Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | pbf2020guidance8-k.htm |

PBF Energy January 2020 1

Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. (“PBF Energy”), the indirect parent of PBF Logistics LP (“PBFX”, or “Partnership”, and together with PBF Energy, the “Companies”, or “PBF”), and their management teams. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Companies’ actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions (including the pending acquisition of the Martinez refinery, and related logistics assets, collectively the “Martinez Acquisition”) and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; ability to consummate pending or potential acquisitions, the timing for the closing of any such acquisition and our plans for financing any acquisition; unforeseen liabilities associated with any pending or potential acquisition; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Companies assume no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date. 2

PBF Energy 2020 Guidance (Figures in millions except per barrel amounts) FY 2020E Q1-2020E East Coast Throughput 350,000 – 370,000 bpd 350,000 – 370,000 bpd Mid-Continent Throughput 140,000 – 150,000 bpd 110,000 – 120,000 bpd Gulf Coast Throughput 185,000 – 195,000 bpd 185,000 – 195,000 bpd West Coast Throughput 165,000 – 175,000 bpd 165,000 – 175,000 bpd Total Throughput 840,000 – 890,000 bpd 810,000 – 860,000 bpd FY 2020E Notes Refining operating expenses $5.25 - $5.50 / bbl Excluding non-refining operating expenses SG&A expenses $180 - $190 Excludes stock-based and incentive compensation D&A $440 - $460 Interest expense, net $170 - $180 Maintenance and Turnaround Capital expenditures $500 - $550 Excludes capital expenditures for PBF Logistics LP Strategic Capital expenditures ~$45 Excludes capital expenditures for PBF Logistics LP Shares outstanding (millions) 123 Turnaround Schedule Period Duration Delaware City – Alkylation Q1 35 – 45 days Toledo – FCC and Alkylation Q1-2 40 – 50 days Paulsboro – CCR Q2 20 – 30 days Delaware City – Crude Q4 35 – 45 days Guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company configuration. Except where otherwise noted, guidance expense figures include consolidated amounts for PBF Logistics LP. All figures and timelines are subject to change based on market and macroeconomic factors, as well as company strategic decision-making and overall company performance. 3

