Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - RigNet, Inc. | rnet-ex322_8.htm |

| EX-32.1 - EX-32.1 - RigNet, Inc. | rnet-ex321_9.htm |

| EX-31.2 - EX-31.2 - RigNet, Inc. | rnet-ex312_11.htm |

| EX-31.1 - EX-31.1 - RigNet, Inc. | rnet-ex311_10.htm |

| EX-23.1 - EX-23.1 - RigNet, Inc. | rnet-ex231_12.htm |

| EX-21.1 - EX-21.1 - RigNet, Inc. | rnet-ex211_176.htm |

| EX-10.15 - EX-10.15 - RigNet, Inc. | rnet-ex1015_405.htm |

| EX-10.14 - EX-10.14 - RigNet, Inc. | rnet-ex1014_404.htm |

| EX-4.1 - EX-4.1 - RigNet, Inc. | rnet-ex41_344.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 001-35003

RigNet, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

76-0677208 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

15115 Park Row Blvd, Suite 300 |

|

|

|

Houston, Texas |

|

77084-4947 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (281) 674-0100

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Stock, $0.001 par value |

RNET |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☑ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☑ |

Emerging growth company ☐ |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2019, which was the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock, $0.001 par value per share (the “Common Stock”) held by non-affiliates of the registrant on such date was approximately $147.7 million. At March 9, 2020, there were outstanding 19,979,284 shares of the registrant’s Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2020 Annual Meeting of Stockholders to be filed with the Commission within 120 days of December 31, 2019 are incorporated herein by reference in Part III of this Annual Report.

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

Item 1 |

5 |

|

|

Item 1A |

19 |

|

|

Item 1B |

30 |

|

|

Item 2 |

30 |

|

|

Item 3 |

30 |

|

|

Item 4 |

30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5 |

31 |

|

|

Item 6 |

32 |

|

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

36 |

|

Item 7A |

49 |

|

|

Item 8 |

49 |

|

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

49 |

|

Item 9A |

49 |

|

|

Item 9B |

52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10 |

53 |

|

|

Item 11 |

53 |

|

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

53 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

53 |

|

Item 14 |

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15 |

54 |

|

|

Item 16 |

57 |

2

3

|

|

Nessco Group Holdings Ltd., acquired in 2012, primarily provides Systems Integration solutions |

|

|

NOC |

|

Network Operations Center |

|

NPT |

|

Non-productive time |

|

OPEC |

|

Organization of Petroleum Exporting Countries |

|

OTT |

|

Software, IoT and other advanced solutions delivered Over-the-Top of the network layer |

|

PLC |

|

Programmable Logic Controller |

|

PUC |

|

Public Utility Commission |

|

QOS |

|

Quality of Service |

|

ROP |

|

Rate of penetration |

|

SaaS |

|

Software as a Service |

|

SAB |

|

Staff Accounting Bulletin |

|

SAFCON |

|

Safety Controls, Inc., acquired in 2018, provides additional safety, security, and maintenance service solutions for oil and gas |

|

Satellite bandwidth – Ka band |

|

Bandwidth typically operating in a frequency range of 27 – 40 gigahertz |

|

Satellite bandwidth – Ku band |

|

Bandwidth typically operating in a frequency range of 12 – 18 gigahertz |

|

Satellite bandwidth – C band |

|

Bandwidth typically operating in a frequency range of 4 – 8 gigahertz |

|

Satellite bandwidth – L band |

|

Bandwidth typically operating in a frequency range of 1 – 2 gigahertz |

|

SCADA |

|

Supervisory Control and Data Acquisition |

|

SEC |

|

United States Securities and Exchange Commission |

|

SI |

|

Systems Integration |

|

SOC |

|

Security Operations Center |

|

TECNOR |

|

Orgtec S.A.P.I. de C.V., d.b.a. TECNOR, acquired in March 2016, increases solutions offerings in Mexico |

|

The Tax Act |

|

The Tax Cuts and Jobs Act |

|

USF |

|

Universal Service Fund |

|

U.S. GAAP |

|

Generally Accepted Accounting Principles in the United States |

|

VMS |

|

Video Management System |

|

VSAT |

|

Very Small Aperture Terminal satellite receivers |

|

WiMax |

|

Worldwide Interoperability for Microwave Access wireless broadband communication standard |

4

For convenience in this Annual Report on Form 10-K, “RigNet”, the “Company”, “we”, “us”, and “our” refer to RigNet, Inc. and its subsidiaries taken as a whole, unless otherwise noted.

Overview

We are a global technology company that provides customized data and communications services. Customers use our private networks to manage information flows and execute mission-critical operations primarily in remote areas where conventional telecommunications infrastructure is either unreliable or unavailable. We provide our clients what is often the sole means of communications for their remote operations. On top of and vertically integrated into these networks we provide services ranging from fully-managed voice, data, and video to more advanced services including: cybersecurity threat detection and prevention; applications to improve crew welfare, safety or workforce productivity; and a real-time AI-backed data analytics platform to enhance customer decision making and business performance.

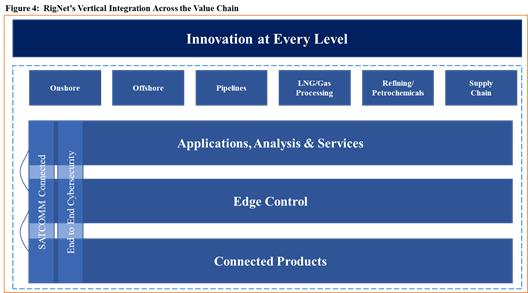

We deliver advanced software and communications infrastructure that allow our customers to realize the business benefits of digital transformation. With world-class, ultra-secure solutions spanning global IP connectivity, bandwidth-optimized Over-The-Top (OTT) applications, Industrial Internet of Things (IIoT) big data enablement, and industry-leading machine learning analytics, we support the full evolution of digital enablement, empowering businesses to respond faster to high priority issues, mitigate the risk of operational disruption, and maximize their overall financial performance.

Historically, our primary focus has been on customers in the upstream exploration and production segment of the energy industry, including offshore drilling rigs and production facilities. In recent years, we have increased our service offerings across the energy value chain to provide solutions to midstream and downstream customers where systems integration and IoT solutions are key elements. In addition, we have created channel partners around the world, creating opportunities to sell our industry-leading security, IoT, and machine-learning solutions outside of our traditional energy-focused markets.

Our business operations are divided into the following segments:

|

|

• |

Managed Communications Services (MCS). Our MCS segment provides remote communications, telephony, and technology services for offshore and onshore drilling rigs and production facilities, support vessels, and other remote sites. In addition, our MCS segment sells communications equipment and associated installation and maintenance services. Our services are generally contracted with terms that typically range from one month to five years and are billed as monthly recurring or usage-based fees. |

|

|

• |

Systems Integration (SI). Our Systems Integration segment provides design and implementation services for customer telecommunications systems. Solutions are delivered based on the customer’s specifications, adhering to international industry standards and best practices. Project services may include consulting, design, engineering, project management, procurement, testing, installation, commissioning, and maintenance. Additionally, SI provides complete monitoring and maintenance for fire and gas detection systems and PLC/automation control systems. Projects are bid on a fixed-cost or time and materials basis with revenue recognized on a percentage of completion basis. |

|

|

• |

Corporate. Corporate costs and eliminations primarily represent unallocated executive and support activities, including back-office software development, interest expense, income taxes, and eliminations. |

For financial information about our reportable segments, see Note 12 ─ “Segment Information” in our consolidated financial statements included in this Annual Report on Form 10-K.

