Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - Ando Holdings Ltd. | ando_ex32.htm |

| EX-31 - CERTIFICATION - Ando Holdings Ltd. | ando_ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| [X] |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| ||

| For the fiscal year ended September 30, 2019 | ||

| OR | ||

| [ ] |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| ||

| For the transition period from ______________ to ______________________. | ||

Commission file number: 001-37834

Ando Holdings Limited

(Exact name of registrant as specified in its charter)

| Nevada |

| 47-4933278 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

Room 1107, 11/F, Lippo Sun Plaza, 28 Canton Road

Tsim Sha Tsui, Kowloon, Hong Kong 00000

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: +852 23519122

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerate filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company”, in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] |

| Accelerated filer [ ] |

| Non-accelerated filer [ ] |

| Smaller reporting company [X] |

| (Do not check if smaller reporting company) |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

At March 31, 2019, there were 6,692,800 shares of the registrant’s Common Stock issued and outstanding held by affiliate and the aggregate market value of voting and non-voting common equity held by non-affiliate were $21,818,400 and $21,818,400 respectively.

At January 16, 2020, there were 12,000,000 shares of the registrant’s Common Stock issued and outstanding.

ii

Ando Holdings Ltd.

FORM 10-K

For The Fiscal Year Ended September 30, 2019

TABLE OF CONTENTS

iii

Explanatory Note

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

·The availability and adequacy of our cash flow to meet our requirements;

·Economic, competitive, demographic, business and other conditions in our local and regional markets;

·Changes or developments in laws, regulations or taxes in our industry;

·Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities;

·Competition in our industry;

·The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business;

·Changes in our business strategy, capital improvements or development plans;

·The availability of additional capital to support capital improvements and development; and

·Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC.

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

·The “Company,” “we,” “us,” or “our,” and “ADHG” are references to Ando Holdings Limited, a Nevada corporation.

·“Common Stock” refers to the common stock, par value $.001, of the Company;

·“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States;

·“Securities Act” refers to the Securities Act of 1933, as amended; and

·“Exchange Act” refers to the Securities Exchange Act of 1934, as amended.

iv

Our Company

Ando Holdings Ltd., formerly known as PC Mobile Media Corp. was formed in the state of Nevada on August 22, 2015. After thorough discussion and analysis on the mobile billboard industry, the Company has decided to terminate its plans in the industry. The Company is currently pursuing business opportunities in Hong Kong. The Company acquired 4 companies during the financial year of 2019, which were Ando Automobile Technology Limited, Ando Capital Investment Limited, Xian Ando Industrial Company Limited and Xian Ando Factoring Commercial Company Limited.

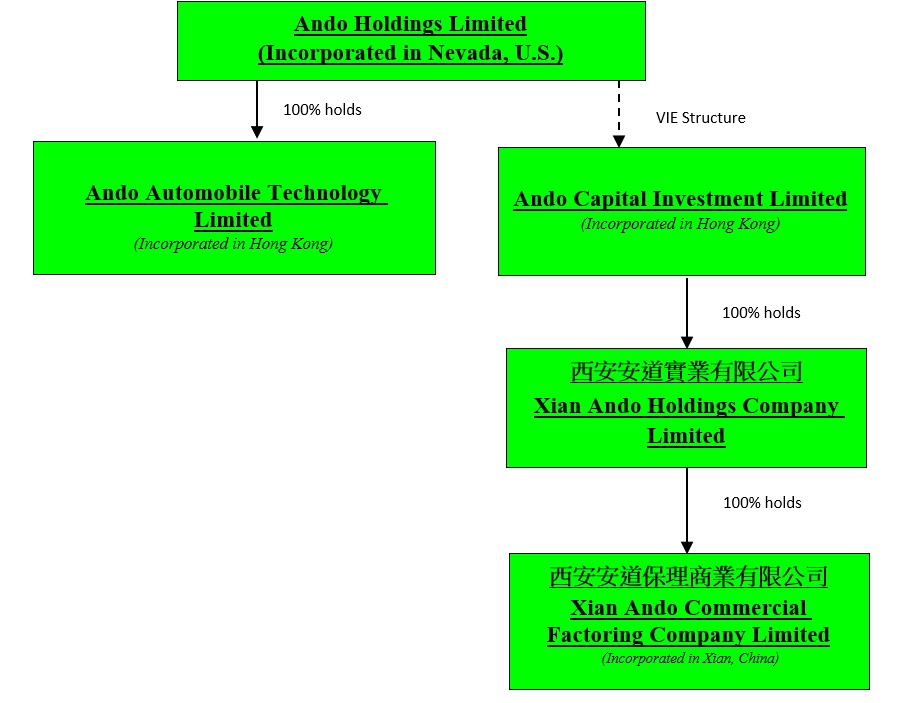

Our corporate structure is set forth below:

A list of our subsidiaries, affiliates and VIE entities together with a brief description of their business is set forth below:

| Name (Domicile) |

| Business |

| Ando Holdings Limited (Nevada, United States) |

| Provides financial services and being an investment holding company |

| Ando Automobile Technology Limited (Hong Kong) |

| Intends to develop in automobile agency services |

| Ando Capital Investment Limited (Hong Kong) |

| Provides insurance products of Sun Life Hong Kong Limited |

| Xian Ando Industrial Company Limited (Xian, China) |

| Being an investment holding company to hold Xian Ando Commercial Factoring Company Limited |

| Xian Ando Commercial Factoring Company Limited (Xian, China) |

| Intends to develop in factoring business in Xian, China |

On June 28, 2017 Mr. Paul Conforte, President and the holder of an aggregate of 8,000,000 shares of Common Stock of PC Mobile Media Corp., representing approximately 66.67% of the issued and outstanding Shares of the Company, sold all 8,000,000 Shares to 12 purchasers. On the same day Mr. Conforte resigned all positions, including Chairman of the Board. Lam Chi Kwong Leo was appointed Chairman of the Board and Chief Executive Officer. Lee Hiu Lan was appointed as Secretary, Treasurer, and Chief Financial Officer. Chan Tung Ngai and Hu Jiasheng were both appointed as a Director. The appointments were effective on June 28, 2017.

