Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit991.htm |

| EX-32.2 - EXHIBIT 32.2 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit311.htm |

| EX-23.2 - EXHIBIT 23.2 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit232.htm |

| EX-23.1 - EXHIBIT 23.1 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit211.htm |

| EX-10.15 - EXHIBIT 10.15 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit1015.htm |

| EX-10.14 - EXHIBIT 10.14 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit1014.htm |

| EX-10.13 - EXHIBIT 10.13 - NATURAL RESOURCE PARTNERS LP | a2019q4exhibit1013.htm |

| EX-4.25 - EXHIBIT 4.25 - NATURAL RESOURCE PARTNERS LP | q42019exhibit425.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019 or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-31465

NATURAL RESOURCE PARTNERS L.P. | |||

(Exact name of registrant as specified in its charter) | |||

Delaware | 35-2164875 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1201 Louisiana Street, Suite 3400 Houston, Texas 77002 (Address of principal executive offices) (Zip Code) (713) 751-7507 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Units representing limited partner interests | NRP | New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of "accelerated filer", "large accelerated filer", "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ |

Accelerated Filer | ý |

Non-accelerated Filer | ¨ |

Smaller Reporting Company | ¨ |

Emerging Growth Company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2) Yes ¨ No ý

The aggregate market value of the common units held by non-affiliates of the registrant on June 28, 2019, was $318 million based on a closing price on that date of $35.46 per unit as reported on the New York Stock Exchange.

Documents incorporated by reference: None.

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this 10-K may constitute forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements which are also forward-looking statements. Such forward-looking statements include, among other things, statements regarding: our business strategy; our liquidity and access to capital and financing sources; our financial strategy; prices of and demand for coal, trona and soda ash, and other natural resources; estimated revenues, expenses and results of operations; projected production levels by our lessees; Ciner Wyoming LLC’s ("Ciner Wyoming's") trona mining and soda ash refinery operations; distributions from our soda ash joint venture; the impact of governmental policies, laws and regulations, as well as regulatory and legal proceedings involving us, and of scheduled or potential regulatory or legal changes; and global and U.S. economic conditions.

These forward-looking statements speak only as of the date hereof and are made based upon our current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and involve a number of risks and uncertainties. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. You should not put undue reliance on any forward-looking statements. See "Item 1A. Risk Factors" in this Annual Report on Form 10-K for important factors that could cause our actual results of operations or our actual financial condition to differ.

ii

PART I

As used in this Part I, unless the context otherwise requires: "we," "our," "us" and the "Partnership" refer to Natural Resource Partners L.P. and, where the context requires, our subsidiaries. References to "NRP" and "Natural Resource Partners" refer to Natural Resource Partners L.P. only, and not to NRP (Operating) LLC or any of Natural Resource Partners L.P.’s subsidiaries. References to "Opco" refer to NRP (Operating) LLC, a wholly owned subsidiary of NRP, and its subsidiaries. NRP Finance Corporation ("NRP Finance") is a wholly owned subsidiary of NRP and a co-issuer with NRP on the 9.125% senior notes due 2025 (the "2025 Senior Notes").

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

Partnership Structure and Management

We are a publicly traded Delaware limited partnership formed in 2002. We own, manage and lease a diversified portfolio of mineral properties in the United States, including interests in coal and other natural resources and own a non-controlling 49% interest in Ciner Wyoming LLC ("Ciner Wyoming"), a trona ore mining and soda ash production business.

Our business is organized into two operating segments:

Coal Royalty and Other—consists primarily of coal royalty properties and coal-related transportation and processing assets. Other assets include industrial mineral royalty properties, aggregates royalty properties, oil and gas royalty properties and timber. Our coal reserves are primarily located in Appalachia, the Illinois Basin and the Northern Powder River Basin in the United States. Our industrial minerals and aggregates properties are located in various states across the United States, our oil and gas royalty assets are primarily located in Louisiana and our timber assets are primarily located in West Virginia.

Soda Ash—consists of our 49% non-controlling equity interest in Ciner Wyoming, a trona ore mining and soda ash production business located in the Green River Basin of Wyoming. Ciner Resources LP, our operating partner, mines the trona, processes it into soda ash, and distributes the soda ash both domestically and internationally into the glass and chemicals industries.

Our operations are conducted through Opco and our operating assets are owned by our subsidiaries. NRP (GP) LP, our general partner, has sole responsibility for conducting our business and for managing our operations. Because our general partner is a limited partnership, its general partner, GP Natural Resource Partners LLC, conducts its business and operations and the Board of Directors and officers of GP Natural Resource Partners LLC make decisions on our behalf. Robertson Coal Management LLC, a limited liability company wholly owned by Corbin J. Robertson, Jr., owns all of the membership interest in GP Natural Resource Partners LLC. Subject to the Board Representation and Observation Rights Agreement with certain entities controlled by funds affiliated with The Blackstone Group Inc. (collectively referred to as "Blackstone") and affiliates of GoldenTree Asset Management LP (collectively referred to as "GoldenTree"), Mr. Robertson, Jr. is entitled to appoint the members of the Board of Directors of GP Natural Resource Partners LLC and has delegated the right to appoint one director to Blackstone.

The senior executives and other officers who manage NRP are employees of Western Pocahontas Properties Limited Partnership or Quintana Minerals Corporation, which are companies controlled by Mr. Robertson, Jr. These officers allocate varying percentages of their time to managing our operations. Neither our general partner, GP Natural Resource Partners LLC, nor any of their affiliates receive any management fee or other compensation in connection with the management of our business, but they are entitled to be reimbursed for all direct and indirect expenses incurred on our behalf.

We have regional offices through which we conduct our operations, the largest of which is located at 5260 Irwin Road, Huntington, West Virginia 25705 and the telephone number is (304) 522-5757. Our principal executive office is located at 1201 Louisiana Street, Suite 3400, Houston, Texas 77002 and our telephone number is (713) 751-7507.

1

Segment and Geographic Information

The amount of 2019 revenues and other income from our two operating segments is shown below. For additional business segment information, please see "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations" and "Item 8. Financial Statements and Supplementary Data—Note 8. Segment Information" in this Annual Report on Form 10-K, which are both incorporated herein by reference.

(In thousands) | Amount | % of Total | ||||

Coal Royalty and Other | $ | 216,846 | 82% | |||

Soda Ash | 47,089 | 18% | ||||

Total | $ | 263,935 | 100% | |||

Coal Royalty and Other Segment

Our coal reserves are primarily located in the Appalachia Basin, the Illinois Basin and the Northern Powder River Basin in the United States. We lease our reserves to experienced mine operators under long-term leases. Approximately two-thirds of our royalty-based leases have initial terms of five to 40 years, with substantially all lessees having the option to extend the lease for additional terms. Leases include the right to renegotiate royalties and minimum payments for the additional terms. We also own and manage coal-related transportation and processing assets in the Illinois Basin that generate additional revenues generally based on throughput or rents. As described in the "—Other Coal Royalty and Other Segment Assets" section below, we also own oil and gas, industrial minerals and aggregates reserves that generate a portion of the Coal Royalty and Other segment revenues.

Under our standard royalty lease, we grant the operators the right to mine and sell our reserves in exchange for royalty payments based on the greater of a percentage of the sale price or fixed royalty per ton of minerals mined and sold. Lessees calculate royalty payments due to us and are required to report tons of minerals mined and sold as well as the sales prices of the extracted minerals. Therefore, to a great extent, amounts reported as royalty revenues are based upon the reports of our lessees. We periodically audit this information by examining certain records and internal reports of our lessees and we perform periodic mine inspections to verify that the information that our lessees have submitted to us is accurate. Our audit and inspection processes are designed to identify material variances from lease terms as well as differences between the information reported to us and the actual results from each property.

In addition to their royalty obligations, our lessees are often subject to minimum payments, which reflect amounts we are entitled to receive even if no mining activity occurs during the period. Minimum payments are usually credited against future royalties that are earned as minerals are produced. In certain leases, the lessee is time limited on the period available for recouping minimum payments and such time is unlimited on other leases.

Because we do not operate any coal mines, our coal royalty business does not bear ordinary operating costs and has limited direct exposure to environmental, permitting and labor risks. Our lessees, as operators, are subject to environmental laws, permitting requirements and other regulations adopted by various governmental authorities. In addition, the lessees generally bear all labor-related risks, including retiree health care costs, black lung benefits and workers’ compensation costs associated with operating the mines on our coal and aggregates properties. We pay property taxes on our properties, which are largely reimbursed by our lessees pursuant to the terms of the various lease agreements.

2

Coal Reserves and Production Information

The following table presents coal reserves information as of December 31, 2019 for the properties that we own by major coal region:

Proven and Probable Reserves (1) | |||||||||

(Tons in thousands) | Underground | Surface | Total | ||||||

Appalachia Basin | |||||||||

Northern | 301,742 | 3,031 | 304,773 | ||||||

Central | 720,378 | 242,379 | 962,757 | ||||||

Southern | 57,881 | 19,794 | 77,675 | ||||||

Total Appalachia Basin | 1,080,001 | 265,204 | 1,345,205 | ||||||

Illinois Basin | 299,818 | 5,074 | 304,892 | ||||||

Northern Powder River Basin | — | 163,555 | 163,555 | ||||||

Gulf Coast | — | 1,957 | 1,957 | ||||||

Total | 1,379,819 | 435,790 | 1,815,609 | ||||||

(1) | In excess of 90% of the reserves presented in this table are currently leased to third parties. |

The following table presents the type of our coal reserves by major coal region as of December 31, 2019:

Type of Coal | |||||||||

(Tons in thousands) | Thermal | Metallurgical (1) | Total | ||||||

Appalachia Basin | |||||||||

Northern | 243,939 | 60,834 | 304,773 | ||||||

Central | 545,949 | 416,808 | 962,757 | ||||||

Southern | 58,554 | 19,121 | 77,675 | ||||||

Total Appalachia Basin | 848,442 | 496,763 | 1,345,205 | ||||||

Illinois Basin | 304,892 | — | 304,892 | ||||||

Northern Powder River Basin | 163,555 | — | 163,555 | ||||||

Gulf Coast | 1,875 | 82 | 1,957 | ||||||

Total | 1,318,764 | 496,845 | 1,815,609 | ||||||

(1) | For purposes of this table, we have defined metallurgical coal reserves as reserves located in seams that historically have been of sufficient quality and characteristics to be able to be used in the steel making process. Some of the reserves in the metallurgical category can also be used as thermal coal. |

