exercise of its Initial Portfolio Sale Option, which resulted in a $2.1 million principal repayment on the Senior Participation.

Liquidation Update

As of the date of this report, the Loan is scheduled to mature on December 9, 2020, with three, one-year extension options at the Borrower’s option subject to satisfying certain conditions. As a result of the Borrower’s sale of certain Initial Portfolio assets in June 2019 and assuming all of the remaining applicable conditions under the Loan are satisfied, including that no event of default exists under the Loan, we anticipate that the Borrower will exercise its first one-year extension option. We do not currently anticipate selling the Loan or the Junior Participation at any time prior to the Loan’s final extended maturity date, at which point the ability to recover the note receivable is largely based on the sale of the collateral properties at that time. As a result, we do not anticipate completing a liquidation of the Trust’s assets, including the Junior Participation, prior to the final extended maturity date of the Loan. However, we can provide no assurance that we will be able to accomplish a liquidation on this anticipated timeframe or at the net realization value of $29.1 million as of December 31, 2019.

Tax Status and Treatment

We are treated as a grantor trust for income tax purposes and accordingly, are not subject to federal or state income tax on any income earned or gain recognized by us. We may recognize taxable income or loss, as the case may be, from our assets prior to their disposition, and taxable gain or loss as and when our assets are disposed of for an amount greater or less than the fair market value of such assets at the time of the initial distribution of the Units on January 31, 2018. Our beneficiaries will be treated as the owner of a pro rata portion of each remaining asset, including cash, received by and held by us and will be required to report on their federal and state income tax return their pro rata share of taxable income, including gains and losses recognized by us.

We will issue an annual information statement to our beneficiaries during the first quarter of 2020 with tax information for their tax returns for the year ended December 31, 2019. Beneficiaries are urged to consult with their tax advisors as to their own filing requirements and the appropriate tax reporting of this information on their returns.

Reports to Beneficiaries

The Trust will file with the SEC annual reports under the cover of Form 10-K showing the net assets in liquidation of the Trust at the end of the applicable calendar year and the receipts and disbursements of the Trust for such period covered by the report. Although not required under the Liquidating Trust Agreement, the financial statements of the Trust will be audited by an independent registered public accounting firm. During the course of each fiscal year, whenever a material event relating to the Trust or its assets occurs, the Trust will file with the SEC a current report on Form 8-K describing such event.

Conflicts of Interest

We are subject to various potential conflicts of interest that could arise out of our relationship with the Advisor and other affiliates and related parties, including: conflicts related to the compensation arrangements among the Advisor, certain affiliates and related parties, and us, and conflicts with respect to the allocation of the Advisor’s and its key personnel’s time. See Item 1A, “Risk Factors,” for additional detail. The independent trustees have an obligation to function on our behalf in all situations in which a conflict of interest may arise. The trustees are required to exercise their rights and powers in good faith and use the same degree of care and skill in their exercise as a prudent person would exercise or use under the circumstances in the conduct of their own affairs.

Employees

We have no employees. Pursuant to the terms of the Management Services Agreement, the Advisor assumes principal responsibility for managing our affairs, and we compensate the Advisor for these services.

9

Item 1A. Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may adversely impact our business. If any of the following risks occur, our liquidation value could be materially adversely affected.

The holders of our Units may receive less than expected or nothing from the Trust.

The value of each Unit, the actual amount of principal and interest payments the Trust will receive with respect to the Junior Participation, the net proceeds from any sale, transfer or other disposition of the Junior Participation and the amounts to be distributed to holders of our Units are subject to various and significant uncertainties, many of which are beyond our control, and which could cause our actual liquidation value to differ materially from current expectations.

The Junior Participation is a subordinated interest in the Loan. Our ability to make distributions to our beneficiaries depends on the amount and timing of principal and interest payments received with respect to the Loan, the amount of such payments owed on the Senior Participation, or the net proceeds from any sale, transfer or other disposition of the Junior Participation, in each case in excess of the expenses and other obligations of the Trust. The Trust has a term of three years, which began on January 31, 2018 and may be extended under certain circumstances. The Loan has an initial maturity date of December 9, 2020, but is subject to three extensions of one year each at the Borrower’s option, subject to the satisfaction of certain conditions. As a result of the Borrower’s sale of certain Initial Portfolio assets in June 2019 and assuming all of the remaining applicable conditions under the Loan are satisfied, including that no event of default exists under the Loan, we anticipate that the Borrower will exercise its first one-year extension option. In addition, while the Loan is not presently in default, it is also possible that the Borrower will default on its obligations under the Loan and that the Trust will have to pursue enforcement of the Loan obligations or negotiate a work-out with the Borrower, the timing of which could be prolonged. Accordingly, the three-year term of the Trust may have to be extended and, while we do not anticipate completing a liquidation of the Trust’s assets, including the Junior Participation, prior to the final maturity date of the Loan, we cannot say with certainty how long it will take before a final distribution is made. Although we believe that principal and interest payments received with respect to the Junior Participation or proceeds of any sale, transfer or other disposition of the Junior Participation will ultimately lead to distributions to holders of our Units, we cannot assure you that the Trust will be able to collect significant principal and interest payments or any payments at all or sell, transfer or otherwise dispose of the Junior Participation for value. There is therefore no assurance of regular distributions, or any distributions at all, to our beneficiaries.

