Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - KAMAN Corp | balsealproforma.htm |

| EX-99.2 - EXHIBIT 99.2 - KAMAN Corp | proformafinancials.htm |

| EX-23.1 - EXHIBIT 23.1 - KAMAN Corp | windesconsent.htm |

CONTENTS Independent Auditors’ Report ........................................................................... 1-2 Consolidated Balance Sheet ............................................................................... 3 Consolidated Statement of Income and Comprehensive Income .................................... 4 Consolidated Statement of Stockholder’s Equity ...................................................... 5 Consolidated Statement of Cash Flows .................................................................. 6 Notes to the Consolidated Financial Statements ................................................... 7-24

Long Beach | Irvine | Los Angeles www.windes.com 844.4WINDES INDEPENDENT AUDITORS’ REPORT To the Board of Directors Bal Seal Engineering, Inc.: We have audited the accompanying consolidated financial statements of Bal Seal Engineering, Inc. and subsidiaries (the Company), which comprise the consolidated balance sheet as of December 31, 2019, and the related consolidated statements of income and comprehensive income, stockholder’s equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditors consider internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. 1

Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Bal Seal Engineering, Inc. and subsidiaries as of December 31, 2019, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter As discussed in Note 2, beginning January 1, 2019, Bal Seal Engineering, Inc. and subsidiaries adopted Accounting Standards Update (ASU) No. 2014 -09, Revenue from Contracts with Customers (Topic 606) and its related amendments using the modified retrospective transition method. Our opinion is not modified with respect to this matter. Irvine, California February 7, 2020 2

BAL SEAL ENGINEERING, INC. CONSOLIDATED BALANCE SHEET DECEMBER 31, 2019 ASSETS CURRENT ASSETS Cash and cash equivalents $ 10,686,164 Accounts receivable, net of allowances of $82,000 10,392,775 Inventory, net 13,527,945 Prepaid expenses and other current assets 2,561,273 Total current assets 37,168,157 DEPOSITS AND OTHER ASSETS 193,042 PROPERTY AND EQUIPMENT, net 22,660,976 TOTAL ASSETS $ 60,022,175 LIABILITIES AND STOCKHOLDER'S EQUITY CURRENT LIABILITIES Accounts payable $ 1,291,182 Accrued expenses 6,056,647 Income taxes payable 15,093 Total current liabilities 7,362,922 NONCURRENT LIABILITIES Deferred compensation 1,931,722 COMMITMENTS AND CONTINGENCIES (Note 9) STOCKHOLDER'S EQUITY Common stock, no par value; 2,000 shares authorized, 107 shares issued and outstanding 11,630 Additional paid-in capital 1,220,070 Retained earnings 49,495,831 Total stockholder’s equity 50,727,531 TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY $ 60,022,175 The accompanying notes are an integral part of these consolidated financial statements. 3

