Attached files

| file | filename |

|---|---|

| EX-99.1 - KAI FORM 8-K EXHIBIT 99.1 02-12-2020 EARNINGS RELEASE - KADANT INC | kaiform8kexhibit991021.htm |

| 8-K - KAI FORM 8-K 02-12-2020 - KADANT INC | kaiform8k02122020er.htm |

Exhibit 99.2 Fourth Quarter and Fiscal Year 2019 Business Review February 13, 2020

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our future financial and operating performance, demand for our products, and economic and industry outlook. These forward-looking statements represent Kadant’s expectations as of February 13, 2020. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause our actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the year ended December 29, 2018 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to the impact of the coronavirus on our operating and financial results; adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; our customers’ ability to obtain financing for capital equipment projects; international sales and operations; the variability and uncertainties in sales of capital equipment in China; the oriented strand board market and levels of residential construction activity; development and use of digital media; currency fluctuations; cyclical economic conditions affecting the global mining industry and the continued demand for coal; price increases or shortages of raw materials; dependence on certain suppliers; our acquisition strategy; failure of our information systems or breaches of data security and cybertheft; changes in government regulations and policies and compliance with laws; our internal growth strategy; competition; soundness of suppliers and customers; changes in our tax provision or exposure to additional tax liabilities; our ability to successfully manage our manufacturing operations; disruption in production; future restructurings; economic conditions and regulatory changes caused by the United Kingdom’s exit from the European Union; our debt obligations; restrictions in our credit agreement and note purchase agreement; loss of key personnel and effective succession planning; protection of intellectual property; fluctuations in our share price; soundness of financial institutions; environmental laws and regulations; climate change; environmental, health and safety laws and regulations; adequacy of our insurance coverage; anti- takeover provisions; and reliance on third-party research. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 2

Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenues that exclude the effect of acquisitions and foreign currency translation (organic revenue), adjusted diluted EPS, adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA), adjusted EBITDA margin, and free cash flow. A reconciliation of those numbers to the most directly comparable GAAP financial measures is shown within this presentation and in our 2019 fourth quarter earnings press release issued February 12, 2020 and in our 2018 fourth quarter earnings press release issued February 13, 2019, which are available in the Investors section of our website at investor.kadant.com under the heading News Releases. We believe these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, operating results, or future outlook. We believe the inclusion of such measures helps investors gain an understanding of our underlying operating performance and future prospects, consistent with how management measures and forecasts our performance, especially when comparing such results to previous periods or forecasts and to the performance of our competitors. Such measures are also used by us in our financial and operating decision-making and for compensation purposes. We also believe this information is responsive to investors' requests and gives them an additional measure of our performance. The non-GAAP financial measures included in this presentation are not meant to be considered superior to or a substitute for the results of operations prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have limitations associated with their use as compared to the most directly comparable GAAP measures, in that they may be different from, and therefore not comparable to, similar measures used by other companies. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 3

BUSINESS REVIEW Jeffrey L. Powell | President & CEO KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 4

Q4 2019 Financial Highlights ($ Millions, except per share amounts) Q4 2019 Q4 2018 % Change2 Bookings $159.8 $147.1 8.6% Revenue $182.7 $163.9 11.4% Gross Margin 40.9% 43.3% n.m. Net Income $8.7 $18.4 -52.5% Adjusted EBITDA1 $32.2 $32.0 0.6% Adjusted EBITDA Margin1 17.6% 19.5% n.m. Diluted EPS $0.76 $1.61 -52.8% Adjusted Diluted EPS1 $1.32 $1.66 -20.5% Cash Flow from Operations $39.2 $10.4 276.1% Net Debt $232.8 $129.7 79.4% 1 Adjusted EBITDA, adjusted EBITDA/revenue (margin), and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our press release dated February 12, 2020. 2 Percent change calculated using actual numbers reported in our press release dated February 12, 2020. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 5

