Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - VIEMED HEALTHCARE, INC. | q42019exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - VIEMED HEALTHCARE, INC. | q42019exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - VIEMED HEALTHCARE, INC. | q42019exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - VIEMED HEALTHCARE, INC. | q42019exhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - VIEMED HEALTHCARE, INC. | a20023438032viemedconsen.htm |

| EX-23.1 - EXHIBIT 23.1 - VIEMED HEALTHCARE, INC. | eyconsent231.htm |

| EX-4.3 - VIEMED HEALTHCARE, INC. | q42019exhibit43.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number: 001-38973

Viemed Healthcare, Inc.

(Exact name of registrant as specified in its charter)

British Columbia, Canada | N/A | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

625 E. Kaliste Saloom Rd. Lafayette, LA 70508 | ||

(Address of principal executive offices, including zip code) | ||

(337) 504-3802 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of exchange on which registered |

Common Shares, no par value | VMD | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Non-Accelerated filer ☐ | Smaller reporting company x Emerging growth company x | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting and non-voting common shares held by non-affiliates of the registrant computed as of June 28, 2019 (the last business day of the registrant’s most recent completed second fiscal quarter) based on the closing price of the common shares on the Toronto Stock Exchange was $117,223,500.

As of February 28, 2020, there were 38,486,772 common shares of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be disclosed in Part III of this report is incorporated by reference from the registrant’s definitive proxy statement or an amendment to this report, which will be filed with the SEC not later than 120 days after the end of the fiscal year covered by this report.

EXPLANATORY NOTE

General

On March 2, 2020, the Audit Committee of the Board of Directors of Viemed Healthcare, Inc. (the "Company") concluded, after discussion with the Company’s management and independent registered public accounting firm, Ernst & Young LLP, that the Company’s consolidated financial statements for the quarters and year-to-date periods ended June 30, 2019 and September 30, 2019 (collectively, the "Non-Reliance Periods") contained errors and should be restated. As a result, the consolidated financial statements and other financial information, earnings press releases, investor presentations or other communications related thereto covering the Non-Reliance Periods should no longer be relied upon.

Restatement and Prior Period Corrections

In connection with the preparation of this Annual Report on Form 10-K, the Company’s management became aware that the Company’s consolidated financial statements for the Non-Reliance Periods contained errors related to revenue recognition as the Company had recorded full monthly rental revenue for its durable medical equipment in the month of billing instead of on a daily, pro-rata basis over the lease term, consistent with the straight-line methodology required by Financial Accounting Standards Board ASC 840 and 842, "Leases." As a result, the Company has made certain corrections to defer revenue and the associated incremental direct costs for rental days that extend outside of the reporting period. As a result, the Company has restated its consolidated financial statements for the Non-Reliance Periods in this Annual Report on Form 10-K. The foregoing errors related to revenue recognition also had immaterial effects on the Company’s consolidated financial statements for the quarters and year-to-date periods ended March 31, 2018, June 30, 2018, September 30, 2018 and March 31, 2019 and for the fiscal year ended December 31, 2018 (collectively, the “Affected Periods”). As a result, the Company has also corrected the immaterial errors in its consolidated financial statements for the Affected Periods in this Annual Report on Form 10-K. The Company has not filed and does not intend to file amendments to the Company’s previously filed Registration Statement on Form 10 or Quarterly Reports on Form 10-Q for the periods affected by the restatement and correction of the Company’s consolidated financial statements as described above. Accordingly, investors and others should rely only on the financial information and other disclosures regarding the Non-Reliance periods as disclosed in this Annual Report on Form 10-K and in future filings with the SEC (as applicable), and not rely on any previously issued or filed registration statements or reports, earning press releases, investor presentations or other communications related thereto covering the Non-Reliance Periods.

Impact of the Restatement and Prior Period Corrections

For a description of the impact of the restatement and corrections on the Non-Reliance Periods and the Affected Periods, see "Note 3. Correction of Prior Period Immaterial Errors" and "Note 13. Unaudited Summarized Quarterly Financial Information" to the Consolidated Financial Statements included in this Annual Report on Form 10-K.

Internal Control Over Financial Reporting and Disclosure Controls and Procedures

In connection with the restatement of the Company’s consolidated financial statements, the Company’s management determined that a material weakness exists in its internal control over financial reporting and that its disclosure controls and procedures were ineffective as of December 31, 2019. For a description of the material weakness identified by the Company’s management and management’s planned remediation for that material weakness, see "Item 9A. Controls and Procedures."

VIEMED HEALTHCARE, INC. | ||

Table of Contents | ||

December 31, 2019 and 2018 | ||

Page | ||

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 or “forward-looking information” as such term is defined in applicable Canadian securities legislation (collectively, “forward-looking statements”). Any statements other than statements of historical information, including those that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking and may involve estimates, assumptions and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. These forward-looking statements are made as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by applicable law.

Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management regarding future events, and include, but are not limited to, statements with respect to: operating results; profitability; financial condition and resources; anticipated needs for working capital; liquidity; capital resources; capital expenditures; milestones; licensing milestones; information with respect to future growth and growth strategies; anticipated trends in our industry; our future financing plans; timelines; currency fluctuations; government regulation; unanticipated expenses; commercial disputes or claims; limitations on insurance coverage; and availability of cash flow to fund capital requirements.

Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “potential”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes”, “projects”, or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “will”, “should”, “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. We believe that the assumptions and expectations reflected in such forward-looking statements are reasonable. We cannot assure you, however, that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, including those identified under “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K and the other documents we file with the SEC and with the securities regulatory authorities in certain provinces of Canada, which contribute to the possibility that the predicted outcomes may not occur or may be delayed. The risks, uncertainties and other factors, many of which are beyond our control, that could influence actual results include, but are not limited to: possibly significant capital requirements and operating risks; the ability to implement business strategies and pursue business opportunities; volatility in the market price of the shares in the capital; our novel business model; the risk that clinical application or treatments that demonstrate positive results in a study may not be positively replicated or that such test results may not be predictive of actual treatment results or may not result in the adoption of such treatments by providers; the state of the capital markets; the availability of funds and resources to pursue operations; decline of reimbursement rates; dependence on few payors; possible new drug discoveries; dependence on key suppliers; granting of permits and licenses in a highly regulated business; competition; low profit market segments; risks relating to the deterioration of global economic conditions; disruptions in or attacks (including cyber-attacks) on information technology, internet, network access or other voice or data communications systems or services; the evolution of various types of fraud or other criminal behavior; the failure of third parties to comply with their obligations; difficulty integrating newly acquired businesses; the impact of new and changes to, or application of, current laws and regulations; the overall difficult litigation environment; increased competition; changes in foreign currency rates; increased funding costs and market volatility due to market illiquidity and competition for funding; critical accounting estimates and changes to accounting standards, policies, and methods; the impact of the restatement and correction of our previously issued consolidated financial statements; the identified material weakness in our internal control over financial reporting and our ability to remediate that material weakness; the initiation of legal or regulatory proceedings with respect to the restatement and correction; the adverse effects on our business, results of operations, financial condition and stock price as a result of the restatement and correction process; our status as an emerging growth company and a foreign private issuer; and the occurrence of natural and unnatural catastrophic events and claims resulting from such events, as well as other general economic, market and business conditions; and other factors beyond our control.

