Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOOPER HOLMES INC | decmor.htm |

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS Provant Health Accountable Health Hooper Wellness, LLC Hooper Distribution Hooper Holmes, Inc. (23302) Hooper Holmes, Inc. (23302) Hooper Kit Services, LLC (23305) Hooper Information Services, Inc (23308) Solutions (23309) Solutions (23310) (23303) Services, LLC (23307) Operating - Central Operating - Central CURRENT MONTH Operating- Central Bank of Operating - SVB DIP Deposit - Wells Deposit- Central Bank of Deposit - Wells Fargo SVB Transaction SVB Utility Bank of the Midwest DIP - SVB (5233) Bank of the Midwest DIP - SVB (2299) SVB (0393) ACTUAL (TOTAL OF Midwest (8928) (0578) Fargo (4850) the Midwest (5233) (4868) ACCOUNT NUMBER (LAST 4) (4502) (8944) ALL ACCOUNTS) CASH BEGINNING OF MONTH $ - $ - $ - $ 2,402,417.66 $ 42,613.18 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 2,445,030.84 RECEIPTS CASH SALES $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - ACCOUNTS RECEIVABLE - PREPETITION $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Total AR Receipts allocated to: ACCOUNTS RECEIVABLE - POSTPETITION $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Total AR Receipts allocated to: Line of Credit - Draw $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Term Loan Draws $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Proceeds from Asset Sale $ - Funding from Quest $ - Intercompany Transfers From $ - $ - $ - $ - $ - $ - $ - $ - $ - Other $ - $ - $ - $ 5,779 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 5,779 TOTAL RECEIPTS $ - $ - $ - $ 5,779 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 5,779 DISBURSEMENTS Bank Fees $ - $ - $ - $ - $ 29 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 29 Contract Labor $ - $ - $ - $ 590 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 590 Event Materials & Supplies $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Freight $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Insurance $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Lab Testing $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Office Supplies $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Other - Payments to US Trustee $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Professional Fees $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Rent & Utilities $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Salaries & Payroll $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Software/Subscriptions/Licenses $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - T&E $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Payment to Secured Creditor - SWK $ - $ - $ - $ 300,000 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 300,000 Intercompany Transfers To $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Transaction Costs $ - $ - $ - $ 115,221 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 115,221 TOTAL DISBURSEMENTS $ - $ - $ - $ 415,811 $ 29 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 415,841 NET CASH FLOW $ - $ - $ - $ (410,032) $ (29.34) $ - $ - $ - $ - $ - $ - $ - $ - $ - $ (410,062) (RECEIPTS LESS DISBURSEMENTS) CASH – END OF MONTH $ - $ - $ - $ 1,992,385.40 $ 42,584 $ - $ - $ - $ - $ - $ - $ - $ - $ - $ 2,034,969 * COMPENSATION TO SOLE PROPRIETORS FOR SERVICES RENDERED TO BANKRUPTCY ESTATE THE FOLLOWING SECTION MUST BE COMPLETED DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES: (FROM CURRENT MONTH ACTUAL COLUMN) TOTAL DISBURSEMENTS $ 415,841 LESS: TRANSFERS TO OTHER DEBTOR IN POSSESSION ACCOUNTS $ - $ - TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE $ 415,841 QUARTERLY FEES FORM MOR-1 2/2008 PAGE 1 OF 1

