Attached files

| file | filename |

|---|---|

| 8-K - 8-K - YELP INC | yelp-20200208.htm |

| EX-99.2 - EX-99.2 - YELP INC | yelpq419ex992shareholdea01.pdf |

| EX-99.1 - EX-99.1 - YELP INC | yelpq419exhibit991pres.htm |

EXHIBIT 99.2 Q4 2019 Letter to Shareholders Feb 13, 2020 | yelp-ir.com

Financial and Operational Highlights > Net revenue was $269 million, up 10% from the fourth > Cash provided by operating activities was $56 million quarter of 2018, a one percentage point increase from for the fourth quarter of 2019, and we ended the fourth the third quarter’s growth rate. Greater-than-expected quarter with cash, cash equivalents and marketable securi- seasonal reductions by small- and medium-sized business ties of $466 million (“SMB”) customers resulted in reported growth slightly In January 2020, our Board authorized a $250 million below our outlook for the quarter; this seasonal activity > increase to our share repurchase program. In 2019, we reversed in January, when our non-term advertising repurchased a total of approximately 14 million shares business saw record monthly advertiser acquisitions and at an aggregate cost of $481 million, which drove a 12% budget retention reduction in our diluted shares outstanding by the end of > Net income was $17 million, or $0.24 per diluted share, the year compared to $32 million, or $0.37 per diluted share, in We expect to accelerate revenue growth and expand the fourth quarter of 2018, reflecting higher income taxes > margins again in 2020. Specifically, we expect Net revenue in the fourth quarter of 2019 and a valuation allowance to grow 10-12% compared to 2019, with Adjusted EBITDA release in the fourth quarter of 2018 margin increasing by 1-2 percentage points compared to > Adjusted EBITDA1 grew to $61 million, an increase of $8 2019 million, or 15%, compared to the fourth quarter of 2018. Adjusted EBITDA margin increased one percentage point to 23% compared to the fourth quarter of 2018 2 26 Net revenue Net income Adjusted EBITDA1 +10% -46% +15% $269M $61M $244M $32M $53M $17M 22% 23% Margin 4Q18 4Q19 4Q18 4Q19 4Q18 4Q19 App unique devices Paying advertising locations Cumulative reviews +8% +4% +16% 36M 33M 541k 565k 205M 177M 4Q18 4Q19 4Q18 4Q19 4Q18 4Q19 Note: Reported figures are rounded; the year-over-year percentage changes are calculated based on reported financial statements and metrics 1Refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented to the most directly comparable GAAP measures Yelp Q4 2019

Our Long-Term Plan is Transforming Our Business 2020 Outlook Expanding Margins Accelerating Growth 1 Net Revenue Adjusted EBITDA margin 22-23% FY’19 +8% +10-12% 21% +11% +10% 19% +5% 2018 1H’19 2H’19 2020E 2018 2019 2020E Returning Capital to Shareholders $250M $950M > Executed $481M share repurchase in 2019 $250M Approved additional $250M share repurchase 3 > authorization in January 2020 26 $250M > Authorized nearly $1B of share repurchases since $200M July 2017 Jul’17 Nov’18 Feb’19 Jan’20 Total Completed as Remaining repurchase of Dec 31, ‘19 Authorization Authorization Date authorization Continually developing our leadership and Board of Directors 2019 Three new independent directors elected Christina Barone Christine Barone appointed as CEO, True Food Kitchen independent director Deep multi-location Restaurant-category experience. Operational expertise scaling True Food Kitchen nationwide. 2020 David Schwarzbach David Schwarzbach appointed Chief Previously CFO & COO, Optimizely Financial Officer Strong track record of driving results and accelerating growth. A rare combination of financial and operational leadership. 1 Yelp Q4 2019 GAAP Net income was $55 million in 2018. Net income was $41 million in 2019. Refer to the accompanying financial tables for further details and a recon- ciliation of the non-GAAP measures presented to the most directly comparable GAAP measures

Dear fellow shareholders, Accelerated growth to double-digits 2019 marked an important point in Yelp’s 15-year history, as we embarked on lower sales headcount on an ambitious, multi-year business transformation plan designed to drive and sustain profitable long-term growth. In our first year executing 10% the plan, we made excellent progress, improving retention of non-term 5% advertisers’ budgets by a mid-teens percentage, increasing Multi-location 0 channel revenue by 22%, and growing Self-serve channel revenue by 30% -5% from last year. Executing our plan accelerated year-over-year revenue -10% growth from 5% in the first half of 2019 to 10% in the second half of the 1Q19 2Q19 3Q19 4Q19 year. Net Revenue, Local Sales y/y Headcount, y/y These improvements are transforming the economics of our business. The retention gains and growth in our accretive Self-serve and Multi-location channels have lessened our dependence on expanding the Local sales force Growth strategy drove to drive revenue growth. In 2019, we reaccelerated revenue growth improved profitability while simultaneously reducing Local sales force headcount by 10% by year end, which helped increase Adjusted EBITDA margin from 19% in 2018 Adjusted EBITDA Margin to 21% in 2019. Our strong financial performance also enabled us to return 21% $481 million to shareholders through share repurchases in 2019. 19% 4 26 Our strategy has begun to unlock the long-term potential created by our 2018 2019 transition to a multi-channel, on-demand business model. In its first full year, our non-term advertising product expanded our customer base and made us even more accountable to it on a day-to-day basis. The flexibility offered by this product also resulted in more December seasonality than we expected in our Local advertising business, dampening fourth quarter results. However, that seasonal trend reversed in January as SMBs stepped up their advertising in the new year. In fact, January was our strongest month on record for both non-term advertiser acquisition and budget retention since we began selling non-term advertising, and at the start of February, year-over-year growth in cost-per-click (“CPC”) advertising budgets—which has historically been a reliable indicator of future Advertising revenue—exceeded 10%. While December-January seasonality became more pronounced, we believe our long-term growth trajectory remains squarely on target. Yelp Q4 2019