CURRENCY

Unless otherwise indicated herein, references in this Annual Report on Form 10-K to “$”, “US$” or “U.S. dollars” are to United States dollars, and references to “$CDN” or “Canadian dollars” are to Canadian dollars. All dollar amounts herein are in United States dollars, unless otherwise indicated.

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

PART I

Item 1. Business

Company Overview

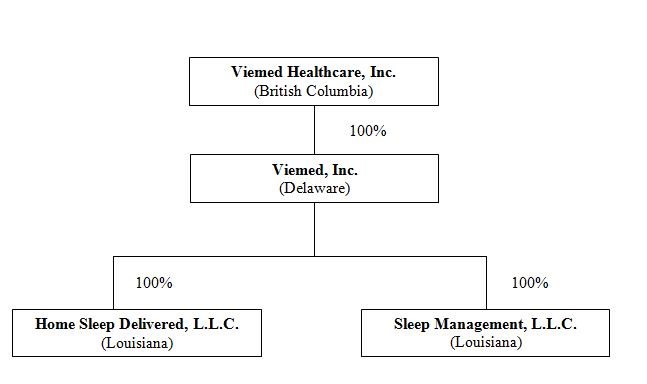

Viemed Healthcare, Inc. (“Viemed” or the “Company”), through its indirect wholly-owned subsidiaries, Sleep Management, L.L.C. (“Sleep Management”) and Home Sleep Delivered, L.L.C. (“Home Sleep”, and, together with Sleep Management, the “Sleepco Subsidiaries”), is a participating Medicare durable equipment supplier that provides post-acute respiratory services in the United States.

Viemed’s primary objective is to focus on the growth of the business of the Sleepco Subsidiaries and thereby solidify its position as one of the largest providers of home therapy for patients suffering from respiratory diseases that require a high level of service, with such programs being designed specifically for payors to have the ability to treat patients in the home for less total cost and with a superior quality of care. The services of the Sleepco Subsidiaries include respiratory disease management, neuromuscular care, in-home sleep testing and sleep apnea treatment, oxygen therapy, and respiratory equipment rentals.

Viemed expects to use an organic growth model whereby expansion is effectuated through existing service areas as well as in new regions through a cost efficient launch that reduces location expenses. Viemed expects that it will continue to employ more respiratory therapists in order to assure the high service model is accomplished in the home. By focusing overhead costs to personnel that service the patient rather than physical location costs, Viemed anticipates continuing to efficiently scale its business in regions that are currently not being effectively serviced.

The continued trend of servicing patients in the home rather than in hospitals is aligned with Viemed’s business objectives and management anticipates that this trend will continue to offer growth opportunities for the Company. Viemed expects to continue to be a solution to the rising health costs in the United States by offering more cost effective home based solutions while increasing the quality of life for patients fighting serious respiratory diseases.

Protech Home Medical Corp., formerly Patient Home Monitoring Corp. (“PHM”), acquired the Sleepco Subsidiaries in June 2015. In December 2017 and pursuant to the terms of the Arrangement Agreement (as defined below), the Sleepco Subsidiaries became indirect wholly-owned subsidiaries of Viemed, as described below.

Sleep Management focuses on disease management and improving the quality of life for respiratory patients through clinical excellence, education and technology. Its service offerings are based on effective home treatment with respiratory care practitioners providing therapy and counseling to patients in their homes using cutting edge technology. Home Sleep focuses on providing in-home sleep testing for sleep apnea sufferers.

Viemed, through the Sleepco Subsidiaries, is one of the largest independent non-invasive ventilator providers in the United States with a service coverage area of 31 states in the United States and prospects to grow. Viemed currently services the following states: Alabama, Arizona, Arkansas, California, Colorado, Florida, Georgia, Illinois, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia.

Our Corporate History and Background

Viemed was incorporated under the Business Corporations Act on December 14, 2016 as a wholly-owned subsidiary of PHM, a corporation continued under the Business Corporations Act, in order to effect the transactions contemplated by the Arrangement Agreement and the Purchase and Sale Agreements (as defined below).

On December 22, 2017, Viemed completed an arrangement under the provisions of Division 5 of Part 9 of the Business Corporations Act (the “Arrangement”) involving Viemed, PHM and the security holders of PHM, pursuant to which PHM completed a spin-out of Viemed pursuant to an arrangement agreement dated January 11, 2017 between Viemed and PHM, as amended on October 31, 2017 (the “Arrangement Agreement”).

Page | 6 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

As a result of the Arrangement, among other things, shareholders of PHM (the “PHM Shareholders”), as of the close of business on December 21, 2017, received one new common share in the capital of PHM (each, a “New PHM Share”) and one-tenth (1/10) of one common share of Viemed for each common share in the capital of PHM held by such PHM Shareholder immediately before the completion of the Arrangement (the “Effective Time”). Also in connection with the Arrangement: (a) for each stock option of PHM held, each option holder that remained employed or engaged by PHM upon completion of the Arrangement received one option to purchase from PHM one New PHM Share (each, a “New PHM Option”) and PHM option holders employed or engaged by Viemed received one New PHM Option (which expired on March 22, 2018) and one tenth (1/10) of one option to purchase from Viemed one common share of Viemed; and (b) for each common share purchase warrant of PHM held, each warrant holder received one warrant to purchase from PHM one New PHM Share and one tenth (1/10) of one warrant to purchase from Viemed one common share of Viemed.

As a result of the Arrangement, PHM separated into two companies:

• | Viemed, a participating Medicare durable equipment supplier that provides post-acute respiratory services in the United States; and |

• | PHM, a durable medical equipment company that specializes in delivering and servicing home-based medical equipment, including oxygen therapy, sleep apnea treatment and mobility equipment. |

To effectuate the Arrangement, in addition to entering into the Arrangement Agreement, on January 11, 2017: (a) PHM and Viemed entered into an asset purchase agreement (the “Asset Purchase Agreement”); and (b) PHM Logistics Corporation (“PHM Logistics”), an indirect wholly-owned subsidiary of PHM, and Viemed, Inc., a company existing under the laws of the State of Delaware and a wholly-owned subsidiary of PHM Logistics (“Holdco”), entered into a share purchase agreement (the “Share Purchase Agreement”, and, together with the Asset Purchase Agreement, the “Purchase and Sale Agreements”).

