Attached files

| file | filename |

|---|---|

| EX-99.5 - EXHIBIT 99.5 - Oblong, Inc. | a995proforma.htm |

| EX-99.4 - EXHIBIT 99.4 - Oblong, Inc. | a994oblongfinancialstateme.htm |

| EX-99.2 - EXHIBIT 99.2 - Oblong, Inc. | a992auditedfinancialstatem.htm |

| EX-23.2 - EXHIBIT 23.2 - Oblong, Inc. | a232hcvtconsent.htm |

| EX-23.1 - EXHIBIT 23.1 - Oblong, Inc. | a231bdoconsent.htm |

| 8-K/A - 8-K/A - Oblong, Inc. | form8-ka.htm |

Exhibit 99.3

Oblong Industries, Inc.

CONSOLIDATED FINANCIAL STATEMENTS

AND

INDEPENDENT AUDITOR’S REPORT

December 31, 2017 AND 2016

Exhibit 99.3

Oblong Industries, Inc.

TABLE OF CONTENTS

Page No. | |

Independent Auditor’s Report | 1-2 |

Consolidated Financial Statements: | |

Consolidated Balance Sheets | 3 |

Consolidated Statements of Operations and Comprehensive Loss | 4 |

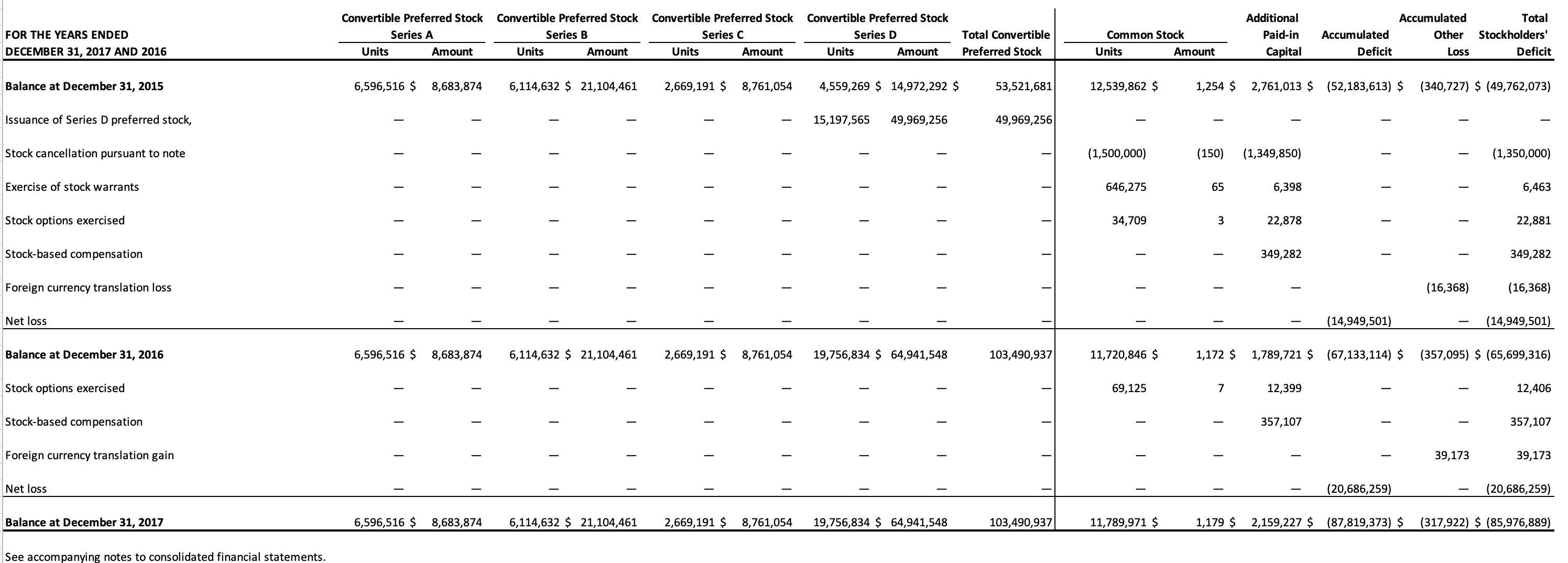

Consolidated Statements of Convertible Preferred Stock and Stockholders’ Deficit | 5 |

Consolidated Statements of Cash Flows | 6 |

Notes to Consolidated Financial Statements | 7 - 28 |

Exhibit 99.3

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors and Stockholders

of Oblong Industries, Inc.:

We have audited the accompanying consolidated financial statements of Oblong Industries, Inc. and subsidiaries (collectively, the "Company"), which comprise the consolidated balance sheets as of December 31, 2017 and 2016, and the related consolidated statements of operations and comprehensive loss, changes in convertible preferred stock and stockholders’ deficit, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Oblong Industries, Inc. and subsidiaries as of December 31, 2017 and 2016, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has incurred

Exhibit 99.3

recurring losses from operations that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of uncertainty. Our opinion is not modified with respect to that matter.

Restatement of Previously Issued Consolidated Financial Statements

As described in Note 11 to the consolidated financial statements, the Company has restated its consolidated balance sheets as of December 31, 2017 and 2016 and the related consolidated statements of cash flows for the years then ended. Our opinion is not modified with respect to that matter.

/s/ Holthouse Carlin & Van Trigt LLP

Encino, California

June 28, 2018

(except for the first paragraph in Note 8 and Note 12, as to

which the date is December 17, 2019)

Exhibit 99.3

Oblong Industries, Inc.

CONSOLIDATED BALANCE SHEETS

As Restated | As Restated | |||||

AS OF DECEMBER 31, | 2017 | 2016 | ||||

ASSETS | ||||||

Current assets: | ||||||

Cash, cash equivalents and restricted cash | $ | 14,684,503 | $ | 38,787,513 | ||

Accounts receivable | 8,311,175 | 5,181,496 | ||||

Note receivable, net (see Note 3) | — | — | ||||

Prepaid expenses and other current assets | 855,494 | 1,095,333 | ||||

Inventory | 2,233,888 | 2,434,105 | ||||

Total current assets | 26,085,060 | 47,498,447 | ||||

Property and equipment, net | 2,574,175 | 2,392,721 | ||||

Intangible assets, net | 4,951,904 | 4,435,548 | ||||

Other assets | 357,198 | 648,930 | ||||

Total assets | $ | 33,968,337 | $ | 54,975,646 | ||

LIABILITIES, CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS' DEFICIT | ||||||

Current liabilities: | ||||||

Accounts payable | $ | 1,209,369 | $ | 1,287,810 | ||

Accrued expenses and other current liabilities | 1,837,216 | 1,954,366 | ||||

Customer deposits | 412,888 | 674,595 | ||||

Current portion of deferred revenue | 6,144,134 | 3,275,893 | ||||

Current portion of deferred rent | 36,722 | 35,628 | ||||

Current portion of long-term debt | 2,744,444 | 1,372,222 | ||||

Total current liabilities | 12,384,773 | 8,600,514 | ||||

Deferred revenue, net current portion | 1,528,206 | 3,079,078 | ||||

Deferred rent, net current portion | 217,230 | 141,773 | ||||

Long-term debt | 2,058,334 | 5,065,967 | ||||

Other long-term liabilities | 265,746 | 296,693 | ||||

Total liabilities | 16,454,289 | 17,184,025 | ||||

Commitments and contingencies | ||||||

Convertible preferred stock: | ||||||

Convertible preferred stock | 103,490,937 | 103,490,937 | ||||

Stockholders' deficit: | ||||||

Common stock | 1,179 | 1,172 | ||||

Additional paid-in capital | 2,159,227 | 1,789,721 | ||||

Accumulated deficit | (87,819,373 | ) | (67,133,114 | ) | ||

Accumulated other comprehensive loss | (317,922 | ) | (357,095 | ) | ||

Total stockholders' deficit | (85,976,889 | ) | (65,699,316 | ) | ||

Total liabilities, convertible preferred stock, and stockholders' deficit | $ | 33,968,337 | $ | 54,975,646 | ||

See accompanying notes to consolidated financial statements (as revised, see note 12). | ||||||

Exhibit 99.3

Oblong Industries, Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE YEARS ENDED DECEMBER 31, | 2017 | 2016 | ||||

