Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - KLDiscovery Inc. | kld-ex322_7.htm |

| EX-32.1 - EX-32.1 - KLDiscovery Inc. | kld-ex321_6.htm |

| EX-31.2 - EX-31.2 - KLDiscovery Inc. | kld-ex312_8.htm |

| EX-31.1 - EX-31.1 - KLDiscovery Inc. | kld-ex311_9.htm |

| EX-23.1 - EX-23.1 - KLDiscovery Inc. | kld-ex231_538.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-38789

KLDiscovery Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

61-1898603 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

8201 Greensboro Drive Suite 300 McLean, VA |

22102 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (703) 288-3380

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

N/A |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 28, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant, based on the closing sales price of $10.15 on the New York Stock Exchange, was approximately $233,450,000.

As of March 19, 2020, there were 42,529,017 of the registrant’s common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2020 (the “2020 Annual Meeting”), to be filed with the Securities and Exchange Commission (the “SEC”) within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated herein by reference where indicated. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, such proxy statement is not deemed to be filed as part hereof.

|

|

|

Page |

|

|

|

|

|

Item 1. |

2 |

|

|

Item 1A. |

16 |

|

|

Item 1B. |

38 |

|

|

Item 2. |

38 |

|

|

Item 3. |

40 |

|

|

Item 4. |

40 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

41 |

|

|

Item 6. |

42 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 |

|

Item 7A. |

56 |

|

|

Item 8. |

56 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

61 |

|

Item 9A. |

61 |

|

|

Item 9B. |

61 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

62 |

|

|

Item 11. |

62 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

62 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

62 |

|

Item 14. |

62 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

63 |

|

|

Item 16 |

65 |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

We believe that this Annual Report on Form 10-K, or some of the information incorporated herein by reference, contains statements that are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding the financial position, business strategy and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Report, or in the information incorporated herein by reference, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. When we discuss our strategies or plans, we are making projections, forecasts or forward-looking statements. Such statements are based on the beliefs of, as well as assumptions made by and information currently available to, our management.

Forward-looking statements in this Annual Report on Form 10-K and in any documents incorporated by reference herein may include, for example, statements about:

|

|

• |

the ability to obtain and maintain the listing of our securities on an over-the-counter market; |

|

|

• |

the potential liquidity and trading of our public securities; |

|

|

• |

the inability to recognize the anticipated benefits of the Business Combination (as defined below); |

|

|

• |

the ability to operate in highly competitive markets, and potential adverse effects of this competition; |

|

|

• |

risk of decreased revenues if we do not adapt our pricing models; |

|

|

• |

the ability to attract, motivate and retain qualified employees, including members of our senior management team; |

|

|

• |

the ability to maintain a high level of client service and expand operations; |

|

|

• |

potential failure to comply with privacy and information security regulations governing the client datasets the we process and store; |

|

|

• |

risk that we are unsuccessful in integrating acquired businesses and product lines; |

|

|

• |

potential issues with our product offerings that could cause legal exposure, reputational damage and an inability to deliver services; |

|

|

• |

the ability to develop new products, improve existing products and adapt our business model to keep pace with industry trends; |

|

|

• |

the ability to maintain, promote or expand our brand through effective marketing practices; |

|

|

• |

risk that our products and services fail to interoperate with third-party systems; |

|

|

• |

the impact of the United Kingdom’s withdrawal from the European Union; |

|

|

• |

potential unavailability of third-party technology that we use in our products and services; |

|

|

• |

the ability to maintain effective controls over disclosure and financial reporting that enable us to comply with regulations and produce accurate financial statements; |

|

|

• |

potential disruption of our products, offerings, website and networks; |

|

|

• |

difficulties resulting from our implementation of new consolidated business systems; |

|

|

• |

the ability to deliver products and services following a disaster or business continuity event; |

|

|

• |

increased risks resulting from our international operations; |

|

|

• |

potential unauthorized use of our products and technology by third parties; |

1

|

|

• |

exchange rate fluctuations and volatility in global currency markets; |

|

|

• |

consequences of our substantial levels of indebtedness; |

|

|

• |

the ability to comply with various trade restrictions, such as sanctions and export controls, resulting from its international operations; |

|

|

• |

potential intellectual property infringement claims; |

|

|

• |

the ability to comply with the anti-corruption laws of the United States and various international jurisdictions; |

|

|

• |

potential impairment charges related to goodwill, identified intangible assets and fixed assets; |

|

|

• |

impacts of tax regulations and laws on our business; |

|

|

• |

a potential litigation involving Pivotal or us; |

|

|

• |

costs related to the Business Combination; |

|

|

• |

the outbreak of disease or similar public health threat, such as COVID-19; |

|

|

• |

expectations regarding the time during which we will be an “emerging growth company” under the Jumpstart of Business Startups Act of 2012, as amended (the “JOBS Act”); and |

|

|

• |

other risks and uncertainties indicated in the section titled “Risk Factors” in Item 1A of this Annual Report on Form 10-K. |

The forward-looking statements contained in this Annual Report on Form 10-K and in any document incorporated by reference are based on current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section titled “Risk Factors” in Item 1A of this Annual Report on Form 10-K. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PART I

In this Annual Report on Form 10-K, we refer to the special purpose acquisition company, Pivotal Acquisition Corp. (“Pivotal”), prior to the Closing Date (as defined below) as the “Company.” Following consummation of the Business Combination, the “Company,” and references to “we,” “us,” or similar such references should be understood to be references to the combined company, KLDiscovery Inc. When this Annual Report on Form 10-K references “LD Topco” and describes the business of KLDiscovery, it refers to the business of LD Topco, Inc. and its subsidiaries prior to the consummation of the Business Combination. Following the date of the Business Consummation, references to “KLDiscovery” should be understood to reference KLDiscovery Inc. This Annual Report on Form 10-K also refers to our websites, but information contained on those sites is not part of this Annual Report on Form 10-K.

Our Company

2

The Company was incorporated under the name “Pivotal Acquisition Corp.” as a blank check company on August 2, 2018 under the laws of the State of Delaware for the purpose of entering into a merger, capital stock exchange, stock purchase, reorganization or similar business combination with one or more businesses or entities. Our efforts to identify a prospective target business were not limited to any particular industry or geographic location but focused on companies in North America in industries ripe for disruption from continuously evolving digital technology and the resulting shift in distribution patterns and consumer purchase behavior.

