Attached files

| file | filename |

|---|---|

| EX-99.5 - EXHIBIT 99.5 - Oblong, Inc. | a995proforma.htm |

| EX-99.3 - EXHIBIT 99.3 - Oblong, Inc. | a993auditedfinancialstatem.htm |

| EX-99.2 - EXHIBIT 99.2 - Oblong, Inc. | a992auditedfinancialstatem.htm |

| EX-23.2 - EXHIBIT 23.2 - Oblong, Inc. | a232hcvtconsent.htm |

| EX-23.1 - EXHIBIT 23.1 - Oblong, Inc. | a231bdoconsent.htm |

| 8-K/A - 8-K/A - Oblong, Inc. | form8-ka.htm |

Exhibit 99.4

OBLONG INDUSTRIES, INC.

As of September 30, 2019, and for the Nine Months Ended

September 30, 2019 and 2018 (Unaudited)

1

Exhibit 99.4

OBLONG INDUSTRIES, INC.

September 30, 2019 and 2018

Table of Contents

Page | ||||

Financial Statements | ||||

Balance Sheet | 3 | |||

Statements of Income | 4 | |||

Statement of Convertible Preferred Stock and Stockholders' Deficit | 5-6 | |||

Statements of Cash Flows | 7 | |||

Notes to Financial Statements | 8-20 | |||

2

Exhibit 99.4

Oblong Industries, Inc.

CONSOLIDATED BALANCE SHEET

September 30, 2019 | |||

(Unaudited) | |||

ASSETS | |||

Current assets: | |||

Cash, cash equivalents and restricted cash | $ | 2,193,891 | |

Accounts receivable | 1,962,264 | ||

Prepaid expenses and other current assets | 571,189 | ||

Inventory | 1,618,118 | ||

Total current assets | 6,345,462 | ||

Property and equipment, net | 1,221,294 | ||

Intangible assets, net | 3,595,117 | ||

Other assets | 215,873 | ||

Total assets | $ | 11,377,746 | |

LIABILITIES, CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS' EQUITY | |||

Current liabilities: | |||

Accounts payable | $ | 296,018 | |

Accrued expenses and other current liabilities | 1,024,365 | ||

Customer deposits | 90,082 | ||

Current portion of deferred revenue | 2,951,977 | ||

Current portion of deferred rent | 62,157 | ||

Notes payable | 3,000,000 | ||

Current portion of long-term debt | 2,627,462 | ||

Total current liabilities | 10,052,061 | ||

Deferred rent, net current portion | 139,260 | ||

Long-term debt | 2,619,538 | ||

Other long-term liabilities | 93,661 | ||

Total liabilities | 12,904,520 | ||

Convertible preferred stock: | |||

Convertible preferred stock | 71,755,175 | ||

Stockholders' deficit: | |||

Common stock | 2,735 | ||

Additional paid-in capital | 43,863,065 | ||

Accumulated deficit | (116,715,472 | ) | |

Retained Earnings | (432,277 | ) | |

Total stockholders' deficit | (73,281,949 | ) | |

Total liabilities, convertible preferred stock, and stockholders' deficit | $ | 11,377,746 | |

The accompanying notes are an integral part of these financial statements | |||

3

Exhibit 99.4

Oblong Industries, Inc.

CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, | 2019 | 2018 | ||||

(Unaudited) | (Unaudited) | |||||

Net Revenues | $ | 12,757,891 | $ | 13,267,053 | ||

Cost of revenues | 2,719,024 | 3,017,507 | ||||

Gross profit | 10,038,867 | 10,249,546 | ||||

Operating expenses: | ||||||

Research and development | 6,321,182 | 6,917,877 | ||||

General and administrative | 5,623,661 | 5,425,866 | ||||

Sales and marketing | 7,585,375 | 9,409,313 | ||||

Depreciation and amortization | 852,272 | 1,016,782 | ||||

Loss on impairment of intangible assets | 426,785 | 136,894 | ||||

Total operating expenses | 20,809,275 | 22,906,732 | ||||

Loss from operations | (10,770,408 | ) | (12,657,186 | ) | ||

Other expenses: | ||||||

Interest expense, net | 260,334 | 51,703 | ||||

Other expenses, net | 11,650 | 27,996 | ||||

Total other expenses, net | 271,984 | 79,699 | ||||

Net loss | (11,042,392 | ) | (12,736,885 | ) | ||

Foreign currency translation loss | (38,287 | ) | (55,822 | ) | ||

Comprehensive loss | $ | (11,080,679 | ) | (12,792,707 | ) | |

The accompanying notes are an integral part of these financial statements | ||||||

4

Exhibit 99.4

Oblong Industries, Inc.