Revenues | $ | 22,283,271 | $ | 25,082,930 | ||

Cost of revenues | 7,304,646 | 8,476,696 | ||||

Gross profit | 14,978,625 | 16,606,234 | ||||

Operating expenses: | ||||||

Research and development | 9,759,225 | 9,224,185 | ||||

General and administrative | 8,200,014 | 6,883,007 | ||||

Sales and marketing | 15,360,166 | 13,238,318 | ||||

Depreciation and amortization | 1,610,485 | 1,224,946 | ||||

Loss on impairment of intangible assets | 382,062 | 536,674 | ||||

Total operating expenses | 35,311,952 | 31,107,130 | ||||

Loss from operations | (20,333,327 | ) | (14,500,896 | ) | ||

Other expenses: | ||||||

Interest expense, net | 207,041 | 382,001 | ||||

Other expenses, net | 145,891 | 66,604 | ||||

Total other expenses, net | 352,932 | 448,605 | ||||

Net loss | (20,686,259 | ) | (14,949,501 | ) | ||

Foreign currency translation gain (loss) | 39,173 | (16,368 | ) | |||

Comprehensive loss | $ | (20,647,086 | ) | (14,965,869 | ) | |

See accompanying notes to consolidated financial statements. | ||||||

Exhibit 99.3

Oblong Industries, Inc.

CONSOLIDATED STATEMENT OF CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' DEFICIT

Exhibit 99.3

Oblong Industries, Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

As Restated | As Restated | |||||

FOR THE YEARS ENDED DECEMBER 31, | 2017 | 2016 | ||||

Cash flows from operating activities: | ||||||

Net loss | $ | (20,686,259 | ) | $ | (14,949,501 | ) |

Adjustments to reconcile net loss to cash used in operating activities: | ||||||

Depreciation and amortization | 1,745,325 | 1,231,201 | ||||

Inventory write-off | 368,540 | 154,120 | ||||

Amortization of deferred financing costs | 137,167 | 132,563 | ||||

Stock-based compensation | 357,107 | 349,282 | ||||

Loss on disposal of property and equipment | 2,536 | 12,536 | ||||

Impairment of intangible assets | 382,062 | 536,674 | ||||

Property and equipment expensed to cost of sales and operating expenses | 90,739 | — | ||||

Non-cash settlement of note receivable | — | (1,350,000 | ) | |||

Change in operating assets and liabilities: | ||||||

Accounts receivable | (3,129,679 | ) | 184,951 | |||

Prepaid expenses and other current assets | 256,463 | (715,372 | ) | |||

Inventory | (1,183,415 | ) | (1,567,652 | ) | ||

Other assets | 154,565 | (112,567 | ) | |||

Accounts payable | (78,442 | ) | (1,010,021 | ) | ||

Accrued expenses and other current liabilities | 27,532 | 624,844 | ||||

Deferred revenue | 642,773 | 2,902,831 | ||||

Customer deposits | 261,708 | (374,040 | ) | |||

Deferred rent | 76,551 | 29,748 | ||||

Other long-term liabilities | (23,114 | ) | (2,441 | ) | ||

Net cash used in operating activities | (20,597,841 | ) | (13,922,844 | ) | ||

Cash flows from investing activities: | ||||||

Purchase of property and equipment | (612,535 | ) | (952,367 | ) | ||

Intangible asset costs | (1,272,378 | ) | (843,430 | ) | ||

Cash used in investing activities | (1,884,913 | ) | (1,795,797 | ) | ||

Cash flows from financing activities: | ||||||

Proceeds from exercise of stock options and warrants | 12,406 | 29,344 | ||||

Proceeds from sale of preferred stock | — | 49,969,256 | ||||

Borrowings from revolving line of credit | 4,805,712 | 8,641,943 | ||||

Borrowings on term loan | — | 462,229 | ||||

Payments on revolving line of credit | (5,068,901 | ) | (8,598,045 | ) | ||

Payments on term loan | (1,372,222 | ) | (1,481,481 | ) | ||

Net cash provided by (used in) financing activities | (1,623,005 | ) | 49,023,246 | |||

Effect of foreign currency exchange rates on cash | 2,749 | (13,291 | ) | |||

Net increase (decrease) in cash, cash equivalents and restricted cash | (24,103,010 | ) | 33,291,314 | |||

Cash, cash equivalents and restricted cash, beginning of year | 38,787,513 | 5,496,199 | ||||

Cash, cash equivalents and restricted cash, end of year | $ | 14,684,503 | $ | 38,787,513 | ||

Supplemental disclosures of cash flow information: | ||||||

Cash paid during the year for interest | $ | 247,045 | $ | 244,292 | ||

Cash paid during the year for income taxes | $ | 34,078 | $ | 62,873 | ||

Non-cash investing and financing activities: | ||||||

Transfer of inventory to property and equipment | $ | 1,015,093 | $ | 412,436 | ||

Patents purchased through credit | $ | — | $ | 364,230 | ||

Conversion of term loans and revolver to new loan facility | $ | — | $ | 5,712,770 | ||

See accompanying notes to consolidated financial statements (as revised, see note 12). | ||||||

Exhibit 99.3

Oblong Industries, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2017 AND 2016

1. ORGANIZATION AND NATURE OF BUSINESS

Oblong Industries, Inc. ("Oblong") was incorporated in the state of Delaware on July 31, 2006. Oblong’s wholly-owned subsidiaries consist of Oblong Industries Europe S.L.U. ("Euroblong") and Oblong Europe Ltd ("Oblong UK") (collectively, the "Company'). Euroblong was incorporated in Spain on March 12, 2007 and Oblong UK was incorporated in England on February 6, 2014. On January 27, 2017, Oblong UK established the branch entity, Oblong Europe Ltd. (German Branch) ("Oblong German Branch").

The Company's core platform is g-speak™ and Mezzanine™ is its flagship product built on this platform. Mezzanine offers advanced collaboration for conference room technology, which amplifies sales presentations, enhances group collaboration, and makes work sessions more productive. The Company offers g-speak development licenses to larger enterprise customers. Oblong is headquartered in Los Angeles, California with a sales and development office in Boston, Massachusetts; regional sales offices in Los Altos, California; New York City, New York; Washington D.C.; Chicago, Illinois; Houston and Dallas, Texas; and Atlanta, Georgia. The Euroblong office is in Barcelona, Spain and focuses on mobile research and development, while the Oblong UK and Oblong German Branch offices are in London, England and Munch, Germany, respectively, and focus on sales and marketing in the European region.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company had net losses of $20,686,259 and $14,949,501 for the years ended December 31, 2017 and 2016, respectively, and accumulated deficits of $87,819,373 and $67,133,114, as of December 31, 2017 and 2016, respectively. Cash used in operating activities amounted to $20,597,841 and $13,922,844 for the years ended December 31, 2017 and 2016, respectively.

Since inception, the Company has financed its business activities through the issuance of equity instruments. The Company expects to obtain funding through additional private equity placement offerings until it achieves a positive cash flow from operations. The Company is subject to various risks and uncertainties frequently encountered by newly formed companies. Such risks and uncertainties include, but are not limited to, undeveloped technology, its limited operating history, dependence on key personnel, and management of rapid growth. To address these risks, the Company must, among other things, successfully develop its customer base; successfully execute its business and marketing strategy; successfully develop its technology; provide superior customer service; and attract, retain, and motivate qualified personnel. Additionally, the Company may be required to obtain additional debt and/or equity financing prior to achieving positive cash flows.

Based on the Company’s projected cash flows and operating results for 2017, management believes it has sufficient cash resources to fund operations and meet its obligations as they become due for the next twelve months. However, there can be no assurance the Company will be able to raise adequate funds, achieve or sustain profitability or positive cash flows from its operations.

Exhibit 99.3

The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Oblong and its wholly-owned subsidiaries Euroblong and Oblong UK, and branch entity, Oblong German Branch. All significant intercompany balances and transactions have been eliminated upon consolidation.

Accounting Method

The Company maintains its accounting records on an accrual method in conformity with accounting principles generally accepted in the United States of America ("US GAAP").

Reclassifications

Certain prior period amounts have been reclassified to conform with the current year presentation.

