Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LANDSTAR SYSTEM INC | d694201dex991.htm |

| 8-K - FORM 8-K - LANDSTAR SYSTEM INC | d694201d8k.htm |

January 30, 2019 Landstar System, Inc. Earnings Conference Call Fourth Quarter 2018 Date Published: 01/30/2019 Exhibit 99.2

The following is a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995. Statements made during this presentation that are not based on historical facts are “forward looking statements.” During this presentation, I may make certain statements, containing forward-looking statements, such as statements which relate to Landstar’s business objectives, plans, strategies and expectations. Such statements are by nature subject to uncertainties and risks, including but not limited to: the operational, financial and legal risks detailed in Landstar’s Form 10-K for the 2017 fiscal year, described in the section Risk Factors, and other SEC filings from time to time. These risks and uncertainties could cause actual results or events to differ materially from historical results or those anticipated. Investors should not place undue reliance on such forward-looking statements, and Landstar undertakes no obligation to publicly update or revise any forward-looking statements. Date Published: 01/30/2019

Landstar is a worldwide, asset-light provider of integrated transportation management solutions delivering safe, specialized transportation services to a broad range of customers utilizing a network of agents, third party capacity providers and employees. Model Definition Date Published: 01/30/2019

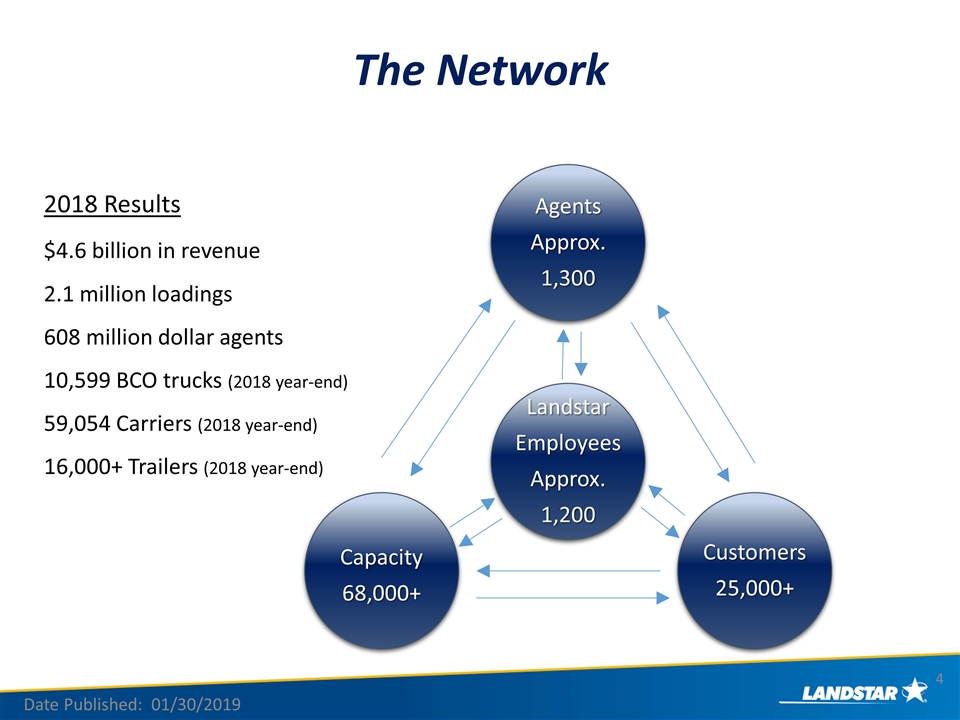

The Network Landstar Employees Approx. 1,200 Agents Approx. 1,300 Customers 25,000+ Capacity 68,000+ 2018 Results $4.6 billion in revenue 2.1 million loadings 608 million dollar agents 10,599 BCO trucks (2018 year-end) 59,054 Carriers (2018 year-end) 16,000+ Trailers (2018 year-end) Date Published: 01/30/2019

