Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Veritex Holdings, Inc. | a8kinvestorpresentation.htm |

V E R I T E X Fourth Quarter and Full Year 2018 Investor Presentation January 29, 2019

Safe Harbor Forward‐looking statements This presentation includes certain “forward‐looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward‐looking statements are based on various facts and derived utilizing assumptions and current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward‐looking statements. Forward‐looking statements include, without limitation, statements relating to the impact Veritex expects its acquisition of Green to have on the combined entity’s operations, financial condition, and financial results, and Veritex’s expectations about its ability to successfully integrate the combined businesses and the amount of cost savings and overall operational efficiencies Veritex expects to realize as a result of the acquisition. These forward‐looking statements may also include statements about Veritex’s future financial performance, business and growth strategy, projected plans and objectives, as well as other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward‐looking in nature and not historical facts, although not all forward‐looking statements include the foregoing words. Further, certain factors that could affect future results and cause actual results to differ materially from those expressed in the forward‐looking statements include, but are not limited to, the possibility that the businesses of Veritex and Green will not be integrated successfully, that the cost savings and any synergies from the acquisition may not be fully realized or may take longer to realize than expected, disruption from the acquisition making it more difficult to maintain relationships with employees, customers or other parties with whom Veritex has (or Green had) business relationships, diversion of management time on merger‐related issues, the reaction to the transaction of the companies’ customers, employees and counterparties and other factors, many of which are beyond the control of Veritex and Green. We refer you to the“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”sectionsofVeritex’sAnnualReportonForm10‐Kfortheyear ended December 31, 2017, the Annual Report on Form 10‐K filed by Green for the year ended December 31, 2017 and any updates to those risk factors set forth in Veritex’s Quarterly Reports on Form 10‐Q, Current Reports on Form 8‐K and other filings with the SEC, which are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any forward‐looking statements. Any forward‐looking statement speaks only as of the date on which it is made. Veritex does not undertake any obligation, and specifically declines any obligation, to update or revise any forward‐looking statements, whether as a result of new information, future developments or otherwise. All forward‐looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward‐looking statements that Veritex or persons acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. 2

