Attached files

Table of Contents

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended June 30, 2010

OR

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to .

Commission File Number: 000-26926

ScanSource, Inc.

(Exact name of registrant as specified in its charter)

| South Carolina | 57-0965380 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 6 Logue Court Greenville, South Carolina |

29615 | |

| (Address of principal executive offices) | (Zip Code) | |

(864) 288-2432

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, no par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ | |||||

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ | |||||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting common stock of the Registrant held by non-affiliates of the Registrant at December 31, 2009 was $701,550,029, as computed by reference to the closing price of such stock on such date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding at August 24, 2010 | |

| Common Stock, no par value per share | 26,713,038 shares |

DOCUMENTS INCORPORATED BY REFERENCE

The registrant has incorporated by referenced into Part III of this report certain portions of its proxy statement for its 2010 Annual Meeting of Shareholders, which is expected to be filed pursuant to Regulation 14A within 120 days after the end of the registrant’s fiscal year ended June 30, 2010.

Table of Contents

Index to Financial Statements

FORWARD-LOOKING STATEMENTS

The forward-looking statements included in the “Business,” “Risk Factors,” “Legal Proceedings,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures About Market Risk” sections and elsewhere herein, which reflect our best judgment based on factors currently known, involve risks and uncertainties. Words such as “expects,” “anticipates,” “believes,” “intends,” “plans,” “hopes,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, we expressly disclaim any obligation to update these forward-looking statements to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors including, but not limited to, the factors discussed in such sections and, in particular, those set forth in the cautionary statements contained in “Risk Factors.” The forward-looking information we have provided in this Annual Report on Form 10-K pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 should be evaluated in the context of these factors.

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

PART I

| ITEM 1. | Business. |

ScanSource, Inc. (the “Company”), incorporated in South Carolina in December 1992, is a leading wholesale distributor of specialty technology products, providing value-added distribution sales to resellers in the specialty technology markets. The Company has two geographic distribution segments: one serving North America from the Southaven, Mississippi distribution center, and an international segment currently serving Latin America (including Mexico) and Europe from distribution centers located in Florida and Mexico, and in Belgium and Germany, respectively. The North American distribution segment markets automatic identification and data capture (“AIDC”) and point-of-sale (“POS”) products through its ScanSource POS and Barcoding sales unit; voice, data and converged communications equipment through its Catalyst Telecom sales unit; video conferencing, telephony, and communications products through its ScanSource Communications sales unit; and electronic security products and wireless infrastructure products through its ScanSource Security Distribution unit. The international distribution segment markets AIDC, POS, communications and security products as follows: ScanSource Latin America markets AIDC, POS, communications and security products. ScanSource Europe markets AIDC and POS products, while communication products are marketed through its ScanSource Communications sales unit in Europe. See Note 14 to the Notes to the Consolidated Financial Statements for financial information concerning the Company’s reporting segments and the geographic areas in which the Company operates.

North American Distribution Segment

ScanSource POS and Barcoding Sales Unit

The ScanSource POS and Barcoding sales unit markets AIDC and POS products which interface with computer systems used to automate the collection, processing and communication of information for commercial and industrial applications, including retail sales, distribution, shipping, inventory control, materials handling and warehouse management. The bar code family of products is referred to as automatic identification and data capture (AIDC) because it includes all types of portable data collection terminals, wireless products and bar code label printers, in addition to scanners. POS products are those PC-based products that have replaced electronic cash registers in retail and hospitality environments and the peripheral products that attach to them. These peripheral devices include such items as cash drawers, pole displays, signature capture units, display monitors and magnetic strip readers. In addition to these peripheral devices, ScanSource POS and Barcoding also sells products that attach to the POS network in the store, including kiosks, network access points, routers and digital signage displays.

ScanSource POS and Barcoding sales unit vendors include most of the leading AIDC and POS manufacturers, including Cisco, Datalogic, Elo, Epson America, Honeywell, IBM, Intermec, Motorola, NCR, and Zebra Technologies.

Catalyst Telecom Sales Unit

The Catalyst Telecom sales unit markets voice, data and converged communication systems and is a distributor of Avaya communications solutions, including Avaya Enterprise Solutions, Small and Medium Enterprise (SME) and internet protocol (IP) products. Catalyst Telecom also markets data and network security products from vendors including Aruba, Extreme Networks, Juniper Networks, as well as Plantronics, Polycom, and multiple wireless vendors.

ScanSource Communications Sales Unit

ScanSource Communications is a comprehensive value-added distributor of total communications solutions, including video and audio conferencing products; telephony solutions including Voice over IP (VoIP); and computer telephony building blocks. ScanSource Communications’ manufacturing partners include Polycom, Audiocodes, Dialogic, and Plantronics.

1

Table of Contents

Index to Financial Statements

ScanSource Security Sales Unit

The ScanSource Security sales unit focuses on hardware distribution of electronic security equipment using the two-tier distribution model, as described below in “Industry Overview”. The product offering includes identification, access control, video surveillance, intrusion-related, and wireless infrastructure products. Manufacturers include Alvarion, Axis, Bosch, Cisco Security, Datacard, DSC, HID, Motorola Wireless, Panasonic, Ruckus Wireless, Sony, Tropos, United Technologies Fire and Security, and Zebra Card.

International Distribution Segment

The Company’s international distribution segment markets AIDC, POS, and communications products exclusively to technology resellers and integrators in the Latin American (including Mexico) and European markets. Key vendors include many of the same vendors that supply the ScanSource POS and Barcoding, Catalyst Telecom, and ScanSource Communications sales units of the North American distribution segment.

See Item 1A. “Risk Factors” below for a discussion of certain risks attendant to the Company’s international operations.

Products and Markets

The Company currently markets over 65,000 products from approximately 200 hardware and software vendors to over 20,000 reseller customers primarily from its central warehouses in Mississippi, Florida, Mexico, Belgium and Germany.

AIDC technology incorporates the capabilities for electronic identification and data processing without the need for manual input and consists of a wide range of products, including bar code printers, hand-held and fixed-mount laser scanners, mobile and wireless data collection devices, and magnetic stripe readers. As AIDC technology has become more pervasive, applications have evolved from traditional uses such as inventory control, materials handling, distribution, shipping and warehouse management to more advanced applications such as health care. POS products include those computer-based systems that have replaced electronic cash registers in grocery, retail, and hospitality environments. POS product lines include computer-based terminals, monitors, receipt printers, pole displays, cash drawers, keyboards, peripheral equipment and fully integrated processing units. Voice and data products include private branch exchanges (PBXs), key systems, and telephone handsets and components used in voice, fax, data, voice recognition, call center management and IP communication applications. Converged communication products combine voice, data, fax, and speech technologies to deliver communications solutions that combine computers, telecommunications and the Internet. Converged communications products include telephone and IP network interfaces, VoIP systems, PBX integration products and carrier-class board systems-level products. Video products include video and voice conferencing and network systems. Electronic security products include identification, access control, video surveillance, and intrusion-related products, and wireless infrastructure products.