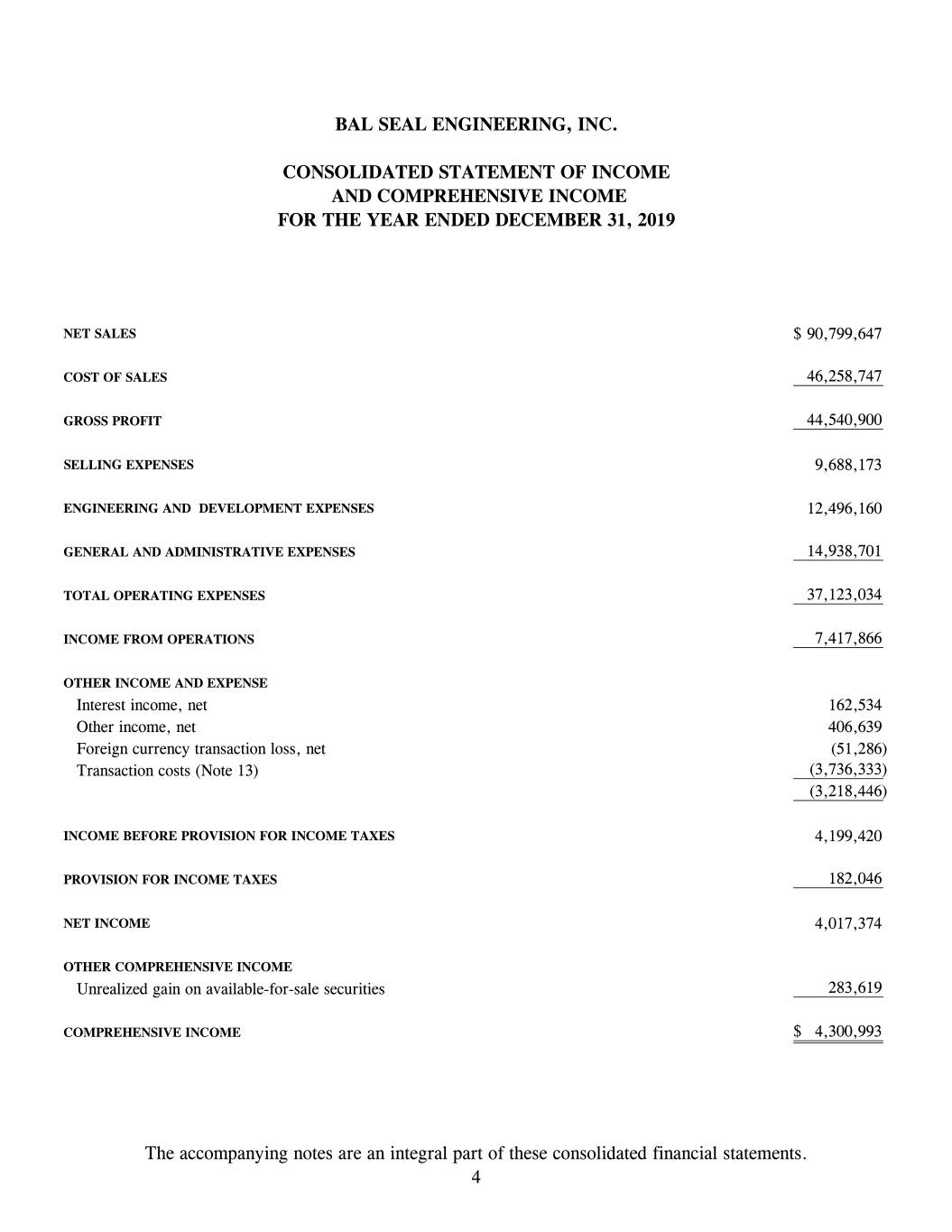

BAL SEAL ENGINEERING, INC. CONSOLIDATED STATEMENT OF INCOME AND COMPREHENSIVE INCOME FOR THE YEAR ENDED DECEMBER 31, 2019 NET SALES $ 90,799,647 COST OF SALES 46,258,747 GROSS PROFIT 44,540,900 SELLING EXPENSES 9,688,173 ENGINEERING AND DEVELOPMENT EXPENSES 12,496,160 GENERAL AND ADMINISTRATIVE EXPENSES 14,938,701 TOTAL OPERATING EXPENSES 37,123,034 INCOME FROM OPERATIONS 7,417,866 OTHER INCOME AND EXPENSE Interest income, net 162,534 Other income, net 406,639 Foreign currency transaction loss, net (51,286) Transaction costs (Note 13) (3,736,333) (3,218,446) INCOME BEFORE PROVISION FOR INCOME TAXES 4,199,420 PROVISION FOR INCOME TAXES 182,046 NET INCOME 4,017,374 OTHER COMPREHENSIVE INCOME Unrealized gain on available-for-sale securities 283,619 COMPREHENSIVE INCOME $ 4,300,993 The accompanying notes are an integral part of these consolidated financial statements. 4

BAL SEAL ENGINEERING, INC. CONSOLIDATED STATEMENT OF STOCKHOLDER'S EQUITY FOR THE YEAR ENDED DECEMBER 31, 2019 Accumulated Additional Other Common Paid-in Retained Comprehensive Stock Capital Earnings Income (Loss) Total BALANCE, DECEMBER 31, 2018 $ 11,630 $ 1,220,070 $ 58,810,820 $ (283,619) $ 59,758,901 Adjustment to adopt ASU 2014-09 (Note 2) - - 718,783 - 718,783 Distributions - - (14,051,146) - (14,051,146) Net income - - 4,017,374 - 4,017,374 Realized gain on available-for-sale securities - - - 283,619 283,619 BALANCE, DECEMBER 31, 2019 $ 11,630 $ 1,220,070 $ 49,495,831 $ - $ 50,727,531 The accompanying notes are an integral part of these consolidated financial statements. 5

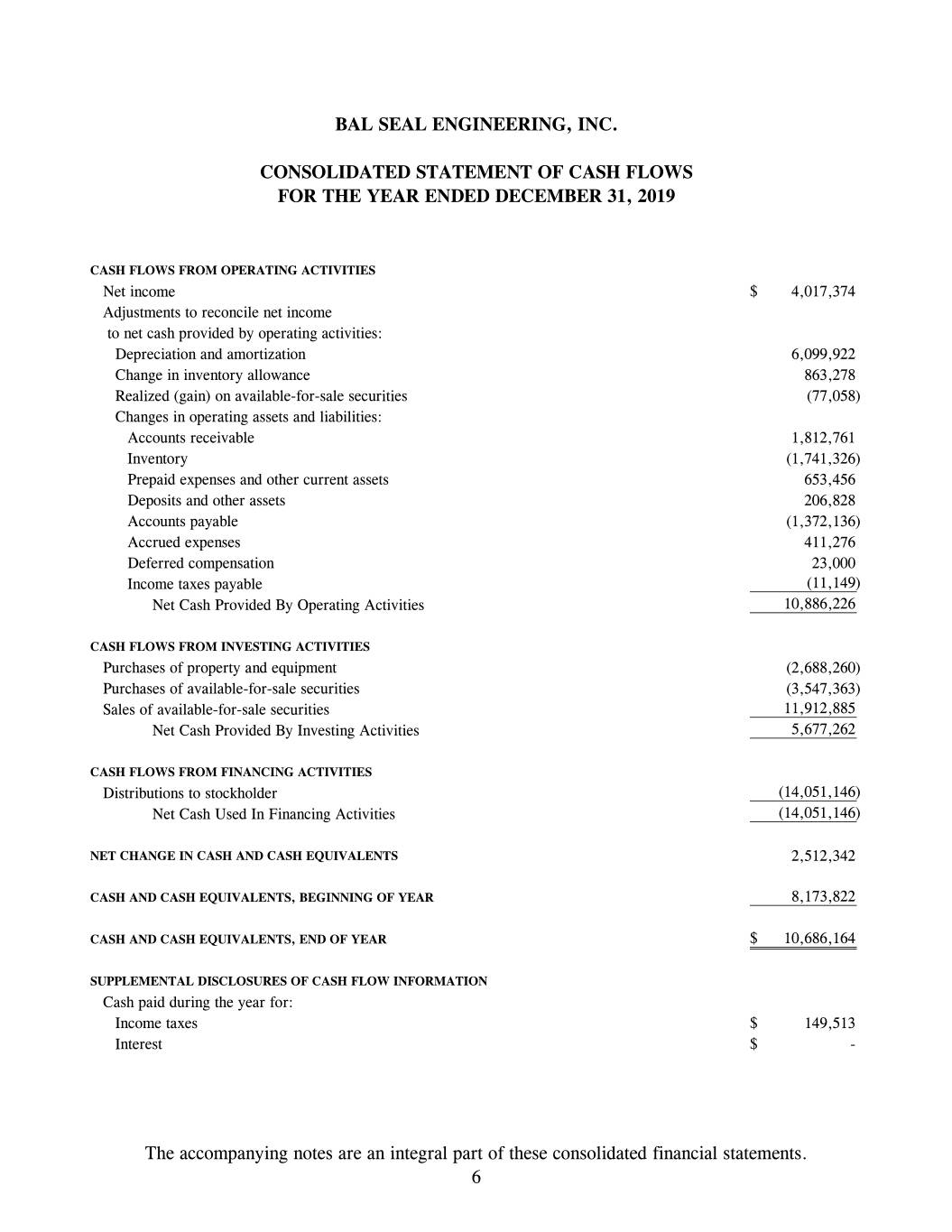

BAL SEAL ENGINEERING, INC. CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2019 CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 4,017,374 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 6,099,922 Change in inventory allowance 863,278 Realized (gain) on available-for-sale securities (77,058) Changes in operating assets and liabilities: Accounts receivable 1,812,761 Inventory (1,741,326) Prepaid expenses and other current assets 653,456 Deposits and other assets 206,828 Accounts payable (1,372,136) Accrued expenses 411,276 Deferred compensation 23,000 Income taxes payable (11,149) Net Cash Provided By Operating Activities 10,886,226 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (2,688,260) Purchases of available-for-sale securities (3,547,363) Sales of available-for-sale securities 11,912,885 Net Cash Provided By Investing Activities 5,677,262 CASH FLOWS FROM FINANCING ACTIVITIES Distributions to stockholder (14,051,146) Net Cash Used In Financing Activities (14,051,146) NET CHANGE IN CASH AND CASH EQUIVALENTS 2,512,342 CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR 8,173,822 CASH AND CASH EQUIVALENTS, END OF YEAR $ 10,686,164 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION Cash paid during the year for: Income taxes $ 149,513 Interest $ - The accompanying notes are an integral part of these consolidated financial statements. 6

