Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CURO Group Holdings Corp. | feb2020creditsuisseconfe.htm |

February 2020 Credit Suisse Annual Financial Services Forum

Disclaimer IMPORTANT: You must read the following information before continuing to the rest of the presentation, which is being provided to you for informational purposes only. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements include statements related to our belief in market trends and outlook; our fiscal 2020 outlook, reconciliations to that outlook and its drivers; and our expectation that, following adoption of ASU No 2016-02, Leases, the difference between GAAP-basis rent expense and cash rent paid will grow. In addition, words such as “guidance,” “estimate,” “anticipate,” “believe,” “forecast,” “step,” “plan,” “predict,” “focused,” “project,” “is likely,” “expect,” “intend,” “should,” “will,” “confident,” variations of such words and similar expressions are intended to identify forward-looking statements. Our ability to achieve these forward-looking statements is based on certain assumptions and judgments, including our ability to accurately interpret macro-economic trends, execute on our business strategy, and accurately predict our future financial results. These assumptions and judgments may prove to be inaccurate in the future. These forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. There are important factors both within and outside of our control that could cause our actual results to differ materially from those in the forward-looking statements. These factors include errors in our internal forecasts; our level of indebtedness; our ability to integrate acquired businesses; our dependence on third-party lenders to provide the cash we need to fund our loans and our ability to affordably access third- party financing; actions of regulators and the negative impact of those actions on our business; our ability to protect our proprietary technology and analytics and keep up with that of our competitors; disruption of our information technology systems that adversely affect our business operations; ineffective pricing of the credit risk of our prospective or existing customers; inaccurate information supplied by customers or third parties could lead to errors in judging customers’ qualifications to receive loans; improper disclosure of customer personal data; failure of third parties who provide products, services or support to us; any failure of third-party lenders upon whom we rely to conduct business in certain states; disruption to our relationships with banks and other third-party electronic payment solutions providers; disruption caused by employee or third-party theft and errors in our stores as well as other factors discussed in our filings with the Securities and Exchange Commission. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual future results. We undertake no obligation to update, amend or clarify any forward-looking statement for any reason. Non-GAAP Financial Measures In addition to the financial information prepared in conformity with U.S. GAAP, we provide in this presentation certain “non-GAAP financial measures,” including: Adjusted Net Income (Net Income from continuing operations minus certain non-cash and other adjusting items); Adjusted Earnings Per Share (Adjusted net income divided by diluted weighted average shares outstanding); Adjusted EBITDA (EBITDA plus or minus certain non-cash and other adjusting items); Gross Combined Loans Receivable (includes loans originated by third-party lenders through CSO programs which are not included in our consolidated financial statements); and Adjusted Return on Average Assets. Such measures are intended as a supplemental measure of the Company’s performance that are not required by, or presented in accordance with, GAAP. The Company presents Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets because it believes that, when viewed with the Company’s GAAP results and the accompanying reconciliation, such measures provide useful information for comparing the Company’s performance over various reporting periods as they remove from the Company’s operating results the impact of items that the Company believes do not reflect its core operating performance. Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets are not substitutes for net earnings, cash flows provided by operating activities or any other measure prescribed by GAAP. There are limitations to using non-GAAP measures such as Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets. Although the Company believes that Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets can make an evaluation of its operating performance more consistent because they remove items that do not reflect its core operations, other companies in the Company’s industry may define Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets differently than the Company does. As a result, it may be difficult to use Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets to compare the performance of those companies to the Company’s performance. Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets should not be considered as measures of the income generated by the Company’s business or discretionary cash available to it to invest in the growth of its business. The Company’s management compensates for these limitations by reference to its GAAP results and using Adjusted Net Income, Adjusted Earnings Per Share, Adjusted EBITDA, Gross Combined Loans Receivable and Adjusted Return on Average Assets as supplemental measures. Reconciliations of non-GAAP metrics utilized in this presentation to their closest GAAP measures can be found in slides 25 – 31. The presentation is confidential and may not be reproduced, redistributed, published or passed on to any other person, directly or indirectly, in whole or in part, for any purpose. This document may not be removed from the premises, and by accepting this document and attending the presentation, you agree to be bound by the foregoing limitations. If this document has been received in error it must be returned immediately to us. 2

CURO at a Glance Business Overview Diversifying Geographic and Product Footprint (Gross Revenue in $Millions) • Founded in 1997, CURO is a tech-enabled, multi-channel and multi-product consumer finance company serving a $1,200 13.1%, Canada wide range of underbanked consumers in the U.S. and Multi-Pay and Canada, and a market leader in the industry based on Ancillary revenues 1.8%, Canada $1,000 Multi-Pay and • Strong position in each of its markets Ancillary 6.9%, Canada Single-Pay 9.9%, U.S. Single-Pay • Rapidly gaining market share in large fragmented $800 markets 21.9%, Canada Single-Pay $600 • Dominant storefront presence with 416 total locations 14.8%, U.S. Single-Pay • United States: 214 stores in 14 states 70.1%, U.S. $400 Multi-Pay and • Canada: 202 stores in 7 provinces and territories Ancillary 61.5%, U.S. Multi-Pay and • Large online lending presence $200 Ancillary • United States: 27 states $- • Canada: Alberta, Nova Scotia, Ontario, 2016 2019 Saskatchewan and British Columbia Strong Brands Product and Channel Distribution Ancillary 5.6% (% of 12/31/19 YTD Revenue) Single-Pay (CAN) 6.9% Single- Pay (US) 9.9% Online Stores Unsecured 47% 53% Installment & Open-End 77.6% 3

Key Investment Highlights Leading large scale lender to underbanked consumers with track record of profitability across credit cycles with over 20 years of history Differentiated omni-channel platform, geographic footprint and diverse revenue base drive consistent profitability and performance Focus on Canadian markets is another key differentiator and driving significant growth and regulatory risk mitigation Continued diversification through new products presents additional growth opportunities; card product growth highly accretive Proven ability to successfully navigate and rapidly adapt to regulatory and competitive changes across all markets 4

(1) Leading large-scale lender in terms of revenue.