5

Managed Communications Services (MCS)

As of December 31, 2019, MCS represented 67.9% of our total revenues. We were the primary provider of remote communications and collaborative services to approximately 500 customers reaching over 1,300 remote sites located in approximately 50 countries on six continents. For the year ended December 31, 2019, our revenue generated from countries outside of the U.S. represented 69.0% of MCS revenue. Key aspects of our services include:

|

|

• |

a secure end-to-end global network to ensure greater network availability, enhanced network cybersecurity and higher Quality of Service (QoS) control to optimize latency-sensitive business applications; |

|

|

• |

a multi-tenant network designed to accommodate multiple customer groups resident at a site, including drilling contractors, exploration and production operators and oilfield service providers; |

|

|

• |

a comprehensive bundle of network optimization value-added services, such as wide-area network acceleration, policy-based content filtering and firewall Wi-Fi hotspot access management, to maximize public-private sharing of assets for multiple tenants and customer groups at one site; |

|

|

• |

proactive network monitoring and management through Network Operations Centers (NOC) that actively manage network availability and serve as in-bound call centers for troubleshooting, 24 hours per day, 365 days per year; and |

|

|

• |

maintenance and support through geographically deployed engineering and service support teams as well as warehoused spare equipment inventories. |

Global MCS Site Counts

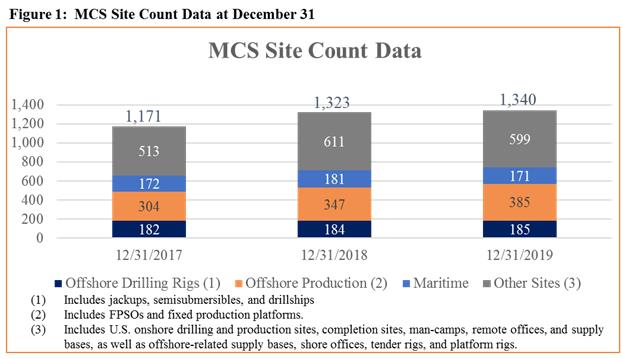

We report the number of sites serviced by MCS on a regular basis and currently define sites based on four categories which include Offshore Drilling Rigs, Offshore Production sites, Maritime, and Other sites, which includes U.S. onshore drilling and production sites, completion sites, man-camps, remote offices, and supply bases, as well as offshore-related supply bases, shore offices, tender rigs, and platform rigs. The MCS site count does not include IoT sites. As of December 31, 2019, we provided MCS to a total of 1,340 U.S. and non-U.S. sites, a 1.3% increase from 1,323 sites served as of December 31, 2018. Site counts fluctuate with industry conditions and are influenced by oil prices, customer capital spending, and other factors. When we provide services for multiple customers at one location, for example, to the drilling contractor, exploration and production operator, and other service companies, we count this as one site. The table below provides site count data as of December 31 of the respective year.

We procure bandwidth from independent commercial satellite-services operators and terrestrial wireless and landline providers to meet the needs of our customers for end-to-end IP-based communications. This allows RigNet

6

to provide hybrid network solutions, which greatly improves network up-time by using multiple and diverse sources of bandwidth. We generally own the network infrastructure and communications equipment we install at remote sites as well as equipment co-located in third-party teleport facilities and data centers, all of which we procure through various equipment providers. By owning the network infrastructure and communications equipment on the customer premises, we are better able to select the optimal equipment for each customer solution as well as ensure the quality of our services.

Applications & Internet-of-Things (Apps & IoT)

Apps & IoT is our fastest growing segment, and is leading our value delivery for our customers’ digital transformation efforts. In addition to already having grown to 14.6% of 2019 revenue compared to 10.8% and. 7.6% of 2018 and 2017 revenue, respectively, the value proposition from Apps & IoT is allowing us to gain share in the MCS market for energy.

The energy sector has embraced “Digital Transformation”, a term that encompasses using technology to significantly reduce human operational process time and increase operating margins. Digital transformation typically uses a combination of Industrial IoT (Internet of Things) combined with powerful Artificial Intelligence (AI) backed predictive analytics to monitor and optimize processes in real-time.

Through our Apps & IoT segment, we deliver a combination of turn-key network solutions, value-added services that simplify the management of multiple communications needs, and digital accelerators that collect, secure and analyze operational intelligence data, allowing our customers to increase margins and focus on core operations. Apps & IoT revenue generated from countries outside of the U.S. represented 32.5% of Apps & IoT revenue. We sell our Apps & IoT services not only via direct sales, but also through a series of channel partners around the world, which enables us to target customers in industry verticals where we have not established a focused salesforce. In some cases, non-energy customers have sought us out because of our unique capabilities.

Apps & IoT services delivered over-the-top of the network layer include:

|

|

• |

The Intelie LIVE and Intelie Planning platforms which provide AI backed advanced real-time predictive analytics and machine learning; |

|

|

• |

Software as a Service (SaaS) applications to enhance remote operations efficiency, safety or crew welfare including weather monitoring primarily in the North Sea (MetOcean) and Advanced Video Intelligence (AVI), including video analytics and a Video Management System (VMS); |

|

|

• |

Machine-to-machine IoT networks such as: Supervisory Control and Data Acquisition (SCADA), Broadband Global Access networks (BGAN), and custom Long-Range Access (LoRA); and |

|

|

• |

LIVE-IT, which is a service introduced in 2019 that allows us to manage our customer’s devices and data at the edge. |

Intelie, our real-time machine learning platform, delivers value to the energy sector and has applications that improve performance and operational safety, enhance well control, and reduce non-productive time (NPT). Examples of Intelie applications follow.

|

|

• |

Industry-proven algorithms transform heterogenous sensor data into key performance indicators (KPIs) to reduce NPT, such as connection time for drill pipe or slip-to-slip time. Another set of models can monitor and advise how to improve the drilling rate of penetration (ROP), the speed at which a drill bit drills through a formation. |

|

|

• |

Intelie improves safety performance using algorithms that verify whether operational policies are being followed, including pressure testing and emergency disconnect sequence (EDS) checks. We can also corroborate that the correct personnel are on board, enhancing a customers’ ability to track personnel and respond during an emergency. |

|

|

• |

Intelie machine learning assists customers with optimizing well-cleaning procedures, the process of bringing up the cuttings that the drill bit generates while drilling. As an example of how this delivers value, the faster the ROP, the more drilling cuttings are generated, which in turn can slow down the ROP as the bit gets stuck on its cuttings. |

7

Intelie has delivered significant results, helping drilling contractors and operators generate time and cost savings in their upstream operations. Examples include reducing NPT by more than 20%. Intelie has also contributed as much as $3.0 million in software savings for a customer by eliminating extra software by consolidating functionality. For one customer, the Intelie platform processed over 300,000 measurements per second at its peak, synthesizing and displaying actionable results to the end-user. Intelie has recently signed a contract to implement Intelie LIVE to support BP’s Remote Collaboration Center and has also been used in oil production and pipeline monitoring use cases. The increased linkage between IoT solutions and Intelie allows us to not only provide communications but also to be directly involved in driving valuable business outcomes for our customers.