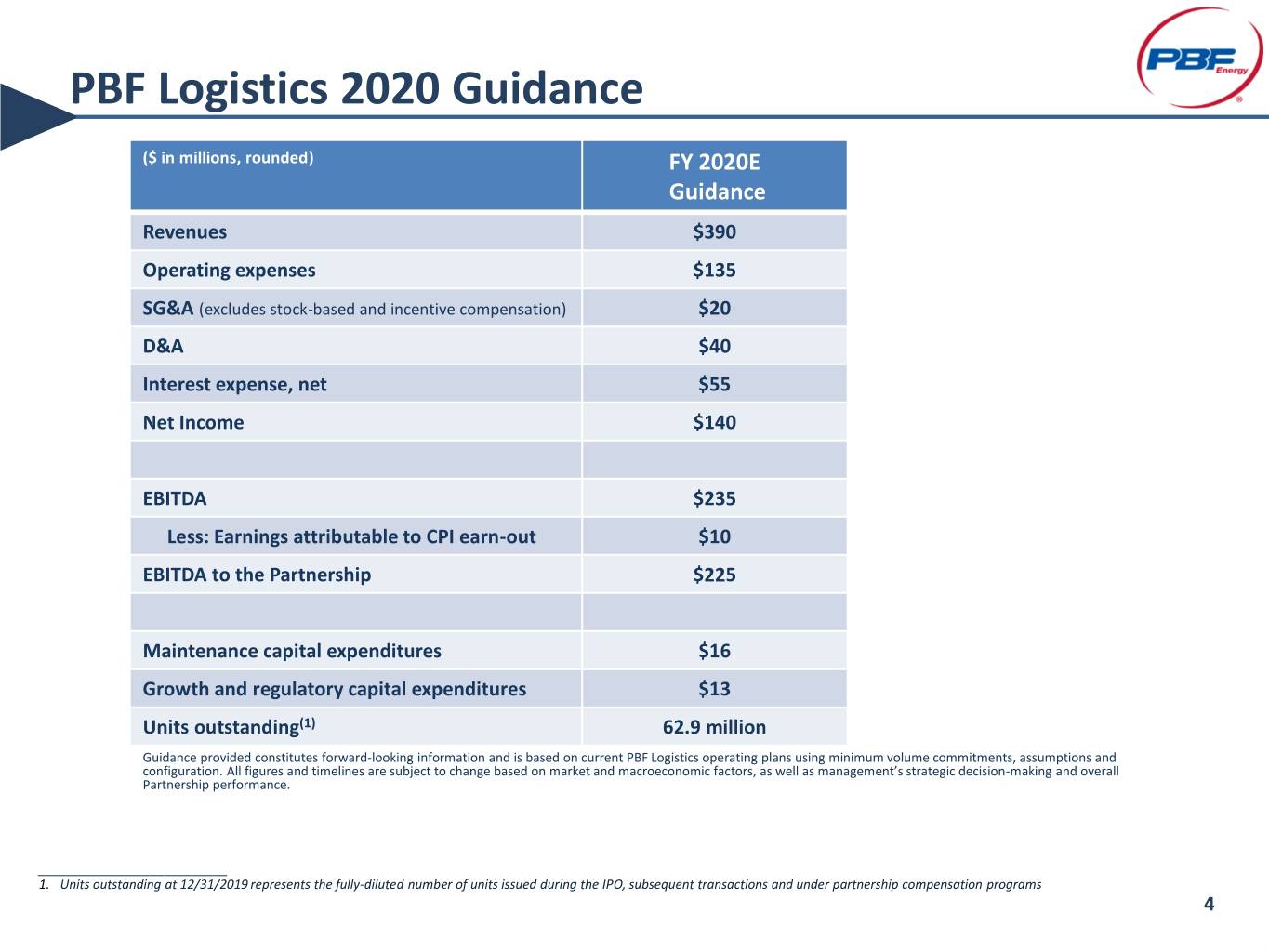

PBF Logistics 2020 Guidance ($ in millions, rounded) FY 2020E Guidance Revenues $390 Operating expenses $135 SG&A (excludes stock-based and incentive compensation) $20 D&A $40 Interest expense, net $55 Net Income $140 EBITDA $235 Less: Earnings attributable to CPI earn-out $10 EBITDA to the Partnership $225 Maintenance capital expenditures $16 Growth and regulatory capital expenditures $13 Units outstanding(1) 62.9 million Guidance provided constitutes forward-looking information and is based on current PBF Logistics operating plans using minimum volume commitments, assumptions and configuration. All figures and timelines are subject to change based on market and macroeconomic factors, as well as management’s strategic decision-making and overall Partnership performance. ___________________________ 1. Units outstanding at 12/31/2019 represents the fully-diluted number of units issued during the IPO, subsequent transactions and under partnership compensation programs 4

Non-GAAP Financial Measures Our management uses EBITDA (earnings before interest, income taxes, depreciation and amortization) as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to readily view operating trends, as a measure for planning and forecasting overall expectations and for evaluating actual results against such expectations, and in communications with our board of directors, creditors, analysts and investors concerning our financial performance. EBITDA is not a presentation made in accordance with GAAP and our computation of EBITDA may vary from others in our industry. EBITDA should not be considered as an alternative to operating income (loss) or net income (loss) as measures of operating performance. In addition, EBITDA is not presented as, and should not be considered, an alternative to cash flows from operations as a measure of liquidity. Due to the forward-looking nature of forecasted EBITDA, information to reconcile forecasted EBITDA to forecasted earnings and cash flow from operating activities is not available as management is unable to project financing terms and working capital changes for future periods at this time. This presentation includes references to EBITDA and EBITDA attributable to PBFX, which is a non-GAAP financial measure that is reconciled to its most directly comparable GAAP measure in the quarterly and annual reports on Forms 10-Q and 10-K for PBFX. We define EBITDA attributable to PBFX as net income (loss) attributable to PBFX before net interest expense, income tax expense, depreciation and amortization expense attributable to PBFX, which excludes the results attributable to noncontrolling interests, acquisitions from affiliate companies under common control prior to the effective dates of such transactions and earnings attributable to the earnout with Crown Point International, LLC in connection with the acquisition of CPI Operations LLC (“CPI”). With respect to projected MLP- qualifying EBITDA, we are unable to prepare a quantitative reconciliation to the most directly comparable GAAP measure without unreasonable effort, as, among other things, certain items that impact these measures, such as the provision for income taxes, depreciation of fixed assets, amortization of intangibles and financing costs have not yet occurred, are subject to market conditions and other factors that are out of our control and cannot be accurately predicted. 5