During 2017, the Company modified the classification of expenses related to the installation departments from sales and marketing to general and administrative, as the Company determined that the role of the department is more operational by providing install and support for internal systems in sales offices, install and support during trade shows, and support for existing customer systems. This resulted in a reclassification of $1,259,745 from sales and marketing to general and administrative.

During 2017, the Company modified the classification of salary expenses for time spent on custom solution professional services and on installation of product from research and development and general and administrative, respectively, to cost of revenues, as the Company determined that these expenses are direct costs of the related revenues. This resulted in a reclassification of $1,621,336 and $291,750 from research and development and general and administrative, respectively, to cost of revenues.

The above reclassifications have been made to the 2016 consolidated statement of operations and comprehensive loss balances to conform with the current year presentation, resulting in a $1,913,086 increase in cost of revenues, $1,621,336 decrease in research and development, $967,995 increase in general and administrative and $1,259,745 decrease in sales and marketing.

The Company reclassified the loss on impairment of intangible assets from other expenses to operating expenses on the 2016 consolidated statement of operations and comprehensive loss to conform with the current year presentation.

The Company reclassified the current portion of the term loan in 2016 from long-term debt to current portion of long-term debt to conform with the current year presentation (see Note 6).

The Company reclassified payments received from customers in advance of revenue recognition from current portion of deferred revenue to customer deposits. The balance of customer deposits was $412,888 and $674,595 for the years ended December 31, 2017 and 2016, respectively.

Use of Estimates

The preparation of consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant items subject to such estimates and assumptions include the valuation of certain accrued expenses, which have been prepared on the basis of the

Exhibit 99.3

most current and best available information. However, actual results from the resolution of such estimates and assumptions may vary from those used in the preparation of the consolidated financial statements.

Revenue Recognition

As required by Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 605, Revenue Recognition, the Company recognizes revenue when persuasive evidence of an arrangement exists, service has been rendered, the sales price is fixed or determinable, and collection is probable. Amounts billed in excess of revenue recognized are included in deferred revenue. Customer deposits represent payments received by the Company from customers for which revenue recognition criteria have not been met.

The Company's products are systems that consist of hardware and software that function together to deliver the system's essential functionality. The Company sells the systems as a complete package and does not sell the hardware and software separately. The Company also sells maintenance and support contracts and license agreements. The Company has determined that its systems and service contracts have value to a customer on a standalone basis; therefore, revenue from each item should be recognized separately.

The Company establishes the relative selling price of each deliverable based on estimated selling price. The Company recognizes product revenue from its systems upon shipment, installation revenue upon completed installation and revenue from maintenance contracts and license agreements ratably over the applicable periods, ranging from 12 to 36 months. Professional service contracts are billed based on time and materials at the contract rate as the services are rendered.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include all cash balances and highly liquid investments, such as money market funds, with original maturities of three months or less from the date of purchase. Restricted cash are cash and cash equivalents that are restricted as to withdrawal or use under the terms of certain contractual agreements.

The Company used a bank guarantee in place of a cash deposit for the lease of the sales office in Munich, Germany. The bank guarantee was collateralized by a restricted cash bank account. As of December 31, 2017, the Company had a restricted cash balance of $93,148. The Company had no restricted cash as of December 31, 2016.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash ("ASU 2016-18"). ASU 2016-18 provides guidance on how restricted cash must be presented on the consolidated statement of cash flows. ASU 2016-18 requires that consolidated statement of cash flows show the change during the period of the total cash, cash equivalents and restricted cash. Private companies are required to apply the guidance in ASU 2016-18 to fiscal years beginning after December 15, 2018, with early adoption permitted. The Company has early adopted this guidance, and restricted cash is included in cash, cash equivalents and restricted cash on the accompanying consolidated balance sheet as of December 31, 2017 and the consolidated statement of cash flows for the year ended December 31, 2017.

Fair Value Measurements

The Company accounts for the fair value of its financial instruments in accordance with FASB ASC Topic 820, Fair Value Measurements and Disclosures ("ASC 820"). Non-recurring, nonfinancial assets and liabilities are also accounted for under the provisions of ASC 820.

ASC 820 defines fair value, establishes a framework for measuring fair value under US GAAP and enhances disclosures about fair value measurements. Fair value is defined under ASC 820 as the price that would be

Exhibit 99.3

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date.

Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value.

The Company’s management used the following methods and assumptions to estimate the fair value of its financial instruments:

• | Level 1 - Quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. |

• | Level 2 - Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of assets or liabilities. |

• | Level 3 - Pricing inputs that are unobservable, supported by little or no market activity and that are significant to the fair value of the assets or liabilities, as described below. |

The Company's money market funds, which are classified as cash and cash equivalents, are stated at fair value based on Level 1 inputs at each reporting period.

As of December 31, 2017 | Level 1 | Level 2 | Level 3 | Total | ||||||

Money market funds | $ | 14,053,172 | $ | — | $ | — | $ | 14,053,172 | ||

As of December 31, 2016 | Level 1 | Level 2 | Level 3 | Total | ||||||

Money market funds | $ | 38,754,929 | $ | — | $ | — | $ | 38,754,929 | ||

Accounts Receivable

Accounts receivable are stated at the amounts due from customers, net of an allowance for doubtful accounts. At the time the accounts receivable are originated, the Company considers a reserve for doubtful accounts based on the creditworthiness of the customer. The allowance for uncollectible amounts is continually reviewed and adjusted to maintain the allowance at a level considered adequate to cover future losses. The allowance is management's best estimate of uncollectible amounts and is determined based on a combination of historical performance and current economic conditions tracked by the Company on an ongoing basis. The losses ultimately incurred could differ materially in the near term from the amounts estimated in determining the allowance. The Company believes the accounts receivable balances outstanding as of December 31, 2017 and 2016 are fully collectible; therefore, no allowance has been recorded.

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with FASB ASC Topic 718, Compensation - Stock Compensation, which requires all share-based payments to employees and non-employees, including grants of employee stock options, to be recognized in the consolidated statements of operations and comprehensive loss based on the fair value of those awards calculated using an option valuation model on the grant date.

Financial Instruments and Concentrations of Business and Credit Risk

Exhibit 99.3

Financial instruments that potentially subject the Company to concentrations of credit and business risk consist of cash, cash equivalents and restricted cash, accounts receivable and accounts payable.

The Company maintains cash, cash equivalents and restricted cash balances that at times exceed amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in these accounts and believes it is not exposed to any significant credit risk in this area.

The Company’s customer concentrations expose it to credit risks such as collectability and business risks such as sales concentration. The Company grants credit in the normal course of business to customers in the United States and other world-wide locations. The Company periodically performs credit analysis and monitors the financial condition of its customers to reduce credit risk. On a case-by-case basis, the Company requires deposits from customers who are unable to verify acceptable credit standards.

For the year ended December 31, 2017, two customers accounted for 49% of total net revenues. Amounts outstanding from these two customers accounted for 47% of total accounts receivable as of December 31, 2017. For the year ended December 31, 2016, one customer accounted for 50% of total net revenues. Amounts outstanding from this one customer accounted for 63% of total accounts receivable as of December 31, 2016.

The Company’s supplier concentrations expose it to business risks, which the Company mitigates by attempting to diversify its supply chain. There was no supplier concentration for the year ended December 31, 2017. For the year ended December 31, 2016, one vendor accounted for 15% of total purchases. Amounts outstanding to this vendor accounted for 19% of total accounts payable as of December 31, 2016.

Inventory

In July 2015, the FASB issued ASU 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory ("ASU 2015-11"). ASU 2015-11 requires that inventory be measured at the lower of cost or net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. This eliminates the need to determine and consider replacement cost or net realizable value less an approximately normal profit margin when measuring inventory. ASU 2015-11 is effective for private entities for annual reporting periods beginning after December 15, 2016. The Company adopted this standard prospectively for the year ended December 31, 2017. The adoption did not have a material impact on the Company’s consolidated financial position or results of operations.

