Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended January 1, 2011 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 1-11406

KADANT INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 52-1762325 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| One Technology Park Drive Westford, Massachusetts |

01886 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (978) 776-2000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by nonaffiliates of the Registrant as of July 3, 2010, was approximately $201,612,000.

As of February 18, 2011, the Registrant had 12,254,737 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement pursuant to Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended, to be used in connection with the Registrant’s 2011 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Annual Report on Form 10-K

for the Fiscal Year Ended January 1, 2011

Table of Contents

Table of Contents

| Kadant Inc. | 2010 Annual Report |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K and the documents that we incorporate by reference in this Report include forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. These forward-looking statements are not statements of historical fact, and may include statements regarding possible or assumed future results of operations. Forward-looking statements are subject to risks and uncertainties and are based on the beliefs and assumptions of our management, using information currently available to our management. When we use words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “seeks,” “should,” “likely,” “will,” “would,” “may,” “continue,” “could,” or similar expressions, we are making forward-looking statements.

Forward-looking statements are not guarantees of performance. They involve risks, uncertainties, and assumptions. Our future results of operations may differ materially from those expressed in the forward-looking statements. Many of the important factors that will determine these results and values are beyond our ability to control or predict. You should not put undue reliance on any forward-looking statements. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. For a discussion of important factors that may cause our actual results to differ materially from those suggested by the forward-looking statements, you should read carefully the section captioned “Risk Factors” in Part I, Item 1A, of this Report.

| Item 1. | Business |

General Development of Business

We were incorporated in Delaware in November 1991 to be the successor-in-interest to several papermaking equipment businesses of Thermo Electron Corporation (Thermo Electron). In November 1992, we completed an initial public offering of a portion of our outstanding common stock. On July 12, 2001, we changed our name to Kadant Inc. from Thermo Fibertek Inc. In August 2001, Thermo Electron disposed of its remaining equity interest in Kadant Inc. by means of a stock dividend to its shareholders. Our common stock is listed on the New York Stock Exchange, where it trades under the symbol “KAI.”

The terms “we,” “us,” “our,” “Registrant,” or “Company” in this Report refer to Kadant Inc. and its consolidated subsidiaries.

Description of Our Business

We are a leading supplier of equipment used in the global papermaking and paper recycling industries and a manufacturer of granules made from papermaking byproducts. Our continuing operations are comprised of one reportable operating segment: Papermaking Systems, and a separate product line, Fiber-based Products. Through our Papermaking Systems segment, we develop, manufacture, and market a range of equipment and products for the global papermaking, paper recycling, and process industries. We have a large customer base that includes most of the world’s major paper manufacturers. We believe our large installed base provides us with a spare parts and consumables business that yields higher margins than our capital equipment business.

Through our Fiber-based Products business, we manufacture and sell granules derived from pulp fiber for use as carriers for agricultural, home lawn and garden, and professional lawn, turf and ornamental applications, as well as for oil and grease absorption.

Papermaking Systems

Our Papermaking Systems segment has a long and well-established history of developing, manufacturing, and marketing equipment for the global papermaking and paper recycling industries. Some of our businesses or their predecessor companies have been in operation for more than 100 years. Our customer base includes major global paper manufacturers and, with our equipment found in most of the world’s pulp and paper mills, we

1

Table of Contents

| Kadant Inc. | 2010 Annual Report |

believe we have one of the largest installed bases of equipment in the pulp and paper industry. We manufacture our products in nine countries in Europe, North and South America, and Asia.

Our Papermaking Systems segment consists of the following product lines: stock-preparation, fluid-handling, doctoring (formerly referred to as paper machine accessory), and water-management.

Stock-preparation

We develop, manufacture, and market complete custom-engineered systems and equipment, as well as standard individual components, for pulping, de-inking, screening, cleaning, and refining recycled and virgin fibers for preparation for entry into the paper machine. Our principal stock-preparation products include:

| – | Recycling and approach flow systems: Our equipment includes pulping, screening, cleaning, and de-inking systems that blend pulp mixtures and remove contaminants, such as ink, glue, metals, and other impurities, to prepare them for entry into the paper machine during the production of recycled paper. |

| – | Virgin pulping process equipment: Our equipment includes pulp washing, evaporator, recausticizing, and condensate treatment systems used to remove lignin, concentrate and recycle process chemicals, and remove condensate gases. |

Fluid-handling

We develop, manufacture and market rotary joints, precision unions, steam and condensate systems, components, and controls used primarily in the dryer section of the papermaking process and during the production of corrugated boxboard, metals, plastics, rubber, textiles, chemicals, and food. Our principal fluid-handling systems include:

| – | Rotary joints: Our mechanical devices, used with rotating shafts, allow the transfer of pressurized fluid from a stationary source into and out of rotating machinery for heating, cooling, or the transfer of fluid power. |

| – | Syphons: Our devices, installed primarily inside the rotating cylinders of paper machines, are used to remove condensate from the drying cylinders through rotary joints located on either end of the cylinder. |

| – | Turbulator ® bars: Our steel or stainless steel axial bars, installed on the inside of cylinders, are used to induce turbulence in the condensate layer to improve the uniformity and rate of heat transfer through the cylinders. |

| – | Engineered steam and condensate systems: Our steam systems control the flow of steam from the boiler to the paper drying cylinders, collect condensed steam, and return it to the boiler to improve energy efficiency during the paper drying process. Our systems and equipment are also used to efficiently and effectively distribute steam in a wide variety of industrial processing applications. |

Doctoring

We develop, manufacture, and market a wide range of doctoring systems and related consumables that continuously clean rolls to keep paper machines running efficiently. Doctor blades are made of a variety of materials to perform a variety of functions including cleaning, creping, web removal, flaking, and the application of coatings. Profiling systems are used to control moisture, web curl, and gloss during paper converting. Our principal doctoring products include:

| – | Doctor systems and holders: Our doctor systems clean papermaking rolls to maintain the efficient operation of paper machines and other equipment by placing a blade against the roll at a constant and uniform pressure. A doctor system consists of the structure supporting the blade and the blade holder. A large paper machine may have as many as 100 doctor systems. |

| – | Profiling systems: We offer profiling systems that control moisture, web curl, and gloss during paper converting. |

2

Table of Contents

| Kadant Inc. | 2010 Annual Report |

| – | Doctor blades: We manufacture doctor and scraper blades made of a variety of materials including metal, bi-metal, or synthetic materials that perform a variety of functions including cleaning, creping, web removal, flaking, and the application of coatings. A typical doctor blade has a life ranging from eight hours to two months, depending on the application. |

Water-management

We develop, manufacture, and market water-management systems and equipment used to continuously clean paper machine fabrics, drain water from pulp mixtures, form the sheet or web, and filter the process water for reuse. Our principal water-management systems include:

| – | Shower and fabric-conditioning systems: Our shower and fabric-conditioning systems assist in the removal of contaminants that collect on paper machine fabrics used to convey the paper web through the forming, pressing, and drying sections of the paper machine. A typical paper machine has between 3 and 12 fabrics. These fabrics can easily become contaminated with fiber, fillers, pitch, and dirt that can have a detrimental effect on paper machine performance and paper quality. Our shower and fabric-conditioning systems assist in the removal of these contaminants. |

| – | Formation systems: We supply structures that drain, purify, and recycle process water from the pulp mixture during paper sheet and web formation. |

| – | Water-filtration systems: We offer a variety of filtration systems and strainers that remove contaminants from process water before reuse and recover reusable fiber for recycling back into the pulp mixture. |

Fiber-based Products

We produce biodegradable, absorbent granules from papermaking byproducts for use primarily as carriers for agricultural, home lawn and garden, and professional lawn, turf and ornamental applications, as well as for oil and grease absorption.