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies This summary of significant accounting policies of Bal Seal Engineering, Inc. and subsidiaries (the “Company”) is presented to assist in understanding the Company’s consolidated financial statements. The consolidated financial statements and notes are a representation of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the consolidated financial statements for December 31, 2019. Business and Organization The Company is engaged in the business of manufacturing and distributing springs and seals used in a variety of industries. The Company’s office headquarters and production facilities are located in Foothill Ranch, California, as well as an office and manufacturing facility in Colorado Springs, Colorado. The Company has wholly owned subsidiaries located globally, including Bal Seal Engineering Europe BV in Amsterdam, the Netherlands and Bal Seal Asia Ltd in Hong Kong, China, which are primarily sales offices, and ASC Continental AG in Switzerland, which is primarily an engineering office. Basis of Consolidation The consolidated financial statements include the accounts of Bal Seal Engineering, Inc. and wholly owned subsidiaries Bal Seal Engineering Europe BV, Bal Seal Asia Ltd, and ASC Continental AG. All significant intercompany accounts and transactions have been eliminated in consolidation. Accounting Estimates The preparation of the consolidated financial statements, in conformity with accounting principles generally accepted in the United States of America, requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Those estimates and assumptions affect reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Significant items subject to such estimates and assumptions include the useful lives of fixed assets, allowances for doubtful accounts, sales returns, inventory obsolescence, and contingencies. Actual results could differ from those estimates. 7

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Foreign Subsidiaries and Foreign Currency Transactions Bal Seal Engineering Europe BV is a sales office for Europe. Net sales generated by the subsidiary totaled approximately $15,795,000 in 2019. Approximately 9% of the Company’s assets, primarily trade receivables and cash, were in Europe at December 31, 2019. Bal Seal Asia Ltd is a sales office in Hong Kong, China. Net sales generated by this subsidiary totaled approximately $11,994,000 in 2019. The Company records all sales transactions, billing, and collections for this subsidiary in United States dollars. The functional currency of all of these subsidiaries is the U.S. dollar. Remeasurement and other transaction gains/losses resulting from ASC Continental AG were insignificant. The financial statements for the foreign subsidiaries are remeasured to U.S. dollars using year- end rates of exchange for all monetary assets and liabilities, historical rates for nonmonetary assets and liabilities, and average rates of exchange in the year for revenues, costs, and expenses. Foreign currency transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the consolidated statements of income under foreign currency transaction gain, as incurred. Transaction gains and losses result from a change in exchange rates between the functional currency and the currency in which a transaction is denominated. Foreign currency transaction gains (losses) consist of the following for the year ended December 31, 2019: Financial statement remeasurement $ (134,404) Foreign currency hedging contracts 52,942 Transactions denominated in foreign currency 30,176 $ (51,286) 8

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Revenue Recognition The Company recognizes revenue in accordance with Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606) and its related amendments effective January 1, 2019 and elected the modified retrospective approach. The results for periods before 2019 were not adjusted for the new standard and the cumulative effect of the change in accounting was recognized through retained earnings at the date of adoption. See Note 2 for a discussion of the effect of the ASU on the Company’s financial statements. Under Topic 606, a performance obligation is a promise in a contract with a customer to transfer a distinct good or service to the customer. Management has determined that the Company’s contracts with customers all contain a single performance obligation. Timing of the satisfaction of performance obligations varies depending upon the specific contractual terms with customers. Performance obligations are satisfied over-time if the customer receives the benefits as the Company performs work, if the customer controls the asset as it is being produced, or if the product being produced for the customer has no alternative use and the Company has a contractual right to payment. Revenue is recognized using costs incurred to date relative to total estimated costs at completion to measure progress. Incurred costs represent work performed, which correspond with and best depict transfer of control to the customer. Contract costs include labor, materials, and overhead costs directly attributable to manufacturing operations. Performance obligations are satisfied as of a point in time if all of the criteria for over-time recognition outlined above are not met, generally for contracts where the Company does not have a contractual right for payment. Revenue is recognized when control of the product transfers to the customer, generally upon product shipment. Revenue recognized during the year ended December 31, 2019, disaggregated by timing of goods transferred, is comprised of the following: Point in time $ 73,315,079 Over time 17,484,568 $ 90,799,647 9

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Revenue Recognition (Continued) Contract assets consist of unbilled receivables, which reflect revenue recognized and performance obligations satisfied in advance of customer billing. The Company receives payments from customers based on the terms established in the underlying contracts. Unbilled receivables totaling $783,786 at December 31, 2019 are included in accounts receivable on the accompanying consolidated balance sheet. For the year ended December 31, 2019, the sales returns were approximately $160,000. At December 31, 2019, the Company had an allowance for sales returns of approximately $79,000. Taxes Collected from Customers and Remitted to Government Authorities Taxes are assessed by various governmental authorities on sales. The Company records taxes collected from customers and remitted to governmental authorities on a net basis (excluded from sales). Cash and Cash Equivalents For the purpose of reporting cash flows, cash includes cash on hand, amounts due from banks, and short-term investments purchased with an original maturity of 90 days or less. The Company maintains balances in financial institutions in excess of federally insured limits. There is risk that these deposits may not be readily available or covered by insurance, although the Company historically has not experienced any losses. Accounts Receivable The Company carries its accounts receivable at invoiced amounts, less allowances for doubtful accounts and sales returns. The Company extends credit to its customers in the normal course of business and performs ongoing credit evaluations of its customers. The Company maintains an allowance for doubtful accounts for estimated losses inherent in its accounts receivable portfolio. In establishing the required allowance, management considers historical losses, current receivables aging, and existing industry and economic data. Management provides for probable uncollectible amounts through a charge to earnings and a credit to valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to accounts receivable. Bad debt expense has historically not been significant. 10