As part of the implementation to a new accounting software system (NetSuite), the Company elected to change its inventory valuation method to the average cost costing method as of the go-live date of February 1, 2017. In prior years, inventory was valued using the first-in, first-out ("FIFO") method. The Company determined the average cost costing method of inventory valuation is preferable because (1) the costs of the Company’s inventories have remained fairly consistent during the past several years, which substantially negated the financial reporting benefits of the FIFO method to provide results in the valuation of inventories at more current costs on the consolidated balance sheets, and (2) the change conforms to a single cost for all of the Company’s inventory items when transferring data into the new accounting software system. The total financial impact of the change in inventory valuation method is immaterial (less than 0.5% total inventory value) to the overall consolidated financial statements.

Inventory consists primarily of equipment, including cameras, tracking hardware, computer equipment, display equipment, and mounts, and was stated at the lower of cost or net realizable value, determined using average cost. The Company periodically performs analysis to identify any obsolete or slow-moving inventory. The obsolete or slow-moving inventory reserved and disposed of totaled $292,139 and $27,175, respectively, for the years ended December 31, 2017 and 2016. There was no additional inventory reserve balance as of December 31, 2017 and 2016. The Company periodically performs cycle counts, which may result in inventory write-offs. The total inventory written-off and disposed of totaled $368,540 and $154,120 for the years ended December 31, 2017 and 2016.

Exhibit 99.3

Deferred Financing Costs

Deferred financing costs represent fees incurred in connection with financing transactions. These fees are capitalized and amortized to interest expense over the terms of the related financing agreements using a method that approximates the effective interest method. FASB ASU 2015-03, Interest-Imputation of Interest (Subtopic 835-30) requires that deferred financing costs are presented, net of accumulated amortization, as an asset for amounts relating to revolving lines of credit, and as direct deductions from the face amounts of all other related long-term debt.

Deferred financing costs, net of accumulated amortization, related to long-term debt is included in other assets on the accompanying consolidated balance sheets, which is not in conformity with US GAAP, however, the Company believes that this departure from US GAAP does not have a material impact on the fair presentation of the financial position of the Company. Deferred financing costs related to long-term debt amounted to $124,688 and $261,854, net of accumulated amortization of $137,167 and $132,563, as of December 31, 2017 and 2016, respectively.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation and amortization. Depreciation and amortization are calculated using the straight-line method over the estimated useful lives of the related assets, which range from two to seven years. Leasehold improvements are amortized using the straight-line method over the shorter of their estimated useful lives or the term of the related lease.

Betterments, renewals and extraordinary repairs that materially extend the useful life of the asset are capitalized; other repairs and maintenance charges are expensed as incurred. The cost and related accumulated depreciation and amortization applicable to assets retired are removed from the accounts, and the gain or loss on disposition, if any, is recognized in the consolidated statement of operations and comprehensive loss for that period. The costs of replacement parts and supplies are charged to expense as they are used. Maintenance costs are expensed as incurred.

Intangible assets

Intangible assets are stated at cost, net of accumulated amortization and consist primarily of patents. Intangible assets with definite useful lives are amortized using the straight-line method over the useful lives.

The Company has applications for patents, which consist of technology, know-how, information, and intellectual property relevant to gestural and dynamic spatial-visual human machine interface. As of December 31, 2017, 59 patents have been granted.

It is the belief of the Company that the remaining patent submissions will be approved; however, amortization of the patents will not occur until approval has been granted. Should a patent be denied or it become likely that a patent application will not be granted, the patent will be considered abandoned and the associated costs will be expensed as impairment. For the years ended December 31, 2017 and 2016, the Company expensed $382,062 and $536,674, respectively, of patent costs for abandoned patents (see Note 5).

Impairment of Long-lived Assets

The Company is subject to the provisions of FASB ASC Topic 360, Property, Plant and Equipment - Impairment or Disposal of Long Lived Assets, which requires impairment losses to be recorded on long-lived assets when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amount of the assets. In such cases, the carrying value of assets to be held and used are adjusted to their estimated fair value and assets held for sale are adjusted to their estimated fair value less

Exhibit 99.3

selling expenses. Other than the patents costs that were abandoned (see Note 5), no impairment losses were recognized for the years ended December 31, 2017 and 2016.

Research and Development Expenses

Research and development costs are expensed as incurred and consist primarily of costs associated with the development and testing of the Company’s products. Research and development expenses include the cost of certain personnel and benefits, consultants, facility costs, supplies and other direct and allocated indirect expenses incurred to support the Company’s research and development programs. Research and development expenses totaled $9,759,225 and $9,224,185 for the years ended December 31, 2017 and 2016, respectively.

Shipping and Handling Costs

The Company has included shipping and handling costs of $186,530 and $173,497 in cost of revenues and $226,168 and $147,231 in general and administrative expenses for the years ended December 31, 2017 and 2016, respectively, on the accompanying consolidated statements of operations and comprehensive loss. Shipping and handling costs billed to customers are included in revenues.

Advertising

Advertising costs are expensed as incurred. Total advertising expenses of $2,901,817 and $1,798,039 are included in sales and marketing expense on the accompanying consolidated statements of operations and comprehensive loss for the years ended December 31, 2017 and 2016, respectively.

Sales Taxes

The Company accounts for sales taxes in accordance with FASB ASC Subtopic 605-45, Revenue Recognition - Principal Agent Considerations, which provides that the presentation of taxes assessed by a governmental authority that are directly imposed on revenue-producing transactions (e.g. sales, use, and excise taxes) between a seller and a customer on either a gross basis (included in revenues and costs) or on a net basis (excluded from revenues) is an accounting policy decision that should be disclosed. In addition, for any such taxes that are reported on a gross basis, the amounts of those taxes should be disclosed in the consolidated financial statements for each period for which a statement of operations and comprehensive loss is presented if those amounts are significant. The Company records sales taxes on a net basis.

Income Taxes

The Company uses the asset and liability method of accounting for income taxes in accordance with FASB ASC Topic 740, Income Taxes ("ASC 740"). Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Valuation allowances are established when necessary to reduce deferred tax assets to the amounts expected to be realized.

The Company follows the provisions of uncertain tax positions as addressed in FASB ASC Subtopic 740-10, Income Taxes. The Company did not recognize a liability for unrecognized tax benefits. Management estimates the tax positions as of December 31, 2017 and 2016 for which the ultimate deductibility is highly certain but

Exhibit 99.3

for which there is uncertainty about the timing of such deductibility is immaterial to the consolidated financial statements. The Company recognizes interest accrued related to unrecognized tax benefits and penalties in income tax expense. No such interest or penalties were recognized during the periods presented. The Company had no accruals for interest and penalties as of December 31, 2017 and 2016.

With few exceptions, the Company is subject to examination by United States federal tax authorities for returns filed for the prior three years and by foreign and state tax authorities for returns filed for the prior four years.

Leases

The Company’s leases are accounted for under the provisions of FASB ASC Topic 840, Leases, which require that leases be evaluated and classified as operating or capital leases for financial reporting purposes. Costs for operating leases that include incentives such as payment escalations or rent abatements are recognized on a straight-line basis over the term of the lease.

Additionally, inducements received from lessors are treated as a reduction of costs over the term of the agreement. Costs for capital leases are capitalized at the present value of the future minimum lease payments, less any taxes and fees, with the corresponding obligation recorded in liabilities. Capital leases are amortized in accordance with property and equipment policies, and the corresponding obligations are reduced as lease payments are made. As of December 31, 2017 and 2016, the Company had no capital leases.

Comprehensive Income and Foreign Currency Translation

Comprehensive income is defined as the change in equity during a period from transactions and other events from non-owner sources. Comprehensive income is the total of net income and other comprehensive income, which includes foreign currency translation adjustments. The functional currencies of the Company's foreign operations are the reported local currencies. Translation adjustments result from translating the Company's foreign subsidiaries’ financial statements into United States dollars. Assets and liabilities of the Company's foreign subsidiaries are translated into United States dollars using the exchange rate in effect at the consolidated balance sheet dates. Equity is translated at the historical rate of the transaction.

Revenues and expenses are translated using average exchange rates for each month during the fiscal year. The Company considers intercompany balances as long-term investments in nature as they do not expect repayment, and therefore, translates the transactions at the historical rate. The resulting translation losses are recorded as a component of accumulated other comprehensive loss in stockholders' equity. The cumulative foreign currency translation adjustment totaled $317,922 and $357,095, as of December 31, 2017 and 2016, respectively. Foreign currency translation gains (losses) were $39,173 and $(16,368) during 2017 and 2016, respectively, and are reported on the consolidated statements of operations and comprehensive loss.

