Attached files

Exhibit 10.4 Form of Relative Value Award under the 2002 Lilly Stock Plan

Eli Lilly and Company

Relative Value Award Agreement

(for Executive Officers)

This Relative Value Award has been granted on February 12, 2020 (“Grant Date”) by Eli Lilly and Company, an Indiana corporation, with its principal offices in Indianapolis, Indiana (“Lilly” or the “Company”), to the Eligible Individual who has received this Relative Value Award Agreement (the “Grantee”).

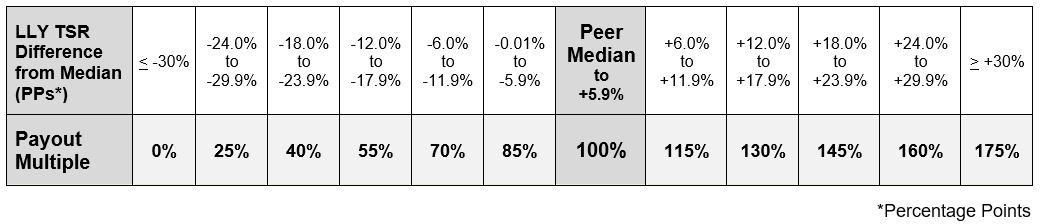

Lilly Relative Total Shareholder Return Performance Levels:

Performance Period: January 1, 2020 - December 31, 2022

Section 1. | Grant of Relative Value Award |

Eli Lilly and Company, an Indiana corporation (“Lilly” or the “Company”), has granted to the Eligible Individual who has received this Relative Value Award Agreement (the “Grantee”) a Performance-Based Award (the “Relative Value Award” or the “Award”) with respect to the target number of shares of Lilly Common Stock (the “Shares”) that the Grantee may view by logging on to the Merrill Lynch website at http://myequity.lilly.com. (the "Target Number of Shares").

The Award is made pursuant to and subject to the terms and conditions set forth in the Amended and Restated 2002 Lilly Stock Plan (the “Plan”) and to the terms and conditions set forth in this Relative Value Award Agreement, including all appendices, exhibits and addenda hereto (the “Award Agreement”). In the event of any conflict between the terms of the Plan and this Award Agreement, the terms of the Plan shall govern.

Any capitalized terms used but not defined in this Award Agreement shall have the meanings set forth in the Plan.

Section 2. | Vesting |

As soon as reasonably practicable following the end of the Performance Period, the Committee shall determine the number of Shares that are eligible to vest which shall be equal to the product of (i) the Target Number of Shares, multiplied by (ii) the Payout Multiple, where:

a. | “Payout Multiple” shall mean the payout multiple set forth in the Lilly Relative Total Shareholder Return Performance Levels table set forth on the first page of this document, representing the attainment level of Lilly’s rTSR, measured against the performance goal attainment levels set forth in the table. |

b. | “Final Lilly Stock Price” shall mean the average of the closing price of a share of Lilly Common Stock on the New York Stock Exchange for each trading day in the last two months of the Performance Period, rounded to the nearest cent. |

c. | “Total Shareholder Return” or “TSR” shall mean the quotient of (i) the Final Lilly Stock Price or Final Peer Stock Price, as applicable, minus the corresponding Beginning Stock Price, including the impact of Dividend reinvestment on each ex-dividend date, if any, paid by the applicable issuer during the Performance Period, divided by (ii) the corresponding Beginning Stock Price. |

The stock prices and cash dividend payments reflected in the calculation of TSR shall be adjusted to reflect stock splits during the Performance Period and dividends shall be assumed to be reinvested in the relevant issuer’s shares for purposes of the calculation of TSR.

d. | “Relative Total Shareholder Return” or “rTSR” shall mean the comparison between Lilly’s TSR and the TSR of the Peer Group over the Performance Period, measured as the absolute percentage point difference in the performance of the Company’s TSR compared to the Peer Group’s median TSR. |

e. | “Beginning Stock Price” shall mean the average closing price of a share of Lilly Common Stock on the New York Stock Exchange or a share of each Peer Group company’s stock, as applicable, for each trading day in the two month period immediately preceding the Performance Period, rounded to the nearest cent. |

f. | “Final Peer Stock Price” shall mean the average of the closing price of a share of each Peer Group company’s stock, on Nasdaq, the New York Stock Exchange, or other market where an independent share price can be determined, for each trading day in the last two months of the Performance Period, rounded to the nearest cent. |

g. | “Dividend” shall mean ordinary or extraordinary cash dividends paid by Lilly or a Peer Group company to its shareholders of record at any time during the Performance Period. |

h. | “Peer Group” shall mean all companies identified and most recently approved by the Committee as a member of the Company’s Peer Group in effect as of the Grant Date. Companies that are members of the Peer Group at the beginning of the Performance Period that subsequently cease to be traded on a market where an independent share price can be determined shall be excluded from the Peer Group. |

In the event the Grantee’s Service is terminated prior to the end of the Performance Period for any reason or in any circumstance other than as described in Section 3 below, the Award shall be forfeited.

Section 3. | Impact of Certain Employment Status Changes |

Unless the Committee determines, in its sole discretion, that such treatment is not advisable after consideration of Applicable Laws, the number of Shares that are eligible to vest upon a change employment status of the Grantee during the Performance Period will be as follows:

a. | Leaves of Absence. In the event the Grantee is on an approved leave of absence during the Performance Period, the number of Shares eligible to vest shall be the number determined in accordance with Section 2 above. |

b. | Death; Disability. In the event the Grantee’s Service is terminated (i) due to the Grantee’s death, or (ii) by reason of Grantee’s Disability, the number of Shares eligible to vest shall be the number determined in accordance with Section 2 above. |

c. | Qualifying Termination. In the event the Grantee’s employment is subject to a Qualifying Termination (as defined below), the number of Shares eligible to vest shall be reduced proportionally for the portion of the total days during the Performance Period in which the Grantee was not in active Service. |

For purposes of this Award Agreement, a “Qualifying Termination” means any one of the following:

i. | retirement as a “retiree,” which is a person who is (A) a retired employee under the Lilly Retirement Plan; (B) a retired employee under the retirement plan or program of an Affiliate; or (C) a retired employee under a retirement program specifically approved by the Committee; |

ii. | the Grantee’s Service is terminated due to a plant closing or reduction in workforce (as defined below); |

iii. | as a result of the Grantee’s failure to locate a position within the Company or an Affiliate following the placement of the Grantee on reallocation or medical reassignment in the United States (or equivalent as determined by the Committee). |

“Plant closing” means the closing of a plant site or other corporate location that directly results in termination of the Grantee’s Service.

“Reduction in workforce” means the elimination of a work group, functional or business unit or other broadly applicable reduction in job positions that directly results in termination of the Grantee’s Service.

d. | Demotions, Disciplinary Actions and Misconduct. The Committee may, in its sole discretion, cancel this Relative Value Award or reduce the number of Shares eligible to vest, prorated according to time or other measure as determined appropriate by the Committee, if during any portion of the Performance Period the Grantee has been (i) subject to disciplinary action by the Company or (ii) determined to have committed a material violation of law or Company policy or to have failed to properly manage or monitor the conduct of an employee who has committed a material violation of law or Company policy whereby, in either case, such conduct causes significant harm to the Company, as determined in the sole discretion of the Company. |

The Committee’s determination as to whether (1) a leave of absence or a transfer of employment between Lilly and an Affiliate or between Affiliates constitutes a termination of Service, (2) the Grantee’s Service has been terminated by reason of Disability, (3) the Grantee’s Service has been terminated as a result of the failure to locate a position within the Company or an Affiliate following reallocation or medical reassignment, and (4) the Grantee’s Service has been terminated as a direct result of either a plant closing or a reduction in workforce shall be final and binding on the Grantee.

