Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Primo Water Corp | d858481dex992.htm |

| EX-10.1 - EX-10.1 - Primo Water Corp | d858481dex101.htm |

| EX-2.1 - EX-2.1 - Primo Water Corp | d858481dex21.htm |

| 8-K - FORM 8-K - Primo Water Corp | d858481d8k.htm |

Exhibit 99.1 Cott to Acquire Primo Creating a leading pure play water company January 13, 2020Exhibit 99.1 Cott to Acquire Primo Creating a leading pure play water company January 13, 2020

Safe Harbor Statements Thispresentationisneitheranoffertopurchasenorasolicitationofanoffertosellsecurities.Nooffer,solicitation,purchaseorsale willbemadeinanyjurisdictioninwhichsuchanoffer,solicitation,orsalewouldbeunlawful. Thispresentationcontainsforward-lookingstatementswithinthemeaningofSection27AoftheSecuritiesActof1933,Section21E oftheSecuritiesExchangeActof1934andapplicableCanadiansecuritieslawsconveying,amongothermatters,management's expectationsastothefuturebasedonplans,estimatesandprojectionsatthetimethesestatementsaremade.Forward-looking statementscanotherwisebeidentifiedbytheuseofwordssuchas“anticipate,”“believe,”“could,”“estimate,”“expect,”“feel,” “forecast,”“intend,”“may,”“plan,”“potential,”“predict,”“project,”“seek,”“should,”“would,”“will,”andsimilarexpressionsintendedto identifyforward-lookingstatements,althoughnotallforward-lookingstatementscontaintheseidentifyingwords.Theforwardlooking statementsinthispresentationinclude,butarenotlimitedto,statementsrelatedtotheabilityofthepartiestoconsummatethe proposedtransactionsonatimelybasisoratallandthesatisfactionoftheconditionsprecedenttotheconsummationofthe proposedtransactions(includingasufficientnumberofPrimosharesbeingvalidlytenderedintotheexchangeoffertomeetthe minimumcondition),thecompletionoftheanticipatedfinancingofthetransactiononatimelybasisifatallandonthetermscurrently proposed,theanticipatedtimingoftheproposedtransactions,theexpectationsinrespectofthefinancialprofileofthecombined companyandexpectedsynergiesassociatedwiththetransactions,includingtheexpectedsynergiesoutlinedinthispresentation, andanycontributionofPrimo’sacquisitiontoCott’sperformance,theriskoflitigationandregulatoryactionrelatedtotheproposed transaction,andthepotentialimpacttheacquisitionwillhaveonPrimoorCottandothermattersrelatedtoeitherorbothofthem. Forward-lookingstatementsinvolveinherentrisksanduncertaintiesandtheCompanycautionsyouthatanumberofimportant factorscouldcauseactualresultstodiffermateriallyfromthosecontainedinanysuchforward-lookingstatement.Theforward- lookingstatementsarebasedonassumptionsregardingmanagement’scurrentplansandestimates.Factorsthatcouldcauseactual resultstodiffermateriallyfromthosedescribedinthispresentationinclude,amongothers:thedegreeofsuccessofCott’sintended explorationofstrategicalternativesforCott’sS&DCoffeeandTeaBusiness;changesinexpectationsastotheclosingofthe transactionandthetimingthereofifatall,includingtimingandchangesinthemethodoffinancingthetransactions;changesin estimatesoffutureearningsandcashflows;expectedsynergiesandcostsavingsarenotachievedorachievedataslowerpace thanexpected;integrationproblems,delaysorotherrelatedcosts;retentionofcustomersandsuppliers;thecostofcapital necessarytofinancethetransaction;thesatisfactionoftheconditionsprecedenttotheconsummationoftheproposedtransactions (includingasufficientnumberofPrimosharesbeingvalidlytenderedintotheexchangeoffertomeettheminimumcondition);the negativeeffectsoftheannouncementortheconsummationoftheproposedtransactionsonthemarketpriceofCott’scommonstock oronCott’soperatingresults;theriskoflitigationandregulatoryactionrelatedtotheproposedtransaction;unanticipatedchangesin laws,regulations,orotherindustrystandardsaffectingthecompaniesandotherrisksandimportantfactorscontainedandidentified inCott’sandPrimo’sfilingswiththeSecuritiesandExchangeCommission(the“SEC”),includingtheirrespectiveQuarterlyReports onForm10-QandAnnualReportsonForm10-K.Theforegoinglistoffactorsisnotexhaustive.Readersarecautionednottoplace unduerelianceontheseforward-lookingstatements,whichspeakonlyasofthedatehereof.Readersareurgedtocarefullyreview andconsiderthevariousdisclosures,includingbutnotlimitedtoriskfactorscontainedinCott’sandPrimo’srespectiveAnnual ReportsonForm10-KandtheirquarterlyreportsonForm10-Q,aswellasotherperiodicandcurrentreportsandotherfilingsfiled withthesecuritiescommissions.NeitherCottnorPrimoundertakes,exceptasexpresslyrequiredbyapplicablelaw,toupdateor reviseanyofthesestatementsinlightofnewinformationorfutureevents. 2Safe Harbor Statements Thispresentationisneitheranoffertopurchasenorasolicitationofanoffertosellsecurities.Nooffer,solicitation,purchaseorsale willbemadeinanyjurisdictioninwhichsuchanoffer,solicitation,orsalewouldbeunlawful. Thispresentationcontainsforward-lookingstatementswithinthemeaningofSection27AoftheSecuritiesActof1933,Section21E oftheSecuritiesExchangeActof1934andapplicableCanadiansecuritieslawsconveying,amongothermatters,management's expectationsastothefuturebasedonplans,estimatesandprojectionsatthetimethesestatementsaremade.Forward-looking statementscanotherwisebeidentifiedbytheuseofwordssuchas“anticipate,”“believe,”“could,”“estimate,”“expect,”“feel,” “forecast,”“intend,”“may,”“plan,”“potential,”“predict,”“project,”“seek,”“should,”“would,”“will,”andsimilarexpressionsintendedto identifyforward-lookingstatements,althoughnotallforward-lookingstatementscontaintheseidentifyingwords.Theforwardlooking statementsinthispresentationinclude,butarenotlimitedto,statementsrelatedtotheabilityofthepartiestoconsummatethe proposedtransactionsonatimelybasisoratallandthesatisfactionoftheconditionsprecedenttotheconsummationofthe proposedtransactions(includingasufficientnumberofPrimosharesbeingvalidlytenderedintotheexchangeoffertomeetthe minimumcondition),thecompletionoftheanticipatedfinancingofthetransactiononatimelybasisifatallandonthetermscurrently proposed,theanticipatedtimingoftheproposedtransactions,theexpectationsinrespectofthefinancialprofileofthecombined companyandexpectedsynergiesassociatedwiththetransactions,includingtheexpectedsynergiesoutlinedinthispresentation, andanycontributionofPrimo’sacquisitiontoCott’sperformance,theriskoflitigationandregulatoryactionrelatedtotheproposed transaction,andthepotentialimpacttheacquisitionwillhaveonPrimoorCottandothermattersrelatedtoeitherorbothofthem. Forward-lookingstatementsinvolveinherentrisksanduncertaintiesandtheCompanycautionsyouthatanumberofimportant factorscouldcauseactualresultstodiffermateriallyfromthosecontainedinanysuchforward-lookingstatement.Theforward- lookingstatementsarebasedonassumptionsregardingmanagement’scurrentplansandestimates.Factorsthatcouldcauseactual resultstodiffermateriallyfromthosedescribedinthispresentationinclude,amongothers:thedegreeofsuccessofCott’sintended explorationofstrategicalternativesforCott’sS&DCoffeeandTeaBusiness;changesinexpectationsastotheclosingofthe transactionandthetimingthereofifatall,includingtimingandchangesinthemethodoffinancingthetransactions;changesin estimatesoffutureearningsandcashflows;expectedsynergiesandcostsavingsarenotachievedorachievedataslowerpace thanexpected;integrationproblems,delaysorotherrelatedcosts;retentionofcustomersandsuppliers;thecostofcapital necessarytofinancethetransaction;thesatisfactionoftheconditionsprecedenttotheconsummationoftheproposedtransactions (includingasufficientnumberofPrimosharesbeingvalidlytenderedintotheexchangeoffertomeettheminimumcondition);the negativeeffectsoftheannouncementortheconsummationoftheproposedtransactionsonthemarketpriceofCott’scommonstock oronCott’soperatingresults;theriskoflitigationandregulatoryactionrelatedtotheproposedtransaction;unanticipatedchangesin laws,regulations,orotherindustrystandardsaffectingthecompaniesandotherrisksandimportantfactorscontainedandidentified inCott’sandPrimo’sfilingswiththeSecuritiesandExchangeCommission(the“SEC”),includingtheirrespectiveQuarterlyReports onForm10-QandAnnualReportsonForm10-K.Theforegoinglistoffactorsisnotexhaustive.Readersarecautionednottoplace unduerelianceontheseforward-lookingstatements,whichspeakonlyasofthedatehereof.Readersareurgedtocarefullyreview andconsiderthevariousdisclosures,includingbutnotlimitedtoriskfactorscontainedinCott’sandPrimo’srespectiveAnnual ReportsonForm10-KandtheirquarterlyreportsonForm10-Q,aswellasotherperiodicandcurrentreportsandotherfilingsfiled withthesecuritiescommissions.NeitherCottnorPrimoundertakes,exceptasexpresslyrequiredbyapplicablelaw,toupdateor reviseanyofthesestatementsinlightofnewinformationorfutureevents. 2