In August 2018, Pivotal Acquisition Holdings LLC (the “Founder”) purchased 5,750,000 shares of Class B common stock (“founder shares”) for an aggregate purchase price of $25,000 in connection with the Company’s organization. The Founder transferred 50,000 founder shares to each of our independent directors in December 2018 and transferred 100,000 founder shares to our chief financial officer in December 2018, in each case at the same per-share purchase price paid by the Founder. These shares were issued pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

On February 4, 2019, we consummated our initial public offering (“IPO”) of 23,000,000 units, including 3,000,000 units subject to the underwriters’ over-allotment option. Each unit consisted of one share of Class A common stock and one redeemable public warrant (“Public Warrants”), with each Public Warrant entitling the holder to purchase one share of Class A common stock at a price of $11.50 per share commencing 30 days after the consummation of an initial business combination. The units were sold at an offering price of $10.00 per unit, generating gross proceeds of $230 million. Cantor Fitzgerald & Co. acted as the sole book-running manager and BTIG, LLC acted as lead manager of the offering. The securities sold in the IPO were registered under the Securities Act on a registration statement on Form S-1 (No. 333-229027), which became effective under Section 8(a) of the Securities Act on January 31, 2019.

Simultaneous with the consummation of the IPO, we consummated the private placement of an aggregate of 6,350,000 private warrants (“Private Warrants” and, together with the Public Warrants, the “Warrants”) to the Founder at a price of $1.00 per Private Warrant, generating total proceeds of $6.35 million. The issuance was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act. The Private Warrants are identical to the Public Warrants included in the units sold in the IPO, except that the Private Warrants are non-redeemable and may be exercised on a cashless basis, in each case so long as they continue to be held by the initial purchaser or its permitted transferees. In connection with the Business Combination, the Founder forfeited 1,764,719 Private Warrants.

Following the IPO, a total of $230 million was placed in the trust account and the remaining proceeds, net of underwriting discounts and commissions and other costs and expenses, became available to be used as working capital to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses.

On December 19, 2019 (the “Closing Date”), the Company and LD Topco, Inc., a Delaware corporation (“LD Topco”), consummated a business combination pursuant to an Agreement and Plan of Reorganization, dated as of May 20, 2019, as amended by (i) the Amendment to Agreement and Plan of Reorganization, dated as of October 30, 2019, and (ii) the Amendment No. 2 to Agreement and Plan of Reorganization, dated as of December 16, 2019 (the “Merger Agreement”), by and among the Company, Pivotal Merger Sub Corp., a Delaware corporation and wholly owned subsidiary of the Company (“Merger Sub”), LD Topco, and, solely in its capacity as representative of the stockholders of LD Topco, Carlyle Equity Opportunity GP, L.P., a Delaware limited partnership (“Carlyle”). Pursuant to the Merger Agreement, among other things, Merger Sub was merged with and into LD Topco, with LD Topco surviving as a wholly owned subsidiary of the Company (the “Business Combination”).

In connection with the consummation of the Business Combination:

|

|

• |

each outstanding share of common stock of LD Topco was converted into the right to receive a pro rata portion of (i) 34,800,000 shares of Company common stock and (ii) 2,200,000 additional shares of Company common stock if during the five-year period following the Closing Date (x) a change of control occurs or (y) the reported closing sale price of Company common stock equals or exceeds $13.50 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations or other similar actions) for any 20 consecutive trading days; |

3

|

|

• |

each share of the Company’s Class B common stock, par value $0.0001 per share, was converted into one share of our single class of common stock, par value $0.0001 per share (“Common Stock”); |

|

|

• |

each outstanding Warrant of the Company entitles the holder to purchase shares of our Common Stock beginning the later of (i) 30 days after the Closing Date and (ii) one year after the date of the Company’s IPO; and |

|

|

• |

the Company issued (i) $200,000,000 of 8% convertible debentures due 2024 (the “Debentures”), (ii) 2,097,974 shares of Common Stock and (iii) 1,764,719 warrants (the “Debenture Holder Warrants”) in a private placement to certain “accredited investors” pursuant to an exemption from registration under Section 4(a)(2) of the Securities Act. |

The Business Combination was accounted for as a reverse merger in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Under this method of accounting, the Company will be treated as the “acquired” company for financial reporting purposes. This determination was primarily based on (i) LD Topco shareholders owning the majority interest of the combined company, (ii) LD Topco being represented on the board of directors of the combined company by up to three members, in addition to the chief executive officer of LD Topco, (iii) LD Topco’s senior management comprising the senior management of the combined company and (iv) LD Topco’s operations comprising the ongoing operations of the combined company. Accordingly, for accounting purposes, the Business Combination was treated as the equivalent of LD Topco issuing stock for the net assets of Pivotal, accompanied by a recapitalization. The net assets of the Company were stated at historical cost, with no goodwill or other intangible assets recorded. Operations prior to the Business Combination will be those of LD Topco.

Emerging Growth Company

We are an “emerging growth company,” as defined under the JOBS Act. As an emerging growth company, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and the requirement to obtain stockholder approval of any golden parachute payments not previously approved.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of an extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. We have elected to take advantage of such extended transition period.

We will remain an emerging growth company until the earlier of (1) December 31, 2024 (the last day of the fiscal year following the fifth anniversary of the consummation of our IPO), (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (4) the date on which we have issued more than $1.0 billion in nonconvertible debt during the prior three-year period.

Overview

We are one of the leading eDiscovery providers and the leading data recovery services provider to corporations, law firms, government agencies and individual consumers. In 2019, we served over 4,300 legal technology clients, including 95% of the American Lawyer 100 (the “AM Law 100”) and 70% of Fortune 500 companies. We have broad geographical coverage in the eDiscovery and data recovery industries with more than 40 locations in 19 countries, 10 data centers and 22 data recovery labs around the globe. Our technology and service offerings protect our clients from growing information governance challenges, litigation, compliance breaches and data loss.

4

Our legal technology service offerings provide a wide variety of solutions for information governance and eDiscovery, including forensic collections, data processing, secure hosting, managed review, advanced analytics and document production. eDiscovery refers to a process in which electronic data is sought, located, secured, searched and analyzed with the intent of using it as evidence in a civil, criminal or investigative legal case or regulatory action. Our data recovery service offerings allow clients to recover data in the event of physical or logical loss and provide data management tools and solutions and proprietary data erasure technologies. We differentiate ourselves through our leading integrated suite of proprietary software and services, geographic scale and award-winning corporate culture, which we believe drives our client service success.

Our longstanding relationships with our clients are driven primarily by two factors: technological excellence and a culture of client service. We were ranked as a top eDiscovery provider in an aggregation of fourteen “Best Of” customer surveys from a variety of ALM online legal publications.