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 BANK RECONCILIATIONS Continuation Sheet for MOR-1 Accountable Health Hooper Wellness, LLC Hooper Distribution Services, Hooper Holmes, Inc. (23302) Hooper Holmes, Inc. (23302) Hooper Kit Services, LLC (23305) Hooper Information Services, Inc (23308) Provant Health Solutions (23309) Solutions (23310) (23303) LLC (23307) Operating - Central Operating - Central Operating- Central Bank of Operating - SVB DIP Deposit - Wells Fargo Deposit- Central Bank of SVB Transaction SVB Utility Bank of the Midwest DIP - SVB (5233) Bank of the Midwest DIP - SVB (2299) SVB (0393) Deposit - Wells Fargo (4868) Midwest (8928) (0578) (4850) the Midwest (5233) (4502) (8944) BALANCE PER BOOKS $ - $ - $ - $ 1,992,385 $ 42,584 $ - $ - $ - $ - $ - $ - $ - $ - $ - BANK BALANCE $ - $ - $ - $ 1,992,385 $ 42,584 $ - $ - $ - $ - $ - $ - $ - $ - $ - (+) DEPOSITS IN TRANSIT (ATTACH $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - LIST) (-) OUTSTANDING CHECKS (ATTACH $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - LIST) : OTHER (ATTACH EXPLANATION) $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - ADJUSTED BANK BALANCE * $ - $ - $ - $ 1,992,385 $ 42,584 $ - $ - $ - $ - $ - $ - $ - $ - $ - *"Adjusted Bank Balance" must equal "Balance per Books" DEPOSITS IN TRANSIT Date Amount Date CHECKS OUTSTANDING Ck. # Amount Ck. # FORM MOR-1 (CONT.) 2/2008 PAGE 1 OF 1

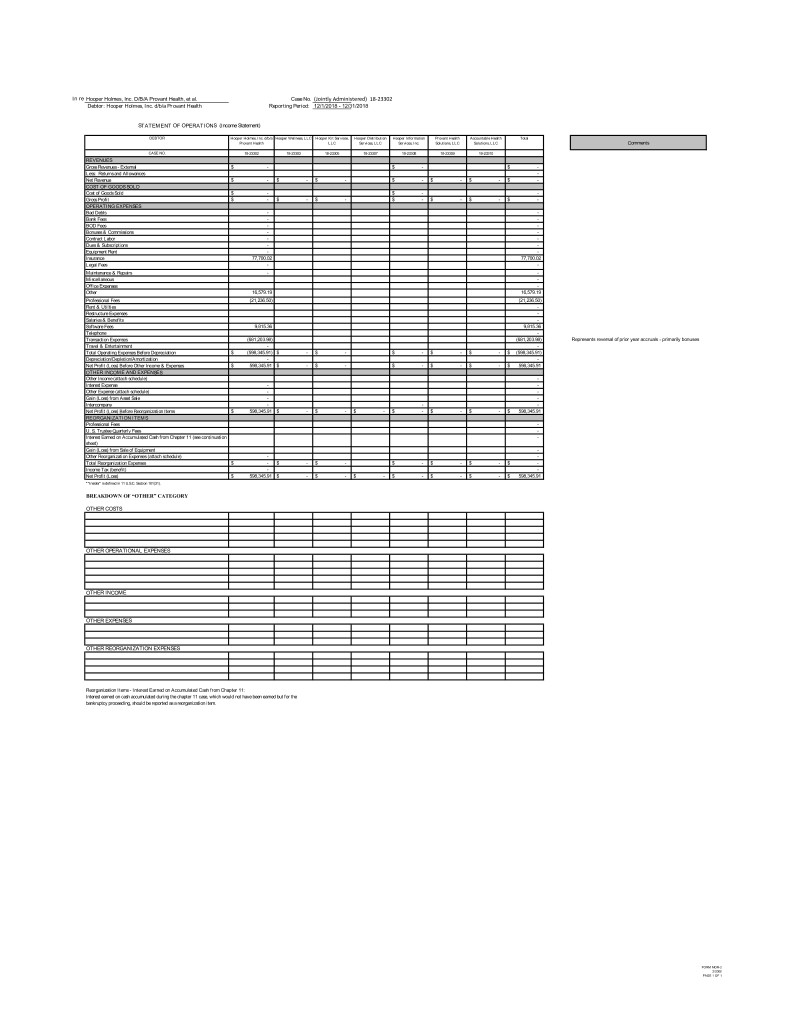

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 STATEMENT OF OPERATIONS (Income Statement) DEBTOR Hooper Holmes, Inc. d/b/a Hooper Wellness, LLC Hooper Kit Services, Hooper Distribution Hooper Information Provant Health Accountable Health Total Provant Health LLC Services, LLC Services, Inc. Solutions, LLC Solutions, LLC Comments CASE NO. 18-23302 18-23303 18-23305 18-23307 18-23308 18-23309 18-23310 REVENUES Gross Revenues - External $ - $ - $ - Less: Returns and Allowances - Net Revenue $ - $ - $ - $ - $ - $ - $ - COST OF GOODS SOLD Cost of Goods Sold $ - $ - - Gross Profit $ - $ - $ - $ - $ - $ - $ - OPERATING EXPENSES Bad Debts - - Bank Fees - - BOD Fees - - Bonuses & Commissions - - Contract Labor - - Dues & Subscriptions - - Equipment Rent - - Insurance 77,700.02 77,700.02 Legal Fees - - Maintenance & Repairs - - Miscellaneous - Office Expenses - Other 16,579.19 16,579.19 Professional Fees (21,236.50) (21,236.50) Rent & Utilties - Restructure Expenses - Salaries & Benefits - Software Fees 9,815.36 9,815.36 Telephone - Transaction Expenses (681,203.98) (681,203.98) Represents reversal of prior year accruals - primarily bonuses Travel & Entertainment - - Total Operating Expenses Before Depreciation $ (598,345.91) $ - $ - $ - $ - $ - $ (598,345.91) Depreciation/Depletion/Amortization - - Net Profit (Loss) Before Other Income & Expenses $ 598,345.91 $ - $ - $ - $ - $ - $ 598,345.91 OTHER INCOME AND EXPENSES Other Income (attach schedule) - Interest Expense - - Other Expense (attach schedule) - - Gain (Loss) from Asset Sale - - Intercompany - - - Net Profit (Loss) Before Reorganization Items $ 598,345.91 $ - $ - $ - $ - $ - $ - $ 