Safe Harbor Statements (continued) Non-GAAP Measures TosupplementitsreportingoffinancialmeasuresdeterminedinaccordancewithGAAP,Cottutilizescertainnon-GAAPfinancial measures.CottutilizesadjustedEBITDAandadjustedEBITDAmarginonastandaloneandproformabasistoseparatetheimpact ofcertainitemsfromtheunderlyingbusiness.CottalsousedproformaLTMrevenueandadjustedEBITDAtoprovideacomparison offullyearperiods.BecauseCottusestheseadjustedfinancialresultsinthemanagementofitsbusiness,managementbelievesthis supplementalinformationisusefultoinvestorsfortheirindependentevaluationandunderstandingofCott'sunderlyingbusiness performanceandtheperformanceofitsmanagement.WithrespecttoourexpectationsofperformanceofPrimoasitisbeing integrated,reconciliationsof2020estimatedadjustedEBITDAandcashoncashIRRarenotavailable,asweareunabletoquantify certainamountsthatwouldberequiredtobeincludedintherelevantGAAPmeasureswithoutunreasonableeffort.Weexpectthat theunavailablereconcilingitems,whichprimarilyincludetaxes,interestcoststhatwouldoccurifthecompanyissueddebt,coststo capturesynergiesandphasingofcapex,couldsignificantlyaffectourfinancialresults.Theseitemsdependonhighlyvariablefactors andanysuchreconciliationswouldimplyadegreeofprecisionthatwouldbeconfusingormisleadingtoinvestors.Weexpectthe variabilityofthesefactorstohaveasignificant,andpotentiallyunpredictable,impactonourfutureGAAPfinancialresults.Thenon- GAAPfinancialmeasuresdescribedaboveareinadditionto,andnotmeanttobeconsideredsuperiorto,orasubstitutefor,Cott's financialstatementspreparedinaccordancewithGAAP.Inaddition,thenon-GAAPfinancialmeasuresincludedinthisearnings announcementreflectmanagement'sjudgmentofparticularitems,andmaybedifferentfrom,andthereforemaynotbecomparable to,similarlytitledmeasuresreportedbyothercompanies. Additional Information and Where to Find It Theexchangeofferreferencedinthispresentationhasnotyetcommenced.Thiscommunicationrelatestoaproposedbusiness combinationbetweenCottandPrimo.Thispresentationisforinformationalpurposesonlyanddoesnotconstituteanofferto purchaseorasolicitationofanoffertosellshares,norisitasubstituteforanyoffermaterialsthatthepartieswillfilewiththeSEC. Atthetimetheexchangeofferiscommenced,CottanditsacquisitionsubsidiarywillfileanexchangeofferstatementonSchedule TO,CottwillfilearegistrationstatementonFormS-4andPrimowillfileaSolicitation/RecommendationStatementonSchedule14D- 9withtheSECwithrespecttotheexchangeoffer.EachofCottandPrimoalsoplantofileotherrelevantdocumentswiththeSEC regardingtheproposedtransaction.THEEXCHANGEOFFERMATERIALS(INCLUDINGANOFFERTOTENDER,ARELATED LETTEROFTRANSMITTALANDCERTAINOTHEREXCHANGEOFFERDOCUMENTS),THESOLICITATION/ RECOMMENDATIONSTATEMENTANDOTHERRELEVANTDOCUMENTSTHATMAYBEFILEDWITHTHESEC,ASWELLAS ANYAMENDMENTSORSUPPLEMENTSTOANYOFTHEFOREGOINGDOCUMENTS,WILLCONTAINIMPORTANT INFORMATION.PRIMOSTOCKHOLDERSAREURGEDTOREADTHESEDOCUMENTSCAREFULLYWHENTHEYBECOME AVAILABLEBECAUSETHEYWILLCONTAINIMPORTANTINFORMATIONTHATHOLDERSOFPRIMOSECURITIESSHOULD CONSIDERBEFOREMAKINGANYDECISIONREGARDINGEXCHANGINGTHEIRSECURITIES.The Solicitation/RecommendationStatement,theOffertoTender,therelatedLetterofTransmittalandcertainotherexchangeoffer documentswillbemadeavailabletoallofPrimo’sstockholdersatnoexpensetothem.Theexchangeoffermaterialsandthe Solicitation/RecommendationStatementwillbemadeavailableforfreeontheSEC'swebsiteatwww.sec.gov.Copiesofthe documentsfiledwiththeSECbyCottwillbeavailablefreeofchargeundertheheadingoftheInvestorRelationssectionofCott’s websiteatwww.cott.com/investor-relations/.CopiesofthedocumentsfiledwiththeSECbyPrimowillbeavailablefreeofcharge undertheSECfilingsheadingoftheInvestorssectionofPrimo’swebsiteathttp://ir.primowater.com/. 3Safe Harbor Statements (continued) Non-GAAP Measures TosupplementitsreportingoffinancialmeasuresdeterminedinaccordancewithGAAP,Cottutilizescertainnon-GAAPfinancial measures.CottutilizesadjustedEBITDAandadjustedEBITDAmarginonastandaloneandproformabasistoseparatetheimpact ofcertainitemsfromtheunderlyingbusiness.CottalsousedproformaLTMrevenueandadjustedEBITDAtoprovideacomparison offullyearperiods.BecauseCottusestheseadjustedfinancialresultsinthemanagementofitsbusiness,managementbelievesthis supplementalinformationisusefultoinvestorsfortheirindependentevaluationandunderstandingofCott'sunderlyingbusiness performanceandtheperformanceofitsmanagement.WithrespecttoourexpectationsofperformanceofPrimoasitisbeing integrated,reconciliationsof2020estimatedadjustedEBITDAandcashoncashIRRarenotavailable,asweareunabletoquantify certainamountsthatwouldberequiredtobeincludedintherelevantGAAPmeasureswithoutunreasonableeffort.Weexpectthat theunavailablereconcilingitems,whichprimarilyincludetaxes,interestcoststhatwouldoccurifthecompanyissueddebt,coststo capturesynergiesandphasingofcapex,couldsignificantlyaffectourfinancialresults.Theseitemsdependonhighlyvariablefactors andanysuchreconciliationswouldimplyadegreeofprecisionthatwouldbeconfusingormisleadingtoinvestors.Weexpectthe variabilityofthesefactorstohaveasignificant,andpotentiallyunpredictable,impactonourfutureGAAPfinancialresults.Thenon- GAAPfinancialmeasuresdescribedaboveareinadditionto,andnotmeanttobeconsideredsuperiorto,orasubstitutefor,Cott's financialstatementspreparedinaccordancewithGAAP.Inaddition,thenon-GAAPfinancialmeasuresincludedinthisearnings announcementreflectmanagement'sjudgmentofparticularitems,andmaybedifferentfrom,andthereforemaynotbecomparable to,similarlytitledmeasuresreportedbyothercompanies. Additional Information and Where to Find It Theexchangeofferreferencedinthispresentationhasnotyetcommenced.Thiscommunicationrelatestoaproposedbusiness combinationbetweenCottandPrimo.Thispresentationisforinformationalpurposesonlyanddoesnotconstituteanofferto purchaseorasolicitationofanoffertosellshares,norisitasubstituteforanyoffermaterialsthatthepartieswillfilewiththeSEC. Atthetimetheexchangeofferiscommenced,CottanditsacquisitionsubsidiarywillfileanexchangeofferstatementonSchedule TO,CottwillfilearegistrationstatementonFormS-4andPrimowillfileaSolicitation/RecommendationStatementonSchedule14D- 9withtheSECwithrespecttotheexchangeoffer.EachofCottandPrimoalsoplantofileotherrelevantdocumentswiththeSEC regardingtheproposedtransaction.THEEXCHANGEOFFERMATERIALS(INCLUDINGANOFFERTOTENDER,ARELATED LETTEROFTRANSMITTALANDCERTAINOTHEREXCHANGEOFFERDOCUMENTS),THESOLICITATION/ RECOMMENDATIONSTATEMENTANDOTHERRELEVANTDOCUMENTSTHATMAYBEFILEDWITHTHESEC,ASWELLAS ANYAMENDMENTSORSUPPLEMENTSTOANYOFTHEFOREGOINGDOCUMENTS,WILLCONTAINIMPORTANT INFORMATION.PRIMOSTOCKHOLDERSAREURGEDTOREADTHESEDOCUMENTSCAREFULLYWHENTHEYBECOME AVAILABLEBECAUSETHEYWILLCONTAINIMPORTANTINFORMATIONTHATHOLDERSOFPRIMOSECURITIESSHOULD CONSIDERBEFOREMAKINGANYDECISIONREGARDINGEXCHANGINGTHEIRSECURITIES.The Solicitation/RecommendationStatement,theOffertoTender,therelatedLetterofTransmittalandcertainotherexchangeoffer documentswillbemadeavailabletoallofPrimo’sstockholdersatnoexpensetothem.Theexchangeoffermaterialsandthe Solicitation/RecommendationStatementwillbemadeavailableforfreeontheSEC'swebsiteatwww.sec.gov.Copiesofthe documentsfiledwiththeSECbyCottwillbeavailablefreeofchargeundertheheadingoftheInvestorRelationssectionofCott’s websiteatwww.cott.com/investor-relations/.CopiesofthedocumentsfiledwiththeSECbyPrimowillbeavailablefreeofcharge undertheSECfilingsheadingoftheInvestorssectionofPrimo’swebsiteathttp://ir.primowater.com/. 3

