Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PARKER HANNIFIN CORP | exhibit9912qfy19.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | coverform8-k2qfy19.htm |

Parker Hannifin Corporation Exhibit 99.2 2nd Quarter Fiscal Year 2019 Earnings Release January 31, 2019

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. Additionally, the actual impact of the U.S. Tax Cuts and Jobs Act on future performance and earnings projections may change based on subsequent judicial or regulatory interpretations of the Act that impact the company’s tax calculations. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance of the company are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions, including the integration of CLARCOR; the ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential labor disruptions; threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; global competitive market conditions, including global reactions to U.S. trade policies, and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law. This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to organic sales, which are sales amounts adjusted to remove the effects of divestitures and the effects of currency exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities and cash flow from operating activities as a percent of sales without the effect of discretionary pension plan contributions, (c) as reported and forecast segment operating income and operating margins reported in accordance with U.S. GAAP to as reported and forecast segment operating income and operating margins without the effect of business realignment charges, CLARCOR Cost to Achieve, (d) as reported and forecast earnings per diluted share reported in accordance with U.S. GAAP to as reported and forecast earnings per diluted share without the effect of business realignment charges, CLARCOR costs to achieve, gain (loss) on sale and writedown of assets, net and U.S. Tax Reform one-time impact, net. This presentation also contains references to EBITDA and adjusted EBITDA. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before business realignment charges, CLARCOR costs to achieve, and gain (loss) on sale and writedown of assets, net. Although EBITDA and Adjusted EBITDA are not measures of performance calculated in accordance with GAAP, we believe that it is useful to an investor in evaluating the results of this quarter versus one year ago. The effects of divestitures, currency exchange rates, discretionary pension plan contributions, business realignment charges, CLARCOR costs to achieve, gain (loss) on sale and writedown of assets, net and U.S. Tax Reform one-time impact, net are removed to allow investors and the company to meaningfully evaluate changes in sales, and cash flow from operating activities as a percent of sales, segment operating income, operating margins, Below the Line Items, Income Tax and earnings per diluted share on a comparable basis from period to period. Full year adjusted guidance removes business realignment charges, CLARCOR costs to achieve and tax expense related to U.S. Tax Reform. Please visit www.PHstock.com for more information 2

Agenda • Chairman & CEO Comments • Results & Outlook • Questions & Answers 3

Parker’s Competitive Differentiators ▪ The Win Strategy™ ▪ Decentralized business model ▪ Technology breadth & interconnectivity ▪ Engineered products with intellectual property ▪ Long product life cycles ▪ Balanced OEM vs. aftermarket ▪ Low capital investment requirements ▪ Great generators and deployers of cash over the cycle 4

Highlights of Quarter Results Key Takeaways ▪ Safety - 23% Reduction in recordable incidents ▪ Strong quarter: reflects benefits of The Win Strategy™ ▪ 2nd quarter records for sales, margins, net income and EPS ▪ Outstanding total segment margin performance of 16.4%, as reported Strong Performance in Fiscal 2019 2nd Quarter ▪ Sales increased 3%, organic growth of 6%: currency headwinds ▪ Order rates moderating against tougher comps ▪ Adjusted total segment operating margins at 16.6% ▪ Operating cash to sales >10%, year to date ▪ Repurchased $500 million in shares in Q2 Going Forward ▪ Increasing earnings guidance for full year Fiscal 2019 ▪ Continue driving the Win Strategy – many areas of opportunity ▪ Confidence in reaching our FY23 financial targets 5

Diluted Earnings Per Share 2nd Quarter FY2019 As Reported EPS Adjusted EPS $2.51 $2.36 $2.15 $.41 FY19 Q2 FY18 Q2 FY19 Q2¹ FY18 Q2² ¹Adjusted for Business Realignment Charges, Clarcor Costs to Achieve and Tax Expense related to US Tax Reform ²Adjusted for Business Realignment Charges, Clarcor Costs to Achieve and Gain on Sale and Writedown of Assets, net and U.S. Tax Reform one-time impact, net 6