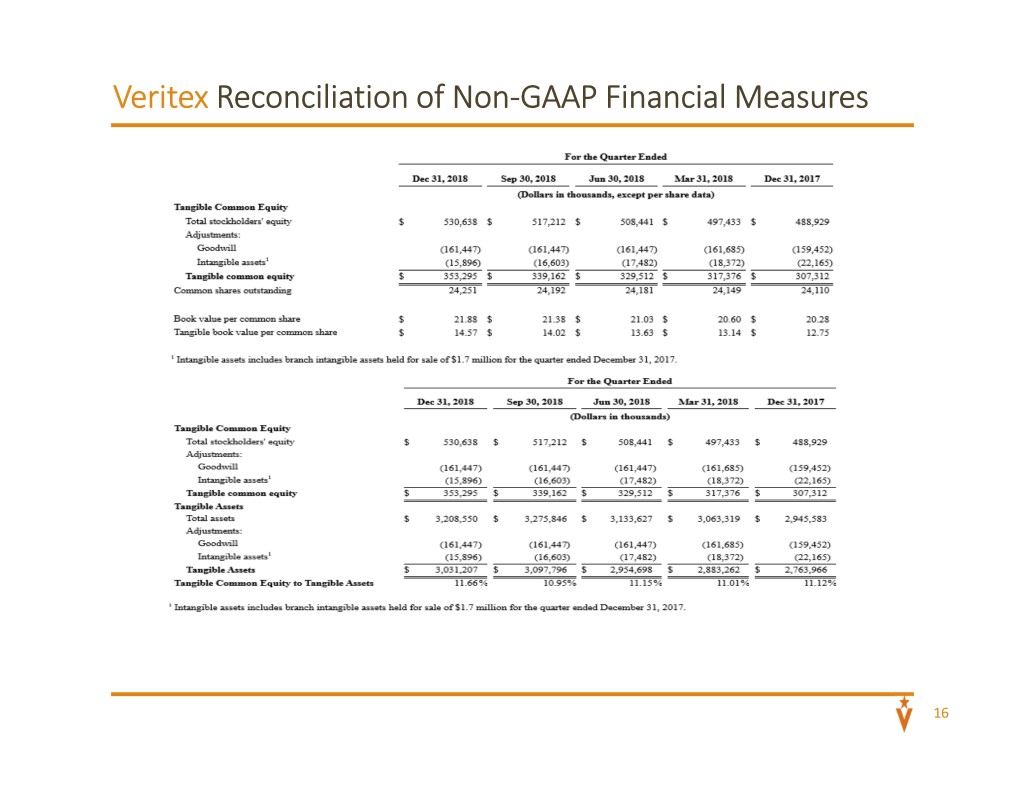

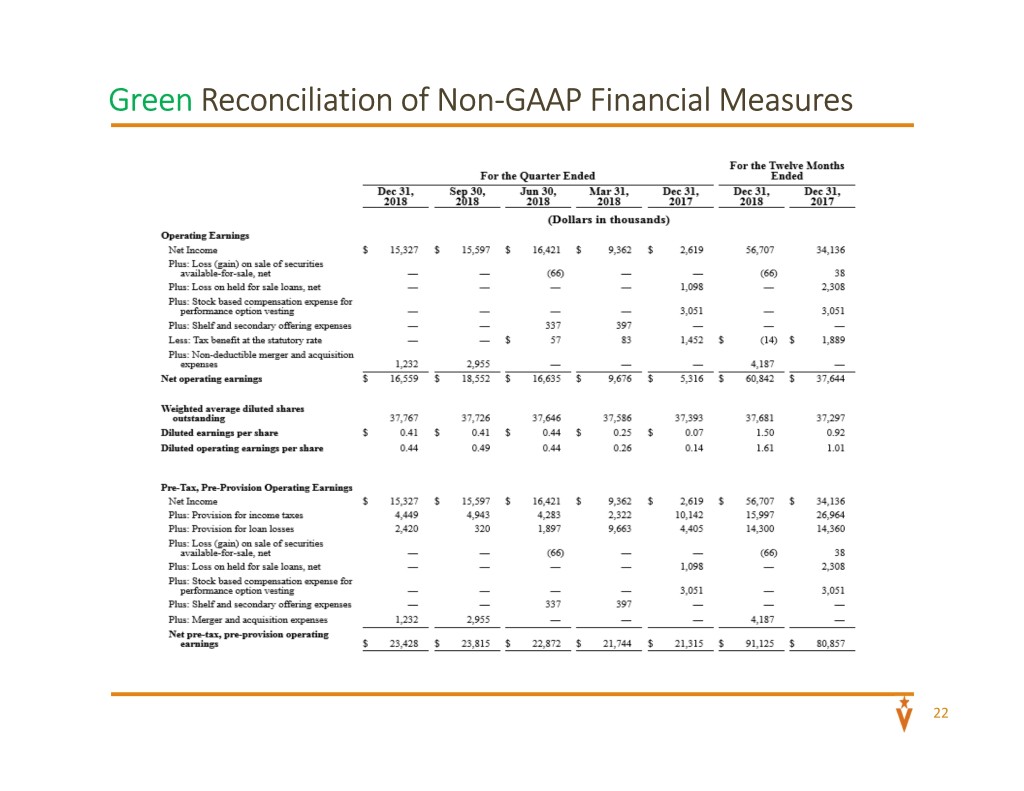

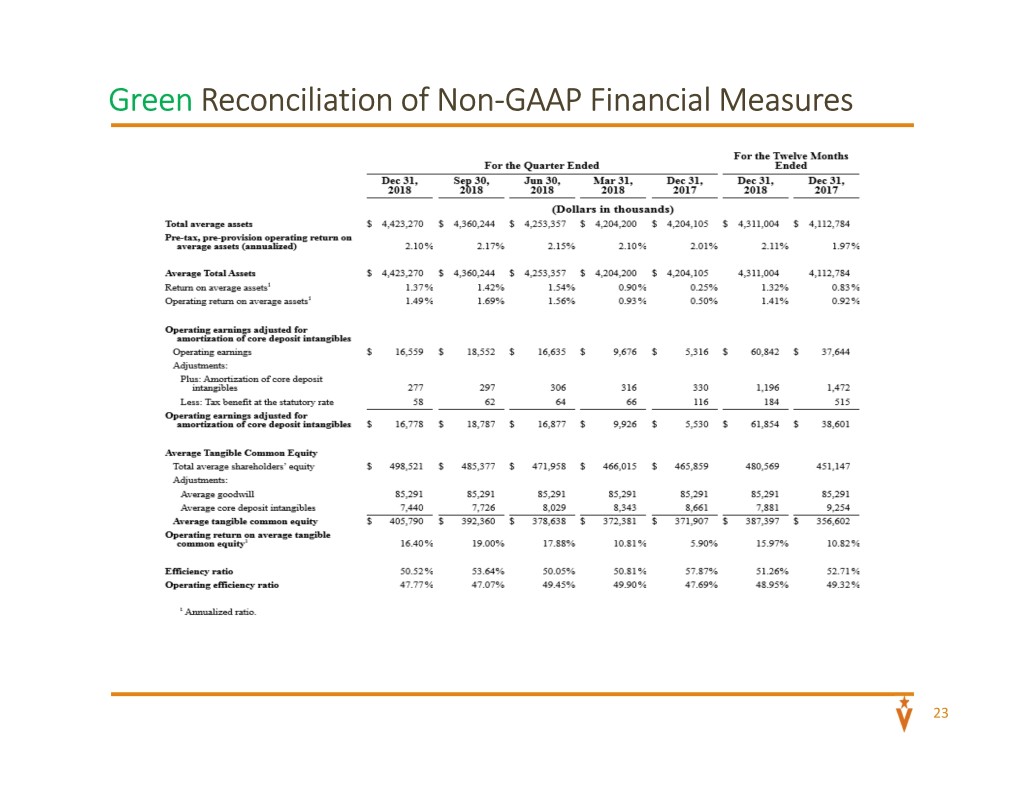

Non‐GAAP Financial Measures Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain supplemental non‐GAAP financial measures used in managing its business provide meaningful information to investors about underlying trends in its business. Management uses these non‐GAAP measures to assess the Company’s operating performance and believes that these non‐GAAP measures provide information that is important to investors and that is useful in understanding Veritex’s results of operations. However, non‐GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with GAAP. The following are the non‐GAAP measures used in this presentation: • Tangible book value per common share; • Tangible common equity to tangible assets; • Returns on average tangible common equity; • Operating earnings; • Diluted operating earnings per share; • Operating return on average assets; • Operating return on average tangible common equity; and • Operating efficiency ratio. • Pre‐tax, pre‐provision operating return on average assets Please see “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for reconciliations to the most directly comparable financial measures calculated in accordance with GAAP. 3