Omni-Channel Platform Supports “Call, Click or Come In” Source customers from a broad base with high retention rates Category-killer stores Synergistic lead funnel for promote brand awareness storefront channel Distinctive and Enhances customer recognizable branding experience Convenient locations with Over 85% of web visitors many open 7 days/week are on mobile (1) Higher approval rates with Site to store: over 70,000 better credit performance loans in Q4 2019 (2) (1) Through December 31, 2019. 6 (2) New and reactivated customers

Comprehensive Product Offerings and Diversified Revenue (1) Open-End Unsecured Secured Single-Pay (Line of Credit) Installment Installment Online & in-store: Online & in-store: Online and in-store: Channel Online & in-store: 15 U.S. states and 7 U.S. states 12 U.S. states & Canada 8 U.S. states and Canada Canada Average Loan Size $744 $607(2) $1,326(2) $319 Revolving / Up to 60 months Up to 42 months Up to 62 days Duration Open-ended Daily interest rates ranging Average monthly Average monthly Fees ranging from $13 Pricing 16.8% 12.3% from 0.13% to 0.99% interest rate(3) interest rate(3) to $25 per $100 borrowed Loans $335 million $235 million(2) $90 million(2) $81 million Receivable Q4 2019 YTD Consolidated Revenue Increasing Installment & Open-End Focus (% of revenue) (% of revenue) Installment & Open-End 77.6% 78% $1,141 59% Ancillary million 5.6% (1) As of 12/31/19 Canada 19% (2) Includes CSO loans. Single-pay (3) Weighted average of 6.9% the contractual interest U.S. rates for the portfolio FY 2010 FY 2016 Q4 2019 as of 12/31/19. Single-pay 7 Excludes CSO. 9.9%

Product and Geographical Diversification Creates Value and Mitigates Risk Product Diversification Since 2016 Consolidated Gross Revenue Consolidated Gross Receivables Ancillary, 4.4% Ancillary, 5.6% Single-Pay, 12.2% Single-Pay, Single-Pay, Single-Pay, 16.8% 32.0% 37.8% Multi-Pay, Multi-Pay, 87.8% 77.0% Multi-Pay, Multi-Pay, 68.0% 57.8% 2016 2019 2016 2019 Anchored by a Successful Transition to Open-End in Canada Canada Gross Revenue Canada Gross Receivables Ancillary, 7.0% Ancillary, Single-Pay, 20.0% $35.8 Single-Pay, 34.3% Single-Pay, 92.4% Multi-Pay, Multi-Pay, Single-Pay, $22.7 $266.6 $44.3 Multi-Pay, 45.0% Multi-Pay, 0.6% 2016 2019 2016 2019 8

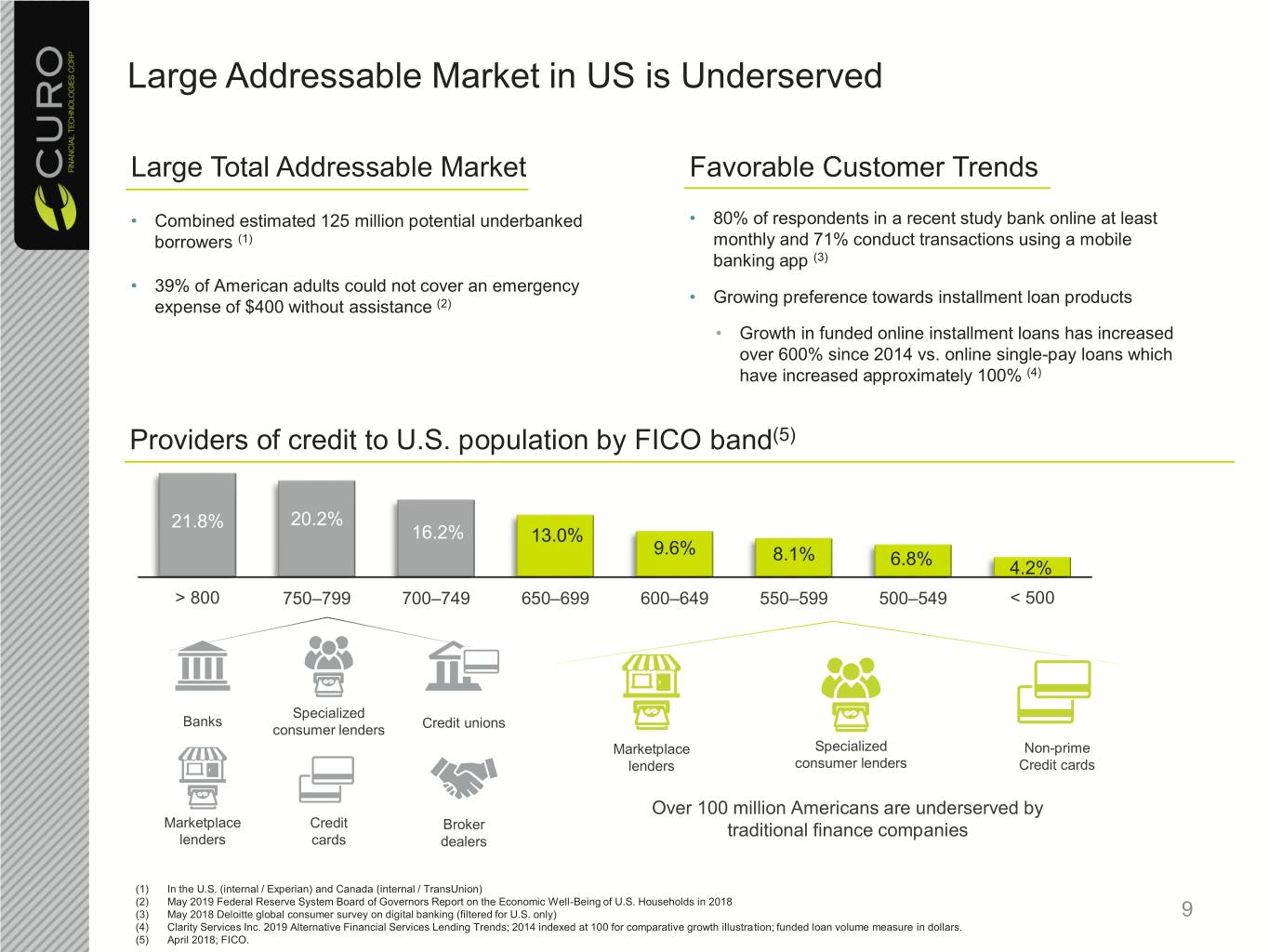

Large Addressable Market in US is Underserved Large Total Addressable Market Favorable Customer Trends • Combined estimated 125 million potential underbanked • 80% of respondents in a recent study bank online at least borrowers (1) monthly and 71% conduct transactions using a mobile banking app (3) • 39% of American adults could not cover an emergency • Growing preference towards installment loan products expense of $400 without assistance (2) • Growth in funded online installment loans has increased over 600% since 2014 vs. online single-pay loans which have increased approximately 100% (4) Providers of credit to U.S. population by FICO band(5) 21.8% 20.2% 16.2% 13.0% 9.6% 8.1% 6.8% 4.2% > 800 750–799 700–749 650–699 600–649 550–599 500–549 < 500 Specialized Banks Credit unions consumer lenders Marketplace Specialized Non-prime lenders consumer lenders Credit cards Over 100 million Americans are underserved by Marketplace Credit Broker traditional finance companies lenders cards dealers (1) In the U.S. (internal / Experian) and Canada (internal / TransUnion) (2) May 2019 Federal Reserve System Board of Governors Report on the Economic Well-Being of U.S. Households in 2018 (3) May 2018 Deloitte global consumer survey on digital banking (filtered for U.S. only) 9 (4) Clarity Services Inc. 2019 Alternative Financial Services Lending Trends; 2014 indexed at 100 for comparative growth illustration; funded loan volume measure in dollars. (5) April 2018; FICO.