Influences on Adjusted Earnings Per Share 2nd Quarter FY2019 vs. 2nd Quarter FY2018 $0.07 $0.03 ($0.06) $0.41 ($0.09) $2.51 $2.15 FY18 Q2 Adjusted Segment Average Shares Interest Expense Tax Expense Corporate G&A FY19 Q2 Adjusted EPS¹ Operating Income EPS² ¹Adjusted for Business Realignment Charges, Clarcor Costs to Achieve and Tax Expense related to US Tax Reform ²Adjusted for Business Realignment Charges, Clarcor Costs to Achieve and Gain on Sale and Writedown of Assets, net and U.S. Tax Reform one-time impact, net 7

Sales & Segment Operating Margin Total Parker $ in millions 2nd Quarter % FY2019 Change FY2018 Sales As Reported $ 3,472 3.0 % $ 3,371 Divestitures (17) (0.5)% Currency (73) (2.2)% Organic Sales $ 3,562 5.7 % % of % of FY2019 Sales FY2018 Sales Segment Operating Margin As Reported $ 568 16.4 % $ 478 14.2 % Business Realignment 3 13 CLARCOR Costs to Achieve 5 12 Adjusted $ 576 16.6 % $ 503 14.9 % 8

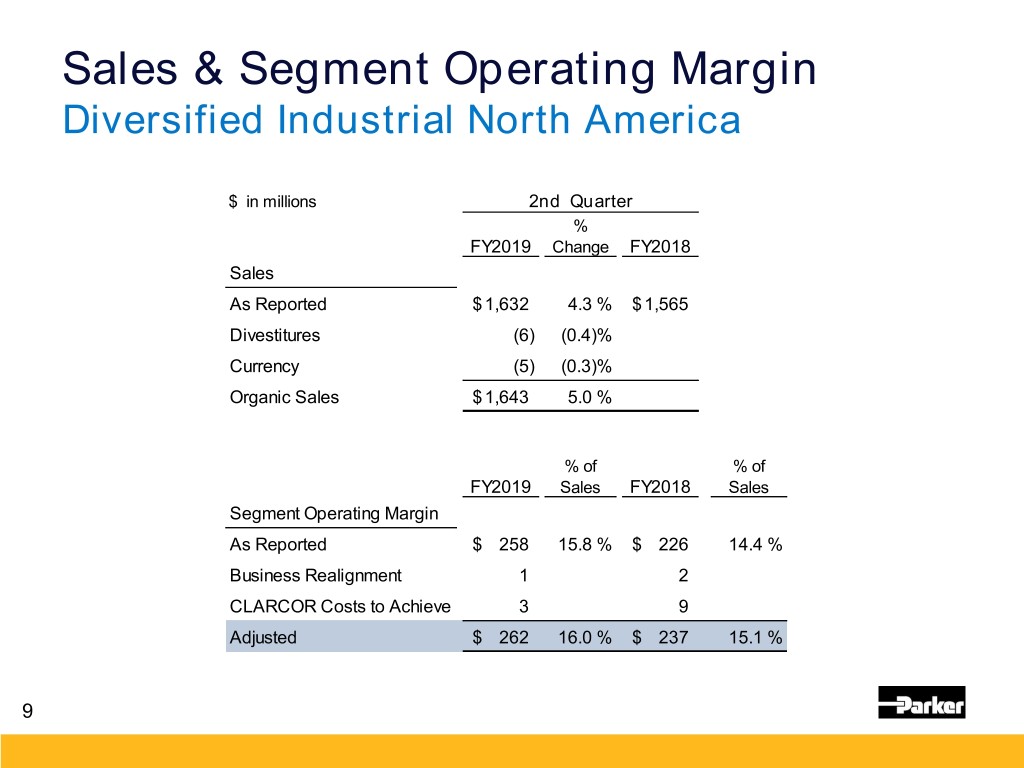

Sales & Segment Operating Margin Diversified Industrial North America $ in millions 2nd Quarter % FY2019 Change FY2018 Sales As Reported $ 1,632 4.3 % $ 1,565 Divestitures (6) (0.4)% Currency (5) (0.3)% Organic Sales $ 1,643 5.0 % % of % of FY2019 Sales FY2018 Sales Segment Operating Margin As Reported $ 258 15.8 % $ 226 14.4 % Business Realignment 1 2 CLARCOR Costs to Achieve 3 9 Adjusted $ 262 16.0 % $ 237 15.1 % 9