There is no public market for our Units and the Units may not be transferred except by operation of law or upon the death of a beneficiary.

Our beneficiaries will not be able to transfer their Units other than in limited circumstances. The Units are not and will not be listed on any exchange, quoted by a securities broker or dealer, or admitted for trading in any market, including the over-the-counter market. Upon the consent of the Trust, the Trust’s beneficiaries may change the title of their beneficial interests from joint tenancy to sole ownership or from sole ownership to joint tenancy with a spouse or domestic partner. Otherwise, the Liquidating Trust Agreement prohibits all transfers of Units of beneficial interest, except by will, intestate succession or operation of law, and except for certain limited transfers by a tax-qualified employee retirement plan or account to the extent required to satisfy a required minimum distribution. Therefore, our Units are illiquid and our beneficiaries have no ability to dispose of them other than in limited circumstances.

If our liquidation costs or unpaid liabilities are greater than we expect, our liquidating distributions to our beneficiaries may be delayed or materially adversely impacted.

Before making the final liquidating distribution to our beneficiaries, we will need to pay or arrange for the payment of all of our transaction costs in the liquidation, and all other costs and all valid claims of our creditors. Our trustees may also decide to acquire one or more insurance policies covering unknown or contingent claims against us, for which we would pay a premium which has not yet been determined. Our trustees may also decide to establish a reserve fund to pay these contingent claims. The total amount of transaction costs in the liquidation is not yet known, and may materially adversely impact the amount of distributions available to be paid to our beneficiaries upon a liquidation. In addition, if the claims of our creditors are greater than we have anticipated, or we decide to acquire one or more insurance policies covering unknown or contingent claims against us or to establish a reserve fund, payment of liquidating distributions to our beneficiaries may be delayed and/or reduced.

10

The Loan, including our Junior Participation, is subject to the risks typically associated with retail real estate, which may materially adversely affect our ability to make distributions to our beneficiaries.

The Loan, including our Junior Participation, is collateralized by retail real estate in the Southeast United States. As a result of this concentration, we could be materially and adversely affected by conditions that materially and adversely affect the retail environment generally, including, without limitation:

• | levels of consumer spending, changes in consumer confidence, income levels, and fluctuations in seasonal spending in the Southeast United states; |

• | the impact on the Borrower’s retail tenants and demand for retail space at the Borrower’s properties from the increasing use of the Internet by retailers and consumers; |

• | local real estate conditions, such as an oversupply of or a reduction in demand for space or retail goods in an area, decreases in rental rates and declines in real estate values; |

• | the creditworthiness of the Borrower’s retail tenants and the availability of new creditworthy tenants and the related impact on the occupancy levels and rental revenues at the Borrower’s properties; |

• | the willingness of retailers to lease space in the Borrower’s properties at attractive rents, or at all; |

• | success of retail tenant businesses; |

• | ability to collect interest, loan obligation and principal; |

• | property management decisions; |

• | property location, condition and design; |

• | competition from comparable types of retail properties; |

• | changes in laws that increase operating expenses or limit rents that may be charged; |

• | increased Borrower operating costs and capital expenditures, whether from redevelopments, replacing tenants or otherwise; |

• | increases in interest rates, real estate tax rates and other operating expenses; |

• | compliance with environmental laws, including costs of remediation and liabilities associated with environmental conditions affecting properties; |

• | costs of remediation and liabilities associated with environmental conditions; |

• | the potential for uninsured or underinsured property losses; |

• | changes in governmental laws and regulations, including fiscal policies, zoning ordinances and environmental legislation and the related costs of compliance; and |

• | acts of God, terrorist attacks, social unrest and civil disturbances. |

The value of the Loan, and therefore the Junior Participation, is affected significantly by the Borrower’s ability to generate cash flow and net income, which in turn depends on the amount of rental or other income that can be generated net of expenses required to be incurred with respect to the management of the Borrower’s properties. Many expenses associated with properties (such as operating expenses and capital expenses) cannot be reduced when there is a reduction in income from the properties.