See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below for a discussion of the amount of the Company’s net sales contributed by product categories.

Industry Overview

The distribution channels for specialty technology products generally consist of manufacturers, wholesale distributors such as ScanSource, resellers and end-users. The “sales channel” for specialty technology products typically evolves through a three-stage process: (i) direct sales by manufacturers to end-users; (ii) single-tier distribution in which manufacturers sell to resellers who, in turn, sell directly to end-users; and (iii) two-tier, or wholesale distribution, in which manufacturers sell to wholesale distributors, including ScanSource, who sell only to resellers who, in turn, sell directly to end-users.

2

Table of Contents

Index to Financial Statements

Currently, the technology products wholesale distribution channel is served by both broad line and specialty distributors. The broad line distributors are engaged primarily in conventional order fulfillment and typically offer their reseller customers less support and fewer value-added services than do specialty distributors. The specialty distributors that compete with ScanSource are generally smaller, both in terms of size and geographic area covered.

Competition among an expanding number of manufacturers typically causes product prices to decrease and product applications to expand, which has resulted in an increasing number of resellers entering the market in order to support a broader base of potential end-users. As the number of resellers and end-users has grown, competition among manufacturers and within the reseller channel has intensified. Because many specialty technology manufacturers develop products that represent only one part of a total solution, most products eventually are developed to provide interoperability among products from multiple manufacturers. As a result of interoperability, a variety of manufacturers’ products are typically configured together to create a system solution. Therefore, both manufacturers and resellers have become more dependent upon value-added wholesale distributors such as ScanSource for the aggregation of products and reseller support services, as well as the organization and maintenance of an efficient market structure.

In addition, manufacturers that face declining product prices and rising costs of direct sales increasingly rely upon value-added wholesale distributors by outsourcing certain support functions, such as product assortment, delivery, inventory management, technical assistance, and marketing. At the same time, shortened product life cycles and the introduction of new products and applications have caused resellers increasingly to rely on wholesale distributors for various inventory management, financing, technical support and related functions. The Company believes that as the reseller market grows and becomes more fragmented, and as specialty technology products continue to transition to open systems, the wholesale distribution channel in which the Company operates will become increasingly more important.

Vendors

The Company’s key vendors for its ScanSource POS and Barcoding sales unit are Cisco, Datalogic, Elo, Epson America, Honeywell, IBM, Intermec, LXE, Motorola, NCR, and Zebra Technologies. The Company’s key vendors in its Catalyst Telecom sales unit are Aruba, Avaya, Extreme Networks, Juniper Networks, Plantronics and Polycom. The Company’s key vendors for its ScanSource Communications sales unit are Audiocodes, Dialogic, Plantronics, and Polycom. The Company’s key vendors for its ScanSource Security sales unit are Axis, Cisco, HID, Panasonic, Sony and Zebra Card.

The Company has approximately 200 hardware and software vendors that currently supply its products. Of all of the Company’s vendors, only two, Motorola and Avaya, each constitute more than 10% of the Company’s net sales. The Company’s products are typically purchased directly from the manufacturer on a non-exclusive basis. The Company’s agreements with its vendors generally do not restrict the Company from selling similar or comparable products manufactured by competitors. The Company has the flexibility to terminate or curtail sales of one product line in favor of another due to technological change, pricing considerations, product availability, customer demand, or vendor distribution policies.

The Company has written distribution agreements with its key vendors and with almost all of its vendors. These agreements are in the form that the Company believes are customarily used by manufacturers and distributors. The Company’s agreements generally provide it with non-exclusive distribution rights and often include territorial restrictions that limit the countries in which the Company can distribute its products. These agreements typically provide the Company with stock rotation and price protection provisions. Stock rotation rights give the Company the ability, subject to certain limitations, to return for credit or exchange a portion of those inventory items purchased from the vendor. Price protection situations occur when a vendor credits the Company for declines in inventory value resulting from the vendor’s price reductions. Along with the Company’s inventory management policies and practices, these provisions are designed to reduce the Company’s risk of loss due to slow-moving inventory, vendor price reductions, product updates or obsolescence.

3

Table of Contents

Index to Financial Statements

Some of the Company’s distribution agreements contain minimum purchase requirements that the Company must meet in order to receive preferential prices. The Company participates in various rebate, cash discount and cooperative marketing programs offered by its vendors to support expenses associated with distributing and marketing the vendor’s products. The rebates and purchase discounts are generally influenced by sales volumes and are subject to change.

The Company’s distribution agreements are generally short term, subject to periodic renewal, and provide for termination by either party without cause upon 30 to 120 days notice. The Company’s vendors generally warrant the products the Company distributes and allow returns of defective products, including those returned to the Company by its customers. The Company generally does not independently warrant the products it distributes; however, local laws may in some cases impose warranty obligations on the Company.

The Company’s merchandising department recruits vendors and manages important aspects of its vendor relationships, such as purchasing arrangements, cooperative marketing initiatives, vendor sales force relationships, product training, monitoring of rebate programs and various contract terms and conditions.

Customers

The Company’s reseller customers currently include over 20,000 active value-added reseller accounts (“VARs”) located in the United States, Canada, Mexico, Latin America and Europe. No single customer accounted for more than 5% of the Company’s total net sales for the fiscal year ended June 30, 2010. The Company generally targets two types of reseller customers:

Specialty Technology VARs

These resellers focus on selling specialty technology products as tailored software or integrated hardware solutions for their end-users’ existing applications or incorporating specialty technology products into customized technology solutions for their end-users. Primary industries served by these resellers include manufacturing, distribution, health care, pharmaceutical, hospitality, government, convenience, grocery, financial, and other retail markets.

Networking or PC VARs

These resellers develop computer solutions and networking for their end-users’ microcomputer needs. They typically have well-established relationships with end-user management information system directors and are seeking additional revenue and profit opportunities in related technology markets, such as AIDC, POS, security, or communications.

Sales and Electronic Commerce

The Company’s sales department consists primarily of inside sales representatives located in the United States, Canada, Mexico, Belgium, France, Germany, the United Kingdom, and the Netherlands. In order to build strong customer relationships, most active resellers are assigned to a sales representative. Each sales representative negotiates pricing directly with their assigned customers. The Company also employs business development representatives who are responsible for developing technical expertise within broad product markets, recruiting customers, creating demand, and reviewing overall product and service requirements of resellers. Each sales representative and business development representative receives comprehensive training with respect to the technical characteristics of each vendor’s products. This training is supplemented by frequent product seminars conducted by vendors’ representatives and bi-weekly meetings among product, marketing and sales managers.

4

Table of Contents

Index to Financial Statements

Increasingly, customers rely upon the Company’s electronic ordering and information systems, in addition to its product catalogs and frequent mailings, as sources for product information, including availability and price. Through the Company’s website, most customers can gain remote access to the Company’s information systems to check real-time product availability, see their customized pricing and place orders. Customers can also follow the status of their orders and obtain United Parcel Service (“UPS”) and Federal Express (“FedEx”) package tracking numbers from this site.