Immediately before the completion of the Arrangement, in accordance with the terms of the Purchase and Sale Agreements, PHM and Viemed affected the reorganization of Viemed whereby: (i) PHM Logistics transferred all of its equity interests in the Sleepco Subsidiaries to Holdco; (ii) all of the common stock in the authorized capital of Holdco (the “Holdco Shares”) was transferred to PHM through a series of distributions by PHM’s wholly-owned subsidiaries to their direct shareholders, with the final distribution to PHM as a return of paid-up capital; and (iii) PHM contributed to Viemed the Holdco Shares on an “as is, where is” basis in exchange for all of the issued and outstanding common shares of Viemed. Following the completion of the Arrangement, the total number of outstanding common shares of Viemed was equal to the total number of common shares of Viemed distributed pursuant to the Arrangement.

The following chart illustrates Viemed’s corporate structure following the completion of the transactions contemplated by the Arrangement Agreement and the Purchase and Sale Agreements.

Page | 7 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Corporate Information

The common shares of Viemed trade in Canada on the Toronto Stock Exchange (the "TSX") under the trading symbol “VMD.TO”, and as of August 9, 2019, trade in the United States on the Nasdaq Capital Market under the trading symbol "VMD". Viemed’s registered and records office is located at Suite 2800, Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2Z7 Canada and its principal executive office is located at 625 E. Kaliste Saloom Road, Lafayette, Louisiana 70508. Viemed’s website is www.viemed.com. Information contained on our website is not part of this Annual Report on Form 10-K.

Products and Services

Viemed’s services, provided through the Sleepco Subsidiaries, include the following:

• | Home Medical Equipment: Viemed provides respiratory and other home medical equipment solutions (primarily through monthly rental arrangements), including home ventilation (invasive and non-invasive), BiPaP (bi-level positive airway pressure) and CPAP (continuous positive airway pressure) devices, percussion vests, and other medical equipment. Revenue derived from the rental and sale of home medical equipment represented a combined 98.2% and 98.5% of Viemed’s 2019 and 2018 revenue, respectively. Viemed provides home medical equipment through the following service programs: |

◦ | Respiratory disease management, including Chronic Obstructive Pulmonary Disease (“COPD”) aims to improve quality of life and reduce hospital readmissions by using proven methodology and leading technologies, such as non-invasive ventilation (“NIV”) and other therapies. Viemed provides ventilation (both invasive and non-invasive), Positive Airway Pressure (“PAP”), and related equipment and supplies to patients suffering from COPD. |

◦ | Neuromuscular care is focused on helping neuromuscular patients to breathe more comfortably while living an active, healthier life and uses respiratory therapy treatments which can lessen the effort required to breathe. |

◦ | Oxygen therapy provides patients with extra oxygen, which is sometimes used to manage certain chronic health problems, including COPD. Oxygen therapy may be performed at a hospital, at home or in another setting. |

◦ | Sleep apnea management provides related solutions and/or equipment such as the AutoPAP (an automatic continuous positive airway pressure) and BiPAP (bi-level positive airway pressure) machines. |

• | In-home sleep testing: Viemed provides in home sleep apnea testing services, which is an alternative to the traditional sleep lab testing environment. These services represented 1.8% and 1.5% of Viemed’s 2019 and 2018 revenue, respectively. |

Monthly rental revenue from ventilators and the sale of associated supplies represented approximately 92% and 94% of total revenue for 2019 and 2018, respectively. While Viemed plans to continue investigating and introducing new complimentary products and services and further expanding the coverage of existing products, home ventilation (both invasive and non-invasive) will continue to represent the substantial majority of Viemed’s revenue.

Patients suffering from neuromuscular or respiratory diseases experience severe difficulty in breathing and require assistance from a ventilator to effectively move air in and out of their lungs. Invasive and non-invasive ventilation differ in how the air is delivered to the person. In invasive ventilation, air is delivered via a tube inserted into the windpipe through the mouth. In non-invasive ventilation, air is delivered through a sealed mask that can be placed over the mouth.

The Centers for Medicare and Medicaid Services (“CMS”) Medicare National Coverage Determinations Manual stipulates that ventilators are covered for the treatment of conditions associated with neuromuscular diseases, thoracic restrictive diseases, and chronic respiratory failure consequent to chronic obstructive pulmonary disease. Ventilators are also included in Medicare’s Frequently & Substantially Serviced payment category and are reimbursed under the Healthcare Common Procedure Coding System (“HCPCS”) codes E0465 (invasive ventilation), E0466 (non-invasive ventilation) and E0467 (multi-function ventilation).

Viemed’s patients are served by licensed Respiratory Therapists (“RTs”) in each of the 31 states where it provides its services. Each of these RTs is a member of the American Association for Respiratory Care (“AARC”). The RT licensure and AARC membership ensure that Viemed is able to provide patients with in-home respiratory care services, equipment setup, training, and on-call services with state-of-the-art clinical protocols. Additionally, Viemed’s Chief Medical Officer, Dr. William Frazier, is a board certified pulmonary disease specialist.

Page | 8 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

Viemed sources hardware from vendors such as Respironics (an affiliate of Philips NV) and Resmed, among other vendors, and pairs them with industry leading respiratory therapy. There are few manufacturers of equipment that can be used for home treatment of patients with ventilation respiratory therapy. The emerging nature of the market presents risks that vendors may not be able to provide equipment to satisfy demand. Viemed has historically financed certain capital expenditures through a financing company affiliated with its primary vendors, but also has a line of credit of up to $10 million pursuant to a loan agreement with an expiration date of March 19, 2021. Amounts borrowed under the loan agreement will bear interest at a rate based on one month ICE LIBOR plus 3.00% per annum, with a 4.00% interest rate floor, from the date of advance until paid and any amounts advanced will be secured by substantially all of Viemed’s assets. Viemed currently has no immediate plans to draw on this facility.

Government Regulation

We are subject to extensive government regulation, including numerous laws directed at regulating reimbursement of our products and services under various government programs and preventing fraud and abuse, as more fully described below. We maintain certain safeguards intended to reduce the likelihood that we will engage in conduct or enter into arrangements in violation of these restrictions. Federal and state laws require that we obtain facility and other regulatory licenses and that we enroll as a supplier with federal and state health programs. Notwithstanding these measures, due to changes in and new interpretations of such laws and regulations, and changes in our business, among other factors, violations of these laws and regulations may still occur, which could subject us to: civil and criminal enforcement actions; licensure revocation, suspension, or non-renewal; severe fines and penalties; and even the termination of our ability to provide services, including those provided under certain government programs such as Medicare and Medicaid.

