Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Endo International plc | a01132020jpmpresentati.htm |

Endo International plc J.P. Morgan Healthcare Conference Paul Campanelli, Chairman, President & CEO January 13, 2020 ©2020 Endo International plc or one of its affiliates.affiliates. All rights reserved 0

Forward Looking Statements This presentation contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future projects” or similar expressions are forward looking statements. Because these statements reflect our current projected views, expectations and beliefs concerning future events, these forward looking statements involve risks and uncertainties. Although Endo believes that these forward looking statements and information are based upon reasonable assumptions and expectations, readers should not place undue reliance on them, or any other forward looking statements or information in this presentation. Investors should note that many factors, as more fully described in the documents filed by Endo with securities regulators in the United States and Canada including under the caption “Risk Factors” in Endo’s Form 10-K, Form 10-Q and Form 8-K filings, as applicable, with the Securities and Exchange Commission and with securities regulators in Canada on System for Electronic Document Analysis and Retrieval (“SEDAR”) and as otherwise enumerated herein or therein, could affect Endo’s future financial results and could cause Endo’s actual results to differ materially from those expressed in any forward looking statements. The forward looking statements in this presentation are qualified by these risk factors. Endo assumes no obligation to publicly update any forward looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities law. ©2020 Endo International plc or one of its affiliates. All rights reserved 1

Our Strategic Priorities 1 2 3 Reshape our Organization Build Our Portfolio and Drive Margin Expansion for Success Capabilities for the Future and De-Lever Simplify our business through process Expand the breadth of our Sterile Drive EBITDA margin improvements and technology enhancements Injectables portfolio through operational execution and Drive productivity improvements Invest in the continued growth of our continuous improvements Leverage the new Endo Culture to highly focused Specialty portfolio De-lever 3-4x range over time; develop, retain and attract top talent Strengthen our Generics business committed to a highly disciplined capital portfolio and profile for the future allocation approach Execute to flawlessly bring the first Accelerate return to EBITDA dollar injectable treatment for cellulite to growth through smart business market development ©2020 Endo International plc or one of its affiliates. All rights reserved 2

2019 Accomplishments Reshape Our Continued double-digit growth in Branded Specialty portfolio and Sterile Organization Injectables business (Q3 ‘19 YTD) for Success Xiaflex® franchise grew 22% Q3 ‘19 YTD; Vasostrict® grew 16% Q3 ‘19 YTD Build Our CCH for Cellulite BLA filing accepted by FDA in Nov-19 Portfolio & Capabilities Launched 14 products in 2019 for Future Successful debt refinancing completed in Mar-19 Drive Margin Settlements to resolve “Track 1” Opioid cases (Cuyahoga and Summit Counties in Expansion Ohio) and State of Oklahoma Investigation (January 2020) & De-Lever Favorable FDA decision to remove vasopressin from the 503B Bulks List Prevailed in district court ruling defending our Adrenalin® 1ml intellectual Other property against generic manufacturer Highlights ©2020 Endo International plc or one of its affiliates. All rights reserved 3

Endo Focused on Core Growth Areas of Sterile Injectables and Specialty Branded Businesses International Branded Pharmaceuticals: Branded Pharmaceuticals: 4% 29% $630m Pharmaceuticals $87m 3Q19 Total YTD Sales: 31% Sales Generic $2,150m Pharmaceuticals: Sterile Injectables: Sterile $654m $778m Injectables 36% International Branded Pharmaceuticals: Generic Pharmaceuticals: 5% 29% $633m Pharmaceuticals $108m 3Q18 Total YTD 35% Sales: Sales Generic $2,161m International Pharmaceuticals: Sterile Injectables: Pharmaceuticals $748m 31% $671m ©2020 Endo International plc or one of its affiliates. All rights reserved 4