Fourth Quarter 2018 Key Accomplishments • Consummation of the Green Bank merger on January 1, 2019 becoming one of the 10 largest banks headquartered in Texas • Announced initiation of a regular quarterly cash dividend of $0.125 per common share beginning in Q1 2019 • Announced stock buyback program to purchase up to $50.0 million during 2019 of outstanding common stock • Diluted EPS was $0.40 and diluted operating EPS1 was $0.47 for the fourth quarter 2018 • Total loans, including held for investment and held for sale, grew by $110.8 million, or 18.2%2 • Expansion in NIM quarter over quarter to 3.82%3 from 3.73%3, excluding cash collections in excess of expected cash flows on purchased credit impaired (“PCI”) loans • Total deposits increased by $343.8 million, or 15.1%, during 2018 • Credit quality remains stable with credit metrics continuing to improve evidenced by a decline in NPAs to total assets to 0.77% as of December 31, 2018 1 Please refer to the “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non‐GAAP financial measures. 2 Annualized ratio. 3 Excludes $354 thousand and $2.0 million of cash collections in excess of expected cash flows on PCI loans for the quarters ended December 31, 2018 and September 30, 2018, respectively. Including the cash collections in excess of expected cash flows, NIM was 3.87% and 4.00% for the quarters ended December 31, 2018 and September 30, 2018, respectively. 4