3

The following table presents the sulfur content and the typical quality of our coal reserves by major coal region as of December 31, 2019:

Sulfur Content | Typical Quality (1) | ||||||||||||||||||||

(Tons in thousands) | Compliance Coal (2) | Low (<1.0%) | Medium (1.0% to 1.5%) | High (>1.5%) | Total | Heat Content (Btu per pound) | Sulfur (%) | ||||||||||||||

Appalachia Basin | |||||||||||||||||||||

Northern | 46,307 | 46,507 | 1,002 | 257,264 | 304,773 | 12,977 | 2.61 | ||||||||||||||

Central | 443,313 | 677,143 | 239,230 | 46,384 | 962,757 | 13,238 | 0.91 | ||||||||||||||

Southern | 43,382 | 47,905 | 27,180 | 2,590 | 77,675 | 13,405 | 0.96 | ||||||||||||||

Total Appalachia Basin | 533,002 | 771,555 | 267,412 | 306,238 | 1,345,205 | 13,189 | 1.30 | ||||||||||||||

Illinois Basin | — | — | 2,152 | 302,740 | 304,892 | 11,476 | 3.29 | ||||||||||||||

Northern Powder River Basin | — | 163,555 | — | — | 163,555 | 8,800 | 0.65 | ||||||||||||||

Gulf Coast | 82 | 1,957 | — | — | 1,957 | 6,964 | 0.69 | ||||||||||||||

Total | 533,084 | 937,067 | 269,564 | 608,978 | 1,815,609 | ||||||||||||||||

(1) | Unless otherwise indicated, the coal quality information in this Annual Report and on the Form 10-K is reported on an as-received basis with an assumed moisture of 6% for Appalachia Basin reserves, and site specific moisture values for Illinois (typically 12% moisture) and Northern Powder River Basin (typically 25% moisture). |

(2) | Compliance coal, when burned, emits less than 1.2 pounds of sulfur dioxide per million Btu and meets the sulfur dioxide emission standards imposed by Phase II of the Clean Air Act without blending with other coals or using sulfur dioxide reduction technologies. Compliance coal is a subset of low sulfur coal and is, therefore, also reported within the amounts for low sulfur coal. |

The following table presents the type of coal sales volumes by major coal region for the year ended December 31, 2019:

Type of Coal | |||||||||

(Tons in thousands) | Thermal | Metallurgical | Total | ||||||

Appalachia Basin | |||||||||

Northern | 2,781 | 679 | 3,460 | ||||||

Central | 3,117 | 10,260 | 13,377 | ||||||

Southern | 470 | 1,200 | 1,670 | ||||||

Total Appalachia Basin | 6,368 | 12,139 | 18,507 | ||||||

Illinois Basin | 2,201 | — | 2,201 | ||||||

Northern Powder River Basin | 3,036 | — | 3,036 | ||||||

Total | 11,605 | 12,139 | 23,744 | ||||||

4

Methodologies Used in Mineral Reserve Estimation

All of the reserves reported above are recoverable proven or probable reserves as determined in accordance with the SEC’s Industry Guide 7 and are estimated by our internal geologists or independent third-party consultants. Significant internally generated reserve studies are reviewed by independent third-party consultants. The technologies and economic data used in the estimation of our proven or probable reserves include, but are not limited to, drill logs, geophysical logs, geologic maps including isopach, mine and coal quality, cross sections, statistical analysis and available public production data. There are numerous uncertainties inherent in estimating the quantities and qualities of recoverable reserves, including many factors beyond our control. Estimates of economically recoverable coal reserves depend upon a number of variable factors and assumptions, any one of which may, if incorrect, result in an estimate that varies considerably from actual results. In addition, the SEC has adopted new rules to modernize the property disclosure requirements for registrants with significant mining activities, which we will be required to begin to comply with for the fiscal year beginning on January 1, 2021 (reported in the Annual Report on Form 10-K for the year ending December 31, 2021). We are in the process of assessing the impact the new rules will have on our disclosures. The new rules require that reserve estimates that are reported be based on technical reports prepared using extensive mine-specific geological and engineering data, as well as market and cost assumptions. As a royalty company, we may not have access to much of the information that is required to prepare the technical reports used to determine reserves under the new rules without unreasonable burden or expense. Accordingly, the amount of coal and other minerals that we are allowed to report under the new rules beginning with the year ending December 31, 2021 may differ materially from the reserves reported above. See "Item 1A. Risk Factors—Risks Related to Our Business—Our reserve estimates depend on many assumptions that may be inaccurate, which could materially adversely affect the quantities and value of our reserves. In addition, compliance with new SEC rules that will become effective beginning in 2021 could result in material adjustments to the quantities of reserves we are allowed to report."

Major Coal Producing Properties

The following table provides a summary of our significant coal royalty properties by sales volumes for 2019 and is followed by additional information for each property:

Region | Property/Lease Name | Operator(s) | Coal Type | 2019 Sales Volumes (Millions of Tons) | ||||

Appalachia Basin | ||||||||

Northern | Hibbs Run | Murray Energy Corporation | Thermal | 2.0 | ||||

Northern | Mettiki Coal | Alliance Resource Partners | Met/Thermal | 0.8 | ||||

Central | Contura-CAPP (VA) | Contura Energy, Inc. | Met | 3.8 | ||||

Central | Coal Mountain | CM Energy Properties, LP | Met | 1.3 | ||||

Central | Aracoma | Contura Energy, Inc. | Met | 1.2 | ||||

Central | Elk Creek | Ramaco Resources, Inc. | Met | 1.1 | ||||

Central | Lynch | Blackjewel, LLC; InMet, LLC | Met/Thermal | 0.9 | ||||

Southern | Oak Grove | Murray Metallurgical Coal Holdings LLC | Met | 1.2 | ||||

Illinois Basin | Macoupin | Foresight Energy LP | Thermal | 1.6 | ||||

Illinois Basin | Williamson | Foresight Energy LP | Thermal | 0.3 | ||||

Illinois Basin | Hillsboro | Foresight Energy LP | Thermal | 0.2 | ||||

Northern Powder River Basin | Western Energy | Rosebud Mining, LLC | Thermal | 3.0 | ||||

5

Appalachia Basin—Northern Appalachia

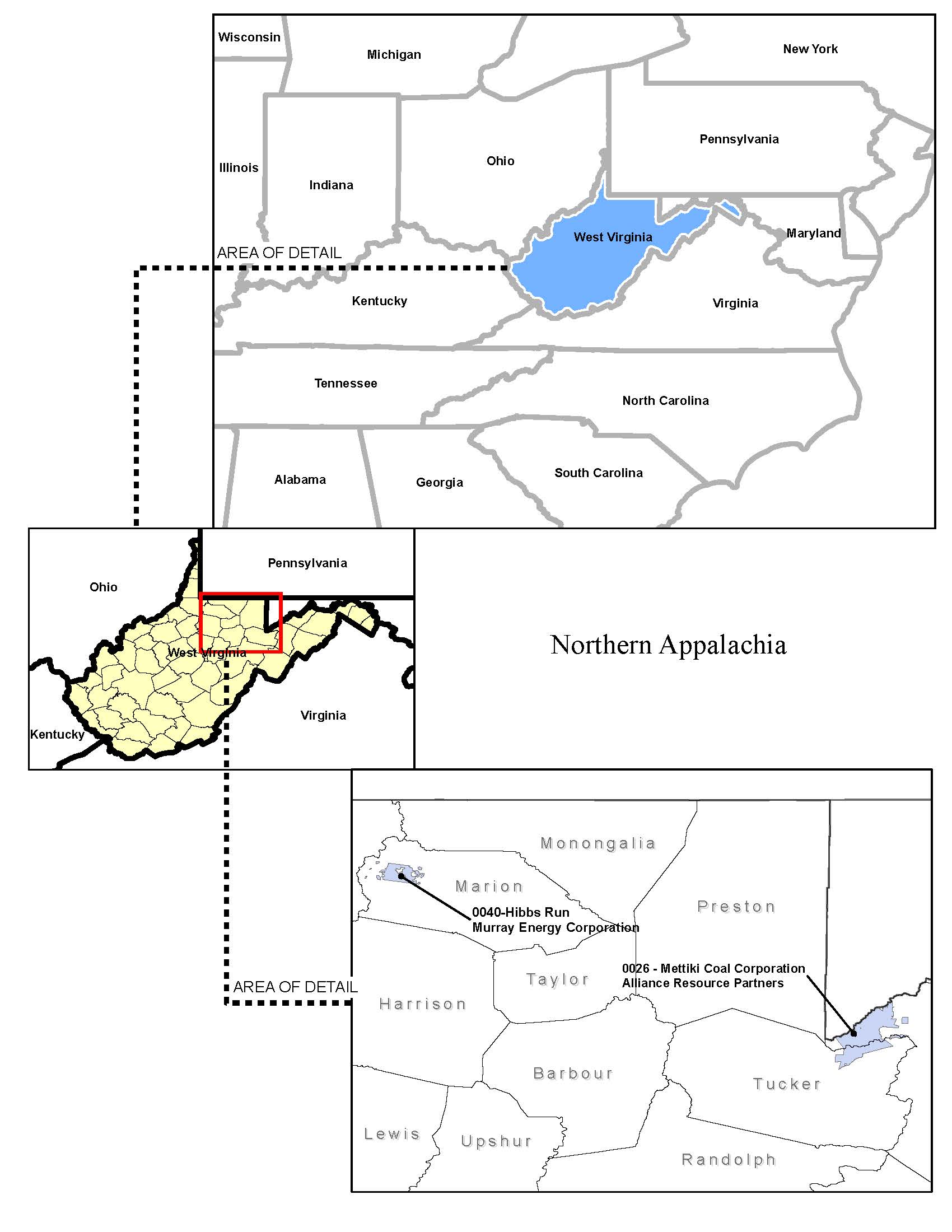

Hibbs Run. The Hibbs Run property is located in Marion County, West Virginia. In 2019, approximately 2.0 million tons were sold from this thermal property. We lease this property to a subsidiary of Murray Energy Corporation. Coal from this property is produced from longwall mines and shipped by rail to utility customers. The royalty rate for this property is a low fixed rate per ton and has a significant effect on the weighted average per ton revenue for the region.