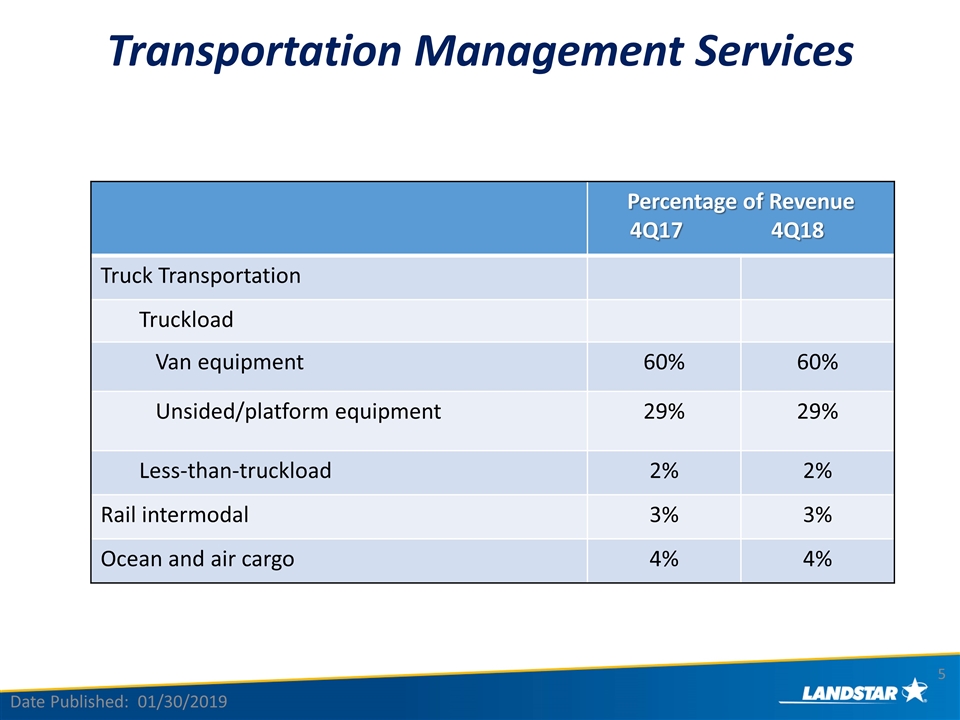

Percentage of Revenue 4Q17 4Q18 Truck Transportation Truckload Van equipment 60% 60% Unsided/platform equipment 29% 29% Less-than-truckload 2% 2% Rail intermodal 3% 3% Ocean and air cargo 4% 4% Transportation Management Services Date Published: 01/30/2019