Our 2019 progress gives us confidence in reaching long- In 2020, we are expanding upon the strategy that successfully term financial targets accelerated growth and improved profitability in 2019. The drivers of our plan to deliver long-term profitable growth remain unchanged: Net Revenue Mid-teens CAGR > generate more value for our business customers, > capture the Multi-location opportunity, > expand Yelp’s product offerings, 2019 2023E > win in Restaurants and Home & Local Services, and > enhance the consumer experience. Adjusted EBITDA Margin 30-35% We expect the successful execution of these initiatives to accelerate 21% revenue growth once again in 2020. We also expect the improved structural economics of our business to yield incremental expense leverage this year, as we look to achieve faster revenue growth without expanding the Local 2019 2023E sales force. The undeniable progress we have made over the past year bolsters our confidence in achieving our long-term financial targets. We look forward to sharing more about our progress in the year ahead. 5 26 Yelp Q4 2019

Driving strong revenue growth Volume of Ad Clicks Generating more value for our business customers 34% In 2019, we delivered significantly more value to our customers. We generated 34% more ad clicks for Yelp advertisers at an average CPC 18% lower than in 2018. We did this by improving the efficiency of our advertising auction system and our ad targeting. We also expanded 2018 2019 advertising inventory in select categories, such as Home & Local Services, while maintaining a great consumer experience. This significant increase Average Cost Per Click in value improved budget retention among non-term advertisers by a mid-teens percentage from 2018 to 2019, which we expect to deliver -18% ongoing benefits in 2020. Despite the increase in ad clicks delivered to advertisers in 2019, we derived revenue from fewer than 10% of the total number of leads we generated 2018 2019 for businesses on our platform. We believe we can deliver far more leads to both existing and new advertisers, driving even greater customer satisfaction and retention, while continuing to delight and engage We plan to deliver more consumers with a great product experience. In the fourth quarter of 2019, 6 leads to Yelp advertisers we began rolling out the first of many planned ad-related improvements 26 and initiatives that will continue in 2020. In the year ahead, we anticipate making further enhancements to our advertising auction and Request-A- Quote lead matching. We also plan to introduce new types of advertising Consumer leads* on Yelp inventory, such as themed ads, which highlight select advertisers that respond quickly to consumers or provide free quotes or consultations. We are also working to expand our customization options to allow advertisers to further tailor their campaigns. Finally, we are enhancing our reporting tools to ensure that advertisers clearly see the impact of their campaigns. <10% We expect these initiatives to drive additional retention gains in 2020. Monetized leads *Includes Calls, Request A Quote requests and url clicks Yelp Q4 2019

New ad features for National Brands Showcase ads Capturing the Multi-location opportunity Our Multi-location business had another excellent year, growing 22% in 2019, and it was particularly strong among National customers. National advertisers responded well to the results of Yelp attribution studies, which demonstrated our ability to deliver consumers to their stores at a compelling cost. By the end of the year, we counted more than one-third of the top 250 restaurants and retailers by revenue* as paying customers. New advertising features designed for National brands, including Showcase Ads, also drove increased spending by existing customers. National advertisers that were customers in both 2018 and 2019 increased their ad budgets by 20% in aggregate in 2019, and annual revenue retention for that group exceeded 100%. We also extended our client coverage in 2019, growing our Multi-location team by more than 25% to build on our successful consultative approach to sales and client care. We continue to see significant opportunity to grow our Multi-location business in 2020 and beyond. In 2019, we focused primarily on restaurants and retailers. In 2020, we are expanding our focus to include the multi- Large Opportunity in Services 7 billion-dollar digital advertising opportunity in the services category. On the 2019 U.S. Local Digital Advertising 26 product side, we plan to introduce more ways for Multi-location advertisers Spend in Key Categories to drive sales during their key selling seasons. $27B $28B $8B Restaurants Other Services We are always looking for new ways to reach our consumers and, given SMB Multi-location Yelp’s dominance in the industry, we sought a partnership to help us drive more customers to our restaurants. We’ve been working with Yelp since Source: BIA Advisory Services, 2020 U.S. Local Advertising Forecast; Yelp internal data 2015, but decided we wanted to take things to the next level when we learned about Yelp Store Visits. YSV has helped us to truly understand the impact of our ad dollars and ensure we’re leveraging the right strategy. We look forward to continuing our partnership in 2020 and uncovering even more valuable ways to attract more customers to Denny's. –Erik Jensen, Vice President of Brand Engagement Yelp Q4 2019 *Source: NPD Group, Technomic, company reports

New products driving Self-serve channel Expanding Yelp’s product offerings Verified License & Business Highlights Since the end of 2018, we have introduced a steady stream of new paid offerings at affordable price points, which have been well received by business owners. Verified License, Business Highlights, and Portfolios together attracted more than 70,000 active subscribing locations by year end, which helped accelerate revenue growth in the Self- serve channel to 30% in 2019. At the end of the fourth quarter, we also launched Yelp Connect—enabling merchants to promote their businesses to consumers visually—which is off to a promising start. Matching advertisers to the right products at the right prices will be a top product priority for 2020. We are differentiating how we market and merchandise our products based on businesses’ unique attributes and needs. We believe that by delivering the right fit, we will drive greater customer satisfaction, and ultimately, greater advertiser lifetime value. In 2020, we plan to introduce additional profile products to complement last year’s offerings, which will help business owners tell their stories and build trust with consumers. 8 Portfolios 26 Yelp Q4 2019