Recent Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases. The new standard establishes a right-of-use ("ROU") model that requires a lessee to record a ROU asset and a lease liability, measured on a discounted basis, on the consolidated balance sheets for all leases with terms greater than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the consolidated statements of operations and comprehensive loss. A modified retrospective transition approach is required for capital and operating leases existing at the date of adoption, with certain practical expedients available. The Company is currently in the process of evaluating the potential impact of this new guidance, which is effective for the Company beginning on January 1, 2020.

On May 28, 2014, the FASB issued Accounting Standards Update Topic 2014-09 ("ASU 2014-09"), Revenue from Contracts with Customers. ASU 2014-09 supersedes existing revenue recognition guidance, including ASC 605-35. ASU 2014-09 outlines a single set of comprehensive principles for recognizing revenue under

Exhibit 99.3

US GAAP. Among other things, it requires companies to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time. These concepts, as well as other aspects of ASU 2014-09, may change the method and/or timing of revenue recognition for certain of the Company contracts. ASU 2014-09 will be effective for privately held companies for annual reporting periods beginning after December 15, 2018 and may be applied either retrospectively or through the use of a modified-retrospective method. Management is currently evaluating both methods of adoption as well as the effect ASU 2014-09 will have on the Company’s consolidated financial position, results of operations and cash flows.

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, to simplify several aspects of the accounting for share-based payment award transactions, including accounting for income tax consequences, classification of awards either equity or liability, and classification on the consolidated statement of cash flows. FASB ASU 2016-09 also simplifies the accounting for private entities such that private entities can (1) apply a practical expedient to estimate the expected term for all awards with performance or service conditions that have certain characteristics; and (2) make a one-time election to switch from measuring all liability-classified awards at fair value to measuring them at intrinsic value. FASB ASU 2016-09 is effective for private entities for annual periods beginning after December 15, 2017, with early adoption permitted. The Company is currently evaluating methods of adoption as well as the impact that adoption of this guidance will have on its consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting, to provide guidance on determining which changes to the terms and conditions of equity-based payment awards require an entity to apply modification accounting under FASB ASC 718. FASB ASU 2017-09 is effective for all entities for years beginning after December 15, 2017, with early adoption being permitted. The Company is currently evaluating methods of adoption as well as the impact that adoption of this guidance will have on its consolidated financial statements.

3. | NOTE RECEIVABLE |

Intellectual Property Purchase

In 2013, the Company ("Seller") entered into an agreement with a technology company ("Buyer") to sell the rights, title and interests, other than the patent rights, in software code for geospatial visualization, analysis, and collaboration tool for synthesis of data from many sources. A $6,000,000 Secured Promissory Note was negotiated, in addition to issuance of 5% of total outstanding shares of Class A common stock of the Buyer which equated to 527,000 shares. The Senior Secured Promissory Note ("Note") had an initial payment in October 2013 and annual payments scheduled from October 2015 through October 2018.

Based on qualitative analysis of the Buyer’s business in the development stage and quantitative analysis of the Buyer’s financial condition, the Company considered the collectability of the Note as reasonably uncertain. As a result, the Company recognized revenue from this agreement upon cash collection and recorded an allowance for the entire balance of the Note at each year-end. Based on the same qualitative and quantitative analysis the fair market value of the Buyer’s common stock was deemed to be zero and was not recorded in the Company’s consolidated financial statements.

In 2015, the Company recognized the collected amount of $750,000 as revenue when received.

In March 2016, the Buyer and the Seller agreed to modify the terms of the Note as follows:

• | The Buyer executed an Amended and Restated Senior Secured Promissory Note ("Amended Note") in the amount of $1,180,331 plus accrued interest. The payments for the Amended Note were to be made in three payments as follows: |

Exhibit 99.3

◦Initial Payment: $250,000 on March 26, 2016.

◦Second Payment: $375,000 on or prior to November 1, 2016.

◦Third Payment: $625,000 on or prior to November 1, 2017.

• | The Buyer assigned to the Seller 1.5 million shares of Oblong common stock, which was retired by the Board of Directors and not held as Treasury Stock. The Seller assigned back to the Buyer 527,000 shares of Class A common stock of the Buyer. |

The Company performed another quantitative and qualitative analysis of the Buyer’s financial condition and determined revenue related to the Amended Note should be recognized as amounts are received. As a result, the transactions from the amended agreement were recorded as follows:

• | The amounts of $250,000 and $375,000 were recognized as revenue when received in March and September 2016, respectively. |

• | The assignment and cancellation of the 1.5 million shares of the Seller’s common stock received by the Seller was recognized as revenue based on the fair value of the common stock at $0.90 per share at the time of the transaction. |

• | There was no transaction recorded by the Seller for the assignment of the Buyer’s Class A common stock because the fair value of the shares was zero on the Seller records. |

In October 2017, the Buyer communicated to the Seller the inability to make the payment of $625,000 on November 1, 2017. The Buyer and the Seller negotiated a settlement that was finalized in March 2018 (see Note 11).

As of December 31, 2017 and 2016, the net receivable balance of the Amended Note was zero, as the Company deemed collectability as reasonably uncertain.

4. | PROPERTY AND EQUIPMENT |

Property and equipment consists of the following:

As of December 31, | 2017 | 2016 | ||

Computer equipment | $ | 5,373,928 | $ | 6,913,807 |

Furniture and fixtures | 293,357 | 212,392 | ||

Leasehold improvements | 952,069 | 1,508,913 | ||

Tooling | 125,433 | 93,235 | ||

6,744,787 | 8,728,347 | |||

Less: accumulated depreciation and amortization | (4,170,612) | (6,335,626) | ||

Property and equipment, net | $ | 2,574,175 | $ | 2,392,721 |

Exhibit 99.3

During the implementation of a new accounting software system (NetSuite), the Company elected to not transfer the accounting records and balances of fully depreciated assets, totaling approximately $3,400,000, as of the go-live date of February 1, 2017.

For the year ended December 31, 2017, depreciation and amortization expense related to property and equipment totaled $1,371,365, of which $1,333,953 and $37,412 were included in operating expenses and cost of revenues, respectively. For the year ended December 31, 2016, depreciation and amortization expense related to property and equipment totaled $1,133,686 and was included in operating expenses.

5. INTANGIBLE ASSETS

Identifiable intangible assets consist of the following:

As of December 31, 2017 | Gross Carrying Amount | Useful Life In Years | Accumulated Amortization | Accumulated Impairment | Net Carrying Amount | ||||||

Patent costs | $ | 5,472,749 | 10 - 20 | $ | (394,409) | $ | (918,737) | $ | 4,159,603 | ||

Trademarks | 69,952 | Indefinite | N/A | — | 69,952 | ||||||

Certification costs | 236,198 | 3 | (103,683) | — | 132,515 | ||||||

Software systems | 711,602 | 5 | (121,768) | — | 589,834 | ||||||

Total | $ | 6,490,501 | $ | (619,860) | $ | (918,737) | $ | 4,951,904 | |||

The gross carrying amount of patent costs consist of the following:

As of December 31, 2017 | Amount | |||||||||

Granted patents | $ | 2,308,805 | ||||||||

Pending patents | 2,245,207 | |||||||||

Abandoned patents | 918,737 | |||||||||

Total | $ | 5,472,749 | ||||||||

Identifiable intangible assets are as follows:

As of December 31, 2016 | Gross Carrying Amount | Useful Life In Years | Accumulated Amortization | Accumulated Impairment | Net Carrying Amount | ||||||

Patent costs | $ | 5,035,578 | 10 - 20 | $ | (239,646) | $ | (536,674) | $ | 4,259,258 | ||

Trademarks | 69,952 | Indefinite | N/A | — | 69,952 | ||||||

Certification costs | 112,593 | 3 | (6,255) | — | 106,338 | ||||||

Total | $ | 5,218,123 | $ | (245,901) | $ | (536,674) | $ | 4,435,548 | |||

For the year ended December 31, 2017, amortization expense related to identifiable intangible assets totaled $373,960, of which $276,532 and $97,428 were included in operating expenses and cost of revenues, respectively. For the year ended December 31, 2016, amortization expense related to identifiable intangible assets totaled $97,515 and was included in operating expenses.