Canadian Market Remains Very Attractive Large Stable Addressable Market Canadian Consumers Total Debt by Risk Tier • Approximately 30 million credit- Near-prime 20.7% active Canadian adults as of Q4 Prime 2019 (1) 14.8% Sub-prime 12.4% • 12% of credit-active Canadian adults (over 3 million) are considered sub- prime in the 300-639 FICO score range (1) Prime plus 15.2% • 21% of credit-active Canadian adults Super-prime (6 million) are considered near-prime 36.9% in the 640-719 FICO score range (1) • Non-prime credit addressable market estimated at approximately Source: TransUnion Industry Insights Summary, 3rd Quarter 2019 $200 billion CAD (2) Limited Competition at Scale • TransUnion Canada 2020 Consumer Credit Forecast indicates no major changes in delinquency rates are expected between Q3 2018 and Q4 2020 for non-mortgage holding borrowers (2) • Total non-prime customers have continued to increase YOY; balances outstanding to these customers have also continued to expand (2) (1) TransUnion Credit Vision Risk data through December 2019 (2) Beacon Securities Limited, February 13, 2020 10 (3) TransUnion Industry Insights Summary, 3rd Quarter 2019

U.S. Market Trends Continue to Favor CURO Underserved market and customers that are in good shape financially People are Working Wage growth is strongest for our customer base Unemployment rate continues at historically low level 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% Source: Goldman Sachs Global Investment Research; “2020 US Outlook: On Firmer Ground Source: Federal Reserve Bank of St. Louis Debt burdens remains consistent Consumer Confidence remains strong Ratio of household debt to disposal income remains flat 14.0% 13.5% 13.0% 12.5% 12.0% 11.5% 11.0% 10.5% 10.0% 9.5% 9.0% 11 Source: Federal Reserve Bank of St. Louis through July 2019, as of February 2020. Source: Advisor Perspective

U.S. Credit Outlook is Positive for CURO Unsecured Personal Loan Performance U.S. Delinquency rates remains stable and below pre-recession levels 6.0% 5.0% 4.0% 3.0% Personal Loan Loan Personal 2.0% Delinquency Rates (60+ DPD) (60+ Rates Delinquency 1.0% 0.0% Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q4 Q1 Q2 Q3 Q4 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2020 2020 2020 Non-Prime Originations as a Percentage of Total Originations . Low unemployment rates, continued wage growth and an overall sound economy allowing 2007 2018 2019 2020 positive delinquency rate trends to hold Auto loans 41% 34% 33% 34% . Total balances for all major credit products Credit cards 44% 38% 38% 39% expected to increase in 2020. Unsecured Mortgage loans 28% 17% 17% 19% personal loans are expected to grow 11% Unsecured personal loans 68% 64% 64% 63% followed by credit cards (3%), mortgage loans (3%) and auto loans (3%). 12 Source: All Actual and Projection data above from TransUnion publication “U.S. Consumers Expected to Maintain Strong Credit Activity in 2020” December 2019

Canadian Market Trends are Similar Underserved market and customers that are in good shape financially People are working Unemployment claims positive on a narrow horizon as well Unemployment rate remains low Last 18 months also highlights strong employment trends Wage growth remains strong Consumer Confidence remains volatile but near the median 13 Source for all charts: Tradeeconomics.com through August 2019.

Continued Diversification = New Growth Opportunities • Launched in Q4 2019 • CURO owns 43.5% • Launched in 2019 • Unsecured Installment loans • Virtual lease-to-own platform • Sponsored by Republic Bank of are decisioned and originated for online, brick and mortar and Chicago and rolling out across by Stride Bank omni-channel retailers CURO’s U.S. stores • CURO drives customer • Customers can qualify for • Card and mobile-app enabled acquisition and services the leases of merchandise with a checking account with FDIC- loans on behalf of Stride Bank purchase price ranging insured deposits between $300 and $3,500 • Stride Bank licenses and uses • Combines a Visa-branded debit Curo’s proprietary credit • Significantly increases retailer card and optional overdraft decisioning platform sales by providing payment protection options for nonprime customers seeking to acquire • Customers have loaded $68.4 • Significant US market furniture, appliances, million on over 24,000 unique expansion opportunity electronics and other cards through December 31, consumer durables 2019 • Ramp up is not accretive to • Rapid expansion of online 2020 earnings but expected to financing option with marquee drive earnings growth in 2021+ brands and partners, such as Wayfair, Lenovo and Affirm

Financial Summary 15

Financial Results at a Glance ($Millions) Gross Combined Loans Receivable Q4 2019 was highlighted by 14% YOY loan growth and 9% YTD revenue growth • Grew $90.5 million (+14%) vs. Q4 2018 (excluding addition of past due Open-End 3 months ended Year ended loans, loans grew $40.5 million or 6.2%) December 31, December 31, ($ in millions) 2019 2018 Growth % 2019 2018 Growth % Revenue Revenue $302.3 $287.6 5.1% $1,141.8 $1,045.1 9.3% • Year-over-year revenue growth of 9.3% • Open-End YTD revenue grew 72.8% year- Gross margin $95.3 $81.7 16.7% $378.6 $325.5 16.3% over-year on organic growth in the U.S. and introduction of Open-End products in Adjusted EBITDA(1) $67.5 $53.4 26.5% $261.1 $219.8 18.8% Canada (excluding impact of past due Open- End loans, Open-End revenue grew $54.2 Adj. Net Income(1) $34.8 $22.9 52.0% $130.1 $92.3 40.8% million or 38.2%) • Open-End growth partially offset by a decrease in Installment loans as a result of California portfolio repositioning and 2020 Full Year Guidance Initiated in Q4 Earnings Release (2) optimization to manage January 1, 2020 regulatory changes 2020 ($ in millions except per share amounts) 2019 Low High Gross Margin Revenue $ 1,141.8 $ 1,165 +2% $ 1,195 +5% • Full year improved 16.3% year-over-year Adjusted Net Income 130.1 135 +4% 145 +11% • Loss provision comparisons were affected by Adjusted EBITDA 261.1 265 +1% 280 +7% launch of Open-End across Ontario in prior year and the Q1 2019 Open-End Loss Effective tax rate 26% 27% Recognition Change Adjusted Diluted Earnings per Share $ 2.83 $ 3.10 +10% $ 3.35 +18% Corporate Expenses(3) (1) Refer to slides 26 and 25 for reconciliation of Adjusted Net Income • Core annual growth of 9.4% vs. 2018 and Adjusted EBITDA to their closest GAAP measures, Net Income. (2) Refer to slide 29 for reconciliation of Non-GAAP Guidance metrics primarily on investment in analytical and IT to their closest GAAP measures. talent, higher professional fees and variable (3) Corporate, district and other expense as defined in the Company’s Annual Report on Form 10-K filed on March 18, 2019. compensation for relative business performance

