Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2020-q2exhibit9911231.htm |

| 8-K - 8-K - SCANSOURCE, INC. | a2020-q2form8xk12312019.htm |

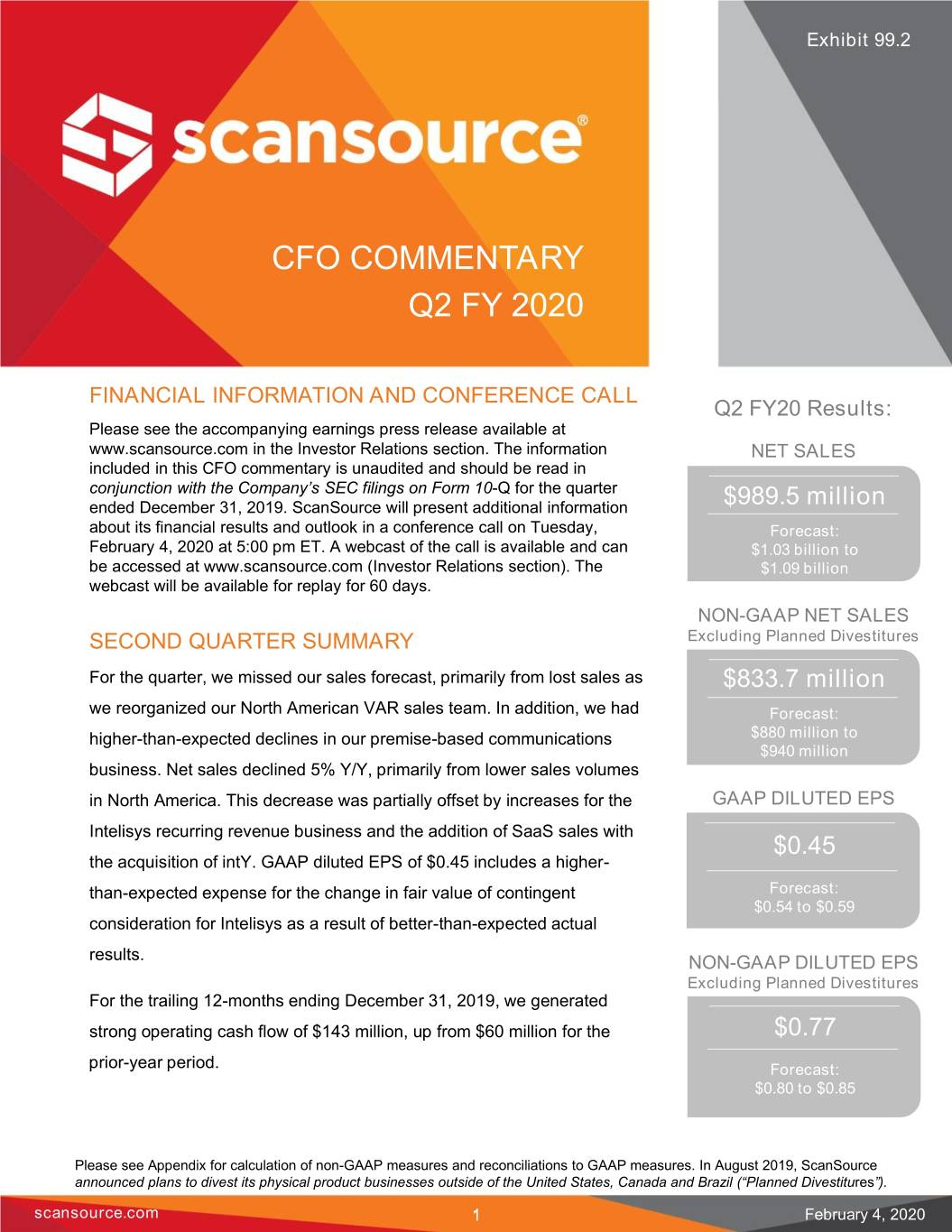

Exhibit 99.2 ScanSource, Inc. CFO COMMENTARY Q2 FY2020 CFO COMMENTARY Q2 FY 2020 FINANCIAL INFORMATION AND CONFERENCE CALL Q2 FY20 Results: Please see the accompanying earnings press release available at www.scansource.com in the Investor Relations section. The information NET SALES included in this CFO commentary is unaudited and should be read in conjunction with the Company’s SEC filings on Form 10-Q for the quarter ended December 31, 2019. ScanSource will present additional information $989.5 million about its financial results and outlook in a conference call on Tuesday, Forecast: February 4, 2020 at 5:00 pm ET. A webcast of the call is available and can $1.03 billion to be accessed at www.scansource.com (Investor Relations section). The $1.09 billion webcast will be available for replay for 60 days. NON-GAAP NET SALES SECOND QUARTER SUMMARY Excluding Planned Divestitures For the quarter, we missed our sales forecast, primarily from lost sales as $833.7 million we reorganized our North American VAR sales team. In addition, we had Forecast: higher-than-expected declines in our premise-based communications $880 million to $940 million business. Net sales declined 5% Y/Y, primarily from lower sales volumes in North America. This decrease was partially offset by increases for the GAAP DILUTED EPS Intelisys recurring revenue business and the addition of SaaS sales with $0.45 the acquisition of intY. GAAP diluted EPS of $0.45 includes a higher- than-expected expense for the change in fair value of contingent Forecast: $0.54 to $0.59 consideration for Intelisys as a result of better-than-expected actual results. NON-GAAP DILUTED EPS Excluding Planned Divestitures For the trailing 12-months ending December 31, 2019, we generated strong operating cash flow of $143 million, up from $60 million for the $0.77 prior-year period. Forecast: $0.80 to $0.85 Please see Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures. In August 2019, ScanSource announced plans to divest its physical product businesses outside of the United States, Canada and Brazil (“Planned Divestitures”). scansource.com 1 February 4, 2020

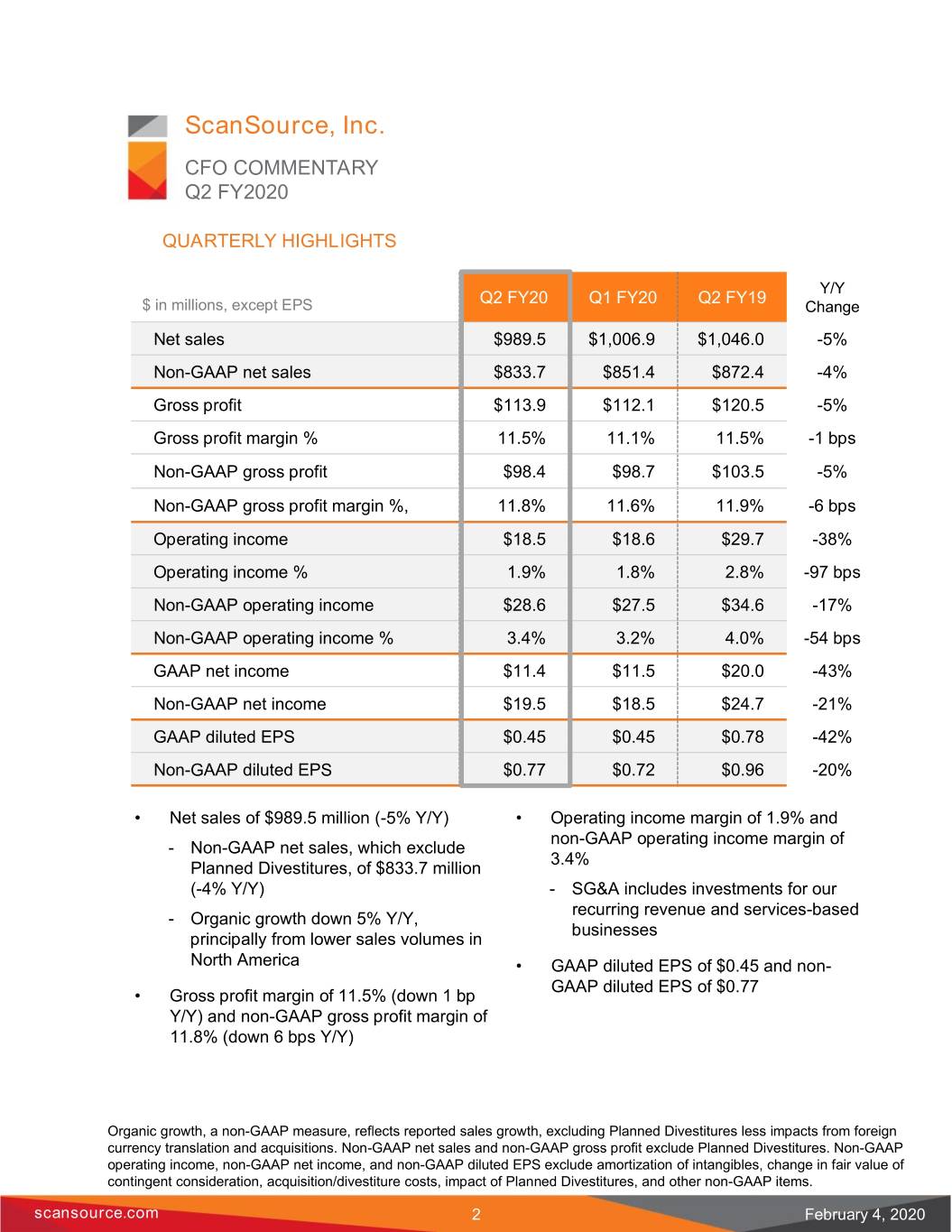

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 QUARTERLY HIGHLIGHTS Y/Y Q2 FY20 Q1 FY20 Q2 FY19 $ in millions, except EPS Change Net sales $989.5 $1,006.9 $1,046.0 -5% Non-GAAP net sales $833.7 $851.4 $872.4 -4% Gross profit $113.9 $112.1 $120.5 -5% Gross profit margin % 11.5% 11.1% 11.5% -1 bps Non-GAAP gross profit $98.4 $98.7 $103.5 -5% Non-GAAP gross profit margin %, 11.8% 11.6% 11.9% -6 bps Operating income $18.5 $18.6 $29.7 -38% Operating income % 1.9% 1.8% 2.8% -97 bps Non-GAAP operating income $28.6 $27.5 $34.6 -17% Non-GAAP operating income % 3.4% 3.2% 4.0% -54 bps GAAP net income $11.4 $11.5 $20.0 -43% Non-GAAP net income $19.5 $18.5 $24.7 -21% GAAP diluted EPS $0.45 $0.45 $0.78 -42% Non-GAAP diluted EPS $0.77 $0.72 $0.96 -20% • Net sales of $989.5 million (-5% Y/Y) • Operating income margin of 1.9% and non-GAAP operating income margin of - Non-GAAP net sales, which exclude 3.4% Planned Divestitures, of $833.7 million (-4% Y/Y) - SG&A includes investments for our recurring revenue and services-based - Organic growth down 5% Y/Y, businesses principally from lower sales volumes in North America • GAAP diluted EPS of $0.45 and non- GAAP diluted EPS of $0.77 • Gross profit margin of 11.5% (down 1 bp Y/Y) and non-GAAP gross profit margin of 11.8% (down 6 bps Y/Y) Organic growth, a non-GAAP measure, reflects reported sales growth, excluding Planned Divestitures less impacts from foreign currency translation and acquisitions. Non-GAAP net sales and non-GAAP gross profit exclude Planned Divestitures. Non-GAAP operating income, non-GAAP net income, and non-GAAP diluted EPS exclude amortization of intangibles, change in fair value of contingent consideration, acquisition/divestiture costs, impact of Planned Divestitures, and other non-GAAP items. scansource.com 2 February 4, 2020

