Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Cannis, Inc. | cann_ex321.htm |

| EX-31.2 - CERTIFICATION - Cannis, Inc. | cann_ex312.htm |

| EX-31.1 - CERTIFICATION - Cannis, Inc. | cann_ex311.htm |

| EX-21.1 - SUBSIDIARIES - Cannis, Inc. | cann_ex211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: August 31, 2019

or

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File No. 333-214122

CANNIS, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | 98-1322537 | |

(State or other jurisdiction of incorporation or formation) | (I.R.S. employer Identification No.) |

20, Jalan 51A/225A, Section 51A

Zone Perindustrian PTJC,

46100 Petaling Jaya, Selangor, Malaysia

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: +603 7865 3638

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x | Smaller reporting company | x |

Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of the last business day of the Issuer’s most recently completed second fiscal quarter, March 31, 2019, the aggregate market value of the voting and non-voting common equity held by non-affiliates was nil due to the lack of a trading market.

As of December 16, 2019, there were 1,488,932,800 shares of Common Stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

| 2 |

| Table of Contents |

FORWARD-LOOKING STATEMENTS

Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Registrant’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Registrant. Although the Registrant believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Registrant or any other person that the objectives and plans of the Registrant will be achieved.

USE OF DEFINED TERMS

Except where the context otherwise requires and for the purposes of this report only:

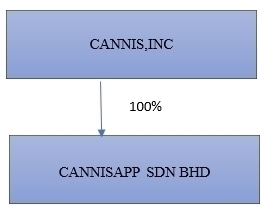

● | “we”, “us”, “our company”, “our” and “Company” refer to the combined business of Cannis, Inc., and its consolidated subsidiary; |

● | “Cannisapp” or “Subsidiary” refers to Cannisapp Sdn. Bhd., a Malaysia corporation and direct, wholly-owned subsidiary of the Company; |

● | “SEC” refers to the United States Securities and Exchange Commission; |

● | “Ringgit Malaysia”, “MYR”, and “RM” refer to the legal currency of Malaysia; |

● | “U.S. dollars”, “dollars” and “$” refer to the legal currency of the United States; |

● | “Securities Act” refers to the United States Securities Act of 1933, as amended; and |

● | “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended. |

Solely for the convenience of the reader, this report contains conversions of certain RM amounts into U.S. dollars at specified rates. No representation is made that the RM or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or RM, as the case may be, at any particular rate or at all. See “Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could adversely affect our business and the value of our securities” for a discussion of the effects on the GMCI fluctuating exchange rates.

Background.

We were incorporated as Zartex, Inc. under the laws of the State of Nevada on August 17, 2016. We changed our name from Zartex, Inc. to Cannis, Inc. on December 6, 2018. The Company was in the business of software development which sought to deliver services for the garment distribution industry.

Effective November 14, 2018, a change of control occurred with respect to the Company. In connection with the change of control transaction, Mr. Eu Boon Ching acquired 6,335,000 shares of our common stock (or 99.9% of our issued and outstanding common stock) from former shareholders of the Company. In addition, the Company has ceased its operations, transferred its assets and became a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). Mr. Ching became our sole officer and director following the change of control.

| 3 |

| Table of Contents |

On April 24, 2019, the Company filed a Certificate of Amendment with the Nevada Secretary of State which;

(a). Increased the authorized shares of its common stock, $0.001 par value, from 75,000,000 to 1,500,000,000 shares, and

(b). Created a class of preferred stock, $0.001 par value, called the Class A Preferred Stock in the amount of 10,000,000 authorized shares, with each share of Class A Preferred Stock having 100 votes to be cast with respect to any and all matters presented to shareholders for a vote whether at a meeting of shareholders or by written consent. Apart from the voting rights stated in the preceding sentence, the Class A Preferred Stock has no other rights, privileges or preferences.

On August 5, 2019 (the “Closing Date”), we closed a share exchange under a Share Exchange Agreement (the “Stock Exchange Agreement”), with Cannisapp, and Mr. Ching, its sole stockholder, who, as mentioned above, is our majority shareholder and sole officer and director. Mr. Ching held 100% of the issued and outstanding stock of Cannisapp. Pursuant to the Stock Exchange Agreement and upon the closing of the Share Exchange, in exchange for all of the issued and outstanding capital stock of Cannisapp, we issued to Mr. Ching 1,482,492,800 shares of our common stock, par value $0.001 per share and 8,500,000 shares of Class A Preferred Stock, $0.001 par value (the Class A Preferred Stock has 100 for 1 voting rights per share). As a result of the Share Exchange, Mr. Ching remains the controlling shareholder of the Company, owning a total of 1,488,827,800 shares of common stock and all of our Class A Preferred Stock.

Immediately prior to the closing of the Stock Exchange Agreement, we had 6,440,000 shares of our common stock, $0.001 par value, and no shares of preferred stock $0.001 par value, issued and outstanding. Immediately after the closing of the Stock Exchange Agreement, we had 1,488,832,800 shares of our common stock, $0.001 par value, issued and outstanding and 8,500,000 shares of our Class A Preferred Stock, $0.001 par value, issued and outstanding issued and outstanding. The Class A Preferred Stock has 100 to 1 one voting rights per share.

The Share Exchange was accounted for under the business combination under common control of accounting. Pursuant to the Stock Exchange Agreement, we acquired the business of Cannisapp, which a technology-oriented company, specializing in the creation of mobile applications operating on Android and iOS operating systems. As a result, we have ceased being a “shell company.”

DESCRIPTION OF OUR BUSINESS

Cannisapp Business History.

Cannisapp was incorporated in Malaysia on April 2, 2018 as Antara Rimbun Sdn Bhd, a private limited liability company. On July 5, 2018, we changed our name to Nimpmos Sdn Bhd and subsequently to Cannisapp Sdn. Bhd. on September 2018. Our website is www.cannis.app. Cannisapp has two distinct, business segments, one is developing proprietary mobile applications and the other is offline sales distributor for nutritional supplements manufactured by third parties. The Company intends to integrate its offline sales with its mobile applications platform as part of its marketing strategy.

| 4 |

| Table of Contents |

We commenced offline sales of nutritional supplements in September 2018 while we are developing and marketing our mobile applications. We purchase nutritional supplement companies from suppliers located in the Peoples Republic of China and New Zealand. All of our revenues generated since inception of Cannisapp Sdn Bhd to date are derived from the offline sales of supplements.

Cannisapp, as a technology-oriented company, specializes in the creation of mobile applications operating on Android and iOS operating systems. We have developed and launched, in part, our app called Cannis App, which is a four-in-one mobile application consisting of Cannis Mall, Cannis Pay, Cannis Chat and Cannis Power.

We began developing our mobile applications during June of 2018 and launched our introductory version of Cannis App in August 18, 2018. Following the launch, in September 2018, we added functions such as discounted shopping with basic functions such as products classification, products search, products recommendation and location positioning. On November 1, 2018, we added Cannis Chat into Cannis App. On January 2019, we beta-tested Cannis Pay by adding it into Cannis App for online shopping payment and in-app function top up. In early February 2019, Cannis Power was introduced as one of the premium features of Cannis App.