Centers for Medicare and Medicaid Services

CMS requires providers of product or services to attain and maintain accreditation in order to participate in federally funded healthcare programs. To attain and maintain accreditation, companies are required to institute policies and procedures that, among other things, formalize the interaction of the company with patients. Accrediting bodies that are approved by CMS will perform audits of these policies and procedures every three years. Should a company fall out of compliance with the requirements of the accrediting body, expulsion from the Medicare program could follow. In December 2008, we became a Durable, Medical Equipment, Prosthetics, Orthotics, and Supplies accredited Medicare supplier by the Accreditation Commission for Health Care for our solutions. Our Medicare accreditation must be renewed every three years through passage of an on-site inspection. We last renewed our accreditation with Medicare in April 2018. Maintaining our accreditation and Medicare enrollment requires that we comply with numerous business and customer support standards. If we are found to be out of compliance with accreditation standards, our enrollment status in the Medicare program could be jeopardized, up to and including termination.

CMS also requires that all durable medical equipment providers who bill the Medicare program maintain a surety bond of $50,000 per National Provider Identifier (“NPI”) number which Medicare has approved for billing privileges. We obtained surety bonds before the October 2009 deadline, and such bonds automatically renew annually.

In order to ensure that Medicare beneficiaries only receive medically necessary and appropriate items and services, the Medicare program has adopted a number of documentation requirements. For example, the Durable Medical Equipment (“DME”) Medicare Administrative Contractor (“MAC”) Supplier Manuals provide that clinical information from the “patient’s medical record” is required to justify the initial and ongoing medical necessity for the provision of DME. Some DME MACs, CMS staff and government subcontractors have taken the position, among other things, that the “patient’s medical record” refers not to documentation maintained by the DME supplier but instead to documentation maintained by the patient’s physician, healthcare facility or other clinician, and that clinical information created by the DME supplier’s personnel and confirmed by the patient’s physician is not sufficient to establish medical necessity. It may be difficult, and sometimes impossible, for us to obtain documentation from other healthcare providers. Moreover, auditors’ interpretations of these policies are inconsistent and subject to individual interpretation. This is then translated to individual supplier significant error rates and aggregated into a Durable Medical Equipment, Prosthetics, Orthotics and Supplies (“DMEPOS”) industry error rate, which is significantly higher than other Medicare provider/supplier types. High error rates lead to further audit activity and regulatory burdens. In fact, DME MACs have continued to conduct extensive pre-payment reviews across the DME industry and have determined a wide range of error rates. For example, error rates for continuous positive airway pressure claims have ranged from 50% to 80%. DME MACs have repeatedly cited medical necessity documentation insufficiencies as the primary reason for claim denials. If these or other burdensome positions are generally adopted by auditors, DME MACs, other contractors or CMS in administering the Medicare program, we would have the right to challenge these positions as being contrary to law. If these interpretations of the documentation requirements are ultimately upheld, however, it could result in our making significant refunds and other payments to Medicare and our future revenues from Medicare may be significantly reduced. We have adjusted certain operational policies to address the current expectations of Medicare and its contractors. We cannot predict the adverse impact, if any, these interpretations of the Medicare documentation requirements or our revised policies might have on our operations, cash flow, and capital resources, but such impact could be material.

Page | 9 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

CMS maintains a Master List of Items Frequently Subject to Unnecessary Utilization. This list identifies items that could potentially be subject to prior authorization as a condition of Medicare payment. CMS has added home ventilators used with a non-invasive interface to the Master List of Items Frequently Subject to Unnecessary Utilization. If CMS requires prior authorization requirements for noninvasive home ventilation, it could materially impact our business.

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 required the Secretary of Health and Human Services to establish and implement programs under which competitive acquisition areas are established throughout the United States for purposes of awarding contracts for the furnishing of competitively priced items of durable medical equipment.

Competitive Bidding Process

CMS conducts a competition for each competitive acquisition area under which providers submit bids to supply certain covered items of durable medical equipment. Under the competitive bidding program, durable medical equipment suppliers compete to become Medicare contract suppliers by submitting bids to furnish certain items in competitive bidding areas. As part of the competitive bidding process, single payment amounts (“SPAs”) replace the current Medicare durable medical equipment fee schedule payment amounts for selected items in certain areas of the country. The SPAs are determined by using bids submitted by DME suppliers. CMS has included noninvasive ventilator products on the list of products subject to the competitive bidding program in Round 2021. There are, however, regulations in place that allow non-contracted providers to continue to provide products and services to their existing customers at the new competitive bidding payment amounts. We cannot predict the outcome of the competitive bidding process for contracted supplier selection or the impact of the competitive bidding process on reimbursements to our existing customers.

Licensure

Several states require that durable medical equipment providers be licensed in order to sell products to patients in that state. Certain of these states require that durable medical equipment providers maintain an in-state location. Most of our state licenses are renewed on an annual basis. Although we believe we are in compliance with all applicable state regulations regarding licensure requirements, if we were found to be noncompliant, we could lose our licensure in that state, which could prohibit us from selling our current or future products to patients in that state. In addition, we are subject to certain state laws regarding professional licensure.

Accreditation

Many payors require accreditation under payor contracts. If we lose accreditation at any location, it could have an adverse impact on our reimbursement under payor contracts.

Fraud and Abuse Regulations

Federal Anti-Kickback and Self-Referral Laws. The Federal Anti-Kickback Statute, among other things, prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration, whether directly or indirectly and overtly or covertly, in return for, or to induce the referral of an individual for the:

• | furnishing or arranging for the furnishing of items or services reimbursable in whole or in part under Medicare, Medicaid or other federal healthcare programs; or |

• | purchase, lease, or order of, or the arrangement or recommendation of the purchasing, leasing, or ordering of any item or service reimbursable in whole or in part under Medicare, Medicaid or other federal healthcare programs. |

There are a number of narrow safe harbors to the Federal Anti-Kickback Statute. Such safe harbors permit certain payments and business practices that, although they would otherwise potentially implicate the Federal Anti-Kickback Statute, are not treated as an offense under the same if all of the requirements of the specific applicable safe harbor are met.

The Federal Anti-Kickback Statute applies to certain arrangements with healthcare providers, product end users and other parties, including marketing arrangements and discounts and other financial incentives offered in connection with the sales of our products. Although we believe that we have structured such arrangements to be in compliance with the Anti-Kickback Statute and other applicable laws, regulatory authorities may determine that our marketing, pricing, or other activities violate the Federal Anti-Kickback Statute or other applicable laws. Noncompliance with the Federal Anti-Kickback Statute can result in civil, administrative and/or criminal penalties, restrictions on our ability to operate in certain jurisdictions, and exclusion from participation in Medicare, Medicaid or other federal healthcare programs. In addition, to the extent we are found to not be in compliance, we may be required to curtail or restructure our operations. Any penalties, damages, fines, exclusions, curtailment or restructuring of our operations could adversely affect our ability to operate our business, our financial condition and our results of operations.