Discontinued Operation

In 2005, our Kadant Composites LLC subsidiary (Composites LLC) sold substantially all of its assets to a third party. Under the terms of the asset purchase agreement, Composites LLC retained certain liabilities associated with the operation of the business prior to the sale, including the warranty obligations related to products manufactured prior to the sale date. Composites LLC retained all of the cash proceeds received from the asset sale and continued to administer and pay warranty claims from the sale proceeds into the third quarter of 2007. On September 30, 2007, Composites LLC announced that it no longer had sufficient funds to honor warranty claims, was unable to pay or process warranty claims, and ceased doing business. All activity related to this business is classified in the results of the discontinued operation in the accompanying consolidated financial statements.

Composites LLC’s inability to pay or process warranty claims has exposed us to greater risks associated with litigation. For more information regarding our current litigation arising from these claims, see Part I, Item 1A, “Risk Factors.”

Research and Development

We develop a broad range of products for all facets of the markets we serve. We operate research and development facilities in Europe and the U.S., and focus our product innovation on process industry challenges and the need for improved fiber processing, heat transfer, showering, filtration, doctoring, and fluid handling. In addition to internal product development activities, our research centers allow customers to simulate their own operating conditions and applications to identify and quantify opportunities for improvement.

3

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Our research and development expenses were $5.3 million, $5.6 million, and $6.2 million in 2010*, 2009, and 2008, respectively.

Raw Materials

The primary raw materials used in our Papermaking Systems segment are steel, stainless steel, brass, and bronze, which have generally been available through a number of suppliers. To date, we have not needed to maintain raw material inventories in excess of our current needs to ensure availability.

The raw material used in the manufacture of our fiber-based granules is obtained from two paper recycling mills. Although we believe that our relationships with the mills are good, the mills may not continue to supply sufficient raw material. From time to time, we have experienced some difficulty in obtaining sufficient raw material to operate at optimal production levels. We continue to work with the mills to ensure a stable supply of raw material. To date, we have been able to meet all of our customer delivery requirements, but there can be no assurance that we will be able to meet future delivery requirements. If the mills were unable or unwilling to supply us sufficient fiber, we would be forced to find one or more alternative suppliers for this raw material.

Patents, Licenses, and Trademarks

We protect our intellectual property rights by applying for and obtaining patents when appropriate. We also rely on technical know-how, trade secrets, and trademarks to maintain our competitive position. We also enter into license agreements with others to grant and/or receive rights to patents and know-how. No particular patent, or related group of patents, is so important that its expiration or loss would significantly affect our operations.

Papermaking Systems

We have numerous U.S. and foreign patents, including foreign counterparts to our U.S. patents, expiring on various dates ranging from 2011 to 2029. From time to time, we enter into licenses of products with other companies that serve the pulp, papermaking, converting, and paper recycling industries.

Fiber-based Products

We currently hold several U.S. patents, expiring on various dates ranging from 2012 to 2026, related to various aspects of the processing of fiber-based granules and the use of these materials in the agricultural, professional turf, home lawn and garden, general absorption, oil and grease absorption, and catbox filler markets.

Seasonal Influences

Papermaking Systems

There are no material seasonal influences on this segment’s sales of products and services.

Fiber-based Products

Our Fiber-based Products business experiences fluctuations in sales, usually in the third and fourth quarters, when sales decline due to the seasonality of the agricultural and home lawn and garden markets.

| * | Unless otherwise noted, references to 2010, 2009, and 2008 in this Annual Report on Form 10-K are for the fiscal years ended January 1, 2011, January 2, 2010, and January 3, 2009, respectively. |

4

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Working Capital Requirements

There are no special inventory requirements or credit terms extended to customers that would have a material adverse effect on our working capital.

Dependency on a Single Customer

No single customer accounted for more than 10% of our consolidated revenues or more than 10% of the Papermaking Systems segment’s revenues in any of the past three years. During 2010, 2009, and 2008, approximately 58%, 59%, and 61%, respectively, of our sales were to customers outside the United States, principally in Europe and China.

Backlog

Our backlog of firm orders for the Papermaking Systems segment was $92.7 million and $60.0 million at year-end 2010 and 2009, respectively. The total consolidated backlog of firm orders was $94.3 million and $61.5 million at year-end 2010 and 2009, respectively. We anticipate that substantially all of the backlog at year-end 2010 will be shipped or completed during the next 12 months. Some of these orders can be canceled by the customer upon payment of a cancellation fee.

Competition

We face significant competition in each of our principal markets. We compete primarily on the basis of quality, price, service, technical expertise, and product performance and innovation. We believe the reputation that we have established for quality products and in-depth process knowledge provides us with a competitive advantage. In addition, a significant portion of our business is generated from our existing worldwide customer base. To maintain this base, we have emphasized technology, service, and a problem-solving relationship with our customers.

We are a leading supplier of stock-preparation systems and equipment used for the preparation of recycled and virgin fibers in the production of recycled paper. Several major competitors supply various pieces of equipment for this process. Our principal competitors in this market are Voith Paper GmbH, Metso Corporation, and Maschinenfabrik Andritz AG. We compete in this market primarily on the basis of technical expertise, price, and product innovation. There are other competitors that specialize in segments within the white- and brown-paper markets.

We are a leading supplier of fluid-handling systems and equipment, offering global sales and service, application expertise, and an extensive rotary joint product line. There are numerous competitors in this market, including Deublin Company, Barco Company, Christian Maier GmbH & Co. KG, and Duff-Norton Company. In addition, we compete with numerous local competitors. We generally compete in this market based on process knowledge, technical competence, price, and product and service quality.

We are a leading supplier of doctoring systems and equipment for paper machines. Our principal global competitors in this market are Joh. Clouth GmbH & Co. KG and Metso Corporation. Because of the high capital cost of paper machines and the role of our doctoring equipment in maintaining the efficiency of these machines, we generally compete in this market on the basis of service, technical expertise, price, and performance.