The application development industry is an emerging industry in the twenty-first century that is undoubtedly important and indispensable to the society. There are two (2) type of applications that are common and trending in the market – desktop application and mobile phone application (“Apps”). Apps play a key role in the modern-day society, especially in those “want-to-know,” “want-to-go,” “want-to-do” and “want-to-buy” moments. It is a powerful and efficient consumer relationship-building medium that complements the growth of e-commerce industry and the connectivity between brands and consumers.

With the exponential growth of the mobile phones users, the app development industry is correspondingly growing rapidly. Our App development aims to develop an App with friendly interface that covers everyone’s daily needs in entertainment, lifestyle, business, social media and more.

It is our vision to create “an App that links the world,” and our Cannis Apps strive to minimize the distance between people and to eliminate all limitations of mobile phones. We envision our App, “Cannis” to be the next must-have App on everyone’s mobile phones, compatible on both Android and IOS operating systems, that could provide convenience and benefits to all mobile phone users.

I - Mobile Applications

Description of Cannisapp.

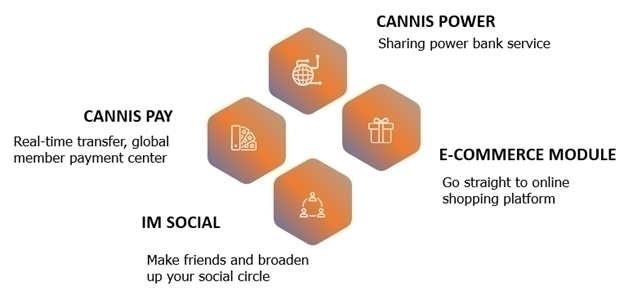

Cannisapp is our proprietary, integrated App that consists of four (4) main segments;

| (i) | Cannis Mall, an e-commerce module, |

| (ii) | Cannis Pay, a payment service, |

| (iii) | Cannis Chat, a social media in the form of instant messaging, and |

| (iv) | Cannis Power, a power bank sharing app. |

The users of Cannisapp can easily access to all four functions of Cannisapp without having the need to download and install other supporting App as all the four main elements of Cannisapp are designed to interface under Cannisapp. These four App segments help each other to draw different users with different needs and preference to the exposure of the diverse multiple applications offered by Cannisapp, with the aim of increasing user traffic.

(Diagram: Cannisapp is a four-in-one App designed to bring convenience to its users)

| 5 |

| Table of Contents |

A. Cannis Mall, an E-Commerce Module.

Cannis Mall, a mobile online e-commerce platform, is one of the main functions of Cannisapp. Our Cannis Mall focuses on healthcare, lifestyle and fashion covering China, Malaysia, Indonesia, Korea, Vietnam, Thailand. Cannis Mall offers a business trading venue that is user-friendly to both merchants and consumers. Through Cannis Mall, merchants are able to promote and enhance its products sales, brand awareness and product recognition towards the consumers. The unique design and user-friendly interface of Cannis Mall is able to foster repeat customers for our merchants.

Cannis Mall contains a sophisticated search engine which enables users to search for a product interactively as the search engine would filter and refine the available products based on the user’s input. Upon the user decided to proceed with the purchase, the user will be redirected to a payment page for payment whereupon the user can make payment through our payment gateway, Cannis Pay.

Despite the fact that we have not officially launched Cannis Mall, we are working on procuring and inviting merchants to list their products with Cannis Mall. The table below sets out the range and number of merchants that are expected to join Cannis Mall.

Business Category | Quantity | Expected Joined Date |

Electronic Accessories | 2 | June 2020 |

Mobile & Gadget | 2 | June 2020 |

Beauty & Health | 7 | June 2020 |

Baby Products | 1 | June 2020 |

Home & Living | 1 | June 2020 |

Home Appliances | 1 | June 2020 |

Clothing | 3 | June 2020 |

Shoe & Bag | 3 | June 2020 |

Food & Beverages | 1 | June 2020 |

In addition to mobile online e-commerce platform, Cannis Mall organizes promotional events from time to time for the participation of its merchants, members and public. By organizing promotional events, Cannis Mall is able to invite the public to explore its Cannisapp and meet with the merchants which has resulted in the increase of new members signing up with Cannis Mall. We are hopeful that these events will contribute positively to our revenue in the future. Cannis Mall generates revenues from commissions on product sales on its site.

| 6 |

| Table of Contents |

The below images depict the homepage to our Cannis Mall:

| | | |

B. Cannis Pay, a Payment Gateway.

The advent and rapid continuous progress of technology continue to push for more frequent, immediate and instantaneous internet access and smartphone usage penetration continue to rise rapidly. As result, new application and frontiers been explored and penetrated. This phenomenon has altered the consumers’ behavior in shopping, consumption, entertainment, retail, financial and other transactional services.

Cannis Pay, an app-based payment gateway was launched in January 2019, specializes in payment processing technology and solution for online merchants that gives consumers a simple, convenient and hassle-free means to pay.

Cannis Pay operates a reliable and secure proprietary technology platform that enables small to large businesses to accept a vast array of payment types and channels in Malaysia, Indonesia, China and Thailand such as Wechat Pay, Paypal and Alipay and by credit card.

We have also signed up with various utilities companies, whereby our users through Cannis Pay will be in due course able to make payment for electricity bill, water bill, telephone bills, and our IT team is connecting up the linkage to expand this service. The table below sets out the range and number of merchants that are expected to join our Cannis Pay platform.

Business Category | Quantity | Expected Joined Date |

Telco (Prepaid Top Up) | 14 | June 2020 |

Telco (Bill/ Postpaid) | 7 | June 2020 |

Utilities | 19 | June 2020 |

Games | 20 | June 2020 |

By providing the utility bills payment service, Cannis Pay is entitled to receive a commission fee from every transaction made through Cannis Pay.

| 7 |

| Table of Contents |

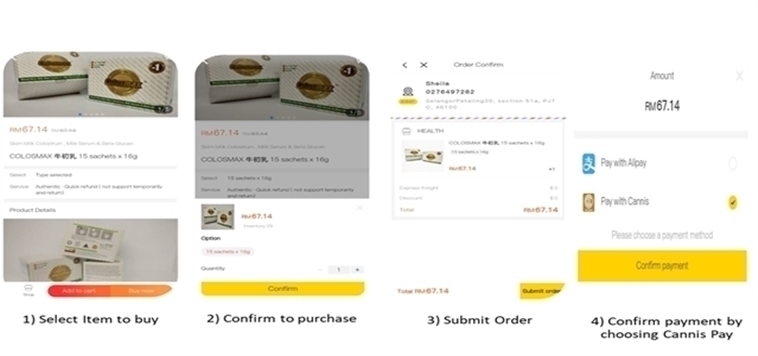

The below images depict transactions through Cannis Pay.

C. Cannis Chat, an Instant Messaging and Social Platform.

Cannis Chat is an instant messaging system created to provide free instant messaging, voice call and video call to facilitate communication between our users and their families and friends. Cannis Chat is compatible to both Android and IOS operating systems. We believe that Cannis Chat will serve as a value-added function to Cannisapp as it will contribute positively to the network traffic of all the other functions of Cannisapp which will promote and attract traffic to Cannisapp.