Strong Loan Growth with Managed Mix Shift Gross Combined Loans Receivable quarterly comparison(1) ($Millions) Unsecured Installment Open-end Secured Installment Single-pay CSO $731 $742 $77 $677 $73 $652 $617 $615 $67 $81 $80 $78 $62 $79 $76 $490 $88 $81 $90 $492 $70 $77 $85 $447 $426 $79 $69 $93 $81 $395 $71 $91 $57 $341 $347 $85 $62 $95 $290 $90 $82 $315 $335 $58 $253 $273 $68 $283 $86 $85 $207 $89 $184 $241 $59 $76 $53 $85 $80 $45 $85 $76 $48 $91 $89 $88 $67 $32 $52 $80 $63 $27 $26 $56 $51 $52 $30 $182 $185 $190 $169 $162 $165 $174 $28 $144 $156 $160 $161 $26 $27 $121 $94 $51 $54 $59 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 (1) Gross combined loans receivable is sum of Company-owned gross loans receivable and gross loans receivable guaranteed by the Company. 17

U.S. Results – Solid Growth with Stable Margins ($Millions) 2019 2018 2017 U.S Full Year Q4 Full Year Q4 Full Year Q4 Revenue $ 913.5 100% $ 240.3 100% $ 853.1 100% $ 235.1 100% $ 737.7 100% $ 205.8 100% Provision for losses 392.1 43% 111.6 46% 348.6 41% 109.0 46% 267.5 36% 86.8 42% Net revenue 521.4 57% 128.7 54% 504.5 59% 126.1 54% 470.2 64% 119.0 58% Advertising costs 46.7 5% 15.0 6% 48.8 6% 13.6 6% 36.1 5% 11.6 6% Non-advertising COPS 171.7 19% 42.8 18% 170.9 20% 43.2 18% 166.9 23% 41.6 20% Total cost of providing services 218.4 24% 57.9 24% 219.7 26% 56.8 24% 203.0 28% 53.1 26% Gross margin 303.0 33% 70.8 29% 284.8 33% 69.3 29% 267.2 36% 65.9 32% Adjusted EBITDA $ 202.2 22% $ 47.3 20% $ 193.9 23% $ 44.6 19% $ 180.1 24% $ 40.3 20% » Provision as a percentage of revenue has trended upward over the past several years because of mix shift to lower-yielding, higher-dollar loan products » 2019 vs. 2018 comparisons of the provision for losses are affected by changes in allowance coverage levels in the second quarter and first half of 2018, the Q1 2019 Open-End Loss Recognition Change and loan growth. NOTE: See slide 30 for reconciliation of Adjusted EBITDA to its closest comparable GAAP measure 18

Canada – Valuable Transition to Multi-Pay Loans ($ in millions, USD) Loan Portfolio Revenue mix shift Open End Single Pay Unsecured Installment Open End Single Pay Unsecured Installment Ancillary $350.0 $250.0 $300.0 $200.0 $250.0 $200.0 $150.0 $150.0 $100.0 $100.0 $50.0 $50.0 $0.0 $0.0 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 2015 2016 2017 2018 2019 AEBITDA through the transition Earnings growth trajectory accelerating AEBITDA AEBITDA Margin AEBITDA AEBITDA Margin $70.0 40% $25.0 40% $60.0 35% 35% $20.0 30% 30% $50.0 25% 25% $15.0 $40.0 20% 20% $10.0 15% $30.0 15% 10% $20.0 $5.0 10% 5% 0% $10.0 5% $0.0 -5% $0.0 0% -$5.0 -10% 2015 2016 2017 2018 2019 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 19 NOTE: See slide 31 for reconciliation of Adjusted EBITDA to its closest comparable GAAP measure.

Improved Quarterly Net Charge-Off Rates NCO Rates by Country – All Products 25.0% » U.S. installment NCO rates increased 20.0% slightly on mix, partially offset by improvements in Open-End, CSO and 15.0% Single-Pay » Canada NCO rates lower YOY on Open 10.0% End improvement from seasoning and successful growth management 5.0% 0.0% U.S. Canada Consolidated Q4 2018 Q4 2019 Consolidated Quarterly NCO Rate by Product » Unsecured and Secured Installment 50.0% NCO rates increased due to California portfolio repositioning and optimization. 40.0% » CSO rates improved because of comparisons to higher relative loss rates 30.0% in the former Ohio portfolio and better credit performance in Texas. 20.0% » Open-End driven by product seasoning in Canada and Virginia 10.0% » Single pay driven by extended payment 0.0% plan changes in Canada Unsecured Secured CSO Open-end Single-Pay Total Installment Installment 20 Q4 2018 Q4 2019

Cash Flow Illustration 2020 at Midpoint of 2019 Guidance ($Millions) Adjusted EBITDA $ 261.1 $ 272.5 Cash Interest (69.1) (67.3) Cash Taxes (3.2) (39.2) Capex (14.0) (23.5) Free Cash Flow 174.8 142.5 Cash Used for Loan growth (1) (56.1) (103.7) Net change in debt (15.0) - Strategic uses of cash (2) (93.7) (38.8) Net Cash Flow $ 10.0 $ - » Strong 2019 Free Cash Flow continues into 2020; 2019 free cash flow includes tax benefit from exiting the UK market in early 2019 » Robust 2020 loan growth led by Open-End loans in Canada and the U.S. financed without incremental borrowing » Resulting implied availability under U.S. and Canadian SPV facilities and revolvers provide additional flexibility and ‘dry powder’ from diverse capital sources (1) Cash used for 2019 Loan growth is based on loans receivable growth net of the impact of the Open End Loss Recognition change (i.e. non-cash additional of approximately $40 million of past due receivables) 21 (2) 2019 strategic uses of cash included a) share repurchases, b) investments in Katapult and c) cash outflows associated with the U.K. disposal; 2020 strategic uses of cash include a) share repurchases, b) dividend payments and c) completion of the acquisition of Ad Astra in January 2020