On September 5, 2017, the amendment to the Company’s articles of incorporation was declared effective in the State of Nevada. The amendment changed the name of the Company from PC Mobile Media Corp. to Ando Holdings Ltd. While as of September 25, 2017, FINRA accepted the name change and issued a new trading symbol for the Company. The new trading symbol for the Company is ADHG.

On November 29, 2018, the Company acquired Ando Automobile Technology Limited from Lam Chi Kwong Leo with a cash consideration of $1,282. The Company intends this fully owned subsidiary to operate as an automobile trading company, trading in foreign-made automobiles to be shipped to Chinese buyers directly. As of September 30, 2019, this subsidiary had no operation.

On February 1, 2019, the Company entered into a securities purchase agreement with accredited investors, Lin Su Hui, pursuant to which the Company issued promissory notes for an aggregate of $50,000, with an interest rate of 10% per annum. The outstanding balance of the Notes would be paid within one year beginning February 1, 2019, which is February 1, 2020. We filed a Form 8-K on February 5, 2019.

1

ACIL has two wholly owned subsidiaries, namely Xian Ando Holdings Company Limited and Xian Ando Commercial Factoring Company Limited. We filed a Form 8-K on October 4, 2019.

The VIE Agreements are as follows:

1) Exclusive Business Cooperation Agreement: Pursuant to the Exclusive Business Cooperation Agreement, ADHG serves as the exclusive provider of financial support, technical support, consulting services and management services to ACIL. In consideration of such services, ACIL has agreed to pay a service fee to ADHG, which is based on the time of services rendered multiplied by the corresponding rate, plus amount of the services fees or ratio decided by the board of directors of ADHG. The Agreement has a term of 10 years but may be extended ADHG in its discretion.

2) Loan Agreement: Pursuant to the Loan Agreement, ADHG granted interest-free loans of Hong Kong Dollars Seventy Eight Thousand (“HK$78,000”), which is equivalent to United States Dollars Ten Thousand (“US$10,000”) to the shareholders of the ACIL for the sole purpose of increasing the registered capital of the ACIL. These loans are eliminated with the capital of ACIL during consolidation.

3) Share Pledge Agreement: Pursuant to the Share Pledge Agreement, the shareholders of ACIL pledged to ADHG a first security interest in all of their equity interests in ACIL to secure ACIL’s timely and complete payment and performance of its obligations under the Exclusive Business Cooperation Agreement. During the term of the Share Pledge Agreement, the pledgors agreed, among other things, not to transfer, place or permit the existence of any security interest or other encumbrance on their interest in ACIL without the prior written consent of ADHG. The pledge shall remain in effect until 10 years after the obligations under the business cooperation agreement will have been fulfilled. However, upon the full payment of the consulting and service fees under the Exclusive Business Cooperation Agreement and upon the termination of ACIL’s obligations under the Exclusive Business Cooperation Agreement, the Share Pledge Agreement shall be terminated and ADHG shall terminate this agreement as soon as reasonably practicable.

4) Power of Attorney: Pursuant to the Power of Attorney, Messrs. Lam Chi Kwong Leo, as the sole shareholder of ACIL, granted to the ADHG the right to (i) attend shareholders meetings of ACIL (ii) exercise all shareholder rights (including voting rights) with respect to such equity interests in ACIL and (iii) designate and appoint on behalf of such shareholders the legal representative, directors, supervisors, and other senior management members of ACIL. The Power of Attorney is irrevocable and is continuously valid from the date of execution of such Power of Attorney, so long as such persons remain shareholders of ACIL.

5) Exclusive Option Agreement: Pursuant to the Exclusive Option Agreement, the shareholders of ACIL granted to the ADHG an irrevocable and exclusive right and option to purchase all of their equity interests in ACIL. The purchase price shall be equal to the capital paid in by the shareholders, adjusted pro rata for the purchase of less than all of the equity interests. The Agreement is effective for a term of 10 years, and may be renewed at ADHG’s election.

For the year ended September 30, 2019, we generated $89 revenue and had $75,645 in expenses for a net loss of $78,750. For the year ended September 30, 2018, we generated $769 in revenue and had $32,172 in expenses for a net loss of $31,428.

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012. Under the JOBS Act, “emerging growth companies”, can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Our principal executive offices are located at Room 1107, 11/F, Lippo Sun Plaza, 28 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong. Our telephone number is +852 23519122. We were incorporated under the laws of the State of Nevada on August 22, 2015. Our fiscal year end is September 30.

2

Principal Business

The Company is currently pursuing business opportunities in Hong Kong. The Company acquired 4 companies during this financial year of 2019, which were Ando Automobile Technology Limited, Ando Capital Investment Limited, Xian Ando Industrial Company Limited and Xian Ando Factoring Commercial Company Limited. As of December 30, 2019, Ando Capital Investment Limited is the only operating company while it provides insurance planning services and sells the insurance products of Sun Life Hong Kong Limited to potential prospects.

Government Regulation

We provide our services initially in Hong Kong and China. We target those customers from Hong Kong and China doing international business and plan to provide our insurance and factoring services to meet their needs for coverage and short-term liquidity.

The following regulations are the laws and regulations that may be applicable to us:

Hong Kong

Our businesses located in Hong Kong are subject to the general laws in Hong Kong governing businesses, including labor, occupational safety and health, general corporations, intellectual property and other similar laws. Because our website is maintained through the server in Hong Kong, we expect that we will be required to comply with the rules of regulations of Hong Kong governing the data usage and regular terms of service applicable to our potential customers. As the information of our potential customers is preserved in Hong Kong, we will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486).

The Employment Ordinance is the main piece of legislation governing conditions of employment in Hong Kong. It covers a comprehensive range of employment protection and benefits for employees, including Wage Protection, Rest Days, Holidays with Pay, Paid Annual Leave, Sickness Allowance, Maternity Protection, Statutory Paternity Leave, Severance Payment, Long Service Payment, Employment Protection, Termination of Employment Contract, Protection Against Anti-Union Discrimination.

An employer must also comply with all legal obligations under the Mandatory Provident Fund Schemes Ordinance, (Cap 485). These include enrolling all qualifying employees in Mandatory Provident Fund (“MPF”) schemes and making MPF contributions for them. Except for exempt persons, employer should enroll both full-time and part-time employees who are at least 18 but under 65 years of age in an MPF scheme within the first 60 days of employment. The 60-day employment rule does not apply to casual employees in the construction and catering industries.