The below images depict our Cannis Chat’s interface:

| |

| 8 |

| Table of Contents |

D. Cannis Power, a Shared Powerbank Service.

Cannis Power is a power bank sharing service operating in conjunction with Cannisapp. The idea of Cannis Power derives from a commonly experienced issue of battery depletion due to frequent mobile device usage. With Cannis Power, we are providing a cost-effective battery charging solution that will allow users to have their mobile devices charged and stay connected wherever they are.

“Cost-Effective Mobility” is a key concept of Cannis Power. The portals of Cannis Power are expected to be widely located at the premises of Cannisapp’s merchant partners. Users are required to scan a QR code endorsed on the portal of Cannis Power and the QR code will redirect the users to Cannisapp for power bank device rental payment page. Upon successful payment, the users may remove the power bank device from the portal of Cannis Power for any outdoor device charging.

The power bank device has large power capacity, and is light, portable, durable and safe to use and is equipped with three types of USB cables compatible for most mobile devices models. The power bank device can be used to charge multiple mobile devices with flexibility and mobility.

As at today we have secured a few merchants that have subscribed for our Cannis Power. The table below sets out the range and number of merchants that are currently subscribing to Cannis Power.

Business Category | Quantity | Number of Portal | Date Subscribed |

Beauty & Health | 2 | 2 | March 2019 |

Health Centre | 1 | 2 | March 2019 |

Club House | 1 | 2 | March 2019 |

Travel Agency | 1 | 1 | March 2019 |

Entertainment | 1 | 1 | March 2019 |

To date, Cannis Power has not contributed to our revenue as Cannis Power is currently under beta-test and is offered free of charge for its users. Upon the expiry of the testing period in June 2020, Cannis Power will charge users at the rate of; RM1.00 per hour and RM12.00 per day. Revenue generated from Cannis Power will be allocated 40% to us, 30% to the merchant and 30% to referral, if any.

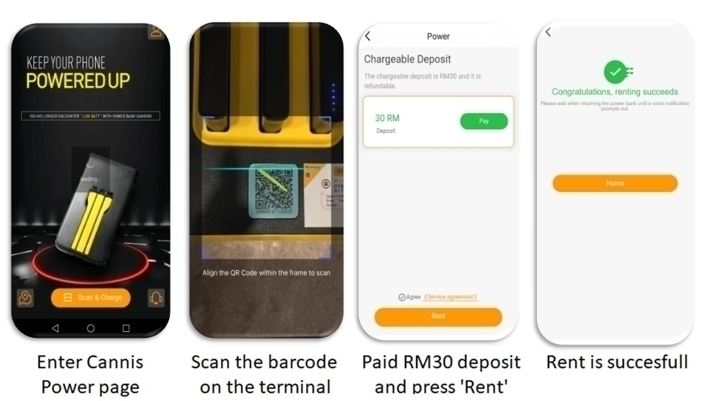

The below images depict the power bank device of Cannis Power:

| 9 |

| Table of Contents |

App development progress

The estimated rollout schedule of our Cannis App with all four distinctive functions is depicted below along with estimated costs to achieve full functionality which is still subject to the availability of funds to complete the product developments.

Milestone | Go-Live Date | Cost to achieve (US$) |

1. Cannisapp Platform with Short Video function | 8.18.2018 | 340,020 |

2. Cannis Power | 3.30.2019 | NIL |

3. IM (Cannis Chat) | 5.31.2019 | 905,139 |

4. Cannis Pay | 6.1.2020 | 1,059,993 |

5. Cannis Mall (E-Commerce) | 6.1.2020 | 694,432 |

We have engaged an external application developer since June 2018 with a team of approximately 100 programmers. The external application developer is engaged to develop Cannisapp and to constantly improve Cannisapp according to our specifications as well as to meet the market requirements. In additional to the external application developer, we have also engaged programmers in China and Indonesia to study internet status of various countries and to produce solutions for the issues that our App may encounter in various countries.

| 10 |

| Table of Contents |

Intellectual Property

We have filed trademarks of our Cannis name and logos with various governmental agencies in People’s Republic of China, Malaysia, Thailand and Indonesia.

We do not have any patents protecting any of our Apps. In general, the level of protection afforded by a patent is directly proportional to the ability of the patent owner to protect and enforce those rights through legal action. Since our financial resources are limited, and patent litigation can be both expensive and time consuming, there can be no assurance that we will be able to successfully prosecute an infringement claim in the event that a competitor develops a technology or introduces a product that infringes on one or more of our patents or patent applications. There can be no assurance that our competitors will not independently develop other technologies that render our proposed products obsolete. In general, we believe the best protection of our proprietary technology will come from market position, technical innovation, speed-to-market, and product performance. There is no assurance that we will realize any benefit from our intellectual property rights.

Instead of patent protection, we rely on trade secrets and know-how. To protect our rights in these areas, we require all employees and consultants that perform work for us to enter into confidentiality agreements.

Government Regulation

We conduct our business in compliance with all governmental regulations in Malaysia, including adherence to the Communications and Multimedia Act 1998 and Consumer Protection Act 1999. We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations in Malaysia. In addition, we will be subject to the laws and regulations of other jurisdictions in which we plan to sell our products, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, other than stated above, the development and operation of our business is not subject to special regulatory and/or supervisory requirements.

Market and Competition

We do not aim to compete with other similar established players in the respective segment of operation, due to their respective operating history, financial and technical strength. However, we believe we are one of the few integrated apps that offers services combining various segments of the internet economy. We set out below the general discussion of our analysis of the market competition of our various segments of commercial activities. The main users of our Apps will be users who prefer integrated services that our App can offer.

Cannis Mall

The growth of e-commerce has great potential in Malaysia, that has a population of 30 million, internet users of 25 million, social media users of 24 million and the number of younger generation and online purchases in Malaysia and other South East Asia countries has been increasing that is beneficial to our business growth. In recent years, the e-commerce sector has been blooming and there are many new e-commerce platforms been launched in Malaysia targeting the Malaysia market and/or the South East Asia market. Among all the e-commerce platforms, we believe Lazada, Shoppe and 11th Street are our main competitors.

Started in 2011 by the Rocket Internet SE, Lazada has grown into Malaysia’s most popular online marketplace where sellers and buyers can trade. Lazada acts as a middleperson, guaranteeing delivery to buyer and payment to seller. In the early days, Lazada fueled its growth by giving out massive discount vouchers as well as offering free shipping to its customers. Lazada makes profit primarily by charging commissions every time a sale is made on its site. Recently, Lazada has also started selling sponsored product ads to sellers on its website.

Shopee is another e-commerce marketplace in Malaysia. Its core service is to facilitate transactions between buyers and sellers. By comparing with Lazada which began mainly as a desktop online marketplace, Shopee began with a focus on mobile shopping and it prioritizing growth on its app. Shopee started in 2015, and Shopee has surpassed online marketplaces such as Lelong and 11Street and become the second most popular e-commerce marketplace in Malaysia. Its growth has been fueled by offerings of free shipping to buyers as well as zero commission chargeable on sellers when a sale in made through the Shopee. Shopee profits through its sponsored ads. At this juncture, it remains unclear how Shopee plans to profit long-term as ad sponsored content is becoming less favorable among consumers.