Sales & Segment Operating Margin Diversified Industrial International $ in millions 2nd Quarter % FY2019 Change FY2018 Sales As Reported $ 1,224 (2.5)% $ 1,256 Divestitures (10) (0.8)% Currency (67) (5.3)% Organic Sales $ 1,301 3.6 % % of % of FY2019 Sales FY2018 Sales Segment Operating Margin As Reported $ 189 15.5 % $ 165 13.1 % Business Realignment 2 11 CLARCOR Costs to Achieve 2 3 Adjusted $ 193 15.7 % $ 178 14.2 % 10

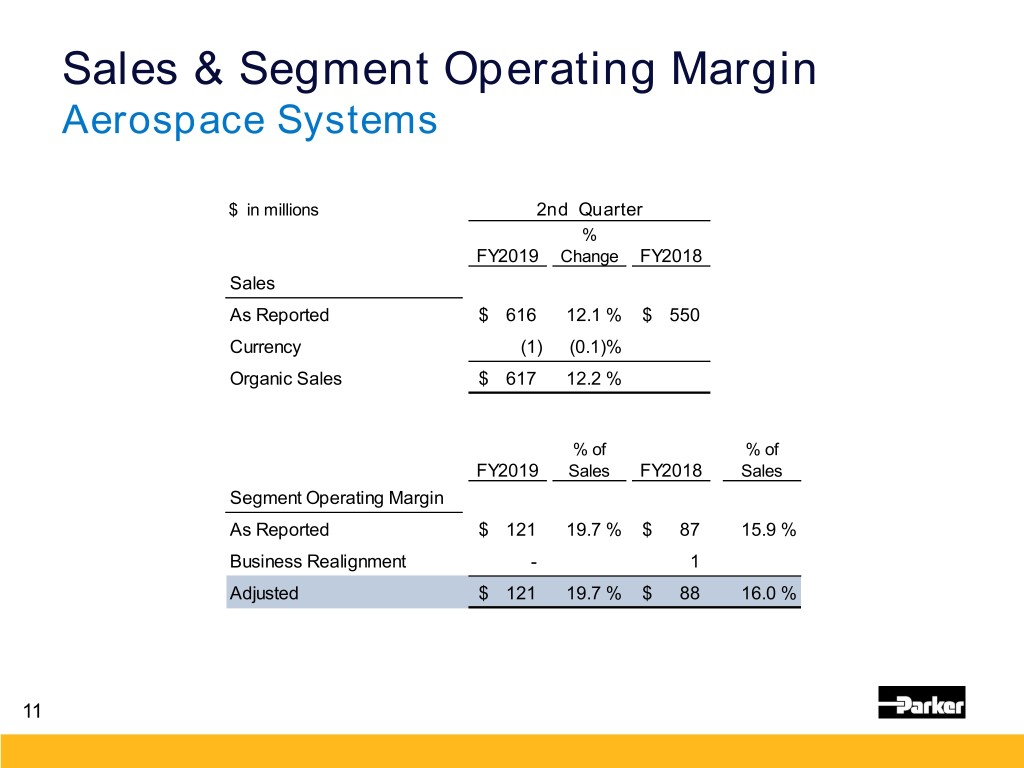

Sales & Segment Operating Margin Aerospace Systems $ in millions 2nd Quarter % FY2019 Change FY2018 Sales As Reported $ 616 12.1 % $ 550 Currency (1) (0.1)% Organic Sales $ 617 12.2 % % of % of FY2019 Sales FY2018 Sales Segment Operating Margin As Reported $ 121 19.7 % $ 87 15.9 % Business Realignment - 1 Adjusted $ 121 19.7 % $ 88 16.0 % 11

Order Rates Dec 2018 Sep 2018 Dec 2017 Sep 2017 Total Parker + 1 % + 5 % + 13 % + 11 % Diversified Industrial North America + 0 % + 8 % + 15 % + 10 % Diversified Industrial International - 2 % + 3 % + 13 % + 15 % Aerospace Systems + 10 % + 3 % + 8 % + 4 % Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average 12