Management Presenters Thomas Harrington Jay Wells Billy Prim Chief Executive Officer Chief Financial Officer Executive Chairman of the Board Cott Corporation Cott Corporation and Interim President and Chief Executive Officer Primo Water Corporation 4Management Presenters Thomas Harrington Jay Wells Billy Prim Chief Executive Officer Chief Financial Officer Executive Chairman of the Board Cott Corporation Cott Corporation and Interim President and Chief Executive Officer Primo Water Corporation 4

Today’s Announcements Cott Corporation (“Cott” or the “Company”) has entered into a definitive agreement to acquire Primo Water Corporation (“Primo”) for $14.00 per share Primo is a leading provider of water dispensers, purified bottled water and selfservice refill drinking water in North America Recently, Cott announced evaluation of strategic alternatives for S&D Coffee and Tea (“S&D”) As a result, Cott continues its transition into a pure play water solutions provider Cott will be assuming the recognized water solutions brand that Primo has built by rebranding its corporate name to Primo Water Corporation (PRMW) 5Today’s Announcements Cott Corporation (“Cott” or the “Company”) has entered into a definitive agreement to acquire Primo Water Corporation (“Primo”) for $14.00 per share Primo is a leading provider of water dispensers, purified bottled water and selfservice refill drinking water in North America Recently, Cott announced evaluation of strategic alternatives for S&D Coffee and Tea (“S&D”) As a result, Cott continues its transition into a pure play water solutions provider Cott will be assuming the recognized water solutions brand that Primo has built by rebranding its corporate name to Primo Water Corporation (PRMW) 5

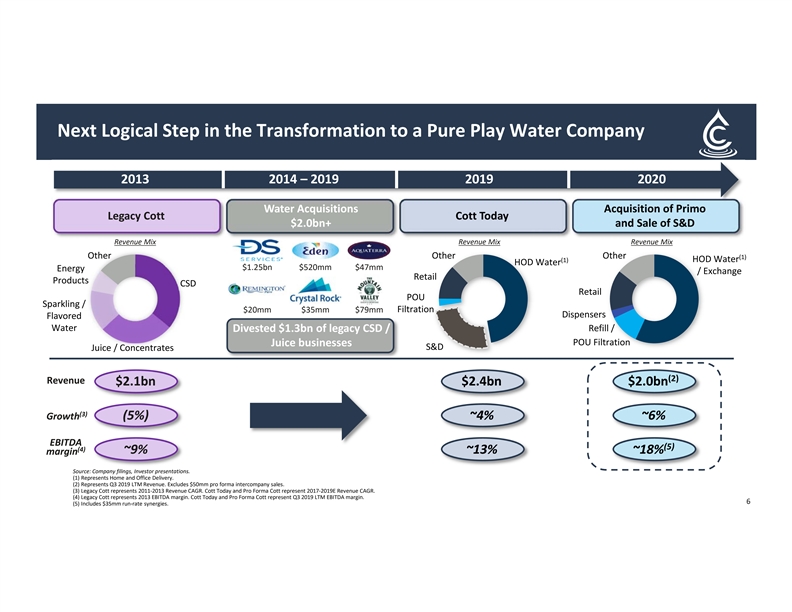

Next Logical Step in the Transformation to a Pure Play Water Company 2013 2014 – 2019 2019 2020 Water Acquisitions Acquisition of Primo Legacy Cott Cott Today $2.0bn+ and Sale of S&D Revenue Mix Revenue Mix Revenue Mix Other Other Other (1) (1) HOD Water HOD Water $1.25bn $520mm $47mm Energy / Exchange Retail Products CSD Retail POU Sparkling / Filtration $20mm $35mm $79mm Dispensers Flavored Water Refill / Divested $1.3bn of legacy CSD / POU Filtration Juice businesses S&D Juice / Concentrates (2) Revenue $2.1bn $2.4bn $2.0bn (3) Growth (5%) ~4% ~6% EBITDA (5) (4) ~9% ~13% ~18% margin Source: Company filings, Investor presentations. (1) Represents Home and Office Delivery. (2) Represents Q3 2019 LTM Revenue. Excludes $50mm pro forma intercompany sales. (3) Legacy Cott represents 20112013 Revenue CAGR. Cott Today and Pro Forma Cott represent 20172019E Revenue CAGR. (4) Legacy Cott represents 2013 EBITDA margin. Cott Today and Pro Forma Cott represent Q3 2019 LTM EBITDA margin. 6 (5) Includes $35mm runrate synergies.Next Logical Step in the Transformation to a Pure Play Water Company 2013 2014 – 2019 2019 2020 Water Acquisitions Acquisition of Primo Legacy Cott Cott Today $2.0bn+ and Sale of S&D Revenue Mix Revenue Mix Revenue Mix Other Other Other (1) (1) HOD Water HOD Water $1.25bn $520mm $47mm Energy / Exchange Retail Products CSD Retail POU Sparkling / Filtration $20mm $35mm $79mm Dispensers Flavored Water Refill / Divested $1.3bn of legacy CSD / POU Filtration Juice businesses S&D Juice / Concentrates (2) Revenue $2.1bn $2.4bn $2.0bn (3) Growth (5%) ~4% ~6% EBITDA (5) (4) ~9% ~13% ~18% margin Source: Company filings, Investor presentations. (1) Represents Home and Office Delivery. (2) Represents Q3 2019 LTM Revenue. Excludes $50mm pro forma intercompany sales. (3) Legacy Cott represents 20112013 Revenue CAGR. Cott Today and Pro Forma Cott represent 20172019E Revenue CAGR. (4) Legacy Cott represents 2013 EBITDA margin. Cott Today and Pro Forma Cott represent Q3 2019 LTM EBITDA margin. 6 (5) Includes $35mm runrate synergies.

Key Takeaways Creates a pure play water company and market leader in Home / Office Delivery (“HOD”), refill, exchange and water cooler dispensers Improves overall growth profile and margin given pure play water focus, underlying water category dynamics, combined distribution footprint, and exit of lower growth and lower margin S&D business Strengthens sustainability platform focused on refillable, reusable and recyclable containers Expected $35mm of cost synergies driven by existing Primo partnership, geographic overlap and elimination of duplicative G&A Strong pro forma financial impact including higher revenue growth, improved adjusted EBITDA margin, accretion to earnings, lower leverage and improved credit profile Singular waterfocused combined company, positioned to succeed in higher growth and higher margin water categories as a rebranded entity, creates the opportunity to be valued in line with water peers 7Key Takeaways Creates a pure play water company and market leader in Home / Office Delivery (“HOD”), refill, exchange and water cooler dispensers Improves overall growth profile and margin given pure play water focus, underlying water category dynamics, combined distribution footprint, and exit of lower growth and lower margin S&D business Strengthens sustainability platform focused on refillable, reusable and recyclable containers Expected $35mm of cost synergies driven by existing Primo partnership, geographic overlap and elimination of duplicative G&A Strong pro forma financial impact including higher revenue growth, improved adjusted EBITDA margin, accretion to earnings, lower leverage and improved credit profile Singular waterfocused combined company, positioned to succeed in higher growth and higher margin water categories as a rebranded entity, creates the opportunity to be valued in line with water peers 7