In our water-management product line, various competitors exist in the formation, shower and fabric-conditioning systems, and filtration systems markets. Principal competitors are IBS-Paper Performance Group in formation, shower and fabric-conditioning systems and Asten/Johnson Foils in formation tables. In addition, a variety of companies compete within the shower and fabric-conditioning systems and filtration systems markets. In each of these markets, we generally compete on the basis of process knowledge, application experience, product quality, price, and service.

Environmental Protection Regulations

We believe that our compliance with federal, state, and local environmental protection regulations will not have a material adverse effect on our capital expenditures, earnings, or competitive position.

5

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Employees

As of year-end 2010, we had approximately 1,600 employees worldwide.

Financial Information

Financial information concerning our segment and product lines is summarized in Note 12 to the consolidated financial statements, which begin on page F-1 of this Report.

Financial information about exports by domestic operations and about foreign operations is summarized in Note 12 to the consolidated financial statements, which begin on page F-1 of this Report.

Available Information

We file annual, quarterly, and current reports, proxy statements, and other documents with the Securities and Exchange Commission (SEC) under the Exchange Act. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at www.sec.gov. We also make available free of charge through our website at www.kadant.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to these Reports filed with or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the SEC. We are not including the information contained in our website as part of this Report nor are we incorporating the information on our website into this Report by reference.

Executive Officers of the Registrant

The following table summarizes certain information concerning individuals who are our executive officers as of March 1, 2011:

| Name |

Age | Present Title (Fiscal Year First Became Executive Officer) | ||||

| Jonathan W. Painter |

52 | President and Chief Executive Officer (1997) | ||||

| Eric T. Langevin |

48 | Executive Vice President and Chief Operating Officer (2006) | ||||

| Thomas M. O’Brien |

59 | Executive Vice President and Chief Financial Officer (1994) | ||||

| Jeffrey L. Powell |

52 | Senior Vice President (2009) | ||||

| Sandra L. Lambert |

55 | Vice President, General Counsel, and Secretary (2001) | ||||

| Michael J. McKenney |

49 | Vice President, Finance and Chief Accounting Officer (2002) | ||||

Mr. Painter has been our chief executive officer and a director since January 2010 and our president since September 1, 2009. Between 1997 and September 2009, Mr. Painter served as an executive vice president and from March 2007 through September 2009 had supervisory responsibility for our stock-preparation and fiber-based products businesses. He served as president of our composite building products business from 2001 until its sale in 2005. He also served as our treasurer and the treasurer of Thermo Electron from 1994 until 1997. Prior to 1994, Mr. Painter held various managerial positions with us and Thermo Electron.

Mr. Langevin has been an executive vice president and our chief operating officer since January 2010. Prior to January 2010, Mr. Langevin had been a senior vice president since March 2007 and had supervisory responsibility for our paperline business, consisting of our doctoring, fluid-handling, and water-management product lines. He served as vice president, with responsibility for our doctoring and water-management product lines, from 2006 to 2007. From 2001 to 2006, Mr. Langevin was president of Kadant Web Systems Inc. (now our Kadant Solutions division) and before that served as its senior vice president and vice president of operations. Prior to 2001, Mr. Langevin managed several product groups and departments within Kadant Web Systems after joining us in 1986 as a product development engineer.

6

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Mr. O’Brien has been an executive vice president since 1998 and our chief financial officer since 2001. He served as our treasurer from 2001 to February 2005 and also as vice president, finance, from 1991 to 1998. Prior to joining us, Mr. O’Brien held various finance positions at Racal Interlan, Inc., Prime Computer, Compugraphic Corporation, and the General Electric Company.

Mr. Powell has been a senior vice president since September 2009 and has supervisory responsibility for our stock-preparation and fiber-based products businesses. From January 2008 to September 2009, Mr. Powell was vice president, new ventures, with principal responsibility for acquisition-related activities. Prior to joining us, Mr. Powell was the chairman and chief executive officer of Castion Corporation, a provider of sustainable wastewater treatment and recovery solutions, from April 2003 through December 2007.

Ms. Lambert has been a vice president and our general counsel since 2001, and our secretary since our incorporation in 1991. Prior to joining us, she was a vice president and the secretary of Thermo Electron since 1999 and 1990, respectively, and before that was a member of Thermo Electron’s legal department.

Mr. McKenney has been our vice president, finance and chief accounting officer since January 2002 and served as our corporate controller from 1997 to 2007. Mr. McKenney was controller of our Kadant AES division (now part of our Kadant Solutions division) from 1993 to 1997. Prior to 1993, Mr. McKenney held various financial positions at Albany International Corp.

| Item 1A. | Risk Factors |

In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we wish to caution readers that the following important factors, among others, in some cases have affected, and in the future could affect, our actual results and could cause our actual results in 2011 and beyond to differ materially from those expressed in any forward-looking statements made by us, or on our behalf.

Our business is dependent on worldwide and local economic conditions as well as the condition of the pulp and paper industry.

We sell products worldwide primarily to the pulp and paper industry, which is a cyclical industry. Generally, the financial condition of the global pulp and paper industry corresponds to general worldwide economic conditions, as well as to a number of other factors, including pulp and paper production capacity relative to demand in the geographic markets in which we compete. Although global markets appear to be recovering from the extreme disruptions which began in 2008, uncertainty about continuing economic stability remains. Our business and performance was significantly affected by the global economic crisis and would be negatively affected by a return of economic uncertainty. Uncertainty about global and regional economic conditions negatively affected, and may in the future negatively affect, demand for our customers’ products and for our products, especially our capital equipment products. Also, uncertainty regarding economic conditions has caused, and may in the future cause, liquidity and credit issues for many businesses, including our customers in the pulp and paper industry as well as other industries, and may result in their inability to fund projects, capacity expansion plans, and to some extent, routine operations. These conditions have resulted, and may in the future result, in a number of structural changes in the pulp and paper industry, including decreased spending, mill closures, consolidations, and bankruptcies, all of which negatively affect our business, revenue, and profitability. Any renewed financial and economic turmoil affecting the worldwide economy or the banking system and financial markets, in particular, due to political or economic developments could cause the expectations for our business to differ materially in the future.

Our financial performance will be negatively impacted if there are delays in customers securing financing or our customers become unable to secure such financing. The inability of our customers to obtain credit may affect our ability to recognize revenue and income, particularly on large capital equipment orders from new customers for which we may require letters of credit. We may also be unable to issue letters of credit to our customers, which are required in some cases to guarantee performance, during periods of economic uncertainty.

Paper producers have been, and may in the future be, negatively affected by higher operating costs. Paper companies curtail their capital and operating spending during periods of economic uncertainty and will likely be

7

Table of Contents

| Kadant Inc. | 2010 Annual Report |

cautious about resuming spending as market conditions improve. As paper companies consolidate operations in response to market weakness, they frequently reduce capacity, increase downtime, defer maintenance and upgrades, and postpone or even cancel capacity addition or expansion projects. It is difficult to accurately forecast our revenues and earnings per share during periods of economic uncertainty.