Specialty Branded Portfolio Continues to Advance with 18% 3Q YTD Growth Strong Specialty Branded portfolio focused on Specialty Branded Revenue Q3 YTD ($M) high margin branded products to treat conditions in urology and men’s health, orthopedics, $400 $371M endocrinology and bariatric $315M Xiaflex® 22% Q3 YTD revenue growth. Strong market expansion, with room for additional $300 growth in both Peyronie’s Disease and Xiaflex Dupuytren’s Contracture (+22%) $200 Strong commercial, marketing and distribution capabilities that will be leveraged for planned expansion into medical aesthetics in 2020 or $100 other products Other Specialty (+11%) $0 Q3'18 YTD Q3'19 YTD ©2020 Endo International plc or one of its affiliates. All rights reserved 5

Consumer Activation Strategies Lead to Growth in Xiaflex® for Peyronie’s and Dupuytren’s Contracture Potential for Sustained Growth Consumer Activation Strategies Diagnosis Rates (Given the Low Diagnosis and Low Treatment Rates) Unbranded Digital In-Office TV Ad Display Materials 29% increase 2% 14% 58% Diagnosis Patients Patients Treated with Rate* Diagnosed Treated Xiaflex Peyronie’s Disease Peyronie’s Elway National & Satellite Non-linear Campaign Media Tours TV 13% increase 3.8% 29% 25% Dupuytren’s Diagnosis Patients Patients Treated with Rate* Diagnosed Treated Xiaflex Source: *Endo analysis of IQVIA Medical Claims data Apr 2017 – April 2019 ©2020 Endo International plc or one of its affiliates. All rights reserved 6

