Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d858048d8k.htm |

Amedisys Presentation J.P. Morgan Health Care Conference 2020 Exhibit 99.1

This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business and clinical operations and control processes, and SEC filings. Forward-looking statements

Making more than 12.3 million visits (nurses, therapists, chaplains, social workers, dieticians, aides and volunteers) Seeing more than 50,000 patients each day More than 21,000 employees company-wide deliver the highest quality care In collaboration with 2,600 hospitals and 67,000 physicians nationwide Amedisys: Who We Are

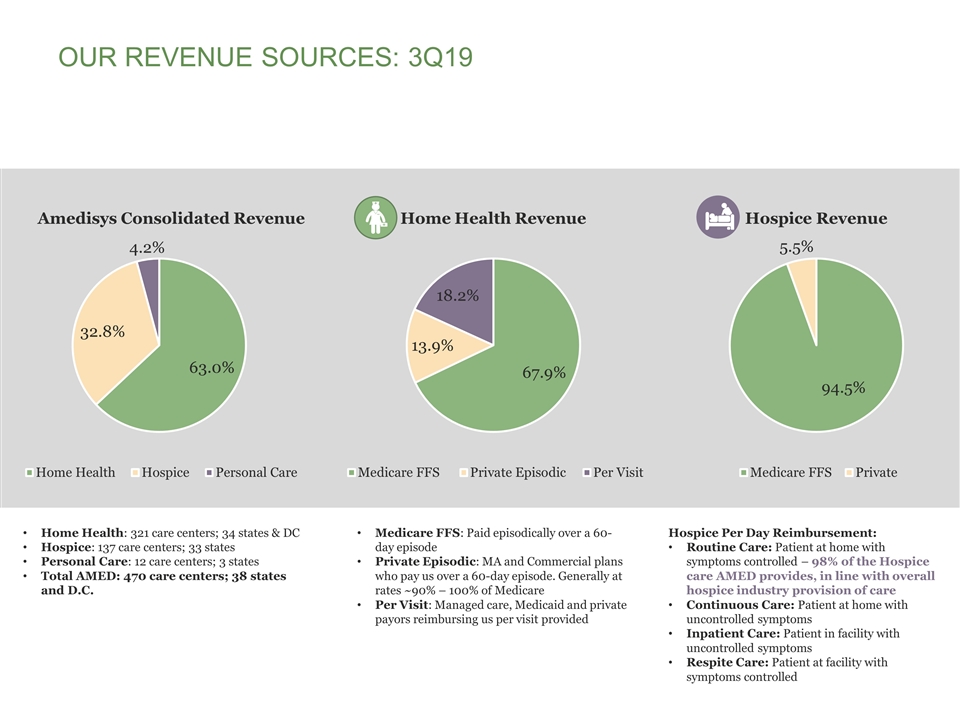

Our revenue sources: 3Q19 Medicare FFS: Paid episodically over a 60-day episode Private Episodic: MA and Commercial plans who pay us over a 60-day episode. Generally at rates ~90% – 100% of Medicare Per Visit: Managed care, Medicaid and private payors reimbursing us per visit provided Hospice Per Day Reimbursement: Routine Care: Patient at home with symptoms controlled – 98% of the Hospice care AMED provides, in line with overall hospice industry provision of care Continuous Care: Patient at home with uncontrolled symptoms Inpatient Care: Patient in facility with uncontrolled symptoms Respite Care: Patient at facility with symptoms controlled Home Health: 321 care centers; 34 states & DC Hospice: 137 care centers; 33 states Personal Care: 12 care centers; 3 states Total AMED: 470 care centers; 38 states and D.C.