Section 4. | Change in Control |

The provisions of Section 13.2 of the Plan apply to this Award with the following modifications:

a. | The only Change in Control event that shall result in a benefit under this Section 4 shall be the consummation of a merger, share exchange, or consolidation of the Company, as defined in Section 2.6(c) of the Plan (a “Transaction”). |

b. | In the event of a Transaction that occurs prior to the end of the Performance Period, the Grantee will be credited with an award of Restricted Stock Units equal to the number of Shares eligible to vest, calculated in a manner consistent with Section 2, but the Final Lilly Stock Price shall be equal to the value of Shares established for the consideration to be paid to holders of Shares in the Transaction and the Final Peer Stock Price shall be equal to the closing price of a share of each Peer Group company’s stock, on Nasdaq, the New York Stock Exchange, or other market where an independent share price can be determined, on the date the Transaction closes (or if such day is not a trading date, the first trading date immediately preceding such date) (the “Credited RSU Award”). The Credited RSU Award shall be eligible to vest on the last day of the Performance Period, subject to the Grantee’s continued Service through the last day of the Performance Period, except as provided below: |

i. | In the event that (A) the Grantee is subject to a termination of Service as described in Sections 3(b) and (c) prior to the end of the Performance Period or (B) the Credited RSU Award is not converted, assumed, substituted, continued or replaced by a successor or surviving corporation, or a parent or subsidiary thereof, in connection with a Transaction, then immediately prior to the Transaction, the Credited RSU Award shall vest automatically in full. |

ii. | In the event that the Credited RSU Award is converted, assumed, substituted, continued or replaced by a successor or surviving corporation, or a parent or subsidiary thereof, in connection with the Transaction and the Grantee is subject to a Covered Termination (as defined below) prior to the end of the Performance Period, then immediately as of the date of the Covered Termination, the Credited RSU Award shall vest automatically in full. |

For purposes of this Award Agreement, “Covered Termination” shall mean a termination of Service as described in Sections 3(b) and (c), Grantee’s termination of Service without Cause or the Grantee’s resignation for Good Reason. “Cause” and “Good Reason” shall have the meanings ascribed to them in the Eli Lilly and Company 2007 Change in Control Severance Pay Plan for Select Employees (as amended from time to time) or any successor plan or arrangement thereto.

c. | If the Grantee is entitled to receive stock of the acquiring entity or successor to the Company as a result of the application of this Section 4, then references to Shares in this Award Agreement shall be read to mean stock of the successor or surviving corporation, or a parent or subsidiary thereof, as and when applicable. |

Section 5. | Settlement |

a. | Except as provided below, the Award shall be paid to the Grantee as soon as practicable, but in no event later than sixty (60) days, following the last day of the Performance Period. |

b. | If the Award vests pursuant to Section 4(b)(i), the Award shall be paid to the Grantee immediately prior to the Transaction, provided that if the Award is considered an item of non-qualified deferred compensation subject to Section 409A of the Code (“NQ Deferred Compensation”) and the Transaction does not constitute a “change in control event,” within the meaning of the U.S. Treasury Regulations |

(a “409A CIC”), then the Award shall be paid in cash (calculated based on the value of the Shares established for the consideration to be paid to holders of Shares in the Transaction) on the earliest of the date that the Grantee experiences a “separation from service” within the meaning of Section 409A of the Code (a “Section 409A Separation”), the date of the Grantee’s death and the date set forth in Section 5(a) above.

c. | If the Award vests pursuant to Section 4(b)(ii), the Award shall be paid to the Grantee as soon as practicable, but in no event later than sixty (60) days, following the date the Grantee is subject to a Covered Termination, provided that if the Award is NQ Deferred Compensation, (i) the Award shall be paid within sixty (60) days following the date the Grantee experiences a Section 409A Separation and (ii) if the Grantee is a “specified employee” within the meaning of Section 409A of the Code as of the payment date, the Award shall instead be paid on the earliest of (1) the first day following the six (6) month anniversary of the Grantee’s Section 409A Separation and (2) the date of the Grantee’s death. |

d. | At the time of settlement provided in this Section 5, Lilly shall issue or transfer Shares or the cash equivalent, as contemplated under Section 5(e) below, to the Grantee. In the event the Grantee is entitled to a fractional Share, the fraction may be paid in cash or rounded, in the Committee’s discretion. |

e. | At any time prior to the end of the Performance Period or until the Award is paid in accordance with this Section 5, the Committee may, if it so elects, determine to pay part or all of the Award in cash in lieu of issuing or transferring Shares. The amount of cash shall be calculated based on the Fair Market Value of the Shares on the last day of the Performance Period in the case of payment pursuant to Section 5(a) and on the date of payment in the case of a payment pursuant to Section 5(c). |

f. | In the event of the death of the Grantee, the payments described above shall be made to the successor of the Grantee. |

Section 6. | Rights of the Grantee |

a. | No Shareholder Rights. The Relative Value Award does not entitle the Grantee to any rights of a shareholder of Lilly until such time as the Relative Value Award is settled and Shares are issued or transferred to the Grantee. |

b. | No Trust; Grantee’s Rights Unsecured. Neither this Award Agreement nor any action in accordance with this Award Agreement shall be construed to create a trust of any kind. The right of the Grantee to receive payments of cash or Shares pursuant to this Award Agreement shall be an unsecured claim against the general assets of the Company. |

Section 7. | Prohibition Against Transfer |

The right of a Grantee to receive payments of Shares and/or cash under this Award may not be transferred except to a duly appointed guardian of the estate of the Grantee or to a successor of the Grantee by will or the applicable laws of descent and distribution and then only subject to the provisions of this Award Agreement. A Grantee may not assign, sell, pledge, or otherwise transfer Shares or cash to which he or she may be entitled hereunder prior to transfer or payment thereof to the Grantee, and any such attempted assignment, sale, pledge or transfer shall be void.

Section 8. | Responsibility for Taxes |

a. | Regardless of any action Lilly and/or the Grantee’s employer (the “Employer”) takes with respect to any or all income tax (including federal, state, local and non-U.S. tax), social insurance, payroll tax, fringe benefits tax, payment on account or other tax related items related to the Grantee’s participation in the Plan and legally applicable to the Grantee (“Tax Related Items”), the Grantee acknowledges that the ultimate liability for all Tax Related Items is and remains the Grantee’s responsibility and may exceed the amount actually withheld by Lilly or the Employer. The Grantee further acknowledges that Lilly and the Employer (i) make no representations or undertakings regarding the treatment of any Tax Related Items in connection with any aspect of the Award, including the grant of the Relative Value Award, the vesting of the Relative Value Award, the transfer and issuance of any Shares, the receipt of any cash payment pursuant to the Award, the receipt of any dividends and the sale of any Shares acquired pursuant to this Award; and (ii) do not commit to and are under no obligation to structure the terms of the grant or any aspect of the Award to reduce or eliminate the Grantee’s liability for Tax Related Items or achieve any particular tax result. Furthermore, if the Grantee becomes subject to Tax Related Items in more than one jurisdiction, the Grantee acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax Related Items in more than one jurisdiction. |