11Street is another popular e-commerce marketplace in Malaysia. It started in 2014 as an expansion of its main company in Korea which was established in 2008. 11Street used to be the second largest online marketplace in Malaysia. Similar to Lazada, 11Street profits from charging a commission to sellers when a sale is concluded on its website as well as through its sponsored product ads.

| 11 |

| Table of Contents |

Cannis Pay

With the emergence of e-commerce and online purchases, the procedure required for payment systems has been changing. Users have migrated from cash payments to card payments, and now to non-cash payments. Non-cash payments occur through digital channels either held on digital wallets or new digital payment mechanisms. As this industry is still evolving, a wide variety of terms are used for such transactions, such as e-money, digital money, micro-payments and so forth.

E-wallet services are generally work through apps on smartphones. An e-wallet is based on an encrypted software which substitutes an analog wallet during monetary transactions. Further, e-wallet allows one to store multiple credit cards and bank accounts in a secure environment and eliminates the need to enter account information while making monetary transactions. Once a user has registered for an e-wallet and creates an e-wallet profile, they can then make swift payments.

In the latest trend, Near Field Communication (NFC) chip enabled smartphones are expected to drive the market as most of the smartphone manufacturers are equipping new phones with NFC. With this, users can place their smartphones within four inches of a pay pad or contactless reader to make payment.

There are many emerging e-wallet companies available in Malaysia and some of the major participants like Paypal, Boost, Grabpay and WeChat are discussed below.

Paypal is one of the most common payment gateways used by small businesses. It allows users to create three types of accounts on PayPal – Personal, Premier, and Business. Users can link their debit or credit cards to carry out transactions. Users can sign up PayPal for free and choose PayPal at the time of checkout when making a purchase. It is protected by “Buyer Protection”, which covers almost all online purchases. Paypal users do not have to pay any fees while making payments through eChecks or PayPal balance on a personal account, but a transaction fees will be charged if the user transfers money using a debit or a credit card to their account.

Boost, a relatively new e-wallet in the Malaysian market, allows users to scan the QR code to pay for their purchases. Their mechanism is that users can send money to friends and family from their Boost wallet without any additional charges and enjoy great deals and discounts on online shopping, gaming, movies, music, and more. Boost has 17 Malaysian banking partners, that includes Maybank 2U, CIMB Clicks, and more. Boost wallet can only be used by topping up the Boost wallet prior to using it.

Grab Pay is another e-wallet competitor in Malaysia originating from a popular e-hailing operator, Grab. Grab Pay offers more than just paying for the cab rides. Cab riders can use their Grab Credits to pay for their rides, to make purchases at a number of partnering stores, to order food, and prepaid credits top up and transfer.

WeChat, a popular Chinese mobile chat giant, launched its digital payment gateway WeChat Pay in Malaysia in June 2018. The e-wallet can be used for peer-to-peer money transfer as well as to make payments to offline merchants through its Quick Pay function. WeChat Pay My offers a range of everyday functions – such as mobile phone top-ups, and bus and plane ticket booking. However, the depth of services is still limited compared to those available in China.

Cannis Chat

Our main objective with Cannis Chat is to develop a new social media platform with new ideas and concepts. Thus, we expect strong comparisons and competition from existing social media applications in the market. The following are market values ascribed to the 3 top social media apps, namely Whatsapp, WeChat and Line.

Whatsapp is among the earliest and longest running social media app in app industry. It has accumulated 1.5 billion users from 180 different countries after their first launch on year 2009. Even though Whatsapp itself has never been listed on any share market, it was acquired by Facebook with $19 billion USD in year 2004, which is 5 years after its launch.

WeChat is the social media app originates from China that gathers most Chinese users around the world. It has monthly active users of 1.8 billion across 20 countries and an estimated $110 billion USD current market evaluation. WeChat is officially launched at year 2011 by parent company, Tencent.

| 12 |

| Table of Contents |

Line Corporation is a Tokyo-based subsidiary of the South Korean internet search giant Naver Corporation. Line Corporation owns Line, a social media app that is mainly associated with instant messaging, gaming and internet services with an estimated market value of $8.4 billion USD. Line gathers 2.18 billion monthly active users from 230 countries since their launch in year 2011.

Cannis Power

Power bank rental is based on the sharing-economy business model that may become the next phenomenon due to the large number of smartphone users. The sharing-economy, also known as collaborative consumption or peer-to-peer-based sharing, is a concept that highlights the ability, and perhaps the preference, of individuals to rent or borrow goods at competitive price rather than buy and own them.

In China, this sector is growing at an exponential rate, with the influx of capital inflows from internet giants. However in Malaysia, this business model has not been explored by any entity on a large scale. We foresee that an early venture into this business will give us the opportunity to be the leader in this industry as power bank rental service is still new in Malaysia. We envision ourselves to be a pioneer in this market.

However, there are two competitors in the Malaysian market, namely Brezze and NoMo, both are Singaporean based companies that have penetrated the Malaysian market with minimal exposure. NoMo is the most competitive of two, providing VIP Package to its members and has expanded its services even up to Ipoh, Malaysia Brezze on the other hand, is a new company that is running test in Malaysian market. Due to the limited operating history in Malaysia, there are limited information available on their services. However, we believe we can distinguish ourselves with these two competitors.

Competitive Advantages

Below are our competitive advantages in comparison with our competitors above.

| 1) | Cannis Mall |

| · | Will be interactive by providing purchase suggestions based on prior viewing or purchasing history. We believe this will provide ease of use thus making product searches, viewing and selection simpler. |

| · | With a sophisticated and efficient search engine, our users can search for a product interactively as the search engine would refine the products available based on the user’s input. |

| · | The simplicity of the design of Cannis Mall can make the execution and operation be more time-saving and cost saving which is the essence of our online shopping platform. |

| 2) | Cannis Pay |

| · | A strategic promotional tagline. |

| The market for cashless payments is already expanding in Malaysia and E-wallet payments constitute half of the total cashless payments made in Malaysia, but it is only 20% of the total payments made in the country. The digital economy is expected to be one of the major contributors to Malaysia’s GDP, is expected to achieve a target of 20% by 2020. In order to attract people to download and use the e-wallet, we have come up with a promotion strategy with a tagline “Download, Spend & Be Rewarded”. The mechanism of this promotion strategy requires user to download the e-wallet and spend RM100.00 on accumulative basis and be rewarded with RM10 worth of voucher. | |

| · | A strategic marketing approach. |

| With more marketing efforts and more education to the public on the benefits of cashless payments and e-wallets, we are confident that more and more Malaysians will learn about Cannis Pay and make the switch in the near future. Our competitive advantage relies mostly on our marketing strategy. When it comes to mobile wallet marketing, the options on how to promote mobile wallet content are nearly endless, although they are subject to monetary constraints. | |

|

|

|

| 3) | Cannis Chat |

| · | Attractive features. |

| There is support for stickers and GIFs, photo and video editing, and group chats among the members. It’s also completely free and doesn’t contain adverts. Cannis mission for its Chat app is to make it free, never sell data, and isn’t aiming to generate revenue. | |

| · | Real time Updates. |

| The basics are solid with real-time updates when messages are delivered, read, and when the recipient is responding. It also offers free voice and video calls, loads of stickers and emoticons. | |

| · | Unique Function. |

| · | The chat also has a unique function where user can choose to ignore the unread messages. There is also function of creative video (similar to Tik Tok) where user can share with their contact. |

| 13 |

| Table of Contents |

| 4) | Cannis Power |

| · | Exploring the untapped market of sharing power bank. |

| We expect Cannis Power, based on the concept of sharing economy, to grow rapidly in the future. According to a research conducted by MCMC (Malaysia Communication and Multimedia Communication), smartphone is the most common device to access Internet, at 89.4%. Additionally, in 2016, there were 28.5 million mobile broadband subscriptions compared to 2.5 million fixed broadband subscriptions. We believe with a growing number of smartphone users and internet subscribers; the sharing power bank service will become a phenomenon in Malaysia. | |

| · | Promotional Strategy. |

| We intend to implement a Free of Charge promotion where user only has to pay RM30 deposit, we confident that people will be attracted to use our service. The convenience that we create to rent the power bank is one of the competitive advantages that Cannis has available. A user can rent and return it anywhere at an affordable fee. The features of the device also contribute to the efficiency of the service. It can cater iOS and Android with three types of USB cables compatible for most mobile device’s models. |