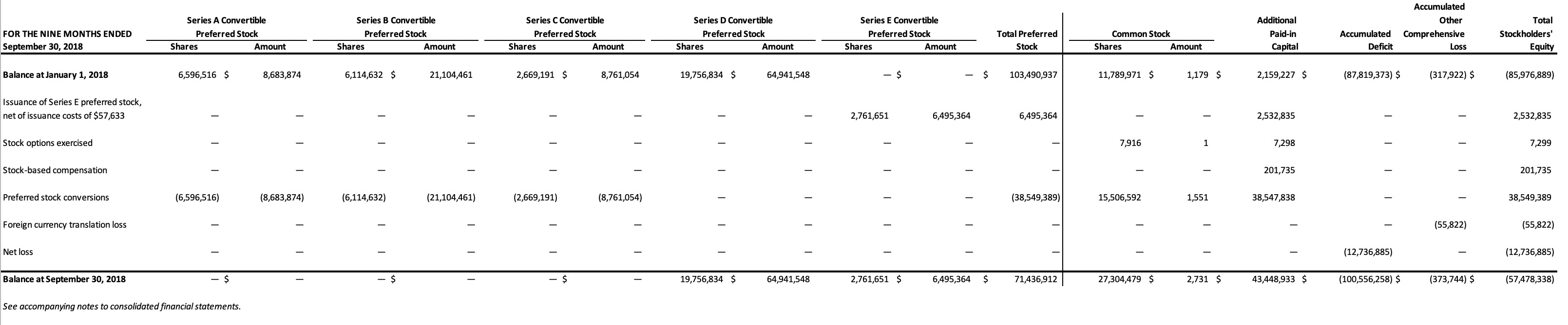

CONSOLIDATED STATEMENT OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY (Unaudited)

Series D Convertible | Series E Convertible | Total Convertible | Additional | Accumulated Other | Total | |||||||||||||||||||||||||||

FOR THE NINE MONTHS ENDED | Preferred Stock | Preferred Stock | Preferred Stock | Common Stock | Paid-in | Accumulated | Comprehensive | Stockholders' | ||||||||||||||||||||||||

SEPTEMBER 30, 2019 | Shares | Amount | Shares | Amount | Amount | Shares | Amount | Capital | Deficit | Loss | Deficit | |||||||||||||||||||||

Balance at January 1, 2019 | 19,756,834 | $ | 64,941,548 | 2,899,266 | $ | 6,813,627 | $ | 71,755,175 | 27,304,479 | $ | 2,731 | $ | 43,607,483 | $ | (105,673,080 | ) | $ | (393,990 | ) | $ | (62,456,856 | ) | ||||||||||

Stock options exercised | — | — | — | — | — | 35,219 | 4 | 17,630 | — | — | 17,634 | |||||||||||||||||||||

Stock-based compensation | — | — | — | — | — | — | — | 237,952 | — | — | 237,952 | |||||||||||||||||||||

Foreign currency translation loss | — | — | — | — | — | — | — | — | — | (38,287 | ) | (38,287 | ) | |||||||||||||||||||

Net loss | — | — | — | — | — | — | — | — | (11,042,392 | ) | — | (11,042,392 | ) | |||||||||||||||||||

Balance at September 30, 2019 | 19,756,834 | $ | 64,941,548 | 2,899,266 | $ | 6,813,627 | $ | 71,755,175 | 27,339,698 | $ | 2,735 | $ | 43,863,065 | $ | (116,715,472 | ) | $ | (432,277 | ) | $ | (73,281,949 | ) | ||||||||||

See accompanying notes to consolidated financial statements. | ||||||||||||||||||||||||||||||||

5

Exhibit 99.4

Oblong Industries, Inc.

CONSOLIDATED STATEMENT OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY (Unaudited)

6

Exhibit 99.4

Oblong Industries, Inc.

CONSOLIDATED STATEMENT OF CASH FLOWS

Nine Months Ended September 30, | |||||||||

2019 | 2018 | ||||||||

(Unaudited) | (Unaudited) | ||||||||

Cash flows from operating activities | |||||||||

Net loss | $ | (11,042,392 | ) | $ | (12,736,885) | ||||

Adjustments to reconcile net loss to cash used in operating activities | |||||||||