Cash Flow from Operating Activities FY2019 YTD As Reported Cash Flow Adjusted Cash Flow $741 $541 $457 $457 FY19 YTD FY18 YTD FY19 YTD¹ FY18 YTD ¹Adjusted for Discretionary Pension Plan Contribution Year to Date FY 2019 % of Sales FY 2018 % of Sales As Reported Cash Flow From Operating Activities $ 541 7.8% $ 457 6.8% Discretionary Pension Plan Contribution $ 200 $ - Adjusted Cash Flow From Operating Activities $ 741 10.7% $ 457 6.8% 13

FY2019 Guidance EPS Midpoint: $11.29 As Reported, $11.60 Adjusted Sales Growth vs. Prior Year Diversified Industrial North America 1.4% - 3.9% Diversified Industrial International (4.9)% - (2.5)% Aerospace Systems 4.5% - 6.6% Total Parker (.4)% - 2.0% Segment Operating Margins As Reported Adjusted¹ Diversified Industrial North America 16.6% - 17.2% 17.0% - 17.5% Diversified Industrial International 15.7% - 16.1% 16.1% - 16.5% Aerospace Systems 18.9% - 19.3% 19.0% - 19.3% Total Parker 16.7% - 17.2% 17.0% - 17.4% Below the Line Items As Reported Corporate General & Administrative Expense, Interest and Other $ 497 M Tax Rate As Reported Full Year 23% Shares Diluted Shares Outstanding 132.3 M Earnings Per Share As Reported Adjusted¹ Range $11.04 - $11.54 $11.35 - $11.85 ¹Expected FY19 Adjusted Segment Operating Margins and Expected Adjusted Earnings Per Share exclude FY19 Business Realignment Charges, Clarcor Costs to Achieve and Tax Expense related to US Tax Reform 14

FY2019 Guidance Reconciliation to Prior Guidance $0.20 ($0.11) ($0.03) $0.11 $0.03 $11.60 $11.40 FY19 Prior Segment Tax Expense Average Shares Corporate G&A, Interest Expense FY19 Updated Adjusted EPS Operating Income Other Expense Adjusted EPS Guidance¹ Guidance² ¹Adjusted for Expected Business Realignment Charges and Clarcor Costs to Achieve 2Adjusted for Expected Business Realignment Charges, Clarcor Costs to Achieve and Tax Expense related to US Tax Reform 15

FY2019 Guidance Reconciliation of Q2 Beat and Updated Guidance Q2 FY19 Beat to Guide Other Q3-Q4 Impacts $0.04 $0.16 ($0.10) ($0.13) ($0.01) $0.21 $0.03 Excellent operating Moderating growth reflected in ($11.60 performance, offset by market operating income, offsetting $11.40 investment losses lower average shares FY19 Prior Segment Average Corporate Tax Expense Average Segment Corporate FY19 Updated Adjusted EPS Operating Shares G&A, Interest Shares Operating G&A, Interest Adjusted EPS Guidance¹ Income & Other Income & Other Guidance² Expense ¹Adjusted for Expected Business Realignment Charges and Clarcor Costs to Achieve 2Adjusted for Expected Business Realignment Charges, Clarcor Costs to Achieve and Tax Expense related to US Tax Reform 16

17

Appendix • Consolidated Statement of Income • Adjusted Amounts Reconciliation • Reconciliation of EPS • Business Segment Information • Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin • Reconciliation of EBITDA to Adjusted EBITDA • Consolidated Balance Sheet • Consolidated Statement of Cash Flows • Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations • Reconciliation of Forecasted EPS • Supplemental Sales Information – Global Technology Platforms