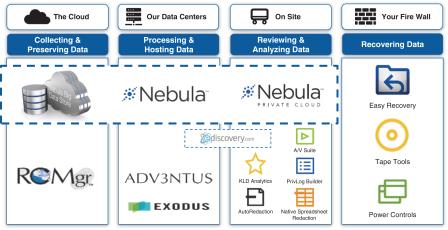

We offer our clients both proprietary and third-party solutions to address their legal technology requirements. Our proprietary end-to-end eDiscovery solution, Nebula, can be deployed on the cloud, on premise or behind a client’s firewall via mobile kits. This technology is a key selling point and these solutions are critical to our success. We believe that our proprietary solutions offer us a unique competitive advantage in the industry, giving us an exclusive product, which allows our clients to execute their job functions quickly and with a high degree of accuracy, thus saving them time and expense. In addition to our proprietary suite of tools, we can integrate third-party applications and tools into our workflow to create what we believe is the best possible solution for our clients. This is useful for projects where clients want to take advantage of our technology platform, but may also have a need to leverage technology that specializes in one narrow aspect. We uphold a core set of client service values including teamwork, responsiveness and sole focus on client service. As we have scaled our global operations, this set of shared beliefs has created a unique environment where employees thrive and work together to deliver our white-glove, 24/7/365 service to our clients. In an industry that is driven by long-term, repeat relationship business, we believe our technology solutions, coupled with our dedication to excellent service, have continued to set us apart from the competition.

LD Topco’s History

We were founded in 2005 as a forensic and eDiscovery company. We recapitalized with an investment from WestView Capital Partners (“WestView”) in September 2011, at which point we began executing a targeted acquisition strategy focused on tuck-in acquisitions of companies that would benefit from our scale and offer us advanced technology solutions and attractive client relationships. Since 2013, we acquired nine U.S. regional eDiscovery companies ranging in size and capabilities, including our 2013 acquisition of AlphaLit and our 2014 acquisition of RenewData. The RenewData acquisition facilitated our entry into the data archiving market, allowing us to increase our geographic reach, diversify our client base, grow our salesforce and further develop our technology platform.

In 2015, we recapitalized with The Carlyle Group (“TCG or Carlyle”) and Revolution Growth III L.P. (“RG or Revolution”). This recapitalization provided us with the resources to execute our largest acquisition to date, Kroll Ontrack, which was completed in December 2016. The Kroll Ontrack acquisition expanded our operations to 19 countries, allowing us to position ourselves as one of a small number of eDiscovery companies with cross-border capabilities. The acquisition also made us a global leader in data recovery services, via the “Ontrack” business, which has been providing data recovery services since 1985.

In 2017, we launched Nebula, a proprietary end-to-end eDiscovery solution optimized for the cloud. In 2018, in order to make further investments in sales and technology, we announced growth equity financing from our prior investor, WestView, together with Carlyle and Revolution. Coinciding with the investment, we released our mobile eDiscovery solution, Nebula Private Cloud (“NPC”), which allows our clients to have a small-scale private data center behind their own firewall. Also in 2018, we furthered our geographic expansion through Western Europe and Canada by opening additional data centers and managed review facilities.

In 2019, we announced our Nebula Big Data Store offering for information governance management which will include legal hold and notification services, thus expanding our proprietary technology suite into the information archiving market. We also opened a new managed review facility in Sydney, Australia and re-opened our managed review facility in Böblingen, Germany.

5

Legal Technology Industry

eDiscovery

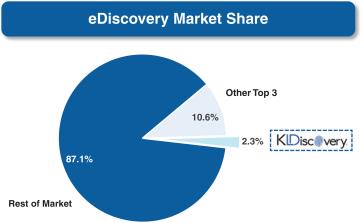

eDiscovery is an essential component of litigation, government investigations and regulatory and compliance submissions, where parties exchange Electronically Stored Information (“ESI”) with each other. eDiscovery is subject to rules and agreed-upon processes, which often involve reviewing data for privilege and relevance before it is exchanged. eDiscovery software and services facilitate the identification, preservation, collection, review and exchange of ESI. The eDiscovery industry is highly fragmented with over 100 vendors, and in 2017, the top three pure play eDiscovery vendors accounted for less than 15% of the industry, according to IDC.

Source: Third-party data and based on our eDiscovery revenue for the year ended December 31, 2017.

According to third-party data, the eDiscovery market is expected to grow from $10.0 billion in 2017 to $12.8 billion in 2022, representing a 5.2% compound annual growth rate (“CAGR”). We believe the industry is in the midst of a transformation driven by data proliferation and compounded by increasing complexity in the makeup and composition of the data we must be equipped to handle. These two factors help drive the rising increase in overall costs.

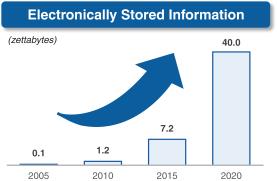

Data Proliferation. Data is growing at an exponential rate due to several factors, including the adoption of mobile devices, accessibility of hosted systems and increased reliance on electronic data storage. With ESI expected to continue growing at a significant rate, the organizations that effectively deploy advanced technologies, such as predictive coding and data analytics, and are able to help their clients work through large data sets quickly and accurately will be best positioned to earn increased market share.

6

Source: IDC and EMC Corporation, The Digital Universe in 2020

Market Shift to the Cloud. eDiscovery solutions are typically deployed in one of three fashions: On-premise (hosted at one of our data centers), in the public cloud (Google, Amazon Web Services, Microsoft Azure) or behind a client’s firewall. Although on-premise hosting has largely been the dominant deployment to date, cloud deployment is expected to see significant growth. Deployment in the public cloud offers many benefits, including scalability, flexibility, security and compliance, and, as a result, the adoption of cloud technology is expected to continue to increase. In particular, small and medium-sized enterprises are adopting cloud deployment mainly due to its cost-effectiveness and advanced results.

Information Archiving

Data archiving serves a critical role in the management of organizational information resources for all businesses, regardless of size. Information archiving addresses information preservation for long-term access, enhancing access to large volumes of information in order to render it more useable and thus valuable. Information archiving also facilitates data management and disposition based on content of such data and need for preservation and/or disposition. As a result, data archiving serves as a primary source of information in legal discovery for litigious organizations. In the cloud economy, data archiving is increasingly displacing traditional backup strategies for disaster recovery purposes, since archiving provides a defense against malicious or inadvertent data loss by insiders and can be an insurance policy against ransomware. The legal hold software market overlaps with both the data archiving market and the eDiscovery software market and addresses the need for organizations to comply with legal requirements to preserve data in the face of pending litigation. Finally, the regulatory compliance software market is driven by the myriad regulatory regimes around the world that require organizations to preserve certain information, sometimes on immutable storage, for specified minimum periods. Conversely, some regulations require verifiable destruction of information when a specified time period has elapsed or certain events arise, and data archiving facilities easy execution of such requirements.