b. | Prior to the applicable taxable or tax withholding event, as applicable, the Grantee shall pay or make adequate arrangements satisfactory to Lilly and/or the Employer to satisfy all Tax Related Items. |

i. | If the Relative Value Award is paid to the Grantee in cash in lieu of Shares, the Grantee authorizes the Company and/or the Employer, or their respective agents, at their discretion, to satisfy any obligation for Tax Related Items by withholding from the cash amount paid to the Grantee pursuant to the Award or from the Grantee’s wages or other cash compensation paid to the Grantee by the Company and/or the Employer. |

ii. | If the Relative Value Award is paid to the Grantee in Shares and the Grantee is not subject to the short-swing profit rules of Section 16(b) of the Exchange Act, the Grantee authorizes Lilly and/or the Employer, or their respective agents, at their discretion, to (A) withhold from the Grantee’s wages or other cash compensation paid to the Grantee by the Company and/or the Employer, (B) arrange for the sale of Shares to be issued upon settlement of the Award (on the Grantee’s behalf and at the Grantee’s direction pursuant to this authorization or such other authorization as the Grantee may be required to provide to Lilly or its designated broker in order for such sale to be effectuated) and withhold from the proceeds of such sale, (C) withhold in Shares otherwise issuable to the Grantee pursuant to this Award, and/or (iv) apply any other method of withholding determined by the Company and, to the extent required by Applicable Laws or the Plan, approved by the Committee. |

iii. | If the Relative Value Award is paid to the Grantee in Shares and the Grantee is subject to the short-swing profit rules of Section 16(b) of the Exchange Act, Lilly will withhold in Shares otherwise issuable to the Grantee pursuant to this Award, unless the use of such withholding method is prevented by Applicable Laws or has materially adverse accounting or tax consequences, in which case the withholding obligation for Tax Related Items may be satisfied by one or a combination of the methods set forth in Section 8(b)(ii)(A) and (B) above. |

c. | Depending on the withholding method, Lilly and/or the Employer may withhold or account for Tax Related Items by considering applicable statutory or other withholding rates, including minimum or maximum rates in the jurisdiction(s) applicable to the Grantee. In the event of over-withholding, the Grantee may receive a refund of any over-withheld amount in cash (without interest and without entitlement to the equivalent amount in Shares). If the obligation for Tax Related Items is satisfied by withholding Shares, for tax purposes, the Grantee will be deemed to have been issued the full number of Shares to which he or she is entitled pursuant to this Award, notwithstanding that a number of Shares are withheld to satisfy the obligation for Tax Related Items. |

d. | Lilly may refuse to deliver Shares or any cash payment to the Grantee if the Grantee fails to comply with the Grantee’s obligation in connection with the Tax Related Items as described in this Section 8. |

Section 9. | Section 409A Compliance |

To the extent applicable, it is intended that this Award comply with the requirements of Section 409A of the U.S. Internal Revenue Code of 1986, as amended and the Treasury Regulations and other guidance issued thereunder (“Section 409A”) and this Award shall be interpreted and applied by the Committee in a manner consistent with this intent in order to avoid the imposition of any additional tax under Section 409A.

Section 10. | Grantee’s Acknowledgment |

In accepting this Award, the Grantee acknowledges, understands and agrees that:

a. | the Plan is established voluntarily by Lilly, it is discretionary in nature and it may be modified, amended, suspended or terminated by Lilly at any time, as provided in the Plan; |

b. | the Award is voluntary and occasional and does not create any contractual or other right to receive future Performance-Based Awards, or benefits in lieu thereof, even if Performance-Based Awards have been granted in the past; |

c. | all decisions with respect to future Performance-Based Awards or other awards, if any, will be at the sole discretion of the Committee; |

d. | the Grantee’s participation in the Plan is voluntary; |

e. | the Award and any Shares subject to the Award are not intended to replace any pension rights or compensation; |

f. | the Award and any Shares subject to the Award, and the income and value of same, are not part of normal or expected compensation for any purpose, including but not limited to, calculating any severance, resignation, termination, redundancy, dismissal, end of service payments, bonuses, long-service awards, holiday pay, leave pay, pension or welfare or retirement benefits or similar mandatory payments; |

g. | unless otherwise agreed with Lilly, the Award and any Shares subject to the Award, and the income and value of same, are not granted as consideration for, or in connection with, the service the Grantee may provide as a director of an Affiliate; |

h. | neither the Award nor any provision of this Award Agreement, the Plan or the policies adopted pursuant to the Plan, confer upon the Grantee any right with respect to employment or continuation of current employment, and in the event that the Grantee is not an employee of Lilly or any subsidiary of Lilly, the Award shall not be interpreted to form an employment contract or relationship with Lilly or any Affiliate; |

i. | the future value of the underlying Shares is unknown, indeterminable and cannot be predicted with certainty; |

j. | no claim or entitlement to compensation or damages shall arise from forfeiture of the Award resulting from the Grantee ceasing to provide employment or other services to Lilly or the Employer (for any reason whatsoever, whether or not later found to be invalid or in breach of local labor laws in the jurisdiction where the Grantee is employed or the terms of Grantee’s employment agreement, if any); |

k. | for purposes of the Award, the Grantee’s employment will be considered terminated as of the date he or she is no longer actively providing services to the Company or an Affiliate and the Grantee’s right, if any, to earn and be paid any portion of the Award after such termination of employment or services (regardless of the reason for such termination and whether or not such termination is later found to be invalid or in breach of employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any) will be measured by the date the Grantee ceases to actively provide services and will not be extended by any notice period (e.g., active service would not include any contractual notice period or any period of “garden leave” or similar period mandated under employment laws in the jurisdiction where the Grantee is employed or the terms of the Grantee’s employment agreement, if any); the Committee shall have the exclusive discretion to determine when the Grantee is no longer actively providing services for purposes of the Award (including whether the Grantee may still be considered to be actively providing services while on a leave of absence) in accordance with Section 409A; |

l. | unless otherwise provided in the Plan or by the Committee in its discretion, the Award and the benefits evidenced by this Award Agreement do not create any entitlement to have the Award or any such benefits transferred to, or assumed by, another company nor to be exchanged, cashed out or substituted for, in connection with any corporate transaction affecting the Shares; |

m. | the Grantee is solely responsible for investigating and complying with any laws applicable to him or her in connection with the Award; and |

n. | neither the Company, the Employer nor any Affiliate shall be liable for any foreign exchange rate fluctuation between the Grantee’s local currency and the United States Dollar that may affect the value of the Award or any amounts due to the Grantee pursuant to the settlement of the Award or the subsequent sale of any Shares acquired upon settlement. |