Consolidated Statement of Income (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands, except per share amounts) 2018 2017 2018 2017 Net sales $ 3,472,045 $ 3,370,673 $ 6,951,339 $ 6,735,324 Cost of sales 2,602,339 2,564,449 5,197,162 5,087,743 Selling, general and administrative expenses 397,259 408,338 791,581 805,322 Interest expense 47,518 53,133 91,857 106,688 Other (income) expense, net (6,225) (15,468) (20,138) 1,048 Income before income taxes 431,154 360,221 890,877 734,523 Income taxes 119,241 303,899 203,065 392,666 Net income 311,913 56,322 687,812 341,857 Less: Noncontrolling interests 176 163 364 301 Net income attributable to common shareholders $ 311,737 $ 56,159 $ 687,448 $ 341,556 Earnings per share attributable to common shareholders: Basic earnings per share $ 2.39 $ .42 $ 5.23 $ 2.57 Diluted earnings per share $ 2.36 $ .41 $ 5.15 $ 2.51 Average shares outstanding during period - Basic 130,361,273 133,112,568 131,361,463 133,144,766 Average shares outstanding during period - Diluted 132,311,210 136,194,919 133,449,673 135,874,530 CASH DIVIDENDS PER COMMON SHARE (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Amounts in dollars) 2018 2017 2018 2017 Cash dividends per common share $ .76 $ .66 $ 1.52 $ 1.32 19

Adjusted Amounts Reconciliation SECOND QUARTER 2019 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION INCOME STATEMENT SECOND QUARTER FY 2019 Business Clarcor Tax Expense As Reported Realignment Costs to Related to Adjusted Dec-18 Charges Achieve U.S. Tax Reform Dec-18 Net sales $ 3,472,045 $ - $ - $ - $ 3,472,045 Cost of sales 2,602,339 868 2,801 - 2,598,670 Selling, general and administrative expenses 397,259 1,647 2,066 - 393,546 Interest expense 47,518 - - - 47,518 Other (income), net (6,225) - 220 - (6,445) Income before income taxes 431,154 (2,515) (5,087) - 438,756 Income taxes 119,241 599 1,211 (14,485) 106,566 Net income 311,913 (1,916) (3,876) (14,485) 332,190 Less: Noncontrolling interests 176 - - - 176 Net income attributable to common shareholders $ 311,737 $ (1,916) $ (3,876) $ (14,485) $ 332,014 EPS attributable to common shareholders: Diluted earnings per share $ 2.36 $ (0.01) $ (0.03) $ (0.11) $ 2.51 SECOND QUARTER FY 2019 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION SEGMENTS SECOND QUARTER FY 2019 Business Clarcor As Reported Realignment Costs to Adjusted Dec-18 Charges Achieve Dec-18 Segment Operating Income Industrial: North America $ 257,774 $ 526 $ 3,293 $ 261,593 International 189,085 1,989 1,574 192,648 Aerospace 121,463 - - 121,463 Total segment operating income 568,322 (2,515) (4,867) 575,704 Corporate administration 63,890 - - 63,890 Income before interest expense and other 504,432 (2,515) (4,867) 511,814 Interest expense 47,518 - - 47,518 Other (income) expense 25,760 - 220 25,540 20 Income before income taxes $ 431,154 $ (2,515) $ (5,087) $ 438,756

Reconciliation of EPS (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Amounts in dollars) 2018 2017 2018 2017 Earnings per diluted share $ 2.36 $ .41 $ 5.15 $ 2.51 Adjustments: Business realignment charges 0.01 0.07 0.02 0.12 Clarcor costs to achieve 0.03 0.07 0.07 0.10 (Gain) loss on sale and w ritedow n of assets, net - (0.05) - 0.02 U.S. Tax Reform one-time impact, net 0.11 1.65 0.11 1.65 Adjusted earnings per diluted share $ 2.51 $ 2.15 $ 5.35 $ 4.40 21