RigNet’s IoT network supports almost 11,000 different sites, predominantly in the U.S. A key element of our network, devices using the L-band satellite network, grew substantially during 2019 to include over 6,200 active L-Band enabled IoT sites at the end of December 2019, consuming approximately 80 gigabytes per month of IoT traffic, or roughly 12.9 megabytes per month per site.

We believe the Apps and IoT segment is an important element of our long-term growth.

System Integration (SI)

Due to our deep knowledge of the energy sector’s needs and a wide range of expertise around critical communications in challenging environments, our clients also turn to us to build large network projects, both offshore and onshore. Solutions are delivered based on the customer’s specifications, adhering to international industry standards and best practices. Project services may include consulting, design, engineering, project management, procurement, testing, installation, commissioning, and maintenance. Additionally, SI provides complete monitoring and maintenance for fire and gas detection systems and PLC/automation control systems. Projects are bid on a fixed-cost or time and materials basis with revenue recognized on a percentage of completion basis. As of December 31, 2019, Systems Integration represented 17.6% of our total revenues and revenue generated from countries outside of the U.S. represented 26.9% of SI revenue.

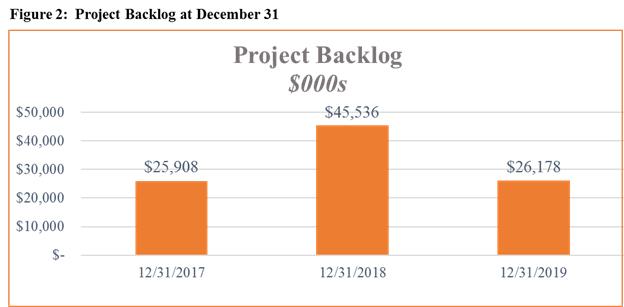

RigNet typically operates as a subcontractor on SI projects, working with other major Engineering, Procurement, and Construction (EPC) companies to deliver the project scope to the end customer. The business is both competitive and cyclical. The typical project length for our SI projects is anywhere from less than one year to approximately three years. Project backlog declined in 2019, meaning that we added $15.7 million in backlog in 2019, but we recognized more revenue and project descoping than we added. Project backlog, or the amount of revenue secured subject to firm contract awards that will be recognized over the life of each project, as of December 31 for the respective years is provided in the table below.

8

Putting the parts back together

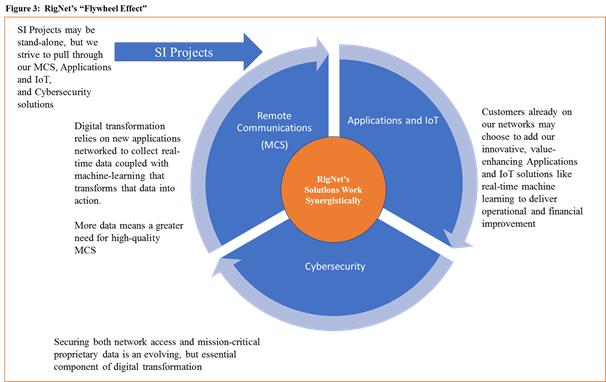

RigNet’s three revenue-generating operating segments can each stand alone as separate services, but many of our global customers are seeing the value in how these products stack together. This has the potential to create what we have termed a synergistic “Flywheel Effect,” illustrated in the graphic below. Customers who are embracing digital transformation are trying to unlock the operational technology potential of Industrial IoT. We believe this will create a proliferation of connected sensors, forming a large neural-network of data, wrapped in cybersecurity for protection and interpreted through SaaS-based machine learning platforms. Customers will be able to accelerate their time to value by working with a set of services that are already vertically integrated and optimized to work under the most extreme of operating conditions. This can lower their execution risk for complex systems integrations and reduce upfront capital risk as a fully-managed SaaS service. For RigNet, the effect creates new streams of revenue, while at the same time stimulates pull-through bandwidth demand for our core network services illustrated in figure 4 below.

9

The technology and remote telecommunications industries are highly dynamic and increasingly evolving with customer needs. We serve customers with customized communications, applications and cybersecurity solutions that connect to remote locations via networks, driving demand for reliable, managed communications services in a variety of environmental conditions. For several decades, our core customer base has primarily been off-shore and remote land oil and gas drilling contractors, exploration and production operators, and oilfield service companies. As part of our growth strategy, we seek to expand to other adjacent markets that share substantially similar technical requirements; these include: global enterprise, midstream pipelines, maritime, engineering and construction, disaster recovery services, banking and government verticals.

The customers we serve depend on maximum reliability, quality and continuity of products and services. Our customers also are generally geographically dispersed and/or have remote operations. These customers are particularly motivated to use secure and highly reliable communications networks because they may require:

|

|

• |

real-time data collection and transfer methods for safe and efficient operational coordination; |

|

|

• |

the ability to maintain safety standards and optimize performance; |

|

|

• |

data and network security designed to defend up to and against state-level actors’ threats; |

|

|

• |

access to key decision makers to enable customers to maximize safety, operational results and financial performance; and |

|

|

• |

access to the internet to allow rig crews and other employees in remote areas to keep in communication with their friends and family and for entertainment during their off-time. |

Our Customers, Their Industry, and Its Impact on RigNet

In 2019, almost all of RigNet’s revenue was derived from customers with some connection to the oil and gas industry. These included our traditional customers in the Upstream segment (drilling contractors, large integrated and independent oil and gas operating companies, and other oilfield service and maritime support companies, etc.), as well as customers in the Midstream segment (pipelines, LNG plants, etc.) and large Engineering, Procurement, and Construction companies working in the Downstream segment. Although no single customer accounted for 10.0% or more of revenue in 2019, our top 5 customers accounted for 25.9% of our total revenue for 2019.

The oil and gas industry is both cyclical and competitive. Our customers’ business plans and activities are significantly impacted by changes in, among other factors, oil and gas prices, global supply and demand for these commodities, geopolitical events, weather, and specific industry sub-segment dynamics (e.g., an oversupply of offshore drilling rigs). Commodity prices are volatile and it is not unusual for our customers to experience rapid increases or declines which can have both short- and long-term impacts on their spending patterns.

In response to continued low oil and gas prices, the industry reduced both capital and operating expenses significantly, negatively impacting RigNet’s business. Recovery for the industry has been challenging. However, 2018 and 2019 saw improved utilization levels for offshore drilling rigs, driven by offshore production declines. The industry we support has a proven resilient need for our advanced software and communications solutions to realize their digital transformation. Additionally, we saw more major construction projects approved for commencement. While we expect conditions for the industry to continue to improve gradually, our long-term growth strategy does not rely solely on significant increases in global offshore drilling activity.