A significant portion of our international sales has, and may in the future, come from China and we operate several manufacturing facilities in China, which exposes us to political, economic, operational and other risks.

We have historically had significant revenues from China, operate significant manufacturing facilities in China, and expect to manufacture and source more of our equipment and components from China in the future. As a result, we are exposed to increased risk in the event of economic slowdowns, changes in the policies of the Chinese government, political unrest, unstable economic conditions, or other developments in China or in U.S.-China relations that are adverse to trade, including enactment of protectionist legislation or trade or currency restrictions. For example, the Chinese premier recently announced plans to target slower economic growth in China in order to avoid inflation and to reduce dependency on exports. Such policies may negatively affect our business in China if customers are unable to expand capacity or obtain financing for expansion or improvement projects.

In addition, orders from customers in China, particularly for large stock-preparation systems that have been tailored to a customer’s specific requirements, have credit risks higher than we generally incur elsewhere, and some orders are subject to the receipt of financing approvals from the Chinese government. For this reason, we do not record signed contracts from customers in China for large stock-preparation systems as orders until we receive the down payments for such contracts. The timing of the receipt of these orders and the down payments are uncertain and there is no assurance that we will be able to recognize revenue on these contracts. Delays in the receipt of payments and letters of credit affect when revenues can be recognized on these contracts, making it difficult to accurately forecast our future financial performance. We may experience a loss if a contract is cancelled prior to the receipt of a down payment in the event we commence engineering or other work associated with the contract. In addition, we may experience a loss if the contract is cancelled, or the customer does not fulfill its obligations under the contract, prior to the receipt of a letter of credit or final payments covering the remaining balance of the contract. In those instances in which a letter of credit is required, it may represent 80% or more of the total order.

We may be unable to expand capacity sufficiently in China to meet current demand.

We experienced a large increase in demand for our stock-preparation products in China in the fourth quarter of 2010 with bookings of nearly $36 million in the quarter. We are implementing a program to meet this demand, which includes expanding our manufacturing capacity in China, hiring additional workers, and accelerating investment in capital equipment. In some cases, we may shift production to our other manufacturing plants outside of China. While we believe that we will meet all of our customer commitments, there can be no assurance that we will be successful, which could expose us to contractual penalties. In addition, the shift to higher-cost production facilities may reduce our gross profit margins on these products. Our business and reputation could be damaged by our inability to perform and our financial performance could suffer as a consequence.

Commodity or component price increases and significant shortages of commodities and component products may adversely impact our financial results or our ability to meet commitments to customers.

We use steel, stainless steel, brass, bronze, and other commodities to manufacture our products. We also use natural gas in the production of our fiber-based granular products. As a result, unanticipated increases in the prices of such commodities could increase our costs more than expected, negatively impacting our business, results of operations and financial condition if we are unable to fully offset the effect of these increased costs through price increases, productivity improvements, or cost reduction programs.

8

Table of Contents

| Kadant Inc. | 2010 Annual Report |

We rely on suppliers to secure commodity and component products required for the manufacture of our products. A disruption in deliveries to or from suppliers or decreased availability of such components or commodities could have an adverse effect on our ability to meet our commitments to customers or increase our operating costs. We believe our sources of raw materials and component products will generally be sufficient for our needs in the foreseeable future. However, our business, results of operations or financial condition could be negatively impacted if supply is insufficient for our operations.

We are dependent on two paper mills for the fiber used in the manufacture of our fiber-based granular products. From time to time we have experienced, and may in the future experience, some difficulty obtaining sufficient raw material to operate at optimal production levels. We continue to work with the mills to ensure a stable supply of raw material. To date, we have been able to meet all of our customer delivery requirements, but there can be no assurance that we will be able to meet future delivery requirements. Although we believe our relationships with the mills are good, the mills could decide not to continue to supply sufficient papermaking byproducts, or may not agree to continue to supply such products on commercially reasonable terms. If the mills were unable or unwilling to supply us sufficient fiber, we would be forced to find one or more alternative sources of supply of this raw material. We may be unable to find alternative supplies on commercially reasonable terms or could incur excessive transportation costs if an alternative supplier were found, which would increase our manufacturing costs, and might prevent prices for our products from being competitive or require closure of this business.

Our business is subject to economic, currency, political, and other risks associated with international sales and operations.

During 2010 and 2009, approximately 58% and 59%, respectively, of our sales were to customers outside the United States, principally in Europe and China. In addition, we operate several manufacturing operations worldwide, including those in China, Europe, Mexico, and Brazil. International revenues and operations are subject to a number of risks, including the following:

| – | agreements may be difficult to enforce and receivables difficult to collect through a foreign country’s legal system, |

| – | foreign customers may have longer payment cycles, |

| – | foreign countries may impose additional withholding taxes or otherwise tax our foreign income, impose tariffs, adopt other restrictions on foreign trade, impose currency restrictions or enact other protectionist or anti-trade measures, |

| – | worsening economic conditions may result in worker unrest, labor actions, and potential work stoppages, |

| – | political unrest, such as that currently occurring in North Africa and the Middle East, may disrupt commercial activities of ours or our customers, |

| – | it may be difficult to repatriate funds, due to unfavorable domestic and foreign tax consequences or other restrictions or limitations imposed by foreign governments, and |

| – | the protection of intellectual property in foreign countries may be more difficult to enforce. |

Although we seek to charge our customers in the same currency in which our operating costs are incurred, fluctuations in currency exchange rates may affect product demand and adversely affect the profitability in U.S. dollars of products we provide in international markets where payment for our products and services is made in their local currencies. In addition, our inability to repatriate funds could adversely affect our ability to service our debt obligations. Any of these factors could have a material adverse impact on our business and results of operations. Furthermore, while some risks can be hedged using derivatives or other financial instruments, or may be insurable, such attempts to mitigate these risks may be costly and not always successful.

9

Table of Contents

| Kadant Inc. | 2010 Annual Report |

We are subject to intense competition in all our markets.

We believe that the principal competitive factors affecting the markets for our products include quality, price, service, technical expertise, and product performance and innovation. Our competitors include a number of large multinational corporations that may have substantially greater financial, marketing, and other resources than we do. As a result, they may be able to adapt more quickly to new or emerging technologies and changes in customer requirements, or to devote greater resources to the promotion and sale of their services and products. Competitors’ technologies may prove to be superior to ours. Our current products, those under development, and our ability to develop new technologies may not be sufficient to enable us to compete effectively. Competition, especially in China, has increased as new companies enter the market and existing competitors expand their product lines and manufacturing operations.

Adverse changes to the soundness of our suppliers and customers could affect our business and results of operations.