Marketing

The Company provides a range of marketing services, including cooperative advertising with vendors through trade publications and direct mail, product catalogs for each of the North American, European and Latin American markets, periodic newsletters, management of sales leads, trade shows with hardware and software companies and vendors, direct mail, and sales promotions. In addition, the Company organizes and operates its own seminars and teams with top vendors to recruit prospective resellers and introduce new applications for the specialty technology products it distributes. The Company frequently customizes its marketing services for vendors and resellers.

Value-Added Services

In addition to the basic order fulfillment and credit services that conventional wholesale distributors typically provide to resellers, the Company differentiates itself by providing an array of value-added services and business tools that assist resellers to provide more complete solutions and improve customer service. Such services include custom configuration, professional services, technical support, partner marketing, web storefronts, custom packaging, and other specialized services.

Operations

Information System

The Company’s information system is a scalable, centralized processing system capable of supporting numerous operational functions including purchasing, receiving, order processing, shipping, inventory management and accounting. Sales representatives rely on the information system for on-line, real-time information on product pricing, inventory availability and reservation, and order status. The Company’s warehouse operations use bar code technology for receiving and shipping, and automated UPS and FedEx systems for freight processing and shipment tracking, each of which is integrated with the Company’s information system. The customer service and technical support departments employ the system for documentation and faster processing of customer product returns. To ensure that adequate inventory levels are maintained, the Company’s buyers depend on the system’s purchasing and receiving functions to track inventory on a continual basis.

Central Warehouse and Shipping

The Company operates a 600,000 square foot distribution center in Southaven, Mississippi, which is located near the FedEx hub facility in Memphis, Tennessee and serves all of North America. The Company utilizes a third party warehouse located in Liege, Belgium and a warehouse in Cologne, Germany that serves all of Europe, including the United Kingdom. The Company has additional warehouse facilities in Florida and Mexico, which serve Latin America (including Mexico). The Company believes that its centralized distribution creates several advantages, including: (i) a reduced amount of “safety stock” inventory which, in turn, reduces the Company’s working capital requirements; (ii) an increased turnover rate through tighter controls over inventory; (iii) maintenance of a consistent order-fill rate; (iv) improved personnel productivity; (v) improved delivery time; (vi) simplified purchasing and tracking; (vii) decreased demand for management personnel; and (viii) flexibility to meet customer needs for systems integration. The Company’s objective is to ship all orders on the same day, using bar code technology to expedite shipments and minimize shipping errors. The Company offers reduced freight rates and flexible delivery options to minimize a reseller’s need for inventory.

5

Table of Contents

Index to Financial Statements

Financial Services

The Company routinely offers competitive credit terms relative to the specific geographic area for qualified resellers and facilitates various third-party financing options, including leasing, flooring, and other secured financing. The Company believes this policy reduces the customer’s need to establish multiple credit relationships with a large number of manufacturers.

Competition

The markets in which the Company operates, as identified above, are highly competitive. Competition is based primarily on factors such as price, product availability, speed and accuracy of delivery, effectiveness of sales and marketing programs, credit availability, ability to tailor specific solutions to customer needs, quality and breadth of product lines and services, and availability of technical and product information.

In the ScanSource POS and Barcoding sales unit, the Company competes with broad-line distributors such as Avnet, Ingram Micro, Synnex and Tech Data, in all geographic segments. Additionally, the Company also competes against other smaller, more specialized AIDC and POS distributors, such as Bluestar. In the Catalyst Telecom sales unit, the Company competes against Avnet, Ingram Micro, Jenne, Tech Data, and Voda One. In the ScanSource Communications sales unit based in North America and in Europe, the Company competes against Ingram Micro, Nimans, Tech Data, and Westcon. In the ScanSource Security sales unit, which is based in North America, the Company competes against other broad-line distributors such as ADI, Synnex, and Tech Data and more specialized distributors such as Anixter and Tri-Northern. As the Company seeks to expand its business into other areas closely related to the Company’s offerings, the Company may encounter increased competition from current competitors and/or from new competitors, some of which may be the Company’s current customers.

The Company’s competitors include regional and national wholesale distributors, as well as hardware manufacturers (including most of the Company’s vendors) that sell directly to resellers and to end-users. In addition, the Company competes with master resellers that sell to franchisees, third-party dealers and end-users. Certain of the Company’s current and potential competitors have greater financial, technical, marketing and other resources than the Company has and may be able to respond more quickly to new or emerging technologies and changes in customer requirements. Certain smaller regional competitors, who are specialty two-tier or mixed model master resellers, may also be able to respond more quickly to new or emerging technologies and changes in customer requirements. Competition has increased for our sales units over the last several years as broad-line and other value-added distributors have entered into the specialty technology markets. Such competition could also result in price reductions, reduced margins and loss of market share by the Company.

Employees

As of June 30, 2010, the Company had 1,074 employees located in North America, Latin America (including Mexico) and Europe. Only employees located in Mexico are considered to be a collective bargaining unit. The Company considers its employee relations to be good.

Service Marks

The Company conducts its business under the trademarks and service marks “ScanSource POS and Barcode”, “Catalyst Telecom”, “ScanSource Communications”, “Partner Services”, and “ScanSource Security”.

The Company has been issued registrations for the service marks “ScanSource” and “Catalyst Telecom” in countries in its principal markets. These trademarks and service marks do not have value assigned to them and have a designated indefinite life. The Company does not believe that its operations are dependent upon any of its trademarks or service marks. The Company also sells products and provides services under various trademarks, service marks and trade names to which reference is made in this report that are the property of owners other than the Company.

6

Table of Contents

Index to Financial Statements

Additional Information

The Company’s principal internet address is www.scansourceinc.com. The information contained on, or that can be accessed through, the Company’s website is not incorporated by reference into this annual report. The Company has included its website address as a factual reference and does not intend it as an active link to its website. The Company provides its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and all amendments to those reports, free of charge on www.scansourceinc.com, as soon as reasonably practicable after they are electronically filed, or furnished to, the Securities and Exchange Commission (“SEC”).

| ITEM 1A. | Risk Factors. |

The following are certain risk factors that could affect our business, financial position and results of operations. These risks should be considered in connection with evaluating the forward looking statements contained in this Annual Report on Form 10-K because these factors could cause the actual results and conditions to differ materially from those projected in the forward looking statements. There also are other risks that we may not describe, generally because we currently do not perceive them to be material, which could impact us. If any of these risks develops into actual events, our business, financial condition or results of operations could be negatively affected, the market price of our common stock could decline and you may lose all or part of your investment in our common stock. We expressly disclaim any obligation to update or revise any risk factors, whether as a result of new information, future events or otherwise, except as required by law.

Global economic instability – Current world-wide economic conditions and market disruptions may adversely affect our business and results of operations.