Customer Contracts

In order to streamline the addition of new projects and solidify our position in the market, we have signed master service agreements with most customers. Generally, we prefer to sign long-term contracts with our customers to increase our confidence in our projected financial performance. Nevertheless, the nature of the oil and gas industry requires us to be flexible to ensure we meet the needs of our customers. The specific services being provided are defined under individual service orders that generally have a term of one to five years for offshore customers with renewal options. These contracts have provisions for early termination or reduced payments for warm or cold stacking of assets, with compensation paid to us based on an agreed formula. Land-based contracts are generally shorter term or terminable on short notice without penalty. Service orders are executed under the contracts for individual remote sites or groups of sites, and generally may be terminated early on short notice without penalty in the event of force majeure, breach of the agreement or cold stacking of a drilling rig.

10

RigNet’s basic strategy remains unchanged: accelerate digital transformation for our customers by leveraging our core MCS business and introducing new, value-added service solutions. The strategy is composed of three elements:

|

|

• |

expand the scale and scope of our services within our primary industry vertical, energy; |

|

|

• |

expand into adjacent industry verticals; and |

|

|

• |

acquire new capabilities and/or scale our business through selective mergers, acquisitions, or in-house development; |

As of December 31, 2019, our merger and acquisition activity has been paused as a result of our current debt load and our equity price. We expect to re-engage in M&A activity at the appropriate time. At this time, we believe that we have largely acquired the necessary capability set and that future merger and acquisition activity may be driven by our belief that networks benefit from scale.

Expand the scale and scope of our services

Our market presence and proven quality of service offer significant organic growth opportunities in energy segments adjacent to upstream where we are well-positioned to deliver remote communications solutions.

In the MCS segment, we seek to leverage our current strong market position in drilling rigs, production facilities, and support vessels to grow additional share. Because of established relationships with our customers, reliable and robust service offerings, and high-quality customer service, we believe that we are well-positioned to capture new build rigs that our customers add to their fleets as well as stacked rigs that are reactivated. We also seek to organically gain market share against our competitors. We are continuously working with our suppliers to ensure that we have the newest and most cost-effective solutions for our customers. We continue to grow our network as well. In 2019, we invested in our Gulf of Mexico communications infrastructure, which we believe is the largest over-water microwave-based network in the world. This upgrade, in a partnership with T-Mobile, added 4G LTE services and 5G capabilities to the pre-existing network to provide both enhanced fixed and mobile services to our customers. This LTE network supports a coverage area of more than 60,000 square miles. Furthermore, as the onshore unconventional drilling and production industry has continued to grow, we have expanded our services to include not only onshore drilling rigs, but other onshore oilfield service providers.

We also intend to expand our Apps & IoT market share on a stand-alone basis and by bundling our new capabilities, including machine learning and cybersecurity, with our MCS offerings for both existing and new customers. Our acquisition of Intelie in 2018 enabled us to offer new solutions to help customers across the value chain continue to focus on improving their operational and financial performance. Through Cyphre, we assist our customers in protecting their mission-critical data both onshore and offshore. Furthermore, we continue to develop additional applications via our internal development team, including AVI, CrewConnect™, and other solutions which deliver increased value to our customers. We have also continued to grow our presence in the IoT market, particularly in energy’s midstream segment, where our robust, bandwidth-optimized applications enable customers to safely, reliably, and efficiently monitor and manage their remote sites and networks.

We continue to seek to expand our Systems Integration market share by pursuing new Systems Integration customers and bids for projects globally to address the growing demand for the buildout of large capital projects. We expect to continue to target traditional upstream and downstream opportunities, such as new fixed production platforms or onshore operating shorebases, as well as expanding our opportunity set to include new FPSOs and midstream projects, such as remote LNG liquefaction facilities. Additionally, our Apps & IoT capabilities are opening opportunities to introduce our machine learning and other solutions to our customers on these projects. In 2019, our SI business pulled-through Intelie development work for a workforce tracking project. We are looking at ways to enhance the pull-through business our SI business generates for our other segments.

Expand into adjacent industry verticals

We believe revenue diversity is desirable in terms of product offerings as well as industry exposure. We also believe that networks benefit from scale regardless of which end markets we serve with our managed communications product. As such, we will continue to look for and review opportunities in other remote communications market adjacencies that offer significant opportunities for growth and where we are well positioned to take advantage of these opportunities such as aviation, government, and mining.

11

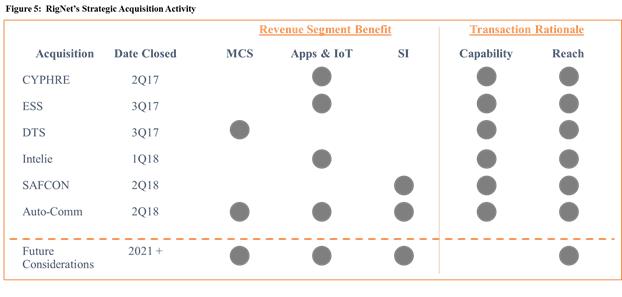

In 2017, we began to build new capabilities that would be complimentary both to our core MCS business and our improving SI business while enabling us to deliver secure, mission-critical solutions to enable our customers to enjoy the benefits of their digital transformation efforts. The graphic below illustrates our significant strategic acquisitions beginning in 2017, their timing, and our rationale for the transaction in terms of whether the acquired company added a capability, expanded our reach to more customers, or both.

Cyphre was our first acquisition in 2017. As digital transformation efforts continue to touch every part of our customers’ businesses from offshore high-pressure blowout preventers to onshore operations planning, data security has become critical and Cyphre expanded our cybersecurity capabilities with advanced enterprise data protection by leveraging hardware-based encryption.

We acquired two additional companies in 2017, ESS and DTS. ESS expanded our product offering, added to our existing midstream SCADA customer portfolio, and strengthened our IoT market position. DTS enhanced our comprehensive communications and IT services to the onshore, offshore, and maritime industries, as well as disaster relief solutions to global corporate clients.

In 2018, we completed the acquisition of Intelie. Intelie is a real-time, predictive analytics company that combines operational expertise with a machine learning approach. Intelie facilitates innovation via Intelie Pipes, a distributed query language with a complex event processor to aggregate and normalize real-time data from a myriad of data sources. The Intelie platform empowers clients to make timely, data-driven decisions in mission-critical real-time operations, including drilling, and longer-term, data-intensive projects, such as well planning.

Finally, in 2018, we completed the separate, but related, acquisitions of Auto-Comm and SAFCON. Auto-Comm provided a broad range of communications services to the oil and gas industry for both onshore and offshore remote locations. Auto-Comm brought over 30 years of systems integration experience in engineering and design, installation, testing, and maintenance. SAFCON offers a diverse set of safety, security, and maintenance services to the oil and gas industry. Auto-Comm and SAFCON have developed strong relationships with major energy companies that complement the relationships that we have established over the years.

