Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LUMINEX CORP | a2019-q4form8xk.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - LUMINEX CORP | a2019-q4form8xkex991.htm |

Q4 and FULL-YEAR 2019 CONFERENCE CALL INVESTOR PRESENTATION February 10, 2020

SAFE HARBOR STATEMENT Certain statements made during the course of this presentation may not be purely historical and consequently may be forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements made regarding: our Licensed Technologies Group model and the ability of our licensees and installed base to drive future growth; the ability of our technology to enhance productivity and efficiency; our financial position and long-term revenue growth; our ability to integrate acquired companies or selected assets; our molecular diagnostic business model, the markets we are targeting, market segmentation, expected growth of such markets, and the ability of our products to address those markets; sales of our products, their technical capabilities, and the anticipated market size and acceptance, demand and regulatory environment and approvals therefor; our direct sales efforts; our system placements; our system and assay product pipeline and anticipated timelines for regulatory approvals and market releases, including for ARIES®, VERIGENE®, VERIGENE® II, and xMAP® INTELLIFLEX instrumentation and assays, and our flow cytometry product lines; market opportunity for ARIES®, VERIGENE®, VERIGENE® II, xMAP® INTELLIFLEX, and our flow cytometry products; functionality and benefits of ARIES®, VERIGENE®, VERIGENE® II, xMAP® INTELLIFLEX, and the flow cytometry products and competitive position; reimbursement trends; our ability to drive growth through investment in R&D and next generation systems and focus on operating leverage and managing operating costs; our long-term financial targets; our key steps and strategies for growth; our strategic outlook and growth plan for our business for 2020 and beyond; operational trends, including those related to sales of systems, assays, consumables, and royalty revenues; competitive threats and products offered by other companies; our business outlook, financial targets and projections about revenues, cash flows, system shipments, expenses and market conditions, and their anticipated impact on Luminex for 2020 and beyond; and, any statements of the plans, strategies and objectives of management for future operations. These forward-looking statements speak only as of the date hereof and are based on our current beliefs and expectations and are subject to known or unknown risks and uncertainties, some of which are beyond our control, that could cause actual results or plans to differ materially and adversely from those anticipated in the forward-looking statements. Factors that could cause or contribute to such differences are detailed in our annual, quarterly, or other filings with the Securities and Exchange Commission. We undertake no obligation to update these forward-looking statements. Also, certain non-GAAP financial measures, as defined by SEC Regulation G, may be covered in this presentation. To the extent that any non-GAAP financial measures are covered, a presentation of and reconciliation to the most directly comparable GAAP financial measures will be included in this presentation and may be available on our website at luminexcorp.com in accordance with Regulation G. complexity simplified. 2

OVERVIEW 2019 Note: all figures approximate $335M MOLECULAR LIFE SCIENCE & DIAGNOSTICS CLINICAL TOOLS (M Dx) (TOOLS) $137M $194M LICENSED FLOW AUTOMATED NON-AUTOMATED TECHNOLOGIES CYTOMETRY $76M $61M GROUP (LTG) $149M $45M complexity simplified. Recurring revenue items 3

INNOVATION, EXECUTION, NEW PRODUCTS Innovative Pipeline $500M NEW PRODUCT LAUNCHES DRIVE REVENUES FROM ~$335M IN 2019 TO $500M BY 2024 Guava Next Gen System 2021 & ® xMAP INTELLIFLEX* BEYOND VERIGENE® II 2020 2020 * “SENSIPLEX” will be launching under the official name, xMAP® INTELLIFLEX 2020 complexity simplified. 4

FINANCIAL OVERVIEW 5

SIGNIFICANT GROWTH IN REVENUE (EX-LABCORP) DOUBLE-DIGIT INCREASE IN ORGANIC REVENUE GROWTH (EX-LABCORP) IN 2020; LABCORP REVENUE HEADWIND OF 2% TO 3% IN 2020 $5M $16M $352M CONSISTENT $47M $319M REVENUE GROWTH $61M EX-LABCORP $55M $268M $245M (incl. 2020 guidance) $56M $48M $215M $179M $182M 2014 2015 2016 2017 2018 2019 2020E* complexity simplified. * midpoint of estimated range KEY: Non-LabCorp LabCorp 6