Consolidated Summary Balance Sheet December 31, ($ in millions) 2016 2017 2018 2019 ($Millions) Cash $ 182.9 $ 153.5 $ 61.2 $ 75.2 Restricted cash 4.5 8.5 25.4 34.8 Gross loans receivable 273.2 413.2 571.5 665.8 Less: allowance for loan losses (36.9) (64.1) (74.0) (106.8) Loans receivable, net 236.3 349.1 497.5 559.0 PP&E net 93.0 85.6 76.8 70.8 ROU asset - - - 117.5 Goodwill and intangibles 147.2 150.3 149.1 154.5 Other assets 63.6 55.1 74.8 70.1 Total assets $ 727.4 $ 802.1 $ 884.8 $ 1,081.9 Senior notes and revolver $ 538.4 $ 585.8 $ 696.6 $ 678.3 ABL facilities 86.5 120.4 107.5 112.2 ROU liability - - - 125.0 Other liabilities 111.2 136.9 125.1 115.8 Total liabilities $ 736.1 $ 843.1 $ 929.3 $ 1,031.4 Total stockholders' equity / (deficit) $ (8.7) $ (41.0) $ (44.5) $ 50.5 LTM adjusted ROAA (1) 11.3% 11.3% 10.9% 13.2% Debt / LTM adjusted EBITDA (1) 3.2x 3.0x 3.7x 3.0x Net Debt / LTM adjusted EBITDA (2) 2.7x 2.5x 3.2x 2.6x » August 2018 issuance of $690.0 million of 8.25% Senior Secured Notes due 2025 to (a) redeem remaining $527.5 million of our 12.00% Senior Secured Notes due 2022 and (b) fully extinguish the $122.4 million Non-Recourse U.S. SPV Facility. » Closed Canadian SPV facility in August 2018 (CAD$175 million capacity) to finance Canadian loan growth » Expanded Senior Revolver to $50 million in the fourth quarter of 2018 » $50 million Share Repurchase Program authorized in April 2019 and fully utilized in February 2020; additional $25 million authorized in February 2020 » Executed Block Share Repurchase of 2 million shares from private equity sponsor in September 2019 Note: Debt balances are reflected net of deferred interest costs. Subtotals may not sum due to rounding. (1) Refer to slides 25 and 26 for reconciliation of Adjusted EBITDA and Adjusted Net Income to their closest GAAP measures, Net Income and slide 27 for calculation of ROAA. (2) Net Debt excludes U.S. and Canada SPV debt. 22

Key Investment Highlights Leading large scale lender to underbanked consumers with track record of profitability across credit cycles with over 20 years of history Differentiated omni-channel platform, geographic footprint and diverse revenue base drive consistent profitability and performance Focus on Canadian markets is another key differentiator and driving significant growth and regulatory risk mitigation Continued diversification through new products presents additional growth opportunities; card product growth highly accretive Proven ability to successfully navigate and rapidly adapt to regulatory and competitive changes across all markets 23

Appendix 24

Historical Consolidated Adjusted EBITDA Reconciliation 3 Months ended December 31, Year ended December 31, ($Millions) 2018 2019 2018 2019 Net Income from continuing operations $ 15.4 $ 29.6 $ 16.5 $ 103.9 Provision for Income Taxes 1.9 9.8 1.7 38.6 Interest Expense 18.2 17.7 84.4 69.8 Depreciation and Amortization 4.7 4.5 18.3 18.6 EBITDA $ 40.2 $ 61.5 $ 120.8 $ 230.8 Loss on extinguishment of debt (1) 9.7 - 90.6 - U.K. related costs (2) - - - 8.8 Loss from equity method investment (3) - 1.2 - 6.3 Share-based compensation (4) 2.1 2.7 8.2 10.3 Legal and related costs (5) 0.9 2.2 (0.3) 3.0 Restructuring costs (6) - - - 1.8 Other Adjustments (7) 0.5 (0.1) 0.5 0.0 Adjusted EBITDA $ 53.4 $ 67.5 $ 219.8 $ 261.1 Adjusted EBITDA Margin 18.6% 22.3% 21.0% 22.9% (1) For the year ended December 31, 2018, the $90.6 million of loss on extinguishment of debt is comprised of (i) $11.7 million incurred in the first quarter of 2018 for the redemption of $77.5 million of the CURO Financial Technologies Corp.'s ("CFTC") 12.00% Senior Secured Notes due 2022, (ii) $69.2 million incurred in the third quarter of 2018 for the redemption of the remaining $525.7 million of these notes and (iii) $9.7 million incurred in the fourth quarter of 2018 for the redemption of the Non-Recourse U.S. SPV Facility. (2) U.K. related costs of $8.8 million for the year ended December 31, 2019 relate to placing the U.K. subsidiaries into administration on February 25, 2019, which included $7.6 million to obtain consent from the holders of the 8.25% Senior Secured Notes to deconsolidate the U.K. Segment and $1.2 million for other costs. (3) The Loss from equity method investment for the year ended December 31, 2019 of $6.3 million includes (i) our share of the estimated GAAP net loss of Katapult and (ii) a $3.7 million market value adjustment recognized during the second quarter of 2019 as a result of an equity raising round from April through July of 2019 that implied a value per share less than the value per share raised in prior raises. As of December 31, 2019, we owned 43.8% of the outstanding shares of Katapult on a diluted basis. (4) We approved the adoption of share-based compensation plans during 2010 and 2017 for key members of senior management. The estimated fair value of share-based awards is recognized as non-cash compensation expense on a straight-line basis over the vesting period. (5) Legal and related costs for the year ended December 31, 2019 include (i) costs related to certain securities litigation and related matters of $2.5 million, (ii) legal and advisory costs of $0.3 million related to the repurchase of shares from Friedman Fleischer & Lowe Capital Partners II, L.P. and its affiliated investment funds (“FFL”) and (iii) $0.3 million of legal and advisory costs related to the purchase of Ad Astra. Legal and related costs for the year ended December 31, 2018 included (i) a $1.8 million reduction of the liability related to our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans, (ii) a securities class action lawsuit and (iii) settlement of certain matters in California and Canada. For more information, see Note 16 - "Contingent Liabilities" of the Notes to Consolidated Financial Statements included in our Form 10-K filed with the SEC on March 18, 2019. (6) Restructuring costs of $1.8 million for the year ended December 31, 2019 were due to eliminating 121 positions in North America. The store employee reductions help better align store staffing with in-store customer traffic and volume patterns, as more of our growth comes from online channels and as store customers require less time in stores as they conduct more of the follow-up activities online. The elimination of certain corporate positions relate to efficiency initiatives and has allowed the Company to reallocate investment to strategic growth activities. (7) Other adjustments include the intercompany foreign exchange impact and, prior to January 1, 2019, deferred rent. Deferred rent represented the non-cash component of rent expense, which was recognized ratably on a straight-line basis over the lease term. As of January 1, 2019, we adopted ASU No. 2016-02, Leases, which requires all leases to be recognized on the 25 balance sheet. As a result, we no longer recognize deferred rent.

