Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Teladoc Health, Inc. | tm202185d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Teladoc Health, Inc. | tm202185d1_ex2-1.htm |

| 8-K - FORM 8-K - Teladoc Health, Inc. | tm202185-1_8k.htm |

Exhibit 99.2

38 th Annual J.P. Morgan Healthcare Conference January 13

Safe harbor • • • •

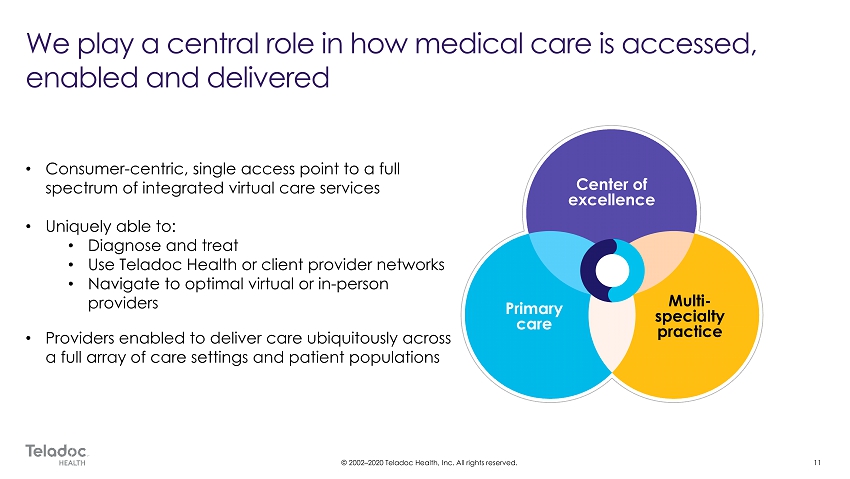

At Teladoc Health, we are transforming how people access healthcare around the world. We are creating a new kind of healthcare experience – one with greater convenience, outcomes, and value.

The Only Comprehensive Virtual Care Solution Industry Leader with Differentiated Assets, Capabilities and Scale Consistent Track Record of Delivering Strong Revenue Growth Global Leadership Position Across Channels Compelling Financial Model

Melbourne Toronto Boston Phoenix Dallas

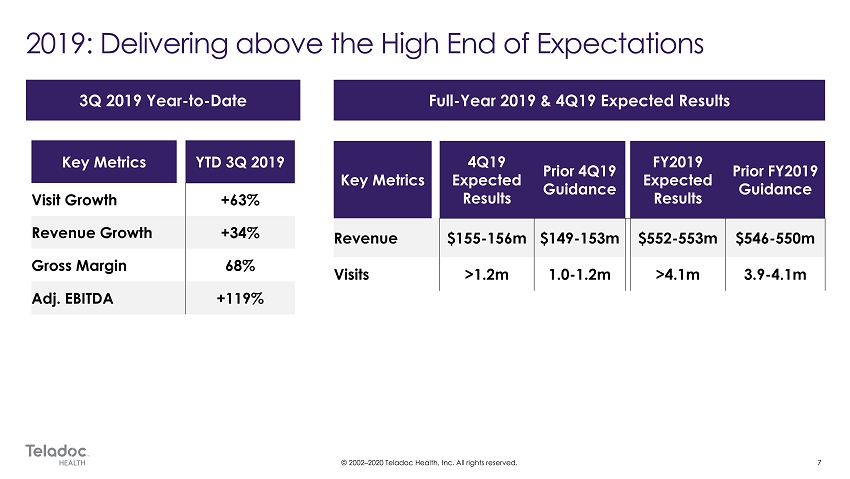

Key Metrics YTD 3Q 2019 Visit Growth +63% Revenue Growth +34% Gross Margin 68% Adj. EBITDA +119% Key Metrics 4Q19 Expected Results Prior 4Q19 Guidance FY2019 Expected Results Prior FY2019 Guidance Revenue $155 - 156m $149 - 153m $552 - 553m $546 - 550m Visits >1.2m 1.0 - 1.2m >4.1m 3.9 - 4.1m

>60% CAGR $123m $233m $418m $552 - 553m $0 $100 $200 $300 $400 $500 $600 >60% CAGR 952,000 1,464,000 2,641,000 ~4,100,000 2016 2017 2018 2019E - $52m - $34m - $5m $12m 2016 2017 2018 YTD 3Q19

RFP pipeline up ~10% y/y Bookings up ~ 30% y/y Larger average deal size Strong demand across all channels

39 40 41 42 43 44 45 46 47 48 49 50 51 52 1 2 3 4 5 6 7 8 9 10 11 12 13 14 2016-2017 2017-2018 2018-2019 2019-2020

8% 10% 11% 11% 14% 18% 19% 22% 23% 32% 32% 40% 43% Source: 2019 J.P. Morgan Hospital Survey