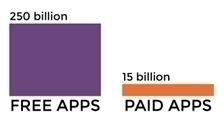

Pricing considerations

The vast majority of users on all continents prefer free mobile applications. Statistics provided by Statista showed that in 2017, free mobile apps are projected to have been downloaded over 250 billion times worldwide. As for paid apps, Statista showed around 15 billion downloads in 2017.

Mobile Apps Downloads 2017

Source: Statista

Cannisapp is free-for-all and as of this date, we have accumulated 200,000 downloads from Malaysia, Indonesia and China.

With large customer base and strong network traffic in our App, each module on our App may provide revenue streams in the future. With the increase of utilization of each the module on our App, the immediate chain effect will be the increase of utilization of Cannis Pay. Users can utilize Cannisapp to perform cashless transactions such as shopping, utility bill payment, mobile credit top up and more.

Marketing strategy

We plan on using conventional marketing methods as well as social media to promote our Apps. We have a team of 15 employees to educate and guide user in using our App and to highlight the competitive strength of our App. Our Chief Marketing Officer will direct the market awareness and branding of our products.

| 14 |

| Table of Contents |

The following elaborates our marketing strategy:

1. Email Marketing

· We intend to use permitted email marketing, and design user-friendly contents (such as discounts, special offers, free gifts, etc.).

2. Popularize Resource Sharing

· The sharing of traffic flow between App to App, including our Apps, can also be considered as a mutual promotion. Through the cooperation with other App, implant each other’s download ports or links on the partner App, (can also embed the download port on strategic alliance companies’ App), the Cannis App will be cross-promoted in different industries to engage more customers.

3. Search Engine Advertisement

· Search engines are main channels for internet users to obtain information. An ordinary user would normally browse in the order of given rankings. We will endeavor to have CANNIS APP as one of the top picks while searching with related keywords and advertising on GOOGLE, Wikipedia, Facebook, YouTube, etc.

4. Online Podcasts and Bloggers

· Online podcasts (or webcasts) and bloggers have become an important component in forming public opinion in Malaysia. We will attempt to use these platforms to effectively improve our exposure. Promotion through online celebrities on platform such as Blogger with soft text can also increase word-of-mouth and publicity.

5. Social platform promotion (Micro-marketing)

· Create a CANNIS APP official platform account, the network promoting personnel will regularly update the public account content, effectively establish a stable user community, which can then proceed on with secondary marketing. Social media platforms are tools that give convenience to users on sharing, commenting and discussing, for instance, Facebook and Instagram, they can be managed by specialist to promote information about CANNIS APP, making full use of such platforms in increasing our users’ allegiance.

6. App Store Promote

· Popularize the APP ranking in major mobile phone app stores, third party app stores (Google store, iTunes), and other third party app download platforms, making it more convenient for users to download from various channels.

7. Mobile Vehicle Advertising

· According to the main road map of public transports, the CANNIS APP advertisements can be printed on huge mobile vehicles or stations, selectively invest a small amount in some taxis (TAXI, GRAB CAR); appropriate light box advertisements in main shopping streets, transit stations, large shopping malls, and certain bus stations, making it more intimate to the audience, and subtly forms a brand effect.

8. TV and Radio Advertising

· TV media advertising has long been integrated into the life of public. And since users normally have a good sense of trust in their favourite channels, cooperating with the Malaysian Radio and Television Stations depending on their viewing rate to place advertisement can be feasible and effective. Radio stations are also the main source for daily news, bridging an interaction between radio and users can help promote CANNIS APP.

9. Newspaper Banners And Single Page Ads

· Newspaper users are considered as a precise targetable group, suitable for explicit advertising. Putting on newspaper banner ads or single page ads in best-selling magazines in main Malaysia urban areas, will help to promote the value of CANNIS APP wishes to deliver to consumers.

10. Product Shopping Bags and Flyers

· Cooperate with partner merchants to customize co-branded shopping bags, while making visible the CANNIS APP information and its download method. Place leaflets at partner merchants’ along with some little gifts to attract more pick-ups or choose the crowded locations (such as shopping malls, schools, MRT transit stations, etc.), with the CANNIS APP QR code uniform on the personnel for more publicity and spreading.

11. Merchant Resource Sharing

· Place brief introductions about CANNIS APP at doorsteps through the cooperation with offline shops. Cannis battery banks can be placed at the cashier counters with eye-catching APP download sign. For those successful set up merchants, while users are renting Cannis battery banks, the users will be able to search for the shop location (sharing between users and merchants, forming a consumer-based reciprocal cycle), can then result in more traffic and customers, therefore increase the chance of our cooperation.

| 15 |

| Table of Contents |

12. Event Promotion.

· As mentioned above, we have organized events and activities with the intention to create market awareness and we will continue our efforts in ths regards. We organized Cannis Open Day on March 31, 2019 in our Head Quarters in Petaling Jaya, Selangor. On Cannis Open Day, we were able to introduce our App to the public which resulted in our user base and the engagement of our App have been increased significantly. Prior to the Cannis Open Day, we distributed flyers throughout the neighboring areas, and advertised it via social media platform. There were also lucky draws for people who showed up on Cannis Open Day.

II - Nutritional Supplements

Background.

In September 2018, we started offline sales distribution of three nutritional supplements manufactured by two separate companies. One company is located in the Peoples Republic of China and manufactures products known as “Tibet Cordyceps” and “Cordyceps King.” The other company is located in New Zealand and manufactures a product known as “BeauZell.”

We are the distributor for both companies, we sell these products by using sales dealers that sell for us. These sales dealers sell directly to consumers located in Malaysia and other parts of South East Asia such as Indonesia.

We do not have a written agreement with either manufacturer. We mark up the price charged to us by the manufacturer by up to 40%. Our sales dealers would mark up the price sold to the consumer. Once we place an order with the manufacturer, the manufacturer directly ships the order to the purchaser.

Product Information.