Business Segment Information (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands) 2018 2017 2018 2017 Net sales Diversified Industrial: North America $ 1,632,059 $ 1,565,416 $ 3,313,103 $ 3,160,107 International 1,223,679 1,255,569 2,457,445 2,494,343 Aerospace Systems 616,307 549,688 1,180,791 1,080,874 Total $ 3,472,045 $ 3,370,673 $ 6,951,339 $ 6,735,324 Segment operating income Diversified Industrial: North America $ 257,774 $ 225,807 $ 532,885 $ 481,834 International 189,085 164,806 395,179 356,597 Aerospace Systems 121,463 87,148 231,318 164,582 Total segment operating income 568,322 477,761 1,159,382 1,003,013 Corporate general and administrative expenses 63,890 46,942 114,215 88,292 Income before interest and other expense 504,432 430,819 1,045,167 914,721 Interest expense 47,518 53,133 91,857 106,688 Other expense 25,760 17,465 62,433 73,510 Income before income taxes $ 431,154 $ 360,221 $ 890,877 $ 734,523 22

Reconciliation of Total Segment Operating Margin to Adjusted Total Segment Operating Margin (Unaudited) Three Months Ended Three Months Ended (Dollars in thousands) December 31, 2018 December 31, 2017 Operating income Operating margin Operating income Operating margin Total segment operating income $ 568,322 16.4% $ 477,761 14.2% Adjustments: Business realignment charges 2,515 13,428 Clarcor costs to achieve 4,867 11,948 Adjusted total segment operating income $ 575,704 16.6% $ 503,137 14.9% 23

Reconciliation of EBITDA to Adjusted EBITDA (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands) 2018 2017 2018 2017 Net sales $ 3,472,045 $ 3,370,673 $ 6,951,339 $ 6,735,324 Earnings before income taxes $ 431,154 $ 360,221 $ 890,877 $ 734,523 Depreciation and amortization 110,052 118,109 222,543 234,216 Interest expense 47,518 53,133 91,857 106,688 EBITDA 588,724 531,463 1,205,277 1,075,427 Adjustments: Business realignment charges 2,515 13,428 4,918 21,654 Clarcor costs to achieve 5,087 11,948 11,297 17,748 (Gain) loss on sale and w ritedow n of assets, net - (8,453) - 5,324 Adjusted EBITDA $ 596,326 $ 548,386 $ 1,221,492 $ 1,120,153 EBITDA margin 17.0% 15.8% 17.3% 16.0% Adjusted EBITDA margin 17.2% 16.3% 17.6% 16.6% 24

Consolidated Balance Sheet (Unaudited) December 31, June 30, December 31, (Dollars in thousands) 2018 2018 2017 Assets Current assets: Cash and cash equivalents $ 1,047,385 $ 822,137 $ 1,024,770 Marketable securities and other investments 30,956 32,995 107,976 Trade accounts receivable, net 1,938,709 2,145,517 1,857,282 Non-trade and notes receivable 324,254 328,399 313,221 Inventories 1,804,564 1,621,304 1,780,262 Prepaid expenses and other 188,868 134,886 202,848 Total current assets 5,334,736 5,085,238 5,286,359 Plant and equipment, net 1,793,805 1,856,237 1,937,074 Deferred income taxes 98,779 57,623 36,668 Goodw ill 5,462,555 5,504,420 5,698,707 Intangible assets, net 1,883,825 2,015,520 2,174,104 Other assets 733,987 801,049 832,269 Total assets $ 15,307,687 $ 15,320,087 $ 15,965,181 Liabilities and equity Current liabilities: Notes payable $ 1,144,347 $ 638,466 $ 1,248,212 Accounts payable 1,307,178 1,430,306 1,229,336 Accrued liabilities 874,792 929,833 896,750 Accrued domestic and foreign taxes 182,617 198,878 163,405 Total current liabilities 3,508,934 3,197,483 3,537,703 Long-term debt 4,303,331 4,318,559 4,798,371 Pensions and other postretirement benefits 937,938 1,177,605 1,363,466 Deferred income taxes 286,622 234,858 137,196 Other liabilities 449,696 526,089 609,235 Shareholders' equity 5,815,209 5,859,866 5,513,401 Noncontrolling interests 5,957 5,627 5,809 25 Total liabilities and equity $ 15,307,687 $ 15,320,087 $ 15,965,181