12

We believe that the capabilities acquired through this set of acquisitions have enabled us to provide a unique set of solutions to our customers that will help them to realize the benefits of their digital transformation efforts and provide us with a differentiating competitive advantage

Competitive Strengths

As a global technology company that provides customized communications services, applications, real-time machine learning, and cybersecurity solutions, our competitive strengths include:

|

|

• |

mission-critical services delivered by a trusted provider with global operations; |

|

|

• |

leading-edge technology with proven track record in-market; |

|

|

• |

high-quality customer support with full-time monitoring and regional service centers; |

|

|

• |

scalable systems using standardized equipment that leverage our global infrastructure; |

|

|

• |

customized Systems Integration solutions provided by expert telecoms systems engineers; |

|

|

• |

flexible, provider-neutral technology platforms; |

|

|

• |

long-term relationships with leading companies in the oil and gas, maritime, pipeline and engineering and construction industries; and |

|

|

• |

ability to design and implement a broad range of communication solutions using a range of frequencies and modes of communication. |

Mission-critical services delivered by a trusted provider with global operations: Our longstanding relationships with customers provide us with an in-depth understanding of the mission-critical needs of our customers that enables us to tailor our services to their requirements. Our global presence allows us to serve our clients around the world, except where government restrictions may apply. Our global terrestrial network also allows us to provide quality of service to prioritize various forms of data traffic for a more effective way to prioritize network traffic. Our ability to offer our customers global coverage sets us apart from regional competitors and allows us to match the breadth of our customers’ global operations and speed of deployment. The addition of Cyphre allows us to offer state-of-the-art encryption and network security services for the data communications necessary to safely and efficiently manage remote operations. In addition, our OTT offerings allow us to leverage our network to provide additional offerings for safety, business productivity improvement, and crew comfort.

Leading-edge technology with proven track record in-market: Our Intelie machine learning and real-time predictive analytics including Intelie Pipes and Intelie LIVE are optimized for remote locations in high-latency, high-packet loss environments. We also deliver Advanced Video Intelligence (AVI) and a wide range of Enhanced Cybersecurity Services (ECS), including a Security Operations Center (SOC), Cyphre encryption, AI-backed intrusion detection, conditional access, and security ratings. We also leverage third party relationships and technologies and have a proven track record of delivering technology in high latency remote locations that others lack.

High-quality customer support with full-time monitoring and regional service centers: Our global end-to-end owned and operated network allows us to provide high-quality customer care by enabling us to fully monitor our network. We can easily and rapidly identify and resolve any network problems that our customers may experience. As of December 31, 2019, we had 29 service operations centers and warehouses to support and service our customers’ remote sites. We maintain field technicians as well as adequate spare parts and equipment in these service operations centers. Our Global Customer Care (GCC) team staffs our Network Operations Center (NOC) and Security Operations Center (SOC) 24 hours per day, 365 days per year and provides engineering, service delivery, and change management to customers globally. We provide non-stop, end-to-end monitoring and technical support for every customer. This proactive network monitoring allows us to detect problems instantly and keep our services running at optimum efficiency. Fully managed technology is a key reason why we can support solutions that deliver high performance and new technologies that improve productivity.

Scalable systems using standardized equipment that leverages our global infrastructure: We have built our global satellite and terrestrial network with a sufficient amount of flexibility to support our growth. Our knowledge and capabilities can be applied to remote sites located anywhere in the world. We generally install standardized equipment at each remote site, which allows us to provide support and maintenance services for our equipment in a cost-efficient manner. Not all of the components of equipment that we install at each site are the same, but the components that vary are limited in number and tend to be the same for sites located in the same geography. As of December 31, 2019, we contracted capacity from 55 satellites that are co-located at 21 teleports and 27 datacenters

13

worldwide in order to provide our end-to-end solutions. By leasing rather than owning our satellite capacity and backhaul and owning the on-site equipment at each site, we are able to both minimize the capital investment required by the base network infrastructure and maintain the flexibility to install high-quality equipment at each site tailored to its locale and environmental conditions. We do own and manage the IP layer end-to-end. The standardized nature of our equipment minimizes execution risk, lowers maintenance and inventory carrying costs, and enables ease of service support. In addition, we are able to remain current with technology upgrades due to our back-end flexibility. Our product and service portfolio offers best-in-class technology platforms using the optimal suite of communications and networking capabilities for customers.

Customized Systems Integration solutions provided by expert telecoms systems engineers: We provide global customized Systems Integration solutions. As the demand for additional telecommunications products and telecoms systems increases with each new technological advance, the need for well-designed, efficient and reliable network infrastructures becomes increasingly vital to customers. Our solutions are custom-designed, built and tested by expert engineers based on the customer’s specifications and requirements, as well as international industry standards and best practices. For those customers requiring reliable remote communications services, maintenance and support services and customized solutions for their network infrastructures, RigNet provides a one-stop-shop to satisfy these demands.

Flexible, provider-neutral technology platform: Because we procure communications connections and network equipment from third parties, we are able to customize the best solution for our customers’ needs and reduce our required fixed capital investments. We aim to preserve the flexibility to select particular service providers and equipment so that we may access multiple providers and avoid downtime if any of our initial providers were to experience any problems. By procuring bandwidth from a variety of communications providers instead of owning our own satellites, we are able to minimize capital investment requirements and can expand our geographic coverage in response to customers’ needs with much greater flexibility.

Long-term relationships with leading companies in the oil and gas, maritime, pipeline, and engineering and construction industries: We have established relationships with some of the largest companies in the oil and gas, maritime, pipeline and engineering and construction industries. Some of our key customers are the leading drilling contractors around the world, with combined fleets of hundreds of rigs, as well as leading oil and gas, oilfield service, maritime, pipeline and engineering and construction companies. In most cases, these customers have high standards of service that favor strategic providers such as RigNet and work in partnership with us to serve their remote operations.

The ability to design and implement a broad range of communication solutions using a range of frequencies and modes of communication: We have the ability to design and implement a broad range of communication solutions using a range of frequencies and modes of communication. These modes of communication include wireless satellite Ku, Ka, C and L frequency bands, wireless WiMAX and Line-of-Sight (LOS) microwave, 3G and 4G LTE services, and 5G-capabilities. This range of communications solutions allows us to offer competitive and reliable communications solutions in a broad range of remote geographic locations where our customers operate. This helps us meet our customers’ requirements for choosing their provider(s) based on network availability while factoring in price.

Environmental, Social and Corporate Governance (ESG)

We believe that the digital transformation solutions that we deliver will lead to a safer and more sustainable energy industry. With our highly reliable network and real-time machine learning solutions, our customers can optimize the efficiency of their own operations and monitor and respond to high priority issues faster and with better information. Some of the solutions we have developed to enhance safety and sustainability include:

|

|

• |

Advanced Video Intelligence, which assists customers with real-time risk detection; |

|

|

• |

Machine learning applications for a) well planning and optimization of drilling operations leading to increased safety and efficiency and less demand on resources and b) fuel optimization for international shipping; |

|

|

• |

Workforce safety solutions including workforce tracking, which enables our customers to know where all employees are at safety-sensitive sites, and man-down technology, which enables customers to detect when an employee has fallen or become injured allowing for a speedier emergency response; and |

|

|

• |

Solutions that enable customers to detect and respond to faulty valves in environmentally sensitive areas. |

14

Finally, we are committed to practicing good corporate governance. We believe that a strong, diverse board and management, following good governance practices and engaging in robust discussion and debate will deliver better results to all of our stakeholders, including shareholders, customers, suppliers, employees, and the communities in which we work. We encourage investors to visit the Corporate Responsibility section of our website. The information found on our website is not incorporated into this Annual Report on Form 10-K.