These factors may have a material adverse effect on the ability of our Borrower to pay the Loan and our ability to make distributions to our beneficiaries.

We have and may continue to experience a decline in the value of the Junior Participation resulting in us recording additional impairments, which may have a material adverse effect on our ability to make distributions to our beneficiaries.

In connection with the Loan Modification, we recognized an impairment charge of $28.1 million in the period ended December 31, 2018 on the Junior Participation. In addition, in accordance with the liquidation basis of accounting under U.S. GAAP, the Trust recognized aggregate losses of $9.5 million relating to the exit fee waiver and the Modified Interest Rate as well as the additional management fees and other Trust expenses that are expected to be incurred over the term of the Loan, as modified by the Loan Modification. We assessed the projected future cash flows of the underlying collateral along with its current fair market

11

value and potential for future increases in fair value as of December 31, 2019. We concluded that as result of changes in market conditions as well as lower occupancy, higher rent concessions and lower rents triggered by co-tenancy provisions, the recurring cash flow and fair market values for the Borrower's collateral had significantly declined. As such, we recorded an additional $27.1 million loan loss provision for the year ended December 31, 2019. We may be required to recognize further impairments on the Junior Participation under U.S. GAAP, as our Borrower may be unable to remain current in payments on the Loan and declining property values weaken our collateral. In addition, the impact of the rapidly evolving Coronavirus pandemic on the cash flow of the collateral, which is still uncertain, may materially and adversely impact the ability of the Borrower to make payments on the Loan. The analysis of the value or income-producing ability of commercial retail property is highly subjective. Our estimates and judgments may not be correct, particularly during challenging economic environments when market volatility may make it difficult to determine the fair value of the collateral underlying the loan or the likelihood of repayment of the loan. Subsequent valuations and estimates, in light of factors then prevailing, may result in additional decreases in the values of the underlying collateral resulting in additional impairment charges or increases in loan loss provisions and therefore our ability to make distributions to our beneficiaries could be materially and adversely impacted.

The Loan Modification may not result in any of the anticipated benefits, which may adversely affect our ability to make distributions to our beneficiaries.

In February 2019, we entered into a Loan Modification, which had the effect of reducing the amount of interest payable on the Junior Participation. While the Trust, in consultation with a third party valuation firm, when entering into the Loan Modification, believes that the Loan Modification is in the best interest of our beneficiaries, the anticipated benefits of the Loan Modification may not be realized fully, in the time anticipated or at all. The Loan Modification provides the Borrower with options during the term of the Loan to sell parts of the Loan collateral in order to pay down Loan principal prior to the final maturity date. In addition, the Loan Modification provides that excess cash flow generated by the Loan collateral (if any) will be applied on interest payment dates to reduce the principal balance of the Loan. While such principal payments are expected to be first applied to the outstanding balance of the Senior Participation, any such principal paydowns will reduce the amount of interest and principal owed on the Senior Participation and therefore are expected to facilitate payment on the outstanding principal on the Junior Participation faster than the Loan originally contemplated. However, there can be no assurances that the Borrower will be able to sell the Loan collateral above or at the agreed-upon prices, within the timeframe contemplated by the Loan Modification or at all. If the Loan Modification does not result in any of the anticipated benefits, our ability to fund our operating expenses through the term of the Trust could be materially adversely impacted, which would, in turn, materially adversely impact the amount of cash available for liquidating distributions to our beneficiaries.

The continuing spread of a new strain of coronavirus, which causes the viral disease known as COVID-19, may have a material adverse effect on our ability to make any distributions to our beneficiaries.

Since its discovery in December 2019, a new strain of coronavirus, which causes the viral disease known as COVID-19, has spread from China to many other countries, including the United States. The outbreak has been declared to be a pandemic by the World Health Organization, and the Health and Human Services Secretary has declared a public health emergency in the United States in response to the outbreak. Considerable uncertainty still surrounds COVID-19 and its potential effects, and the extent of and effectiveness of any responses taken on a national and local level. The impact of COVID-19 on the U.S. and world economies is uncertain and could result in a world-wide economic downturn that may lead to corporate bankruptcies in the most affected industries and an increase in unemployment.