All of our businesses are exposed to risk associated with the creditworthiness of our key suppliers and customers, including pulp and paper manufacturers and other industrial customers, many of which may be adversely affected by the volatile conditions in the financial markets, worldwide economic downturns, and difficult economic conditions. These conditions could result in financial instability, bankruptcy, or other adverse effects at any of our suppliers or customers. The consequences of such adverse effects could include the interruption of production at the facilities of our suppliers, the reduction, delay or cancellation of customer orders, delays in or the inability of customers to obtain financing to purchase our products, and bankruptcy of customers or other creditors. Any adverse changes to the soundness of our suppliers or customers may adversely affect our cash flow, profitability and financial condition.

Changes in our effective tax rate may impact our results of operations.

We derive a significant portion of our revenue and earnings from our international operations, and are subject to income and other taxes in the U.S. and numerous foreign jurisdictions. A number of factors may increase our effective tax rate, including: increases in tax rates in various jurisdictions; unanticipated decreases in the amount of profit in jurisdictions with low statutory tax rates; the resolution of issues arising from tax audits with various tax authorities; changes in the valuation of our deferred tax assets and liabilities; adjustments to income taxes upon finalization of various tax returns; increases in expenses not deductible for tax purposes, including impairments of goodwill in connection with acquisitions; changes in available tax credits or our ability to utilize foreign tax credits; and changes in tax laws or the interpretation of such tax laws. Any significant increase in our future effective tax rates would adversely impact our net income for future periods.

We may be required to reorganize our operations in response to changing conditions in the worldwide economy and the pulp and paper industry, and such actions may require significant expenditures and may not be successful.

We have undertaken various restructuring measures in response to changing market conditions in the countries in which we operate and in the pulp and paper industry in general, which have affected our business. We may engage in additional cost reduction programs in the future. We may not recoup the costs of programs we have already initiated, or other programs in which we may decide to engage in the future, the costs of which may be significant. In connection with any future plant closures, delays or failures in the transition of production from existing facilities to our other facilities in other geographic regions could also adversely affect our results of operations. In addition, it is difficult to accurately forecast our financial performance given the continuing uncertainly in the global economic environment, and the efforts we have made or may make to align our cost structure may not be sufficient or able to keep pace with rapidly changing business conditions. Our profitability may decline if our restructuring efforts do not sufficiently reduce our future costs and position us to maintain or increase our sales.

10

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Adverse changes to the soundness of financial institutions could affect us.

We have relationships with many financial institutions, including lenders under our credit facilities and insurance underwriters, and from time to time, we execute transactions with counterparties in the financial industry, such as our interest rate swap arrangements and other hedging transactions. As a consequence of volatility in the financial markets, these financial institutions or counterparties could be adversely affected and we may not be able to access credit facilities in the future, complete transactions as intended, or otherwise obtain the benefit of the arrangements we have entered into with such financial parties, which could adversely affect our business and results of operations.

Our debt may adversely affect our cash flow and may restrict our investment opportunities.

In 2008, we entered into a five-year unsecured revolving credit facility (2008 Credit Agreement) in the aggregate principal amount of up to $75 million. The 2008 Credit Agreement also includes an uncommitted unsecured incremental borrowing facility of up to an additional $75 million. We had $15 million outstanding under the 2008 Credit Agreement as of January 1, 2011 and we have also borrowed additional amounts under other agreements to fund our operations. We may also obtain additional long-term debt and working capital lines of credit to meet future financing needs, which would have the effect of increasing our total leverage. Our indebtedness could have negative consequences, including:

| – | increasing our vulnerability to adverse economic and industry conditions, |

| – | limiting our ability to obtain additional financing, |

| – | limiting our ability to pay dividends on or to repurchase our capital stock, |

| – | limiting our ability to complete a merger or an acquisition, |

| – | limiting our ability to acquire new products and technologies through acquisitions or licensing agreements, and |

| – | limiting our flexibility in planning for, or reacting to, changes in our business and the industries in which we compete. |

Our existing indebtedness bears interest at floating rates and as a result, our interest payment obligations on our indebtedness will increase if interest rates increase. As of January 1, 2011, $17.8 million of our outstanding floating rate debt was hedged through interest rate swap agreements. The unrealized loss associated with these swap agreements was $1.6 million as of January 1, 2011. This unrealized loss represents the estimated amount for which the swap agreements could be settled. The counterparty to the swap agreements could demand an early termination of the swap agreements if we are in default under the 2008 Credit Agreement, or any agreement that amends or replaces the 2008 Credit Agreement in which the counterparty is a member, and we are unable to cure the default. If these swap agreements were terminated prior to the scheduled maturity date and if we were required to pay cash for the value of the swap, we would incur a loss, which would adversely affect our financial results.

Our ability to satisfy our obligations and to reduce our total debt depends on our future operating performance and on economic, financial, competitive, and other factors beyond our control. Our business may not generate sufficient cash flows to meet these obligations or to successfully execute our business strategy. The 2008 Credit Agreement includes certain financial covenants and our failure to comply with these covenants could result in an event of default under the 2008 Credit Agreement, the swap agreements, and our other credit facilities, and would have significant negative consequences for our current operations and our future ability to fund our operations and grow our business. If we are unable to service our debt and fund our business, we may be forced to reduce or delay capital expenditures or research and development expenditures, seek additional financing or equity capital, restructure or refinance our debt, or sell assets.

11

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Restrictions in our 2008 Credit Agreement may limit our activities.

Our 2008 Credit Agreement contains, and future debt instruments to which we may become subject may contain, restrictive covenants that limit our ability to engage in activities that could otherwise benefit us, including restrictions on our ability and the ability of our subsidiaries to:

| – | incur additional indebtedness, |

| – | pay dividends on, redeem, or repurchase our capital stock, |

| – | make investments, |

| – | create liens, |

| – | sell assets, |

| – | enter into transactions with affiliates, and |

| – | consolidate, merge, or transfer all or substantially all of our assets and the assets of our subsidiaries. |

We are also required to meet specified financial covenants under the terms of our 2008 Credit Agreement. Our ability to comply with these financial restrictions and covenants is dependent on our future performance, which is subject to prevailing economic conditions and other factors, including factors that are beyond our control such as currency exchange rates, interest rates, changes in technology, and changes in the level of competition. Our failure to comply with any of these restrictions or covenants may result in an event of default under our 2008 Credit Agreement and other loan obligations, which could permit acceleration of the debt under those instruments and require us to repay the debt before its scheduled due date. If an event of default were to occur, we might not have sufficient funds available to make the payments required under our indebtedness. If we are unable to repay amounts owed under our debt agreements, those lenders may be entitled to foreclose on and sell the collateral that secures our borrowings under the agreements.

The inability of Composites LLC to pay claims against it has exposed us to litigation, which if we are unable to successfully defend, could have a material adverse effect on our consolidated financial results.

On October 21, 2005, our Composites LLC subsidiary sold substantially all of its assets to a third party and retained certain liabilities associated with the operation of the business prior to the sale, including warranty obligations related to products manufactured prior to the sale date (Retained Liabilities). Composites LLC retained all of the cash proceeds received from the asset sale in 2005 and continued to administer and pay warranty claims from the sale proceeds into the third quarter of 2007, when it announced that it no longer had sufficient funds to honor warranty claims, was unable to pay or process warranty claims, and ceased doing business.