Primo Acquisition 8Primo Acquisition 8

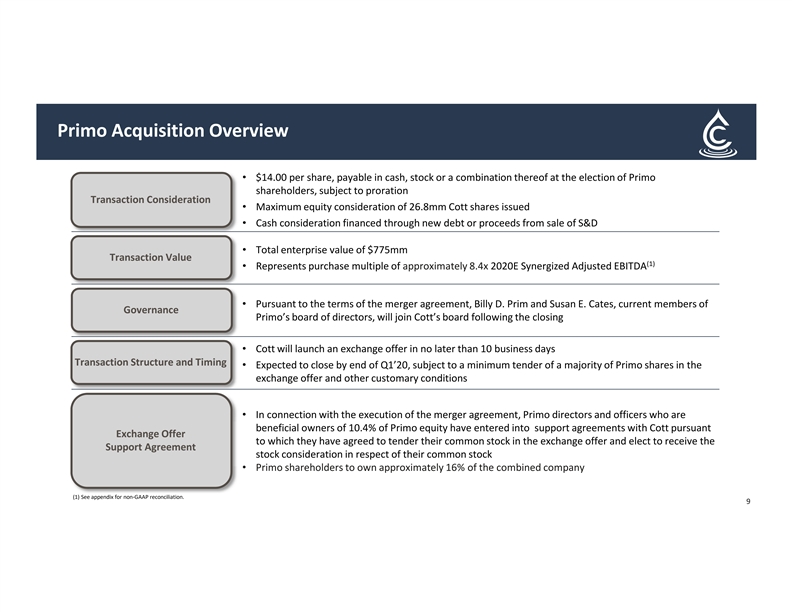

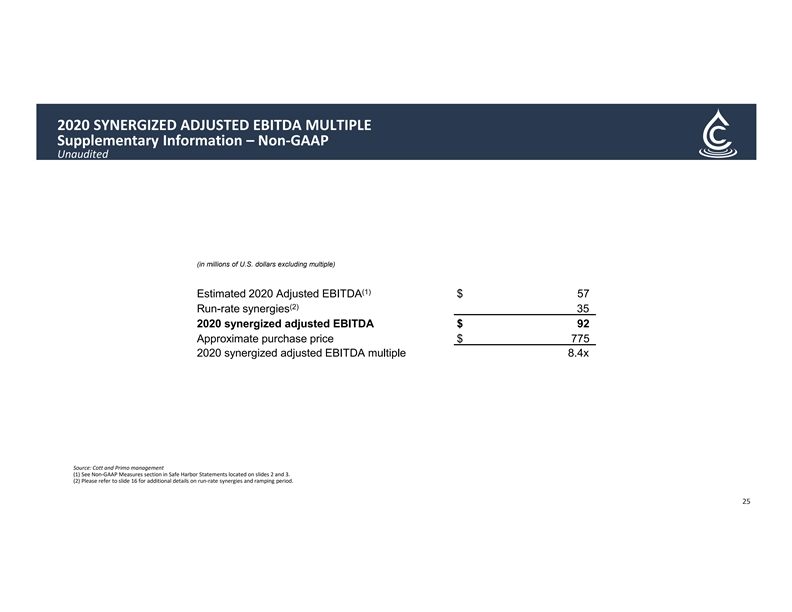

Primo Acquisition Overview • $14.00 per share, payable in cash, stock or a combination thereof at the election of Primo shareholders, subject to proration Transaction Consideration • Maximum equity consideration of 26.8mm Cott shares issued • Cash consideration financed through new debt or proceeds from sale of S&D • Total enterprise value of $775mm Transaction Value (1) • Represents purchase multiple of approximately 8.4x 2020E Synergized Adjusted EBITDA • Pursuant to the terms of the merger agreement, Billy D. Prim and Susan E. Cates, current members of Governance Primo’s board of directors, will join Cott’s board following the closing • Cott will launch an exchange offer in no later than 10 business days Transaction Structure and Timing • Expected to close by end of Q1’20, subject to a minimum tender of a majority of Primo shares in the exchange offer and other customary conditions • In connection with the execution of the merger agreement, Primo directors and officers who are beneficial owners of 10.4% of Primo equity have entered into support agreements with Cott pursuant Exchange Offer to which they have agreed to tender their common stock in the exchange offer and elect to receive the Support Agreement stock consideration in respect of their common stock • Primo shareholders to own approximately 16% of the combined company (1) See appendix for nonGAAP reconciliation. 9Primo Acquisition Overview • $14.00 per share, payable in cash, stock or a combination thereof at the election of Primo shareholders, subject to proration Transaction Consideration • Maximum equity consideration of 26.8mm Cott shares issued • Cash consideration financed through new debt or proceeds from sale of S&D • Total enterprise value of $775mm Transaction Value (1) • Represents purchase multiple of approximately 8.4x 2020E Synergized Adjusted EBITDA • Pursuant to the terms of the merger agreement, Billy D. Prim and Susan E. Cates, current members of Governance Primo’s board of directors, will join Cott’s board following the closing • Cott will launch an exchange offer in no later than 10 business days Transaction Structure and Timing • Expected to close by end of Q1’20, subject to a minimum tender of a majority of Primo shares in the exchange offer and other customary conditions • In connection with the execution of the merger agreement, Primo directors and officers who are beneficial owners of 10.4% of Primo equity have entered into support agreements with Cott pursuant Exchange Offer to which they have agreed to tender their common stock in the exchange offer and elect to receive the Support Agreement stock consideration in respect of their common stock • Primo shareholders to own approximately 16% of the combined company (1) See appendix for nonGAAP reconciliation. 9

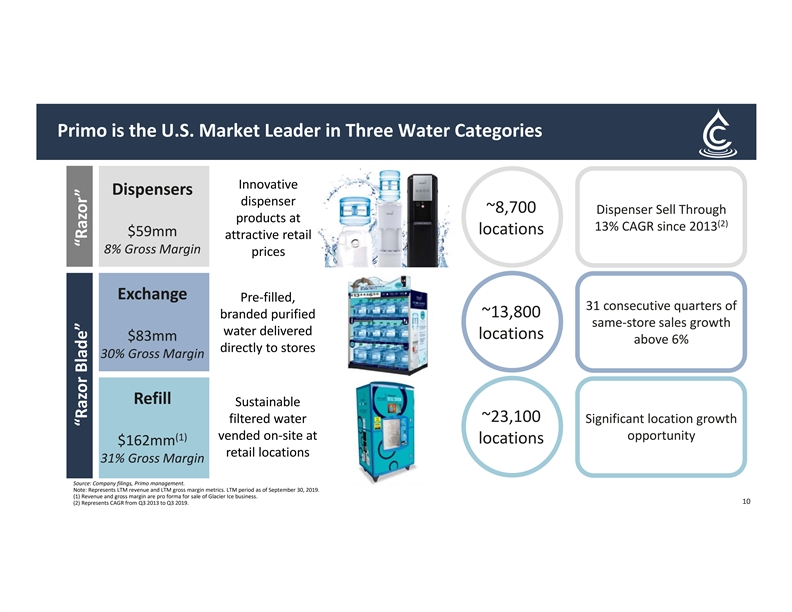

Primo is the U.S. Market Leader in Three Water Categories Innovative Dispensers dispenser ~8,700 Dispenser Sell Through products at (2) 13% CAGR since 2013 locations $59mm attractive retail 8% Gross Margin prices Exchange Prefilled, 31 consecutive quarters of ~13,800 branded purified samestore sales growth water delivered locations $83mm above 6% directly to stores 30% Gross Margin Refill Sustainable ~23,100 filtered water Significant location growth vended onsite at opportunity (1) locations $162mm retail locations 31% Gross Margin Source: Company filings, Primo management. Note: Represents LTM revenue and LTM gross margin metrics. LTM period as of September 30, 2019. (1) Revenue and gross margin are pro forma for sale of Glacier Ice business. 10 (2) Represents CAGR from Q3 2013 to Q3 2019.Primo is the U.S. Market Leader in Three Water Categories Innovative Dispensers dispenser ~8,700 Dispenser Sell Through products at (2) 13% CAGR since 2013 locations $59mm attractive retail 8% Gross Margin prices Exchange Prefilled, 31 consecutive quarters of ~13,800 branded purified samestore sales growth water delivered locations $83mm above 6% directly to stores 30% Gross Margin Refill Sustainable ~23,100 filtered water Significant location growth vended onsite at opportunity (1) locations $162mm retail locations 31% Gross Margin Source: Company filings, Primo management. Note: Represents LTM revenue and LTM gross margin metrics. LTM period as of September 30, 2019. (1) Revenue and gross margin are pro forma for sale of Glacier Ice business. 10 (2) Represents CAGR from Q3 2013 to Q3 2019.