Depreciation and amortization | 1,027,670 | 1,074,118 | |||||||

Inventory write-off | 187,650 | 120,521 | |||||||

Amortization of deferred financing costs | 112,961 | 62,563 | |||||||

Stock-based compensation | 237,952 | 201,735 | |||||||

Loss on disposal of property, plant, and equipment | 9,438 | 6,647 | |||||||

Impairment of intangibles assets | 426,785 | 254,594 | |||||||

Changes in operating assets and liabilities: | |||||||||

Accounts receivable | 267,358 | 6,497,283 | |||||||

Prepaid expenses and other current assets | 234,091 | 118,194 | |||||||

Inventory | 62,385 | (114,744) | |||||||

Other assets | 44,971 | 94,756 | |||||||

Accounts payable | (254,407 | ) | (658,768) | ||||||

Accrued expenses | 81,891 | (974,479) | |||||||

Deferred revenue | (416,126) | (3,187,917) | |||||||

Customer deposits | (343,117) | (35,432) | |||||||

Deferred rent | (15,813) | (27,542) | |||||||

Other long-term liabilities | (22,663 | ) | (147,245 | ) | |||||

Net cash used in operating activities | (9,401,366) | (9,452,601 | ) | ||||||

Cash flows from investing activities | |||||||||

Purchase of property and equipment | (60,025 | ) | (192,199) | ||||||

Intangible asset costs | 27,994 | (193,798) | |||||||

Net cash used/provided by investing activities | (32,031) | (385,997) | |||||||

Cash flows from financing activities | |||||||||

Proceeds from exercise of options | 17,634 | 7,299 | |||||||

Borrowing from revolving line of credit | — | 2,750,065 | |||||||

Borrowing from promissory notes | 3,000,000 | — | |||||||

Payments on revolving line of credit | — | (2,750,065 | ) | ||||||

Payments on term loan | — | (2,058,333 | ) | ||||||

Proceeds from sale of preferred stock | — | 9,028,199 | |||||||

Net cash provided by financing activities | 3,017,634 | 6,977,165 | |||||||

Effect of foreign currency on cash | (38,286 | ) | (55,822 | ) | |||||

Net decrease in cash | (6,454,049 | ) | (2,917,255 | ) | |||||

Cash, cash equivalents, and restricted cash, beginning of period | 8,647,940 | 14,684,503 | |||||||

Cash, cash equivalents, and restricted cash, end of period | $ | 2,193,891 | $ | 11,767,248 | |||||

The accompanying notes are an integral part of these financial statements

7

Exhibit 99.4

OBLONG INDUSTRIES, INC.

Notes to Financial Statements

Information as of September 30, 2019 and for the Nine Months Ended

September 30, 2019 and 2018 is unaudited

Note 1 - Description of Business and Summary of Significant Accounting Policies

Nature of Operations

Oblong Industries, Inc. ("Oblong") was incorporated in the state of Delaware on July 31, 2006. Oblong’s wholly owned subsidiaries consist of Oblong Industries Europe S.L.U. ("Euroblong") and Oblong Europe Ltd ("Oblong UK") (collectively, the "Company"). Euroblong was incorporated in Spain on March 12, 2007 and Oblong UK was incorporated in England on February 6, 2014. On January 27, 2017, Oblong UK established the branch entity, Oblong Europe Ltd. (German Branch) ("Oblong German Branch").

The Company’s core platform is g-speak™ and Mezzanine™ is its flagship product built on this platform. Mezzanine offers advanced collaboration for conference room technology, which amplifies sales presentations, enhances group collaboration, and makes work sessions more productive. The Company offers g-speak development licenses to larger enterprise customers. Oblong is headquartered in Los Angeles, California with a sales and development office in Boston, Massachusetts; regional sales offices in Los Altos, California; New York City, New York; Washington D.C.; Chicago, Illinois; Houston and Dallas, Texas; and Atlanta, Georgia. The Euroblong office is in Barcelona, Spain and focuses on mobile research and development, while the Oblong UK and Oblong German Branch offices are in London, England and Munich, Germany, respectively, and focus on sales and marketing in the European region.

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company had an accumulated deficit of $116,715,472 as of September 30, 2019, and net losses of $11,042,392 for the nine months ended September 30, 2019. Cash used in operating activities amounted to $9,401,366 for the nine months ended September 30, 2019. These conditions raise substantial doubt as to the Company’s ability to continue to operate as a going concern.

Since inception, the Company has financed its business activities through the issuance of equity instruments and debt. The Company is subject to various risks and uncertainties frequently encountered by newly formed companies. Such risks and uncertainties include, but are not limited to, undeveloped technology, its limited operating history, dependence on key personnel, and management of rapid growth. To address these risks, the Company must, among other things, successfully develop its customer base; successfully execute its business and marketing strategy; successfully develop its technology; provide superior customer service; and attract, retain, and motivate qualified personnel.

Based on the Company's projected cash flows and operating results for 2019, management does not believe it has sufficient cash resources to fund operations and meet its obligations as they become due for the next twelve months. Management has no further funding commitments from current investors and is in active pursuit of finding new investors or potential acquirers. As a result, there is substantial doubt the Company will be able to raise adequate funds, get acquired, or achieve and sustain profitability of positive cash flows from its operations.

The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

8

Exhibit 99.4

Interim Financial Statements

In the opinion of the Company's management, the accompanying unaudited consolidated financial statements of the Company contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly its financial position as of September 30, 2019 and the results of its operations and its cash flows for the nine months ended September 30, 2019 and 2018. These interim financial statements are condensed and therefore do not include all of the information and footnotes required by generally accepted accounting principles in the United States of America ("GAAP"). The actual results for the nine months ended September 30, 2019 are not necessarily indicative of the results that can be expected for the year ended December 31, 2019.

Accounting Method

The Company maintains its accounting records on an accrual method in conformity with accounting principles generally accepted in the United States of America ("US GAAP").

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Oblong and its wholly-owned subsidiaries Euroblong and Oblong UK, and branch entity, Oblong German Branch. All significant intercompany balances and transactions have been eliminated upon consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant items subject to such estimates and assumptions include the valuation of certain accrued expenses, which have been prepared on the basis of the most current and best available information. However, actual results from the resolution of such estimates and assumptions may vary from those used in the preparation of the consolidated financial statements.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include all cash balances and highly liquid investments, such as money market funds, with original maturities of three months or less from the date of purchase. Restricted cash are cash and cash equivalents that are restricted as to withdrawal or use under the terms of certain contractual agreements.

The Company used a bank guarantee in place of a cash deposit for the lease of the sales office in Munich, Germany. The bank guarantee was collateralized by a restricted cash bank account of $93,150, which was included in cash, cash equivalents and restricted cash.