As a result of the collateral underlying the Junior Participation being comprised entirely of retail properties located in the United States, COVID-19 will impact the Borrower’s ability to pay interest and principal on the Loan, and therefore impact the income received by the Trust from the Junior Participation, to the extent that its continued spread within the United States reduces occupancy, decreases customer traffic or results in quarantines where the collateral is located, increases the cost of operation or results in limited hours or necessitates the closure of the collateral properties. Recently, certain owners of shopping center properties located in the United States have announced temporary closures of such properties as a result of COVID-19. In late March 2020, the Borrower notified us that two enclosed malls in the Portfolio, representing a substantial portion of the collateral underlying the Loan and Junior Participation, have been temporarily closed. Additional temporary closures of the remaining properties within the collateral may also be mandated by federal or local government. There can be no assurances as to when such properties may be re-opened, and a prolonged closure may materially and adversely impact the Borrower’s ability to pay interest and principal on the Loan.

In addition, many of the tenants are subject to license agreements which are terminable on 30 days’ notice. If the property closures are prolonged or COVID-19 continues to result in decreases in customer traffic or disruption to the tenants’ supply chain, tenants may terminate their license agreements, which may materially and adversely impact the Borrower’s ability to pay interest and principal on the Loan.

12

As a result of these and related events due to COVID-19, we may determine to negotiate with the Borrower to modify the Loan or exercise our rights under the Loan documentation, including but not limited to foreclosure of the collateral properties. Modifying the Loan or foreclosing on the collateral may have a material adverse effect on the Trust’s income and expenses, as well as the ability to liquidate its assets in the manner and timeframe contemplated, or at all. The extent to which COVID-19 impacts the Trust’s income, expenses and ability to pay any distributions to beneficiaries will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the pandemic, new information that may emerge concerning the severity of COVID-19 and the actions taken to contain COVID-19 or treat its impact, among others.

Federal, state, and local lending laws may restrict our ability to exercise our rights under the Loan documentation, increase the time and expense associated with the foreclosure process, or prevent us from foreclosing at all.

As a result of COVID-19, certain federal, state and local lending authorities have and may continue to impose moratoriums on foreclosures of commercial properties. These and similar borrower protection initiatives could impact our ability to exercise our rights under the Loan documentation should we determine to do so in the future, including but not limited to foreclosure of the collateral properties. Even if we are legally permitted to pursue our right to foreclose, similar laws and regulations imposed by state and local governments could substantially increase the time and expense associated with the foreclosure process. If new state, federal or local laws or regulations are ultimately enacted that significantly raise the cost of foreclosure or raise outright barriers, such measures may have a material adverse effect on our ability to liquidate the Trust’s assets and make distributions to our beneficiaries.

Insurance may not cover all potential losses on the collateral underlying the Junior Participation, which may adversely affect our ability to make distributions to our beneficiaries.

We require that the Borrower under the Loan retain comprehensive insurance covering the collateral, including liability, fire and extended coverage. However, there are certain types of losses, generally of a catastrophic nature, such as earthquakes, floods and hurricanes, as well as pandemics such as COVID-19, that may be uninsurable or not economically insurable. Inflation, changes in building codes and ordinances, environmental considerations and other factors might make it infeasible to use insurance proceeds to replace a property if it is damaged or destroyed. Further, it is possible that our Borrower could breach its obligation to us and not maintain sufficient insurance coverage. Under such circumstances, the insurance proceeds, if any, might not be adequate to restore the economic value of the property, which might decrease the value of the property and in turn impair the value of the Junior Participation.

We depend on the Borrower for all of our revenue and, accordingly, our revenue and our ability to make distributions to beneficiaries is dependent upon the success and economic viability of the Borrower and its tenants.

The value we derive from the Junior Participation solely depends on the financial stability of the Borrower and its tenants. Before making the Loan, NorthStar I conducted due diligence to assess the strength and skills of Borrower’s management and other factors that it believed were material to the performance of the Loan. There can be no assurance that these due diligence processes uncovered all relevant facts or that the investment will be successful. The inability of the Borrower or its tenants to meet their payment obligations could adversely affect our ability to make distributions to our beneficiaries.

The leases at the properties underlying the Loan may not be relet or renewed on favorable terms, or at all, which may materially adversely affect our ability to make distributions to our beneficiaries.

The performance of the Loan, and in particular the Junior Participation as it is subordinated to the Senior Participation, will be pressured if economic conditions and rental markets continue to be challenging. For instance, upon expiration or early termination of leases for space located at the properties underlying the Loan, the space may not be relet or, if relet, the terms of the renewal or reletting (including the cost of required renovations or concessions to tenants) may be less favorable than current lease terms. The Borrower may be receiving above or at market rental rates that will decrease upon renewal, which will adversely impact our ability to collect principal and interest and could harm our ability to make distributions to our beneficiaries. Weak economic conditions would likely reduce tenants’ ability to make rent payments in accordance with the contractual terms of their leases and lead to early termination of leases. Furthermore, in the retail markets, space needs have and may continue to contract, resulting in lower lease renewal rates and longer releasing periods when leases are not renewed. Any of these situations may result in extended periods where there is a significant decline in revenues or no revenues generated by the properties underlying the Loan. Additionally, to the extent that market rental rates are reduced, property-level cash flow would likely be negatively affected as existing leases renew at lower rates. If the Borrower is unable to relet or renew leases for all or substantially all of the space at the underlying properties or if the rental rates upon such renewal or reletting are significantly lower than expected, the Borrower will experience a reduction in net income and our ability to make distributions to our beneficiaries may be materially adversely affected.