Section 11. | Data Privacy |

a. | Data Collection and Usage. The Company and the Employer may collect, process and use certain personal information about the Grantee, and persons closely associated with the Grantee, including, but not limited to, the Grantee’s name, home address and telephone number, email address, date of birth, social insurance number, passport or other identification number (e.g., resident registration number), salary, nationality, job title, any shares of stock or directorships held in the Company, details of all Relative Value Awards or any other entitlement to shares of stock awarded, canceled, exercised, vested, unvested or outstanding in the Grantee’s favor (“Data”), for the purposes of implementing, administering and managing the Plan. The legal basis, where required, for the processing of Data is the Grantee’s consent. Where required under Applicable Laws, Data may also be disclosed to certain securities or other regulatory authorities where the Company’s securities are listed or traded or regulatory filings are made and the legal basis, where required, for such disclosure are the Applicable Laws. |

b. | Stock Plan Administration Service Providers. The Company transfers Data to Bank of America Merrill Lynch and/or its affiliated companies (“Merrill Lynch”), an independent service provider, which is assisting the Company with the implementation, administration and management of the Plan. In the future, the Company may select a different service provider and share Data with such other provider serving in a similar manner. The Grantee may be asked to agree on separate terms and data processing practices with the service provider, with such agreement being a condition to the ability to participate in the Plan. The Company may also transfer Data to KPMG, an independent service provider, which is also assisting the Company with certain aspects of the implementation, administration and |

management of the Plan. In the future, the Company may select a different service provider and share Data with such other provider serving in a similar manner.

c. | International Data Transfers. The Company and its service providers are based in the United States. The Grantee’s country or jurisdiction may have different data privacy laws and protections than the United States. For example, the European Commission has issued a limited adequacy finding with respect to the United States that applies only to the extent companies register for the EU-U.S. Privacy Shield program, which is open to companies subject to Federal Trade Commission jurisdiction and in which the Company participates with respect to employee data. The Company also participates in the Swiss-U.S. Privacy Shield program under which the Company certifies compliance with certain Swiss data protection requirements with respect to employee data. The Company’s legal basis, where required, for the transfer of Data is Grantee’s consent. |

d. | Data Retention. The Company will hold and use the Data only as long as is necessary to implement, administer and manage the Grantee’s participation in the Plan, or as required to comply with legal or regulatory obligations, including under tax and security laws. |

e. | Voluntariness and Consequences of Consent Denial or Withdrawal. Participation in the Plan is voluntary and the Grantee is providing the consents herein on a purely voluntary basis. If the Grantee does not consent, or if the Grantee later seeks to revoke the Grantee’s consent, the Grantee’s salary from or employment and career with the Employer will not be affected; the only consequence of refusing or withdrawing the Grantee’s consent is that the Company would not be able to grant this Award or other awards to the Grantee or administer or maintain such awards. |

f. | Data Subject Rights. The Grantee understands that data subject rights regarding the processing of Data vary depending on Applicable Laws and that, depending on where the Grantee is based and subject to the conditions set out in such Applicable Laws, the Grantee may have, without limitation, the right to (i) inquire whether and what kind of Data the Company holds about the Grantee and how it is processed, and to access or request copies of such Data, (ii) request the correction or supplementation of Data about the Grantee that is inaccurate, incomplete or out-of-date in light of the purposes underlying the processing, (iii) obtain the erasure of Data no longer necessary for the purposes underlying the processing, (iv) request the Company to restrict the processing of the Grantee’s Data in certain situations where the Grantee feels its processing is inappropriate, (v) object, in certain circumstances, to the processing of Data for legitimate interests, and to (vi) request portability of the Grantee’s Data that the Grantee has actively or passively provided to the Company or the Employer (which does not include data derived or inferred from the collected data), where the processing of such Data is based on consent or the Grantee’s employment and is carried out by automated means. In case of concerns, the Grantee understands that he or she may also have the right to lodge a complaint with the competent local data protection authority. Further, to receive clarification of, or to exercise any of, the Grantee’s rights, the Grantee understands that he or she should contact his or her local human resources representative. |

g. | Declaration of Consent. By accepting the Award and indicating consent via the Company’s online acceptance procedure, the Grantee is declaring that he or she agrees with the data processing practices described herein and consents to the collection, processing and use of Data by the Company and the transfer of Data to the recipients mentioned above, including recipients located in countries which do not adduce an adequate level of protection from a European (or other non-U.S.) data protection law perspective, for the purposes described above. |

Section 12. | Additional Terms and Conditions |

a. | Country-Specific Conditions. The Award shall be subject to any special terms and conditions set forth in any Appendix to this Award Agreement for the Grantee’s country. Moreover, if the Grantee relocates to one of the countries included in the Appendix, the special terms and conditions for such country will apply to the Grantee, to the extent the Company determines that the application of such terms and conditions is necessary or advisable for legal or administrative reasons. The Appendix constitutes part of this Award Agreement. |

b. | Insider Trading / Market Abuse Laws. The Grantee may be subject to insider trading restrictions and/or market abuse laws in applicable jurisdictions, including but not limited to the United States and the Grantee’s country of residence, which may affect the Grantee’s ability to directly or indirectly, for the Grantee or for a third party, acquire or sell, or attempt to sell, or otherwise dispose of Shares, rights to acquire Shares (e.g., the Relative Value Award) under the Plan during such times as the Grantee is considered to have “inside information” regarding the Company (as determined under the laws or |

regulations in the applicable jurisdictions). Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. The Grantee acknowledges that it is his or her responsibility to comply with any applicable restrictions, and the Grantee should consult with his or her personal legal advisor on this matter.

c. | Imposition of Other Requirements. The Company reserves the right to impose other requirements on the Award and any Shares acquired under the Plan, to the extent the Company determines it is necessary or advisable for legal or administrative reasons, and to require the Grantee to execute any additional agreements or undertakings that may be necessary to accomplish the foregoing. Without limitation to the foregoing, the Grantee agrees that the Relative Value Award and any benefits or proceeds the Grantee may receive hereunder shall be subject to forfeiture and/or repayment to the Company to the extent required to comply with any requirements imposed under Applicable Laws or any compensation recovery policy of the Company that reflects the provisions of Applicable Laws. |

Section 13. | Governing Law and Choice of Venue |

The validity and construction of this Award Agreement shall be governed by the laws of the State of Indiana, U.S.A. without regard to laws that might cause other law to govern under applicable principles of conflict of laws. For purposes of litigating any dispute that arises under this Award Agreement, the parties hereby submit to and consent to the jurisdiction of the State of Indiana, and agree that such litigation shall be conducted in the courts of Marion County, Indiana, or the federal courts for the United States for the Southern District of Indiana, and no other courts, where this Award is granted and/or to be performed.

Section 14. | Miscellaneous Provisions |

a. | Notices and Electronic Delivery and Participation. Any notice to be given by the Grantee or successor Grantee shall be in writing, and any notice shall be deemed to have been given or made only upon receipt thereof by the Corporate Secretary of Lilly at Lilly Corporate Center, Indianapolis, Indiana 46285, U.S.A. Any notice or communication by Lilly in writing shall be deemed to have been given in the case of the Grantee if mailed or delivered to the Grantee at any address specified in writing to Lilly by the Grantee and, in the case of any successor Grantee, at the address specified in writing to Lilly by the successor Grantee. In addition, Lilly may, in its sole discretion, decide to deliver any documents related to the Award and participation in the Plan by electronic means or request the Grantee’s consent to participate in the Plan by electronic means. By accepting this Award, the Grantee hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an on-line or electronic system established and maintained by Lilly or a third party designated by Lilly. |

b. | Language. The Grantee acknowledges that he or she is proficient in the English language, or has consulted with an advisor who is sufficiently proficient in English, so as to allow the Grantee to understand the terms and conditions of this Award Agreement. If the Grantee has received this Award Agreement or any other document related to the Plan translated into a language other than English and if the meaning of the translated version is different than the English version, the English version will control. |

c. | Waiver. The waiver by Lilly of any provision of this Award Agreement at any time or for any purpose shall not operate as or be construed to be a waiver of the same or any other provision of this Award Agreement at any subsequent time or for any other purpose. |

d. | Severability and Section Headings. If one or more of the provisions of this Award Agreement shall be held invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and the invalid, illegal or unenforceable provisions shall be deemed null and void; however, to the extent permissible by law, any provisions which could be deemed null and void shall first be construed, interpreted or revised retroactively to permit this Award Agreement to be construed so as to foster the intent of this Award Agreement and the Plan. |