The Company has credit cards issued through the Company's bank. In September 2019, The Company was required to provide cash collateral equal to the credit limits on all open credit cards. All credit cards were closed and canceled as of September 30, 2019.

As of September 30, 2019, the Company's cash balance included restricted cash balance of $328,350.

In November 2016, the FASB issued Accounting Standards Update ("ASU") 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash ("ASU 2016-18"). ASU 2016-18 provides guidance on how restricted cash must be presented on the consolidated statement of cash flows. ASU 2016-18 requires that consolidated statement of cash flows show the change during the period of the total cash, cash equivalents and restricted cash. Private companies are required to apply the guidance in ASU 2016-18 to fiscal years beginning after December 15, 2018, with early adoption permitted.

9

Exhibit 99.4

The Company has early adopted this guidance, and restricted cash is included in cash, cash equivalents and restricted cash on the accompanying consolidated balance sheet as of September 30, 2019.

Fair Value Measurements

The Company accounts for the fair value of its financial instruments in accordance with FASB ASC Topic 820, Fair Value Measurements and Disclosures ("ASC 820"). Non-recurring, nonfinancial assets and liabilities are also accounted for under the provisions of ASC 820.

ASC 820 defines fair value, establishes a framework for measuring fair value under US GAAP and enhances disclosures about fair value measurements. Fair value is defined under ASC 820 as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date.

Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value.

The Company’s management used the following methods and assumptions to estimate the fair value of its financial instruments:

Level 1 - Quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of assets or liabilities.

Level 3 - Pricing inputs that are unobservable, supported by little or no market activity and that are significant to the fair value of the assets or liabilities, as described below.

As of September 30, 2019 | Level 1 | Level 2 | Level 3 | Total | ||||||

Money market funds | $ | 2,131,671 | $ | — | $ | — | $ | 2,131,671 | ||

Accounts Receivable

Accounts receivables are receivables from customers carried at their estimated collectible amounts. Credit is generally extended on a short-term basis; thus, accounts receivables do not bear interest. The Company extends credit based upon past credit history and an evaluation of the customers’ financial condition. Generally, collateral is not required. Accounts receivables are periodically evaluated and charged against an allowance account, if deemed to be uncollectible. The Company believes the accounts receivable balances outstanding as of September 30, 2019 are fully collectible; therefore, no allowance has been recorded.

Inventories

Inventory consists primarily of equipment, including cameras, tracking hardware, computer equipment, display equipment, and mounts. Inventory was stated at the lower of cost or net realizable value, determined using average cost. The Company uses the average cost costing method for inventory. The Company periodically performs analysis to identify any obsolete or slow-moving inventory. The obsolete or slow-moving inventory reserved and disposed of totaled $182,903 at September 30, 2019. There were no additional inventory reserve balances as of September 30, 2019. The Company periodically performs cycle counts, which may result in inventory write-offs. Write-offs are also due to excess and obsolete inventory identified as part of the analysis performed annually.

10

Exhibit 99.4

Deferred Financing Costs

Deferred financing costs represent fees incurred in connection with financing transactions. These fees are capitalized and amortized to interest expense over the terms of the related financing agreements using a method that approximates the effective interest method. FASB ASU 2015-03, Interest-Imputation of Interest (Subtopic 835-30) requires that deferred financing costs are presented, net of accumulated amortization, as an asset for amounts relating to revolving lines of credit, and as direct deductions from the face amounts of all other related long-term debt.

Deferred financing costs related to long-term debt amounted to $172,401, as of September 30, 2019, which is recorded in other long-term liabilities.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation and amortization. Depreciation and amortization are calculated using the straight-line method over the estimated useful lives of the related assets, which range from two to seven years. Leasehold improvements are amortized using the straight-line method over the shorter of their estimated useful lives or the term of the related lease.

Betterments, renewals and extraordinary repairs that materially extend the useful life of the asset are capitalized; other repairs and maintenance charges are expensed as incurred. The cost and related accumulated depreciation and amortization applicable to assets retired are removed from the accounts, and the gain or loss on disposition, if any, is recognized in the consolidated statement of operations and comprehensive loss for that period. The costs of replacement parts and supplies are charged to expense as they are used. Maintenance costs are expensed as incurred.

Intangible Assets

Intangible assets are stated at cost, net of accumulated amortization and consist primarily of patents. Intangible assets with definite useful lives are amortized using the straight-line method over the useful lives.

The Company has applications for patents, which consist of technology, know-how, information, and intellectual property relevant to gestural and dynamic spatial-visual human machine interface. As of September 30, 2019, 80 patents have been granted.

It is the belief of the Company that the remaining patent submissions will be approved; however, amortization of the patents will not occur until approval has been granted. Should a patent be denied, or it becomes likely that a patent application will not be granted, the patent will be considered abandoned and the associated costs will be expensed as an impairment. For the period ended September 30, 2019, the Company expensed $426,785 of patent costs for abandoned patents.