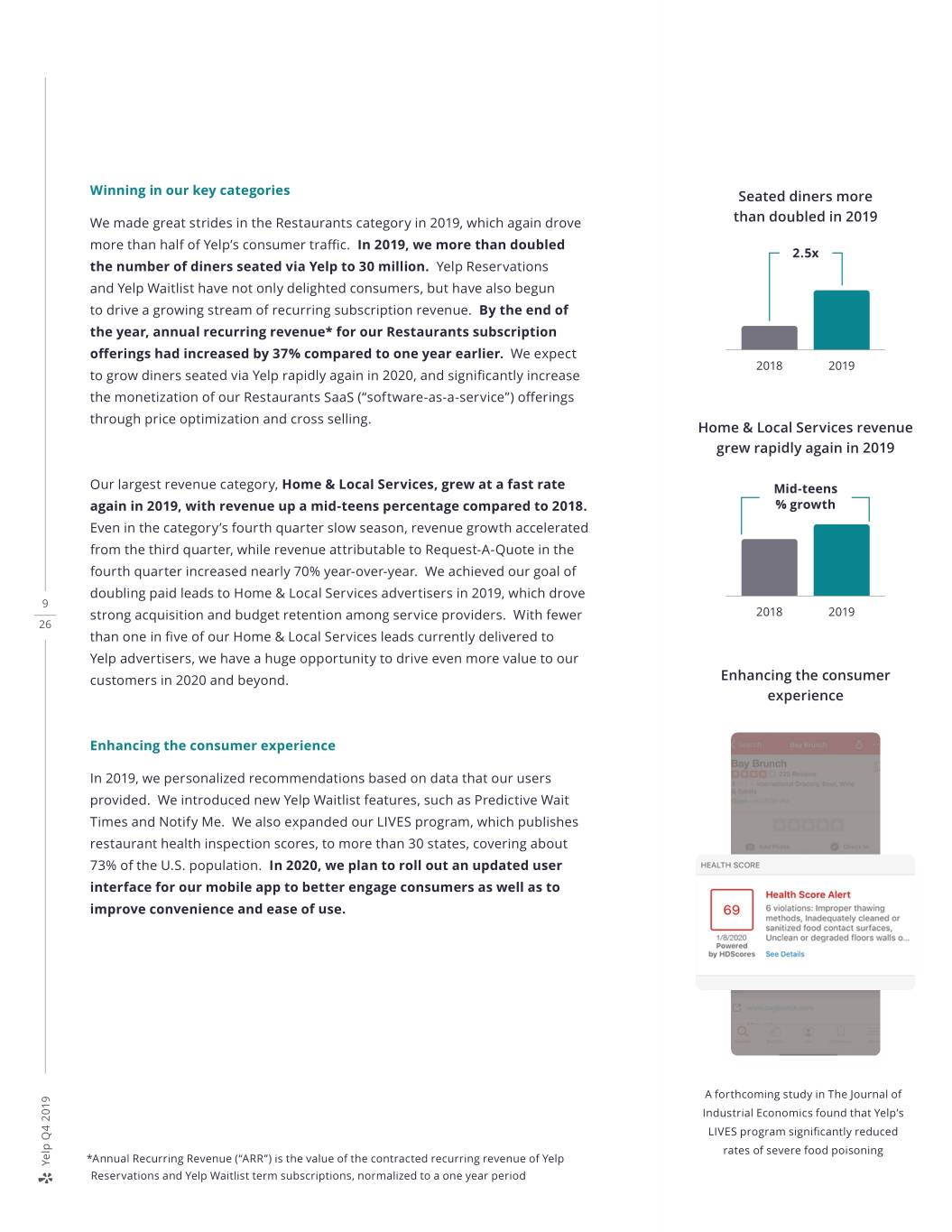

Winning in our key categories Seated diners more We made great strides in the Restaurants category in 2019, which again drove than doubled in 2019 more than half of Yelp’s consumer traffic. In 2019, we more than doubled 2.5x the number of diners seated via Yelp to 30 million. Yelp Reservations and Yelp Waitlist have not only delighted consumers, but have also begun to drive a growing stream of recurring subscription revenue. By the end of the year, annual recurring revenue* for our Restaurants subscription offerings had increased by 37% compared to one year earlier. We expect 2018 2019 to grow diners seated via Yelp rapidly again in 2020, and significantly increase the monetization of our Restaurants SaaS (“software-as-a-service”) offerings through price optimization and cross selling. Home & Local Services revenue grew rapidly again in 2019 Our largest revenue category, Home & Local Services, grew at a fast rate Mid-teens again in 2019, with revenue up a mid-teens percentage compared to 2018. % growth Even in the category’s fourth quarter slow season, revenue growth accelerated from the third quarter, while revenue attributable to Request-A-Quote in the fourth quarter increased nearly 70% year-over-year. We achieved our goal of doubling paid leads to Home & Local Services advertisers in 2019, which drove 9 strong acquisition and budget retention among service providers. With fewer 2018 2019 26 than one in five of our Home & Local Services leads currently delivered to Yelp advertisers, we have a huge opportunity to drive even more value to our customers in 2020 and beyond. Enhancing the consumer experience Enhancing the consumer experience In 2019, we personalized recommendations based on data that our users provided. We introduced new Yelp Waitlist features, such as Predictive Wait Times and Notify Me. We also expanded our LIVES program, which publishes restaurant health inspection scores, to more than 30 states, covering about 73% of the U.S. population. In 2020, we plan to roll out an updated user interface for our mobile app to better engage consumers as well as to improve convenience and ease of use. A forthcoming study in The Journal of Industrial Economics found that Yelp’s LIVES program significantly reduced rates of severe food poisoning *Annual Recurring Revenue (“ARR”) is the value of the contracted recurring revenue of Yelp Yelp Q4 2019 Reservations and Yelp Waitlist term subscriptions, normalized to a one year period

Driving improved long-term profitability Our growth strategy continues to drive profitability. Stronger budget retention across sales channels and the mix shifts to our accretive Multi- location and Self-serve channels have improved the economics of our business, enabling us to accelerate year-over-year revenue growth from the first half to the second half of 2019, while simultaneously reducing Local sales headcount by 10% in 2019. We believe this transformation in our business model will support profitable growth for years to come. Our investments are focused on returns. We reduced marketing spending on consumer traffic in 2019, choosing instead to lean more heavily on our sub- stantial organic traffic and our fast-growing proprietary restaurant reservation and waitlist experiences. As we continue to leverage our Restaurants category investments to drive user engagement, we will likely see slower App unique device growth in the short term. However, we believe the higher quality traffic and independent distribution will be far more beneficial for Yelp and its share- holders in the long term. We are managing overhead expenses wisely. In 2019, we significantly 10 reduced the size of our San Francisco sales office and relocated a portion of 26 our G&A organization from San Francisco to our Phoenix office, reducing some future recurring operating expenses. We are also expanding our office in Toronto to tap into a deep well of technical talent, while reducing reliance on the high-cost San Francisco Bay Area. Together with the structural benefits of our new growth model, our expense discipline drove a strong incremental Adjusted EBITDA margin of 43% in 2019. We expect the retention gains, sales mix shift, and expense discipline from 2019 to help us deliver profitable growth again in 2020 and ultimately drive us towards our 30-35% long-term Adjusted EBITDA margin target. Yelp Q4 2019