According to The Radicati Group, the information archiving market is expected to grow from $5.2 billion in 2018 to $8.5 billion in 2022, representing a 13.2% CAGR. Significant trends affecting this market include the shift to cloud computing and storage from traditional on-premises computing and storage, increased demands for storage to do more than simply preserve data and the advent of the “API economy,” in which vendors offer application programming interfaces (“APIs”) that enable other vendors to integrate with, extend and enhance the functionality of their core product, thereby increasing value for an end-client. These trends are driven by the widespread and general adoption of cloud services for many functions, a need for businesses or functions with variable demand to favor operational expenditures over capital expenditures, and a need for systems and data to support multiple functions, thereby driving efficiency and cost containment.

Data Recovery Industry

When consumers and businesses lose or cannot access data due to system failures, accidental deletion, physical damage, natural disasters, ransomware or user error, and no backup is available, data recovery service companies can help recover data which would have otherwise been lost. Data recovery service vendors can typically recover data from hard disk or solid state drives, flash drives and USB external drives, while some have the capability to recover data from servers, Redundant Array of Inexpensive Disks (“RAID”) systems, enterprise storage areas networks and network attached storage systems, backup tapes, optical disks, databases and virtual machines. Data recovery service companies use software tools and physical inspection to diagnose and determine the condition of the media and what data may be recovered. They then make an image of the data and perform a logical reconstruction of the data. In the case of physical damage, the device may need to be disassembled in a clean room lab and spare parts used to facilitate the recovery.

This fragmented industry is served by thousands of vendors, the majority of which are small electronics repair shops using off-the-shelf data recovery software tools. There are very few global data recovery providers that have clean room labs and physical data recovery capability with multiple labs. Factors affecting the industry include the increasing use of mobile devices, use of the cloud, streaming content, cost of storage and complexities of edge and analytics workloads and advanced data protection systems.

7

We have built an integrated suite of eDiscovery tools and services covering information governance, forensic collections, data processing, secure online hosting, managed review, advanced analytics and document production. In addition, we offer data recovery solutions ranging from cleanroom facilities to proprietary data erasure, data recovery and data management tools.

eDiscovery Solutions

We are one of the largest globally scaled eDiscovery providers in a highly-fragmented industry of over 100 vendors. With approximately 2.3% of the current eDiscovery market, based on 2017 eDiscovery revenue, we are poised to continue to gain market share via strategic acquisitions.

Source: Third-party data and based on our eDiscovery revenue for the year ended December 31, 2017.

We offer a variety of eDiscovery solutions to our clients, including:

Nebula. Nebula is a proprietary end-to-end information governance and eDiscovery platform which helps to facilitate the identification, preservation, collection, processing, review and exchange of ESI. Nebula is powered by our in-house technology that has been developed, tested and trusted to improve the eDiscovery experience. Nebula is unique to us and contains the latest advancements in eDiscovery, while still delivering essential functionality. We offer three hosting options for Nebula: On-Premise at our data centers, in the public cloud (via Microsoft Azure cloud), and at a client’s location via NPC. NPC is particularly noteworthy as it allows for processing, filtering, analysis, review and production of ESI without the need to transfer data outside of the client’s location or across borders.

8

eDiscovery.com Review (“EDR”). EDR is an all-encompassing, single platform used to search, review and exchange ESI. Over the past decade, our clients have produced to requesting parties over one billion documents and billions of pages using EDR.

Relativity. In 2006, we became the first vendor to license Relativity, a widely used document review tool. Shortly thereafter, we hosted the first case to reach one million records on the platform, and we have consistently worked to improve our clients’ experiences by offering a suite of proprietary enhancements exclusive to us, together with our white-glove client service. Our differentiated data hosting environment offers our clients optimal performance, reliability and redundancy. We currently host Relativity in six countries worldwide.

KLD Analytics. Developed through collaboration among our data scientists, software engineers and legal professionals, KLD Analytics offers a full range of technology-assisted review tools, supported by our team of technologists and consultants. This suite of tools offers features such as:

|

|

• |

Predictive Coding—Leverages human expertise to automatically classify large populations of documents. Predictive coding supports entirely custom workflows and methodologies and is capable of continuous prioritization of important documents for review. |

|

|

• |

Workflow—Automates the routing and distribution of documents to streamline document review and maximize accuracy and defensibility. Workflow eliminates the need to maintain static batch sets and manually transition documents to different review teams. Workflow works hand-in-hand with Predictive Coding to make document review as efficient as possible. |

|

|

• |

Email Threading—Determines the relationship between email messages and identifies the most content-inclusive messages to avoid redundant review. |

|

|

• |

Near-Duplicate Detection—Identifies and groups similar records and highlights the subtle differences among them for a quicker review. |

|

|

• |

Language Identification—Automatically identifies the primary language on documents in a dataset. |

KLD Processing. Our proprietary processing platform has been used exclusively by us for over 15 years. KLD Processing is a highly scalable platform which ingests disparate data types and sources, extracts the content of documents, removes duplicative or otherwise innocuous data, such as operating and system files, and exports data for review and production.

Managed Review Services. Our managed review services provide the facilities, staffing and expertise necessary to review large and complex data sets with a high degree of accuracy and efficiency. We assemble review teams of experienced legal professionals for any type of case. Each team member is a qualified attorney who has passed a selective screening process and has received training from our review managers. Review managers utilize proven methodologies to target and address quality issues early, allowing us to intelligently prioritize the documents that need to be reviewed more closely. Review managers are able to glean insights into productivity and quality using our proprietary technology to deliver a higher quality production. We have experience handling managed reviews for a variety of types of matters, ranging from litigation, investigations and regulatory reviews, such as second requests, and have conducted reviews in over 30 languages. We currently maintain approximately 1,500 review seats spanning thirteen facilities in six countries.