Future amortization expense on granted patents are as follows:

Exhibit 99.3

For the Years Ending December 31: | Amount | |

2018 | $ | 169,713 |

2019 | 169,713 | |

2020 | 169,713 | |

2021 | 169,713 | |

2022 | 169,713 | |

Thereafter | 1,065,833 | |

Total | $ | 1,914,398 |

6. | LONG-TERM DEBT |

In January 2014, the Company entered into a loan and security agreement with a financial institution, consisting of a term loan (the "Term Loan") with an original principal balance of $5,000,000 and a $5,000,000 revolving line of credit (the "Revolver"). The Revolver is subject to a borrowing base of 80% of eligible accounts receivable, plus the lesser of 50% of the value of the Company’s inventory or $500,000. The loan and security agreement is collateralized by substantially all of the assets, not including the intellectual property consisting of copyrights, trademarks and patents. The Term Loan matures in July 2018 and the Revolver matures in September 2019. The Term Loan and Revolver bear interest at the Wall Street Journal prime rate plus 0.375% (4.875% and 4.125% as of December 31, 2017 and 2016, respectively).

Pursuant to the First Amendment to Amended and Restated Loan and Security Agreement executed in July 2016, the Term Loan increased to $6,175,000 and the Revolver increased to $10,000,000. Pursuant to the Default Waiver and Second Amendment to the Amended and Restated Loan and Security Agreement ("Second Amendment") executed in June 2017, the financial covenants were revised to require the Company to maintain 75% of purchase order contracts compared to an annual published business plan that will be measured on a trailing 6-month basis, rather than trailing 12-month basis. Further, the Company’s adjusted quick ratio shall be no less than 1.10. Pursuant to the Default Waiver and Third Amendment to Amended and Restated Loan and Security Agreement ("Third Amendment") executed in December 2017, the Revolver decreased to $7,500,000 and the annual business plan to measure against 75% of purchase order contracts on a trailing 6-month basis for the financial covenant was revised.

The borrowings available under the Revolver were $7,139,589 and $5,265,459 as of December 31, 2017 and 2016, respectively. The Revolver consists of interest-only payments, payable in arrears, and principal is due in full at maturity. As of December 31, 2016, the outstanding balance on the Revolver was $263,189. There was no outstanding balance on the Revolver as of December 31, 2017.

The Term Loan consisted of interest-only payments through June 31, 2017 followed by twenty-seven equal monthly payments of principal, plus monthly payments of accrued interest through maturity. The outstanding balance on the Term Loan was $4,802,778 and $6,175,000 as of December 31, 2017 and 2016.

The Second Amendment included a final payment related to the Term Loan over and above the principal balance due at maturity in the amount of $216,125. The Company recorded these loan costs on the consolidated balance sheets and is amortizing the costs as interest expense over the amended terms of the loans to recognize the effective interest rate related to the loans.

The Company was in compliance with the quick ratio covenant as of December 31, 2017 but was not in compliance with the minimum booking from January to March and July to November during the year ended December 31, 2017. The Company was in compliance with the quick ratio covenant as of December 31, 2016 but was not in compliance with the minimum bookings from November to December during the year ended December 31, 2016. The lender waived default pursuant to the Third and Second Amendment, respectively.

Exhibit 99.3

Future maturities of the Term Loan are as follows:

Years Ending December 31: | Amount | |

2018 | $ | 2,744,444 |

2019 | 2,058,334 | |

Total | $ | 4,802,778 |

7. | CONTRACTS AND OTHER CONTINGENCIES |

Lease Commitments

The Company leases its facilities under non-cancellable operating lease agreements that expire on various dates through May 2023. In addition, the Company has facility leases that provide for rent adjustment increases. The accompanying consolidated statements of operations and comprehensive loss reflect rent expense on a straight-line basis over the term of the leases.

The differences between rent expense recorded and the amount paid are credited or charged to deferred rent, which were included in the accompanying consolidated balance sheets. Under these agreements, net rent expense was $1,425,151 and $976,121 for the years ended December 31, 2017 and 2016, respectively. Total deferred rent as of December 31, 2017 and 2016 was $253,952 and $177,401, respectively.

The approximate aggregate future minimum lease commitments for these leases are as follows:

Years Ending December 31: | Cash Payments | Straight-line Rent Expense | Deferred Rent | |||

2018 | $ | 1,502,436 | $ | 1,465,714 | $ | 36,722 |

2019 | 1,469,914 | 1,424,309 | 45,605 | |||

2020 | 1,247,835 | 1,181,359 | 66,476 | |||

2021 | 1,049,244 | 988,978 | 60,266 | |||

2022 | 450,339 | 413,336 | 37,003 | |||

Thereafter | 115,668 | 107,788 | 7,880 | |||

Totals | $ | 5,835,436 | $ | 5,581,484 | $ | 253,952 |

In 2017 and 2016, the Company received $109,142 and $84,736, respectively, for reimbursement of tenant improvements from the landlord for lease facilities. The amount of this reimbursement was included with deferred rent and is amortized as a rent reduction over the term of the lease.

Purchase Commitments

In 2016, the Company entered into inventory purchase commitments with two vendors for future orders over the next twelve months. As a result, the Company committed to minimum purchases of $1,753,202. In 2017, the purchase commitment was amended. Correspondingly, the minimum purchase commitment increased to $1,757,370 and the commitment was extended through December 2018. Of the $1,757,370 committed, $395,786 remains outstanding as of December 31, 2017.

Litigation

The Company is subject to certain legal proceedings and claims that arise in the normal course of business. Based on the advice of legal counsel, management believes that no actions or claims depart from customary litigation or claims incidental to the business or the subsidiaries and that the resolution of all such litigation

Exhibit 99.3

or claims will not have a material adverse effect on the Company’s consolidated financial position, results of operations and cash flows.

8. | CONVERTIBLE PREFERRED STOCK |

The convertible preferred stock described below has been classified outside of stockholders' equity to comply with Regulation S-X because the shares contain certain redemption features that are not solely within the control of the Company.

In May 2016, the Company and its investors amended the Series D Purchase Agreement dated February 3, 2015 to extend the period during which additional Series D convertible preferred stock could be issued, through July 31, 2016. In May 2016, the Company issued an additional 4,559,269 shares of Series D at $3.29.

In July 2016, the Company and its investors agreed to amend the Series D Stock Purchase Agreement whereby the Company could sell up to 15,300,000, shares before September 30, 2016. To facilitate this amendment, the Company amended and restated the certificate of incorporation to increase the authorized shares to 50,000,000 shares of common stock at par value of $0.0001 and 32,150,000 shares of preferred stock with par value of $0.0001 designated as 6,800,000 as Series A; 7,300,000 as Series B; 2,750,000 as Series C; and 15,300,000 as Series D. In July 2016, the Company issued an additional 4,559,269 shares of Series D at $3.29.

In September 2016, the Company and its investors agreed to amend the Series D Stock Purchase Agreement whereby the Company could sell up to 19,800,000 shares before September 30, 2016. To facilitate this amendment, the Company amended and restated the certificate of incorporation to increase the authorized shares to 54,500,000 shares of common stock at par value of $0.0001 and 36,650,000 shares of preferred stock with par value of $0.0001 designated as 6,800,000 as Series A; 7,300,000 as Series B; 2,750,000 as Series C; and 19,800,000 as Series D. In September 2016, the Company issued an additional 6,079,027 shares of Series D at $3.29.

The Series D shares issued in 2016 were recorded net of issuance costs of $30,728. The Company issued no shares of Series D during 2017. The liquidation preference on Series D is $64,999,984 as of December 31, 2017 and 2016.

As of December 31, 2017, the Company had authorized 2,750,000 shares of Series C convertible preferred stock ("Series C") with a par value of $0.0001. The Company issued no shares of Series C during 2017 and 2016. The Company had 2,669,191 shares of Series C issued and outstanding as of December 31, 2017 and 2016, of which 1,453,386 shares were a result of a conversion of notes payable and accrued interest in previous years. The liquidation preference on Series C is $8,781,638 as of December 31, 2017 and 2016.