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Business Concentrations The Company has certain concentrations of credit risk in its accounts receivable. As of December 31, 2019, the ten largest customers represented 44% of the total net accounts receivable balance. The Company’s top ten customers accounted for 42% of total net sales for the year ended December 31, 2019. A decision by a major customer to cancel or delay purchases could have a material impact on the results of operations for the Company. The Company’s customers are principally located in North America, Europe, and Asia. Approximately 31% of the Company’s net sales are generated from sales to customers outside the United States in 2019. As of December 31, 2019, 24% of outstanding accounts receivable were related to these customers. Inventory Inventory is stated at the lower of cost, determined by the first-in, first-out method, or net realizable value. An allowance for inventory obsolescence is based on usage and is reviewed monthly. Derivative Instruments and Hedging Activities The Company accounts for derivatives and hedging activities in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 815, Derivatives and Hedging, which requires entities to recognize all derivative instruments as either assets or liabilities in the consolidated balance sheet at their respective fair values. For derivatives designated in hedging relationships, changes in the fair value are either offset through earnings against the change in fair value of the hedged item attributable to the risk being hedged, or recognized in accumulated other comprehensive income, to the extent the derivative is effective at offsetting the changes in cash flows being hedged until the hedged item affects earnings. 11

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Derivative Instruments and Hedging Activities (Continued) For all hedging relationships, the Company does not formally document the hedging relationship and its risk management objective and strategy for undertaking the hedge, the hedging instrument, the hedged transaction, the nature of the risk being hedged, how the hedging instrument’s effectiveness in offsetting the hedged risk will be assessed prospectively and retrospectively, and a description of the method used to measure ineffectiveness. The Company also does not formally assess, both at the inception of the hedging relationship and on an ongoing basis, whether the derivatives that are used in hedging relationships are highly effective in offsetting changes in cash flows of hedged transactions. As a result, the Company records the change in fair value of the hedge directly to other income (expense) in the current period. The Company uses derivative instruments to manage exposure to fluctuations in currency rates. The Company does not hold or issue derivative financial instruments for trading or speculative purposes. The Company enters into financial instruments with either major financial institutions or highly rated counterparties and makes reasonable attempts to diversify transactions among counterparties, thereby limiting exposure to credit-related and performance-related risks. By using derivative financial instruments to hedge exposures to changes in currency exchange rates, the Company exposes itself to credit risk and market risk. Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. When the fair value of a derivative contract is positive, the counterparty owes the Company, which creates credit risk for the Company. When the fair value of a derivative contract is negative, the Company owes the counterparty and, therefore, the Company is not exposed to the counterparty’s credit risk in those circumstances. The derivative instruments entered into by the Company do not contain credit-risk-related contingent features. Market risk is the adverse effect on the value of a derivative instrument that results from a change in currency exchange rates. The market risk associated with currency exchange contracts is managed by establishing and monitoring parameters that limit the types and degree of market risk that may be undertaken. Investments The Company’s investments primarily include marketable securities, which are classified as available-for-sale securities. These securities are included in the consolidated balance sheet and are measured at fair value. 12

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Investments (Continued) Realized gains are included in earnings and in other comprehensive income (loss). At December 31, 2019, the Company had no remaining available-for-sale securities and recognized in a cumulative realized gain of $664,297 for the year then ended. The Company evaluates its investments periodically for other-than-temporary impairment and reviews factors such as length of time and extent to which fair value has been below cost basis and the Company’s ability and intent to hold the investment for a period of time, which may be sufficient for anticipated recovery in market value. Fair Value of Financial Instruments The Company applies the provisions of FASB ASC Topic 825, Financial Instruments, which requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the consolidated balance sheet, for which it is practicable to estimate fair value. FASB ASC Topic 825 defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of December 31, 2019, the carrying amounts reflected in the accompanying consolidated balance sheet for cash and cash equivalents, accounts receivable, other receivables, accounts payable, accrued expenses and long-term debt approximate fair value due to the short-term nature of the instruments or the variable interest rate fluctuating with the market rates. These estimates are subjective in nature, involving uncertainties and matters of significant judgment and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect these estimates. Fair Value Measurements FASB ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. 13

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Fair Value Measurements (Continued) The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a nonrecurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a consolidated financial statement is prepared. The Company’s financial assets carried at fair value on a recurring basis consist of investments in available-for-sale securities. Property and Equipment Property and equipment are stated at cost, less accumulated depreciation and amortization. When depreciable property or equipment are retired or otherwise disposed of, the related cost and accumulated depreciation and amortization are removed from the accounts and any gain or loss is reflected in the consolidated statements of income. Expenditures for major additions and improvements are capitalized, and minor replacements, maintenance, and repairs are charged to expense as incurred. Depreciation of property and equipment is computed using the straight-line method based on estimated useful lives ranging from three to seven years. Amortization of leasehold improvements is computed over the lesser of the lease term or the useful lives of the related assets, ranging from five to ten years, and is included in depreciation and amortization expense. Depreciation and amortization expense for the year ended December 31, 2019 amounted to approximately $6,100,000. 14