Historical Consolidated Adjusted Net Income Reconciliation 3 Months ended December 31, Year ended December 31, ($Millions) 2018 2019 2018 2019 Net Income from continuing operations $ 15.4 $ 29.6 $ 16.5 $ 103.9 Loss on extinguishment of debt (1) 10.0 - 93.8 - Restructuring costs (2) - - - 1.8 Legal and related costs (3) 0.9 2.2 (0.3) 3.0 U.K. related costs (4) - - - 8.8 Loss from equity method investment (5) - 1.2 - 6.3 Share-based compensation (6) 2.1 2.7 8.2 10.3 Intangible asset amortization 0.7 0.6 2.8 2.9 Impact of tax law changes (7) (2.8) - (1.6) - Cumulative tax effect of adjustments (3.4) (1.4) (27.0) (7.0) Adjusted net income from continuing operations $ 22.9 $ 34.8 $ 92.3 $ 130.1 Net income from continuing operations $ 15.4 $ 29.6 $ 16.5 $ 103.9 Diluted Weighted Average Shares Outstanding 47.8 43.2 48.0 46.0 Diluted Earnings per Share from Continuing Operations $ 0.32 $ 0.68 $ 0.34 $ 2.26 Per share impact of adjustments to net income $ 0.16 $ 0.12 $ 1.59 $ 0.57 Adjusted Diluted Earnings per Share from Continuing Operations $ 0.48 $ 0.80 $ 1.93 $ 2.83 (1) For the year ended December 31, 2018, the $90.6 million of loss on extinguishment of debt is comprised of (i) $11.7 million incurred in the first quarter of 2018 for the redemption of $77.5 million of the CFTC 12.00% Senior Secured Notes due 2022, (ii) $69.2 million incurred in the third quarter of 2018 for the redemption of the remaining $525.7 million of these notes and (iii) $9.7 million incurred in the fourth quarter of 2018 for the redemption of the Non-Recourse U.S. SPV Facility. (2) Restructuring costs of $1.8 million for the year ended December 31, 2019 were due to eliminating 121 positions in North America. The store employee reductions help better align store staffing with in-store customer traffic and volume patterns, as more of our growth comes from online channels and as store customers require less time in stores as they conduct more of the follow-up activities online. The elimination of certain corporate positions relate to efficiency initiatives and has allowed the Company to reallocate investment to strategic growth activities. (3) Legal and related costs for the year ended December 31, 2019 include (i) costs related to certain securities litigation and related matters of $2.5 million, (ii) legal and advisory costs of $0.3 million related to the repurchase of shares from FFL and (iii) $0.3 million of legal and advisory costs related to the purchase of Ad Astra. Legal and related costs for the year ended December 31, 2018 included (i) a $1.8 million reduction of the liability related to our offer to reimburse certain bank overdraft or non-sufficient funds fees because of possible borrower confusion about certain electronic payments we initiated on their loans, (ii) a securities class action lawsuit and (iii) settlement of certain matters in California and Canada. For more information, see Note 16 - "Contingent Liabilities" of the Notes to Consolidated Financial Statements included in our Form 10-K filed with the SEC on March 18, 2019. (4) U.K. related costs of $8.8 million for the year ended December 31, 2019 relate to placing the U.K. subsidiaries into administration on February 25, 2019, which included $7.6 million to obtain consent from the holders of the 8.25% Senior Secured Notes to deconsolidate the U.K. Segment and $1.2 million for other costs (5) The Loss from equity method investment for the year ended December 31, 2019 of $6.3 million includes (a) our share of the estimated GAAP net loss of Katapult and (b) a $3.7 million market value adjustment recognized during the second quarter of 2019 as a result of an equity raising round from April through July of 2019 that implied a value per share less than the value per share raised in prior raises. As of December 31, 2019, we owned 43.8% of the outstanding shares of Katapult on a diluted basis. (6) We approved the adoption of share-based compensation plans during 2010 and 2017 for key members of senior management. The estimated fair value of share-based awards is recognized as non-cash compensation expense on a straight-line basis over the vesting period. (7) As a result of the Tax Cuts and Jobs Act of 2017 ("2017 Tax Act"), which became law on December 22, 2017, we provided an estimate of the new repatriation tax as of December 31, 2017. Subsequent to further guidance published in the first quarter of 2018, we booked additional tax expense of $1.2 million for the 2017 repatriation tax. Based upon additional interpretations and finalization of our 2017 income tax returns, the total repatriation tax was further adjusted in the fourth quarter of 2018, producing a tax benefit of $2.8 million in that period. This resulted in a net tax benefit of $1.6 million for the full year. 26

Historical Gross Combined Loan Receivables and Adjusted ROAA Reconciliations Year ending (in millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2019 Company-owned gross loans receivable $273.2 $413.2 $571.6 $665.8 Gross loans receivable guaranteed by the Company 68.0 78.8 80.4 76.7 Gross combined loans receivable $341.2 $492.0 $652.0 $742.5 (in millions) Dec. 31, 2016 Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2019 Total assets $727.4 $802.1 $884.8 $1,081.9 Average assets 661.7 764.8 843.4 983.3 LTM Adjusted Net Income from Continuing Operations 74.5 86.8 92.3 130.1 LTM Adjusted ROAA 11.3% 11.3% 10.9% 13.2% Note: Subtotals may not sum due to rounding. The above table summarizes Company-owned gross loans receivable, a GAAP balance sheet measure, and reconciles it to gross combined loans receivable, a non-GAAP measure including loans originated by third-party lenders through CSO programs, which are not included in our Condensed Consolidated Financial Statements but from which we earn revenue and for which we provide a guarantee to the lender. 27

Adjusted Pre-tax Income and Adjusted Tax Expense Reconciliations 3 Months ended December 31, Year ended December 31, 2018 2019 2018 2019 Pre-tax income $ 17.3 $ 39.4 $ 18.1 $ 142.5 Loss on extinguishment of debt (1) 10.0 - 93.8 - Restructuring costs (2) - - - 1.8 Legal and related costs (3) 0.9 2.2 (0.3) 3.0 U.K. related costs (4) - - - 8.8 Loss from equity method investment (5) - 1.2 - 6.3 Share-based compensation (6) 2.1 2.7 8.2 10.3 Intangible asset amortization 0.7 0.6 2.8 2.9 Adjusted pre-tax income $ 31.0 $ 46.0 $ 122.6 $ 175.6 Tax expense $ 1.9 $ 9.8 $ 1.7 $ 38.6 Impact of tax law changes (7) (2.8) - (1.6) - Cumulative tax effect of adjustments (3.4) (1.4) (27.0) (7.0) Adjusted tax expense $ 8.2 $ 11.2 $ 30.3 $ 45.5 Adjusted tax expense / Adjusted pre-tax income 26.3% 24.4% 24.7% 25.9% Refer to slide 26 for explanation of footnotes referenced above. 28

Guidance Metrics Reconciliations Fiscal 2020 Outlook Year Ending December 31, 2020 Low High Net income from Continuing Operations $ 125,700 $ 135,500 Adjustments: Share-based compensation 9,600 9,600 Intangible asset amortization 2,400 2,400 Cumulative tax effect of adjustments (3,000) (3,000) Adjusted Net Income from Continuing Operations $ 134,700 $ 144,500 Diluted Weighted Average Shares Outstanding 43,400 43,100 Diluted Earnings per Share from Continuing Operations $ 2.89 $ 3.14 Per Share impact of adjustments to Net Income $ 0.21 $ 0.21 Adjusted Diluted Earnings per Share from Continuing Operations $ 3.10 $ 3.35 Net income from Continuing Operations $ 125,700 $ 135,500 Provision for income taxes 44,300 48,000 Interest expense 68,000 69,500 Depreciation and amortization 18,300 18,300 EBITDA $ 256,300 $ 271,300 Non-cash rent expense and foreign currency exchange rate impact (1) (2) (900) (900) Share-based compensation 9,600 9,600 Adjusted EBITDA $ 265,000 $ 280,000 (1) The Company has historically excluded the impact of non-cash interest from adjusted earnings metrics. With the adoption of ASU 2016-02 Leases, effective January 1, 2019, the Company anticipates the difference between GAAP-basis rent expense and cash rent paid will grow. However, the Company will continue to adjust for this difference. (2) The Company has historically excluded the impact of foreign currency translation and hedges from adjusted earnings metrics; the Company does not include the impact of 29 any hedge settlement or realized currency gains or losses in its outlook.