Composites LLC, jointly and severally with its parent company Kadant Inc., agreed to indemnify the original buyer and a subsequent purchaser of the business against losses arising from claims associated with the Retained Liabilities. This indemnification obligation is contractually limited to approximately $8.4 million. All activity related to this business is classified in the results of the discontinued operation in our consolidated financial statements.

We were previously named as co-defendants, together with Composites LLC and two other defendants, in several state class action complaints and one federal class action complaint filed in 2008 and 2009, as disclosed in our prior filings. These complaints sought to recover damages allegedly associated with the composite building products manufactured by Composites LLC between April 2002 and October 2003. This litigation has been dismissed, in the case of the federal class action, and voluntarily withdrawn without prejudice by the state plaintiffs. We continue to discuss with these plaintiffs potential alternative dispute resolution or other settlement of these matters. There can be no assurance that the parties will reach a resolution on terms satisfactory to the parties, or that these or other plaintiffs will not file new complaints against us or the other parties indemnified by Composites LLC. While we believe any such asserted or possible claims against us or other indemnified parties would be without merit, the cost of litigation and the outcome, including any settlement, could adversely affect our consolidated financial results.

12

Table of Contents

| Kadant Inc. | 2010 Annual Report |

An increase in the accrual for warranty costs of the discontinued operation adversely affects our consolidated financial results.

The discontinued operation has experienced significant liabilities associated with warranty claims related to its composite decking products manufactured prior to the sale of the business in 2005. The accrued warranty costs of the discontinued operation as of January 1, 2011 represents the low end of the estimated range of warranty costs based on the level of claims received before Composites LLC ceased operations and judgments entered against it in litigation. Composites LLC has calculated that the total potential warranty cost ranges from $2.1 million to approximately $13.1 million. The high end of the range represents the estimated maximum level of warranty claims remaining based on the total sales of the products under warranty. On September 30, 2007, the discontinued operation ceased doing business and has no employees or other service providers to collect or process warranty claims. Composites LLC will continue to record adjustments to accrued warranty costs to reflect the minimum amount of the potential range of loss for products under warranty based on any judgments entered against it in litigation, which will adversely affect our consolidated results.

Our inability to successfully identify and complete acquisitions or successfully integrate any new or previous acquisitions could have a material adverse effect on our business.

Our strategy includes the acquisition of technologies and businesses that complement or augment our existing products and services. Any such acquisition involves numerous risks that may adversely affect our future financial performance and cash flows. These risks include:

| – | competition with other prospective buyers resulting in our inability to complete an acquisition or in us paying substantial premiums over the fair value of the net assets of the acquired business, |

| – | inability to obtain regulatory approval, including antitrust approvals, |

| – | difficulty in assimilating operations, technologies, products and the key employees of the acquired business, |

| – | inability to maintain existing customers or to sell the products and services of the acquired business to our existing customers, |

| – | diversion of management’s attention away from other business concerns, |

| – | inability to improve the revenues and profitability or realize the cost savings and synergies expected in the acquisition, |

| – | assumption of significant liabilities, some of which may be unknown at the time, |

| – | potential future impairment of the value of goodwill and intangible assets acquired, and |

| – | identification of internal control deficiencies of the acquired business. |

In 2008, we recorded a $40.3 million impairment charge to write down the goodwill associated with the stock-preparation reporting unit within our Papermaking Systems segment. We may incur additional impairment charges to write down the value of our goodwill and acquired intangible assets in the future if the assets are not deemed recoverable, which could have a material adverse effect on our operating results.

Our inability to protect our intellectual property could have a material adverse effect on our business. In addition, third parties may claim that we infringe their intellectual property, and we could suffer significant litigation or licensing expense as a result.

We seek patent and trade secret protection for significant new technologies, products, and processes because of the length of time and expense associated with bringing new products through the development process and into the marketplace. We own numerous U.S. and foreign patents, and we intend to file additional applications, as appropriate, for patents covering our products. Patents may not be issued for any pending or future patent applications owned by or licensed to us, and the claims allowed under any issued patents may not be sufficiently broad to protect our technology. Any issued patents owned by or licensed to us may be challenged, invalidated, or circumvented, and the rights under these patents may not provide us with competitive advantages. In addition,

13

Table of Contents

| Kadant Inc. | 2010 Annual Report |

competitors may design around our technology or develop competing technologies. Intellectual property rights may also be unavailable or limited in some foreign countries, which could make it easier for competitors to capture increased market share. We could incur substantial costs to defend ourselves in suits brought against us, including for alleged infringement of third party rights, or in suits in which we may assert our intellectual property rights against others. An unfavorable outcome of any such litigation could have a material adverse effect on our business and results of operations. In addition, as our patents expire, we rely on trade secrets and proprietary know-how to protect our products. We cannot be sure the steps we have taken or will take in the future will be adequate to deter misappropriation of our proprietary information and intellectual property. Of particular concern are developing countries, such as China, where the laws, courts, and administrative agencies may not protect our intellectual property rights as fully as in the United States or Europe.

We seek to protect trade secrets and proprietary know-how, in part, through confidentiality agreements with our collaborators, employees, and consultants. These agreements may be breached, we may not have adequate remedies for any breach, and our trade secrets may otherwise become known or be independently developed by our competitors, or our competitors may otherwise gain access to our intellectual property.

Our share price will fluctuate.

Stock markets in general and our common stock in particular experienced significant price and volume volatility during 2008 and 2009 and may experience significant price and volume volatility from time to time in the future. The market price and trading volume of our common stock may continue to be subject to significant fluctuations due not only to general stock market conditions but also to a change in sentiment in the market regarding our operations, business prospects, or future funding. Given the nature of the markets in which we participate and the impact of accounting standards related to revenue recognition, we may not be able to reliably predict future revenues and profitability, and unexpected changes may cause us to adjust our operations. A large proportion of our costs are fixed, due in part to our significant selling, research and development, and manufacturing costs. Thus, small declines in revenues could disproportionately affect our operating results. Other factors that could affect our share price and quarterly operating results include:

| – | failure of our products to pass contractually agreed upon acceptance tests, which would delay or prohibit recognition of revenues under applicable accounting guidelines, |

| – | changes in the assumptions used for revenue recognized under the percentage-of-completion method of accounting, |

| – | fluctuations in revenues due to customer-initiated delays in product shipments, |

| – | failure of a customer, particularly in Asia, to comply with an order’s contractual obligations or inability of a customer to provide financial assurances of performance, |

| – | adverse changes in demand for and market acceptance of our products, |

| – | competitive pressures resulting in lower sales prices for our products, |

| – | adverse changes in the pulp and paper industry, |

| – | delays or problems in our introduction of new products, |

| – | delays or problems in the manufacture of our products, |

| – | our competitors’ announcements of new products, services, or technological innovations, |

| – | contractual liabilities incurred by us related to guarantees of our product performance, |

| – | increased costs of raw materials or supplies, including the cost of energy, |

| – | changes in the timing of product orders, |

| – | fluctuations in our effective tax rate, |

| – | the operating and share price performance of companies that investors consider to be comparable to us, and |

| – | changes in global financial markets and global economies and general market conditions. |

14

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Anti-takeover provisions in our charter documents, under Delaware law, and in our shareholder rights plan could prevent or delay transactions that our shareholders may favor.