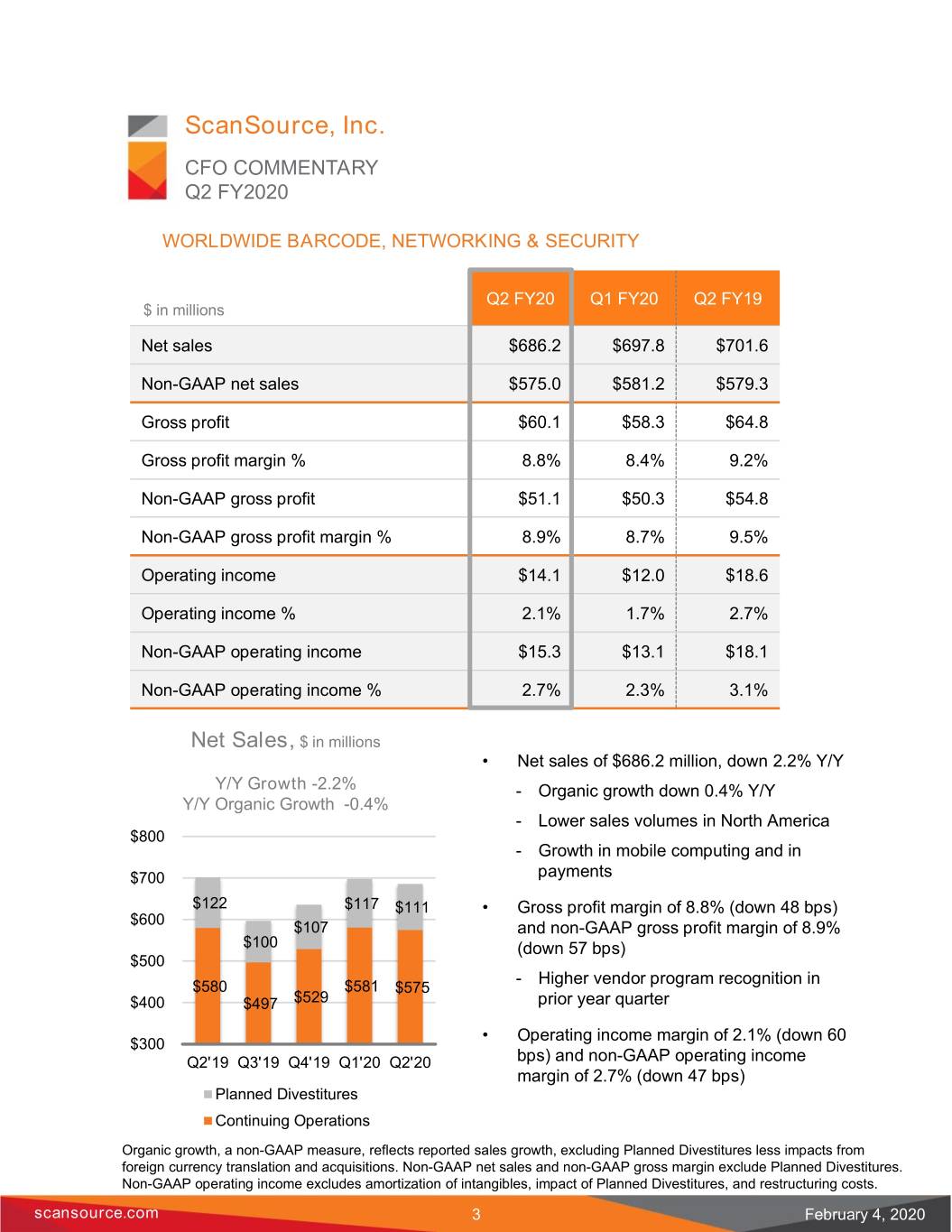

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 WORLDWIDE BARCODE, NETWORKING & SECURITY Q2 FY20 Q1 FY20 Q2 FY19 $ in millions Net sales $686.2 $697.8 $701.6 Non-GAAP net sales $575.0 $581.2 $579.3 Gross profit $60.1 $58.3 $64.8 Gross profit margin % 8.8% 8.4% 9.2% Non-GAAP gross profit $51.1 $50.3 $54.8 Non-GAAP gross profit margin % 8.9% 8.7% 9.5% Operating income $14.1 $12.0 $18.6 Operating income % 2.1% 1.7% 2.7% Non-GAAP operating income $15.3 $13.1 $18.1 Non-GAAP operating income % 2.7% 2.3% 3.1% 1 Net Sales, $ in millions • Net sales of $686.2 million, down 2.2% Y/Y Y/Y Growth -2.2% - Organic growth down 0.4% Y/Y Y/Y Organic Growth -0.4% - Lower sales volumes in North America $800 - Growth in mobile computing and in $700 payments $122 $117 $111 • Gross profit margin of 8.8% (down 48 bps) $600 $107 and non-GAAP gross profit margin of 8.9% $100 (down 57 bps) $500 - Higher vendor program recognition in $580 $581 $575 $400 $497 $529 prior year quarter • Operating income margin of 2.1% (down 60 $300 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 bps) and non-GAAP operating income margin of 2.7% (down 47 bps) Planned Divestitures Continuing Operations Organic growth, a non-GAAP measure, reflects reported sales growth, excluding Planned Divestitures less impacts from foreign currency translation and acquisitions. Non-GAAP net sales and non-GAAP gross margin exclude Planned Divestitures. Non-GAAP operating income excludes amortization of intangibles, impact of Planned Divestitures, and restructuring costs. scansource.com 3 February 4, 2020

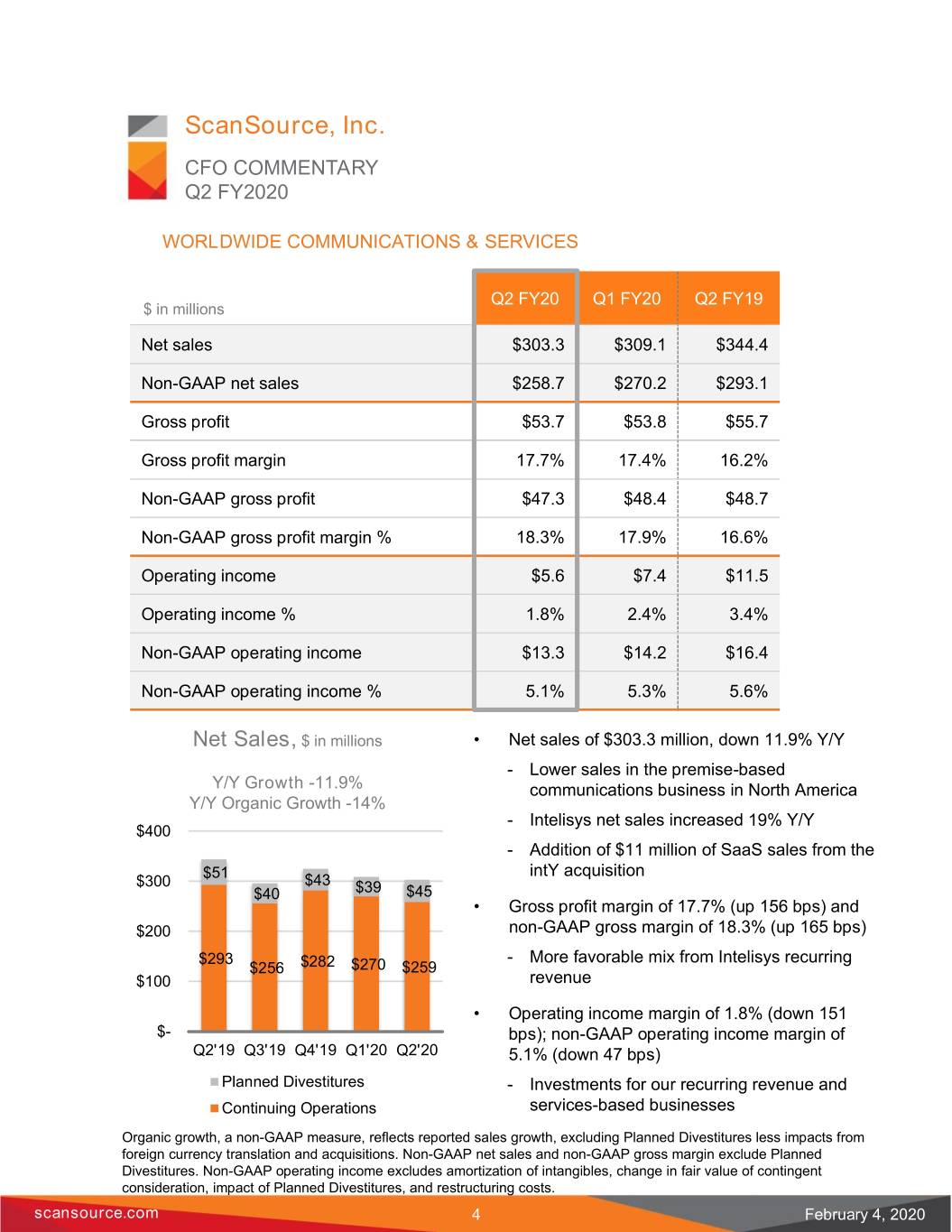

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 WORLDWIDE COMMUNICATIONS & SERVICES Q2 FY20 Q1 FY20 Q2 FY19 $ in millions Net sales $303.3 $309.1 $344.4 Non-GAAP net sales $258.7 $270.2 $293.1 Gross profit $53.7 $53.8 $55.7 Gross profit margin 17.7% 17.4% 16.2% Non-GAAP gross profit $47.3 $48.4 $48.7 Non-GAAP gross profit margin % 18.3% 17.9% 16.6% Operating income $5.6 $7.4 $11.5 Operating income % 1.8% 2.4% 3.4% Non-GAAP operating income $13.3 $14.2 $16.4 Non-GAAP operating income % 5.1% 5.3% 5.6% Net Sales, $ in millions • Net sales of $303.3 million, down 11.9% Y/Y - Lower sales in the premise-based Y/Y Growth -11.9% communications business in North America Y/Y Organic Growth -14% - Intelisys net sales increased 19% Y/Y $400 - Addition of $11 million of SaaS sales from the $51 intY acquisition $300 $43 $40 $39 $45 • Gross profit margin of 17.7% (up 156 bps) and $200 non-GAAP gross margin of 18.3% (up 165 bps) $293 - More favorable mix from Intelisys recurring $256 $282 $270 $259 $100 revenue • Operating income margin of 1.8% (down 151 $- bps); non-GAAP operating income margin of Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 5.1% (down 47 bps) Planned Divestitures - Investments for our recurring revenue and Continuing Operations services-based businesses Organic growth, a non-GAAP measure, reflects reported sales growth, excluding Planned Divestitures less impacts from foreign currency translation and acquisitions. Non-GAAP net sales and non-GAAP gross margin exclude Planned Divestitures. Non-GAAP operating income excludes amortization of intangibles, change in fair value of contingent consideration, impact of Planned Divestitures, and restructuring costs. scansource.com 4 February 4, 2020