The section headings in this Award Agreement are for convenience of reference only and shall not be deemed a part of, or germane to, the interpretation or construction of this instrument.

e. | No Advice Regarding Grant. Lilly is not providing any tax, legal or financial advice, nor is Lilly making any recommendations regarding the Grantee’s participation in the Plan or the Grantee’s acquisition or sale of the underlying Shares. The Grantee should consult with his or her own personal tax, legal and financial advisors regarding the Grantee’s participation in the Plan before taking any action related to the Plan. |

Section 15. | Compensation Recovery |

At any time during the three years following the date on which the number of Shares eligible to vest under this Award has been determined under Section 2 above, the Company reserves the right to and, in appropriate cases, will seek restitution of all or part of any Shares that have been issued or cash that has been paid pursuant to this Award if:

a. | (i) the number of Shares or the amount of the cash payment was calculated based, directly or indirectly, upon the achievement of financial results that were subsequently the subject of a restatement of all or a portion of the Company’s financial statements, (ii) the Grantee engaged in intentional misconduct that caused or partially caused the need for such a restatement; and (iii) the number of Shares or the amount of cash payment that would have been issued or paid to the Grantee had the financial results been properly reported would have been lower than the number of Shares actually issued or the amount of cash actually paid; or |

b. | the Grantee has been determined to have committed a material violation of law or Company policy or to have failed to properly manage or monitor the conduct of an employee who has committed a material violation of law or Company policy whereby, in either case, such misconduct causes significant harm to the company. |

Furthermore, in the event the number of Shares issued or cash paid pursuant to this Award is determined to have been based on materially inaccurate financial statements or other Company performance measures or on calculation errors (without any misconduct on the part of the Grantee), the Company reserves the right to and, in appropriate cases, will (A) seek restitution of the Shares or cash paid pursuant to this Award to the extent that the number of Shares issued or the amount paid exceeded the number of Shares that would have been issued or the amount that would have been paid had the inaccuracy or error not occurred, or (B) issue additional Shares or make additional payment to the extent that the number of Shares issued or the amount paid was less than the correct amount.

This Section 15 is not intended to limit the Company’s power to take such action as it deems necessary to remedy any misconduct, prevent its reoccurrence and, if appropriate, based on all relevant facts and circumstances, punish the wrongdoer in a manner it deems appropriate.

Section 16. | Award Subject to Acknowledgement of Acceptance |

Notwithstanding any provisions of this Award Agreement, the Award is subject to acknowledgement of acceptance by the Grantee prior to 4:00 PM (EDT) April 30, 2020, through the website of Merrill Lynch, the Company’s stock plan administrator. If the Grantee does not acknowledge acceptance of the Award prior to 4:00 PM (EDT) April 30, 2020, the Award will be cancelled, subject to the Committee’s discretion for unforeseen circumstances.

IN WITNESS WHEREOF, Lilly has caused this Award Agreement to be executed in Indianapolis, Indiana, by its proper officer.

ELI LILLY AND COMPANY

By: _________________________

David A. Ricks

Chairman of the Board, President and

Chief Executive Officer

Appendix

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

This Appendix includes special terms and conditions applicable to the Grantee’s country. These terms and conditions supplement or replace (as indicated) the terms and conditions set forth in the Award Agreement to which it is attached. If the Grantee is a citizen or resident of a country other than the one in which the Grantee is currently working and/or residing (or is considered as such for local law purposes), or if the Grantee transfers employment or residency to a different country after the Award is granted, Lilly will, in its discretion, determine the extent to which the terms and conditions herein will apply. This Appendix also includes other information relevant to the Award.

Unless otherwise defined herein, the terms defined in the Plan or the Award Agreement, as applicable, shall have the same meanings in this Appendix.

There are no special terms and conditions or information for the following countries:

Austria

Belgium

Germany

Japan

Puerto Rico

However, the Grantee should be aware that he or she may be required to take certain steps to comply with Applicable Laws in the Grantee’s country in connection with the Award. For example, exchange control, foreign asset and/or account and/or other tax reporting obligations may apply to the Grantee upon receipt of the Award or the Shares subject to the Award or upon the sale of Shares. For more information regarding such obligations, the Grantee should refer to the Employee Information Supplement for the Grantee’s country, if any. The Grantee should also consult with his or her own personal tax and legal advisors to determine what, if any, obligations exist with respect to the Award and/or the acquisition or sale of Shares. Neither the Company nor the Employer is responsible for any failure on the part of the Grantee to be aware of or comply with Applicable Laws.

Appendix for China

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Vesting.

This provision supplements Section 2 of the Award Agreement:

To facilitate compliance with any Applicable Laws or regulations in China, the Grantee agrees and acknowledges that Lilly (or a brokerage firm instructed by Lilly) is entitled to sell any or all Shares issued to the Grantee on or as soon as practicable after the applicable Vesting Date or other vesting event (on behalf of the Grantee and at the Grantee’s direction pursuant to this authorization), either immediately after such Shares are issued to the Grantee or when the Grantee ceases Service or at such other time as the Company may determine is necessary or advisable to facilitate compliance with Applicable Laws or the administration of the Plan. The Grantee also agrees to sign any forms and/or consents that may be required by the brokerage firm to effectuate the sale of the Shares and acknowledges that neither Lilly nor the brokerage firm are under any obligation to arrange for such sale of the Shares at any particular price. In any event, when the Shares acquired under the Plan are sold, the proceeds of the sale of the Shares, less any Tax Related Items and broker’s fees or commissions, will be remitted to the Grantee in accordance with applicable exchange control laws and regulations.

Adjustments for Certain Employment Status Changes.

This provision replaces Section 3(b) of the Award Agreement:

In the event the Grantee’s Service is terminated (i) due to the Grantee’s death or (ii) by reason of Grantee’s Disability, the number of shares eligible to vest shall be equal to the Target Number of Shares.

This provision replaces the first sentence of Section 3(c) of the Award Agreement:

In the event the Grantee’s employment is subject to a Qualifying Termination (as defined below), the number of Shares eligible to vest shall be equal to the Target Number of Shares reduced proportionally for the portion of the total days during the Performance Period in which the Grantee was not in active Service.

Settlement.

This provision replaces Section 5(a) of the Award Agreement:

Except as provided below, the Award shall be paid to the Grantee as soon as practicable, but in no event later than sixty (60) days, following the last day of the Performance Period, provided, however, that (i) in the event the Grante’s Service is terminated (A) due to the Grantee’s death, (B) by reason of Grantee’s Disability, or (C) as a result of the Grantee’s failure to locate a position within the Company or an Affiliate following the placement of the Grantee on reallocation or medical reassignment in the United States (or equivalent as determined by the Committee) or (ii) in the event of a Qualifying Termination, the Award shall be paid to the Grantee no later than sixty (60) days following the date of the Grantee’s termination of Service.

Exchange Control Restrictions.