We have several announcements to share that support our efforts to drive long-term value for our shareholders: David Schwarzbach named Yelp’s CFO We are excited to welcome David Schwarzbach to our executive team as our new Chief Financial Officer, effective February 14. David brings a rare and valuable combination of financial and operational leadership talent to the team, having served as Chief Financial Officer and Chief Operating Officer of Optimizely, Inc. Prior to joining Optimizely, David held senior finance positions at eBay, Inc., including serving as Vice President and Chief Financial Officer of eBay’s North American Marketplaces business, where he had a key role in growing Gross Merchandise Volume to more than $30 billion. David also David Schwarzbach helped to drive significant improvements in marketing efficiency there. Earlier Chief Financial Officer in his career, David was an Executive Director in Morgan Stanley’s Global Capital Markets division. We are looking forward to partnering with David to drive our long-term financial strategy for the years to come. Christine Barone appointed to Yelp’s board 11 26 In 2019, we added three talented and experienced independent directors to our Board to help drive the execution of our long-term plan, and in 2020, we are continuing to enhance our world-class Board. To that end, we are pleased to announce that Christine Barone will join Yelp’s Board of Directors effective March 1. Christine will replace Mariam Naficy on the Board and as a member of the Nominating and Corporate Governance Committee. Christine brings deep Restaurant-category experience to our Board, having scaled True Food Kitchen to more than 30 stores in 14 states in her role there Christine Barone Yelp Director as Chief Executive Officer. Prior to True Food Kitchen, she served as Senior Vice President, Food, Evenings and Licensed Stores at Starbucks. Earlier in Member of Nominating & her career, she spent more than a decade at Bain & Company, and began her Corporate Governance Committee career as an investment banker. We believe her leadership and restaurant experience will help us serve both our shareholders and customers. Yelp Q4 2019

Board approved $250 million increase to share repurchase program Committed to Returning Capital to Shareholders Yelp’s Board of Directors authorized a $250 million increase to our share repurchase program, bringing the amount we have committed to reducing $250M $950M dilution, returning excess capital to shareholders, and optimizing our capital structure to nearly $1 billion since we initiated our buyback program in $250M July 2017. Our management team and Board remain focused on managing investors’ capital wisely and will continue to explore opportunities to drive $250M shareholder value through effective and flexible capital allocation, and we believe the execution of our plan will continue to support a strong balance $200M sheet. Jul’17 Nov’18 Feb’19 Jan’20 Total repurchase In summary, Authorization authorization Date We made excellent progress on our long-term strategic plan in 2019. We Completed as Remaining not only accelerated revenue growth in the second half of the year, but also of Dec 31, ‘19 Authorization improved the margin structure of our business. I am proud of our team’s hard work and focused execution, which has driven strong momentum. These achievements create a foundation for another year of profitable growth and bring us closer to realizing our long-term financial targets. 12 26 Sincerely, Jeremy Stoppelman James Miln Yelp Q4 2019

Fourth Quarter and Full Year 2019 Financial Review Net revenue grew to $269 million in the fourth quarter of 2019, a 10% Net revenue increase over the fourth quarter of 2018. While strong, Net revenue growth +10% was slightly below our Business Outlook range of 11-13% for the quarter. $269M Although budget retention continued to improve year-over-year in each $244M month of the quarter, the improvement in December narrowed more than we anticipated due to seasonal spending reductions among our SMB customers. In January 2020, non-term advertiser acquisition and budget retention 4Q18 4Q19 rebounded to record levels as businesses resumed spending in the new year. For the full year 2019, Net revenue was $1 billion, an 8% year-over-year growth rate, in line with our updated full-year 2019 Business Outlook of 8% Advertising revenue was $259 million in the fourth quarter of 2019, a 10% increase over the fourth quarter of 2018. For the full year 2019, Advertising revenue was $977 million, an increase of 8% from the full year 2018. The 13 increases in both periods were driven by growth in the number of Paying 26 advertising locations and higher advertising budgets from Multi-location customers. The number of Paying advertising locations in the fourth quarter grew 4% year-over-year to 565,000, reflecting improved Local revenue retention and productivity from our Local advertising sales force. Yelp Q4 2019

Transactions revenue was $3 million in the fourth quarter of 2019, down 12% from the fourth quarter of 2018, and $12 million in the full year 2019, down 9% from the full year 2018. The decreases in both periods were primarily due to declines in fees earned from Grubhub for processing credit card transactions related to Grubhub orders that originated on our platform. Other services revenue was $7 million in the fourth quarter of 2019, up 23% from the fourth quarter of 2018, and $25 million in the full year 2019, up 15% from the full year 2018. The increases in both periods were primarily driven by growth in Yelp Waitlist and Yelp Reservations subscription revenue. 14 Total net revenue 20 Yelp Q4 2019

Operating expenses & Adjusted EBITDA Cost of revenue (exclusive of depreciation and amortization) was $17 COR % of Revenue million in the fourth quarter of 2019, up $2 million, or 17%, compared to the fourth quarter of 2018, and $62 million in the full year 2019, up 8% from the 6% 6% full year 2018. The increases in both periods were primarily due to an increase in advertising fulfillment costs as well as increased website infrastructure 4Q18 4Q19 expense. Sales and marketing expenses totaled $126 million in the fourth quarter S&M % of Revenue of 2019 and $500 million for the full year 2019, in both cases up 4% from the prior-year periods. Despite the decrease in our Local sales force, the increase 50% 47% in expenses in both periods was driven by higher commissions earned from stronger sales force productivity and higher employee costs as tenured sales representatives comprised a larger proportion of our sales force. These increases were partially offset by lower marketing expenses from continued 4Q18 4Q19 efforts to optimize our marketing spend. We expect overall sales headcount to be flat in 2020 as compared to the 15 prior year, with our Local sales headcount decreasing by a low single-digit 26 percentage, offsetting growth in headcount of our Multi-location sales teams. PD % of Revenue Product development expenses were $61 million in the fourth quarter, up 13% compared to the fourth quarter of 2018, driven by higher employee costs as we expanded our product development and engineering teams to deliver our 2020 product initiatives. For the full year 2019, Product development expenses increased by 9% due to employee costs associated with increased headcount. We expect to continue to expand our product and engineering teams in 2020 to support our increased focus on business-owner products and marketplace transaction features, as well as to continue enhancing the Yelp consumer experience. Yelp Q4 2019