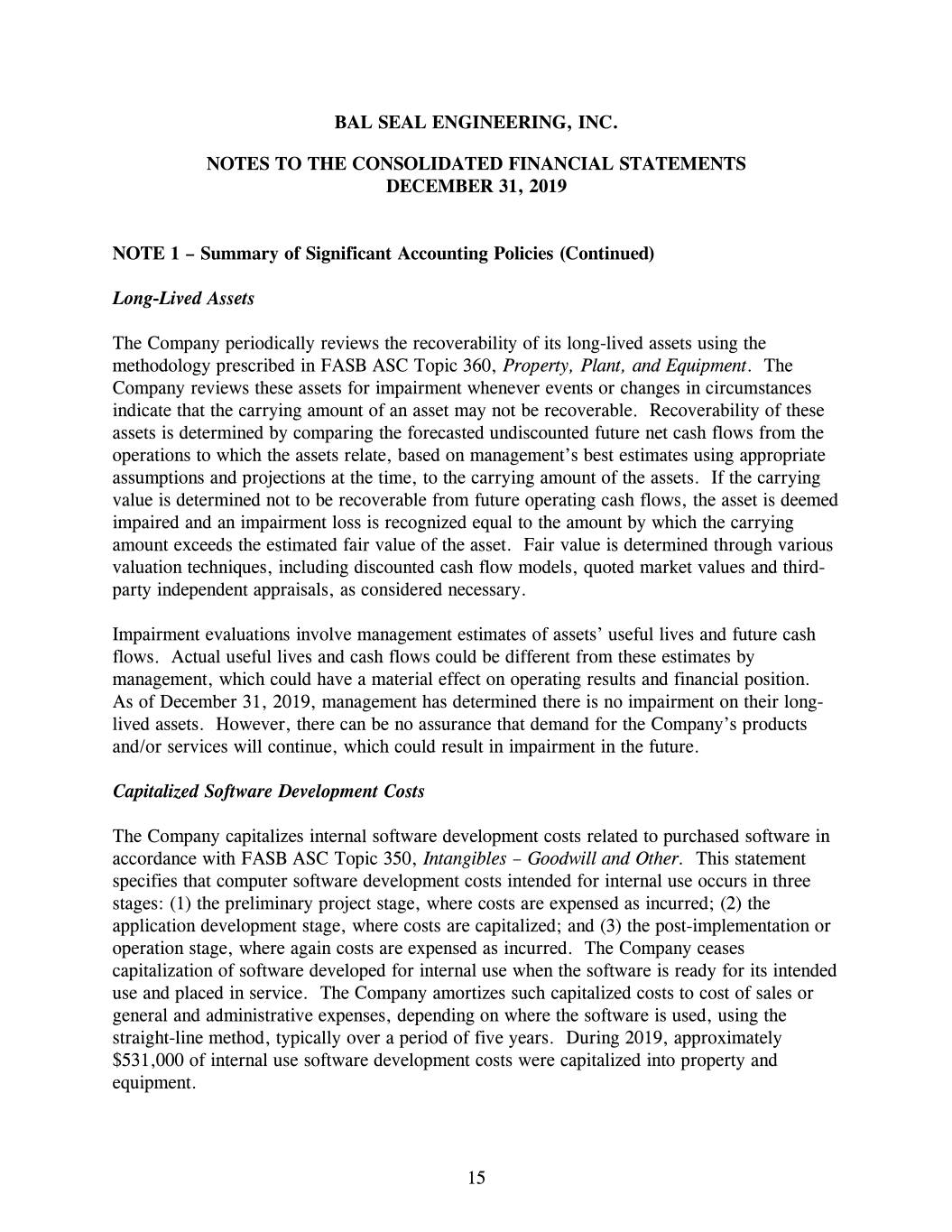

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Long-Lived Assets The Company periodically reviews the recoverability of its long-lived assets using the methodology prescribed in FASB ASC Topic 360, Property, Plant, and Equipment. The Company reviews these assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of these assets is determined by comparing the forecasted undiscounted future net cash flows from the operations to which the assets relate, based on management’s best estimates using appropriate assumptions and projections at the time, to the carrying amount of the assets. If the carrying value is determined not to be recoverable from future operating cash flows, the asset is deemed impaired and an impairment loss is recognized equal to the amount by which the carrying amount exceeds the estimated fair value of the asset. Fair value is determined through various valuation techniques, including discounted cash flow models, quoted market values and third- party independent appraisals, as considered necessary. Impairment evaluations involve management estimates of assets’ useful lives and future cash flows. Actual useful lives and cash flows could be different from these estimates by management, which could have a material effect on operating results and financial position. As of December 31, 2019, management has determined there is no impairment on their long- lived assets. However, there can be no assurance that demand for the Company’s products and/or services will continue, which could result in impairment in the future. Capitalized Software Development Costs The Company capitalizes internal software development costs related to purchased software in accordance with FASB ASC Topic 350, Intangibles – Goodwill and Other. This statement specifies that computer software development costs intended for internal use occurs in three stages: (1) the preliminary project stage, where costs are expensed as incurred; (2) the application development stage, where costs are capitalized; and (3) the post-implementation or operation stage, where again costs are expensed as incurred. The Company ceases capitalization of software developed for internal use when the software is ready for its intended use and placed in service. The Company amortizes such capitalized costs to cost of sales or general and administrative expenses, depending on where the software is used, using the straight-line method, typically over a period of five years. During 2019, approximately $531,000 of internal use software development costs were capitalized into property and equipment. 15

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Shipping and Handling Shipping and handling costs billed to the customer in a sales transaction are reported as freight billed to the customer and are included in net sales. Costs incurred by the Company for shipping and handling are included in cost of sales. Advertising and Promotion The Company expenses advertising and promotion costs the first time the advertising and promotion takes place. Approximately $51,000 of advertising costs were expensed in 2019. Patents The Company expenses costs for developing, maintaining and defending patents as incurred. Costs related to maintaining and defending patents are included in general and administrative expenses. Costs associated with developing new patents are included in engineering and development expenses. Research and Development Engineering and research and development costs not connected to software development are expensed as incurred. Substantially all engineering and research and development expenses are related to new product development and designing improved or increased functionality in current products. Research and development costs were approximately $3,144,000 for the year ended December 31, 2019, are included in engineering and development expenses in the accompanying consolidated statements of income and comprehensive income. Income Taxes The Company’s stockholder has elected Bal Seal Engineering, Inc. to be taxed under the provisions of subchapter S of the Internal Revenue Code for federal and state purposes. Under these provisions, the Company does not pay U.S. corporate income taxes on its taxable income. However, the Company is subject to various state and franchise taxes. In addition, the stockholder is liable for individual federal and state income taxes on the Company’s taxable income. The Company disburses funds necessary to satisfy the stockholder’s estimated personal income tax liabilities. 16