We are required to make MPF contributions for our Hong Kong employees once every contribution period (generally the wage period). Employers and employees are each required to make regular mandatory contributions of 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly-paid employee, the minimum and maximum relevant income levels are $7,100 and $30,000 respectively. As of December 30, 2019, we have no employee employed under our Hong Kong subsidiaries.

We are in compliance with the above applicable ordinances and regulations in Hong Kong and have not involved any lawsuit or prosecuted by the local authority resulting from any breach of the ordinances and regulations.

People’s Republic of China (“China” or the “PRC”)

A portion of our acquired businesses are located in China and subject to the general laws in China governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

Employment Contracts

The Employment Contract Law was promulgated by the National People’s Congress’ Standing Committee on June 29, 2007 and took effect on January 1, 2008. The Employment Contract Law governs labor relations and employment contracts (including the entry into, performance, amendment, termination and determination of employment contracts) between domestic enterprises (including foreign-invested companies), individual economic organizations and private non-enterprise units (collectively referred to as the “employers”) and their employees.

3

a. Execution of employment contracts

Under the Employment Contract Law, an employer is required to execute written employment contracts with its employees within one month from the commencement of employment. In the event of contravention, an employee is entitled to receive double salary for the period during which the employer fails to execute an employment contract. If an employer fails to execute an employment contract for more than 12 months from the commencement of the employee’s employment, an employment contract would be deemed to have been entered into between the employer and employee for a non-fixed term.

b. Right to non-fixed term contracts

Under the Employment Contract Law, an employee may request a non-fixed term contract without an employer’s consent to renew. In addition, an employee is also entitled to a non-fixed term contract with an employer if he has completed two fixed term employment contracts with such employer; however, such employee must not have committed any breach or have been subject to any disciplinary actions during his employment. Unless the employee requests to enter into a fixed term contract, an employer who fails to enter into a non-fixed term contract pursuant to the Employment Contract Law is liable to pay the employee double salary from the date the employment contract is renewed.

c. Compensation for termination or expiry of employment contracts

Under the Employment Contract Law, employees are entitled to compensation upon the termination or expiry of an employment contract. Employees are entitled to compensation even in the event the employer (i) has been declared bankrupt; (ii) has its business license revoked; (iii) has been ordered to cease or withdraw its business; or (iv) has been voluntarily liquidated. Where an employee has been employed for more than one year, the employee will be entitled to such compensation equivalent to one month’s salary for every completed year of service. Where an employee has been employed for less than one year, such employee will be deemed to have completed one full year of service.

d. Trade union and collective employment contracts

Under the Employment Contract Law, a trade union may seek arbitration and litigation to resolve any dispute arising from a collective employment contract; provided that such dispute failed to be settled through negotiations. The Employment Contract Law also permits a trade union to enter into a collective employee contract with an employer on behalf of all the employees.

Where a trade union has not been formed, a representative appointed under the recommendation of a high-level trade union may execute the collective employment contract. Within districts below county level, collective employment contracts for industries such as those engaged in construction, mining, food and beverage and those from the service sector, etc., may be executed on behalf of employees by the representatives from the trade union of each respective industry. Alternatively, a district-based collective employment contract may be entered into.

As a result of the Employment Contract Law, all of our employees have executed standard written employment agreements with us. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

On October 28, 2010, the National People’s Congress of China promulgated the People’s Republic of China (“PRC”) Social Insurance Law, which became effective on July 1, 2011. In accordance with the PRC Social Insurance Law, the Interim Regulations on the Collection and Payment of Social Security Fund and other relevant laws and regulations, China establishes a social insurance system including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance and maternity insurance. An employer shall pay the social insurance for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance that should be assumed by the employees. The authorities in charge of social insurance may request an employer’s compliance and impose sanctions if such employer fails to pay and withhold social insurance in a timely manner. Under the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds.

4

The Ministry of Human Resources and Social Security promulgated the Interim Provisions on Labor Dispatch on January 24, 2014. The Interim Provisions on Labor Dispatch, which became effective on March 1, 2014, sets forth that labor dispatch should only be applicable to temporary, auxiliary or substitute positions. Temporary positions shall mean positions subsisting for no more than six months, auxiliary positions shall mean positions of non-major business that serve positions of major businesses, and substitute positions shall mean positions that can be held by substitute employees for a certain period of time during which the employees who originally hold such positions are unable to work as a result of full-time study, being on leave or other reasons. The Interim Provisions further provides that, the number of the dispatched workers of an employer shall not exceed 10% of its total workforce, and the total workforce of an employer shall refer to the sum of the number of the workers who have executed labor contracts with the employer and the number of workers who are dispatched to the employer.

Foreign Exchange Control and Administration

Foreign exchange in China is primarily regulated by:

The Foreign Currency Administration Rules (1996), as amended; and

The Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules.

Under the Foreign Currency Administration Rules, if documents certifying the purposes of the conversion of RMB into foreign currency are submitted to the relevant foreign exchange conversion bank, the RMB will be convertible for current account items, including the distribution of dividends, interest and royalty payments, and trade and service-related foreign exchange transactions. Conversion of RMB for capital account items, such as direct investment, loans, securities investment and repatriation of investment, however, is subject to the approval of SAFE or its local counterpart.

Under the Administration Rules for the Settlement, Sale and Payment of Foreign Exchange, foreign-invested enterprises may only buy, sell and/or remit foreign currencies at banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from SAFE or its local counterpart.