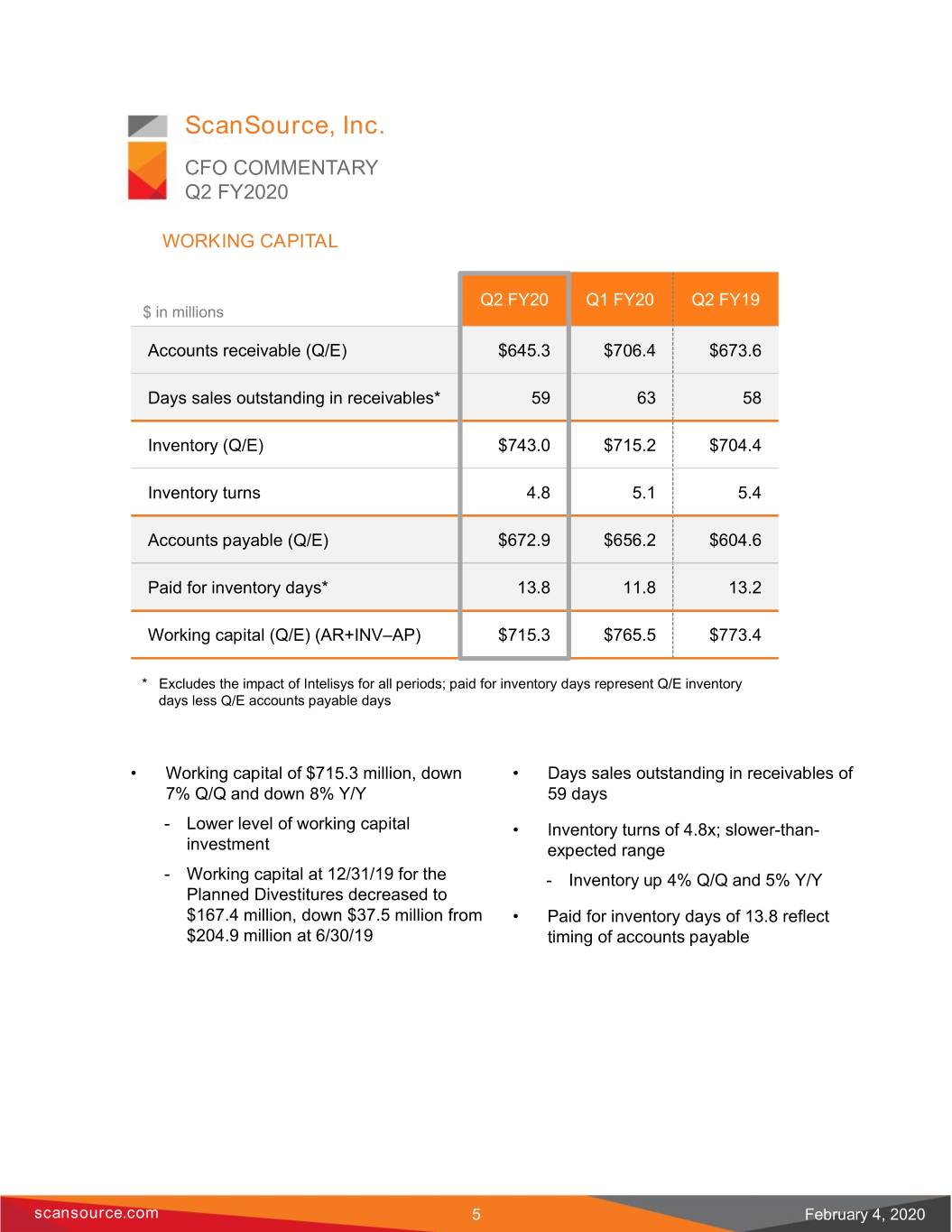

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 WORKING CAPITAL Q2 FY20 Q1 FY20 Q2 FY19 $ in millions Accounts receivable (Q/E) $645.3 $706.4 $673.6 Days sales outstanding in receivables* 59 63 58 Inventory (Q/E) $743.0 $715.2 $704.4 Inventory turns 4.8 5.1 5.4 Accounts payable (Q/E) $672.9 $656.2 $604.6 Paid for inventory days* 13.8 11.8 13.2 Working capital (Q/E) (AR+INV–AP) $715.3 $765.5 $773.4 * Excludes the impact of Intelisys for all periods; paid for inventory days represent Q/E inventory days less Q/E accounts payable days • Working capital of $715.3 million, down • Days sales outstanding in receivables of 7% Q/Q and down 8% Y/Y 59 days - Lower level of working capital • Inventory turns of 4.8x; slower-than- investment expected range - Working capital at 12/31/19 for the - Inventory up 4% Q/Q and 5% Y/Y Planned Divestitures decreased to $167.4 million, down $37.5 million from • Paid for inventory days of 13.8 reflect $204.9 million at 6/30/19 timing of accounts payable scansource.com 5 February 4, 2020

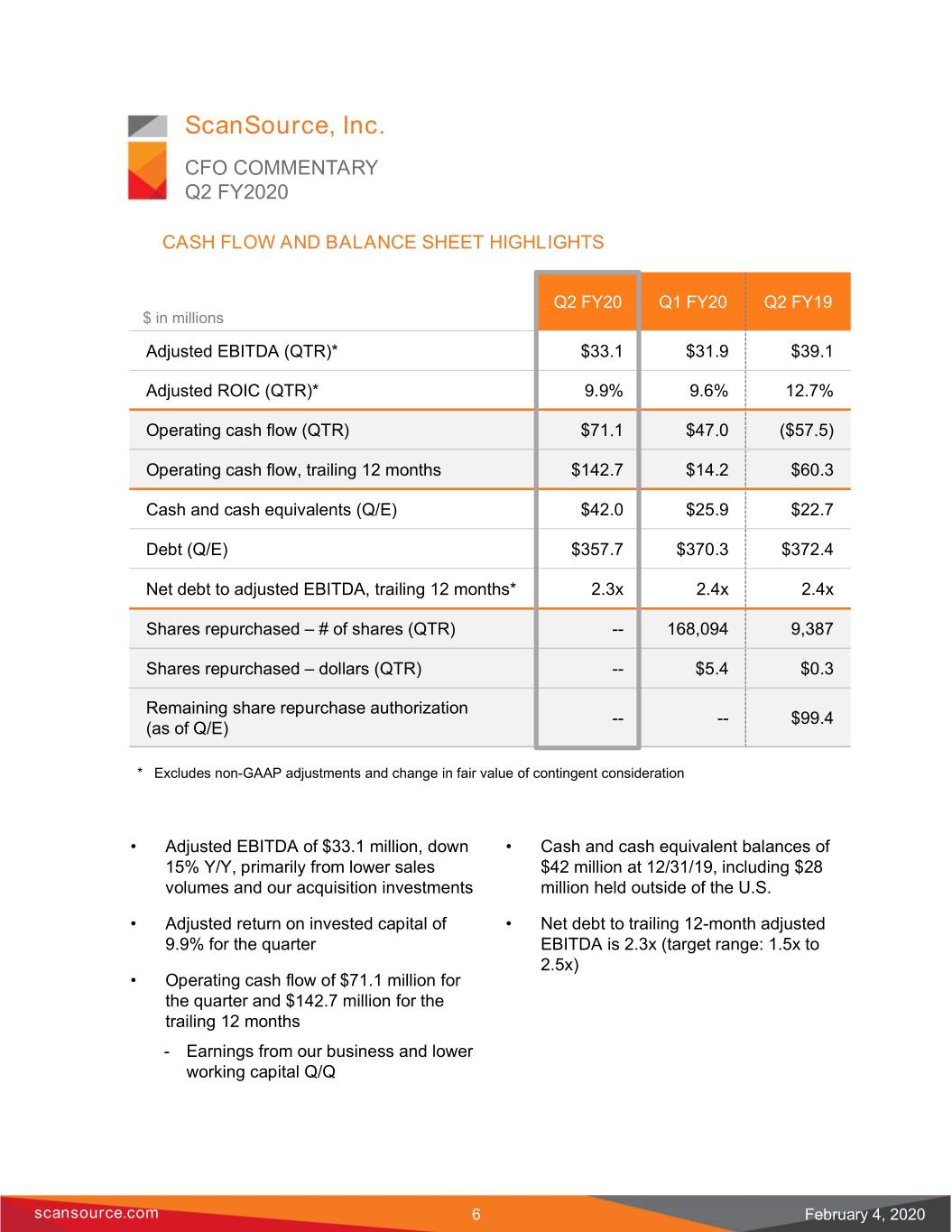

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 CASH FLOW AND BALANCE SHEET HIGHLIGHTS Q2 FY20 Q1 FY20 Q2 FY19 $ in millions Adjusted EBITDA (QTR)* $33.1 $31.9 $39.1 Adjusted ROIC (QTR)* 9.9% 9.6% 12.7% Operating cash flow (QTR) $71.1 $47.0 ($57.5) Operating cash flow, trailing 12 months $142.7 $14.2 $60.3 Cash and cash equivalents (Q/E) $42.0 $25.9 $22.7 Debt (Q/E) $357.7 $370.3 $372.4 Net debt to adjusted EBITDA, trailing 12 months* 2.3x 2.4x 2.4x Shares repurchased – # of shares (QTR) -- 168,094 9,387 Shares repurchased – dollars (QTR) -- $5.4 $0.3 Remaining share repurchase authorization -- -- $99.4 (as of Q/E) * Excludes non-GAAP adjustments and change in fair value of contingent consideration • Adjusted EBITDA of $33.1 million, down • Cash and cash equivalent balances of 15% Y/Y, primarily from lower sales $42 million at 12/31/19, including $28 volumes and our acquisition investments million held outside of the U.S. • Adjusted return on invested capital of • Net debt to trailing 12-month adjusted 9.9% for the quarter EBITDA is 2.3x (target range: 1.5x to 2.5x) • Operating cash flow of $71.1 million for the quarter and $142.7 million for the trailing 12 months - Earnings from our business and lower working capital Q/Q scansource.com 6 February 4, 2020