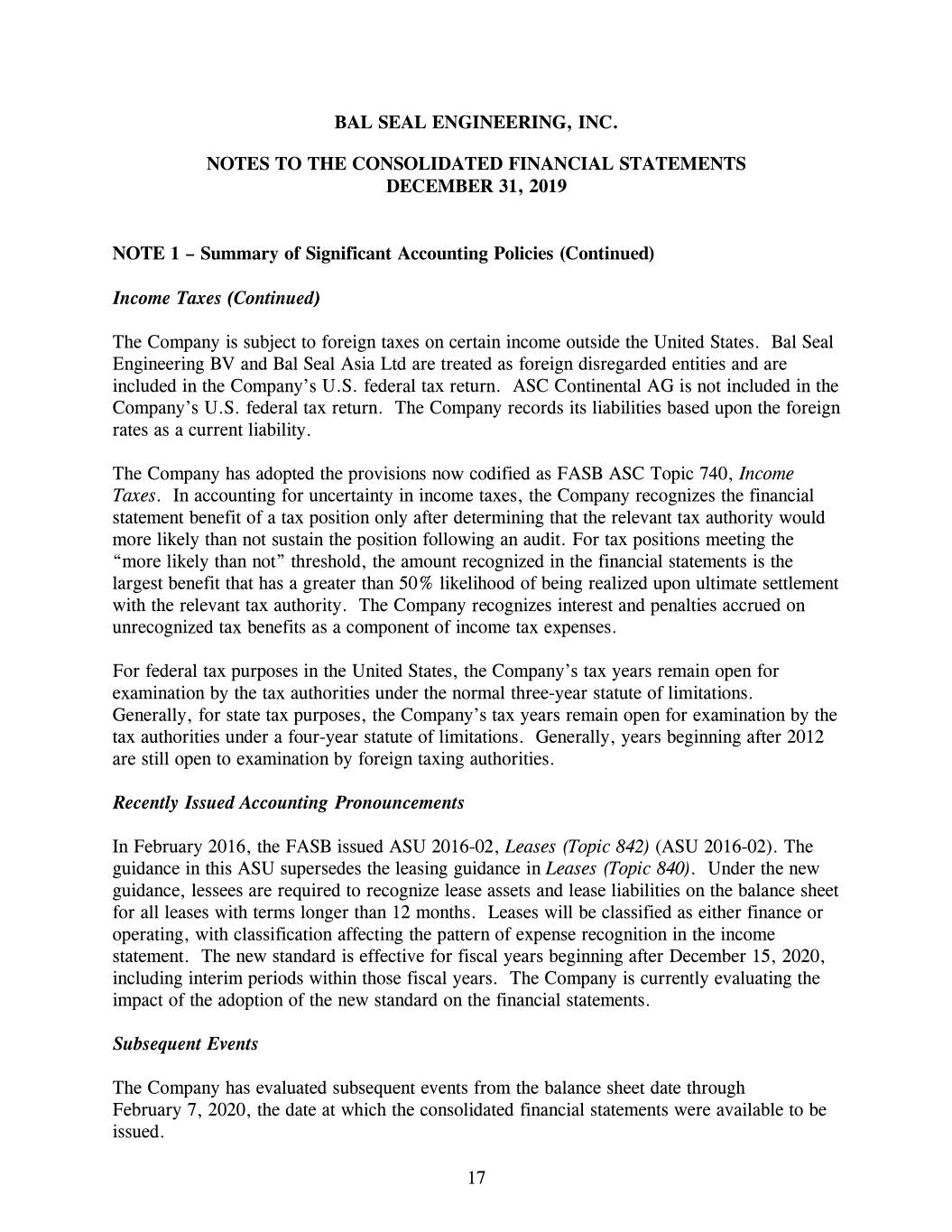

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 1 – Summary of Significant Accounting Policies (Continued) Income Taxes (Continued) The Company is subject to foreign taxes on certain income outside the United States. Bal Seal Engineering BV and Bal Seal Asia Ltd are treated as foreign disregarded entities and are included in the Company’s U.S. federal tax return. ASC Continental AG is not included in the Company’s U.S. federal tax return. The Company records its liabilities based upon the foreign rates as a current liability. The Company has adopted the provisions now codified as FASB ASC Topic 740, Income Taxes. In accounting for uncertainty in income taxes, the Company recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. For tax positions meeting the “more likely than not” threshold, the amount recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant tax authority. The Company recognizes interest and penalties accrued on unrecognized tax benefits as a component of income tax expenses. For federal tax purposes in the United States, the Company’s tax years remain open for examination by the tax authorities under the normal three-year statute of limitations. Generally, for state tax purposes, the Company’s tax years remain open for examination by the tax authorities under a four-year statute of limitations. Generally, years beginning after 2012 are still open to examination by foreign taxing authorities. Recently Issued Accounting Pronouncements In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (ASU 2016-02). The guidance in this ASU supersedes the leasing guidance in Leases (Topic 840). Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Company is currently evaluating the impact of the adoption of the new standard on the financial statements. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through February 7, 2020, the date at which the consolidated financial statements were available to be issued. 17

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 2 – Recently Adopted Accounting Standards Beginning January 1, 2019, the Company adopted Accounting Standards Update (ASU) 2014- 09, Revenue from Contracts with Customers (Topic 606) and its related amendments, which supersedes the revenue recognition requirements in Revenue Recognition (Topic 605). This ASU requires an entity to recognize revenue when goods are transferred or services are provided to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This ASU also requires disclosures enabling users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The ASU permits the use of either a full retrospective transition method or a modified retrospective transition method with the cumulative effect adjusted to the opening balance of retained earnings. The Company has elected the use of the modified retrospective method. The following table summarizes the impact of the ASU on the consolidated balance sheet as of the adoption date of January 1, 2019: Under Impact Previous from ASU Under New Standard Adoption ASU Accounts receivable $ 10,891,000 $ 1,314,536 $ 12,205,536 Inventory $ 13,245,650 $ (595,753) $ 12,649,897 Retained earnings $ 58,810,820 $ 718,783 $ 59,529,603 NOTE 3 - Inventory Inventory consists of the following at December 31, 2019: Raw materials and component parts $ 10,516,477 Work-in-process 2,271,502 Finished goods 3,287,138 Inventory allowance (2,547,172) $ 13,527,945 18

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 4 – Fair Value Hierarchy In accordance with FASB ASC Topic 825, the carrying value of financial assets and liabilities recorded at fair value is measured on a recurring basis. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a consolidated financial statement is prepared. The Company’s financial assets and liabilities carried at fair value on a recurring basis consist of investments in available-for-sale securities. The availability of inputs observable in the market varies from instrument to instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the market and may require management’s judgment. In determining the fair value of its investments, the Company based the fair value on quoted market prices. The Company assesses the inputs used to measure fair value using a three-tier hierarchy. The hierarchy indicates the extent to which inputs used in measuring fair value are observable in the market. Level 1 inputs include quoted prices for identical instruments and are most observable. Level 2 inputs include quoted prices for similar assets and observable inputs such as interest rates, foreign currency exchange rates, commodity rates, and yield curves. Level 3 inputs are not observable in the market and include management’s own judgments about the assumptions market participants would use in pricing the asset or liability. The use of observable and unobservable inputs is reflected in the hierarchy assessment disclosed in the table below. The following table presents information about the Company’s assets and liabilities measured at fair value on a recurring basis, and indicates the fair value hierarchy of the valuation techniques utilized by the Company to determine such fair value: Fair Value Measurements at December 31, 2019 Total Level 1 Level 2 Level 3 Assets: Available-for-sale securities $ - $ - - - 19