13

The loss of anchor tenants in or adjacent to the retail properties that collateralize the Loan, or the bankruptcy of tenants, have and could continue to materially and adversely affect the cash flow generated by such retail properties or the Borrower’s ability to make payments on the Loan and, in turn, our ability to make distributions to our beneficiaries.

The retail properties collateralizing the Loan are typically anchored by department stores and other large nationally recognized tenants. Certain of those anchors and other tenants have ceased their operations, downsized their brick-and-mortar presence or failed to comply with their contractual obligations to the Borrower and others. For example, in November 2019, one of the anchor tenants within the Portfolio closed its store, triggering certain co-tenancy provisions. As a result of these co-tenancy provisions, along with other factors, the Trust recognized a $27.1 million impairment on the Junior Participation for the year ended December 31, 2019. In addition, a second anchor tenant adjacent to the Portfolio is expected to close its store during 2020. If this or another department store or large nationally recognized tenant were to close its stores at or adjacent to the retail properties collateralizing the Loan, either as a result of bankruptcy or otherwise, the Borrower may continue to experience difficulty and delay and incur significant expense in re-tenanting the space (to the extent owned by the Borrower), as well as in leasing spaces in areas adjacent to the vacant store, at attractive rates, or at all. Additionally, such department store or tenant closures have and may continue to trigger co-tenancy provisions which may result in decreases in rental rates for other tenants and otherwise adversely affect net income generated at the retail property, all of which could require us to take additional impairments on the Junior Participation. Further, such tenant closures may result in decreased customer traffic, which could lead to decreased sales at the Borrower’s properties. Tenant or anchor department store bankruptcies can exacerbate these challenges for the Borrower as well as add strain on their resources. All of which could materially and adversely affect the Borrower’s ability to make interest or principal payments on the Loan when due, which, in turn, could materially and adversely affect our ability to make distributions to our beneficiaries.

Real estate valuation is inherently subjective and uncertain.

The valuation of real estate and therefore the valuation of the collateral underlying the Loan is inherently subjective due to, among other factors, the individual nature of each property, its location, the expected future rental revenues from that particular property and the valuation methodology adopted. As a result, the valuations of the real estate assets underlying the Loan, including the Junior Participation, are subject to a large degree of uncertainty and are made on the basis of assumptions and methodologies that may not prove to be accurate, particularly in periods of volatility, low transaction flow or restricted debt availability in the retail real estate markets.

If we were to foreclose on the Loan, we may come to own and operate the properties securing the Loan, which would expose us to the risks inherent in that activity.

If we were to foreclose on the Loan, we may take title to the properties securing the Loan, and if we do not or cannot sell the properties, we would then come to own and operate them as “real estate owned.” Owning and operating real property involves risks that are different (and in many ways more significant) than the risks faced in owning an asset secured by real property. In addition, as a liquidating trust, we are extremely limited in our ability to generate additional capital necessary to own and operate retail real estate properties, and while CFI Holdings has committed to providing us with a $10.0 million loan to the extent we end up taking title to these properties, such loan might not be sufficient to maintain the operations at the properties or otherwise operate them in a manner to preserve the properties’ value. Further, we have not had experience owning real property directly. Accordingly, we or our Advisor may not manage these properties as well as they might be managed by another owner, and our distributions to beneficiaries could suffer. If we foreclose on and come to own property, our ability to make distributions to our beneficiaries may be adversely affected.

The retail properties underlying the Loan may be subject to unknown liabilities that could affect the value of these properties and as a result, the value of the Loan and the Junior Participation.

The retail properties underlying the Loan may be subject to unknown or unquantifiable liabilities that may adversely affect the value of the Loan. Such defects or deficiencies may include title defects, title disputes, liens, servitudes or other encumbrances on the collateral properties. The discovery of such unknown defects, deficiencies and liabilities could affect the ability of our Borrower to make payments to us or could affect our ability to foreclose and sell the underlying properties, which could adversely affect our ability to make distributions to our beneficiaries.