The Grantee understands and agrees that, due to exchange control laws in China, the Grantee will be required to immediately repatriate to China any funds (e.g., proceeds from the sale of Shares) received pursuant to this Award. The Grantee further understands that such repatriation of the funds may need to be effected through a special exchange control account established by Lilly or an Affiliate. The Grantee hereby consents and agrees that any funds received pursuant to this Award may be transferred to such special account prior to being delivered to the Grantee’s personal account. The Grantee also understands that the Company will deliver the funds to the Grantee as soon as possible, but there may be delays in distributing the funds to the Grantee due to exchange control requirements in China. Funds may be paid to the Grantee in U.S. dollars or local currency at the Company’s discretion. If the funds are paid to the Grantee in U.S. dollars, the Grantee will be required to set up a U.S. dollar bank account in China so that the funds may be deposited into this account. If the funds are paid to the Grantee

in local currency, the Company is under no obligation to secure any particular exchange conversion rate and the Company may face delays in converting the funds to local currency due to exchange control restrictions. The Grantee further agrees to comply with any other requirements that may be imposed by the Company in the future in order to facilitate compliance with exchange control requirements in China.

Appendix for France

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Award Not French-Qualified.

The Award is not intended to be “French-qualified,” i.e., it is not intended to qualify for specific tax and/or social security treatment in France.

Language Consent.

In accepting the Award, the Grantee confirms having read and understood the documents relating to the Award (the Plan and the Award Agreement including this Appendix), which were provided in English. The Grantee accepts the terms of those documents accordingly.

Consentement Relatif à la Langue Utilisée.

En acceptant cette Attribution, le Bénéficiaire confirme avoir lu et compris les documents relatifs à cette Attribution (le Plan le Contrat d’Attribution incluant cette Annexe), qui ont été remis en langue anglaise. Le Bénéficiaire accepte les termes de ces documents en conséquence.

Appendix for Ireland

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Director Notification Information.

Directors (including shadow directors A shadow director is an individual who is not on the board of the Irish Affiliate but who has sufficient control so that the board of directors acts in accordance with the “directions or instructions” of the individual.) and secretaries of an Irish Affiliate For purposes of this requirement, the interests of spouses, children under 18 years of age and family-held companies or trusts will be considered interests of the director or secretary, as applicable. whose interests exceed 1% of the Company’s voting rights, pursuant to Section 53 of the Irish Company Act 1990, must notify the Irish Affiliate in writing when (i) receiving or disposing of an interest in the Company (e.g., Relative Value Awards, Shares), (ii) becoming aware of the event giving rise to the notification requirement, or (iii) becoming a director or secretary of an Irish Affiliate if such an interest exists at the time.

Appendix for Italy

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Plan Document Acknowledgment.

In accepting the Award, the Grantee acknowledges that he or she has received a copy of the Plan, has reviewed the Plan and the Award Agreement (including this Appendix) in their entirety and fully understands and accepts all provisions of the Plan and the Award Agreement (including this Appendix) and, in particular, Section 2 (Vesting).

Appendix for Mexico

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Acknowledgement of the Award Agreement.

By accepting the Relative Value Awards, the Grantee acknowledges that he or she has received a copy of the Plan and the Award Agreement, including this Appendix, which he or she has reviewed. The Grantee further acknowledges that he or she accepts all the provisions of the Plan and the Award Agreement, including this Appendix. The Grantee also acknowledges that he or she has read and specifically and expressly approves the terms and conditions set forth in the “Grantee's Acknowledgement” section of the Award Agreement, which clearly provide as follows:

(1) | The Grantee’s participation in the Plan does not constitute an acquired right; |

(2) | The Plan and the Grantee’s participation in it are offered by the Company on a wholly discretionary basis; |

(3) | The Grantee’s participation in the Plan is voluntary; and |

(4) | The Company and its Affiliates are not responsible for any decrease in the value of any Shares acquired pursuant to the Relative Value Awards. |

Labor Law Acknowledgement and Policy Statement.

By accepting the Award, the Grantee acknowledges that Eli Lilly and Company, with registered offices at Lilly Corporate Center, Indianapolis, Indiana, 46285, U.S.A., is solely responsible for the administration of the Plan. The Grantee further acknowledges that his or her participation in the Plan, the grant of Relative Value Awards and any acquisition of Shares under the Plan do not constitute an employment relationship between the Grantee and Eli Lilly and Company because the Grantee is participating in the Plan on a wholly commercial basis and his or her sole employer is Eli Lilly y Compania de Mexico, S.A. de C.V. (“Lilly-Mexico”). Based on the foregoing, the Grantee expressly acknowledges that the Plan and the benefits that he or she may derive from participation in the Plan do not establish any rights between the Grantee and his or her Employer, Lilly-Mexico, and do not form part of the employment conditions and/or benefits provided by Lilly-Mexico, and any modification of the Plan or its termination shall not constitute a change or impairment of the terms and conditions of the Grantee’s employment.

The Grantee further understands that his or her participation in the Plan is the result of a unilateral and discretionary decision of Eli Lilly and Company and, therefore, Eli Lilly and Company reserves the absolute right to amend and/or discontinue the Grantee’s participation in the Plan at any time, without any liability to the Grantee.

Finally, the Grantee hereby declares that he or she does not reserve to him- or herself any action or right to bring any claim against Eli Lilly and Company for any compensation or damages regarding any provision of the Plan or the benefits derived under the Plan, and that he or she therefore grants a full and broad release to Eli Lilly and Company, its subsidiaries, affiliates, branches, representation offices, shareholders, officers, agents or legal representatives, with respect to any claim that may arise.

Spanish Translation

Reconocimiento del Convenio de Concesión

Al aceptar el Premio de Valor Relativo el Beneficiario reconoce que ha recibido y revisado una copia del Plan y del Convenio de Concesión, incluyendo este Apéndice. El Beneficiario reconoce y acepta todas las disposiciones del Plan y del Convenio de Concesión, incluyendo este apéndice. El Beneficiario también reconoce que ha leído y aprobado de forma expresa los términos y condiciones establecidos en la sección: “Naturaleza de la Concesión” del Convenio de Concesión, que claramente establece lo siguiente:

(1) | La participación del Beneficiario en el Plan no constituye un derecho adquirido; |

(2) | El Plan y la participación del Beneficiario en el es ofrecido por la Compañía de manera completamente discrecional; |

(3) | La participación del Beneficiario en el Plan es voluntaria; y |

(4) | La Compañía y sus Afiliadas no son responsables por ninguna disminución en el valor de las Acciones adquiridas de conformidad con el Premio de Valor Relativo. |

Reconocimiento de la legislación Laboral aplicable y Declaración de la Política

Al aceptar el Premio, el Beneficiario reconoce que Eli Lilly and Company, con domicilio social en Lilly Corporate Center, Indianapolis, Indiana, 46285, E.U.A., es la única responsable por la administración del Plan. Además, el Beneficiario reconoce que su participación en el Plan, la concesión de Premios de Valor Relativo y cualquier adquisición de Acciones bajo el Plan no constituyen una relación laboral entre el Beneficiario y Eli Lilly and Company, en virtud de que el Beneficiario está participando en el Plan en su totalidad sobre una base comercial y su único empleador es Eli Lilly y Compania de México, S.A. de C.V. (“Lilly-México”). Por lo anterior, el Beneficiario expresamente reconoce que el Plan y los beneficios que puedan derivarse de su participación no establecen ningún derecho entre el Beneficiario y su empleador, Lilly-México, y que no forman parte de las condiciones de trabajo y/o beneficios otorgados por Lilly-México, y cualquier modificación del Plan o la terminación del mismo no constituirá un cambio o modificación de los términos y condiciones en el empleo del Beneficiario.