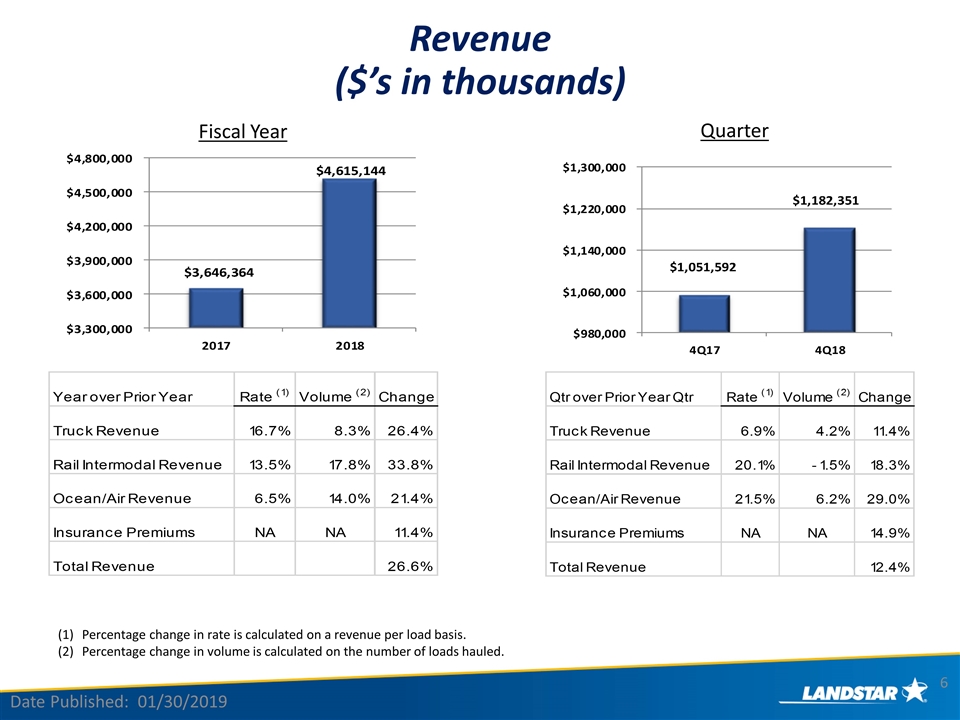

Percentage change in rate is calculated on a revenue per load basis. Percentage change in volume is calculated on the number of loads hauled. Revenue ($’s in thousands) Date Published: 01/30/2019 Quarter Fiscal Year Qtr over Prior Year Qtr Rate (1) Volume (2) Change Truck Revenue 6.9% 4.2% 0.114 Rail Intermodal Revenue 0.20100000000000001 -1.5% 0.183 Ocean/Air Revenue 0.215 6.2% 0.28999999999999998 Insurance Premiums NA NA 0.14899999999999999 Total Revenue 0.124 Year over Prior Year Rate (1) Volume (2) Change Truck Revenue 0.16700000000000001 8.3% 0.26400000000000001 Rail Intermodal Revenue 0.13500000000000001 0.17799999999999999 0.33800000000000002 Ocean/Air Revenue 6.5% 0.14000000000000001 0.214 Insurance Premiums NA NA 0.114 Total Revenue 0.26600000000000001