Digital Forensics Services. One of our specialties is computer forensics, including collections and analysis. Without a sound forensic collection, critical electronic evidence may be missed, inadvertently altered or otherwise rendered inadmissible. Whether it be for a small matter, such as a collection of data from a single device, or a large corporate investigation involving multiple custodians and data sources, in-person or remote, our collection analysts will determine and execute the most defensible, efficient and cost-effective strategy. Each year, we regularly collect data from many countries around the world. As a result, we possess a deep bench of talent with knowledge of country-specific discovery laws and customs. With offices across the globe, our collection team can be on the ground quickly in most regions. Our proprietary Remote Collection Manager (“RCMgr”) product is a suite of tools used to facilitate document collections remotely and by end-users, allowing defensibility and accuracy to be maintained without the need to deploy personnel onsite. RCMgr hard drives can arrive pre-configured to collect only the data within scope and the RCMgr tool logs the entire collection in granular detail, ensuring that we can track the process from start to finish. Upon completion of the collection, RCMgr verifies and encrypts the collected data for secure shipment back to one of our labs.

9

Our digital forensic services include analysis and investigative services in addition to collection services. Wherever electronic equipment is used, there is a potential source of electronic evidence and digital information, including a “bread crumb” trail to illuminate misuse or wrongdoing. Our computer forensics teams help extract critical evidence, recover any data that culprits may have sought to erase or hide, retrieve key data buried in documents and organize data contained in multiple information sources. A forensic investigation may be undertaken on a wide range of media as anything that stores data can potentially be investigated.

Information Archiving Services

Legal Hold Management. A legal hold plan that recognizes when the duty to preserve data begins, what it entails, how to implement it and when it ends is essential to any information governance or eDiscovery strategy. Our Legal Hold Management solution addresses these issues through comprehensive technology and defensible processes. With a flexible Software-as-a-Service (“SaaS”) delivery model, clients can choose to manage holds on their own using our technology or leverage our consultants to oversee and manage the process. In addition to leveraging commercially available tools, such as Relativity Legal Hold, we offer Nebula Legal Hold, which simplifies the legal hold process by managing and tracking legal hold communications and key data in a single location. Project initiation and management is efficient and flexible, whether utilizing customized communications or leveraging a full bank of legal hold templates, including initial notices, questionnaires, follow-ups and acknowledgments.

Office 365 Migration & Management. As an inaugural Microsoft Office compliance and eDiscovery partner, we have decades of industry experience partnering with clients as they prepare for unexpected lawsuits and regulatory investigations. Our experts receive a large volume of questions from outside counsel and corporate legal departments concerning Office 365. As a Microsoft partner, we provide the expertise and services necessary to reliably and defensibly leverage the Data Governance, Search & Investigation and Advanced eDiscovery suites in Office 365. Examples of common challenges our consultants assist with include:

|

|

• |

constructing a defensible process for Office 365 eDiscovery, including the creation and maintenance of appropriate documentation; |

|

|

• |

ensuring appropriate organizational boundaries are enforced and confidentiality is protected within Office 365; |

|

|

• |

legacy data management and remediation; |

|

|

• |

litigation readiness and data preservation and collection strategies; and |

|

|

• |

cloud migration. |

Nebula Big Data Store. Nebula Big Data Store is a highly scalable, enterprise-grade storage solution with economics that rival back-up tape. Nebula Big Data Store runs on Microsoft’s Azure cloud, allowing it to be available anywhere in the world in a highly secure and resilient manner. Time- and event-based retention policies, defensible deletion and preservation controls are all built-in, offering excellent value. Nebula Big Data Store works hand-in-hand with Nebula Legal Hold for seamless preservation activities. The product eliminates costly, highly duplicative, on-premises “dumping grounds” that cannot be searched or managed effectively.

Nebula Big Data Store is designed to solve enterprise problems stemming from burgeoning data volumes, fragmented application landscapes and increasing business, regulatory and legal demands, and it positions us to take advantage of evolving trends in the information archiving services industry. Nebula Big Data Store offers an API, making it simple for other products to connect to it and further extend and enhance the value of the information stored within the tool. The tool can assist with legacy application retirement, dark data remediation and information governance, among other use cases. Nebula Big Data Store works seamlessly with our eDiscovery offerings, covering the entire eDiscovery lifecycle. It is also less expensive and simpler to deploy than traditional archiving solutions. Finally, our experience and expertise in machine learning in eDiscovery positions us well to extend our archiving offering into the regulatory compliance intelligence market.

10

Data Recovery. Business and private users routinely store business-critical data on servers, laptops, mobile devices and phones. As a result, data loss events can be devastating. The cost to an enterprise can amount to millions of dollars if they are unable to access important data for business operations.

To address those data loss events when they occur, we provide data recovery services worldwide. Data recovery refers to the recovery of specific information that is inaccessible due to accidental deletion, ransomware, hard drive accidental formatting, Windows reinstallation, partition loss, virtual machine deletion, system booting failure or physical damage of a storage device. The data recovery process involves a secure chain of custody and begins with a diagnosis of the media (hard disk drive, solid state drive, flash drive, RAID, database, tape or optical disk) by our data recovery engineers. The next step is to image the media, a bit by bit copy of the storage areas of the media, along with the system and hidden areas. The engineers then use proprietary tools and methods to reconstruct the data structures from the media image, which includes hidden and system areas. Physical damage may require additional clean room lab procedures, disassembly and use of new parts to access and reconstruct as much of the data as possible.

Ontrack Data Recovery performs over 50,000 data recoveries each year all over the world, and in 2019, we performed data recoveries in over 60 countries. Most of our clients believed that their data was secure, safe and backed-up although, for various reasons, it was not. When other data protection efforts fail, Ontrack can often recover our clients’ data, documents and critical systems. We believe that Ontrack is a global leader in the in-lab data recovery services industry and we have a 30-year history of developing our own recovery tools and making significant investments in automation. More than 20% of our data recovery jobs worldwide come from IT service companies or other data recovery companies who re-sell our data recovery services to their clients.

Email Extraction. We offer professional email recovery services for consumers and businesses alike. From individual files to entire databases, we maintain the expertise and technology to support practically any use case. The success of email recovery is dependent on where the email is stored. Email software, such as Microsoft Outlook, commonly stores email on hardware like a laptop, desktop, mobile phone, tablet or server. We can easily recover email from both functioning and non-functioning hardware. Additionally, our recovery engineers are experienced in recovering enterprise email no matter how it is stored on a client’s server, whether it is inside a database, a Microsoft Exchange Information Store or individual messages in separate files, such as .pst containers.