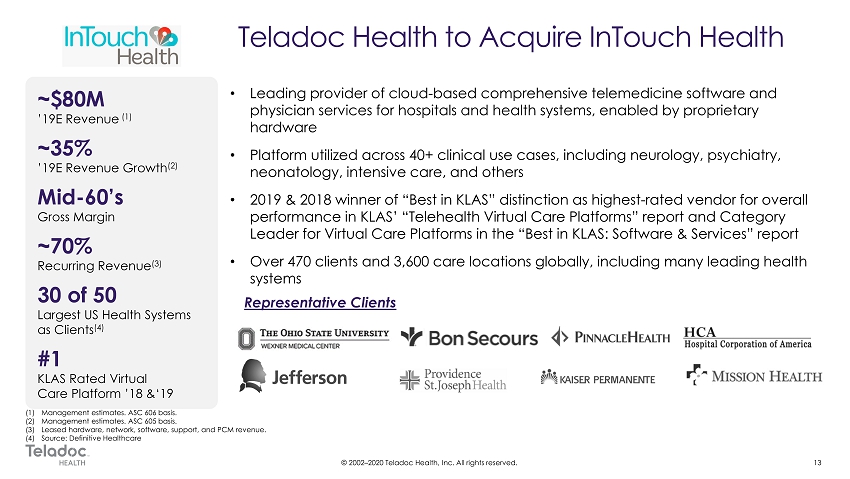

~$80M ’19E Revenue (1) ~35% ’19E Revenue Growth (2) Mid - 60’s Gross Margin ~70% Recurring Revenue (3) 30 of 50 Largest US Health Systems as Clients (4) #1 KLAS Rated Virtual Care Platform ’18 &‘19 Representative Clients

% of 2019 Contract Value (1)

InTouch leadership position in critical, Provider to Provider Virtual Care Teladoc leadership in Consumer Virtual Care Critical Chronic Everyday Care Hospital Home Worksite Pharmacy Retail Clinic Physician Office Post - Acute ED Ambulance

Note: Competitor information represents Teladoc management estimates and other industry data. Teladoc Health

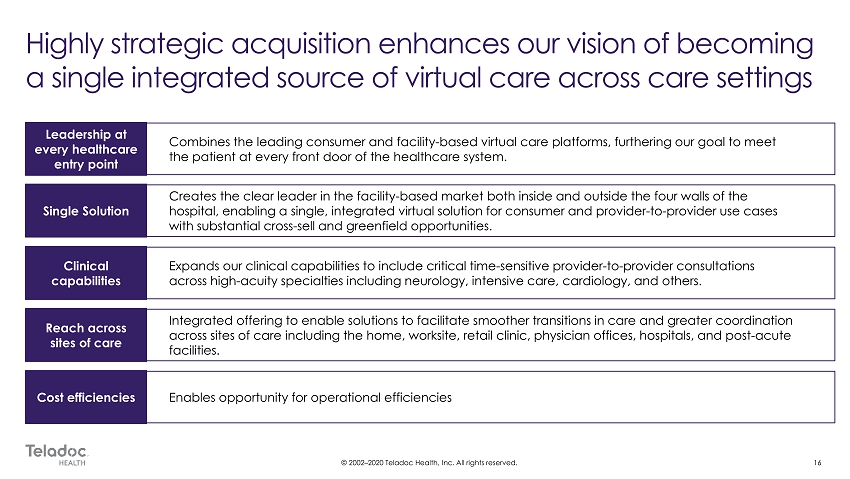

~$630m in • • • • • • • • • •

x Existing distribution channels x Product cross sell/upsell x Government programs • Direct to consumer • Global markets leadership • Virtual primary care x Integrated behavioral health solutions x Virtual Center of Excellence specialty services x Chronic care x Clinical quality leadership • Integrated, intuitive consumer experiences • Engagement science and surround sound investments • Virtual first experience x Expanding access points and modalities x Health system use cases x Insurer scope of services x In home solutions x Integration with local delivery system x Significant expansion from InTouch Health

12m 18m 23m 32m 54m 2015 2016 2017 2018 2019E Source: US Kaiser Family Foundation, AIS x x x x o o o

(1) First year utilization measured as annualized utilization of first calendar year with eligibility. Current year utilizati on reflects annualized YTD 2019 through Dec 15 th . Min. membership size of 300. 1.0x 1.0x 1.0x 1.0x 1.1x 1.3x 1.7x 2.0x 2018 Cohort 2017 Cohort 2016 Cohort 2015 Cohort 1st Year Current Year (2019)

(1) Represents average change in PEPM for 40+ employer clients lives adding product in 2019. Usage Case Study 2 : Utilization following product additions PEPM Prior to Product Add PEPM After Product Add 1.0X 1.6X 2.3X 2017 2018 2019 (2) Represents large client that rolled our behavioral and dermatology products over 4Q17 and 1Q18.

High degree of visibility Gross margin strength Customer acquisition and engagement spending efficiency Operating efficiencies and leverage

Global leadership position across channels

(1) Based on TDOC 10 day VWAP as of 1/7/20. Key terms • Purchase price of approximately $600 million; consideration consisting of: • $150 million of cash • $450 million in Teladoc Health stock Transaction structure • Cash portion of consideration funded by cash on hand • Implied 5.4M TDOC shares issued to sellers (subject to customary lock - up) (1) Process and timing • Transaction is expected to close in Q2’20 Financial impact • Upon closing of the transaction, Teladoc Health will provide an updated full - year 2020 financial outlook and guidance for the combined company after completing valuation and related purchase accounting considerations • $300+ million cash on balance sheet post - transaction