2019 Financial Highlights ($ Millions, except per share amounts) 2019 2018 % Change2 Bookings $688.3 $670.4 2.7% Revenue $704.6 $633.8 11.2% Gross Margin 41.7% 43.9% n.m. Net Income $52.1 $60.4 -13.8% Adjusted EBITDA1 $127.1 $115.2 10.4% Adjusted EBITDA Margin1 18.0% 18.2% n.m. Diluted EPS $4.54 $5.30 -14.3% Adjusted Diluted EPS1 $5.36 $5.34 0.4% Cash Flow from Operations $97.4 $63.0 54.7% Free Cash Flow3 $87.5 $46.4 88.4% 1 Adjusted EBITDA, adjusted EBITDA margin, and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our press release dated February 12, 2020. 2 Percent change calculated using actual numbers reported in our press release dated February 12, 2020. 3 Free cash flow is a non-GAAP measure that excludes certain items as detailed on slide 36. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 6

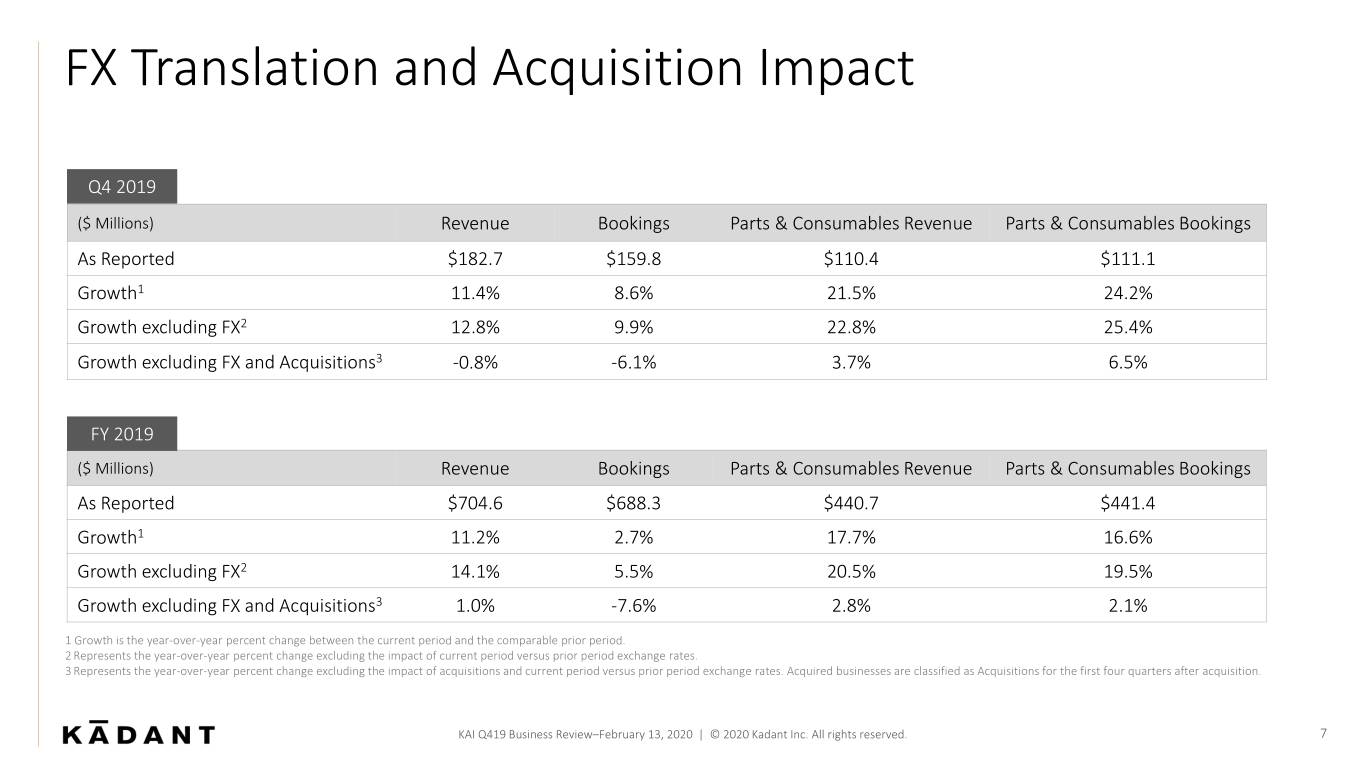

FX Translation and Acquisition Impact Q4 2019 ($ Millions) Revenue Bookings Parts & Consumables Revenue Parts & Consumables Bookings As Reported $182.7 $159.8 $110.4 $111.1 Growth1 11.4% 8.6% 21.5% 24.2% Growth excluding FX2 12.8% 9.9% 22.8% 25.4% Growth excluding FX and Acquisitions3 -0.8% -6.1% 3.7% 6.5% FY 2019 ($ Millions) Revenue Bookings Parts & Consumables Revenue Parts & Consumables Bookings As Reported $704.6 $688.3 $440.7 $441.4 Growth1 11.2% 2.7% 17.7% 16.6% Growth excluding FX2 14.1% 5.5% 20.5% 19.5% Growth excluding FX and Acquisitions3 1.0% -7.6% 2.8% 2.1% 1 Growth is the year-over-year percent change between the current period and the comparable prior period. 2 Represents the year-over-year percent change excluding the impact of current period versus prior period exchange rates. 3 Represents the year-over-year percent change excluding the impact of acquisitions and current period versus prior period exchange rates. Acquired businesses are classified as Acquisitions for the first four quarters after acquisition. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 7

Bookings and Revenue US$ (millions) BOOKINGS REVENUE $200 $160 $120 $80 $40 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 8

Parts and Consumables Bookings and Revenue US$ (millions) BOOKINGS REVENUE $140 $120 $100 $80 $60 $40 $20 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 9

North America Bookings and Revenue US$ (millions) BOOKINGS REVENUE $120 $100 $80 $60 $40 $20 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 10