Mettiki Coal. The Mettiki Coal property is located in Tucker and Grant Counties, West Virginia. In 2019, approximately 0.8 million metallurgical and thermal tons were sold from this property. We lease this property to a subsidiary of Alliance Resource Partners. Production comes from this mine via a longwall operation. Coal is shipped by truck to a local utility customer and by train to metallurgical customers. NRP pays an override royalty equal to the royalty received from Mettiki to Western Pocahontas Properties Limited Partnership per the terms of the deed.

The map below shows the location of our major properties in Northern Appalachia:

6

Appalachia Basin—Central Appalachia

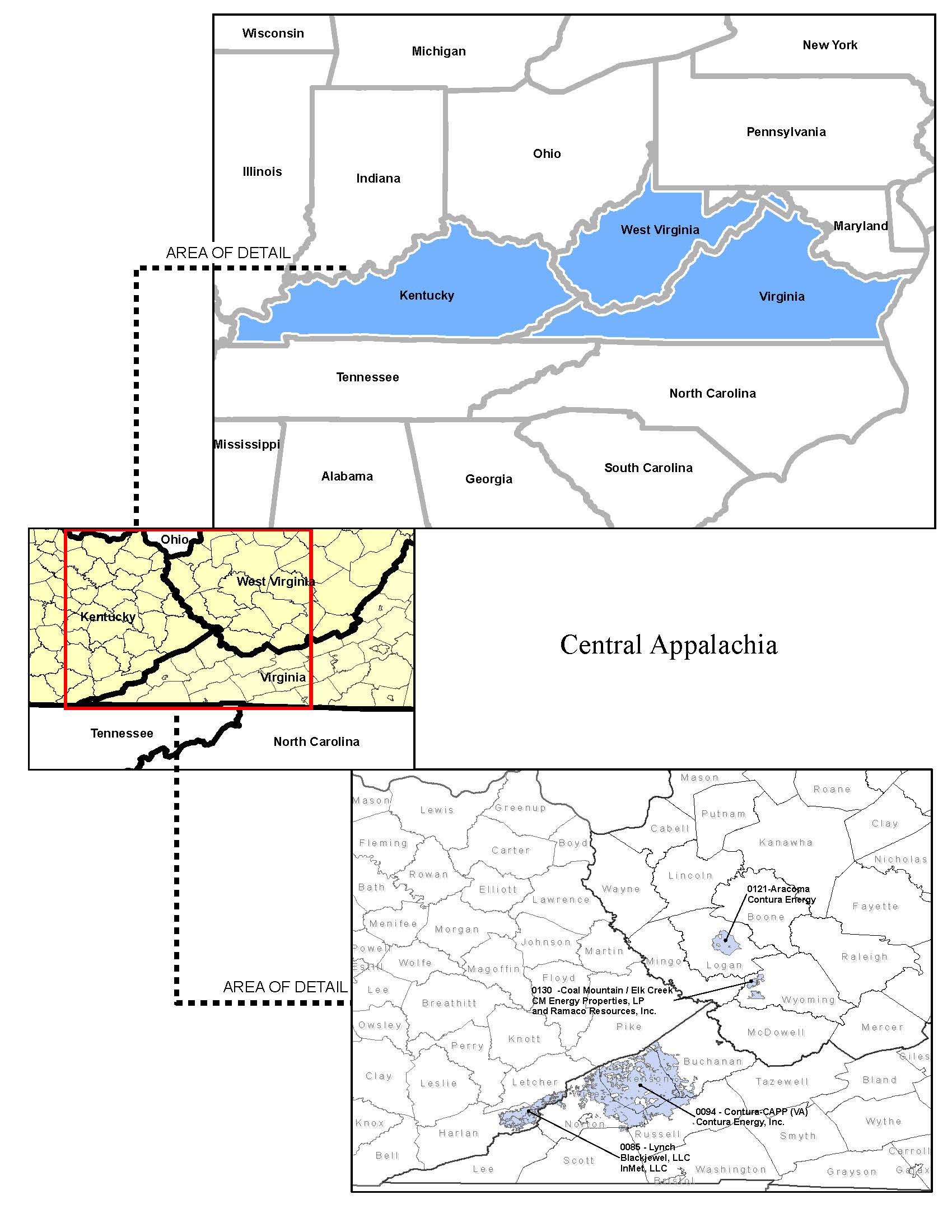

Contura-CAPP (VA). The Contura-CAPP (VA) property is located in Wise, Dickenson, Russell and Buchanan Counties, Virginia. In 2019, approximately 3.8 million tons were sold from this property, substantially all of which was metallurgical coal. We lease this property to subsidiaries of Contura Energy, Inc ("Contura Energy"). Production comes from underground room and pillar and surface mines and is trucked to one of two preparation plants. Coal is shipped via the CSX and Norfolk Southern railroads to utility and metallurgical customers.

Coal Mountain. The Coal Mountain property is located in Wyoming County, West Virginia. In 2019, approximately 1.3 million tons of metallurgical coal were sold from this property. We lease this property to CM Energy Properties, LP. Metallurgical coal is produced from a multi-seam surface mine and coal is transported by truck to a preparation plant on the property. Coal is shipped via the Norfolk Southern railroad to both domestic and export metallurgical customers.

Aracoma. The Aracoma property is located in Logan County, West Virginia. Approximately 1.2 million tons of coal, substantially all of which is metallurgical coal, were sold in 2019 from this property. We lease this property to a subsidiary of Contura Energy. Coal is produced from underground mines and transported by belt or truck to the preparation plant on the property. Coal is shipped via the CSX railroad to export metallurgical customers.

Elk Creek. The Elk Creek property is located in Logan and Wyoming Counties, West Virginia. In 2019, approximately 1.1 million tons were sold from this property. We lease this property to Ramaco Resources, Inc. Metallurgical coal is produced from surface and underground mines and is transported by belt and truck to a preparation plant on the property. Coal is shipped via the CSX railroad to both domestic and export metallurgical customers.

Lynch. The Lynch property is located in Harlan and Letcher Counties, Kentucky and Wise County, Virginia. In 2019, approximately 0.9 million tons were sold from this property. Blackjewel, LLC ("Blackjewel") operated this property until it filed for bankruptcy in the third quarter of 2019. InMet, LLC obtained lease rights to a substantial portion of this property through the Blackjewel bankruptcy process and is currently operating on this lease. Production comes from underground room and pillar and surface mines. This property has the ability to ship coal on the CSX and Norfolk Southern railroads to utility and metallurgical customers.

7

The map below shows the location of our major properties in Central Appalachia:

8

Appalachia Basin—Southern Appalachia

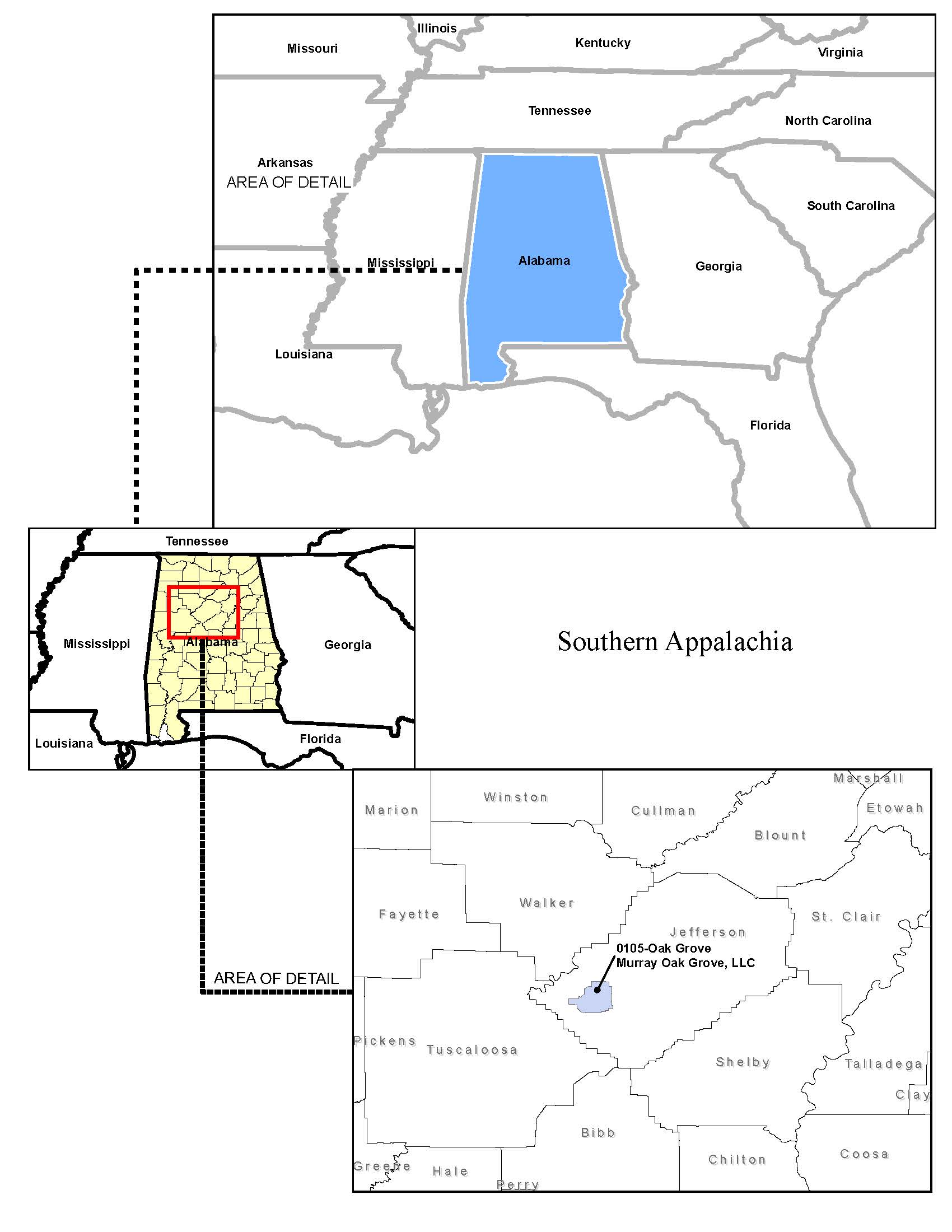

Oak Grove. The Oak Grove property is located in Jefferson County, Alabama. In 2019, approximately 1.2 million tons of metallurgical coal were sold from this property. We lease this property to Murray Metallurgical Coal Holdings, LLC ("Murray Metallurgical"). The lease was transferred to Murray Metallurgical in connection with Mission Coal LLC's bankruptcy proceedings. Production comes from a longwall mine and is transported by beltline to a preparation plant. Metallurgical products are then shipped via railroad and barge to both domestic and export customers. While the mine was temporarily idled during the last quarter of 2019 and Murray Metallurgical filed bankruptcy in the first quarter of 2020, the Oak Grove mine is expected to resume production in 2020.