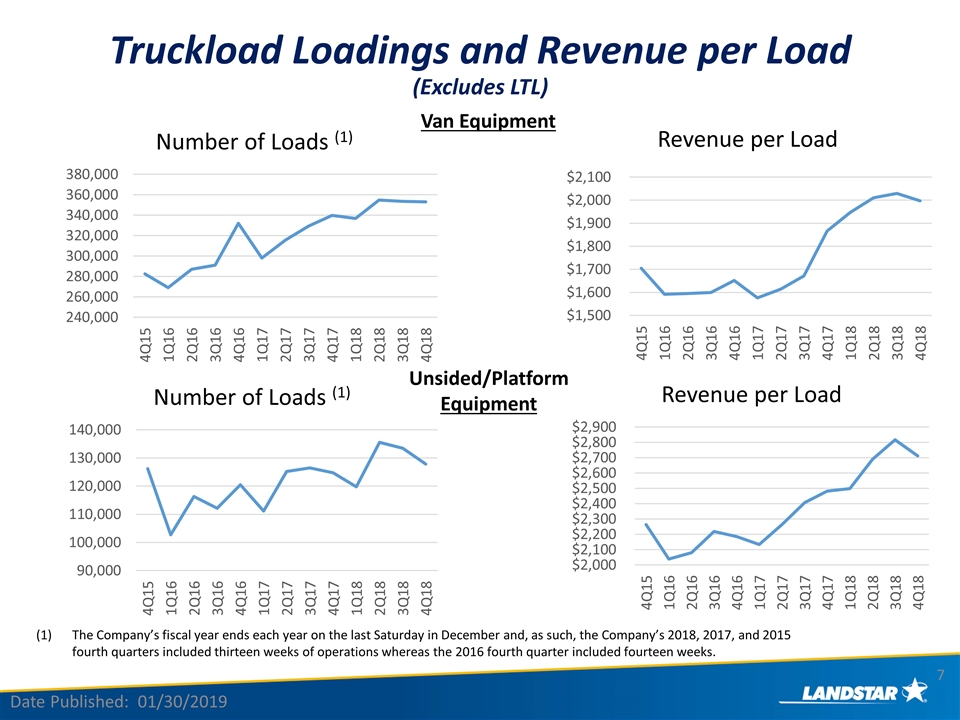

Van Equipment Unsided/Platform Equipment Truckload Loadings and Revenue per Load (Excludes LTL) Date Published: 01/30/2019 The Company’s fiscal year ends each year on the last Saturday in December and, as such, the Company’s 2018, 2017, and 2015 fourth quarters included thirteen weeks of operations whereas the 2016 fourth quarter included fourteen weeks.

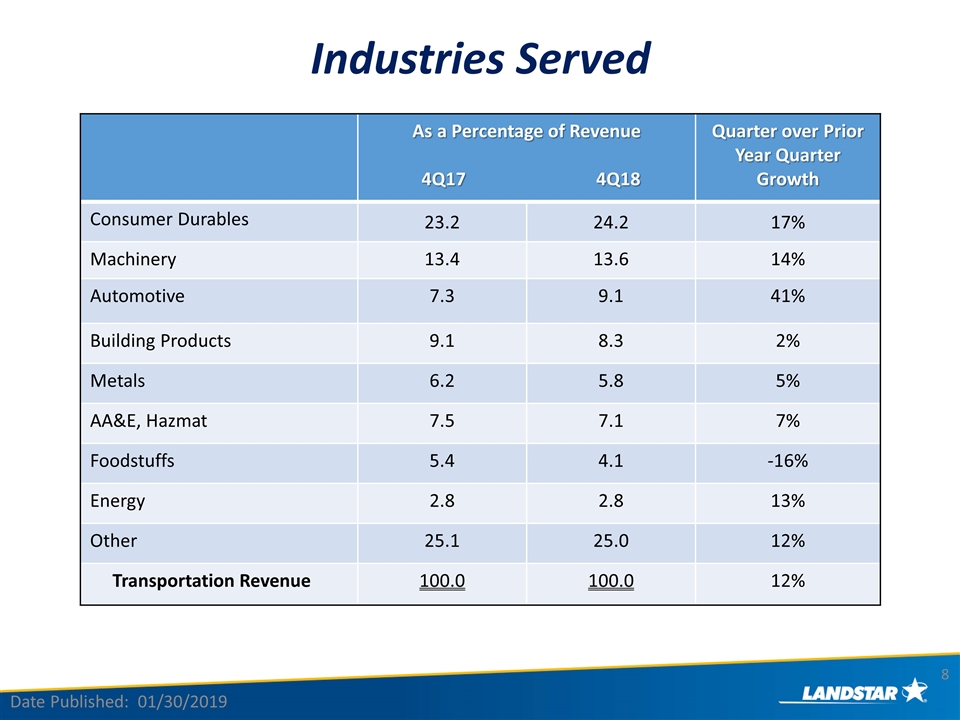

As a Percentage of Revenue 4Q17 4Q18 Quarter over Prior Year Quarter Growth Consumer Durables 23.2 24.2 17% Machinery 13.4 13.6 14% Automotive 7.3 9.1 41% Building Products 9.1 8.3 2% Metals 6.2 5.8 5% AA&E, Hazmat 7.5 7.1 7% Foodstuffs 5.4 4.1 -16% Energy 2.8 2.8 13% Other 25.1 25.0 12% Transportation Revenue 100.0 100.0 12% Industries Served Date Published: 01/30/2019