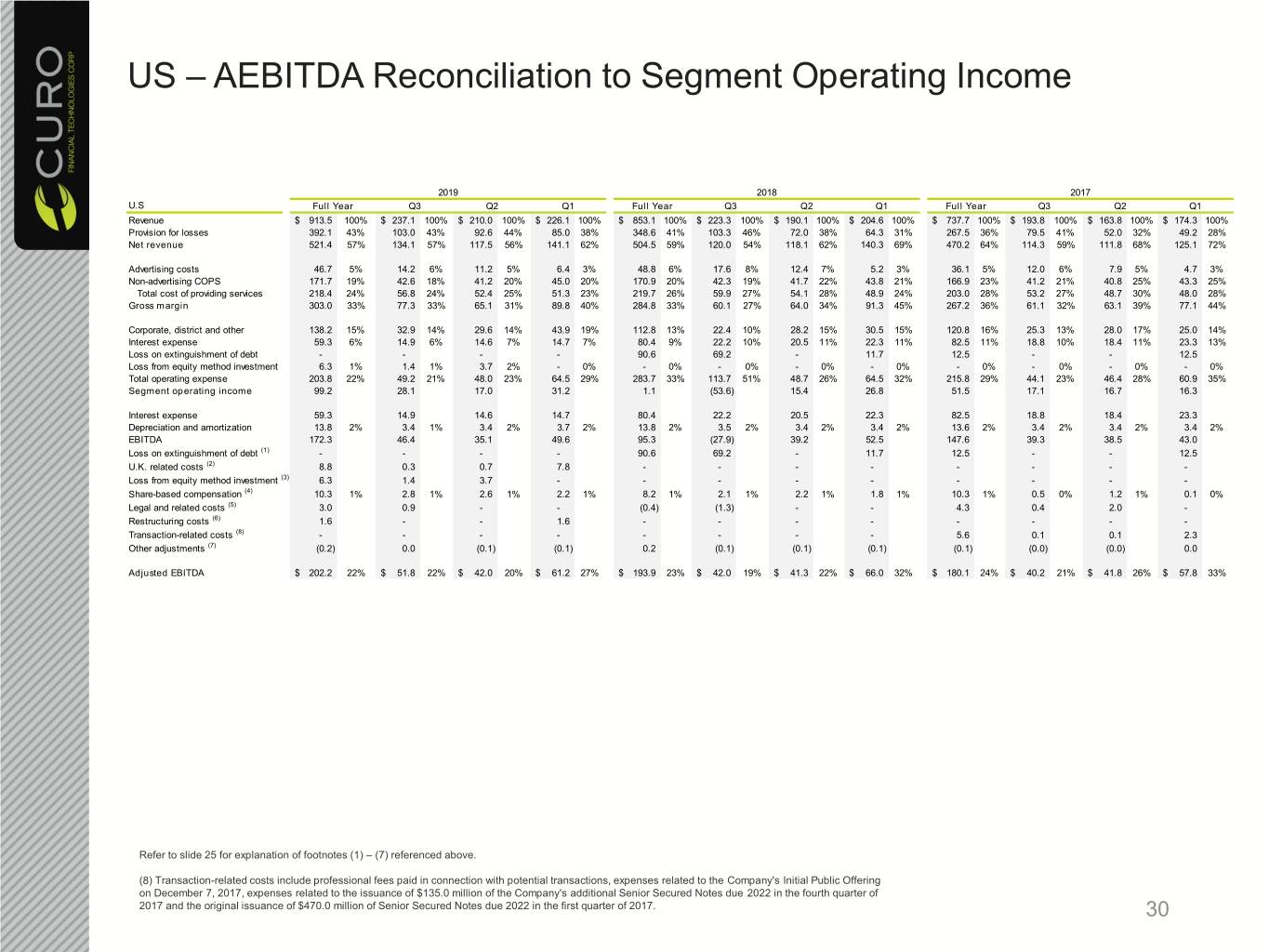

US – AEBITDA Reconciliation to Segment Operating Income 2019 2018 2017 U.S Full Year Q3 Q2 Q1 Full Year Q3 Q2 Q1 Full Year Q3 Q2 Q1 Revenue $ 913.5 100% $ 237.1 100% $ 210.0 100% $ 226.1 100% $ 853.1 100% $ 223.3 100% $ 190.1 100% $ 204.6 100% $ 737.7 100% $ 193.8 100% $ 163.8 100% $ 174.3 100% Provision for losses 392.1 43% 103.0 43% 92.6 44% 85.0 38% 348.6 41% 103.3 46% 72.0 38% 64.3 31% 267.5 36% 79.5 41% 52.0 32% 49.2 28% Net revenue 521.4 57% 134.1 57% 117.5 56% 141.1 62% 504.5 59% 120.0 54% 118.1 62% 140.3 69% 470.2 64% 114.3 59% 111.8 68% 125.1 72% Advertising costs 46.7 5% 14.2 6% 11.2 5% 6.4 3% 48.8 6% 17.6 8% 12.4 7% 5.2 3% 36.1 5% 12.0 6% 7.9 5% 4.7 3% Non-advertising COPS 171.7 19% 42.6 18% 41.2 20% 45.0 20% 170.9 20% 42.3 19% 41.7 22% 43.8 21% 166.9 23% 41.2 21% 40.8 25% 43.3 25% Total cost of providing services 218.4 24% 56.8 24% 52.4 25% 51.3 23% 219.7 26% 59.9 27% 54.1 28% 48.9 24% 203.0 28% 53.2 27% 48.7 30% 48.0 28% Gross margin 303.0 33% 77.3 33% 65.1 31% 89.8 40% 284.8 33% 60.1 27% 64.0 34% 91.3 45% 267.2 36% 61.1 32% 63.1 39% 77.1 44% Corporate, district and other 138.2 15% 32.9 14% 29.6 14% 43.9 19% 112.8 13% 22.4 10% 28.2 15% 30.5 15% 120.8 16% 25.3 13% 28.0 17% 25.0 14% Interest expense 59.3 6% 14.9 6% 14.6 7% 14.7 7% 80.4 9% 22.2 10% 20.5 11% 22.3 11% 82.5 11% 18.8 10% 18.4 11% 23.3 13% Loss on extinguishment of debt - - - - 90.6 69.2 - 11.7 12.5 - - 12.5 Loss from equity method investment 6.3 1% 1.4 1% 3.7 2% - 0% - 0% - 0% - 0% - 0% - 0% - 0% - 0% - 0% Total operating expense 203.8 22% 49.2 21% 48.0 23% 64.5 29% 283.7 33% 113.7 51% 48.7 26% 64.5 32% 215.8 29% 44.1 23% 46.4 28% 60.9 35% Segment operating income 99.2 28.1 17.0 31.2 1.1 (53.6) 15.4 26.8 51.5 17.1 16.7 16.3 Interest expense 59.3 14.9 14.6 14.7 80.4 22.2 20.5 22.3 82.5 18.8 18.4 23.3 Depreciation and amortization 13.8 2% 3.4 1% 3.4 2% 3.7 2% 13.8 2% 3.5 2% 3.4 2% 3.4 2% 13.6 2% 3.4 2% 3.4 2% 3.4 2% EBITDA 172.3 46.4 35.1 49.6 95.3 (27.9) 39.2 52.5 147.6 39.3 38.5 43.0 Loss on extinguishment of debt (1) - - - - 90.6 69.2 - 11.7 12.5 - - 12.5 U.K. related costs (2) 8.8 0.3 0.7 7.8 - - - - - - - - Loss from equity method investment (3) 6.3 1.4 3.7 - - - - - - - - - Share-based compensation (4) 10.3 1% 2.8 1% 2.6 1% 2.2 1% 8.2 1% 2.1 1% 2.2 1% 1.8 1% 10.3 1% 0.5 0% 1.2 1% 0.1 0% Legal and related costs (5) 3.0 0.9 - - (0.4) (1.3) - - 4.3 0.4 2.0 - Restructuring costs (6) 1.6 - - 1.6 - - - - - - - - Transaction-related costs (8) - - - - - - - - 5.6 0.1 0.1 2.3 Other adjustments (7) (0.2) 0.0 (0.1) (0.1) 0.2 (0.1) (0.1) (0.1) (0.1) (0.0) (0.0) 0.0 Adjusted EBITDA $ 202.2 22% $ 51.8 22% $ 42.0 20% $ 61.2 27% $ 193.9 23% $ 42.0 19% $ 41.3 22% $ 66.0 32% $ 180.1 24% $ 40.2 21% $ 41.8 26% $ 57.8 33% Refer to slide 25 for explanation of footnotes (1) – (7) referenced above. (8) Transaction-related costs include professional fees paid in connection with potential transactions, expenses related to the Company's Initial Public Offering on December 7, 2017, expenses related to the issuance of $135.0 million of the Company's additional Senior Secured Notes due 2022 in the fourth quarter of 2017 and the original issuance of $470.0 million of Senior Secured Notes due 2022 in the first quarter of 2017. 30