598,345.91 REORGANIZATION ITEMS Professional Fees - U. S. Trustee Quarterly Fees - Interest Earned on Accumulated Cash from Chapter 11 (see continuation - sheet) Gain (Loss) from Sale of Equipment - Other Reorganization Expenses (attach schedule) - - Total Reorganization Expenses $ - $ - $ - $ - $ - $ - $ - Income Tax (benefit) - - Net Profit (Loss) $ 598,345.91 $ - $ - $ - $ - $ - $ - $ 598,345.91 *"Insider" is defined in 11 U.S.C. Section 101(31). BREAKDOWN OF “OTHER” CATEGORY OTHER COSTS OTHER OPERATIONAL EXPENSES OTHER INCOME OTHER EXPENSES OTHER REORGANIZATION EXPENSES Reorganization Items - Interest Earned on Accumulated Cash from Chapter 11: Interest earned on cash accumulated during the chapter 11 case, which would not have been earned but for the bankruptcy proceeding, should be reported as a reorganization item. FORM MOR-2 2/2008 PAGE 1 OF 1

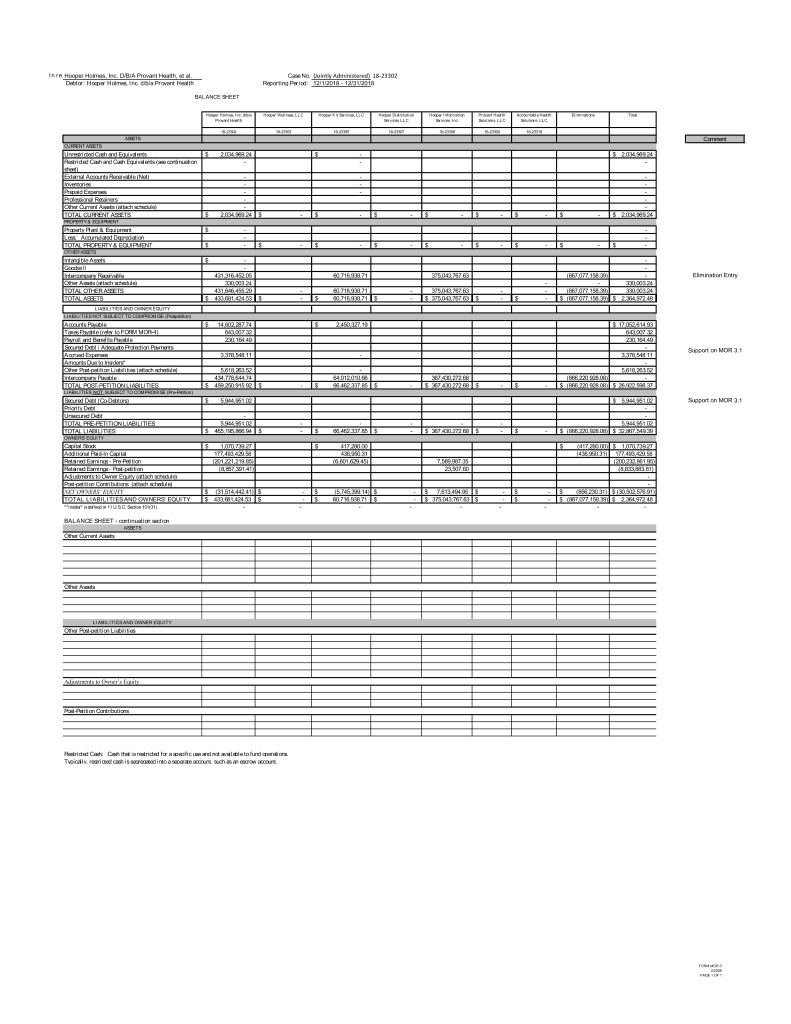

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 BALANCE SHEET Hooper Holmes, Inc. d/b/a Hooper Wellness, LLC Hooper Kit Services, LLC Hooper Distribution Hooper Information Provant Health Accountable Health Eliminations Total Provant Health Services, LLC Services, Inc. Solutions, LLC Solutions, LLC 18-23302 18-23303 18-23305 18-23307 18-23308 18-23309 18-23310 ASSETS Comment CURRENT ASSETS Unrestricted Cash and Equivalents $ 2,034,969.24 $ - $ 2,034,969.24 Restricted Cash and Cash Equivalents (see continuation - - - sheet) External Accounts Receivable (Net) - - - Inventories - - - Prepaid Expenses - - - Professional Retainers - - Other Current Assets (attach schedule) - - TOTAL CURRENT ASSETS $ 2,034,969.24 $ - $ - $ - $ - $ - $ - $ - $ 2,034,969.24 PROPERTY & EQUIPMENT Property Plant & Equipment $ - - Less: Accumulated Depreciation - - TOTAL PROPERTY & EQUIPMENT $ - $ - $ - $ - $ - $ - $ - $ - $ - OTHER ASSETS Intangible Assets $ - - Goodwill - - Intercompany Receivable 431,316,452.05 60,716,938.71 375,043,767.63 (867,077,158.39) - Elimination Entry Other Assets (attach schedule) 330,003.24 - - 330,003.24 TOTAL OTHER ASSETS 431,646,455.29 - 60,716,938.71 - 375,043,767.63 - - (867,077,158.39) 330,003.24 TOTAL ASSETS $ 433,681,424.53 $ - $ 60,716,938.71 $ - $ 375,043,767.63 $ - $ - $ (867,077,158.39) $ 2,364,972.48 LIABILITIES AND OWNER EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE (Postpetition) Accounts Payable $ 14,602,287.74 $ 2,450,327.19 $ 17,052,614.93 Taxes Payable (refer to FORM MOR-4) 643,007.32 643,007.32 Payroll and Benefits Payable 230,164.49 230,164.49 Secured Debt / Adequate Protection Payments - Support on MOR 3.1 Accrued Expenses 3,378,548.11 - 3,378,548.11 Amounts Due to Insiders* - Other Post-petition Liabilities (attach schedule) 5,618,263.52 - 5,618,263.52 Intercompany Payable 434,778,644.74 64,012,010.66 367,430,272.68 (866,220,928.08) - TOTAL POST-PETITION LIABILITIES $ 459,250,915.92 $ - $ 66,462,337.85 $ - $ 367,430,272.68 $ - $ - $ (866,220,928.08) $ 26,922,598.37 LIABILITIES NOT SUBJECT TO COMPROMISE (Pre-Petition) Secured Debt (Co-Debtors) $ 5,944,951.02 $ 5,944,951.02 Support on MOR 3.1 Priority Debt - Unsecured Debt - - TOTAL PRE-PETITION LIABILITIES 5,944,951.02 - - - - - 5,944,951.02 TOTAL LIABILITIES $ 465,195,866.94 $ - $ 66,462,337.85 $ - $ 367,430,272.68 $ - $ - $ (866,220,928.08) $ 32,867,549.39 OWNERS' EQUITY Capital Stock $ 1,070,739.27 $ 417,280.00 $ (417,280.00) $ 1,070,739.27 Additional Paid-In Capital 177,493,429.58 438,950.31 (438,950.31) 177,493,429.58 Retained Earnings - Pre-Petition (201,221,219.85) (6,601,629.45) 7,589,987.35 (200,232,861.95) Retained Earnings - Post-petition (8,857,391.41) 23,507.60 (8,833,883.81) Adjustments to Owner Equity (attach schedule) - Post-petition Contributions (attach schedule) - NET OWNERS’ EQUITY $ (31,514,442.41) $ - $ (5,745,399.14) $ - $ 7,613,494.95 $ - $ - $ (856,230.31) $ (30,502,576.91) TOTAL LIABILITIES AND OWNERS' EQUITY $ 433,681,424.53 $ - $ 60,716,938.71 $ - $ 375,043,767.63 $ - $ - $ (867,077,158.39) $ 2,364,972.48 *"Insider" is defined in 11 U.S.C. Section 101(31). - - - - - - - - - BALANCE SHEET - continuation section ASSETS Other Current Assets Other Assets LIABILITIES AND OWNER EQUITY Other Post-petition Liabilities Adjustments to Owner’s Equity Post-Petition Contributions Restricted Cash: Cash that is restricted for a specific use and not available to fund operations. Typically, restricted cash is segregated into a separate account, such as an escrow account. FORM MOR-3 2/2008 PAGE 1 OF 1

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 STATUS OF POST-PETITION TAXES Hooper Holmes, Inc. Hooper Information Services, Inc. Amount Amount Withheld Withheld Comments Federal Beginning Tax and/or Accrued Amount Paid Date Paid Beginning Tax and/or Accrued Amount Paid Date Paid Check # or EFT Ending Tax Withholding $ - $ 128,219.65 $ 128,219.65 12/14, 12/28, 12/31 $ - $ 19,253.33 $ 19,253.33 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Social Sec. - Employee $ - $ 61,337.36 $ 61,337.36 12/14, 12/28, 12/31 $ - $ 16,924.57 $ 16,924.57 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Social Sec. - Employer $ - $ 61,337.39 $ 61,337.39 12/14, 12/28, 12/31 $ - $ 16,924.50 $ 16,924.50 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Medical - Employee $ - $ 15,751.66 $ 15,751.66 12/14, 12/28, 12/31 $ - $ 3,958.04 $ 3,958.04 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Medical - Employer $ - $ 15,751.75 $ 15,751.75 12/14, 12/28, 12/31 $ - $ 3,958.15 $ 3,958.15 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Unemployment $ - $ 185.50 $ 185.50 12/14, 12/28, 12/31 $ - $ 568.30 $ 568.30 12/10, 12/14, 12/17, 12/26, 12/31 Various $ - Income $ 26,756.41 $ - $ - $ - $ - $ - $ 26,756.41 MED Surtax - Employee $ - $ 242.16 $ 242.16 12/14, 12/28, 12/31 $ - $ - $ - $ - Total Federal Taxes $ 26,756.41 $ 282,825.47 $ 282,825.47 $ - $ - $ 61,586.89 $ 61,586.89 $ - $ 26,756.41 State and Local Withholding $ - $ - $ - $ - $ - $ - $ - Sales $ 341,250.91 $ 275,000.00 $ - $ - $ - $ - $ 616,250.91 Excise $ - $ - $ - $ - $ - $ - $ - Income $ - $ 43,811.82 $ 43,811.82 12/14, 12/28, 12/31 $ - $ 5,757.13 $ 5,757.13 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Disability $ - $ 5,209.75 $ 5,209.75 12/14, 12/28, 12/31 $ - $ 1,987.97 $ 1,987.97 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Local Income $ - $ 377.33 $ 377.33 12/14, 12/28, 12/31 $ - $ 128.69 $ 128.69 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Unemployment $ - $ 6,767.11 $ 6,767.11 12/14, 12/28, 12/31 $ - $ 1,518.62 $ 1,518.62 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Worker's Benefit - Employee $ - $ - $ - $ - $ 1.17 $ 1.17 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Worker's Benefit - Employer $ - $ - $ - $ - $ 1.17 $ 1.17 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Transit Tax $ - $ - $ - $ - $ 2.28 $ 2.28 11/9, 11/15, 11/20, 11/26, 11/30 