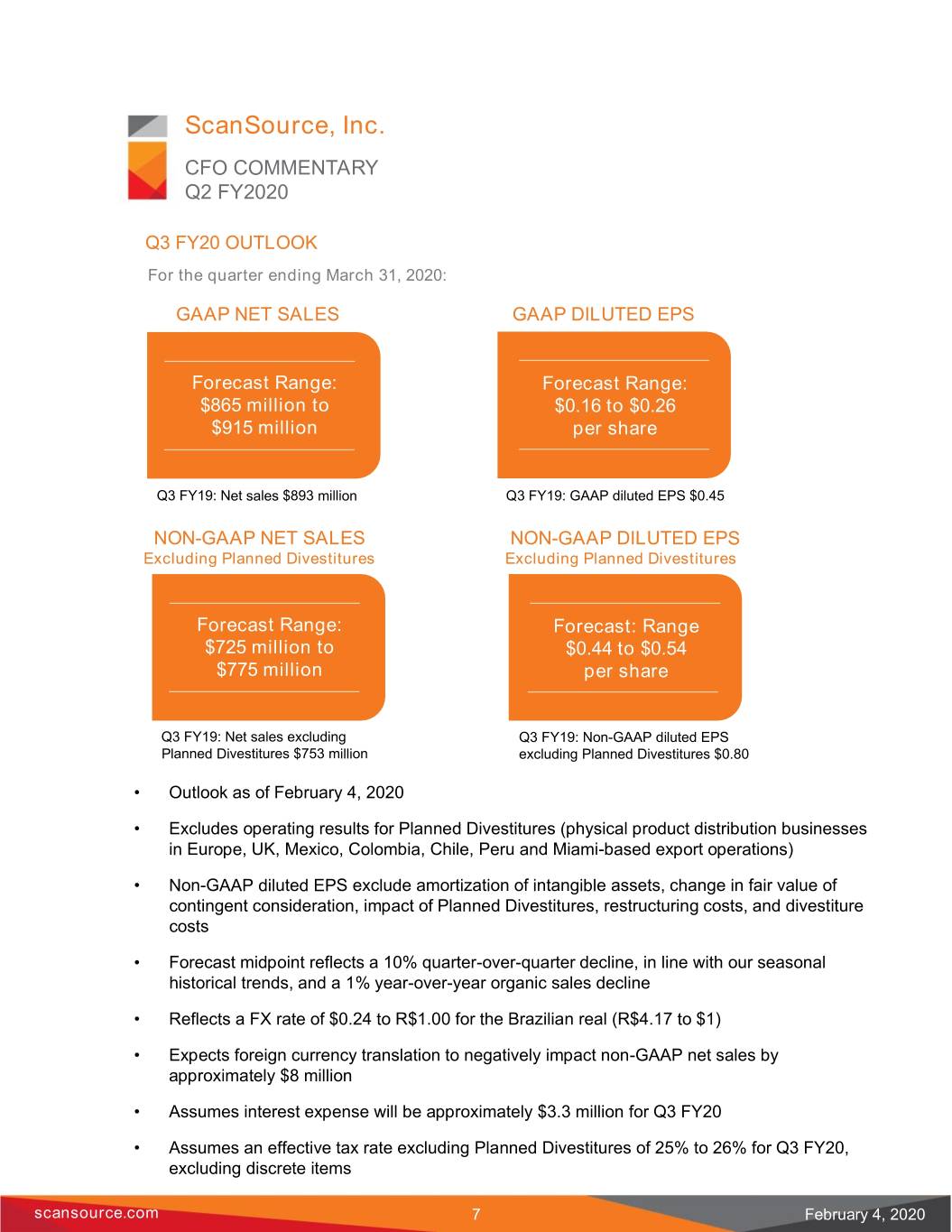

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 Q3 FY20 OUTLOOK For the quarter ending March 31, 2020: GAAP NET SALES GAAP DILUTED EPS Forecast Range: Forecast Range: $865 million to $0.16 to $0.26 $915 million per share Q3 FY19: Net sales $893 million Q3 FY19: GAAP diluted EPS $0.45 NON-GAAP NET SALES NON-GAAP DILUTED EPS Excluding Planned Divestitures Excluding Planned Divestitures Forecast Range: Forecast: Range $725 million to $0.44 to $0.54 $775 million per share Q3 FY19: Net sales excluding Q3 FY19: Non-GAAP diluted EPS Planned Divestitures $753 million excluding Planned Divestitures $0.80 • Outlook as of February 4, 2020 • Excludes operating results for Planned Divestitures (physical product distribution businesses in Europe, UK, Mexico, Colombia, Chile, Peru and Miami-based export operations) • Non-GAAP diluted EPS exclude amortization of intangible assets, change in fair value of contingent consideration, impact of Planned Divestitures, restructuring costs, and divestiture costs • Forecast midpoint reflects a 10% quarter-over-quarter decline, in line with our seasonal historical trends, and a 1% year-over-year organic sales decline • Reflects a FX rate of $0.24 to R$1.00 for the Brazilian real (R$4.17 to $1) • Expects foreign currency translation to negatively impact non-GAAP net sales by approximately $8 million • Assumes interest expense will be approximately $3.3 million for Q3 FY20 • Assumes an effective tax rate excluding Planned Divestitures of 25% to 26% for Q3 FY20, excluding discrete items scansource.com 7 February 4, 2020

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 FORWARD-LOOKING STATEMENTS Although ScanSource believes the expectations in its forward-looking statements This CFO Commentary contains certain are reasonable, it cannot guarantee future comments that are “forward-looking” results, levels of activity, performance or statements, including statements about achievement. ScanSource disclaims any expected sales, Planned Divestitures, GAAP obligation to update or revise any forward- diluted earnings per share (“EPS”), non-GAAP looking statements, whether as a result of new diluted EPS, operating cash flow, foreign information, future events, or otherwise, currency rates, tax rates and interest expense except as may be required by law. that involve plans, strategies, economic performance and trends, projections, expectations, costs or beliefs about future NON-GAAP FINANCIAL INFORMATION events and other statements that are not In addition to disclosing results that are descriptions of historical facts. Forward- determined in accordance with United States looking information is inherently subject to Generally Accepted Accounting Principles risks and uncertainties. (“GAAP”), the Company also discloses certain non-GAAP measures, including non-GAAP Any number of factors could cause actual operating income, non-GAAP operating results to differ materially from anticipated or income margin, non-GAAP net income, non- forecasted results, including but not limited to, GAAP diluted EPS, non-GAAP net sales, non- our ability to complete the Planned GAAP gross profit, non-GAAP gross margin, Divestitures on acceptable terms or at all, adjusted EBITDA, ROIC and net sales changes in our operating strategy, changes in excluding the Planned Divestitures less interest and exchange rates and regulatory impacts from foreign currency translation and regimes impacting our international acquisitions (organic growth). A reconciliation operations, the impact of tax reform laws, the of the Company's non-GAAP financial failure of acquisitions to meet our information to GAAP financial information is expectations, the failure to manage and provided in the Appendix and in the implement our organic growth strategy, credit Company’s Form 8-K, filed with the SEC, with risks involving our larger customers and the quarterly earnings press release for the vendors, termination of our relationship with period indicated. key vendors or a significant modification of the terms under which we operate with a key vendor, the decline in demand for the products and services that we provide, reduced prices for the products and services that we provide due both to competitor and customer actions, and other factors set forth in the “Risk Factors” contained in our annual report on Form 10-K for the year ended June 30, 2019, filed with the Securities and Exchange Commission (“SEC”). scansource.com 8 February 4, 2020