Page | 10 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

The Ethics in Patient Referrals Act, commonly known as the “Stark Law,” prohibits a physician from making referrals for certain “designated health services” payable by Medicare to an entity, including a company that furnishes durable medical equipment, in which the physician or an immediate family member of such physician has an ownership or investment interest or with which the physician has entered into a compensation arrangement, unless a statutory exception applies. Violation of the Stark Law could result in denial of payment, disgorgement of reimbursements received under a noncompliance arrangement, civil penalties, damages and exclusion from Medicare or other governmental programs. Although we believe that we have structured our provider arrangements to comply with current Stark Law requirements, these requirements are highly technical and there can be no guarantee that regulatory authorities will not determine or assert that our arrangements are in violation of the Stark Law and do not otherwise meet applicable Stark Law exceptions.

Additionally, because some of these laws continue to evolve, we lack definitive guidance as to the application of certain key aspects of these laws as they relate to our arrangements with providers with respect to patient training. We cannot predict the final form that these regulations will take or the effect that the final regulations will have on us. As a result, our provider arrangements may ultimately be found to be non-compliant with applicable federal law.

False statements. The federal false statements statute prohibits knowingly and willfully falsifying, concealing, or omitting a material fact or making any materially false statement in connection with the delivery of healthcare benefits, items, or services. In addition to criminal penalties, violation of this statute may result in collateral administrative sanctions, including exclusion from participation in Medicare, Medicaid and other federal health care programs.

Federal False Claims Act and Civil Monetary Penalties Law. The Federal False Claims Act provides, in part, that the federal government or a private party on behalf of the government may bring a lawsuit against any person whom it believes has knowingly presented, or caused to be presented, a false or fraudulent request for payment from the federal government, or who has made a false statement or used a false record to get a claim paid or to avoid, decrease or conceal an obligation to pay money to the federal government or who has knowingly retained an overpayment. In addition, amendments in 1986 to the Federal False Claims Act have made it easier for private parties to bring whistleblower lawsuits against companies.

The Civil Monetary Penalties Law provides, in part, that the federal government may seek civil monetary penalties against any person who presents or causes to be presented claims to a Federal health care program that the person knows or should know is for an item or services that was not provided as claimed or is false or fraudulent, or the person has made a false statement or used a false record to get a claim paid. The federal government may also seek civil monetary penalties for a wide variety of other conduct, including offering remuneration to influence a Medicare or Medicaid beneficiary’s selection of providers and violations of the Federal Anti-Kickback Statute.

Although we believe that we are in compliance with the Federal False Claims Act as well as the Civil Monetary Penalties Law, if we are found in violation of the same, include penalties ranging from $11,665 to $23,331 for each false claim violation of the Federal False Claims Act and varying amounts based on the type of violation of the Civil Monetary Penalties Law, plus up to three times the amount of damages that the federal government sustained because of the act of that person. In addition, the federal government may also seek exclusion from participation in all federal health care programs.

In addition, we bill Medicare Part B and other insurers directly for each sale to patients. As a result, we must comply with all laws, rules and regulations associated with filing claims with the Medicare program, including the Social Security Act, Medicare regulations, the Federal False Claims Act and the Civil Monetary Penalties Law, as well as a variety of additional federal and state laws. During an audit, insurers typically expect to find explicit documentation in the medical record to support a claim. Physicians and other clinicians, who are responsible for prescribing our products for patients, are expected to create and maintain the medical records that form the basis for the claims we submit to Medicare and other insurers. Any failure by physicians and other clinicians to properly document the medical records for patients using our products could invalidate claims, impair our ability to collect submitted claims and subject us to overpayment liabilities, Federal False Claims Act liabilities and other penalties including exclusion from the Medicare, Medicaid or private insurance programs.

To the extent we are found to not be in compliance with applicable federal and state laws and regulations, we may be required to curtail or restructure our operations. Any penalties, damages, fines, exclusions, curtailment or restructuring of our operations could adversely affect our ability to operate our business, our financial condition and our results of operations.

State fraud and abuse provisions. Many states have also adopted some form of anti-kickback and anti-referral laws and false claims acts that apply regardless of payor, in addition to items and services reimbursed under Medicaid and other state programs. In some states, these laws apply and we believe that we are in compliance with such laws. Nevertheless, a determination of liability under such laws could result in fines and penalties, as well as restrictions on our ability to operate in these jurisdictions.

Page | 11 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

The U.S. Foreign Corrupt Practices Act and Other Anti-Corruption Laws. We may be subject to a variety of domestic and foreign anti-corruption laws with respect to our regulatory compliance efforts and operations. The U.S. Foreign Corrupt Practices Act (the “FCPA”) is a criminal statute that prohibits an individual or business from paying, offering, promising or authorizing the provision of money (such as a bribe or kickback) or anything else of value (such as an improper gift, hospitality, or favor), directly or indirectly, to any foreign official, political party or candidate for the purpose of influencing any act or decision in order to assist the individual or business in obtaining, retaining, or directing business or other advantages (such as favorable regulatory rulings). The FCPA also obligates companies with securities listed in the United States to comply with certain accounting provisions. Those provisions require a company such as ours to (i) maintain books and records that accurately and fairly reflect all transactions, expenses and asset dispositions, and (ii) devise and maintain an adequate system of internal accounting controls sufficient to provide reasonable assurances that transactions are properly authorized, executed and recorded. The FCPA is subject to broad interpretation by the U.S. government. The past decade has seen a significant increase in enforcement activity. In addition to the FCPA, there are a number of other federal and state anti-corruption laws to which we may be subject, including, the U.S. domestic bribery statute contained in 18 USC § 201 (which prohibits bribing U.S. government officials) and the U.S. Travel Act (which in some instances addresses private-sector or commercial bribery both within and outside the United States).

We could be held liable under the FCPA and other anti-corruption laws for the illegal activities of our employees, representatives, contractors, collaborators, agents, subsidiaries, or affiliates, even if we did not explicitly authorize such activity. Although we will seek to comply with anti-corruption laws, there can be no assurance that all of our employees, representatives, contractors, collaborators, agents, subsidiaries or affiliates will comply with these laws at all times. Violation of these laws could subject us to whistleblower complaints, investigations, sanctions, settlements, prosecution, other enforcement actions, disgorgement of profits, significant fines, damages, other civil and criminal penalties or injunctions, suspension and/or debarment from contracting with certain governments or other persons, the loss of export privileges, reputational harm, adverse media coverage and other collateral consequences. In addition, our directors, officers, employees, and other representatives who engage in violations of the FCPA and certain other anti-corruption statutes may face imprisonment, fines and penalties. If any subpoenas or investigations are launched, or governmental or other sanctions are imposed, or if we do not prevail in any possible civil or criminal litigation, our business, financial condition and results of operations could be materially harmed. In addition, responding to any action will likely result in a materially significant diversion of management’s attention and resources and significant defense costs and other professional fees. Enforcement actions and sanctions could further harm our business, financial condition and results of operations.