G&A % of Revenue General and administrative expenses were $34 million in the fourth quarter, up 15%, or $4 million, compared to the fourth quarter of 2018, due to increases in employee costs associated with increased headcount in our general and administrative functions, as well as higher bad debt expense resulting from the increase in Advertising revenue. For the full year 2019, General and administrative expenses increased by 13%, due to employee costs associated with increased headcount, as well as $7 million in fees related to shareholder activism. Excluding these fees related to shareholder activism, the increase in General and administrative expenses for the full year would have been 7%. Total costs and expenses were $251 million in the fourth quarter, up 9% from $231 million in the fourth quarter of 2018, and $979 million for the full year 2019, a 7% increase compared to $917 million for the full year 2018. 16 Income tax expense was $3 million in the fourth quarter of 2019 and $9 26 million for the full year 2019, compared to an Income tax benefit of $15 million in the fourth quarter of 2018 and for the full year 2018. The benefit recorded in the fourth quarter of 2018 was related to the release of a valuation allowance against certain of our deferred tax assets. Net income Net income was $17 million in the fourth quarter of 2019 compared to Net -46% income of $32 million in the fourth quarter of 2018, and $41 million for the $32M full year 2019, down from $55 million for the full year 2018. The year-over-year declines were due to higher taxes in 2019 compared to 2018, which included $17M the previously noted valuation allowance release. 4Q18 4Q19 Diluted earnings per share was $0.24 in the fourth quarter of 2019, down from the $0.37 we reported in the fourth quarter of 2018, resulting from a decrease in Net income partially offset by an 15% reduction in weighted- average diluted shares outstanding resulting from our share repurchases. Yelp Q4 2019

Adjusted EBITDA was $61 million in the fourth quarter of 2019, a 15% Adjusted EBITDA1 increase from $53 million in the fourth quarter of 2018. Adjusted EBITDA +15% margin improved to 23% in the fourth quarter of 2019 compared with 22% in $61M the year-ago quarter, driven by controlled growth in operating expenses and $53M the sales mix shift. Stock-based compensation expense was $31 million in the fourth quarter of 2019, an increase of 6% compared to the fourth quarter of 22% 23% Margin 2018. Full year Adjusted EBITDA was $213 million, up 17% from $183 million for 4Q18 4Q19 the full year 2018. Balance sheet and cash flow At the end of December 2019, we held $466 million in cash, cash equivalents and marketable securities on our consolidated balance sheet, with no debt. In 2019, we repurchased approximately 14 million shares for an aggregate purchase price of $481 million. Since initiating our repurchase program in July 2017, we have returned $681 million to shareholders as part of our program designed to reduce dilution and manage shareholder capital wisely. In January 2020, our board authorized a $250 million increase to 17 the repurchase program. 26 During the year ended December 31, 2019, we also used $43 million in cash to cover employee tax liabilities associated with the vesting of restricted stock units that were settled through net share withholding. Taken together with our repurchases, diluted share count for the fourth quarter of 2019 was 73.0 million, a decrease of 13.3 million, or 15%, from the year ago period. Yelp Q4 2019