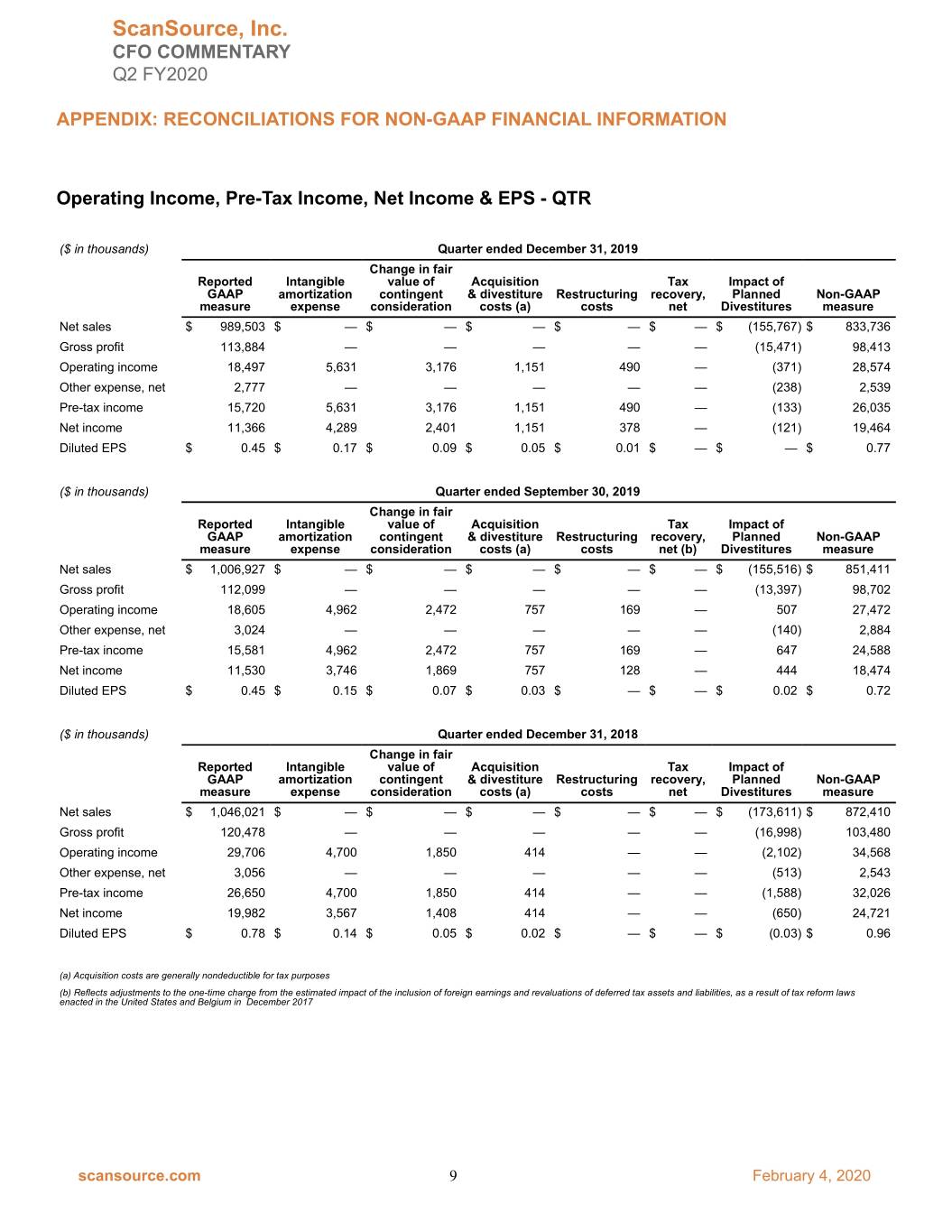

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Operating Income, Pre-Tax Income, Net Income & EPS - QTR ($ in thousands) Quarter ended December 31, 2019 Change in fair Reported Intangible value of Acquisition Tax Impact of GAAP amortization contingent & divestiture Restructuring recovery, Planned Non-GAAP measure expense consideration costs (a) costs net Divestitures measure Net sales $ 989,503 $ — $ — $ — $ — $ — $ (155,767) $ 833,736 Gross profit 113,884 — — — — — (15,471) 98,413 Operating income 18,497 5,631 3,176 1,151 490 — (371) 28,574 Other expense, net 2,777 — — — — — (238) 2,539 Pre-tax income 15,720 5,631 3,176 1,151 490 — (133) 26,035 Net income 11,366 4,289 2,401 1,151 378 — (121) 19,464 Diluted EPS $ 0.45 $ 0.17 $ 0.09 $ 0.05 $ 0.01 $ — $ — $ 0.77 ($ in thousands) Quarter ended September 30, 2019 Change in fair Reported Intangible value of Acquisition Tax Impact of GAAP amortization contingent & divestiture Restructuring recovery, Planned Non-GAAP measure expense consideration costs (a) costs net (b) Divestitures measure Net sales $ 1,006,927 $ — $ — $ — $ — $ — $ (155,516) $ 851,411 Gross profit 112,099 — — — — — (13,397) 98,702 Operating income 18,605 4,962 2,472 757 169 — 507 27,472 Other expense, net 3,024 — — — — — (140) 2,884 Pre-tax income 15,581 4,962 2,472 757 169 — 647 24,588 Net income 11,530 3,746 1,869 757 128 — 444 18,474 Diluted EPS $ 0.45 $ 0.15 $ 0.07 $ 0.03 $ — $ — $ 0.02 $ 0.72 ($ in thousands) Quarter ended December 31, 2018 Change in fair Reported Intangible value of Acquisition Tax Impact of GAAP amortization contingent & divestiture Restructuring recovery, Planned Non-GAAP measure expense consideration costs (a) costs net Divestitures measure Net sales $ 1,046,021 $ — $ — $ — $ — $ — $ (173,611) $ 872,410 Gross profit 120,478 — — — — — (16,998) 103,480 Operating income 29,706 4,700 1,850 414 — — (2,102) 34,568 Other expense, net 3,056 — — — — — (513) 2,543 Pre-tax income 26,650 4,700 1,850 414 — — (1,588) 32,026 Net income 19,982 3,567 1,408 414 — — (650) 24,721 Diluted EPS $ 0.78 $ 0.14 $ 0.05 $ 0.02 $ — $ — $ (0.03) $ 0.96 (a) Acquisition costs are generally nondeductible for tax purposes (b) Reflects adjustments to the one-time charge from the estimated impact of the inclusion of foreign earnings and revaluations of deferred tax assets and liabilities, as a result of tax reform laws enacted in the United States and Belgium in December 2017 scansource.com 9 February 4, 2020

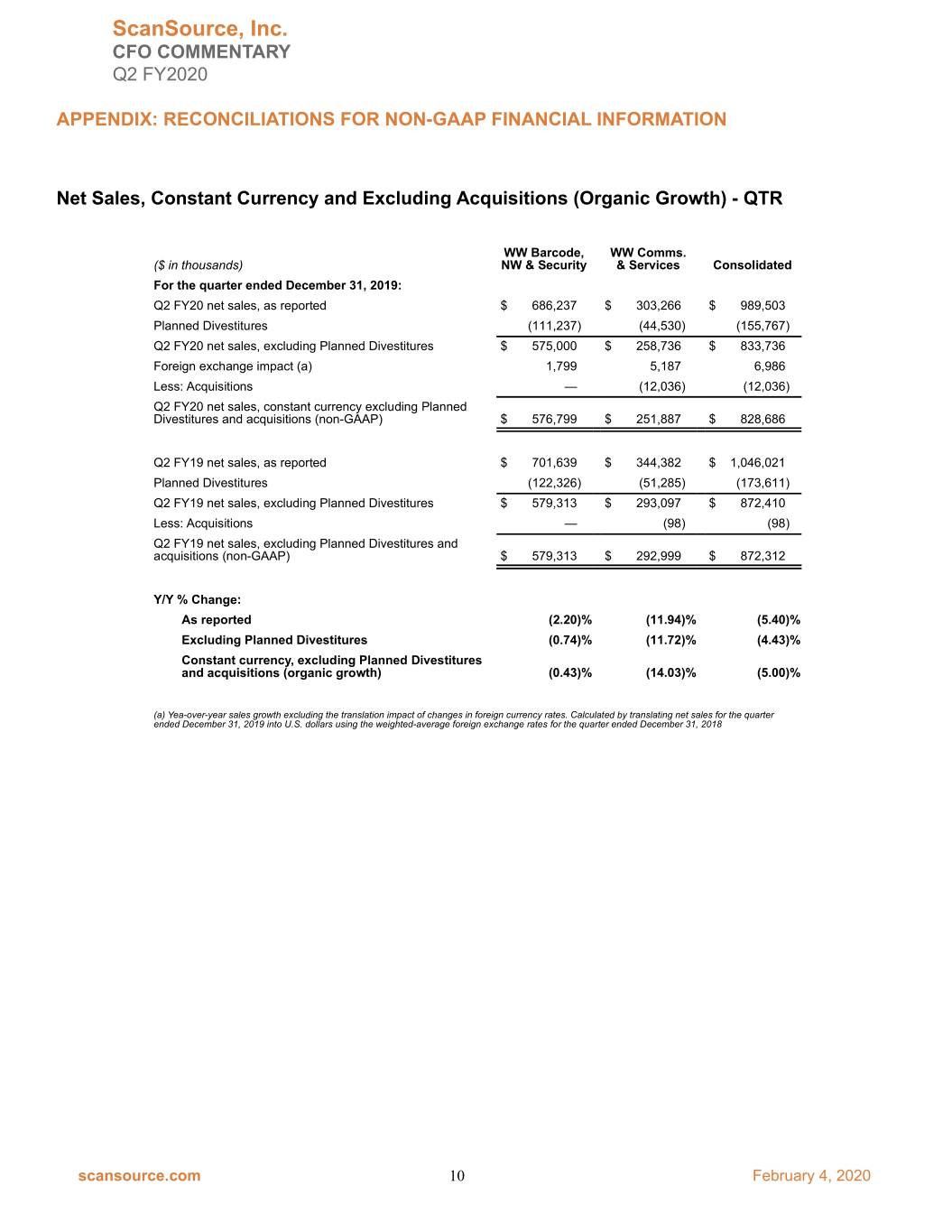

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Sales, Constant Currency and Excluding Acquisitions (Organic Growth) - QTR WW Barcode, WW Comms. ($ in thousands) NW & Security & Services Consolidated For the quarter ended December 31, 2019: Q2 FY20 net sales, as reported $ 686,237 $ 303,266 $ 989,503 Planned Divestitures (111,237) (44,530) (155,767) Q2 FY20 net sales, excluding Planned Divestitures $ 575,000 $ 258,736 $ 833,736 Foreign exchange impact (a) 1,799 5,187 6,986 Less: Acquisitions — (12,036) (12,036) Q2 FY20 net sales, constant currency excluding Planned Divestitures and acquisitions (non-GAAP) $ 576,799 $ 251,887 $ 828,686 Q2 FY19 net sales, as reported $ 701,639 $ 344,382 $ 1,046,021 Planned Divestitures (122,326) (51,285) (173,611) Q2 FY19 net sales, excluding Planned Divestitures $ 579,313 $ 293,097 $ 872,410 Less: Acquisitions — (98) (98) Q2 FY19 net sales, excluding Planned Divestitures and acquisitions (non-GAAP) $ 579,313 $ 292,999 $ 872,312 Y/Y % Change: As reported (2.20)% (11.94)% (5.40)% Excluding Planned Divestitures (0.74)% (11.72)% (4.43)% Constant currency, excluding Planned Divestitures and acquisitions (organic growth) (0.43)% (14.03)% (5.00)% (a) Yea-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for the quarter ended December 31, 2019 into U.S. dollars using the weighted-average foreign exchange rates for the quarter ended December 31, 2018 scansource.com 10 February 4, 2020