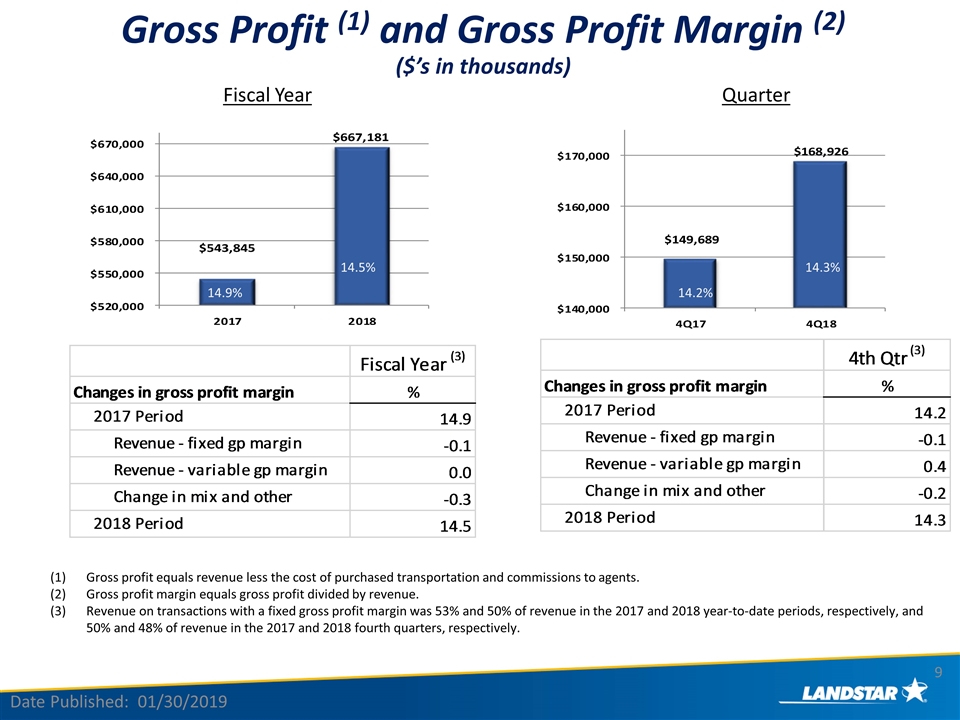

14.2% 14.3% Gross profit equals revenue less the cost of purchased transportation and commissions to agents. Gross profit margin equals gross profit divided by revenue. Revenue on transactions with a fixed gross profit margin was 53% and 50% of revenue in the 2017 and 2018 year-to-date periods, respectively, and 50% and 48% of revenue in the 2017 and 2018 fourth quarters, respectively. Gross Profit (1) and Gross Profit Margin (2) ($’s in thousands) Date Published: 01/30/2019 Quarter Fiscal Year 14.9% 14.5% 4th Qtr (3) Changes in gross profit margin % 2017 Period 14.2 Revenue - fixed gp margin -0.1 Revenue - variable gp margin 0.4 Change in mix and other -0.2 2018 Period 14.3 Fiscal Year (3) Changes in gross profit margin % 2017 Period 14.9 Revenue - fixed gp margin -0.1 Revenue - variable gp margin 0.0 Change in mix and other -0.3 2018 Period 14.5