Furthermore, to the extent we foreclose on any of the properties underlying the Loan, we may be subject to environmental liabilities arising from such foreclosed properties. Under various U.S. federal, state and local laws, an owner or operator of real property may become liable for the costs of removal of certain hazardous substances released on its property. These laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the release of such hazardous substances.

If we foreclose on any properties underlying the Loan, the presence of hazardous substances on a property may adversely affect our ability to sell the property and we may incur substantial remediation costs; therefore, the discovery of material environmental liabilities attached to such properties could adversely affect our ability to make distributions to our beneficiaries.

14

We may be subject to lender liability claims, and if we are held liable under such claims, our ability to make distributions to our beneficiaries may be adversely affected.

In recent years, a number of judicial decisions have upheld the right of borrowers to sue lending institutions on the basis of various evolving legal theories, collectively termed “lender liability.” Generally, lender liability is founded on the premise that a lender has either violated a duty, whether implied or contractual, of good faith and fair dealing owed to the borrower or has assumed a degree of control over the borrower resulting in the creation of a fiduciary duty owed to the borrower or its other creditors or stockholders. We cannot assure our beneficiaries that such claims will not arise or that we will not be subject to significant liability if a claim of this type did arise.

Our Borrower may be unable to repay the remaining principal balance of the Loan on the maturity date.

Our Borrower’s ability to repay the Loan on its stated maturity date typically will depend upon its ability either to refinance the Loan or to sell the underlying retail properties at a price sufficient to permit repayment. Our Borrower’s ability to achieve either of these goals will be affected by a number of factors, including:

• | the availability of, and competition for, credit for retail or commercial real estate projects, which fluctuate over time; |

• | the prevailing interest rates; |

• | the net operating income generated by the underlying properties; |

• | the fair market value of the underlying properties; |

• | our Borrower’s equity in the underlying properties; |

• | significant tenant rollover at the underlying properties; |

• | our Borrower’s financial condition; |

• | the operating history and occupancy level of the underlying properties; |

• | reductions in applicable government assistance/rent subsidy programs; |

• | changes in zoning or tax laws; |

• | changes in competition in the relevant location; |

• | changes in rental rates in the relevant location; |

• | changes in government regulation and fiscal policy; |

• | the state of fixed income and mortgage markets; |

• | the availability of credit for multifamily and commercial properties; and |

• | prevailing general and regional economic conditions. |

If our Borrower defaults on the Loan and the underlying collateral value is less than the amount due, our ability to make distributions to our beneficiaries will be materially adversely affected.

If the Borrower defaults on the Loan, we will only have recourse to the properties collateralizing the Loan. In addition, the Junior Participation that we hold is subordinated in priority of payments of principal and interest to the Senior Participation. Further, if the Borrower defaults, pursuant to the Participation Agreement, the Senior Participation is entitled to receive all amounts available for payment on the Loan (including any proceeds of a sale of the underlying properties) until all of the interest, principal and unreimbursed expenses owed to CFI Holdings is paid in full, before the Junior Participation is able to receive any Loan proceeds. As a result, if the underlying collateral value is less than the Loan amount, we will suffer a loss and such loss may be material. We may lack control over the underlying assets collateralizing the loan or the underlying assets of the Borrower before a default, and, as a result, the value of the collateral may be reduced by acts or omissions by owners or managers of the assets. In addition, the value of the underlying real estate may be adversely affected by some or all of the risks referenced above with respect to real estate assets generally.

If the value of collateral underlying the Loan declines further or interest rates increase during the term of the Loan, the Borrower may not be able to obtain the necessary funds to repay the Loan at maturity through refinancing because the underlying property revenue cannot satisfy the debt service coverage requirements necessary to obtain new financing.

15

We are subject to risks, including conflicts of interest, associated with CFI Holdings’ Senior Participation in the Loan.

As a result of our Junior Participation in the Loan, we share the rights, obligations and benefits of the Loan with CFI Holdings, the holder of the Senior Participation and an affiliate of our Advisor. We may need the consent of CFI Holdings to exercise our rights under the Loan, including rights with respect to amendment of the loan documentation, a sale or transfer of the Junior Participation, enforcement proceedings upon a default and the institution of, and control over, foreclosure proceedings. Similarly, CFI Holdings may be able to take actions to which we object but to which we will be bound because our participation interest represents a junior interest. We may be adversely affected by this lack of control. In addition, CFI Holdings is an affiliate of our Advisor, which may incentivize either CFI Holdings or our Advisor to make decisions or recommendations to us that are in either of their best interests and not in our best interest. Upon liquidation of the Trust, after payment is made to the holder of the Senior Participation, there may not be sufficient funds remaining for the Junior Participation to be paid in full and as a result, the amount of distributions available for our beneficiaries may be materially adversely impacted.