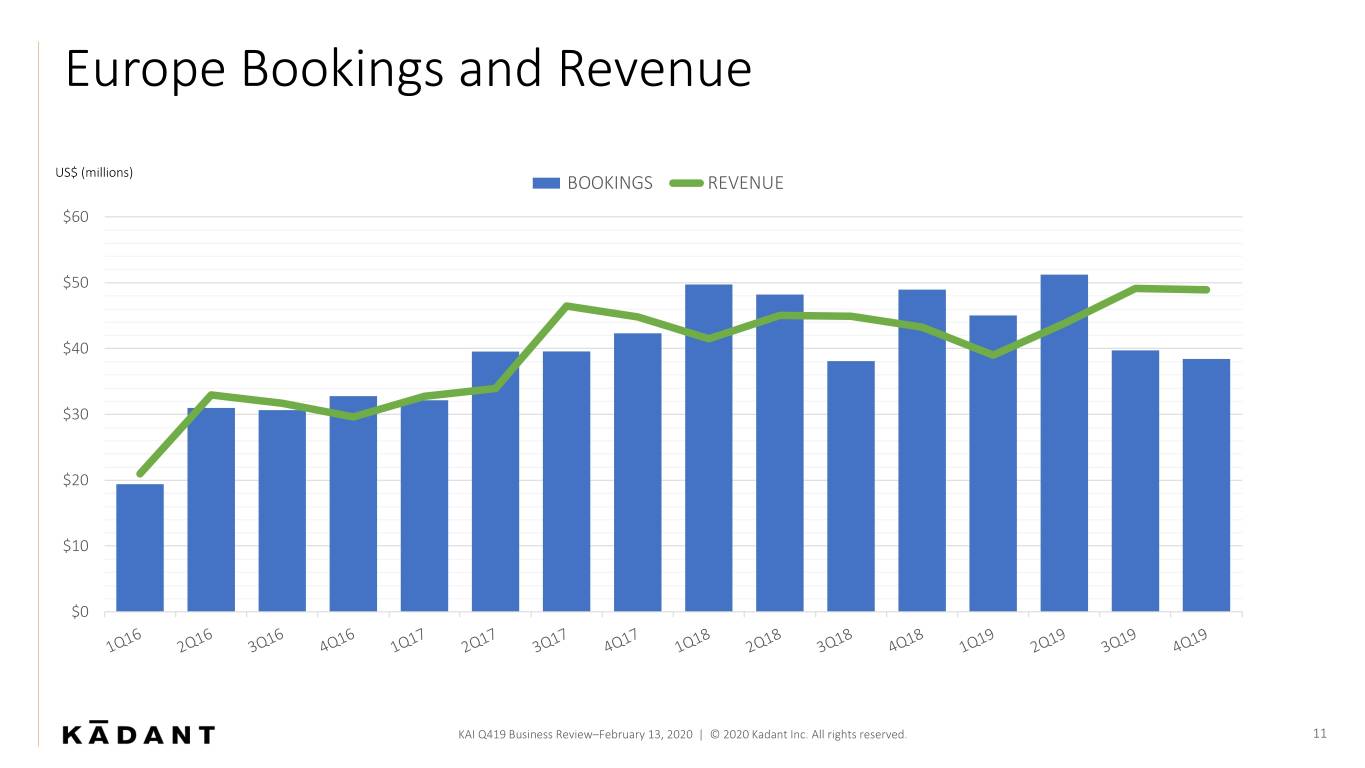

Europe Bookings and Revenue US$ (millions) BOOKINGS REVENUE $60 $50 $40 $30 $20 $10 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 11

Asia Bookings and Revenue US$ (millions) BOOKINGS REVENUE $40 $30 $20 $10 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 12

Rest-of-World Bookings and Revenue US$ (millions) BOOKINGS REVENUE $20 $15 $10 $5 $0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 13

Guidance • FY 2020 GAAP diluted EPS of $4.98 to $5.08 • FY 2020 adjusted diluted EPS* of $5.00 to $5.10 • FY 2020 revenue of $690 to $700 million • Q1 2020 GAAP diluted EPS of $0.80 to $1.08 • Q1 2020 revenue of $153 to $163 million * Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our press release dated February 12, 2020. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 14

FINANCIAL REVIEW Michael J. McKenney | Executive Vice President & CFO KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 15

Quarterly Gross Margin 50% 47.9% 48% 47.7% 46.0% 46% 45.6% 45.6% 44.9% 44.3% 44.0% 44.1% 44% 43.3% 43.3% 42.8% 42.3% 42.0% 42% 41.2% 40.9% 40% 38% 36% All data for 2017, 2018, and 2019 is presented in conformity with the Financial Accounting Standards Board’s Accounting Standards Update No. 2017-07. 2016 has not been restated. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 16