As of December 31, 2017, the Company had authorized 7,300,000 shares of Series B convertible preferred stock ("Series B") with a par value of $0.0001. During 2017 and 2016, the Company issued no shares of Series B. The Company had 6,114,632 shares issued and outstanding as of December 31, 2017 and 2016. The liquidation preference on Series B is $21,156,627 as of December 31, 2017 and 2016.

As of December 31, 2017, the Company had authorized 6,800,000 shares of Series A convertible preferred stock ("Series A") with a par value of $0.0001. During 2017 and 2016, the Company issued no shares of Series A. The Company had 6,596,516 shares issued and outstanding as of December 31, 2017 and 2016. The liquidation preference on Series A is $8,752,813 as of December 31, 2017 and 2016.

The rights associated with Series A, Series B, Series C and Series D (collectively "Series Preferred") are as follows:

Dividend Rights

Exhibit 99.3

Holders of Series A, Series B, Series C and Series D, in preference to the holders of common stock, are entitled to receive cash dividends at the annual rate of $0.1064, $0.2768, $0.2632, and $0.2632 per share, respectively. The dividends are payable only when and if declared by the Board of Directors and are non-cumulative. No dividends were paid in 2017 and 2016.

Conversion Rights

Each share of Series Preferred is convertible into shares of common stock at the option of the holder at any time after the date of issuance. The number of shares of common stock into which a holder of Series Preferred can convert is obtained by multiplying the conversion rate that is in effect by the number of shares of Series Preferred being converted. The conversion rate is determined by dividing the original issue price by the applicable conversion price (initially the original issue price, as adjusted for certain dilutive events). As a result of antidilution adjustments afforded by Series B, in connection with the issuance of shares of Series C and Series D, as of December 31, 2016, the conversion price of the Series B had been adjusted from $3.46 to $3.39. As a result, its conversion rate into shares of Common Stock is approximately 1.0206 as of December 31, 2017.

Under the terms, each share of Series Preferred will be automatically converted into shares of common stock (based on the then effective Series Preferred conversion price) immediately upon closing of a firm underwritten public offering pursuant to an effective registration statement on Form S-1 or SB-2 under the Securities Act of 1933, as amended, covering the offer and sale of common stock for the account of the Company in which the per share price to the public is at least $6.92 and the gross cash proceeds to the Company (before underwriting discounts, commissions, and fees) are at least $30,000,000 or if there is an affirmative election of the holders of the majority of the outstanding shares of Series Preferred on an as-converted basis.

To affect the automatic conversion of the Series B, the affirmative election of the holders of the majority of the outstanding shares of Series B, voting as a separate class, is also required. Similarly, to affect the automatic conversion of the Series C, the affirmative election of the holders of the majority of the outstanding shares of Series C, voting as a separate class, is required. Furthermore, to affect the automatic conversion of the Series D, the affirmative election of the holders of the majority of the outstanding shares of Series D, voting as a separate class, is required.

Liquidation Rights

In accordance with the certificate of incorporation, upon any liquidation, dissolution, change in control, or winding up of the Company ("Liquidating Event"), the holders of Series Preferred are entitled to be paid out of the assets of the Company legally available for distribution an amount per share of Series Preferred equal to the original issue price plus all declared and unpaid dividends on the Series Preferred, before any distribution or payment is made to the holders of any common stock.

If after the liquidation preference there are assets remaining, the assets will be distributed ratably amongst the common stock, Series A holders, and Series D holders, on an as-converted to common stock basis. Series Preferred will be deemed converted to common stock upon a Liquidating Event if the holder would receive a greater amount than if they had not been converted. If the Company has insufficient assets upon the Liquidating Event to make payment in full to all holders of Series Preferred their liquidation preference, then such assets (or consideration) will be distributed among the holders of Series Preferred ratably in proportion to the full amounts to which they would otherwise be respectively entitled. Any transaction or series of transactions that meets the definition of a Liquidating Event may be waived as a Liquidating Event by a majority vote of the Series Preferred holders.

Voting Rights

Exhibit 99.3

Series Preferred holders are entitled to the number of votes equal to the number of common shares the preferred shares is convertible into. So long as at least 2,500,000 shares of Series Preferred remain outstanding, 1,000,000 shares of Series B remain outstanding, 1,000,000 shares of Series C remain outstanding or 1,000,000 shares of Series D remain outstanding, the vote or written consent of the holders of a majority of the outstanding Series Preferred, Series B, Series C, or Series D, respectively, shall be necessary for defined significant events.

9. | STOCKHOLDERS’ EQUITY |

Common Stock

As of December 31, 2017, the Company had authorized 54,500,000 shares of common stock with a par value of $0.0001. During 2017 and 2016, the Company issued 69,125 and 34,709 shares of common stock, respectively, through the exercise of stock options. In 2016, the Company issued 646,275 shares of common stock related to the exercise of warrants. In March 2016, the Company re-acquired 1,500,000 shares of common stock related to a contract renegotiation, which shares were subsequently retired by the Company in May 2016 (see Note 3). The Company had 11,783,971 and 11,720,846, respectively, of common stock shares issued and outstanding as of December 31, 2017 and 2016.

Stock Options

On January 22, 2007, the Company adopted the 2007 Stock Plan (the "Plan") under which the Company is authorized to grant incentive and non-qualified stock option awards to employees, directors, consultants, and affiliates of the Company. The Plan provides both for the direct award or sale of shares and for the grant of options to purchase shares. The Company is authorized to grant up to 5,405,376 shares of stock awards. The option price and vesting terms are determined by the Board of Directors of the Company and evidenced in the award agreement extended to the employee. The options granted generally vest over a period of one to four years and terminate ten years from the grant date. As of December 31, 2017 and 2016, $559,703 and $704,715, respectively, remained to be expensed over the vesting period and the forfeiture rate has been estimated at 10%. During the years ended December 31, 2017 and 2016, the Company recognized $357,107 and $349,282, respectively, in stock-based compensation expense.

The following presents the activity for options outstanding:

Weighted | ||||||

Incentive | Non-Qualified | Average | ||||

Stock | Stock | Exercise | ||||

As of December 31, 2017 | Options | Options | Price | |||

December 31, 2015 | 3,500,333 | 125,000 | $ | 0.77 | ||

Granted | 560,250 | — | $ | 0.93 | ||

Exercised | (34,709) | — | $ | 0.66 | ||

Forfeited/canceled | (153,791) | (70,000) | $ | 0.55 | ||

December 31, 2016 | 3,872,083 | 55,000 | $ | 0.77 | ||

Granted | 631,195 | 23,833 | $ | 0.97 | ||

Exercised | (69,125) | — | $ | 0.25 | ||

Forfeited/canceled | (596,013) | — | $ | 0.75 | ||

December 31, 2017 | 3,838,140 | 78,833 | $ | 0.81 | ||

The following table presents the composition of options outstanding and exercisable as of December 31, 2017:

Exhibit 99.3

Options Outstanding | Options Exercisable | ||||||||||||

Range of Exercise Prices | Number | Price* | Life* | Number | Price* | ||||||||

$0.13 | — | $ | 0.13 | — | — | $ | 0.13 | ||||||

$0.16 | — | $ | 0.16 | — | — | $ | 0.16 | ||||||

$0.21 | 185,000 | $ | 0.21 | 2.04 | 185,000 | $ | 0.21 | ||||||

$0.30 | 155,000 | $ | 0.30 | 2.98 | 155,000 | $ | 0.30 | ||||||

$0.71 | 409,000 | $ | 0.71 | 4.08 | 409,000 | $ | 0.71 | ||||||

$0.80 | 667,303 | $ | 0.80 | 4.80 | 667,303 | $ | 0.80 | ||||||

$0.84 | 810,315 | $ | 0.84 | 6.48 | 721,347 | $ | 0.84 | ||||||

$0.90 | 653,160 | $ | 0.90 | 7.44 | 419,641 | $ | 0.90 | ||||||

$0.93 | 392,500 | $ | 0.93 | 8.29 | 168,349 | $ | 0.93 | ||||||

$0.94 | 69,000 | $ | 0.94 | 6.80 | 55,715 | $ | 0.94 | ||||||

$0.97 | 575,695 | $ | 0.97 | 9.28 | 15,066 | $ | 0.97 | ||||||

December 31, 2017 | 3,916,973 | $ | 0.81 | 6.35 | 2,796,421 | $ | 0.76 | ||||||

* Price and Life reflect the weighted average exercise price and weighted average remaining contractual life, respectively.