Tape Services. We provide a range of tape services to solve the problems associated with legacy backup tapes and regularly support our clients to solve the following challenges:

|

|

• |

backup infrastructure migration and consolidation; |

|

|

• |

legacy tape and data remediation; |

|

|

• |

recovery from physically-damaged tapes; and |

|

|

• |

recovery from quickly-erased or partially-overwritten tapes. |

Data Destruction Services. Permanently deleting data isn’t as straightforward as pressing a delete button – it takes time and proper resources. Data that is not completely expunged before the media is disposed of is vulnerable to exposure. To increase the security of data, a secure, verified data destruction process is required. Based on their knowledge, our data experts seek to select and execute the most appropriate data destruction method for the client’s media. Once the data has been destroyed, we provide a certificate of destruction and disposal.

We support our clients throughout the whole data destruction process by offering data destruction services in our labs or onsite using Blancco Erasing Software or our Ontrack Degausser. For clients who want to handle the data destruction process themselves, we sell these products to the client and advise them how to best use them.

Mobile Phone Repair. We can repair broken screens and replace damaged batteries in many commonly-used Apple and Samsung devices at our labs around the world. Additionally, we operate a “UBreakIFix” franchise in New York City (with the option to open four more), which has more robust device repair capabilities.

11

Ontrack EasyRecovery. Developed through our partnership with one of the world’s leading data recovery software manufacturers, Ontrack EasyRecovery is able to handle nearly every type of logical data loss (not physical damage) situation. Ontrack EasyRecovery allows clients to perform precise file recovery of data lost through deletion, reformatting and a number of other data loss scenarios. The product recovers data from solid-state drives (“SSD”) and conventional hard drives, memory cards, USB hard drives, flash drives and optical media. The product functions on both Windows and Mac operating systems and comes in several different versions, ranging from a free version ideal for small one-time recoveries to a Toolkit version which would give a professional the ability to handle complex projects. There is a “free” version that is capable of recovering up to 1 GB of data, a “Home” version for straightforward recoveries, a “Professional” version suitable for small to medium businesses and a “Technician” version that includes the tools needed to successfully perform data recoveries on all types of computer storage devices and rebuild broken RAID volumes.

Ontrack PowerControls. We believe Ontrack PowerControls is the market leading granular restore software product, developed from Ontrack’s expertise in data recovery. This product enables email and backup administrators and database administrators to restore individual mailboxes and messages, without having to restore the entire database. Ontrack PowerControls is used to find and export email, SharePoint items and structured query language (“SQL”) tables for eDiscovery, litigation, investigations, compliance, selective migration, develop and test and general restore use cases for IT. We believe Ontrack PowerControls provides a more powerful and faster search tool than native tools, and, most importantly for legal and compliance use cases, it does not alter the metadata, making it forensically sound. Most enterprise backup platforms do not have granular restore capabilities, so they partner with Ontrack and integrate Ontrack PowerControls with their products.

Payment and Billing Terms

Our eDiscovery solutions and information archiving services are billed on a monthly basis in arrears with amounts typically due within 30 to 45 days. Our data recovery services are billed as the services are provided, with payments due within 30 days of billing. The majority of our data recovery software is billed monthly in advance with amounts typically due within 30 to 45 days; however, depending on the client contract, billing can occur annually, quarterly or monthly.

Competitive Strengths

Market Leader Across the eDiscovery Space.We are the third largest pure play electronic services discovery provider in the $10.6 billion eDiscovery industry, according to third-party data. We have established our market-leading position by leveraging our expansive sales force, national sales and service network, longstanding client relationships and operational expertise. Based on this prior experience, we believe that we will be able to further develop our market share.

Comprehensive Product Offering.We have a broad product offering of premium proprietary technology, such as eDiscovery processing, managed review, data hosting, data analytics, forensic collection, data recovery, archiving, managed services, email management and information governance. We believe that our diverse and comprehensive products and offerings make us the provider of choice for our clients.

Nebula Product Offering. Nebula provides us with several distinct advantages. First, the breadth of Nebula allows us to capture clients as early as the identification phase, via Nebula Big Data Store and Nebula Legal Hold, and keep them in the platform all the way through production. Second, our scale allows the platform to be deployed in many key geographic regions around the world, allowing us to penetrate underserved markets. Third, the flexibility to deploy Nebula in the cloud or at a client’s location, via NPC, removes significant geographical barriers to sales. Lastly, the platform is supported by our team of approximately 216 project managers and hosting support analysts globally.

Expansive Geographic Footprint.Our geographic presence spans the globe, with over 40 offices in 19 countries. Our broad reach provides us with a first responder-type advantage when clients have urgent work requiring immediate attention. In addition, our familiarity with local laws and regulations allows us effectively assist clients in navigating complex, cross-border situations.

12

Established Client Relationships and Industry Expertise.We have longstanding relationships with a large and diverse group of clients, which include 95% of the AM Law 100 and 70% of Fortune 500 companies. We provide our clients with 24/7/365, follow-the-sun service.

Proven and Experienced Management.We have a strong and highly experienced management team. Our chief executive officer Chris Weiler has more than 25 years of experience in the eDiscovery industry, and is one of the longest tenured CEO’s in the eDiscovery industry globally. During his tenure, Mr. Weiler and his team have identified, acquired and integrated 16 acquisitions and he has a proven track record and playbook for accretive acquisitions with the ability to target companies that meet rigorous criteria focused on people, culture, client base, geography and technology. As a result of these acquisitions, the acquired company’s client bases are efficiently onboarded onto our proprietary platforms allowing a seamless transition for our clients and full access to our global capabilities, resulting in significant cross-selling opportunities and creating increased revenues and incremental profitability. Our chief financial officer Dawn Wilson has over 20 years of experience in finance and accounting, primarily with public companies in the technology and services industry, and has successfully acquired and integrated over 40 acquisitions in her career.

Growth Strategies

Increased Product Innovation. Adoption of cloud technology is expected to continue increasing. This shift presents market opportunities that we believe we are well positioned to capitalize upon. Our Nebula platform is a mature product, deployed globally in the cloud, in use by over 3,000 users and backed by our global client support and development teams, ensuring around-the-clock, “white glove” service and a rigorous, yet consistent, cadence for upgrades and improvements. The growth potential for this platform is further accentuated by our breadth of reach, powered largely by Nebula Big Data Store, which pushes our products’ capabilities into the information archiving market. We will also continue to advance our technology platform, both in and around Nebula, to give clients useful functionality and increased value.

Growth and Strengthening of Sales Force. We have been and will remain focused on attracting and retaining top sales professionals. We recently hired several key members of the team that will lead efforts in both established and untapped markets, which we believe will result in an acceleration of incremental revenue. We believe that certain key initiatives we are currently undertaking will ensure that accounts have proper coverage and penetration and will allow us to maximize wallet share.