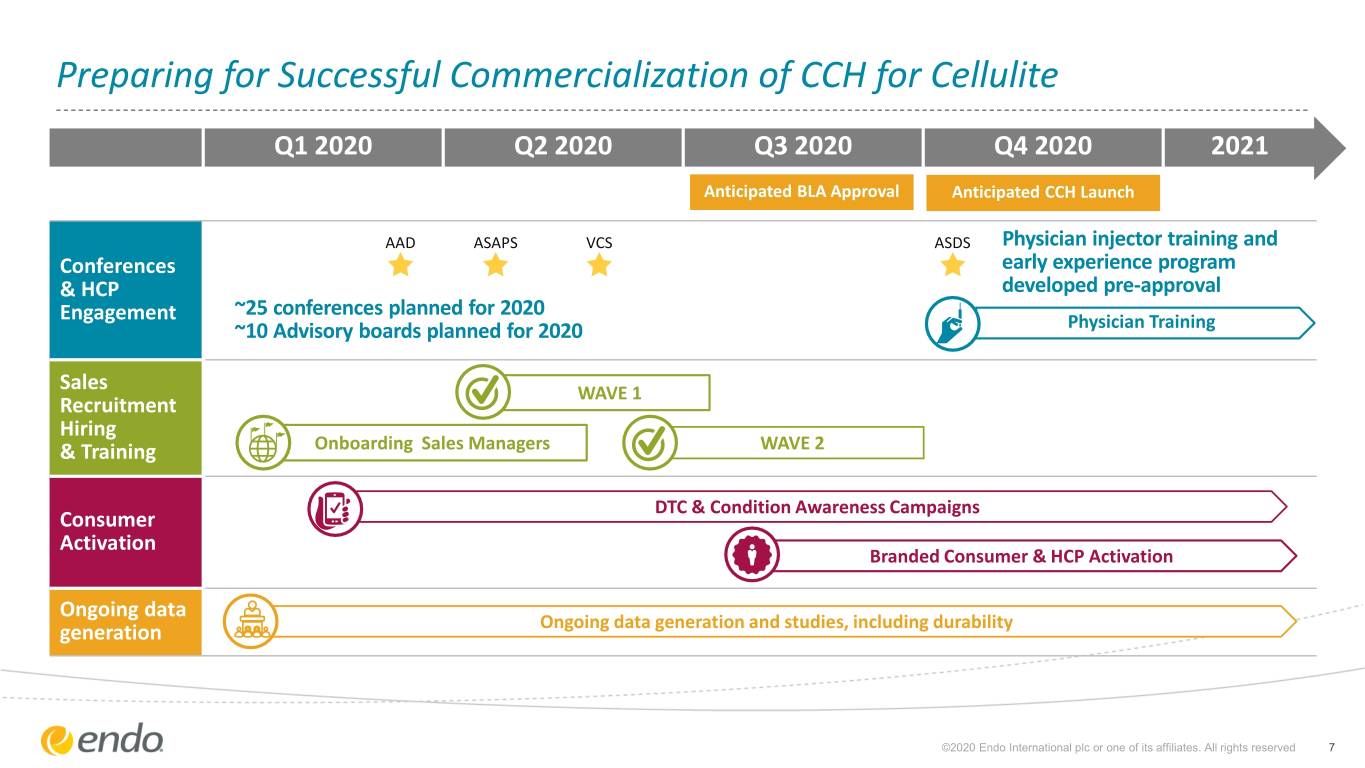

Preparing for Successful Commercialization of CCH for Cellulite Q1 2020 Q2 2020 Q3 2020 Q4 2020 2021 Anticipated BLA Approval Anticipated CCH Launch AAD ASAPS VCS ASDS Physician injector training and Conferences early experience program & HCP developed pre-approval Engagement ~25 conferences planned for 2020 ~10 Advisory boards planned for 2020 Physician Training Sales WAVE 1 Recruitment Hiring & Training Onboarding Sales Managers WAVE 2 DTC & Condition Awareness Campaigns Consumer Activation Branded Consumer & HCP Activation Ongoing data generation Ongoing data generation and studies, including durability ©2020 Endo International plc or one of its affiliates. All rights reserved 7

Sterile Injectables Continue to Deliver with 16% Q3 YTD Growth Trusted manufacturer & distributor of Sterile Sterile Injectables Revenue Q3 YTD ($M) Injectable products to hospital/critical care setting $900 $778M On track to exceed $1bn in FY2019 revenues $800 $671M GPOs provide strategic channel access….with $700 hospitals retaining individual formulary and $600 purchasing decision Vasostrict $500 (+16%) Positioned to expand 505(b) (2) products and to $400 grow through expanding Ready-to-Use (RTU) Adrenalin and other higher-value products in hospital $300 (+31%) setting $200 Other (+10%) $100 $0 Q3'18 YTD Q3'19 YTD ©2020 Endo International plc or one of its affiliates. All rights reserved 8