Impairment of Long-lived Assets

The Company is subject to the provisions of FASB ASC Topic 360, Property, Plant and Equipment - Impairment or Disposal of Long-lived Assets, which requires impairment losses to be recorded on long-lived assets with definite lives when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of the assets. In such cases, the carrying value of assets to be held and used are adjusted to their estimated fair value and assets held for sale are adjusted to their estimated fair value less selling expenses. Other than the patents costs that were abandoned, no impairment losses were recognized for the period ended September 30, 2019.

Indefinite lived intangible assets are tested for impairment using a qualitative approach by first assessing qualitative factors to determine whether it is more-likely-than-not that the fair value of an indefinite lived intangible asset is impaired as a basis for determining whether it is necessary to perform quantitative impairment testing. The Company’s

11

Exhibit 99.4

indefinite-lived intangible assets consist of trade marks with a carrying value of $69,952 at September 30, 2019. The results of the qualitative analysis of the Company’s indefinite lived intangible assets, indicated that the fair value of the indefinite lived intangible assets exceeded their carrying value. The Company foregoes a qualitative assessment and tests indefinite-lived intangible assets for impairment when it concludes that it is more-likely-than-not there may be an impairment. If needed, the annual or interim quantitative test of the recovery of indefinite-lived intangible assets involve a comparison of the estimate fair value of the indefinite-lived assets to its carrying value. If the estimated fair value of the indefinite-lived assets exceeds its carrying value, the indefinite-lived intangible assets are not impaired. If the carrying value of the indefinite-lived assets exceeds the estimated fair value, an impairment loss equal to the excess is recorded.

Revenue Recognition

As required by Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 605, Revenue Recognition, the Company recognizes revenue when persuasive evidence of an arrangement exists, service has been rendered, the sales price is fixed or determinable, and collection is probable. Amounts billed in excess of revenue recognized are included in deferred revenue. Customer deposits represent payments received by the Company from customers for which revenue recognition criteria have not been met.

The Company's products are systems that consist of hardware and software that function together to deliver the system's essential functionality. The Company sells the systems as a complete package and does not sell the hardware and software separately. The Company also sells maintenance and support contracts and license agreements. The Company has determined that its systems and service contracts have value to a customer on a standalone basis; therefore, revenue from each item should be recognized separately.

The Company establishes the relative selling price of each deliverable based on estimated selling price. The Company recognizes product revenue from its systems upon shipment, installation revenue upon completed installation and revenue from maintenance contracts and license agreements ratably over the applicable periods, ranging from 12 to 36 months. Professional service contracts are billed based on time and materials at the contract rate as the services are rendered.

Advertising Costs

The Company expenses advertising costs as incurred. Advertising expense for the nine months ended September 30, 2019 and 2018 was $745,386 and $1,602,242, respectively.

Research and Development Expenses

Research and development costs are expensed as incurred and consist primarily of costs associated with the development and testing of the Company’s products. Research and development expenses include the cost of certain personnel and benefits, consultants, facility costs, supplies and other direct and allocated indirect expenses incurred to support the Company’s research and development programs. Research and development expense for the nine months ended September 30, 2019 and 2018 was $6,321,182 and $6,917,877, respectively.

Sales Taxes

The Company accounts for sales taxes in accordance with FASB ASC Subtopic 605-45, Revenue Recognition - Principal Agent Considerations, which provides that the presentation of taxes assessed by a governmental authority that are directly imposed on revenue-producing transactions (e.g. sales, use, and excise taxes) between a seller and a customer on either a gross basis (included in revenues and costs) or on a net basis (excluded from revenues) is an accounting policy decision that should be disclosed. In addition, for any such taxes that are reported on a gross basis, the amounts of those taxes should be disclosed in the consolidated financial statements for each period for which a statement of operations and comprehensive loss is presented if those amounts are significant. The Company records sales taxes on a net basis.

12

Exhibit 99.4

Income Taxes

The Company uses the asset and liability method of accounting for income taxes in accordance with FASB ASC Topic 740, Income Taxes ("ASC 740"). Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Valuation allowances are established when necessary to reduce deferred tax assets to the amounts expected to be realized.

The Company follows the provisions of uncertain tax positions as addressed in FASB ASC Subtopic 740-10, Income Taxes. The Company did not recognize a liability for unrecognized tax benefits. Management estimates the tax positions as of September 30, 2019 for which the ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility is immaterial to the consolidated financial statements. The Company recognizes interest accrued related to unrecognized tax benefits and penalties in income tax expense. No such interest or penalties were recognized during the periods presented. The Company had no accruals for interest and penalties in the financial statements for the nine months ended September 30, 2019.

With few exceptions, the Company is subject to examination by United States federal tax authorities for returns filed for the prior three years and by foreign and state tax authorities for returns filed for the prior four years.

Stock-Based Compensation

The Company accounts for stock-based transactions using a fair-value-based method. Accordingly, compensation cost for stock is recognized on a straight-line basis over the requisite service (vesting) period for the entire award.

Litigation

The Company is subject to certain legal proceedings and claims that arise in the normal course of business. Based on the advice of legal counsel, management believes that no actions or claims depart from customary litigation or claims incidental to the business or the subsidiaries and that the resolution of all such litigation or claims will not have a material adverse effect on the Company’s consolidated financial position, results of operations and cash flows.

Financial Instruments and Concentrations of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit and business risk consist of cash, cash equivalents and restricted cash, marketable securities, accounts receivable and accounts payable.