Full-Year Gross Margin 47% 46.2% 45.8% 45.5% 44.9% 45% 44.4% 43.9% 43.9% 43% 41.7% 41% 39% 37% 35% 2012 2013 2014 2015 2016 2017 2018 2019 All data for 2017, 2018, and 2019 is presented in conformity with the Financial Accounting Standards Board’s Accounting Standards Update No. 2017-07. Prior period amounts have not been restated. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 17

Quarterly SG&A as a % of Revenue 40% 35% 30% 27.1% 26.6% 25% 26.1% 20% KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 18

Full-Year SG&A as a % of Revenue 40% 35% 34.1% 32.2% 32.6% 31.0% 31.5% 30% 31.1% 28.0% 27.3% 25% 20% 2012 2013 2014 2015 2016 2017 2018 2019 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 19

One-time Charges ACTUAL GUIDANCE ($ Millions, except per share amounts) Q4 2019 Per Share Q4 2019 Per Share Pre-tax Settlement Loss $5.9 - $7.2 - After-tax Settlement Loss $6.4 $0.55 $7.3 $0.64 Pre-tax Intangible Asset Impairment Charge $2.3 - n/a - After-tax Intangible Asset Impairment Charge $1.8 $0.16 n/a n/a Pre-tax Restructuring Charge $0.2 - n/a - After-tax Restructuring Charge $0.1 $0.01 n/a n/a KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 20