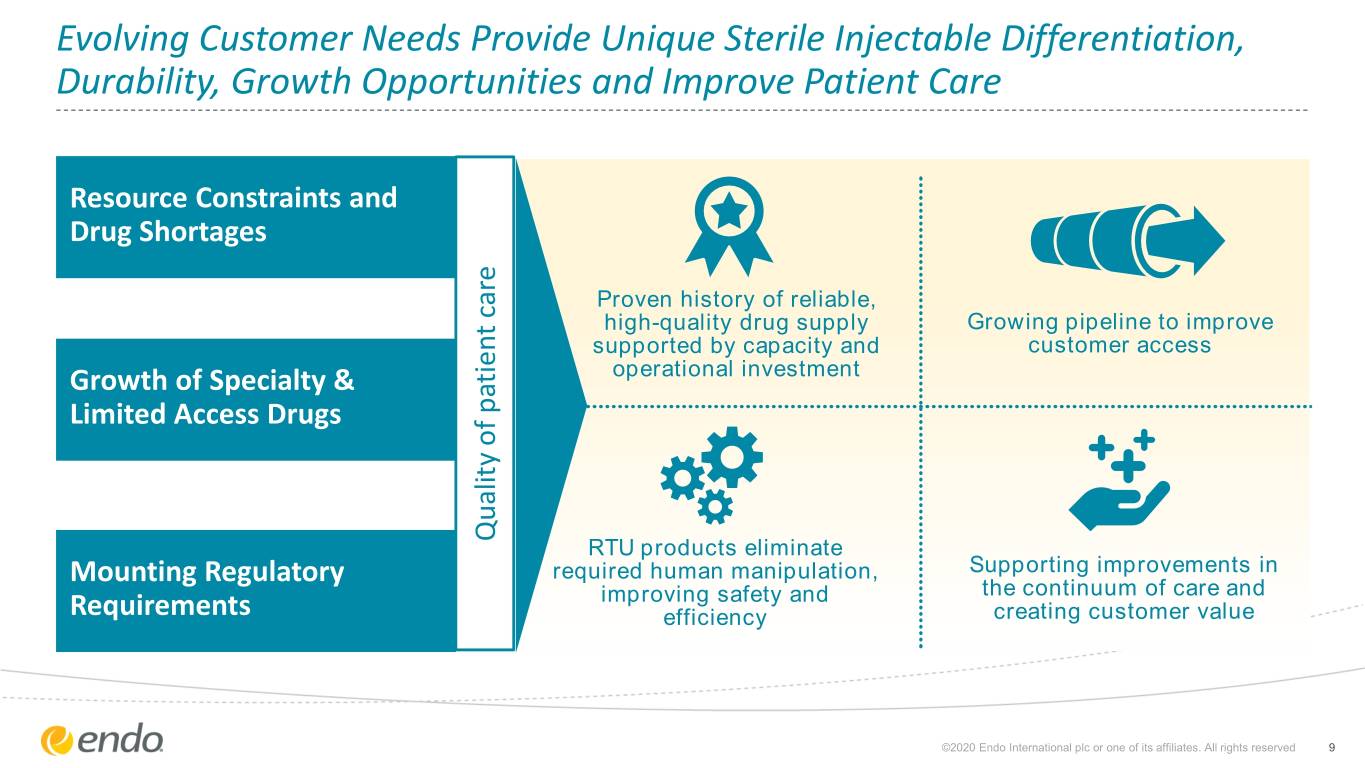

Evolving Customer Needs Provide Unique Sterile Injectable Differentiation, Durability, Growth Opportunities and Improve Patient Care Resource Constraints and Drug Shortages Proven history of reliable, high-quality drug supply Growing pipeline to improve supported by capacity and customer access Growth of Specialty & operational investment Limited Access Drugs Quality of patient Quality of care patient RTU products eliminate Mounting Regulatory required human manipulation, Supporting improvements in improving safety and the continuum of care and Requirements efficiency creating customer value ©2020 Endo International plc or one of its affiliates. All rights reserved 9