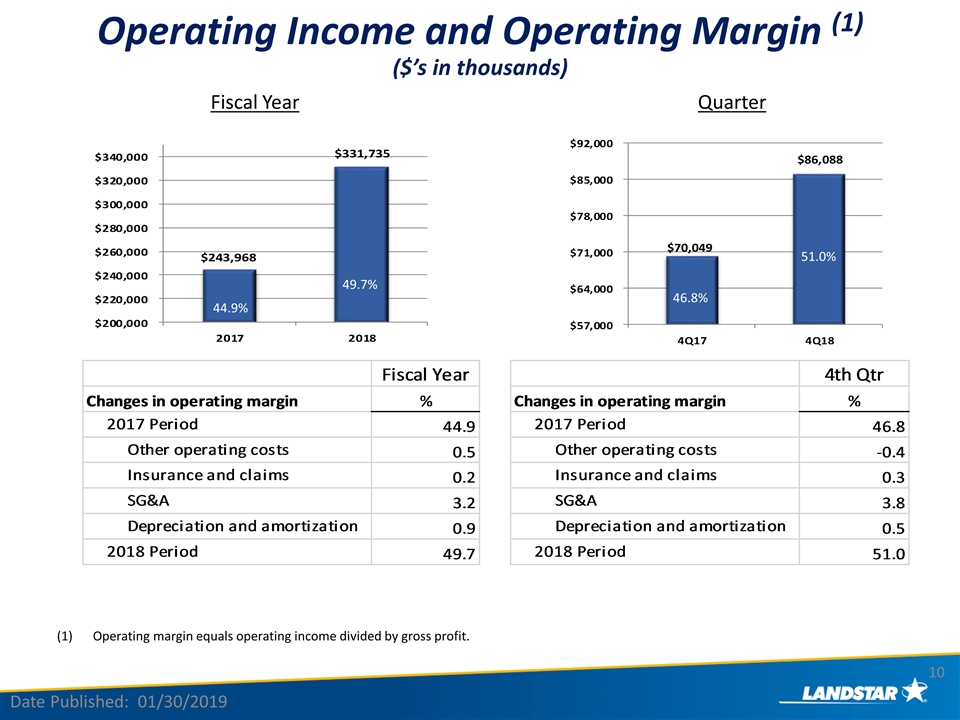

50.5% 48.4% 4 Operating margin equals operating income divided by gross profit. Operating Income and Operating Margin (1) ($’s in thousands) Date Published: 01/30/2019 Quarter Fiscal Year 46.8% 51.0% 44.9% 10 49.7% 4th Qtr Changes in operating margin % 2017 Period 46.8 Other operating costs -0.4 Insurance and claims 0.3 SG&A 3.8 Depreciation and amortization 0.5 2018 Period 51 Fiscal Year Changes in operating margin % 2017 Period 44.9 Other operating costs 0.5 Insurance and claims 0.2 SG&A 3.2 Depreciation and amortization 0.9 2018 Period 49.7