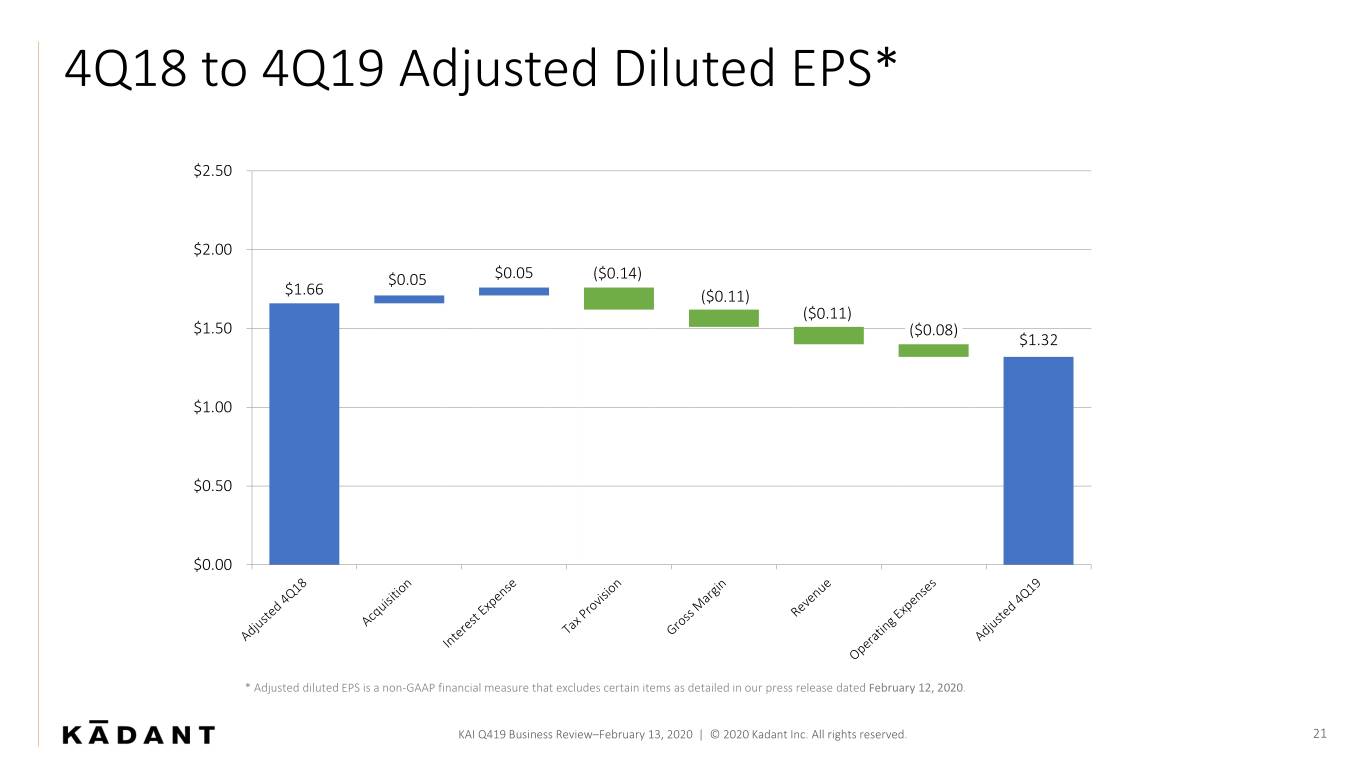

4Q18 to 4Q19 Adjusted Diluted EPS* $2.50 $2.00 $0.05 $0.05 ($0.14) $1.66 ($0.11) ($0.11) $1.50 ($0.08) $1.32 $1.00 $0.50 $0.00 * Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our press release dated February 12, 2020. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 21

2018 to 2019 Adjusted Diluted EPS* $8.00 $7.00 $0.16 $0.11 $0.07 ($0.35) $6.00 $0.22 $5.34 ($0.17) ($0.02) $5.36 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 * Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our press release dated February 12, 2020. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 22

Quarterly Adjusted EBITDA* Adjusted EBITDA* Adjusted EBITDA Margin* 25% $35 $30 20% 19.5% $25 18.6% 17.6% 15% $20 $15 10% % OF REVENUE OF % ADJUSTED EBITDA ADJUSTED $10 5% $5 0% $0 * Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures that exclude certain items as detailed in our press release dated February 12, 2020. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 23