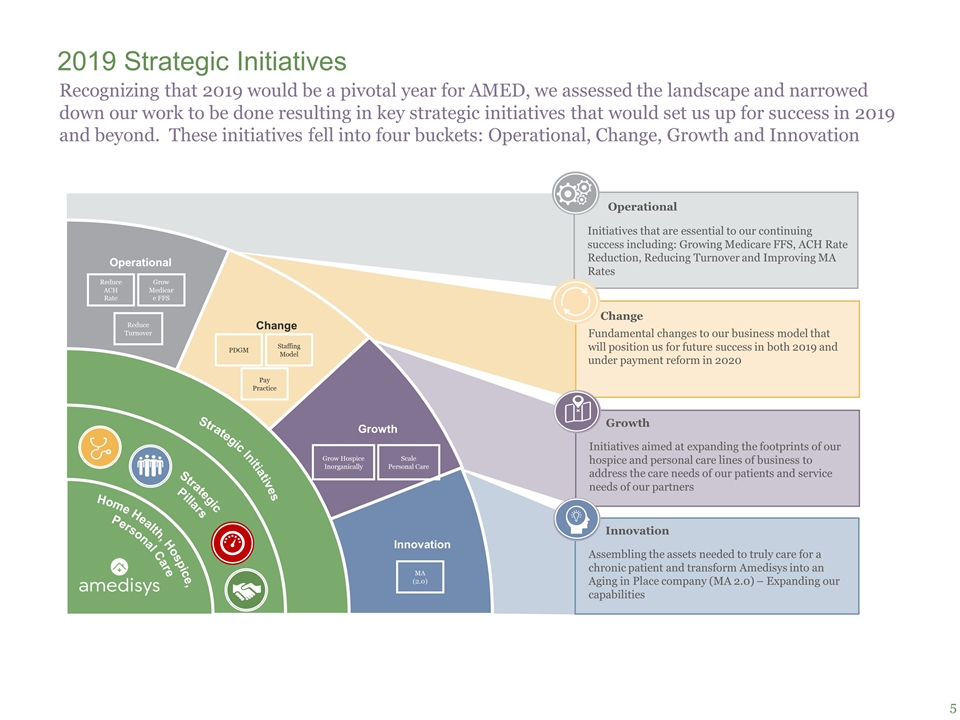

Recognizing that 2019 would be a pivotal year for AMED, we assessed the landscape and narrowed down our work to be done resulting in key strategic initiatives that would set us up for success in 2019 and beyond. These initiatives fell into four buckets: Operational, Change, Growth and Innovation Operational Change Growth Innovation Home Health, Hospice, Personal Care Strategic Pillars Strategic Initiatives Reduce ACH Rate Grow Medicare FFS PDGM Staffing Model Pay Practice Grow Hospice Inorganically Scale Personal Care MA (2.0) Reduce Turnover Change Growth Operational Fundamental changes to our business model that will position us for future success in both 2019 and under payment reform in 2020 Initiatives aimed at expanding the footprints of our hospice and personal care lines of business to address the care needs of our patients and service needs of our partners Initiatives that are essential to our continuing success including: Growing Medicare FFS, ACH Rate Reduction, Reducing Turnover and Improving MA Rates Innovation Assembling the assets needed to truly care for a chronic patient and transform Amedisys into an Aging in Place company (MA 2.0) – Expanding our capabilities 2019 Strategic Initiatives

OPERATIONAL Grow Medicare FFS Reduce ACH Rate Reduce Turnover CHANGE Operationalize PDGM Optimize Staffing Model Change Pay Practices GROWTH Grow Hospice Inorganically Scale Personal Care INNOVATION MA Risk Arrangements How we segmented our business priorities in 2019 2019 Strategic Initiatives