The Company maintains cash, cash equivalents and restricted cash balances that at times exceed amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in these accounts and believes it is not exposed to any significant credit risk in this area.

The Company’s customer concentrations expose it to credit risks such as collectability and business risks such as sales concentration. The Company grants credit in the normal course of business to customers in the United States and other world-wide locations. The Company periodically performs credit analysis and monitors the financial condition of its customers to reduce credit risk. On a case-by-case basis, the Company requires deposits from customers who are unable to verify acceptable credit standards.

13

Exhibit 99.4

During the nine months ended September 30, 2019, two customers accounted for 37% of total net revenues, and for the same period in 2018, two customers accounted 42% of total net revenues. At September 30, 2019, two customers accounted for 32% of total accounts receivable.

The Company’s supplier concentrations expose it to business risks, which the Company mitigates by attempting to diversify its supply chain. There was no supplier concentration for the period ended September 30, 2019.

Note 2 - Balance Sheet Disclosures

Property and equipment, net consisted of the following:

September 30, | ||||

2019 | ||||

Computer Equipment | $ | 5,131,985 | ||

Furniture and fixtures | 301,401 | |||

Leasehold Improvements | 926,955 | |||

Tooling | 170,741 | |||

6,531,082 | ||||

Less accumulated depreciation and amortization | 5,309,788 | |||

$ | 1,221,294 | |||

Depreciation and amortization expense for the nine months ended September 30, 2019 was $629,372 of which $586,686 and $42,686 were included in operating expenses and cost of revenues, respectively. Depreciation and amortization expense for the nine months ended September 30, 2018 was $790,586 of which $752,582 and $38,004 were included in operating expenses and cost of revenues, respectively.

Note 3 - Comprehensive Income and Foreign Currency Translation

Comprehensive income is defined as the change in equity during a period from transactions and other events from non-owner sources. Comprehensive income is the total of net income and other comprehensive income, which includes foreign currency translation adjustments. The functional currencies of the Company's foreign operations are the reported local currencies. Translation adjustments result from translating the Company's foreign subsidiaries’ financial statements into United States dollars. Assets and liabilities of the Company's foreign subsidiaries are translated into United States dollars using the exchange rate in effect at the consolidated balance sheet dates. Equity is translated at the historical rate of the transaction.

Revenues and expenses are translated using average exchange rates for each month during the fiscal year. The Company considers intercompany balances as long-term investments in nature as they do not expect repayment, and therefore, translates the transactions at the historical rate. The resulting translation losses are recorded as a component of accumulated other comprehensive loss in stockholders' equity. The cumulative foreign currency translation adjustment totaled $432,277 as of September 30, 2019. Foreign currency translation gains (losses) were ($38,287) and ($55,822) as of September 30, 2019 and 2018, respectively, and are reported on the consolidated statements of operations and comprehensive loss.

Note 4 - Employee Benefit Plan

14

Exhibit 99.4

The Company maintains a Section 401(k) plan (the "Plan"). Eligible employees may make voluntary contributions to the Plan. In addition, the Company may, at its discretion, make matching contributions to the Plan. For the nine months ended September 30, 2019 and 2018, the Company made no matching contributions.

Note 5 - Convertible Preferred Stock

Convertible Preferred Stock

The convertible preferred stock described below has been classified outside of stockholders' equity to comply with Regulation S-X because the shares contain certain redemption features that are not solely within the control of the Company.

In September 2018, the Company and its investors agreed to enter into an agreement to sell and issue Series E convertible preferred stock ("Series E") with a par value of $.0001 and warrants to purchase common stock. To facilitate this sale, the Company amended and restated its certificate of incorporation to increase the authorized shares to 65,000,000 of common stock at par value of $.0001 and to decrease the authorized shares to 23,007,000 of preferred stock at par value of $.0001 designated as 19,757,000 as Series D, and 3,250,000 as Series E. The Company had authorized to sell 3,039,514 shares of Series E convertible stock, and issued 2,899,266 shares, which are outstanding as of September 30, 2019. The 2,899,266 share of Series E preferred stock were sold along with 2,899,266 common stock purchase warrants, exercisable for $0.01 per share, for cash proceeds of $9,480,952, net of issuance costs of $57,633. The $9,480,952 of net cash proceeds was allocated to the Series E preferred stock and the common stock warrants, as an increase to additional paid in capital, based on the relative fair value of the Series E preferred stock and common stock warrants. The fair value of the Series E preferred stock and common stock warrants was based on a third-party valuation. The liquidation preference on Series E is $9,538,585 as of September 30, 2019.

In September 2018, the Company and its investors approved the conversion of all of its outstanding shares of Series A convertible preferred stock, Series B convertible preferred stock, and Series C convertible preferred stock, totaling 15,380,339 preferred stock into 15,506,592 common stock (the "Conversion"). Prior to the Conversion, the Company had 6,596,516 Series A convertible preferred stock issued and outstanding, 6,114,632 Series B convertible preferred stock issued and outstanding, and 2,669,191 Series C convertible preferred stock issued and outstanding. Series A and C outstanding preferred stock were converted using a 1:1 ratio. Series B outstanding preferred stock using a 1.0206 ratio.