Full-Year Adjusted EBITDA* Adjusted EBITDA* Adjusted EBITDA Margin * 18.2% 20% 18.0% $140 17.8% 15.8% $120 15.2% 15% 13.5% 14.0% 13.0% $100 $80 10% $127.1 % OF REVENUE OF % $115.2 $60 $91.7 EBITDA ADJUSTED $40 5% $56.3 $61.5 $63.0 $44.8 $44.7 $20 0% $0 2012 2013 2014 2015 2016 2017 2018 2019 * Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures that exclude certain items as detailed in our press release dated February 12, 2020. All data for 2016, 2017, 2018, and 2019 is presented in conformity with the Financial Accounting Standards Board’s Accounting Standards Update No. 2017-07. Prior period amounts have not been restated. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 24

Cash Provided by Operations US$ (millions) $100 $97.4 $80 $60 $65.2 $63.0 $51.1 $51.0 $40 $39.9 $40.4 $30.5 $20 $0 2012 2013 2014 * 2015 * 2016 * 2017 2018 2019 * Periods have been restated as a result of the adoption of the Financial Accounting Standards Board's Accounting Standards Update No. 2016-09. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 25

Free Cash Flow* US$ (millions) $100 $87.5 $80 $60 $46.4 $44.4 $45.2 $40 $47.9 $26.2 $33.7 $34.9 $20 $0 2012 2013 2014** 2015** 2016** 2017 ** 2018 ** 2019** * Free cash flow, a non-GAAP financial measure, is defined as cash flows from continuing operations less capital expenditures, as calculated in the Appendix on slide 36. ** Presented in conformity with the Financial Accounting Standards Board’s Accounting Standards Update No. 2016-09. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 26

Key Working Capital Metrics Q4 2019 Q3 2019 Q4 2018 Days in Receivables 54 60 59 Days in Inventory 88 99 86 Days in Payables 38 37 35 Days in Receivables Days in Inventory Days in Payables 140 120 99 100 86 88 80 Days 59 60 60 54 40 35 37 38 20 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 27

Working Capital and Cash Conversion Days Q4 2019 Q3 2019 Q4 2018 Working Capital % LTM Revenues* 12.2% 14.6% 12.5% Cash Conversion Days** 104 days 122 days 110 days *Working Capital is defined as current assets less current liabilities, excluding cash and debt. ** Based on days in receivables plus days in inventory less days in accounts payable. Cash Conversion Days** Working Capital % LTM Revenues * 20% 200 15% 150 10% 100 DAYS % OF REVENUE OF % 5% 50 0% 0 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 28

Cash and Debt US$ (millions) Q4 2019 Q3 2019 Q4 2018 Cash, cash equivalents, and restricted cash $68.2 $49.9 $46.1 Debt (294.8) (310.5) (171.4) Other borrowings (6.2) (6.3) (4.4) Net debt $(232.8) $(266.9) $(129.7) $75 $33.9 $22.2 $25 $7.2 $2.5 ($25) $(14.7) $(3.3) ($75) ($125) $(135.6) $(129.7) ($175) $(145.7) $(165.2) $(167.2) US$ (millions) US$ ($225) $(187.4) $(232.8) ($275) $(266.9) $(288.7) ($325) $(303.7) KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 29

Leverage Ratio Debt/EBITDA * 4.00 3.50 3.00 2.50 2.03 2.00 1.50 1.00 0.50 0.00 *For purposes of our leverage ratio, “EBITDA” is calculated by adding or subtracting certain items from Adjusted EBITDA, as defined in our Credit Facility. Our amended and restated Credit Facility defines “Debt” as debt less worldwide cash of up to $30 million. For periods 1Q16 to 4Q16, “Debt” is defined as debt less domestic cash of up to $25 million. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 30