As an offshore holding company with a PRC subsidiary, we may (i) make additional capital contributions to our PRC subsidiaries, (ii) establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, (iii) make loans to our PRC subsidiaries or consolidated affiliated entities, or (iv) acquire offshore entities with business operations in China in offshore transactions. However, most of these uses are subject to PRC regulations and approvals. For example:

Capital contributions to our PRC subsidiaries, whether existing or newly established ones, must be approved by the Ministry of Commerce or its local counterparts;

Loans by us to our PRC subsidiaries, each of which is a foreign-invested enterprise, to finance their activities cannot exceed statutory limits and must be registered with SAFE or its local branches; and

Loans by us to our consolidated affiliated entities, which are domestic PRC entities, must be approved by the National Development and Reform Commission and must also be registered with SAFE or its local branches.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-invested Enterprises, or “Circular 142”. On March 30, 2015, SAFE issued the Circular of the State Administration of Foreign Exchange Concerning Reform of the Administrative Approaches to Settlement of Foreign Exchange Capital of Foreign-invested Enterprises, or “Circular 19”, which became effective on June 1, 2015, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into RMB by restricting how the converted RMB may be used. Circular 19 requires that RMB converted from the foreign currency-dominated capital of a FIE shall be managed under the Accounts for FX settlement and pending payment. The expenditure scope of such Accounts includes expenditure within the business scope, payment of funds for domestic equity investment and RMB deposits, repayment of the RMB loans after completed utilization and so forth. A FIE shall truthfully use its capital

5

by itself within the business scope and shall not, directly or indirectly, use its capital or RMB converted from the foreign currency-dominated capital for (i) expenditure beyond its business scope or expenditure prohibited by laws or regulations, (ii) disbursing RMB entrusted loans (unless permitted under its business scope), repaying inter-corporate borrowings (including third-party advance) and repaying RMB bank loans already refinanced to any third party. Where a FIE, other than a foreign-invested investment company, foreign-invested venture capital enterprise or foreign-invested equity investment enterprise, makes domestic equity investment by transferring its capital in the original currency, it shall obey the current provisions on domestic re-investment. Where such a FIE makes domestic equity investment by its RMB conversion, the invested enterprise shall first go through domestic re-investment registration and open a corresponding Accounts for FX settlement and pending payment, and the FIE shall thereafter transfer the conversion to the aforesaid Account according to the actual amount of investment. In addition, according to the Regulations of the People’s Republic of China on Foreign Exchange Administration, which became effective on August 5, 2008, the use of foreign exchange or RMB conversion may not be changed without authorization.

Violations of the applicable circulars and rules may result in severe penalties, including substantial fines as set forth in the Foreign Exchange Administration Regulations.

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will always be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans to our PRC subsidiary or future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to capitalize or otherwise fund our PRC operations may be negatively affected, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

Currently, we are in compliance with the above applicable ordinances and regulations in China and have not involved any lawsuit or prosecuted by the local authority resulting from any breach of the ordinances and regulations.

As of December 30, 2019, we haven’t commenced our factoring business plan in China and there is no employee employed under our China subsidiaries.

Insurance

We do not current maintain property, business interruption and casualty insurance. As our business matures, we expect to obtain such insurance in accordance with customary industry practices in Hong Kong and China, as applicable.

Seasonality

Our businesses are not subject to seasonality.

Research and Development

We have not spent any funds on research and development activities in connection with our business.

Personnel

As of September 30, 2019, we employed two persons on a part-time basis, who are our CEO, Mr Lam Chi Kwong Leo and our CFO, Ms. Lee Hiu Lan. None of our employees is subject to a collective bargaining agreement. We believe that our relationship with our employees is good.

Not applicable to smaller reporting companies.

Item 1B. Unresolved Staff Comments.

None.

6

Our executive offices are located at Room 1107, 11/F, Lippo Sun Plaza, 28 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong. The Company does not own or rent property. The office space is provided by Ando Credit Limited, a Hong Kong company, at no charge. We believe that this space is adequate for our present needs.

We are not a party to any legal proceedings, nor are we aware of any threatened litigation whatsoever.

Item 4. Mine Safety Disclosures

Not applicable to smaller reporting companies.

7

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is currently quoted on the OTCQB under the trading symbol “ADHG”. Our common stock did not trade prior to May 8, 2017.

Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company’s operations or business prospects. We cannot assure you that there will be a market for our common stock in the future.

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Fiscal Year 2019 |

| High Bid |

| Low Bid | ||

| First Quarter |

| $ | 8.00 |

| $ | 4.00 |

| Second Quarter |

| $ | 4.00 |

| $ | 4.00 |

| Third Quarter |

| $ | 4.00 |

| $ | 4.00 |

| Fourth Quarter |

| $ | 4.00 |

| $ | 4.00 |

|

|

|

|

|

|

|

|

| Fiscal Year 2018 |

| High Bid |

| Low Bid | ||

| First Quarter |

| $ | 1.25 |

| $ | 0.10 |

| Second Quarter |

| $ | 50.00 |

| $ | 1.25 |

| Third Quarter |

| $ | 26.375 |

| $ | 26.375 |

| Fourth Quarter |

| $ | 26.375 |

| $ | 8.00 |

We have issued 12,000,000 shares of our common stock since our inception on August 8, 2015. There are no outstanding options or warrants or securities that are convertible into shares of common stock.

Holders of Record

As of September 30, 2019, we have 39 shareholders of record of our common stock.

Equity Compensation Plan Information

We have not adopted or approved an equity compensation plan. None of options, warrants or other convertible securities have been granted outside of an approved equity compensation plan.

Transfer Agent and Registrar

The transfer agent for our capital stock is Globex Transfer LLC, with an address at 80 Deltona Blvd., Suite 202, Deltona, FL 32725 and telephone number is +1 813 344 4490.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the

8

penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

Dividends

No cash dividends were paid on our shares of common stock during the fiscal year ended September 30, 2019, 2018, 2017 and 2016. We have not paid any cash dividends since August 22, 2015 (inception) and do not foresee declaring any cash dividends on our common stock in the foreseeable future.

Recent Sales of Registered Securities

None.

Item 6. Selected Financial Data.

Not applicable to smaller reporting companies.

Item 7. Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

The following discussion and analysis should be read in conjunction with our financial statements, including the notes thereto, appearing in this Form 10-K and are hereby referenced. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this report. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. We believe it is important to communicate our expectations. However, our management disclaims any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise.