Various $ - Total State and Local $ 341,250.91 $ 331,166.01 $ 56,166.01 $ - $ 9,397.03 $ 9,397.03 $ 616,250.91 Total Taxes $ 368,007.32 $ 613,991.48 $ 338,991.48 $ - $ - $ 70,983.92 $ 70,983.92 $ - $ 643,007.32 SUMMARY OF UNPAID POST-PETITION DEBTS Number of Days Past Due Current 30 Days 60 Days 90 Days 120 Days Total Notes Accounts Payable $ 1,538,706.87 $ 228,672.98 $ 163,988.79 $ 491,340.72 $ (9,295.29) $ 2,413,414.07 Accounts Payable - Hooper Holmes $ 1,532,361.87 $ 228,329.02 $ 163,988.79 $ 490,265.62 $ (10,758.94) $ 2,404,186.36 Accounts Payable - Hooper Kits $ 6,345.00 $ 343.96 $ - $ 1,075.10 $ 1,463.65 $ 9,227.71 Wages Payable $ - $ - Taxes Payable $ 275,000.00 50,000.00 72,156.00 51,446.97 $ 448,602.97 Rent/Leases-Building $ - $ - Rent/Leases-Equipment $ - $ - Secured Debt $ 2,533,075.54 $ 2,533,075.54 Support on MOR 3.1 Professional Fees (Incl. in Current AP Balance) $ 663,705.06 $ 663,705.06 Inclusive in the Post Petition AP balance Amounts Due to Insiders (Incl. in Current AP Balance) $ 45,000.33 $ 45,000.33 Inclusive in the Post Petition AP balance Other:______________ Other:______________ Total Post-petition Debts $ 4,346,782 $ 278,673 $ 236,145 $ 542,788 $ 5,395,093 Explain how and when the Debtor intends to pay any past due post-petition debts. Secured Debt is paid from the transaction sale proceeds. Professional fees are paid based on fee application, subject to approval of the court. All other debts are being paid in the normal course. FORM MOR-4 2/2008 PAGE 1 OF 1

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING Accounts Receivable Reconciliation Hooper Holmes Hooper Kits Consolidated Total Accounts Receivable at the beginning of the reporting period $ - $ - $ - Plus: Amounts billed during the period $ - $ - $ - Plus: Amounts Unbilled during the period $ - $ - $ - Less: Amounts collected during the period $ - $ - $ - Less: Amounts transferred due to Asset Sale $ - $ - $ - Total Accounts Receivable at the end of the reporting period $ - $ - $ - Accounts Receivable Aging 0-30 Days 31-60 Days 61-90 Days 91+ Days Total Total Accounts Receivable $ - $ - $ - $ - $ - Accounts Receivable - Hooper Holmes $ - $ - $ - $ - $ - Accounts Receivable - Hooper Kits $ - $ - $ - $ - $ - Less: Bad Debts (Amount considered uncollectible) $ - Bad Debts - Hooper Holmes $ - Bad Debts - Hooper Kits $ - Net Accounts Receivable $ - TAXES RECONCILIATION AND AGING Taxes Payable 0-30 Days 31-60 Days 61-90 Days 91+ Days Total Total Taxes Payable $ 275,000.00 $ 121,756.00 $ 246,251.32 $ 643,007.32 Total Accounts Payable $ 1,538,706.87 $ 228,672.98 $ 163,988.79 $ 15,146,246.28 $ 17,077,614.92 Total Accounts Payable - Hooper Holmes $ 1,532,361.87 $ 228,329.02 $ 163,988.79 $ 12,702,608.05 $ 14,627,287.73 Total Accounts Payable - Hooper Kits $ 6,345.00 $ 343.96 $ - $ 2,443,638.23 $ 2,450,327.19 FORM MOR-5 2/2008 PAGE 1 OF 1

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 PAYMENTS TO INSIDERS AND PROFESSIONALS INSIDERS TOTAL PAID TO NAME TYPE OF PAYMENT AMOUNT PAID DATE Salois, Marc Payroll $ 19,167 $ 86,854 Clermont, Mark A Payroll $ 27,760 $ 124,922 Basiliere, Thomas Payroll $ 24,863 $ 106,584 Kevin Johnson Payroll $ 52,083 David Ashley License $ 11,364 Paul Daoust T&E $ 8,333 Larry Ferguson T&E $ 8,333 Ronald Aprahamian T&E $ 8,333 TOTAL PAYMENTS TO INSIDERS $ 71,790.52 $ 390,139.72 PROFESSIONALS DATE OF COURT ORDER TOTAL PAID TO TOTAL INCURRED & NAME AMOUNT APPROVED