Fourth Quarter and Full Year 2018 Highlights Veritex Holdings, Inc. Green Bancorp, Inc. GAAP GAAP Financial Highlights Fourth Quarter Full Year 2018 Financial Highlights Fourth Quarter Full Year 2018 Net income $9.8 million $39.3 million Net income $15.3 million $56.7 million Diluted EPS $0.40 $1.60 Diluted EPS $0.41 $1.50 Return on average assets2 1.20% 1.26% Return on average assets2 1.37% 1.32% Return on average tangible 12.12% 12.89% Return on average tangible 15.20% 14.88% common equity2 common equity2 Efficiency Ratio 54.27% 54.92% Efficiency Ratio 50.52% 51.26% Non‐GAAP1 Non‐GAAP1 Financial Highlights Fourth Quarter Full Year 2018 Financial Highlights Fourth Quarter Full Year 2018 Operating net income $11.5 million $45.3 million Operating net income $16.5 million $60.8 million Diluted operating EPS $0.47 $1.84 Diluted operating EPS $0.44 $1.61 Operating return on 1.40% 1.45% Operating return on 1.49% 1.41% average assets2 average assets2 Operating return on 13.99% 14.68% Operating return on 16.40% 16.40% average tangible common average tangible common equity2 equity2 Operating efficiency Ratio 50.65% 49.60% Operating efficiency Ratio 47.77% 48.95% 1 Please refer to the “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non‐GAAP financial measures. 2 Annualized ratio. 5

Fully Diluted EPS and TBVPS Veritex Holdings, Inc. Green Bancorp, Inc. Diluted Earnings Per Share1 Diluted Earnings Per Share1 $0.60 $0.50 $0.60 $0.50 $0.46 $0.47 $0.42 $0.49 $0.42 $0.42 $0.50 $0.40 $0.44 $0.44 $0.44 $0.40 $0.36 $0.41 $0.41 $0.31 $0.40 $0.30 $0.26 $0.30 $0.25 $0.20 $0.14 $0.20 $0.14 $0.10 $0.10 $0.07 $0.00 $0.00 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Reported Operating Reported Operating Tangible Book Value Per Common Share1 Tangible Book Value Per Common Share1 $15.00 $11.50 $14.57 $11.18 $14.50 $11.25 $14.02 $11.00 $14.00 $13.63 $10.75 $10.63 $13.50 $13.14 $10.50 $10.36 $12.75 $10.25 $10.10 $13.00 $9.97 $10.00 $12.50 $9.75 $12.00 $9.50 $11.50 $9.25 $11.00 $9.00 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 1 Please refer to the “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non‐GAAP financial measures. 6

Performance Metrics Veritex Holdings, Inc. Green Bancorp, Inc. ROATCE1 ROATCE1 19.00% 20% 16.99% 20% 17.88% 14.82% 16.40% 13.14% 13.99% 15% 15% 17.65% 10.26% 14.70% 10.81% 16.01% 13.53% 15.20% 10% 11.41% 12.12% 10% 5.90% 10.47% 5% 5% 4.93% 3.02% 0% 0% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Reported Operating Reported Operating ROAA1 ROAA1 2.5% 2.14% 2.5% 2.10% 2.15% 2.17% 2.10% 2.01% 2.03% 1.98% 1.95% 2.01% 2.0% 1.65% 2.0% 1.69% 1.56% 1.49% 1.47% 1.40% 1.5% 1.28% 1.5% 1.09% 0.93% 1.54% 1.0% 1.41% 1.34% 1.0% 1.42% 1.37% 1.10% 1.20% 0.50% 0.5% 0.5% 0.90% 0.48% 0.25% 0.0% 0.0% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Reported Operating PTPP Operating Reported Operating PTPP Operating 1 Please refer to the “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non‐GAAP financial measures. 7 1

Performance Metrics Veritex Holdings, Inc. Green Bancorp, Inc. Efficiency Ratio1 Efficiency Ratio1 65% 65% 60% 57.58% 60% 57.87% 54.28% 53.51% 53.60% 54.27% 53.64% 55% 55% 50.05% 50.81% 50.52% 50% 50% 49.98% 49.94% 50.65% 49.90% 45% 48.67% 49.09% 45% 49.45% 47.69% 47.07% 47.77% 40% 40% 35% 35% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Reported Operating Reported Operating 1 Please refer to the “Reconciliation of Non‐GAAP Financial Measures” at the end of this presentation for a description and reconciliation of these non‐GAAP financial measures. 8 1