These forward-looking statements are based on our management’s current expectations and beliefs and involve numerous risks and uncertainties that could cause actual results to differ materially from expectations. You should not rely upon these forward-looking statements as predictions of future events because we cannot assure you that the events or circumstances reflected in these statements will be achieved or will occur. You can identify a forward-looking statement by the use of the forward-terminology, including words such as “may”, “will”, “believes”, “anticipates”, “estimates”, “expects”, “continues”, “should”, “seeks”, “intends”, “plans”, and/or words of similar import, or the negative of these words and phrases or other variations of these words and phrases or comparable terminology. These forward-looking statements relate to, among other things: our sales, results of operations and anticipated cash flows; capital expenditures; depreciation and amortization expenses; sales, general and administrative expenses; our ability to maintain and develop relationship with our existing and potential future customers; and, our ability to maintain a level of investment that is required to remain competitive. Many factors could cause our actual results to differ materially from those projected in these forward-looking statements, including, but not limited to: variability of our revenues and financial performance; risks associated with technological changes; the acceptance of our products in the marketplace by existing and potential customers; disruption of operations or increases in expenses due to our involvement with litigation or caused by civil or

9

political unrest or other catastrophic events; general economic conditions, government mandates; and, the continued employment of our key personnel and other risks associated with competition.

Overview

Ando Holdings Ltd., formerly known as PC Mobile Media Corp. was formed in the state of Nevada on August 22, 2015. After thorough discussion and analysis on the mobile billboard industry, the Company decided to terminate its plans in that industry. The Company is currently pursuing business opportunities in Hong Kong. The Company is contemplating purchasing two existing companies, one in financing and the other in the retail tea business. As of December 28, 2018, there has been no major progress regarding these acquisitions.

On September 5, 2017, the amendment to the Company’s articles of incorporation was declared effective in the State of Nevada. The amendment changed the name of the Company from PC Mobile Media Corp. to Ando Holdings Ltd.

As of September 25, 2017, FINRA accepted the name change and issued a new trading symbol for the Company. The new trading symbol for the Company is ADHG.

On November 29, 2018, the Company acquired Ando Automobile Technology Limited from Lam Chi Kwong Leo with a cash consideration of $1,282. The Company intends this fully owned subsidiary to operate as an automobile trading company, trading in foreign-made automobiles to be shipped to Chinese buyers directly. As of September 30, 2019, this subsidiary has no operation.

On September 30, 2019, the Company and Ando Capital Investment Limited, a limited liability company incorporated in Hong Kong (“ACIL”) and Mr. Lam Chi Kwong Leo, a permanent Hong Kong resident, a major shareholder of the Company, our director and Chief Executive Officer and the sole shareholder of ACIL, entered into the a set of agreements, collectively named as the “Variable Interest Entity or VIE Agreements,” pursuant to which the Company has contractual rights to control and operate the business of ACIL (the “VIE”). ACIL currently has insurance business and was established as our VIE for our future business expansion and development in Hong Kong. We filed a Form 8-K on October 4, 2019.

Plan of Operation

The Company is currently pursuing business opportunities in Hong Kong. The Company acquired 4 companies during this financial year, which were Ando Automobile Technology Limited, Ando Capital Investment Limited, Xian Ando Industrial Company Limited and Xian Ando Factoring Commercial Company Limited. As of December 30, 2019, only Ando Capital Investment Limited is an operating company while it provides insurance planning services and sells the insurance products of Sun Life Hong Kong Limited to potential prospects.

Results of Operations for the Year Ended September 30, 2019 Compared to the Year Ended September 30, 2018

Revenues. The Company had no revenue for the years ended September 30, 2019 and 2018.

Selling, General and Administrative Expenses. Selling, general and administrative expenses for the year ended September 30, 2019 were $75,645 as compared to $32,172 for the year ended September 30, 2018. General and administrative expenses increased due to professional fee incurred during the acquisition of subsidiaries.

Finance Cost. Interest Expense for the year ended September 30, 2019 was $3,244 as compared to $0 for the year ended September 30, 2018. The increase of such interest expense was due to the issuance of a promissory note with principal $50,000 at 12% per annum on February 1, 2019.

10

Liquidity and Capital Resources

We measure our liquidity in a number of ways, including the following:

|

| As of |

| As of | ||

|

| September 30, 2019 |

| September 30, 2018 | ||

|

|

|

|

| ||

| Cash | $ | 61,816 |

| $ | 878 |

| Prepaid Expenses |

| 13,000 |

|

| 9,000 |

| Related Party Loans |

| 123,610 |

|

| 48,958 |

| Working Deficit |

| (120,669) |

|

| (41,919) |

| Total Current liabilities | $ | 195,485 |

| $ | 51,797 |

Impact of Inflation

We believe that the rate of inflation has had negligible effect on our operations. We believe we can absorb most, if not all, increased non-controlled operating costs by increasing sales prices, whenever deemed necessary and by operating our Company in the most efficient manner possible.

Net Cash Used in Operating Activities

We experienced net cash used in operating activities for the year ended September 30, 2019 of $64,368 due to cash used to fund a net loss of $78,750. We experienced net cash used in operating activities of $35,737 for the year ended September 30, 2018 due to cash used to fund a net loss of $32,197.

Net Cash Used in Investing Activities

We experienced no cash flow from investing activities for years ended September 30, 2019 and 2018.

Net Cash Provided by Financing Activities

We experienced net cash provided by financing activities in the amount of $125,306 for year ended September 30, 2019 due to related party loans and an issuance of promissory note. We experienced net cash provided by financing activities in the amount of $35,737 for the year ended September 30, 2018 due to the related party loans.

Availability of Additional Funds

Based on our working capital deficit as of September 30, 2019, we will need additional equity and/or debt financing to continue our operations during the next 12 months.

Critical Accounting Policies and Estimates

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from these estimates. Our significant estimates and assumptions include the fair value of our stock, and the valuation allowance relating to the Company’s deferred tax assets.

We qualify as an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act, which became law in April 2012. Under the JOBS Act, “emerging growth companies”, can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

11

Recently Issued Accounting Pronouncements

Reference is made to the “Significant Accounting Pronouncements” in Note 3 to our financial statements included elsewhere in this report for information related to new accounting pronouncements.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Material Commitments

Nil.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We are not subject to risks related to foreign currency exchange rate fluctuations. Our functional currency is the United States dollar. We do not transact our business in other currencies. As a result, we are not subject to exposure from movements in foreign currency exchange rates. We do not use derivative financial instruments for speculative trading purposes.