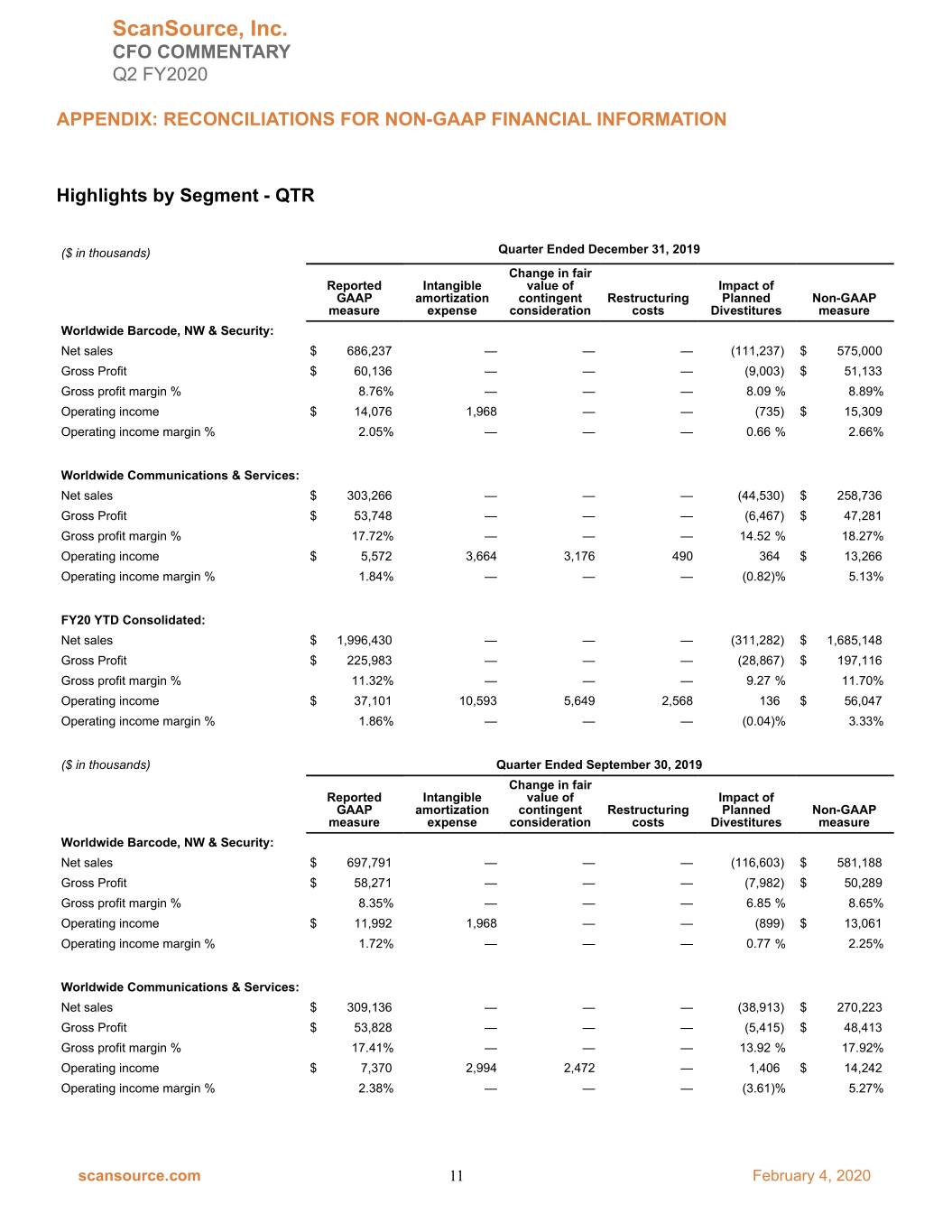

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Highlights by Segment - QTR ($ in thousands) Quarter Ended December 31, 2019 Change in fair Reported Intangible value of Impact of GAAP amortization contingent Restructuring Planned Non-GAAP measure expense consideration costs Divestitures measure Worldwide Barcode, NW & Security: Net sales $ 686,237 — — — (111,237) $ 575,000 Gross Profit $ 60,136 — — — (9,003) $ 51,133 Gross profit margin % 8.76% — — — 8.09 % 8.89% Operating income $ 14,076 1,968 — — (735) $ 15,309 Operating income margin % 2.05% — — — 0.66 % 2.66% Worldwide Communications & Services: Net sales $ 303,266 — — — (44,530) $ 258,736 Gross Profit $ 53,748 — — — (6,467) $ 47,281 Gross profit margin % 17.72% — — — 14.52 % 18.27% Operating income $ 5,572 3,664 3,176 490 364 $ 13,266 Operating income margin % 1.84% — — — (0.82)% 5.13% FY20 YTD Consolidated: Net sales $ 1,996,430 — — — (311,282) $ 1,685,148 Gross Profit $ 225,983 — — — (28,867) $ 197,116 Gross profit margin % 11.32% — — — 9.27 % 11.70% Operating income $ 37,101 10,593 5,649 2,568 136 $ 56,047 Operating income margin % 1.86% — — — (0.04)% 3.33% ($ in thousands) Quarter Ended September 30, 2019 Change in fair Reported Intangible value of Impact of GAAP amortization contingent Restructuring Planned Non-GAAP measure expense consideration costs Divestitures measure Worldwide Barcode, NW & Security: Net sales $ 697,791 — — — (116,603) $ 581,188 Gross Profit $ 58,271 — — — (7,982) $ 50,289 Gross profit margin % 8.35% — — — 6.85 % 8.65% Operating income $ 11,992 1,968 — — (899) $ 13,061 Operating income margin % 1.72% — — — 0.77 % 2.25% Worldwide Communications & Services: Net sales $ 309,136 — — — (38,913) $ 270,223 Gross Profit $ 53,828 — — — (5,415) $ 48,413 Gross profit margin % 17.41% — — — 13.92 % 17.92% Operating income $ 7,370 2,994 2,472 — 1,406 $ 14,242 Operating income margin % 2.38% — — — (3.61)% 5.27% scansource.com 11 February 4, 2020

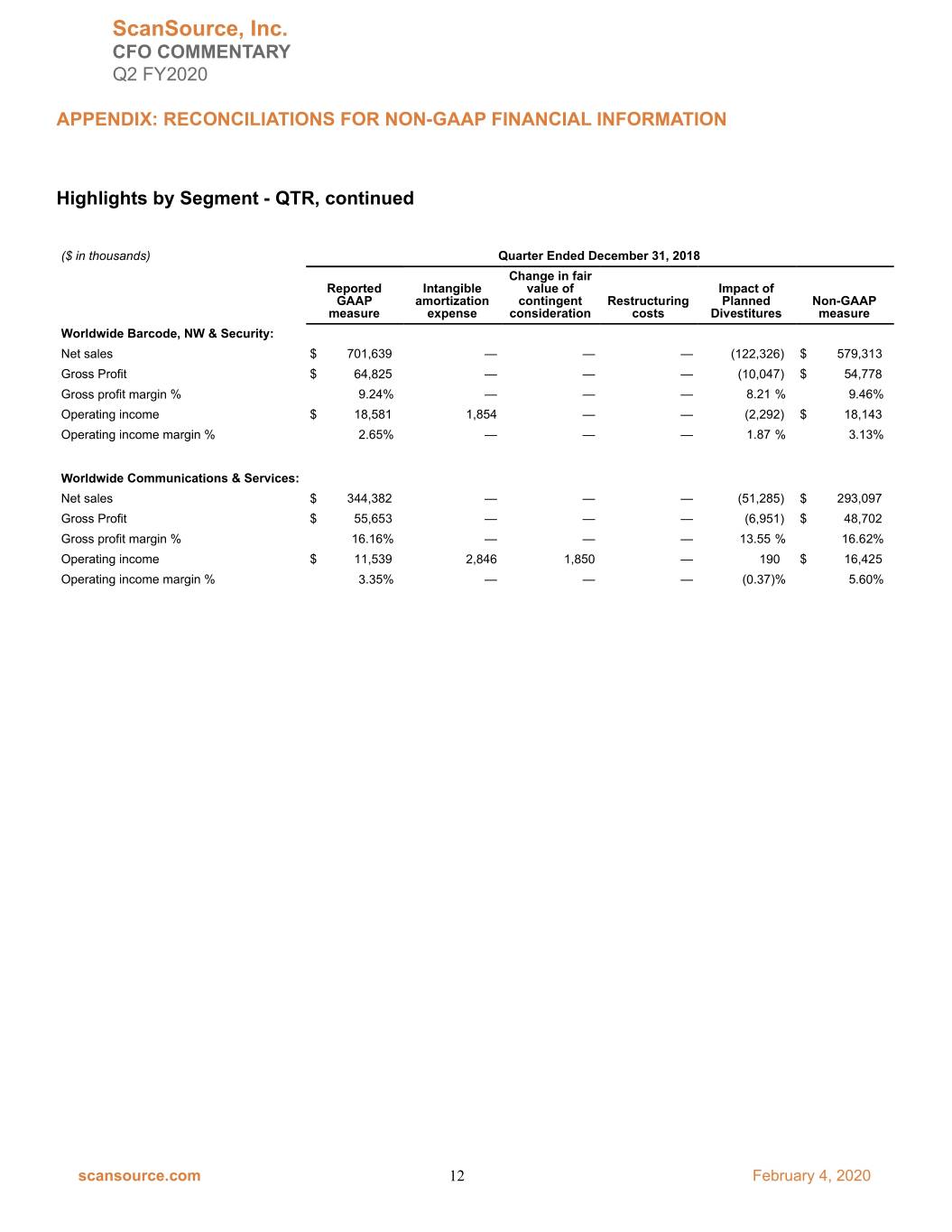

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Highlights by Segment - QTR, continued ($ in thousands) Quarter Ended December 31, 2018 Change in fair Reported Intangible value of Impact of GAAP amortization contingent Restructuring Planned Non-GAAP measure expense consideration costs Divestitures measure Worldwide Barcode, NW & Security: Net sales $ 701,639 — — — (122,326) $ 579,313 Gross Profit $ 64,825 — — — (10,047) $ 54,778 Gross profit margin % 9.24% — — — 8.21 % 9.46% Operating income $ 18,581 1,854 — — (2,292) $ 18,143 Operating income margin % 2.65% — — — 1.87 % 3.13% Worldwide Communications & Services: Net sales $ 344,382 — — — (51,285) $ 293,097 Gross Profit $ 55,653 — — — (6,951) $ 48,702 Gross profit margin % 16.16% — — — 13.55 % 16.62% Operating income $ 11,539 2,846 1,850 — 190 $ 16,425 Operating income margin % 3.35% — — — (0.37)% 5.60% scansource.com 12 February 4, 2020