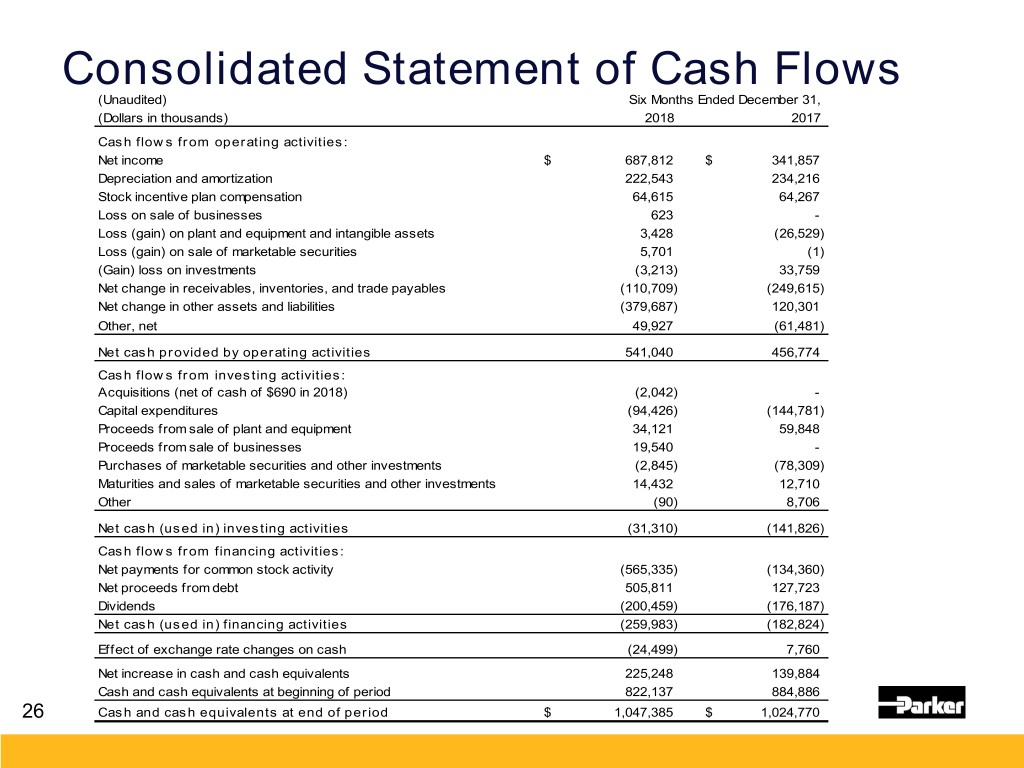

Consolidated Statement of Cash Flows (Unaudited) Six Months Ended December 31, (Dollars in thousands) 2018 2017 Cash flow s from operating activities: Net income $ 687,812 $ 341,857 Depreciation and amortization 222,543 234,216 Stock incentive plan compensation 64,615 64,267 Loss on sale of businesses 623 - Loss (gain) on plant and equipment and intangible assets 3,428 (26,529) Loss (gain) on sale of marketable securities 5,701 (1) (Gain) loss on investments (3,213) 33,759 Net change in receivables, inventories, and trade payables (110,709) (249,615) Net change in other assets and liabilities (379,687) 120,301 Other, net 49,927 (61,481) Net cash provided by operating activities 541,040 456,774 Cash flow s from investing activities: Acquisitions (net of cash of $690 in 2018) (2,042) - Capital expenditures (94,426) (144,781) Proceeds from sale of plant and equipment 34,121 59,848 Proceeds from sale of businesses 19,540 - Purchases of marketable securities and other investments (2,845) (78,309) Maturities and sales of marketable securities and other investments 14,432 12,710 Other (90) 8,706 Net cash (used in) investing activities (31,310) (141,826) Cash flow s from financing activities: Net payments for common stock activity (565,335) (134,360) Net proceeds from debt 505,811 127,723 Dividends (200,459) (176,187) Net cash (used in) financing activities (259,983) (182,824) Effect of exchange rate changes on cash (24,499) 7,760 Net increase in cash and cash equivalents 225,248 139,884 Cash and cash equivalents at beginning of period 822,137 884,886 26 Cash and cash equivalents at end of period $ 1,047,385 $ 1,024,770