Financial markets throughout the world could continue to experience extreme disruption, including, among other things, severely diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations and pricing volatility of others, volatile energy costs, geopolitical issues and failure and potential failures of major financial institutions. These continuing developments and the related general economic downturn may adversely impact our business and financial condition in a number of ways. The slowdown could lead to reduced information technology spending by end users, which could adversely affect our sales. The global economic downturn and instability may also result in changes in vendor terms and conditions, such as rebates, cash discounts and cooperative marketing efforts, which may result in downward pressure on our gross margins. The tightening of credit in financial markets and the general economic downturn may adversely affect the ability of our reseller customers, vendors and service providers to obtain financing for significant purchases and operations and to perform their obligations under our agreements with them. This could result in a decrease in or cancellation of orders for our products and services, could negatively impact our ability to collect our accounts receivable on a timely basis, could result in additional reserves for uncollectible accounts receivable being required, and could lead to elevated levels of obsolete inventory. Deterioration in the financial and credit market heightens the risk of customer bankruptcies and delay in payment. Significant volatility and fluctuations in the rates of exchange for the U.S. dollar against currencies such as the Euro, could also negatively impact our customer pricing and operating results.

We continue to be unable to predict the duration and severity of the current economic downturn and disruption in financial markets or their effects on our business and results of operations.

People – If we cannot continue to hire and retain high quality employees, our business and financial results may be negatively affected.

Our operating results could be adversely affected by increased competition for employees, higher employee turnover, or increased salary and benefit costs. Like most businesses, our employees are important to our success and we are dependent in part on our ability to retain the services of our key management, sales, IT, operational, finance and administrative personnel. We have built our business on a set of core values and we attempt to hire employees who are committed to these values. We want employees who will fit our culture of providing

7

Table of Contents

Index to Financial Statements

exceptional service to our vendors and customers. In order to compete and to continue to grow, we must attract, retain, and motivate employees, including those in executive, senior management, sales, marketing, logistics, technical support and other operating positions.

Many of our employees work in small teams to provide specific services to vendors and customers. They are trained to develop their knowledge of vendor products, programs and practices, and customer business needs, as well as to enhance the skills required to provide exceptional service and to manage our business. As they gain experience and develop their knowledge and skills, our employees become highly desired by other businesses. Therefore, to retain our employees, we have to provide a satisfying work environment and competitive compensation and benefits. If our costs to retain our skilled employees increase, then our business and financial results may be negatively affected.

Our continued growth is also dependent, in part, on the skills, experience and efforts of our senior management, including but not limited to, Michael Baur, our Chief Executive Officer. We may not be successful in retaining the members of our senior management team or our other key employees. While we have entered into employment agreements with key executives and have obtained a key person life insurance policy on our CEO’s life, the loss of the services of Mr. Baur or any member of our senior management team could also have an adverse effect on our business, financial condition and results of operations.

Vendor relationships – Terminations of a distribution or services agreement or a significant change in supplier terms, authorizations, or lack of product availability, or conditions of sale could negatively affect our operating margins, revenue or the level of capital required to fund our operations.

A significant percentage of our net sales relates to products sold to us by relatively few vendors. As a result of such concentration risk, terminations of supply or services agreements or a significant change in terms or conditions of sale from one or more of our more significant vendors could negatively affect our operating margins, revenues or the level of capital required to fund our operations. Our vendors have the ability to make significantly adverse changes in their sales terms and conditions, such as reducing the level of purchase discounts and rebates they make available to us. We have no guaranteed price or delivery agreements with our significant vendors. In certain product categories, limited price protection or return rights offered by our vendors may have a bearing on the amount of product we may be willing to stock. Our inability to pass through to our reseller customers the impact of these changes, as well as our failure to develop systems to manage ongoing vendor programs, could cause us to record inventory write-downs or other losses and could have significant negative impact on our gross margins.

We receive purchase discounts and rebates from some vendors based on various factors, including goals for quantitative and qualitative sales or purchase volume and customer related metrics. Certain purchase discounts and rebates may affect gross margins. Many purchase discounts from vendors are based on percentage increases in sales of products. Our operating results could be negatively impacted if these rebates or discounts are reduced or eliminated or if our vendors significantly increase the complexity of process and costs for us to receive such rebates.

Our ability to obtain particular products or product lines in the required quantities and to fulfill customer orders on a timely basis is critical to our success. Our manufacturers have experienced product supply shortages from time to time due to the inability of certain suppliers to supply certain products on a timely basis. As a result, we have experienced, and may in the future continue to experience, short-term shortages of specific products. In addition, vendors who currently distribute their products through us may decide to shift to or substantially increase their existing distribution, through other distributors, their own dealer networks, or directly to resellers or end-users. Suppliers have, from time to time, made efforts to reduce the number of distributors with which they do business. This could result in more intense competition as distributors strive to secure distribution rights with these vendors, which could have an adverse effect on our operating results. If vendors are not able to provide us with an adequate supply of products to fulfill our customer orders on a timely basis or we cannot otherwise obtain particular products or a product line or vendors substantially increase their existing distribution through other distributors, their own dealer networks, or directly to resellers, our reputation, sales and profitability may suffer.

8

Table of Contents

Index to Financial Statements

Customer relationships – We operate in a highly competitive environment and good customer relations are critical to our success. There can be no assurance that we will be able to retain and expand our customer relationships or acquire new customers.

Meeting our customers’ needs quickly and fairly is critical to our business success. Our transactions with our customers are generally performed on a purchase order basis rather than under long term supply agreements. Our customers generally do not have an obligation to purchase from us. Therefore, our customers can readily switch vendors. From time to time, we experience shortages in availability of some products from vendors, and this impacts our customers’ decisions regarding whether to make purchases from us. Anything that negatively impacts our customer relations also can negatively impact our operating results. Accordingly, our sales can vary as a result of fluctuations in pricing, product availability, and general competitive and economic conditions.

Centralized functions – We have centralized a number of functions to provide efficient support to our business. As a result, a loss or reduction of use of one of our locations could have an adverse effect on our business operations and financial results.

In order to be as efficient as possible, we centralize a number of critical functions. For instance, we currently distribute products in North America from a single warehouse near Memphis, Tennessee (with corresponding arrangements for our Latin American and European markets). Similarly, we utilize a single information system based in Greenville, South Carolina. While we have backup systems and business continuity plans, any significant or lengthy interruption of our ability to provide these centralized functions could significantly impair our ability to continue normal business operations. In addition, the centralization of these functions increases our exposure to local risks, such as the availability of qualified employees and the lessening of competition for critical services, such as freight and communications.

Although we have business interruption insurance, not all losses are covered, and an uninsured loss from electrical or telephone failure, fire or other casualty, or other disruption could have an adverse effect on our business, financial condition, and results of operations. In addition, there are limits on all of our insurance coverage, and it is possible that losses might exceed that coverage.

Systems – Our ability to manage our business and monitor results is highly dependent upon information and communication systems. A failure of these systems could disrupt our business.