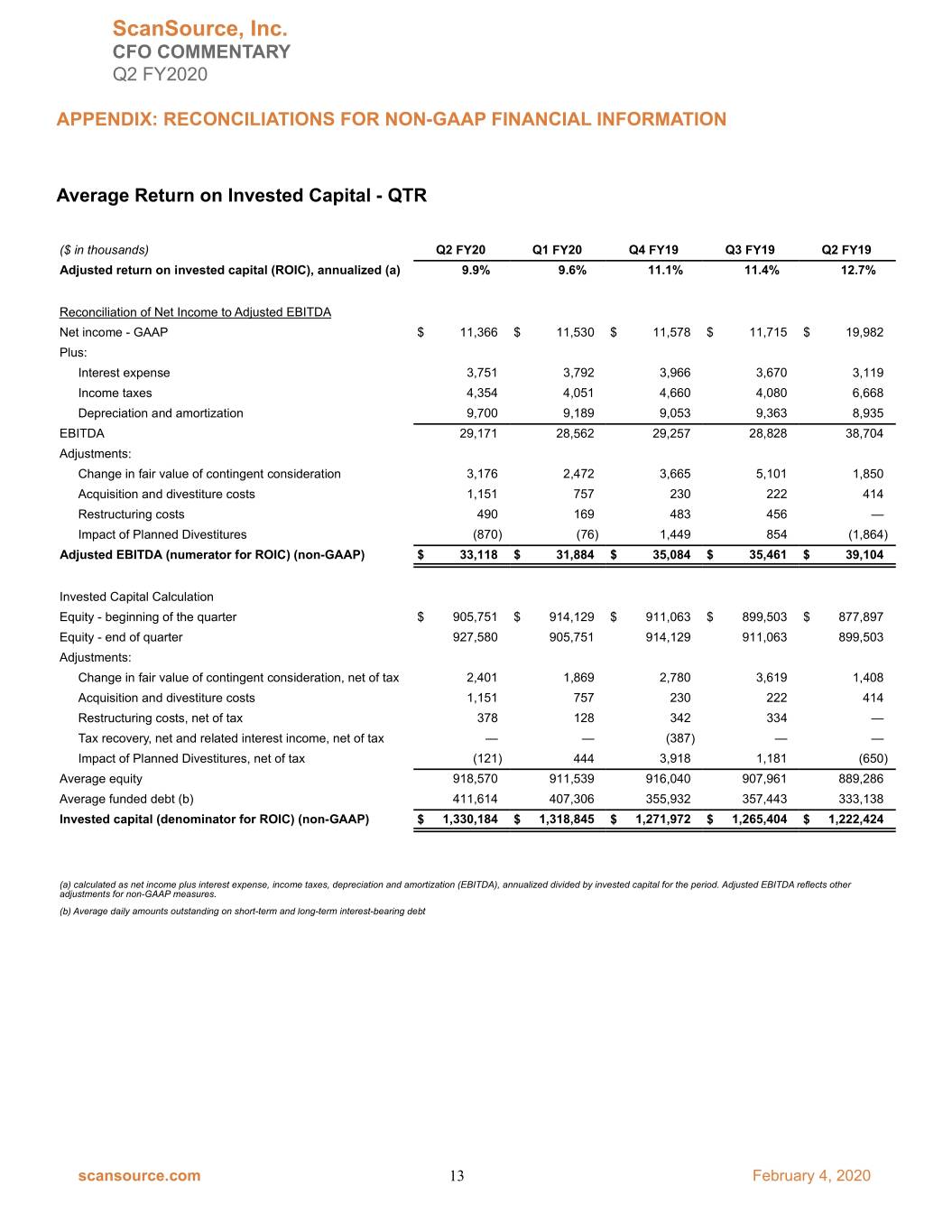

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Average Return on Invested Capital - QTR ($ in thousands) Q2 FY20 Q1 FY20 Q4 FY19 Q3 FY19 Q2 FY19 Adjusted return on invested capital (ROIC), annualized (a) 9.9% 9.6% 11.1% 11.4% 12.7% Reconciliation of Net Income to Adjusted EBITDA Net income - GAAP $ 11,366 $ 11,530 $ 11,578 $ 11,715 $ 19,982 Plus: Interest expense 3,751 3,792 3,966 3,670 3,119 Income taxes 4,354 4,051 4,660 4,080 6,668 Depreciation and amortization 9,700 9,189 9,053 9,363 8,935 EBITDA 29,171 28,562 29,257 28,828 38,704 Adjustments: Change in fair value of contingent consideration 3,176 2,472 3,665 5,101 1,850 Acquisition and divestiture costs 1,151 757 230 222 414 Restructuring costs 490 169 483 456 — Impact of Planned Divestitures (870) (76) 1,449 854 (1,864) Adjusted EBITDA (numerator for ROIC) (non-GAAP) $ 33,118 $ 31,884 $ 35,084 $ 35,461 $ 39,104 Invested Capital Calculation Equity - beginning of the quarter $ 905,751 $ 914,129 $ 911,063 $ 899,503 $ 877,897 Equity - end of quarter 927,580 905,751 914,129 911,063 899,503 Adjustments: Change in fair value of contingent consideration, net of tax 2,401 1,869 2,780 3,619 1,408 Acquisition and divestiture costs 1,151 757 230 222 414 Restructuring costs, net of tax 378 128 342 334 — Tax recovery, net and related interest income, net of tax — — (387) — — Impact of Planned Divestitures, net of tax (121) 444 3,918 1,181 (650) Average equity 918,570 911,539 916,040 907,961 889,286 Average funded debt (b) 411,614 407,306 355,932 357,443 333,138 Invested capital (denominator for ROIC) (non-GAAP) $ 1,330,184 $ 1,318,845 $ 1,271,972 $ 1,265,404 $ 1,222,424 (a) calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures. (b) Average daily amounts outstanding on short-term and long-term interest-bearing debt scansource.com 13 February 4, 2020

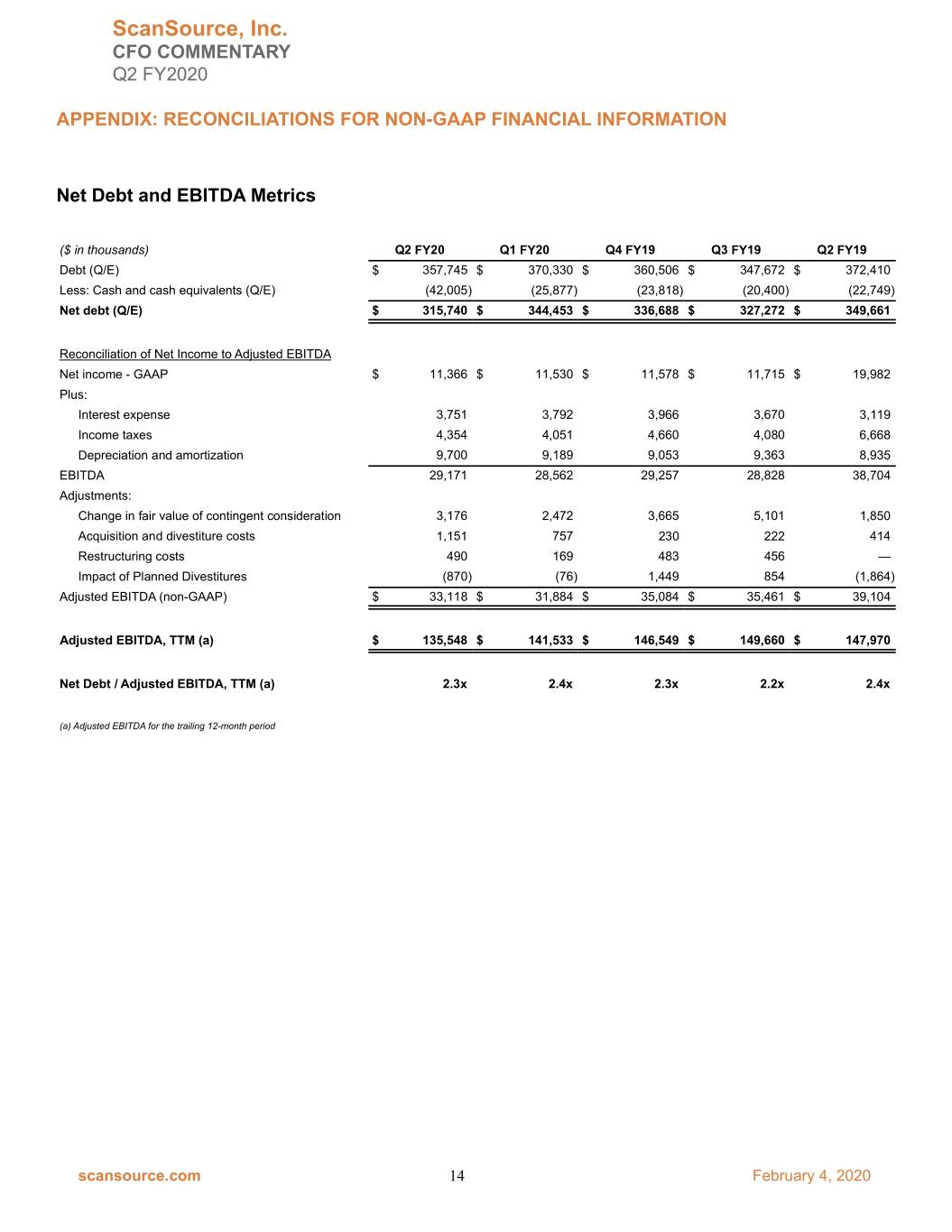

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Net Debt and EBITDA Metrics ($ in thousands) Q2 FY20 Q1 FY20 Q4 FY19 Q3 FY19 Q2 FY19 Debt (Q/E) $ 357,745 $ 370,330 $ 360,506 $ 347,672 $ 372,410 Less: Cash and cash equivalents (Q/E) (42,005) (25,877) (23,818) (20,400) (22,749) Net debt (Q/E) $ 315,740 $ 344,453 $ 336,688 $ 327,272 $ 349,661 Reconciliation of Net Income to Adjusted EBITDA Net income - GAAP $ 11,366 $ 11,530 $ 11,578 $ 11,715 $ 19,982 Plus: Interest expense 3,751 3,792 3,966 3,670 3,119 Income taxes 4,354 4,051 4,660 4,080 6,668 Depreciation and amortization 9,700 9,189 9,053 9,363 8,935 EBITDA 29,171 28,562 29,257 28,828 38,704 Adjustments: Change in fair value of contingent consideration 3,176 2,472 3,665 5,101 1,850 Acquisition and divestiture costs 1,151 757 230 222 414 Restructuring costs 490 169 483 456 — Impact of Planned Divestitures (870) (76) 1,449 854 (1,864) Adjusted EBITDA (non-GAAP) $ 33,118 $ 31,884 $ 35,084 $ 35,461 $ 39,104 Adjusted EBITDA, TTM (a) $ 135,548 $ 141,533 $ 146,549 $ 149,660 $ 147,970 Net Debt / Adjusted EBITDA, TTM (a) 2.3x 2.4x 2.3x 2.2x 2.4x (a) Adjusted EBITDA for the trailing 12-month period scansource.com 14 February 4, 2020