With Primo’s Strong Performance Driving Q4 2019 Sales Growth All three segments delivered growth in Q4’19 and are wellpositioned for growth in Fiscal 2020 Dispensers: Q4’19 Dispensers segment experienced historical sellthrough which should drive strong first half 2020 sales in Exchange st Exchange: Strong continued momentum in Q4’19, representing the 31 consecutive quarter of samestore sales growth above 6% Refill: Q4’19 Refill segment revenue return to growth, driven by improved samestore sales growth and reduced downtime 11With Primo’s Strong Performance Driving Q4 2019 Sales Growth All three segments delivered growth in Q4’19 and are wellpositioned for growth in Fiscal 2020 Dispensers: Q4’19 Dispensers segment experienced historical sellthrough which should drive strong first half 2020 sales in Exchange st Exchange: Strong continued momentum in Q4’19, representing the 31 consecutive quarter of samestore sales growth above 6% Refill: Q4’19 Refill segment revenue return to growth, driven by improved samestore sales growth and reduced downtime 11

Solidifies Position as a Leading Complete Water Solutions Provider New North America HOD Water Refill Exchange Bottled Water Dispensers (3-5 gallons) POU Filtration Dispensers Europe HOD Water Refill Exchange Bottled Water Dispensers (3-5 gallons) POU Filtration Dispensers Source: Euromonitor, Nielsen, Technavio industry report, Beverage Marketing Corporation. Zenith International – USA POU and Bottled Water Coolers Report. Beverage Marketing Corporation – US Bottled Water Through 2023 Report (August 2019) and Company websites. 12Solidifies Position as a Leading Complete Water Solutions Provider New North America HOD Water Refill Exchange Bottled Water Dispensers (3-5 gallons) POU Filtration Dispensers Europe HOD Water Refill Exchange Bottled Water Dispensers (3-5 gallons) POU Filtration Dispensers Source: Euromonitor, Nielsen, Technavio industry report, Beverage Marketing Corporation. Zenith International – USA POU and Bottled Water Coolers Report. Beverage Marketing Corporation – US Bottled Water Through 2023 Report (August 2019) and Company websites. 12

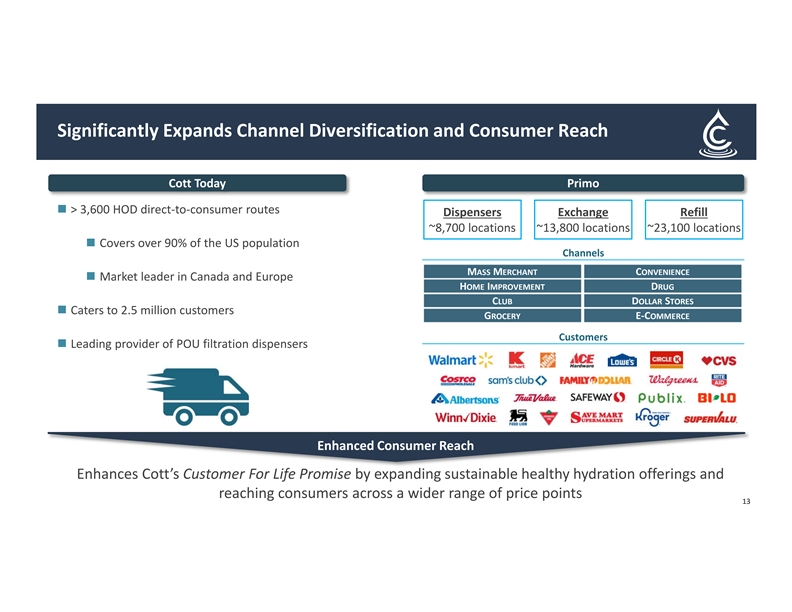

Significantly Expands Channel Diversification and Consumer Reach Cott Today Primo > 3,600 HOD directtoconsumer routes Dispensers Exchange Refill ~8,700 locations ~13,800 locations ~23,100 locations Covers over 90% of the US population Channels MASS MERCHANT CONVENIENCE Market leader in Canada and Europe HOME IMPROVEMENT DRUG CLUB DOLLAR STORES Caters to 2.5 million customers GROCERY E-COMMERCE Customers Leading provider of POU filtration dispensers Enhanced Consumer Reach Enhances Cott’s Customer For Life Promise by expanding sustainable healthy hydration offerings and reaching consumers across a wider range of price points 13Significantly Expands Channel Diversification and Consumer Reach Cott Today Primo > 3,600 HOD directtoconsumer routes Dispensers Exchange Refill ~8,700 locations ~13,800 locations ~23,100 locations Covers over 90% of the US population Channels MASS MERCHANT CONVENIENCE Market leader in Canada and Europe HOME IMPROVEMENT DRUG CLUB DOLLAR STORES Caters to 2.5 million customers GROCERY E-COMMERCE Customers Leading provider of POU filtration dispensers Enhanced Consumer Reach Enhances Cott’s Customer For Life Promise by expanding sustainable healthy hydration offerings and reaching consumers across a wider range of price points 13

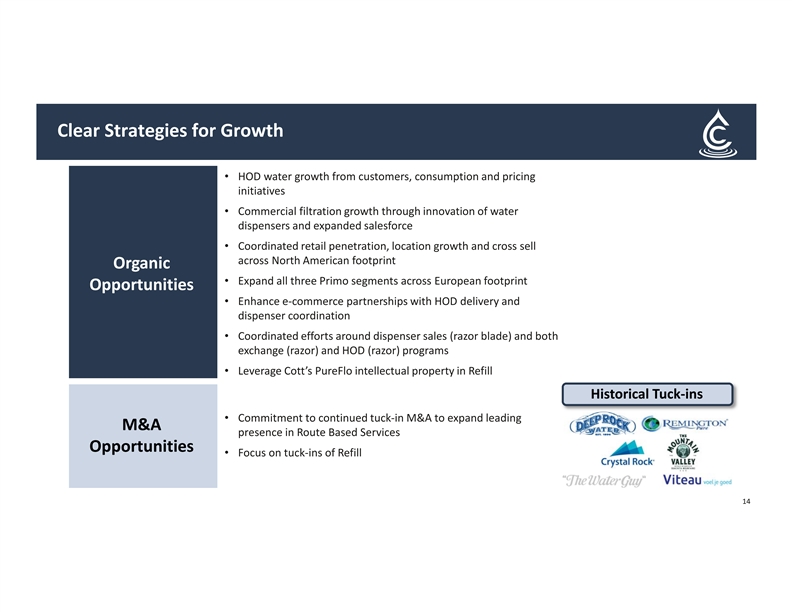

Clear Strategies for Growth • HOD water growth from customers, consumption and pricing initiatives • Commercial filtration growth through innovation of water dispensers and expanded salesforce • Coordinated retail penetration, location growth and cross sell across North American footprint Organic • Expand all three Primo segments across European footprint Opportunities • Enhance ecommerce partnerships with HOD delivery and dispenser coordination • Coordinated efforts around dispenser sales (razor blade) and both exchange (razor) and HOD (razor) programs • Leverage Cott’s PureFlo intellectual property in Refill Historical Tuck-ins • Commitment to continued tuckin M&A to expand leading M&A presence in Route Based Services Opportunities • Focus on tuckins of Refill 14Clear Strategies for Growth • HOD water growth from customers, consumption and pricing initiatives • Commercial filtration growth through innovation of water dispensers and expanded salesforce • Coordinated retail penetration, location growth and cross sell across North American footprint Organic • Expand all three Primo segments across European footprint Opportunities • Enhance ecommerce partnerships with HOD delivery and dispenser coordination • Coordinated efforts around dispenser sales (razor blade) and both exchange (razor) and HOD (razor) programs • Leverage Cott’s PureFlo intellectual property in Refill Historical Tuck-ins • Commitment to continued tuckin M&A to expand leading M&A presence in Route Based Services Opportunities • Focus on tuckins of Refill 14