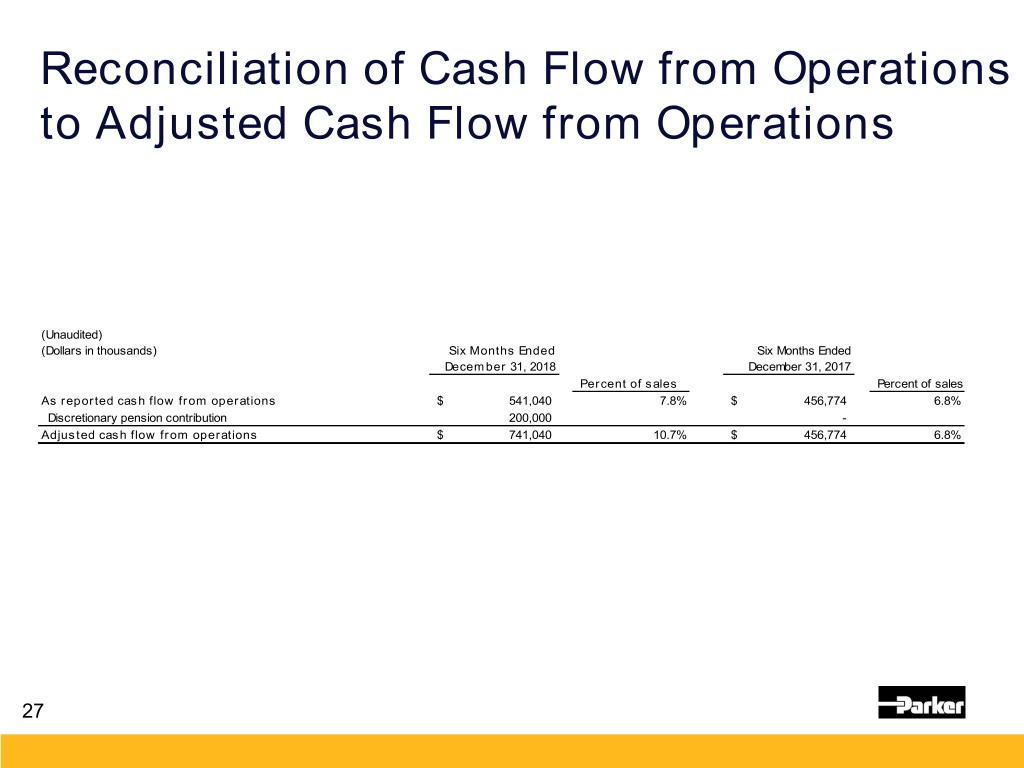

Reconciliation of Cash Flow from Operations to Adjusted Cash Flow from Operations (Unaudited) (Dollars in thousands) Six Months Ended Six Months Ended December 31, 2018 December 31, 2017 Percent of sales Percent of sales As reported cash flow from operations $ 541,040 7.8% $ 456,774 6.8% Discretionary pension contribution 200,000 - Adjusted cash flow from operations $ 741,040 10.7% $ 456,774 6.8% 27

Reconciliation of Forecasted EPS (Unaudited) (Amounts in dollars) Fiscal Year 2019 Fiscal Year 2019 Prior Guide Revised Guide Forecasted earnings per diluted share $10.90 - $11.50 $11.04 - $11.54 Adjustments: Business realignment charges 0.13 0.11 Clarcor costs to achieve 0.07 0.09 U.S. Tax Reform income tax expense adjustment 0.11 Adjusted forecasted earnings per diluted share $11.10 - $11.70 $11.35 - $11.85 28

Supplemental Sales Information Global Technology Platforms (Unaudited) (Dollars in thousands) Three Months Ending Six Months Ending December 31, December 31, 2018 2017 2018 2017 Net sales Diversified Industrial: Motion Systems $ 856,357 $ 825,695 $ 1,715,930 $ 1,635,442 Flow and Process Control 1,015,200 997,837 2,076,264 1,993,184 Filtration and Engineered Materials 984,181 997,453 1,978,354 2,025,824 Aerospace Systems 616,307 549,688 1,180,791 1,080,874 Total $ 3,472,045 $ 3,370,673 $ 6,951,339 $ 6,735,324 29