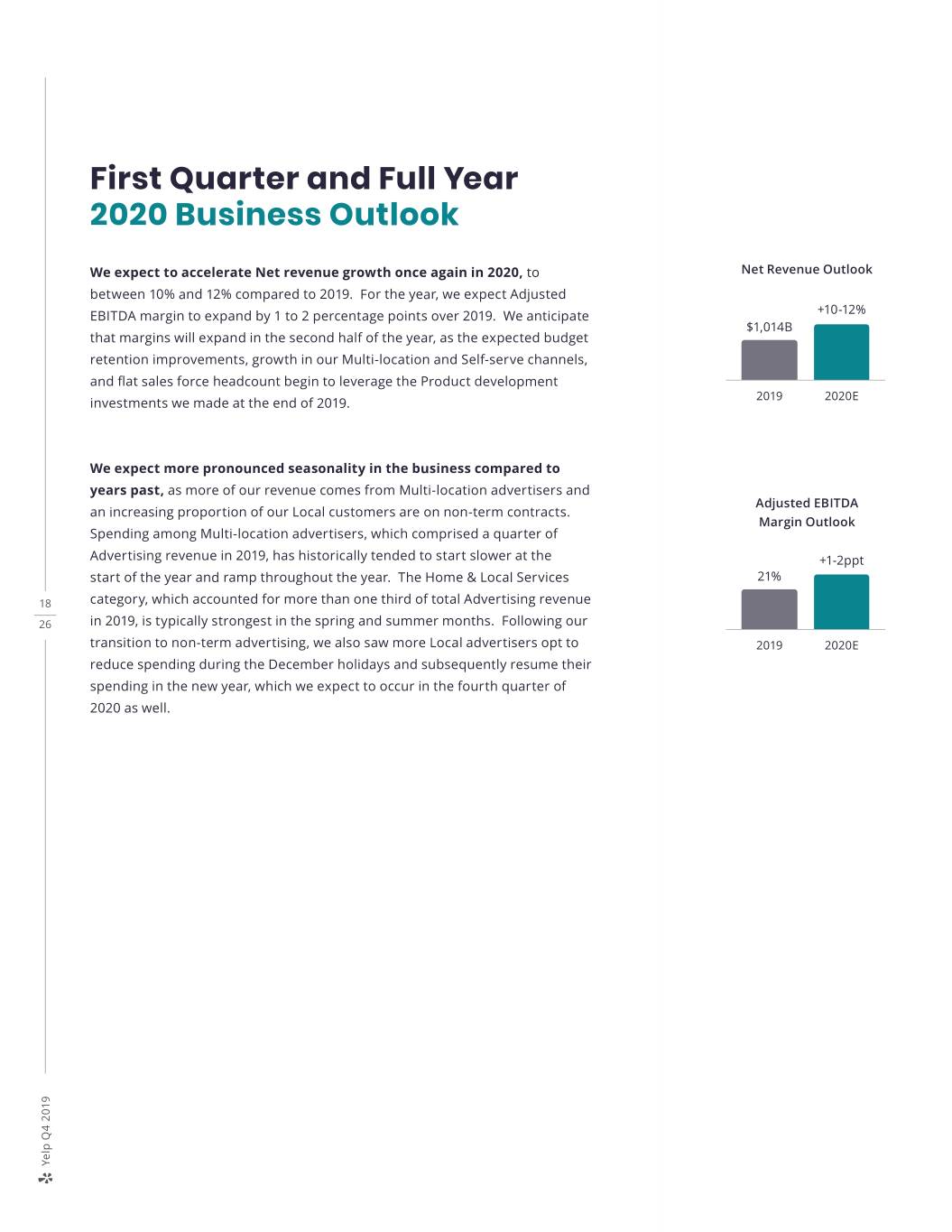

First Quarter and Full Year 2020 Business Outlook We expect to accelerate Net revenue growth once again in 2020, to Net Revenue Outlook between 10% and 12% compared to 2019. For the year, we expect Adjusted EBITDA margin to expand by 1 to 2 percentage points over 2019. We anticipate +10-12% $1,014B that margins will expand in the second half of the year, as the expected budget retention improvements, growth in our Multi-location and Self-serve channels, and flat sales force headcount begin to leverage the Product development 2019 2020E investments we made at the end of 2019. We expect more pronounced seasonality in the business compared to years past, as more of our revenue comes from Multi-location advertisers and Adjusted EBITDA an increasing proportion of our Local customers are on non-term contracts. Margin Outlook Spending among Multi-location advertisers, which comprised a quarter of Advertising revenue in 2019, has historically tended to start slower at the +1-2ppt start of the year and ramp throughout the year. The Home & Local Services 21% 18 category, which accounted for more than one third of total Advertising revenue 26 in 2019, is typically strongest in the spring and summer months. Following our transition to non-term advertising, we also saw more Local advertisers opt to 2019 2020E reduce spending during the December holidays and subsequently resume their spending in the new year, which we expect to occur in the fourth quarter of 2020 as well. Yelp Q4 2019

For the first quarter of 2020, we expect Net revenue growth of 8 to 10% compared to the first quarter of 2019, as advertisers’ spending ramps up from the start of the year. We expect Adjusted EBITDA margin to be approximately 2 percentage points lower than in the year-ago quarter, owing to investments in product development and marketing to drive our 2020 growth initiatives outlined previously. First Quarter Full Year 2020 2020 Net revenue growth (y-y) 8% to 10% 10% to 12% Increase in Adjusted EBITDA* as a % ~ (2) ppts 1 to 2 ppts of Net revenue Stock-based compensation expense ~12% ~11% as a % of Net revenue Depreciation and amortizationas a % ~5% ~5% of Net revenue 19 *Yelp has not reconciled its Adjusted EBITDA outlook to GAAP Net income (loss) because it does not provide an outlook for GAAP Net income (loss) due to the uncertainty and 26 potential variability of Other income, net and Provision for (benefit from) income taxes, which are reconciling items between Adjusted EBITDA and GAAP Net income (loss). Because Yelp cannot reasonably predict such items, a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure is not available without unreasonable effort. We caution, however, that such items could have a significant impact on the calculation of GAAP Net income (loss). For more information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below. Quarterly Earnings Webcast Yelp will host a live webcast today at 2:00 p.m. PST to discuss the fourth quarter 2019 financial results. The webcast can be accessed on the Yelp Investor Relations website at yelp-ir.com. A replay of the webcast will be available at the same website. About Yelp Yelp Inc. (www.yelp.com) connects people with great local businesses. With unmatched local business information, photos and review content, Yelp provides a one-stop local platform for consumers to discover, connect, and transact with local businesses of all sizes by making it easy to request a quote, join a waitlist, and make a reservation, appointment, or purchase. Yelp was founded in San Francisco in July 2004. Yelp Q4 2019

Condensed Consolidated Balance Sheets (In thousands; unaudited) December 31, December 31, 2019 2018 Assets Current assets: Cash and cash equivalents $ 170,281 $ 332,764 Short-term marketable securities 242,000 423,096 Accounts receivable, net 106,832 87,305 Prepaid expenses and other current assets 14,196 17,104 Total current assets 533,309 860,269 Long-term marketable securities 53,499 – Property, equipment and software, net 110,949 114,800 Operating lease right-of-use assets 197,866 – Goodwill 104,589 105,620 Intangibles, net 10,082 13,359 Restricted cash 22,037 22,071 Other non-current assets 38,369 59,444 20 Total assets $ 1,070,700 $ 1,175,563 26 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable and accrued liabilities $ 72,333 $ 61,062 Operating lease liabilities - current 57,507 – Deferred revenue 4,315 3,843 Total current liabilities 134,155 64,905 Operating lease liabilities - long-term 174,756 – Other long-term liabilities 6,798 35,140 Total liabilities 315,709 100,045 Stockholders’ equity Common stock – – Additional paid-in capital 1,259,803 1,139,462 Accumulated other comprehensive loss (11,759) (11,021) Accumulated deficit (493,053) (52,923) Total stockholders' equity 754,991 1,075,518 Total liabilities and stockholders' equity $ 1,070,700 $ 1,175,563 Yelp Q4 2019

Condensed Consolidated Statements of Operations (In thousands, except per share data; unaudited) Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 Net revenue $ 268,823 $ 243,740 $ 1,014,194 $ 942,773 Costs and expenses: Cost of revenue1 16,656 14,255 62,410 57,872 Sales and marketing1 126,370 121,256 500,386 483,309 Product development1 61,138 54,273 230,440 212,319 General and administrative1 34,164 29,677 136,091 120,569 Depreciation and amortization 12,849 11,557 49,356 42,807 Total costs and expenses 251,177 231,018 978,683 916,876 Income from operations 17,646 12,722 35,511 25,897 Other income, net 2,611 4,160 14,256 14,109 Income before income taxes 20,257 16,882 49,767 40,006 Provision for (benefit from) income taxes 3,105 (15,064) 8,886 (15,344) Net income attributable to common stockholders $ 17,152 $ 31,946 $ 40,881 $ 55,350 21 26 Net income per share attributable to common stockholders: Basic $ 0.24 $ 0.39 $ 0.55 $ 0.66 Diluted $ 0.24 $ 0.37 $ 0.52 $ 0.62 Weighted-average shares used to compute net income per share attributable to common stockholders: Basic 70,627 82,706 74,627 83,573 Diluted 72,987 86,287 77,969 88,709 1Includes stock-based compensation expense as follows: Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 Cost of revenue $ 1,119 $ 1,227 $ 4,535 $ 4,572 Sales and marketing 7,524 7,265 30,668 30,779 Product development 16,861 15,004 63,433 56,882 General and administrative 5,001 5,157 22,876 22,153 Total stock-based compensation $ 30,505 $ 28,653 $ 121,512 $ 114,386 Yelp Q4 2019