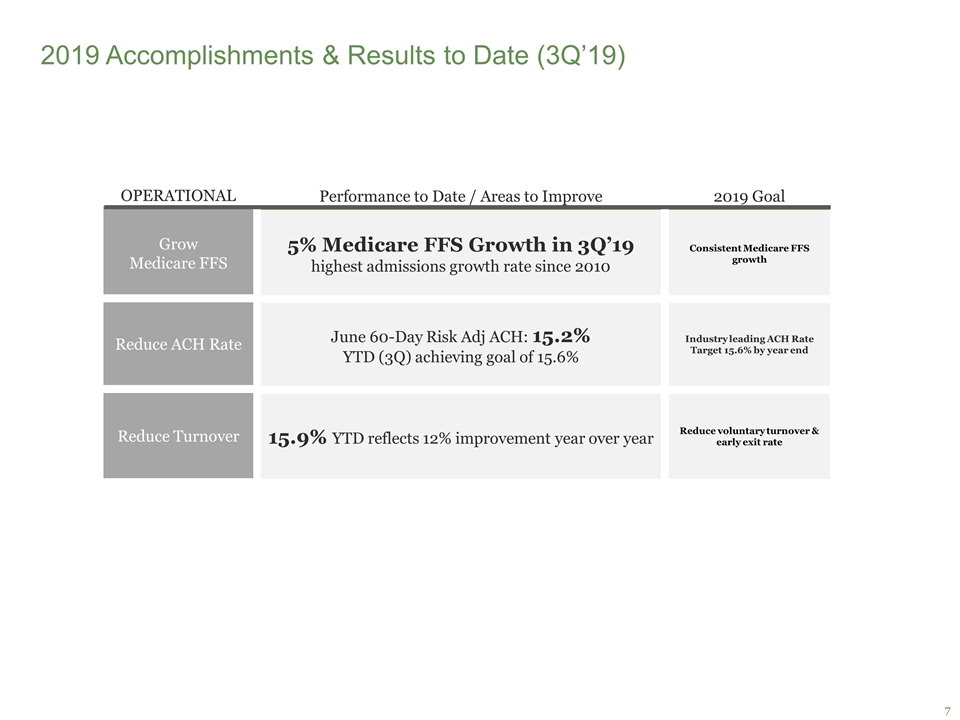

OPERATIONAL Grow Medicare FFS Reduce ACH Rate Reduce Turnover Performance to Date / Areas to Improve 5% Medicare FFS Growth in 3Q’19 highest admissions growth rate since 2010 June 60-Day Risk Adj ACH: 15.2% YTD (3Q) achieving goal of 15.6% 15.9% YTD reflects 12% improvement year over year 2019 Goal Consistent Medicare FFS growth Industry leading ACH Rate Target 15.6% by year end Reduce voluntary turnover & early exit rate 2019 Accomplishments & Results to Date (3Q’19)