Suppliers

Although we have preferred suppliers of technology, telecommunications, and networking equipment, nearly all technology utilized in our solutions is available from more than one supplier.

In addition, we do not rely on one satellite provider for our entire satellite bandwidth needs except for certain instances in which only one satellite bandwidth provider is available in an operating location, which is typically due to licensing restrictions or where only one satellite provider can offer a particular bandwidth. This approach generally allows us the flexibility to use the satellite provider that offers the best service for specific areas and to change providers if one provider experiences any problems.

Competition

The technology and remote telecommunications industry is highly competitive. We expect competition in the markets that we serve to persist, intensify and change. We face varying degrees of competition from a wide variety of companies, including potential new entrants from providers to adjacent vertical markets and from forward integration by some of our suppliers deeper in the industry value chain.

Our primary global competitor in MCS is Speedcast International Ltd. Both Panasonic, through its ITC Global subsidiary, and Tampnet have expanded their presence as active providers of communications services to the oil and gas, mining and maritime markets. We also compete with regional competitors in the countries in which we operate. Specifically, in our U.S. onshore operations, we face competition from: wireless network providers, drilling instrumentation providers, living quarters companies, and other pure-play providers like us.

With the downturn in the oil and gas industry, price-based competition has become more important. However, our customers require high quality and availability of the service as well as a provider with the ability to restore service quickly when there is an outage. Breadth of service offerings are also important to our oil and gas customers. Our customers depend on maximum availability, quality and continuity of products and services.

While we experience competition in our markets, we believe that our Apps & IoT offerings are a key differentiator that strategically aligns with our customers’ need to achieve digital transformation and business synergy goals. However, as our serviceable market has seen significant expansion due to our organic and inorganic growth in Apps & IoT, so has our competitor list. Our competitors now include IBM, Microsoft, Google, Kongsberg Gruppen and other smaller pure-play providers, as well as large, established oilfield technology providers like Schlumberger and Haliburton. Additionally, in the SI space, we compete primarily with ABB Ltd., Speedcast, and other construction contractors.

Our customers choose the accelerated speed and value created by a vertically aligned stack. We believe that we are unique in our vertical offering of Apps & IoT solutions over-the-top of our MCS offering.

Employees

As of December 31, 2019, we had approximately 625 full-time employees consisting of 296 in North America, 149 in Latin America, 105 employees in Europe/Africa and 75 employees in the Middle East and the Asia Pacific.

Geographic Information

See Note 12 — “Segment Information,” in our consolidated financial statements included in this Annual Report on Form 10-K for more information regarding revenues and assets attributable to our domestic and international operations.

Other Information

Corporate Structure and History

We were incorporated in Delaware on July 6, 2004. Our predecessor began operations in 2000 as RigNet, Inc., a Texas corporation. In July 2004, our predecessor merged into us. The communications services we provide to the

15

offshore drilling and production industry were established in 2001 by our predecessor, who launched initial operations in the Asia Pacific region. Through companies recently acquired, our experience dates back more than 40 years. We have since evolved into one of the leading global providers of remote communications services.

Principal Executive Offices

Our corporate headquarters is located at 15115 Park Row Blvd, Suite 300, Houston, Texas. Our main telephone number is +1 (281) 674-0100.

Company Website and Available Information

The Company’s internet website is www.rig.net. The information found on our website is not incorporated into this Annual Report on Form 10-K. The Company makes available free of charge on its website Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act). This information can also be found on the SEC website at www.sec.gov.

In addition, in the “Governance” section of the Investors page on our web site, we make available our code of ethics and business conduct, our corporate governance guidelines, the charters for our audit, compensation, and corporate governance and nominating committees and various other corporate governance policies and documents.

Additionally, in the “Corporate Responsibility link on our main website contains important information about our Environmental, Social and Governance (ESG) initiatives including relevant information on policies, safety performance, and employee statistics, as well as our commitment to following good corporate governance practices.

Smaller Reporting Company Status

In June 2018, the SEC issued Release 33-10513; 34-83550, Amendments to Smaller Reporting Company Definition, which changed the definition of a smaller reporting company in Rule 12b-2 of the Exchange Act. Under this release, the new thresholds for qualifying are (1) public float of less than $250 million or (2) annual revenue of less than $100 million and a public float of less than $700 million (including no public float). Under the amended rule, RigNet now qualifies as a smaller reporting company. A smaller reporting company may choose to comply with scaled or non-scaled financial and non-financial disclosure requirements on an item-by-item basis. The Company may determine to provide scaled disclosures of financial or non-financial information in future quarterly reports, annual reports and/or proxy statements if it remains a smaller reporting company under SEC rules.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended, that are subject to a number of risks and uncertainties, many of which are beyond the Company’s control. These statements may include statements about:

|

|

• |

new regulations, delays in drilling permits or other changes in the oil and gas industry; |

|

|

• |

competition and competitive factors in the markets in which we operate; |

|

|

• |

demand for our services and solutions; |

|

|

• |

the advantages of our services compared to others; |

|

|

• |

changes or advances in technology (including satellite capacity) and customer preferences and our ability to adapt our product and services offerings; |

|

|

• |

our ability to develop and maintain positive relationships with our customers; |

|

|

• |

our ability to retain and hire necessary employees and appropriately staff our marketing, sales and distribution efforts; |

|

|

• |

our cash and liquidity needs and expectations regarding cash flow from operations, capital expenditures and borrowing availability under our Revolving Credit Facility; |

|

|

• |

our expectations regarding the deductibility of goodwill for tax purposes; |

|

|

• |

our business and corporate development strategy, including statements concerning our plans regarding and ability to pursue, consummate and integrate merger and acquisition opportunities successfully; |

|

|

• |

the amount and timing of contingent consideration payments arising from our acquisitions; |

16

|

|

• |

our ability to develop and market additional products and services; |

|

|

• |

our cost reduction, restructuring activities and related expenses; and |

|

|

• |

our financial performance, including our ability to expand Adjusted EBITDA through our operational leverage. |

Forward-looking statements may be found in Item 1. “Business;” Item 1A. “Risk Factors;” Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other items within this Annual Report on Form 10-K. In some cases, forward-looking statements can be identified by terminology such as “may,” “could,” “should,” “would,” “expect,” “plan,” “project,” “intend,”, “will”, “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms and other comparable terminology that convey uncertainty of future events or outcomes. All of these types of statements, other than statements of historical fact included in this Annual Report on Form 10-K, are forward-looking statements.