Condensed Consolidated Statements of Cash Flows (In thousands; unaudited) Year Ended December 31, 2019 2018 Operating activities Net income $ 40,881 $ 55,350 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 49,356 42,807 Provision for doubtful accounts 22,543 24,515 Stock-based compensation 121,512 114,386 Non-cash lease cost 41,365 - Deferred income taxes (2,799) (15,469) Other adjustments, net (2,997) (722) Changes in operating assets and liabilities: Accounts receivable (42,070) (35,664) Prepaid expenses and other assets (1,349) (5,192) Operating lease liabilities (41,808) - Accounts payable, accrued liabilities and other liabilities 20,148 (19,824) Net cash provided by operating activities 204,782 160,187 22 26 Investing activities Purchases of marketable securities (541,451) (751,237) Maturities of marketable securities 674,097 613,700 Sale of investment prior to maturity – 17,895 Release of escrow deposit 28,750 – Purchases of property, equipment and software (37,522) (44,972) Other investing activities 461 245 Net cash provided by (used in) investing activities 124,335 (164,369) Financing activities Proceeds from issuance of common stock for employee stock-based plans 32,263 29,779 Taxes paid related to net share settlement of equity awards (42,771) (50,144) Repurchases of common stock (481,011) (187,382) Net cash used in financing activities (491,519) (207,747) Effect of exchange rate changes on cash, cash equivalents and restricted cash (115) 360 Change in cash, cash equivalents and restricted cash (162,517) (211,569) Cash, cash equivalents and restricted cash - Beginning of period 354,835 566,404 Cash, cash equivalents and restricted cash - End of period $ 192,318 $ 354,835 Yelp Q4 2019

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands; unaudited) Three Months Ended December 31, Year Ended December 31, 2019 2018 2019 2018 EBITDA and adjusted EBITDA: GAAP net income $ 17,152 $ 31,946 $ 40,881 $ 55,350 Provision for (benefit from) income taxes 3,105 (15,064) 8,886 (15,344) Other income, net (2,611) (4,160) (14,256) (14,109) Depreciation and amortization 12,849 11,557 49,356 42,807 EBITDA $ 30,495 $ 24,279 $ 84,867 $ 68,704 Stock-based compensation 30,505 28,653 121,512 114,386 Fees related to shareholder activism* – – 7,116 – Adjusted EBITDA $ 61,000 $ 52,932 $ 213,495 $ 183,090 Net revenue $ 268,823 $ 243,740 $ 1,014,194 $ 942,773 Adjusted EBITDA margin 23% 22% 21% 19% 23 *Recorded within general and administrative expenses on our Condensed Consolidated Statements of Operations 26 Yelp Q4 2019

Non-Financial Metrics 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Key operational metrics (in thousands) App Unique Devices1 28,845 30,115 32,062 34,025 32,891 35,001 36,737 37,662 35,599 Paying Advertising Locations2 478 508 517 524 541 529 549 563 565 Sales Headcount 3,300 3,300 3,350 3,700 3,850 3,450 3,300 3,650 3,600 Active Claimed Local Business Locations3,4 3,681 3,870 4,037 4,180 4,310 4,467 4,616 4,772 4,913 Other non-financial metrics (in thousands) Cumulative Reviews 148,298 155,328 162,969 170,865 177,385 184,386 191,735 199,309 205,382 Desktop Unique Visitors1 76,748 73,668 73,939 68,807 62,140 62,779 61,797 62,427 54,006 Mobile Web Unique Visitors1 64,221 69,901 72,328 74,789 69,148 68,891 76,650 80,590 68,756 Total Headcount 5,200 5,250 5,300 5,700 6,000 5,550 5,400 5,900 5,950 Percentage of advertising revenue 24 by category 26 Home & Local Services 31% 32% 33% 34% 33% 33% 35% 36% 36% Restaurants 14% 14% 14% 14% 14% 14% 13% 14% 14% Beauty & Fitness 12% 12% 12% 12% 12% 12% 12% 12% 12% Health 11% 11% 10% 10% 10% 10% 10% 9% 9% Shopping 9% 8% 8% 8% 9% 8% 8% 8% 8% Note: Desktop unique visitors and mobile website unique visitors are ated with a business owner account when a business representative visits calculated using Google Analytics, while we calculate App Unique Devices our platform and claims the free business listing page associated with the internally. For further discussion of the differences in how these metrics business. are calculated and their limitations, please review the “Key Metrics-Traffic” 4Reflects updated methodology for calculating Active Claimed Local section of our most recent Quarterly Report on Form 10-Q Business Locations 1On a monthly average basis More information about the Company, including the factors that could 2All business locations associated with a business account from which we affect the Company’s operating results, is included under the captions recegonize revenue in a given month, averaged for the quarter “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent Quar- 3Active claimed local business locations represent the number of active terly or Annual Report filed with the SEC, available at www.yelp-ir.com or business locations that are associated with an active business owner the SEC’s website at www.sec.gov. account as of a given date. Active business locations consist of all business locations that are listed on our platform that have not been marked as closed as of a given date. A business location becomes associ- Yelp Q4 2019