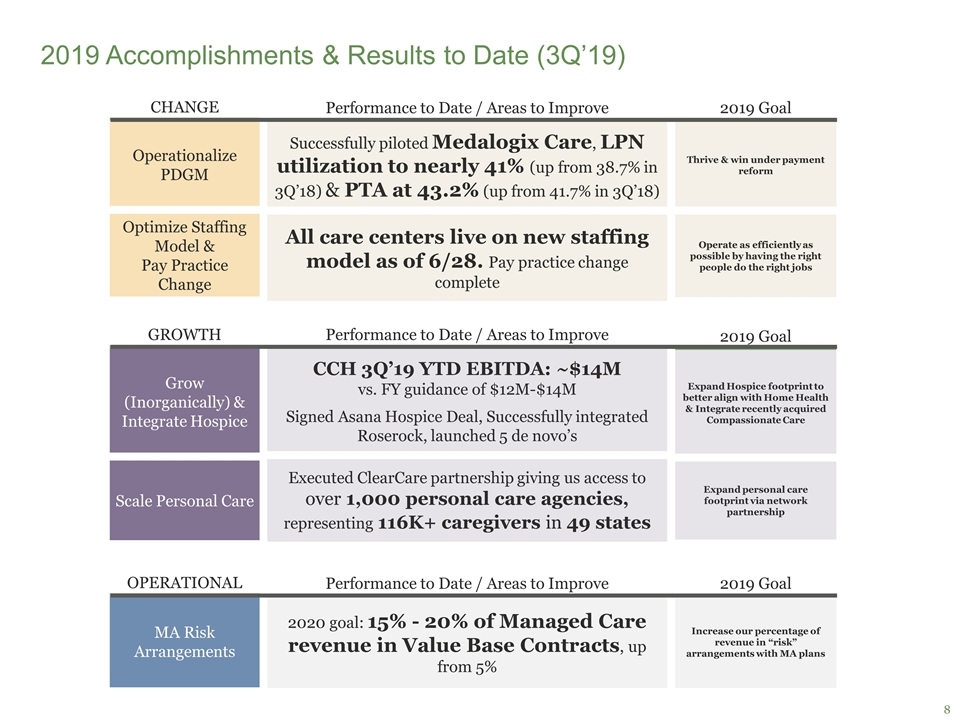

CHANGE Operationalize PDGM Optimize Staffing Model & Pay Practice Change Performance to Date / Areas to Improve Successfully piloted Medalogix Care, LPN utilization to nearly 41% (up from 38.7% in 3Q’18) & PTA at 43.2% (up from 41.7% in 3Q’18) All care centers live on new staffing model as of 6/28. Pay practice change complete 2019 Goal Thrive & win under payment reform Operate as efficiently as possible by having the right people do the right jobs 2019 Accomplishments & Results to Date (3Q’19) GROWTH Grow (Inorganically) & Integrate Hospice Scale Personal Care Performance to Date / Areas to Improve CCH 3Q’19 YTD EBITDA: ~$14M vs. FY guidance of $12M-$14M Signed Asana Hospice Deal, Successfully integrated Roserock, launched 5 de novo’s Executed ClearCare partnership giving us access to over 1,000 personal care agencies, representing 116K+ caregivers in 49 states 2019 Goal Expand Hospice footprint to better align with Home Health & Integrate recently acquired Compassionate Care Expand personal care footprint via network partnership OPERATIONAL MA Risk Arrangements Performance to Date / Areas to Improve 2020 goal: 15% - 20% of Managed Care revenue in Value Base Contracts, up from 5% 2019 Goal Increase our percentage of revenue in “risk” arrangements with MA plans