The fair value of each option grant was estimated on the grant date using the Black-Scholes option pricing model with the following weighted-average assumptions:

For the years ended December 31, | 2017 | 2016 | |

Approximate risk-free rate | 1.84 - 2.33% | 1.84 - 2.14% | |

Average expected life | 6 years | 6 years | |

Dividend yield | 0% | 0% | |

Volatility | 62% | 62% | |

Fair value of common stock | $0.83 - $0.97 | $0.79 - $0.93 | |

Estimated fair value of options granted | $0.58 - $0.66 | $0.64 - $0.66 | |

Estimated forfeiture rate | 10% | 10% | |

Warrants In 2008 through 2013, the Company issued warrants to a bank and stockholders. The following presents activity for warrants:

For the years ended December 31, 2017 and 2016 | Series A Warrants | Series B Warrants | Common Stock Warrants | ||||||

December 31, 2015 | — | 43,731 | 1,453,385 | ||||||

Granted | — | — | — | ||||||

Exercised | — | — | (646,275) | ||||||

Forfeited/canceled | — | — | — | ||||||

December 31, 2016 | — | 43,731 | 807,110 | ||||||

Granted | — | — | — | ||||||

Exercised | — | — | — | ||||||

Forfeited/canceled | — | — | — | ||||||

December 31, 2017 | — | 43,731 | 807,110 | ||||||

Exhibit 99.3

10. | INCOME TAXES |

The provision (benefit) for income taxes is as follows:

For the years ended December 31, | 2017 | 2016 | ||||

Current: | ||||||

Federal | $ | — | $ | — | ||

State | 5,006 | — | ||||

Foreign | 96,708 | — | ||||

101,714 | — | |||||

Deferred: | ||||||

Federal | 3,035,393 | (4,452,330) | ||||

State | (150,834) | (1,986,746) | ||||

Foreign | — | — | ||||

2,884,559 | (6,439,076) | |||||

Less: change in valuation allowance | (2,884,559) | 6,439,076 | ||||

— | — | |||||

Total | $ | 101,714 | $ | — | ||

The provision for income taxes of $101,714 for the year ended December 31, 2017 is included in other expenses, net on the accompanying consolidated statement of operations and comprehensive loss.

The reconciliation of income taxes calculated at the U.S. federal tax statutory rate to the Company’s effective tax rate is set forth below:

For the years ended December 31, | 2017 | 2016 | ||

U.S. federal statutory rate | 34.00% | 34.00% | ||

State income tax, net of federal benefit | 3.43% | 4.43% | ||

Change in valuation allowance | 14.03% | (43.25%) | ||

Other | (2.74%) | 4.82% | ||

Federal rate change | (48.72%) | 0.00% | ||

Effective income tax rate | 0.00% | 0.00% | ||

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and liabilities were as follows as of December 31:

For the years ended December 31, | 2017 | 2016 | ||||

Deferred tax assets: | ||||||

Net operating loss carry forwards | $ | 19,958,052 | $ | 23,916,514 | ||

Income tax credits | 3,007,357 | 2,560,882 | ||||

Others | 2,344,495 | 3,247,819 | ||||

Total gross deferred tax assets | 25,309,904 | 29,725,215 | ||||

Deferred tax liabilities: | ||||||

State income taxes | (1,151,908) | (1,810,332) | ||||

Property and equipment | 147,988 | (66,622) | ||||

Intangible assets | (1,081,346) | (1,739,066) | ||||

Total gross deferred tax liabilities | (2,085,266) | (3,616,020) | ||||

Less: valuation allowance | (23,224,638) | (26,109,195) | ||||

Total | $ | — | $ | — | ||

Exhibit 99.3

The Company’s ability to utilize net operating loss carryforwards may be limited in the event of an ownership change as defined in the Internal Revenue Code. As of December 31, 2017 and 2016, the Company had net operating loss carryforwards for federal and state income tax purposes of $77,269,251 and $59,086,048, respectively. If not utilized, the federal and state net operating losses will begin to expire in 2028. In addition, the Company has research and development ("R&D") credits for federal and state income tax purposes of $1,573,336 and $1,172,653, respectively. The federal R&D credits, if not utilized, will begin to expire in 2027. The California R&D credits can be carried forward indefinitely. The Company also has a carryover of California Enterprise Zone and New Job credits totaling $147,676, which will expire beginning in 2018.

Based on pretax losses sustained by the Company and uncertainty of realizing future income, a valuation allowance was recorded against the net deferred tax assets. The Company’s effective income tax rate differs from the statutory federal income tax rate due to the change in valuation allowance.

The Company’s subsidiaries, Oblong Europe, Ltd. and Oblong Industries Europe, S.L.U. are subject to foreign income tax in Germany, Spain, and United Kingdom. The amount of such foreign current income tax expense incurred amounted to $96,708 for 2017.

On December 22, 2017, H.R.1, also known as the Tax Cuts and Jobs Act (the "Tax Reform Act"), was enacted into law. The Tax Reform Act makes broad and complex changes to the U.S. tax code, including, but not limited to, (i) reducing the U.S. federal statutory tax rate from 35% to 21%; (ii) requiring companies to pay a one-time transition tax on certain unrepatriated earnings of foreign subsidiaries (the "Transition Tax"); (iii) generally eliminating U.S. federal income taxes on dividends from foreign subsidiaries; (iv) requiring a current inclusion in U.S. federal taxable income of certain earnings of controlled foreign corporations; (v) eliminating the corporate alternative minimum tax (AMT) and changing how existing AMT credits can be realized; (vi) creating the base erosion anti-abuse tax (BEAT), a new minimum tax; (vii) creating a new limitation on deductible interest expense, and (viii) changing rules related to uses and limitations of net operating loss carryforwards created in tax years beginning after December 31, 2017. As a result of the Tax Reform Act, the Company recorded an income tax benefit of $10,018,768 before the valuation allowance due to a remeasurement of deferred tax assets and liabilities using the income tax rate applicable for future periods in which they are expected to reverse.

11. | Profit Sharing Plan |

The Company sponsors a 401(k) Plan (the "Plan") for all eligible employees. All full-time employees are eligible to participate in the Plan during their first payroll period. The Company contributions to the Plan are at the sole discretion of the Company’s Board of Directors. Employees may elect to have a portion of their compensation deferred and contributed to their 401(k) accounts. Vesting and the allocation of Company contributions to the eligible employee accounts are determined in accordance with the terms of the Plan. Matching contributions were discontinued in September 2012. There were no contributions for the years ended December 31, 2017 and 2016.

12. | Restatement of Previously Issued Financial Statements |

The Company has restated its previously issued consolidated balance sheets as of December 31, 2017 and 2016 and the related consolidated statements of cash flows for the years ended. The Company determined that its holdings of certain money market funds with a financial institution were erroneously classified as marketable securities on its consolidated balance sheets as of December 31, 2017 and 2016, and instead should have been included in cash, cash equivalents and restricted cash. Cash, cash equivalents and restricted cash, beginning of year (December 31, 2017 and December 31, 2016), in the accompanying consolidated statements of cash flows have been adjusted for the effects of this revision.

Exhibit 99.3

As Previously | As | |||||||

Oblong Industries, Inc. Consolidate Balance Sheet | Reported | Adjustment | Restated | |||||

December 31, 2017 | ||||||||

Cash, cash equivalents, and restricted cash | $ | 631,331 | $ | 14,053,172 | $ | 14,684,503 | ||

Marketable securities | $ | 14,053,172 | $ | (14,053,172) | $ | — | ||

December 31, 2016 | ||||||||

Cash, cash equivalents, and restricted cash | $ | 32,584 | $ | 38,754,929 | $ | 38,787,513 | ||

Marketable securities | $ | 38,754,929 | $ | (38,754,929) | $ | — | ||

13. SUBSEQUENT EVENTS

The Company has evaluated subsequent events that have occurred from January 1, 2018 through the date of the independent auditor’s report, which is the date that the consolidated financial statements were available to be issued, and determined that there were no subsequent events or transactions that required recognition or disclosure in the consolidated financial statements, except as disclosed below.