The map below shows the location of our major property in Southern Appalachia:

9

Illinois Basin

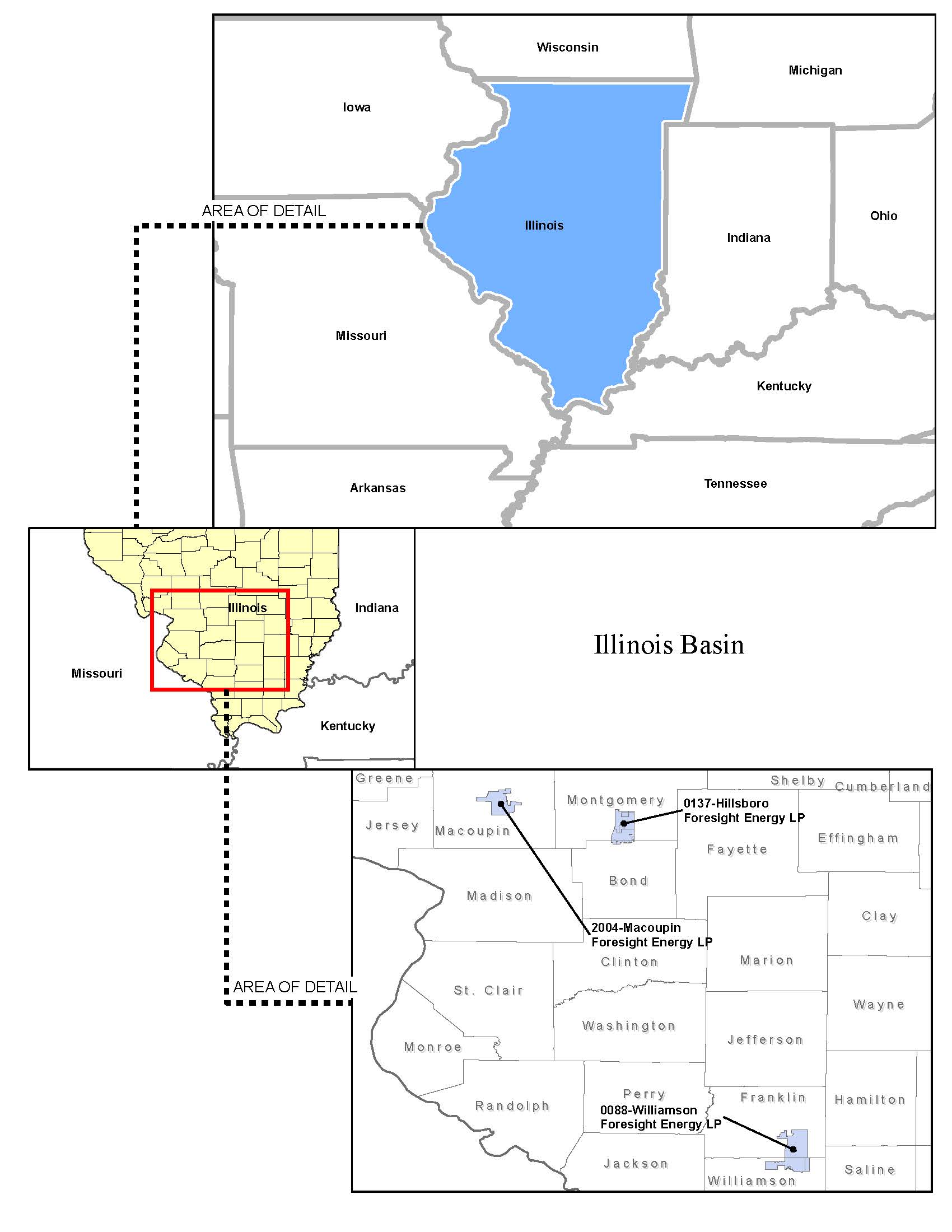

Macoupin. The Macoupin property is located in Macoupin County, Illinois. This property is under lease to Macoupin Energy, a subsidiary of Foresight Energy LP ("Foresight Energy"). In 2019, approximately 1.6 million tons of thermal coal were sold from this property. Production is from an underground room and pillar mine. Coal is shipped by the Norfolk Southern or Union Pacific railroads or by barge to domestic utility customers.

Williamson. The Williamson property is located in Franklin and Williamson Counties, Illinois. This property is under lease to Williamson Energy, a subsidiary of Foresight Energy. In 2019, approximately 0.3 million tons of thermal coal were sold from this property. Production comes from a longwall mine. Coal is shipped primarily via the Canadian National railroad to export customers. In 2019, we also received overriding royalties from approximately 5.5 million tons of coal sold from non-NRP property.

Hillsboro. The Hillsboro property is located in Montgomery and Bond Counties, Illinois. This property is under lease to Hillsboro Energy, a subsidiary of Foresight Energy. This property had been idled from March 2015 until production resumed in January 2019. In 2019, approximately 0.2 million tons of thermal coal were sold from this property. Production at the mine has historically come from longwall mining methods; however, 2019 production came from continuous mining methods for development of a longwall panel. Coal is shipped by rail via either the Union Pacific, Norfolk Southern or Canadian National railroads, or by barges to domestic utilities customers.

In addition to these properties, we own loadout and other transportation assets at the Williamson and Macoupin mines and at the Sugar Camp mine, which are also operated by Foresight Energy. See "—Coal Transportation and Processing Assets" below for additional information on these assets.

10

The map below shows the location of our major properties in the Illinois Basin:

11

Northern Powder River Basin

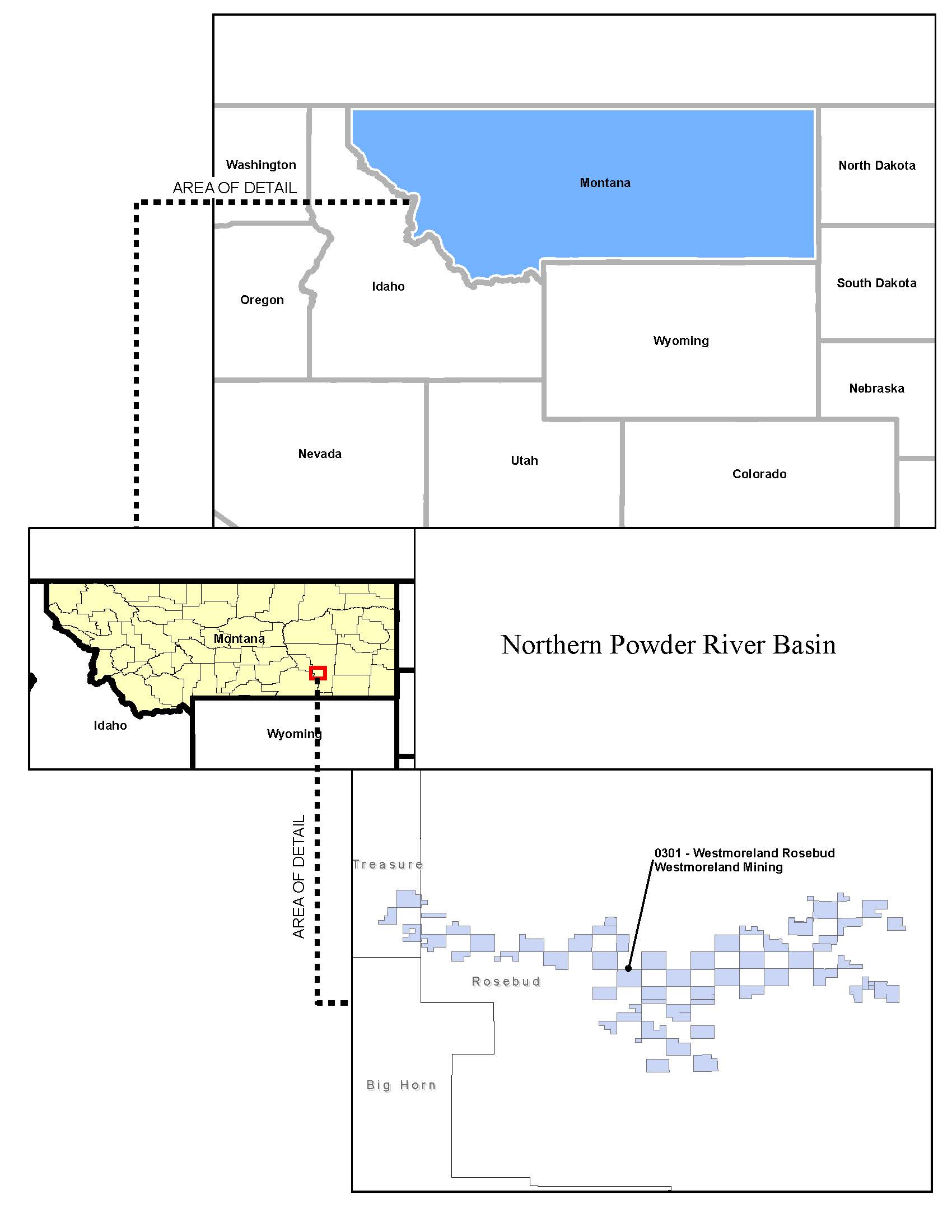

Western Energy. The Western Energy property is located in Rosebud and Treasure Counties, Montana. In 2019, approximately 3.0 million tons were sold from this property by a subsidiary of Rosebud Mining, LLC. Coal is produced by surface dragline mining methods. Coal is transported by either truck or beltline to the Colstrip generation station located at the mine mouth.