The forward-looking statements contained in this Annual Report on Form 10-K are largely based on Company expectations, which reflect estimates and assumptions made by management. These estimates and assumptions reflect management’s best judgment based on currently known market conditions and other factors. Although the Company believes such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond its control. In addition, management’s assumptions may prove to be inaccurate. The Company cautions that the forward-looking statements contained in this Annual Report on Form 10-K are not guarantees of future performance, and it cannot assure any reader that such statements will be realized, or the forward-looking statements or events will occur. Risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements include, without limitation:

|

|

• |

the effect of economic conditions in the oil and gas industry, including fluctuations in commodity prices and the level of oil and gas exploration, development and production; |

|

|

• |

the outcome of legal proceedings in which the Company is a party; |

|

|

• |

changes in the demand for our services and solutions; |

|

|

• |

the availability of labor at reasonable prices and/or rates of labor cost inflation; |

|

|

• |

changes in laws and regulations in the telecommunications, technology or oil and gas industries; |

|

|

• |

our ability to renew, extend or retain our contracts or to obtain new contracts with significant customers; |

|

|

• |

our lack of long-term, committed-volume purchase contracts with our customers; |

|

|

• |

increased competition and competitive factors in the markets in which we operate; |

|

|

• |

the concentration of our customer base as well as our dependence on a limited number of key customers; |

|

|

• |

our ability to protect our intellectual property and the cost of doing so; |

|

|

• |

our ability to extend our presence into other verticals and complementary remote communication segments; |

|

|

• |

our ability to increase secondary and tertiary customer penetration at remote sites; |

|

|

• |

the risk that we fail to fully realize the potential benefits of or have difficulty in integrating the companies we acquire or have already acquired; |

|

|

• |

our ability to develop and market additional products and services; |

|

|

• |

the possibility that we or our third-party providers may violate the complex regulatory schemes, including anti-corruption laws, in foreign countries in which we operate; |

|

|

• |

the impact on our business, or the business of our customers, as a result of credit rating downgrades and fluctuating interest rates; |

|

|

• |

changes in currency exchange rates; |

|

|

• |

our ability to comply with the financial covenants in our credit agreement and the consequences of failing to comply with such financial covenants; |

|

|

• |

changes in technology and customer preferences and our ability to adapt our product and services offerings; |

17

|

|

• |

the effect of changes in political conditions in the U.S. and other countries in which we operate; |

|

|

• |

the possibility that we, or our third-party providers, may experience equipment failures, natural disasters, cyber-attacks or terrorist attacks; |

|

|

• |

the possibility that we experience failures in compliance with applicable consumer-protection and data privacy laws and regulations; |

|

|

• |

the possibility that we are unable to operate in certain foreign countries due to export control laws; and |

|

|

• |

other risks and uncertainties described under “Item 1A. Risk Factors” and other sections in this Annual Report on Form 10-K and as included in our other filings with the U.S. Securities and Exchange Commission. |

If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual future results, performance or achievements may vary materially from any projected future results, performance or achievements expressed or implied by these forward-looking statements. The forward-looking statements speak only as of the date made, and other than as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Government Regulation

The following is a summary of the regulatory environment in which we currently operate and does not describe all present or proposed international, federal, state and local legislation and regulations affecting the communications industry, some of which may change the way the industry operates as a result of administrative or judicial proceedings or legislative initiatives. We cannot predict the outcome of any of these matters or the impact on our business.

The telecommunications industry is highly regulated. Most of the services we provide in our MCS segment require licenses or approvals from regulatory authorities in various countries. In the United States, we are subject to the regulatory authority of the Federal Communications Commission (FCC). Regulation of the telecommunications industry continues to change rapidly. Our U.S. services are currently provided on a private carrier basis, rather than a common carrier basis, and are therefore subject to lighter regulation under the U.S. Communications Act of 1934, as amended (the Act), and the regulations of the FCC. If the FCC determines that the services of RigNet or its subsidiaries constitute common carrier offerings subject to common carrier regulations, we may be subject to significant costs to ensure compliance with the applicable provisions of those laws and regulations. We may be subject to enforcement actions including, but not limited to, fines, cease and desist orders, or other penalties if we fail to comply with all applicable requirements.

For our U.S. business, we maintain licenses with rights to the electromagnetic spectrum, including fixed microwave licenses, very small aperture terminal (VSAT) earth station licenses, various private and commercial mobile radio service licenses, and various wireless licenses. Failure to maintain appropriate licenses could subject RigNet to fines imposed by the FCC.

The FCC constantly reviews spectrum policy to ensure it is in alignment with national communications strategy. One such example is the Facilitate America’s Superiority in 5G Technology (FAST), whereby the FCC aims to propel the United States into global 5G leadership. As part of such strategies, the FCC may decide to reallocate spectrum or introduce spectrum sharing among various services. If the FCC introduces spectrum sharing in the frequency bands where RigNet has existing licenses, the new services could cause harmful interference to RigNet’s network and thus degrade its quality. RigNet may not be able to migrate to other frequency bands without incurring significant equipment and logistics costs.

As a non-dominant international and domestic communications carrier, among other requirements, RigNet must pay various fees including contribution of a percentage of its revenues from telecommunications services to the FCC’s Universal Service Fund (USF) and other federal program funds to subsidize certain user segments, file various reports, and comply with rules that protect customer information and the processing of emergency calls. RigNet is also subject to the Communications Assistance for Law Enforcement Act (CALEA) and associated FCC regulations that require telecommunications service providers to configure their networks to facilitate electronic surveillance by law enforcement authorities.

Like the FCC, the state public utility commissions (PUCs) impose various regulatory fees, universal service requirements, reporting and prior approval requirements for transfer or assignments. The FCC and state PUCs have jurisdiction to hear complaints regarding the compliance or non-compliance with these and other carrier requirements of the Act and the FCC’s rules, and similar state laws and regulations.

18

If the FCC or any state PUC determines that RigNet has not complied with federal and/or state regulatory requirements, we may be subject to enforcement actions including, but not limited to, fines, cease and desist orders, license revocation, or other penalties.

Several proceedings pending before the FCC have the potential to significantly alter our USF contribution obligations. The FCC is considering: (1) changing the basis upon which USF contributions are determined from a revenue percentage measurement, as well as increasing the breadth of the USF contribution base to include certain services now exempt from contribution; (2) the classification of MPLS; and (3) the classification of various IP-enabled services. Adoption of these proposals could have a material adverse effect on our costs of providing service. We are unable to predict the timing or outcome of these proceedings. We cannot predict the application and impact of changes to the federal or state USF contribution requirements on the communications industry generally and on certain of our business activities in particular.

We must generally register to provide our telecommunications services in each country in which we do business. The foreign laws and regulations governing these services are often complex and subject to change with short or no notice. At times, the rigs or vessels on which our equipment is located and to which our services are provided will need to operate in a new location on short notice, and we must quickly make regulatory provisions to provide our services in such countries. Failure to comply with any of the laws and regulations to which we are subject may result in various sanctions, including fines, loss of authorizations and denial of applications for new authorizations or for renewal of existing authorizations.

We must comply with export control laws and regulations, trade and economic sanction laws and regulations of the United States and other countries with respect to the export of telecommunications equipment and services. State and local regulations additionally apply to certain aspects of our business. We are also subject to various anti-corruption laws, including the Foreign Corrupt Practices Act, that prohibit the offering or giving anything of value to government officials for the purpose of obtaining or retaining business or for gaining an unfair advantage.

Factors that could materially affect our business, financial position, operating results or liquidity and the trading price of our common stock are described below. This information should be considered carefully, together with other information in this report and other reports and materials we file with the SEC.

A large portion of our business fluctuates with the level of global oil and natural gas exploration, development and production, as a large portion of our customers are energy-related.