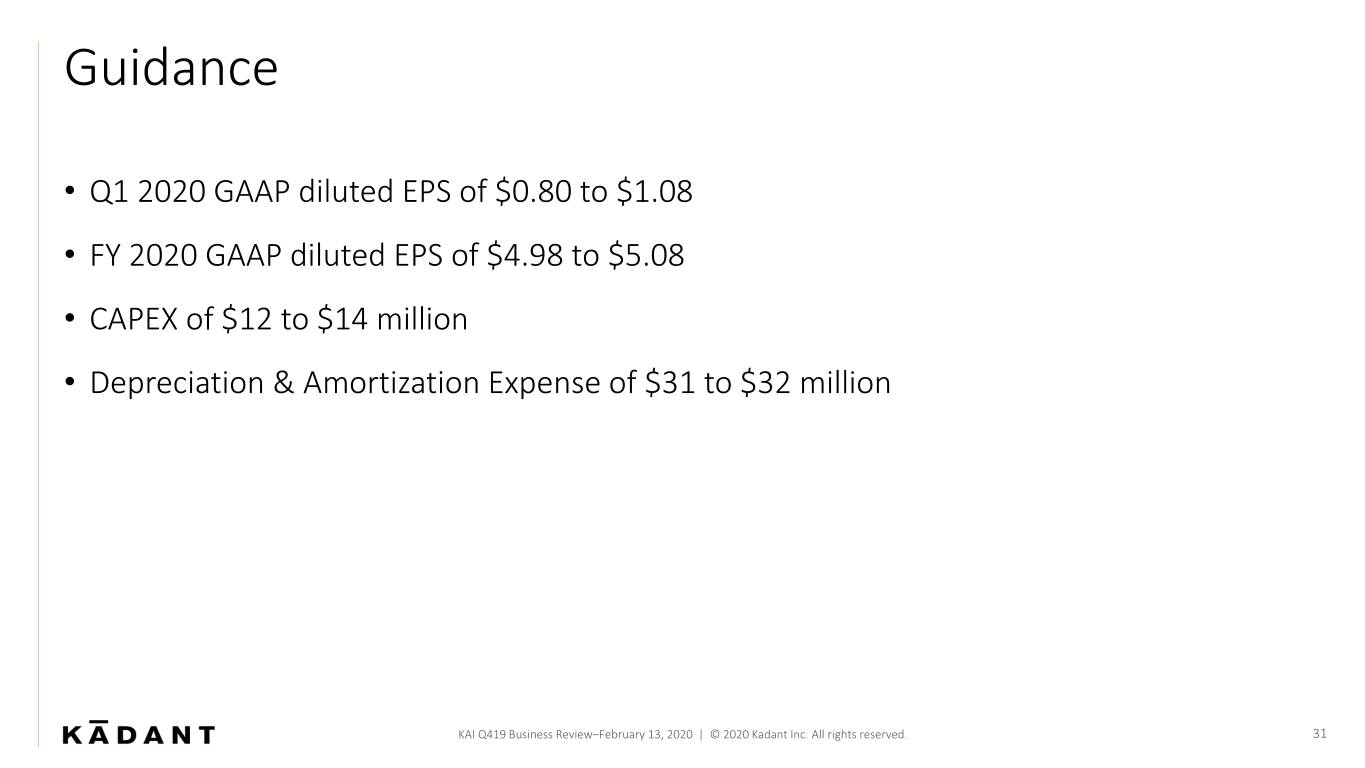

Guidance • Q1 2020 GAAP diluted EPS of $0.80 to $1.08 • FY 2020 GAAP diluted EPS of $4.98 to $5.08 • CAPEX of $12 to $14 million • Depreciation & Amortization Expense of $31 to $32 million KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 31

Questions & Answers To ask a question, please call 888-326-8410 within the U.S. or 704-385-4884 outside the U.S. and reference 747 3987. Please mute the audio on your computer. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 32

Key Take-Aways • Record 2019 revenue, bookings, adjusted EBITDA, adjusted diluted EPS, and free cash flow • Continued organic growth in parts and consumables • Challenging environment to start 2020 KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 33

APPENDIX KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 35

Free Cash Flow Reconciliation ($ Millions) 2012 2013 2014 2015 2016 2017 2018 2019 Cash Provided by Continuing Operations, as reported $ 30.5 $ 39.9 $ 51.1 $ 40.4 $ 51.0 $ 65.2 $ 63.0 $ 97.4 Capital Expenditures $ (4.3) $ (6.2) $ (6.7) $ (5.5) $ (5.8) $ (17.3) $ (16.6) $ (9.9) Free Cash Flow* $ 26.2 $ 33.7 $ 44.4 $ 34.9 $ 45.2 $ 47.9 $ 46.4 $ 87.5 *Free Cash Flow is a non-GAAP financial measure. KAI Q419 Business Review–February 13, 2020 | © 2020 Kadant Inc. All rights reserved. 36