Tibet Cordyceps and Cordyceps King

Cordyceps is also known as the caterpillar fungus and sometimes even the winter worm. It is also known as the zombie caterpillar and is native to China and Tibet. It has been known to be used as a magic herb for years in the Chinese and Tibetan culture and medicine. Cordyceps King is sold in a one bottle packaging containing 60g. The cordyceps for this product is sourced at elevations around 3,000 feet above sea level. Tibet Cordyceps is sold in two bottle packaging of 60g each. The cordyceps for this product is sourced at elevations around 5,500 feet above sea level and is believed to have a higher anti-oxidant affect. Both Cordyceps is categorized as Cordyceps Sinensis which is known to slow aging in individuals and to induce great vitality in people. It is often used as a secret herb to produce stamina and youthful beauty and to speed up the healing process from various illnesses and weaknesses and injuries. It also helps in boosting one’s energy levels, thereby fighting fatigue.

| 16 |

| Table of Contents |

| |

Tibet Cordyceps – 2 bottles x 60g | Cordyceps King - 60g |

BeauZell

BeauZell on the other hand is a supplement that is made from deer placenta extract which is widely regarded as the best grade for supplemental use as the molecular structure of deer placenta matches well with human protein and BeauZell capsules are some of the most powerful products on the market, promoting everything from glowing skin to organ health and healthy blood sugar levels.

BeauZell – 30 capsules-9000mg

| 17 |

| Table of Contents |

We started selling these products in September 2018. Below is our revenue breakdown by fiscal quarter for each product category during the past 12 month, respectively:

|

| Quarter ended November 30, 2018 (US$) |

|

| Quarter ended February 28, 2019 (US$) |

|

| Quarter ended May 31, 2019 (US$) |

|

| Quarter ended August 31, 2019 (US$) |

|

| Total |

| |||||

Product |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Tibet Cordyceps |

|

| 292,199 |

|

|

| 561,964 |

|

|

| 976,914 |

|

|

| 413,990 |

|

|

| 2,245,067 |

|

Cordyceps King |

|

| - |

|

|

| 80,014 |

|

|

| 282,804 |

|

|

| 165,632 |

|

|

| 528,449 |

|

Beauzell |

|

| 10,874 |

|

|

| 41,585 |

|

|

| 253,857 |

|

|

| 185,915 |

|

|

| 492,231 |

|

Others |

|

| 8,834 |

|

|

| 135,487 |

|

|

| 36,724 |

|

|

| 82,272 |

|

|

| 263,317 |

|

Total |

|

| 311,907 |

|

|

| 819,049 |

|

|

| 1,550,299 |

|

|

| 847,809 |

|

|

| 3,529,064 |

|

Market Analysis.

A. Cordyceps

Cordyceps Sinesis is native to the Himalayas and other mountainous parts of Asia. It has been one of the most prized compounds in Traditional Chinese Medicine for millennia, where it’s used for virility and stress. More recently, scientists have found a few benefits to C. sinensis:

| · | Physical endurance. A well-controlled study in older men found that, after 3 months of supplementing, C. sinensis increased lactate threshold by 10% and ventilatory threshold by 8.5% over placebo. In other words, C. sinensis increased cardio endurance by a substantial margin. |

|

|

|

| · | Curbing stress. Several studies shows that C. sinensis eases the physical effects of stress, including decreased inflammation and response. |

|

|

|

| · | Immune/organ function. C. sinensis improved liver function and kidney function in patients struggling with each. |

B. Deer Placenta

The ancient Chinese herbalist and acupuncturist Li Shizhen wrote about the benefits of the placenta as a medical supplement as early as the 1500s and dried placenta has been used for centuries to help patients suffering from everything from impotence to skin disorders and fatigue. Today, celebrities like Victoria Beckham and Kim Kardashian use sheep placenta facials for younger looking skin due to its high protein content and actress January Jones hit headlines for remedying postpartum depression with tablets made from the dried placenta which is known to be high in the blues-busting vitamin B6.

Placentophagy or the practice of consuming placenta is still new to western medicine but there is evidence to suggest that it could help to boost energy, improve iron levels and ward off depression. Deer placenta is widely regarded as the best grade for supplemental use as the molecular structure of deer placenta matches well with human protein. Deer placenta is highly prized because it contains a tremendous amount of stem cells and these have a powerful ability to regenerate and repair damaged cells, tissue and organs while protecting healthy cells and nurturing new life cycles. All of this activity promotes healthy glowing skin and overall wellness and vitality.

| 18 |

| Table of Contents |

Marketing.

Presently, we use independent sales dealers to market these supplements. Each independent dealer can choose how they want to sell the products. They generally use the following off-line methods:

-Direct Mail to a target audience.

-Cold Calls or word of mouth referrals.

-Booths at various health related trade shows, generally in Malaysia

In an effort to increase sales of this offline segment of our business, we intend to employ the following marketing strategies;

- Seek more sales dealers to broaden our sales channel. We intend to do this through word of mouth.

- Identify more health care related products to push through our sales channel.

- Open market in other countries such as Indonesia and China

- Use our Cannis Mall as a marketing tool once it is fully operational.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Notes Regarding Forward-Looking Statements” immediately following these risk factors for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

OUR CASH REQUIREMENTS ARE SIGNIFICANT. THE FAILURE TO RAISE ADDITIONAL CAPITAL WILL HAVE A SIGNIFICANT ADVERSE EFFECT ON OUR FINANCIAL CONDITION AND OUR OPERATIONS. Our business plan of developing, introducing and marketing our Apps will require a signification cash infusion. As stated herein, we estimate our monthly cash requirements to approximate $240,000 until we achieve positive cash flow. At August 31, 2019 and 2018, the Company reported accumulated deficit of $4,954,178 and $1,341,636, respectively. In addition, as of August 31, 2019, the Company had a working capital deficit of approximately $5.4 million (consisting in significant part of $3.9 million in debt to our largest shareholder and our officer and director) with cash on hand less than $0.2 million. Our auditor’s report for the period from April 2, 2018 (Inception) to August 31, 2018 and for the year ended August 31, 2019 for Cannis, Inc. and its subsidiaries includes an explanatory paragraph to their audit opinion stating that our recurring losses from operations and working capital deficiency raise substantial doubt about our ability to continue as a going concern. We do not currently have sufficient financial resources to fund our operations or those of our subsidiaries. Therefore, we need additional financing to continue these operations.

We believe that our existing capital resources are not adequate to enable it to execute its business plan and as of the date of these financial statements and has no firm commitment for either additional debt or equity financing available to it in order to meet our current commitments. These conditions raise substantial doubt as to the Company’s ability to continue as a going concern. We estimate that we will require additional cash resources during fiscal 2019 and beyond based on our current operating plan and condition. We expect cash flows from operating activities to improve, primarily as a result of an increase in revenue and a decrease in certain operating expenses, although there can be no assurance thereof. If we fail to generate positive cash flow or obtain additional financing, when required, we may have to modify, delay, or abandon some or all of our business and expansion plans.