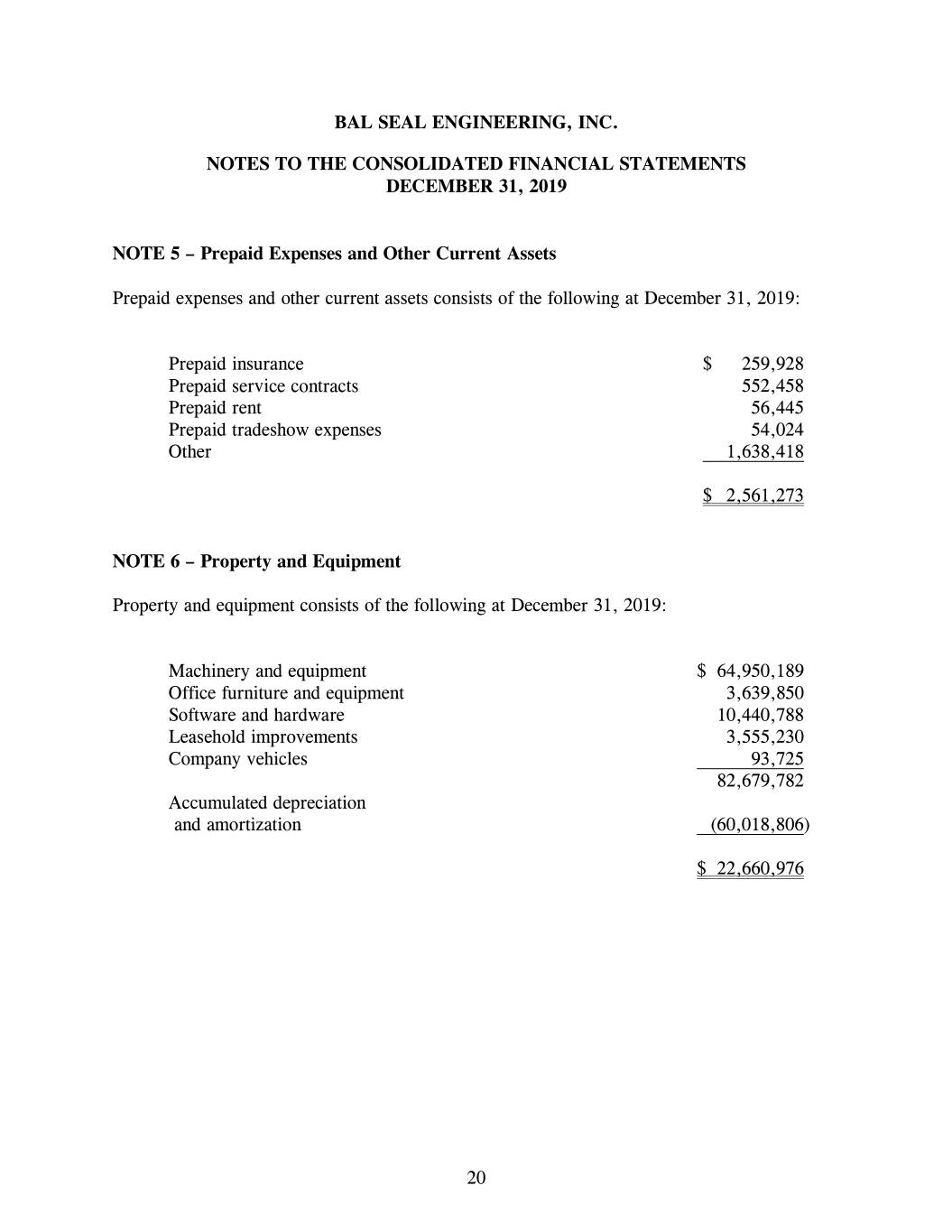

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 5 – Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets consists of the following at December 31, 2019: Prepaid insurance $ 259,928 Prepaid service contracts 552,458 Prepaid rent 56,445 Prepaid tradeshow expenses 54,024 Other 1,638,418 $ 2,561,273 NOTE 6 – Property and Equipment Property and equipment consists of the following at December 31, 2019: Machinery and equipment $ 64,950,189 Office furniture and equipment 3,639,850 Software and hardware 10,440,788 Leasehold improvements 3,555,230 Company vehicles 93,725 82,679,782 Accumulated depreciation and amortization (60,018,806) $ 22,660,976 20

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 6 – Property and Equipment (Continued) At December 31, 2019, future amortization of software costs is as follows: Year Ending December 31, 2020 $ 637,050 2021 450,904 2022 237,845 2023 53,997 2024 15,966 $ 1,395,762 NOTE 7 – Accrued Expenses Accrued expenses consists of the following at December 31, 2019: Bonuses $ 3,113,939 Salaries and related wages 695,382 Vacation 1,227,895 Other 1,019,431 $ 6,056,647 21

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 8 – Credit Facilities Current Line of Credit On July 25, 2014, the Company entered into a $10 million revolving line of credit arrangement with a bank. The line of credit, as most recently amended during 2018, matures on September 30, 2020 and bears interest at LIBOR plus 1.5%. There was no outstanding balance at December 31, 2019; however, the Company had $161,000 in outstanding letters of credit at December 31, 2019. Borrowings under the line of credit facility described above are secured by substantially all the assets of the Company. In connection with the financing agreements, the Company is required to maintain certain financial and nonfinancial covenants, with which it was in compliance at December 31, 2019. NOTE 9 – Commitments and Contingencies and Related-Party Transactions Leases The Company leases its manufacturing and office facility in Foothill Ranch, California, under an operating lease agreement through May 2036 from 19650 Pauling LLC, a limited liability company owned by the stockholder, for an aggregate monthly payment of approximately $194,000. The lease payment is adjusted annually each October based on the Orange County, California Consumer Price Index. The Company leases its manufacturing and office facility in Colorado Springs, Colorado under an operating lease agreement through May 2036 from Pauling Properties LLC (“PPL”), a limited liability company owned by the stockholder, for an aggregate monthly payment of approximately $196,000. The lease payment is adjusted annually each November based on the Consumer Price Index for all Urban Consumers (CPI-U) for the Midwest region. The Company also leases office space in the Netherlands, Hong Kong, Switzerland, the Czech Republic, and Germany. Rent expense amounted to approximately $5,218,000 for the year ended December 31, 2019. 22