The map below shows the location of our property in the Northern Powder River Basin:

12

Coal Transportation and Processing Assets

We own transportation and processing infrastructure related to certain of our coal properties, including loadout and other transportation assets at Foresight Energy's Williamson and Macoupin mines in the Illinois Basin, for which we collect throughput fees or rents. We lease our Macoupin and Williamson transportation and processing infrastructure to subsidiaries of Foresight Energy and are responsible for operating and maintaining the transportation and processing assets at the Williamson mine that we subcontract to a subsidiary of Foresight Energy. In addition, we own rail loadout and associated infrastructure at the Sugar Camp mine, an Illinois Basin mine also operated by a subsidiary of Foresight Energy. While we own coal reserves at the Williamson and Macoupin mines, we do not own coal reserves at the Sugar Camp mine. The infrastructure at the Sugar Camp mine is leased to a subsidiary of Foresight Energy and we collect minimums and throughput fees. We recorded $19.3 million in revenue related to our coal transportation and processing assets during the year ended December 31, 2019.

Other Coal Royalty and Other Segment Assets

As of December 31, 2019, we owned an estimated 172 million tons of aggregates reserves primarily located in Kentucky and Indiana. We lease a portion of these reserves to third parties in exchange for royalty payments. The structure of these leases is similar to our coal leases, and these leases typically require minimum rental payments in addition to royalties. In addition, we hold overriding royalty interests in approximately 82 million tons of frac sand at operations in Wisconsin and Texas and sand and gravel reserves in Washington. During 2019, our lessees sold 4.5 million tons from these properties and we received $4.3 million in aggregates royalty revenues, including overriding royalty revenues.

Through our 51% ownership of BRP LLC ("BRP"), a joint venture with International Paper Company, we own approximately 10 million mineral acres in 31 states in the U.S. that include the following assets:

• | approximately 300,000 gross acres of oil and natural gas mineral rights primarily in Louisiana, of which over 53,000 acres were leased as of December 31, 2019; |

• | approximately 50 million tons of aggregates reserves primarily located in North Carolina, Arkansas and South Carolina and approximately 6 million tons of override royalty interest in South Carolina and Georgia; |

• | approximately 2 million tons of coal reserves (primarily lignite and some bituminous coal) on 95,000 net mineral acres of coal rights in the Gulf Coast region, of which approximately 5,600 acres are leased in Louisiana, Mississippi and Texas; |

• | an overriding royalty interest of 1% (net) on approximately 25,000 mineral acres in Louisiana; |

• | copper rights in Michigan's Upper Peninsula; and |

• | various other mineral rights including coalbed methane, metals, aggregates, water and geothermal, in several states throughout the United States. |

While the vast majority of the 10 million acres owned by BRP remain largely undeveloped, BRP has an ongoing program to identify additional opportunities to lease its minerals to operating parties or otherwise monetize these assets.

13

Soda Ash Segment

We own a 49% non-controlling equity interest in Ciner Wyoming. Ciner Resources LP, our operating partner, controls and operates Ciner Wyoming. Ciner Resources LP mines the trona, processes it into soda ash, and distributes the soda ash both domestically and internationally into the glass and chemicals industries. Ciner Resources LP is a publicly traded master limited partnership that depends on distributions from Ciner Wyoming in order to make distributions to its public unitholders.

Ciner Wyoming is one of the largest and lowest cost producers of soda ash in the world, serving a global market from its facility located in the Green River Basin of Wyoming. The Green River Basin geological formation holds the largest, and one of the highest purity, known deposits of trona ore in the world. Trona, a naturally occurring soft mineral, is also known as sodium sesquicarbonate and consists primarily of sodium carbonate, or soda ash, sodium bicarbonate and water. Ciner Wyoming processes trona ore into soda ash, which is an essential raw material in flat glass, container glass, detergents, chemicals, paper and other consumer and industrial products. The vast majority of the world’s accessible trona reserves are located in the Green River Basin. According to historical production statistics, approximately one-quarter of global soda ash is produced by processing trona, with the remainder being produced synthetically through chemical processes. The costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining trona for trona-based production. In addition, trona-based production consumes less energy and produces fewer undesirable by-products than synthetic production.

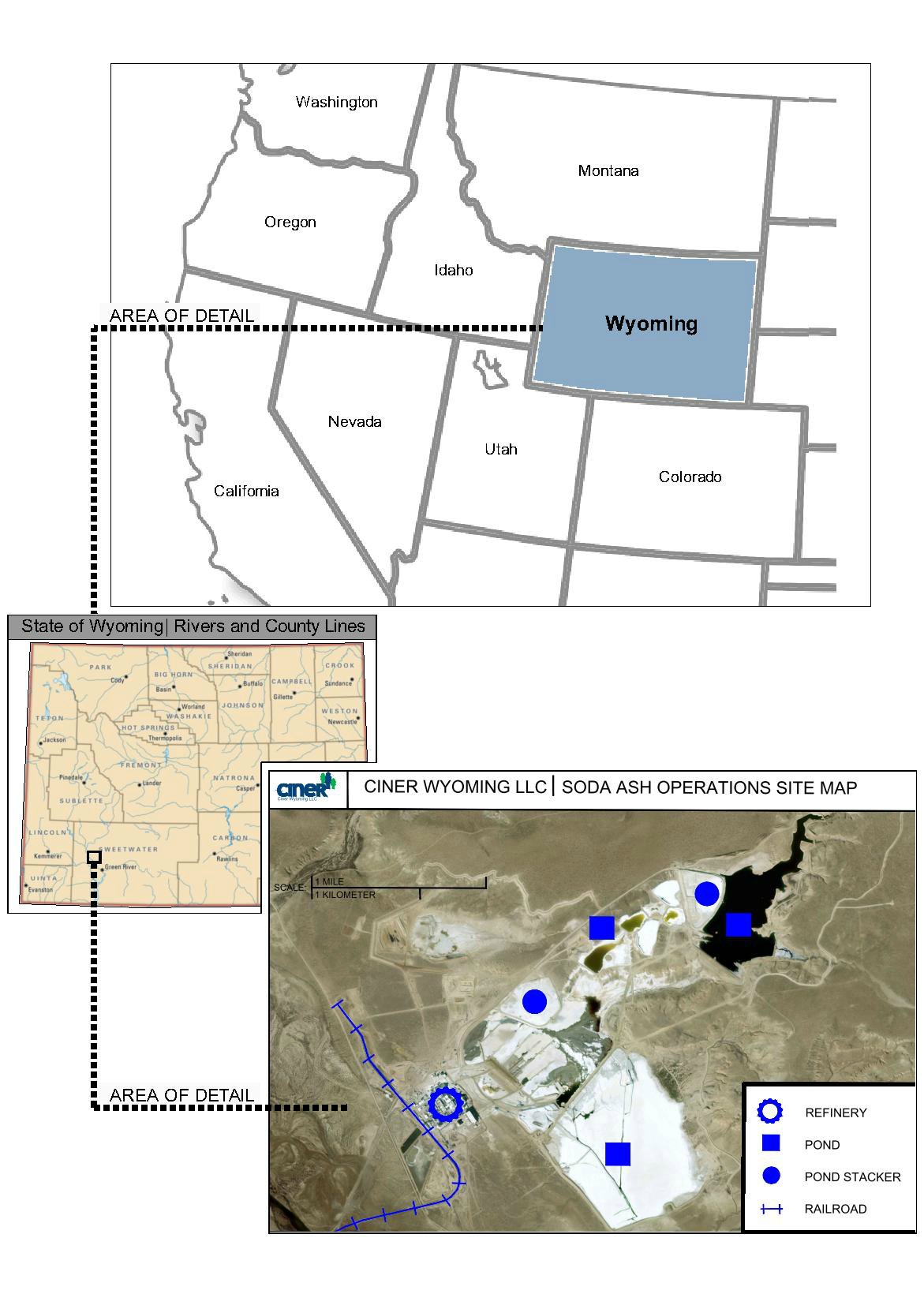

Ciner Wyoming’s Green River Basin surface operations are situated on approximately 880 acres in Wyoming, and its mining operations consist of approximately 23,500 acres of leased and licensed subsurface mining area. The facility is accessible by both road and rail. Ciner Wyoming uses seven large continuous mining machines and 14 underground shuttle cars in its mining operations. Its processing assets consist of material sizing units, conveyors, calciners, dissolver circuits, thickener tanks, drum filters, evaporators and rotary dryers.

14

The following map provides an aerial overview of Ciner Wyoming’s surface operations:

In trona ore processing, insoluble materials and other impurities are removed by thickening and filtering liquor, a solution consisting of sodium carbonate dissolved in water. Ciner Wyoming then adds activated carbon to filters to remove organic impurities, which can cause color contamination in the final product. The resulting clear liquid is then crystallized in evaporators, producing sodium carbonate monohydrate. The crystals are then drawn off and passed through a centrifuge to remove excess water. The resulting material is dried in a product dryer to form anhydrous sodium carbonate, or soda ash. The resulting processed soda ash is then stored in on-site storage silos to await shipment by bulk rail or truck to distributors and end customers. Ciner Wyoming’s storage silos can hold up to 65,000 short tons of processed soda ash at any given time. The facility is in good working condition and has been in service for 57 years.

15

Deca Rehydration. The evaporation stage of trona ore processing produces a precipitate and natural by-product called deca. "Deca," short for sodium carbonate decahydrate, is one part soda ash and ten parts water. Solar evaporation causes deca to crystallize and precipitate to the bottom of the four main surface ponds at the Green River Basin facility. The deca rehydration process enables Ciner Wyoming to recover soda ash from the deca-rich purged liquor as a by-product of the refining process. The soda ash contained in deca is captured by allowing the deca crystals to evaporate in the sun and separating the dehydrated crystals from the soda ash. The separated deca crystals are then blended with partially processed trona ore in the dissolving stage of the production process. This process enables Ciner Wyoming to reduce waste storage needs and convert what is typically a waste product into a usable raw material. Ciner Wyoming anticipates that its current deca stockpiles will be exhausted by 2023 and production rates decline approximately 200,000 short tons per year if that production is not replaced.