WE HAVE INCURRED NET LOSS IN THE PAST AND WE MAY CONTINUE TO EXPERIENCE LOSSES IN THE FUTURE. We incurred a net loss of $3,612,542 and $1,322,940 for the year ended August 31, 2019 and 2018. We cannot assure you that we will be able to generate net profits or positive cash flow from operating activities in the future. Our ability to achieve and maintain profitability will depend in large part on our ability to, among other things, increase our number of members and other users, grow and diversify our supplier base, and optimize our cost structure. We may not be able to achieve any of the above. We intend to continue to invest heavily for the foreseeable future in our fulfillment infrastructure and technology platform to support an even more carefully curated selection of products and to offer additional value-added services. As a result of the foregoing, we believe that we may incur net losses in the future.

| 19 |

| Table of Contents |

OUR OPERATING LOSSES AND WORKING CAPITAL DEFICIENCY RAISE SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN. IF WE DO NOT CONTINUE AS A GOING CONCERN, INVESTORS COULD LOSE THEIR ENTIRE INVESTMENT. Our operating losses and working capital deficiency raise substantial doubt about our ability to continue as a going concern. If we do not generate revenues, do not achieve profitability and do not have other sources of financing for our business, we may have to curtail or cease our development plans and operations, which could cause investors to lose the entire amount of their investment.

THE ADMINISTRATIVE COSTS OF PUBLIC COMPANY REGULATORY COMPLIANCE COULD BECOME BURDENSOME AND CONSUME A SIGNIFICANT AMOUNT OF OUR CASH RESOURCES WHICH COULD MATERIALLY AND ADVERSELY AFFECT OUR BUSINESS. We will incur significant costs and expenses in connection with assuring compliance with all laws, rules and regulations applicable to us as a public company. We anticipate that our ongoing costs and expenses of complying with our public reporting company obligations will be approximately $100,000 annually. Our reporting and compliance costs and expenses may increase substantially if we are able to deploy our business model on an international basis, which will add significant cross-border jurisdictional complexity to our regulatory compliance and our accounting controls and procedures. Our compliance costs and expenses could also increase substantially if we apply for trading of our securities on a national stock exchange which may have listing requirements that engender additional administration and compliance costs. We have assigned a high priority to establishing and maintaining controls, procedures, corporate compliance and public company reporting; however, there can be no assurance that we will have sufficient cash resources available to satisfy our public company reporting and compliance obligations. If we are unable to cover the cost of proper administration of our public company compliance and reporting obligations, we could become subject to sanctions, fines and penalties, our stock could be barred from trading in public capital markets and we may have to cease doing business.

INABILITY TO MAINTAIN OPERATIONAL INFRASTRUCTURE AND SYSTEMS. We understand that there are several challenges related to IT infrastructure that we going to face in future. The main challenges are regarding computing platforms, data acquisition, compute provisioning and management, data storage architectures, data analytics, and networks and communication. Some challenges that we may face in the future such as:

- Lack of Powerful Computing Platforms

The major challenge in growing processing power of computers has been the lack of energy and space to power supercomputers. IT managers have always been on the lookout for better and faster systems which will help in the faster processing of the large amounts of data available today.

- Data Acquisition Problems

Firewalls which protect emails, applications and web browsing can cause important packet losses in the TCP/IP networks. This can result in important data loss and reduce the network speeds considerably, making the online collaboration impossible. Similar losses can occur due to the switches and routers which do not have the required high-speed memory.

- Dearth of Ways to Improve Data Analytics

Currently there are not many methods in place which can be used by app company to separate quality data from the humongous data sets. It is important to identify patterns in the data and correctly analyse it and use it to take business decisions in infrastructure management.

- Improper Networks and Connectivity

For any app company to work smoothly, it is important that there is a good and reliable network in place. Without a reliable network connection, it be a difficult task for us to maintain service quality. New software-based methods and network architecture design are required for the optimization of data.

WE HAVE LIMITED OPERATING HISTORY MAKES IT DIFFICULT TO EVALUATE OUR BUSINESS AND PROSPECTS. We commenced operations in April 2018 and have a limited operating history. However, our historical performance may not be indicative of our future growth or financial results. Our growth may slow down or become negative, and revenues may decline for a number of possible reasons, some of which are beyond our control, including decreasing consumer spending, increasing competition, declining growth of our overall market or industry, the emergence of alternative business models, changes in rules, regulations, government policies or general economic conditions. It is difficult to evaluate our prospects, as we may not have sufficient experience in addressing the risks to which companies operating in rapidly evolving markets may be exposed. You should consider our prospects in light of the risks and uncertainties that companies with a limited operating history may encounter.

| 20 |

| Table of Contents |

INTELLECTUAL PROPERTY INFRINGEMENT RESULTING IN COSTLY LITIGATION. Our success depends in part upon our proprietary technology. We rely primarily on trademark, copyright, service mark and trade secret laws, confidentiality procedures, license agreements and contractual provisions to establish and protect our proprietary rights. Despite these precautions, third parties could copy or otherwise obtain and use our technology without authorization or develop similar technology independently. We also pursue the registration of our domain names, trademarks, and service marks in the United States. We cannot assure you that the protection of our proprietary rights will be adequate or that our competitors will not independently develop similar technology, duplicate our products and services or design around any intellectual property rights we hold.

We cannot assure you that third parties will not claim our current or future products infringe their intellectual property rights. Any such claims, with or without merit, could cause costly litigation that could consume significant management time. Such claims also might require us to enter into royalty or license agreements. If required, we may not be able to obtain such royalty or license agreements or obtain them on terms acceptable to us.

WE DO NOT HAVE FORMAL AGREEMENTS WITH THE TWO SUPPLEMENT SUPPLIERS. Presently, we do not have formal, written agreements with the two supplement companies. Instead, we operate under oral arrangements with such companies. Therefore, either or both companies, at any time, can change the existing terms to terms less favorable to the Company or otherwise terminate the agreement. The occurrence of either event may have a material adverse impact on the Company and its existing revenue stream.

WE MAY BE NEGATIVELY AFFECTED BY ADVERSE GENERAL ECONOMIC CONDITIONS. Current conditions in domestic and global economies are extremely uncertain. Adverse changes may occur as a result of softening global economies, wavering consumer confidence caused by the threat of terrorism and war, and other factors capable of affecting economic conditions. Such changes could have a material adverse effect on our business, financial condition, and results of operations.

BECAUSE OUR PRINCIPAL SHAREHOLDER CONTROLS OUR ACTIVITIES, HE MAY CAUSE US TO ACT IN A MANNER THAT IS MOST BENEFICIAL TO HIMSELF AND NOT TO OTHER SHAREHOLDERS WHICH COULD CAUSE US NOT TO TAKE ACTIONS THAT OUTSIDE INVESTORS MIGHT VIEW FAVORABLY. Our principal shareholder owns approximately 99% of our outstanding common stock. As a result, he effectively controls all matters requiring stockholder approval, including the election of directors, the approval of significant corporate transactions, such as mergers and related party transaction. These insiders also have the ability to delay or perhaps even block, by their ownership of our stock, an unsolicited tender offer. This concentration of ownership could have the effect of delaying, deterring or preventing a change in control of our company that you might view favorably.

OUR DIRECTORS MAY HAVE CONFLICTS OF INTEREST WHICH MAY NOT BE RESOLVED FAVORABLY TO US. Certain conflicts of interest may exist between our sole officer and director and us. Our sole officer and director has other business interests to which he also must devote his time, resources and attention. Thus, a conflict of interest may arise in the future that may cause our business to fail, including conflicts of interest in allocating his resources, time and attention to our Company and his other business interests.

WE MAY DEPEND UPON OUTSIDE ADVISORS; WHO MAY NOT BE AVAILABLE ON REASONABLE TERMS AND AS NEEDED. To supplement the business experience of our officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, it is anticipated that such persons may be engaged on an “as needed” basis without a continuing fiduciary or other obligation to us. In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able to provide the required services.