We are highly dependent upon a variety of internal computer and telecommunication systems to operate our business. Our customers rely increasingly on our electronic ordering and information systems as a source for product information, including availability and pricing. There can be no assurance that our systems will not fail or experience disruptions, and any significant failure or disruption of these systems could prevent us from making sales, ordering and delivering products and otherwise conducting our business. Many of our customers use our website to check real-time product availability, see their customized pricing and to place orders. The Internet and individual websites have experienced a number of disruptions and slowdowns. In addition, some websites have experienced security breakdowns. While our website has not experienced any material disruptions or security breakdowns, any disruptions or breaches in security or a breach that compromises sensitive information could harm our relationship with our vendors, customers and other business partners. Any material disruption of our website or the Internet in general could impair our order processing or prevent our vendors and customers from accessing information and cause us to lose business.

In order to continue support of our growth, we plan to make significant technological upgrades to our information systems. This can be a lengthy and expensive process that may result in a significant diversion of resources from other operations. In addition, the information systems of companies we acquire may not be sufficient to meet our standards or we may not be able to successfully convert them to provide acceptable information on a timely and cost-effective basis. In addition, we must attract and retain qualified people to operate our systems, expand and improve them, integrate new programs effectively with our existing programs,

9

Table of Contents

Index to Financial Statements

and convert to new systems efficiently when required. Any disruption to our business due to such issues, or an increase in our costs to cover these issues that is greater than what we have anticipated, could have an adverse affect on our financial results and operations.

In addition, the information systems of companies we acquire may not be sufficient to meet our standards or we may not be able to successfully convert them to provide acceptable information on a timely and cost-effective basis. In addition, we must attract and retain qualified people to operate our systems, expand and improve them, integrate new programs effectively with our existing programs, and convert to new systems efficiently when required.

International operations – Our international operations expose us to risks that are different from, or possibly greater than, the risks we are exposed to domestically.

We currently have facilities in seven countries outside the United States and sell products in a number of others. A significant portion of our revenue is derived from our international operations. These operations are subject to a variety of risks that either are in addition to the risks that we face domestically or are similar risks but with potentially greater exposure. These risks include:

| • | Changes in international trade laws, such as the North American Free Trade Agreement, affecting our import and export activities, including export license requirements, restrictions on the export of certain technology, and tariff changes; |

| • | Difficulties in collecting accounts receivable and longer collection periods; |

| • | Changes in, or expiration of, various foreign incentives that provide economic benefits to us; |

| • | Changes in labor laws and regulations affecting our ability to hire and retain employees; |

| • | Difficulties in staffing and managing operations in foreign countries; |

| • | Fluctuations of foreign currency, exchange controls and currency devaluations; |

| • | Changes in the interpretation and enforcement of laws (in particular related to items such as duty and taxation); |

| • | Potential political and economic instability and changes in governments; |

| • | Terrorist or military actions that result in destruction or seizure of our assets or suspension or disruption of our operations or those of our customers; |

| • | Potential regulatory changes, including foreign environmental restrictions; and |

| • | Different general economic conditions. |

Because we have operations in Canada, Mexico and Europe, we are exposed to fluctuations in foreign currency exchange rates. Exchange rate fluctuations may cause our international results to fluctuate significantly when reflected in U.S. Dollar terms. We manage our exposure to fluctuations in the value of currencies using various derivative instruments. However, we may not be able to mitigate all foreign currency related risk.

In addition, in foreign markets we are more dependent upon third party providers of key services, such as third party freight forwarders and third party warehouses. Adverse changes in any of these third party services could have an adverse effect on our business, financial condition, and results of operations. As we expand our international operations, we expect these risks to increase.

10

Table of Contents

Index to Financial Statements

In addition, the value of our equity investment in foreign countries, such as our purchase of Algol Europe, GmbH in 2009, may fluctuate based on changes in foreign currency exchange rates. These fluctuations may result in losses in the event a foreign subsidiary is sold or closed at a time when the foreign currency is weaker than when we initially invested.

Credit exposure – We have credit exposure to our reseller customers. Any adverse trends in their businesses could cause us to suffer credit losses.

We have credit exposure to our reseller customers and negative trends in their businesses could increase our credit risk. As is customary in our industry, we extend credit to our reseller customers and most of our sales are on open accounts. We may be unable to collect on receivables if our reseller customers experience decreases in demand for their products and services, do not manage their businesses adequately, or otherwise become less able to pay due to adverse economic conditions. As we grow and compete for business, our typical payment terms tend to be longer, and therefore may increase our credit risk.

While we evaluate resellers’ qualifications for credit and monitor our extensions of credit, these efforts cannot prevent all credit losses, and credit losses in excess of historical levels would negatively impact our performance. In addition, for financial reporting purposes we estimate future credit losses and establish an appropriate reserve. To the extent that our credit losses exceed those reserves, our financial performance will be negatively impacted. During the past 12 months our operating expenses increased as a result of bad debt expense that we recognized primarily from a single customer. There is no guarantee that our operating expenses will not increase as a result of the recognition of bad debt expense from our reseller customers.

Terrorist or military operations – Future terrorist or military operations could result in a disruption of our operation or loss of assets in certain markets.

Future terrorist or military actions, in the United States or abroad, could result in destruction or seizure of assets or suspension or disruption of our operations. Additionally, such actions could affect the operations of our suppliers or customers, resulting in loss of access to products, potential losses on supplier programs, loss of business, higher losses on receivables or inventory, and/or other disruptions in our business, which could negatively affect our operating results. We do not carry broad insurance covering such terrorist or military actions, and even if we were to seek such coverage, the cost would likely be prohibitive.

Narrow profit margins – Our narrow margins significantly impact our operating results.

Our industry is highly competitive and characterized by narrow gross and operating margins. As a result, we have significant price competition that results in narrow gross profit and operating profit margins. Because these margins are narrow, fluctuations in sales can have a significant impact on our overall operating results.

Competition – We experience intense competition in all of our markets. Such competition could result in reduced margins and loss of our market share.

The markets that we operate in are highly competitive. We compete on the basis of price, product availability, speed and accuracy of delivery, effectiveness of sales and marketing programs, credit availability, ability to tailor solutions to the needs of our customers, quality and breadth of product line and services, and availability of technical and product information. Our competitors include regional and national wholesale distributors as well as hardware manufacturers (including most of our vendors) that sell directly to resellers and to end users. In addition, we compete with master resellers that sell to franchisees, third party dealers and end-users. Certain of our current and potential competitors have greater financial, technical, marketing and other resources than we have and may be able to respond more quickly to new or emerging technologies and changes in customer requirements. Certain smaller, regional competitors, who are specialty two-tier or mixed model master resellers, may also be able to respond more quickly to new or emerging technologies and changes in

11

Table of Contents

Index to Financial Statements

customer requirements. Competition has increased for our sales units as broad line and other value-added distributors have entered into the specialty technology markets. Such competition could result in price reductions, reduced margins and loss of our market share. As a result of intense price competition in our industry, our gross margins and our operating profit margins have historically been narrow and we expect them to be narrow in the future. To remain competitive we may be forced to offer more credit or extended payment terms to our customers. This could result in an increase in our need for capital, increase our financing costs, increase our bad debt expenses and have a negative impact on our financial results.