The duration of the Trust is uncertain as the trustees may continue the existence of the Trust beyond the initial three-year term if necessary to fulfill the purposes of the Trust. As a result, liquidating distributions to our beneficiaries may be delayed or reduced.

The Liquidating Trust Agreement currently provides that the Trust will terminate upon the earlier of (i) the liquidation and distribution of the net proceeds of all of the assets of the Trust and its subsidiaries and (ii) the expiration of a period of three years from January 31, 2018. However, the trustees may continue the existence of the Trust beyond the three-year term if the trustees reasonably determine that an extension is necessary to fulfill the purposes of the Trust.

Our sole asset is the Junior Participation in the Loan, which has an initial maturity date of December 9, 2020 and, subject to the exercise of the Borrower’s options to extend, a fully extended maturity date of December 9, 2023. As a result, the maturity date of the Loan may extend beyond the current term of the Trust, which currently ends on January 31, 2021. To the extent that the Borrower meets the required conditions and exercises its options to extend the term of the Loan, the Trust expects to extend the term of the Trust accordingly and, as a result, payment of liquidating distributions to our beneficiaries will be delayed. As a result of the Borrower’s sale of certain Initial Portfolio assets in June 2019 and assuming all of the remaining applicable conditions under the Loan are satisfied, including that no event of default exists under the Loan, we anticipate that the Borrower will exercise its first one-year extension option.

In addition, in connection with an extension of the Trust’s term, the Trust will continue to incur expenses, such as the management fee payable to its Advisor. The more expenses the Trust incurs over its term could also reduce the amount of liquidating distributions available for our beneficiaries. Moreover, in connection with an extension of the term of the Trust, the Trust has undertaken to request and obtain additional no-action assurances from the SEC to continue having reduced reporting obligations under the rules and regulations of the Exchange Act. There can be no assurances that the Staff will grant such additional no-action assurances regarding any extension. To the extent that the Staff does not grant no-action assurances or other form of relief, the Trust would need to incur substantial additional expense to comply with the full reporting obligations under the Exchange Act, which could materially reduce the amount of liquidating distributions available for our beneficiaries.

Further, we cannot guarantee that the trustees will determine to extend the term of the Trust in connection with the Borrower’s exercise of an extension option or at all. If the term of the Trust is not extended, we may be forced to sell our Junior Participation, or foreclose on the Loan and sell the collateral, both in a fire sale, or take other measures that could substantially reduce the amount of liquidating distributions available for our beneficiaries.

The Trust has and will continue to incur the expenses of complying with certain public company reporting requirements until the termination of the Trust following the liquidation and distribution of the net proceeds from the sale of the Junior Participation.

Until the Trust completes a liquidation of its assets and dissolves, the Trust will continue to have an obligation to comply with certain of the applicable reporting requirements of the Exchange Act, even if compliance with these reporting requirements is economically burdensome. In order to curtail expenses, we sought and obtained relief from the SEC from certain reporting requirements under the Exchange Act. Given this grant of such relief, the Trust will continue to file an annual report under the cover of Form 10-K and current reports on Form 8-K to disclose material events relating to the Trust, along with any other reports that the SEC may require, but we are not required to file quarterly reports on Form 10-Q or proxy statements. Even with the SEC’s grant of the requested reporting relief, the Trust expects to incur substantial expenses associated with such reporting obligations and other expenses associated with the conduct of its operations, including the management fee payable to the Advisor, costs of servicing the Junior Participation, and other matters. Any expenses the Trust incurs will reduce the amount of distributions the Trust is able to pay to its beneficiaries.

In addition, if the trustees determine to extend the term of the Trust, the Trust will need to obtain additional relief from the SEC to continue having reduced reporting obligations for the extended term. There can be no assurances that the Staff will grant such

16

additional relief. To the extent that the Staff does not grant no-action assurances or other form of relief, the Trust would need to incur substantial additional expense to comply with the full reporting obligations under the Exchange Act, which could materially reduce the amount of liquidating distributions available for our beneficiaries.

Payment of fees and expense reimbursements to our Advisor and its affiliates reduces the amount of cash available for liquidating distributions to our beneficiaries.

Our Advisor and its affiliates perform services for us in connection with the management of our assets and operations. We pay them substantial fees for these services, which results in immediate dilution to the value of the Units held by our beneficiaries. Our Advisor is entitled to receive these fees regardless of the performance of the Trust’s assets. The Trust also is obligated, subject to certain limitations, to reimburse the Trust Advisor for certain costs incurred by the Trust Advisor or its affiliates, such as personnel and other expenses, in connection with the services provided to the Trust under the Management Services Agreement. The payment of these fees and expense reimbursements to our Advisor will reduce the amount of cash available for liquidating distributions to our beneficiaries.