Demand for our remote communication services and collaborative applications depends on our customers’ willingness to make operating and capital expenditures to explore, develop and produce oil and natural gas. Our business will suffer if these expenditures decline. Our customers’ willingness to explore, develop and produce oil and natural gas depends largely upon prevailing market conditions that are influenced by numerous factors over which we have no control, including:

|

|

• |

the supply, demand and price expectations for oil and natural gas; |

|

|

• |

capital expenditure levels of producers of oil and natural gas and drilling contractors; |

|

|

• |

the addressable market and utilization rate for drilling rigs and oilfield services; |

|

|

• |

the ability of the Organization of Petroleum Exporting Countries (OPEC) or non-OPEC countries to influence and maintain production levels and pricing; |

|

|

• |

the worldwide political, regulatory and economic environment; |

|

|

• |

natural disasters, acts of war or terrorism, pandemics, or other “acts of God” affecting significant oil-importing countries, including the recent worldwide outbreak of coronavirus and its effect on travel, commerce and industry; |

|

|

• |

the degree to which alternative energy sources displace oil and natural gas; and |

|

|

• |

advances in exploration, development and production technology. |

Oil and gas prices are volatile, and the oil and gas business is cyclical. When prices are perceived as being too low to generate acceptable returns, companies reduce expenditures for exploration and production. Oil prices declined

19

significantly in the last quarter of 2018 and remained depressed throughout 2019. At the start of 2020, oil prices decreased further largely as a result of anticipated declines in demand from the coronavirus outbreak. Subsequently, in March 2020, the Saudi state producer, Aramco, reduced crude pricing in response to a split and price war with Russia. Following the Saudi reduction in pricing, Brent crude spot prices declined steeply to a mid-30 dollar per barrel range. As a result, we have seen a material decline in the demand for our products and services and significant pressure on the prices we can charge. Furthermore, our customers have experienced declines in their cash flows which has led to delays in payment, or nonpayment, for our products and services. Commodity price declines and increased volatility have particularly affected our customers’ budgets for offshore capital investments and expenditures, which has had a material and adverse effect on our addressable market.

Furthermore, the coronavirus has increased the volatility of oil and gas prices and has caused delays, supply chain disruptions and travel restrictions that have impacted the oil and gas industry and certain projects in the Asia Pacific region.

These conditions have had and may continue to have, a material adverse effect on our financial condition, results of operations and cash flows.

Continued growth in satellite capacity has adversely affected our MCS segment revenues.

New digital applications are driving demand growth for bandwidth in our core MCS segment. However, we also continue to see growth in available satellite capacity and expect that growth to continue over the intermediate-term. While we have experienced bandwidth price declines from our satellite suppliers, due to competition for our oil and gas customers and declining capital investment by our customers, we have passed much of our realized savings onto our customers. While our site count has increased in the MCS segment, our revenue has continued to decline. If satellite capacity growth continues to outstrip demand growth or is expected to continue, we may be forced to reduce our prices in the MCS segment further, which could have a material adverse effect on our financial condition, results of operations and cash flows.

If we fail to timely collect receivables, our business and financial results may be harmed.

Some of our customers in the oil and gas industry have been through bankruptcy proceedings or other restructurings. In addition, as the global oil and gas industry has continued to experience reduced activity, many of our customers have unilaterally extended their payment practices. We actively manage our credit exposures and accounts receivable collections, but restructuring or insolvency proceedings by our largest customers, or continued lengthening of payment cycles could significantly and materially harm our business, financial condition and results of operations.

Our industry is characterized by rapid technological change, and if we fail to keep pace with these changes or if access to telecommunications in remote locations becomes easier or less expensive, our business, financial condition and results of operations may be harmed.

Recently some remote communications providers are offering the use of LTE and high-throughput satellite (HTS) service, instead of or in addition to the conventional Ku-band and C-band satellite space segments used today. Our business may be harmed if our competitors are more successful than us in introducing LTE and or HTS services to meet customer needs.

If alternative telecommunications services to remote locations become more readily accessible or less expensive, our business will suffer. New disruptive technologies could make our VSAT-based networks or other services obsolete or less competitive than they are today, requiring us to reduce the prices that we are able to charge for our services or causing us to undergo expensive transitions to new technologies. We may not be able to successfully respond to new technological developments and challenges or identify and respond to new market opportunities, services or solutions offered by competitors. In addition, our efforts to respond to technological innovations and competition may require significant capital investments and resources. Furthermore, if we invest either organically or through acquisition in new technology and any such technology is not successful, our business, financial conditions and results of operations may be harmed.

Our business model has historically required significant capital expenditures to win new business. To the extent we are unsuccessful in shifting some of those capital expenditures to our customers or suppliers, our business, financial condition and results of operations may be harmed.

20

Historically we have purchased much of the equipment to provide new services to our customers and recovered the cost of that equipment through service charges over the life of the contract. This business model requires large capital expenditures at the start of new customer contracts. We are attempting to shift some of the upfront capital expenditures to our customers and/or suppliers through new contractual arrangements with them. However, we may be unsuccessful in shifting those required capital investments to our customers and/or suppliers. To the extent we are unable to finance growth capital or to change our business model, our business, financial condition and results of operations may be harmed. Furthermore, future new technologies could be capital intensive and may require capital expenditures in order for us to remain competitive.

Failure to obtain and retain skilled personnel could impede our business and growth strategy.

Our operations depend on a highly qualified executive, sales, technical, development, service and management team. Competition for personnel talent in the artificial intelligence, machine learning, engineering and cybersecurity industry is intense, and these roles are critical to our operation. Additionally, at our 2020 annual meeting of stockholders we are seeking approval to add additional shares to our 2019 Omnibus Incentive Plan. If stockholders fail to approve this amendment, we will not have sufficient shares available for future inducement and retention awards. If we are unable make future awards, our ability to attract and retain qualified personnel will be materially affected. Failure to attract, recruit, retain and develop qualified personnel could have a material adverse effect on our business, financial condition and results of operations.

In the event that our cybersecurity measures fail or are otherwise inadequate, our systems or reputation may be damaged which could harm our business, financial conditions and results of operations. Further, failure to comply with data privacy requirements applicable to us could result in costly regulatory enforcement actions and the imposition of significant penalties.

We rely heavily on information systems to run our business and our customers rely on our networks and security measures in running their businesses. Given that our customers own and operate critical infrastructure, the nature of cybersecurity threats are advanced and persistent. There can be no assurance that the systems we have designed to prevent or limit the effects of cyber incidents or attacks will be sufficient to prevent or detect such attacks. If such incidents or attacks do occur, they could have a material impact on our systems including degradation of service, service disruption, excessive call volume to call centers and damage to our facilities, equipment and data. In addition, we could be adversely affected by the theft or loss of confidential customer data or intellectual property. With the acquisition of Cyphre, we now market our cybersecurity services as an expertise. A successful cyberattack against us or one of our cybersecurity customers may create negative publicity resulting in reputation or brand damage with customers. We may be required to expend significant resources to protect against these events or to alleviate problems, including reputational harm, customer loss and litigation, caused by these events or the failure or inadequacy of our security systems, which could have a material adverse effect on our business, financial condition and results of operations.