Growth strategies – If we fail to effectively manage and implement our organic growth strategies, we may experience a negative effect on our business and financial results.

A significant component of our growth strategy has been to add new vendors and products, and we expect to be able to enter new product markets in the future. Expansion of our existing product markets and entry into new product markets divert the use of our resources and systems, require additional resources that might not be available (or available on acceptable terms), result in new or more intense competition, may require longer implementation times or greater start-up expenditures than anticipated, and may otherwise fail to achieve the desired results in a timely fashion, if at all. In addition, while we have been very successful in adding new vendors in the past, we already represent most of the significant vendors in our primary areas of focus, and there is regular consolidation among our vendors. As a result, there may be fewer expansion opportunities of this nature in the future. If we are unable to increase our sales and earnings by expanding our product offerings in a cost effective manner, then our revenues may not grow.

Our ability to successfully manage our growth will require continued enhancement of our operational, managerial, and financial resources and controls. Our failure to effectively manage our growth could have an adverse effect on our business, financial condition, and results of operations. Additionally, our growth may increase our working capital requirements and as a result, we may require additional equity or debt financing. Such financing may not be available on terms that are favorable to us, if at all.

Acquisitions – Our growth strategy includes potential acquisitions of companies that complement or expand or existing business. Acquisitions involve a number of risks and uncertainties.

We have and expect to continue to acquire companies that complement or expand our business in the United States or internationally. Acquisitions may involve significant risks and uncertainties including distraction of management’s attention away from normal business operations; sufficient revenue generation to offset liabilities assumed and expenses associated with the acquisition; difficulty in the integration of acquired businesses, including new employees, business systems and technology; inability to adapt to challenges of new markets, including geographies, products and services, or to attract new sources of profitable business from expansion of products or services; exposure to new regulations; and issues not discovered in our due diligence process. Our operations may be adversely impacted by an acquisition that (i) is not suited for us, (ii) is improperly executed, or (iii) substantially increases our debt. Any of these factors could adversely affect our operating results or financial condition.

Inventory – The value of our inventory may be adversely affected by market and other factors.

Our business, like that of other distributors, is subject to the risk that the value of our inventory will be adversely affected by price reductions by manufacturers or by technological changes affecting the usefulness or desirability of our products. Under the terms of most of our vendor agreements and the policy of most manufacturers of specialty technology products, we have some price protection and stock rotation opportunities with respect to slow moving or obsolete inventory items. However, these protections are limited in scope and do not protect against all declines in inventory value, excess inventory, or product obsolescence, and in some instances we may not be able to fulfill all necessary conditions or successfully manage such price protection or stock rotation opportunities. In addition, these industry practices are sometimes not reflected in vendor

12

Table of Contents

Index to Financial Statements

agreements and their application in a particular situation is dependent upon negotiations between our vendors and us. As a result, from time-to-time we are required to write down the value of excess and obsolete inventory, and should any of these write-downs occur at a significant level, they could have an adverse effect on our business, financial condition, and results of operations.

Should the current economic downturn persist, it is possible that prices may decline due to an oversupply of product, and therefore, there may be a greater risk of declines in inventory value. In addition, our vendors may become insolvent and unable to fulfill their product obligations to us. Significant declines in inventory value in excess of established inventory reserves or dramatic changes in prevailing technologies could have an adverse effect on our business, financial condition, and results of operations.

Laws and regulations – Changes in tax laws, and other laws and regulations may adversely impact us.

We are subject to a wide range of local, state and federal laws and regulations both in the United States and in the other countries in which we operate. While we plan our operations based upon existing and anticipated laws and regulations, we cannot anticipate every change and can have only little, if any, impact on others. We are particularly susceptible to changes in income and other tax laws, laws regulating international trade, and accounting and securities disclosure laws and regulations. To a lesser degree, changes in environmental regulation, including electronic waste recovery legislation, may impact us. In each case, a change in the laws or regulations that we are required to comply with could have an adverse impact on our business operations or financial results.

Accounting rules – Changes in accounting rules or standards could have a significant adverse affect on our reported earnings.

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles. These principles are subject to interpretations by various governing bodies including the Financial Accounting Standards Board, the Public Accounting Oversight Board, the SEC and the American Institute of Certified Public Accountants. These governing bodies create and interpret appropriate accounting standards. Future periodic assessments required by current or new accounting standards may result in additional non-cash charges and/or changes in presentation or disclosure. A change from current accounting standards could have a significant adverse effect on our financial position or results of operations.

Quarterly fluctuations – Our net sales and operating results are dependent on a number of factors. Our net sales may fluctuate from quarter to quarter and these fluctuations may cause volatility in our stock price.

Our net sales and operating results may fluctuate quarterly as a result of changes in demand for our products and services, the introduction of new technology, actions by our competitors, changes in vendors’ prices or price protection policies, changes in vendors’ business practices or strategies, changes in freight rates, the timing of the addition of operating expenses to support our growth, the timing of major marketing or other service projects, product supply shortages, changes in product mix, and the general economic factors referenced above. In addition, a substantial portion of our net sales in each quarter results from orders booked in that quarter, which are difficult to accurately forecast in advance. As a result, our performance in one period may vary significantly from our performance in the preceding quarter, and may differ significantly from our forecast of performance from quarter to quarter. The impact of these variances may cause volatility in our stock price.

Third-party freight carriers – We are dependent on third-parties for the delivery of a majority of our products. Changes in shipping terms or the failure or inability of our third-party shippers to perform could have an adverse impact on our business and results of operations.

We are dependent upon major shipping companies, including Federal Express and United Parcel Service, for the shipment of our products to and from our centralized warehouses. Changes in shipping terms, or the

13

Table of Contents

Index to Financial Statements

inability of these third-party shippers to perform effectively (whether as a result of mechanical failure, casualty loss, labor stoppage, or any other reason), could have an adverse effect on our business, financial condition, and results of operations. From time to time, we have experienced significant increases in shipping costs due to increases in fuel costs. If our shipping costs increase, it may adversely affect our financial results if we are unable to pass on these higher costs to our customers.

Litigation – We routinely are involved in litigation that can be costly and lead to adverse results.

In the ordinary course of our business, we are involved in a wide range of disputes, some of which result in litigation. In addition, as a public company with a large shareholder base, we are susceptible to class-action and other litigation resulting from disclosures that we make and our other activities. Litigation is expensive to bring and defend, and the outcome of litigation can be adverse and significant. Not all adverse outcomes can be anticipated, and applicable accounting rules do not always require or permit the establishment of a reserve until a final result has occurred or becomes probable and estimable. In some instances we are insured for the potential losses; in other instances we are not. An uninsured adverse outcome in significant litigation could have an adverse effect on our business, financial condition and results of operations.