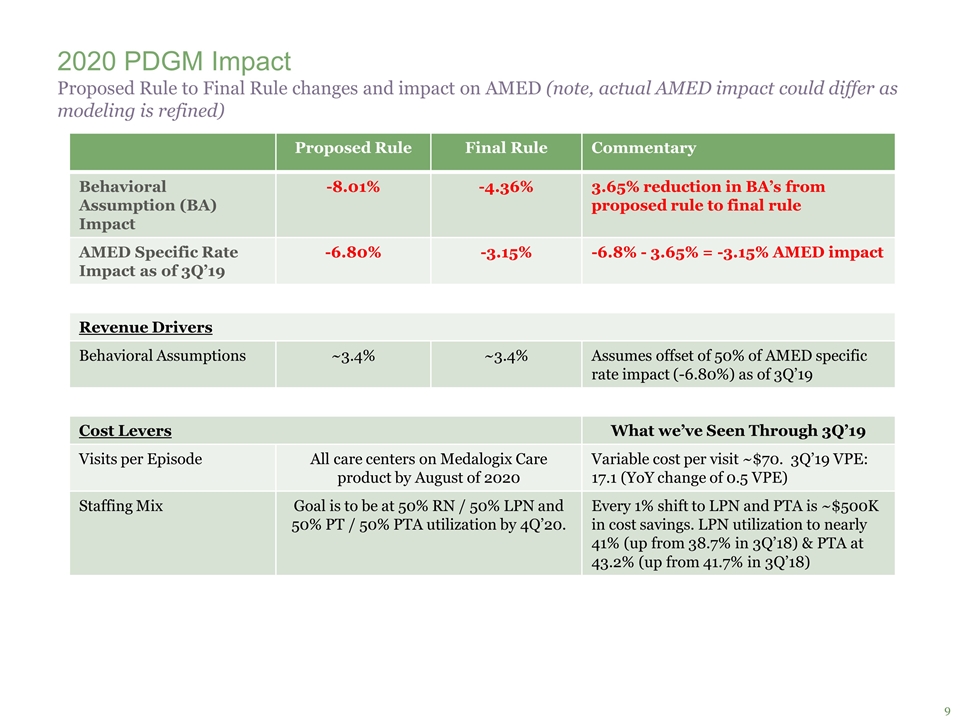

2020 PDGM Impact Proposed Rule Final Rule Commentary Behavioral Assumption (BA) Impact -8.01% -4.36% 3.65% reduction in BA’s from proposed rule to final rule AMED Specific Rate Impact as of 3Q’19 -6.80% -3.15% -6.8% - 3.65% = -3.15% AMED impact Revenue Drivers Behavioral Assumptions ~3.4% ~3.4% Assumes offset of 50% of AMED specific rate impact (-6.80%) as of 3Q’19 Cost Levers What we’ve Seen Through 3Q’19 Visits per Episode All care centers on Medalogix Care product by August of 2020 Variable cost per visit ~$70. 3Q’19 VPE: 17.1 (YoY change of 0.5 VPE) Staffing Mix Goal is to be at 50% RN / 50% LPN and 50% PT / 50% PTA utilization by 4Q’20. Every 1% shift to LPN and PTA is ~$500K in cost savings. LPN utilization to nearly 41% (up from 38.7% in 3Q’18) & PTA at 43.2% (up from 41.7% in 3Q’18) Proposed Rule to Final Rule changes and impact on AMED (note, actual AMED impact could differ as modeling is refined)

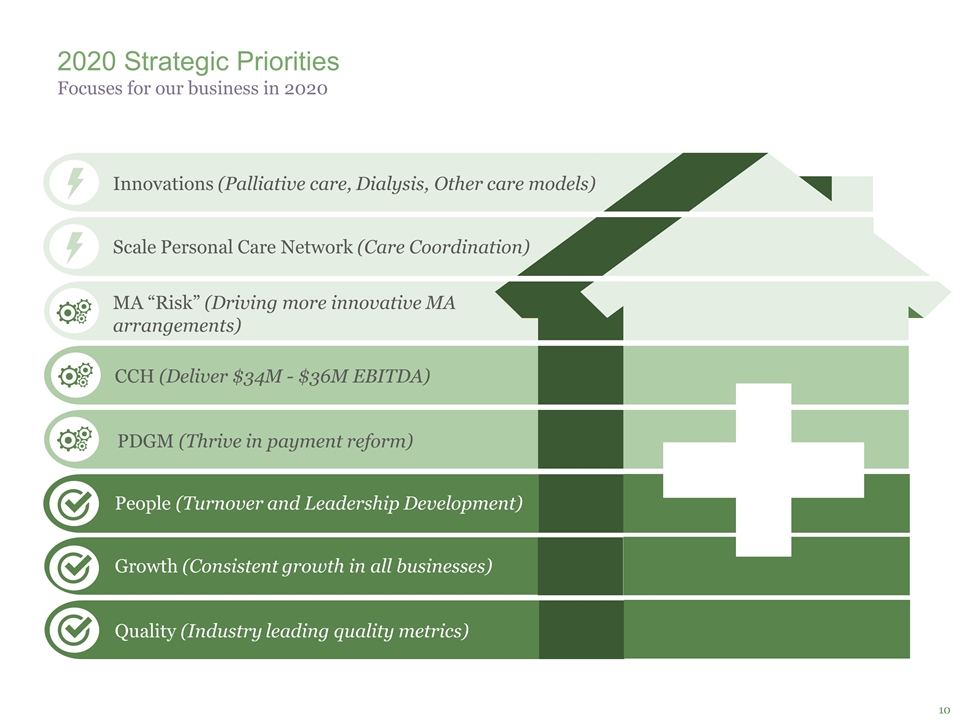

2020 Strategic Priorities Focuses for our business in 2020 Innovations (Palliative care, Dialysis, Other care models) Scale Personal Care Network (Care Coordination) CCH (Deliver $34M - $36M EBITDA) PDGM (Thrive in payment reform) People (Turnover and Leadership Development) Growth (Consistent growth in all businesses) Quality (Industry leading quality metrics) MA “Risk” (Driving more innovative MA arrangements)