Item 8. Financial Statements and Supplementary Data.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

| Page |

| Financial Statements |

|

|

|

|

| Report of Independent Registered Public Accounting Firm | F-1 |

|

|

|

| Consolidated Balance Sheets as of September 30, 2019 and 2018 | F-2 |

|

|

|

| Consolidated Statements of Operations for the years ended September 30, 2019 and 2018 | F-3 |

|

|

|

| Consolidated Statements of Changes in Stockholders’ Equity (Deficit) for the years ended September 30, 2019 and 2018 | F-4 |

|

|

|

| Consolidated Statements of Cash Flows for the years ended September 30, 2019 and 2018 | F-5 |

|

|

|

| Notes to the Consolidated Financial Statements | F-6 |

12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To: The Board of Directors and Stockholders of Ando Holdings Limited

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of Ando Holdings Ltd. and subsidiaries (the “Company”) as of September 30, 2019 and 2018, the related statements of operations , stockholders’ deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2019 and 2018, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Going Concern Matter

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has suffered recurring losses from operations that raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. Our audits included performing procedures to assess the risks of material misstatement, whether due to error fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Emphasis of Matter

As discussed in Note 9 to the financial statements, subsequent to the date of the financial statements, the Company issued promissory notes to several note holders for an aggregate of $1,380,000 with an interest rate of 10% per annum. In December, 2019, the Company loaned $988,000 to Ando Credit Limited, a related party which the CEO of the Company has significant influence on, with an interest rate of 12% per annum.

/s/ TAAD LLP

We have served as the Company’s auditor since 2017

Diamond Bar, California

January 16, 2020

F-1

ANDO HOLDINGS LIMITED

AS OF SEPTEMBER 30, 2019 AND 2018

(Currency expressed in United States Dollars (“US$”), except for number of share)

|

| September 30, 2019 |

| September 30, 2018 | ||

|

|

|

|

| ||

| ASSETS |

|

|

| ||

|

|

|

|

| ||

| Current Assets |

|

|

|

|

|

| Cash and Cash Equivalents | $ | 61,816 |

| $ | 878 |

| Prepaid Expenses |

| 13,000 |

|

| 9,000 |

| Total Current Assets | $ | 74,816 |

| $ | 9,878 |

|

|

|

|

|

|

|

| TOTAL ASSETS | $ | 74,816 |

| $ | 9,878 |

|

|

|

|

|

|

|

| LIABILITIES & STOCKHOLDERS' DEFICIT |

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

| Income Tax Payable | $ | 28 |

| $ | 28 |

| Amount Due To Director |

| 2,789 |

|

| 2,135 |

| Amount Due To Related Parties |

| 123,610 |

|

| 48,958 |

| Accounts Payable & Accrued Expenses |

| 19,058 |

|

| 676 |

| Related Party - Note Payable |

| 50,000 |

|

| - |

| Total Current Liabilities | $ | 195,485 |

| $ | 51,797 |

|

|

|

|

|

|

|

| TOTAL LIABILITIES | $ | 195,485 |

| $ | 51,797 |

|

|

|

|

|

|

|

| STOCKHOLDERS' DEFICIT |

|

|

|

|

|

| Common Stock, $0.001 Par Value Authorized Common Stock 75,000,000 shares at $0.001 Issued and Outstanding 12,000,000 Common Shares at September 30, 2019 and September 30, 2018 | $ | 12,000 |

| $ | 12,000 |

| Additional Paid In Capital |

| 58,853 |

|

| 58,853 |

| Accumulated Deficit |

| (191,522) |

|

| (112,772) |

| TOTAL STOCKHOLDERS' DEFICIT | $ | (120,669) |

| $ | (41,919) |

|

|

|

|

|

|

|

| TOTAL LIABILITIES & STOCKHOLDERS' DEFICIT | $ | 74,816 |

| $ | 9,878 |

The auditor's report and accompanying notes are an integral part of these consolidated financial statements.

F-2

ANDO HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED SEPTEMBER 30, 2019 AND 2018

(Currency expressed in United States Dollars (“US$”), except for number of share)

|

| Year ended September 30, 2019 |

| Year ended September 30, 2018 | ||

|

|

|

|

| ||

| REVENUE | $ | - |

| $ | - |

|

|

|

|

|

|

|

| COST OF REVENUE |

| - |

|

| - |

|

|

|

|

|

|

|

| GROSS PROFIT |

| - |

|

| - |

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

| General and Administrative |

| (75,645) |

|

| (32,172) |

|

|

|

|

|

|

|

| Total Expenses |

| (75,645) |

|

| (32,172) |

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

| (75,645) |

|

| (32,172) |

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

| Sundry Income |

| 39 |

|

| - |

| Finance Cost |

| (3,244) |

|

| - |

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAX |

| (78,850) |

|

| (32,172) |

| Income Tax Refund (Expense) |

| 100 |

|

| (25) |

| NET LOSS FROM CONTINUING OPERATIONS | $ | (78,750) |

| $ | (32,197) |

|

|

|

|

|

|

|

| BASIC AND DILUTED LOSS PER COMMON SHARE | $ | (0.01) |

| $ | (0.00) |

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING |

| 12,000,000 |

|

| 12,000,000 |

The auditor's report and accompanying notes are an integral part of these consolidated financial statements.

F-3

ANDO HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE YEARS ENDED SEPTEMBER 30, 2019 AND 2018

|

| Common Stock |

|

|

| |||||

|

| Number of Shares | Amount | Additional Paid-In Capital | Accumulated Deficit | Total | ||||

|

|

|

|

|

|

| ||||

| Balance, as of September 30, 2017 | 12,000,000 | $ | 12,000 | $ | 58,853 | $ | (80,575) | $ | (9,722) |

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) for the year ended September 30, 2018 |

|

|

|

|

|

| (32,197) |

| (32,197) |

|

|

|

|

|

|

|

|

|

|

|

| Balance, as of September 30, 2018 | 12,000,000 | $ | 12,000 | $ | 58,853 | $ | (112,772) | $ | (41,919) |

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) for the year ended September 30, 2019 |

|

|

|

|

|

| (78,750) |

| (78,750) |

|

|

|

|

|

|

|

|

|

|

|

| Balance, as of September 30, 2019 | 12,000,000 | $ | 12,000 | $ | 58,853 | $ | (191,522) | $ | (120,669) |

The auditor's report and accompanying notes are an integral part of these consolidated financial statements.