Liquidity and capital resources – Market factors may increase the cost and availability of capital. Additional capital may not be available to us on acceptable terms to fund our working capital needs and growth.

Our business requires significant levels of capital to finance accounts receivable and product inventory that is not financed by trade creditors. We have an increased demand for capital when our business is expanding, including through acquisitions. Changes in payment terms with either suppliers or customers could increase our capital requirements. We have historically relied upon cash generated from operations, borrowings under our revolving credit facility, secured and unsecured borrowings, and, to a lesser extent, borrowings under a subsidiary’s line of credit to satisfy our capital needs and to finance growth. While we believe that our existing sources of liquidity will provide sufficient resources to meet our current working capital and cash requirements, if we require capital to meet our future business needs, such capital may not be available to us on terms acceptable to us, or at all. Changes in how lenders rate our credit worthiness, as well as macroeconomic factors such as the current economic downturn and global economic instability may restrict our ability to raise capital in adequate amounts or on terms acceptable to us, and the failure to do so could harm our ability to operate our business.

In addition, our cash and cash equivalents are deposited with various financial institutions located in the various countries in which we operate. We endeavor to monitor these financial institutions regularly for credit quality; however, we are exposed to risk of loss on such funds or we may experience significant disruptions in our liquidity needs if one or more of these financial institutions were to suffer bankruptcy or similar restructuring.

| ITEM 1B. | Unresolved Staff Comments. |

Not applicable.

| ITEM 2. | Properties. |

The Company owns a 70,000 square foot building in Greenville, South Carolina, which is the site of its principal executive and sales offices, and a 103,000 square foot building on adjacent property, of which approximately 70,000 feet is subleased to an unrelated third parties.

North American Distribution Facilities

In February 2008, the Company completed the process of relocating its North American distribution operations from Memphis, Tennessee to its current location in Southaven, Mississippi, allowing for substantially

14

Table of Contents

Index to Financial Statements

expanded warehousing capacity. The Southaven facility accommodates approximately 600,000 square feet with an optional 147,000 square feet of available expansion space. A subsidiary of the Company entered into a ten-year lease associated with this facility, with options to extend the lease for two consecutive five-year periods. Shortly after operations commenced in the Southaven facility, the Company completed the sale of its former distribution facility in Memphis, Tennessee.

The Company or its subsidiaries also have offices, each of 10,000 square feet or less, in leased facilities in Norcross, Georgia; Williamsville, New York; Tempe, Arizona; Lenexa, Kansas; Eagan, Minnesota; and Toronto, Canada.

International Distribution Facilities

The Company or its subsidiaries lease 22,000 square feet of office and distribution center space in Miami, Florida and 25,000 square feet of office and distribution center space in Mexico City, Mexico, and 17,000 square feet of office space in Brussels, Belgium. The Company or its subsidiaries lease approximately 38,000 square feet of third party warehouse space in Liege, Belgium and 2,884 square feet of office and distribution center space in Cologne, Germany. During the last part of this year, the Company consolidated the Egham, U.K. distribution facility for communications products into its Liege, Belgium facility, continuing its efforts to gain additional efficiencies and economies of scale.

The Company or its subsidiaries have additional sales offices, each of 10,000 square feet or less, in leased facilities in Bad Homburg, Germany; Hull, England; Crawley, England; Egham, England; Olivet, France; and Eindhoven, Netherlands.

Management believes the Company’s office and warehouse facilities are adequate to support its operations at their current levels and for the foreseeable future.

| ITEM 3. | Legal Proceedings. |

The Company and its subsidiaries are, from time to time, parties to lawsuits arising out of operations. Although there can be no assurance, based upon information known to the Company, the Company believes that any liability resulting from an adverse determination of such lawsuits would not have a material adverse effect on the Company’s financial condition or results of operations.

| ITEM 4. | Removed and Reserved. |

15

Table of Contents

Index to Financial Statements

PART II

| ITEM 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

The Company’s common stock is quoted on the NASDAQ Global Select Market under the symbol “SCSC.” The Company has never paid or declared a cash dividend since inception and the Board of Directors does not intend to institute a cash dividend policy in the foreseeable future. Under the terms of the Company’s revolving credit facility, the payment of cash dividends is restricted. As of August 24, 2010, there were approximately 569 holders of record of our common stock. The following table sets forth, for the periods indicated, the high and low sales prices of the Company’s common stock on the NASDAQ Global Select Market.

| High | Low | |||||

| Fiscal Year 2010 |

||||||

| First quarter |

$ | 31.50 | $ | 23.37 | ||

| Second quarter |

32.40 | 22.70 | ||||

| Third quarter |

30.67 | 24.90 | ||||

| Fourth quarter |

30.29 | 22.98 | ||||

| Fiscal Year 2009 |

||||||

| First quarter |

$ | 34.74 | $ | 25.18 | ||

| Second quarter |

29.09 | 13.58 | ||||

| Third quarter |

20.59 | 13.78 | ||||

| Fourth quarter |

27.64 | 16.59 | ||||

16

Table of Contents

Index to Financial Statements

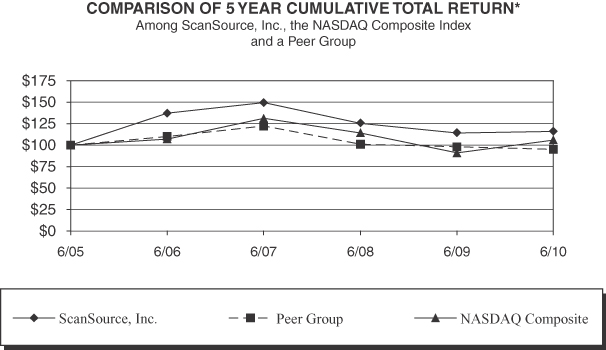

Stock Performance Chart

The following stock performance graph compares cumulative total shareholder return on the Company’s common stock over a five-year period with the Nasdaq Market Index and with the Standard Industrial Classification (“SIC”) Code Index (SIC Code 5045 – Wholesale Computers and Peripheral Equipment and Software) for the same period. Total shareholder return represents stock price changes and assumes the reinvestment of dividends. The graph assumes the investment of $100 on June 30, 2005.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||

| ScanSource, Inc. |

$ | 100 | $ | 137 | $ | 149 | $ | 125 | $ | 114 | $ | 116 | ||||||

| SIC Code 5045 – Computers & Peripheral Equipment |

$ | 100 | $ | 110 | $ | 122 | $ | 101 | $ | 98 | $ | 95 | ||||||

| NASDAQ Market Index |

$ | 100 | $ | 107 | $ | 131 | $ | 114 | $ | 91 | $ | 106 | ||||||

17

Table of Contents

Index to Financial Statements

| ITEM 6. | Selected Financial Data. |

The selected financial data below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes thereto included elsewhere in this Annual Report on Form 10-K. The following statement of income data and balance sheet data were derived from the Company’s consolidated financial statements.