Provisions of our charter and bylaws may discourage, delay, or prevent a merger or acquisition that our shareholders may consider favorable, including transactions in which shareholders might otherwise receive a premium for their shares. For example, these provisions:

| – | authorize the issuance of “blank check” preferred stock without any need for action by shareholders, |

| – | provide for a classified board of directors with staggered three-year terms, |

| – | require supermajority shareholder voting to effect various amendments to our charter and bylaws, |

| – | eliminate the ability of our shareholders to call special meetings of shareholders, |

| – | prohibit shareholder action by written consent, and |

| – | establish advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted on by shareholders at shareholder meetings. |

In addition, our board of directors adopted a shareholder rights plan in 2001 intended to protect shareholders in the event of an unfair or coercive offer to acquire our company and to provide our board of directors with adequate time to evaluate unsolicited offers. Preferred stock purchase rights have been distributed to our common shareholders pursuant to the rights plan. This rights plan may have anti-takeover effects. The rights plan will cause substantial dilution to a person or group that attempts to acquire us on terms that our board of directors does not believe are in our best interests and those of our shareholders and may discourage, delay, or prevent a merger or acquisition that shareholders may consider favorable, including transactions in which shareholders might otherwise receive a premium for their shares. The shareholder rights plan will expire in July 2011 and our board of directors does not intend to renew it at this time.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

| Item 2. | Properties |

We believe that our facilities are in good condition and are suitable and adequate for our present operations. We do not anticipate significant difficulty in obtaining lease renewals or alternative space as needed. The location and general character of our principal properties as of year-end 2010 are as follows:

Papermaking Systems

We own approximately 1,715,000 square feet and lease approximately 133,000 square feet, under leases expiring on various dates ranging from 2011 to 2022, of manufacturing, engineering, and office space. In addition, in China we lease the land associated with our buildings under long-term leases, which expire on dates ranging from 2044 to 2054. Our principal engineering and manufacturing facilities are located in Vitry-le-Francois, France; Jining, China; Three Rivers, Michigan, U.S.A; Auburn, Massachusetts, U.S.A; Yanzhou, China; Theodore, Alabama, U.S.A; Weesp, The Netherlands; Wuxi, China; Hindas, Sweden; Guadalajara, Mexico; Bury, England; Sao Paulo, Brazil; Mason, Ohio, U.S.A; and Summerstown, Ontario, Canada.

Fiber-based Products

We own approximately 31,000 square feet of manufacturing and office space located in Green Bay, Wisconsin. We also lease approximately 25,000 square feet of manufacturing space located in Green Bay, Wisconsin, on a tenant-at-will basis.

Corporate

We lease approximately 10,000 square feet in Westford, Massachusetts, for our corporate headquarters under a lease expiring in 2017.

15

Table of Contents

| Kadant Inc. | 2010 Annual Report |

| Item 3. | Legal Proceedings |

Not applicable.

| Item 4. | Reserved |

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

Market Price of Common Stock

Our common stock trades on the New York Stock Exchange under the symbol “KAI”. The closing market price on the New York Stock Exchange for our common stock on February 18, 2011, was $21.94 per share.

The following table sets forth the high and low sales prices of our common stock for 2010 and 2009, as reported in the consolidated transaction reporting system.

| 2010 | 2009 | |||||||||||||||

| Quarter |

High | Low | High | Low | ||||||||||||

| First |

$ | 17.46 | $ | 13.24 | $ | 14.13 | $ | 6.50 | ||||||||

| Second |

22.77 | 14.57 | 14.88 | 10.05 | ||||||||||||

| Third |

19.98 | 15.97 | 14.31 | 8.99 | ||||||||||||

| Fourth |

24.44 | 18.29 | 16.91 | 11.90 | ||||||||||||

Holders of Common Stock

As of February 18, 2011, we had approximately 4,438 holders of record of our common stock. This does not include holdings in street or nominee name.

Dividend Policy

We have never declared or paid cash dividends and we do not at this time expect to pay cash dividends in the foreseeable future because our policy has been to use earnings to finance expansion and growth, as well as repurchase our stock. Payment of dividends will rest within the discretion of the board of directors and will depend upon, among other factors, our earnings, capital requirements, and financial condition. Our ability to pay dividends is restricted by the terms of our 2008 Credit Agreement.

Issuer Purchases of Equity Securities

We did not repurchase any of our common stock in the fourth quarter of 2010.

16

Table of Contents

| Kadant Inc. | 2010 Annual Report |

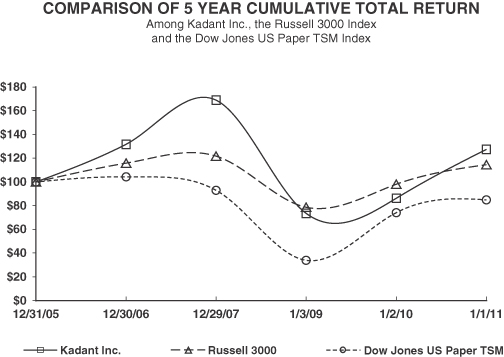

Performance Graph

This performance graph compares the cumulative, five-year total shareholder return assuming an investment of $100 (and the reinvestment of dividends) in our common stock, the Russell 3000 Stock Index and the Dow Jones U.S. Paper Total Stock Market (TSM) Index. Our common stock trades on the New York Stock Exchange under the ticker symbol “KAI.” Because our fiscal year ends on a Saturday, the graph uses the last trading day of our fiscal year.

| 12/31/05 | 12/30/06 | 12/29/07 | 1/3/09 | 1/2/10 | 1/1/11 | |||||||||||||||||||

| Kadant Inc. |

100.00 | 131.78 | 168.76 | 73.41 | 86.27 | 127.41 | ||||||||||||||||||

| Russell 3000 |

100.00 | 115.71 | 121.66 | 78.58 | 97.89 | 114.46 | ||||||||||||||||||

| Dow Jones U.S. Paper Total Stock Market |

100.00 | 104.09 | 93.01 | 33.78 | 74.10 | 84.90 | ||||||||||||||||||

The information included under the heading “Performance Graph” in Item 5 of this Annual Report on Form 10-K is “furnished” and not “filed” and shall not be deemed to be “soliciting material” or subject to Regulation 14A , shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