As of September 30, 2019, the Company had authorized 19,757,000 shares of Series D convertible preferred stock ("Series D") with a par value of $0.0001. The Company issued no shares of Series D during the nine months ended September 30, 2019. The Company had 19,756,834 shares of Series D issued and outstanding as of September 30, 2019. The liquidation preference on Series D is $64,999,984 as of September 30, 2019.

Following the Conversion, holders of Series D and Series E (collectively "Post-Conversion Series Preferred"), in preference to the holders of common stock, are entitled to receive cash dividends at the annual rate of $0.2632 per share. The dividends are payable only when and if declared by the Board of Directors and are non-cumulative. No dividends were paid in the nine months ended September 30, 2019.

Conversion Rights

Each share of Post-Conversion Series Preferred is convertible into shares of common stock at the option of the holder at any time after the date of issuance. The number of shares of common stock into which a holder of Post-Conversion Series Preferred can convert is obtained by multiplying the conversion rate that is in effect by the number of shares of Post-Conversion Series Preferred being converted. The conversion rate is determined by dividing the original issue price by the applicable conversion price (initially the original issue price, as adjusted for certain dilutive events).

15

Exhibit 99.4

Under the terms, each share of Post-Conversion Series Preferred will be automatically converted into shares of common stock (based on the then effective Post-Conversion Series Preferred conversion price) immediately upon closing of a firm underwritten public offering pursuant to an effective registration statement on Form S-1 or SB-2 under the Securities Act of 1933, as amended, covering the offer and sale of common stock for the account of the Company in which the per share price to the public is at least $6.92 and the gross cash proceeds to the Company (before underwriting discounts, commissions, and fees) are at least $30,000,000 or if there is an affirmative election of the holders of the majority of the outstanding shares of Post-Conversion Series Preferred on an as-converted basis.

Liquidation Rights

In accordance with the certificate of incorporation, upon any liquidation, dissolution, change in control, or winding up of the Company ("Liquidating Event"), the holders of Series E are entitled to be paid out of the assets of the Company legally available for distribution an amount per share of Post-Conversion Series Preferred equal to the original issue price plus all declared and unpaid dividends on the Series E, before any distribution or payment is made to the holders of any Series D or common stock.

If after the liquidation preference there are assets remaining, the assets will be distributed to the Series D before any distribution or payment is made to the holders of common stock.

If after the liquidation preference there are assets remaining, the assets will be distributed ratably amongst the common stock. Post-Conversion Series Preferred will be deemed converted to common stock upon a Liquidating Event if the holder would receive a greater amount than if they had not been converted. If the Company has insufficient assets upon the Liquidating Event to make payment in full to all holders of Post-Conversion Series Preferred their liquidation preference, then such assets (or consideration) will be distributed among the holders of Post-Conversion Series Preferred ratably in proportion to the full amounts to which they would otherwise be respectively entitled. Any transaction or series of transactions that meets the definition of a Liquidating Event may be waived as a Liquidating Event by a majority vote of the Post-Conversion Series Preferred holders.

Voting Rights

Post-Conversion Series Preferred holders are entitled to the number of votes equal to the number of common shares the preferred shares is convertible into. So long as at least 2,500,000 shares of Post-Conversion Series Preferred remain outstanding, the vote or written consent of the holders of a majority of the outstanding Post-Conversion Series Preferred, respectively, shall be necessary for defined significant events.

Note 6 - Stockholders' Equity

Common Stock

As of September 30, 2019, the Company had authorized 65,000,000 shares of common stock with a par value of $0.0001. During the nine-month ended September 30, 2019, the Company issued 35,219 shares of common stock, through the exercise of stock options. The Company had 27,339,698 of common stock shares issued and outstanding as of September 30, 2019.

Stock Options

On January 22, 2007, the Company adopted the 2007 Stock Plan (the "Plan") under which the Company is authorized to grant incentive and non-qualified stock option awards to employees, directors, consultants, and affiliates of the Company. The Plan provides both for the direct award or sale of shares and for the grant of options to purchase shares. The Company is authorized to grant up to 5,405,376 shares of stock awards. The option price and vesting terms are determined by the Board of Directors of the Company and evidenced in the award agreement extended to the employee. The options granted generally vest over a period of one to four years and terminate ten years from the grant date.

16

Exhibit 99.4

During the nine months ended September 30, 2019, the Company recognized $237,952 in stock-based compensation expense.

The following presents the activity for options outstanding:

Incentive | Non-Qualified | Weighted Average | |||||

Stock Options | Stock Options | Exercise Price | |||||

December 31, 2018 | 3,576,198 | 155,000 | $ | 0.82 | |||

Granted | 930,300 | 62,500 | 0.74 | ||||

Exercised | (35,219 | ) | 0.21 | ||||

Forfeited/canceled | (347,901 | ) | (5,000 | ) | 0.97 | ||

September 30, 2019 | 4,123,378 | 212,500 | $ | 0.79 | |||

The fair value of each option grant was estimated on the grant date using the Black-Scholes option pricing model with the following weighted-average assumptions:

Nine months ended September 30, | 2019 | |

Approximate risk-free rate | 2.56 - 2.96 | % |

Average expected life | 6.25 | years |

Dividend yield | 0 | % |

Volatility | 55 - 62 | % |

Fair value of common stock | $0.78 - $0.98 | |

Estimated fair value of options granted | $0.43 - $0.58 | |

Estimated forfeiture rate | 10 | % |

Note 7 - Operating Lease Commitments

The Company leases its facilities under non-cancelable operating lease agreements that expire on various dates through May 2023. In addition, the Company has facility leases that provide for rent adjustment increases. The accompanying consolidated statements of operations and comprehensive loss reflect rent expense on a straight-line basis over the term of the leases.