AMOUNT PAID Comments AUTHORIZING DATE UNPAID* PAYMENT Downes McMahon $ 25,000 $ 25,000 Duane Morris $ 150,000 $ 150,000 Holland & Knight $ 150,000 $ 150,000 PMCM $ 6,893 $ 6,893 $ 421,854 $ 421,854 EPIQ Corp. $ 270,646 $ 270,646 Office of US Trustee $ 85,277 $ 85,277 $ 170,554 $ 170,554 Brown Rudnick $ 78,867 $ 78,867 $ 312,993 $ 312,993 Halpern Battaglia Benzija $ 4,403 $ 4,403 Miller Advertising $ 6,418 $ 6,418 Berkely Research Group $ 29,462 $ 29,462 $ 144,126 $ 144,126 Foley Ladner $ 448,146 $ 448,146 Spencer Fane $ 33,312 $ 33,312 SWK $ 300,000 $ 300,000 $ 300,000 $ 300,000 TOTAL PAYMENTS TO PROFESSIONALS $ 500,498 $ 500,498 $ 2,437,451 $ 2,437,451 * INCLUDE ALL FEES INCURRED, BOTH APPROVED AND UNAPPROVED POST-PETITION STATUS OF SECURED NOTES, LEASES PAYABLE AND ADEQUATE PROTECTION PAYMENTS SCHEDULED MONTHLY PAYMENT AMOUNT PAID TOTAL UNPAID POST- NAME OF CREDITOR DUE DURING MONTH PETITION Comments 96-OP Prop (Landlord) $ 80,250.00 $ 80,250.00 All leases are paid current, N/A for secured notes and adequate protection payments Greenwich Mills, LLC (Landlord) $ 57,000.00 $ 113,819.89 ELVI Associates, LLC (Landlord) $ 515.00 $ 1,030.00 COHOCTON (Landlord) $ 500.00 $ 500.00 TOTAL PAYMENTS $ - $ 195,599.89 FORM MOR-6 2/2008 PAGE 1 OF 1

In re Hooper Holmes, Inc. D/B/A Provant Health, et al. Case No. (Jointly Administered) 18-23302 Debtor: Hooper Holmes, Inc. d/b/a Provant Health Reporting Period: 12/1/2018 - 12/31/2018 DEBTOR QUESTIONNAIRE Hooper Holmes Comments Must be completed each month. If the answer to any of the Yes No questions is “Yes”, provide a detailed explanation of each item. Attach additional sheets if necessary. Have any assets been sold or transferred outside the normal course of X 1 business this reporting period? Have any funds been disbursed from any account other than a debtor in X 2 possession account this reporting period? Is the Debtor delinquent in the timely filing of any post-petition tax X 3 returns? Are workers compensation, general liability or other necessary X 4 insurance coverages expired or cancelled, or has the debtor received notice of expiration or cancellation of such policies? X 5 Is the Debtor delinquent in paying any insurance premium payment? Have any payments been made on pre-petition liabilities this reporting X Payments have been made in accordance with requests granted from Bankruptcy Court in 6 period? regards to First Day Motions. Are any post petition receivables (accounts, notes or loans) due from X 7 related parties? 8 Are any post petition payroll taxes past due? X 9 Are any post petition State or Federal income taxes past due? X 10 Are any post petition real estate taxes past due? X 11 Are any other post petition taxes past due? X Sales and use taxes X 12 Have any pre-petition taxes been paid during this reporting period? 13 Are any amounts owed to post petition creditors delinquent? X 14 Are any wage payments past due? X Have any post petition loans been been received by the Debtor from X 15 any party? 16 Is the Debtor delinquent in paying any U.S. Trustee fees? X Is the Debtor delinquent with any court ordered payments to attorneys X 17 or other professionals? Have the owners or shareholders received any compensation outside of X 18 the normal course of business? FORM MOR-7 2/2008 PAGE 1 OF 1