Shipping and Logistics. All of the soda ash produced is shipped by rail or truck from the Green River Basin facility. For the year ended December 31, 2019, Ciner Wyoming shipped approximately 96.9% of its soda ash to its customers initially via a single rail line owned and controlled by Union Pacific Railroad Company (“Union Pacific”). The Ciner Wyoming plant receives rail service exclusively from Union Pacific. The agreement with Union Pacific expires on December 31, 2021 and there can be no assurance that it will be renewed on terms favorable to Ciner Wyoming or at all. The rail freight rate charged under the agreement increases annually based on a published index tied to certain rail industry metrics. Ciner Resources Corporation leases a fleet of more than 2,000 hopper cars that serve as dedicated modes of shipment to its domestic customers. For export, Ciner Wyoming ships soda ash on unit trains consisting of approximately 100 cars to two primary ports located in Texas and Oregon. From these ports, the soda ash is loaded onto ships for delivery to ports all over the world. American Natural Soda Ash Corporation ("ANSAC") currently provides logistics and support services for all of Ciner Wyoming’s export sales. For domestic sales, Ciner Resources Corporation provides similar services.

Customers. Ciner Wyoming’s customers, including end users to whom ANSAC makes sales overseas, consist primarily of glass manufacturing companies, which account for 50% or more of the consumption of soda ash around the world; and chemical and detergent manufacturing companies. Ciner Wyoming’s largest customer currently is ANSAC, which buys soda ash (through Ciner Resources Corporation, which serves as Ciner Wyoming’s sales agent in its agreement with ANSAC) and other of its member companies for export to its customers. ANSAC accounted for approximately 60% of Ciner Wyoming’s net sales in 2019. ANSAC takes soda ash orders directly from its overseas customers and then purchases soda ash for resale from its member companies pro rata based on each member’s production volumes. ANSAC is the exclusive distributor for its members to the markets it serves. However, Ciner Resources Corporation, on Ciner Wyoming’s behalf, negotiates directly with, and Ciner Wyoming exports to, customers in markets not served by ANSAC.

In November 2018, Ciner Resources Corporation delivered a notice to terminate the membership in ANSAC, which will be effective as of December 31, 2021. Until the effective termination date, ANSAC will continue to sell Ciner Wyoming’s soda ash to ANSAC-designated overseas territories and continue to provide logistics and support services for Ciner Wyoming’s other export sales. After the termination period, Ciner Resources Corporation will begin marketing soda ash directly into international markets which are currently being served by ANSAC, and Ciner Wyoming intends to utilize the distribution network that has already been established by the global Ciner Group. The ANSAC agreement provides that in the event an ANSAC member exits or the ANSAC cooperative is dissolved, the exiting members are obligated for their respective portion of the residual net assets or deficit of the cooperative. The withdrawal from ANSAC is expected to enable Ciner Wyoming to combine volumes with Ciner Group’s soda ash exports from Turkey and therefore to leverage the larger, global Ciner Group’s soda ash operations. Ciner Wyoming believes this will eventually lower its cost position and improve its ability to optimize its market share both domestically and internationally. However, initial costs may be higher than costs incurred through ANSAC sales. In addition, Ciner Wyoming will need access to an international logistic infrastructure that includes, among other things, a domestic port for export capabilities. These export capabilities are currently being developed by Ciner Group, and options being evaluated range from continued outsourcing in the near term to developing Ciner Group’s own port capabilities in the longer term. Ciner Wyoming expects to bear a portion of these development costs. See "Item 1A—Risk Factors—Risks Related to Our Business—A significant portion of Ciner Wyoming’s historical international sales of soda ash have been to ANSAC, and the termination of the ANSAC membership could adversely affect Ciner Wyoming’s ability to compete in certain international markets and increase Ciner Wyoming’s international sales costs."

For customers in North America, Ciner Resources typically enters into contracts on Ciner Wyoming’s behalf with terms ranging from one to three years. Under these contracts, customers generally agree to purchase either minimum estimated volumes of soda ash or a certain percentage of their soda ash requirements at a fixed price for a given calendar year. Although Ciner Wyoming does not have a “take or pay” arrangements with its customers, substantially all sales are made pursuant to written agreements and

16

not through spot sales. In 2019, Ciner Wyoming had more than 70 domestic customers and has had long-term relationships with the majority of its customers.

Leases and License. Ciner Wyoming is party to several mining leases and one license for its subsurface mining rights. Some of the leases are renewable at Ciner Wyoming’s option upon expiration. Ciner Wyoming pays royalties to the State of Wyoming, the U.S. Bureau of Land Management and Rock Springs Royalty Company, an affiliate of Occidental Petroleum Corporation (formerly an affiliate of Anadarko Petroleum Corporation), which are calculated based upon a percentage of the value of soda ash and related products sold at a certain stage in the mining process. These royalty payments may be subject to a minimum domestic production volume from the Green River Basin facility. Ciner Wyoming is also obligated to pay annual rentals to its lessors and licensor regardless of actual sales. In addition, Ciner Wyoming pays a production tax to Sweetwater County, and trona severance tax to the State of Wyoming that is calculated based on a formula that utilizes the volume of trona ore mined and the value of the soda ash produced.

Expansion Project. Ciner Wyoming has announced a significant capacity expansion capital project that would increase production levels to up to 3.5 million tons of soda ash per year. Ciner Wyoming has conducted the initial basic design and is currently evaluating and pursuing the related permits and detailed cost analysis pursuant to the basic design. This project will require capital expenditures materially higher than have been incurred by Ciner Wyoming over the past few years, and Ciner Wyoming intends to fund the project in part by reinvesting cash that would otherwise be distributed to its partners. In the third quarter of 2019, Ciner Wyoming significantly reduced its cash distributions to its partners, and we expect for cash distributions from Ciner Wyoming to remain at approximately $25 million to $28 million per year until the project is funded. However, the costs of the expansion project could be higher than expected, or the execution of the project could be substantially delayed, which could materially impact Ciner Wyoming’s profitability and result in a further reduction of cash distributions to us. See "Item 1A—Risk Factors—Risks Related to Our Business—Significant delays and/or higher than expected costs associated with Ciner Wyoming’s capacity expansion project could adversely affect Ciner Wyoming’s profitability and ability to make distributions to us."

As a minority interest owner in Ciner Wyoming, we do not operate and are not involved in the day-to-day operation of the trona ore mine or soda ash production plant. Our partner, Ciner Resources LP, manages the mining and plant operations. We appoint three of the seven members of the Board of Managers of Ciner Wyoming and have certain limited negative controls relating to the company.

Significant Customers

We have a significant concentration of revenues with Foresight Energy and its subsidiaries, with total revenues of $58.9 million in 2019 from four different mining operations, including transportation and processing services revenues, coal overriding royalty revenues and wheelage revenues. We also have a significant concentration of revenues from Contura Energy, with total revenues of $40.7 million in 2019 from several different mining operations, including wheelage revenues. For additional information on significant customers, refer to "Item 8. Financial Statements and Supplementary Data—Note 15. Major Customers."

Competition

We face competition from land companies, coal producers, international steel companies and private equity firms in purchasing coal reserves and royalty producing properties. Numerous producers in the coal industry make coal marketing intensely competitive. Our lessees compete among themselves and with coal producers in various regions of the United States for domestic sales. Lessees compete with both large and small producers nationwide on the basis of coal price at the mine, coal quality, transportation cost from the mine to the customer and the reliability of supply. Continued demand for our coal and the prices that our lessees obtain are also affected by demand for electricity and steel, as well as government regulations, technological developments and the availability and the cost of generating power from alternative fuel sources, including nuclear, natural gas, wind, solar and hydroelectric power.

17

Ciner Wyoming's trona mining and soda ash refinery business faces competition from a number of soda ash producers in the United States, Europe and Asia, some of which have greater market share and greater financial, production and other resources than Ciner Wyoming does. Some of Ciner Wyoming’s competitors are diversified global corporations that have many lines of business and some have greater capital resources and may be in a better position to withstand a long-term deterioration in the soda ash market. Other competitors, even if smaller in size, may have greater experience and stronger relationships in their local markets. Competitive pressures could make it more difficult for Ciner Wyoming to retain its existing customers and attract new customers, and could also intensify the negative impact of factors that decrease demand for soda ash in the markets it serves, such as adverse economic conditions, weather, higher fuel costs and taxes or other governmental or regulatory actions that directly or indirectly increase the cost or limit the use of soda ash.

Title to Property

We owned substantially all of our coal and aggregates reserves in fee as of December 31, 2019. We lease the remainder from unaffiliated third parties. Ciner Wyoming leases or licenses its trona reserves. We believe that we have satisfactory title to all of our mineral properties, but we have not had a qualified title company confirm this belief. Although title to these properties is subject to encumbrances in certain cases, such as customary easements, rights-of-way, interests generally retained in connection with the acquisition of real property, licenses, prior reservations, leases, liens, restrictions and other encumbrances, we believe that none of these burdens will materially detract from the value of our properties or from our interest in them or will materially interfere with their use in the operation of our business.

For most of our properties, the surface, oil and gas and mineral or coal estates are not owned by the same entities. Some of those entities are our affiliates. State law and regulations in most of the states where we do business require the oil and gas owner to coordinate the location of wells so as to minimize the impact on the intervening coal seams. We do not anticipate that the existence of the severed estates will materially impede development of the minerals on our properties.

Regulation and Environmental Matters

General

Operations on our properties must be conducted in compliance with all applicable federal, state and local laws and regulations. These laws and regulations include matters involving the discharge of materials into the environment, employee health and safety, mine permits and other licensing requirements, reclamation and restoration of mining properties after mining is completed, management of materials generated by mining operations, surface subsidence from underground mining, water pollution, legislatively mandated benefits for current and retired coal miners, air quality standards, protection of wetlands, plant and wildlife protection, limitations on land use, storage of petroleum products and substances which are regarded as hazardous under applicable laws and management of electrical equipment containing polychlorinated biphenyls ("PCBs"). Because of extensive, comprehensive and often ambiguous regulatory requirements, violations during natural resource extraction operations are not unusual and, notwithstanding compliance efforts, we do not believe violations can be eliminated entirely.