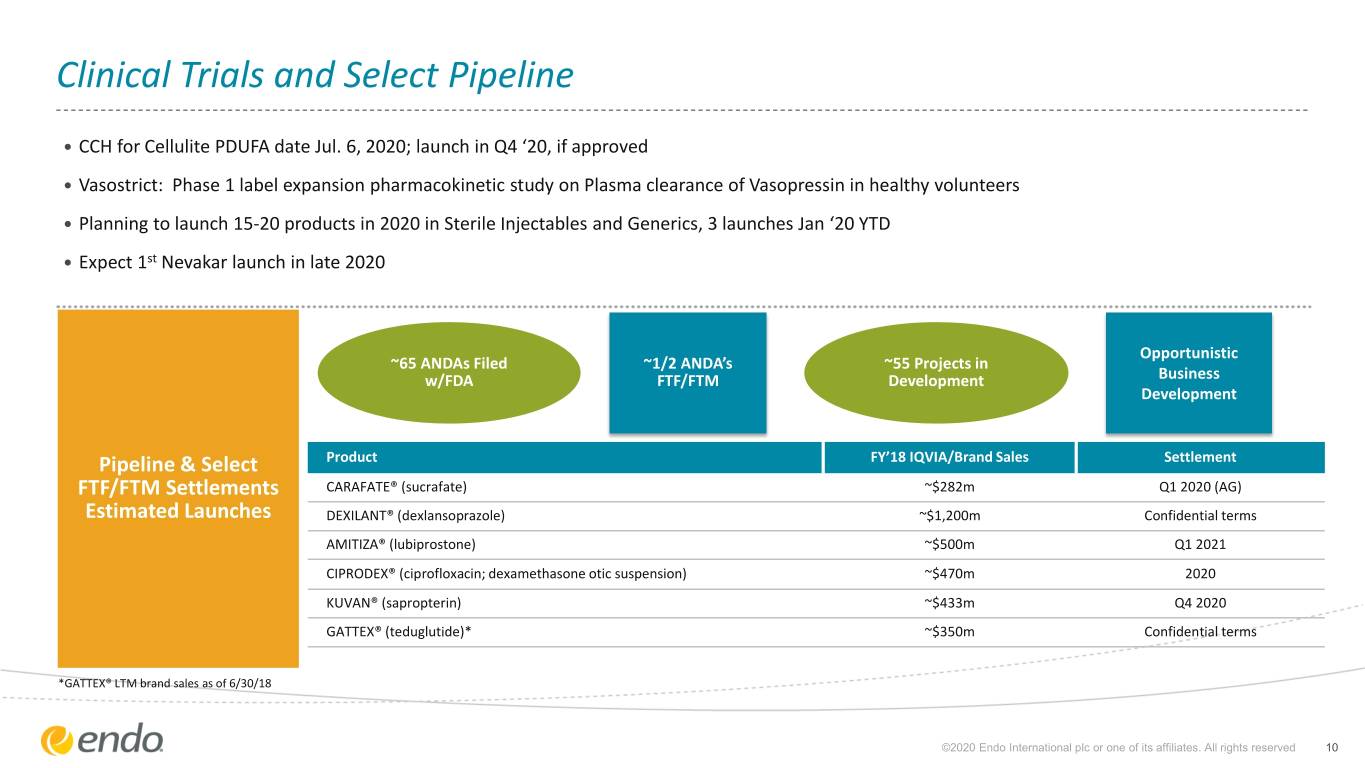

Clinical Trials and Select Pipeline CCH for Cellulite PDUFA date Jul. 6, 2020; launch in Q4 ‘20, if approved Vasostrict: Phase 1 label expansion pharmacokinetic study on Plasma clearance of Vasopressin in healthy volunteers Planning to launch 15-20 products in 2020 in Sterile Injectables and Generics, 3 launches Jan ‘20 YTD Expect 1st Nevakar launch in late 2020 Opportunistic ~65 ANDAs Filed ~1/2 ANDA’s ~55 Projects in w/FDA FTF/FTM Development Business Development Pipeline & Select Product FY’18 IQVIA/Brand Sales Settlement FTF/FTM Settlements CARAFATE® (sucrafate) ~$282m Q1 2020 (AG) Estimated Launches DEXILANT® (dexlansoprazole) ~$1,200m Confidential terms AMITIZA® (lubiprostone) ~$500m Q1 2021 CIPRODEX® (ciprofloxacin; dexamethasone otic suspension) ~$470m 2020 KUVAN® (sapropterin) ~$433m Q4 2020 GATTEX® (teduglutide)* ~$350m Confidential terms *GATTEX® LTM brand sales as of 6/30/18 ©2020 Endo International plc or one of its affiliates. All rights reserved 10

Successful Execution on Strategic Priorities to Date, but Journey Continues Significant progress achieved on our multi-year turnaround plan Focus on continuing to build our portfolio and capabilities for the future, anchored on Branded Pharmaceuticals and Sterile Injectables Excellence in overall execution including strong commercial, marketing and distribution capabilities that will be leveraged for expansion into medical aesthetics or other products Continued strong liquidity profile and disciplined approach against our stated capital allocation priorities ©2020 Endo International plc or one of its affiliates. All rights reserved 11

©2020 Endo International plc or one of its affiliatesaffiliates.. All rights reserved 12