FIVE YEAR FINANCIAL SUMMARY

| Fiscal Year Ended June 30, | ||||||||||||||||||||

| 2010 | 2009 | 2008(1) | 2007(1) | 2006(1) | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Statement of income data: |

||||||||||||||||||||

| Net sales |

$ | 2,114,979 | $ | 1,847,969 | $ | 2,175,485 | $ | 1,986,927 | $ | 1,665,600 | ||||||||||

| Cost of goods sold |

1,896,052 | 1,639,121 | 1,947,867 | 1,776,255 | 1,497,248 | |||||||||||||||

| Gross profit |

218,927 | 208,848 | 227,618 | 210,672 | 168,352 | |||||||||||||||

| Selling, general and administrative expenses |

143,151 | 134,730 | 133,653 | 135,339 | 105,042 | |||||||||||||||

| Operating income |

75,776 | 74,118 | 93,965 | 75,333 | 63,310 | |||||||||||||||

| Interest expense, net |

85 | 771 | 3,959 | 6,804 | 1,620 | |||||||||||||||

| Other (income) expense, net |

(50 | ) | (2,307 | ) | (212 | ) | (144 | ) | 57 | |||||||||||

| Income before income taxes and minority interest |

75,741 | 75,654 | 90,218 | 68,673 | 61,633 | |||||||||||||||

| Provision for income taxes |

26,929 | 27,966 | 34,586 | 25,987 | 21,592 | |||||||||||||||

| Consolidated net income |

48,812 | 47,688 | 55,632 | 42,686 | $ | 40,041 | ||||||||||||||

| Noncontrolling interest in income of subsidiary |

- | - | - | (60 | ) | (225 | ) | |||||||||||||

| Net income attributable to shareholders of ScanSource |

$ | 48,812 | $ | 47,688 | $ | 55,632 | $ | 42,626 | $ | 39,816 | ||||||||||

| Net income per common share, basic |

$ | 1.83 | $ | 1.80 | $ | 2.13 | $ | 1.65 | $ | 1.56 | ||||||||||

| Weighted-average shares outstanding, basic |

26,605 | 26,445 | 26,098 | 25,773 | 25,491 | |||||||||||||||

| Net income per common share, diluted |

$ | 1.82 | $ | 1.79 | $ | 2.10 | $ | 1.63 | $ | 1.53 | ||||||||||

| Weighted-average shares outstanding, diluted |

26,869 | 26,588 | 26,445 | 26,213 | 26,034 | |||||||||||||||

| As of June 30, | ||||||||||||||||||||

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Working capital |

$ | 436,953 | $ | 399,647 | $ | 368,636 | $ | 352,955 | $ | 262,171 | ||||||||||

| Total assets |

859,750 | 748,631 | 772,206 | 738,448 | 617,497 | |||||||||||||||

| Total long-term debt (including current portion) |

30,429 | 30,429 | 56,623 | 107,730 | 32,185 | |||||||||||||||

| Total shareholders’ equity |

486,851 | 445,446 | 395,753 | 324,744 | 273,409 | |||||||||||||||

| (1) | Included in the statement of income for the fiscal years ended June 30, 2008 and 2007 are $1.0 million and $9.9 million, respectively, of direct costs associated with the special committee review of the Company’s stock option practices. See Note 1A to the Notes to Consolidated Financial Statements included in Part II, Item 8 of the Company’s amended Annual Report on Form 10-K/A for the fiscal year ended June 30, 2006. |

18

Table of Contents

Index to Financial Statements

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Certain statements within this Annual Report on Form 10-K, including this Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), are not historical facts and contain “forward-looking statements” as described in the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks and uncertainties and actual results could differ materially from those projected. Factors that could cause actual results to differ materially include the following: our ability to retain key employees, particularly senior management; our ability to retain and expand our existing and new customer relationships; our dependence on vendors, product supply, and availability; our ability to centralize certain functions to provide efficient support to our business; our dependence upon information systems; our ability to manage the potential adverse effects of operating in foreign jurisdictions; our ability to manage and limit our credit exposure due to the deterioration in the financial condition of our customers; our ability to remain profitable in the face of narrow margins; our ability to compete in new and existing markets that are highly competitive; our ability to manage our business when general economic conditions are poor; our ability to effectively manage and implement our growth strategies; our ability to manage and negotiate successful pricing and stock rotation opportunities associated with inventory value decreases; our ability to anticipate adverse changes in tax laws, accounting rules, and other laws and regulations; our inability to eliminate potential volatility in our net sales and operating results on a quarterly basis as a result of changes in demand for our products; our dependence on third-party freight carriers; our inability to resolve or settle potentially adverse litigation matters; and our inability to obtain required capital at acceptable terms to fund our working capital and growth strategies. Additional discussion of these and other factors affecting our business and prospects is contained in our periodic filings with the SEC, copies of which can be obtained under the “Investors Relations” tab on website at www.scansourceinc.com. Please refer to the cautionary statements and important factors discussed in Item 1A. “Risk Factors” in this Annual Report on Form 10-K for further information. This discussion and analysis should be read in conjunction with “Selected Financial Data” and the Consolidated Financial Statements and the Notes thereto included elsewhere in this Annual Report on Form 10-K.

Overview

ScanSource, Inc. is a leading wholesale distributor of specialty technology products, providing value-added distribution sales to resellers in the specialty technology markets. The Company distributes more than 65,000 products worldwide. The Company has two geographic distribution segments: one serving North America from the Southaven, Mississippi distribution center, and an international segment currently serving Latin America (including Mexico) and Europe from distribution centers located in Florida and Mexico, and in Belgium and Germany, respectively. The North American distribution segment markets automatic identification and data capture (“AIDC”) and point-of-sale (“POS”) products through its ScanSource POS and Barcoding sales unit; voice, data and converged communications equipment through its Catalyst Telecom sales unit; video conferencing, telephony and communications products through its ScanSource Communications sales unit; and electronic security products and wireless infrastructure products through its ScanSource Security sales unit. The international distribution segment markets AIDC, POS and Barcode, communications, and security products through its ScanSource Latin America sales unit; POS and AIDC products through its ScanSource Europe sales unit, and communication products through its ScanSource Communications sales unit in Europe.

The Company was incorporated in South Carolina in December 1992 and is headquartered in Greenville, South Carolina. The Company serves North America from a single, centrally located distribution center located in Southaven, Mississippi, near the FedEx hub. The single warehouse and strong management information system form the cornerstone of the Company’s cost-driven operational strategy. This strategy has been expanded to Latin America and Europe, with distribution centers located in Florida and Mexico, and in Belgium and Germany, respectively.

On November 30, 2009 the Company acquired substantially all of the assets and certain liabilities of Algol Europe, GmbH, a value added distributor specializing in convergence communication solutions. Algol,

19

Table of Contents

Index to Financial Statements

headquartered in Cologne, Germany, was renamed ScanSource Communications GmbH and joined ScanSource Communications UK as part of ScanSource Communications Europe.

North American Distribution Segment