Entity: Hooper Holmes, Inc. Deposit/Professional Retainer Account breakout Balance 12/31/18 Balance 11/30/18 Balance 10/31/18 Balance 9/30/18 Balance 8/31/18 Other LT Assets 17100-00-00-05 Deposits 242,969.09 385,003.24 Deposit Matthew Eiffert 569.28 569.28 Deposit Olathe - Rent Op 89 properties 57,005.81 57,005.81 Retainer Buns & Levinson 15,000.00 15,000.00 Retainer Phoenix 90,000.00 90,000.00 Retainer EPIQ Corp 25,000.00 17,034.15 Retainer Duane Morrison 150,000.00 Retainer Halperin Battaglia 50,000.00 50,000.00 Deposit Continuity of Ops Planning 5,394.00 5,394.00 Liabilities Balance Sheet Classification GL Account Description Balance 12/31/18 Balance 11/30/18 Balance 10/31/18 Balance 9/30/18 Balance 8/31/18 Comments Accounts Payable 20100-00-00-05 Accounts Payable 13,103,767.58 13,604,576.94 14,038,340.63 13,915,314.06 12,836,970.93 Accrued Expenses 22900-00-00-05 Accrued Payables 1,498,520.16 2,154,952.87 2,666,945.98 2,344,154.61 1,228,209.62 Accounts Payable 14,602,287.74 15,759,529.81 16,705,286.61 16,259,468.67 14,065,180.55 Accrued Expenses 21200-00-00-05 Salaries Payable 149,893.12 850,698.78 1,569,939.51 1,084,728.73 919,720.43 Accrued Expenses 21350-00-00-05 Group Insurance Payable 15,500.00 Accrued Expenses 21370-00-00-05 401K Payable - 5,180.15 22,824.43 41,434.69 39,351.29 Accrued Expenses 21400-00-00-05 Accrued Insurance 64,771.37 75,073.37 88,332.37 105,824.64 119,083.64 Accrued Expenses 22400-00-00-05 Accrued Incentive Bonus - 511,500.00 511,500.00 511,500.00 491,500.00 Accrued Expenses 22400-00-00-06 Accrued Incentive Bonus - 209,399.49 200,000.00 180,000.00 160,000.00 Accrued Payroll 230,164.49 1,651,851.79 2,392,596.31 1,923,488.06 1,729,655.36 Sales Accrued Expenses 22300-00-00-05 Accrued State Tax 4,178.93 4,178.93 4,178.93 4,178.93 4,178.93 Sales Accrued Expenses 22700-00-00-06 Sales Tax Payable - - - 400.00 Sales Accrued Expenses 22750-00-00-05 Use Tax Payable 616,250.91 341,250.91 291,250.91 219,094.91 167,247.94 Federal Accrued Expenses 24500-00-00-05 Reserve for Fedral Income Tax 3,242.00 3,242.00 3,242.00 3,242.00 3,242.00 Federal Other Long-term Liabilities 24600-00-00-05 Deferred Tax Payable (6,500,480.84) (6,500,480.84) (6,500,480.84) (6,500,480.84) (6,500,480.84) Federal Other Long-term Liabilities 24601-00-00-05 Deferred Tax Valuation Allowance 6,519,816.32 6,519,816.32 6,519,816.32 6,519,816.32 6,519,816.32 Accrued Taxes 643,007.32 368,007.32 318,007.32 245,851.32 194,404.35 LOC Accrued Expenses 22100-00-00-05 Accrued Interest - Line of Credit - - - 11,368.78 - LOC Short Term Debt 23000-00-00-05 Line of Credit - - - 1,930,871.26 4,811,421.69 LOC Short Term Debt 23010-00-00-05 Line of Credit - Post - - - 4,576,293.86 Term Accrued Expenses 22101-00-00-05 Accrued Interest - Term - - - 1,344,272.44 988,723.71 Term Accrued Expenses 22102-00-00-05 Termination Fees - Term Loan 1,260,596.85 1,260,596.85 1,260,596.85 1,260,596.85 1,115,071.87 Term Short Term Debt 20110-00-00-05 Current Portion - Term Loan - - - 11,315,140.00 11,157,000.00 Term Short Term Debt 20111-00-00-05 Current Portion Term Loan - Post - - - 1,479,000.00 Term Short Term Debt 24750-00-00-05 Term Loan 4,858,365.11 5,158,365.11 5,158,365.11 6,500,000.00 6,500,000.00 Term Short Term Debt 24751-00-00-05 Debt Issue Discount - - - (400,023.42) (429,570.46) Term Short Term Debt 24752-00-00-05 Deferred Financing Fees - Term - - - (149,106.19) (160,119.65) Secured Debt 6,118,961.96 6,418,961.96 6,418,961.96 27,868,413.58 23,982,527.16 Capital Lease Short Term Debt 20110-00-00-06 Capital Leases 22,461.58 22,461.58 