Además, el Beneficiario comprende que su participación en el Plan es el resultado de una decisión discrecional y unilateral de Eli Lilly and Company, por lo que Eli Lilly and Company se reserva el derecho absoluto de modificar y/o suspender la participación del Beneficiario en el Plan en cualquier momento, sin responsabilidad frente al Beneficiario.

Finalmente, el Beneficiario manifiesta que no se reserva acción o derecho alguno que origine una demanda en contra de Eli Lilly and Company, por cualquier compensación o daño relacionada con las disposiciones del Plan o de los beneficios otorgados en el mismo, y en consecuencia el Beneficiario libera de la manera más amplia y total de responsabilidad a Eli Lilly and Company, sus subsidiarias, afiliadas, sucursales, oficinas de representación, sus accionistas, directores, agentes y representantes legales de cualquier demanda que pudiera surgir.

Appendix for Spain

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Vesting.

This provision supplements Section 2 of the Award Agreement:

As a condition of the grant of the Award, termination of the Grantee’s Service for any reason (including for the reasons listed below but excluding for the reasons specified in Sections 3(b) and 3(c) of the Award Agreement) will automatically result in the forfeiture and loss of the Award and the underlying Shares to the extent that the Award has not yet vested as of the date of termination of the Grantee’s Service. In particular, and without limitation to the provisions of the Award Agreement and the Plan, the Grantee understands and agrees that the Award will be cancelled without entitlement to the underlying Shares or to any amount as indemnification if the Grantee terminates employment by reason of, including, but not limited to: resignation, disciplinary dismissal adjudged to be with cause, disciplinary dismissal adjudged or recognized to be without good cause (i.e., subject to a “despido improcedente”), individual or collective layoff on objective grounds, whether adjudged to be with cause or adjudged or recognized to be without cause (unless such layoff falls within the meaning of a plant closing or reduction in workforce as described in Section 3(c)), material modification of the terms of employment under Article 41 of the Workers’ Statute, relocation under Article 40 of the Workers’ Statute, Article 50 of the Workers’ Statute, unilateral withdrawal by the Employer, and under Article 10.3 of Royal Decree 1382/1985 (unless such layoff falls within the meaning of a medical reassignment as described in Section 3(c)). The Grantee acknowledges that he or she has read and specifically accepts the vesting conditions referred to in Section 2 of the Award Agreement.

Grantee’s Acknowledgement.

This provision supplements Section 10 of the Award Agreement:

The Grantee understands that the Company has unilaterally, gratuitously and discretionally decided to grant Relative Value Awards under the Plan to individuals who may be Employees of the Company or its Affiliates throughout the world. The decision is a limited decision that is entered into upon the express assumption and condition that any grant will not economically or otherwise bind the Company or any of its Affiliates on an ongoing basis except to the extent otherwise provided in the Plan and this Award Agreement. Consequently, the Grantee understands that the Relative Value Awards are granted on the assumption and condition that the Relative Value Awards and any Shares acquired pursuant to the Relative Value Awards shall not become a part of any employment contract (either with the Company or any of its Affiliates) and shall not be considered a mandatory benefit, salary for any purposes (including severance compensation) or any other right whatsoever. In addition, the Grantee understands that this grant would not be made to the Grantee but for the assumptions and conditions referred to above; thus, the Grantee acknowledges and freely accepts that should any or all of the assumptions be mistaken or should any of the conditions not be met for any reason, then any grant of Relative Value Awards may be cancelled.

Securities Law Information.

No “offer of securities to the public,” as defined under Spanish law, has taken place or will take place in the Spanish territory in connection with the Award. The Award Agreement has not nor will it be registered with the Comisión Nacional del Mercado de Valores, and does not constitute a public offering prospectus.

Appendix for Turkey

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Securities Law Information.

Under Turkish law, the Grantee is not permitted to sell any Shares acquired under the Plan in Turkey. The Shares are currently traded on the New York Stock Exchange in the United States of America, under the ticker symbol of “LLY” and Shares acquired under the Plan may be sold through this exchange.

Appendix for the United Kingdom

Eli Lilly and Company

Amended and Restated 2002 Lilly Stock Plan

Relative Value Award Agreement

Settlement.

Section 5(e) of the Award Agreement shall not apply to Relative Value Awards granted in the United Kingdom.

Responsibility for Taxes.

This provision supplements Section 8 of the Award Agreement:

Without limitation to Section 8 of the Award Agreement, the Grantee agrees that he or she is liable for all Tax Related Items and hereby covenants to pay all such Tax Related Items, as and when requested by the Company and/or the Employer or by Her Majesty’s Revenue & Customs (“HMRC”) (or any other tax authority or any other relevant authority). The Grantee also agrees to indemnify and keep indemnified the Company and/or the Employer against any Tax Related Items that they are required to pay or withhold or have paid or will pay to HMRC (or any other tax authority or any other relevant authority) on the Grantee’s behalf.

Notwithstanding the foregoing, if the Grantee is a director or executive officer of the Company (within the meaning of Section 13(k) of the Exchange Act), the foregoing provision will not apply. In this case, the amount of any Tax Related Items not collected from or paid by the Grantee may constitute a benefit to the Grantee on which additional income tax and National Insurance contributions (“NICs”) may be payable. The Grantee understands that he or she will be responsible for reporting and paying any income tax due on this additional benefit directly to HMRC under the self-assessment regime and for paying to the Company and/or the Employer (as appropriate) the amount of any employee NICs due on this additional benefit.

Joint Election.

As a condition of the vesting of the Relative Value Awards, the Grantee agrees to accept any liability for secondary Class 1 national insurance contributions which may be payable by the Company and/or the Employer in connection with the Relative Value Awards and any event giving rise to Tax Related Items (the “Employer NICs”). Without prejudice to the foregoing, by accepting this Award, the Grantee is entering into a joint election with the Company or the Employer if he or she has not already done so, the form of such joint election being formally approved by HMRC (the “Joint Election”), a copy of which is attached to this Appendix for the United Kingdom as Annex 1, and any other required consent or election. The Grantee further agrees to execute such other joint elections as may be required between him or her and any successor to the Company and/or the Employer. The Grantee further agrees that the Company and/or the Employer may collect the Employer NICs from him or her by any of the means set forth in the Joint Election.

Annex 1 to Appendix for United Kingdom

Important Note on the Joint Election for Transfer of Liability for Employer National Insurance Contributions to the Grantee:

As a condition of the Grantee’s participation in the Eli Lilly and Company Amended and Restated 2002 Lilly Stock Plan, as amended from time to time (the “Plan”), the Grantee is required to enter into a joint election to transfer to the Grantee any liability for employer National Insurance contributions (the “Employer NICs”) that may arise in connection with the Relative Value Award (the “Award”) and in connection with future awards, if any, that may be granted to the Grantee under the Plan (the “Joint Election”).

By entering into the Joint Election:

• | the Grantee agrees that any liability for Employer NICs that may arise in connection with or pursuant to the vesting of the Award and the acquisition of shares of common stock of Eli Lilly and Company (the “Company”) or other taxable events in connection with the Award will be transferred to the Grantee; and |

• | the Grantee authorizes the Company and/or the Grantee’s employer to recover an amount sufficient to cover this liability by any method set forth in the Award Agreement and/or the Joint Election. |

To enter into the Joint Election, please selecting the button next to “Accept” where indicated on the Pending Acceptance screen. Please note that selecting the button next to “Accept” indicates the Grantee’s agreement to be bound by all of the terms of the Joint Election.