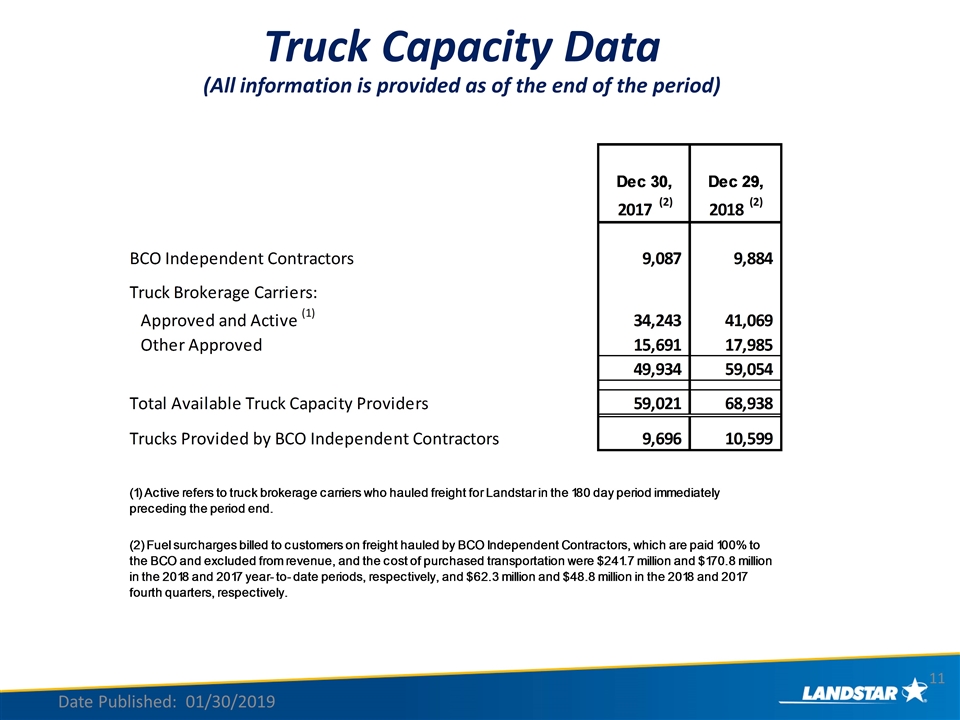

Date Published: 01/30/2019 Truck Capacity Data (All information is provided as of the end of the period) KEY INCOME STATEMENT DATA ($ in Millions) % of 2013 % of 2013 % of 2012 Rev/GP Plan Rev/GP Proj Rev/GP Dec 30, Dec 29, External Revenue $9,087 #REF! #REF! 2017 (2) 2018 (2) Purchased Transportation #REF! #REF! #REF! #REF! #REF! #REF! BCO Independent Contractors 9,087 9,884 Truck Brokerage Carriers: Interest and Debt Expense #REF! #REF! #REF! Approved and Active (1) 34,243 41,069 Income Before Income Taxes #REF! #REF! #REF! Other Approved 15,691 17,985 49,934 59,054 Income Taxes #REF! #REF! #REF! Total Available Truck Capacity Providers 59,021 68,938 Trucks Provided by BCO Independent Contractors 9,696 10,599 (1) Active refers to truck brokerage carriers who hauled freight for Landstar in the 180 day period immediately preceding the period end. (2) Fuel surcharges billed to customers on freight hauled by BCO Independent Contractors, which are paid 100% to the BCO and excluded from revenue, and the cost of purchased transportation were $241.7 million and $170.8 million in the 2018 and 2017 year-to-date periods, respectively, and $62.3 million and $48.8 million in the 2018 and 2017 fourth quarters, respectively.