HIPAA. The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) established uniform standards governing the conduct of certain electronic healthcare transactions and protecting the security and privacy of individually identifiable health information maintained or transmitted by healthcare providers, health plans and healthcare clearinghouses (collectively “covered entities”). The following standards have been promulgated under HIPAA’s regulations:

• | the Standards for Privacy of Individually Identifiable Health Information, which restrict the use and disclosure of individually identifiable health information, or “protected health information”; |

• | the Standards for Electronic Transactions, which establish standards for common healthcare transactions, such as claims information, plan eligibility, payment information and the use of electronic signatures; |

• | the Security Standards, which require covered entities to implement and maintain certain security measures to safeguard certain electronic health information, including the adoption of administrative, physical and technical safeguards to protect such information; and |

• | the breach notification rules, which require covered entitles to provide notification to affected individuals, the Department of Health and Human Services and the media in the event of a breach of unsecured protected health information. |

In 2009, Congress passed the American Recovery and Reinvestment Act of 2009 (“ARRA”) which included sweeping changes to HIPAA, including an expansion of HIPAA’s privacy and security standards. ARRA includes the Health Information Technology for Economic and Clinical Health Act of 2009 (“HITECH”) which, among other things, made HIPAA’s privacy and security standards directly applicable to business associates of covered entities. A business associate is a person or entity that performs certain functions or activities on behalf of a covered entity that involve the use or disclosure of protected health information. As a result, business associates are now subject to significant civil and criminal penalties for failure to comply with applicable standards. Moreover, HITECH creates a new requirement to report certain breaches of unsecured, individually identifiable health information and imposes penalties on entities that fail to do so. HITECH also increased the civil and criminal penalties that may be imposed against covered entities, business associates and possibly other persons and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce the federal HIPAA laws and seek attorney fees and costs associated with pursuing federal civil actions.

Page | 12 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

The 2013 final HITECH omnibus rule (the “HITECH Final Rule”) modifies the breach reporting standard in a manner that makes more data security incidents qualify as reportable breaches. Any liability from a failure to comply with the requirements of HIPAA or the HITECH Act could adversely affect our financial condition. The costs of complying with privacy and security related legal and regulatory requirements are burdensome and could have a material adverse effect on our results of operations. The HITECH Final Rule will continue to be subject to interpretation by various courts and other governmental authorities, thus creating potentially complex compliance issues for us, as well as referring providers.

In addition to federal regulations issued under HIPAA, some states have enacted privacy and security statutes or regulations that, in certain cases, are more stringent than those issued under HIPAA. In those cases, it may be necessary to modify our planned operations and procedures to comply with the more stringent state laws. Most states have also adopted breach notification laws that require notification to affected individuals and certain state agencies if there is a security breach of certain individually-identifiable information. If we suffer a privacy or security breach, we could be required to expend significant resources to provide notification to the affected individuals and address the breach, as well as reputational harm associated with the breach. If we fail to comply with applicable state laws and regulations, we could be subject to additional sanctions. Any liability from failure to comply with the requirements of HIPAA, HITECH or state privacy and security statutes or regulations could adversely affect our financial condition. The costs of complying with privacy and security related legal and regulatory requirements are burdensome and could have a material adverse effect on our business, financial condition and results of operations.

General Regulatory Compliance and Health Care Reform

The evolving regulatory and compliance environment and the need to build and maintain robust systems to comply with different compliance or reporting requirements in multiple jurisdictions increase the possibility that a healthcare company may fail to comply fully with one or more of these requirements. If our operations are found to be in violation of any of the health regulatory laws described above or any other laws that apply to us, we may be subject to penalties, including potentially significant criminal and civil and administrative penalties, damages, fines, disgorgement, imprisonment, exclusion from participation in government healthcare programs, contractual damages, reputational harm, administrative burdens, diminished profits and future earnings and the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business, financial condition and our results of operations.

In March 2010, the Affordable Care Act (“ACA”) was enacted into law in the United States. This healthcare reform, which included a number of provisions aimed at improving the quality and decreasing the cost of healthcare, has resulted in significant reimbursement cuts in Medicare payments to hospitals and other healthcare providers in the healthcare reimbursement system, evolving toward value- and outcomes-based reimbursement methodologies. It is uncertain what long-term consequences these provisions will have on patient access to new technologies and what impact these provisions will have on Medicare reimbursement rates. Other elements of the ACA, including comparative effectiveness research, an independent payment advisory board and payment systems reform, including shared savings pilots and other reforms, may result in fundamental changes to federal healthcare reimbursement programs. The Tax Cuts and Jobs Act of 2017 repealed penalties for noncompliance with the requirement for insurance coverage known as the “individual mandate.” This change could affect whether individuals enroll in health plans and could impact insurers with which we contract. Other changes to the ACA could impact the number of patients who have access to our products. Existing and additional legislative or administrative reforms, or any repeal of provisions, of the U.S. healthcare reimbursement systems may significantly reduce reimbursement or otherwise impact coverage for our medical devices, or adverse decisions relating to our products by administrators of such systems in coverage or reimbursement issues could have an adverse impact on our financial condition and results of operations.

Third-Party Reimbursement

In the United States and elsewhere, sales of medical devices depend in significant part on the availability of coverage and reimbursement to providers and patients from third-party payors. Third-party payors include private insurance plans and governmental programs. As with other medical devices, reimbursement for our products can differ significantly from payor to payor, and our products are not universally covered by third- party commercial payors. Further, third-party payors continually review existing technologies for continued coverage and can, with limited notice, deny or reverse coverage for existing products.

Two principal governmental third-party payors in the United States are Medicare and Medicaid. Medicare is a federal program that provides certain medical insurance benefits to persons age 65 and over, certain disabled persons and others. In contrast, Medicaid is a medical assistance program jointly funded by federal and state governments to serve certain individuals and families with low incomes and who meet other eligibility requirements. Each state administers its own Medicaid program which determines the benefits made available to the Medicaid recipients in that state. The Medicare and Medicaid statutory framework is subject to administrative rulings, interpretations and discretion that affect the amount and timing of reimbursement made under Medicare and Medicaid.