Selectively Pursue Strategic Acquisitions. Due to the fragmentation in the legal technology and data recovery industries, there is substantial opportunity to continue completing strategic acquisitions of scale, as well as smaller, accretive tuck-in acquisitions. We have successfully sourced, executed and integrated ten strategic acquisitions since 2013. Acquisitions allow us to grow the company both inorganically and organically in that we can significantly increase revenue organically due to the breadth of service offerings and proprietary technology that we can provide to newly acquired customer relationships that were not available for the acquired sales people to sell before joining our company. For example, we acquired AlphaLit in 2013, and AlphaLit did not offer Managed Review services or Forensic Collection services. After the acquisition, the AlphaLit sales people could sell these service offerings to existing AlphaLit customers, thereby increasing revenues. We will primarily focus on small to mid-size opportunities in order to leverage our scalable platform. We are experienced in quickly integrating acquired companies into our broader business, which has allowed us to significantly increase revenue and meaningfully increase EBITDA by focusing on preserving client facing personnel, client retention, seamless transition of clients of the target business and the ability for our new salespeople to sell across a broader platform. Our past acquisitions demonstrate our management’s ability to effectively source, execute and integrate acquisitions into their existing and growing platform. We plan to continue to pursue our acquisition strategy to continue to consolidate the highly fragmented $15.8 billion eDiscovery and information governance industries, which are expected to grow to $21.2 billion in 2022 according to third-party data.

Clients

Our legal technology clients include both law firms and corporations serving many industry sectors including finance and banking, pharmacuetical and biotechnology, technology, insurance, real estate and government. Our data recovery clients include individuals and corporations requiring recovery and accessing of data. For the year ended December 31, 2019, we served over 4,300 legal technology clients, including 95% of the AM Law 100 and 70% of Fortune 500 companies. We have longstanding relationships with our clients, and for the years ended December 31, 2018 and 2019, no single client accounted for more than 5% of our revenues.

13

The eDiscovery market is highly fragmented, competitive and evolving. Our competitors in the eDiscovery market include Consilio, EPIQ, FTI Consulting, Inc, United Lex, E&Y, Deloitte, KPMG, Navigant, Conduent, Lighthouse, Everlaw and Transperfect. We believe the principal competitive factors in this industry include:

|

|

• |

client service and support; |

|

|

• |

breadth of geographic coverage; |

|

|

• |

quality and depth of services offered; |

|

|

• |

pricing of service offerings; |

|

|

• |

security; and |

|

|

• |

client relationships and brand loyalty. |

There are hundreds of small regional eDiscovery providers which may have a few captive relationships but lack the resources or scale to compete for meaningful work. Likewise, of the global and national providers, most lack an end-to-end proprietary platform to complement their global scale and resources. We believe we are uniquely positioned with an ideal complement of global reach, scale of resources and proprietary technology to address almost any client need.

The data recovery market is highly fragmented and generally competitive. Clients choose vendors based on brand awareness and reputation, speed, price and security. Our competitors in the data recovery market include Drivesavers, Gillware Data Recovery, Disk Doctors, Digital Data Recovery DDC and Myung Information Technologies.

Sales and Marketing

Sales

We operate with a global sales team to address the specialized needs of our client base and cultivate strategic partnerships with key clients in our industry. Our sales organization comprises over 40 professionals and is led by our sales executives and regional managers. Our business development managers have developed “first-call” relationships with several of our largest clients while providing significant expertise in the technical nature of the services.

Our global sales structure is tailored to deliver quick responses to sales executives on pricing, account ownership requests and general assistance with client requests and training. This structure is built on our foundational values of teamwork and responsiveness. Our global sales force pursues opportunities in a wide range of geographies and is not confined by the traditional territorial structure that competitors offer. This allows us to maximize relationships and revenue.

Sales leadership encourages representatives around the world to collaborate. A global sales strategy initiative has been implemented to facilitate communication between teams on shared major accounts, which includes the coordination of regular calls and information sharing on key accounts. Most law firms have multiple buyers and this model maximizes our ability to increase wallet share.

Sales executives are encouraged to act as their own entrepreneurs, backed by the support of seasoned sales leadership and a global sales operations team. The sales operations team assists the sales team with all client requests including conflict checks, SalesForce data entry, estimate creation and generation of client agreements and work orders. This global support team allows the sales representatives to focus on what they do best – generating new business and maintaining existing client relationships. Our global sales structure and sales operations teams deliver quick responses to representatives and clients, flexible pricing models and simplified matter initiation, giving us a competitive advantage in a fast-paced industry.

14

We focus on connecting with our clients through our marketing team. Our marketing campaigns are home-grown and highlight the “KLD Difference. One KLD.”

We advertise in a wide variety of trade publications and at sports and entertainment events. We also sponsor a variety of events, seminars and conferences around the world. We operate approximately 35 global websites which highlight our leadership, products, services, technology, industry experience, press clippings and our community contributions. Holding true to our values, we are heavily focused on charitable donations and community work, which are highlighted on our “KLD Community” website page. We also have a number of video advertising campaigns which are shared via YouTube, Twitter and LinkedIn.

Locations

We are headquartered in McLean, VA where we house key functions including accounting, finance, human resources, legal, eDiscovery operations, eDiscovery project management, managed review and data recovery. We maintain a diverse geographic footprint globally, with over 40 locations in 19 countries. In addition, we have 10 data centers and 22 data recovery labs worldwide. We offer approximately 1,600 seats for contract attorney review in eight domestic and five international review facilities.

In addition to on-premise data centers, we deliver our proprietary Nebula platform via the cloud and Nebula Private Cloud, which means that a Nebula environment can be established in any Microsoft Azure location worldwide. The Nebula Private Cloud devices are custom-built hardware running the Nebula platform and, thus, can be deployed virtually anywhere.

Intellectual Property

We own a range of registered intellectual property rights across the world, primarily trademark registrations and patents.

We own 115 trademark registrations globally and currently have 33 trademark applications at various stages in the application process. Our material trademarks are either registered or are pending applications for registrations in the U.S. Patent and Trademark office and various non-U.S. jurisdictions (but with a focus on the European Union, the United Kingdom, Norway, Switzerland, Japan, Australia, China, Singapore and Hong Kong). We us “KLDiscovery,” “Ontrack” and “Ibas” as our primary corporate trademarks. The trademark “KLDiscovery” has proceeded to registration in Australia, China, the European Union, Hong Kong, India, Switzerland and the United Kingdom. Additionally, we have applied to register “Nebula,” the brand name for our proprietary e-discovery platform, in our key markets and, to date, applications have proceeded to registration in the United States, the European Union, United Kingdom, Switzerland and Brazil.