While it is not possible to quantify the costs of compliance with all applicable federal, state and local laws and regulations, those costs have been and are expected to continue to be significant. Our lessees in our coal and aggregates royalty businesses are required to post performance bonds pursuant to federal and state mining laws and regulations for the estimated costs of reclamation and mine closures, including the cost of treating mine water discharge when necessary. In many states our lessees also pay taxes into reclamation funds that states use to achieve reclamation where site specific performance bonds are inadequate to do so. Determinations by federal or state agencies that site specific bonds or state reclamation funds are inadequate could result in increased bonding costs for our lessees or even a cessation of operations if adequate levels of bonding cannot be maintained. We do not accrue for reclamation costs because our lessees are both contractually liable and liable under the permits they hold for all costs relating to their mining operations, including the costs of reclamation and mine closures. Although the lessees typically accrue adequate amounts for these costs, their future operating results would be adversely affected if they later determined these accruals to be insufficient. In recent years, compliance with these laws and regulations has substantially increased the cost of coal mining for all domestic coal producers.

18

In addition, the electric utility industry, which is the most significant end-user of thermal coal, is subject to extensive regulation regarding the environmental impact of its power generation activities, which has affected and is expected to continue to affect demand for coal mined from our properties. Current and future proposed legislation and regulations could be adopted that will have a significant additional impact on the mining operations of our lessees or their customers’ ability to use coal and may require our lessees or their customers to change operations significantly or incur additional substantial costs that would negatively impact the coal industry.

Many of the statutes discussed below also apply to Ciner Wyoming’s trona mining and soda ash production operations, and therefore we do not present a separate discussion of statutes related to those activities, except where appropriate.

Air Emissions

The Clean Air Act and corresponding state and local laws and regulations affect all aspects of our business. The Clean Air Act directly impacts our lessees’ coal mining and processing operations by imposing permitting requirements and, in some cases, requirements to install certain emissions control equipment, on sources that emit various hazardous and non-hazardous air pollutants. The Clean Air Act also indirectly affects coal mining operations by extensively regulating the air emissions of coal-fired electric power generating plants. There have been a series of federal rulemakings that are focused on emissions from coal-fired electric generating facilities, including the Cross-State Air Pollution Rule ("CSAPR"), regulating emissions of nitrogen oxide and sulfur dioxide, and the Mercury and Air Toxics Rule ("MATS"), regulating emissions of hazardous air pollutants. Installation of additional emissions control technologies and other measures required under these and other U.S. Environmental Protection Agency ("EPA") regulations make it more costly to operate coal-fired power plants and could make coal a less attractive or even effectively prohibited fuel source in the planning, building and operation of power plants in the future. These rules and regulations have resulted in a reduction in coal’s share of power generating capacity, which has negatively impacted our lessees’ ability to sell coal and our coal-related revenues. Further reductions in coal’s share of power generating capacity as a result of compliance with existing or proposed rules and regulations would have a material adverse effect on our coal-related revenues.

Carbon Dioxide and Greenhouse Gas ("GHG") Emissions

In December 2009, EPA determined that emissions of carbon dioxide, methane, and other GHGs present an endangerment to public health and welfare because emissions of such gases are, according to EPA, contributing to warming of the Earth’s atmosphere and other climatic changes. Based on its findings, EPA began adopting and implementing regulations to restrict emissions of GHGs under various provisions of the Clean Air Act.

In August 2015, EPA published its final Clean Power Plan ("CPP") Rule, a multi-factor plan designed to cut carbon pollution from existing power plants, including coal-fired power plants. The rule required improving the heat rate of existing coal-fired power plants and substituting lower carbon-emission sources like natural gas and renewables in place of coal. As promulgated, the rule would force many existing coal-fired power plants to incur substantial costs in order to comply or alternatively result in the closure of some of these plants, likely resulting in a material adverse effect on the demand for coal by electric power generators. The rule was being challenged by several states, industry participants and other parties in the United States Court of Appeals for the District of Columbia Circuit. In February 2016, the Supreme Court of the United States stayed the CPP Rule pending a decision by the District of Columbia Circuit as well as any subsequent review by the Supreme Court. In April 2017, the United States Court of Appeals for the District of Columbia Circuit granted EPA’s motion to hold the litigation in abeyance. In December 2017, EPA issued a proposed rule repealing the CPP Rule and issued an Advance Notice of Proposed Rulemaking soliciting information regarding a potential replacement rule to the CPP Rule. In August 2018, EPA formally proposed the Affordable Clean Energy ("ACE") Rule, which would replace the CPP Rule. The ACE Rule contemplates a narrower approach than the CPP Rule, focusing on efficiency improvements at existing power plants and eliminating the CPP Rule’s broader goals that envisioned switches to non-fossil fuel energy sources and the implementation of efficiency measures on demand-side entities, which the EPA now considers beyond the reach of its authority under the Clean Air Act. The ACE Rule would also omit specific numerical emissions targets that had been established under the CPP Rule. The ACE Rule went into effect on September 6, 2019. As a result, the United States Court of Appeals for the District of Columbia Circuit dismissed the pending challenges to the CPP Rule as moot. The ACE Rule has been challenged by public health groups, environmental groups, and a coalition of twenty-two states and six municipalities; various industry groups and power providers have sought to intervene.

19

In October 2015, EPA published its final rule on performance standards for greenhouse gas emissions from new, modified, and reconstructed electric generating units. The final rule requires new steam generating units to use highly efficient supercritical pulverized coal boilers that use partial post-combustion carbon capture and storage technology. The final emission standard is less stringent than EPA had originally proposed due to updated cost assumptions, but could still have a material adverse effect on new coal-fired power plants. The final rule has been challenged by several states, industry participants and other parties in the United States Court of Appeals for the District of Columbia Circuit, but is not subject to a stay. In April 2017, the court granted EPA’s motion to hold the litigation in abeyance while EPA reviews the rule.

President Obama also announced an emission reduction agreement with China’s President Xi Jinping in November 2014. The United States pledged that by 2025 it would cut climate pollution by 26% to 28% from 2005 levels. China pledged it would reach its peak carbon dioxide emissions around 2030 or earlier, and increase its non-fossil fuel share of energy to around 20% by 2030. In December 2015, the United States was one of 196 countries that participated in the Paris Climate Conference, at which the participants agreed to limit their emissions in order to limit global warming to 2°C above pre-industrial levels, with an aspirational goal of 1.5°C. While there is no way to estimate the impact of these climate pledges and agreements, they could ultimately have an adverse effect on the demand for coal, both nationally and internationally, if implemented. In 2019, President Trump withdrew from the Paris Climate Agreement.

Hazardous Materials and Waste

The Federal Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA" or the Superfund law) and analogous state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. We could become liable under federal and state Superfund and waste management statutes if our lessees are unable to pay environmental cleanup costs relating to hazardous substances. In addition, we may have liability for environmental clean-up costs in connection with Ciner Wyoming's soda ash businesses.

Water Discharges

Operations conducted on our properties can result in discharges of pollutants into waters. The Clean Water Act and analogous state laws and regulations create two permitting programs for mining operations. The National Pollutant Discharge Elimination System (NPDES) program under Section 402 of the statute is administered by the states or EPA and regulates the concentrations of pollutants in discharges of waste and storm water from a mine site. The Section 404 program is administered by the Army Corps of Engineers and regulates the placement of overburden and fill material into channels, streams and wetlands that comprise “waters of the United States.” The scope of waters that may fall within the jurisdictional reach of the Clean Water Act is expansive and may include land features not commonly understood to be a stream or wetlands. The Clean Water Act and its regulations prohibit the unpermitted discharge of pollutants into such waters, including those from a spill or leak. Similarly, Section 404 also prohibits discharges of fill material and certain other activities in waters unless authorized by the issued permit. In June 2015, EPA issued a new rule defining the scope of “Waters of the United States” (WOTUS) that are subject to regulation. The 2015 WOTUS rule was challenged by a number of states and private parties in federal district and circuit courts. In December 2017, EPA and the Corps proposed a rule to repeal the 2015 WOTUS rule and implement the pre-2015 definition. The repeal of the 2015 WOTUS rule took effect in December 2019. In December 2018, EPA and the Corps issued a proposed rule again revising the definition of “Waters of the United States.” In January 2020, EPA and the Corps announced that the 2018 proposed rule was final. The repeal of the 2015 WOTUS rule and implementation of the pre-2015 rule have been challenged in federal courts, and the 2020 final WOTUS rule will likely be challenged as well.

In connection with its review of permits, EPA has at times sought to reduce the size of fills and to impose limits on specific conductance (conductivity) and sulfate at levels that can be unachievable absent treatment at many mines. Such actions by EPA could make it more difficult or expensive to obtain or comply with such permits, which could, in turn, have an adverse effect on our coal-related revenues.

20

In addition to government action, private citizens’ groups have continued to be active in bringing lawsuits against operators and landowners. Since 2012, several citizen group lawsuits have been filed against mine operators for allegedly violating conditions in their National Pollutant Discharge Elimination System (“NPDES”) permits requiring compliance with West Virginia’s water quality standards. Some of the lawsuits alleged violations of water quality standards for selenium, whereas others alleged that discharges of conductivity and sulfate were causing violations of West Virginia’s narrative water quality standards, which generally prohibit adverse effects to aquatic life. The citizen suit groups have sought penalties as well as injunctive relief that would limit future discharges of selenium, conductivity or sulfate. The federal district court for the Southern District of West Virginia has ruled in favor of the citizen suit groups in multiple suits alleging violations of the water quality standard for selenium and in two suits alleging violations of water quality standards due to discharges of conductivity (one of which was upheld on appeal by the United States Court of Appeals for the Fourth Circuit in January 2017). Additional rulings requiring operators to reduce their discharges of selenium, conductivity or sulfate could result in large treatment expenses for our lessees. In 2015, the West Virginia Legislature enacted certain changes to West Virginia’s NPDES program to expressly prohibit the direct enforcement of water quality standards against permit holders. EPA approved those changes as a program revision effective March 27, 2019. This approval may prevent future citizen suits alleging violations of water quality standards.

Since 2013, several citizen group lawsuits have been filed against landowners alleging ongoing discharges of pollutants, including selenium and conductivity, from valley fills located at reclaimed mountaintop removal mining sites in West Virginia. In each case, the mine on the subject property has been closed, the property has been reclaimed, and the state reclamation bond has been released. Any determination that a landowner or lessee has liability for discharges from a previously reclaimed mine site could result in substantial compliance costs or fines and would result in uncertainty as to continuing liability for completed and reclaimed coal mine operations.