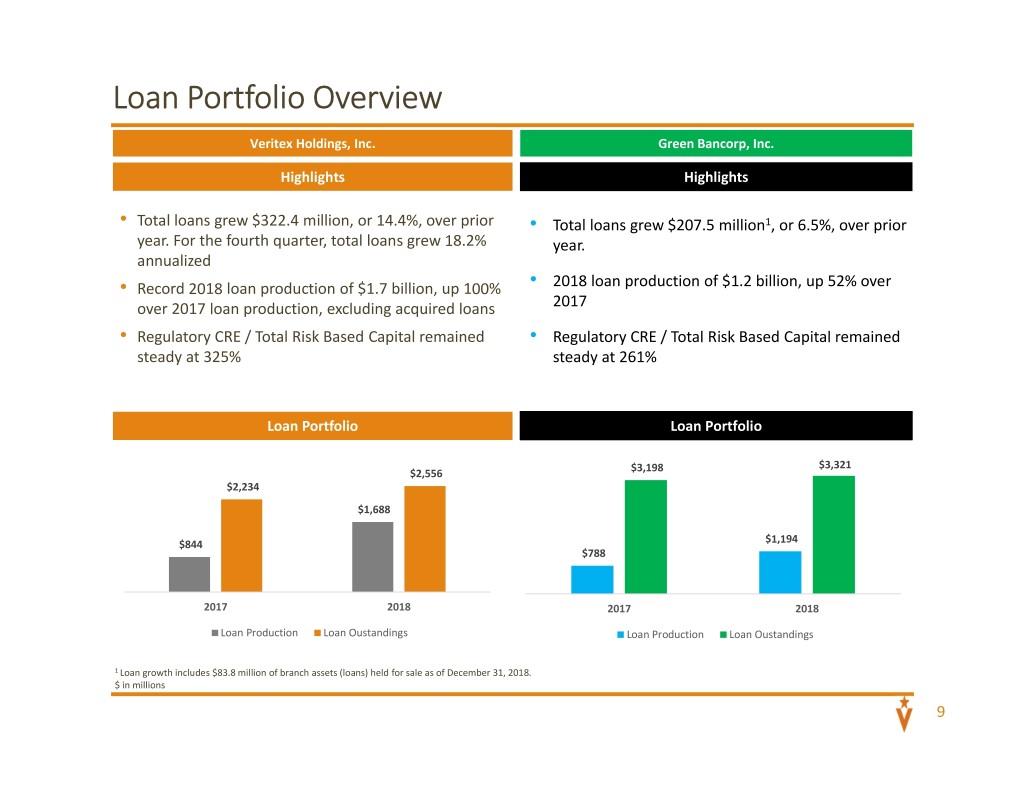

Loan Portfolio Overview Veritex Holdings, Inc. Green Bancorp, Inc. Highlights Highlights • Total loans grew $322.4 million, or 14.4%, over prior • Total loans grew $207.5 million1, or 6.5%, over prior year. For the fourth quarter, total loans grew 18.2% year. annualized • Record 2018 loan production of $1.7 billion, up 100% • 2018 loan production of $1.2 billion, up 52% over over 2017 loan production, excluding acquired loans 2017 • Regulatory CRE / Total Risk Based Capital remained • Regulatory CRE / Total Risk Based Capital remained steady at 325% steady at 261% Loan Portfolio Loan Portfolio $3,198 $3,321 $2,556 $2,234 $1,688 $844 $1,194 $788 2017 2018 2017 2018 Loan Production Loan Oustandings Loan Production Loan Oustandings 1 Loan growth includes $83.8 million of branch assets (loans) held for sale as of December 31, 2018. $ in millions 9

Deposits and Liquidity Veritex Holdings, Inc. Green Bancorp, Inc. Highlights Highlights • Noninterest‐bearing deposits totaled $626.3 million, • Noninterest‐bearing deposits totaled $840.2 million which comprised 23.9% of total deposits as of December which comprised 23.8% of total deposits as of December 31, 2018 31, 2018 • Total deposits increased by 15.1%, or $343.8 million, • Total deposits increased by 3.6%, or $122 million, during during 2018 2018 • Loan to deposit ratio was 97.4% at December 31, 2018 • Loan to deposit ratio was 95.5% at December 31, 2018 Average Cost of Total Deposits Average Cost of Total Deposits 1.32% 1.05% 1.20% 1.23% 0.74% 0.91% 1.05% 0.69% 0.77% 0.79% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Total Deposits Total Deposits $3,397 $3,519 $2,622 $2,279 4Q17 4Q18 4Q17 4Q18 10