F-4

ANDO HOLDINGS LIMITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED SEPTEMBER 30, 2019 AND 2018

|

| Year ended September 30, 2019 |

| Year ended September 30, 2018 | ||

|

|

|

|

| ||

| OPERATING ACTIVITIES |

|

|

| ||

| Net Loss | $ | (78,750) |

| $ | (32,197) |

| Adjustments to reconcile Net Loss to net cash provided by operations: |

|

|

|

|

|

| Increase in Prepaid Expenses |

| (4,000) |

|

| (1,100) |

| Increase / (Decrease) in AP & Accrued Expenses |

| 18,382 |

|

| (2,465) |

| Increase in Tax Liabilities |

| - |

|

| 25 |

| Net cash used in Operating Activities | $ | (64,368) |

| $ | (35,737) |

|

|

|

|

|

|

|

| FINANCING ACTIVITIES |

|

|

|

|

|

| Advances from directors |

| 654 |

|

| 929 |

| Proceeds from Related Party - Promissory Note |

| 50,000 |

|

| - |

| Proceeds from Related Party Loan |

| 74,652 |

|

| 34,808 |

| Net cash provided by Financing Activities | $ | 125,306 |

| $ | 35,737 |

|

|

|

|

|

|

|

| Net increase in Cash for period |

| 60,938 |

|

| - |

| Cash at beginning of period |

| 878 |

|

| 878 |

| Cash at end of period | $ | 61,816 |

| $ | 878 |

|

|

|

|

|

|

|

| Supplemental Cash Flow Information and noncash Financing Activities: |

|

|

|

|

|

| Expenses paid by related party on behalf of the Company | $ | 74,652 |

| $ | 34,808 |

| Finance Cost Paid | $ | 2,827 |

| $ | - |

The auditor's report and accompanying notes are an integral part of these consolidated financial statements.

F-5

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED SEPTEMBER 30, 2019 AND 2018

NOTE 1 - NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Ando Holdings Ltd. (“Ando Holdings Ltd.” or the “Company”) was incorporated in the State of Nevada on August 22, 2015 and its fiscal year end is September 30. The primary business of the company was previously to offer mobile billboard display advertising. After thorough analysis, the Company terminated its advertising business. The Company is currently pursuing business opportunities in Hong Kong. The Company acquired 4 companies during this financial year, which were Ando Automobile Technology Limited, Ando Capital Investment Limited, Xian Ando Industrial Company Limited and Xian Ando Factoring Commercial Company Limited.

On November 29, 2018, the Company acquired Ando Automobile Technology Limited, a limited liability company incorporated in Hong Kong (“AATL”), from Lam Chi Kwong Leo with a cash consideration of $1,282. The Company intends this fully owned subsidiary to operate as an automobile trading company, trading in foreign-made automobiles to be shipped to Chinese buyers directly. As of September 30, 2019, this subsidiary had no operation.

On September 30, 2019, the Company and Ando Capital Investment Limited, a limited liability company incorporated in Hong Kong (“ACIL”) and Mr. Lam Chi Kwong Leo, a permanent Hong Kong resident, a major shareholder of the Company, our director and Chief Executive Officer and the sole shareholder of ACIL, entered into the a set of agreements, collectively named as the “Variable Interest Entity or VIE Agreements,” pursuant to which the Company has contractual rights to control and operate the business of ACIL (the “VIE”). ACIL currently has insurance business and has been our VIE for our future business expansion and development in Hong Kong. ACIL has two wholly owned subsidiaries, namely Xian Ando Holdings Company Limited and Xian Ando Commercial Factoring Company Limited, and these two wholly owned subsidiaries have minimal operations.

Mr. Lam Chi Kwong Leo is the common director and major shareholder of the Company and ACIL. As a result of this common ownership and in accordance with the FASB Accounting Standards Codification Section 805 “Business Combination”, the transaction is being treated as a combination between entities under common control. The recognized assets and liabilities were transferred at their carrying amounts at the date of the transaction. The equity accounts of the combining entities are combined. Further, the companies will be combined retrospectively for prior year comparative information as if the transaction had occurred on October 1, 2017.

NOTE 2 - GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. For the period from inception on August 22, 2015 through September 30, 2019, the Company has had minimal operations, and has accumulated a deficit of $191,522. In view of this, the Company’s ability to continue as a going concern is dependent upon the Company’s ability to continue operations and to achieve a level of profitability large enough to cover the Company’s expenses. The Company intends on financing its future development activities and its working capital needs largely from the sale of public equity securities, with some additional funding from other traditional financing sources, until such time that funds provided by operations are sufficient to fund working capital requirements. The financial statements of the Company do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern. Management has evaluated these factors and has determined that they raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued.

The officers and directors have agreed to advance funds to the Company to meet its obligations.

F-6

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with generally accepted accounting principles requires us to establish accounting policies and make estimates and assumptions that affect our reported amounts of assets and liabilities at the date of the financial statements. These financial statements include some estimates and assumptions that are based on informed judgments and estimates of management. We evaluate our policies and estimates on an on-going basis and discuss the development, selection, and disclosure of critical accounting policies with the Board of Directors. Predicting future events is inherently an imprecise activity and as such requires the use of judgment. Our financial statements may differ based upon different estimates and assumptions.

Basis of Presentation

The accompanying financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

The accompanying financial statements include the accounts of the Company and its wholly-owned subsidiaries. Intercompany transactions and balances were eliminated in consolidation.

Below is the organization chart of the Group.

F-7

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Our deposit is currently deposit in DBS Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited, and there is a Deposit Protection Scheme protects our eligible deposits held with bank in Hong Kong which is members of the Scheme. The scheme will pay us a compensation up to a limit of HKD500,000, which is equivalent to $64,102, if DBS Bank (Hong Kong) Limited or Shanghai Commercial Bank Limited fails.

Revenue recognition

Prior to October 1, 2018, the Company recognized its revenue in accordance with Accounting Standards Codification (ASC) 605 Revenue Recognition, upon the delivery of its services or products when: (1) delivery had occurred or services rendered; (2) persuasive evidence of an arrangement existed; (3) there are no continuing obligations to the customer; and (4) the collection of related accounts receivable was probable.