CLNY’s announcement that it is pursuing a strategic shift to focus on digital real estate and infrastructure, or the CLNY Strategic Transition, could have an adverse impact on our business.

In 2019, CLNY, an affiliate of the Advisor, announced that it is pursuing the CLNY Strategic Transition, including among other initiatives, the potential transfer of CLNY’s credit management business to CLNC. The CLNY Strategic Transition may be time consuming and disruptive to CLNY business operations, including its service to us as the Advisor. As a result of the CLNY Strategic Transition, the Advisor could undergo a change of control involving CLNC or a third party, which could result in a change to the management of the Advisor and its affiliates, including CFI Holdings, the holder of the Senior Participation. Consequently, we could be managed by an entity and personnel that do not have the experience and track record of CLNY and its personnel and suitable alternatives may not be available. New management and personnel could change the manner in which the Advisor provides services to us and may not be as effective. Any such change to CLNY or the Advisor could be disruptive to our business and operations and could have a material adverse effect on our liquidating distributions to beneficiaries. Further, to the extent that CLNY effects a sale and/or transfer of the Senior Participation and the Management Services Agreement such that the Senior Participation holder and the Trust’s advisor are unaffiliated third parties, there could be resulting conflicts of interest between us and such unaffiliated parties, as the Senior Participation holder’s interest may not be aligned with our or our advisor’s interests.

The Advisor and its affiliates and related parties, including our officers and certain of our trustees, face conflicts of interest caused by compensation arrangements with us, which could result in actions that are not in our beneficiaries’ best interests.

The Advisor and its affiliates and related parties and our officers and certain of our trustees, indirectly through their relationships with the Advisor, receive substantial fees from us in return for their services and these fees could influence the Advisor’s advice to us. The Trust pays to the Advisor a monthly management fee equal to one-twelfth of 1.25% of the fair market value of the Trust’s net assets as compensation for the management and disposition of the Trust’s assets under the Management Services Agreement. These fees may incentivize the Advisor to recommend courses of action with respect to disposition transactions that may not be in our best interests at the time. In addition, an affiliate of the Advisor holds the Senior Participation, which has priority over our Junior Participation in terms of payments made on the Loan. As a result, the Advisor may be incentivized to recommend courses of action regarding the Loan or underlying collateral that may benefit the Senior Participation to our detriment. Considerations relating to compensation from us to the Advisor and its affiliates or related parties, or the Senior Participation, could result in decisions that are not in our or our beneficiaries’ best interests, which could hurt our ability to pay them distributions.

The Advisor’s management personnel, other employees and affiliates face conflicts of interest relating to time management and, accordingly, may not be able to devote adequate time to the Trust, and the Advisor may not be able to hire or retain adequate additional employees.

All of the Advisor’s management personnel, other personnel, affiliates and related parties may also provide services to other entities affiliated with CLNY and related parties. We are not able to estimate the amount of time that such management personnel, other personnel, affiliates and related parties will devote to the Trust. In addition, we may only terminate our management services agreement with the Advisor for misconduct by the Advisor or material breach of the Management Services Agreement by the Advisor. As a result, the Advisor’s management personnel, other personnel, affiliates and related parties may have conflicts of interest in allocating their time between the Trust and their other activities. During times of significant activity in these other pursuits, the time they devote to the Trust may decline. Accordingly, there is a risk that the Advisor’s affiliates and related parties may not devote adequate time to the Trust’s activities and the Advisor may not be able to hire adequate additional personnel. Moreover, if the Advisor were to lose the benefit of the experience, efforts and abilities of one or more of these individuals through their resignation, retirement, or due to an internalization transaction effected by another investment sponsored by CLNY or its affiliates, or due to such individual or individuals becoming otherwise unavailable because of other activities on behalf of CLNY or its affiliates, we may be adversely affected and our liquidating distributions to our beneficiaries could be reduced or delayed.

17

We have and may continue to enter into transactions with the Advisor or affiliates or other related entities of the Advisor; as a result, in any such transaction, we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties and we may incur additional expenses.

We have and may continue to enter into transactions with the Advisor or its affiliates or other related entities of the Advisor. For example, we may sell our assets to affiliates or other related entities of the Advisor. The Advisor and/or its management team could experience a conflict in representing our interests in such transactions. In any such transaction, we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties and may receive terms that are less beneficial to us than if such transactions were with a third party, which could have an adverse effect on our liquidation value.