Other Regulations Affecting the Mining Industry

Mine Health and Safety Laws

The operations of our coal lessees and Ciner Wyoming are subject to stringent health and safety standards that have been imposed by federal legislation since the adoption of the Mine Health and Safety Act of 1969. The Mine Health and Safety Act of 1969 resulted in increased operating costs and reduced productivity. The Mine Safety and Health Act of 1977, which significantly expanded the enforcement of health and safety standards of the Mine Health and Safety Act of 1969, imposes comprehensive health and safety standards on all mining operations. In addition, the Black Lung Acts require payments of benefits by all businesses conducting current mining operations to coal miners with black lung or pneumoconiosis and to some beneficiaries of miners who have died from this disease.

Mining accidents in recent years have received national attention and instigated responses at the state and national level that have resulted in increased scrutiny of current safety practices and procedures at all mining operations, particularly underground mining operations. Since 2006, heightened scrutiny has been applied to the safe operations of both underground and surface mines. This increased level of review has resulted in an increase in the civil penalties that mine operators have been assessed for non-compliance. Operating companies and their supervisory employees have also been subject to criminal convictions. The Mine Safety and Health Administration ("MSHA") has also advised mine operators that it will be more aggressive in placing mines in the Pattern of Violations program, if a mine’s rate of injuries or significant and substantial citations exceed a certain threshold. A mine that is placed in a Pattern of Violations program will receive additional scrutiny from MSHA.

Surface Mining Control and Reclamation Act of 1977

The Surface Mining Control and Reclamation Act of 1977 ("SMCRA") and similar statutes enacted and enforced by the states impose on mine operators the responsibility of reclaiming the land and compensating the landowner for types of damages occurring as a result of mining operations. To ensure compliance with any reclamation obligations, mine operators are required to post performance bonds. Our coal lessees are contractually obligated under the terms of our leases to comply with all federal, state and local laws, including SMCRA. Upon completion of the mining, reclamation generally is completed by seeding with grasses or planting trees for use as pasture or timberland, as specified in the reclamation plan approved by the state regulatory authority. In addition, higher and better uses of the reclaimed property are encouraged.

21

Mining Permits and Approvals

Numerous governmental permits or approvals such as those required by SMCRA and the Clean Water Act are required for mining operations. In connection with obtaining these permits and approvals, our lessees may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed production of coal may have upon the environment. The requirements imposed by any of these authorities may be costly and time consuming and may delay commencement or continuation of mining operations.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators, including our lessees, must submit a reclamation plan for reclaiming the mined property upon the completion of mining operations. Our lessees have obtained or applied for permits to mine a majority of the reserves that are currently planned to be mined over the next five years. Our lessees are also in the planning phase for obtaining permits for the additional reserves planned to be mined over the following five years. However, given the imposition of new requirements in the permits in the form of policies and the increased oversight review that has been exercised by EPA, there are no assurances that they will not experience difficulty and delays in obtaining mining permits in the future. In addition, EPA has used its authority to create significant delays in the issuance of new permits and the modification of existing permits, which has led to substantial delays and increased costs for coal operators.

Employees and Labor Relations

As of December 31, 2019, affiliates of our general partner employed 56 people who directly supported our operations. None of these employees were subject to a collective bargaining agreement.

Website Access to Partnership Reports

Our Internet address is www.nrplp.com. We make available free of charge on or through our Internet website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. Information on our website is not a part of this report. In addition, the SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information filed by us.

Corporate Governance Matters

Our Code of Business Conduct and Ethics, our Disclosure Controls and Procedures Policy and our Corporate Governance Guidelines adopted by our Board of Directors, as well as the charter for our Audit Committee are available on our website at www.nrplp.com. Copies of our annual report, our Code of Business Conduct and Ethics, our Disclosure Controls and Procedures Policy, our Corporate Governance Guidelines and our committee charters will be made available upon written request to our principal executive office at 1201 Louisiana St., Suite 3400, Houston, Texas 77002.

22

ITEM 1A. RISK FACTORS

Risks Related to Our Business

Cash distributions are not guaranteed and may fluctuate with our performance and the establishment of financial reserves. In addition, our debt agreements and our partnership agreement place restrictions on our ability to pay, and in some cases raise, the quarterly distribution under certain circumstances.

Because distributions on the common units are dependent on the amount of cash we generate, distributions fluctuate based on our performance. The actual amount of cash that is available to be distributed each quarter depends on numerous factors, some of which are beyond our control and the control of the general partner. Cash distributions are dependent primarily on cash flow, and not solely on profitability, which is affected by non-cash items. Therefore, cash distributions might be made during periods when we record losses and might not be made during periods when we record profits. The actual amount of cash we have to distribute each quarter is reduced by payments in respect of debt service and other contractual obligations, including distributions on the preferred units, fixed charges, maintenance capital expenditures and reserves for future operating or capital needs that the board of directors may determine are appropriate. We have significant debt service obligations and obligations to pay cash distributions on our preferred units. To the extent our board of directors deems appropriate, it may determine to decrease the amount of the quarterly distribution on our common units or suspend or eliminate the distribution on our common units altogether. In addition, because our unitholders are required to pay income taxes on their respective shares of our taxable income, our unitholders may be required to pay taxes in excess of any future distributions we make. Our unitholders' share of our portfolio income may be taxable to them even though they receive other losses from our activities. See "—Tax Risks to Our Unitholders—Our unitholders are required to pay taxes on their share of our income even if they do not receive any cash distributions from us. Our unitholders' share of our portfolio income may be taxable to them even though they receive other losses from our activities."

The agreements governing our indebtedness and preferred units restrict our ability to raise, and in some cases continue to pay, distributions on our common units. Opco’s revolving credit agreement, the indenture governing our 2025 Senior Notes and our partnership agreement each require that we meet certain consolidated leverage tests in order to raise our quarterly distribution on the common units above the current level of $0.45 per quarter. The maximum leverage covenant under Opco’s revolving credit facility will step down permanently from 4.0x to 3.0x if we increase the common unit distribution above the current level of $0.45 per common unit per quarter. In addition, under our partnership agreement, to the extent we have paid any distributions on the preferred units in kind ("PIK units") and such PIK units are still outstanding at any time after January 1, 2022, we will be prohibited from making any distributions with respect to our common units until we have redeemed all such PIK units in cash. For more information on restrictions on our ability to make distributions on our common units, see "Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" and "Item 8. Financial Statements and Supplementary Data—Note 12. Debt, Net."

Our leverage and debt service obligations may adversely affect our financial condition, results of operations and business prospects.

As of December 31, 2019, we and our subsidiaries had approximately $524.1 million of total indebtedness. The terms and conditions governing the indenture for NRP’s 2025 Senior Notes and Opco’s revolving credit facility and senior notes:

• | require us to meet certain leverage and interest coverage ratios; |

• | require us to dedicate a substantial portion of our cash flow from operations to service our existing debt, thereby reducing the cash available to finance our operations and other business activities and could limit our flexibility in planning for or reacting to changes in our business and the industries in which we operate; |

• | increase our vulnerability to economic downturns and adverse developments in our business; |

• | limit our ability to access the bank and capital markets to raise capital on favorable terms or to obtain additional financing for working capital, capital expenditures or acquisitions or to refinance existing indebtedness; |

• | place restrictions on our ability to obtain additional financing, make investments, lease equipment, sell assets and engage in business combinations; |

23

• | place us at a competitive disadvantage relative to competitors with lower levels of indebtedness in relation to their overall size or less restrictive terms governing their indebtedness; |

• | make it more difficult for us to satisfy our obligations under our debt agreements and increase the risk that we may default on our debt obligations; and |

• | limit management’s discretion in operating our business. |

Our ability to meet our expenses and debt obligations will depend on our future performance, which will be affected by financial, business, economic, regulatory and other factors. We will not be able to control many of these factors, such as economic conditions and governmental regulation. We cannot be certain that our cash flow will be sufficient to allow us to pay the principal and interest on our debt and meet our other obligations, including payment of distributions on the preferred units. If we do not have sufficient funds, we may be required to refinance all or part of our existing debt, borrow more money, or sell assets or raise equity at unattractive prices, including higher interest rates. We are required to make substantial principal repayments each year in connection with Opco’s senior notes, with approximately $46 million due thereunder during 2020. To the extent we borrow to make some of these payments, we may not be able to refinance these amounts on terms acceptable to us, if at all. We may not be able to refinance our debt, sell assets, borrow more money or access the bank and capital markets on terms acceptable to us, if at all. Our ability to comply with the financial and other restrictive covenants in our debt agreements will be affected by the levels of cash flow from our operations and future events and circumstances beyond our control. Failure to comply with these covenants would result in an event of default under our indebtedness, and such an event of default could adversely affect our business, financial condition and results of operations.

In July 2017, the U.K. Financial Conduct Authority announced that it intends to stop persuading or compelling banks to submit LIBOR rates after 2021. Opco’s revolving credit facility includes provisions to determine a replacement rate for LIBOR if necessary during its term, which provide that we will adopt a replacement rate that is broadly accepted by the syndicated loan market. We currently do not expect the transition from LIBOR to have a material impact on us. However, if clear market standards and replacement methodologies have not developed as of the time LIBOR becomes unavailable, we may have difficulty establishing a replacement rate under Opco’s revolving credit facility. In the event that we do not determine a replacement rate for LIBOR, in certain circumstances, Eurodollar Loans under Opco’s revolving credit facility may be suspended and converted to ABR Loans, which could bear higher interest rates. If we are unable to negotiate replacement rates on favorable terms, it could adversely affect our business, financial condition and results of operations. For a description of the interest rate on borrowings under Opco’s revolving credit facility, see “Item 8. Financial Statements and Supplementary Data—Note 12. Debt, Net.”

Prices for both metallurgical and thermal coal are volatile and depend on a number of factors beyond our control. Declines in prices could have a material adverse effect on our business and results of operations.

Coal prices continue to be volatile and prices could decline substantially from current levels. Production by some of our lessees may not be economic if prices decline further or remain at current levels. The prices our lessees receive for their coal depend upon factors beyond their or our control, including:

• | the supply of and demand for domestic and foreign coal; |

• | domestic and foreign governmental regulations and taxes; |