Page | 13 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

CMS, which is the agency within the Department of Health and Human Services that administers both Medicare and Medicaid, has the authority to decline to cover particular products or services if it determines that they are not “reasonable and necessary” for the treatment of Medicare beneficiaries. A coverage determination for a product, which establishes the indications that will be covered, and any restrictions or limitations, can be developed at the national level by CMS through a National Coverage Determination (“NCD”) or at the local level through a Local Coverage Determination (“LCD”) by a regional DME MAC. CMS could issues new NCDs or the regional DME MACs could issue LCDs related to a full range of respiratory DME products. If such NCDs or LCDs are issued or revised, they could significantly alter the coverage under Medicare and materially impact our business.

With respect to our ventilator products, an NCD for the DME Reference List, which has been effective since April 1, 2003, indicates that ventilators, including our products, are covered for the treatment of neuromuscular diseases, thoracic restrictive diseases, and chronic respiratory failure consequent to chronic obstructive pulmonary disease. While the NCD for the DME Reference List has been updated, no separate NCD has been issued for ventilators. Monthly rental revenue from ventilators and the sale of associated supplies represented approximately 92% and 94% of total revenue for 2019 and 2018, respectively. Medicare Administrative Contractors responsible for processing durable medical equipment claims have issued LCDs for Respiratory Assist Devices (“RADs”) which contain language describing an overlap in conditions used to determine coverage for RADs and ventilator devices. These LCDs state that the treatment plan for any individual patient, including the determination to use a ventilator or a bi-level Positive Airway Pressure device, may vary and will be made based upon the specifics of each individual beneficiary’s medical condition. Due to this variability, determinations of coverage for our ventilator products are subject to scrutiny of individual medical records and claims. Revenues from Medicare and Medicaid accounted for 64% and 70% of the total revenues for the year ended December 31, 2019 and 2018, respectively.

Because Medicare criteria is extensive, we have a team dedicated to educating prescribers to help them understand how Medicare policy affects their patients and the medical record documentation needed to meet both NCD and LCD requirements. We maintain open communication with physician key opinion leaders and with Medicare Administrative Contractors to provide data as it becomes available that could potentially influence coverage decisions. We also continue to closely monitor our Medicare business to identify trends that could have a negative impact on certain Medicare patients’ access to our products, which in turn could have an adverse effect on our business and results of operations.

Commercial payors that reimburse for our products do so in a variety of ways, depending on the insurance plan’s policies, employer and benefit manager input, and contracts with their provider network. Moreover, Medicaid programs and some commercial insurance plans, especially Medicare Advantage plans (commercial insurers that are administering Medicare benefits to certain beneficiaries), are frequently influenced by Medicare coverage determinations. In working with payors who follow Medicare criteria, we have focused on clear communications with insurers to ensure mutual understanding of criteria interpretation, which differs significantly among the plans from very restrictive to quite lenient, and we then work closely with prescribers to educate them accordingly. While this approach has had positive impact, we do not know if or when additional payors may adopt the LCD criteria nor do we know how they will choose to interpret it.

We believe a reduction or elimination of coverage or reimbursement of our products by Medicare would likely cause some commercial third-party payors to implement similar reductions in their coverage or reimbursement of our products. If we are unable to expand coverage of our products by additional commercial payors, or if third-party payors that currently cover or reimburse for our products reverse or limit their coverage in the future, our business and results of operations could be adversely affected.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). For as long as we are an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and shareholder advisory votes on golden parachute compensation. We will remain an “emerging growth company” until the earliest of (i) the last day of our fiscal year in which we have total annual gross revenues of $1.07 billion (as such amount is indexed for inflation every five years by the SEC to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest $1 million) or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”); (iii) the date on which we have, during the prior three-year period, issued more than $1 billion in non-convertible debt; and (iv) the date on which we are deemed to be a “large accelerated filer” under the Exchange Act.

We cannot predict if investors will find our common shares less attractive to the extent we rely on the exemptions available to emerging growth companies. If some investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and our share price may be more volatile.

Page | 14 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We may choose to take advantage of such extended transition period.

Competition

The respiratory care industry is highly competitive. While Viemed is one of the top three providers of NIVs and related services in the United States, its current competitors may gain market share, and any new entrants, with greater financial and technical resources, may provide additional competition. Accordingly, there can be no assurance that Viemed will be able to grow its operations organically to meet the competitive environment.

Significant Customers

For the years ended December 31, 2019 and 2018, Viemed had no customers that accounted for 10% or more of its consolidated revenues.

Viemed earns revenues by seeking reimbursement from Medicare and private health insurance companies, with the Medicare program of the United States government being the primary entity making payments. If the Medicare program were to slow payments of Viemed receivables for any reason, Viemed would be adversely impacted.

A majority of the Company’s revenues are derived from the fee for service pricing guidelines set by the CMS. These pricing guidelines are subject to change at the discretion of CMS.

Employees

At December 31, 2019, Viemed had 418 employees, in addition to consultants working directly with hospitals and other healthcare providers to help simplify the administrative process for patients transitioning from hospital to home care.

Item 1A. Risk Factors

Risks Related to Our Industry and Business

We have a limited history of operations and we might be unsuccessful in increasing our sales and cannot assure you that we will ever generate substantial revenue or be profitable.

We have a limited history of operations. There can be no assurance that our business will be successful and generate, or maintain, any profit.

Our novel business model may not be accepted by the market, which would harm our financial condition and results of operations.

Home monitoring of patients is a relatively new business, making it difficult to predict market acceptance, development, expansion and direction. The home monitoring services to be provided by us represent a relatively new development in the United States healthcare industry. Accordingly, adoption by patients and physicians can require education, which can result in a lengthy sales cycle. The market may take time to develop. Physicians and/or patients may be slow to adopt new methods. The development of our home monitoring business is dependent on a number of factors. These factors include: our ability to differentiate our services from those of our competitors; the extent and timing of the acceptance of our services as a replacement for, or supplement to, traditional methods of servicing patients; the effectiveness of our sales and marketing and engagement efforts with customers and their health plan participants; and our ability to provide quality customer service, as perceived by patients and physicians. If our home monitoring business is not fully developed as a result of the failure of any of these factors or if our novel business model is not accepted by the market, our financial condition and results of operations would be significantly impacted.

Page | 15 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

We compete against companies that have longer operating histories and greater resources, which may result in reduced profit margins and loss of market share.

While we are currently one of the top three providers of NIVs and related services in the United States, the respiratory care industry is highly competitive and dynamic and may become more competitive as new players enter the market. Certain competitors will be subsidiaries or divisions of larger, much better capitalized companies. Certain competitors will have vertically integrated manufacturing and services sectors of the market. We may have less capital and may encounter greater operational challenges in serving the market. Better capitalized competitors may also be able to borrow money or raise debt to purchase equipment more easily than us. Potential competitors could have significantly greater financial, research and development, manufacturing, and sales and marketing resources than we have and could utilize their greater resources to acquire or develop new technologies or products that could effectively compete with our existing products. Additionally, demand for our home monitoring services and other services could be diminished by equivalent or superior products and services developed by competitors.