22,461.58 22,461.58 22,461.58 Sub debt Accrued Expenses 21902-00-00-06 Accrued Interest - Sub Debt 218,813.53 218,813.53 218,813.53 131,808.06 122,708.88 Sub debt Accrued Expenses 22100-00-00-06 Accrued Interest - Subordinated Debt - - - 87,005.47 81,805.94 Sub debt Short Term Debt 21900-00-00-06 Subordinated Convertable Debt 1,916,998.00 1,916,998.00 1,916,998.00 1,916,998.00 1,916,998.00 Sub debt Short Term Debt 21901-00-00-06 Subordinated Debt Discount - - - (325,158.71) (331,656.14) Unsecured Secured Debt 2,158,273.11 2,158,273.11 2,158,273.11 1,833,114.40 1,812,318.26 Accrued Expenses 22500-00-00-05 Accrued Auditing Fees - - - 9,644.92 Accrued Expenses 22900-00-00-06 Accrued Payables 2,865,530.37 2,867,115.18 2,865,530.37 2,865,530.37 2,853,030.37 Zipongo Contract Other Current Liabilities 22901-00-00-05 Accrued Payables - AHS 696,994.72 696,994.72 696,994.72 696,994.72 696,994.72 22900-00-00-10 Accrued Payable - Quest (289,809.05) - (993,127.16) Accrued Expenses 3,272,716.04 3,564,109.90 2,569,397.93 3,562,525.09 3,559,670.01 Other Current Liabilities 20400-00-00-05 Deferred Revenue 778,359.66 582,829.83 44,747.87 60,417.70 69,449.14 Other Current Liabilities 20400-00-00-06 Deferred Revenue 459,833.01 459,833.01 1,002,303.43 1,073,089.60 781,758.13 Other Current Liabilities 20400-00-00-10 Deferred Revenue - Quest (600,396.34) (582,829.83) (601,520.16) Other Current Liabilities 20401-00-00-05 Deferred Revenue - At Home - 6,708.00 51,103.70 50,361.70 44,230.38 Other Current Liabilities 20402-00-00-05 Deferred Revenue 355,723.31 355,723.31 355,723.31 355,723.31 374,890.03 Other Current Liabilities 20404-00-00-05 Deferred Implementation Fees 54,494.26 54,494.26 54,494.26 39,309.61 71,526.01 Other Current Liabilities 20500-00-00-06 Perf Guarantee 281,156.19 81,156.19 81,156.19 81,156.19 81,156.19 Other Current Liabilities 20500-00-00-10 Perf Guarantee - Quest (281,156.19) (81,156.19) (81,156.19) Other Current Liabilities 21700-00-00-05 Restructure Reserve 607,863.09 607,863.09 607,863.09 607,863.09 607,863.09 Other Current Liabilities 21800-00-00-05 Short Term Lease Obligation - Lenexa 175,889.57 175,889.57 175,889.57 175,889.57 75,889.57 Other Current Liabilities 21801-00-00-05 Short Term Lease - Olathe - 33,007.59 33,007.59 33,007.59 44,010.40 Other Current Liabilities 21802-00-00-05 Lease Obligation - Provant - 3,331.09 3,331.09 3,331.09 4,441.44 Other Current Liabilities 24400-00-00-05 Escheat Liability 1,298,907.97 1,298,907.97 1,298,907.97 1,208,494.45 1,208,494.45 Other Long-term Liabilities 21365-00-00-05 Executive Health Insurance 92,990.56 93,540.80 94,091.04 94,641.28 95,191.52 20403-00-00-05 Deferred Revenue Combined Billing 62,314.38 - 14,301.90 Other Long-term Liabilities 24404-00-00-05 Deferred Implementation - L.T. - - - 15,184.65 11,959.95 Other Long-term Liabilities 24710-00-00-05 Derivative Liability - - - 8,094.86 8,094.86 Unsecured obligations 3,285,979.47 3,089,298.69 3,134,244.66 3,806,564.69 3,478,955.16 InterCompany Payable 24000-00-00-05 Intercompany Payables - HLI 59,734,877.11 58,963,973.08 56,350,573.45 55,772,974.92 55,335,310.52 InterCompany Payable 24010-00-00-05 Intercompany Payables - HISI 375,043,767.63 374,268,301.29 373,492,834.95 372,717,368.61 371,941,902.27 Intercompany 434,778,644.74 433,232,274.37 429,843,408.40 428,490,343.53 427,277,212.79 Total Liabilities 465,090,034.87 466,242,306.95 463,540,176.30 483,989,769.34 476,099,923.64