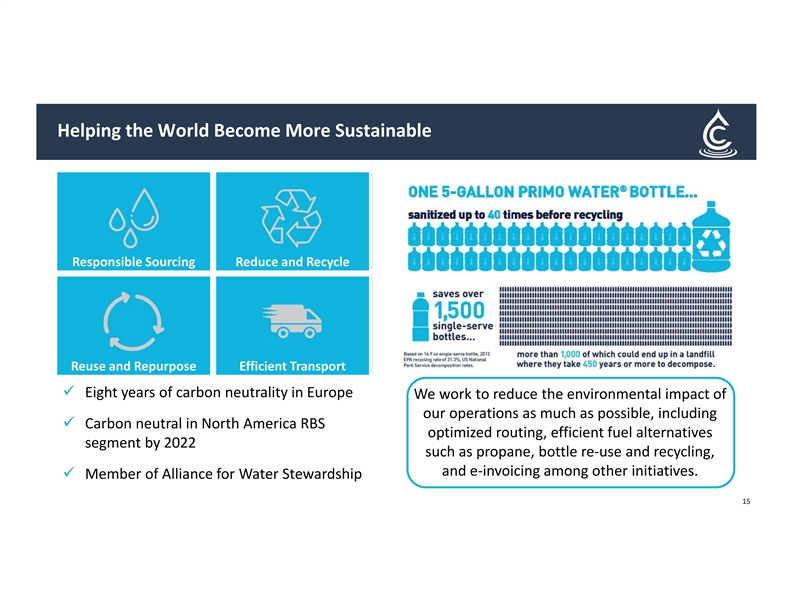

Helping the World Become More Sustainable Responsible Sourcing Reduce and Recycle Reuse and Repurpose Efficient Transport Eight years of carbon neutrality in Europe We work to reduce the environmental impact of our operations as much as possible, including Carbon neutral in North America RBS optimized routing, efficient fuel alternatives segment by 2022 such as propane, bottle reuse and recycling, and einvoicing among other initiatives. Member of Alliance for Water Stewardship 15Helping the World Become More Sustainable Responsible Sourcing Reduce and Recycle Reuse and Repurpose Efficient Transport Eight years of carbon neutrality in Europe We work to reduce the environmental impact of our operations as much as possible, including Carbon neutral in North America RBS optimized routing, efficient fuel alternatives segment by 2022 such as propane, bottle reuse and recycling, and einvoicing among other initiatives. Member of Alliance for Water Stewardship 15

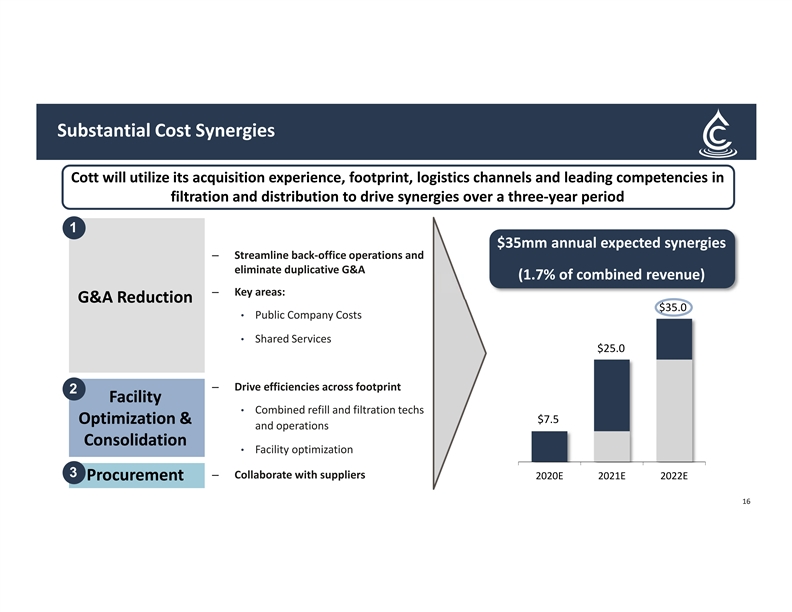

Substantial Cost Synergies Cott will utilize its acquisition experience, footprint, logistics channels and leading competencies in filtration and distribution to drive synergies over a threeyear period 1 $35mm annual expected synergies Streamline backoffice operations and eliminate duplicative G&A (1.7% of combined revenue) Key areas: G&A Reduction $35.0 • Public Company Costs • Shared Services $25.0 Drive efficiencies across footprint 2 Facility • Combined refill and filtration techs $7.5 Optimization & and operations Consolidation • Facility optimization 3 Collaborate with suppliers 2020E 2021E 2022E Procurement 16Substantial Cost Synergies Cott will utilize its acquisition experience, footprint, logistics channels and leading competencies in filtration and distribution to drive synergies over a threeyear period 1 $35mm annual expected synergies Streamline backoffice operations and eliminate duplicative G&A (1.7% of combined revenue) Key areas: G&A Reduction $35.0 • Public Company Costs • Shared Services $25.0 Drive efficiencies across footprint 2 Facility • Combined refill and filtration techs $7.5 Optimization & and operations Consolidation • Facility optimization 3 Collaborate with suppliers 2020E 2021E 2022E Procurement 16

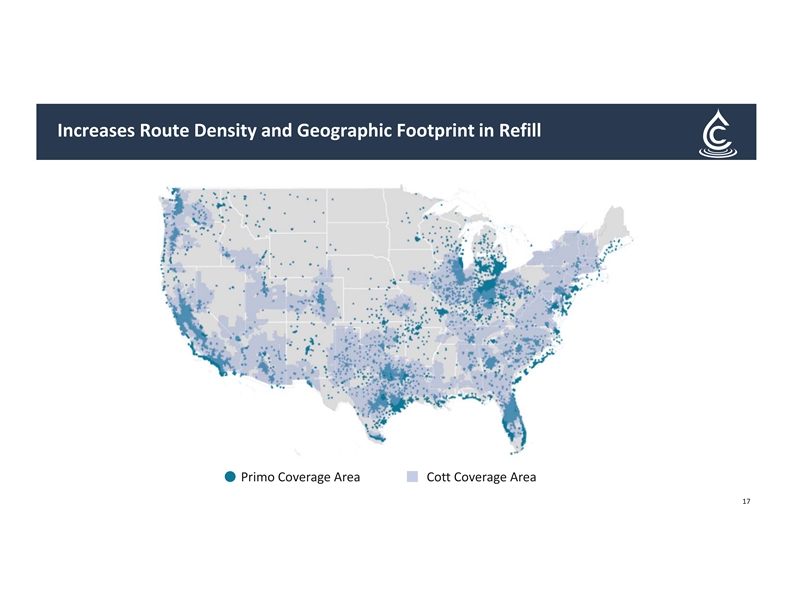

Increases Route Density and Geographic Footprint in Refill Primo Coverage Area Cott Coverage Area 17Increases Route Density and Geographic Footprint in Refill Primo Coverage Area Cott Coverage Area 17

Financial Impact 18Financial Impact 18

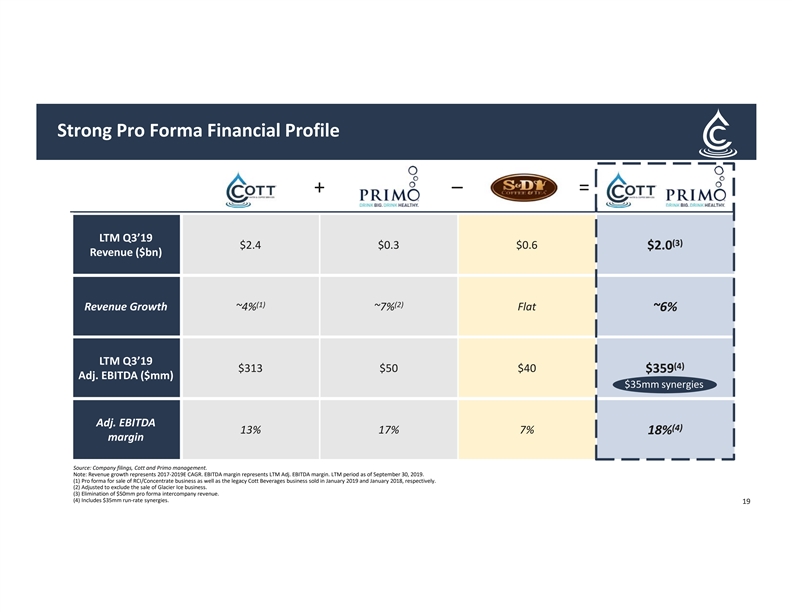

Strong Pro Forma Financial Profile + – = LTM Q3’19 (3) $2.4 $0.3 $0.6 $2.0 Revenue ($bn) (1) (2) Revenue Growth ~4% ~7% Flat ~6% LTM Q3’19 (4) $313 $50 $40 $359 Adj. EBITDA ($mm) $35mm synergies Adj. EBITDA (4) 13% 17% 7% 18% margin Source: Company filings, Cott and Primo management. Note: Revenue growth represents 20172019E CAGR. EBITDA margin represents LTM Adj. EBITDA margin. LTM period as of September 30, 2019. (1) Pro forma for sale of RCI/Concentrate business as well as the legacy Cott Beverages business sold in January 2019 and January 2018, respectively. (2) Adjusted to exclude the sale of Glacier Ice business. (3) Elimination of $50mm pro forma intercompany revenue. (4) Includes $35mm runrate synergies. 19Strong Pro Forma Financial Profile + – = LTM Q3’19 (3) $2.4 $0.3 $0.6 $2.0 Revenue ($bn) (1) (2) Revenue Growth ~4% ~7% Flat ~6% LTM Q3’19 (4) $313 $50 $40 $359 Adj. EBITDA ($mm) $35mm synergies Adj. EBITDA (4) 13% 17% 7% 18% margin Source: Company filings, Cott and Primo management. Note: Revenue growth represents 20172019E CAGR. EBITDA margin represents LTM Adj. EBITDA margin. LTM period as of September 30, 2019. (1) Pro forma for sale of RCI/Concentrate business as well as the legacy Cott Beverages business sold in January 2019 and January 2018, respectively. (2) Adjusted to exclude the sale of Glacier Ice business. (3) Elimination of $50mm pro forma intercompany revenue. (4) Includes $35mm runrate synergies. 19