Competing in these markets could result in price-cutting, reduced profit margins and loss of market share, any of which would harm our business, financial condition and results of operations. Our ability to compete effectively depends upon our ability to distinguish our company and our services from our competitors and their products, on such factors as safety and effectiveness, product pricing, compelling clinical data and quality of customer support.

Reductions in reimbursement rates may have a materially adverse impact on the profitability of our operations.

Reimbursement for services to be provided by us come primarily from Medicare, Medicaid, and private health insurance companies. The reimbursement rates offered are outside of our control. Reimbursement rates in this area, and much of the United States health care market in general, have been subject to continual reductions as health insurers and governmental entities attempt to control health care costs. We cannot predict the extent and timing of any reduction in reimbursement rates.

Reductions in reimbursement rates may have a material adverse impact on the profitability of our operations. A reduction in reimbursement may be unrelated to any concurrent decline in the cost of operations, thereby resulting in reduced profitability. Our costs of operations could increase, but the cost increases may not be passed on to customers because reimbursement rates are set without regard to the cost of service.

Our reliance on only a few sources of repayment for our services could result in delays in repayment, which could adversely affect cash flow and revenues.

We earn revenues by seeking reimbursement from Medicare, Medicaid, and private health insurance companies, with the Medicare program of the United States government being the primary entity making payments. If the Medicare program were to slow payments of our receivables for any reason, we would be adversely impacted. In addition, both governmental and private health insurance companies may seek ways to avoid or delay reimbursement, which could adversely affect our cash flow and revenues.

Our dependence on key suppliers puts us at risk of interruptions in the availability of the equipment we need for our services, which could reduce our revenue and adversely affect our results of operations.

We require the timely delivery of a sufficient supply of equipment with which we can perform our home treatment of patients. Our dependence on third-party suppliers involves several other risks, including limited control over pricing, availability, quality and delivery schedules. For example, there are few manufacturers of the equipment that can be used for home treatment of patients with ventilation respiratory therapy. The emerging nature of this market presents risks that suppliers may not be able to provide equipment to satisfy demand. Demand may outstrip supply, leading to equipment shortages. Conversely, incorrect demand forecasting could lead to excess inventory. If we fail to achieve certain volume of sales, prices of ventilators may increase. The industry is subject to a high level of regulatory scrutiny, and government or manufacturer recalls could adversely affect our ability to provide services and achieve revenue targets.

Inadequate supply could impair our ability to attract new business and could create upward pricing pressure on equipment and supplies, adversely affecting our margins. Additionally, the market for financing ventilators other supplies we need could be more difficult in the future.

Page | 16 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

We conduct all of our operations through our United States subsidiaries and our ability to extract value from these subsidiaries may be limited.

We conduct all of our operations through our United States subsidiaries. Therefore, to the extent of these holdings, we (directly and indirectly) will be dependent on the cash flows of these subsidiaries to meet our obligations. The ability of such subsidiaries to make payments to their parent companies may be constrained by a variety of factors, including, the level of taxation, particularly corporate profits and withholding taxes, in the jurisdiction in which each subsidiary operates, and the introduction of exchange controls or repatriation restrictions or the availability of hard currency to be repatriated. Additionally, our subsidiaries are restricted from making distributions to us by the loan agreement, subject to certain exceptions.

The failure to attract or to retain management or key operating personnel, including directors, could adversely affect operations.

Our success to date has depended, and will continue to depend, largely on the skills and efforts of our management team, including our ability to interpret market data correctly and to interpret and respond to economic, market and other conditions in order to locate and adopt appropriate opportunities. We have a small management team and the loss of a key individual or the inability to attract suitably qualified staff could have a material adverse impact on our business. We may also encounter difficulties in obtaining and maintaining suitably qualified staff. No assurance can be given that individuals with the required skills will continue employment with us or that replacement personnel with comparable skills can be found. We are dependent on the services of key executives, including our directors and a small number of highly skilled and experienced executives and personnel. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees may adversely affect our business and future operations.

We may be unable to achieve our strategy to grow our business, which could adversely impact our revenues and profits.

We may have difficulty identifying or acquiring suitable acquisition targets and maintaining our organic growth, which is a significant aspect of our business model. In the event that we are successful in consummating acquisitions in the future, such acquisitions may negatively impact our business, financial condition, results of operations, cash flows and prospects because of a variety of factors, including the acquired company’s business not achieving the anticipated revenue, earnings or cash flows, our assumption of liabilities or risks beyond our estimates or the diversion of the attention of management from our existing business.

If we are unable to continue to grow or manage our growth for any of these reasons, we may be unable to achieve our expansion strategy, which could adversely impact our earnings per share and our revenue and profits.

We have significant ongoing capital expenditure requirements. If we are unable to obtain necessary capital on favorable terms or at all, we may not be able to execute on our business plans and our business, financial condition, results of operations, cash flows and prospects may be adversely affected.

Our development and the business (including acquisitions) may require additional financing, which may involve high transaction costs, dilution to shareholders, high interest rates or unfavorable terms and conditions. Failure to obtain sufficient financing may result in the delay or indefinite postponement of our business plans and our business, financial condition, results of operations and prospects may be adversely affected. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favorable to us.

Certain of our directors may engage in business opportunities on behalf of other companies that are in competition with us.

Some of our directors are engaged and will continue to be engaged in the search for additional business opportunities on behalf of other corporations, and situations may arise where these directors will be in direct competition with us. Some of our directors are or may become directors or officers of other companies engaged in other business ventures.

Conflicts of interest, if any, which arise may be subject to and be governed by procedures prescribed by the Business Corporations Act, which require a director or officer of a corporation who is a party to or is a director or an officer of or has a material interest in any person who is a party to a material contract or proposed material contract with us to disclose his interest and to refrain from voting on any matter in respect of such contract unless otherwise permitted under the Business Corporations Act. Any decision made by any of such directors and officers involving us should be made in accordance with their duties and obligations to deal fairly and in good faith with a view to our best interests and the best interests of our shareholders. Such transactions will also be subject to and governed by procedures in our Code of Ethics and Business Conduct.

Page | 17 | |

VIEMED HEALTHCARE, INC. | ||

December 31, 2019 and 2018 | ||

We are subject to the risks of litigation and governmental proceedings, which could adversely affect our business.

We are, and in the future may be, subject to legal and governmental proceedings and claims. The parties in such legal actions may seek amounts from us that may not be covered in whole or in part by insurance. Defending ourselves against such legal actions could result in significant costs and could require a substantial amount of time and effort by our management team. We cannot predict the outcome of litigation or governmental proceedings to which we are a party or whether we will be subject to future legal actions. As a result, the potential costs associated with legal actions against us could adversely affect our business, financial condition, results of operations, cash flows or prospects.