Effective October 1, 2018, the Company adopted the guidance of ASC 606, Revenue from Contracts. The implementation of ASC 606 did not have a material impact on the Company’s consolidated financial statements. ASC 606 creates a five-step model that requires entities to exercise judgment when considering the terms of contracts, which includes (1) identifying the contracts or agreements with a customer, (2) identifying our performance obligations in the contract or agreement, (3) determining the transaction price, (4) allocating the transaction price to the separate performance obligations, and (5) recognizing revenue as each performance obligation is satisfied. The Company only applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange for the services it transfers to its clients. The adoption of ASC 606 had no effect on previously reported balances.

Income taxes

The Company accounts for income taxes using the asset and liability method. The asset and liability method requires recognition of deferred tax assets and liabilities for expected future tax consequences of temporary differences that currently exist between tax bases and financial reporting bases of the Company’s assets and liabilities. Deferred income tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which these temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is provided on deferred taxes if it is determined that it is more likely than not that the asset will not be realized. The Company recognizes penalties and interest accrued related to income tax liabilities in the provision for income taxes in its Consolidated Statements of Income.

Significant management judgment is required to determine the amount of benefit to be recognized in relation to an uncertain tax position. The Company uses a two-step process to evaluate tax positions. The first step requires an entity to determine whether it is more likely than not (greater than 50% chance) that the tax position will be sustained. The second step requires an entity to recognize in the financial statements the benefit of a tax position that meets the more-likely-than-not recognition criterion. The amounts ultimately paid upon resolution of issues raised by taxing authorities may differ materially from the amounts accrued and may materially impact the financial statements of the Company in future periods.

F-8

Cash Flow Reporting

The Company follows ASC 230, Statement of Cash Flows, for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method (“Indirect method”) as defined by ASC 230, Statement of Cash Flows, to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and payments.

The Company reports the reporting currency equivalent of foreign currency cash flows, using the current exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides information about investing and financing activities not resulting in cash receipts or payments in the period.

Net Loss Per Share

Basic loss per share includes no dilution and is computed by dividing loss available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive loss per share reflects the potential dilution of securities that could share in the losses of the Company. Because the Company does not have any potentially dilutive securities, the accompanying presentation is only of basic loss per share.

Related Parties

Parties are considered to be related to the Company if the parties that, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. Transactions with related parties are disclosed in the financial statements.

Economic and Political Risks

Substantially all of the Company’s services are conducted in Hong Kong. The Company’s operations are subject to various political, economic, and other risks and uncertainties inherent in Hong Kong and China in the future. Among other risks, the Company’s operations are subject to the risks of restrictions on transfer of funds; export duties, quotas, and embargoes; domestic and international customs and tariffs; changing taxation policies; foreign exchange restrictions; and political conditions and governmental regulations in Hong Kong and China.

The Company’s operations in the People’s Republic of China (“PRC” or “China”) are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (FASB) issued a new accounting standard update on revenue recognition from contracts with customers (Topic 606). The new guidance replaces all current GAAP guidance on this topic and requires entities to recognize revenue when control of the promised goods or services is transferred to customers at an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services. The Company adopted the new accounting standard on October 1, 2018. The Company evaluated the adoption of Topic 606 and has determined that it will not have a material impact on the Company’s financial statements as of September 30, 2019

F-9

Other than as noted above the Company has not implemented any pronouncements that had material impact on the financial statements, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

NOTE 4 - CAPITAL STOCK

The Company is authorized to issue an aggregate of 75,000,000 common shares with a par value of $0.001 per share. No preferred shares have been authorized or issued. As of September 30, 2019 and 2018, 12,000,000 common shares were issued and outstanding.

At September 30, 2018, there are no warrants or options outstanding to acquire any additional shares of common stock of the Company.

NOTE 5 - RELATED PARTY TRANSACTIONS

On February 1, 2019, the Company entered into a Note Purchase Agreement with an accredited related investor Lin Su Hui. Pursuant to this agreement, the Company issued a promissory note to Lin Su Hui for $50,000, at 10% interest per annum, with a maturity date of February 6, 2020. Per the agreement, the note began to accrue interest 5 days after the effective date February 1, 2019. The interest on the note is to be paid monthly. At September 30, 2019 and September 30, 2018, the Company has paid interest of $2,827 and $0 to Lin Su Hui in form of cash, and has accrued interest of $417 and $0, respectively.

At September 30, 2019 and 2018, a related party, that our CEO and director, Mr. Lam Chi Kwong Leo is the authorized representative, has paid expenses on behalf of the Company in the amount of $123,610 and $48,958, respectively. The loans are unsecured, payable on demand, and carry no interest.

For the year ended September 30, 2019, our CEO and director, Mr. Lam Chi Kwong Leo loaned certain amount to the Company. As of September 30, 2019 and 2018, the amounts due to director are recorded at $2,789 and $2,135 respectively. This loan is unsecured, payable on demand, and carry no interest.

The Company does not own or rent any property. The office space is provided by a related party at no charge.

NOTE 6 - INCOME TAXES

The income (loss) before income taxes of the Company for the years ended September 30, 2019 and 2018 were comprised of the following:

|

| For the years ended September 30, | ||||

|

| 2019 |

| 2018 | ||

| Tax jurisdictions from: |

|

|

|

|

|

| - Local | $ | (77,518) |

| $ | (31,243) |

| - Foreign, representing: |

|

|

|

|

|

| Hong Kong |

| (1,332) |

|

| (929) |

| PRC |

| - |

|

| - |

|

|

|

|

|

|

|

| Loss before income taxes | $ | (78,850) |

| $ | (32,172) |

F-10

Provision for income taxes consisted of the following:

|

| For the years ended September 30, | ||||

|

| 2019 |

| 2018 | ||

| Current: |

|

|

|

|

|

| - Local | $ | - |

| $ | - |

| - Foreign: |

|

|

|

|

|

| Hong Kong |

| - |

|

| - |

| PRC |

| - |

|

| - |

|

|

|

|

|

|

|

| Deferred: |

|

|

|

|

|

| - Local |

| - |

|

| - |

| - Foreign: | $ | - |

| $ | - |

The effective tax rate in the periods presented is the result of the mix of income earned in various tax jurisdictions that apply a broad range of income tax rates. During the periods presented, the Company has a number of subsidiaries that operates in different countries and is subject to tax in the jurisdictions in which its subsidiaries operate, as follows:

United States of America