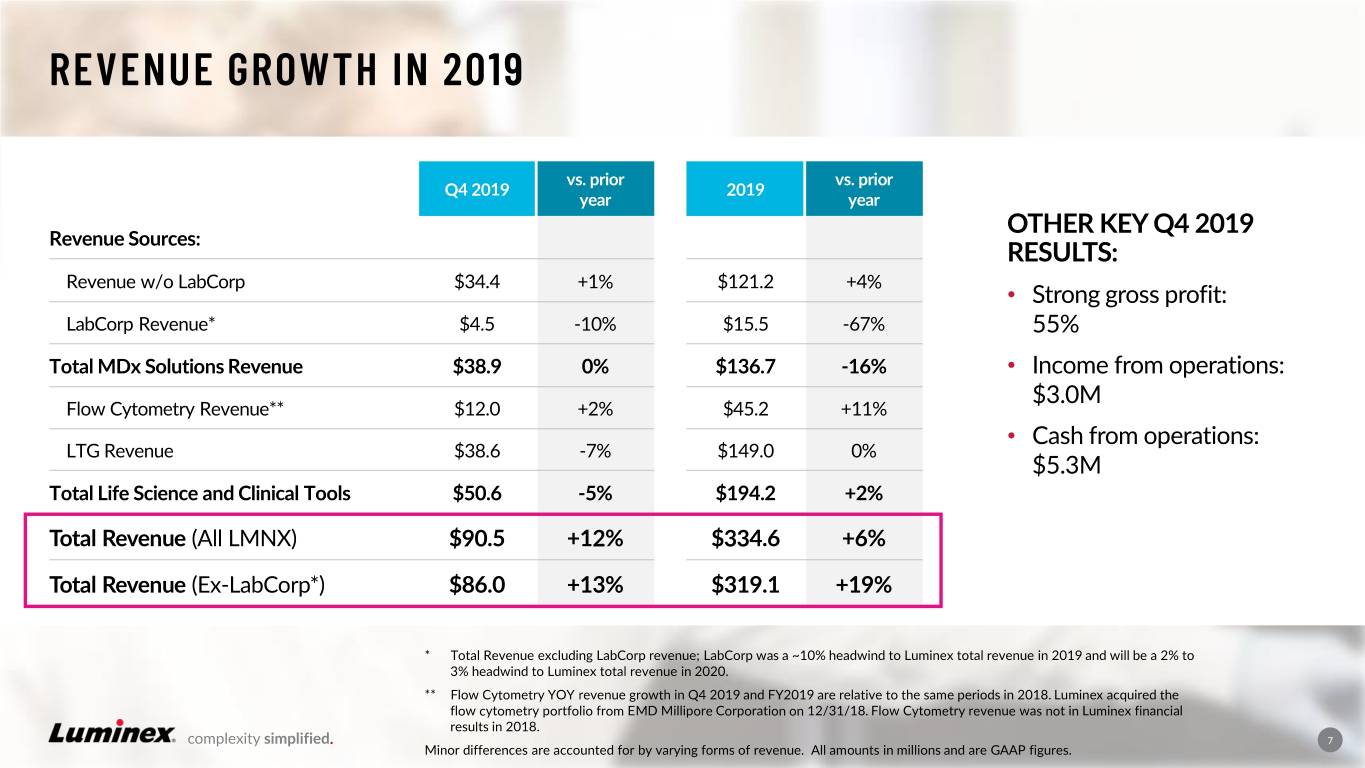

REVENUE GROWTH IN 2019 vs. prior vs. prior Q4 2019 2019 year year OTHER KEY Q4 2019 Revenue Sources: RESULTS: Revenue w/o LabCorp $34.4 +1% $121.2 +4% • Strong gross profit: LabCorp Revenue* $4.5 -10% $15.5 -67% 55% Total MDx Solutions Revenue $38.9 0% $136.7 -16% • Income from operations: $3.0M Flow Cytometry Revenue** $12.0 +2% $45.2 +11% • Cash from operations: LTG Revenue $38.6 -7% $149.0 0% $5.3M Total Life Science and Clinical Tools $50.6 -5% $194.2 +2% Total Revenue (All LMNX) $90.5 +12% $334.6 +6% Total Revenue (Ex-LabCorp*) $86.0 +13% $319.1 +19% * Total Revenue excluding LabCorp revenue; LabCorp was a ~10% headwind to Luminex total revenue in 2019 and will be a 2% to 3% headwind to Luminex total revenue in 2020. ** Flow Cytometry YOY revenue growth in Q4 2019 and FY2019 are relative to the same periods in 2018. Luminex acquired the flow cytometry portfolio from EMD Millipore Corporation on 12/31/18. Flow Cytometry revenue was not in Luminex financial results in 2018. complexity simplified. 7 Minor differences are accounted for by varying forms of revenue. All amounts in millions and are GAAP figures.

REVENUE IN 2020 LONG-TERM REVENUE TARGET IS $500M FULL-YEAR 2020 • The company expects stronger organic growth, strong gross margins, and income and cash flow from operations • Launch in mid-2020: FULL-YEAR 2020 ‒ VERIGENE® II REVENUE GUIDANCE ‒ xMAP® INTELLIFLEX* ‒ Guava Next-Gen System $352 to $362M REVENUE STREAMS: • Tools (LTG + Flow Cytometry): mid-to-high single-digit growth • MDx Solutions: mid-to-high single-digit growth Q1 2020 REVENUE GUIDANCE STRONG FINANCIAL DISCIPLINE: • Income and cash flow from operations • Strong gross margins: mid 50’s $82 to $84M • Operating expenses relatively flat compared to full-year 2019 • Anticipate continued dividend ® complexity simplified. * “SENSIPLEX” will be launching under the official name, xMAP INTELLIFLEX 8

WRAP-UP 9

LUMINEX INVESTMENT HIGHLIGHTS DIVERSIFIED PRODUCT SERVING MULTI-BILLION OFFERINGS DOLLAR MARKETS • Automated & Flexible MDx Solutions • Life Science Research – Targeted • Clinical Diagnostics – Syndromic • Non-Automated MDx Solutions • Life Science and Clinical Tools STRONG BALANCE SHEET Entering a New & RAZOR/RAZORBLADE • No Debt Transformative Era MODEL • Quarterly Cash Dividend with Strong Organic • Expanding Installed Base Across Growth, Profitability EXCITING NEW Multiple Channels and Cash Flow • Recurring (Annuity) Revenue PRODUCT PIPELINE Comprising Over 75% of Total • 3 New Product Launches in 2020 • Healthy Selection of New Platforms & Opportunities complexity simplified. 10