The differences between rent expense recorded and the amount paid are credited or charged to deferred rent, which were included in the accompanying consolidated balance sheets. Under these agreements, net rent expense for the nine months ended September 30, 2019 and 2018 was $1,089,371 and $1,264,788 respectively. Total deferred rent as of September 30, 2019 and 2018 was $201,417 and 226,410, respectively.

The approximate aggregate future minimum lease commitments for these leases are as follows:

17

Exhibit 99.4

Year Ending | Straight-Line | |||||

December 31, | Cash Payments | Rent Expense | Deferred Rent | |||

2019 | 366,449 | 357,870 | 8,579 | |||

2020 | 1,290,795 | 1,218,375 | 72,420 | |||

2021 | 1,095,442 | 1,027,216 | 68,226 | |||

2022 | 508,064 | 463,756 | 44,308 | |||

Thereafter | 115,672 | 107,788 | 7,884 | |||

3,376,422 | 3,175,005 | 201,417 | ||||

Note 8 - Debt

Term Loan

The Company is party to a loan and security agreement with a financial institution consisting of a term loan (the "Term Loan") and revolving line of credit (the "Revolver"). The loan and security agreement is collateralized by substantially all of the Company’s assets, not including the intellectual property consisting of copyrights, trademarks and patents. The outstanding balance on the Term Loan was $5,247,000 as of September 30, 2019. There was no outstanding balance on the Revolver as of September 30, 2019. As further discussed in Note 8, on October 1, 2019, in connection with the closing of the merger transaction on such date, Glowpoint and Oblong, as borrowers, and Silicon Valley Bank ("SVB"), as lender, executed a Second Amended and Restated Loan and Security Agreement (the "Loan Agreement"), which amended and restated, in its entirety, the Amended and Restated Loan and Security Agreement by and between Oblong and SVB.

Promissory Notes

During the nine months ended September 30, 2019, the Company received net proceeds of $3,000,000 from the issuance of promissory notes to certain existing shareholders of the Company. The promissory notes carried an annual interest rate of 2.13%, and principal and interest were due and payable 12 months from the issuance date of the promissory notes. Although the terms of these promissory notes were not originally convertible into stock, on October 1, 2019, in connection with the merger with Glowpoint, Inc., the full amount of these promissory notes were converted to preferred stock of Oblong and then converted to Glowpoint Merger Preferred Stock (see further discussion in Note 9).

Note 9 - Subsequent Events

The Company has evaluated subsequent events that have occurred from September 30, 2019 through December 17, 2019, which is the date that the consolidated financial statements were available to be issued, and determined that there were no subsequent events or transactions that required recognition or disclosure in the consolidated financial statements, except as disclosed below.

On October 1, 2019, the Company completed a merger with Glowpoint, Inc. (NYSE American: GLOW), a managed service provider of video collaboration and network applications. In connection with the merger:

• | Glowpoint’s board of directors will consist of five members after completion of the Merger, of which four members will be appointed by the members of Glowpoint’s board existing prior to closing and one member will be appointed by the members of Oblong’s board existing prior to closing; |

• | i) the common and preferred stock of Oblong issued and outstanding immediately prior to the Effective Time (as defined in the Merger Agreement) of the Merger were converted into the right to receive an aggregate of |

18

Exhibit 99.4

approximately 1.68 million shares of Glowpoint’s 6.0% Series D Convertible Preferred Stock, par value $0.0001 per share ("Merger Preferred Stock"); ii) at the Effective Time, Glowpoint will assume all then-outstanding options to purchase shares of Oblong’s common stock ("Oblong Options") held by previously terminated employees of Oblong, which Oblong Options will be deemed to constitute options to acquire shares of Glowpoint’s Common Stock, par value $0.0001 per share ("Common Stock"); and (iii) any Oblong Options held by current employees of Oblong will be canceled in exchange for restricted shares.

SVB Loan Agreement and Warrant

On October 1, 2019, in connection with the Closing of the Merger on such date, Glowpoint and Oblong, as borrowers, and Silicon Valley Bank ("SVB"), as lender, executed a Second Amended and Restated Loan and Security Agreement (the "Loan Agreement"), which amended and restated, in its entirety, the Amended and Restated Loan and Security Agreement by and between Oblong and SVB. The Loan Agreement provides for a term loan facility of approximately $5.2 million (the "Loan"), all of which is currently outstanding. The Loan Agreement provides that interest-only payments will be due through March 31, 2020, after which equal monthly principal and interest payments will be made to fully repay the loan by September 1, 2021. The Loan accrues interest at a rate equal to the Prime Rate (as defined in the Loan Agreement) plus 200 basis points (for a total of 7.00% as of October 1, 2019).

19