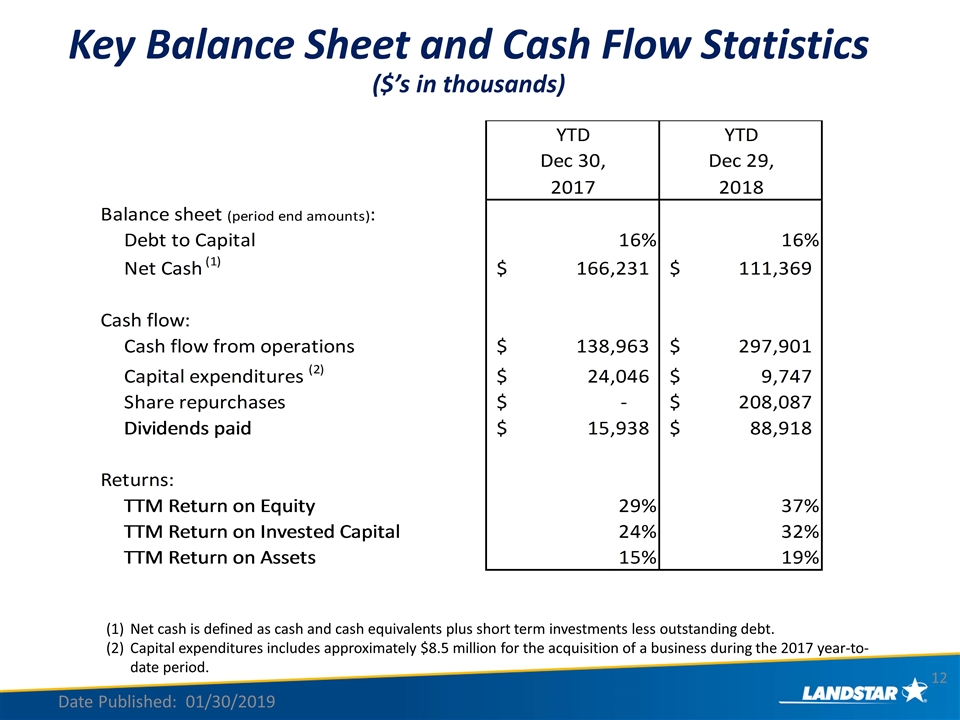

Net cash is defined as cash and cash equivalents plus short term investments less outstanding debt. Capital expenditures includes approximately $8.5 million for the acquisition of a business during the 2017 year-to-date period. Date Published: 01/30/2019 Key Balance Sheet and Cash Flow Statistics ($’s in thousands) % of 2013 % of 2013 % of 2012 Rev/GP Plan Rev/GP Proj Rev/GP YTD YTD Dec 30, Dec 29, External Revenue $0.21 #REF! #REF! 2017 2018 Purchased Transportation #REF! #REF! #REF! #REF! #REF! #REF! Balance sheet (period end amounts): Debt to Capital 0.16 0.16 Net Cash (1) $,166,231 $,111,369 Cash flow: Cash flow from operations $,138,963 $,297,901 Capital expenditures (2) $24,046 $9,747 Income Before Income Taxes #REF! #REF! #REF! Share repurchases $0 $,208,087 Dividends paid $15,938 $88,918 Returns: TTM Return on Equity 0.28999999999999998 0.37 TTM Return on Invested Capital 0.24 0.32 TTM Return on Assets 0.15 0.19

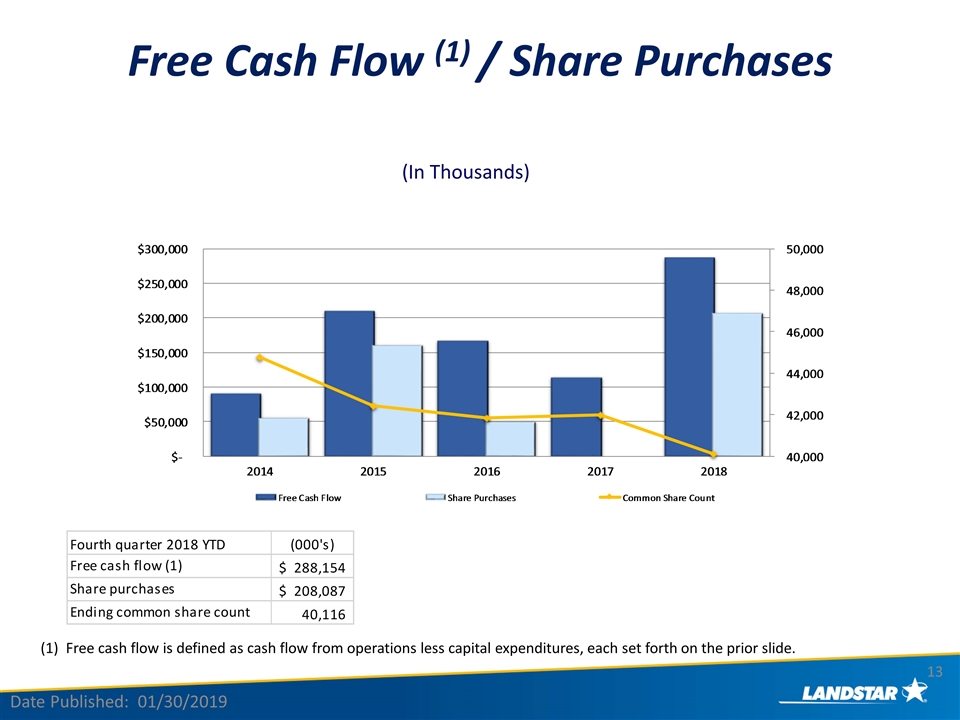

Free Cash Flow (1) / Share Purchases Date Published: 01/30/2019 (In Thousands) (1) Free cash flow is defined as cash flow from operations less capital expenditures, each set forth on the prior slide. Fourth quarter 2018 YTD (000's) Free cash flow (1) $,288,154 Share purchases $,208,087 Ending common share count 40,116

Date Published: 01/30/2019