Please note that even if the Grantee has indicated his or her acceptance of this Joint Election electronically, the Grantee may still be required to sign a paper copy of this Joint Election (or a substantially similar form) if the Company determines such is necessary to give effect to the Joint Election.

Please read the terms of the Joint Election carefully before accepting the Award Agreement and the Joint Election. The Grantee should print and keep a copy of this Joint Election for his or her records.

Joint Election for Transfer of Liability for

Employer National Insurance Contributions to Employee

Election To Transfer the Employer’s National Insurance Liability to the Employee

This Election is between:

A. | The individual who has obtained authorised access to this Election (the “Employee”), who is employed by one of the employing companies listed in the attached schedule (the “Employer”) and who is eligible to receive performance based awards (the “Relative Value Award”) pursuant to the Amended and Restated 2002 Lilly Stock Plan (the “Plan”), and |

B. | Eli Lilly and Company, an Indiana corporation, with registered offices at Lilly Corporate Center, Indianapolis, Indiana, 46285, U.S.A. (the “Company”), which may grant Relative Value Awards under the Plan and is entering into this Election on behalf of the Employer. |

1. | Introduction |

1.1 | This Election relates to all Relative Value Awards granted to the Employee under the Plan on or after November 15, 2018 up to the termination date of the Plan. |

1.2 | In this Election the following words and phrases have the following meanings: |

(a) | “Chargeable Event” means any event giving rise to Relevant Employment Income. |

(b) | “ITEPA” means the Income Tax (Earnings and Pensions) Act 2003. |

(c) | “Relevant Employment Income” from Relative Value Awards on which Employer's National Insurance Contributions becomes due is defined as: |

(i) | an amount that counts as employment income of the earner under section 426 ITEPA (restricted securities: charge on certain post-acquisition events); |

(ii) | an amount that counts as employment income of the earner under section 438 of ITEPA (convertible securities: charge on certain post-acquisition events); or |

(iii) | any gain that is treated as remuneration derived from the earner's employment by virtue of section 4(4)(a) SSCBA, including without limitation: |

(A) | the acquisition of securities pursuant to the Relative Value Awards (within the meaning of section 477(3)(a) of ITEPA); |

(B) | the assignment (if applicable) or release of the Relative Value Awards in return for consideration (within the meaning of section 477(3)(b) of ITEPA); |

(C) | the receipt of a benefit in connection with the Relative Value Awards, other than a benefit within (i) or (ii) above (within the meaning of section 477(3)(c) of ITEPA). |

(d) | “SSCBA” means the Social Security Contributions and Benefits Act 1992. |

1.3 | This Election relates to the Employer’s secondary Class 1 National Insurance Contributions (the “Employer’s Liability”) which may arise in respect of Relevant Employment Income in respect of the Relative Value Awards pursuant to section 4(4)(a) and/or paragraph 3B(1A) of Schedule 1 of the SSCBA. |

1.4 | This Election does not apply in relation to any liability, or any part of any liability, arising as a result of regulations being given retrospective effect by virtue of section 4B(2) of either the SSCBA, or the Social Security Contributions and Benefits (Northern Ireland) Act 1992. |

1.5 | This Election does not apply to the extent that it relates to relevant employment income which is employment income of the earner by virtue of Chapter 3A of Part VII of ITEPA (employment income: securities with artificially depressed market value). |

2. | The Election |

The Employee and the Company jointly elect that the entire liability of the Employer to pay the Employer’s Liability that arises on any Relevant Employment Income is hereby transferred to the Employee. The Employee understands that, by electronically accepting this Election, he or she will become personally liable for the Employer’s Liability covered by this Election. This Election is made in accordance with paragraph 3B(1) of Schedule 1 of the SSCBA.

3. | Payment of the Employer’s Liability |

3.1 | The Employee hereby authorises the Company and/or the Employer to collect the Employer’s Liability in respect of any Relevant Employment Income from the Employee at any time after the Chargeable Event: |

(a) | by deduction from salary or any other payment payable to the Employee at any time on or after the date of the Chargeable Event; and/or |

(b) | directly from the Employee by payment in cash or cleared funds; and/or |

(c) | by arranging, on behalf of the Employee, for the sale of some of the securities which the Employee is entitled to receive in respect of the Relative Value Awards, the proceeds from which must be delivered to the Employer in sufficient time for payment to be made to Her Majesty’s Revenue & Customs (“HMRC”) by the due date; and/or |

(d) | where the proceeds of the gain are to be paid through a third party, the Employee will authorize that party to withhold an amount from the payment or to sell some of the securities which the Employee is entitled to receive in respect of the Relative Value Awards, such amount to be paid in sufficient time to enable the Company and/or the Employer to make payment to HMRC by the due date; and/or |

(e) | by any other means specified in the applicable Relative Value Award agreement entered into between the Employee and the Company. |

3.2 | The Company hereby reserves for itself and the Employer the right to withhold the transfer of any securities to the Employee in respect of the Relative Value Awards until full payment of the Employer’s Liability is received. |

3.3 | The Company agrees to procure the remittance by the Employer of the Employer’s Liability to HMRC on behalf of the Employee within 14 days after the end of the UK tax month during which the Chargeable Event occurs (or within 17 days after the end of the UK tax month during which the Chargeable Event occurs if payments are made electronically). |

4. | Duration of Election |

4.1 | The Employee and the Company agree to be bound by the terms of this Election regardless of whether the Employee is transferred abroad or is not employed by the Employer on the date on which the Employer’s Liability becomes due. |

4.2 | Any reference to the Company and/or the Employer shall include that entity’s successors in title and assigns as permitted in accordance with the terms of the Plan and relevant award agreement. This |

Election will continue in effect in respect of any awards which replace the Relative Value Awards in circumstances where section 483 of ITEPA applies.

4.3 | This Election will continue in effect until the earliest of the following: |

(a) | the date on which the Employee and the Company agree in writing that it should cease to have effect; |

(b) | the date on which the Company serves written notice on the Employee terminating its effect; |

(c) | the date on which HMRC withdraws approval of this Election; or |

(d) | the date on which, after due payment of the Employer’s Liability in respect of the entirety of the Relative Value Awards to which this Election relates or could relate, the Election ceases to have effect in accordance with its own terms. |

4.4 | This Election will continue in force regardless of whether the Employee ceases to be an employee of the Employer. |

Acceptance by the Employee

The Employee acknowledges that, by clicking on the button next to “Accept” to accept the Relative Value Awards Agreement and this Election (or by signing this Election), the Employee agrees to be bound by the terms of this Election.

Acceptance by the Company

The Company acknowledges that, by signing this Election or arranging for the scanned signature of an authorised representative to appear on this Election, the Company agrees to be bound by the terms of this Election.

Signature for and on behalf of the Company

Sr VP-Human Resources and Diversity

Position

Schedule of Employer Companies

The employing companies to which this Election relates include:

Name | Eli Lilly and Company Limited |

Registered Office: | Lilly House, Priestley Road, Basingstoke, Hants RG24 9NL |

Company Registration Number: | 00284385 |

Corporation Tax Reference: | 7953096404 |

PAYE Reference: | 581/ML114 |