Financial Highlights The acquisition squarely meets the Company’s quantitative and qualitative acquisition criteria, including: Accretive to revenue growth and EBITDA margin Accretive to earnings per share Cashoncash returns in excess of the Company’s cost of capital Targeting <3.5x leverage after sale of S&D and <3.0x post synergy capture Further solidifies credit profile Limited commodity exposure Free cash flow generation used for capital deployment including commitment to: Accretive M&A Dividend policy Debt reduction Share buybacks Tax efficiency Tax efficient divestiture of S&D using existing NOLs Acquisition of Primo includes $254mm of Federal NOLs 20Financial Highlights The acquisition squarely meets the Company’s quantitative and qualitative acquisition criteria, including: Accretive to revenue growth and EBITDA margin Accretive to earnings per share Cashoncash returns in excess of the Company’s cost of capital Targeting <3.5x leverage after sale of S&D and <3.0x post synergy capture Further solidifies credit profile Limited commodity exposure Free cash flow generation used for capital deployment including commitment to: Accretive M&A Dividend policy Debt reduction Share buybacks Tax efficiency Tax efficient divestiture of S&D using existing NOLs Acquisition of Primo includes $254mm of Federal NOLs 20

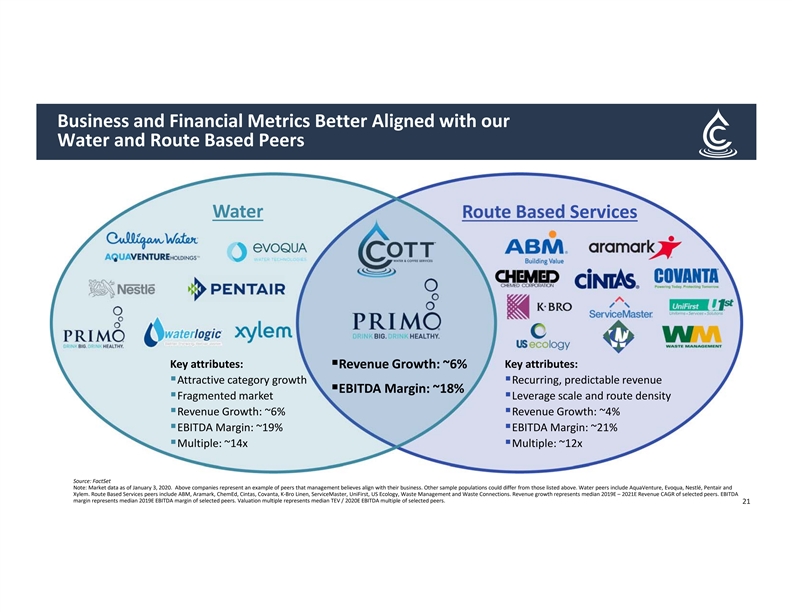

Business and Financial Metrics Better Aligned with our Water and Route Based Peers Water Services Key attributes: Revenue Growth: ~6% Key attributes: Attractive category growth Recurring, predictable revenue EBITDA Margin: ~18% Fragmented market Leverage scale and route density Revenue Growth: ~6% Revenue Growth: ~4% EBITDA Margin: ~19% EBITDA Margin: ~21% Multiple: ~14x Multiple: ~12x Source: FactSet Note: Market data as of January 3, 2020. Above companies represent an example of peers that management believes align with their business. Other sample populations could differ from those listed above. Water peers include AquaVenture, Evoqua, Nestlé, Pentair and Xylem. Route Based Services peers include ABM, Aramark, ChemEd, Cintas, Covanta, KBro Linen, ServiceMaster, UniFirst, US Ecology, Waste Management and Waste Connections. Revenue growth represents median 2019E – 2021E Revenue CAGR of selected peers. EBITDA margin represents median 2019E EBITDA margin of selected peers. Valuation multiple represents median TEV / 2020E EBITDA multiple of selected peers. 21Business and Financial Metrics Better Aligned with our Water and Route Based Peers Water Services Key attributes: Revenue Growth: ~6% Key attributes: Attractive category growth Recurring, predictable revenue EBITDA Margin: ~18% Fragmented market Leverage scale and route density Revenue Growth: ~6% Revenue Growth: ~4% EBITDA Margin: ~19% EBITDA Margin: ~21% Multiple: ~14x Multiple: ~12x Source: FactSet Note: Market data as of January 3, 2020. Above companies represent an example of peers that management believes align with their business. Other sample populations could differ from those listed above. Water peers include AquaVenture, Evoqua, Nestlé, Pentair and Xylem. Route Based Services peers include ABM, Aramark, ChemEd, Cintas, Covanta, KBro Linen, ServiceMaster, UniFirst, US Ecology, Waste Management and Waste Connections. Revenue growth represents median 2019E – 2021E Revenue CAGR of selected peers. EBITDA margin represents median 2019E EBITDA margin of selected peers. Valuation multiple represents median TEV / 2020E EBITDA multiple of selected peers. 21

Key Takeaways Creates a pure play water company and market leader in HOD, refill, exchange and water cooler dispensers Improves overall growth profile and margin given pure play water focus, underlying water category dynamics, combined distribution footprint, and exit of lower growth and lower margin S&D business Strengthens sustainability platform focused on refillable, reusable and recyclable containers Expected $35mm of cost synergies driven by existing Primo partnership, geographic overlap and elimination of duplicative G&A Strong pro forma financial impact including higher revenue growth, improved adjusted EBITDA margin, accretion to earnings, lower leverage and improved credit profile Singular water-focused combined company, positioned to succeed in higher growth and higher margin water categories as a rebranded entity, creates the opportunity to be valued in line with water peers 22Key Takeaways Creates a pure play water company and market leader in HOD, refill, exchange and water cooler dispensers Improves overall growth profile and margin given pure play water focus, underlying water category dynamics, combined distribution footprint, and exit of lower growth and lower margin S&D business Strengthens sustainability platform focused on refillable, reusable and recyclable containers Expected $35mm of cost synergies driven by existing Primo partnership, geographic overlap and elimination of duplicative G&A Strong pro forma financial impact including higher revenue growth, improved adjusted EBITDA margin, accretion to earnings, lower leverage and improved credit profile Singular water-focused combined company, positioned to succeed in higher growth and higher margin water categories as a rebranded entity, creates the opportunity to be valued in line with water peers 22

thankyou www.cott.comthankyou www.cott.com

Appendix – Non-GAAP ReconciliationsAppendix – Non-GAAP Reconciliations

2020 SYNERGIZED ADJUSTED EBITDA MULTIPLE Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars excluding multiple) (1) Estimated 2020 Adjusted EBITDA $ 57 (2) Run-rate synergies 35 2020 synergized adjusted EBITDA $ 92 Approximate purchase price $ 775 2020 synergized adjusted EBITDA multiple 8.4x Source: Cott and Primo management (1) See NonGAAP Measures section in Safe Harbor Statements located on slides 2 and 3. (2) Please refer to slide 16 for additional details on runrate synergies and ramping period. 252020 SYNERGIZED ADJUSTED EBITDA MULTIPLE Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars excluding multiple) (1) Estimated 2020 Adjusted EBITDA $ 57 (2) Run-rate synergies 35 2020 synergized adjusted EBITDA $ 92 Approximate purchase price $ 775 2020 synergized adjusted EBITDA multiple 8.4x Source: Cott and Primo management (1) See NonGAAP Measures section in Safe Harbor Statements located on slides 2 and 3. (2) Please refer to slide 16 for additional details on runrate synergies and ramping period. 25