Non-GAAP Financial Measures This letter and statements made during the above refer- > EBITDA and Adjusted EBITDA do not reflect the impact of enced webcast may include information relating to EBITDA, the recording or release of valuation allowances or tax Adjusted EBITDA and Adjusted EBITDA margin, each of which payments that may represent a reduction in cash available the Securities and Exchange Commission has defined as a to Yelp; “non-GAAP financial measure.” > Adjusted EBITDA does not take into account any costs that management determines are not indicative of ongoing We define EBITDA as net income, adjusted to exclude: operating performance, such as restructuring and integra- provision for (benefit from) income taxes; other income, net; tion costs or fees related to shareholder activism; and and depreciation and amortization. > other companies, including those in Yelp’s industry, may We define Adjusted EBITDA as net income, adjusted to calculate Adjusted EBITDA differently, which reduces its exclude: provision for (benefit from) income taxes; other usefulness as a comparative measure. income, net; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items. For the full year 2019, these Because of these limitations, you should consider EBITDA, other income and expense items consisted of certain fees Adjusted EBITDA and Adjusted EBITDA margin alongside related to shareholder activism. We define Adjusted EBITDA other financial performance measures, including net income margin as Adjusted EBITDA divided by net revenue. and Yelp’s other GAAP results. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are Forward-Looking Statements key measures used by Yelp management and the board of This letter contains, and statements made during the directors to understand and evaluate core operating perfor- above-referenced webcast will contain, forward-looking mance and trends, to prepare and approve Yelp’s annual bud- statements relating to, among other things, the future per- get and to develop short- and long-term operational plans. formance of Yelp and its consolidated subsidiaries that are The presentation of this financial information, which is not 25 based on Yelp’s current expectations, forecasts and assump- prepared under any comprehensive set of accounting rules 26 tions and involve risks and uncertainties. These statements or principles, is not intended to be considered in isolation or include, but are not limited to, statements regarding: as a substitute for the financial information prepared and presented in accordance with generally accepted accounting > Yelp’s expected financial results for the first quarter and principles in the United States (“GAAP”). full year 2020; Yelp’s expectation that improved structural economics will EBITDA and Adjusted EBITDA has limitations as an analytical > yield incremental expense leverage in 2020; tool, and you should not consider it in isolation or as a substi- tute for analysis of Yelp’s financial results as reported under > Yelp’s expectation that its improved non-term budget GAAP. In particular, EBITDA and Adjusted EBITDA should not retention in 2019 will deliver ongoing benefits in 2020; be viewed as substitutes for, or superior to, net income pre- > Yelp’s beliefs that it can deliver far more valuable leads pared in accordance with GAAP as a measure of profitability to both existing and new advertisers, while maintaining or liquidity. Some of these limitations are: a great product experience for consumers, and that such leads will drive greater customer satisfaction and > although depreciation and amortization are non-cash retention; charges, the assets being depreciated and amortized may have to be replaced in the future, Adjusted EBITDA does > Yelp’s plans to make further improvements to its advertis- not reflect all cash capital expenditure requirements for ing auction and Request A Quote lead matching, introduce such replacements or for new capital expenditure require- new types of advertising inventory and profile products, ments; enhance its reporting tools, and roll out an updated user interface for its mobile app, as well as the expected bene- > EBITDA and Adjusted EBITDA does not reflect changes in, fits of these initiatives; or cash requirements for, Yelp’s working capital needs; > Yelp’s plan to deliver additional attribution insights and > Adjusted EBITDA does not consider the potentially dilutive new ad formats, increase National client coverage, and impact of equity-based compensation; expand into more verticals to continue to drive strong Yelp Q4 2019

growth in the multi-location business; > Potential strategic opportunities and Yelp’s ability to suc- cessfully manage the acquisition and integration of new > Yelp’s plans to expand the focus of its Multi-location adver- tising business to include service providers in 2020 and businesses, solutions or technologies, as well as to mone- beyond; tize the acquired products, solutions or technologies; Yelp’s reliance on traffic to its website from search engines > Yelp’s product priorities for 2020, including matching > advertisers to the right products at the right prices, like Google and Bing and the quality and reliability of such and the expected benefits from the execution of these traffic; priorities; > Yelp’s ability to generate and maintain sufficient high quality content from its users; > Yelp’s expectations that it will double diners seated via Yelp and significantly increase the monetization of its Restau- > maintaining a strong brand and managing negative rant SaaS offerings in 2020; publicity that may arise; Yelp’s opportunity to drive even more value to Home & > > maintaining and expanding Yelp’s base of advertisers, local services customers in 2020 and beyond; particularly as an increasing portion of advertisers have the ability to cancel their ad campaigns at any time; > Yelp’s belief that the transformation of its business model will allow it to improve profitability for years to come; > Yelp’s ability to timely upgrade and develop its systems, infrastructure and customer service capabilities; and > Yelp’s belief that its user acquisition priorities will be more beneficial for Yelp and its shareholders in the long term > Yelp’s ability to purchase shares under the stock than alternative approaches; repurchase purchase program, or the modification, suspension or termination of that program. > Yelp’s expectation that its budget retention gains, sales mix shift, and expense discipline in 2019 will deliver profitable growth in 2020; Factors that could cause or contribute to such differences > Yelp’s expectations of increased seasonality due to non- also include, but are not limited to, those factors that could 26 term contracts and its sales mix shift; affect Yelp’s business, operating results and stock price 26 > Yelp’s confidence in achieving the long-term financial included under the captions “Risk Factors” and “Manage- targets; and ment’s Discussion and Analysis of Financial Condition and > Yelp’s plans and ability to reduce dilution and return capital Results of Operations” in Yelp’s most recent Annual Report on to shareholders, including through its share repurchase Form 10-K or Quarterly Report on Form 10-Q at http://www. program and plans to continue to explore opportunities yelp-ir.com or the SEC’s website at www.sec.gov. to drive shareholder value through effective and flexible capital allocation, as well as the expected benefits from such actions. Undue reliance should not be placed on the forward-looking Yelp’s actual results could differ materially from those pre- statements in this letter or the above-referenced webcast, dicted or implied by such forward-looking statements and which are based on information available to Yelp on the date reported results should not be considered as an indication of hereof. Such forward-looking statements do not include the future performance. Factors that could cause or contribute to potential impact of any acquisitions or divestitures that may such differences include, but are not limited to: be announced and/or completed after the date hereof. Yelp assumes no obligation to update such statements. > Yelp’s limited operating history in an evolving industry; > Yelp’s ability to generate sufficient revenue to maintain profitability, particularly in light of its significant ongoing sales and marketing expenses and its ongoing investments in product development; Yelp Q4 2019