17

Table of Contents

| Kadant Inc. | 2010 Annual Report |

| Item 6. | Selected Financial Data |

| (In thousands, except per share amounts) |

2010 (a) | 2009 (b) | 2008 (c) | 2007 | 2006 | |||||||||||||||

| Statement of Operations Data |

||||||||||||||||||||

| Revenues |

$ | 270,029 | $ | 225,565 | $ | 329,158 | $ | 366,496 | $ | 341,613 | ||||||||||

| Operating Income (Loss) |

24,949 | (474 | ) | (13,007 | ) | 37,038 | 29,442 | |||||||||||||

| Amounts Attributable to Kadant: |

||||||||||||||||||||

| Income (Loss) from Continuing Operations |

18,409 | (5,906 | ) | (22,595 | ) | 25,418 | 18,281 | |||||||||||||

| Income (Loss) from Discontinued Operation, Net of Tax |

98 | (18 | ) | 37 | (2,750 | ) | (1,184 | ) | ||||||||||||

| Net Income (Loss) |

$ | 18,507 | $ | (5,924 | ) | $ | (22,558 | ) | $ | 22,668 | $ | 17,097 | ||||||||

| Earnings (Loss) per Share for Continuing Operations: |

||||||||||||||||||||

| Basic |

$ | 1.49 | $ | (.48 | ) | $ | (1.67 | ) | $ | 1.80 | $ | 1.32 | ||||||||

| Diluted |

$ | 1.48 | $ | (.48 | ) | $ | (1.67 | ) | $ | 1.78 | $ | 1.30 | ||||||||

| Earnings (Loss) per Share: |

||||||||||||||||||||

| Basic |

$ | 1.50 | $ | (.48 | ) | $ | (1.67 | ) | $ | 1.61 | $ | 1.24 | ||||||||

| Diluted |

$ | 1.48 | $ | (.48 | ) | $ | (1.67 | ) | $ | 1.59 | $ | 1.21 | ||||||||

| Balance Sheet Data |

||||||||||||||||||||

| Working Capital (d) |

$ | 79,006 | $ | 66,917 | $ | 98,017 | $ | 107,487 | $ | 80,542 | ||||||||||

| Total Assets |

336,772 | 307,656 | 356,917 | 437,069 | 393,085 | |||||||||||||||

| Long-Term Obligations |

17,250 | 22,750 | 52,122 | 30,460 | 44,652 | |||||||||||||||

| Shareholders’ Investment |

207,301 | 194,031 | 194,393 | 280,213 | 238,982 | |||||||||||||||

| (a) | Reflects a $1.0 million pre-tax gain on the sale of real estate, a $0.2 million pre-tax curtailment gain, and $0.2 million of pre-tax restructuring costs. |

| (b) | Reflects $4.4 million of pre-tax restructuring costs. |

| (c) | Reflects a $40.3 million pre-tax goodwill impairment charge, a $15.4 million tax provision related to applying a valuation allowance to certain deferred tax assets, and $2.0 million of pre-tax restructuring costs, net of gains. |

| (d) | Includes ($2.0) million, ($1.9) million, ($1.9) million, ($1.1) million, and $3.0 million in 2010, 2009, 2008, 2007, and 2006, respectively, associated with the discontinued operation. |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Reference is made throughout this Management’s Discussion and Analysis of Financial Condition and Results of Operations to Notes included in our consolidated financial statements beginning on page F-1 of this Report.

Overview

Company Overview

We are a leading supplier of equipment used in the global papermaking and paper recycling industries and a manufacturer of granules made from papermaking byproducts. Our continuing operations are comprised of one reportable operating segment: Papermaking Systems, and a separate product line, Fiber-based Products. Through our Papermaking Systems segment, we develop, manufacture, and market a range of equipment and products for the global papermaking and paper recycling industries. We have a large customer base that includes most of the world’s major paper manufacturers. We believe our large installed base provides us with a spare parts and consumables business that yields higher margins than our capital equipment business.

18

Table of Contents

| Kadant Inc. | 2010 Annual Report |

Through our Fiber-based Products business, we manufacture and sell granules derived from pulp fiber for use as carriers for agricultural, home lawn and garden, and professional lawn, turf and ornamental applications, as well as for oil and grease absorption.

International Sales

During 2010 and 2009, approximately 58% and 59%, respectively, of our sales were to customers outside the United States, principally in Europe and China. We generally seek to charge our customers in the same currency in which our operating costs are incurred. However, our financial performance and competitive position can be affected by currency exchange rate fluctuations affecting the relationship between the U.S. dollar and foreign currencies. We seek to reduce our exposure to currency fluctuations through the use of forward currency exchange contracts. We may enter into forward contracts to hedge certain firm purchase and sale commitments denominated in currencies other than our subsidiaries’ functional currencies. These contracts hedge transactions principally denominated in U.S. dollars.

Application of Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of our consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Our actual results may differ from these estimates under different assumptions or conditions.

Critical accounting policies are defined as those that entail significant judgments and uncertainties, and could potentially result in materially different results under different assumptions and conditions. We believe that our most critical accounting policies upon which our financial position depends, and which involve the most complex or subjective decisions or assessments, are those described below. For a discussion on the application of these and other accounting policies, see Note 1 in the Notes to consolidated financial statements.

Revenue Recognition and Accounts Receivable. We enter into arrangements with customers that have multiple deliverables, such as equipment and installation, and we recognize revenues and profits on certain long-term contracts using the percentage-of-completion method of accounting.

| • | Percentage-of-Completion. Revenues recorded under the percentage-of-completion method of accounting pursuant to Accounting Standards Codification (ASC) 605, “Revenue Recognition” (ASC 605), were $26.1 million in 2010, $32.0 million in 2009, and $58.1 million in 2008. We determine the percentage of completion by comparing the actual costs incurred to date to an estimate of total costs to be incurred on each contract. If a loss is indicated on any contract in process, a provision is made currently for the entire loss. Our contracts generally provide for billing of customers upon the attainment of certain milestones specified in each contract. Revenues earned on contracts in process in excess of billings are classified as unbilled contract costs and fees, and amounts billed in excess of revenues are classified as billings in excess of contract costs and fees. The estimation process under the percentage-of-completion method affects the amounts reported in our consolidated financial statements. A number of internal and external factors affect our percentage-of-completion and cost of sales estimates, including labor rate and efficiency variances, estimates of warranty costs, estimated future material prices from vendors, and customer specification and testing requirements. In addition, we are exposed to the risk, primarily relating to our orders in China, that a customer will not comply with the order’s contractual obligations to take delivery of the equipment. The contractual obligations relating to the order may be difficult to enforce through a foreign country’s legal system, which could result in a significant credit exposure in the period or periods that were to be affected by the breach of contract. Although we make every effort to ensure the accuracy of our estimates in the application of |

19

Table of Contents

| Kadant Inc. | 2010 Annual Report |

| this accounting policy, if our actual results differed from our estimates, or if we were to use different assumptions, it is possible that materially different amounts could be reported as revenues in our consolidated financial statements. |