LTM PRO FORMA REVENUE Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars) Cott Consolidated QTD 12/29/18 YTD 9/28/19 LTM 9/28/19 Revenue $ 599.2 $ 1,794.3 $ 2,393.5 Pro forma adjustments for RCI / Concentrate (20.4) (7.2) (27.6) Pro forma revenue $ 578.8 $ 1,787.1 $ 2,365.9 S&D Coffee and Tea QTD 12/29/18 YTD 9/28/19 LTM 9/28/19 Revenue $ 155.8 $ 443.4 $ 599.2 Primo Water QTD 12/31/18 YTD 9/30/19 LTM 9/30/19 Revenue $ 70.9 $ 236.3 $ 307.2 (1) Pro forma adjustments for Glacier Ice (1.2) (2.7) (3.9) Pro forma revenue $ 69.6 $ 233.6 $ 303.3 Source: Company filings, Cott and Primo management. (1) QTD 12/31/18 figure represents an estimate. 26LTM PRO FORMA REVENUE Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars) Cott Consolidated QTD 12/29/18 YTD 9/28/19 LTM 9/28/19 Revenue $ 599.2 $ 1,794.3 $ 2,393.5 Pro forma adjustments for RCI / Concentrate (20.4) (7.2) (27.6) Pro forma revenue $ 578.8 $ 1,787.1 $ 2,365.9 S&D Coffee and Tea QTD 12/29/18 YTD 9/28/19 LTM 9/28/19 Revenue $ 155.8 $ 443.4 $ 599.2 Primo Water QTD 12/31/18 YTD 9/30/19 LTM 9/30/19 Revenue $ 70.9 $ 236.3 $ 307.2 (1) Pro forma adjustments for Glacier Ice (1.2) (2.7) (3.9) Pro forma revenue $ 69.6 $ 233.6 $ 303.3 Source: Company filings, Cott and Primo management. (1) QTD 12/31/18 figure represents an estimate. 26

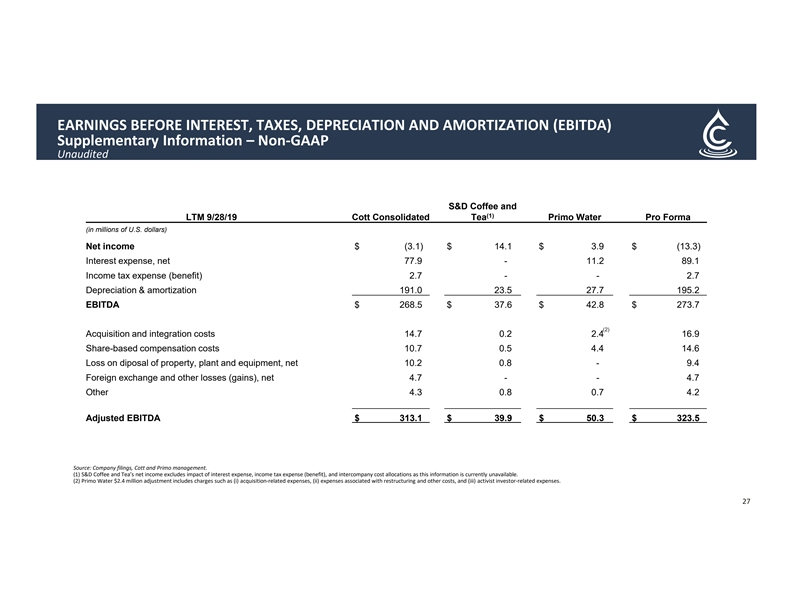

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (EBITDA) Supplementary Information – NonGAAP Unaudited S&D Coffee and (1) LTM 9/28/19 Cott Consolidated Tea Primo Water Pro Forma (in millions of U.S. dollars) Net income $ (3.1) $ 14.1 $ 3.9 $ (13.3) Interest expense, net 77.9 - 11.2 89.1 Income tax expense (benefit) 2.7 - - 2.7 Depreciation & amortization 191.0 23.5 27.7 195.2 EBITDA $ 268.5 $ 37.6 $ 42.8 $ 273.7 (2) Acquisition and integration costs 14.7 0.2 2.4 16.9 Share-based compensation costs 10.7 0.5 4.4 14.6 Loss on diposal of property, plant and equipment, net 10.2 0.8 - 9.4 Foreign exchange and other losses (gains), net 4.7 - - 4.7 Other 4.3 0.8 0.7 4.2 Adjusted EBITDA $ 313.1 $ 39.9 $ 50.3 $ 323.5 Source: Company filings, Cott and Primo management. (1) S&D Coffee and Tea’s net income excludes impact of interest expense, income tax expense (benefit), and intercompany cost allocations as this information is currently unavailable. (2) Primo Water $2.4 million adjustment includes charges such as (i) acquisitionrelated expenses, (ii) expenses associated with restructuring and other costs, and (iii) activist investorrelated expenses. 27EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (EBITDA) Supplementary Information – NonGAAP Unaudited S&D Coffee and (1) LTM 9/28/19 Cott Consolidated Tea Primo Water Pro Forma (in millions of U.S. dollars) Net income $ (3.1) $ 14.1 $ 3.9 $ (13.3) Interest expense, net 77.9 - 11.2 89.1 Income tax expense (benefit) 2.7 - - 2.7 Depreciation & amortization 191.0 23.5 27.7 195.2 EBITDA $ 268.5 $ 37.6 $ 42.8 $ 273.7 (2) Acquisition and integration costs 14.7 0.2 2.4 16.9 Share-based compensation costs 10.7 0.5 4.4 14.6 Loss on diposal of property, plant and equipment, net 10.2 0.8 - 9.4 Foreign exchange and other losses (gains), net 4.7 - - 4.7 Other 4.3 0.8 0.7 4.2 Adjusted EBITDA $ 313.1 $ 39.9 $ 50.3 $ 323.5 Source: Company filings, Cott and Primo management. (1) S&D Coffee and Tea’s net income excludes impact of interest expense, income tax expense (benefit), and intercompany cost allocations as this information is currently unavailable. (2) Primo Water $2.4 million adjustment includes charges such as (i) acquisitionrelated expenses, (ii) expenses associated with restructuring and other costs, and (iii) activist investorrelated expenses. 27

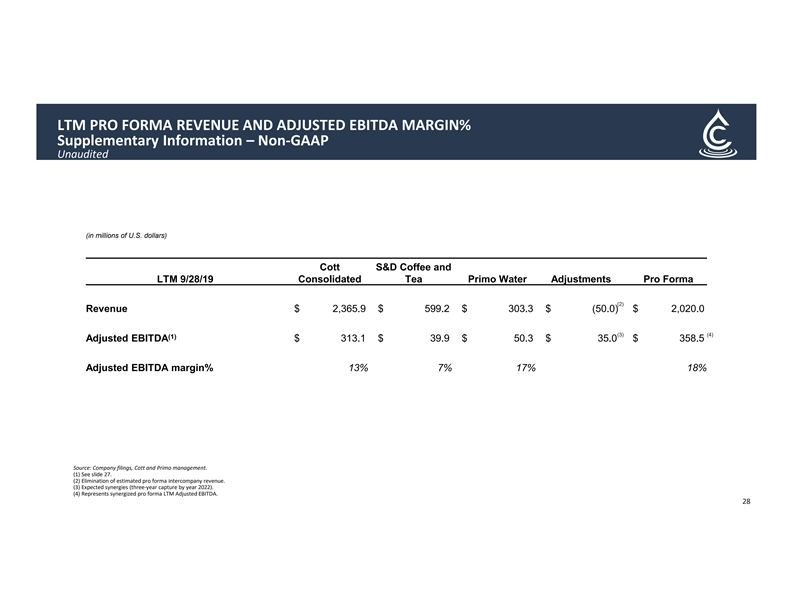

LTM PRO FORMA REVENUE AND ADJUSTED EBITDA MARGIN% Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars) Cott S&D Coffee and LTM 9/28/19 Consolidated Tea Primo Water Adjustments Pro Forma (2) Revenue $ 2,365.9 $ 599.2 $ 303.3 $ (50.0) $ 2,020.0 (3) (4) (1) Adjusted EBITDA $ 313.1 $ 39.9 $ 50.3 $ 35.0 $ 358.5 Adjusted EBITDA margin% 13% 7% 17% 18% Source: Company filings, Cott and Primo management. (1) See slide 27. (2) Elimination of estimated pro forma intercompany revenue. (3) Expected synergies (threeyear capture by year 2022). (4) Represents synergized pro forma LTM Adjusted EBITDA. 28LTM PRO FORMA REVENUE AND ADJUSTED EBITDA MARGIN% Supplementary Information – Non-GAAP Unaudited (in millions of U.S. dollars) Cott S&D Coffee and LTM 9/28/19 Consolidated Tea Primo Water Adjustments Pro Forma (2) Revenue $ 2,365.9 $ 599.2 $ 303.3 $ (50.0) $ 2,020.0 (3) (4) (1) Adjusted EBITDA $ 313.1 $ 39.9 $ 50.3 $ 35.0 $ 358.5 Adjusted EBITDA margin% 13% 7% 17% 18% Source: Company filings, Cott and Primo management. (1) See slide 27. (2) Elimination of estimated pro forma intercompany revenue. (3) Expected synergies (threeyear capture by year 2022). (4) Represents synergized pro forma LTM Adjusted EBITDA. 28