Net Interest Margin Veritex Holdings, Inc. Green Bancorp, Inc. Highlights Highlights • NIM declined to 3.87% in 4Q18 from 4.00% in 3Q18 • NIM increased to 3.82% in 4Q18 from 3.78% in 3Q18 • Excluding cash collections in excess of expected cash • Loan yields increased to 5.80% as the impact of the flows on PCI loans, NIM expanded to 3.82%1 for the September Fed Funds increase impacted the portfolio quarter ended December 31, 2018 from 3.73%1 for the quarter ended September 30, 2018. 5.80% 5.80% 5.80% 5.55% 5.65% 5.75% 5.72% 5.62% 5.42% 5.55% 5.30% 5.42% 5.51% 5.32% 5.30% 5.38% 5.18% 5.25% 5.13% 5.12% 5.02% 4.80% 4.94% 4.80% 4.91% 4.74% Margin Margin 4.46% 4.30% 4.30% 4.24% Interest Interest 4.07% 4.00% 3.94% 3.87% 3.82% Net Net 3.87% 3.64% 3.78% 3.80% 3.80% 3.30% 3.30% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q182 3Q18 4Q18 Loan Yield Contractual Loan Rate2 NIM NIM Contractual Loan Rate Loan Yield 1 Excludes $354 thousand and $2.0 million of cash collections in excess of expected cash flows on PCI loans for the quarters ended December 31, 2018 and September 30, 2018, respectively. 2 Contractual loan yield excludes loan fees and accretion on purchased performing and PCI loans. $ in millions 11

Credit Quality Veritex Holdings, Inc. Green Bancorp, Inc. Asset Quality 2.00% 0.80% 0.77% 1.68% 1.64% 1.36% 1.38% 0.16% 0.12% 0.03% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 NPAs / Total Assets NPAs / Total Assets Allowance for Loan Losses Ratio1 Allowance for Loan Losses Ratio1 1.65% 1.33% 1.37% 1.29% 1.29% 1.23% 1.14% 1.11% 1.22% 1.08% 0.75% 0.61% 0.73% 1.09% 0.99% 0.57% 0.58% 1.05% 0.98% 0.96% 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 ALLL ALLL + Remaining PD ALLL ALLL + Remaining PD 1 Based on percentage of total gross loans held for investment. 12

Merger Integration Update Team Impact Customer Impact Technology Impact • Best‐of‐blend approach with a • Disciplined execution resulting in • Continued focus on technology with “better together” mindset led by merger closing on January 1st the following strategic selections dedicated project teams led by made to enhance user experience: member of Veritex and Green . Migrate Veritex to Jack Henry • Initiated customer and brand (Green’s current technology awareness communications through platform) • Talent assessments completed with social media, mailings, in‐branch retention offers extended to 18 key marketing and e‐mail blasts . Migrate Green to Veritex’s team members with a 100% e‐banking platform acceptance rate • Selected products and services to enhance existing and new customer • Our Chief Information Officer hired a • Reinforced focus on investing in our experiences until full system new Chief Technology Officer people through the importance of conversion in late 2Q19 training with the hire of a Director of Training • Implementation of robust sales • Initiated an independent brand pipeline tracking system agency to gauge and challenge our • Inclusive communication efforts brand awareness to better connect deployed including implementation with our customers of streamline credit approval processes 13

Key Success Factors for 2019 • Additional relationship management hires Talent/Culture • Monthly employee communications • Improved focus on training • Successful management & implementation of Stock Buyback Capital • Initiate regular quarterly common dividend • Dedicated to preserving and enhancing our credit process and structure Risk • Technology focused upgrades Management • Continued focus on BSA/AML, Compliance and CRA teams • Complete data conversion in Q2 2019 • Deposit growth strategies –“top of mind” Revenue • Treasury management growth through Green platform Synergies • Commencing an HOA division in Q1 • Continued focus on growing the middle market lending business 14

V E R I T E X Reconciliation of Non‐GAAP Financial Measures

Veritex Reconciliation of Non‐GAAP Financial Measures 16

Veritex Reconciliation of Non‐GAAP Financial Measures 17

Veritex Reconciliation of Non‐GAAP Financial Measures 18

Veritex Reconciliation of Non‐GAAP Financial Measures 19

Green Reconciliation of Non‐GAAP Financial Measures 20

Green Reconciliation of Non‐GAAP Financial Measures 21

Green Reconciliation of Non‐GAAP Financial Measures 22

Green Reconciliation of Non‐GAAP Financial Measures 23

24