“Ontrack” and “Ontrack Data Recovery” are used in Canada by us subject to a perpetual license from Kroll, LLC who own the “Kroll Ontrack” trademark in that jurisdiction. This license was granted as part of the Kroll Ontrack acquisition in December 2016.

We are the registered proprietor of over 400 domain names including our key domains used to promote our activities, being kldiscovery.com, ontrack.com and ibas.com together with many local variants of these main domain names.

We own the copyright of many of our business software and tools as they have been created by employees in the course of their employment. These include the Nebula and EDR platforms (two proprietary eDiscovery platforms for access and review of data), the PMDB Database (internal job tracking tool), Service Cloud (data recovery portal), PowerControls (data recovery software for email) and several Relativity applications to enhance the license of standard Relativity platform services.

We have a total of 24 patents, either registered in their respective jurisdiction or at application stage, including recent applications for our Nebula offering.

15

As of December 31, 2019, we had 2,522 employees. This total included 1,335 temporary contingent employees who are employed temporarily to work on active managed review matters. Our employees are not represented by a labor union and we have not experienced any work stoppages. We believe that our employee relations are excellent.

Corporate Information

The mailing address of our principal executive office is 8201 Greensboro Dr., Suite 300, McLean, VA 22102 and the telephone number is (703) 288-3380. The website address is www.kldiscovery.com. Information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this Annual Report on Form 10-K.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s website at www.sec.gov. Our SEC filings are also available free of charge on our website at www.kldiscovery.com as soon as reasonably practicable after they are filed with or furnished to the SEC. Our website and the information contained on, or that can be accessed through, our website is not incorporated into this Annual Report on Form 10-K.

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this Annual Report on Form 10-K, including our historical financial statements and related notes included elsewhere in this Annual Report on Form 10-K, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our Common Stock and Warrants. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to Our Business

We operate in highly competitive markets and may be adversely affected by this competition.

The markets for our products and services are highly competitive and are subject to rapid technological changes and evolving client demands and needs. We compete on the basis of various factors, including product functionality, product integration, platform coverage, quality of service interoperability with third-party technologies, ability to scale and price products and services, worldwide sales infrastructure, global technical support, name recognition and reputation.

Our competitors vary in size, scope and breadth of the products and services they offer. Our competitors include software vendors that offer software products that directly compete with our product offerings. In our Data & Storage Technology (“DST”) business, we face growing competition from network equipment, computer hardware manufacturers, large operating system providers and other technology companies. These firms are increasingly developing and incorporating into their products storage, server management software and backup that compete at some levels with our product offerings. Our competitive position could be materially adversely affected to the extent that our clients perceive the functionality incorporated into these products as replacing the need for our products. Many of our principal competitors are established companies that have substantial financial resources, recognized brands, technological expertise and market experience, and these competitors sometimes have more established

16

positions in certain product lines and geographies than we do. We also compete with smaller and sometimes newer companies, some of which are specialized with a narrower focus than our company, and face competition from other eDiscovery and data management services providers. These companies are investing significantly in research and development as well as sales and marketing. In addition, we are facing competition from the backup services solutions offered by cloud IT providers.

Our competitors may be able to adopt new or emerging technologies or address client requirements more quickly than we can. New and emerging technologies can also have the impact of allowing startup companies to enter the market more quickly than they would have been able to in the past. We may also face increased competition from companies that could pose a threat to our business by providing more in-depth offerings, adapting their products and services to meet the demands of their clients or combining with one of their competitors to enhance their products and services. A number of our principal competitors may continue to make acquisitions as a means to improve the competitiveness of their offerings. Increased competition could harm our business by causing, among other things, price reductions of our products, reduced profitability and loss of market share. In order to better serve the needs of our existing clients and to attract new clients, we must continue to:

|

|

• |

enhance and improve our existing products and services (such as by adding new content and functionalities); |

|

|

• |

develop new products and services; |

|

|

• |

invest in technology; and |

|

|

• |

strategically acquire additional businesses and partner with other businesses in key sectors that will allow us to offer a broader array of products and services. |

If we fail to compete effectively, our financial condition and results of operations would be adversely affected.

We may need to change our pricing models in order to compete successfully.

General economic and business conditions together with the intense competition we face in the sales of our products and services place pressure on us to reduce prices for our software and services, and we frequently encounter aggressive price competition. If our competitors offer deep discounts on certain products or services or develop products that the marketplace considers more valuable than ours, we may need to lower our prices or offer other favorable terms in order to compete successfully. Any such changes may reduce margins and could adversely affect operating results. Additionally, the increasing prevalence of cloud and SaaS delivery models offered by us and our competitors may unfavorably impact pricing of both our on-site software business and our cloud business, as well as overall demand for our on-site software product and service offerings, which could reduce our revenues and profitability. Our competitors sometimes offer lower pricing on their support offerings, which places pressure on us to further discount our product or support pricing.

Industry pricing models are also evolving, and we anticipate that clients may increasingly request alternative pricing models. These pricing models may exacerbate existing pricing pressures, require investments in different product solutions or place us at a competitive disadvantage relative to our competitors. Moreover, the use of evolving technology by our clients to develop more complex pricing models may lead to additional pricing pressures. If we are unable to adapt our operations to these evolving pricing models, our results of operations may be adversely affected or we may not be able to offer pricing that is attractive relative to our competitors.

Any broad-based change to our prices and pricing policies could cause our revenues to decline or be delayed as our sales force implements, and our clients adjust to, such new pricing policies. Some of our competitors may bundle products for promotional purposes or as a long-term pricing strategy or provide guarantees of prices and product implementations. These practices could, over time, significantly constrain the prices that we can charge for certain of our products. If we do not adapt our pricing models to reflect changes in client use of our products or changes in client demand, our revenues could decrease. An increase in open source software distribution may also cause us to change our pricing models.

17

If we do not continue to attract, motivate and retain members of our senior management team and highly qualified employees, we may not be able to develop new and enhanced products and services or effectively manage or expand our business.

Our future success depends upon the continued service and performance of our senior management team and certain of our key technical and sales personnel. In particular, we are highly dependent on the services of Christopher J. Weiler, who currently serves as our chief executive officer. If we lose any of our senior management term or key technical and sales personnel, we may not be able to effectively manage our current and future operations, and our business, financial condition and results of operations would be adversely affected.