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 9 – Commitments and Contingencies and Related-Party Transactions (Continued) Leases (Continued) Future minimum rental payments under the noncancelable operating leases, excluding cost of living increases, are as follows: Year Ending Related December 31, Party Other Total 2020 $ 4,678,291 $ 317,635 $ 4,995,926 2021 4,678,291 178,352 4,856,643 2022 4,678,291 - 4,678,291 2023 4,678,291 - 4,678,291 2024 4,678,291 - 4,678,291 Thereafter 53,410,487 - 53,410,487 $ 76,801,942 $ 495,987 $ 77,297,929 Legal Matters In the normal course of business, the Company has been involved in various other disputes, which are routine and incidental to the business. Management believes the results of such disputes will not have a significant adverse effect on the financial position or the results of operations of the Company. NOTE 10 – Key Employee Retention Plans In November 2006, the Company implemented two new Key Employee Retention Plans, with a revision released in December 2010. Both plans allow the participants to receive an allocation of a distribution pool when certain events take place in the Company. Both plans vest over time, with the first vesting period generally being three years from the award date. The plan had vested amounts of approximately $1,932,000 at December 31, 2019. The related liability is recorded under deferred compensation in each year with a corresponding charge to operations. 23

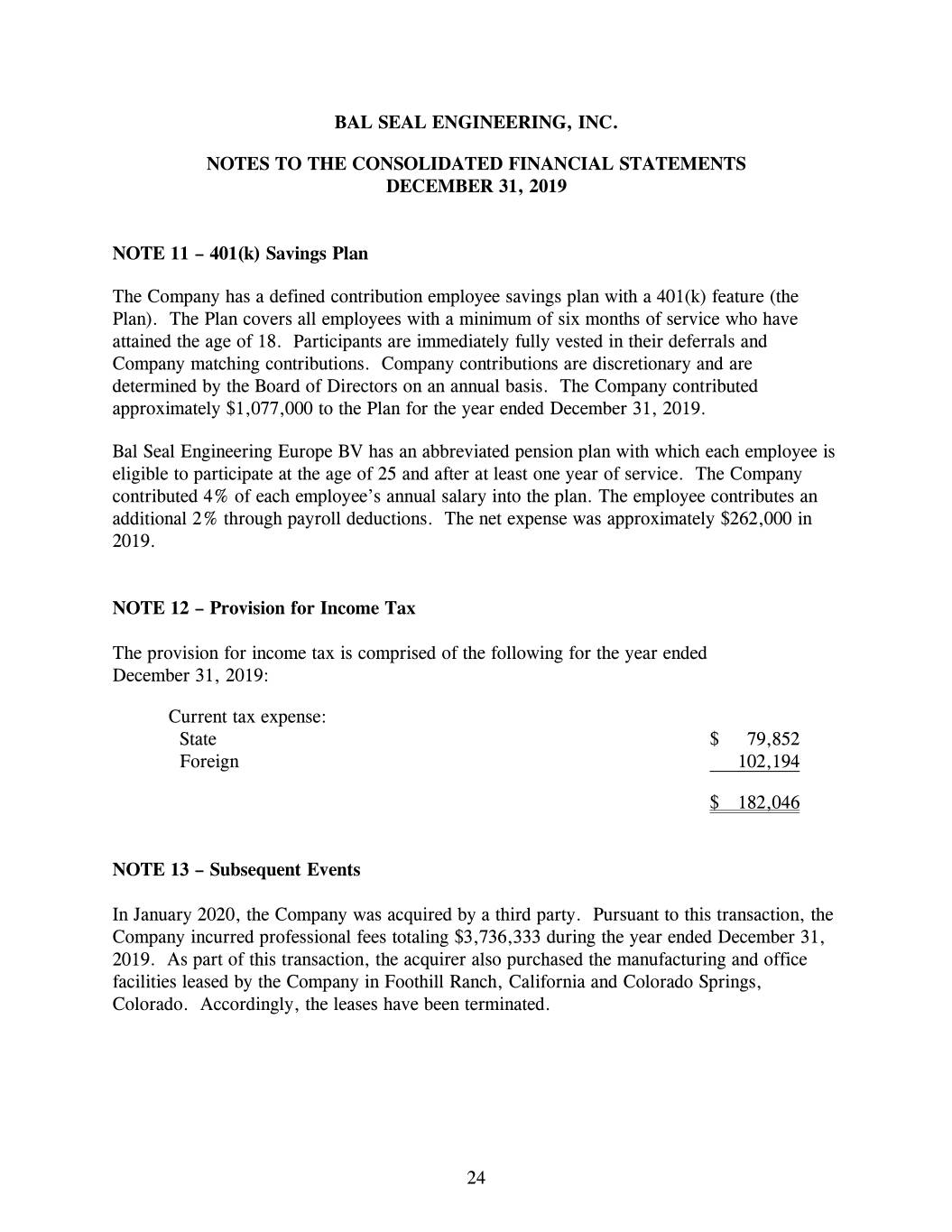

BAL SEAL ENGINEERING, INC. NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 NOTE 11 – 401(k) Savings Plan The Company has a defined contribution employee savings plan with a 401(k) feature (the Plan). The Plan covers all employees with a minimum of six months of service who have attained the age of 18. Participants are immediately fully vested in their deferrals and Company matching contributions. Company contributions are discretionary and are determined by the Board of Directors on an annual basis. The Company contributed approximately $1,077,000 to the Plan for the year ended December 31, 2019. Bal Seal Engineering Europe BV has an abbreviated pension plan with which each employee is eligible to participate at the age of 25 and after at least one year of service. The Company contributed 4% of each employee’s annual salary into the plan. The employee contributes an additional 2% through payroll deductions. The net expense was approximately $262,000 in 2019. NOTE 12 – Provision for Income Tax The provision for income tax is comprised of the following for the year ended December 31, 2019: Current tax expense: State $ 79,852 Foreign 102,194 $ 182,046 NOTE 13 – Subsequent Events In January 2020, the Company was acquired by a third party. Pursuant to this transaction, the Company incurred professional fees totaling $3,736,333 during the year ended December 31, 2019. As part of this transaction, the acquirer also purchased the manufacturing and office facilities leased by the Company in Foothill Ranch, California and Colorado Springs, Colorado. Accordingly, the leases have been terminated. 24