RISKS RELATED TO DOING BUSINESS IN MALAYSIA

WE FACE THE RISK THAT CHANGES IN THE POLICIES OF THE MALAYSIA GOVERNMENT COULD HAVE A SIGNIFICANT IMPACT UPON THE BUSINESS WE MAY BE ABLE TO CONDUCT IN THE MALAYSIA AND THE PROFITABILITY OF SUCH BUSINESS. Policies of the Malaysia government can have significant effects on the economic conditions of the Malaysia. A change in policies by the Malaysia government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. We cannot assure you that the government will continue to pursue current policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the Malaysia’s political, economic and social environment.

| 21 |

| Table of Contents |

THE FLUCTUATION OF MALAYSIA RIGGIT (“RM”) AND CHINESE YUAN (“CNY”) MAY MATERIALLY AND ADVERSELY AFFECT YOUR INVESTMENT. The value of the RM against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the Malaysia’s political and economic conditions. As we rely entirely on revenues earned in the Malaysia, any significant revaluation of RM may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into RM for our operations, appreciation of the RM against the U.S. dollar could cause the RM equivalent of U.S. dollars to be reduced and therefore could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert our RM into U.S. dollars for the purpose of making dividend payments on our common stock or for other business purposes and the U.S. dollar appreciates against the RM, the U.S. dollar equivalent of the RM we convert would be reduced. In addition, the depreciation of significant U.S. dollar denominated assets could result in a change to our operations and a reduction in the value of these assets.

The Company incur significant costs and expenses that are denominated in Chinese Yuan (“CNY”) as supplier and service provider are located in China. The fluctuations in the exchange rates between the U.S. dollar, Malaysia Ringgit, and Chinese Yuan may affect our results of operations and financial condition.

The CNY’s exchange rate with the Malaysia Ringgit and other currencies is affected by, among other things, changes in China’s political and economic conditions and China’s foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the CNY to the U.S. dollar. Under such policy, the CNY was permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Later on, the People’s Bank of China has decided to further implement the reform of the CNY exchange regime and to enhance the flexibility of CNY exchange rates. Such changes in policy have resulted in a significant appreciation of the CNY against the U.S. dollar since 2005 though there have been periods when the U.S. dollar has appreciated against the CNY as well. There remains significant international pressure on the PRC government to adopt a more flexible currency policy, which could result in a further and more significant adjustment of the CNY against the U.S. dollar.

To the extent that we need to convert Malaysia Ringgit or other currencies into the Chinese Yuan for our operations or other uses, appreciation of the Chinese Yuan against the Malaysia Ringgit or other currencies would have an adverse effect on the Chinese Yuan amount we would receive from the conversion. On the other hand, a decline in the value of the Chinese Yuan against the Malaysia Ringgit could reduce the Malaysia Ringgit equivalent amounts of our financial results.

BECAUSE OUR PRINCIPAL ASSETS ARE LOCATED OUTSIDE OF THE UNITED STATES AND ALL OF OUR DIRECTORS AND ALL OUR OFFICERS RESIDE OUTSIDE OF THE UNITED STATES, IT MAY BE DIFFICULT FOR YOU TO ENFORCE YOUR RIGHTS BASED ON U.S. FEDERAL SECURITIES LAWS AGAINST US AND OUR OFFICERS AND DIRECTORS OR TO ENFORCE A JUDGMENT OF A UNITED STATES COURT AGAINST US OR OUR OFFICERS AND DIRECTORS IN THE PRC. All of our directors and officers reside outside of the United States. In addition, substantially all of our assets are located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or the Malaysia and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in Malaysia courts.

FAILURE TO COMPLY WITH THE U.S. FOREIGN CORRUPT PRACTICES ACT AND MALAYSIA ANTI-CORRUPTION LAWS COULD SUBJECT US TO PENALTIES AND OTHER ADVERSE CONSEQUENCES. We are required to comply the Malaysia’s anti-corruption laws and the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in Malaysia. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other cooperative dealers will not engage in such conduct for which we might be held responsible. If our employees or other cooperative dealers are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations. In addition, our brand and reputation, our sales activities or the price of our common stock could be adversely affected if we become the target of any negative publicity as a result of actions taken by our employees or other cooperative dealers.

| 22 |

| Table of Contents |

RISKS RELATED TO OUR SECURITIES

WE WILL NEED TO RAISE ADDITIONAL CAPITAL. IF WE ARE UNABLE TO RAISE ADDITIONAL CAPITAL, OUR BUSINESS MAY FAIL. We will need to raise additional capital to fund our ongoing operations. We have no cash on hand nor any working capital. To secure additional financing, we may need to borrow money or sell more securities. Under the current circumstances, we may be unable to secure additional financing on favorable terms, if available at all.

OUR NEED FOR CAPITAL WILL CREATE ADDITIONAL RISKS AND CREATE POTENTIAL SUBSTANTIAL DILUTION TO EXISTING SHAREHOLDERS. As mentioned above, we will need to raise additional capital in the future. These capital expenditures are intended to be funded from third party sources and from affiliates if available, including the incurring of debt (which may be converted into common stock) and/or the sale of additional equity securities. As of the date of this agreement, the Company is indebted to certain affiliates in the amount of $22,550. This debt is due on demand and the Company has no means to repay its existing debt. To the extent that this debt is converted to common stock, the conversion of this debt will cause additional dilution to existing shareholders, which may be substantial. In addition, the sale of additional equity securities or the sale and conversion of other debt likewise will be dilutive to the interests of current equity holders and such dilution may be substantial. In addition, there can be no assurance that such additional financing, whether debt or equity, will be available to the Company or that it will be available on acceptable commercial terms. Any inability to secure such additional financing on appropriate terms could have a materially adverse impact on the business, financial condition and operating results of the Company.

THE REGULATION OF PENNY STOCKS BY SEC AND FINRA MAY HAVE AN EFFECT ON THE TRADABILITY OF OUR SECURITIES. Our shares are subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase “accredited investors” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000).

For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also may affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate “penny stocks.” Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities Exchange Act of 1934, as amended. Because our securities constitute “penny stocks” within the meaning of the rules, the rules would apply to us and to our securities. The rules may further affect the ability of owners of Shares to sell our securities in any market that might develop for them.

Shareholders should be aware that, according to Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

| 23 |

| Table of Contents |

The shares of our common stock may be thinly-traded on OTC-Pink, meaning that the number of persons interested in purchasing our shares of common stock at or near ask prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven, early stage company such as ours or purchase or recommend the purchase of our shares of common stock until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares of common stock is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on Securities price.

OUR STOCK WILL IN ALL LIKELIHOOD BE THINLY TRADED AND AS A RESULT YOU MAY BE UNABLE TO SELL AT OR NEAR ASK PRICES OR AT ALL IF YOU NEED TO LIQUIDATE YOUR SHARES. We cannot give you any assurance that a broader or more active public trading market for our shares of Common Stock will develop or be sustained, or that any trading levels will be sustained. Due to these conditions, we can give investors no assurance that they will be able to sell their shares of common stock at or near ask prices or at all if you need money or otherwise desire to liquidate your shares of common stock of our Company.