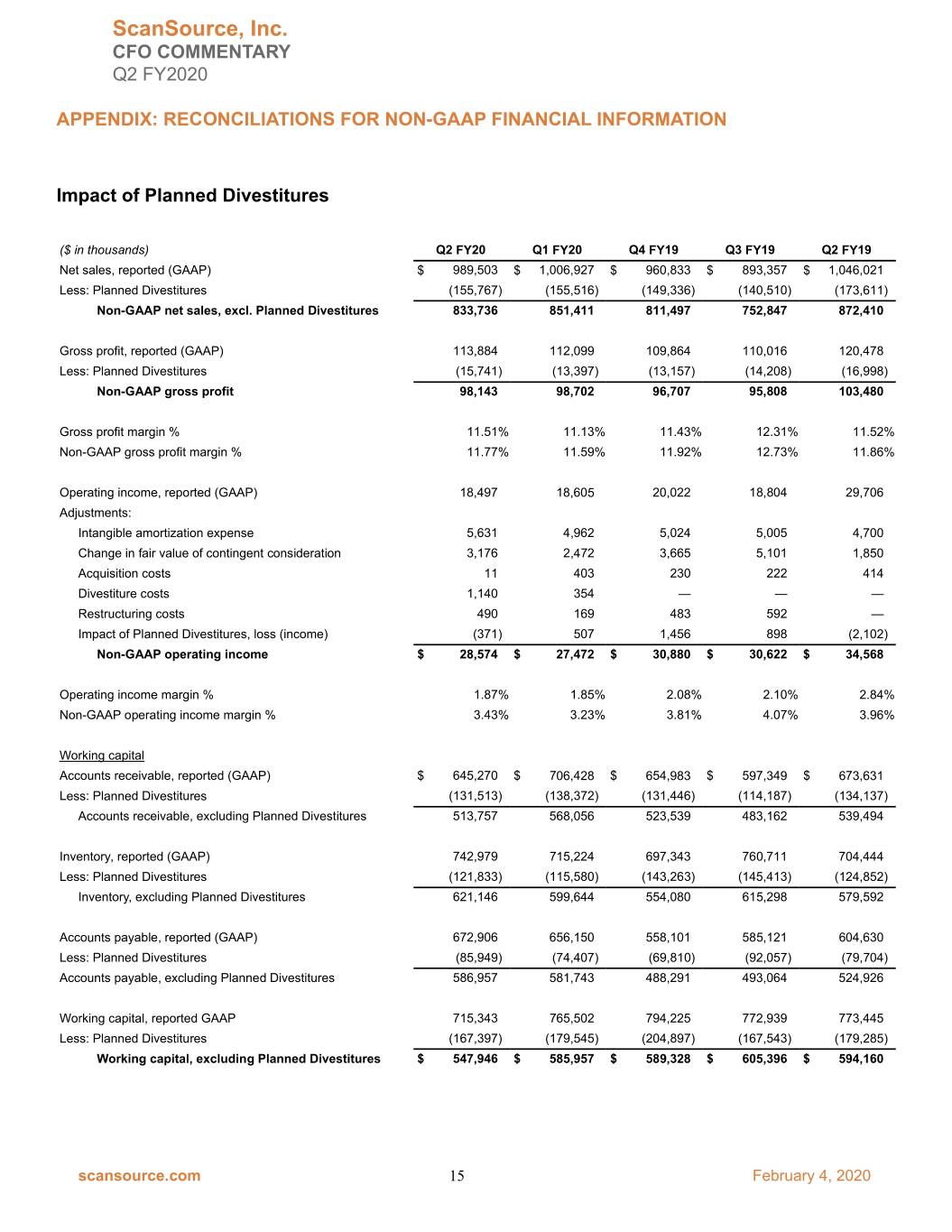

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Impact of Planned Divestitures ($ in thousands) Q2 FY20 Q1 FY20 Q4 FY19 Q3 FY19 Q2 FY19 Net sales, reported (GAAP) $ 989,503 $ 1,006,927 $ 960,833 $ 893,357 $ 1,046,021 Less: Planned Divestitures (155,767) (155,516) (149,336) (140,510) (173,611) Non-GAAP net sales, excl. Planned Divestitures 833,736 851,411 811,497 752,847 872,410 Gross profit, reported (GAAP) 113,884 112,099 109,864 110,016 120,478 Less: Planned Divestitures (15,741) (13,397) (13,157) (14,208) (16,998) Non-GAAP gross profit 98,143 98,702 96,707 95,808 103,480 Gross profit margin % 11.51% 11.13% 11.43% 12.31% 11.52% Non-GAAP gross profit margin % 11.77% 11.59% 11.92% 12.73% 11.86% Operating income, reported (GAAP) 18,497 18,605 20,022 18,804 29,706 Adjustments: Intangible amortization expense 5,631 4,962 5,024 5,005 4,700 Change in fair value of contingent consideration 3,176 2,472 3,665 5,101 1,850 Acquisition costs 11 403 230 222 414 Divestiture costs 1,140 354 — — — Restructuring costs 490 169 483 592 — Impact of Planned Divestitures, loss (income) (371) 507 1,456 898 (2,102) Non-GAAP operating income $ 28,574 $ 27,472 $ 30,880 $ 30,622 $ 34,568 Operating income margin % 1.87% 1.85% 2.08% 2.10% 2.84% Non-GAAP operating income margin % 3.43% 3.23% 3.81% 4.07% 3.96% Working capital Accounts receivable, reported (GAAP) $ 645,270 $ 706,428 $ 654,983 $ 597,349 $ 673,631 Less: Planned Divestitures (131,513) (138,372) (131,446) (114,187) (134,137) Accounts receivable, excluding Planned Divestitures 513,757 568,056 523,539 483,162 539,494 Inventory, reported (GAAP) 742,979 715,224 697,343 760,711 704,444 Less: Planned Divestitures (121,833) (115,580) (143,263) (145,413) (124,852) Inventory, excluding Planned Divestitures 621,146 599,644 554,080 615,298 579,592 Accounts payable, reported (GAAP) 672,906 656,150 558,101 585,121 604,630 Less: Planned Divestitures (85,949) (74,407) (69,810) (92,057) (79,704) Accounts payable, excluding Planned Divestitures 586,957 581,743 488,291 493,064 524,926 Working capital, reported GAAP 715,343 765,502 794,225 772,939 773,445 Less: Planned Divestitures (167,397) (179,545) (204,897) (167,543) (179,285) Working capital, excluding Planned Divestitures $ 547,946 $ 585,957 $ 589,328 $ 605,396 $ 594,160 scansource.com 15 February 4, 2020

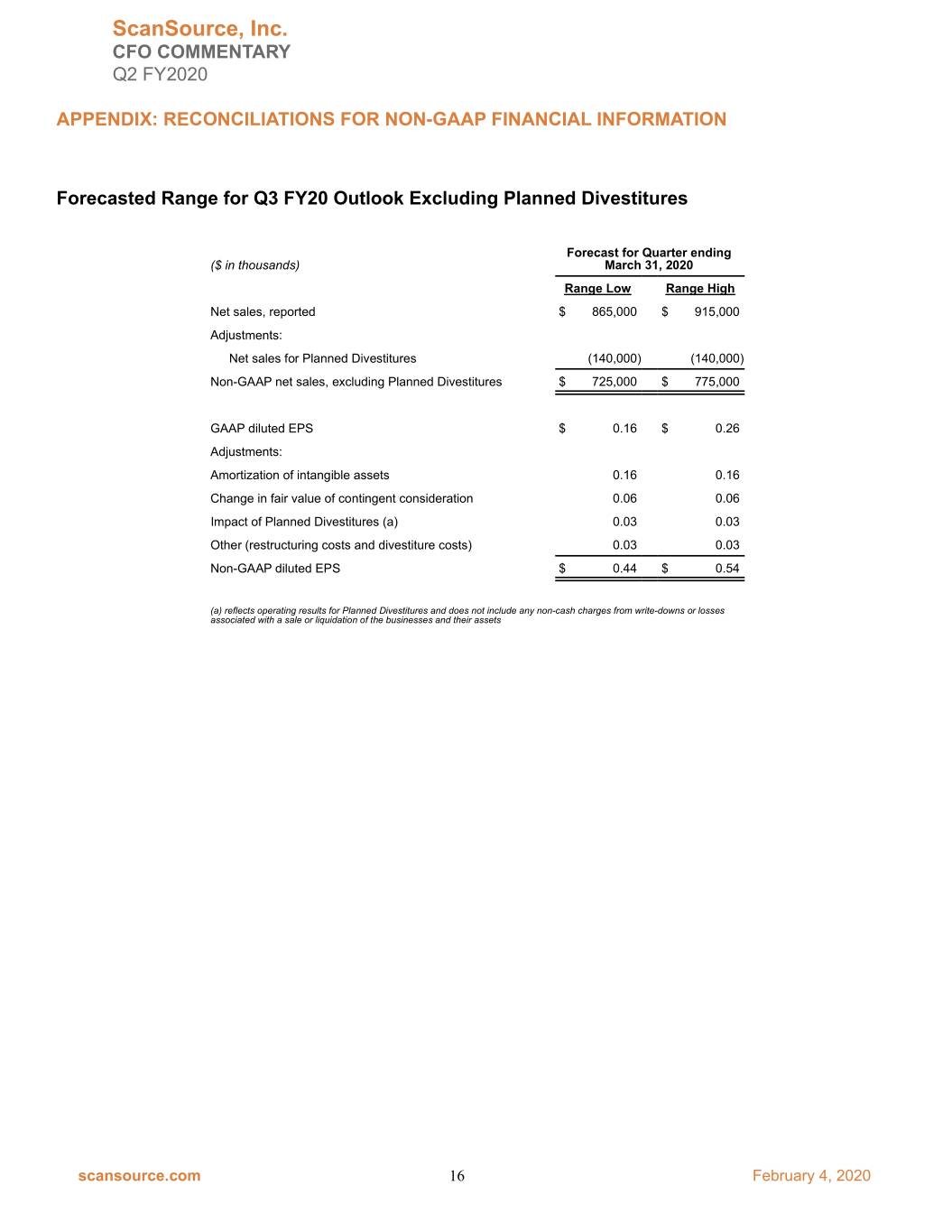

ScanSource, Inc. CFO COMMENTARY Q2 FY2020 APPENDIX: RECONCILIATIONS FOR NON-GAAP FINANCIAL INFORMATION Forecasted Range for Q3 FY20 Outlook Excluding Planned Divestitures Forecast for Quarter ending ($ in thousands) March 31, 2020 Range Low Range High Net sales, reported $ 865,000 $ 915,000 Adjustments: Net sales for Planned Divestitures (140,000) (140,000) Non-GAAP net sales, excluding Planned Divestitures $ 725,000 $ 775,000 GAAP diluted EPS $ 0.16 $ 0.26 Adjustments: Amortization of intangible assets 0.16 0.16 Change in fair value of contingent consideration 0.06 0.06 Impact of Planned Divestitures (a) 0.03 0.03 Other (restructuring costs and divestiture costs) 0.03 0.03 Non-GAAP diluted EPS $ 0.44 $ 0.54 (a) reflects operating results for Planned Divestitures and does not include any non-cash charges from write-downs or losses associated with a sale or liquidation of the businesses and their assets scansource.com 16 February 4, 2020