Canada – AEBITDA Reconciliation to Segment Operating Income 2019 2018 2017 Canada Income Statement Full Year Q4 Q3 Q2 Q1 Full Year Q4 Q3 Q2 Q1 Full Year Q4 Q3 Q2 Q1 Revenue $ 228.3 $ 62.0 $ 60.2 $ 54.3 $ 51.8 $ 191.9 $ 52.4 $ 46.2 $ 47.0 $ 46.3 $ 186.4 $ 50.6 $ 50.7 $ 43.6 $ 41.6 Provision for losses 76.4 18.7 20.9 19.5 17.4 73.0 21.6 24.4 14.4 12.6 45.1 8.8 15.7 10.3 10.2 Net revenue 151.8 43.3 39.3 34.8 34.4 118.9 30.8 21.8 32.7 33.7 141.3 41.8 34.9 33.3 31.3 Advertising costs 6.7 1.4 2.2 1.6 1.4 10.5 1.4 3.7 2.7 2.7 10.4 3.5 2.9 2.3 1.8 Non-advertising costs of providing services 69.5 17.5 17.7 17.1 17.3 67.8 17.1 17.6 16.7 16.5 63.0 16.3 16.4 15.1 15.3 Total cost of providing services 76.2 18.8 19.9 18.7 18.7 78.3 18.4 21.3 19.4 19.2 73.4 19.7 19.3 17.3 17.0 Gross margin 75.7 24.5 19.4 16.1 15.7 40.6 12.4 0.5 13.3 14.5 68.0 22.0 15.6 16.0 14.3 Corporate, district and other 21.9 5.3 5.8 5.6 5.2 19.6 4.8 5.1 4.8 4.9 17.0 4.5 4.7 4.4 3.4 Interest expense 10.4 2.6 2.5 2.4 3.0 4.0 2.7 1.2 0.0 0.1 0.2 0.1 0.1 0.1 0.0 Total operating expense 32.4 7.9 8.3 8.0 8.2 23.6 7.6 6.4 4.8 5.0 17.2 4.6 4.7 4.4 3.4 Segment operating income 43.3 16.6 11.1 8.1 7.5 17.0 4.8 (5.9) 8.5 9.5 50.8 17.4 10.9 11.5 10.9 Interest expense 10.4 2.6 2.5 2.4 3.0 4.0 2.7 1.2 0.0 0.1 0.2 0.1 0.1 0.1 0.0 Depreciation and amortization 4.8 1.2 1.2 1.2 1.2 4.5 1.2 1.1 1.1 1.1 4.5 1.2 1.2 1.1 1.1 EBITDA 58.6 20.3 14.8 11.7 11.7 25.5 8.7 (3.6) 9.6 10.7 55.5 18.7 12.2 12.7 12.0 Share-based compensation (4) - - - - - - - - - - 0.2 0.2 - - - Legal and related costs (5) - - - - - 0.1 - 0.1 - - - - - - - Other adjustments (7) 0.3 (0.1) 0.4 (0.0) 0.0 0.3 0.1 0.1 0.2 0.0 (1.1) (0.4) (0.2) (0.2) (0.3) Adjusted EBITDA 58.9 20.3 $ 15.3 $ 11.7 $ 11.7 $ 25.9 $ 8.8 $ (3.4) $ 9.8 $ 10.7 $ 54.6 $ 18.4 $ 12.0 $ 12.5 $ 11.7 Adjusted EBITDA Margin 25.8% 32.7% 25.4% 21.5% 22.6% 13.5% 16.7% NM 20.8% 23.2% 29.3% 36.4% 23.6% 28.7% 28.2% Refer to slide 25 for explanation of footnotes referenced above. For 2016, Canada segment operating income was $60.5 million. Excluding Interest expense of $0.1 million, depreciation and amortization of $4.8 million, restructuring costs of $0.9 million and other currency related adjustments of $0.4 million), 2016 Adjusted EBITDA was $65.9 million. For 2015, Canada segment operating income was $56.2 million. Excluding interest expense of $0.1 million, depreciation and amortization of $5.2 million and other currency related adjustments of $1.2 million, 2015 Adjusted EBITDA was $62.8 million 31